#(the bottom bit)

Explore tagged Tumblr posts

Text

Kandi making ages me like five times faster

#been working on my bag for like 6 or so hours combined so far. only the front panel and side panels done....#still gott a make the back panel#the bottom bit#and the strap.... ouuUyg#talkin

14 notes

·

View notes

Text

here's my wonderful isopod child, handcrafted in leather

#art#leatherworking#isopod#marine life#he was super fun to make and i learned quite a bit#honestly id love to make another#id need to check the pattern designers website but i think im allowed to sell these as long as i repurchase the pattern every few sales#if thats the case i'd totally take commissions to make these#its a lot of work but its fun!#also yes he is a bag#there are attachments for a strap and a zipper on the bottom#ill reblog and link to the pattern i used if anyone wants to know where i got it

18K notes

·

View notes

Text

ARTISTS! UPLIFT EACH OTHER! ☞ shop / patreon ☜

#ok turns out i didn't do much to it except delete the extraneous hands and move some things around a tiny bit#i just ordered some stickers but idk how well they'll do. we'll see#art tag#i pushed the outer edges out a little too it was kind of tight before. i shouldve chopped off some of the bottom but whatev#THIS one you are all encouraged to reblog. because it's finished

6K notes

·

View notes

Text

along with the tv interview, i honestly really prefer the deleted scenes version of scaryoke, but i get why they changed it to show stan working on the portal more and him giving back the journal because he knows there's no way he can keep it hidden from dipper for long

but dangit i want more drama focusing on the journals and author with all the dramatic irony in full force!!!

#gravity falls#stan pines#stanley pines#dipper pines#im fine with stan looking at either journal tho#j1 being what ford entrusted to him + the reason for their fight + a memento he pored over for decades#while j3 is what he had been searching for for ages + reveals ford at his rock bottom and#being what drew dipper and mabel into the weirdness of the town + potentially putting them in the same danger ford was in#anyway know that stan reaching for ford's hand kills me everytime!!!#it seems like the confrontation about dipper calling the agents would be a bit different here tho#since here stan still has j3 so how the heck did dipper summon the zombies

1K notes

·

View notes

Text

collecting every one of Damian's "TT" with Dick in hearing range

Batman and Robin (2009) / Grayson (2014) #12 / Blackest Night: Batman #3 / Nightwing (2016) #29, 16, 17 / Batman (1940) #700, 706, 711 / DCU Halloween Special 2010 / Justice League of America (2006) #41 / Secret Origins (2014) #4 / Batman: Streets of Gotham #6 / Red Robin #11 / Batman and Robin (2011) #10 / Batman Inc (2012) #8 / Robin: Son of Batman #7 / Detective Comics #968, 975, 1000 / Batman (2016) #34 / Suicide Squad (2016) #26 / Dark Nights: Metal #3 / Batman: Alfred Pennyworth RIP / Batman: Urban Legends #21 / Batman: Gotham Nights (2020) #12 / All New-Batman: The Brave and the Bold #13 / Damian: Son of Batman #1 / The Boy Wonder #1 / Robins #5, 1

inspired by Dick doing the "TT" in Nightwing (2016) #121

#damian wayne#dick grayson#dynamic duo 2.0: what would you do without me?#rambling#originally compiled canon comics but figured i might as well get em all lol so gathered non-canon to the bottom#big stretch with a couple panels:#Dick was knocked out for Damian and the Heretic's TT#the Robin War one is under the assumption there was audio from the monitor when Damian was revealed lol#Ollie and Damian were a bit of a distance from Dick when Ollie even had to shout his name#also the Brave and the Bold 13 Robins issue has an extra T in there haha#anyway! if anyone catches a stray TT i've missed please feel free to add it or lmk!#Dick picking this up from Damian because he’s heard it so often is ridiculously cute to me 😭#UPDATED! I FORGOT TO ADD THE TITLES AND TEC 975

1K notes

·

View notes

Text

goodnight, himemiya

#my art#revolutionary girl utena#rgu#utena tenjou#anthy himemiya#2024#ask to tag#wanted to keep this one sketchier and less polished. it suits the mood better i think#drew this one on the same day i drew that screenshot redraw also from episode 33#but i didn’t want to be too evil and post two things related to that episode in one night ^^’#so here it is now#i also decided not to add panels to this one. i wanted everything to look like its blurring together a bit#there is an order here. top left to top right. then bottom left to bottom right#but i decided not to keep the panels i had in my sketch ^^#feel like i gotta draw these two being happy soon to make up for this lol#gotta balance the ecosystem

2K notes

·

View notes

Text

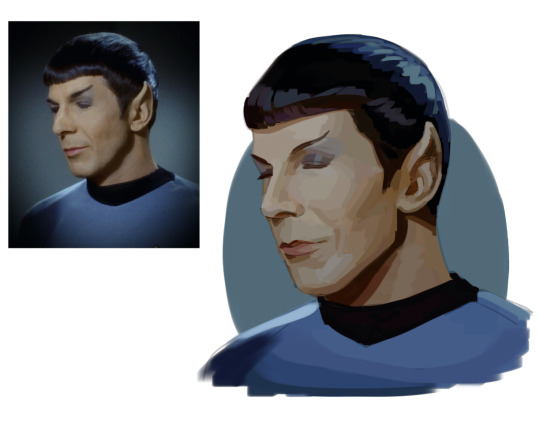

me when i start trekking

#i've been reawakened!!haiii#while i scrap the bottom of the barrel looking for unposted art to share have some assorted trek stuff#star trek#star trek tos#star trek fanart#james t kirk#spock#nyota uhura#there's a lil bit of McCoy's chin showing but not enough for me to tag him<//3

5K notes

·

View notes

Text

🦅 🐦⬛ 💀

I did try.. welp! Love wins yeah! No worries, i still love all of the Veilguard's companions. I wish i can play & love em all! Based on The Breaking Ice poster. Looks cosy & calm movie, me likey especially its ot3 👀. The no-edit version

#dragon age#dragon age the veilguard#datv#dragon age fanart#davrin#lucanis dellamorte#emmrich volkarin#ot3 meme#ot3 art meme#polyamory#well well#anyone can be top and bottom#anyway have fun with the game#when i have enough money i'll buy it. i want to romance them all 😫💕#davrin x lucanis#emmrich x lucanis#i just realized all of them have moles and im weak for that!#emmrich x davrin x lucanis#me and luce joke a bit what their ship name lol#its#L.E.D#i see myself out#emmcanis#lucarich#lucavrin

2K notes

·

View notes

Text

Blood brothers in desperation, An oath of silence for the voice of our generation // happy 18 years Infinity on High

#WHEWWWW ITS FINALLY DONE#cant beleive my timing on this one holy shit i like actually finished it on time for iohs birthday?#this is a watercolor painting btw!#sorry the coloring is a bit off on the bottom near andy#it is insanely hard to get good lighting to photograph a painting and i just kinda gave up lmao#fall out boy#fob#pete wentz#andy hurley#joe trohman#patrick stump#infinity on high#scribbles draws a thing#fob art#anyways happy birthday to the light of my life one of the greatest albums ever infinity on high<333

1K notes

·

View notes

Text

first rule of fandom is everything goes back to destiel

second rule of fandom is everything goes back to kirk/spock

third rule of fandom is everything goes back to holmes & watson

fourth rule of fandom is everything goes back to achilles & patroclus

#plato was debating whether achilles was a top or bottom in 385 BC. the more things change the more they stay the same#< I'm not joking. there's a whole bit about it in plato's symposium#he basically argued that achilles is prettier and therefore a twink and therefore the eromenos and therefore a bottom#fandom#destiel#kirk/spock#spirk#holmes x watson#johnlock#achilles x patroclus#patrochilles#supernatural#star trek#sherlock#bbc sherlock#sherlock holmes#the iliad#the song of achilles

2K notes

·

View notes

Text

it's still really hard to believe that I made it. Even in the pre-op there was a part of me that was convinced that I would have this dick forever and that I'd never be fixed... but I did! I have a vagina now! and a vulva! and even though my pussy is swollen and bruised I almost cry every time I see it because it's so beautiful.

You can make it too. It's doable. It's hard and takes a lot of energy but you can do it. I believe in you.

If anyone ever needs help with bottom surgery, please DM me. If I can help, I will. You'll make it to the finish line. I believe in you.

#transgender#grs#srs#bottom surgery#gender reassignment surgery#trans#I'm also happy to send pics in dms once things have healed a bit better

1K notes

·

View notes

Text

Paying consumer debts is basically optional in the United States

The vast majority of America's debt collection targets $500-2,000 credit card debts. It is a filthy business, operated by lawless firms who hire unskilled workers drawn from the same economic background as their targets, who routinely and grotesquely flout the law, but only when it comes to the people with the least ability to pay.

America has fairly robust laws to protect debtors from sleazy debt-collection practices, notably the Fair Debt Collection Practices Act (FDCPA), which has been on the books since 1978. The FDCPA puts strict limits on the conduct of debt collectors, and offers real remedies to debtors when they are abused.

But for FDPCA provisions to be honored, they must be understood. The people who collect these debts are almost entirely untrained. The people they collected the debts from are likewise in the dark. The only specialized expertise debt-collection firms concern themselves with are a series of gotcha tricks and semi-automated legal shenanigans that let them take money they don't deserve from people who can't afford to pay it.

There's no better person to explain this dynamic than Patrick McKenzie, a finance and technology expert whose Bits About Money newsletter is absolutely essential reading. No one breaks down the internal operations of the finance sector like McKenzie. His latest edition, "Credit card debt collection," is a fantastic read:

https://www.bitsaboutmoney.com/archive/the-waste-stream-of-consumer-finance/

McKenzie describes how a debt collector who mistook him for a different PJ McKenzie and tried to shake him down for a couple hundred bucks, and how this launched him into a life as a volunteer advocate for debtors who were less equipped to defend themselves from collectors than he was.

McKenzie's conclusion is that "paying consumer debts is basically optional in the United States." If you stand on your rights (which requires that you know your rights), then you will quickly discover that debt collectors don't have – and can't get – the documentation needed to collect on whatever debts they think you owe (even if you really owe them).

The credit card companies are fully aware of this, and bank (literally) on the fact that "the vast majority of consumers, including those with the socioeconomic wherewithal to walk away from their debts, feel themselves morally bound and pay as agreed."

If you find yourself on the business end of a debt collector's harassment campaign, you can generally make it end simply by "carefully sending a series of letters invoking [your] rights under the FDCPA." The debt collector who receives these letters will have bought your debt at five cents on the dollar, and will simply write it off.

By contrast, the mere act of paying anything marks you out as substantially more likely to pay than nearly everyone else on their hit-list. Paying anything doesn't trigger forbearance, it invites a flood of harassing calls and letters, because you've demonstrated that you can be coerced into paying.

But while learning FDCPA rules isn't overly difficult, it's also beyond the wherewithal of the most distressed debtors (and people falsely accused of being debtors). McKenzie recounts that many of the people he helped were living under chaotic circumstances that put seemingly simple things "like writing letters and counting to 30 days" beyond their needs.

This means that the people best able to defend themselves against illegal shakedowns are less likely to be targeted. Instead, debt collectors husband their resources so they can use them "to do abusive and frequently illegal shakedowns of the people the legislation was meant to benefit."

Here's how this debt market works. If you become delinquent in meeting your credit card payments ("delinquent" has a flexible meaning that varies with each issuer), then your debt will be sold to a collector. It is packaged in part of a large spreadsheet – a CSV file – and likely sold to one of 10 large firms that control 75% of the industry.

The "mom and pops" who have the other quarter of the industry might also get your debt, but it's more likely that they'll buy it as a kind of tailings from one of the big guys, who package up the debts they couldn't collect on and sell them at even deeper discounts.

The people who make the calls are often barely better off than the people they're calling. They're minimally trained and required to work at a breakneck pace. Employee turnover is 75-100% annually: imagine the worst call center job in the world, and then make it worse, and make "success" into a moral injury, and you've got the debt-collector rank-and-file.

To improve the yield on this awful process, debt collection companies start by purging these spreadsheets of likely duds: dead people, people with very low credit-scores, and people who appear on a list of debtors who know their rights and are likely to stand on them (that's right, merely insisting on your rights can ensure that the entire debt-collection industry leaves you alone, forever).

The FDPCA gives you rights: for example, you have the right to verify the debt and see the contract you signed when you took it on. The debt collector who calls you almost certainly does not have that contract and can't get it. Your original lender might, but they stopped caring about your debt the minute they sold it to a debt-collector. Their own IT systems are baling-wire-and-spit Rube Goldberg machines that glue together the wheezing computers of all the companies they've bought over the last 25 years. Retrieving your paperwork is a nontrivial task, and the lender doesn't have any reason to perform it.

Debt collectors are bottom feeders. They are buying delinquent debts at 5 cents on the dollar and hoping to recover 8 percent of them; at 7 percent, they're losing money. They aren't "large, nationally scaled, hypercompetent operators" – they're shoestring operations that can only be viable if they hire unskilled workers and fail to train them.

They are subject to automatic damages for illegal behavior, but they still break the law all the time. As McKenzie writes, a debt collector will "commit three federal torts in a few minutes of talking to a debtor then follow up with a confirmation of the same in writing." A statement like "if you don’t pay me I will sue you and then Immigration will take notice of that and yank your green card" makes the requisite three violations: a false threat of legal action, a false statement of affiliation with a federal agency, and "a false alleged consequence for debt nonpayment not provided for in law."

If you know this, you can likely end the process right there. If you don't, buckle in. The one area that debt collectors invest heavily in is the automation that allows them to engage in high-intensity harassment. They use "predictive dialers" to make multiple calls at once, only connecting the collector to the calls that pick up. They will call you repeatedly. They'll call your family, something they're legally prohibited from doing except to get your contact info, but they'll do it anyway, betting that you'll scrape up $250 to keep them from harassing your mother.

These dialing systems are far better organized than any of the company's record keeping about what you owe. A company may sell your debt on and fail to keep track of it, with the effect that multiple collectors will call you about the same debt, and even paying off one of them will not stop the other.

Talking to these people is a bad idea, because the one area where collectors get sophisticated training is in emptying your bank account. If you consent to a "payment plan," they will use your account and routing info to start whacking your bank account, and your bank will let them do it, because the one part of your conversation they reliably record is this payment plan rigamarole. Sending a check won't help – they'll use the account info on the front of your check to undertake "demand debits" from your account, and backstop it with that recorded call.

Any agreement on your part to get on a payment plan transforms the old, low-value debt you incurred with your credit card into a brand new, high value debt that you owe to the bill collector. There's a good chance they'll sell this debt to another collector and take the lump sum – and then the new collector will commence a fresh round of harassment.

McKenzie says you should never talk to a debt collector. Make them put everything in writing. They are almost certain to lie to you and violate your rights, and a written record will help you prove it later. What's more, debt collection agencies just don't have the capacity or competence to engage in written correspondence. Tell them to put it in writing and there's a good chance they'll just give up and move on, hunting softer targets.

One other thing debt collectors due is robo-sue their targets, bulk-filing boilerplate suits against debtors, real and imaginary. If you don't show up for court (which is what usually happens), they'll get a default judgment, and with it, the legal right to raid your bank account and your paycheck. That, in turn, is an asset that, once again, the debt collector can sell to an even scummier bottom-feeder, pocketing a lump sum.

McKenzie doesn't know what will fix this. But Michael Hudson, a renowned scholar of the debt practices of antiquity, has some ideas. Hudson has written eloquently and persuasively about the longstanding practice of jubilee, in which all debts were periodically wiped clean (say, whenever a new king took the throne, or once per generation):

https://pluralistic.net/2020/03/24/grandparents-optional-party/#jubilee

Hudson's core maxim is that "debt's that can't be paid won't be paid." The productive economy will have need for credit to secure the inputs to their processes. Farmers need to borrow every year for labor, seed and fertilizer. If all goes according to plan, the producer pays off the lender after the production is done and the goods are sold.

But even the most competent producer will eventually find themselves unable to pay. The best-prepared farmer can't save every harvest from blight, hailstorms or fire. When the producer can't pay the creditor, they go a little deeper into debt. That debt accumulates, getting worse with interest and with each bad beat.

Run this process long enough and the entire productive economy will be captive to lenders, who will be able to direct production for follies and fripperies. Farmers stop producing the food the people need so they can devote their land to ornamental flowers for creditors' tables. Left to themselves, credit markets produce hereditary castes of lenders and debtors, with lenders exercising ever-more power over debtors.

This is socially destabilizing; you can feel it in McKenzie's eloquent, barely controlled rage at the hopeless structural knot that produces the abusive and predatory debt industry. Hudson's claim is that the rulers of antiquity knew this – and that we forgot it. Jubilee was key to producing long term political stability. Take away Jubilee and civilizations collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Debts that can't be paid won't be paid. Debt collectors know this. It's irrefutable. The point of debt markets isn't to ensure that debts are discharged – it's to ensure that every penny the hereditary debtor class has is transferred to the creditor class, at the hands of their fellow debtors.

In her 2021 Paris Review article "America's Dead Souls," Molly McGhee gives a haunting, wrenching account of the debts her parents incurred and the harassment they endured:

https://www.theparisreview.org/blog/2021/05/17/americas-dead-souls/

After I published on it, many readers wrote in disbelief, insisting that the debt collection practices McGhee described were illegal:

https://pluralistic.net/2021/05/19/zombie-debt/#damnation

And they are illegal. But debt collection is a trade founded on lawlessness, and its core competence is to identify and target people who can't invoke the law in their own defense.

Going to Defcon this weekend? I’m giving a keynote, “An Audacious Plan to Halt the Internet’s Enshittification and Throw it Into Reverse,” today (Aug 12) at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

#pluralistic#jubilee#debts that cant be paid wont be paid#Patrick McKenzie#patio11#bits about money#debt#debt collection#do not pay#bottom feeders#Fair Debt Collection Practices Act#fdcpa#finance#armbreakers

11K notes

·

View notes

Text

more sketches! zs on the brain

#my art#zosan#one piece tag#top + bottom left were reffed off a pose catalog book i have a complicated relationship with#every time reach the point of 'ugh this was a bad purchase i haven't used it in ages' i end up finding some portion of some pose to use#i would like to get better at suggesting muscle though silhouette/mass rather than defining muscle w/ lines... muscles are nice and soft#i like it when you get definition only through subtle bits of dimpling : )

1K notes

·

View notes

Text

quotes by Victorians about the 1920s view of their generation's women

"We are frequently told that the Victorian woman...generally behaved like a pampered and neurotic infant. This is all moonshine. I do not think that I ever saw a woman faint before I came to London in 1869, and not often after then...they enjoyed a hearty laugh, and a good many of them a contest of wits with any man." -Nineteenth Century, a Monthly Review, 1927 (written by a man born in 1850)

"What queer ideas the girl of 1929 has about the Victorian period- they are not a bit true...Marriage was by no means the end and aim of our existence. Oxford and Cambridge claimed quite a few of us after school days were over. We had great ideas about 'life' and what it all might mean to us." -St. Petersburg Times, 1929 (written by a woman born in 1853)

"True, debutantes were chaperoned at balls. But that fact did not prevent them from dancing as frequently as they chose with their favorite partners. The idea that girls in the Victorian era spent their days sewing seams and practicing scales is another fallacy." -Gettysburg Times, July 1, 1927 (quote from the Dowager Lady Raglan, Ethel Jemima Somerset, who lived from 1857 to 1940)

#history#when they were still alive to defend themselves#maybe- much as I rag on modern historical fiction -we've gotten a bit closer to the truth than our grandparents did#see this is one reason I love studying the Victorian era (besides hoarding their detritus like a dragon I mean what)#it just is One Of The Eras Of All Time in pop culture#and it means so much to so many people that getting to the real human bottom of it fascinates me#spoiler: it boils down to 'people were people and always have been'

10K notes

·

View notes

Text

ROCK HUDSON & TONY RANDALL as Jerry Webster and Pete Ramsey in LOVER COME BACK (1961) dir. Delbert Mann

#filmedit#filmgifs#filmblr#classicfilmedit#classicfilmblr#oldhollywoodedit#classicfilmsource#cinemaspast#moviegifs#usermichi#rock hudson#tony randall#lover come back#1961#1960s#*mygifs#the most clear representation of a top and a bottom i have ever seen in my entire life#also them wearing complementary colors and matching suits is KILLING ME#(will be posting some old drafts for a little bit bc there's a LOT)

765 notes

·

View notes

Text

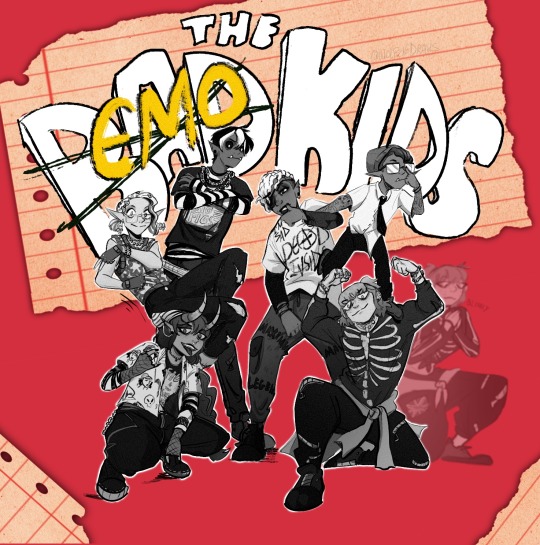

Alter Emos

#im so sorry to people who followed me for animorphs or fallout lol#in this house we post about the same fandom for a week straight before switching again#anyway the intrepid heros have an insane drip game#and i simply had to draw the pcs wearing the same outfits#bottoms had to be improvised a bit tho#d20#dimension 20 fhjy#fantasy high junior year#fanart#intrepid heroes#riz gukgak#gorgug thistlespring#fabian aramais seacaster#kristen applebees#k2 fantasy high#fig faeth#adaine abernant

2K notes

·

View notes