#30-Year Fixed-Rate Mortgage

Explore tagged Tumblr posts

Text

Discover the power of smart financial planning with our Mortgage Refinance Calculator. This comprehensive guide walks you through the intricacies of mortgage refinancing, helping you make informed decisions about your home loan. Use our advanced calculator to analyze potential savings, compare interest rates, and determine the most favorable terms for your mortgage refinance. Empower yourself with the tools you need to unlock financial freedom and secure a brighter future for your home investment. Start your journey towards a more affordable mortgage today

#mortgage refinance calculator#loan comparison calculator#Mortgage Affordability Calculator#Homebuying Budget Calculator#Home Affordability Calculator#VA Loan Calculator (Veterans Affairs)#FHA Loan Calculator#Check your FHA mortgage payment#30-Year Fixed-Rate Mortgage#VA home Loans

0 notes

Text

What is a good Mortgage Rate for 30 Years

30-Year Mortgage Rates: For homebuyers in the United States. 30-year mortgages continue to rank highly among loan types. Mortgages tend to be quite stable and affordable.

#insurance#mortgage#30 year mortgage rates#30 year rate#30 year fixed rate loan rates#mortgage rates#mortgage refinancing#loans#15 year mortgage rates#30 year mortgage rates today#interest rates today 30 year fixed#insurance aims#insuranceaims

0 notes

Text

Secure Stability with a 30-Year Fixed Rate Mortgage | All Mortgages

Achieve financial stability and long-term peace of mind with a 30-year fixed rate mortgage from All Mortgages. This popular loan option provides predictable monthly payments and a locked-in interest rate, making it easier to plan your budget and focus on what truly matters—your home and future.

Our 30-year fixed rate mortgage is perfect for homebuyers seeking affordability and stability. With a longer repayment term, you can enjoy lower monthly payments, giving you flexibility in managing your finances. Plus, with All Mortgages, you’ll benefit from competitive rates and expert guidance throughout the entire process.

Whether you’re buying your first home or refinancing an existing property, we’re here to make the journey seamless and stress-free. Our team will work closely with you to tailor a loan that fits your unique needs and goals.

Start building your future today with a trusted partner by your side. Visit allmortgages.net to learn more about our 30-year fixed rate mortgage options and take the first step toward securing your dream home.

0 notes

Text

How to get best mortgage rates in Kentucky for FHA VA USDA and Fannie Mae conventional loans

How to get best mortgage rates in Kentucky for FHA VA USDA and Fannie Mae conventional loans

View On WordPress

#15 year rates#30 year fixed rates#Best mortgage rates in Kentucky for FHA#Credit score#fha rates#fha rates ky#First-time buyer#Kentucky#kentucky mortgage rates#kentucky rates#ky housing rates#ky mortgage rates#louisville#louisville ky rates#Louisville Rates#Mortgage loan#Refinancing#USDA#VA loan#Zero down home loans

0 notes

Video

youtube

(via Mortgage rates and the rest of 2023 (Video))

0 notes

Text

How the Biden-Harris Economy Left Most Americans Behind

A government spending boom fueled inflation that has crushed real average incomes.

By The Editorial Board -- Wall Street Journal

Kamala Harris plans to roll out her economic priorities in a speech on Friday, though leaks to the press say not to expect much different than the last four years. That’s bad news because the Biden-Harris economic record has left most Americans worse off than they were four years ago. The evidence is indisputable.

President Biden claims that he inherited the worst economy since the Great Depression, but this isn’t close to true. The economy in January 2021 was fast recovering from the pandemic as vaccines rolled out and state lockdowns eased. GDP grew 34.8% in the third quarter of 2020, 4.2% in the fourth, and 5.2% in the first quarter of 2021. By the end of that first quarter, real GDP had returned to its pre-pandemic high. All Mr. Biden had to do was let the recovery unfold.

Instead, Democrats in March 2021 used Covid relief as a pretext to pass $1.9 trillion in new spending. This was more than double Barack Obama’s 2009 spending bonanza. State and local governments were the biggest beneficiaries, receiving $350 billion in direct aid, $122 billion for K-12 schools and $30 billion for mass transit. Insolvent union pension funds received a $86 billion rescue.

The rest was mostly transfer payments to individuals, including a five-month extension of enhanced unemployment benefits, a $3,600 fully refundable child tax credit, $1,400 stimulus payments per person, sweetened Affordable Care Act subsidies, an increased earned income tax credit including for folks who didn’t work, housing subsidies and so much more.

The handouts discouraged the unemployed from returning to work and fueled consumer spending, which was already primed to surge owing to pent-up savings from the Covid lockdowns and spending under Donald Trump. By mid-2021, Americans had $2.3 trillion in “excess savings” relative to pre-pandemic levels—equivalent to roughly 12.5% of disposable income.

So much money chasing too few goods fueled inflation, which was supercharged by the Federal Reserve’s accommodative policy. Historically low mortgage rates drove up housing prices. The White House blamed “corporate greed” for inflation that peaked at 9.1% in June 2022, even as the spending party in Washington continued.

In November 2021, Congress passed a $1 trillion bill full of green pork and more money for states. Then came the $280 billion Chips Act and Mr. Biden’s Green New Deal—aka the Inflation Reduction Act—which Goldman Sachs estimates will cost $1.2 trillion over a decade. Such heaps of government spending have distorted private investment.

While investment in new factories has grown, spending on research and development and new equipment has slowed. Overall private fixed investment has grown at roughly half the rate under Mr. Biden as it did under Mr. Trump. Manufacturing output remains lower than before the pandemic.

Magnifying market misallocations, the Administration conditioned subsidies on businesses advancing its priorities such as paying union-level wages and providing child care to workers. It also boosted food stamps, expanded eligibility for ObamaCare subsidies and waved away hundreds of billions of dollars in student debt. The result: $5.8 trillion in deficits during Mr. Biden’s first three years—about twice as much as during Donald Trump’s—and the highest inflation in four decades.

Prices have increased by nearly 20% since January 2021, compared to 7.8% during the Trump Presidency. Inflation-adjusted average weekly earnings are down 3.9% since Mr. Biden entered office, compared to an increase of 2.6% during Mr. Trump’s first three years. (Real wages increased much more in 2020, but partly owing to statistical artifacts.)

Higher interest rates are finally bringing inflation under control, which is allowing real wages to rise again. But the Federal Reserve had to raise rates higher than it otherwise would have to offset the monetary and fiscal gusher. The higher rates have pushed up mortgage costs for new home buyers.

Three years of inflation and higher interest rates are stretching American pocketbooks, especially for lower income workers. Seriously delinquent auto loans and credit cards are higher than any time since the immediate aftermath of the 2008-09 recession.

Ms. Harris boasts that the economy has added nearly 16 million jobs during the Biden Presidency—compared to about 6.4 million during Mr. Trump’s first three years. But most of these “new” jobs are backfilling losses from the pandemic lockdowns. The U.S. has fewer jobs than it was on track to add before the pandemic.

What’s more, all the Biden-Harris spending has yielded little economic bang for the taxpayer buck. Washington has borrowed more than $400,000 for every additional job added under Mr. Biden compared to Mr. Trump’s first three years. Most new jobs are concentrated in government, healthcare and social assistance—60% of new jobs in the last year.

Administrative agencies are also creating uncertainty by blitzing businesses with costly regulations—for instance, expanding overtime pay, restricting independent contractors, setting stricter emissions limits on power plants and factories, micro-managing broadband buildout and requiring CO2 emissions calculations in environmental reviews.

The economy is still expanding, but business investment has slowed. And although the affluent are doing relatively well because of buoyant asset prices, surveys show that most Americans feel financially insecure. Thus another political paradox of the Biden-Harris years: Socioeconomic disparities have increased.

Ms. Harris is promising the same economic policies with a shinier countenance. Don’t expect better results.

#Wall Street Journal#kamala harris#Tim Walz#Biden#Obama#destroyed the economy#america first#americans first#america#donald trump#trump#trump 2024#president trump#ivanka#repost#democrats#Ivanka Trump#art#landscape#nature#instagram#truth

165 notes

·

View notes

Text

Sorry for reposting this photo but, look at the advertisement at the bottom of the page: A 30 year fixed rate mortgage has more than DOUBLED since 2019!

This photo is from 2019. The 30 year fixed rate mortgage was 3%. It's over 7% today!

Never mind the fact that the front page story is about how right wing counter protestors were told to never come back to Boston, while LeftTards were and are given carte blanche...

Joe Biden is such an inexcusable disaster that a 30 year fixed rate mortgage has gone up 233% since 2019!

"Cannibals ate my uncle!"

#god is a republican#make america great again#kyle rittenhouse#president trump#Interest rates#mortgage loan#suck my freedom#donald trump#trump#congress#MAGA#too big to steal#America love it or vote for Biden

40 notes

·

View notes

Text

Oh while I'm on U.S. economics, I have another thing that bugs the hell out of me: the hiking of mortgage interest rates.

For those who don't know, mortgage interest rates dropped low during the pandemic. Which is not all sunshine since it resulted in many bidding wars and a ton of way-over-asking offers in competitive areas, but it put home-ownership way more within reach for a lot of people.

Then the fed started to pee their pants over inflation, and hiked their rates up, prompting mortgage companies to follow.

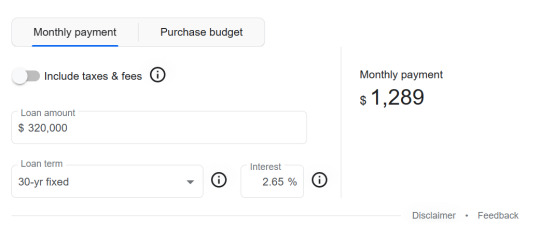

Here's a chart of mortgage interest rates over the last 4 years

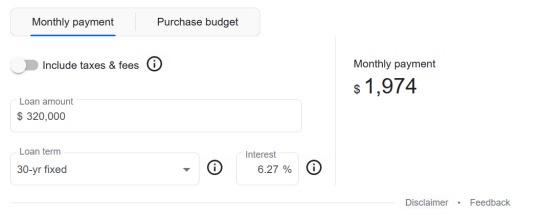

It hit a trough at 2.65% on average in early January 2021, and then you see it hiked itself way back up, now chilling at 6.27%

For context on how different these are: let's use an example of a $400,000 home - someone pays 20% down ($80,000) in cash, and finances the remaining 80% ($320,000).

Monthly payments at 2.65%:

This results in paying back, in total, $464,040. You'll notice that's well over the initial $320,000, and that's because of the interest paid over those 30 years.

Now, monthly payments at 6.27%:

This results in paying back, in total, $710,640. That's more than twice the initial loan of $320,000.

And, of course, it means the same exact property which could be paid for with a monthly budget of ~$1,300 in early 2021 now requires a monthly budget of ~$2,000 in 2023.

Also, those pandemic lows were an anomaly... Historically, mortgage interest rates were on average HIGHER than 6.27% - but also, historically, wages were much better relative to the prices of homes and people could afford the high interest rates (with the exception of the people who got screwed over in the 2008 housing market meltdown... There's a really good Cold Fusion video on that.)

And because these low interest rates were an anomaly, they may never come back...

So with mortgage interest rates going up, home-buying becomes harder. When home-buying becomes harder, rents increase (because renters have no alternative).

So who DOESN'T get affected?

ENTITIES THAT CAN PAY IN ALL CASH.

They need no mortgage. They pay the sticker price on-spot with no interest applying to them. And I say ENTITIES because, sure, some people can buy their home in all-cash. But a huge number of the entities that can buy in all cash are BIG investment companies--the Blackrocks and the Mega-landlords who scoop up properties to sit on, rent out, and turn for a profit later like it's a piece of stock, and not a habitable property...

Anyway I don't have a conclusion for this. Fix wages, or bring interest rates back down, or kill Blackrock. Preferably all 3.

#Federal Reserve shivering quaking 'but if poor people have disposable income then companies will have no CHOICE but to price-gouge and#turn record profits and fuel inflation... theres no helping it... we have to make#everything harder for poor people...'#gonna start a bingo card if this breaches containment and sparks an argument on libertarian tumblr

279 notes

·

View notes

Text

A $150,000 House in 1988 Now Costs $707,500 Thank You Fed

The Fed has grossly distorted the housing market and no fix is in sight. A couple of images will explain.

Chart data from Case-Shiller, mortgage calculation based on Fannie Mae 30-year mortgage rates, chart by Mish

Home Price Calculation Notes

Case-Shiller measures repeat sales of the same home over time.

Case-Shiller is a much better, but less timely measure than median or average home price. However, the measure lags. Recent data is through May representing sales in February, March, and April.

The price above reflects the increasing value of the Case-Shiller index over time.

Mortgage Payment and Mortgage Rate

The above chart represents the mortgage payment of the same house as the lead chart reflecting the changing price and interest rate over time.

17 notes

·

View notes

Text

Mortgage rates topped 7% this week, a key psychological threshold, in a sign of the US housing market’s unrelenting affordability challenges. The average rate on a standard, 30-year fixed mortgage was 7.04% in the week ending January 16, according to a survey of lenders released Thursday by Freddie Mac. It’s the fifth consecutive weekly increase and the highest level since May. Mortgage rates this week were nearly a full percentage point higher than in late September, when the Federal Reserve began to cut interest rates. The yield on the 10-year US Treasury note, which influences mortgage rates, ratcheted higher over the past several weeks on signs of stubborn inflation, but tumbled Wednesday after the latest Consumer Price Index showed progress is back on track. The Fed has signaled only two rate cuts this year, which may not come until later in the year, according to Wall Street’s expectations. In addition to elevated borrowing costs, homebuyers are also contending with home prices that are hovering around all-time highs; and in some regions, surging home insurance premiums. Buyers could be stuck waiting a while for any meaningful relief: Economists do not expect the housing market to improve much this year as mortgage rates will likely remain above 6% through 2026.

10 notes

·

View notes

Text

So we’re sort of stuck. What the American political system wants is to have re-financeable 30-year fixed-rate mortgages widely available at attractive rates, and it also wants it to be the case that this is delivered by the free market rather than by a government program. But a free market just won’t deliver that outcome.

-Matt Yglesias

41 notes

·

View notes

Photo

15- and 30-Year Fixed Rate Mortgage Average in the United States

by ionychal

7 notes

·

View notes

Note

♥️ for your choice:]

♥ - Family Headcanon (Movie Verse)

Pio (Mario & Luigi's Dad), Arthur, and Tony have always lived under the same roof, despite working different jobs; Pio as a dock worker, Arthur as a surveyor (he's how Mario and Luigi got connected to Spike's company), and Tony as a janitor.

Pooling their money is how they managed to mortgage such a large house in a relatively nice Brooklyn neighborhood. Even when Pio and Arthur got married to their respective wives, they decided to stay put since their house was large enough for everyone (albeit a tad bit crowded), and moving out would ultimately mean relocating to a shoddier home in a worse neighborhood.

Also, they're still working together to pay off the mortgage, but they've only got about 10 years left on the 30-year fixed-rate contract.

#mario movie#Mario Family#super mario brothers#sorry for the delay#a couple of asks got buried but Imma getting to them!

42 notes

·

View notes

Text

Your Quick Guide to Self-Employed, Construction, and Rental Loans

If you're self-employed, work in construction, or want to get a rental property loan, financing can seem complicated. But have no fear - this quick guide breaks down the key things you need to know about getting a mortgage if you don't have a typical 9-to-5 job or wage income.

As a borrower for rental, construction or self-employed loans, providing documentation of your income is one of the tricky parts of qualifying for a mortgage. Most lenders want to see two years of consistent self-employment income.

#Self-Employed Loans#Construction-to-Permanent Loans#30 year fixed rate mortgage#Short-Term Rental Loans#Long-Term Rental Loans#Understanding P&L Loans#where to get a dscr loan#P&L Loans for Small Businesses#all mortgages#mortgages

0 notes

Text

Best mortgage rates in Kentucky for FHA, VA, USDA and Conventional Home Loans

How to get the best mortgage rate in Kentucky Your credit score plays a significant role in determining the interest rate you qualify for. Lenders use credit scores to assess your creditworthiness and the risk associated with lending to you. Generally, the higher your credit score, the lower the interest rate you can secure. Here’s how different credit score ranges typically impact mortgage…

View On WordPress

#2-1 and 1-0 buydowns for Kentucky Rural Housing USDA RD loans Interest Rates.#30 year interest rates#current mortgage rates#fixed interest rates#Kentucky#ky first time home buyer#Mortgage loan#mortgage rates#mortgage rates louisville ky#rates#Refinancing#rhs rates ky#Rural development#rural housing mortgage rates#usda rates 30 year fixed#USDA Rural Development#zero down kentucky home loan

0 notes

Text

Joe Biden’s America. Bidenomics = High mortgage rates, high inflation rates, collapsed banks, expensive groceries, record high rent, and dwindling retirement accounts. The popular 30-year fixed mortgage rates are headed to 8%, economists warned. In early July 30-year fixed-rate mortgage spiked 31 basis points in one week to 7.22%! The average payment on a $400,000 mortgage is $1,000 more per month than it was 2 years ago.

27 notes

·

View notes