#30 year mortgage rates today

Explore tagged Tumblr posts

Text

What is a good Mortgage Rate for 30 Years

30-Year Mortgage Rates: For homebuyers in the United States. 30-year mortgages continue to rank highly among loan types. Mortgages tend to be quite stable and affordable.

#insurance#mortgage#30 year mortgage rates#30 year rate#30 year fixed rate loan rates#mortgage rates#mortgage refinancing#loans#15 year mortgage rates#30 year mortgage rates today#interest rates today 30 year fixed#insurance aims#insuranceaims

0 notes

Text

Sorry for reposting this photo but, look at the advertisement at the bottom of the page: A 30 year fixed rate mortgage has more than DOUBLED since 2019!

This photo is from 2019. The 30 year fixed rate mortgage was 3%. It's over 7% today!

Never mind the fact that the front page story is about how right wing counter protestors were told to never come back to Boston, while LeftTards were and are given carte blanche...

Joe Biden is such an inexcusable disaster that a 30 year fixed rate mortgage has gone up 233% since 2019!

"Cannibals ate my uncle!"

#god is a republican#make america great again#kyle rittenhouse#president trump#Interest rates#mortgage loan#suck my freedom#donald trump#trump#congress#MAGA#too big to steal#America love it or vote for Biden

40 notes

·

View notes

Text

Senator Bernie Sanders, progressive independent from Vermont, said he will "absolutely" be willing to work with President-elect Donald Trump, especially if the Republican "follows through" with a proposed credit card interest rate limit.

Sanders joined The New York Times' Michael Barbaro on "The Daily" podcast Friday. Barbaro asked Sanders if there are "any areas where you are prepared to work with the President-elect." Trump had suggested during his campaigning in September that he would put a cap on credit card interest rates at 10 percent.

"If Trump, for example, follows through on his proposal to limit interest rates on credit cards to 10 percent, which is what he campaigned on, absolutely I will be there," Sanders said.

"I think it's a very good idea. I think it's time we told the people on Wall Street they cannot charge the desperate working-class people who have a hard time paying their bills' 25, 30, 40 percent interest rates."

The current average for credit card interest rates is 21.5 percent, according to Federal Reserve data. This is six percentage points higher than the rates were prior to the Covid-19 pandemic. Sanders called these rates "immoral."

Additionally, Americans are currently tackling $1.28 trillion in credit card debit, a $36 billion increase during the second quarter of 2024 alone.

"We're going to cap it at around 10 percent. We can't let them make 25 and 30 percent," Trump said at a Long Island, New York event in September. "While working Americans catch up, we're going to put a temporary cap on credit card interest rates."

Karoline Leavitt, a Trump campaign spokesperson, told CNN in September that Trump's proposal would "provide temporary and immediate relief for hardworking Americans who are struggling to make ends meet and cannot afford hefty interest payments on top of the skyrocketing costs of mortgages, rent, groceries and gas."

Sanders and progressive Democratic Representative Alexandria Ocasio-Cortez of New York have previously proposed similar ideas in Congress, but they were stalled. In 2019, the two proposed a Loan Shark Prevention Act to limit the annual percentage rate for an extension of consumer credit to 15 percent. This would create a ceiling, similar to what Trump suggested, for consumer credit products, which includes both loans and credit cards.

"The reality is that today's modern-day loan sharks are no longer lurking on street corners breaking kneecaps to collect their payments," Sanders said at the time. "They wear three-piece suits and work on Wall Street, where they make hundreds of millions in total compensation and head financial institutions like JPMorgan Chase, Citigroup, Bank of America and American Express."

Sanders, who unsuccessfully sought the Democratic party's presidential nomination in 2016 and 2020, has said since Trump's election win that Vice President Kamala Harris' defeat "should come as no great surprise" because Democrats had "abandoned working-class people."

While Sanders praised Harris for her messages on abortion rights, democracy and Trump's perceived unfitness for office, he—and other progressive critics—said the campaign fell short on bold, economic policy plans that they believe would have appealed to more working-class voters.

In August, Sanders told Newsweek that "many working-class people feel that the Democratic Party has kind of abandoned them." He had hoped at the time that Harris and her campaign would reprioritize the working-class voters.

"This is a pivotal moment in American history, and the next year or two will determine what happens in this country for decades in my view," Sanders said Friday on "The Daily."

11 notes

·

View notes

Text

Fic-O-Ween 2023!

Day 1: First Frost

Characters: Finn O'Hara

Ships: Finn O'Hara/Logan Tremblay/Leo Knut (referenced)

Rating: General/Teen

"Mornings are for running and contemplations", featuring an autumn run from the mind of Finn O'Hara.

@noots-fic-fests for the prompt, @lumosinlove for the lovely boy(s)

Enjoy! :)

Alarm at 4:30.

(Pull himself away from the glorious warmth and snugglyness that is his boys in their wonderful bed.)

Gather clothes and put them on in the bathroom.

Check weather. 44° in Gryffindor currently, with a high of 68° at 3:00 PM.

Water bottle. Earbuds. Phone, wallet, keys.

Head out at 4:50.

Turn on your tracker.

Run.

It was cold, colder than it had been all week. They'd had a bit of a second summer the week before and now it seemed winter was fast approaching, even with all the tourists coming to New England for all the gorgeous fall colors. If the weather continued like this, Finn would need a gaiter for his face by November 1st.

His shoes hit the pavement in his warmup mile to the BeeGees and ELO. He left behind their house-- their house oh my god they have a house together and a mortgage and a water bill-- and approached the park only a few blocks away. Picked especially for easy walks with future little ones. Across the sprawling grass, Finn noticed a silver sheen sparkling under the laplight as he ran along the swaying trail. First frost, October 19th, two days earlier than last year. He'd have to tell Logan when he got home, he and his sisters tracked that sort of thing.

Warm up mile.

Change playlist, then 5 more miles.

Pause and stretch, consider which cafe to stop at to pick up breakfast-- or did Leo have plans?

Decide to stop in at Java Hut during the cool-down mile on the way home to get coffees and pastries. Yum.

Remember to call Alex soon.

Give kisses to the boys.

Finn arrived home-- home!-- with caffeine drinks and treats and 10 miles done today and fished his keys out of his zipped jacket pocket.

Open the door and go inside.

#oknutzy#sweater weather#lumosinlove#finn o'hara#fic o ween#Fic-O-Ween 2023#adhd finn is me and i am him

37 notes

·

View notes

Text

Even a slight drop in interest rates can save you thousands over the life of a 30-year mortgage! 🏡 Now is the perfect time to take advantage of these savings and get closer to owning your dream home. Ready to start your search? Contact me today!

2 notes

·

View notes

Text

youtube

Making Sense of Temporary Rate Buy-Downs: A 2025 Guide

If rising mortgage rates have you hesitating, a temporary rate buy-down might be the solution you need. Let’s explore how this option works and why it’s gaining popularity in 2025. 🌟📖

📌 What’s a 2-1 Buy-Down?

It’s simple:

1️⃣ Year 1: 2% rate reduction = big savings. 2️⃣ Year 2: 1% rate reduction = moderate savings. 3️⃣ Years 3–30: Standard fixed rate applies.

This structure gives you breathing room during the early years of homeownership.

🏠 Example Scenario

Home Price: $500,000

Seller Credit: $15,000

Savings: $615/month in Year 1, $315/month in Year 2.

For many buyers, the upfront savings outweigh a small discount on the sales price. 🤑

💡 Why It Works

Helps buyers manage budgets during high-rate periods.

Allows time to refinance if rates drop.

Keeps negotiations appealing for sellers.

🌈 Ready to Explore Your Options?

Temporary buy-downs aren’t just a trend—they’re a tool to make homeownership more accessible. Visit GreatMortgageBroker.com today to see how you can benefit.

📝 Your Turn: What’s your biggest concern when buying a home? Let’s discuss in the comments!

2 notes

·

View notes

Text

Well, the Fed has now cut its benchmark interest rate 75 basis points, and yet mortgage rates have RISEN -- back up near 7% for the average 30-year fixed mortgage.

This has NOT been good news for the housing market, which has been frozen transaction-wise at record levels of unaffordability for the majority of aspiring purchasers.

It's been often asked on this program: How long can the housing market remain broken like this?

Well, we may be finding out the answer to that in real time.

In a growing number of metros, inventory is rising (substantially in many cases), prices are coming down, and long-standing real estate barons are starting to break their cardinal rule to "never sell".

Is this growing trickle of motivated sellers we're now seeing as more and more regional housing markets start to thaw likely to soon become a flood?

For answers, we're fortunate to hear today from mortgage expert and housing analyst Melody Wright.

Given the speed of rising mortgage delinquencies, she expects a big drop in average home prices in 2025, followed by several more years of declines.

For all the details why, click here or on the video below:

2 notes

·

View notes

Photo

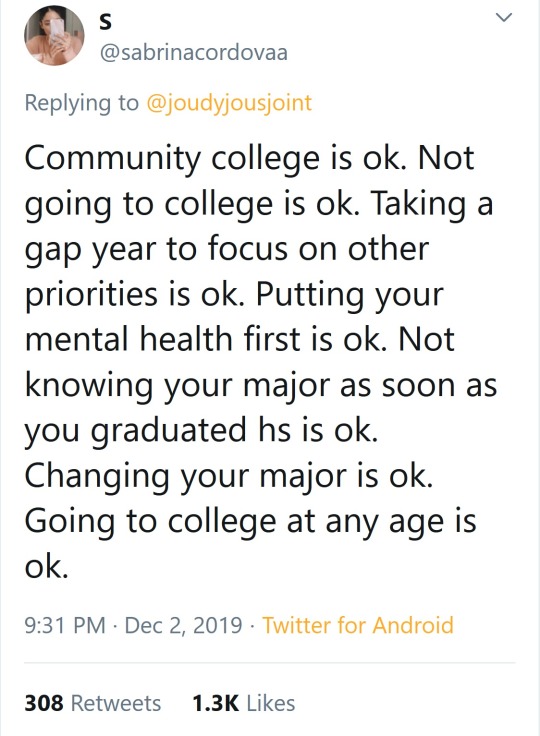

Don't buy into the hype that you *have* to go to college right after high school. Yes, its easier if you do because if you wait, you have things like bills that you now need to pay, but sometimes waiting is better.

Case 1; me - A hundred years ago, when I graduated HS, I had a really shitty guidance counselor. The dude did my entire graduation class, and he legit sucked ass. I, like most of my classmates, was on the "college track" in high school, which meant that we didn't take any practical classes, like accounting or shop, we took languages, and extra science/math/English classes. Senior year when we're talking to the guidance counselor about applying to college, 90% of us were told 'college might not be for you, you should try community college and see if you can do it,' which is a nice sentiment, but if you can't you don't have any marketable skills now. Needless to say, I went to CC, ran out of money, and got a job. Jobs mean college is now part time, and since it was a 9 to 5 job, I just stopped going when it got to hard. I didn't go back until I was 30, and since I now had a career, spouse, kids and a mortgage, it took me a long time to finish. I graduated at 43, with a BS that started in the CC and then transferred to a 4 year school. Transferring saved me a ton of money. A few years passed, and I went back to school for my masters, which I got at 53.

tl;dr, its never to late to go to college

Case 2; oldest kid - Oldest kid was smart, and genuinely loved learning and school. In his junior year, he had some significant mental health fuckery going on, but managed to get through it and graduate with pretty good grades. We decided that it would be good for his mental fuckery to go away to college, and he got accepted to a good one, about 4 hours away. He did not do well because he wasn't ready for college. He dropped out in his freshman year, and none of the classes he took were considered completed, so there was nothing to transfer. He decided that college was bullshit, and went to work in food service. He loved working, but started with some health issues that took forever to figure out and consequently lost that job. Figured out the health problem (apparently he can no longer tolerate caffeine), got a better job still in food service, worked there for a while before quitting because food service sucks. While all this was going on, his friends were graduating college, and starting their careers, and he'd grown up a great deal and decided that college might be less bullshit than he thought. So he moved in with his grandparents and started going to CC and is now pulling straight A's and loving it. He's planning on transferring to a 4 year school, and becoming a teacher. ALSO, he just found out today that the CC has an "honors" track, and that a relatively local Ivy League will accept students from the CC with a high GPA in that honor program. They have an acceptance rate of 6% for students out of high school, but according to the honors advisor, love taking people from the honors CC program. They're now his "reach" school, and the local, highly ranked, teaching college is his "sure thing" when he applies to transfer next spring, after he graduates.

tl;dr its ok to delay college a few years until you're ready, and in some cases can be beneficial since you have a better idea of what you want to do, and how to get there. But still start at the community college because its cheaper.

Case 3; youngest kid - We learned from the oldest kid, and did not send the youngest to college right away. We were dealing with the fallout from being in HS during Covid, as well as relocating to a new house in a different state. Once we'd settled in, I did make her get a job, and it had to be a 9 to 5, or at least something with regular hours. She ended up working at a dairy packaging/making milk and butter. She fucking hated it, but did it for almost a year before she couldn't take it anymore. Faced with going to college, or getting another shit job, she opted for college. She is now a sophomore at a four year college, and doing much better than she expected based on how she felt in HS.

tl;dr sometimes taking a gap year or two will mean the difference between succeeding and failing, so don't be afraid to do it.

every year we have to say it

144K notes

·

View notes

Text

The lowest 30 -year rate since mid -December

Interest rates on many mortgage terms have decreased. According to Zillow, the 30 -year fixed mortgage rate has been declining for several days, down three base points today to 6.55%. This puts it at its lowest point since mid -December when it was at 6.50%. It may seem strange that mortgage rates were falling although the Federal Fund did not break the federal funds rate at last week's meeting.…

0 notes

Text

The lowest 30 -year rate since mid -December

Interest rates on many mortgage terms have decreased. According to Zillow, the 30 -year fixed mortgage rate has been declining for several days, down three base points today to 6.55%. This puts it at its lowest point since mid -December when it was at 6.50%. It may seem strange that mortgage rates were falling although the Federal Fund did not break the federal funds rate at last week's meeting.…

0 notes

Text

Mortgage Rates Today: What are Mortgage Rates Today

Mortgage Rates Today: The financial figure that dominates all others during home purchasing. mortgage refinancing is your mortgage rate. Mortgage rate figures today

#insurance#mortgage#mortgage rates today#current mortgage rates#interest rates today#30 year mortgage rates#lowest mortgage rates#mortgage interest rates today#current va mortgage rates#housing interest rates today#insurance aims#insuranceaims

0 notes

Text

The lowest 30 -year rate since mid -December

Interest rates on many mortgage terms have decreased. According to Zillow, the 30 -year fixed mortgage rate has been declining for several days, down three base points today to 6.55%. This puts it at its lowest point since mid -December when it was at 6.50%. It may seem strange that mortgage rates were falling although the Federal Fund did not break the federal funds rate at last week's meeting.…

0 notes

Text

Lowest 30-year rate since mid-December

Interest rates on many mortgage terms have decreased. According to Zillow, the 30-year fixed mortgage rate has been declining for several days, down three basis points today to 6.55%. This puts it at its lowest point since mid-December when it was at 6.50%. It may seem strange that mortgage rates are going down even though the Federal Reserve didn’t cut the federal funds rate at last week’s…

0 notes

Text

At the end of 30 years of 30 years from half December

Interest rates on several mortgage terms have declined. According to Zillow, the rate of 30 year old mortgage has been decaying for several days, in three basic points today 6.55%. I am These put on their lower point from half December when it was 6.50%. May they look weird that mortgage rates are gone even if the federal reserve did not cut federal federal rate to the next week meeting. Home…

0 notes

Text

Best Mortgage Loan Services in Chitradurga, Karnataka

Best Mortgage Loan Services in Karnataka: A Comprehensive Guide

In today’s fast-paced world, owning a property is one of the most important financial milestones. Whether you're purchasing your first home, refinancing an existing loan, or funding an investment property, finding the right mortgage loan service is crucial. The state of Karnataka, with its rapidly growing economy and diverse real estate market, offers a wide array of mortgage loan services tailored to meet various needs. This article delves into the factors that make certain mortgage loan services in Karnataka stand out, helping you make an informed decision when choosing the best option.

Understanding Mortgage Loans

A mortgage loan is a financial product that allows individuals to borrow money from a lender, typically a bank or financial institution, to purchase or refinance a property. The borrower agrees to repay the loan over time, with interest, and the property serves as collateral for the loan. Mortgage loans come in various forms, including home loans, loan against property, and commercial property loans, with varying terms and conditions based on the type of loan and the borrower’s profile.

Factors to Consider When Choosing the Best Mortgage Loan Services

When it comes to selecting the best mortgage loan services in Karnataka, there are several key factors to consider:

1. Interest Rates and Terms

Interest rates are one of the most significant factors influencing the overall cost of a mortgage loan. Lenders in Karnataka offer both fixed and floating interest rates, each with its own advantages. Fixed rates provide the security of consistent monthly payments, while floating rates can fluctuate over time based on market conditions. Before choosing a mortgage service, it's essential to compare interest rates and loan terms from various providers to ensure you are getting the best deal.

2. Loan Amount and Tenure

The loan amount and repayment tenure play a crucial role in your ability to repay the loan comfortably. Different lenders have varying criteria for loan eligibility, including income levels, credit scores, and the value of the property being mortgaged. Additionally, mortgage lenders in Karnataka offer flexible tenures, which range from 5 years to 30 years, allowing borrowers to choose a tenure that fits their financial situation.

#home loan#mortgage loan#loan against property#agriculture loan#new startup business loan#new startup project loan#new start up company loan#business loan#unsecured loan#secured loan

0 notes

Text

How a Mortgage Calculator Simplifies Home Buying

Buying a home is one of life’s biggest financial decisions. Whether you’re a first-time buyer or a seasoned homeowner, understanding the numbers behind your mortgage is critical. That’s where a mortgage calculator comes in—a simple yet powerful tool that can help you navigate the home-buying process with confidence.

What Is a Mortgage Calculator?

A mortgage calculator is an online tool designed to estimate your monthly mortgage payments based on key factors like the loan amount, interest rate, and loan term. It provides an easy way to assess the financial feasibility of a property before committing to a mortgage, ensuring that your dream home aligns with your budget.

Key Benefits of Using a Mortgage Calculator

Budget Planning A mortgage calculator helps you set a realistic home-buying budget. By inputting your income, expected down payment, and loan term, you can get an estimate of your monthly payments. This insight ensures you don’t overextend financially while pursuing your ideal home.

Loan Comparisons With so many loan options available, comparing them can feel overwhelming. A mortgage calculator allows you to explore different scenarios, such as fixed-rate versus adjustable-rate mortgages or varying loan terms. This empowers you to choose the option that best fits your financial goals.

Transparency in Costs Beyond the principal and interest, mortgages often include additional costs like property taxes, homeowners’ insurance, and private mortgage insurance (PMI). Advanced mortgage calculators can factor in these expenses, giving you a comprehensive picture of your total monthly payments.

Time-Saving Tool Instead of manually crunching numbers or waiting for your lender to provide estimates, a mortgage calculator offers instant results. It’s a quick way to refine your options and focus on properties within your price range.

How to Use a Mortgage Calculator

Using a mortgage calculator is simple. Follow these steps:

Enter the Loan Amount: This is the total amount you plan to borrow.

Set the Interest Rate: Input the interest rate offered by your lender.

Choose the Loan Term: Typical terms range from 15 to 30 years.

Include Additional Costs: If applicable, add taxes, insurance, and other fees.

The calculator will generate your estimated monthly payment, making it easier to plan your finances.

Why Choose Haven Home Lending?

At Haven Home Lending, we understand that buying a home is more than a transaction—it’s a significant life milestone. That’s why we offer tailored mortgage solutions designed to meet your unique needs. Our user-friendly mortgage calculator simplifies the process, empowering you to make informed decisions.

With a team of experienced professionals by your side, you’ll receive personalized guidance every step of the way. Whether you’re exploring first-time buyer programs, refinancing an existing loan, or seeking competitive rates, Haven Home Lending is your trusted partner in achieving homeownership.

Start Your Journey Today

Don’t let the complexity of mortgage calculations hold you back from your dream home. Use the Haven Home Lending mortgage calculator to take the first step toward a confident and informed purchase. Visit our website today and let us help you turn your homeownership dreams into reality.

1 note

·

View note