#Bureau!

Explore tagged Tumblr posts

Text

"The Protectorate" remains an odd thing to have called the superhero organization because it's kind of the inverse of what I understand a protectorate to be. The Protectorate being that which is protected, I.E. the civilian body, vs that which does the protecting. It makes sense if you treat it as an extension of what they were going for with the Wards Program, for whom the pitch is very much "if you join you will be a protected ward of the government." Like if the Protectorate is called that because of a safety-in-numbers pitch, I'd get it. Thematically that's pretty rich for the same reason the Wards are rich, and more, too, because it also foreshadows the rank-closing, ass-covering behavior The Protectorate so freely displays during the events of the story proper. But that's also kind of an odd thing to bake into the branding so foundationally in-universe. "Here's our nationwide superhero franchise, known as The Guys Who We're Protecting." Cause now you're inviting the question of who's protecting them, and what from. (I wonder if that observation caught on as rhetoric for the conspiracy crank set on PHO.)

#similar gripe regarding the parahuman response TEAM#the TEAM?#A team is like maybe ten people!#Department!#Bureau!#Division!#thoughts#meta#late night ramblings

111 notes

·

View notes

Text

#consumer protection bureau#space Karen#elongated muskrat#Elonia#corporate greed#oligarch greed#union buster#Tesla blows

2K notes

·

View notes

Text

#control 2019#alan wake#fbc#twitter#Remedy Entertainment#remedyverse#federal bureau of control#funny#video games#anime#unibomber

3K notes

·

View notes

Text

House Beautiful Weekend Homes, 1990

#vintage#vintage interior#1990s#90s#interior design#home decor#bathroom#clawfoot tub#antique#armchair#bureau#wicker basket#tile#striped#wallpaper#country#cottage#style#House Beautiful#home#architecture

1K notes

·

View notes

Text

🐸🚨New Frog Just Dropped!🚨🐸

Meet the ✨Most Beautiful Tree Frog✨, Guibemantis pulcherrimus, a new species described by my colleagues and me in the journal Zootaxa this week. The scientific name 'pulcherrimus' literally means 'most beautiful'. It's a close relative of Guibemantis pulcher (just 'beautiful', ha!), but has more little spots and less pronounced lateral blotches. It's found in the northeast of Madagascar, where it lives in Pandanus screw-palms.

#zoology#science#animals#beautiful#frogs#Guibemantis#Guibemantis pulcherrimus#the most beautiful frog#like if you agree#reblog if you disagree#save as PDF and email to your grandmother to share the good news#fax to your nearest Bureau of Outdated Technology to make sure they don't miss out

7K notes

·

View notes

Text

bitter tea & oranges

sequel -> tea & dates

#inspired by the amount of time i spent just standing in jerusalem bureau#and my hc that malik would drink bitter medicinal teas to help with chronic pain#also my hc is that altair has chronic pain. so hes familiar how to deal with it#sort of a peace offering to offer orange to counteract the bitter tea#peeling oranges as an act of love ok ty#THIS WAS SUPPOSED TO BE A WARM UP the ghost of altair possessed me to draw malik lovingly#my art#asscreed#assassin's creed 1#assassins creed 1#assassins creed#assassin's creed#altair ibn la'ahad#altaïr ibn la'ahad#malik al sayf#altmal#ac1#ac#ac 1#i will never shut up about jerusalem bureau being my safe place rn#altaïr visiting malik. he can scold me however much he wants. atleast he still sees me as someone worth talking to#maliks hatred recognising altair as his own existence vs al mualims adoration of altair like a well kept weapon

2K notes

·

View notes

Text

Cannot believe I just fucking realised this

#phineas and ferb#milo murphy's law#pnf#mml#ferb fletcher#balthazar cavendish#vinnie dakota#bureau of time travel#bott#dwampyverse

645 notes

·

View notes

Text

Shifting $677m from the banks to the people, every year, forever

I'll be in TUCSON, AZ from November 8-10: I'm the GUEST OF HONOR at the TUSCON SCIENCE FICTION CONVENTION.

"Switching costs" are one of the great underappreciated evils in our world: the more it costs you to change from one product or service to another, the worse the vendor, provider, or service you're using today can treat you without risking your business.

Businesses set out to keep switching costs as high as possible. Literally. Mark Zuckerberg's capos send him memos chortling about how Facebook's new photos feature will punish anyone who leaves for a rival service with the loss of all their family photos – meaning Zuck can torment those users for profit and they'll still stick around so long as the abuse is less bad than the loss of all their cherished memories:

https://www.eff.org/deeplinks/2021/08/facebooks-secret-war-switching-costs

It's often hard to quantify switching costs. We can tell when they're high, say, if your landlord ties your internet service to your lease (splitting the profits with a shitty ISP that overcharges and underdelivers), the switching cost of getting a new internet provider is the cost of moving house. We can tell when they're low, too: you can switch from one podcatcher program to another just by exporting your list of subscriptions from the old one and importing it into the new one:

https://pluralistic.net/2024/10/16/keep-it-really-simple-stupid/#read-receipts-are-you-kidding-me-seriously-fuck-that-noise

But sometimes, economists can get a rough idea of the dollar value of high switching costs. For example, a group of economists working for the Consumer Finance Protection Bureau calculated that the hassle of changing banks is costing Americans at least $677m per year (see page 526):

https://files.consumerfinance.gov/f/documents/cfpb_personal-financial-data-rights-final-rule_2024-10.pdf

The CFPB economists used a very conservative methodology, so the number is likely higher, but let's stick with that figure for now. The switching costs of changing banks – determining which bank has the best deal for you, then transfering over your account histories, cards, payees, and automated bill payments – are costing everyday Americans more than half a billion dollars, every year.

Now, the CFPB wasn't gathering this data just to make you mad. They wanted to do something about all this money – to find a way to lower switching costs, and, in so doing, transfer all that money from bank shareholders and executives to the American public.

And that's just what they did. A newly finalized Personal Financial Data Rights rule will allow you to authorize third parties – other banks, comparison shopping sites, brokers, anyone who offers you a better deal, or help you find one – to request your account data from your bank. Your bank will be required to provide that data.

I loved this rule when they first proposed it:

https://pluralistic.net/2024/06/10/getting-things-done/#deliverism

And I like the final rule even better. They've really nailed this one, even down to the fine-grained details where interop wonks like me get very deep into the weeds. For example, a thorny problem with interop rules like this one is "who gets to decide how the interoperability works?" Where will the data-formats come from? How will we know they're fit for purpose?

This is a super-hard problem. If we put the monopolies whose power we're trying to undermine in charge of this, they can easily cheat by delivering data in uselessly obfuscated formats. For example, when I used California's privacy law to force Mailchimp to provide list of all the mailing lists I've been signed up for without my permission, they sent me thousands of folders containing more than 5,900 spreadsheets listing their internal serial numbers for the lists I'm on, with no way to find out what these lists are called or how to get off of them:

https://pluralistic.net/2024/07/22/degoogled/#kafka-as-a-service

So if we're not going to let the companies decide on data formats, who should be in charge of this? One possibility is to require the use of a standard, but again, which standard? We can ask a standards body to make a new standard, which they're often very good at, but not when the stakes are high like this. Standards bodies are very weak institutions that large companies are very good at capturing:

https://pluralistic.net/2023/04/30/weak-institutions/

Here's how the CFPB solved this: they listed out the characteristics of a good standards body, listed out the data types that the standard would have to encompass, and then told banks that so long as they used a standard from a good standards body that covered all the data-types, they'd be in the clear.

Once the rule is in effect, you'll be able to go to a comparison shopping site and authorize it to go to your bank for your transaction history, and then tell you which bank – out of all the banks in America – will pay you the most for your deposits and charge you the least for your debts. Then, after you open a new account, you can authorize the new bank to go back to your old bank and get all your data: payees, scheduled payments, payment history, all of it. Switching banks will be as easy as switching mobile phone carriers – just a few clicks and a few minutes' work to get your old number working on a phone with a new provider.

This will save Americans at least $677 million, every year. Which is to say, it will cost the banks at least $670 million every year.

Naturally, America's largest banks are suing to block the rule:

https://www.americanbanker.com/news/cfpbs-open-banking-rule-faces-suit-from-bank-policy-institute

Of course, the banks claim that they're only suing to protect you, and the $677m annual transfer from their investors to the public has nothing to do with it. The banks claim to be worried about bank-fraud, which is a real thing that we should be worried about. They say that an interoperability rule could make it easier for scammers to get at your data and even transfer your account to a sleazy fly-by-night operation without your consent. This is also true!

It is obviously true that a bad interop rule would be bad. But it doesn't follow that every interop rule is bad, or that it's impossible to make a good one. The CFPB has made a very good one.

For starters, you can't just authorize anyone to get your data. Eligible third parties have to meet stringent criteria and vetting. These third parties are only allowed to ask for the narrowest slice of your data needed to perform the task you've set for them. They aren't allowed to use that data for anything else, and as soon as they've finished, they must delete your data. You can also revoke their access to your data at any time, for any reason, with one click – none of this "call a customer service rep and wait on hold" nonsense.

What's more, if your bank has any doubts about a request for your data, they are empowered to (temporarily) refuse to provide it, until they confirm with you that everything is on the up-and-up.

I wrote about the lawsuit this week for @[email protected]'s Deeplinks blog:

https://www.eff.org/deeplinks/2024/10/no-matter-what-bank-says-its-your-money-your-data-and-your-choice

In that article, I point out the tedious, obvious ruses of securitywashing and privacywashing, where a company insists that its most abusive, exploitative, invasive conduct can't be challenged because that would expose their customers to security and privacy risks. This is such bullshit.

It's bullshit when printer companies say they can't let you use third party ink – for your own good:

https://arstechnica.com/gadgets/2024/01/hp-ceo-blocking-third-party-ink-from-printers-fights-viruses/

It's bullshit when car companies say they can't let you use third party mechanics – for your own good:

https://pluralistic.net/2020/09/03/rip-david-graeber/#rolling-surveillance-platforms

It's bullshit when Apple says they can't let you use third party app stores – for your own good:

https://www.eff.org/document/letter-bruce-schneier-senate-judiciary-regarding-app-store-security

It's bullshit when Facebook says you can't independently monitor the paid disinformation in your feed – for your own good:

https://pluralistic.net/2021/08/05/comprehensive-sex-ed/#quis-custodiet-ipsos-zuck

And it's bullshit when the banks say you can't change to a bank that charges you less, and pays you more – for your own good.

CFPB boss Rohit Chopra is part of a cohort of Biden enforcers who've hit upon a devastatingly effective tactic for fighting corporate power: they read the law and found out what they're allowed to do, and then did it:

https://pluralistic.net/2023/10/23/getting-stuff-done/#praxis

The CFPB was created in 2010 with the passage of the Consumer Financial Protection Act, which specifically empowers the CFPB to make this kind of data-sharing rule. Back when the CFPA was in Congress, the banks howled about this rule, whining that they were being forced to share their data with their competitors.

But your account data isn't your bank's data. It's your data. And the CFPB is gonna let you have it, and they're gonna save you and your fellow Americans at least $677m/year – forever.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/11/01/bankshot/#personal-financial-data-rights

#pluralistic#Consumer Financial Protection Act#cfpa#Personal Financial Data Rights#rohit chopra#finance#banking#personal finance#interop#interoperability#mandated interoperability#standards development organizations#sdos#standards#switching costs#competition#cfpb#consumer finance protection bureau#click to cancel#securitywashing#oligarchy#guillotine watch

464 notes

·

View notes

Text

i feel like. Certain books being published these days. You can smell the reylo fanfic writer circa 2016 off them

2K notes

·

View notes

Text

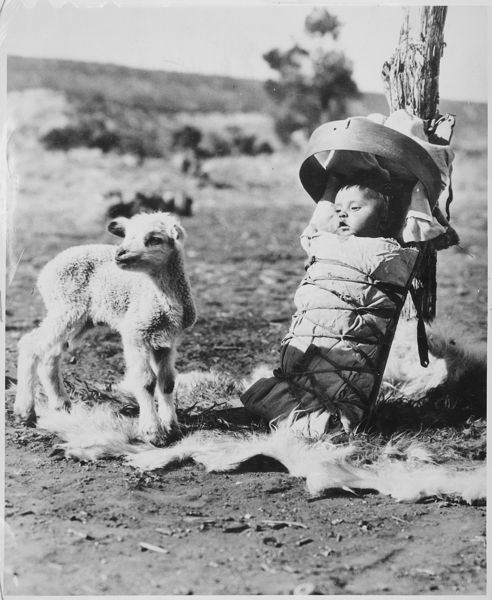

Navajo papoose on a cradleboard with a baby lamb, Window Rock, AZ, 1936. 🐑

Records of the Bureau of Indian Affairs (NARA ID 519160).

#Native American Records#Native American#Navajo#Bureau of Indian Affairs#National Archives#Research#History#Records

435 notes

·

View notes

Text

Please Post Conspicuously. People, please consider the humble carp. It is easily digestible. Also, it can be cooked in such a way as to remove the muddy taste. Catch the carp! Buy the carp! Make carp jelly! Give it for the holidays! Keep it as a pet! Wear it as a hat!

CARP!

Brought to you by the United States Bureau of Fisheries, 1911.

#1911#United States Bureau of Fisheries#1900s#CARP!#carp loves you and you love it#vintage advice#PSA#vintage psa

319 notes

·

View notes

Text

chayanne is havign a great time

3K notes

·

View notes

Text

Warm Springs wild horse gather

By Bureau of Land Management Oregon & Washington

#bureau of land management oregon & washington#photographer#flickr#wild horse herd#herd#horses#animal#mammal#wildlife#nature#warm springs

337 notes

·

View notes

Text

Diana Rigg (1969)

#diana rigg#photoshoot#photography#the assassination bureau#60s movies#adventure movies#promotional stills#sixties#1969

355 notes

·

View notes

Text

Unmatched blue tones on a painted chair, slipper chair, and loveseat pillows lend the bedroom a casual air.

House Beautiful Color, 1993

#vintage#interior design#home#vintage interior#architecture#home decor#style#1990s#bedroom#French#mirror#bureau#blue#distressed#furniture#wallpaper#antique#slipper chair#toile#house plants#country

1K notes

·

View notes