#Africa Oil and Gas Market

Explore tagged Tumblr posts

Text

Africa Oil and Gas Projects Market: Opportunities and Trends in 2024

Africa's oil and gas industry has been gaining attention globally, with significant developments expected in the coming years. The continent is poised to become one of the major players in the energy sector due to untapped resources, increasing investments, and ongoing projects. In this article, we’ll explore the key drivers, major projects, and future opportunities in the African oil and gas market in 2024.

Market Overview

Africa holds approximately 7.2% of the world’s proven oil reserves and 7.5% of the global gas reserves, with countries like Nigeria, Angola, Algeria, and Egypt leading in production. The region is expected to see further growth as major oil and gas companies invest in new exploration and production projects across the continent. With global demand for energy increasing, Africa's role in meeting this demand is critical.

Key Drivers of Growth

Untapped Resources: Sub-Saharan Africa, in particular, is home to vast untapped oil and gas reserves. Countries like Mozambique, Senegal, and Ghana are now emerging as key players in gas production, especially with the discovery of major offshore gas fields.

Energy Transition and Natural Gas: As the global energy transition continues, natural gas is seen as a bridge fuel. Africa’s rich gas resources offer the potential to support global decarbonization efforts, with liquefied natural gas (LNG) projects gaining traction in places like Mozambique, Tanzania, and Senegal.

Increased Investment: International oil companies (IOCs) and national oil companies (NOCs) are increasing their investments in Africa’s oil and gas sector. This is driven by the need for new sources of hydrocarbons to meet future demand and offset production declines in older fields.

Regional Collaboration: African countries are collaborating to create a more unified energy market. The African Continental Free Trade Agreement (AfCFTA) is expected to boost infrastructure development and cross-border energy projects, making it easier for African nations to work together on large oil and gas initiatives.

Major Oil and Gas Projects in Africa

Mozambique LNG Project: One of the largest LNG projects in Africa, the Mozambique LNG project is expected to play a pivotal role in supplying global LNG demand. The project, led by TotalEnergies, is projected to produce 12.88 million tons per annum (MTPA) of LNG once operational, contributing significantly to Mozambique's economy.

Nigeria’s Deepwater Projects: Nigeria remains Africa’s largest oil producer and continues to attract investment in its deepwater fields. The Egina Project, operated by TotalEnergies, started production in 2018 and continues to be a major contributor to Nigeria's output. Additionally, the Bonga Southwest/Aparo Project is expected to drive future growth.

Tanzania LNG Project: Tanzania is progressing with its own massive LNG project, which has attracted interest from international energy companies like Shell and Equinor. This project has the potential to make Tanzania a major gas exporter.

Senegal’s Offshore Oil and Gas: Senegal’s Greater Tortue Ahmeyim Project is expected to transform the country into a regional LNG hub. The project is being developed by BP and Kosmos Energy and is expected to produce up to 10 MTPA of LNG once fully operational.

Algeria’s Gas Fields: Algeria, a long-established oil and gas producer, is expanding its gas production to meet growing European demand. With the potential for new discoveries and investments, Algeria remains a key player in the North African energy landscape.

Opportunities and Challenges

Opportunities

Renewable Energy Integration: Africa’s oil and gas resources can play a pivotal role in powering the continent's economic growth. With the increasing emphasis on energy transition, there are opportunities for African oil and gas producers to integrate renewable energy projects into their operations, particularly solar and wind power.

LNG Export Market: Africa's emerging LNG sector presents a massive export opportunity, particularly as Europe seeks to reduce its dependence on Russian gas. African nations could benefit from long-term contracts and partnerships with European and Asian buyers.

Domestic Energy Development: There is significant potential for oil and gas projects to boost domestic energy availability, supporting local industries, job creation, and improved living standards. Many African countries are focusing on using their natural resources to address domestic energy deficits.

Challenges

Political and Regulatory Risks: Political instability, corruption, and regulatory uncertainties remain significant challenges in several African countries. Investors need to navigate complex political landscapes, particularly in countries with ongoing conflicts or unstable governments.

Environmental Concerns: The environmental impact of oil and gas projects, including concerns over carbon emissions, pollution, and impacts on local ecosystems, is increasingly becoming a focus. Companies must adopt sustainable practices to mitigate these risks and comply with environmental regulations.

Infrastructure Gaps: Despite progress, there are still significant gaps in Africa’s infrastructure, particularly for transportation, storage, and processing of oil and gas. This lack of infrastructure can slow down project development and increase costs.

Future Outlook

As global demand for energy continues to rise, Africa is expected to become a more prominent player in the oil and gas market. The ongoing projects, coupled with increasing investments in infrastructure and exploration, position the continent as a crucial source of future energy supply. While challenges remain, the outlook for Africa’s oil and gas industry is bright, with new opportunities on the horizon for both investors and local economies.

The development of Africa’s oil and gas resources has the potential to transform the continent’s economic landscape, provide energy security, and create opportunities for sustainable growth. For investors and stakeholders, the African oil and gas market offers both opportunities and risks, but the potential rewards are significant.

Buy the Full Report for More Sector Insights into the Africa Oil and Gas Market

Download a Free Report Sample

0 notes

Text

[BBC is UK State Media]

Months in jail alongside ally and kingmaker Ousmane Sonko ended suddenly, with the pair released the week before the presidential election.

Now Mr Clean, as he's nicknamed, must get to work on the sweeping reforms he has promised.[...]

Fighting poverty, injustice and corruption are top of Mr Faye's agenda. While working at the Treasury, he and Mr Sonko created a union taskforce to tackle graft.

Gas, oil, fishing and defence deals must all be negotiated to better serve the Senegalese people, says Mr Faye.

He is ushering in an era of "sovereignty" and "rupture" as opposed to more of the same, he told voters, and that is especially true of ties to France.

Senegal's president-elect says he will drop the much-criticised CFA franc currency, which is pegged to the euro and backed by former colonial power France.

Mr Faye wants to replace it with a new Senegalese, or regional West African, currency[...]

Strengthening judicial independence and creating jobs for Senegal's large young population are also key priorities for Mr Faye[...]

One of Mr Faye's heroes is the late Senegalese historian Cheikh Anta Diop - whose work is seen as a precursor to Afrocentrism. Both are seen as left-wing cheerleaders for pan-Africanism.

As early results came in on Monday showing Mr Faye was set for victory, people in the capital, Dakar, celebrated by honking car horns and singing to loud music.

The reaction from international markets was less jubilant, with Senegal's dollar bonds falling to their lowest level in five months. Reuters news agency reports that investors are concerned Mr Faye's presidency may wind down the country's business-friendly policies.

25 Mar 24

295 notes

·

View notes

Text

🌍 1) Largest country in Africa by land mass - Algeria 🇩🇿

2) Largest country in Africa by population - Nigeria 🇳🇬

3) Largest movie industry in Africa - Nigeria 🇳🇬

4) Largest democracy in Africa - Nigeria 🇳🇬

5) Richest Black man - Nigerian 🇳🇬

6) Richest African woman - Nigerian 🇳🇬

7) largest single solar power plant in Africa - Morocco 🇲🇦

8) Largest Museum in Africa - Egypt 🇪🇬

9) Tallest building in Africa - Egypt 🇪🇬

10) Largest rice mill in Africa - Nigeria 🇳🇬

11) Largest fertilizer plant in Africa - Nigeria 🇳🇬

12) largest oil refinery in Africa - Nigeria 🇳🇬

13) largest fish farm in Africa - Egypt 🇪🇬

14) largest cement plant in Africa - Nigeria 🇳🇬

15) largest tea farm in Africa - Kenya 🇰🇪

16) largest music industry in Africa - Nigeria 🇳🇬

17) largest stadium in Africa - South Africa 🇿🇦

18) Fastest train in Africa - Nigeria 🇳🇬

19) longest subsea gas pipeline in Africa - Nigeria 🇳🇬

20) largest city by population - Nigeria 🇳🇬

21) Largest news network in Africa - Nigeria 🇳🇬

22) largest car race arena in Africa - South Africa 🇿🇦

23) largest pharmaceutical industry in Africa - Nigeria 🇳🇬

24) Fastest woman in Africa - Nigerian 🇳🇬

25) Fastest man in Africa - Kenyan 🇰🇪

26) largest stock exchange by market capitalization in Africa - South Africa 🇿🇦

27) largest stock exchange by number of listings - south Africa 🇿🇦

28) longest concrete road in Africa - Nigeria 🇳🇬

29) largest airline in Africa - Ethiopia 🇪🇹

30) most streamed musicians in Africa - Nigeria 🇳🇬

31) most awarded artist in Africa - Nigerian 🇳🇬

32) largest mall in Africa by structure - Morocco 🇲🇦

33) most valuable tech startup in Africa - Nigeria 🇳🇬

34) most valuable company in Africa - South Africa 🇿🇦

35) largest economy in Africa - Nigeria 🇳🇬

36) Most tribes in Africa - Nigeria 🇳🇬

37) most languages in Africa - Nigeria 🇳🇬

39) largest seaport In Africa by size - Morocco 🇲🇦

40) largest university in Africa by area - Nigeria 🇳🇬

60 notes

·

View notes

Text

When William Ruto was sworn in as Kenya’s fifth president in September 2022, he used his inauguration speech to demand an end to humanity’s “addiction to fossil fuels” and reaffirmed Kenya’s commitment to reach 100% clean energy by 2030. Kenya is not far off this target today.

In 2021, 81% of Kenya’s electricity generation came from the low carbon sources of geothermal, hydro, wind, and solar power. Over half of this low carbon electricity came from geothermal energy, which Kenya has in abundance. So much in fact, that excess geothermal energy is released during the night when electricity demand is low. Installed geothermal capacity in Kenya could be increased by at least eightfold, which could open opportunities for scaling up green manufacturing capacity or exporting excess electricity to neighbouring countries.

Renewable rollouts have substantially improved energy access. In 2013, around 28% of Kenyans had access to electricity. By 2020, this had risen to over 71%. This was achieved as the population grew by over seven million over the same period, while the rate of urbanisation continued to gather pace. According to the World Bank, barely one million Kenyans had electricity in 1990 [which, back then, was approximately just 5% of the population].

Ruto’s words, and Kenya’s actions, are timely due to the backdrop they are made against. Amid Russia’s invasion of Ukraine, and the vacuum created in global energy markets, European leaders and multinational fossil fuel firms have launched a ‘dash for gas’ across Africa, where a raft of new oil and gas projects, as well as old ones, are being given the green light. At COP27, Ruto kicked back against the dash for gas, stating that “we [Kenya] have taken a position that as a country we are going green and we are well on course.”

-via Rapid Transition Alliance, November 17, 2022

#kenya#green energy#sustainability#carbon emissions#air pollution#africa#world bank#developing nations#electrification#wind power#solar#solar power#geothermal#geothermalpower#fossil fuels#clean energy#good news#hope

224 notes

·

View notes

Text

Petrobras Eyes 40% Ownership in Namibia's Mopane Oil Block

Petrobras PBR, a Brazil-based integrated energy company controlled by the government of Brazil, has its eyes set on acquiring the entire 40% stake in the Mopane oil and gas exploration block in Namibia, currently owned by Portugal’s Galp Energia, SGPS, S.A. GLPEY. This strategic move aligns with PBR’s expansion plans and its focus on establishing a stronger presence in international oil and gas markets, particularly in Africa.

Continue reading.

#brazil#brazilian politics#politics#namibia#namibian politics#economy#petrobras#image description in alt#mod nise da silveira

4 notes

·

View notes

Text

How many more U.N. climate conferences will it take for the world to admit that the current climate policy path is at a dead end?

Calls by politicians, activists, and journalists to double down ring increasingly hollow in the face of overwhelming evidence that 2024 will be the first year in which average global surface temperature is likely to be more than 1.5 degrees Celsius (or about 2.7 degrees Fahrenheit) above that of the preindustrial period before 1900. The long-term average increase since that period will pass 1.5 degrees in 2030. Even staying significantly below 2 degrees Celsius—the target that the climate policy community used until 2015 before lowering it in order to galvanize lawmakers—now looks unlikely.

Missing the 1.5 degree target does not mean that we’re all going to boil, bake, and die. Global emissions growth has slowed down enough that the extreme warming scenarios brandished so carelessly in the public debate have become all but impossible. Deaths due to natural disasters, such as floods, droughts, storms, and wildfires, have also declined radically as countries have become richer and more resilient. And economic losses due to climate shocks have decreased fivefold between the 1980s and mid 2000s.

Sticking to an unrealistic temperature target has severe economic and geopolitical effects. Panic over not reaching the target has led to a radical push for an immediate phaseout of fossil fuels, ignoring the fact that they still make up 80 percent of the world’s primary energy supply. That call is being led by rich countries that have become wealthy using fossil fuels and continue to gobble up oil and gas—and which now want to restrict less-developed countries from using these fuels to lift themselves out of energy poverty, a primary reason for their destitution. Development advocates are rightly calling out these unfair policies, enforced through institutions such as the World Bank, as eco-colonialism.

Unrealistic temperature targets combined with continued high consumption of fossil fuels has meant that there is little to no carbon budget available for the poorest countries to grow their energy use. Sticking to the goal of freezing emissions—or even targeting negative emissions to compensate for any overshoot—turns global economic activity into a zero-sum game.

Room for one country to develop, which may require increased use of fossil fuels for the foreseeable future, means that another must shrink its economy. The distribution conflict over emissions rights will be epic and bitter, not just between rich and poor countries but also among poor countries themselves, making any new agreements to reduce emissions even more difficult.

Enter Russia and China, which have made it clear that they will not play by Western rules, including those on climate policy. Since launching the war in Ukraine, the Kremlin has sought to strengthen its ties to OPEC and secure its role in oil and gas markets. China is investing everywhere in resource extraction, including fossil fuels in Africa and the Middle East. The three main Chinese energy companies—CNPC, CNOOC, and Sinopec—have emerged as major investors in Africa’s oil and gas sectors.

Despite these concerns, Western governments refuse to support investments in poor countries’ energy sectors in hopes that starving the developing world of energy will help meet the 1.5-degree target. This has created a huge opening for Russia and China, which they will likely leverage to strengthen autocracy across these regions.

Paradoxically, acknowledging the demise of the 1.5-degree target in 2024 could reduce tensions between rich and poor countries—provided that governments seize the opportunity to reset climate goals. This could be the year when unrealistic temperature goals and endless theoretical fights over a phase-down versus a phaseout of fossil fuels are replaced by a focus on the three positive ideas that came out of the most recent U.N. climate conference, COP28, which concluded in Dubai in December.

In the conference’s outcome statement, nearly 200 signatory countries agreed on the need for transition fuels in poor countries—in other words, their use of fossil fuels will grow faster than their ability to transition away from them. Second, the signatories agreed that countries have different resource endowments and will therefore follow very different trajectories to decarbonize. Third, there was a strong commitment that nuclear energy can be an important source of clean and reliable power.

For the first time, COP28 officially recognized that transition fuels—a euphemism for fossil fuels tolerated to prevent economic collapse and allow development if abundant green energy is not yet available—“can play a role in facilitating the energy transition while ensuring energy security.” COP signatories finally acknowledged, albeit implicitly, that poor countries consume only a tiny fraction of the energy gobbled up by rich countries and desperately need more electricity to power homes, schools, hospitals, and factories.

Indeed, the gap between rich and poor is enormous: The average American consumes about 12,000 kilowatt-hours of electric power per year, whereas the average sub-Saharan African consumes only 130 kilowatt-hours. In other words, an African consumes about as much electricity in an entire year as an American consumes in four days. Or, as Todd Moss of the Energy for Growth Hub illustrated in a chart that went viral, many sub-Saharan Africans consume less electricity per person than the average U.S. refrigerator.

Transition fuels are not only critical for development in poor countries, but also for their adaptation to climate change. Natural gas is the best and cheapest feedstock to produce ammonia-based fertilizers, which in turn improves agricultural yields. Gas-fired power plants provide electricity for homes, schools, hospitals, emergency warning systems, air conditioning, and cold storage systems that prevent food losses. Africa’s vast reserves of natural gas can be harnessed for industrial production as well. Clean cooking fuels such as liquid petroleum gas improve the lives of millions of people who suffer from indoor air pollution as the result of cooking with animal dung or biomass. Gas as a backup fuel source allows countries to add unstable wind and solar to their energy systems.

Demonizing gas—as part of a rushed fossil fuel phaseout in service of an unreachable temperature target—is equal to demonizing development, and that will be true for a very long time. For industrial uses, in particular, the technologies to replace gas aren’t even visible on the horizon.

The COP28 statement also acknowledged that countries have “different national circumstances, pathways and approaches,” building on discussions at last year’s G-7 summit in Hiroshima and G-20 summit in New Delhi. In other words, countries lucky enough to have abundant, cheap, nonintermittent renewable energy sources such as geothermal and hydropower can achieve a lower carbon footprint quickly and cheaply. But for those that rely on coal, oil, or gas, the process of decarbonizing is much harder. The “all of the above” approach endorsed at COP suggests that technologies such as carbon capture and storage have a role in lowering emissions.

This is both pragmatic and inclusive: Countries such as India, China, South Africa, and those in Southeast Asia are heavily dependent on coal for electricity, and they will now have options to address emissions in the near term while shifting toward renewable energy sources in the long term. Carbon capture in heavy industry, for example, could abate continued emissions from sectors indispensable for development, including steel, cement, and chemicals.

COP28 made history by treating nuclear power as equal to other renewable energy sources. A declaration to triple nuclear energy by 2050, signed by more than 20 countries, underscores the importance of nuclear power in reducing greenhouse gas emissions. Rich countries with significant civilian nuclear sectors, such as France, Japan, and the United States, appear on the list of signatories, but so do Ghana, Jamaica, Mongolia, and Morocco, all of which are eager for reliable sources of clean energy to power their growing economies.

New, smaller reactors, the signatories agreed, “could occupy a small land footprint and can be sited where needed, partner well with renewable energy sources, and have additional flexibilities that support decarbonization beyond the power sector, including hard-to-abate industrial sectors.”

Of course, words by themselves don’t mean much. But the declaration includes a call on the shareholders of the World Bank to include nuclear energy in the portfolio of financed projects. If the bank can overcome the objections of a tiny group of rich countries (centered on Germany) that are ideologically opposed to nuclear power, the bank can play an important role by bringing down the cost for poor countries.

Safety is paramount when it comes to nuclear reactors, and the bank’s richest shareholders can help with newer, safer, and more efficient technologies. The United States is at the forefront of building advanced reactors that use better fuels, require less substantial containment, and need fewer redundant safety systems. These smaller, cheaper reactors function better than their larger, more complex predecessors and suffer fewer construction delays.

Japan, too, is an innovator. Tokyo’s so-called green transformation strategy calls for the development of next-generation innovative reactors, including next-generation light-water reactors, small modular reactors, fast reactors, high-temperature gas reactors, and nuclear fusion, all of which could be at the core of a new, more effective global climate policy that looks far beyond wind and solar to decarbonize.

The catastrophism surrounding the impending failure to reach the 1.5-degree target has generated both panic and distrust of climate science. Governments and civil society should abandon today’s ritualized, performative, and highly politicized discourse—and instead concentrate on the full spectrum of technologies to lower carbon emissions while helping poor countries to develop and become more resilient to climate change.

Investments to improve energy access, expand the roster of low-carbon technologies, and generate abundant, clean, and reliable power are a good starting point.

16 notes

·

View notes

Text

Coiled Tubing Insights: A Deep Dive into Services, Operations, and Applications

Coiled Tubing Market Overview:

Request Sample

Inquiry Before Buying

Coiled Tubing Market Report Coverage

The “Coiled Tubing Market Report — Forecast (2024–2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Coiled Tubing Industry. By Service: Well Intervention & Production, Drilling, Perforating, Fracturing, Engineering Services, Milling Services, Nitrogen services and others. By Operations: Circulation, Pumping, Logging, Perforation, Milling and Others. By Technology/Services: Software Solutions, Hardware By Location: On-Shore, Off-Shore By Application: Wellbore Cleanouts, Electrical Submersible Pump Cable Conduit, Fracturing, Pipeline Cleanout, Fishing, Cementing, Nitrogen Jetting and others. By End Use Industry: Oil and gas Industry, Engineering Procurement and Construction Industry, Others By Geography: North America (U.S, Canada, Mexico), South America (Brazil, Argentina, and others), Europe (Germany, UK, France, Italy, Spain, and Others), APAC (China, Japan India, SK, Australia and Others), and RoW (Middle East and Africa)

Schedule a Call

Key Takeaways

North America dominates the Coiled Tubing Market share of 46.6% in 2023, owing to its advanced oil and gas industry, technological innovation, and substantial investments in exploration and production activities.

The development of unconventional resources, such as shale oil and gas, has increased the demand for coiled tubing services. Coiled tubing is often employed in hydraulic fracturing (fracking) operations in these unconventional reservoirs.

Well intervention services, including well cleaning, stimulation, and logging, are major applications of coiled tubing. As older wells require maintenance and newer wells require optimization, as a result growing the Demand for Well Intervention Services using coiled tubing continues to increase.

Buy Now

Coiled Tubing Market Drivers

Increased Exploration and Production Activities

The surge in oil and gas exploration, notably in unconventional resources such as shale, tight gas, and heavy oil, is fueling the demand for coiled tubing services. Integral to well intervention and stimulation procedures, coiled tubing plays a pivotal role in sustaining and augmenting production rates. This heightened exploration and production activity underscores the significance of coiled tubing services in maintaining operational efficiency and maximizing output in the energy sector.

Increasing Energy Demand

The escalating global energy demand propels the coiled tubing market forward. With an ever-growing need for energy resources, particularly in oil and gas sectors, there’s a heightened requirement for efficient extraction methods. Coiled tubing technology offers a versatile and cost-effective solution for various well intervention and drilling operations, catering to the increasing complexities of resource extraction. Its flexibility, mobility, and ability to access challenging environments make it indispensable in meeting the surging energy demands worldwide. As industries strive to optimize production and enhance operational efficiency, coiled tubing emerges as a crucial component in the quest for sustainable energy solutions.

3 notes

·

View notes

Text

Underwater Concrete Market Share, Demand, Growth, and Forecast 2025-2033

Global Underwater Concrete Industry: Key Statistics and Insights in 2025-2033

Summary:

The global underwater concrete market size reached USD USD 184.6 Billion in 2024.

The market is expected to reach USD 256.2 Billion by 2033, exhibiting a growth rate (CAGR) of 3.52% during 2025-2033.

North America leads the market, accounting for the largest underwater concrete market share.

Aggregates represent the largest segment due to their crucial role in providing the necessary bulk, strength, and durability for underwater concrete mixtures.

Hydropower holds the biggest market share because the construction and maintenance of dams and other hydropower infrastructure require extensive use of underwater concrete.

Ongoing advancements in underwater construction are impelling the growth of the market.

The growing demand for marine infrastructure is offering a favorable market outlook.

Industry Trends and Drivers:

Technological Advancements in Underwater Construction:

Advancements in underwater construction are boosting the market. Innovations like new concrete mixes and additives improve underwater concrete. These technologies ensure concrete stays strong against high pressure and salt. Moreover, the rise of self-compacting concrete and special admixtures is making underwater construction faster and more reliable. This not only enhances underwater structures but also cuts labor costs and project times.

Increasing Demand for Marine Infrastructure:

Demand for marine infrastructure is rising, creating a positive market outlook. Urban growth and economic expansion boost maritime trade. This, in turn, calls for better ports and harbors. Coastal cities now invest in flood defenses, seawalls, and tunnels to combat climate change effects. These projects need special underwater concrete. It must resist harsh marine conditions. Additionally, the growth of offshore oil, gas, and wind projects increases the need for reliable materials.

Government Initiatives and Funding:

Government initiatives and funding significantly boost market growth. Worldwide, governments are investing in infrastructure to enhance economies and tackle environmental issues. They are allocating substantial funds for coastal protections like sea walls and breakwaters against climate change. Moreover, support for offshore renewable energy projects, which need extensive underwater concrete, is also growing. In developing regions, incentives and subsidies are encouraging the use of advanced materials, including underwater concrete.

Request for a sample copy of this report: https://www.imarcgroup.com/underwater-concrete-market/requestsample

Underwater Concrete Market Report Segmentation:

By Raw Material:

Admixtures

Cement

Aggregates

Others

Aggregates represent the largest segment due to their crucial role in providing the necessary bulk, strength, and durability for underwater concrete mixtures.

By Application:

Hydropower

Marine

Shore Protection

Underwater Repairs

Tunnels

Swimming Pools

Others

Hydropower holds the biggest market share because the construction and maintenance of dams and other hydropower infrastructure require extensive use of underwater concrete.

Regional Insights:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America’s dominance in the underwater concrete market is attributed to its significant investments in marine infrastructure, coastal protection projects, and the expansion of offshore energy installations.

Top Underwater Concrete Market Leaders:

The underwater concrete market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

Buzzi Unicem S.p.A.

CEMEX S.A.B. de C.V.

CONMIX Ltd.

Five Star Products Inc.

Heidelberg Materials

Larsen Building Products

MUHU (China) Construction Materials Co. Ltd.

Rockbond SCP Ltd

Sika AG, Tarmac (CRH plc)

Unibeton Ready Mix (Al Fara’a Group)

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

2 notes

·

View notes

Text

Acetic Acid Market - Forecast(2024 - 2030)

Acetic Acid Market Overview

Acetic Acid Market Size is forecast to reach $14978.6 Million by 2030, at a CAGR of 6.50% during forecast period 2024-2030. Acetic acid, also known as ethanoic acid, is a colorless organic liquid with a pungent odor. The functional group of acetic acid is methyl and it is the second simplest carboxylic acid. It is utilized as a chemical reagent in the production of many chemical compounds. The major use of acetic acid is in the manufacturing of vinyl acetate monomer, acetic anhydride, easter and vinegar. It is a significant industrial chemical and chemical reagent used in the production of photographic film, fabrics and synthetic fibers. According to the Ministry of Industry and Information Technology, from January to September 2021, the combined operating revenue of 12,557 major Chinese garment companies was US$163.9 billion, showing a 9% increase. Thus, the growth of the textile industry is propelling the market growth for Acetic Acid.

Report Coverage

The “Acetic Acid Market Report – Forecast (2024-2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Acetic Acid industry.

By Form: Liquid and Solid.

By Grade: Food grade, Industrial grade, pharmaceutical grade and Others.

By Application: Vinyl Acetate Monomer, Purified Terephthalic Acid, Ethyl Acetate, Acetic Anhydride, Cellulose Acetate, Acetic Esters, Dyes, Vinegar, Photochemical and Others

By End-use Industry: Textile, Medical and Pharmaceutical, Oil and Gas, Food and Beverages, Agriculture, Household Cleaning Products, Plastics, Paints & Coating and Others.

By Geography: North America (the USA, Canada and Mexico), Europe (the UK, Germany, France, Italy, Netherlands, Spain, Russia, Belgium and the Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia and New Zealand, Indonesia, Taiwan, Malaysia and the Rest of APAC), South America (Brazil, Argentina, Colombia, Chile and the Rest of South America) and the Rest of the World (the Middle East and Africa).

Request Sample

Key Takeaways

The notable use of Acetic Acid in the food and beverages segment is expected to provide a significant growth opportunity to increase the Acetic Acid Market size in the coming years. As per the US Food and Agriculture Organization, world meat production reached 337 million tonnes in 2019, up by 44% from 2000.

The notable demand for vinyl acetate monomer in a range of industries such as textile finishes, plastics, paints and adhesives is driving the growth of the Acetic Acid Market.

Increase in demand for vinegar in the food industry is expected to provide substantial growth opportunities for the industry players in the near future in the Acetic Acid industry.

Acetic Acid Market Segment Analysis – by Application

The vinyl acetate monomer segment held a massive 44% share of the Acetic Acid Market share in 2021. Acetic acid is an important carboxylic acid and is utilized in the preparation of metal acetates and printing processes, industrially. For industrial purposes, acetic acid is manufactured by air oxidation of acetaldehyde with the oxidation of ethanol, butane and butene. Acetic acid is extensively used to produce vinyl acetate which is further used in formulating polyvinyl acetate. Polyvinyl acetate is employed in the manufacturing of plastics, paints, textile finishes and adhesives. Thus, several benefits associated with the use of vinyl acetate monomer is boosting the growth and is expected to account for a significant share of the Acetic Acid Market.

Inquiry Before Buying

Acetic Acid Market Segment Analysis – by End-use Industry

The food and beverages segment is expected to grow at the fastest CAGR of 7.5% during the forecast period in the Acetic Acid Market. Acetic Acid is also known as ethanoic acid and is most extensively used in the production of vinyl acetate monomer. Vinyl acetate is largely used in the production of cellulose acetate which is further used in several industrial usage such as textiles, photographic films, solvents for resins, paints and organic esters. PET bottles are manufactured using acetic acid and are further utilized as food containers and beverage bottles. In food processing plants, acetic acid is largely used as cleaning and disinfecting products. Acetic acid is extensively used in producing vinegar which is widely used as a food additive in condiments and the pickling of vegetables. According to National Restaurant Association, the foodservice industry is forecasted to reach US$898 billion by 2022. Thus, the advances in the food and beverages industry are boosting the growth of the Acetic Acid Market.

Acetic Acid Market Segment Analysis – by Geography

Asia-Pacific held a massive 41% share of the Acetic Acid Market in 2021. This growth is mainly attributed to the presence of numerous end-use industries such as textile, food and beverages, agriculture, household cleaning products, plastics and paints & coatings. Growth in urbanization and an increase in disposable income in this region have further boosted the industrial growth in this region. Acetic acid is extensively used in the production of metal acetates, vinyl acetate and vinegar which are further utilized in several end-use industries. Also, Asia-Pacific is one of the major regions in the domain of plastic production which provides substantial growth opportunities for the companies in the region. According to Plastic Europe, China accounted for 32% of the world's plastic production. Thus, the significant growth in several end-use industries in this region is also boosting the growth of the Acetic Acid Market.

Acetic Acid Market Drivers

Growth in the textile industry:

Acetic Acid, also known as ethanoic acid, is widely used in the production of metal acetate and vinyl acetate which are further used in the production of chemical reagents in textiles, photographic films, paints and volatile organic esters. In the textile industry, acetic acid is widely used in textile printing and dyes. According to China’s Ministry of Industry and Information Technology, in 2020, textile and garment exports from China increased by 9.6% to US$291.22 billion. Also, according to the U.S. Department of Commerce, from January to September 2021, apparel exports increased by 28.94% to US$4.385 billion, while textile mill products rose by 17.31% to US$12.365 billion. Vinyl acetate monomer is utilized in the textile industry to produce synthetic fibers. Thus, the global growth in demand for textiles is propelling the growth and is expected to account for a significant share of the Acetic Acid Market size.

Schedule a call

Surge in use of vinegar in the food industry:

The rapid surge in population along with the adoption of a healthy and sustainable diet has resulted in an increase in demand for food items, thereby increasing the global production level of food items. As per US Food and Agriculture Organization, in 2019, global fruit production went up to 883 million tonnes, showing an increase of 54% from 2000, while global vegetable production was 1128 million tonnes, showing an increase of 65%. Furthermore, world meat production reached 337 million tonnes in 2019, showing an increase of 44% from 2000. Acetic acid is majorly used in the preparation of vinegar which is further widely utilized as a food ingredient and in personal care products. Vinegar is used in pickling liquids, marinades and salad dressings. It also helps to reduce salmonella contamination in meat and poultry products. Furthermore, acetic acid and its sodium salts are used as a food preservative. Thus, the surge in the use of vinegar in the food industry is boosting the growth of the Acetic Acid Market.

Acetic Acid Market Challenge

Adverse impact of acetic acid on human health:

Acetic Acid is considered a strong irritant to the eye, skin and mucous membrane. Prolong exposure to and inhalation of acetic acid may cause irritation to the nose, eyes and throat and can also damage the lungs. The workers who are exposed to acetic acid for more than two or three years have witnessed upper respiratory tract irritation, conjunctival irritation and hyperkeratotic dermatitis. The Occupational Safety and Health Administration (OSHA) reveals that the standard exposure to airborne acetic acid is eight hours. Furthermore, a common product of acetic acid i.e., vinegar can cause gastrointestinal tract inflammatory conditions such as indigestion on excess consumption. Thus, the adverse impact of Acetic Acid may hamper the market growth.

Buy Now

Acetic Acid Industry Outlook

The top 10 companies in the Acetic Acid Market are:

Celanese Corporation

Eastman Chemical Company

LyondellBasell

British Petroleum

Helm AG

Pentoky Organy

Dow Chemicals

Indian Oil Corporation

Daicel Corporation

Jiangsu Sopo (Group) Co. Ltd.

Recent Developments

In March 2021, Celanese Corporation announced the investment to expand the production facility of vinyl portfolio for the company’s acetyl chain and derivatives in Europe and Asia.

In April 2020, Celanese Corporation delayed the construction of its new acetic acid plant and expansion of its methanol production by 18 months at the Clear Lake site in Texas.

In October 2019, BP and Chian’s Zhejiang Petroleum and Chemical Corporation signed MOU in order to create a joint venture to build a 1 million tonne per annum Acetic Acid plant in eastern China.

Key Market Players:

The Top 5 companies in the Acetic Acid Market are:

Celanese Corporation

Ineos Group Limited

Eastman Chemical Company

LyondellBasell Industries N.V.

Helm AG

For more Chemicals and Materials Market reports, please click here

#Acetic Acid Market#Acetic Acid Market Share#Acetic Acid Market Size#Acetic Acid Market Forecast#Acetic Acid Market Report#Acetic Acid Market Growth

2 notes

·

View notes

Text

Valves Market is Estimated to Witness High Growth

Valves Market is Estimated to Witness High Growth Owing to Rising Constructional and Infrastructure Development Activities The valves market comprises products such as gate valves, globe valves, check valves, butterfly valves, ball valves and pressure regulating valves which are used to control the flow, pressure and direction of fluids. Valves are extensively used in power plants, refineries, oil & gas, water & wastewater and construction activities. These products play a key role in fluid transportation and management which makes them an integral component across various industrial sectors. Rising infrastructure development projects across both developed and developing nations are augmenting the demand for valves. Moreover, growing pipeline networks for oil & gas transportation is also favoring market growth. The Global valves market is estimated to be valued at US$ 83 Mn in 2024 and is expected to exhibit a CAGR of 3.5% over the forecast period 2024 To 2031. Key Takeaways Key players operating in the valves market are Tyson Foods, Inc., JBS S.A., Pilgrim's Pride Corporation, Wens Foodstuff Group Co. Ltd., BRF S.A., Perdue Farms, Sanderson Farms, Baiada Poultry, Bates Turkey Farm, and Amrit Group. The major players are focusing on capacity expansion plans and mergers & acquisitions to gain market share. Rising population and changing diets are expected to fuel the growth of the poultry sector which presents significant opportunities for valve manufacturers. With the growing poultry industry, demand for processing equipment including valves is also projected to rise substantially over the forecast period. The global valves market is estimated to witness growth across key regions such as North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. This can be attributed to surging investments in oil & gas, water & wastewater infrastructure, and industrial development projects worldwide. Emerging economies with high urbanization rates like China and India also offer lucrative prospects for market expansion. Market Drivers The key driver behind the Valves Market Demand is the increasing constructional and infrastructure development activities worldwide. There is huge government focus as well as private investments toward projects such as roadways, railways, metro stations, power generation, water supply, etc. which involves extensive use of valves in various process applications. Further, the rising need for energy and growing focus on rural electrification has boosted investments in power transmission and distribution sector augmenting valves demand.

PEST Analysis

Political: The valves market is regulated by laws pertaining to safety, environmental protection and quality standards. New regulations regarding emissions could impact demand patterns. Economic: Changes in the global and regional economic conditions directly impact spending on industries like oil & gas, energy & power, and water & wastewater management which influences Valves demand. Social: Growing population and urbanization is increasing requirements for water, energy and other infrastructure development which boost the usage of valves. Technological: Advancements in materials and designs of valves are improving efficiency, lowering costs and enabling usage in newer applications. Digitalization is also aiding remote monitoring of industrial valves. The regions concentrating maximum valves market share in terms of Valves Market Size and Trends include North America, Europe and Asia Pacific. North America accounts for a major portion owing to strong presence of end-use industries like oil & gas and significant infrastructure spending. Europe and Asia Pacific are also sizable markets led by Germany, China, India respectively. The fastest growing regional market for valves is expected to be Asia Pacific led by increasing investments in water & wastewater management, power projects and industrial activities in China and India. Rising standards of living and initiatives to improve urban infrastructure will further drive the demand across developing nations in the region.

Get more insights Valves Market

Discover the Report for More Insights, Tailored to Your Language.

French German Italian Russian Japanese Chinese Korean Portuguese

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

#Coherent Market Insights#Valves Market#Control Valves#Globe Valves#Plug Valves#Gate Valves#Ball Valves#Butterfly Valves

2 notes

·

View notes

Text

The Economic Impact of Paraffin Dispersant Exports: A Global Perspective

In the modern oil and gas industry, paraffin or wax deposition has emerged as a significant challenge. Paraffin, a naturally occurring hydrocarbon, can solidify in pipelines, tanks, and other equipment, leading to blockages that disrupt production and transportation. The answer to this growing problem lies in the development and export of wax or paraffin dispersants, chemicals designed to mitigate wax build-up by keeping the wax particles suspended in oil.

India has established itself as a key player in the production and export of wax or paraffin dispersants, supplying global markets with these critical chemicals. With the growing demand for oil, especially in emerging economies, the need for these dispersants continues to rise. This blog explores the economic impact of paraffin dispersant exports, with a focus on India’s role as a key manufacturer, exporter, and supplier in the global market.

Understanding the Role of Paraffin Dispersants in the Oil and Gas Industry

Wax build-up in pipelines and storage tanks is a costly and time-consuming issue for oil producers worldwide. Paraffin dispersants, also known as wax dispersants, are chemicals that prevent the solidification of paraffin by dispersing it into smaller particles, allowing it to flow with the crude oil. This significantly reduces the risk of blockages in pipelines, maintains efficient flow, and ensures smoother operations in oilfields.

The demand for paraffin dispersants has increased over the past decade due to the global expansion of oil production, especially in regions with colder climates where paraffin solidification is more likely to occur. As oil exploration and production continue to grow globally, especially in emerging economies like Africa, Latin America, and Southeast Asia, the need for reliable paraffin dispersants will only increase.

India: A Leading Wax / Paraffin Dispersant Manufacturer

India has become a major hub for the production of wax dispersants. As a wax dispersant manufacturer in India, the country is home to several companies that specialize in producing high-quality paraffin dispersants. These companies have invested heavily in research and development to create efficient and eco-friendly dispersants that meet global standards.

Indian manufacturers benefit from a robust chemical production infrastructure and access to raw materials, making them competitive on the global stage. The strategic geographic location of India also allows for easy access to key markets in Asia, the Middle East, and Africa, where oil production is booming. Companies like Imperial Oilfield Chemicals Pvt. Ltd. have emerged as leaders in the production and export of wax dispersants, driving economic growth through international trade.

The Growing Importance of Paraffin Dispersant Exports

As a leading wax dispersant exporter in India, the country plays a critical role in supplying global markets with the chemicals necessary to ensure the smooth operation of oil and gas infrastructure. The export of paraffin dispersants contributes significantly to India’s foreign exchange earnings, supporting the nation’s economy and positioning it as a key player in the global oil and gas supply chain.

India’s wax dispersant exports have found markets in oil-producing countries across the Middle East, Africa, Latin America, and Asia. These regions are experiencing rapid growth in oil exploration and production, leading to an increased demand for chemicals that can enhance operational efficiency. By providing high-quality dispersants at competitive prices, India has established itself as a trusted supplier on the global stage.

Economic Impact of Wax Dispersant Exports on India’s Economy

The economic impact of paraffin dispersant exports on India’s economy is multifaceted. The growth of this industry has created jobs, generated foreign exchange, and driven innovation in the chemical sector. Some key impacts include:

Job Creation: The manufacturing and export of paraffin dispersants have led to job creation in both the chemical production sector and related industries, such as logistics and transportation. This has helped boost local economies, particularly in regions where manufacturing facilities are located.

Foreign Exchange Earnings: As a major wax dispersant exporter in India, the country generates significant foreign exchange earnings. These earnings contribute to the overall economic stability of the nation, supporting investments in infrastructure, education, and healthcare.

Technological Advancements: The increasing demand for high-quality dispersants has encouraged Indian manufacturers to invest in research and development. This has led to innovations in the production of eco-friendly dispersants, enhancing the competitiveness of Indian companies on the global stage.

Trade Relationships: Exporting paraffin dispersants has strengthened India’s trade relationships with oil-producing nations. These relationships open doors to further collaboration and trade opportunities, particularly in related sectors such as oilfield services and equipment.

Diversification of the Economy: The growth of the paraffin dispersant industry helps diversify India’s economy. As the country becomes less reliant on traditional exports like textiles and agriculture, it builds a more resilient economy capable of weathering global economic fluctuations.

Challenges and Opportunities in the Global Wax Dispersant Market

While the global demand for paraffin dispersants is on the rise, there are also challenges that manufacturers and exporters face. These include fluctuating oil prices, environmental regulations, and competition from other global suppliers.

Fluctuating Oil Prices: The price of oil is a major factor influencing the demand for paraffin dispersants. When oil prices drop, oil producers may cut back on production, leading to reduced demand for dispersants. However, when prices rise, production increases, driving up the need for dispersants. Indian manufacturers must be agile and responsive to these market fluctuations to remain competitive.

Environmental Regulations: With increasing global concern about the environmental impact of chemicals used in the oil industry, there is a growing demand for eco-friendly dispersants. Indian manufacturers are investing in the development of biodegradable dispersants to meet these regulatory demands. This presents an opportunity for India to position itself as a leader in the production of environmentally sustainable chemicals.

Competition from Other Suppliers: As a wax dispersant supplier in India, Indian companies face competition from manufacturers in other countries, particularly those in the United States, China, and Europe. To maintain their competitive edge, Indian exporters must continue to focus on quality, cost-efficiency, and customer service.

The Future of India’s Paraffin Dispersant Exports

The future looks bright for India’s paraffin dispersant export industry. As oil production continues to expand globally, especially in regions like Africa and Southeast Asia, the demand for dispersants will rise. Indian manufacturers are well-positioned to meet this demand, thanks to their competitive pricing, innovative solutions, and established trade relationships.

In addition, India’s focus on sustainability and environmentally friendly dispersants will allow the country to capture a growing segment of the market that prioritizes eco-conscious products. By staying ahead of global trends and continuing to invest in research and development, Indian companies can ensure long-term success in the global wax dispersant market.

Conclusion

India’s role as a wax dispersant manufacturer in India, exporter, and supplier is having a significant economic impact both domestically and globally. The country’s ability to produce high-quality paraffin dispersants at competitive prices has positioned it as a trusted supplier in key oil-producing regions. As the global demand for these chemicals continues to grow, India stands to benefit economically from its leadership in this critical sector.

From job creation to foreign exchange earnings, the export of paraffin dispersants is a vital part of India’s economic landscape. By continuing to innovate and meet the demands of the global market, Indian manufacturers will play a crucial role in ensuring the smooth operation of the world’s oil and gas infrastructure.

#Wax / Parrafin Disperssant supplier in India#Wax / Parrafin Disperssant Manufacturer in India#Wax / Parrafin Disperssant exporter in India

4 notes

·

View notes

Text

CREATIVE SEO STRATEGIST MENA

CREATIVE SEO VIDEO STRATEGY

MENA SEO EXPERT Predrag Petrovic

The Middle East and North Africa (MENA) region is poised for significant growth in the coming years, driven by several factors:

Economic Diversification: MENA countries are moving away from dependence on oil and gas, focusing on developing other sectors like tourism, technology, and renewable energy.

Young Population: The MENA region boasts a young and tech-savvy population, a significant driver of innovation and entrepreneurship.

Technological Advancements: Increased internet penetration and smartphone adoption will continue to fuel e-commerce, fintech, and other digital services.

Here are some predictions for the MENA region's future:

Rise of Q-commerce: Quick commerce, focusing on hyper-local deliveries within minutes, is expected to see explosive growth.

E-commerce Boom: The e-commerce market in MENA is expected to continue its rapid expansion, with a growing focus on mobile shopping.

Investment in Infrastructure: Governments are likely to invest heavily in infrastructure development, including transportation and logistics networks, to support economic growth.

Geopolitical Shifts: The region's geopolitical landscape will likely remain complex, but there could be increased cooperation on regional issues.

SEO Predictions

Search Engine Optimization (SEO) is constantly evolving, but here are some predictions specific to the MENA region:

Focus on Mobile-First Indexing: As mobile usage continues to dominate, Google will likely prioritize mobile-friendly websites in search results.

Rise of Voice Search: With the growing popularity of voice assistants, optimizing websites for voice search queries will become increasingly important.

Importance of Local SEO: As MENA consumers become more locally focused, local SEO strategies like optimizing Google My Business listings will be crucial.

Multilingual SEO: Since the MENA region is linguistically diverse, creating Arabic-language content and optimizing for other regional languages will be advantageous.

Content Reigns Supreme: High-quality, informative, and localized content will remain a key factor in achieving high search engine rankings.

By staying updated on these trends, businesses in the MENA region can leverage SEO to reach their target audience and thrive in the digital landscape.

FINTECH SEO EXPERT MENA - EMEA

RECOMMENDED MARKETING AND SEO STRATEGY 2025

VIDEO SEO EXPERT STRATEGIST near me

www.יִשְרָאֵל.net

#seo#creative#strategist#seostrategist#creativeseo#mena#menaseo#menaseoexpert#emea#seomena#seoexpertemea#fintech#fintechseo#fintechseoexpert#VIDEO#VIDEO SEO#VIDEOSEOEXPERT#RECOMMENDED MARKETING#RECOMMENDED MARKETING EXPERT#RECOMMENDED SEO#SEOSTRATEGY#ai marketing emea#ai marketing mena#AI STRATEGIST MENA

2 notes

·

View notes

Text

Aquatic Robot Market to Eyewitness Huge Growth by 2030

Latest business intelligence report released on Global Aquatic Robot Market, covers different industry elements and growth inclinations that helps in predicting market forecast. The report allows complete assessment of current and future scenario scaling top to bottom investigation about the market size, % share of key and emerging segment, major development, and technological advancements. Also, the statistical survey elaborates detailed commentary on changing market dynamics that includes market growth drivers, roadblocks and challenges, future opportunities, and influencing trends to better understand Aquatic Robot market outlook. List of Key Players Profiled in the study includes market overview, business strategies, financials, Development activities, Market Share and SWOT analysis: Atlas Maridan ApS. (Germany), Deep Ocean Engineering Inc. (United States), Bluefin Robotics Corporation (United States), ECA SA (France), International Submarine Engineering Ltd. (Canada), Inuktun Services Ltd. (Canada), Oceaneering International, Inc. (United States), Saab Seaeye (Sweden), Schilling Robotics, LLC (United States), Soil Machine Dynamics Ltd. (United Kingdom) Download Free Sample PDF Brochure (Including Full TOC, Table & Figures) @ https://www.advancemarketanalytics.com/sample-report/177845-global-aquatic-robot-market Brief Overview on Aquatic Robot: Aquatic robots are those that can sail, submerge, or crawl through water. They can be controlled remotely or autonomously. These robots have been regularly utilized for seafloor exploration in recent years. This technology has shown to be advantageous because it gives enhanced data at a lower cost. Because underwater robots are meant to function in tough settings where divers' health and accessibility are jeopardized, continuous ocean surveillance is extended to them. Maritime safety, marine biology, and underwater archaeology all use aquatic robots. They also contribute significantly to the expansion of the offshore industry. Two important factors affecting the market growth are the increased usage of advanced robotics technology in the oil and gas industry, as well as increased spending in defense industries across various countries. Key Market Trends: Growth in AUV Segment Opportunities: Adoption of aquatic robots in military & defense

Increased investments in R&D activities Market Growth Drivers: Growth in adoption of automated technology in oil & gas industry

Rise in awareness of the availability of advanced imaging system Challenges: Required highly skilled professional for maintenance Segmentation of the Global Aquatic Robot Market: by Type (Remotely Operated Vehicle (ROV), Autonomous Underwater Vehicles (AUV)), Application (Defense & Security, Commercial Exploration, Scientific Research, Others) Purchase this Report now by availing up to 10% Discount on various License Type along with free consultation. Limited period offer. Share your budget and Get Exclusive Discount @: https://www.advancemarketanalytics.com/request-discount/177845-global-aquatic-robot-market Geographically, the following regions together with the listed national/local markets are fully investigated: • APAC (Japan, China, South Korea, Australia, India, and Rest of APAC; Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka) • Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania) • North America (U.S., Canada, and Mexico) • South America (Brazil, Chile, Argentina, Rest of South America) • MEA (Saudi Arabia, UAE, South Africa)Furthermore, the years considered for the study are as follows: Historical data – 2017-2022 The base year for estimation – 2022 Estimated Year – 2023 Forecast period** – 2023 to 2028 [** unless otherwise stated] Browse Full in-depth TOC @: https://www.advancemarketanalytics.com/reports/177845-global-aquatic-robot-market

Summarized Extracts from TOC of Global Aquatic Robot Market Study Chapter 1: Exclusive Summary of the Aquatic Robot market Chapter 2: Objective of Study and Research Scope the Aquatic Robot market Chapter 3: Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis Chapter 4: Market Segmentation by Type, End User and Region/Country 2016-2027 Chapter 5: Decision Framework Chapter 6: Market Dynamics- Drivers, Trends and Challenges Chapter 7: Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile Chapter 8: Appendix, Methodology and Data Source Buy Full Copy Aquatic RobotMarket – 2021 Edition @ https://www.advancemarketanalytics.com/buy-now?format=1&report=177845 Contact US : Craig Francis (PR & Marketing Manager) AMA Research & Media LLP Unit No. 429, Parsonage Road Edison, NJ New Jersey USA – 08837 Phone: +1 201 565 3262, +44 161 818 8166 [email protected]

#Global Aquatic Robot Market#Aquatic Robot Market Demand#Aquatic Robot Market Trends#Aquatic Robot Market Analysis#Aquatic Robot Market Growth#Aquatic Robot Market Share#Aquatic Robot Market Forecast#Aquatic Robot Market Challenges

2 notes

·

View notes

Text

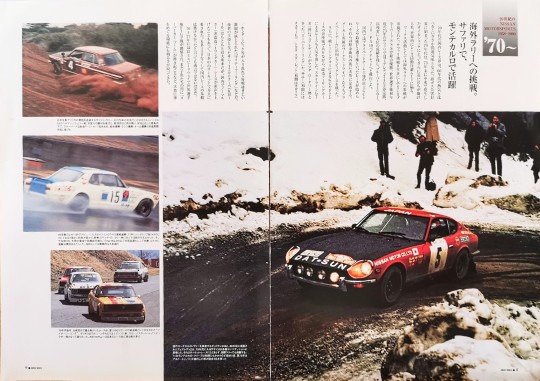

20th century

NISSAN MOTORSPORTS

1958-2000

70~

Taking on the challenge of overseas rallies.

On a safari

Active in Monte Carlo

The domestic racing world of the 170s was compared to the excitement of the 1960s.

The market has become somewhat sluggish. This was further exacerbated by the oil crisis caused by exhaust gas pollution, and the world fell into a mood of refraining from racing activities.

The 1970s began with a strategic plan, but it started in the Middle East at the end of 1973.

Participation in overseas rallies was emphasized as a works activity. 510 Bluebird SSS won the overall victory in the 8th year of the safari challenge. The Fairlady 240Z won the safari in the first year of the World Championship, and has consistently maintained top results ever since, moving on to the Bluebird 160J and 710/PA10 Violet.

In Japan, the Fuji GC system, which is dominated by private teams,

Races such as Leeds and Suzuka F2 Championship started.

After many twists and turns, they gradually become established.

Works drivers belonging to the manufacturer also

He was transferred to an event team and competed in big races.

Furthermore, GC and F2 races using pure racing cars are also available.

Although it was an undercard race for the race, the race for modified touring cars also gained popularity. Skyline GT-R (later Fairlady Z) competes with Mazda rotary cars

The "Super Touring" that I made, and the Sunny (in the early days Cherry too)/Toyota Starlet (initial Corolla)

Every race is amazing with Honda, Civic, etc.

``Minor Touring'' was a fierce battle. The Sunny 1200 Coupe (KB110), which became the main character of the latter, was originally a popular car, but with the birth of normal car (unmodified touring car) racing in Japan, it became popular with everyone at circuits throughout Japan. Loved. It is no exaggeration to say that without the KB110, the foundation for domestic racing could not have been built.

World racer at Fuji Speedway from 1970 to 1977

The F1GP match was held, and there was also a sense of excitement among the children.

``Car boom'' began, and cars gradually became popular.

Brightness has returned to the environment surrounding the world.

PIC CAPTIONS

A Datsun 240Z races through the snowy Monte Carlo Rally. Announced in the fall of 1969

The Fairlady Z appeared in various competitions as soon as the 1970s began. It is active not only in circuit races but also in international rallies. At the 1971 Monte Carlo Rally, it placed 5th overall despite being the first to race, and the following year, in 1972, this car of Aaltonen/Todt took 3rd place overall.

_____________________________________________

The 510 Bluebird SSS (Hermann/Schuller) achieved an impressive victory in the 17th year of the Safari Rally, which is run over the rough roads of vast East Africa. Despite the poor conditions of rain on the first day of the competition, which turned into a quagmire, Bluebird finished in 1st, 2nd, 4th, and 7th place overall, achieving complete domination with overall victory, class victory, and team victory.

_____________________________________________

The Skyline GT-R, which debuted at the JAF-GP in the spring of 1969, went on to win consecutive races, and in 1971, when the hardtop version (KPGC10) was introduced, its strength increased, giving no chance to the new Mazda Rotary team. Then, in March 1972, at Fuji in heavy rain, this No. 15, driven by Kunimitsu Takahashi, lapped the 2nd place and below and won an easy victory, giving the GT-R its 50th victory in total. This was an amazing record at the time.

_____________________________________________

In the late 1970s, the hottest race in Japan was the "Minor Touring" race held as the undercard of the Fuji GC Series. 1.3'' engine cars tuned to the limit, Sunny, Starlet, and Civic all competed together. KB110 Sunny is a masterpiece car that will remain in Japanese racing history.

5 notes

·

View notes

Text

ASX BHP: A Diversified Mining and Petroleum Giant with Strong Financial Performance

BHP Group, also known as ASX BHP, is a multinational mining, metals, and petroleum company headquartered in Melbourne, Australia. With operations in over 90 locations worldwide, BHP is one of the largest diversified resource companies in the world.

In this article, we will take a closer look at ASX BHP, including its history, current operations, financial performance, and future prospects.

History of ASX BHP

BHP was originally founded in 1885 as the Broken Hill Proprietary Company Limited, named after the Broken Hill silver and lead mine in western New South Wales, Australia. Over the years, the company expanded into other commodities, including iron ore, copper, coal, and petroleum.

In 2001, BHP merger with Billiton plc, a mining company based in London, to form BHP Billiton. The merger created one of the largest mining companies in the world, with operations in over 25 countries.

In 2017, the company simplified its name to BHP Group, reflecting its focus on its core operations in mining, metals, and petroleum.

Current Operations

BHP operates in four main segments: iron ore, copper, coal, and petroleum. The company is the world's largest producer of iron ore and the second-largest producer of copper.

Iron Ore: BHP's iron ore operations are located in the Pilbara region of Western Australia. The company's operations in the region include five mines, a railway network, and two port facilities.

Copper: BHP's copper operations are located in Chile, Peru, and the United States. The company's copper assets include the Escondida mine in Chile, the world's largest copper mine.

Coal: BHP's coal operations are located in Australia, Colombia, and South Africa. The company produces both metallurgical coal (used in steelmaking) and thermal coal (used in electricity generation).

Petroleum: BHP's petroleum operations are located in Australia, the Gulf of Mexico, Trinidad and Tobago, and the Caribbean. The company produces both oil and gas.

Financial Performance

In the first half of the 2022 financial year, BHP reported a net profit of US$10.9 billion, up from US$3.9 billion in the same period the previous year. The company attributed the increase to higher commodity prices and increased production.

BHP's share price has also performed well in recent years, with the company's market capitalization reaching over A$300 billion in 2021.

Future Prospects

BHP is well-positioned to benefit from the growing demand for commodities, particularly from emerging economies such as China and India. The company has also been investing in renewable energy and technology to reduce its carbon footprint and improve its environmental performance.

In 2021, BHP announced plans to invest over US$5 billion in its petroleum business over the next five years, focusing on high-return growth opportunities in the Gulf of Mexico and Trinidad and Tobago.

Overall, ASX BHP is a well-established and financially sound company with a strong position in the global mining, metals, and petroleum markets. Its focus on sustainable and responsible business practices, combined with its diversified operations, make it a compelling investment opportunity for long-term investors.

Also check related tickers

ASX CBA

ASX FMG

ASX APT

ASX NAB

2 notes

·

View notes

Text

Polymer Nanomembrane Market Industry Leaders Size & Share Outlook & New Revenue Pockets

The global polymer nanomembrane market size is estimated to be USD 637 million in 2021 and is projected to reach USD 1,103 million by 2026, at a CAGR of 11.6% between 2021 and 2026. The polymer nanomembrane market is expected to witness a steady growth forecast period due to growth in the water & wastewater treatment industry.

Download PDF Brochure at https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=12758357

The evolution of nanotechnology over time has led to a breakthrough for the membrane segment. The nanomembrane produced from polymer (PAN, PVDF, PES, and others) constitutes polymer nanomembrane. The pore size of the membrane in the range of nanometers (1nm to 300 nm). These membranes are mainly utilized as nanofiltration membranes and nanofiber membranes in various end-use applications. The nanofiltration membrane finds its application for membrane separation processes in the water & wastewater treatment industry and industrial processes. Nanofiber membranes are utilized in pharmaceutical and other industries such as textiles for providing high breathability and controlled permeability.

Based on type, the polymer nanomembrane market is segmented into polyacrylonitrile (PAN), polyethylene (PE), polyvinylidene fluoride (PVDF), polyamide, polypropylene (PP), polyethersulfone (PES), polytetrafluoroethylene (PTFE), and others. These are the different types of polymers utilized in the production of nanomembranes. For instance, PVDF and PE provide hydrophobic membranes, whereas, PES provides hydrophilic membranes.

Based on end use industry, the market is segmented into water & wastewater treatment, chemical, electronics, oil & gas, food & beverages, pharmaceutical & biomedical, and others. The water & wastewater treatment industry is the largest end user of polymer nanomembrane. Nanomembranes are utilized as nanofiltration, nanofiber, and other membranes for various end-use applications. Unlike reverse osmosis, which blocks all solutes, the nanofiltration membrane selectively allows monovalent ions to pass through. NF membrane operates under lower pressure and is utilized in various process solutions such as water purification, desalination, separation, whey demineralization & concentration, and others. It is also used in facemasks, protective apparel, and others.

The polymer nanomembrane market is studied for five regions, namely, North America, APAC, Europe, Middle East & Africa, and South America. North America accounted for the largest share of the polymer nanomembrane market in 2020, followed by Europe and APAC. US, China and Germany are major markets for polymer nanomembrane in North America, APAC and Europe respectively. The increased demand for polymer nanomembrane in North America is due to growing urbanization, aging water treatment utilities, faster adoption of newer technologies, and declining freshwater resources. The US is a developed market focused on newer applications of membranes such as polymer nanomembrane in chemical, food & beverage, pharmaceutical & biomedical, oil & gas, and water & wastewater. The country offers a favorable business environment with a strong infrastructure, supportive government policies, and a growing demand for sustainable water management solutions.

Request For FREE Sample of Report at https://www.marketsandmarkets.com/requestsampleNew.asp?id=12758357

The COVID-19 pandemic in 2020 impacted the global economy, with governments enforcing regulations and restrictions to minimize the spread of the virus. According to the International Monetary Fund (IMF), the world GDP growth rate in 2020 was -3.3% and is projected to grow by 6% in 2021 and 4.4% in 2022. Due to lockdowns, business activities halted for many food & beverage, processing industries, water & wastewater treatment, and other industries. Nanomembrane is utilized for purification, separation, demineralization, concentration, and other processes in various industries. COVID-19 impacted these industries, which further impacted the nanomembrane market. However, the market is expected to grow steadily during the forecast period, with business operations returning to normal.

#Polymer Nanomembrane Market#Polymer Nanomembrane#Polymer Market#Polymers Market#Nanomembrane Market#Polymer Nanomembranes#Nanomembrane#Nanomembranes

0 notes