#Benefits of Management Accounts

Explore tagged Tumblr posts

Text

Importance of Management Accounts

New Post has been published on https://www.fastaccountant.co.uk/importance-of-management-accounts/

Importance of Management Accounts

In this article, you will gain a clear understanding of management accounts and their significance in business operations. By exploring the realm of management accounts, you will discover how they provide valuable insights into a company’s financial health and performance. From analyzing cash flow to assessing profitability, this article will equip you with the knowledge to make informed decisions and drive success in your business ventures. So, let’s embark on this journey to unravel the world of management accounts!

Definition of Management Accounts

Management accounts refer to financial reports that are prepared within an organization to provide internal stakeholders with valuable insights into the financial performance and health of the business. Unlike financial statements that are prepared for external parties such as investors and creditors, management accounts are solely focused on serving the needs of the management team in making informed decisions and evaluating the overall performance of the organization.

The purpose of management accounts

The primary purpose of management accounts is to enhance decision-making within a company. By providing key financial information and analysis, management accounts enable managers to identify trends, assess performance, and evaluate the impact of their decisions on the financial health of the business. These reports play a crucial role in strategic planning, budgeting, and monitoring the overall financial performance of the organization.

Differences between management accounts and financial statements

While both management accounts and financial statements involve financial information, they serve different purposes and audiences. Financial statements, such as the income statement, balance sheet, and cash flow statement, are prepared in accordance with accounting standards and are primarily intended for external parties like investors, shareholders, and regulatory bodies. On the other hand, management accounts are tailored specifically to meet the internal informational needs of managers and executives to help drive decision-making and evaluate the performance of the organization.

Key Components of Management Accounts

To provide a comprehensive picture of the financial performance and health of a business, management accounts typically include various key components. These components encompass critical aspects of the company’s operations, financial position, and cash flow dynamics, enabling managers to make informed decisions.

Sales and revenue analysis

Sales and revenue analysis is a crucial component of management accounts. It involves evaluating the sales performance of the company, including revenue generation, customer acquisition, and sales trends. This analysis assists managers in identifying the most profitable products or services, assessing the effectiveness of sales strategies, and making informed decisions regarding pricing, promotions, and sales channels.

Cost of goods sold and gross margin

The cost of goods sold (COGS) and gross margin analysis provide insights into the direct costs associated with producing or delivering a product or service. By understanding the COGS and gross margin, managers can assess the efficiency of their production processes, control costs, and determine the profitability of different product lines or services.

Operating expenses and net profit

Operating expenses include all the costs incurred by a company in its day-to-day operations, such as rent, salaries, marketing expenses, and utilities. Analysing operating expenses allows managers to identify areas of cost reduction or efficiency improvement. Additionally, the net profit component of management accounts provides a clear picture of the company’s overall profitability after considering both revenues and expenses.

Cash flow and liquidity analysis

Cash flow and liquidity analysis focus on the inflows and outflows of cash within a business. By evaluating the timing and reliability of cash inflows and outflows, managers can effectively manage their liquidity position, ensure the availability of funds for short-term obligations, and make informed decisions regarding investment, expansion, or financing strategies.

youtube

Importance of Management Accounts

Management accounts play a crucial role in the effective operation and decision-making within an organization. Their importance stems from several key benefits that they provide to the management team.

Enable effective decision-making

By providing timely and accurate financial information, management accounts empower managers to make informed decisions that are aligned with the organization’s objectives and financial capabilities. The analysis and insights derived from these reports enable managers to evaluate different courses of action, assess their impact on financial performance, and choose the most beneficial option for the company.

Monitor business performance

Management accounts serve as a monitoring tool to track the financial performance and health of a business. By regularly reviewing and analysing these reports, managers can identify areas of strength and weakness, assess the effectiveness of their strategies and operations, and implement necessary adjustments to ensure the achievement of the company’s goals.

Evaluate and improve financial health

Understanding the financial health of a business is crucial in ensuring its long-term sustainability and growth. Management accounts provide comprehensive financial information that allows managers to evaluate the company’s profitability, liquidity, and overall financial stability. This evaluation enables them to identify potential risks, implement necessary controls, and make strategic decisions to improve the financial health of the organization.

Types of Management Accounts

To cater to the specific informational needs of different businesses and industries, management accounts can take various forms. These types provide the management team with insights into different aspects of the company’s operations and financial performance.

Sales performance reports

Sales performance reports track and analyse the company’s sales activities, revenue generation, and customer acquisition. These reports provide managers with invaluable insights into the effectiveness of their sales strategies, identify top-performing products or services, and highlight opportunities or challenges in the market.

Budget and variance analysis

Budget and variance analysis involves comparing actual financial results with the budgeted expectations. By analyzing the variances between projected and actual outcomes, managers can identify areas of underperformance or exceptional performance, adjust their future projections, and make informed decisions to ensure the company’s financial objectives are met.

Profitability analysis

Profitability analysis focuses on evaluating the profitability of different divisions, products, or services within the business. This analysis allows managers to identify areas of high or low profitability, assess the efficiency of resource allocation, and make decisions regarding pricing, cost control, or product/service expansion.

Cash flow forecasts

Cash flow forecasts provide managers with a projection of the company’s future cash inflows and outflows. By anticipating potential cash flow gaps or surpluses, managers can effectively manage the company’s liquidity position, plan for necessary financing or investment, and make informed decisions regarding operating or capital expenditure.

Balance sheet analysis

Balance sheet analysis involves evaluating the company’s financial position, including its assets, liabilities, and equity. This analysis enables managers to understand the company’s leverage and financial stability, assess its ability to meet short-term and long-term obligations, and make strategic decisions regarding capital structure or financial risk management.

Preparation and Presentation

To ensure the effectiveness and usefulness of management accounts, their preparation and presentation must be carefully planned and executed. Considerations such as frequency, timing, format, structure, and key stakeholders play a crucial role in maximizing the value derived from these reports.

Frequency and timing

The frequency of preparing management accounts depends on the specific needs and requirements of the business. Some organizations may choose to generate these reports on a monthly basis, while others may opt for a quarterly or annual cycle. The timing of preparation should align with the need for timely and relevant information to support decision-making.

Format and structure

The format and structure of management accounts should be tailored to the informational needs of the management team. This may include the use of charts, graphs, and tables to present financial data in a visually appealing and easily understandable manner. Well-defined sections and headings should be used to organize the information logically and allow for efficient analysis.

Key stakeholders

Identifying the key stakeholders who will receive and use the management accounts is essential. The content and level of detail within the reports may vary based on the needs of different stakeholders, such as executives, department managers, or board members. By understanding their informational requirements, the management team can ensure that the reports effectively address their concerns and assist them in decision-making.

Interpreting Management Accounts

Interpreting management accounts involves analysing financial data and deriving valuable insights to guide decision-making and evaluate the performance of the organization. Several techniques and considerations can aid in the interpretation process.

Analysing key performance indicators

Key performance indicators (KPIs) are specific metrics that provide insights into the performance of a particular aspect of the business. By tracking and analysing relevant KPIs within the management accounts, managers can assess the progress towards achieving goals, identify areas requiring improvement, and make data-driven decisions to drive performance.

Identifying trends and patterns

Management accounts often contain historical financial data. By analysing trends and patterns within this data, managers can identify recurring patterns, seasonality, or shifts in performance. This analysis enables them to anticipate future developments, adjust strategies accordingly, and make informed decisions based on historical patterns.

Comparing actual results to budgets or forecasts

Comparing actual results to budgets or forecasts is a crucial step in interpreting management accounts. By assessing the variances, managers can identify areas of underperformance or exceptional performance, understand the reasons behind the deviations, and take corrective actions or revise future projections when necessary.

Limitations of Management Accounts

While management accounts provide valuable insights, they also have certain limitations that should be recognized and taken into account when using these reports for decision-making.

Reliance on accuracy of underlying data

The accuracy and reliability of management accounts heavily depend on the accuracy and completeness of the underlying financial data. Errors in data entry or inconsistencies in recording financial transactions can lead to misleading insights or inaccurate conclusions. Therefore, it is essential to ensure the accuracy of the data used in the preparation of management accounts.

Inability to predict external factors

Management accounts use historical financial data to analyse past performance and guide decision-making. However, these reports cannot predict or account for future external factors such as changes in market conditions, economic downturns, or shifts in consumer preferences. Managers should be cautious not to solely rely on historical data when making forward-looking decisions.

Lack of forward-looking information

Management accounts primarily focus on analysing past and current financial performance. While these reports provide valuable insights into the company’s historical data, they do not provide explicit forward-looking information or projections. It is important for managers to supplement the analysis of management accounts with additional forecasting techniques or business intelligence to make informed decisions about the future.

Management Accounts vs Financial Statements

Management accounts and financial statements serve different purposes, target different audiences, and have varying levels of detail and regulatory requirements.

Primary audience and purpose

Financial statements are primarily prepared for external stakeholders, including investors, creditors, and regulatory bodies, with the objective of providing a comprehensive picture of the company’s financial performance, position, and cash flows. In contrast, management accounts are specifically tailored for internal stakeholders, focusing on providing timely and relevant financial information to support decision-making and evaluate the organization’s performance.

Level of detail and breadth

Financial statements adhere to established accounting standards and need to present financial information in a standardized manner. As a result, they typically include detailed information about the company’s financial transactions and economic events. Management accounts, however, offer more flexibility in terms of the level of detail and focus on providing summarized and actionable financial insights.

Regulatory requirements

Financial statements are subject to various regulatory requirements and standards, such as generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS). These requirements are designed to ensure consistency, comparability, and transparency in financial reporting. In contrast, management accounts are not subject to the same regulatory obligations, allowing for greater customization and adaptability to meet the specific needs of the management team.

Examples of Management Accounts

Management accounts can vary depending on the nature of the business. Here are a few examples:

Manufacturing company: production costs and efficiency

A manufacturing company may focus on analysing production costs, including direct materials, direct labour, and overhead expenses. Management accounts for such a company may include detailed reports on raw material costs, labour productivity, machinery utilization, and overall production efficiency. This information allows managers to identify cost-saving opportunities, streamline operations, and maintain optimal efficiency levels.

Retail company: sales by store and product category

For a retail company, analysing sales performance by store and product category can be crucial. Management accounts in this context may include reports that highlight the sales figures, profit margins, and market shares for each store and product category. Such analysis enables managers to make informed decisions regarding store locations, product assortment, pricing strategies, and promotional activities.

Service-based company: billable hours and project profitability

In a service-based company, management accounts may focus on billable hours, project profitability, and resource allocation. These reports would track the hours spent by employees on client projects, the billing rates of different services, and the profitability of each project. By analysing these accounts, managers can assess the profitability of different services or projects, optimize resource allocation, and make decisions regarding service pricing or capacity planning.

Tips for Effective Management Accounts

To ensure the effectiveness and usefulness of management accounts, consider the following tips:

Ensure accurate and timely data input

The accuracy and timeliness of the data input are essential for generating reliable management accounts. Establish robust processes to collect, validate, and record financial data accurately and in a timely manner. Regularly review data sources and implement controls to minimize errors and inconsistencies.

Tailor reports to specific needs

Recognize that different stakeholders have varying informational needs. Customize the format, content, and level of detail of management accounts to ensure they provide relevant and actionable insights to the intended audience. Consider using visual aids, charts, or graphs to make the information easier to comprehend and analyse.

Regularly review and update reports based on feedback

Management accounts should not be considered static documents. Solicit feedback from stakeholders and users of these reports to identify areas of improvement or additional information needs. Regularly review and update the reports to ensure they remain relevant, provide valuable insights, and support informed decision-making.

In conclusion, management accounts play a vital role in providing internal stakeholders with comprehensive financial information and analysis to support decision-making and monitor the financial performance of an organization. By including key components such as sales analysis, cost analysis, and cash flow analysis, management accounts enable managers to make informed decisions, evaluate business performance, and improve the financial health of the company. While management accounts have limitations and differ from financial statements, they provide tailored insights that cater to the unique needs of managers and executives. By following best practices and considering specific tips for effective management accounts, businesses can optimize the benefits derived from these reports and enhance overall financial management.

0 notes

Text

Importance of Management Accounts

In this article, you will gain a clear understanding of management accounts and their significance in business operations. By exploring the realm of management accounts, you will discover how they provide valuable insights into a company’s financial health and performance. From analyzing cash flow to assessing profitability, this article will equip you with the knowledge to make informed…

View On WordPress

0 notes

Text

(empty look of death)

#in case you're wondering how i'm doing uhh#ya boy is considering opening commissions at some point#on account of his life rapidly going to shit#given the whole 'i either spend all my savings fixing my car or i spend all my savings getting a new car'#'and i don't have many other options because it's either i go to work or the company physically implodes and i don't have a job anymore'#benefits of being the one load-bearing employee <333#because your main terrible boss never managed to pick up anyone else as all the other employees left one by one <333#anyway. sorry. i've been. crying on and off all day#it's not like there haven't been good times these past six months (i've been grabbing little mouthfuls of life) but#i'm feeling it on my psyche. i'm feeling the fact that i've been holding my brain to the grindstone since 2023 and it's <333 bad <3333#the fact that twice today i've had brief Ideations tells you all you need to know </333#anyway. i will be okay. ultimately.#life has to get easier sooner or later but. unironically i may need to look into supplementing my job income#or else i'm not going to survive the upcoming gap season

35 notes

·

View notes

Text

Discover the key differences between accounting and bookkeeping tasks with our insightful infographic. By separating these roles, you can significantly enhance your business’s financial management. Partner with expert accountants and bookkeepers from Unison Globus to ensure accuracy, efficiency, and strategic growth. Ready to optimize your financial management? Partner with Unison Globus for expert bookkeeping and accounting services. Hire bookkeepers from India for high-quality services at competitive rates.

#outsourced accounting services#accounting firms#accounting#accounting services#unison globus#Expert accountants and bookkeepers#hire bookkeepers from India#accountants#bookkeepers#bookkeeping and accounting services#accounting vs Bookkeeping#Difference between Accounting and Bookkeeping#Role of an Accountant#Role of a Bookkeeper#Benefits of Separate Accounting and Bookkeeping#Financial Management Tips#Small Business Accounting

2 notes

·

View notes

Text

my job atp is like... fine? it pays enough for me to get by and the work doesn't take a ton of brain power, but oh my god the drama of working somewhere where there's less than 20 employees at any given time is fucking exhausting

#personal#there's no accountability for anything#our store doesn't even have an actual manager. it's a high school girl making the fucking schedule lmao#thank god i don't work in the store but even production has its own issues#after top surgery im going to start seriously looking for something that's full time. and benefits would be nice.

3 notes

·

View notes

Text

one more time w feeling: i have an upcoming job interview and if i don't get this one i'm actually going to be offended

#full time w full benefits; set schedule w very normal hours no nights no weekends no holidays#weekly pay starting at $19 an hour but usually more w tips and bonuses#it's as a house cleaner but honestly i just need something that gives me insurance and money in my bank account at this point#all of the employee reviews say it's super low stress and that management is actually really supportive so hopefully this works out for me#my posts#.txt

2 notes

·

View notes

Text

💻 A massive 2025 data breach exposed 16 billion passwords, threatening accounts on Apple, Google, Facebook, and more. 💻 Learn how to protect your accounts with 2FA, passkeys, and expert tips 👇🏻

#16 billion passwords leaked#cybersecurity breach prevention#data breach#facebook#github#google#identity theft protection#infostealer malware attack#massive data breach 2025#multi-factor authentication guide#passkey adoption trends#password manager benefits#passwords leaked#phishing attack prevention#protect online accounts#telegram

0 notes

Text

Accounts Payable: Is Outsourcing a Better Option Than In-House Teams?

For many businesses, deciding between accounts payable outsourcing and in-house processing is a key financial decision. Both methods have their pros and cons, but when it comes to efficiency, cost, and scalability, outsourcing often takes the lead.

Let’s start with the AP process comparison. In-house processing requires a dedicated team, regular training, and constant oversight. It can be effective for small volumes, but as businesses grow, the process often becomes inefficient. On the other hand, accounts payable outsourcing provides access to experts and advanced systems that streamline operations and reduce the need for internal oversight.

One major advantage of outsourcing is cost efficiency. Maintaining an in-house AP department involves fixed expenses such as salaries, software licenses, and hardware. In contrast, outsourcing offers flexible pricing based on usage, which can lead to significant savings—especially for growing businesses.

The outsourcing benefits also include reduced risk of late payments, improved compliance, and faster invoice processing. Service providers often have robust systems in place for tracking, verifying, and paying invoices, leading to better accuracy and fewer vendor issues.

Speaking of vendor management, outsourcing partners are equipped to handle communications and disputes efficiently. They ensure vendors are paid on time, which helps maintain strong supplier relationships and may open the door to early-payment discounts.

Ultimately, for companies seeking scalability, improved performance, and long-term savings, accounts payable outsourcing is a clear winner. While in-house teams may work for some, outsourcing offers professional-grade solutions that adapt to your needs and free up resources for core business activities.

#accounts payable outsourcing#AP process comparison#cost efficiency#outsourcing benefits#vendor management

0 notes

Text

CareCredit: Your Health and Wellness Credit Card Marketplace

Managing out-of-pocket healthcare expenses can be overwhelming, especially when insurance doesn’t cover all costs. The CareCredit credit card offers a practical solution, enabling you to pay for a wide range of health and wellness services over time. From dental care to veterinary treatments, Care Credit simplifies healthcare financing and helps manage your health-related bills. Let’s explore how…

#accepted providers#CareCredit#CareCredit account management#CareCredit application process#CareCredit benefits#CareCredit credit card#CareCredit interest rates#CareCredit promotional plans#CareCredit tips#cosmetic procedure financing#credit card for medical bills#credit score impact#dental care financing#dental treatments financing#Flexible payment options#health and wellness costs#health credit card#health expenses card#health financing#healthcare costs#healthcare credit card#healthcare financing options.#healthcare financing tool#healthcare payment plans#healthcare providers#how to apply for CareCredit#manage healthcare costs#managing healthcare expenses#medical credit card#medical expenses

0 notes

Text

Bookkeeping is an essential aspect of any successful business, especially for those using accounting & tax services in New London, Connecticut. With organized financial records, businesses can track income, expenses, and profits more effectively, helping to make informed decisions for growth. Accurate bookkeeping keeps you prepared for tax season, eases the reporting process, and ensures compliance with financial regulations. It also gives a clear image of the company’s financial situation, which is important when trying to get loans or investments. Maintaining accurate records also makes it easier to spot areas where expenses can be cut and income raised, which eventually boosts overall profitability.

0 notes

Text

#financial software solution#financial management system#financial accounting automation#financial solution#benefits#erp software

1 note

·

View note

Text

Google My Business (GMB) क्या है और यह क्यों ज़रूरी है?

डिजिटल युग में व्यवसायों की ऑनलाइन उपस्थिति का महत्व बढ़ गया है। अब लोग घर बैठे ही इंटरनेट के माध्यम से किसी भी प्रोडक्ट या सर्विस के बारे में जान सकते हैं। इसमें Google My Business (GMB) एक अहम भूमिका निभाता है। GMB एक मुफ्त टूल है, जो छोटे और बड़े व्यवसायों को गूगल पर अपनी जानकारी प्रस्तुत करने का अवसर देता है। GMB का उपयोग कर आप अपने व्यवसाय के बारे में ऐसी महत्वपूर्ण जानकारी साझा कर सकते…

#benefits of Google My Business#create Google My Business profile#free Google My Business listing#Google My Business account#Google My Business dashboard#Google My Business FAQs#Google My Business features#Google My Business for local SEO#Google My Business for small business#Google My Business guide#Google My Business insights#Google My Business listing#Google My Business login#Google My Business marketing#Google My Business optimization#Google My Business post ideas#Google My Business profile tips#Google My Business reviews#Google My Business SEO benefits#Google My Business services#Google My Business setup#Google My Business tools#Google My Business verification#how to use Google My Business#increase visibility on Google My Business#local business with Google My Business#manage Google My Business#optimize Google My Business page#update Google My Business

0 notes

Text

USA please listen to me: the price of “teaching them a lesson” is too high. take it from New Zealand, who voted our Labour government out in the last election because they weren’t doing exactly what we wanted and got facism instead.

Trans rights are being attacked, public transport has been defunded, tax cuts issued for the wealthy, they've mass-defunded public services, cut and attacked the disability funding model, cut benefits, diverted transport funding to roads, cut all recent public transport subsidies, cancelled massive important infrastructure projects like damns and ferries (we are three ISLANDS), fast tracked mining, oil, and other massive environmentally detrimental projects and gave the power the to approve these projects singularly to three ministers who have been wined and dined by lobbyists of the companies that have put the bids in to approve them while one of the main minister infers he will not prioritise the protection of endangered species like the archeys frog over mining projects that do massive environmental harm. They have attacked indigenous rights in an attempt to negate the Treaty of Waitangi by “redefining it”; as a backup, they are also trying to remove all mentions of the treaty from legislation starting with our Child Protection laws no longer requiring social workers to consider the importance of Maori children’s culture when placing those children; when the Waitangi Tribunal who oversees indigenous matters sought to enquire about this, the Minister for Children blocked their enquiry in a breach of comity that was condemned in a ruling — too late to do anything — by our Supreme Court. They have repealed labour protections around pay and 90 day trials, reversed our smoking ban, cancelled our EV subsidy, cancelled our water infrastructure scheme that would have given Maori iwi a say in water asset management, cancelled our biggest city’s fuel tax, made our treasury and inland revenue departments less accountable, dispensed of our Productivity Commission, begun work on charter schools and military boot camps in an obvious push towards privatisation, cancelled grants for first home buyers, reduced access to emergency housing, allowed no cause evictions, cancelled our Maori health system that would have given Maori control over their own public medical care and funding, cut funding of services like budgeting advice and food banks, cancelled the consumer advocacy council, cancelled our medicine regulations, repealed free prescriptions, deferred multiple hospital builds, failed to deliver on pre-election medical promises, reversed a gun ban created in response to the mosque shootings, brought back three strikes = life sentence policy, increased minimum wage by half the recommended amount, cancelled fair pay for disabled workers, reduced wheelchair services, reversed our oil and gas exploration ban, cancelled our climate emergency fund, cut science research funding including climate research, removed limits on killing sea lions, cut funding for the climate change commission, weakened our methane targets, cancelled Significant National Areas protections, have begun reversing our ban on live exports. Much of this was passed under urgency.

It’s been six months.

18K notes

·

View notes

Text

#outsourced bookkeeping guide#benefits of outsourced accounting#outsourced bookkeeping services#small business bookkeeping#accounting outsourcing solutions#outsourced accounting benefits#virtual bookkeeping#small business financial management#outsourcing bookkeeping for startups#bookkeeping vs accounting#accounting outsourcing for small businesses

0 notes

Text

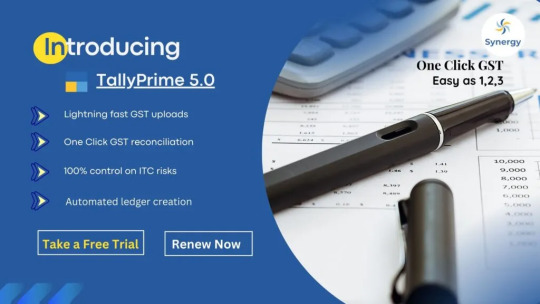

Benefits of Upgrading to Tally Prime 5.0 for Your Business

Upgrading to Tally Prime 5.0 presents a unique opportunity for businesses to enhance their financial management and streamline their operations. With the Tally Prime 5.0 download available, users can access a range of robust features designed to elevate their accounting processes. From small startups to large enterprises, the versatility offered by Tally Prime 5.0 makes it a suitable choice for companies across various sectors. By embracing this latest version, businesses not only improve their efficiency but also gain the flexibility needed to adapt to the demands of an ever-changing commercial landscape.

One of the standout aspects of Tally Prime 5.0 is its user-friendly interface and simplified navigation. Users can expect to save precious time on routine accounting tasks, thanks to enhancements that allow for quicker access to essential features. This upgrade also introduces advanced reporting capabilities, enabling businesses to generate insightful analyses of their financial health seamlessly. With the new tools and analytics at their disposal, decision-makers can expect to make more informed choices, ultimately driving growth and profitability.

Additionally, Tally Solutions has integrated cutting-edge technology into this update, enhancing security and data integrity. Businesses can rest assured that their sensitive financial information is well protected, thanks to improved encryption and backup features. This emphasis on security provides peace of mind for users, allowing them to focus on their core operations without the worry of data breaches. The new features and benefits accompanying Tally Prime 5.0 make it easier than ever to manage various aspects of a business while ensuring robust protection against potential threats.

In conclusion, the decision to upgrade to Tally Prime 5.0 is one that can significantly benefit organizations looking to maximize their operational efficiency and safeguard their financial data. The combination of a user-friendly interface, advanced reporting tools, and enhanced security measures positions this software as a leading solution in the accounting field. With the Tally Prime 5.0 download readily available, businesses are encouraged to leverage the new features and benefits with Tally Solutions, ensuring they remain competitive in today’s dynamic marketplace.

#TallyPrime 5.0#TallyPrime upgrade#accounting software#business management software#TallyPrime features#TallyPrime benefits#financial management#GST compliance#data security#automated ledger#Tally solution

0 notes

Text

Why Self-Employed Individuals Should Explore SETC and FFCRA Benefits

Why Self-Employed Small Business Owners Should Explore SETC and FFCRA Benefits As a self-employed small business owner, gig worker, or 1099 contractor, managing finances can often feel like walking a tightrope. Between fluctuating incomes, rising costs, and complex tax regulations, it’s easy to overlook potential benefits that could significantly ease your financial burden. Among these benefits,…

#1099 contractors#accounting firms#business growth#cash advances#cash flow#eligibility criteria#Families First Coronavirus Response Act#FFCRA#financial benefits#financial management#financial relief#gig workers#IRS regulations#securing loans#Self-Employed#Self-Employed Tax Credit#setc#small business owners#tax credits#tax software

0 notes