#Budget Expense Management Softwar

Explore tagged Tumblr posts

Link

2 notes

·

View notes

Text

How a Construction Cost Estimating Service Helps in Risk Management

Risk management is a fundamental aspect of any construction project, as unforeseen challenges can lead to cost overruns, delays, and financial losses. One of the most effective ways to mitigate these risks is through a reliable construction cost estimating service. Accurate cost estimation allows contractors, project managers, and stakeholders to anticipate potential risks, allocate resources wisely, and ensure the financial stability of a project. This article explores how construction cost estimating services contribute to effective risk management and enhance project success.

Understanding Risk in Construction Projects

Construction projects involve multiple uncertainties, from fluctuating material costs to unexpected site conditions. Some of the common risks include:

Financial Risks: Cost overruns due to inaccurate estimates, inflation, or unexpected expenses.

Project Delays: Scheduling issues arising from unforeseen circumstances such as labor shortages or material delivery delays.

Legal and Compliance Risks: Issues related to permits, regulations, and contractual obligations.

Design Changes: Modifications made during the project lifecycle that impact costs and timelines.

Safety and Environmental Risks: Accidents, weather conditions, and environmental regulations affecting project execution.

A well-structured construction cost estimating service helps in identifying, assessing, and mitigating these risks before they escalate into costly problems.

Key Ways Construction Cost Estimating Services Help in Risk Management

1. Enhancing Budget Accuracy

Accurate cost estimates form the foundation of financial planning in construction projects. A reliable estimating service considers material costs, labor expenses, equipment needs, and contingency funds, ensuring that the project budget is realistic. By reducing budget uncertainties, contractors can avoid unexpected financial strain and ensure smoother project execution.

2. Identifying Potential Cost Overruns

A detailed cost estimate highlights potential cost overruns before the project begins. By analyzing past project data and industry trends, an estimating service can pinpoint areas where costs are likely to exceed initial expectations. This proactive approach allows project managers to allocate contingency funds appropriately and prevent financial shortfalls.

3. Facilitating Better Resource Allocation

Efficient resource allocation is crucial for minimizing risks in construction projects. A comprehensive cost estimate helps contractors determine the right amount of materials, labor, and equipment required for each phase of construction. This prevents shortages, reduces waste, and ensures that resources are used optimally.

4. Minimizing Schedule Delays

Delays in construction projects often lead to increased costs and client dissatisfaction. A precise cost estimate incorporates realistic timelines and accounts for potential disruptions such as weather delays, labor shortages, or supply chain issues. This foresight allows project managers to implement contingency plans and minimize schedule disruptions.

5. Supporting Contract Negotiations

A construction cost estimating service provides valuable data that strengthens contract negotiations with suppliers, subcontractors, and clients. By having a well-documented cost breakdown, contractors can negotiate better pricing, prevent disputes, and establish clear financial expectations before the project starts.

6. Mitigating Market Fluctuation Risks

The construction industry is highly susceptible to market fluctuations, including changes in material costs and labor rates. Cost estimating services use predictive analytics and historical data to assess these fluctuations and incorporate them into the project budget. This helps contractors prepare for potential price hikes and avoid last-minute financial setbacks.

7. Ensuring Regulatory Compliance

Legal and regulatory compliance is a critical aspect of risk management in construction. An experienced estimating service considers permit costs, environmental impact fees, safety regulations, and other legal expenses to ensure full compliance with local and national laws. This reduces the risk of fines, project delays, and legal disputes.

8. Providing Contingency Planning

Unexpected expenses are inevitable in construction projects. A cost estimating service factors in contingency budgets to cover unforeseen costs such as design modifications, equipment failures, or sudden labor shortages. Having a contingency plan in place ensures that unexpected challenges do not derail the project’s financial stability.

9. Reducing the Risk of Design Errors

Inaccurate estimates can lead to design errors that require costly rework. Construction cost estimating services utilize advanced tools such as Building Information Modeling (BIM) to detect design inconsistencies before construction begins. Identifying potential errors early in the planning stage prevents costly modifications during execution.

10. Enhancing Decision-Making with Data Analytics

Modern cost estimating services leverage big data analytics and AI-driven tools to provide data-backed insights for better decision-making. By analyzing previous project costs, labor productivity rates, and material price trends, estimators can offer more precise forecasts, helping project managers make informed financial and operational decisions.

The Role of Technology in Risk Management Through Cost Estimating

Technological advancements have further improved the risk management capabilities of construction cost estimating services. Some key innovations include:

AI and Machine Learning: These technologies analyze vast amounts of historical data to identify potential risks and predict cost trends.

Cloud-Based Estimating Software: Enables real-time collaboration, ensuring that all stakeholders have access to up-to-date cost data.

BIM Integration: Enhances accuracy by providing detailed visual representations of the project, reducing design-related risks.

Drones and Remote Sensing: Provide accurate site data, reducing uncertainties related to site conditions and topography.

By integrating these technologies, construction firms can improve estimate accuracy, reduce human errors, and enhance overall risk management strategies.

Conclusion

A reliable construction cost estimating service is a critical tool for risk management in construction projects. By providing accurate cost assessments, identifying potential financial risks, and incorporating contingency planning, these services help contractors avoid costly overruns and delays. Additionally, leveraging modern technology enhances the precision and effectiveness of estimating, making it an indispensable asset for successful project execution. Investing in a professional cost estimating service not only improves financial stability but also ensures that construction projects are completed efficiently, safely, and within budget.

#construction cost estimating service#risk management in construction#accurate cost estimation#cost overrun prevention#construction budgeting#financial risk mitigation#project delays solutions#construction project planning#estimating software#AI in cost estimating#BIM technology#cost estimation accuracy#resource allocation in construction#predictive analytics in estimating#market fluctuations in construction#contract negotiation strategies#contingency planning#regulatory compliance in construction#reducing design errors#construction project efficiency#data-driven estimating#cloud-based estimating tools#subcontractor cost estimation#supplier cost management#construction legal risks#unexpected expenses in construction#estimating service benefits#modern construction estimating#AI-driven construction forecasting#improving construction cost control

0 notes

Text

#personal finance#free personal finance software#money management#budgeting#financial planning#financial goals#financial freedom#money saving tips#free budgeting software#free money management tools#personal finance apps#financial software comparison#online budgeting tools#free financial software#financial planning tools#money management apps#best free finance apps#financial independence#free personal finance software for students#best free personal finance software for beginners#free budgeting software for small business#free financial software for tracking expenses#how to choose free personal finance software#free personal finance software comparison

0 notes

Text

From Startup to Success: How Moolamore Cash Flow Forecasting Can Boost Your Business

Wishing you could predict cash flow fluctuations with remarkable accuracy and make brilliant decisions to propel your SME company to unprecedented success?

Say goodbye to all your worries! There is a solution on the way! Enter the revolutionary Moolamore cash flow tool into the picture! Join us on this journey from startup to success as we discover how Moolamore can improve your financial management and decision-making processes! Make sure to read this blog to the end!

#cash flow forecasting for startup#cash flow forecasting tool#best cash flow forecasting software#financial forecasting software#budgeting tool#financial planning software#cash flow management tool#money management tool#business forecasting software#revenue forecasting tool#financial analysis tool#expense tracking software

0 notes

Text

Starting a new business venture is an exhilarating journey, but it’s crucial to lay a strong financial foundation from the outset. This begins with understanding the fundamentals of startup accounting.

#Introduction to Startup Accounting#What is Startup Accounting?#Why is Startup Accounting Important?#Setting Up Your Accounting System#Choosing the Right Accounting Software#Establishing a Chart of Accounts#Understanding Basic Accounting Principles#Managing Startup Finances#Budgeting for Startup Expenses#Tracking Revenue and Expenses#Cash Flow Management#Tax Planning for Startups

0 notes

Text

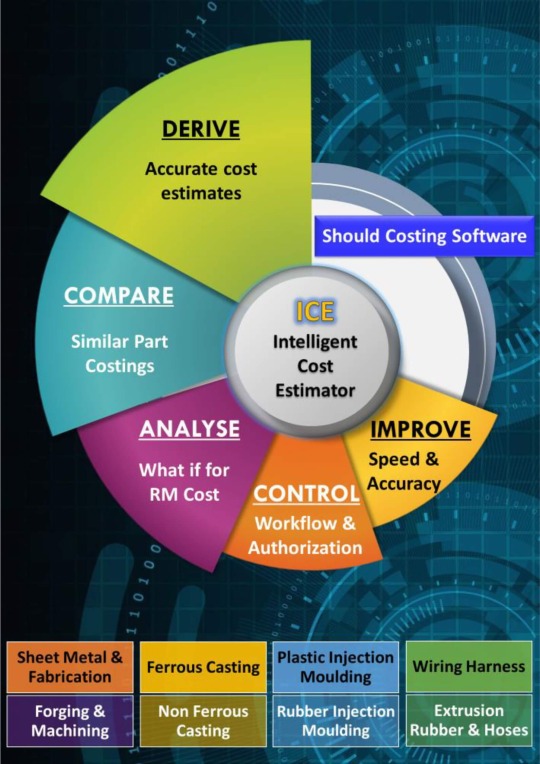

Best Estimating and Costing Software - Cost Masters

Find reliable project cost estimation and optimization with Cost Masters – a trusted provider of estimating and costing software. Streamline your budgeting process with our precise and efficient tools. Eliminate errors and simplify cost management. Learn more about Cost Masters today.

#Estimation and costing software#Cost management tools#Project cost estimation software#Budgeting software solutions#Cost optimization software#Price tracking and analysis tools#Procurement management software#Material cost estimation solutions#Cost calculation software#Project budgeting solutions#Pricing analysis tools#Expense management software#Cost forecasting and planning tools#Profitability analysis software#Resource allocation solutions#Financial planning and analysis software#Cost control and management tools#Spend analysis software

1 note

·

View note

Text

Outsourced bookkeeping services have emerged as a powerful tool for streamlining CPA practices, enabling professionals to focus on what truly matters: delivering exceptional financial advisory and consulting services. As the accounting landscape continues to evolve, embracing the advantages of outsourced bookkeeping can position CPA firms at the forefront of success.

#CPA Bookkeeping#Certified Public Accountant#Financial Accounting#Small Business Accounting#Tax Preparation#Financial Reporting#Ledger Management#Income Statement#Balance Sheet#Cash Flow Analysis#Expense Tracking#Payroll Services#Tax Compliance#Budgeting and Forecasting#Audit Support#Tax Planning#QuickBooks Accounting#Financial Statements#Tax Filing#Accounting Software

0 notes

Text

The 5 Best Budgeting Apps to Keep Your Finances in Check

Keeping your finances in check is essential for financial well-being. Fortunately, there are numerous budgeting apps available to help you track expenses, create budgets, and achieve your financial goals. In this comprehensive guide, we will explore the five best budgeting apps that can revolutionize your money management. Mint Mint is a popular and comprehensive budgeting app that offers a…

View On WordPress

#Budgeting App Reviews#Budgeting Apps#Budgeting Software#Expense Trackers#Financial Apps#Financial Planning Tools#Money Apps#Money Management Apps#Personal Finance Apps#Saving Apps

0 notes

Text

Maximizing Your Film's Financial Potential: A Complete Budgeting Handbook

🎥📊 Ready to take your film to the next level? Check out our new budgeting handbook to maximize your financial potential! 💰🤑 #filmfinance #budgetinghandbook #financialpotential

If you’re planning to create a film, it’s important to have a clear understanding of your finances. Budgeting is a crucial aspect of filmmaking, as it ensures that you have enough resources to bring your vision to life. With the right approach, you can maximize your film’s financial potential and create a masterpiece that captivates your audience. In this budgeting handbook, we’ll cover all the…

View On WordPress

#budget allocation#budget analysis#budget forecasting#budget management#budget planning#budget preparation#budget software#budget template#budgeting handbook#budgeting tips#cost estimation#cost management#expense tracking#film accounting#film budgeting#film finance#film funding#film industry#film production#filmmaking#financial control#financial planning#independent film#money management#movie budget#production budget#project budget

1 note

·

View note

Note

Hello Nicholas!

I hope this isn't a weird question, but I saw in one of your posts that you used to be in a huge amount of debt and now you're living more comfortably- how did you manage to get out of debt? I feel like every time I start even trying to figure out where to start, it's just all too big to ever get out from under. Do you have any advice for me?

Hope you have a great day!

Hey there! Yes, from about 2007-2010 (before I transitioned), I was making less than $10k/year. I defaulted on all my credit cards, exhausted my retirement, and nearly lost my house. It sucked, and in 2024, I'm finally start to feel somewhat secure. What I learned (assuming living in the US, I also did not have student loan debt):

I had to first figure out the sources of my debt. A big chunk of it was because of bad spending habits due to mental illness (hoarding + retail therapy when I was dysphoric/depressed). Another chunk was from being in an abusive friendship. Another, from being unemployed. And the last, was general capitalism (this was during the housing crisis.)

I started working on improving myself to curb behaviors that led to debt. I started working on my hoarding. I started transition to improve my mental health (had to sell some stuff to afford HRT). It took until 2015 to ditch my abuser, alas.

I started working on new job skills. I swallowed my pride and got an office job after a failed 3-year stint at freelancing. It was shitty, but enough to take care of my income emergencies -- keeping my house out of foreclosure. I got a better job 8 months later. It also sucked and I was in it for 7 years, but eventually changed industries and that's when my career took off. Because with each new job, I've gotten better and better pay.

I started using budgeting software. YNAB is my favorite. I try to account for every single dollar I have.

I started spending smarter. Food was the expense I had the most control over. I went to the salvage grocery store (you can find non-expired stuff if you hunt) and bought the "ugly" produce 1 day away from rotting from the local markets. I actually managed to eat well once I found these grocery stores, and my food bill became a fraction of what it'd been at typical grocery stores. I do wish that I had given food pantries a shot, but I was in denial about my poverty at the time.

I sold a ton of useless crap. I got rid of a good chunk of my nerd "collectibles". I only miss a few things over a decade later.

I negotiated with my debt collectors. I managed to set up payment plans with my credit card companies, condo association, and the IRS. I also did a debt consolidation loan once I qualified and was sure I could commit to the monthly payments. It forced me to be super strict about my budget and for about 5 years I didn't buy much for myself. It sucked, but I cleared a bunch of debt that way.

I got help from my family. I was embarrassed to tell my family about my predicament, but it became impossible to hide. I got help cleaning out my hoard and my mother has gracefully given me generous cash gifts every now and then. Never enough to be life-changing, but enough to give me a mental breather.

I played the credit score game. This one seems counter-intuitive, and requires some self-control about not abusing credit cards. Many people recommend the "snowball" method for paying off cards (pay off your lowest debt asap, then go to the next one), but I went with a "credit utilization" method (bring my highest used cards down to the next utilization level, then move to other cards) so I would see immediate changes in my credit score. What is credit card utilization? It's the percentage of how much of your credit card you're using. A card with a $1,000 limit and $100 on it = 10% utilization. Your credit score changes when you cross the following thresholds: 90%, 70%, 50%, 30%, 10%. Once my credit score started going up past 400 (especially as defaults started falling away), I applied for a secured card. As I started using that better, I applied for a few more cards, then for credit line increases every 6 months. My car insurance rates were tied to my credit score, so as soon as that improved, I switched companies and saved money there.

Mistakes I made:

Being in denial that I was poor. I didn't really look for resources on how to live while in poverty. This hurt me a lot because I ended up neglecting myself out of pride, which made my situation even worse.

Payday loans. I got stuck in the payday cycle for about 8 years. I wish I had sold more stuff or asked family for money to have never needed that initial loan. Once you are in the cycle, it becomes very difficult to get out.

Not going to a food bank.

Not asking for help sooner. And not just financial help.

Not getting out of abusive situations sooner. This is hard, and I sympathize with anyone in a similar position. But if you think it's time to move on, trust your gut - don't sacrifice yourself for people who don't care about you.

Ignoring debt collectors, because I was too afraid to negotiate for a plan. The IRS was so patient with me in the end, even after defaulting twice on plans.

Not considering getting a roommate to reduce costs, or not thinking of doing more things like shared meals with my fellow poor friends. Again, denial and pride. Humility is not a bad word and I wished I had learned it sooner.

Not changing jobs sooner. Curbing my hoarding and getting a better job are responsible for about 90% of me being where I am financially today.

Getting out of debt is a marathon. It took over a decade for me, and I am *still* feeling the sting of poverty. I wish you the best of luck. Folks are welcome to tack on specific tricks and strategies -- this is just a general outline of my particular journey.

#chit chat#my most toxic traits at the time were individualism and stoicism and by god they nearly killed me

134 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

January 1, 2025

Heather Cox Richardson

Jan 01, 2025

Twenty-five years ago today, Americans—along with the rest of the world—woke up to a new century date…and to the discovery that the years of work computer programmers had put in to stop what was known as the Y2K bug from crashing airplanes, shutting down hospitals, and making payments systems inoperable had worked.

When programmers began their work with the first wave of commercial computers in the 1960s, computer memory was expensive, so they used a two-digit format for dates, using just the years in the century, rather than using the four digits that would be necessary otherwise—78, for example, rather than 1978. This worked fine until the century changed.

As the turn of the twenty-first century approached, computer engineers realized that computers might interpret 00 as 1900 rather than 2000 or fail to recognize it at all, causing programs that, by then, handled routine maintenance, safety checks, transportation, finance, and so on, to fail. According to scholar Olivia Bosch, governments recognized that government services, as well as security and the law, could be disrupted by the glitch. They knew that the public must have confidence that world systems would survive, and the United States and the United Kingdom, where at the time computers were more widespread than they were elsewhere, emphasized transparency about how governments, companies, and programmers were handling the problem. They backed the World Bank and the United Nations in their work to help developing countries fix their own Y2K issues.

Meanwhile, people who were already worried about the coming of a new century began to fear that the end of the world was coming. In late 1996, evangelical Christian believers saw the Virgin Mary in the windows of an office building near Clearwater, Florida, and some thought the image was a sign of the end times. Leaders fed that fear, some appearing to hope that the secular government they hated would fall, some appreciating the profit to be made from their warnings. Popular televangelist Pat Robertson ran headlines like “The Year 2000—A Date with Disaster.”

Fears reached far beyond the evangelical community. Newspaper tabloids ran headlines that convinced some worried people to start stockpiling food and preparing for societal collapse: “JANUARY 1, 2000: THE DAY THE EARTH WILL STAND STILL!” one tabloid read. “ALL BANKS WILL FAIL. FOOD SUPPLIES WILL BE DEPLETED! ELECTRICITY WILL BE CUT OFF! THE STOCK MARKET WILL CRASH! VEHICLES USING COMPUTER CHIPS WILL STOP DEAD! TELEPHONES WILL CEASE TO FUNCTION! DOMINO EFFECT WILL CAUSE A WORLDWIDE DEPRESSION!”

In fact, the fix turned out to be simple—programmers developed updated systems that recognized a four-digit date—but implementing it meant that hardware and software had to be adjusted to become Y2K compliant, and they had to be ready by midnight on December 31, 1999. Technology teams worked for years, racing to meet the deadline at a cost that researchers estimate to have been $300–$600 billion. The head of the Federal Aviation Administration at the time, Jane Garvey, told NPR in 1998 that the air traffic control system had twenty-three million lines of code that had to be fixed.

President Bill Clinton’s 1999 budget had described fixing the Y2K bug as “the single largest technology management challenge in history,” but on December 14 of that year, President Bill Clinton announced that according to the Office of Management and Budget, 99.9% of the government's mission-critical computer systems were ready for 2000. In May 1997, only 21% had been ready. “[W]e have done our job, we have met the deadline, and we have done it well below cost projections,” Clinton said.

Indeed, the fix worked. Despite the dark warnings, the programmers had done their job, and the clocks changed with little disruption. “2000,” the Wilmington, Delaware, News Journal’s headline read. “World rejoices; Y2K bug is quiet.”

Crises get a lot of attention, but the quiet work of fixing them gets less. And if that work ends the crisis that got all the attention, the success itself makes people think there was never a crisis to begin with. In the aftermath of the Y2K problem, people began to treat it as a joke, but as technology forecaster Paul Saffo emphasized, “The Y2K crisis didn’t happen precisely because people started preparing for it over a decade in advance. And the general public who was busy stocking up on supplies and stuff just didn’t have a sense that the programmers were on the job.”

As of midnight last night, a five-year contract ended that had allowed Russia to export natural gas to Europe by way of a pipeline running through Ukraine. Ukraine president Volodymyr Zelensky warned that he would not renew the contract, which permitted more than $6 billion a year to flow to cash-strapped Russia. European governments said they had plenty of time to prepare and that they have found alternative sources to meet the needs of their people.

Today, President Joe Biden issued a statement marking the day that the new, lower cap on seniors’ out-of-pocket spending on prescription drugs goes into effect. The Inflation Reduction Act, negotiated over two years and passed with Democratic votes alone, enabled the government to negotiate with pharmaceutical companies over drug prices and phased in out-of-pocket spending caps for seniors. In 2024 the cap was $3,400; it’s now $2,000.

As we launch ourselves into 2025, one of the key issues of the new year will be whether Americans care that the U.S. government does the hard, slow work of governing and, if it does, who benefits.

Happy New Year, everyone.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Con Man#Mike Luckovich#Letters From An American#heather cox richardson#history#American History#Y2K#do your job#the work of government#Inflation Reduction Act#technology management#the hard slow work of governing

14 notes

·

View notes

Text

Streamline Financial Operations with Budget and Expense Management Software

0 notes

Text

How a Construction Estimating Service Helps Prevent Cost Overruns

Cost overruns are a common concern in the construction industry. When not properly managed, they can lead to project delays, financial strain, and disputes between contractors and clients. Fortunately, a professional construction estimating service can help prevent cost overruns by providing accurate cost projections, identifying potential risks, and facilitating better decision-making throughout the project lifecycle. Here’s how an estimating service can help ensure your construction project stays on budget and on schedule.

1. Accurate Initial Estimates

One of the most important ways a construction estimating service prevents cost overruns is by providing highly accurate initial cost estimates. A professional estimator carefully evaluates all the variables that will affect the project’s cost, such as material prices, labor rates, project scope, and other associated costs. They use advanced estimating software and databases that are continuously updated to reflect the most current market prices.

Accurate estimates ensure that you have a clear understanding of the costs involved before the project begins. This reduces the risk of underbidding, which can lead to unanticipated cost increases during the course of the project.

2. Consideration of Hidden Costs

Construction projects often involve hidden costs that are not immediately apparent, such as permits, site preparation, waste removal, and unforeseen issues like soil contamination or structural damage. A professional estimating service identifies these hidden costs early on by conducting thorough site evaluations and assessing all potential project risks.

By accounting for these factors upfront, you can incorporate contingency funds into the budget, reducing the likelihood of unexpected expenses that may cause a cost overrun later in the project.

3. Identification of Potential Risks and Delays

Construction projects face many uncertainties, from fluctuating material prices to delays in supply chains or adverse weather conditions. A skilled estimating service is trained to recognize and anticipate potential risks that could lead to project delays and cost overruns.

For example, estimators can predict that certain materials may be in short supply due to market fluctuations, or that a particular phase of construction might take longer due to the complexity of the site. By identifying these risks early, they can advise on ways to mitigate them, such as adjusting timelines or securing materials in advance.

4. Efficient Resource Allocation

Accurate estimating helps with better resource allocation, which is key to keeping a project within budget. A professional estimator will break down the project into smaller, manageable components and calculate the exact amount of materials, labor, and equipment needed for each phase. This level of detail helps avoid unnecessary purchases, reduces waste, and ensures that all resources are allocated efficiently.

With accurate resource estimates, contractors can avoid running out of essential materials, and labor shortages or surpluses can be minimized. The result is a more streamlined, cost-effective project that stays on track.

5. Monitoring and Adjusting the Estimate Throughout the Project

Construction is an evolving process, and conditions on the ground can change over time. A professional estimating service helps monitor and adjust the cost estimates as the project progresses. This ongoing monitoring ensures that any changes or new developments are accounted for, and adjustments can be made to keep the project within budget.

For example, if a client requests changes to the scope of the project or if the cost of materials increases, the estimator can quickly update the cost estimate to reflect these changes. By continuously reassessing the budget, estimators help prevent major cost overruns by making sure that all unforeseen factors are taken into consideration.

6. Providing Contingency Planning

A critical aspect of cost control is contingency planning. Even with the most accurate estimates, unexpected events can occur that affect the project’s cost. Professional estimating services typically build contingency allowances into their cost estimates. These contingencies account for unforeseen expenses, such as price fluctuations or changes in project scope.

By planning for these potential contingencies upfront, construction teams can reduce the financial strain of unexpected costs. Without contingency planning, a small unforeseen issue can spiral into a significant overrun. Having a clear contingency plan allows for better financial management and greater flexibility to handle unexpected developments.

7. Enhancing Bid Accuracy

Inaccurate or overly optimistic bids can lead to cost overruns when the actual project costs exceed initial estimates. An estimating service can help ensure that bids are accurate and comprehensive by factoring in all necessary components, including labor, materials, and indirect costs like insurance and permits.

This accuracy helps contractors submit more competitive and realistic bids, reducing the risk of underbidding. Contractors can also gain a better understanding of the true cost of the project, ensuring that they don’t end up absorbing unforeseen costs later on.

8. Better Vendor and Subcontractor Management

Another area where construction estimating services help prevent cost overruns is through improved vendor and subcontractor management. Estimators help evaluate potential subcontractors and suppliers based on price, quality, and reliability. They ensure that subcontractor bids align with the project’s overall cost estimate and that there is no room for scope creep, which can lead to cost overruns.

By selecting the right subcontractors and suppliers and negotiating contracts with clear, agreed-upon costs, estimating services help ensure that all aspects of the project remain within budget.

9. Data-Driven Decision Making

Construction estimating services often use advanced software that aggregates and analyzes large amounts of project data. These systems can provide insights into trends, benchmarks, and historical cost data, which allows estimators to make more informed decisions about the project.

Data-driven decisions help avoid cost overruns by ensuring that all factors influencing project costs are accounted for based on the most current and relevant information. Additionally, these insights can be used to suggest alternative approaches or materials that may reduce costs without sacrificing quality or performance.

10. Streamlining Communication

One of the key contributors to cost overruns is poor communication between project stakeholders. With accurate and detailed cost estimates, estimators improve communication between contractors, clients, and subcontractors. By providing clear, consistent updates on cost projections, potential issues, and any changes to the scope, estimating services ensure that everyone is on the same page throughout the project.

Streamlined communication helps prevent misunderstandings that could result in costly mistakes or delays. It also allows stakeholders to make timely decisions and adjustments that help keep the project within budget.

Conclusion

Construction cost overruns can have a devastating impact on a project’s financial success. However, by leveraging the expertise of a professional construction estimating service, you can reduce the likelihood of overruns and ensure that your project stays on track. From providing accurate initial estimates to anticipating risks and adjusting projections as the project progresses, estimating services help prevent cost overruns at every stage. With careful planning, accurate resource allocation, and contingency strategies, you can avoid the financial pitfalls that often accompany construction projects, leading to more successful outcomes and higher client satisfaction.

#construction estimating service#prevent cost overruns#accurate project estimates#professional cost estimation#construction budget management#estimating services for contractors#reduce project costs#accurate bidding process#resource allocation in construction#project cost control#estimating software for construction#risk management in construction#construction project forecasting#construction cost breakdown#expert cost estimation#subcontractor management#material cost estimation#accurate labor cost calculation#detailed project budget#cost estimation tools#construction project budgeting#cost prediction services#managing construction expenses#contractor estimating services#construction cost tracking#project timeline and budgeting#accurate construction estimates#budgeting for contractors#cost estimation professionals#prevent budget surprises

0 notes

Text

Elon Musk’s so-called Department of Government Efficiency put a $1 spending limit on most credit cards belonging to employees and contractors of the General Services Administration—a critical agency that manages IT and office buildings for the US government—along with at least three other federal agencies. Similar restrictions are expected to roll out to the entire government workforce soon, according to several sources familiar with the matter.

“Effective immediately, all GSA SmartPay Travel and Purchase Cards issued to GSA employees and contractors are being paused and will not be available for use except in very limited circumstances,” GSA wrote in a memo to staff Thursday morning viewed by WIRED. The memo later stated that for “up to 0.1% of the GSA workforce, requests may be made for certain individual purchase charge card spend thresholds be set above $1. Please provide the rationale for all such deviations on an employee-by-employee basis along with the proposed increased threshold.”

The GSA, one of the first agencies that Musk allies infiltrated after DOGE was established, manages the SmartPay program for more than 250 federal agencies and organizations. The SmartPay website claims it is “the world’s largest government charge card and commercial payment solutions program.”

The spending freeze comes after DOGE posted on X earlier this week that it was working to “simplify” the government credit card program and “reduce costs.”

The restrictions immediately apply to GSA, the Office of Personnel Management, the Consumer Finance Protection Bureau, and the United States Agency for International Development, according to a source with direct knowledge of the project. All four of the agencies have been prominent targets of DOGE in recent weeks. Employees who spoke with WIRED say the changes will result in enormous complications to their existing workflows and that excessive or fraudulent spending is rare. Those who’ve already received approval for travel expenses (and may currently be traveling) have to request a temporary spending limit increase, the sources say.

One important reason that federal employees typically put expenses on special government-issued credit cards is to ensure they avoid paying state sales tax on things like hotels and rental cars, which federal agencies are supposed to be exempt from. The GSA’s website states that the state sales tax exemption is “determined by method of payment,” not by the employee’s ability to prove they work for the federal government.

Got a Tip?Are you a current or former government employee who wants to talk about what's happening? We'd like to hear from you. Using a nonwork phone or computer, contact the reporter securely on Signal at zoeschiffer.87.

As DOGE attempts to cut billions of dollars from the federal budget, Elon Musk has been posting examples of alleged “fraud” his team has uncovered to his over 218 million followers on X. In some cases, reporting from WIRED and other outlets suggests DOGE may be misinterpreting or misrepresenting what they’ve found.

For example, Musk has falsely claimed that 150-year-olds were receiving Social Security benefits. Experts told WIRED that DOGE likely overlooked a quirk in the payments system that doles out these benefits, which automatically sets a person’s birthday to May 20, 1875 if the real date is unknown, making these individuals appear to be 150 in the system.

The new spending restrictions apply to both SmartPay travel and purchase cards. Travel cards are widely used across the government (for example, most army reservists have these cards). The government tracks travel expenses, like hotel and airline fees, through software tools like Concur. The GSA already requires receipts for any purchase that its employees make over $75. “The system is a pain in the ass and requires authorization from a supervisor before any money can be spent,” says a current GSA employee.

Once a trip is done, employees have to submit a voucher that matches the approved expenses. Expenses are scrupulously tracked—employees are told to minimize ATM withdrawals to avoid unnecessary fees, according to a current GSA employee, who like the others in this story, spoke to WIRED on the condition of anonymity because they were not authorized to speak publicly. They say misusing a card is already grounds for disciplinary action, including termination.

Purchase cards are more rare and are used for work expenses under $10,000; anything above this amount requires a formal government contract. They’re used for office supplies, IT equipment, and trainings, among other things. If employees want to spend money on a purchase card, they have to submit a form, which then needs to be approved and signed by a supervisor. When that’s done, the form is submitted for approval to the approving office, with the name of the person who wants to make the purchase, a description of the item, the estimated price, an accounting code, and the date when the goods or services are needed.

Once the payment is approved, it’s assigned a purchase request number. Only then can the employee actually spend money. If they spend 10 percent more than the approved amount, they need written approval again. At the GSA, each purchase is tracked through a program called Pegasys, which requires a separate form to access. Pegasys has two sides: The purchase side, which shows the money that was spent, and the reconciliation side. The card holder has to match these two sides, cent for cent, using the request number.

“To commit fraud, you’d have to have the employee, supervisor, and likely someone in finance in on it,” says another current GSA employee. “It’s not as easy as [DOGE is] claiming.”

7 notes

·

View notes

Text

Exploring the Best Cash Flow Forecasting Tools: A Comprehensive Comparison

Are you fed up with the financial uncertainty affecting your business? Do you wish there was a way to easily monitor and precisely predict your ins and outs, allowing you to make well-informed decisions about the next steps for your small business?

If so, you're in for a treat! Prepare to transform your financial management and planning as we explore cash flow forecasting with the industry's best tool, Moolamore. Discover its amazing features, advantages, and everything in between. This comprehensive blog guide will explain why this is the solution you've been searching for.

#cash flow forecasting tool#best cash flow forecasting software#financial forecasting software#budgeting tool#financial planning software#cash flow management tool#money management tool#business forecasting software#revenue forecasting tool#financial analysis tool#expense tracking software

0 notes

Text

Planning and estimating construction projects are crucial to their success. There are many complex processes involved. As part of this process, construction takeoffs are essential. Construction takeoffs are itemized and quantified lists of the materials, labor, and other resources required for construction projects.

Construction takeoffs are essential to project estimation, planning, and success in general. They give a thorough analysis of the necessary labor, materials, and resources, allowing for precise cost estimation and efficient project management. With enhanced accuracy and time savings, the process has been further streamlined with the introduction of digital takeoff tools and BIM-based solutions.

Importance of Construction Takeoffs

Accurate project estimation

Accurate project estimation is built on the foundation of construction takeoffs. Takeoffs give project stakeholders a thorough grasp of the project scope and associated costs by estimating the materials, equipment, and labor required. Realistic timetables and budgets can be created with the use of this information.

Enhanced project planning

A crucial aspect of project planning is takeoffs. Construction teams may create accurate project timetables, manage resources wisely, and spot potential bottlenecks or areas that need extra care with a full assessment of the available resources. This degree of planning ensures that the construction process runs more smoothly and helps to avoid delays and expensive change orders.

Improved communication and collaboration

Communication among project stakeholders is standardized by construction takeoffs. Takeoffs allow for simple and clear communication between architects, contractors, suppliers, and other team members by quantifying and clarifying requirements. This promotes teamwork and increases overall project efficiency by cutting down on ambiguity and errors.

Methods for Construction Takeoffs

Manual takeoffs

Traditional manual takeoffs entail looking at blueprints, plans, and specifications to manually calculate the amount of resources and materials needed. Even though it takes a lot of time and is prone to mistakes, this method is still employed occasionally, especially for smaller projects or when digital versions of certain details are not available.

Digital takeoff software

The building sector has undergone a change since the introduction of digital takeoff software. By eliminating laborious computations and lowering human error, these software solutions allow users to electronically measure quantities directly from digital designs. Software for digital takeoffs streamlines the process by providing features like annotation tools, automatic measurements, and simple cooperation.

3D modeling and BIM

The building sector has undergone a change since the introduction of digital takeoff software. By eliminating laborious computations and lowering human error, these software solutions allow users to electronically measure quantities directly from digital designs. Software for digital takeoffs streamlines the process by providing features like annotation tools, automatic measurements, and simple cooperation.

Read more

3 notes

·

View notes