#80G

Explore tagged Tumblr posts

Text

#35mm#film#35mm film#filmisalive#filmisbetter#filmisnotdead#analog#analog photography#m'c#analog picture#fotografia rolo#film photography#fotografia#fotografia analogica#olympus#olympus superzoom 80g#80g#olympus superzoom#superzoom#superzoom 80g#c200#fuji c200#fuji#fujifilm

14 notes

·

View notes

Text

योग दिवस की सभी को बधाई योग चिंता, तनाव को कम करता है और व्यक्ति के मूड और शारीरिक और मनोवैज्ञानिक कल्याण में सुधार करता है

yoga #yogaeverydamnday #yogalife #yogainspiration #yogalove #yogagirl #yogachallenge #yogaeverywhere #yogaeveryday #yogapractice #yogateacher #yogapose #instayoga #igyoga

#yoga#yogaeverydamnday#yogalife#yogainspiration#yogalove#yogagirl#yogachallenge#yogaeverywhere#yogaeveryday#yogapractice#yogateacher#yogapose#instayoga#igyoga#JagannathRathYatra2023#bhiwadi#oshifoundation#donation#donate#charity#love#nonprofit#volunteer#help#education#giveback#ngo#support#csr#80g

2 notes

·

View notes

Text

Simplified NGO Tax & Compliance Services with the LegalDost

Non-Governmental Organizations (NGOs) play a big role in solving social problems and giving people more power. However, to ensure continuous operations, NGOs need to adhere to numerous tax and legal regulations. The LegalDost offers NGO tax and compliance services that allow you to focus on your objectives, while we handle the necessary details. Here's how we make it simple for NGOs to follow the rules.

Why Choose the LegalDost for Your NGO Compliance Needs?

We offer a wide range of services to NGOs, such as Section 8 compliance, Sec. 80G and Sec. 12A registrations and renewals, and tax audits. We provide the following services:

Comprehensive Section 8 Compliance:

We take care of all the post-incorporation compliance of Section 8 companies, which includes everything from filing documents to making sure that the rules are clear.

We are well-versed in ROC compliance for Section 8 companies, ensuring timely as well as accurate entries.

Utilizing a custom compliance checklist for Section 8 companies, we make sure processes that are free of mistakes.

Expertise in Sec.80G & Sec.12A Registration and Renewal:

We make Sec. 80G and Sec. 12A renewals a hassle-free process.

Make sure you follow all the rules for the tax audit, like meeting the due date and staying within the income tax audit limit.

Custom NGO Compliance Checklist and Support:

The LegalDost makes an in-depth NGO compliance checklist that includes all legal and financial requirements.

We offer specialized help for FCRA compliance for NGOs, which makes sure that the handling of foreign donations goes smoothly.

Key Compliance Requirements for Section 8 Companies

Companies that are subject to Section 8 needs to comply with the following every year:

The Section 8 Company Annual Compliances file needs to be submitted to the Registrar of Companies.

Meet with the board regularly and hold annual general meetings (AGMs) every year.

Keeping detailed financial records and filing tax reports are important.

Stick to a strict compliance checklist for Section 8 companies, which includes filings and checks.

Post Incorporation Compliances: After incorporation, Section 8 companies need to:

Obtain the required approvals and licenses.

Submit commencement documents to the RoC.

Keep statutory registrations and records.

The LegalDost ensures smooth compliance with these regulations, preventing fines and delays.

Sec.80G and Sec.12A of the Income Tax Act

What is Sec.80G?

Donors to NGOs can benefit from tax advantages under Sec. 80G. Important points consist of:

Donors may deduct up to 50% or 100% of donations.

For NGOs to be eligible for donor tax benefits, they must fulfill several requirements.

The LegalDost makes it easier for NGOs to raise funds by facilitating a seamless Sec. 80G registration.

What is Sec.12A?

NGOs are exempt from taxes under Sec. 12A, which allows them to allocate funds efficiently. The LegalDost assists with:

In order to obtain further exemptions, we are abiding by Section 10 (12A) of the Income Tax Act.

Specific compliance needs, such Sec. 12A Panchkula, are being addressed.

Tax Audit Support for NGOs

Tax audits make sure transparency as well as compliance with financial regulations. The LegalDost assists NGOs in:

The submission was finished ahead of the tax audit due date.

We must adhere to the income tax audit turnover limit and stay updated on any amendments.

Preparing detailed tax audit reports that meet statutory guidelines.

For NGOs, we also provide clearer tax audit definitions to simplify the procedure.

The LegalDost Advantage

The following factors contribute to NGOs' faith in the LegalDost:

Expertise in Section 8 Compliance: We handle everything from post-incorporation procedures to annual compliance for Section 8 companies.

Simplified Sec. 80G & Sec. 12A Services: We guarantee seamless procedures for registration, renewal, and compliance.

Comprehensive Compliance Support: We manage FCRA compliance, from developing an NGO compliance checklist to doing it all.

Proactive Tax Assistance: Our team ensures you never overlook a rule change or deadline.

Summary

Complying with NGO regulations doesn't have to be difficult. From Section 8 company compliance to tax audits the LegalDost streamlines every process. Let us take care of the compliance issues so you can concentrate on making an impact.

To make sure your NGO's smooth compliance journey, check out our services at the LegalDost right now!

0 notes

Text

Karamell Waffeln, 80g

#Finest Bakery#Waffel#Karamell#Karamellwaffeln#Continental Bakeries Deutschland GmbH#De Banketgroep B.V.#Nope#Aldi#Zucker#80g

0 notes

Text

csr registration for ngo

Non-governmental organizations (NGOs) play a crucial role in addressing social issues, advocating for human rights, and driving positive change in society. These organizations work tirelessly to bridge the gaps left by governments and contribute towards building a more equitable world. However, for an NGO to operate effectively and gain credibility, it is essential to register itself under a legally recognized framework. One such framework is registration as a trust, which provides NGOs with numerous benefits and opportunities to fulfill their mission.

In this article, we delve into the process of NGO registration as a trust and explore its significance in empowering these organizations to make a lasting impact. We are the experts in trust registration.

#ngo consultancy#ngo registration#ngo registration process#trust registration#ngo registration online#what is ngo#12a registration#80g#12a

1 note

·

View note

Text

An addition to the cocktail chapter of the @worldsbeyondpod Unofficial Cookbook:

Honey With A Note Of Song

an absinthe wash (the green fairy, for your roots)

2 oz. rye (your liquor of choice, strong and spicy)

1/4 oz. pine and rosemary honey syrup (you cannot go home again)

1 barspoon of saline solution (for your first divine smite, where you found your breath once more)

1-2 dashes of peychauds bitters (because this is a play on a sazerac)

a grapefruit twist (a touch of the bitterness age has brought you)

serve in a glass reminiscent of a chalice

#worlds beyond number#wbn unofficial cookbook#Eursulon#the wizard the witch and the wild one#for absinthe wash: swirl a small amount of absinthe around the sides of your glass#for honey syrup: 2:1 honey to water ratio#i used pine in the common sense foraging various evergreen needles including pine fir and cedar (and rosemary)#for saline solution: 20g of salt dissolved in 80g of hot water#when foraging for needles make sure u know what ur grabbing and be wary of yew especially#in the words of Alexsis Nicole happy snacking don’t die!!!#cw alcohol#your honey is quiet (non-alc drink with honey syrup) and Ame cocktail coming soon#no idea what to make for a Suvi cocktail i’m so sorry Aabria#Ame cocktail will be slightly impossible to replicate bc it uses local ingredients but that’s the point u will have to brew ur own potion#if u make this ur not legally obligated to tell me about it in the tags or comments but it would make me really happy if u did!!!!!#update after staging the Ame cocktail with a little extra ✨✨ i wish i put more ✨✨ into staging this one as well#put my thing of bark behind it#¯\_(ツ)_/¯ o well

162 notes

·

View notes

Text

fell asleep scrying her lmao

#flight rising#80g much to think abt#dragon sales#tundras#shes not mine if you like her go get her#by fell asleep i do mean i woke up at 3am and my phone was not on my charger and this scry was on my screen

19 notes

·

View notes

Text

#olympus#olympussuperzoom80g#superzoom80g#80g#olympus superzoom#c200#fujic200#fuji c200#m'c#35mm#35mm film#film photography#analog#fotografia analógica#filmisalive#filmisnotdead#istillshootfilm#hangout#friends

6 notes

·

View notes

Text

कपड़ा बैंक* - विंटर डोनेशन कैंपेन (WDC): पिछले 6 सालों से चल रही यह पहल समाज के दानदाताओं से प्राप्त पुराने कपड़ों से वंचित लोगों को सर्दियों में गर्म कपड़े प्रदान करती है।

#bhiwadi#donation#donate#csr#80g#charity#love#nonprofit#volunteer#help#education#giveback#ngo#support#community#fundraiser#children#fundraising#change#womenempowerment#ngoindia#foundation#health#humanrights#causes#awareness#helpinghands#youth#women#socialworker

0 notes

Text

I'm impulsively setting up a lil ten gallon so i can get something at Aquashella next weekend, a friend is letting me skim cycled water and an established filter cartridge and some substrate from her tanks, I'm not just dumping something in an uncycled system, and I'm just fucking Excited about it. it's been over 3 years since i could have a tank. but since I'm going to be doing twice weekly jellyfish tank maintenance for my parents following Aquashella, I'll be able to get water that's been put through the ro system i installed for them like obviously I'll have to re-mineralize it, but as a temporary thing until the new place is done and i can get my own filters and ro set up it should work out.

#city water even. not well water with a mystery 1500 dps reading.#their ro system is rated for 80g a day because they wanted less limscale on their fancy glasses and plates#80 g is still over kill for that but its what they wanted#the jellyfish tank is only 5 gallons. which is why maintenance is a twice a week thing

7 notes

·

View notes

Text

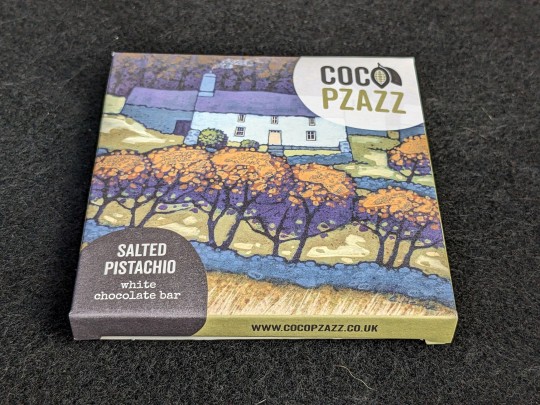

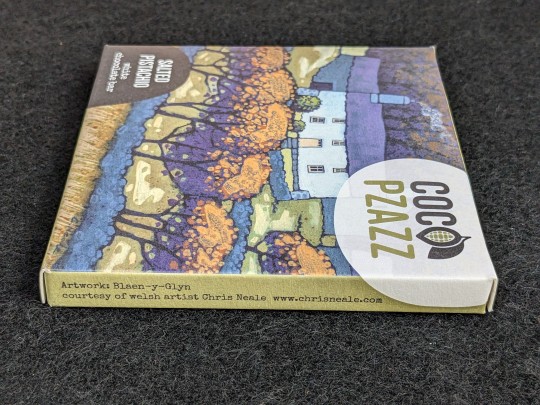

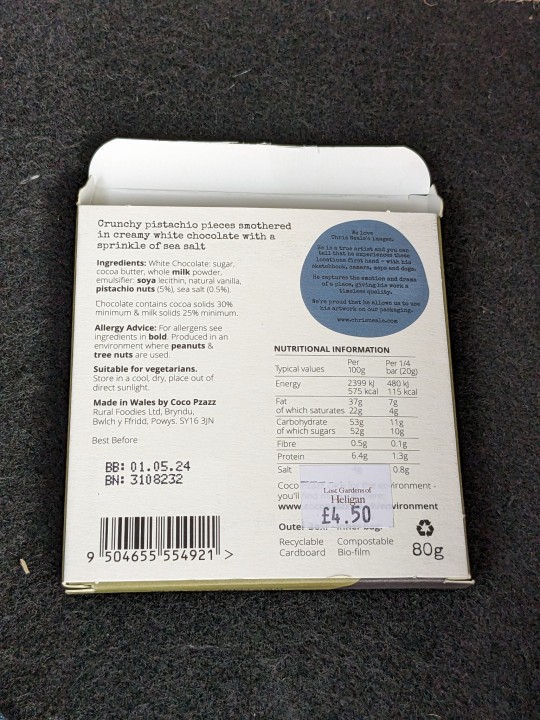

Coco Pzazz Salted Pistachio white chocolate bar, 80g

#Chocolate bar#White chocolate#Chocolate#Schoko#Schokolade#80g#Choco Pzazz#Salted Pistachio#Pistachio#Pistazien#zucker#Okayish

0 notes

Text

Benefits of National Level NGO Registration

Non-governmental organizations (NGOs) play a significant role in shaping society by addressing social, environmental and economic issues. They are independent entities that work towards the betterment of communities. In most countries, NGOs operate without any legal recognition or registration, which makes it difficult for them to function effectively. However, national level ngo registration can provide many benefits for these organizations. Google Map: ngo consultancy.

#ngo registration online#society registration#what is ngo#12a registration#80g#trust registration#ngo registration#ngo consultancy#12a

0 notes

Text

12A and 80G Registration: Know All About It

1 note

·

View note

Text

How 80G and 12A Registration Can Transform Your NGO’s Tax Strategy

In the ever-evolving landscape of non-profit organizations, optimizing your tax strategy is crucial for sustainability and growth. For NGOs in India, securing 80G and 12A registration is a game-changer, offering significant tax benefits that can enhance your fundraising efforts and overall financial health. This blog explores how these registrations can transform your NGO’s tax strategy, with a focus on the 12A and 80G registration process online, how to online apply for 12A and 80G, the importance of the 80G certificate for trust, and the associated 12A and 80G registration fees.

1. Understanding the Importance of 12A and 80G Registration

For NGOs, obtaining 12A and 80G registration is more than just a regulatory requirement—it’s a strategic move that can open doors to numerous financial benefits. 12A registration allows your NGO to be exempt from paying income tax on its surplus income, provided the funds are used for charitable purposes. On the other hand, 80G registration enables your donors to claim tax deductions on their donations, making your organization more attractive to potential contributors.

This dual benefit not only enhances your NGO’s financial stability but also positions your organization as a credible and tax-compliant entity, which is crucial for long-term sustainability.

2. Navigating the 12A and 80G Registration Process Online

The 12A and 80G registration process online has been streamlined by the government to make it more accessible for NGOs across the country. By applying online, your organization can expedite the registration process and ensure compliance with the latest regulations. To start the process, you need to gather essential documents, including your NGO’s incorporation certificate, PAN card, and audited financial statements. After submission, the authorities will review your application, and upon approval, your NGO will be granted the 80G certificate for trust and the 12A registration.

Navigating this process efficiently can save your NGO valuable time and resources, allowing you to focus more on your charitable activities.

3. How to Online Apply for 12A and 80G: A Step-by-Step Guide

Applying for 12A and 80G registration has never been easier, thanks to the government’s online portal. Here’s a step-by-step guide to help your NGO successfully apply:

Create an Account: Visit the official income tax e-filing portal and create an account for your NGO.

Fill in the Application Form: Complete the necessary forms (Form 10A for 12A and Form 10G for 80G) with accurate details about your organization.

Upload Required Documents: Attach the necessary documents, including your NGO’s incorporation certificate, PAN card, and audited financials.

Submit the Application: Once all details are filled in and documents uploaded, submit the application online.

Track Application Status: After submission, you can track the status of your application on the portal.

Completing this process correctly is essential to securing your 80G certificate for trust and obtaining tax exemption under 12A registration.

4. Maximizing Tax Benefits While Minimizing 12A and 80G Registration Fees

While the benefits of 12A and 80G registration are substantial, it’s important to be mindful of the associated 12A and 80G registration fees. Fortunately, these fees are relatively minimal compared to the long-term tax benefits your NGO will receive.

The fees typically cover administrative costs and processing charges, but they are a small price to pay for the potential to attract more donors and ensure your NGO’s income is tax-exempt. By maximizing these tax benefits, your NGO can allocate more funds towards its core mission, driving greater impact and achieving your charitable goals more efficiently.

Conclusion

Securing 12A and 80G registration is a vital step for any NGO looking to optimize its tax strategy and attract more donors. By understanding the 12A and 80G registration process online, knowing how to online apply for 12A and 80G, and managing the 12A and 80G registration fees, your NGO can transform its financial strategy, ensuring long-term sustainability and growth. With the right approach, these registrations can be a catalyst for positive change, empowering your organization to do more good in the world.

0 notes