#ngo registration online

Explore tagged Tumblr posts

Text

A Comprehensive Guide to NGO Registration Online || Registerkaro.in

NGO Registration Online play a pivotal role in addressing various social, economic, and environmental issues. Registering an NGO is a crucial step towards formalizing its operations, gaining legal recognition, and accessing various benefits. With advancements in technology, the process of NGO registration has become more streamlined and accessible through online platforms. This blog provides a comprehensive guide to NGO registration online, detailing the steps involved and the benefits of going digital.

Understanding NGO Registration

An NGO can be registered under different legal frameworks in India, such as:

Societies Registration Act, 1860

Indian Trusts Act, 1882

Section 8 of the Companies Act, 2013

Each of these frameworks has its own set of requirements and implications. However, the online registration process simplifies these varied procedures by providing a unified platform for submission and processing.

Benefits of Online Registration

Convenience: Online registration eliminates the need for multiple visits to government offices. The entire process can be completed from the comfort of your home or office.

Transparency: The online system ensures transparency, reducing the chances of corruption and delays.

Speed: Digital processing significantly reduces the time required for registration, allowing NGOs to commence their activities sooner.

Accessibility: Information and guidance on the registration process are readily available online, making it easier for applicants to understand and comply with the requirements.

Steps to Register an NGO Online

Step 1: Choose the Type of NGO

The first step is to decide the type of NGO you wish to register—Society, Trust, or Section 8 Company. Each type has its own set of rules and benefits, so it’s important to choose the one that best aligns with your objectives and operational plans.

Step 2: Obtain Digital Signature Certificate (DSC)

For online registration, key members of the NGO need to obtain a Digital Signature Certificate. This certificate is essential for signing digital documents securely. DSCs can be obtained from authorized certifying authorities.

Step 3: Apply for Director Identification Number (DIN)

If you are registering a Section 8 Company, the proposed directors must apply for a Director Identification Number (DIN). This can be done through the Ministry of Corporate Affairs (MCA) portal.

Step 4: Name Approval

Choosing a unique name for your NGO is crucial. The name should not be identical or similar to any existing entity. You can check the availability of the desired name through the online portal and submit an application for name approval.

0 notes

Text

Flawless Registration: Document Checklist for Your Section 8 NGO

If you want to establish a non-profit organization with an aim of promoting social welfare, education, art, science, sports, or environmental protection, the Section 8 Company Registration is best for you. It is crucial for you to keep all the essential documents handy for a flawless registration process. In this article, we will discuss about the documents required for Section 8 registration.

Essential Documents Required for Section 8 Company Registration

DSC i.e. Digital Signature Certificate: DSC i.e. Digital Signature Certificate of all the directors must be required for the online registration. It will be used to sign the documents electronically.

DIN i.e. Director Identification Number: All the directors of the company must have to acquire their 8 digit unique Director Identification Number i.e. DIN that has been allotted by the central government.

MOA i.e. Memorandum of Association: MOA i.e. Memorandum of Association is one of the most important document. It defines the objectives & scope of a section 8 Company and must be filed with INC 13.

AOA i.e. Article of Association: AOA i.e. Articles of Association is also a very important document. It will define the internal management & working of the section 8 company.

The other necessary documents are-

Copy of Aadhaar Card of all the directors

Copy of PAN card of all the directors

Email address & contact number of all the directors

Passport size photographs of all the directors

Updated bank statement of saving account of all the directors (not older than 2 months)

Passport of all the directors as identity & nationality proof (in case of foreign nationality)

Any utility bill of the registered address including electricity bill or the telephone bill (not older than 2 months)

A notarized copy of the lease/ rent agreement of office place along with the rent receipt which is not older than 1 month (if available)

NOC given by the Office Owner (if you are not the owner of the registered office)

Conclusion

You can simplify the process of Section 8 Company Registration Online by organizing the above mentioned documents properly. You should make sure that all the forms are accurately filled & submitted in order to establish your NGO, so that you can focus on making a meaningful impact in your chosen field

#ngo formation process#Section 8 company#ngo trust registration#section 8 ngo#ngo registration online#ngo registration process#NGO Registration#section 8 registration#section 8 company registration online#section 8 company registration

0 notes

Text

Do NGO people get paid?

Yes, many people who work for non-governmental organizations (NGOs) receive salaries for their work. NGOs can vary widely in size, structure, and funding sources. Some larger NGOs operate on significant budgets and employ staff members who receive salaries commensurate with their roles and responsibilities. These salaries may vary depending on factors such as the organization's budget, location, and the specific job responsibilities of the individual. However, it's worth noting that some NGOs also rely on volunteers or offer unpaid internships, particularly smaller or grassroots organizations with limited resources.

Why Choose Vakilkaro for NGO registration in Varanasi?

Looking to register your NGO in Varanasi? Trust Vakilkaro for expert assistance in navigating the process seamlessly. With their dedicated team and proven track record, they'll ensure your NGO registration is smooth and efficient. Save time by choosing Vakilkaro as your trusted partner for NGO registration in Varanasi. So contact Vakilkaro's team today at this number: 9828123489.

#ngo registration#ngo registration process#trust registration#society registration#ngo registration online#ngo registration in chennai#ngo registration fees#niti aayog registration#ngo registration in hindi#trust registration process#ngo registration in pakistan#registrations#fcra registration#registration of ngo#registration tamil#new ngo registration#registration chennai#darpan id registration#ngo registration in india#ngo registration in tamil

0 notes

Text

Annual compliance for NGOs is crucial for maintaining transparency and trust. It involves adhering to legal and regulatory requirements, financial reporting, and governance standards. NGOs must regularly file tax returns, disclose financial information, and report on their activities to regulatory bodies and donors. https://www.valcus.in/ngo-compliance.php

0 notes

Text

Trust Registration

Trust registration involves drafting a trust deed outlining the objectives and rules of the trust and obtaining a unique trust name. Necessary documentation such as identity proofs is prepared. The trust deed is then signed by trustees and submitted along with required paperwork to the local registrar or sub-registrar office for registration enabling the trust to operate officially within the jurisdiction.

#ngo registration#ngo consultancy#trust registration#ngo registration process#ngo registration online#80g registration#13 february#business#taxi service

0 notes

Text

Online Trademark Registration Fees, Process, Documents

Trademark registration distinguishes your brand from competitors and help in identifying your product & services as source. Trademark could be a Name, Slogan, Logo or Number which a company uses on its business name, Product or services.

Registering a trademark could be a time taking process as brand registration could take minimum 6 months to 24 months of time depending upon the result of the Examination Report, that's why Professional Utilities provides Brand Name Search Report to get a fair idea about the turnaround time for registration.

Once a Trademark application is processed with the government department, applicants can start using the TM symbol on their mark & ® when the registration certificate has been issued. The registration of the trademark is valid for ten years & can be renewed after ten years. (Read More)

NOTE: If you are a manufacturer then you should also read about EPR Registration

#india#business#earnings#startup#trademark#intellectual property#intellectual disability#private limited company registration in chennai#private limited company registration in bangalore#private limited company registration online#sole proprietorship#limited liability partnership#limited liability company#ngo#ngo donation#nidhi company registration#partnership#partnership firm registration#manage business#taxes#income tax#management#accounting#entrepreneur#import export business#import export data#industry#commerce#government#marketplace

3 notes

·

View notes

Text

Discover if online NGO registration is possible in 2025. Learn the steps, documents, and benefits of Section 8 company registration in India.

#ngo registration#ngo procedure for registration#registration of non governmental organization#section 8 company#section 8 company registration online#section 8 company registration process

0 notes

Text

Common Mistakes to Avoid During the Online 12A Registration Process

The Online 12A Registration Process is an essential step for NGOs and charitable companies searching for tax exemptions under the Income Tax Act. However, like all registration procedures, it comes with its challenges. So we bring you this article mentioning the common errors to be avoided in the Registration process, which can make sure you have a smooth registration. What is 12A Registration?

The 12A registration is a provision below the Income Tax Act that permits charitable or non profit agencies to assert tax exemptions. Once registered below section 12A, the enterprise becomes eligible to obtain donations which might be tax-deductible under section 80G. Common Mistakes to Avoid

Incorrect Documentation One of the most frequent mistakes is filing incomplete or incorrect files. Ensure that each one of the required documents, inclusive of the corporation’s memorandum and PAN card, is successfully scanned and uploaded. Missing or wrong files can cause delays or rejection.

Inaccurate Information Filling in wrong information at some point of the Online 12A Registration Process, which includes incorrect PAN numbers, organizational information, or the date of formation, can cause tremendous troubles. Cross check every area for accuracy before submission.

Not Having a Valid Bank Account The company ought to have a legitimate financial institution account in its name. Make certain that the bank account details are updated and match the corporation’s registered details. If there's any mismatch, the registration method may not be on time.

Failure to Update Details of Trustees Trustees are an essential part of any NGO or charitable consider. Many candidates overlook updating the information of the trustees at some point in the registration system. Ensure all trustees are listed with the right information, along with PAN numbers.

Not Following the Legal Framework The company must follow the legal framework under which it is formed. Whether it's trust, society, or a Section 8 company, ensuring that it complies with the necessary legal guidelines is crucial. Failing to achieve this may lead to rejection or delays.

Ignoring the Timely Filing Requirement The Online 12A Registration Process requires that all programs be filed within a special term. Late submissions can affect the business enterprise’s tax-exempt status and delay the entire process.

Failure to Provide the Correct Object Clause The object clause in the memorandum must align with the employer’s dreams and goals. If the object clause doesn’t match the actual activities of the NGO, the registration application can be rejected.

Benefits of 12A Registration

No Tax on Income: Your business enterprise might not need to pay income tax on the cash it gets, as long as it's used for charitable purposes. In this manner, more money can cross closer to helping human beings.

Government Help:It will become easier to get grants and funds from the government.

Trust and Respect: Having this registration makes your company look extra trustworthy to the general public and donors. People are more likely to donate if they recognize you're formally recognized.

Tax Benefits for Donors:People who donate to your registered business enterprise can also get tax benefits, which encourages extra donations.

Conclusion The Online 12A Registration Process is important for any NGO trying to operate efficiently and get access to tax exemptions. Avoiding these common mistakes will make the procedure smoother and increase the probability of a successful registration. Always ensure that you have the right documents, accurate information, and are following the legal procedures.

0 notes

Text

Obtaining 12AB registration is crucial for NGOs in India, offering significant benefits that enhance their operational efficiency and credibility. Primarily, it provides income tax exemptions under Sections 11 and 12 of the Income Tax Act, allowing NGOs to allocate more resources towards their charitable activities. Additionally, 12AB registration facilitates the receipt of government and private sector grants, as many funding bodies require this certification for eligibility. This registration also enhances the organisation's credibility among donors, beneficiaries, and the public, promoting financial transparency and accountability. Furthermore, it mandates the maintenance of proper books of accounts, ensuring compliance with regulatory standards and fostering trust among stakeholders.

#legal#tax#legal services#ngo#trusts#12ab registration#12a registration online#section 12ab registration#12ab of income tax act

0 notes

Text

URSB to Purge 10,000 Companies from Register

The Uganda Registration Services Bureau (URSB) has announced an impending mass de-registration of at least 10,001 companies that have failed to comply with statutory requirements. This move is part of a broader effort to maintain the integrity of the business register, promote transparency, and enhance accountability in Uganda’s corporate sector. Why URSB is De-registering Non-Compliant…

#How to certify company documents with URSB#Obrs ursb#Online company registration in Uganda#Ursb e services#URSB list of registered companies#Ursb name search#URSB NGO registration#URSB portal#URSB purge#URSB to De-register 10000 companies#Ursb tracking

0 notes

Text

0 notes

Text

rni registration

Simplify your RNI registration process with expert PSR compliance services tailored for quick and hassle-free results.

1 note

·

View note

Photo

(via Documents Required for Section 8 Company Registration (Section 8 NGO))

#section 8 company registration#section 8 company registration online#section 8 registration#NGO Registration#ngo registration process#ngo registration online#ngo trust registration#Section 8 company#ngo formation process

0 notes

Text

Do NGO pay income tax?

Whether NGOs (Non-Governmental Organizations) are required to pay income tax depends on several factors, including the jurisdiction in which they operate and the specific activities they engage in.

In many countries, NGOs that are registered as charitable organizations or have obtained tax-exempt status may be eligible for tax exemptions on certain types of income, such as donations or revenue generated from charitable activities. However, they may still be required to pay taxes on income from commercial activities or investments that are not directly related to their charitable purposes.

Why Choose Vakilkaro for NGO registration in Kushinagar

Do you want NGO registration in Kushinagar? Choose VakilKaro for seamless NGO registration services. Our experienced team ensures a hassle-free process, efficiently guiding you at every step. With Vakilkaro, your NGO registration journey will be smooth and worry-free. So contact the team of lawyers today on this number: 9828123489!

#ngo registration#trust registration#ngo registration process#ngo registration online#registration of ngo#ngo registration fees#ngo registration in hindi#fcra registration#niti aayog registration#ngo registration in pakistan#ngo registration process in hindi#new ngo registration#ngo registration 2023#csr registration for ngo#online ngo registration#ngo darpan registration#ngo registration in india#ngo registration in chennai#ngo registration fees in india

0 notes

Text

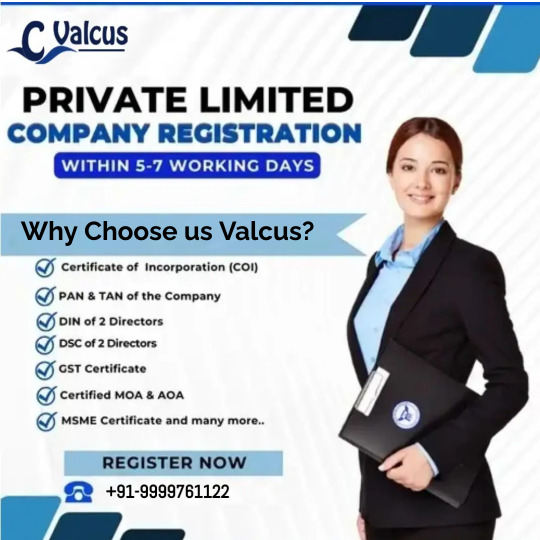

Starting a business is exciting, and picking the right structure is crucial. In Delhi, many business owners choose Private Limited Company registration (Pvt Ltd) for its credibility, limited liability, and growth potential. Let us break down the important steps and benefits of this process in simple terms. https://www.valcus.in/private-limited-company-registration.php

#ca services#gst registration#trust registration#ngo registration#ngo registration online#pvt ltd registration

1 note

·

View note

Text

csr registration for ngo

Non-governmental organizations (NGOs) play a crucial role in addressing social issues, advocating for human rights, and driving positive change in society. These organizations work tirelessly to bridge the gaps left by governments and contribute towards building a more equitable world. However, for an NGO to operate effectively and gain credibility, it is essential to register itself under a legally recognized framework. One such framework is registration as a trust, which provides NGOs with numerous benefits and opportunities to fulfill their mission.

In this article, we delve into the process of NGO registration as a trust and explore its significance in empowering these organizations to make a lasting impact. We are the experts in trust registration.

#ngo consultancy#ngo registration#ngo registration process#trust registration#ngo registration online#what is ngo#12a registration#80g#12a

1 note

·

View note