#Black Wealth Gap

Explore tagged Tumblr posts

Video

youtube

Black-owned banks and credit unions work to close the racial wealth gap

the history and importance of the nation’s minority depositories, with Black-owned banks and credit unions navigating concerns amid recent regional bank failures.

#youtube#Black-owned banks and credit unions work to close the racial wealth gap#Racial Wealth Gap in America#American Wealth#Racism#American Wealth Gap#Black Wealth Gap#Economic Disinfranchisement

3 notes

·

View notes

Text

https://x.com/KeneAkers/status/1701622042867740837?t=KX40ahKWIO6wPuPIyf2fnQ&s=09

The homeownership rates for different racial and ethnic groups in 2021 were as follows, based on the most recent data analyzed by NAR: -

White Americans: 72.7% -

Black Americans: 44% -

Asian Americans: 62.8% -

Hispanic Americans: 50.6%

These figures highlight the disparities in homeownership rates among different racial and ethnic groups, emphasizing the need for equitable opportunities and initiatives to address the gaps and promote equal access to homeownership for all Americans.

#redlining#generational wealth accumulation#Black wage gap#Black wealth gap#ethnic wealth gap#home ownership by race#homeownership disparities#White Lies

1 note

·

View note

Text

Racial covenants can be found in the property records of every American community. These restrictive clauses were inserted into property deeds to prevent people who were not White from buying or occupying land.

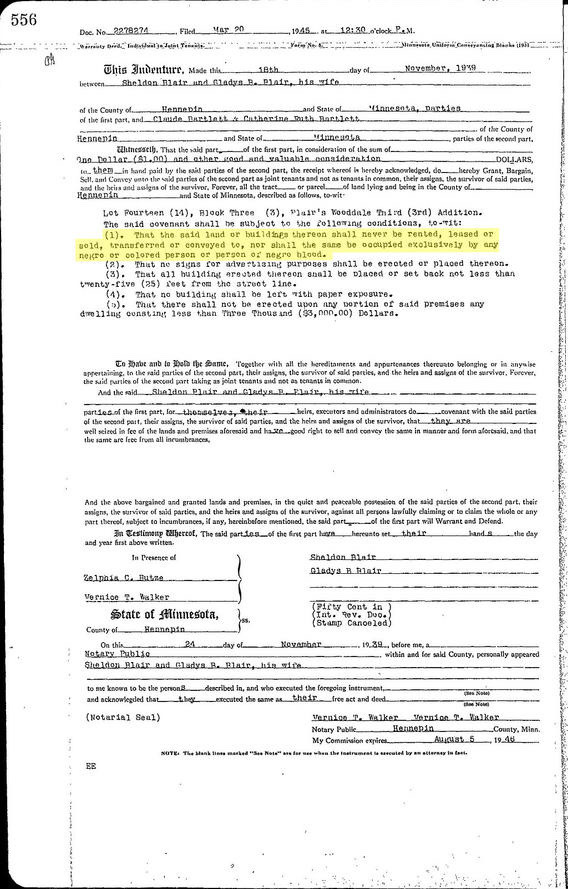

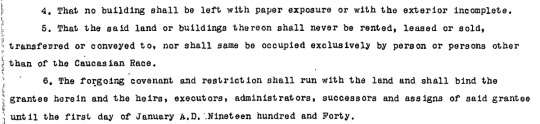

Racial covenants served as legally-enforceable contracts. They stipulated that the property had to remain in the hands of White people and they ran with the land, which meant that it could be enforced in perpetuity. Anyone who dared to challenge this ban risked forfeiting their claim to the property.

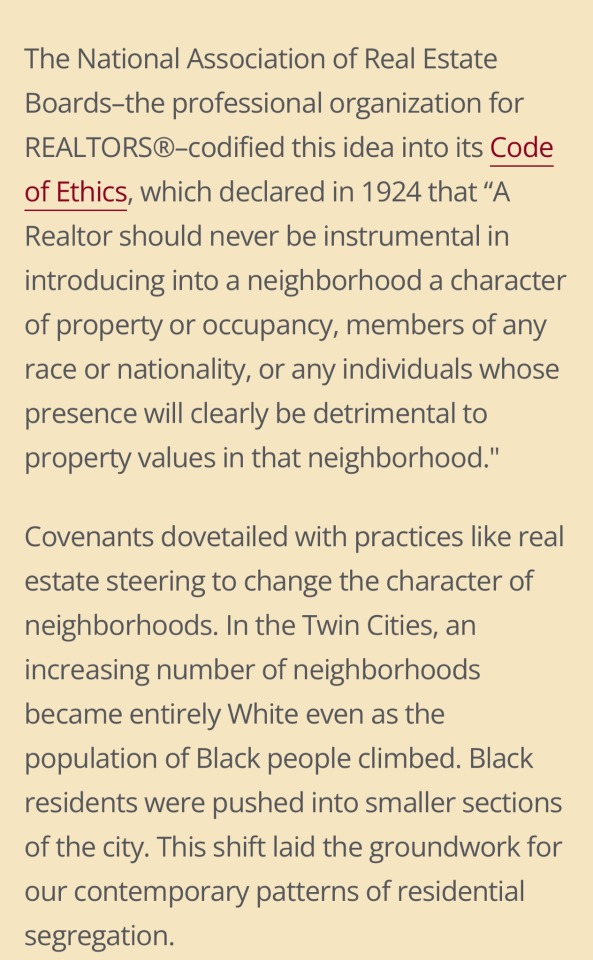

A survey of the 30,000 covenants unearthed in Hennepin and Ramsey Counties illuminates the wide variety of people targeted. An early Minneapolis restriction proclaimed that the "premises shall not at any time be conveyed, mortgaged or leased to any person or persons of Chinese, Japanese, Moorish, Turkish, Negro, Mongolian or African blood or descent." Before 1919, Jews were often included in this laundry list of “objectionable” people.

This language shifted with time. This eugenics-inspired list gave way to simpler declarations that the property could only be “be occupied exclusively by person or persons. . .of the Caucasian Race.” While many different kinds of people were targeted by racial covenants, every restriction identified by Mapping Prejudice bars Black people, as they were perceived by White Minnesotans to be particularly likely to decrease property values.

Real estate developers used racial covenants to sell houses, promising home buyers that covenants would protect their investment.

These same developers worked with park commissioners to make land adjacent to racially-restricted neighborhoods into public green space. These parks, they argued, would enhance the value of the property in these new neighborhoods. These rising values would also benefit municipal governments by swelling local tax coffers.

White homeowners also profited from racial covenants. A team of University of Minnesota researchers has demonstrated that Minneapolis houses that had covenants are worth 14 percent more than identical houses that never had covenants. This “bonus” value persists today, more than 50 years after the Fair Housing Act made these racial restrictions illegal.

The families who owned houses with covenants were able to pass that value on to the next generation. This intergenerational transfer of assets continues to drive the racial wealth gap in the United States today.

(continue reading)

#politics#racism#racial covenants#redlining#housing discrimination#structural racism#anti blackness#housing#realestate#national association of realtors#racial wealth gap#generational wealth

54 notes

·

View notes

Text

The Racial Wealth Gap

Racial differences in wealth between Black and White Americans represent historical and present-day inequities. Click the link to learn more or listen via podcast. #blackmail4u #blackhistory #BHM #RacialWealthGap #BlackWealth #BlackHistoryMonth

Welcome To Black Mail! Where we bring you Black History, Special Delivery. The current racial wealth gap in the United States poses a significant threat to Black Americans and the United States economy as a whole. Wealth is critical for economic growth and mobility. It provides the resources necessary to finance education, home purchases, investments, business startup, etc. The correlation…

View On WordPress

2 notes

·

View notes

Text

Why Is There More Liquor Stores and Chinese Food Businesses in Afro-American Communities? The Wealth Race Gap Was Established to Keep Slavery Descendents Impecunious

Positionality is when one group is used to keep another group down, in this case Asian American business owners and Black communities. If you go to the chinese food store, you pay lets say $20 for a meal for 2-3 people. That money is then re-invested into the Asian business. What did the Black community gain in this transaction? Food is one of the main ways other races steal wealth from Black…

View On WordPress

0 notes

Text

Baradaran challenges the long-standing notion that black banking and community self-help is the solution to the racial wealth gap. These initiatives have functioned as a potent political decoy to avoid more fundamental reforms and racial redress. (via The Color of Money | Harvard University Press)

#banking#finance#Black banks#Mehrsa Baradaran#nonfiction#The Colour of Money#racial wealth gap#wealth

1 note

·

View note

Quote

50% of jobs are over-credentialed.

Ginni Rometty (Co-Chair of OneTen and Former IBM Chief Executive Officer)

#ginni rometty#racial inequality#gender equality#blm#gender parity#black americans#workforce equality#paraphase#racial parity#shes referring to jobs requiring a four year degree#close the opportunity gap#$143k is the average difference in family net wealth between white and black families

1 note

·

View note

Text

also like. feels kind of obvious that there was "one income" because one of the two adults was legally barred from getting a job (assuming they were a white nuclear family, otherwise they were just fucked)

#also part of why i think a class based analysis of history is superior bc like#recent events are much more explainable if you accept that as black people (and other poc ofc) started gaining wealth some lucky white ppl#got poorer to fill the gap in the class structure#rather than the middle class suddenly vanishing because of reagan/clinton (which isnt to say nafta was good)

12K notes

·

View notes

Text

So another interesting thing about Jane Eyre is its take on relationship inequality.

Like, Jane is 18 at the beginning of the story and Rochester is said to be something like 35-38. And it's not casually brushed aside like that was normal back in the day. It wasn't. Concerns about the age gap are raised within the text. But the story emphasizes that Jane feels comfortable accepting Rochester's proposal, despite the age difference, the class difference, and him being her boss, because Jane feels that Rochester regards her as an equal. When they converse, Jane doesn't feel any tension, like she has to impress him or try to read his mind and say whatever he wants to hear. She feels that he respects her and values her thoughts and isn't compelled to use his power against her if she says something to displease him. Around the midpoint of the story, Jane believes that Rochester is going to marry another woman, and resolves to leave because she's heartbroken, believing that because she is poor and plain Rochester can't possibly be as hurt by their parting as she is, and he'll forget her and move on long before she does. But it turns out to be the opposite. After finding out about Bertha, Rochester begs Jane to stay and insists he'll be miserable forever without her, while Jane, still thinking she's too poor and plain to ever attract someone like him again, resists all temptation and leaves him. And she does this specifically because she feels that if she were to compromise her morals and self-respect to be Mr. Rochester's mistress, then he would lose respect for her and the relationship would fall apart. It was only by maintaining her integrity that the relationship could stay in-tact when the reconciled at the end.

St. John Rivers on the other hand, I don't think is given a definite age, but I think he's intended to be a much younger man, probably in his early 20s. He is poor and without relations aside from his sisters or any other connections, just as Jane. Jane finds out they're actually cousins at the same time she learns she's come into a vast fortune that was willed to her rather than the Rivers, but decides to share her fortune equally with them. So she arguably had more social capital, even though she made an effort to put St. John on equal footing with her, because the money was hers by right and she could've presumably cut him off at any time, just as easily as Rochester could've terminated Jane from her job.

And yet, Jane's relationship with St. John is vastly more unequal than her relationship with Rochester. Even though Jane practically worshiped Rochester but only cares for St. John as a brother and is acutely aware of his faults, she still finds herself desperately craving his approval in a way she never did with Rochester. And St. John is willing to exploit that intentionally. He asks her to do things she doesn't want to and make sacrifices for him just because he knows she'll do anything to please him, and that's why he thinks she's the perfect wife for him. Where Rochester tries to explain himself and persuade Jane not to leave him by addressing her concerns, St. John basically tries to command Jane to marry him and refuses to accept her "no" as final. He withholds affection from Jane as a tactic to get her to compromise in order to reconcile with him when he's the one who should be apologizing to her and considering her needs and not just his own. Jane knows that she can't ever be happy with him because he doesn't respect her and his lack of respect only makes her want to seek his approval, which he is all too happy to exploit for his own benefit.

But Jane ultimately stays firm and rejects St. John's proposal of a loveless marriage, just as she rejected Rochester's proposal of an unlawful marriage, because both situations were doomed to fail if she didn't put her own self-respect first.

So this novel from 1847 was really saying that power dynamics aren't pure black and white. Age and class and wealth and status can be a factor in making a relationship unequal, but you can also be equal on pretty much all social axis and still have inequality in a relationship. What's really important is that there's mutual respect.

2K notes

·

View notes

Text

Black homeowners have less housing wealth than White homeowners. This study explores the reasons for the wealth gap at age 55.

Black homeowners faced obstacles at every step – from accumulating a down payment to buying in attractive areas to accessing credit to upsize.

The analysis compares similar Black and White households to see what share of the wealth gap is due to the early hurdles vs. slower appreciation.

The results show that both factors – smaller down payments and slower growth in home values – were equally important contributors to the gap.

0 notes

Text

MarketWatch: Would reparations cause unwise spending? Studies on cash windfalls suggest not.

The perception that people often succumb to misfortune and bad decision-making after suddenly receiving large amounts of cash isn’t based in fact, researchers said in a report published Thursday by the Roosevelt Institute, a progressive think tank.

That means potential reparations payouts to Black Americans are unlikely to result in reckless spending, financial ruin and reduced labor productivity, the report’s authors wrote after undertaking a review of prior research concerning consumer behavior after lottery windfalls and inheritances, as well as more minor cash transfers through tax refunds and guaranteed-income programs.

“There’s what we really describe as kind of an urban myth … that people who receive lottery winnings squander the money very quickly,” reparations scholar William “Sandy” Darity, a Duke University professor of public policy and economist who co-authored the report, said in an interview. “The best available evidence indicates that that’s not the case.”

Whether Black residents and descendants of enslaved people in the U.S. are owed reparative payments has been debated for centuries. But as the country has grown more economically unequal while a stubborn racial wealth gap persists, the reparations movement has picked up traction.

In California, a first-of-its-kind state task force on reparations approved a slate of recommendations for lawmakers this month that, if implemented through legislation, would potentially provide hundreds of billions of dollars in reparative monetary payments to Black Californians to address harms caused by factors including racial health disparities, housing discrimination and mass incarceration. San Francisco, which has its own reparations task force, is also considering one-time reparative payments of $5 million for eligible people.

Read more: California task force approves sweeping reparations potentially worth billions of dollars

Still, detractors say that granting reparations to Black Americans — as was done for Japanese Americans incarcerated in internment camps during World War II and, on a state level, for survivors who owned property in the town of Rosewood, Fla., before a race massacre destroyed it — is unwise.

Some argue that giving people reparative payments without requiring certain parameters or personal-finance courses could result in irresponsible spending behavior, or that reparations proposals are themselves racist in suggesting that Black people need “handouts.”

“‘One of the important things that lottery winners do with the money is that they frequently set up trust accounts or the equivalent for their children or their grandchildren.’”

— William ‘Sandy’ Darity, a leading reparations scholar

The authors of the Roosevelt Institute report, for their part, said the assumption that Black Americans would be unable to handle sudden windfalls is rooted in racism — noting the racial wealth gap wasn’t created through “defective” spending habits but through policies that pumped money into white households, including unequal land distribution and subsidies for homebuyers.

“Widely held, inaccurate, and racist beliefs about dysfunctional financial behavior of Black Americans as the foundation for racial economic inequality leads to a conclusion that monetary reparations will be ineffective in eliminating the gap,” they wrote. “According to this perspective, if eligible Black Americans do not change their financial mindset and behavior after receiving financial reparations, the act of restitution will be empty.”

How people spend lottery winnings and inheritances

Even so, there’s not really “any carefully drawn-out study of what has happened to folks who have received reparations payments,” Darity said. It’s “impossible to understand” the impacts of such programs, because there haven’t historically been “systems in place that give money directly to individuals” — allowing “anecdotal cynicism and urban mythology” to drive the narrative, the report’s authors wrote.

“The best that we could do is try to think about other types of instances in which people have received windfalls where there has been some follow-up on what the consequences have been,” Darity said.

To see how people really react when they’re granted new amounts of money, the authors examined outcomes both from people who had received “major” windfalls — ones that immediately and majorly change a person’s wealth status, like winning the lottery — and “minor” windfalls, or those that affect a person’s income but don’t meaningfully shift their wealth status, like the stimulus checks doled out earlier in the COVID-19 pandemic.

Darity, who directs Duke University’s Samuel DuBois Cook Center on Social Equity, worked alongside the report’s lead author, Katherine Rodgers, a former research assistant at the Cook Center who currently works as a senior associate at the consulting firm Kroll, as well as Sydney A. Grissom, an analyst for BlackRock. Lucas Hubbard, an associate in research at the Cook Center, was also an author of the report.

They found that while a person’s behavior can vary based on the windfall amount and how it’s framed to the recipient, as well as their previous economic status, their reactions tend to buck stereotypes.

For example, only 11% of lottery winners quit their job in the findings of one 1987 study that examined 576 lottery winners across 12 states — and none of the people who got less than $50,000 left work, according to the Roosevelt Institute report. However, people were more likely to quit their jobs if they won a sum worth $1 million, had less education, were making under $100,000 a year, and hadn’t been in their job for more than four years.

Studies of lottery winners in other countries have found similarly muted labor responses, the report said. A separate U.S. study from 1993 of the labor effects on people who had received inheritances ranging from $25,000 to $150,000 or more also found that only a “small but statistically significant percentage of heirs left their jobs after receiving their inheritance,” with workers most likely to leave their jobs if they got a big payout.

But it’s still “less than what the stereotype would say,” Hubbard said in an interview: 4.6% of individuals quit their jobs after receiving a small inheritance of less than $25,000, compared to 18.2% of workers who got an inheritance of more than $150,000, he noted.

Instead, studies have shown that people who get windfalls may be more likely to become self-employed, participate in financial markets, save, and spend money on necessary goods like housing and transportation, the report’s authors wrote.

“One of the important things that lottery winners do with the money,” Darity said, “is that they frequently set up trust accounts or the equivalent for their children or their grandchildren.”

Small windfalls, including those offered through monthly checks from guaranteed-income pilot programs, have also been shown to be used for essentials like food and utilities without negative effects on employment. The framing of the money received can also have an effect on how it’s spent, the authors said: People who get a payout from bequests or life insurance tend to have more negative emotions about the money and will use it for more “utilitarian” purposes, according to one 2009 study.

From the archives (March 2021): Employment rose among those in California universal-income experiment, study finds

Reparations wouldn’t unleash ‘flagrant spending,’ researchers say

Despite their findings, “windfalls are not magical panaceas for all financial woes,” the authors emphasized.

For example, a 2011 study cited in the report found that among people who were already in precarious financial positions, lottery winnings delayed, rather than prevented, an eventual bankruptcy filing. Another report from 2006 found that “large inheritances led to disproportionately less saving,” the researchers noted in the Roosevelt Institute report.

“Research over the past two decades has demonstrated that their bounties are not limitless, and, crucially, that informed stewardship of received assets is still necessary (albeit, not always sufficient) to achieve and maximize long-term financial success,” the authors wrote.

But they added that reparations, particularly if “framed not as handouts but rather as reparative payments” to Black Americans, would not unleash “flagrant spending on nonessential goods” based on studies on windfalls, and could instead improve recipients’ emotional well-being and financial stability.

“Of course, the merits of making such payments should not be assessed solely on the basis of the anticipated economic effects,” the authors said. “Moreover, using the absence of evidence of this type as a justification for delaying reparative payments, such as those to Black descendants of American slavery, is inconsistent with the fact that other groups previously have received similar payments in the wake of atrocities and tragedies.”

From the archives (January 2023): How to pay for reparations in California? ‘Swollen’ wealth could replace ‘stolen’ wealth through taxes.

#Would reparations lead to irresponsible spending? Studies on other cash windfalls suggest not#new report says#reparations#Black Economic Disinfranchisement#wealth gap#american wealth gap#Black Wealth Gap

2 notes

·

View notes

Text

The COVID-19 pandemic has inflicted devastating effects on the U.S. economy, with job losses especially concentrated among women, minorities, and low-wage workers. Economists have described the uneven and unequal economic recovery from the COVID-19 recession as a “K-shaped” recovery, characterized by divergent recovery trajectories for the affluent relative to those of less means.

While considerable attention has been devoted to examining the preexisting disparities in labor market outcomes that left some households more vulnerable than others to the COVID-19 recession, less attention has been paid to the role of wealth in determining a household’s ability to buffer the pandemic’s economic shocks.

Wealth (defined as the difference between a household’s assets and debt) provides a critical safety net to households during economic downturns. Wealth holds several advantages over wages as an economic resource: In particular, income from wealth is taxed at much lower rates than income from work, and wealth can serve as a source of savings to absorb temporary setbacks such as a loss of employment income.

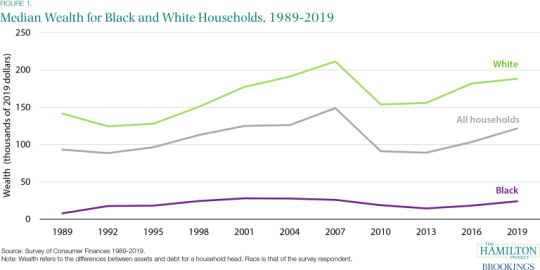

A previous Hamilton Project analysis revealed staggering inequalities in wealth held by white versus Black households. Using updated data from the Survey of Consumer Finances (SCF) for 2019, we find that the Black-white wealth gap persisted heading into the COVID-19 pandemic, leaving Black households with far fewer resources to weather the storm.

Wealth Inequality Preceding COVID-19

In 2019 the median white household held $188,200 in wealth—7.8 times that of the typical Black household ($24,100; figure 1). It is worth noting that levels of average wealth, which are more heavily skewed by households with the greatest amounts of wealth, are higher: white households reported average wealth of $983,400, which is 6.9 times that of Black households ($142,500; SCF). While median wealth is more reflective of the typical household, the scale of average wealth is indicative of the outsized levels of wealth held by the richest households.

The Black-white wealth gap today is a continuation of decades-long trends in wealth inequality, as shown in figure 1. Over the past 30 years, the median wealth of white households has consistently dwarfed that of Black households—ranging from a gap of $106,900 in 1992 to $185,400 in 2007 (both adjusted for inflation to 2019 dollars). Furthermore:

In the second quarter of 2020, white households—who account for 60 percent of the U.S. population—held 84 percent ($94 trillion) of total household wealth in the U.S.

Comparatively, Black households—who account for 13.4 percent of the U.S. population—held just 4 percent ($4.6 trillion) of total household wealth.

Buffering Economic Shocks during Downturns

The ability of wealth to buffer economic shocks can provide critical support to households during economic downturns—yet not all households have equal holdings of wealth at their disposal. The Black-white wealth gap serves as an important factor in understanding how economic recoveries can become uneven and unequal across demographics. Black and white households both experienced a reduction in median wealth from 2007 to 2010 during the Great Recession. Despite white households holding higher levels of wealth than Black households throughout the Great Recession, the decline in median wealth for white and Black households was nearly equal during this period: the median white household experienced a 27 percent decline in wealth from 2007 to 2010 compared to a 28 percent decline for the median Black household (figure 1; authors’ calculations).

Yet in the aftermath of the Great Recession, white households began to recover the wealth they had lost: wealth for the median white household rose by 1 percent from 2010 to 2013. By contrast, wealth for the median Black household continued to fall—declining by 23 percent during this period (figure 1; authors’ calculations). These divergent changes in wealth in the years immediately following the Great Recession illustrate how recoveries from recessions do not necessarily benefit all households equally. In fact, the Great Recession exacerbated the Black-white wealth gap and left Black households more vulnerable to the current COVID-19 recession.

The Intersection of the Black-white and Gender Wealth Gaps

In addition to the Black-white wealth gap, a gender wealth gap (and its intersections with race) reveals another dimension of wealth inequality. We use microdata from the 2019 Survey of Consumer Finances (SCF) to analyze how the Black-white wealth gap varies by gender throughout the life cycle. Because the SCF is a household-level survey and the vast majority of householder respondents within married couples are men, our analyses involving gender are limited to single households. In single households, male and female respondents are each representative of their personal holdings of wealth.

Figure 2 shows that single white men start with the highest median wealth, which continues to outpace that of single white women and single Black men and women throughout the life cycle. The median wealth of single white men under the age of 35 ($22,640) is 3.5 times greater than that of single white women ($6,470), 14.6 times greater than that of single Black men ($1,550), and 224.2 times greater than that of single Black women ($101). By the age of 55 and older, single white men hold 1.3 times more wealth than single white women and 8.1 times more wealth than single Black men. The median wealth of single Black women trails slightly behind that of single Black men until the age of 55, when single Black women hold $40,760 in median wealth compared to single Black men with $27,100.

Evaluating wealth gaps by race as well as gender provides clear evidence of the relatively meager resources that women—Black women, in particular—have to withstand the economic shocks of the COVID-19 recession. Labor market data show how women have been hit particularly during the COVID-19 recession: of the 1.1 million people who left the labor market in September 2020, over 860,000 were women. Black women have faced especially large job losses; the share of Black women with a job decreased by 11.0 percentage points from February to April 2020 compared to a 9.9 percentage point reduction in the share of white women with a job and a 9.2 percentage point decline in the share of white men with a job.

It is important to note that these racial and gender wealth gaps cannot simply be attributed to differences in household savings patterns or cashflow management challenges; rather, they are the outcome of public policy decisions spanning centuries throughout U.S. history. For example, landmark progressive laws, ranging from the New Deal to the formation of Social Security, excluded many occupations (such as domestic workers) widely held by Black women—the majority of whom remain excluded from Social Security today. Accordingly, it is imperative to evaluate wealth gaps by both race and gender to fully understand the depth and breadth of continued wealth inequality in the U.S. today.

Inherited Wealth

Though wealth accumulates with age, the persistence of wealth gaps at every stage of the life cycle further reflects disparities in the intergenerational transfer of wealth via inheritances. White households are substantially more likely to expect and receive inheritances than Black households. Figure 3 shows that in 2019, 17 percent of white households expected to receive an inheritance compared to just 6 percent of Black households. These differing expectations of inheritance receipt comport with disparities in the actual occurrence and magnitude of intergenerational wealth transfers: 30 percent of white households received an inheritance in 2019 at an average level of $195,500 compared to 10 percent of Black households at an average level of $100,000. Because inheritances are lightly taxed, inequalities in inheritances play a significant role in perpetuating a Black-white wealth gap that spans generations.

The Black-White Wealth Gap Intensifies the Effects of Labor Market Disparities

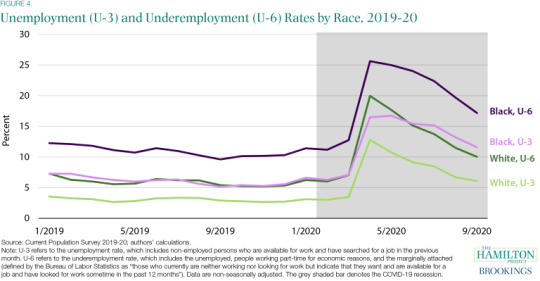

Racial disparities in wealth can intensify the severity of income shocks, as households with lower levels of wealth have fewer resources available to temper the adverse economic impacts of job loss. For Black households who have reported disproportionately high levels of unemployment—and even more so during the COVID-19 recession—this means the Black-white wealth gap can exacerbate the effects of the negative labor market outcomes that Black households are more likely to face.

When comparing the labor market distress of Black families relative to white families, it is important to consider trends in both unemployment and underemployment rates. Unemployment—the number of people who do not have a job and are actively seeking work—is a common indicator of labor market strength. However, an equally important measure is underemployment, defined as the number of people who currently work part-time but would rather have a full-time job and people who want and are able to take a job but have not sought work in the last four weeks. Underemployment can more broadly capture the share of the population that is ready and willing to work more if employers were hiring.

Rates of unemployment for Black individuals—whether measured by the traditional, narrower metric of unemployment (“U-3”) or the broader metric of underemployment (“U-6”)—have been consistently higher than unemployment among white individuals in every year since 1994 (authors’ calculations). Figure 4 focuses on unemployment and underemployment rates beginning in January 2019 through September 2020 of the COVID-19 recession. At the onset of the pandemic, unemployment and underemployment rates for Black and white Americans more than doubled from March to April 2020. Unemployment and underemployment peaked in April 2020 for both groups, but these rates were significantly higher for Black Americans. More than one quarter of Black Americans were classified as underemployed at its peak—1.5 times the underemployment rate for white Americans. Notably, even the narrower measure of unemployment for Black Americans surpassed the broader measure of underemployment for white Americans since June 2020. As of September 2020, the unemployment rate of Black Americans was still 5.5 percentage points higher than that of white Americans, while the underemployment rate of Black Americans was 7.2 percentage points higher than that of white Americans.

One reason that labor market outcomes in the COVID-19 recession have been worse for Black workers is that they are more likely to be employed in industries hit hardest by the COVID-19 recession. Three of the hardest-hit industries by the pandemic in terms of job loss—retail trade, transportation and warehousing, and leisure and hospitality—are among the top ten employers of Black workers. When it comes to outcomes for Black-owned businesses during the COVID-19 recession, the statistics are also grim: analysis by the Economic Policy Institute found that 28 percent of Black-owned businesses were in industries with the largest total job losses relative to just 20 percent of white-owned businesses. Although Black-owned businesses only represent a minority of all businesses, they are disproportionately likely to operate in sectors most severely affected by the COVID-19 pandemic and associated shutdowns.

Black Households Face Higher Rates of Distress during COVID-19

With lower levels of wealth prior to the pandemic, compounded by continued labor market disparities during the pandemic, access to emergency savings and other assets are crucial for Black households to withstand the COVID-19 recession. Yet black households have substantially less emergency savings than white households: the average value of liquid assets among white households was $8,100 in 2019 compared to $1,500 for Black households. Furthermore, 72 percent of white households say they could get $3,000 from family or friends compared to 41 percent of Black households.

Racial disparities between Black and white households are present in holdings of nonliquid assets as well. In 2019, 73 percent of white families compared to 42 percent of Black families owned a home. Black families are not only less likely to own a home, but their homeownership also yields lower levels of assets. In 2019 the typical white families’ home value was $230,000 compared to $150,000 for Black families. Similarly, of the $30.8 trillion in total real estate assets reported in the second quarter of 2020, white households held 78 percent ($23.9 trillion) compared to 5 percent ($1.6 trillion) held by Black households.

With fewer nonliquid assets to borrow against or sell, Black households were particularly vulnerable to economic shocks heading into the COVID-19 pandemic. For some Black households, this has led to taking extraordinary measures to stay afloat. Leveraging data from the Survey of Household Economics and Decisionmaking (SHED) along with the SCF, we can observe how families have been utilizing their retirement assets to weather the COVID-19 recession.

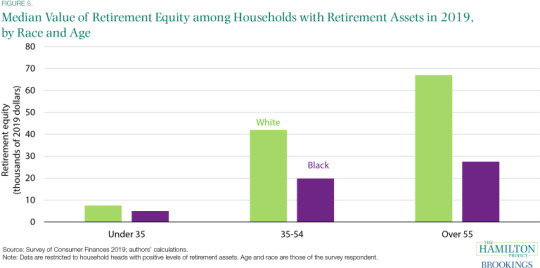

Despite holding lower levels of retirement assets, young Black families were more likely to borrow from or cash out their retirement savings during the current crisis. Among households with positive retirement equity, figure 5 shows that the median value of retirement equity for households with a household head under the age of 35 in 2019 was $5,000 for Black Americans compared to $7,500 for white Americans. Although Black households tended to hold lower levels of retirement equity at this age, 14 percent of Black Americans under the age of 35 borrowed from or cashed out their retirement savings compared to just 4 percent of white Americans under the age of 35 in July 2020 (SHED; authors’ calculations). Figure 5 shows that the median value of retirement equity among white households with a household head at least 55 with retirement assets was 2.4 times that among Black households—yet only 10 percent of white Americans over the age of 55 borrowed from or cashed out their retirement savings compared to 22 percent of Black Americans over the age of 55 (SHED; authors’ calculations).

Conclusion

In the short-term, renewed fiscal support is needed to curb the economic pain many households are experiencing because they are unable to absorb the economic shocks of the COVID-19 recession. More specifically, policies aimed at providing income support and strengthening the safety net, along with implementing automatic stabilizers that trigger expansions of economic aid during fiscal crises, are critical during this time.

Yet while a stronger safety net and additional income support can provide families with immediate protection against economic crises, it is unlikely to provide them with the long-term stability to prepare for future shocks in the same way that wealth can. Accordingly, when designing policies to reduce the Black-white wealth gap, avoiding the conflation of income with wealth is imperative. In fact, our previous Hamilton Project analysis showed that the Black-white wealth gap remains even among households of similar incomes. Neither differences in income nor differences in educational attainment, indebtedness, or a host of other demographic and socioeconomic indicators can fully account for the persistence of the Black-white wealth gap.

Indeed, closing the Black-white wealth gap will require that the deep and systemic economic disparities brought about by centuries of discriminatory policies are addressed through significant structural changes across a range of policy areas. As discussed in a previous Hamilton Project analysis, these policies range from redlining and the denial of financial services to minority communities, to the Jim Crow Era’s “Black Codes” strictly limiting opportunities in many southern states—all of which contributed to the disproportionate accumulation of wealth held by white households while exacerbating the economic fragility of many Black households. Overcoming the effects of these policies will necessitate substantive and systemic changes in education, small business, healthcare, broadband access, tax reform, and broader place-based policies.

The COVID-19 pandemic underscores the importance of the Black-white wealth gap and its impact on the ability of households to weather the economic shocks caused by recessions. By expanding policymakers’ focus not only on strengthening the safety net and income supports, but also on the inclusion of systemic and structural public policy changes across a range of areas to close the Black-white wealth gap, disparities in the ability of Black and white households to weather the next economic storm will be greatly reduced.

#The Black-white wealth gap left Black households more vulnerable#Black White wealth gap#financial inequality

1 note

·

View note

Video

youtube

Intelexual Media: Black Children & The American Dream

Here is a short, straightforward clip about the racial wealth gap, and how it affects black children who want to achieve the american dream.

#racial wealth gap#black america#black history month#intelexual media#black children & the american dream

1 note

·

View note

Text

By analyzing the Federal Reserve's Survey of Consumer Finances, CAP found that in 2022, union households held $338,482 in median wealth. Meanwhile, nonunion households had $199,948. Being in a union also substantially chips away at racial and educational wealth gaps, per CAP's analysis. Black, nonunion households have a median household wealth of $61,500; meanwhile, Black union households hold around $164,6000 in median household wealth. Black workers are also more likely than workers of other races to be in a union, according to the Bureau of Labor Statistics, with their union membership rates outpacing their white, Asian, and Hispanic counterparts. Unions particularly pay off for workers without a high school degree and again seem to be bridging educational wealth gaps, per the data. The median wealth of union members without a high school degree is over three times that of nonunion workers without a high school degree — $69,510 compared to $22,800 respectively.

Unions work, Unionize.

Source: Juliana Kaplan, Business Insider, Mar 21, 2024.

2K notes

·

View notes

Text

Things Biden and the Democrats did, this week #14

April 12-19 2024

The Department of Commerce announced a deal with Samsung to help bring advanced semiconductor manufacturing and research and development to Texas. The deal will bring 45 billion dollars of investment to Texas to help build a research center in Taylor Texas and expand Samsung's Austin, Texas, semiconductor facility. The Biden Administration estimates this will create 21,000 new jobs. Since 1990 America has fallen from making nearly 40% of the world's semiconductor to just over 10% in 2020.

The Department of Energy announced it granted New York State $158 million to help support people making their homes more energy efficient. This is the first payment out of a $8.8 billion dollar program with 11 other states having already applied. The program will rebate Americans for improvements on their homes to lower energy usage. Americans could get as much as $8,000 off for installing a heat pump, as well as for improvements in insulation, wiring, and electrical panel. The program is expected to help save Americans $1 billion in electoral costs, and help create 50,000 new jobs.

The Department of Education began the formal process to make President Biden's new Student Loan Debt relief plan a reality. The Department published the first set of draft rules for the program. The rules will face 30 days of public comment before a second draft can be released. The Administration hopes the process can be finished by the Fall to bring debt relief to 30 million Americans, and totally eliminate the debt of 4 million former students. The Administration has already wiped out the debt of 4.3 million borrowers so far.

The Department of Agriculture announced a $1 billion dollar collaboration with USAID to buy American grown foods combat global hunger. Most of the money will go to traditional shelf stable goods distributed by USAID, like wheat, rice, sorghum, lentils, chickpeas, dry peas, vegetable oil, cornmeal, navy beans, pinto beans and kidney beans, while $50 million will go to a pilot program to see if USAID can expand what it normally gives to new products. The food aid will help feed people in Bangladesh, Burkina Faso, Burundi, Chad, Democratic Republic of the Congo, Djibouti, Ethiopia, Haiti, Kenya, Madagascar, Mali, Nigeria, Rwanda, South Sudan, Sudan, Tanzania, Uganda, and Yemen.

The Department of the Interior announced it's expanding four national wildlife refuges to protect 1.13 million wildlife habitat. The refuges are in New Mexico, North Carolina, and two in Texas. The Department also signed an order protecting parts of the Placitas area. The land is considered sacred by the Pueblos peoples of the area who have long lobbied for his protection. Security Deb Haaland the first Native American to serve as Interior Secretary and a Pueblo herself signed the order in her native New Mexico.

The Department of Labor announced new work place safety regulations about the safe amount of silica dust mine workers can be exposed to. The dust is known to cause scaring in the lungs often called black lung. It's estimated that the new regulations will save over 1,000 lives a year. The United Mine Workers have long fought for these changes and applauded the Biden Administration's actions.

The Biden Administration announced its progress in closing the racial wealth gap in America. Under President Biden the level of Black Unemployment is the lowest its ever been since it started being tracked in the 1970s, and the gap between white and black unemployment is the smallest its ever been as well. Black wealth is up 60% over where it was in 2019. The share of black owned businesses doubled between 2019 and 2022. New black businesses are being created at the fastest rate in 30 years. The Administration in 2021 Interagency Task Force to combat unfair house appraisals. Black homeowners regularly have their homes undervalued compared to whites who own comparable property. Since the Taskforce started the likelihood of such a gap has dropped by 40% and even disappeared in some states. 2023 represented a record breaking $76.2 billion in federal contracts going to small business owned by members of minority communities. This was 12% of federal contracts and the President aims to make it 15% for 2025.

The EPA announced (just now as I write this) that it plans to add PFAS, known as forever chemicals, to the Superfund law. This would require manufacturers to pay to clean up two PFAS, perfluorooctanoic acid and perfluorooctanesulfonic acid. This move to force manufacturers to cover the costs of PFAS clean up comes after last week's new rule on drinking water which will remove PFAS from the nation's drinking water.

Bonus:

President Biden met a Senior named Bob in Pennsylvania who is personally benefiting from The President's capping the price of insulin for Seniors at $35, and Biden let Bob know about a cap on prosecution drug payments for seniors that will cut Bob's drug bills by more than half.

#Thanks Biden#Joe Biden#jobs#Economy#student loan debt#Environment#PFAS#politics#US politics#health care

764 notes

·

View notes

Text

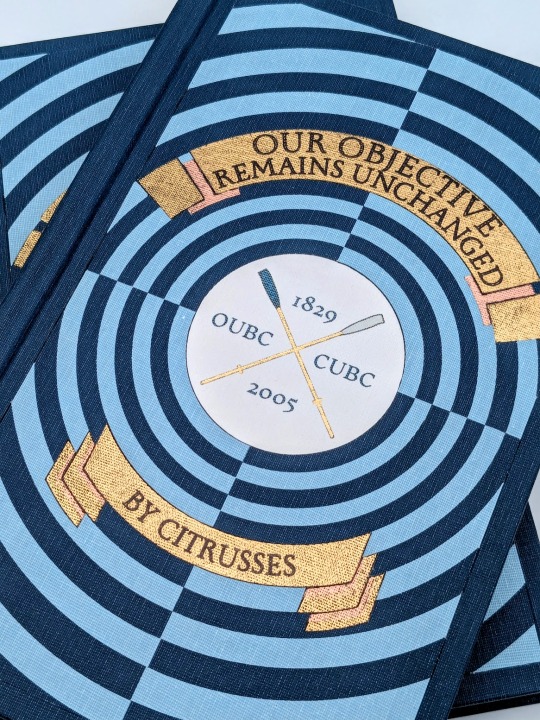

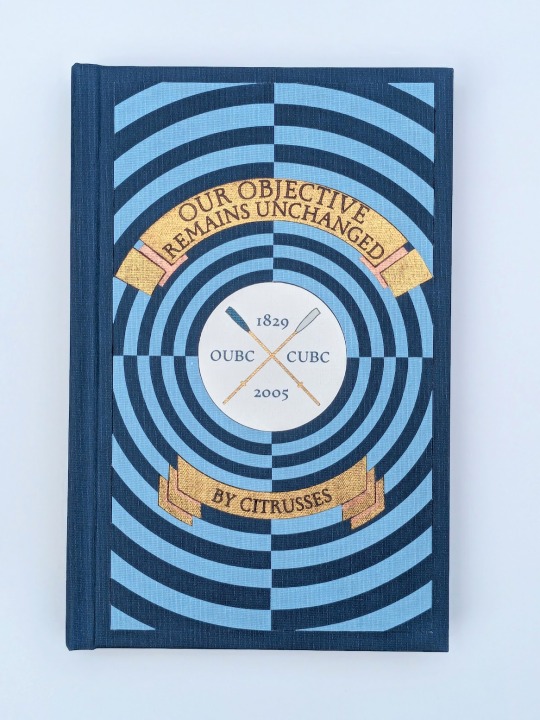

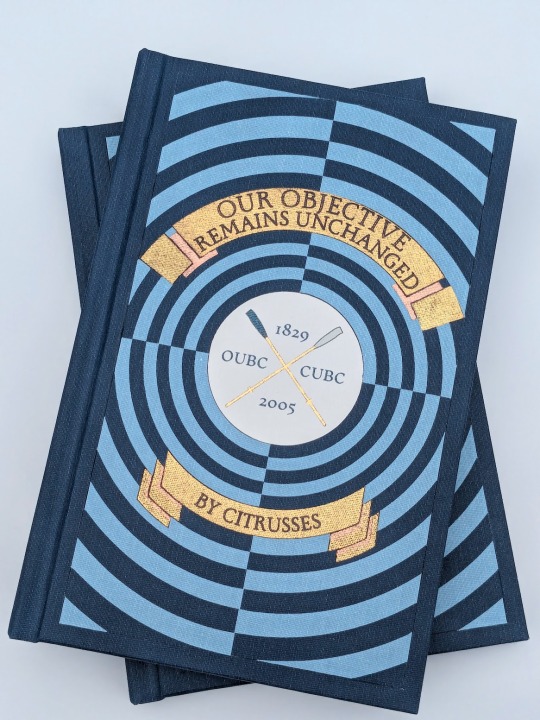

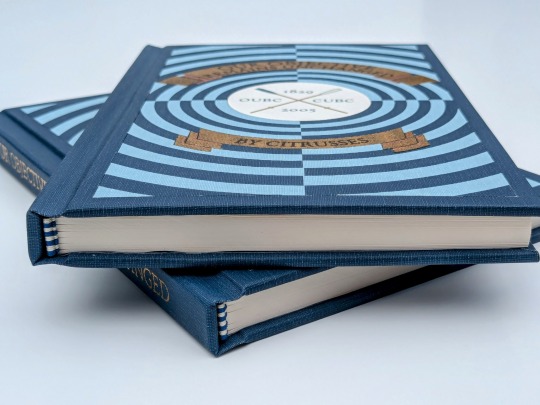

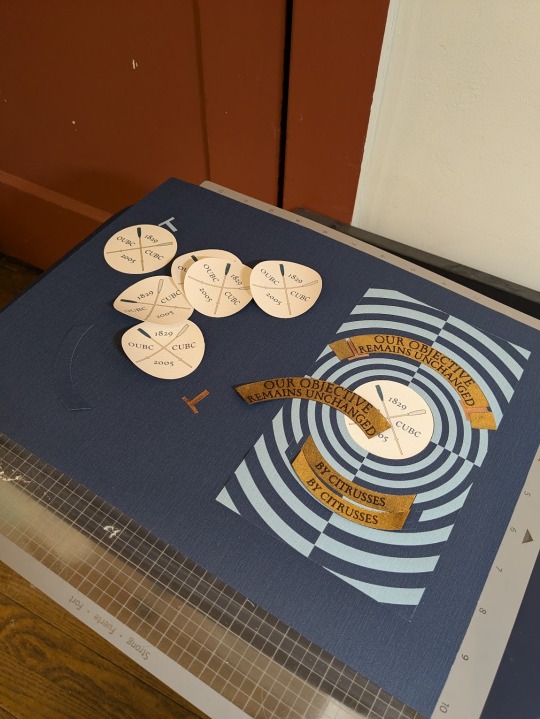

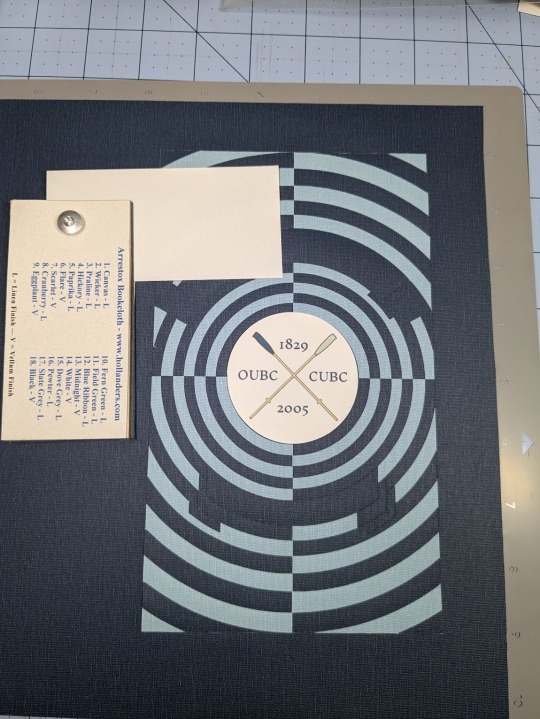

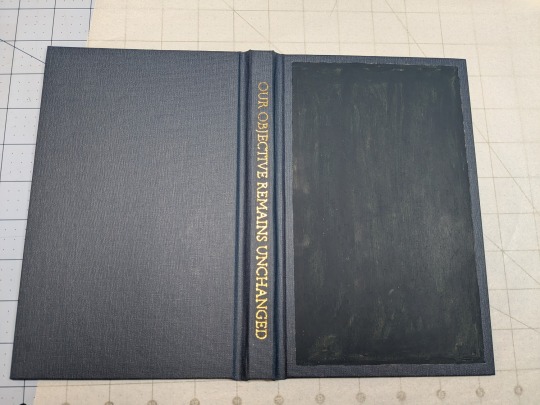

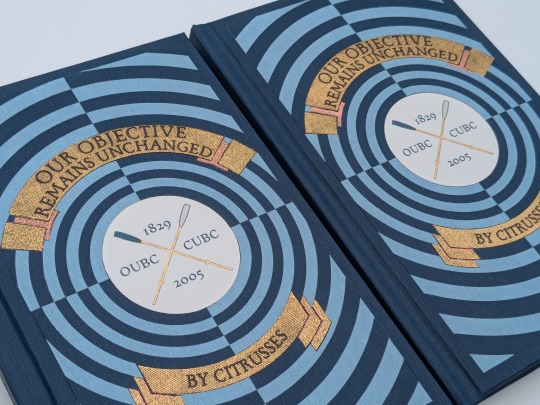

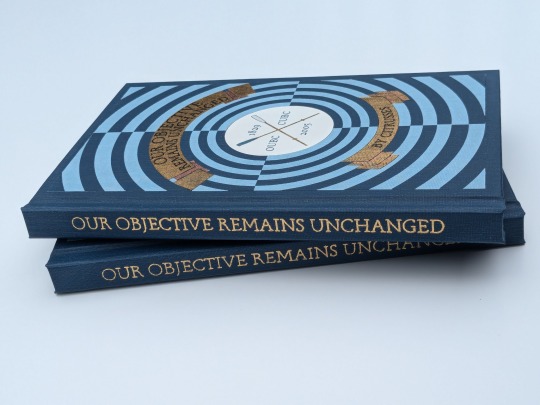

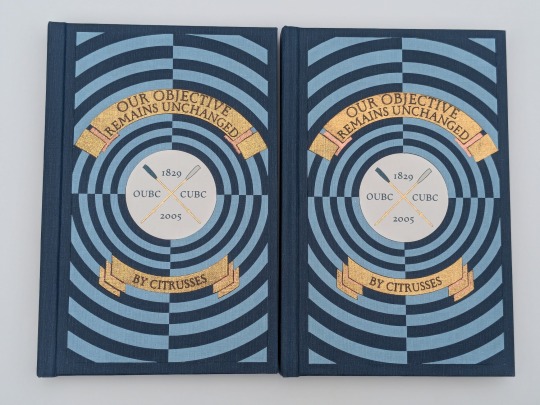

Our Objective Remains Unchanged by @citrusses

"Harry Potter, returning member of the Oxford University Boat Club, has two goals for the spring of 2005: beat Cambridge, and beat Draco Malfoy. Perhaps not in that order."

This has to be one of the most creative and meticulously researched fics I have ever had the pleasure of reading. If you haven't read it yet, don't walk— run! Citrusses is an absolute genius, and kindly gave me permission to bind her masterpiece.

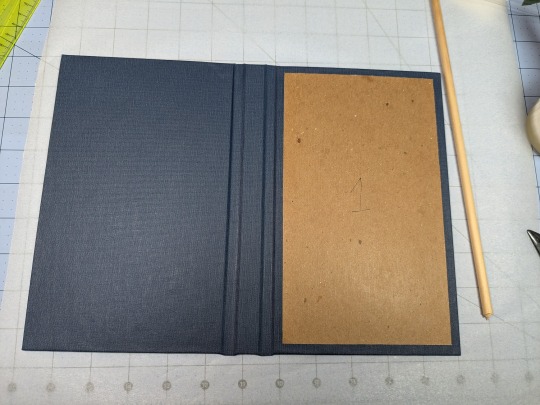

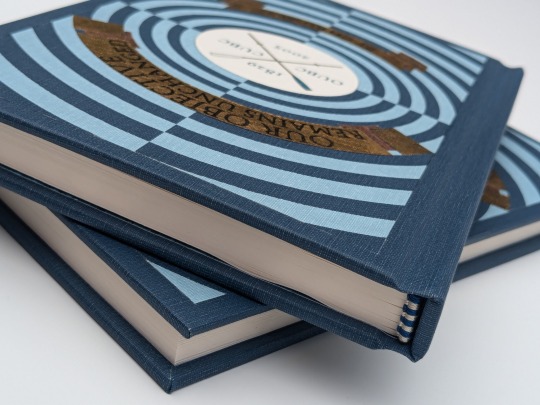

The cover of this bind is made out four different shades of Allure bookcloth cut by my Cameo 4, and the centerpiece is printed and hand foiled. The banners were machine foiled in gold and black with hand foiled rose gold shading. The endbands were hand sewn with Gutermann silk thread.

You can find more pictures and information about my process under the cut.

The amount of inspiration this fic gave me was overwhelming, and Citrusses' writing fully immersed me in the world of competitive rowing. While designing this bind, I was struck by the sheer wealth of Oxford rowing memorabilia available to me. I settled on this 1929 illustration from an official publication on the Oxford and Cambridge Centenary Boat Race for the cover.

"How hard could it possibly be?" I thought, foolishly. The answer was HARD, but I'll get into that later.

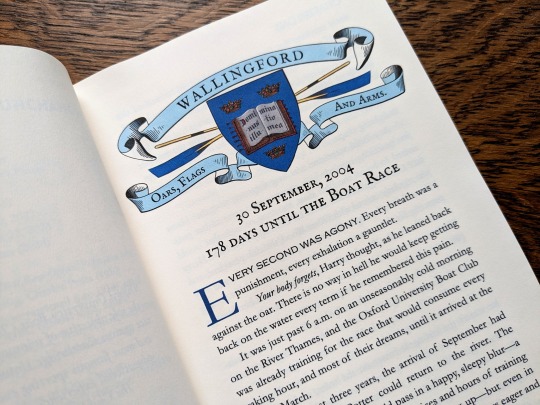

Due to the wealth of design options, I believe that this may be the best typeset I have created to date. Thanks to the help of my friend @tsurashi-bindery, I was able to learn the basics of InDesign (kicking and screaming all the way). There will be spoilers in the text of these photos, so try not to read them if you haven't finished the fic!

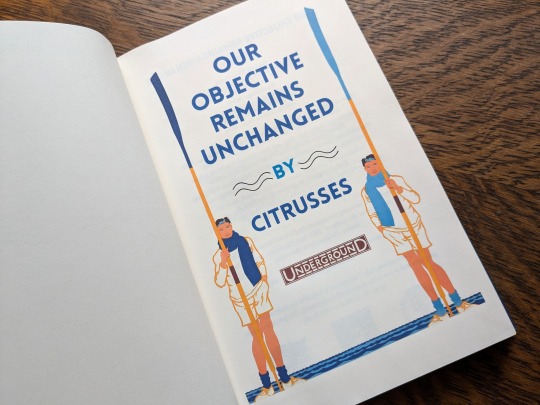

For the title page, I modified To See the Crews in Training by Charles Pears (1930). I believe that this was part of a series of advertisements for the race in the London Underground.

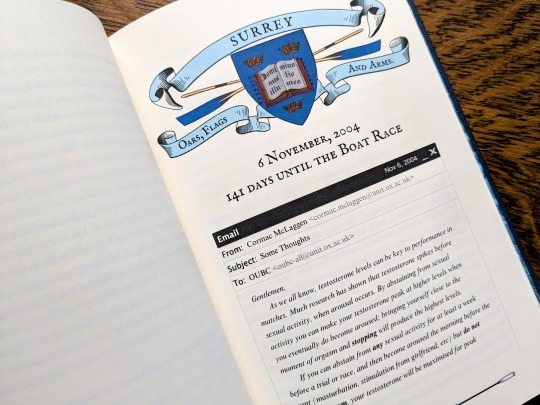

For the chapter headers, I redrew the crest from an Oxford Oars, Flags, and Arms postcard, presumably pre 1914. I also had some fun creating a mock email using La_Temperanza's How to Mimic Email Windows on Ao3. Cormac's email makes me laugh every time I read it, and Citrusses provided an appropriately pompous subject.

I also had lots of fun editing the oars from the official OUBC logo to serve as dividers and decorations for the page numbers.

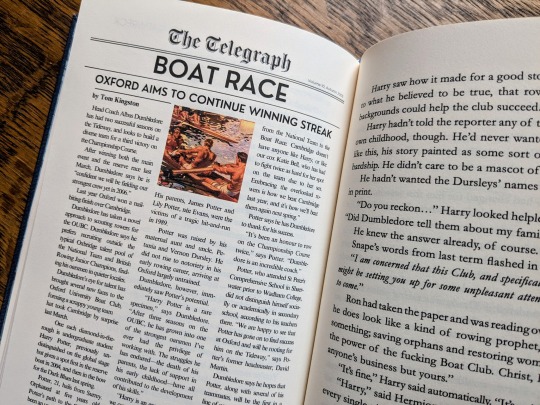

Additionally, I got to edit a full newspaper page for the fic! I was very excited find an opportunity to slip Leyendecker's The Finish (1908) in.

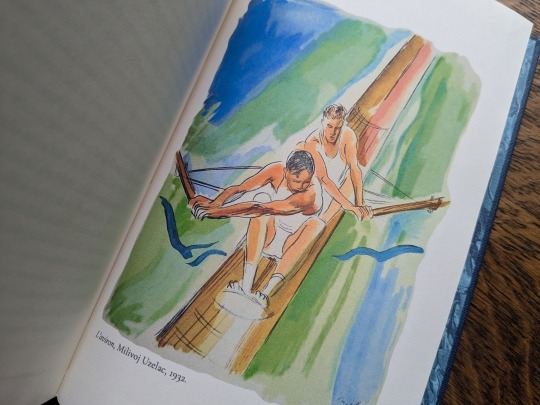

The fic ended beautifully, so I wanted to include one last element at the end to capture the atmosphere. I settled on L'aviron (1932) by Milivoj Uzelac. It makes me feel as though Harry and Draco will continue rowing together long after I've closed the book.

I of course had lots of fun sewing the headbands, and got to do it with not one but TWO copies!

Things got tricky when I had to recreate the cover. I had a poor understanding of how vector images worked, and ended up having to redraw it three times. Once I finally cracked and taught myself how to use Illustrator, the program crashed...and I had to redraw it a fourth time!

I set the vector to cut on my Cameo 4, and I assembled the pieces together like a puzzle on my Silhouette mat. I used Allure's indigo, skylight, white, and black bookcloth in the process. I will be making a tutorial video on this method, so I will keep it brief here.

I also cut a piece of bookcloth to 8.5"x 11" and fed it through my inktank printer to print the center design. I then cut it out using the print and cut feature on my Cameo 4. Both of these methods were a first for me, and they were very scary!!

To be perfectly frank, the foiling was a nightmare and I don't want to get into it. I machine foiled the gold, and then foiled black lettering on top of it. I foiled the rose gold shading by hand, and then foiled a thin black outline along the edge of the banners to make them stand out more.

I hand foiled the spines (because I'm scared of measuring), painted the exposed board (to hide any gaps in the inlays), and used transfer tape to lift my design from the Silhouette mat and onto the cover.

One more fun detail— my copy and the author's copy are sisters! The dark blue and the light blue are inverted on the author's copy, making it distinguishable from mine. This is the first time I have made an author's copy for a fic, and I was admittedly incredibly nervous. I always worry about what authors will think of my work, but Citrusses gave me an incredible amount of encouragement and support throughout the process! Thank you for trusting me with your precious fic!

This story is a work of fanfiction and can be read on Ao3 for free. My bind and typeset are for personal use only and not for sale or profit. Keep fandom free!

#book binding#fic binding#fanbinding#fanfic binding#drarry#our objective remains unchanged#harry x draco#my binds

290 notes

·

View notes