#401k rollovers

Explore tagged Tumblr posts

Text

Sometimes,... You simply have to take a moment,... carefully and closely,... look at your finances,... as say,... I NEED HELP! WE DO THIS "EVERYDAY". stevenlhodge.com

#health insurance#401k rollovers#rollovers#annuities#final expense insurance#insurance#investments#living benefits#mutual funds#retirement plans

0 notes

Text

{ MASTERPOST } Everything You Need to Know about Retirement and How to Retire

How to start saving for retirement

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over.

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

How To Save for Retirement When You Make Less Than $30,000 a Year

Workplace Benefits and Other Cool Side Effects of Employment

Your School or Workplace Benefits Might Include Cool Free Stuff

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Financial Order of Operations: 10 Great Money Choices for Every Stage of Life

Advanced retirement moves

How to Painlessly Run the Gauntlet of a 401k Rollover

The Resignation Checklist: 25 Sneaky Ways To Bleed Your Employer Dry Before Quitting

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 8: “I’m Queer, and Want To Find an Affordable Place To Retire. How Do I Balance Safety With Cost of Living?”

How Dafuq Do Couples Share Their Money?

Ask the Bitches: “Do Women Need Different Financial Advice Than Men?”

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Speaking of advanced money moves, make sure you’re not funneling money to The Man through unnecessary account fees. Roll over your old retirement accounts FO’ FREE with our partner Capitalize:

Roll over your retirement fund with Capitalize

Investing for the long term

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Stocks vs. Bonds

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Financial Independence, Retire Early (FIRE)

The FIRE Movement, Explained

Your Girl Is Officially Retiring at 35 Years Old

The Real Story of How I Paid off My Mortgage Early in 4 Years

My First 6 Months of Early Retirement Sucked Shit: What They Don’t Tell You about FIRE

Bitchtastic Book Review: Tanja Hester on Early Retirement, Privilege, and Her Book, Work Optional

Earning Her First $100K: An Interview with Tori Dunlap

We’ll periodically update this list with new links as we continue writing about retirement. And by “periodically,” we mean “when we remember to do it.” Maybe remind us, ok? It takes a village.

Contribute to our staff’s retirement!

Holy Justin Baldoni that’s a lot of lengthy, well-researched, thoughtful articles on the subject of retirement. It sure took a lot of time and effort to finely craft all them words over the last five years!

In case I’m not laying it on thick enough: running Bitches Get Riches is a labor of love, but it’s still labor. If our work helped you with your retirement goals, consider contributing to our Patreon to say thanks! You’ll get access to Patreon exclusives, giveaways, and monthly content polls! Join our Patreon or comment below to let us know if you would be interested in a BGR Discord server where you can chat with other Patrons and perhaps even the Bitches themselves! Our other Patrons are neat and we think you should hang out together.

Join the Bitches on Patreon

#retirement#retire#how to retire#retirement account#retirement fund#retirement funds#401k#403b#Roth IRA#Traditional IRA#investing#investors#investing in stocks#Capitalize#401k rollover#personal finance#money tips

443 notes

·

View notes

Text

instagram

#financialsuccess#retirementsavings#account#missingmoney#gold 401k rollover#howtorollover#good financial planning#Instagram

8 notes

·

View notes

Text

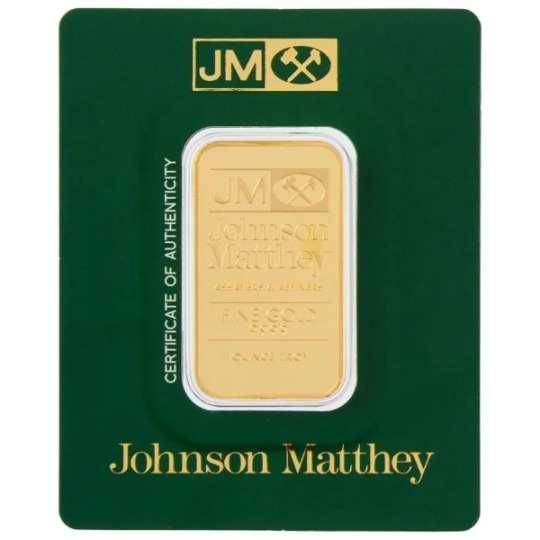

Gold Investing and Retirement

Investing in gold as a hedge against inflation is a great idea in a high inflation economy, and times of stock bear market and declining dollar.

Unfortunately right now it looks like we are going through all 3 at the same time. We give information on how using gold and other precious medals can hedge your investments against inflation as well as preserve them for your retirement.

Explore our channel and learn how to invest in gold, or start or rollover an existing 401k or other plan into a Gold IRA or other precious metals IRA.

#gold IRA#buy gold#best gold IRA#gold IRA companies#best gold IRA company#best gold ira company reviews#best company to rollover ira to gold#401k to gold IRA rollover#best gold investment companies. Augusta Precious Metals Review

2 notes

·

View notes

Text

What's an appropriate way to say put that in language that a dumbass like me can understand?

#dealing with lots of shit I've been avoiding#like the status of my 401k rollover and my student loan deferment and other shit#snafustuff

2 notes

·

View notes

Text

A Strategic Approach to College Savings Using Life Insurance for Long-Term Financial Security

Saving for college is a significant financial commitment, and families are constantly seeking strategies to ease this burden. One often overlooked option is saving for college with life insurance. This strategy offers flexibility and financial stability since it not only creates a safety net but also lets cash worth increase with time. Understanding the benefits of a life insurance college fund strategy can help families create a versatile and effective college savings plan.

What is Saving for College with Life Insurance?

Using a permanent life insurance policy—such as whole life or universal life insurance—saving for college with life insurance means building cash worth over time. Permanent life insurance policies generate cash value that is accessible to the policyholder for the duration of their lifetime, whereas term life insurance only offers coverage for a predetermined time. This growing cash value can be borrowed against or withdrawn to help cover the costs of college tuition, books, or other educational expenses.

Why Consider a Life Insurance College Fund Strategy?

A life insurance college fund strategy offers several unique advantages over traditional savings plans. Unlike 529 plans or other college savings accounts, the cash value in a life insurance policy can be used for any purpose, not just education. This flexibility ensures that if your child decides not to attend college, the money can still be utilized for other significant financial goals. Furthermore, the cash value grows tax-deferred, making this strategy a valuable tool for building long-term wealth.

How Does Life Insurance Help with College Savings?

The life insurance college fund strategy is particularly appealing because of the potential for tax-advantaged growth. As premiums are paid into the policy, a portion goes toward building cash value. Over time, this cash value grows, and when it’s time to pay for college, the policyholder can borrow against or withdraw from it. Since loans from life insurance policies are not taxed, it’s a tax-efficient way to access funds for higher education.

Flexibility and Security in College Planning

Unlike traditional college savings vehicles, saving for college with life insurance provides more flexibility. In cases where a child may receive scholarships or choose an alternative career path, the funds in a 529 plan can face tax penalties if used for non-educational purposes. Life insurance, on the other hand, does not have this limitation. The cash value remains available for a wide range of uses, offering financial security beyond education.

Start Early for Maximum Benefits

Starting alife insurance college fund strategy early is crucial for maximizing the benefits. The earlier a policy is purchased, the more time the cash value has to accumulate. By the time college expenses arise, there will be a substantial amount available to cover educational costs. Additionally, starting early ensures lower premiums, making it a more affordable long-term solution for families planning for the future.

Conclusion

Saving for college with life insurance is a flexible and tax-efficient strategy that provides both financial security and peace of mind. With a life insurance college fund strategy, families can build wealth, ensure protection, and fund educational expenses without facing the restrictions of traditional savings plans. Visit retirenowis.com for professional advice to investigate how this strategy might be customized to meet your financial objectives.

Blog Source URL :

#IRA rollover#rollover IRA#401k to IRA rollover#retirement plan rollover#tax-free rollover#rollover retirement funds#retirenow#retire now#Saving for College with Life Insurance#Children’s College Fund Investment#Life Insurance College Fund Strategy#Best Life Insurance for College Savings#College Savings Plans with Life Insurance#Investing in Life Insurance for College#Life Insurance as College Fund#Financial Planning for College with Life Insurance#Tax Benefits of Life Insurance for College Savings#Life Insurance Investment for Education Fund#College Fund Financial Consulting#Life Insurance College Savings Plan#IRA Rollover Guide#Roth IRA Rollover Process#Retirement Account Rollover#How to Rollover 401(k) to IRA#Roth IRA Conversion#IRA Rollover Rules#Rollover IRA vs. Roth IRA#401(k) to Roth IRA Rollover#IRA Rollover Financial Consulting#Best IRA Rollover Options

0 notes

Text

youtube

#Required Minimum Distributions#death and taxes#us taxes#ira#roth#pottlewealth#retirement#401k#gold 401k rollover#403b#finance#Youtube

0 notes

Text

Sign up for Robinhood with my link and we'll both pick our own gift stock 🎁 https://join.robinhood.com/rondak35

https://join.robinhood.com/rondak35

I have been with Robinhood for almost 4 years, as a rookie investor for 2 and I started banking with them about 2 years ago when they officially started banking!! they also let you buy and sell crypto and offer 401k etc it's a really cool platform user friendly and will teach you from the bottom up if you want to invest they'll even give you pointers on what stocks are good to buy and which aren't etc

I highly recommend Robinhood!

#crypto#banking#aitomaticdeposit#brockerage#transfers#freestock#robin hood#stocks#ira#gold 401k rollover

0 notes

Text

Gold often behaves differently than stocks and bonds, so adding it to your retirement portfolio can help spread risk and potentially improve overall stability. There are basically two options: direct and indirect rollovers. A direct rollover involves the transfer of funds directly from your old 401(k) to your new self-directed gold IRA. Gold held within a retirement account can be passed down to beneficiaries upon your death, providing a way to transfer wealth to future generations in a tax-efficient manner. 401K to Gold IRA Rollover.

0 notes

Text

Unlock Your Financial Future with RolloverWise

Experience the ease of managing your retirement accounts with RolloverWise. Our comprehensive services simplify the complex task of overseeing your financial future. We specialize in locating forgotten 401(k) accounts, ensuring no savings are left behind. Facilitating seamless rollovers, we make transitions effortless, and our expert guidance ensures you navigate the intricacies of retirement planning with confidence. Trust RolloverWise to streamline your financial journey, providing the support and services you need for a secure and optimized retirement.

Visit Now: https://www.rolloverwise.com/

1 note

·

View note

Text

Sometimes,... You simply have to take a moment,... carefully and closely,... look at your finances,... as say,... I NEED HELP! WE DO THIS "EVERYDAY". stevenlhodge.com

#health insurance#401k rollovers#annuities#insurance#final expense insurance#living benefits#mutual funds#investments#rollovers#retirement plans

0 notes

Text

Why you should roll over your old 401k

The opportunity cost. Compound interest—the Eighth Wonder of the World according to Our Lady of Berkshire Hathaway, Warren Buffett—requires two ingredients to work its magic: money and time. If you leave an old retirement plan to languish, you’re giving it time… but you aren’t giving it any more money. Your deposits stop when your paychecks do. You’ll still earn compound interest, but that interest won’t benefit from the fattening influence of regular fresh and meaty deposits.

The fees can add up. Even though you’re no longer depositing cash on the monthly, you still could be paying servicing fees. And those are therefore coming straight out of whatever dividend interest you earn.

If you don’t do it, they’ll do it for you. Some companies don’t allow former employees to keep a retirement plan open past a certain point. So if you don’t roll that bad boy over, they’ll do it for you. And they won’t be nice about it: they could just mail you a check minus the taxes and 10% early withdrawal fee whether you like it or not.

Your old retirement plan might suck. Every retirement plan servicer is different. Why would you want to keep money in your old 401k at Bank A when their fees are way higher than those Bank B is charging for your new 401k, or the pennies Bank C is charging for your glorious Roth IRA???

Keep reading.

If you found this helpful, consider joining our Patreon.

#401(k)#401k#retirement#retirement fund#retirement account#capitalize#401k rollover#roll over your 401(k)#saving money#saving for retirement#personal finance#career advice

65 notes

·

View notes

Text

youtube

🥇🥇Get a Free Gold Guide Now From Noble Gold Investments🥇🥇 http://www.NobleGoldInfo.com Why Noble Gold Investments? 🌟 Highest Customer Satisfaction Ratings 🌟 Exclusive secure storage in TEXAS 🌟 $20,000 Minimum for Gold IRAs/$10,000 min Cash Purchase 🌟 Gold, Silver, Platinum & Palladium all available! EASY to get started! Visit: http://www.NobleGoldInfo.com Disclosure: This website contains affiliate links. When you click on these links and make a purchase, we may receive a commission at no additional cost to you. We only promote companies that we have personally used or researched and believe will add value to our readers.The content we provide here isn’t financial advice and cannot be taken as such. Please speak to your financial advisor before making any investment decision. Also, note that every investment comes with its own risks and drawbacks. Lastly, we would like to remind you that past results cannot guarantee future returns. If you're considering investing in a Gold IRA, it's essential to choose a reputable and trustworthy company that will prioritize your financial well-being. That's where Noble Gold Investments comes in. With their exceptional track record and commitment to customer satisfaction, it's clear why they stand out in the industry. One of the primary reasons to choose a Gold IRA with Noble Gold Investments is their solid reputation. With an A+ rating from the Better Business Bureau (BBB), Noble Gold has proven their commitment to integrity and ethical business practices. This accreditation serves as a testament to the trustworthiness and reliability of the company. Another crucial aspect to consider when selecting a Gold IRA provider is the fees associated with the account. With Noble Gold Investments, you can expect transparent and competitive fees. They believe in putting their clients first and ensuring that their investments are maximized. By offering fair and reasonable fees, Noble Gold Investments allows you to keep more of your hard-earned money working for you. When it comes to researching and choosing a Gold IRA provider, having access to accurate and up-to-date information is key. Noble Gold Investments understands this and provides an informative and user-friendly website. Their website serves as a valuable resource for potential investors, offering a wealth of information about the company, the gold market, and the process of opening a Gold IRA. This transparency and accessibility demonstrate Noble Gold Investments' commitment to empowering their clients with the knowledge they need to make informed investment decisions. Additionally, Noble Gold Investments has established itself as a reputable company within the precious metals industry. With a strong presence and a focus on gold bars, Noble Gold Investments is well-positioned to guide investors towards a secure and successful investment. Their expertise and knowledge of the market make them a trusted partner for savvy investors looking to diversify their portfolios. Overall, when considering a Gold IRA, it's crucial to choose a provider that offers a solid reputation, competitive fees, transparent information, and expertise in the field. Noble Gold Investments checks all of these boxes, making them a top choice for investors seeking to safeguard their wealth through a Noble Gold IRA. #noblegoldinvestmentsreview #goldira #goldinvestment #401krollover #retirementpreparation Noble Gold Investments | Noble Gold Investments Review #noblegoldinvestmentsreview published first on https://www.youtube.com/@goldinvestingandretirement9337/

#best company to rollover ira to gold#401k to gold IRA rollover#best gold investment companies. Augusta Precious Metals Review#Youtube

0 notes

Video

youtube

FDIC Lied About Banks on Purpose | Exposing Policy Lies and Hidden Agend...

You better pay attention here. Your future depends on it.

0 notes

Text

friday night in your 20s be like: making some pasta. i need to rollover my 401k. when i was a kid i assumed i'd be married by now. does my new fake plant look classy. i think i have a yeast infection. do my cats understand me. ran out of capri sun. i should do laundry. and then you don't do laundry

4K notes

·

View notes

Text

Gold Bullion Bars | Nyfederalgold

Looking for pure Gold Bullion Bars in USA? Nyfederalgold is one of the well-established and trusted organisation for purchasing coins, bullion and bars. We have team of professionals who are there to give you best advice as per your portfolio. You can diversifying your retirement portfolio with precious metals of gold, silver and platinum. You’ll will have a powerful tool to protect your wealth as well as potentially grow it over time.

Visit Here:- https://nyfederalgold.com/

#Gold Bullion Bars#Convert 401K to Gold#401K to Gold IRA Rollover#Gold and Silver Bullion#Gold Is a Great Hedge to Invest#Investing in Gold Bullion#Ny federal gold#Nyfederalgold#Ny federal gold bullion bars#Ny federal gold online

0 notes