#Annual Return Filing For company

Text

Annual Income Tax Returns Filing for Private Limited Company Service

Get expert assistance for Private Limited Companies Annual Filing. Simplify compliance, and ensure accuracy. Paper Tax is your financial governance trusted partner. https://bit.ly/3ZgjYvC

#Annual Filing Private Limited Company#Annual Filing Pvt Ltd Company#accounting#finance#Private Limited Annual Filing support#Annual Return Filing For Company#Annual ITR Filing for Pvt Ltd Company#investing

0 notes

Text

Chennai Filings offers seamless ROC (Registrar of Companies) return filing services in Chennai, ensuring compliance with legal obligations efficiently. Our team of experts simplifies the complex process, guiding clients through every step with precision and professionalism. From preparation to submission, we handle all documentation meticulously, guaranteeing accuracy and adherence to deadlines. With a deep understanding of local regulations and years of experience, Chennai Filings ensures a hassle-free experience for businesses, allowing them to focus on their core operations. Trust us for reliable ROC return filing services in Chennai and stay ahead in your compliance journey.

#ROC Return Filing in Chennai#ROC Filing#Annual Return Filing For company#roc annual filing#ROC Annual Return Filing

0 notes

Text

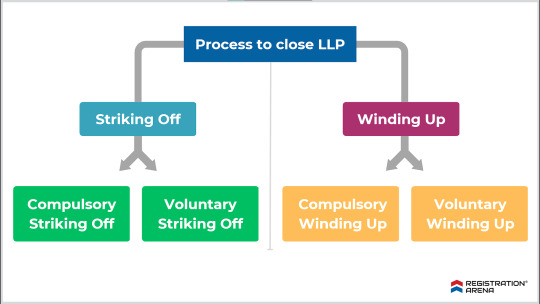

Process of closing an LLP in India

The Limited Liability Partnership (LLP) is a trendy type of business entity, established in 2008 by the Limited Liability Partnership Act, that integrates the features of a company and a partnership. In earlier articles, we discussed the documents mandated for LLP registration and the registration process itself.

This article aims to assist you with the procedure for closing an LLP in India.

Although LLPs offer several benefits over other kinds of business entities, such as ease of incorporation and limited liability for members, these advantages do not necessarily translate into flourishing business operations. This article will explain the Strike Off method of closure and provide an overview of other closure options.

The process to close a Limited Liability Partnership

An LLP can be closed in two ways:

1. Strike-off method-

a. Voluntary Strike Off

The LLP should not have been engaged in commercial activities for a period of at least one year.

The LLP must file an application in Form 24 LLP with the Registrar of LLPs to apply for voluntary strike-off status.

The LLP should have completed all compliance requirements by the date of filing for closure. However, it is only required to file annual returns until the end of the year when commercial activities are discontinued.

The LLP must have obtained the approval of all parties involved, including members, creditors, and any regulatory authorities under whose domain the LLP works.

The LLP should not have any assets or liabilities as of the date of preparation of financial statements.

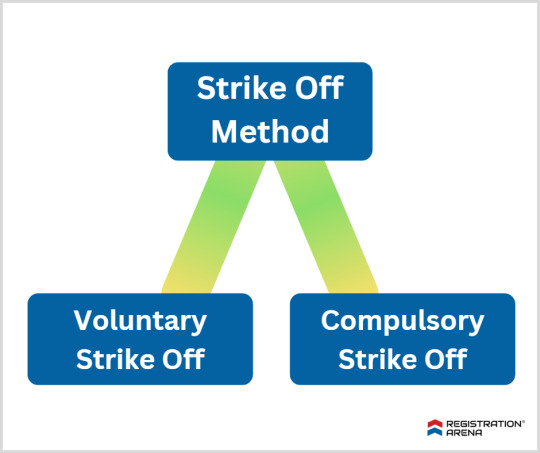

The process to close LLP through Strike Off method

In order to move forward with the Strike Off process, the LLP must follow the steps outlined below:

The LLP must plan a meeting of all partners to pass a resolution to strike off the name.

The LLP must pay all outstanding debts and liabilities before proceeding with the Strike Off process.

The meeting of partners must permit a designated partner to file the application for Strike Off.

The designated partner must file an application in e-Form 24 and submit it to the Registrar. The application must have the approval of all members.

Read more to know about the Procedure of Closing LLP in India

#closure of llp#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal services#legal consultation

0 notes

Photo

Corpsee ITES Pvt Ltd company is the best llp compliance registration services provide. LLP stands for Limited Liability Partnership and is a concoction of a corporation and a partnership, LLPs are gaining tremendous popularity among investors because it provides several advantages that have helped boost the need and want to create more LLPs among entrepreneurs.

#llp compliance#llp annual return#annual filing for llp#checklist for llp registration#annual compliance for llp#annual return for llp#llp company compliance#llp compliance license#llp registration in india#llp registration india#online llp formation#register a llp in india#register llp online#register llp in india#registration of llp#llp formation india

0 notes

Text

The hack against the Trump campaign is not an effort to "stoke discord and undermine confidence in our electoral process," as feds claim.

Jordan Schachtel

Sep 18, 2024

The U.S. intelligence community has finally acknowledged that hackers working for the Iranian government infiltrated and stole private communications from top Trump campaign officials, and then attempted to launder that information to the Biden-Harris administration for use against their political opponent.

However, the acknowledgment came with a giant information operation affixed to it.

2478 everyday investors shared $1,123,615 net profit on a Monet

It’s one of the oldest markets in the world, but until recently, the average person would never dream of investing in it.

The company that makes it all possible is called Masterworks, a unique investment platform that enables investors to invest in blue-chip art for a fraction of the cost.

Shares of every offering are limited, but The Dossier readers can skip the waitlist to join with our exclusive link.

Past performance is not indicative of future returns. Investment involves risk. See Important Reg A Disclosures at masterworks.com/cd. The content is not intended to provide legal, tax, or investment advice. No money is being solicited or will be accepted until the offering statement for a particular offering has been qualified by the SEC. Offers may be revoked at any time. Contacting Masterworks involves no commitment or obligation. “Net Annualized Return” refers to the annualized internal rate of return net of all fees and expenses, calculated from the offering closing date to the date the sale is consummated. IRR may not be indicative of Masterworks paintings not yet sold and past performance is not indicative of future results. For additional information regarding the calculation of IRR for a particular investment in an artwork that has been sold, a reconciliation will be filed as an exhibit to Form 1-U and will be available on the SEC’s website. Masterworks has realized illustrative annualized net returns of 17.6% (1067 days held), 17.8% (672 days held), and 21.5% (638 days held) on 13 works held longer than one year (not inclusive of works held less than one year and unsold works). *“Net proceeds” represents the total liquidation proceeds distributed back to investors, net of all fees, expenses and proceeds reinvested in Masterworks offerings, of all works Masterworks has exited to date. This metric is not considered a presentation of performance but rather a mathematical figure that displays a platform metric on size, scale, and operation of the platform.

In a joint statement released Wednesday evening, the U.S. intelligence community declared that the hack was a mere effort to break Americans’ faith in our electoral system and our “democratic institutions.”

“This malicious cyber activity is the latest example of Iran’s multipronged approach … to stoke discord and undermine confidence in our electoral process,” reads the statement.

17 notes

·

View notes

Text

The IRS will do your taxes for you (if that's what you prefer)

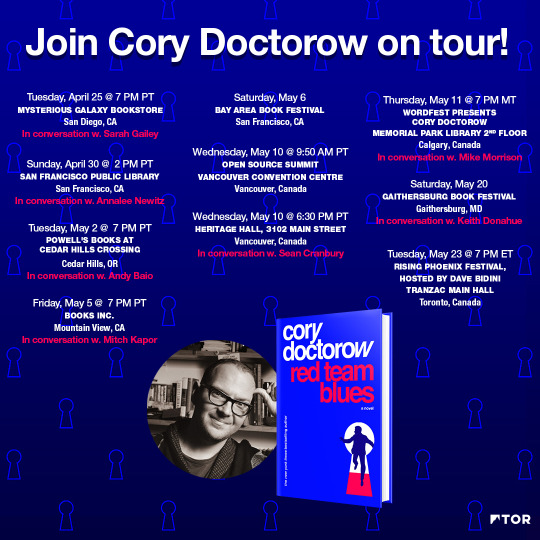

This Saturday (May 20), I’ll be at the GAITHERSBURG Book Festival with my novel Red Team Blues; then on May 22, I’m keynoting Public Knowledge’s Emerging Tech conference in DC.

On May 23, I’ll be in TORONTO for a book launch that’s part of WEPFest, a benefit for the West End Phoenix, onstage with Dave Bidini (The Rheostatics), Ron Diebert (Citizen Lab) and the whistleblower Dr Nancy Olivieri.

America is a world leader in allowing private companies to levy taxes on its citizens, including (stay with me here), a tax on paying your taxes.

In most of the world, the tax authorities prepare a return for each taxpayer, sending them a prepopulated form with all their tax details — collected from employers and other regulated entities, like pension funds and commodities brokers, who must report income to the tax office. If the form is correct, the taxpayer signs it and sends it back (in some countries, taxpayers don’t even have to do that — they just ignore the return unless they want to amend it).

No one has to use this system, of course. If you have complex finances, or cash income that doesn’t show up in mandatory reporting, or if you’d just prefer to prepare your own return or pay an accountant to do so for you, you can. But for the majority of people, those with income from a job or a pension, and predictable deductions, say, from caring for minor children, filing your annual tax return takes between zero and five minutes and costs absolutely nothing.

Not so in America. America is one of the very few rich countries (including Canada, though this is changing), where the government won’t just send you a form containing all the information it already has, ready to file. As is common in complex societies, America has a complex tax code (further complexified by deliberate obfuscation by billionaires and their lickspittle Congressjerks, who deliberately perforate the tax code with loopholes for the ultra-rich):

https://pluralistic.net/2021/08/11/the-canada-variant/#shitty-man-of-history-theory

That complexity means that most of us can’t figure out how to file our own taxes, at least not without committing scarce hours out of the only life we will ever have to poring over the ramified and obscure maze of tax-law.

Why doesn’t the IRS just send you a tax-return? Well, because the tax-prep industry — an oligopoly dominated by a handful of massive, ultra-profitable firms — bribes Congress (that is, “lobbies”) to prohibit this. They are aided in this endeavor by swivel-eyed lunatic anti-tax obsessives, like Grover Nordquist and Americans for Tax Reform, who argue that paying taxes should be as difficult and painful as possible in order to foment opposition to taxation itself.

The tax-prep industry is dominated by a single firm, Intuit, who took over tax-prep through its anticompetitive acquisition of TurboTax, itself a chimera of multiple companies gobbled up in a decades-long merger orgy. Inuit is a freaky company. For decades, its defining CEO Brad Smith ran the company as a cult of personality organized around his trite sayings, like “Do whatever makes your heart beat fastest,” stenciled on t-shirts worn by employees. Other employees donned Brad Smith masks for selfies with their Beloved Leader.

Smith’s cult also spent decades lobbying to keep the IRS from offering a free filing service. Instead, Intuit joined a cartel that offered a “Free File” service to some low- and medium-income Americans:

https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free

But the cartel sabotaged Free File from the start. They blocked search engines from indexing their Free File services, then bought Google ads for “free file” that directed searchers to soundalike programs (“Free Filing,” etc) that hit them for hundreds of dollars in tax-prep fees. They also funneled users to versions of Free File they were ineligible for, a fact that was only revealed after the user spent hours painstaking entering their financial information, whereupon they would be told that they could either start over or pay hundreds of dollars to finish filing with a commercial product.

Intuit also pioneered the use of binding arbitration waivers that stripped its victims of the right to sue the company after it defrauded them. This tactic blew up in Intuit’s face after its victims banded together to mass-file thousands of arbitration claims, sending the company to court to argue that binding arbitration wasn’t enforceable after all:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

But justice eventually caught up with Intuit. After a series of stinging exposes by Propublica journalists Justin Elliot, Paul Kiel and others, NY Attorney General Letitia James led a coalition of AGs from all 50 states and DC that extracted a $141m settlement for 4.4 million Americans who had been tricked into paying for Turbotax services they were entitled to get for free:

https://www.msn.com/en-us/news/us/turbotax-to-begin-payouts-after-it-cheated-customers-new-york-ag-says/ar-AA1aNXfi

Fines are one thing, but the only way to comprehensively end the predatory tax-prep scam is to bring the USA kicking and screaming into the 20th century, when most of the rest of the world brought in free tax-prep for ordinary income earners. That’s just what’s happening: the IRS is trialing a free tax prep service for next year’s tax season:

https://www.washingtonpost.com/business/2023/05/15/irs-free-file/

This, despite Intuit’s all-out blitz attack on Congress and the IRS to keep free tax-prep from ever reaching the American people:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

That charm offensive didn’t stop the IRS from releasing a banger of a report that made it clear that free tax-prep was the most efficient, humane and cost-effective way to manage an advanced tax-system (something the rest of the world has known for decades):

https://www.irs.gov/pub/irs-pdf/p5788.pdf

Of course, Intuit is furious, as in spitting feathers. Rick Heineman, Intuit’s spokesprofiteer, told KQED that “A direct-to-IRS e-file system is wholly redundant and is nothing more than a solution in search of a problem. That solution will unnecessarily cost taxpayers billions of dollars and especially harm the most vulnerable Americans.”

https://www.kqed.org/news/11949746/the-irs-is-building-its-own-online-tax-filing-system-tax-prep-companies-arent-happy

Despite Upton Sinclair’s advice that “it is difficult to get a man to understand something, when his salary depends on his not understanding it,” I will now attempt to try to explain to Heineman why he is unfuckingbelievably, eye-wateringly wrong.

“e-file…is wholly redundant”: Well, no, Rick, it’s not redundant, because there is no existing Free File system except for the one your corrupt employer made and hid “in the bottom of a locked filing cabinet stuck in a disused lavatory with a sign on the door saying ‘Beware of the Leopard.’”

“nothing more than a solution in search of a problem”: The problem this solves is that Americans have to pay Intuit billions to pay their taxes. It’s a tax on paying taxes. That is a problem.

“unnecessarily cost taxpayers billions of dollars”: No, it will save taxpayers the billions of dollars (they pay you).

“harm the most vulnerable Americans”: Here is an area where Heineman can speak with authority, because few companies have more experience harming vulnerable Americans.

Take the Child Tax Credit. This is the most successful social program in living memory, a single initiative that did more to lift American children out of poverty than any other since the days of the Great Society. It turns out that giving poor people money makes them less poor, which is weird, because neoliberal economists have spent decades assuring us that this is not the case:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

But the Child Tax Credit has been systematically sabotaged, by Intuit lobbyists, who successfully added layer after layer of red tape — needless complexity that makes it nearly impossible to claim the credit without expert help — from the likes of Intuit:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It worked. As Ryan Cooper writes in The American Prospect: “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies”:

https://prospect.org/economy/2023-05-17-irs-takes-welcome-step-20th-century/

So yes, I will defer to Rick Heineman and his employer Intuit on the subject of “harming the most vulnerable Americans.” After all, they’re the experts. National champions, even.

Now I want to address the peply guys who are vibrating with excitement to tell me about their 1099 income, the cash money they get from their lemonade stand, the weird flow of krugerrands their relatives in South African FedEx to them twice a year, etc, that means that free file won’t work for them because the IRS doesn’t actually understand their finances.

That’s a hard problem, all right. Luckily, there is a very simple answer for this: use a tax-prep service.

Actually, it’s not a hard problem. Just use a tax-prep service. That’s it. No one is going to force you to use the IRS’s free e-file. All you need to do to avoid the socialist nightmare of (checks notes) living with less red-tape is: continue to do exactly what you’re already doing.

Same goes for those of you who have a beloved family accountant you’ve used since the Eisenhower administration. All you need to do to continue to enjoy the advice of that trusted advisor is…nothing. That’s it. Simply don’t change anything.

One final note, addressing the people who are worried that the IRS will cheat innocent taxpayers by not giving them all the benefits they’re entitled to. Allow me here to simply tap the sign that says “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies.” In other words, when you fret about taxpayers being ripped off, you’re thinking of Intuit, not the IRS. Just calm down. Why not try using fluoridated toothpaste? You’ll feel better, and I promise I won’t tell your friends at the Gadsen Flag appreciation society.

Your secret is safe with me.

Catch me on tour with Red Team Blues in Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

If you’d like an essay-formatted version of this thread to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

[Image ID: A vintage drawing of Uncle Sam toasting with a glass of Champagne, superimposed over an IRS 1040 form that has been fuzzed into a distorted halftone pattern.]

#pluralistic#earned income tax credit#eitc#irs#grover nordquist#guillotine watch#turbotax#taxes#death and taxes#freefile#monopoly#intuit

177 notes

·

View notes

Text

Excerpt from this story from The American Prospect:

The Clean Air Act (CAA) has been fiercely opposed by polluters and their allies since its passage in 1970. Industry has never quite stopped fighting to prevent the government from protecting American lives and communities at the expense of even a bit of their profits. But over the past few years, opposition to the law has reached new feverish heights. Multiple cases seeking to gut the CAA have been filed by (or with the support of) oil and gas organizations, their dark-money front groups, and their political allies since 2022.

The ringleaders of this effort are the usual trade groups driving climate apocalypse, including the American Fuel and Petrochemical Manufacturers (AFPM) and the American Petroleum Institute (API), as well as oil giants themselves, like ExxonMobil.

Yet the coordinated attacks on this lifesaving, popular, and historically successful regulation go beyond the singularly destructive interests of the oil industry alone. And they go beyond the federal rule too, and are working their way into litigation against state enactments of the CAA.

Of course, many of the companies driving these suits are some of the biggest names in corporate greenwashing, like Amazon, FedEx, SoCalGas, and more.

These companies have continuously insisted that they are committed to leading the clean-energy transition, even while they fight for the right to poison the general public for profit, and have endeavored—at every turn—to destroy any opportunity the public may have to pursue recourse for it.

Last year, the Truck and Engine Manufacturers Association (EMA) threatened a lawsuit against the California Air Resources Board (CARB) over the state regulator’s Advanced Clean Fleets (ACF) rule.

The rule, which would mandate a “phased-in transition toward zero-emission medium- and heavy-duty vehicles,” threatens the transportation sector’s historically noxious way of doing business; the sector accounts for more than 35 percent of California’s nitrogen oxide emissions and nearly a quarter of California’s on-road greenhouse gas emissions. CARB’s rule could go a long way toward actualizing rapid reductions in the state’s annually generated emissions.

However, later that year EMA and some major truck manufacturers reached an agreement with CARB not to sue over the rules, in exchange for the state’s loosening of some near-term emissions reductions standards.

EMA has by and large kept its promise to not intervene with the regulation in courts, but litigation challenging CARB’s rule would soon be picked up by the California Trucking Association (CTA). Enforcement of the rule has since been on hold, as CARB waits to be issued an ACF-related waiver from the EPA in return for CTA not filing for preliminary injunction against the law.

Even despite these agreements, some of EMA’s own members—and even some of those specifically signed on to the CARB deal—pop up on CTA’s member rolls, as per CTA’s own 2023 membership directory. Daimler Trucks North America and Navistar, Inc., are specifically listed as Allied Members of CTA for 2023.

Amazon is listed among CTA’s Carrier Members, while separately making routine promises to be a partner in the fight against climate change. While Amazon announced its “Climate Pledge” in 2019 of reaching net-zero emissions by 2040 to great fanfare, and has since branded itself a climate leader, the Center for Investigative Reporting has detailed how the e-commerce giant is overselling its green credentials by drastically undercounting its carbon emissions.

In truth, Amazon’s emissions have increased more than 40 percent in the time since it issued the pledge. Amazon also remains the largest emitter of the “Big Five” tech companies, producing no less than 16.2 million metric tons of CO2 every year. Without question, the corporation should be regarded as an industry leader in greenwashing, rather than in actual climate action.

FedEx is also a CTA Carrier-level member. Like Amazon, the company has also made promises “to achieve carbon neutral operations by 2040,” an initiative FedEx has labeled “Priority Earth.” In the years since, FedEx has funneled intensive time and resources into lobbying directly against climate action while pushing its net-zero greenwashing narrative.

UPS is another CTA Carrier-level member. UPS has historically been less effusive in its climate promises than have other corporations on this list, but the delivery giant has continuously reinforced its stance that “everyone shares responsibility to improve energy efficiency and to reduce GHG emissions in the atmosphere.”

7 notes

·

View notes

Text

⋆⠀⠀&.⠀⠀٬⠀⠀❝ LETALIS INVOLVED IN SERIOUS CAR ACCIDENT, THREE MEMBERS & TWO CIVILIANS HOSPITALIZED. ❞ ┉ published nov. 10, 2016

ʬ.ʬ.⠀written by ⸻ chitalisred.

Representatives from Apricus Culture have confirmed reports that Letalis was involved in a serious car accident early this morning. According to the statement made by the agency, on November 10 (KST), the members of the girl group had wrapped up rehearsals for the company's annual end of year showcase and were on their way back to their dorm around 2AM. As the driver of the vehicle attempted to make a left turn, they lost control due to icy road conditions and spun into a railing alongside the road.

Currently, it is unclear who was driving the vehicle and which members were directly involved. The representative confirmed that three members were hospitalized along with two civilians who had been rear-ended.

The company concluded stating, "The health, both mental and physical, of the seven members of Letalis is our top priority. As a result, we will be rescheduling the group's upcoming activities in accordance with medical guidance."

UPDATED ARTICLE ⸻ nov. 17, 2016.

On November 10, Letalis was involved in a car accident that left three members and two civilians hospitalized. Seoul Police released additional details about the crash to the public this afternoon in an official press release.

According to the report, three members of the girl group: Melanie, Heri, and Naryun left the rehearsal space at approximately 1:47 AM on November 10. The three entered Melanie's vehicle to return back to their dorm, approximated to be a 10 minute drive. Around 1:52 AM, traffic cameras captured footage of the car, driven by Melanie, spinning out of control out of a left turn, colliding with another vehicle before crashing into a railing.

Police were called to the scene where Melanie passed a breathalyzer test with a blood alcohol level of 0.0% BAC. All five individuals involved received medical attention on the scene before being transported to the hospital.

The two civilians involved in the accident were diagnosed with minor injuries and released to go home hours later. Heri was diagnosed with a broken wrist and Melanie with a minor concussion and shoulder strain before both members were similarly discharged from the hospital.

The most severe of the injuries of the five belonged to Naryun who was kept for overnight observation due to severe bruising, whiplash, a dislocated shoulder, and bruised ribs. In addition to her injuries, Naryun was reported to be in "severe emotional distress" and required psychiatric attention several times over the course of her hospitalization before being released on November 14.

The group's label, Apricus Culture, released their own statement on November 15 announcing that the group had agreed to pull out of the company's end of year showcase as well as pausing any individual activities while their members recovered. Fans have taken to social media to voice their support for the three involved members, trending #GetWellSoon on Twitter over several days.

┉ * VIEW COMMENTS

## USERNAME — 10 minutes ago

get well soon girls

533 ↑ | ↓ 0

## USERNAME — 21 minutes ago

"blood alcohol level of 0.0% BAC" they really want us to believe APRICUS CULTURE isn't above bribing a few officers to cover up a dui???

1060 ↑ | ↓ 400

## USERNAME — 29 minutes ago

so first emmy has a stalker in her apartment, naira has to file a restraining order, they fuck up juniper's hair, and now melanie, naryun, and heri get into a car accident? wtf is going on in letalisland?

571 ↑ | ↓ 103

## USERNAME — 6 minutes ago

can we just say get well soon and move on, y'all do way too damn much

256 ↑ | ↓ 17

## USERNAME — 18 minutes ago

i cannot be the only one who saw those three names together and thought what the hell are they doing in a moving car alone?

201 ↑ | ↓ 183

## USERNAME — 10 minutes ago

not to be rude or anything, but don't those three hate each other's guts? it's kind of a given this would happen lol

318 ↑ | ↓ 206

# ⋆⠀⠀ʬ.ʬ.⠀⠀٬⠀⠀(⠀⠀&.⠀⠀)⠀...⠀DEVELOPMENT.#ficnetfairy#fictional kpop idol#fictional kpop company#fictional kpop oc#fictional kpop community#fictional idol community#fictional idol group#fictional idol oc#fictional kpop soloist#fake idol group#fake kpop group#fake kpop idol#fake kpop girl group#fake kpop oc#fake kpop gg#idol au#idol kpop#idol oc#idolverse#kpop idol#kpop au#kpop#kpopidol#kpop gg

26 notes

·

View notes

Text

I hope you all had a wonderful holiday season and that you're all ready for this year to end already. I'm pretty sure given what's happened in Jensen's life, he sure is ready for 2023 to go out the door. Big Sky and The Winchesters getting cancelled, FBBC having 2 brewers quit in 1 week, firing several other employees according to some posts that were here on Tumblr and on Instagram, and let's not forget The Winchesters lawsuit that was filed earlier this year. I'm aware some people here have been speculating on what is to come of Jensen's brewery FBBC, so I thought I'd share a little bit of some interesting history with regards to the Ackles and Graul families in business.

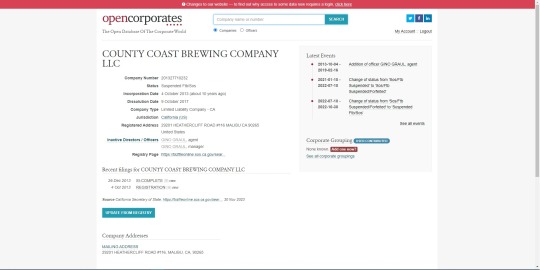

In a previous post, I talked about some of the history of FBBC itself being tied to a brewery called County Coast Brewing Company that was in the Malibu, California area back in 2013. The former address was 29201 Heathercliff Road #116 in Malibu, CA. Gino was the listed owner of this brewery that was incorporated 10/4/2013 and became inactive 10/9/2017, 4 years and 5 days after this company was formed. Its current inactive status is listed as Suspended Ftb/Sos. One noteworthy mention here, I couldn't find this County Coast Brewing Company anywhere as being say "permanently closed" as you would other businesses. No Google reviews or searches are available either for this company. Hmm, it's just like it never existed unless you know to look up Gino's name and affiliated LLCs or remember the name of this company...

According to this website, it says under the Why is My Business Suspended section: "Generally, businesses are suspended when they fail to:

File a return

Pay

Taxes

Penalties

Fees

Interest

You may be able to find out the reason for suspension using MyFTB. Business entities registered with Secretary of State (SOS) must file and pay at least $800 franchise or annual tax from their registration date to current, regardless of business activity. Visit due dates for businesses for more information on when to file and pay."

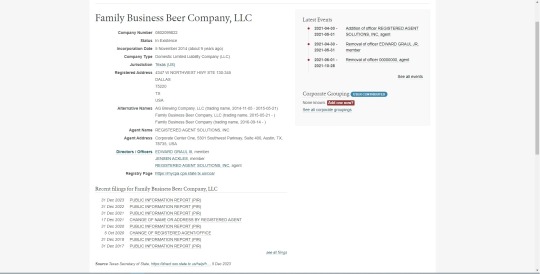

After doing some further research thanks to this Tumblr post, it does seem that after Jensen filed for the incorporation of Family Business Beer Company back on 11/5/2014 in Dallas Texas, 1 year, 1 month and 1 day after County Coast Brewing Company was filed in California under Gino's name. Interestingly enough, a couples post that were seemingly tied to the County Coast Brewing Company dated prior to FBBC opening doors in January 2018 are still on the Facebook page. This post dated 4/8/2014 BEFORE FBBC was incorporated but is on the FBBC Facebook page states "On our way to Denver for the 2014 Craft brewer's Conference!!!" This photo dated 12/8/2013 has a caption stating "looking forward to trying out our newest batch of Pale Ale!" Again, no comments on it date past 3/17/2017 just like the other post that predates the official opening of FBBC in Austin on 1/10/2018 by several years.

The other Tumblr post I mentioned here even has a screenshot (along with several others) of posts that have been deleted including one that was posted on 1/24/2015 at 6:56pm saying "County Coast is moving location and names!!!!!! WTF?! Haha, relocating to the South. #AustinTexas get ready!!!!" Given the Graul and Ackles family histories of deleting comments they deemed unsavory on the FBBC Instagram page, it doesn't surprise me that they cleaned up shop on the internet and Facebook pages to try eliminating the existence of the failed County Coast Brewing Company and rebranding their Facebook page to become Family Business Beer Company's. According to this article, it states "While living in California, Jensen and Gino often brewed their own beers at home. The family moved to Austin and decided to finally open their own place. They found the Dripping Springs property in 2014, hooked up with now-head brewer Nate Seale, and got started from there." Guess they forgot to mention the former location the had in California that got suspended due to noncompliance with state tax regulations. Hmm....

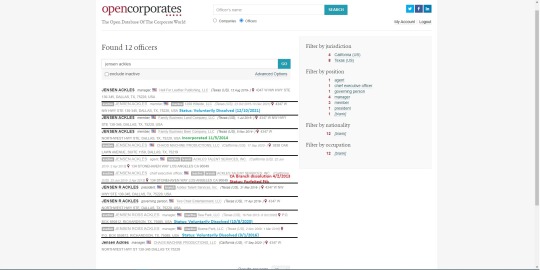

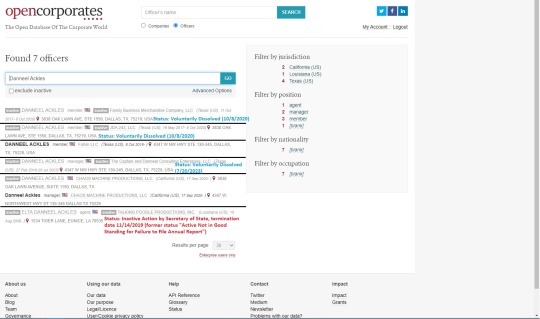

Now, this is where things start to get interesting regarding the history of both the Ackles and Graul families and business. I mentioned the suspended ftb status that was put on the County Coast Brewing Company before. I also took the liberty of researching LLCs affiliated with Jensen and Danneel and found some similar statuses on previous companies they had incorporated in the past. I elected to put some notes to summarize things like when these companies were voluntarily dissolved (or straight up suspended) in the screenshots below. The Ackles Talent Services, Inc. California branch that was incorporated 6/22/2010 was suspended on 4/2/2013 and also has a forfeited ftb status which translates to the same status that is on the other brewing company that was in Gino Graul's name.

Looking over Danneel's companies, there is a Talking Poodle Productions, Inc. that holds the status "Inactive action by Secretary of State" that used to read as "Active not in good standing for failure to file annual report". According to this website for 2006 Louisiana laws titled 2006 Louisiana Laws - RS 12:163 — Failure to file annual reports; revocation and reinstatement of articles and limitation on authority to do business with the state, it states the following interesting tidbits of information: "§163. Failure to file annual reports; revocation and reinstatement of articles and limitation on authority to do business with the state

A. Where a corporation has failed to designate and maintain a registered office, or to designate and maintain a registered agent pursuant to the provisions of R.S. 12:104, for a period of ninety consecutive days, or where a corporation has failed to file an annual report for three consecutive years, according to the records of the secretary of state, the secretary of state shall revoke the articles of incorporation and franchise of such corporation."

Also, "F.(1) As used in this Subsection the phrase "not in good standing" means any corporation which is delinquent in filing an annual report.

(2) Each corporation, domestic and foreign, which is not in good standing is prohibited from engaging in commercial business operation with the state or its boards, agencies, departments, or commissions. Any contract between a corporation which is not in good standing and the state or its boards, agencies, departments, or commissions is subject to be declared null and void, by said board, agency, department, or commission or by the Division of Administration."

There are of course other parts I didn't put in here for the sake of keeping this post a reasonable length but it seems that the bottom line message is the same here: The Grauls and Ackles have a history of not complying with tax laws and is unlikely they simply forgot to file taxes or annual reports as necessary. Was this to hide questionable financial practices? Are both families hiding unethical behaviors? Are they unable to afford accountants who can properly file all reports with state and federal tax governmental branches appropriately, so they can stay in business? Are these simple, honest mistakes on behalf of the Graul and Ackles' families? Not sure what you all think of this but it is entirely possible with this information here that there are some questionable business practices going on here and that the speculations here about FBBC not doing so good just might have some factual basis.

#jensen critical#gino graul#anti danneel#anti elta#family business beer company#graul family#danneel graul#fbbc speculation

28 notes

·

View notes

Note

Hii! I have two questions about your mind map (love it by the way F1 is an absolute mess let's out the double standards)

1. I thought Lando had said in the past he wasn't a pay driver? (I feel like I might have seen tiktok comments about this but I think they're usually about his former testing position 🤔)

2. Where did you hear that Zak was CEO of Quadrant? (in no way discounting you i liked to think I was fairly up to date/itk about Lando lore/his career and I've never heard of this)

Thankss 🫶🥰

Hello bb,

I wasn't calling lando a pay driver per se but his dad definitely paid for his entry into f1. While he did have a good junior career, seats were even more scarce then than they are now, and McLaren was on the brink of financial collapse so they made no secret of the fact that money would be part of the equation, and lando was too young to have sponsors so his dad paid for it. First to secure his position as a sim and test driver in 2017-18 then a payment to the tune of 12-18 million (accounts vary) to secure his entry into f1 in 2019.

As for the Quadrant stuff, neither zak nor lando have advertised or ever acknowledged that fact (for obvious reasons, its iffy at best), but these things have to registered and you can find it on the UK government website lol

If you want to have a look for yourself:

17 notes

·

View notes

Text

A Republican in Florida's Legislature has filed a bill that, if enacted, would eliminate the Florida Democratic Party.

“The Ultimate Cancel Act,” filed Tuesday by state Sen. Blaise Ingoglia, would require the state’s Division of Elections to “immediately cancel” the filings of any political party whose platform had “previously advocated for, or been in support of, slavery or involuntary servitude.”

The bill, called SB 1248, would require Florida officials to notify all registered voters who belong to any canceled parties that their parties no longer exist. It would also change their voter registrations to “no party affiliation” and “provide procedures” for those voters to update their affiliations to “an active political party.”

The bill would allow any canceled political parties to re-register with the Florida State Department — but only under the condition that the party change its name to something “substantially different from the name of any other party previously registered” with the agency.

The proposed legislation doesn’t explicitly mention the Democratic Party. But the party, throughout much of the early and mid-1800s, supported slavery. Southern Democrats in particular supported protecting slavery in the U.S. and opposed civil rights reforms for decades after the Civil War. The party underwent a major realignment in the 19th century, and support for such policies has been absent from its platform or general discourse for many years.

Florida Democrats said the intention of the bill was abundantly clear.

“Presenting a bill that would disenfranchise 5 million voters is both unconstitutional and unserious. Under Ron DeSantis, Senator Ingoglia is using his office to push bills that are nothing more than publicity stunts instead of focusing on the issues that matter most to Floridians,” the Florida Democratic Party said in a statement.

Florida Republicans hold a supermajority in the Legislature. Its legislative sessions kick off Tuesday.

Ingoglia suggested in a news release that his bill was designed to get back at Democrats and “leftist activists” who he said had “been trying to ‘cancel’ people and companies for things they have said or done in the past,” including “the removal of statues and memorials, and the renaming of buildings.”

“Using this standard, it would be hypocritical not to cancel the Democrat Party itself for the same reason,” Ingoglia said. “Some people want to have ‘uncomfortable conversations’ about certain subjects. Let’s have those conversations.”

Ingoglia noted that the Democratic Party had “adopted pro-slavery positions into their platforms” at its national conventions in 1840, 1844, 1856, 1860 and 1864.

In a series of tweets Tuesday, Ingoglia, who previously was the chairman of the Florida GOP, had also indicated his bill was designed to target Democrats.

In a tweet at Nikki Fried, Florida’s former state agriculture commissioner, who was elected over the weekend as the new chair of the state Democratic Party, Ingoglia wrote that “Florida Dems should be thankful I’m not asking them to return all the money they’ve raised previously from their Jefferson/Jackson Dinners.”

The tweet was a reference to a name Democrats used for years as a label for annual fundraising dinners that were named to honor Presidents Thomas Jefferson and Andrew Jackson, who both owned slaves.

Many Democratic organizations have changed the names of the dinners in recent years.

#us politics#news#nbc news#2023#Democrats#republicans#conservatives#gop#gop policy#gop platform#florida#The Ultimate Cancel Act#florida legislature#Florida Senate#Blaise Ingoglia#Florida Division of Elections#SB 1248#Florida State Department#Nikki Fried#tweet#twitter

53 notes

·

View notes

Text

Chennai Filings offers seamless ROC (Registrar of Companies) return filing services in Chennai, ensuring compliance with legal obligations efficiently. Our team of experts simplifies the complex process, guiding clients through every step with precision and professionalism. From preparation to submission, we handle all documentation meticulously, guaranteeing accuracy and adherence to deadlines. With a deep understanding of local regulations and years of experience, Chennai Filings ensures a hassle-free experience for businesses, allowing them to focus on their core operations. Trust us for reliable ROC return filing services in Chennai and stay ahead in your compliance journey.

#ROC Return Filing in Chennai#ROC Filing#Annual Return Filing For company#roc annual filing#ROC Annual Return Filing

0 notes

Text

Formation of Wholly Owned Subsidiary In India

A Wholly Owned Subsidiary refers to a company whose shares or voting rights are totally owned by the parent company.

A Wholly Owned Subsidiary (WOS) is distinct from a subsidiary since the former signifies that the parent company holds 100% of the whole shares or voting rights, while the subsidiary implies the parent company holds 51% or more of the subsidiary company.

In India, a Private Limited company can be established by Foreign companies to conduct business or invest, which would be considered a Wholly Owned Subsidiary. However, this is subject to government regulations on Foreign Direct Investment (FDI) and other applicable provisions.

Requirements of Wholly Owned Subsidiaries

At least one director to be a resident of India: A Wholly Owned Subsidiary company must have at least one director who is a resident of India.

The term "resident" refers to an individual director who has lived in India for an equivalent of or more than 182 days in the preceding year.

No Minimum Capital: As per MCA guidelines, there is no minimum capital required to create the company.

Minimum one shareholder (and nominee) and 2 directors: As per Section 3(1)(b) of the Companies Act, 2013, it is crucial for every company to have at least one shareholder and one nominee shareholder, along with a minimum of two directors.

How to Form a Wholly Owned Subsidiary in India

Application for Name approval of Wholly Owned Subsidiary – Part A of formation

Retain Original Name: The foreign company can decide to keep its original name for the subsidiary in India to carry forward its goodwill.

Add India as a Suffix: The foreign company can add India as a suffix to its original name to indicate its status as a subsidiary in India.

Use Registered Trademark: If the foreign company has a registered trademark in another country, it can use the same trademark for the subsidiary in India.

Choose a New Name: The foreign company can also pick a new name for the subsidiary if it wishes to do so.

Read more to know about the formation of WOS in India

#wholly owned subsidiary#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal consultation#legal services

0 notes

Text

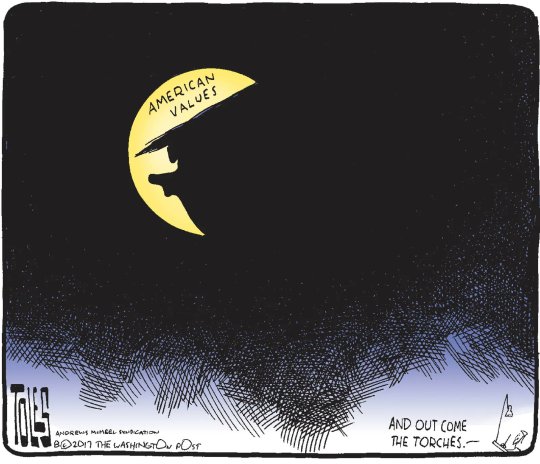

Tom Toles

* * * *

LETTERS FROM AN AMERICAN

April 26, 2024

HEATHER COX RICHARDSON

APR 27, 2024

Yesterday, in a long story about “the petty feud between the [New York Times] and the White House,” Eli Stokols of Politico suggested that the paper’s negative coverage of President Joe Biden came from the frustration of its publisher, A. G. Sulzberger, at Biden’s refusal to do an exclusive interview with the paper. Two people told Stokols that Sulzberger’s reasoning is that only an interview with an established paper like the New York Times “can verify that the 81-year-old Biden is still fit to hold the presidency.”

For his part, Stokols reported, Biden’s frustration with the New York Times reflects “the resentment of a president with a working-class sense of himself and his team toward a news organization catering to an elite audience,” and their conviction that the newspaper is not taking seriously the need to protect democracy.

A spokesperson for the New York Times responded to the story by saying the idea that it has skewed its coverage out of pique over an interview is “outrageous and untrue,” and that the paper will continue to cover the president “fully and fairly.”

Today, Biden sat for a live interview of more than an hour with SiriusXM shock jock Howard Stern. Writer Kurt Andersen described it as a “*Total* softball interview, mostly about his personal life—but lovely, sweet, human, and Biden was terrific, consistently clear, detailed, charming, moving. Which was the point. SO much better than his opponent could do.”

Also today, the Treasury Department announced that the pilot program of the Internal Revenue Service (IRS) that enabled taxpayers to file their tax returns directly with the IRS for free had more users than the program’s stated goal, got positive ratings, and saved users an estimated $5.6 million in fees for tax preparation. The government had hoped about 100,000 people would use the pilot program; 140,803 did.

Former deputy director of the National Economic Council Bharat Ramamurti wrote on social media, “Of all the things I was lucky enough to work on, this might be my favorite. You shouldn’t have to pay money to pay your taxes. As this program continues to grow, most people will get pre-populated forms and be able to file their taxes with a few clicks in a few minutes.” Such a system would look much like the system other countries already use.

Also today, the Federal Trade Commission announced that Williams-Sonoma will pay a record $3.17 million civil penalty for advertising a number of products as “Made in USA” when they were really made in China and other countries. This is the largest settlement ever for a case under the “Made in USA” rule. Williams-Sonoma will also be required to file annual compliance certifications.

FTC chair Lina Khan wrote on social media: “Made in USA fraud deceives customers and punishes honest businesses. FTC will continue holding to account businesses that misrepresent where their product[s] are manufactured.”

In another win for the United Auto Workers (UAW), the union negotiated a deal today with Daimler Trucks over contracts for 7,300 Daimler employees in four North Carolina factories. The new contracts provide raises of at least 25% over four years, cost of living increases, and profit sharing. This victory comes just a week after workers at a Volkswagen plant in Chattanooga, Tennessee, voted overwhelmingly to join the UAW.

Today was the eighth day of Trump’s criminal trial for his efforts to interfere with the 2016 election by paying to hide negative information about himself from voters and then falsifying records to hide the payments. David Pecker, who ran the company that published the National Enquirer tabloid, finished his testimony.

In four days on the stand, Pecker testified that he joined Michael Cohen and others in killing stories to protect Trump in the election. Trump’s longtime executive assistant Rhona Graff took the stand after Pecker, and testified that both Karen McDougal and Stormy Daniels were in Trump’s contacts. Next up was Gary Farro, a bank employee who verified banking information that showed how Michael Cohen had hidden payments to Daniels in 2016.

Once again, Trump appeared to be trying to explain away his lack of support at the trial, writing on his social media channel that the courthouse was heavily guarded. “Security is that of Fort Knox,” he wrote, “all so that MAGA will not be able to attend this trial….” But CNN’s Kaitlan Collins immediately responded: “Again, the courthouse is open [to] the public. The park outside, where a handful of his supporters have gathered on [trial] days, is easily accessible.”

Dispatch Politics noted today that when co-chairs Michael Whatley and Lara Trump and senior campaign adviser Chris LaCivita took over the Republican National Committee (RNC), they killed a plan to open 40 campaign offices in 10 crucial states and fired 60 members of the RNC staff. According to Dispatch Politics, Trump insisted to the former RNC chair that he did not need the RNC to work on turning out voters. He wanted the RNC to prioritize “election integrity” efforts.

The RNC under Trump has not yet developed much infrastructure or put staff into the states. It appears to have decided to focus only on those that are key to the presidential race, leaving down-ballot candidates on their own.

While Trump appears to be hoping to win the election through voter suppression or in the courts, following his blueprint from 2020, Biden’s campaign has opened 30 offices in Michigan alone and has established offices in Wisconsin, Pennsylvania, Nevada, Arizona, Georgia, North Carolina, New Hampshire, and Florida.

Finally today, news broke that in her forthcoming book, South Dakota governor Kristi Noem wrote about shooting her 14-month-old dog because it was “untrainable” and dangerous. “I hated that dog,” she wrote, and she recorded how after the dog ruined a hunting trip, she shot it in a gravel pit. Then she decided to kill a goat that she found to be “nasty and mean” as well as smelly and aggressive. She “dragged him to the gravel pit,” too, and “put him down.”

Noem has been seen as a leading contender for the Republican vice presidential nomination on a ticket with Trump, and it seems likely she was trying to demonstrate her ruthlessness—a trait Trump appears to value—as a political virtue. But across the political spectrum, people have expressed outrage and disgust. In The Guardian, Martin Pengelly said her statement, “I guess if I were a better politician I wouldn’t tell the story,” was “a contender for the greatest understatement of election year.”

—

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Tom Toles#American Values#political cartoons#Letters From An American#Heather Cox Richardson#election 2024#South Dakota governor Kristi Noem#Ugly American#A. G. Sulzberger#NYTimes#Biden's accomplishments

3 notes

·

View notes

Text

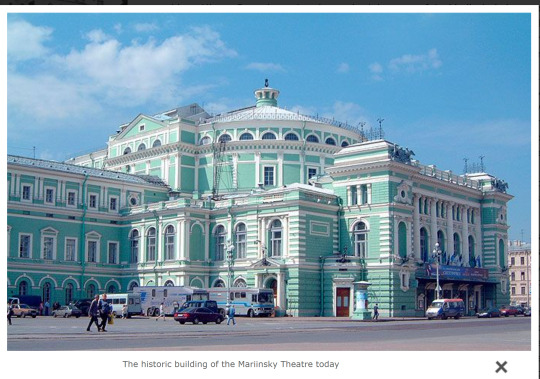

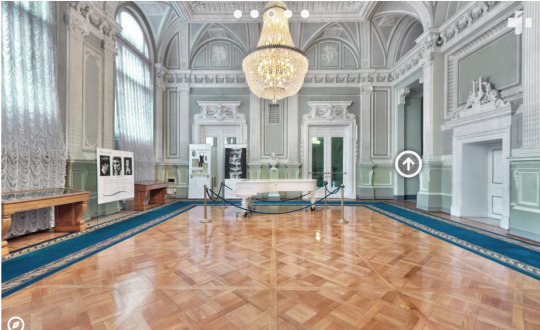

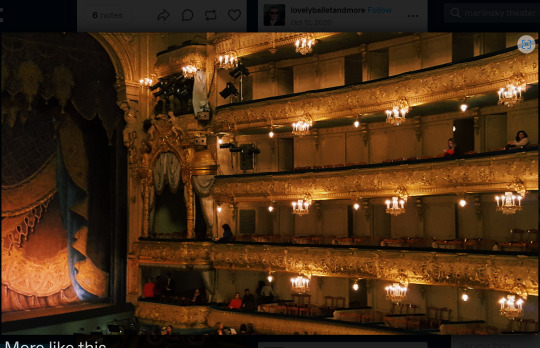

Photographs: 1. The exterior of the Mariinsky as it looks today; 2. A view of the facade; 3. The lobby; 4. A view of the orchestra and of the "Royal Box" which was in fact used by the Tsar only when there was visiting Royalty from other countries, etc. in attendance; 5. The "Royal Box" as seen from the stage; 6. The stage as seen from the "Royal Box" (notice the decorated ceiling and lamp); 7. Another view of the stage. 8. Notice the box next to the stage; that was the Tsar's real box - that was where he sat when he attended a performance with his family; 9. Another view of the Tsar's box next to the stage

"The Season" at Saint Petersburg, the Tsars and the Mariinsky Theater

Those interested in Romanov history and how the members of the dynasty lived know that "The Season," the ballet, opera, balls, etc., were an important part of their personal and political lives. So important, that one of the many factors contributing to the fall of Nicholas II might have been his withdrawal from the social activities "The Season" entailed.

"The Season" in St. Petersburg began in the last two weeks of September. The nobility returned from their vacation in their country dachas at the end of October, at the same time as the Tsar and his family. The most brilliant part of the Season took place during this time, and long-term visitors reported the city looked most brilliant and glorious during this exciting time of gala court balls, festivals, and masquerades.

All of this revolved around the person on the Tsar, who was the most important host, guest, and critic. Nicholas I attended the theater almost every day during the Season. This pattern continued until the reign of Alexander III, when he began to cut back his attendance. His son Nicholas loved the theater (he wrote in his diary that nothing moved him more than music), and as Tsarevich, he attended operas, ballets, plays, and concerts as often as he could. After he married, his wife's frequent pregnancies and illnesses increasingly cut into his attendance. In 1900 the Imperial couple was still attending concerts and performances in the city. Still, they were becoming fewer and fewer each year.

At the center of much of Saint Petersburg's entertainment life was the famous Mariinsky Theatre. Today, it still plays a significant role in Russia's cultural life. The Mariinsky underwent several rebuildings over the years. The luxurious building went up in 1860. In 1883 it was extensively remodeled, and more decoration was added to the facade. The Mariinsky was the center of the famous Imperial Ballet and Opera, home to many of the most famous performing artists of the last 100 years.

Many of the names of these stars are legendary - Nijinsky, Karsavina, Pavlova, Kschessinska, Chaliapin, Petipa, and many others. The artists of the Imperial theatre and the upkeep of its facilities were the responsibility of the Tsar, and all of these costs came out of the annual revenues of the Imperial estates.

Tickets to the Mariinsky were hard to get. Most of them were pre-assigned to subscribers who held their seats for life; when Prince Felix Yussupov married the Tsar's niece, Irina, the Tsar asked him what he wanted as a wedding present. Yussupov, a fan of the performing arts, asked for the right to use the Tsar's box at the theater when he was away - which was a gift beyond price. His request surprised and amused the Tsar, who granted it. The Tsar's private box was on the left-hand side of the Mariinsky stage. It had an incredibly intimate view of the stage, a dining room, and its own elegant bathroom. It also had a private entrance to the building and a staircase.

The Mariinsky Theatre invariably began the Season with A Life for the Tsar, a patriotic opera. The ballet opened on the first Sunday of September, the company having assembled two weeks before.

The competition for seats and the right to subscribe proved the interest it aroused. A petition to the Chancery of the Imperial Theatres had to be filed to obtain a seat; the chance of success was so small that advertisements constantly offered big premiums to the original holders of the stalls. Fathers handed their seats down to their sons. There may have been personal motives in the attachment of some to the ballet, but the cult of this delicate art was always uppermost. (gcl)

12 notes

·

View notes

Text

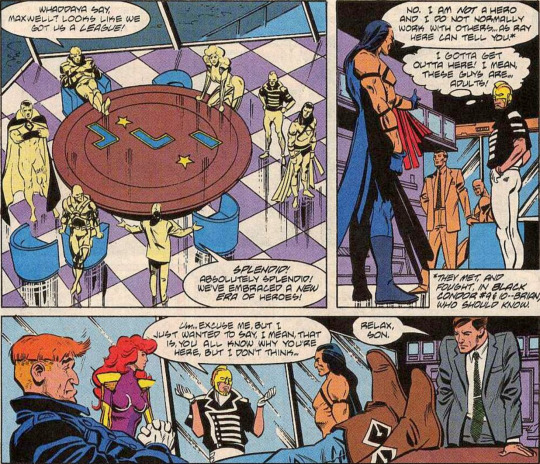

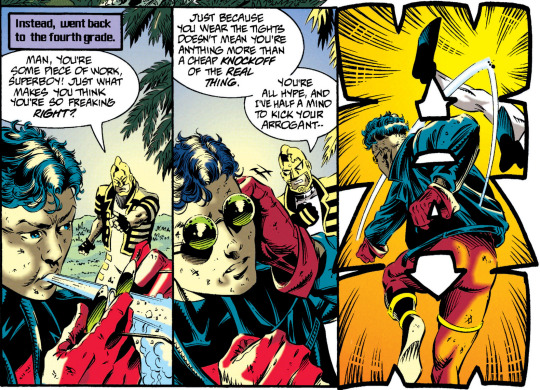

Young Justice 1998 had the difficult task of not existing in isolation, since for nearly all its run, half the main cast were featuring in their own solo books. So YJ's stories had to interact with all of those narratives and characterization with consistency. Writer Peter David did seem to be carefully keeping up with all that, and YJ's narrative is made richer if you're aware of what was going on in the other books, as the reader is generally assumed to be.

So when Ray came along, that would have been two solo books for David to familiarize himself with (which had already concluded, with no potential new curveballs to work around), and he must have, for there are multiple references (some definite, some maybe only potential) to Ray's previous appearances.

Such as...

YJ first encounter Ray while on a train, when they see him swoop in to rescue someone. Most of the onlookers don't recognize this hero and assume he's Superman. This has happened before. Ray once averted a plane crash and was mistaken by the media for Superman, to the point that Superman had to come to Philadelphia to set the record straight.

(Young Justice 1998 #41 / The Ray Annual #1)

As YJ seek Ray out, we learn two things: 1) he has JLA experience, and 2) Bart admires him and talks about him a lot, although we've never seen him do that.

Not long after Ray begins his heroic career, he is recruited by the JLA, who are currently suffering for members. He's significantly younger than his new teammates and very inexperienced at this point--the complete opposite of how it will be for him with YJ.

And Ray and Bart have met before, when Bart tried to appropriate Grant Emerson's invitation to join the Justice League Task Force. The two didn't work together directly, although Bart did inadvertently save Ray's life by stealing bullets before a shootout. But it's not implausible that Bart might continue--despite the TF's rejecting him--to admire Ray. And of course there's the alternate future of the two of them growing to be friends, of sorts.

(Young Justice 1998 #41 / Justice League America #71 / Justice League Task Force #26)

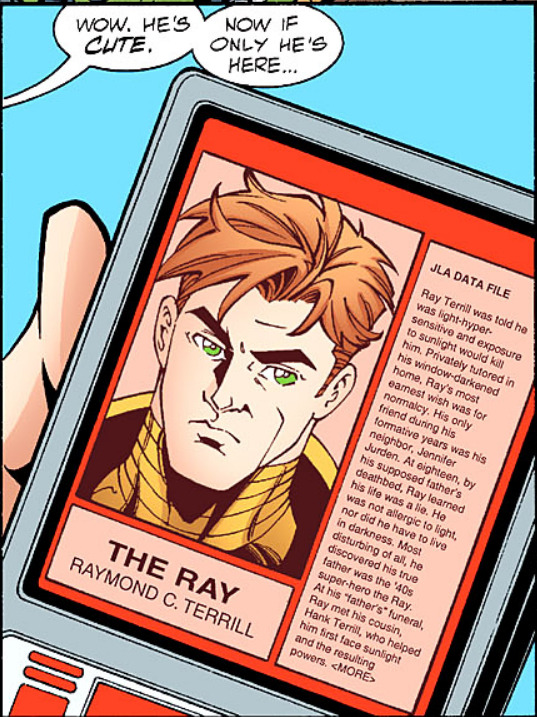

Cassie brings up Ray's file from the JLA's database. His bio is lifted directly from one written around the time of his debut miniseries.

If you have the paperback volumes of YJ, as I do, you might note that in that edition the text on the file Cassie reads is omitted, for some reason.

(Young Justice 1998 #41 / Who's Who in the DC Universe Update 1993 #2)

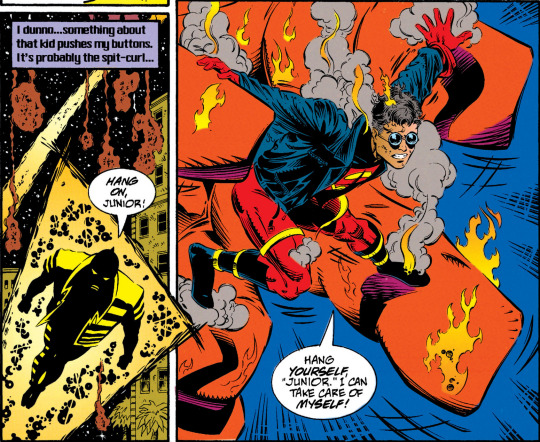

Kon reminds Ray that they "met awhile back." It was even earlier than the YJ editor points out; they ran into each in the very first issue of The Ray 1994. Not the most successful team-up!

(Young Justice 1998 #41 / The Ray 1994 #1)

The first glimpse we get of Ray after he joins the team officially is when most of the team returns from the World Without Young Justice arc and find Secret and Ray playing tennis outdoors at night.

And this may be a stretch, but one of Ray's TF teammates jokingly taunts him about an "urgent badminton lesson" keeping him from helping out during the time that he was working for Vandal Savage and affecting the lifestyle of the wealthy. We don't know that he actually plays badminton for sure, and of course that's a distinct sport from tennis, but this seems the likeliest point when he could have learned tennis.

(Young Justice 1998 #45 / Justice League Task Force #31)

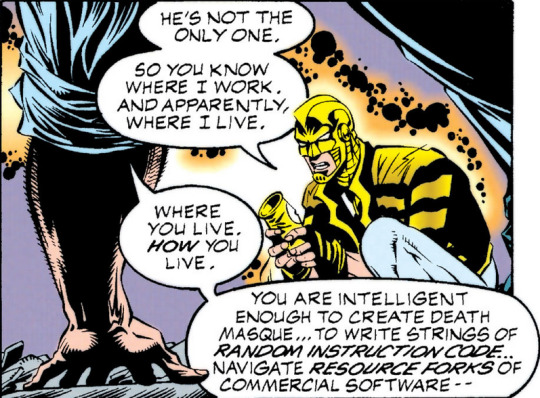

Ray gets YJ the components for their fancy new computer system, sets it up, and establishes himself as knowledgeable about technology.

Back when he expected to live his entire life in darkened seclusion, Ray's plan for adulthood apparently was to work at home using his computer skills. He is a gifted programmer and hacker, skills that have gotten him into serious trouble. For a while he worked for one of Vandal Savage's companies as a systems analyst.

(Young Justice 1998 #46, 52 / The Ray 1992 #1 / The Ray 1994 #14)

Kon out of all of YJ is most antagonistic to Ray, slinging insults and getting into power struggles with him.

He and Ray have a history of animosity since their first meeting, when their egos and insecurities collided and they ended up fighting. Eventually they are able to work together, exchange backstories, and part on...if not effusively friendly terms, then at least tolerant terms.

(Young Justice 1998 #46 / The Ray 1994 #1)

When Kon attempts to assert dominance with the team by showing off his powers, Ray interferes with a blast of his own powers, which indicates to readers who might not be familiar with him just how scary powerful he is.

This is not unlike Ray's response to Kon's punching him when they first met; TTK is no match for blasts of light energy.

(Young Justice 1998 #46 / The Ray 1994 #1)

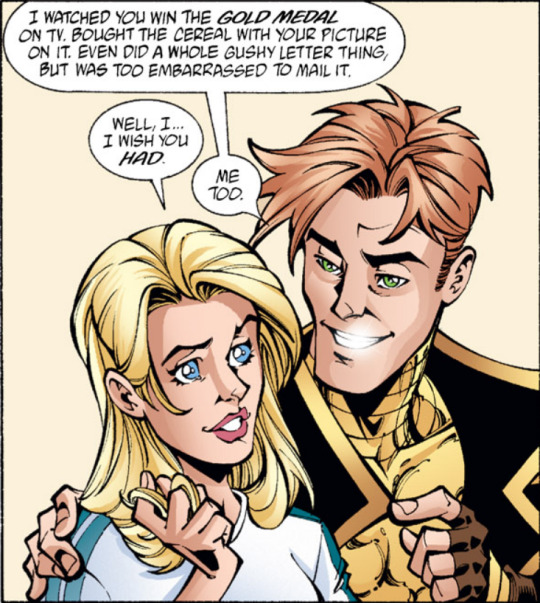

While trying to get Cissie's vote during the election for YJ's new leader, Ray claims that he's a big fan of hers and wrote her "a whole gushy letter thing, but was too embarrassed to mail it."

And that is very unlikely to be true, but it would be in character for him to write an embarrassing letter. The first several issues of The Ray 1994 are narrated through his letters oversharing about his life to Dinah Lance (Black Canary), whom he at that point had met once and developed a crush on.

(Young Justice 1998 #46 / The Ray 1994 #2)

He also tells Cissie that he made most of his costume and had to because he kept burning his clothes off.

This is true. When he first started using his powers, there were several very embarrassing incidents, including one that resulted in arrest, until his father taught him how to create a light-construct costume that wouldn't burn off. The jacket was something he had already and wears in his civilian identity too; somehow it seems to be immune to his powers.

(Young Justice 1998 #46 / The Ray 1992 #3)

Ray's initial interactions with Slo-bo don't go well.

...would Slo-bo remember that adult Lobo and Ray have had a couple of run-ins before, both of which involved Ray's destroying Lobo's bike?

(Young Justice 1998 #46 / The Ray 1994 #8)

The others think that Ray is about to challenge a dangerous plan they're putting together, but he really just wants to know where the bathroom is.

...for whatever reason, such breaks come up a lot more in Ray's solo than in most comics. Anxiety thing, maybe?

(Young Justice 1998 #49 / The Ray 1994 #3)

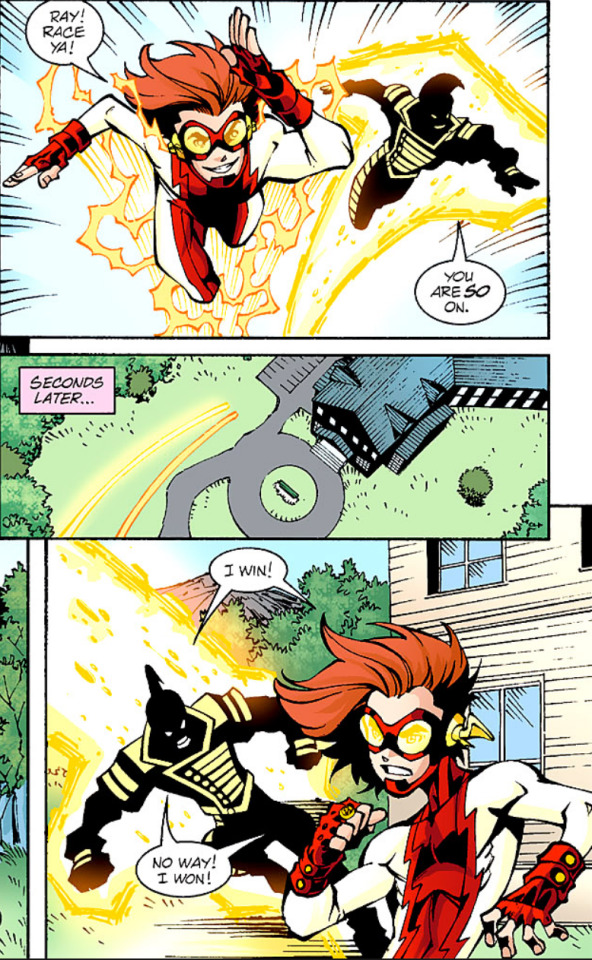

Bart and Ray race and get into an argument about who won. Ray is not a speedster, but he's capable of going at light speed, and at the start of YJ 1998, Bart is nearly that fast. By the time Ray joins the team, Bart has improved (even making it to the Speed Force to save his mentor), so they might be about evenly matched.

There was a plotline in Ray's solo about a possible future in which he goes evil, has amassed a lot of power and killed most other heroes, and is the current Fastest Man Alive, even more so than Bart, who in this continuity is the current Flash.

(Young Justice 1998 #53 / The Ray 1994 #25)

#comicsposting again#RT: born with the light#YJ: so glad we found each other#I could do something like this for most of them#but I went with Ray because almost no one has read his series#and that enriches what crumbs of characterization there are

6 notes

·

View notes