#Business USA

Explore tagged Tumblr posts

Text

Dow Jones Futures: Jobs Report Due As Trump Blames 'Globalists' For Market Dive; Broadcom Jumps

#breaking news#news usa#usa politics#world news#news#american politics#us politics#politics#usa news#usa government#job in usa#business usa

2 notes

·

View notes

Text

Wouldn't you like to get my soft cock hard in your mouth honey ❣️?

Zangi :10-1482-7360

Telegram :@Hazellush120

#transfem#trans feedee#transgender#trans nsft#lbgtqcommunity#lgbtq#trans oc#trans community#trans cock#trans onlyfans#trans hrt#trans xx#trans kink#trans owned business#trans on tumblr#trans artist#trans are beautiful#trans visibility#trans zine#trans k!nk#trans history#trans queen#trans omo#trans pride#trans people#transparent#trans positivity#trans puppy#trans princess#trans usa

619 notes

·

View notes

Text

This might seem like an "old man yells at cloud" situation, but it's just wild growing up and being told how dangerous distracted driving is - how, at highway speeds, you can traverse the length of a football field (100 yards, 91 meters) in a matter of seconds - how one split second sending a text while driving could result in a potential fatal crash, and then getting on the road as a driver and being surrounded by billboards. Their entire purpose is to catch one's attention, so they're lining major roads, which tend to be highways. How is it that you're told how important it is to never be distracted while driving, but still being advertised to?

At best, this type of advertising is an eyesore to pedestrians and motorists and a general waste of electricity to light it, and at worst, it is an active danger considering they are there to advertise and therefore, must catch people's attention.

I'm not even against advertising in theory, but this particular mode bothers me so much and I hate how pervasive it is - especially in large cities or highways.

#politics#i don't know much about são paulo banning marketing billboards but on paper i want that here in the USA#as a motorist it at best just makes me more anxious driving in those larger cities because i want to FOCUS ON THE ROAD#and passing 5000 billboards per mile isn't helping actually!#i've gotten good at filtering that out of my FOV but it's still fucking exhausting lol#i especially hate those modern electric billboards. despise them actually#i am aware that advertising is a critical aspect to business management in some cases...#...but it shouldn't risk the safety of the populous for you to advertise to them and i see things like billboards as risking safety...#...i feel similarly about online advertising in that so much of it risks internet user's safety...#...such as flashing ads online which risk triggering epileptic seizures in light/photo-sensitive folks#distracted driving (texting): NO >:( || distracted driving (being advertised to): YAYYYY :D#i've been driving on my own for a few years now and i've been thinking about this for ENTIRELY too long

4K notes

·

View notes

Text

Support Local Palestinian Businesses!!!

This is Freddy Zebara, the owner of King of Falafel and Shawarma. He is Palestinian. As many of you know, Palestinians outside of Palestine are facing many challenges regarding discrimination and hate crimes.

We must be there for our Palestinian sisters and brothers no matter where they are.

If you live in New York, heck if you like to try good food, please support Freddy at his shop.

The location is 3015 Broadway, Astoria, NY 11106.

#free palestine#palestine#gaza#from the river to the sea palestine will be free#pray for palestine#free gaza#support palestinian business#Freddy Zebara#new york#queens nyc#nyc#falafel#food#cultural food#ceasefire#permanent ceasefire#foodie#palestinian food#usa#america

2K notes

·

View notes

Text

Two weak spots in Big Tech economics

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me in AUSTIN on Mar 10. I'm also appearing at SXSW and at many events around town, for Creative Commons, Fediverse House, and EFF-Austin. More tour dates here.

Big Tech's astonishing scale is matched only by its farcical valuations – price-to-earnings ratios that consistently dwarf the capitalization of traditional hard-goods businesses. For example, Amazon's profit-to-earnings ratio is 37.65; Target's is only 13.34. That means that investors value every dollar Amazon brings in at three times the value they place on a dollar spent at Target.

The fact that Big Tech stocks trade at such a premium isn't merely of interest to tech investors, or even to the personal wealth managers who handle the assets of tech executives whose personal portfolios are full of their employers' stock options.

The high valuations of tech stocks don't just reflect an advantage over bricks and mortar firms – they are the advantage. If you're Target and you're hoping to hire someone who's just interviewed at Amazon, you have to beat Amazon's total compensation offer. But when Amazon makes that offer, they can pay some – maybe even most – of the offer in stock, rather than in cash.

This is a huge advantage! After all, to get dollars, both Amazon and Target have to convince you to spend money in their stores (or, in Amazon's case, with its cloud, or as a Prime sub, etc etc). Both Amazon and Target get their dollars from entities outside of the firm's four walls, and the dollars only come in when they convince someone else to do business with them.

But stock comes from inside the firm. Amazon makes new Amazon shares by typing zeroes into a spreadsheet. They don't have to convince you to buy anything in order to issue that new stock. That is their call, and their call alone.

Amazon can buy lots of things with stock – not just the labor of in-demand technical workers who command six-figure salaries. They can even buy whole companies using stock. So if Amazon and Target are bidding against one another for an anticompetitive acquisition of a key supplier or competitor, Amazon can beat Target's bid without having to spend the dollars its shareholders would like them to divert to dividends, stock buybacks, etc.

In other words, a company with a fantastic profit/earning ratio has its own money-printer that produces currency that can be used to buy labor and even acquire companies.

But why do investors value tech stocks so highly? In part, it's just circular reasoning: a company with a high stock price can beat its competitors because it has a high stock price, so I should buy its stock, which will drive up its stock price even further.

But there's more to this than self-fulfilling prophecy. The high price of tech stocks reflects the market's belief that these companies will continue to grow. If you think a company will be ten times bigger in two years, and it's only priced at three times as much as mature rivals that have stopped growing altogether, then that 300% stock premium is a bargain, because the company will have 1,000% growth in just a couple years. Tech companies have proven themselves, time and again, to be capable of posting incredible growth – think of how quickly Google went from a niche competitor to established search engines to the dominant player, with a 90% market share.

That kind of growth is enough to make anyone giddy, but it eventually runs up against the law of large numbers: doubling a small number is easy, doubling a large number is much, much harder. A search engine that's used by 90% of the world can't double its users – there just aren't enough people to sign up. They'd need to breed several billion new humans, raise them to maturity, and then convince them to be Google users.

And here's the thing: the flipside of the huge profits that can be reaped by investors who buy stocks at a premium in anticipation of growth is the certainty that you will be wiped out if you're still holding the stock when the growth halts. When Amazon stops growing, its PE ratio should fall to something like Target's, which means that its stock should decline by two thirds on that day.

Which is why Big Tech investors tend to be twitchy, hair-trigger types, easily stampeded into mass selloffs. That's what happened in 2022, when Facebook admitted to investors that it had grown more slowly than it had projected, and investors staged the largest stock selloff in history (to that point – hi, Nvidia!), wiping a quarter-trillion dollars off Meta's valuation in a day:

https://www.forbes.com/sites/sergeiklebnikov/2022/02/03/stocks-plunge-after-facebooks-massive-sell-off-nasdaq-falls-37/

As Stein's Law has it: "anything that can't go on forever eventually stops." Growth stocks have to stop growing, eventually, and when they do, you'd better beat everyone else to the fire exit, or you're going to get crushed in the stampede.

Which is why tech companies are so obsessed with both actual growth, and stories about growth. Facebook spent tens of billions on bribes to telcos around the world, demanding that they charge extra to access non-Facebook websites and apps, in a bid to sign up "the next billion users":

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

That wasn't just about some ideological commitment to growth – it was about the real, material advantages that a growing company has, namely, that it can substitute the stock it creates for free by typing zeroes into a spreadsheet for money that it can only get by convincing you to give your money to it.

"Facebook Zero" (as this bribery program was called) was about actual growth: finding people who weren't Facebook users and turning them into Facebook users, preferably forever (thanks to Facebook's suite of lock-in tactics that make it a digital roach motel that users check into but don't check out of):

https://www.eff.org/deeplinks/2021/08/facebooks-secret-war-switching-costs

But plenty of the things that Big Tech gets up to are about the narrative of growth. That's why Big Tech has pumped every tech bubble of this stupid decade: metaverse, cryptocurrency, AI. These technologies have each been at the forefront of Big Tech marketing and investor communications, but not solely because they represented a market opportunity. Rather, they represented a more-or-less plausible explanation for how these companies that were on the wrong side of the law of large numbers could continue to double in size, without breeding billions of new customers to sign up for their services.

The tell – as always – comes in the way that these companies refute their critics. When critics point out that Facebook spent $1.2 billion on a metaverse product that only has 32 users:

https://futurism.com/the-byte/metaverse-decentraland-report-active-users

Or that practically no one buys anything with cryptocurrency:

https://www.mollywhite.net/annotations/latecomers-guide-to-crypto/

Not even when the government gives them free crypto and passes a law forcing merchants to accept crypto:

https://bitcoinblog.de/2024/09/02/weak-bitcoin-adoption-in-el-salvador-disappoints-the-president/

Or that hardly anyone uses AI, and what uses it does have are often low-value:

https://www.wheresyoured.at/oai-business/

The "narrative entrepreneurs" behind the claims of infinite growth from these technologies all have the same response: "That's what they said about the web, and yet it grew really fast! People who lacked the vision to understand the web's potential missed out. Buy [crypto|metaverse|AI] or have fun being poor!"

It's true – there were a lot of people who were blithely dismissive of the web, and they were wrong. But the fact that the web's skeptics were wrong doesn't mean that skepticism itself is foolish. People were also skeptical of Qibi, Beanie Babies, and the Segway – all of which were predicted to continue to increase in value forever and become permanently installed as significant facts in the economy. The fact that lots of people think something is stupid is not a reliable indicator that it is actually great.

So it's not just that capitalism adopts "the ideology of a tumor" in insisting that infinite growth is possible. The value in corporate claims to eternal growth is not aesthetic, it is material. If the market believes a company will grow, then that company gets to print its own money, which lets it outcompete mature rivals, which lets it grow some more.

But! When the company runs out of growth potential, the process runs in reverse. Not only do executives – whose portfolios are stuffed full of their own company's shares – stand to lose most of their net worth overnight, but once a company's stock starts to decline, it can expect to see an exodus of the key personnel who are compensated in now-worthless stock. That means that once a company hits a bad bump in the road that sets it off course, it needs to worry about losing all the skilled employees who can get it back on the road.

So growth is important, not for its own sake, but for how it affects the cost basis of companies, and thus determines their competitive outlook. But not all growth is created equal.

Remember when Facebook pissed away billions in a bid to capture "the next billion users"? Those users – people from poor countries in the global south – were not as valuable to Facebook as its US customers. The news that sparked a $250 billion, one-day selloff of Facebook shares wasn't merely about anemic growth – it was specifically about anemic growth in the USA.

American customers are worth more than other users to Big Tech – that's true even of users from other populous countries, and of users from other wealthy countries. Norway is rich as hell, but each Norwegian Facebook user is worth pennies on the kroner compared to American users. And there are brazilians of people in South America, but they're worth even less per capita than Norwegians are. Even the whole EU, with its 500m+ relatively wealthy consumers, is only worth a fraction of the US market.

Why is the American market so prized by Big Tech? Because it the only country in the world at the center of a Venn diagram with three overlapping circles. America is the only country in the world that is:

a) populous;

b) wealthy; and

c) totally lacking in legal privacy protections.

The US Congress last updated American consumer privacy law in 1988, when the Video Privacy Protection Act was passed to protect Americans from the high-tech threat of…video store clerks leaking your rental history to the newspapers. Despite the bewildering, obvious, serious privacy risks that have emerged since Die Hard was in theaters, Congress has done nothing to extend Americans' consumer privacy rights.

There are other rich countries where privacy law sucks, but they are small countries with few people. There are extremely populous poor countries with shitty privacy laws, but they're poor. Tech has to steal the private data of dozens of those people to make as much money as they can get from selling the data of just one American. And there are other rich, populous countries – like Germany, say – but those countries actually defend the privacy of the people who live there, and so the revenue tech gets from each of those users is even lower than the RPU for the undefended poor people of the global south.

America is exceptional in that it represents the one place where there are lots of wealthy people who are totally defenseless. We're an all-you-can-eat buffet for the privacy-annihilating voyeurs of Silicon Valley.

These are the two dirty secrets of Big Tech's economics. These companies are reliant on the fragile narrative of infinite growth, and that narrative isn't merely about global growth, but it is particularly and especially about growth in the USA.

Tech's power comes from an implausible story of discovering an endless stream of Americans to sign up and screw over. That story is extremely load-bearing – so much so that by the instant at which the first crack appears, collapse is only moments away. And boy, are there cracks:

https://www.wheresyoured.at/power-cut/

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/03/06/privacy-last/#exceptionally-american

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#privacy first#usa usa usa#bubblenomics#economics#business#big tech#monopolies#financialization#privacy#surveillance advertising#commercial surveillance#ai#metaverse#stock swindles#cryptocurrency

242 notes

·

View notes

Text

even a 6’2” athlete can look sultry sometimes 😌

#anti trans#mtf trans#trans#trans artist#trans beauty#trans community#trans cult#trans girl#trans goddess#trans man#transformation#transgender#transsexual#transparent#transformers#transfem#trans nsft#trans pride#trans rights#trans woman#transgirl#transisbeautiful#transmasc#trans is sexy#trans guy#trans onlyfans#trans owned business#trans feedee#trans is beautiful#trans usa

217 notes

·

View notes

Text

⠀ Economists have repeatedly warned that the second Trump administration will be a boon to the ultra wealthy and a backslide for everyone else. Elon Musk is in agreement, and he wants regular Americans to just suck it up. Under Trump, Musk will not only be granted a tax boon, but a position in the federal government where his decisions would — by his own admission — steamroll Americans desperate for economic stability.

#elon musk#trump#politics#government#us politics#America#USA#donald trump#democracy#republicans#democrats#GOP#American politics#aesthetic#election#elections#beauty-funny-trippy#Washington DC#maga#conservatives#vote#voting#presidential election#oligarchy#news#current events#economy#economics#finance#business

128 notes

·

View notes

Text

soulmates

#valentine's day is for all kinds of love#which is a good thing because no one knows wtf these four have going on#i don't think they know either#they're too busy solving crimes#i love them so much they all deserve all the hugs and kisses#shawn spencer#burton guster#juliet o'hara#carlton lassiter#polyclue#psych#psych usa#psych tv#psych tv show#psych 2006#valentine's day#my art#my posts#remember to click on the picture for better quality!

136 notes

·

View notes

Text

Injunction lifted on Trump executive orders slashing federal DEI support

#world news#breaking news#news usa#news#usa politics#politics#american politics#usa news#business usa

0 notes

Text

McConnell Announces He Won’t Seek Re-election

#auto news#bbc news#bitcoin news#celebrity news#business news#breaking news#crypto news#entertainment news#news#politics#usa news#us politics#donald trump#public news#news update#world news#inauguration#star trek#fuck trump#president trump#trump administration#trump#trump 2024#trump inauguration#trump supporters#trump tariffs#america#jd vance#dump trump#trumps

68 notes

·

View notes

Text

Indian Prime Minister Narendra Modi hailed a "mega partnership" with the US during his meeting with President Donald Trump, announcing a deal to boost US oil and gas imports to India, aiming to reduce the trade deficit. Modi expressed openness to lowering tariffs, repatriating undocumented Indians, and purchasing US fighter jets, while Trump criticized India's high trade tariffs as a "big problem."

The leaders also discussed immigration, with Trump agreeing to extradite a suspect in the 2008 Mumbai attacks. Despite trade tensions, both emphasized strengthening ties, with Modi playfully adapting Trump's slogan: "Maga plus Miga equals Mega partnership for prosperity."

#general knowledge#generalknowledge#affairsmastery#current events#current news#upscaspirants#upsc#india#generalknowledgeindia#world news#india news#breaking news#news#government#business news#pm modi#modi#narendra modi#trumps#donald trump#president donald trump#trump administration#trump#america#jd vance#president trump#usa news#us politics#politics#usa

55 notes

·

View notes

Text

An update to an older story that’s goods news!

When Jenny Nguyen signed the lease to create her dream bar, she wasn’t sure it would stay open for more than a few months.

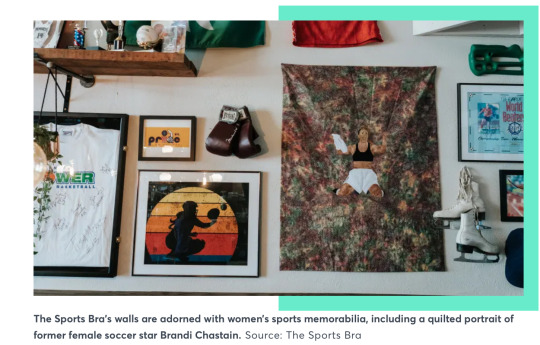

But earlier this month, 43-year-old Nguyen’s first-of-its-kind establishment in Portland, Oregon, celebrated its one-year anniversary. Aptly named The Sports Bra, it’s a sports bar where only women athletes appear on the TVs.

Business has been good, despite the niche business model and record inflation sending food and beverage prices soaring. The Sports Bra brought in $944,000 in revenue in the eight months it was open in 2022, according to documents reviewed by CNBC Make It.

It was profitable in that first year of business, Nguyen adds.

“It turns out, it’s pretty universal — that feeling of being a women’s sports fan and going into a public place, like a sports bar, and having a difficult time finding a place to show a [women’s] game, especially when there are other men’s sports playing,” Nguyen says.

Initially, she wasn’t sure the idea would work at all. The vast majority of money and attention historically goes to men’s sports only — a big reason why The Sports Bra was reportedly the country’s first bar to only play women’s sports on TV.

It’s also not the kind of thing Nguyen would ordinarily do: She describes herself as “very cautious, risk averse.” But her obsession with women’s sports and frustration with its lack of representation on television screens drove her to empty her life savings — about $27,000 — and give it a try.

“Me, personally, I thought the idea was brilliant and that [it was] what the world needs,” Nguyen says. “But I had no idea that the world would want it. I just wanted to give it a shot.”

How The Sports Bra went from running joke to reality

Nguyen is a lifelong basketball fan who played the sport at Clark College in Vancouver, Washington, before tearing her ACL. She’s also a longtime restaurant worker who spent three years as Reed College’s executive chef.

In 2018, Nguyen and a group of friends wanted to watch the NCAA women’s basketball championship game. They went to a mostly empty sports bar and still had to plead with a bartender to switch one of the smallest TVs — which played without sound — from a men’s sport to the women’s championship game, she recalls.

Together, they jumped up and down celebrating “one of the best games I’ve ever seen,” Nguyen says, as a buzzer-beating three-point shot sealed the championship title for Notre Dame. Afterward, she was struck by the normalcy of her situation.

″[We’d] gotten so used to watching a game like that in the way that we did,” she says, adding that they’d only find better viewing conditions “if we had our own place.”

Days later, she channeled her disappointment into a hypothetical: What would she name her bar? “The very first thing that came into my mind was The Sports Bra,” Nguyen says. “And once I thought it, I couldn’t un-think it, you know? It was catchy. I thought it was hilarious.”

For years, she joked about it. Then, the fallout from social justice movements like #MeToo and the country’s racial reckoning after George Floyd’s murder left her wanting to make a meaningful impact on the world and her community.

Nguyen, who came out as a lesbian at age 17, says she doesn’t always feel welcome at most traditional sports bars. The Sports Bra could help her, and anyone else who’d rarely felt accepted in other sports establishments, feel like she belonged.

“I thought about, if we can even get one kid in here and have them feel like they belong in sports, it’d be worth it,” she says.

Helping other women’s sports bars get started

At first, Nguyen had her savings, and $40,000 in loans cobbled together from friends and family. That would keep The Sports Bra afloat for three months, based on her cost estimates for labor, inventory and other overhead.

In February 2022, she launched a Kickstarter to raise $48,000 — enough money for an extra six-month financial cushion, to build up the sort of regular clientele any bar or restaurant needs to survive long-term.

To Nguyen’s surprise, the campaign raised more than $105,000 in just 30 days, thanks to a viral article in online food publication Eater. “At that moment, when I was looking at that Kickstarter graph, I thought to myself, ‘This might work,’” she says.

But the money, which came from around the country and world, was no guarantee of success. Actual people in Portland still needed to frequent the bar.

Today, there’s often a line out the door. Women’s basketball icons like Sue Bird and Diana Taurasi showed up, for an event sponsored by Buick, earlier this month. Ginny Gilder, co-owner of the WNBA’s Seattle Storm, has even waited in line to watch her team play on The Sports Bra’s TVs, Nguyen says.

That’s a far cry from the Kickstarter days, which Nguyen says only happened after she was denied business loans by multiple banks and small business associations. The denials commonly cited the high risk of a unique concept run by a first-time entrepreneur during a pandemic, she adds.

Even the bar’s core concept is a struggle: It’s hard to find enough women’s sporting events to fill up the televisions. Only about 5% of all TV sports coverage focuses on female athletes, according to a 2021 University of Southern California study.

Nguyen says she’s taken to reaching out directly to sports networks and streaming services, some of which have hooked her up with access to more women’s sports content. She also spends an inordinate amount of time “scouring” TV listings, a process she likens to “taking a machete and chopping through a jungle.”

But she’s no longer alone. Another bar specializing in women’s sports has opened in nearby Seattle, and Nguyen says she’s in touch with a handful of other prospective entrepreneurs asking her for advice on opening similar visions in other cities.

“I would love to have as many people experience the feeling people experience when they walk through these doors,” she says. “It feels very selfish to keep it to this one building that holds 40 people at a time.”

#USA#oregon#Portland#jenny nguyen#The Sports Bra#A sports bar for women and women’s sports#She was originally denied business loans

1K notes

·

View notes

Text

i took a break from suits because the only reason i was there in the first place was for how absolutely batshit insane harvey specter is when it comes to mike ross and once mike went to prison i kinda went okay i think the shows run its course for me byeeee

anyway i just started s6 and i'm happy to see harvey specter is still batshit insane for mike ross

#threatening gallo like that because he got under his skin about mike omggggg#harvey please be normal about mike ross for like 2 seconds#(i'm kidding never ever be normal about that annoying little twink)#i didn't really plan on picking it back up tbh#but i saw some marvey shit that takes place in s6#and threw my hands up like I GUESS and opened netflix#i'm probably gonna stop watching after this season because i heard it just gets worse lmao#my theory that shows get Bad after their 5th season has yet to be disproven#i'm still in that ao3 tag like no ones business though don't get it twisted#still want them to fuck nasty in the back of ray's car LOL#can i tag this as#marvey#suits usa#harvey specter#mike ross

127 notes

·

View notes

Text

Psych (season 5, episode 6): Viagara Falls

THEYRE SO FREAKING ADORABLE ACTUALLY

#psych usa#psych#shawn and gus#shawn spencer#burton guster#bruton gaster#besties#me n my bestie#shenanigans#I wonder if I’ll be like them when I’m 30#how does one actually become a business owner#genius who’s an idiot#or#an idiot who’s a genius

42 notes

·

View notes

Text

when you’re being mean to me this is who you’re being mean to

#anti trans#mtf trans#trans#trans artist#trans beauty#trans community#trans cult#trans girl#trans goddess#transgender#transformation#transparent#transsexual#transformers#trans man#trans nsft#trans pride#trans rights#trans woman#transfem#transgirl#transisbeautiful#transmasc#trans usa#trans is sexy#trans guy#trans oc#trans onlyfans#trans owned business#trans omo

166 notes

·

View notes

Text

Trump's Press Secretary Accidentally Blurts Out Real Goal of His Tariff Scam, then Later, Lies to Americans about How Tariffs Work

"In his speech to Congress, President Trump kept lying about his tariffs, falsely claiming that Canada is letting huge amounts of fentanyl into our country and suggesting the trade wars will only get worse. Then press secretary Karoline Leavitt told reporters directly that if Canada wants to avoid tariffs in the future, it should become the fifty-first U.S. state.

She revealed it: Trump’s tariffs are not about fentanyl or any supposed unfair treatment of the U.S. They’re about forcing Canada, with no justification whatsoever, to submit to his will. Newsflash: It’s not OK for the American president to lie relentlessly about our allies and threaten them with economic Armageddon to bend them to his deranged, passing whims." (source)

The Trump administration is still trying to gaslight Americans into believing that tariffs will be good for the economy, even as the stock market hemorrhages cash. White House press secretary Leavitt got into a heated back-and-forth with an Associated Press reporter on Tuesday, in which she revealed that she really doesn’t understand how tariffs affect consumers—or at least is totally willing to lie about it. (source)

When asked why Trump isn't trying to lower prices like he promised, but instead, is raising prices with higher taxes in the form of tariffs, Leavitt said “He’s actually not implementing tax hikes. Tariffs are a tax hike on foreign countries, ...Tariffs are a tax cut for the American people.”

She blatantly lied. Tariffs are not paid by the foreign countries selling the goods. They are a type of sales tax paid by the American businesses buying the goods. That increase in cost is generally passed on to you, the consumer. Simply put, tariffs are hidden taxes that siphon money out of your wallet, and into the federal government.

Even Donald Trump has admitted that his tariffs will destabilize the economy, but has repeatedly dodged questions about whether his tariffs would dive the U.S. headlong into a recession. Trump's own lack of confidence in his handling of the economy sent the stock market into a tail spin.

It seems Trump is using tariffs to kill two birds with one stone. He's willing to risk economic hardship on the American people, taking money out of our wallets, in order to make up for the huge tax cuts he promised his billionaire buddies, and to coerce other countries to submit to his will.

As usual, when Trump gets his way — WE all have to pay.

#news#economy#economics#karoline leavitt#trump#politics#government#us politics#America#USA#donald trump#democracy#republicans#democrats#American politics#election#aesthetic#beauty-funny-trippy#Washington DC#conservatives#vote#voting#presidential election#current events#capitalism#tariffs#foreign policy#important#business#finance

73 notes

·

View notes