#Barter System

Explore tagged Tumblr posts

Note

Another pair of time traveling children have appeared!

"Well since there's two of you, I do think I could fetch an arm and a leg for both. Literally. An arm and a leg. I'm hungry."

9 notes

·

View notes

Text

I’m trying an experiment inspired by One Red Paperclip, where a man made 14 trades over the course of a year starting with one red paperclip. I’m interested in seeing where it can go in a year! So I’m starting with this bracelet. Would anyone like to trade and help me with my experiment?

7 notes

·

View notes

Text

Starting a new crafting project for the 12MonthsOfCrafting subreddit.

May’s theme is upcycling, so I’m going to make reusable bags out of plarn from grocery sacks.

Pattern by ChiarosCurosity (sp?), bought from Etsy

#barter system#I’ve been trading people origami for colored shopping sacks#most of mine are white with red text#plarn#upcycling#reduce reuse recycle#reusable bags#mushroom 🍄#crochet#crochetblr#craftochism

8 notes

·

View notes

Text

5 notes

·

View notes

Text

Please. I need an app that makes it easy to do very dumb and silly barters easily. You give me two tablets of Midol Complete, I give you five Girl Scout cookies in a Ziploc bag. No money changes hands. You give me a paperback copy of any Robert Asprin book, I give you two random DVDs and a can of chicken soup. We part ways nameless friends for life.

#i need to live my life#like that one tiny flea market#i went to when i was like 12#traded the book i had just finished reading#for a vhs copy of the birdcage ft robin williams#faint things#barter system

6 notes

·

View notes

Text

Could someone just make me different articles of clothing? (Mostly crocheted/knitted sweaters) And in return you get so many books from me. Like a bartering system? I’ll even make you some homemade cookies. I make a mean homemade blueberry pie. It’s a NYTimes recipe. It’s so good I promise

#just wandering here#send help#library science#support libraries#barter system#books & libraries#librarian#knitblr#crochet

5 notes

·

View notes

Text

There is this guy at the dormitory I work at who left in all anime clothes, like AOT sweater and Chainsaw man PJ pants left 20 minutes ago with two fishing poles. He just came back with McDonald's- burger with fries and a chocolate shake. From all that I know, he just traded two fishing poles for McDonald's.

9 notes

·

View notes

Text

The Culture of Winning: What If There Were No Losers?

Today, I had a conversation with my 13-year-old autistic son that stopped me in my tracks. We had just gotten into the car when he casually mentioned, “You know, if no one buys any properties in Monopoly, no one loses.” Without thinking, I instinctively replied, “Well, in that case, no one would win either.” He looked at me and said, “That’s the point—there would be no losers.” A simple yet…

#barter system#collaboration#collective growth#community#cooperation#harmony#helping each other#inclusive community#mutual support#non-competitive#peaceful exchange#peaceful society#shared success#skill sharing#social harmony#sustainable living#teamwork#Unity#working together

3 notes

·

View notes

Text

The Evolution of Money: From Barter to Blockchain

The history of money is a complex journey that mirrors the evolution of human societies and economies. Here's a broad overview:

1. Barter System (Prehistoric Era)

Before money, people relied on barter, exchanging goods and services directly. Barter had limitations because it required a double coincidence of wants (both parties needing what the other offered), which made transactions difficult and less efficient.

2. Commodity Money (Around 3000 BCE)

Early societies started using commodities that had intrinsic value—like cattle, grains, and shells—as a form of money. These items were widely desired, and their value was universally recognized within societies.

Eventually, metals like gold, silver, and copper became popular as they were durable, divisible, and had intrinsic value. These metals could be melted into standardized units, making trade easier.

3. Metal Coins (7th Century BCE)

The first coins were minted in the Kingdom of Lydia (modern-day Turkey) around 600 BCE, made from a gold-silver alloy called electrum. These coins bore symbols that guaranteed their weight and value, creating a more reliable and portable form of money.

The concept of standardized coinage spread across empires, including Greece, Persia, and Rome, creating the foundation for monetary systems in the ancient world.

4. Paper Money (7th Century China)

China was the first to use paper money during the Tang Dynasty, and its use expanded significantly under the Song Dynasty in the 11th century. Merchants would deposit metals with trusted agents and receive receipts (essentially early banknotes) that could be exchanged for goods.

This concept eventually spread westward, leading to the use of banknotes in medieval and Renaissance Europe, where banks and governments began issuing their own currency.

5. Gold Standard (19th Century)

By the 19th century, many countries adopted the gold standard, linking their national currencies to a fixed quantity of gold. This system enabled stable exchange rates between countries, boosting international trade and investment.

The gold standard provided financial stability but was difficult to maintain, especially during economic crises and wars, when countries faced pressure to print money without adequate gold reserves.

6. Fiat Money (20th Century)

The Great Depression and World Wars strained the gold standard, leading many countries to abandon it. After World War II, the Bretton Woods Agreement (1944) established the U.S. dollar as a global reserve currency, pegged to gold, while other currencies were pegged to the dollar.

In 1971, the U.S. abandoned the gold standard, making the dollar a fiat currency backed only by government decree. Today, most of the world uses fiat money, which derives value from government backing and public trust rather than intrinsic or commodity value.

7. Digital and Cryptocurrencies (21st Century)

Digital banking and electronic transactions have transformed how money moves. The rise of cryptocurrencies like Bitcoin in 2009 introduced decentralized digital money not controlled by any government or central bank.

Blockchain technology powers cryptocurrencies, creating secure and transparent transactions. This innovation has spurred debate on the future of money, especially regarding privacy, control, and economic policy.

Key Themes in the Evolution of Money

Trust: As money evolved from commodities to fiat currency, its value has increasingly relied on collective trust in institutions and governments.

Convenience and Security: The transition from physical to digital currency aims to make transactions faster and more secure, reducing the need for physical assets.

Control and Decentralization: Fiat money is centralized and regulated, while cryptocurrencies challenge this model, offering decentralized alternatives.

Today, the concept of money continues to evolve with digital currencies, reflecting shifts in technology, society, and economic philosophy. The future of money may include further decentralization, more efficient global transactions, and innovative ways to store and exchange value in an increasingly digital world.

#philosophy#epistemology#knowledge#learning#education#chatgpt#economics#sociology#History of Money#Evolution of Currency#Barter System#Commodity Money#Gold Standard#Fiat Currency#Cryptocurrency#Digital Money#Financial Systems#Economic History

2 notes

·

View notes

Text

I HATE BEING BROKE

HOW AM I SUPPOSE TO BE ON THAT HOT GIRL SHIT AND GET MY BIG ASS PHANTOM JELLYFISH TATTOO WHEN IM BROKE

AHHHHHHH

ok im fine.

wait.

AHHHHHHHHHHHH

ok yeah im good

2 notes

·

View notes

Text

when I was in kindergarten, we had a toy exchange, the theme song to which was “Barter barter when you’re broke, trading things with other folk, goods and services at play, exchange things in different ways.”

Should have been teaching us quid pro quo.

You used to be able to exchange money for goods and services. Now you can’t do that. Because of broke.

27K notes

·

View notes

Text

I put some stuff up and my new apartment 🐾

#A bit cluttered#good bit of thus will be put on my shelves and wardrobe#but I do love how it turned out!!#room decor#maximalism#room#whimsical#whimsicore#fantasy#toys#anime#kawaii#desk setup#my room#aesthetic#barter system#academia

0 notes

Text

Neither are such unscrupulous motives limited to Central Asia. They seem inherent to the very nature of barter—which would explain the fact that in the century or two before Smith’s time, the English words “truck and barter,” like their equivalents in French, Spanish, German, Dutch, and Portuguese, literally meant “to trick, bamboozle, or rip off.” Swapping one thing directly for another while trying to get the best deal one can out of the transaction is, ordinarily, how one deals with people one doesn’t care about and doesn’t expect to see again. What reason is there not to try to take advantage of such a person? If, on the other hand, one cares enough about someone—a neighbor, a friend—to wish to deal with her fairly and honestly, one will inevitably also care about her enough to take her individual needs, desires, and situation into account. Even if you do swap one thing for another, you are likely to frame the matter as a gift.

David Graeber, Debt: The First 5000 Years

0 notes

Text

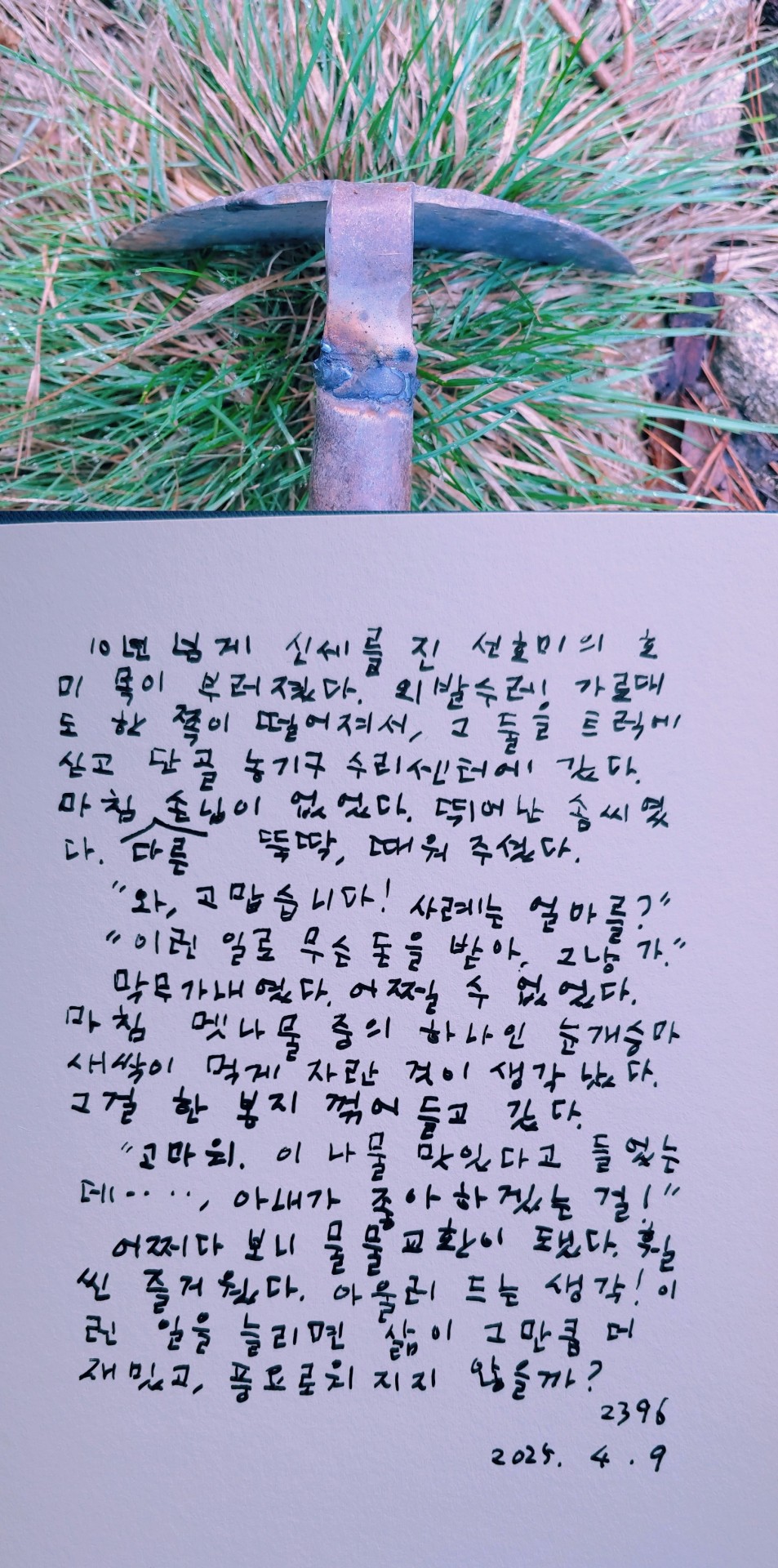

2025年4月9日/こんな仕事を増やせば(No.2396)

10年以上お世話になった草刈り鍬の首が取れてしまった。手押し一輪車の横木も一方が取れて、その二つをトラックに乗せて馴染みの農機具修理センターに行った。

ちょうど他の客がいなかった。優れた技術だった。ぽんぽんとはめてくださった。

「わー、ありがとうございました! おいくらでしょうか?」

「こんなことで金なんて貰えねー。帰りな。」

取り付くしまがなかった。どうしようななかった。ちょうど山菜のひとつであ���山吹升麻の新芽が食べごろに育っているのを思い出した。それを一袋取って持って行った。

「ありがとう。このナムルは美味しいと聞いてたんだ…妻が喜ぶだろうよ!」

そんなこんなで物々交換となった。はるかに楽しかった。さらにこんなことを考えた! こんなことを増やせば人生はもっとおもしろく豊かになるのではないだろうか?

0 notes

Text

i think we should bring back the barter system actually

0 notes

Text

Time Banks: Building Communities Through Time Exchanged

Have you ever heard about the Time Bank concept? It was new to me and it is so interesting that I thought to share it with you dear friends. Time banks are an innovative approach to exchanging services within a community. They allow people to share their time, skills, and talents with others without using money. Instead of cash, time banks use time as currency. For every hour you spend helping…

#Alternative Economy#Barter System#Community Building#Community Exchange#Community Support#Economic Equality#Economic Inequality#Elderly Care#Equal Value#Japan#Local Economy#Skill Sharing#Social Currency#Social Impact#Social Isolation#Spain#sustainable living#Time Bank#Time Banking#Time Credits#UK#USA

1 note

·

View note