#“we would have to re-mint all the currency”

Explore tagged Tumblr posts

Text

hate running into bad takes on tumblr

not cuz the take is bad but because I refuse to argue with people online cuz it's a waste of time and energy

but I still wanna...

#a full town council in Yukon decided not to do their oath to the “king”#and one of the tumblr comments was how it would be Soooo Harddddd and Expensiveeee to make Canada a republic#so basically we should just shut the fuck up or move to america#“we would have to rewrite all of our laws”#ummmmmm no?#thats the stupidest shit ive ever heard#“we would have to re-mint all the currency”#my dude king charlie isnt even on our currency yet they havent started minting his horrible gob onto things yet#leigh.txt

1 note

·

View note

Text

Guidebooks don’t lie (To HEL and back 2)

Our hotel is located on a boulevard misleading called Arcadian Street ("Arkadiankatu ", pictured above). Walking from the train station yesterday, we didn't see anything idyllic about it.

But we still look forward to our first full day in Helsinki. Guidebooks don't lie.

When we get to the classical heart of the capital, we find it every bit as majestic as they say.

The go-to architect in the first half of the 19th century seems to have been one Carl Ludvig Engel. His works are everywhere in the city centre.

The Government Palace (1822) was his first big commission. Finland had just been absorbed into the Russian empire, but it ran its own affairs as an autonomous duchy.

The Diet told Engel to build a seat of government that reflected the power of the Finnish state.

The grandees were impressed by the result:

Ten years later the Diet decided to build university facing the palace. Engel was told to build a seat of learning that reflected the power of knowledge.

He came up with this:

The Diet made admiring noises, but one grandee noted that the two buildings looked a bit similar.

"I thought you liked my style!" Engel bristled. "Oh we all love it! It's just that slight variations wouldn't hurt." "You don't know what you're talking about! Look at the lintels above the windows: semi-circular here, straight there. Totally different!"

When the Diet asked Engel to build barracks for the Russian navy, here was the outcome:

The commission for City Hall (1833) led Engel to innovate.

He tried blue paint:

But for the National Library, another decade on, he was back to good old yellow.

“You can’t really beat it,” he said.

And again for the presidential palace (1845):

Engel, however, did venture out of his comfort zone later in life.

Helsinki's Lutheran cathedral (1852) is widely regarded as his masterpiece:

I have a lot of time for Engel.

If you look down on Senate Square from those, you get an eyeful of his works:

But Carl Ludvig's erections are not the only things that catch my eye as lunchtime approaches.

On side streets, many businesses advertise something called "Ravintola". I love the sound of it. When my wife kindly asks me to stop repeating the word out-loud, I start taking photos of the intriguing signs.

The spell, however, is broken by a Google search: "Ravintola", it turns out, simply means "restaurant".

We repair to the Esplanadi, a mini-Champs-Elysées just south of Senate Square. Its gardens were designed by Engel - who else? - but more to the point at this time of day, it is lined with ravintolas and caf��s.

The one we enter looks classical enough on the outside, but the inside is anything but.

The arches, the esoteric squiggles carved in granite are more reminiscent of Dark-Age revivalism than Enlightenment pomp.

When I ask staff about the history of the café, they say it used to be a bank. Engel would not have approved: he took his orders from government officials, not money changers.

In that café, I've stumbled on Finland's architectural revolution of the late 19th century: the advent of national romanticism, the Finnish rendition of Art Nouveau or Jugendstil.

But the transition from austere classicism to retro-Nordic was slow. From the 1860s to the 1890s, a jumble of styles competed for attention.

There was what I would call "classical light": a modicum of stately pomp is maintained, but the column-heavy bombast is gone.

Look at the mint (the Russians, remember, let the Finns use their own currency) completed in 1872:

The House of Nobility (1862) even features gothic frills:

The designers of the House of Estates (1890) re-introduced columns, but in a mock-solemn spirit:

Another trend in Finnish architecture in the fourth quarter of the 19th century is neo-renaissance.

The Esplanadi provides a good showcase for this floury style.

Grönqvist House (above), built in the early 1880s as an apartment block, is a feast of turrets and other baroque features.

One building on the Esplanadi is appropriately called "Pompier" (a word that means "pompous" in French).

There is something playful about these pompier fantasias. It's as if their designer both anticipated and parodied in-your-face medievalist style that was to take hold a few years later.

But our exploration of the full-blown, non-ironic version of romantic nationalism must wait until later. We have booked a ravintola in the euphonious district of Etu-Töölö for 19:30.

Once again, we have no complaint about the food. I watch intently as the waiter pours wine into my glass, willing to his hand to keep the bottle horizontal for an extra second. But no: what I get is 12cl, not a drop more – and that is one euro per centilitre, not a cent less.

When the credit-card reader asks if I want to add a tip, I pause. The bill was €146.40. I quickly work out that 15% is €21 or €22. I draw the line at €20.

14 notes

·

View notes

Text

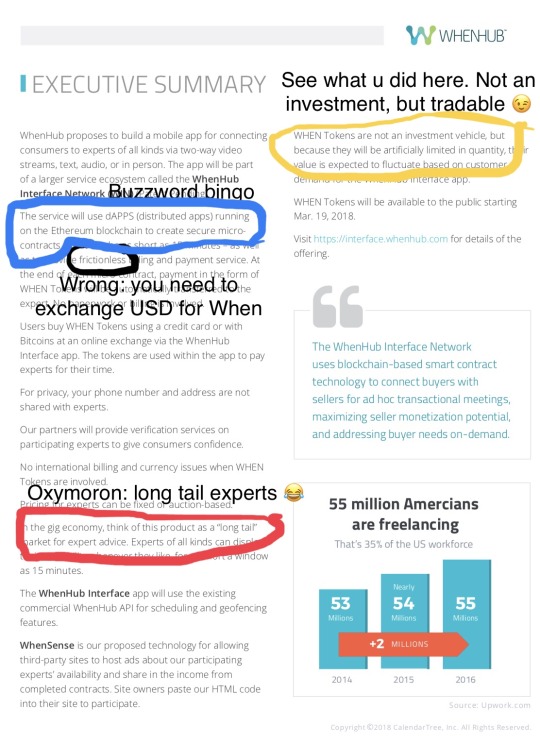

There's been some discussion about "ethical" NFTs and I'm here to explain why that won't happen.

The discussion in the comments of this tweet is full of people who don't understand why and how we can't just have NFTs but good. That's by design. They're made obscure and difficult to grasp by design, so your FOMO gets you before you can even research. Long Post incoming. This is re-formatted from a twitter thread so sorry if it looks a bit weird.

Artists feel pressured to mint NFTs because they see a demand, or they see others are just stealing their art and minting it. They feel like they're between a rock and a hard place and they don't even know where to start looking for answers and many cave into the pressure and mint their own.

NFTs currently are almost all hosted on the Ethereum blockchain, which is incredibly destructive and uses a Proof of Work system. That means each new addition to it requires more and more energy, driving up the cost of each minted coin or NFT.

This isn't a bug, it's a feature. That's half of how this type of crypto becomes valuable. You need to make sure people can't just go and mint a shitload of NFTs and flood the market with cheap versions, or the value tanks. However, since NFTs are digital only, there is no labor, no material cost, nothing that could boost the value of an NFT beyond what an artist might charge normally for a print. And that's not enough to make it worth people's time and money.

And this is the second part of how NFTs become valuable - you convince people they need them. You make it look like an investment, trading cards etc. The point isn't for the people collecting them to make money though. It's for your specific blockchain to make money.

If you collect beanie babies you might sell some for an inflated price. But the entity that actually benefits is Ty INC. When you mint an NFT you may sell it for ETH of value that's beneficial to you.

But the people really benefiting are the founders of the blockchain. When they started ETH, minting was cheap. It always starts that way.Crypto in a PoW system is mined by making computers solve more and more complex puzzles, but they start off fairly easy and any PC can mine a bunch of coins at the start. They all have a decent amount of ETH in their crypto wallets. But if you want to get some now, you get it from them or contribute to mining new coins by wasting a shitload of energy in crypto mining setups.

I will use ETH as the main example, but know that just replacing ETH with a currently less damaging Proof Of Work crypto coin won't solve anything, because it will get to a similar energy drain eventually. It's designed to. It doesn't matter if it's ETH, or BTC, or DOGE, it all sucks.

So, moving on to NFTs.

Every new NFT that's minted on that blockchain is paid for with ETH. You have to buy ETH from them to even make an NFT. You pay them cash. They get real money. You get a token. Then you don't keep that ETH, you spend it to mint an NFT. If someone buys it, you then lose some ETH to transaction fees. On every step, you lose. The way to profit from this is to be either someone who already has ETH and wants it to raise in value ( when more people invest in it, for example via NFTs) or are an already established, usually rich artist, who knows everyone will buy their art.

This is why it's so often called a pyramid scheme, or ponzi scheme. People who have ETH in their wallets pay out when you buy their ETH to mint your NFTs. But if everyone suddenly decided to pay out all of their ETH they made on NFTs, the market would crash, because there would not be enough people to sell their ETH too. Sure, the founders probably have some cash to pay out small amounts, but they do not have anywhere near enough to actually pay everything out, because this isn't, in reality, a currency exchange.

You're swapping tokens for cash at a casino that only functions because all of the people who think they're winners were convinced they will be bigger winners if they hold on to their chips for just a bit longer.

Basically even if you had a perpetual motion machine, you'd reach a point where you can't get more crypto. If you make it easier to get enough processing power, the puzzles needed to mine new coins will just become too difficult to solve for existing hardware. Then you can't get new coins and make it harder for new people to get into the system. If you can't feed new people into the system, you don't get new cash to pay out to the initial buy-ins and the pyramid collapses. This is why you hear a lot of promises and you have people make their own crypto mines with solar panels, but the coins are still incredibly environmentally damaging.

With ETH especially, each transaction costs massive amounts of energy and even if we got it all from solar, that would require for our entire global grid to be solar. Which is possible nowadays, but the creators of the coin do not have the ability to do that. No one single entity does. We've had this talk for years now and it's against the holders of the majority of the world's capital to swap to solar, they don't give a shit if the planet dies because they're all too old to live through the fallout.

Replacing a Proof of Work system with a less damaging one like Proof of Stake won't fix much. It will fix the environmental aspect but not the pyramid scheme. You end up with a situation where you might have theoretical income, but can't pay it out. It's less than exposure.

You see, if you want to pay out crypto, you trade it for a fiat currency, just like you would stock. And as someone who used to hold some inherited stock and had trouble selling it when I desperately needed to fix my car, that doesn't always go well. It requires someone to want to buy it, and while for now people are excited about NFTs and crypto, that doesn't mean they'll buy it all the time, or at the price you believed you'd be able to sell.

Oh and participating in the NFT market doesn't protect you from getting your work stolen and sold for less, by the way. The anonymous aspect of the blockchain means you don't even know who to send a CnA to. This might change soon though, since the IRS is now demanding NFTs are declared.

If this means they have to show what they're selling as NFT, then you can just take them to court without the need to make your own NFT. If they just have to declare they sell NFT, which is unlikely, then making your own won't help you locate them to DMCA.

There is a hypothetical use for blockchain technology that isn't destructive. Maybe. But not under capitalism. I don't think it was created to be a scam, but neither was the stock market, at least not entirely. Yet both only benefit those who are already established in them.

As blockchain exists now, as we exist now, there is no way to "redeem" NFTs. There's no option where this won't lose a lot of people a lot of money. The system being pay to play should already make people realize it, but with MLMs thriving, I'm not surprised so many fall for it.

We shouldn't dismiss every artist that feels pressured to participate. We shouldn't demonize people who feel they have to do this before someone just steals their art. But I genuinely believe there's no way we can salvage anything out of this. This was meant to fuck people over.

#nft#cryptocurrency#why nft is awful#dan explains crypto#dan explains nft#apparently this is my legacy now#i am being asked by people I don't even know well to explain this#not that I mind#I hope this helps people

13 notes

·

View notes

Text

HEY YALL, back on my bullshit of being too invested in fantasy economics but this time with a bit more world building and alchemy prospects! Also this time I legit was looking up sources from the wiki...

Sooooo I was playing Genshin(surprise surprise) and one of the loading screen tips/tidbits about Mora caught my fancy**spoilers ahead**:

"It's a catalyst of sorts, in that it is a medium for physical transformation. That is why so many things can only be accomplished through the use of Mora"

I remember in a different discussion about the economy of Teyvet and how the events of Rex Lapis's death would have on it as he was the only one who could make Mora as known today we kinda discounted its importance to the culture of Teyvet as just a currency. The furthest we got into its elemental properties was when they pointed out that we know it has an elemental signature as evident when you go to redeem whatever you have left of Childes budget the bank clerk notes that it's legit cause it has an elemental signature.

But like, if it is used as a catalyst (of sorts) and not just a simple currency that puts things in a while new light. (Also means we downplayed the effects that not minting new Mora would have on the economy in said previous discussion, cause the consensus was that they could always revert back to paper money or older forms of currency, but I digress)

Like compare it to the the type of alchemy Albedo uses. "[T]he 'Art of Khemia', a kind of alchemy that focuses on the creation of life and is wholly different from the alchemical arts practiced in the seven nations of Teyvat"(from albedos stories): Does this mean that their 'catalyst' is the essential building blocks of life itself? A lot of his storyline refers to dust/soil as the base for all things and chalk being purified soil and thus what is used to create life, or at least life-like things(Homonculous Albedo anyone? Lol but that's a whole other topic). Also that he had to be trained to learn how to use that form of alchemy to create life from said dust, chalk, and ash(Albedo uses ash from the flower on a dendro slime to grow into a flower in the Chalk Prince quests).

Here's where I'm drawing my own conclusions and tentatively connecting dots: what if because the Art of Khemia uses basic building blocks and no catalyst like the rest of Teyvets alchemy, the 'catalyst' is the innate transformative energy/properties of the ingredients themselves and that requires training to access and manipulate? From what I'm reading the Art of Khemia is all about life and creating it but you can't create something from nothing(re: full metal Alchemist- equivalent exchange!) So the 'creating life' is really taking the essence of a thing and using transformative energy to make another thing, that transformative energy has to come from somewhere and I think it would be from the essence itself, sort of using a portion of that essence to initiate the transformation process of the alchemy but like, the process itself will then generate enough energy/essence/whatever to create the end product. And or the alchemist themself needs to give up some of THEIR energy to kickstart the process.

Using chalk is standard for the Art of Khemia as it's purified dust, which is the basic building block of all life. Being the thing from which all else is derived gives chalk/dust an enormous potential to become anything, that potential making it (theoretically) the most powerful and versatile component to Khemian Alchemy, albeit likely also a very volatile one thus the intensive training needed. For example, in Albedo's stories it mentions a time where he watched his master create a living thing from a chunk of chalk.

But that's life itself whereas for other things that already have life essence and whatnot can just have their essence accessed and combined with other things essences to create new things? Kinda filling in the blanks as there isn't a lot of actual discussion/display on how the Art of Khemia works....

Anyways, jumping off all that, Rex Lapis is the god of rock/earth which is kinda dust? (There is technically a Goddess of dust pre archon war but too tired to look up her name rn. She was a good friend of Rex Lapis' tho as Guili plains was named after the two of them) But due to Rex Lapis' connection to the earth( and dust?) He can instead take this basic volatile and versitle essence and bind the with another earthlike thing(aka metal) without actually USING UP it's energy. Thus creating Mora, an item imbued with the transformative properties of chalk/dust in an easy access form! Although because it is no longer dust/chalk it loses the potential to become life, and thus a bit of its power when compared to dust/chalk alchemy BUT still very usable and user friendly for other alchemic processes.

Which leaves me with some questions: what does that mean for more than economy but the way of life for teyvetians with mora no longer being created? The Art of Khemia isn't known by many, just Albedo and his master are mentioned I believe? Which makes sense as it's from a now practically non existent country. Like we know it's used for alchemy to make weapons and character enhancements as well as potions does its power go beyond that? If not why not? Why is it limited to weapons and character enhancements materials? Just for game mechanics or is there a logical in-game reason?

Also tho... again the amount of economical and political power this gives Liyue is both awe-inspiring and quite terrifying as they are the sole creators and distributers of said currency.

21 notes

·

View notes

Text

Anonymous asked: I noticed you did post to acknowledge the death of Uderzo, the co-creator of the Asterix comics. I have to ask Tintin or Asterix? Which one do you prefer?

It’s like asking Stones or Beatles? I love both but for different reasons. I would hate to choose between the two.

Both Tintin and Asterix were the two halves of a comic dyad of my childhood. Whether it was India, China, Hong Kong, Japan, or the Middle East the one thing that threads my childhood experience of living in these countries was finding a quiet place in the home to get lost reading Asterix and Tintin.

Even when I was eventually carted off to boarding school back in England I took as many of my Tintin and Asterix comics books with me as I could. They became like underground black market currency to exchange with other girls for other things like food or chocolates sent by parents and other illicit things like alcohol. Having them and reading them was like having familiar friends close by to make you feel less lonely in new surroundings and survive the bear pit of other girls living together.

If you asked my parents - especially my father - he would say Tintin hands down. He has - and continues to have in his library at home - a huge collection of Tintin comic books in as many different language translations as possible. He’s still collecting translations of each of the Tintin books in the most obscure languages he can find. I have both all the Tintin comic books - but only in English and French translations, and the odd Norwegian one - as well as all the Asterix comic books (only in English and French).

Speaking for myself I would be torn to decide between the two. Each have their virtues and I appreciate them for different reasons.

Tintin was truly about adventure that spoke deeply to me. Tintin was always a good detective story that soon turned to a travel adventure. It has it all: technology, politics, science and history. Of course the art is more simpler, but it is also cleaner and translates the wondrous far-off locations beautifully and with a sense of awe that you don’t see in the Asterix books. Indeed Hergé was into film-noir and thriller movies, and the panels are almost like storyboards for The Maltese Falcon or African Queen.

The plot lines of Tintin are intriguing rather than overly clever but the gallery of characters are much deeper, more flawed and morally ambiguous. Take Captain Haddock I loved his pullover, his strangely large feet, his endless swearing and his inability to pass a bottle without emptying it. He combined bravery and helplessness in a manner I found irresistible.

I’ve read that there is a deeply Freudian reading to the Tintin books. I think there is a good case for it. The Secret of the Unicorn and Red Rackham's Treasure are both about Captain Haddock's family. Haddock's ancestor, Sir Francis Haddock, is the illegitimate son of the French Sun King – and this mirrors what happened in Hergé's family, who liked to believe that his father was the illegitimate son of the Belgian king. This theme played out in so many of the books. In The Castafiore Emerald, the opera singer sings the jewel song from Faust, which is about a lowly woman banged up by a nobleman – and she sings it right in front of Sir Francis Haddock, with the captain blocking his ears. It's like the Finnegans Wake of the cartoon. Nothing happens - but everything happens.

Another great part is that the storylines continue on for several albums, allowing them to be more complex, instead of the more simplistic Asterix plot lines which are always wrapped up nicely at the end of each book.

Overall I felt a great affinity with Tintin - his youthful innocence, wanting to solve problems, always resourceful, optimistic, and brave. Above all Tintin gave me wanderlust. Was there a place he and Milou (Snowy) didn’t go to? When they had covered the four corners of the world Tintin and Milou went to the moon for heaven’s sake!

What I loved about Asterix was the style, specifically Uderzo’s visual style. I liked Hergé’s clean style, the ligne claire of his pen, but Asterix was drawn as caricature: the big noses, the huge bellies, often being prodded by sausage-like fingers. This was more appealing to little children because they were more fun to marvel at.

In particular I liked was the way Uderzo’s style progressed with each comic book. The panels of Asterix the Gaul felt rudimentary compared to the later works and by the time Asterix and Cleopatra, the sixth book to be published, came out, you finally felt that this was what they ought to look like. It was an important lesson for a child to learn: that you could get better at what you did over time. Each book seemed to have its own palette and perhaps Uderzo’s best work is in Asterix in Spain.

I also feel Asterix doesn’t get enough credit for being more complex. Once you peel back the initial layers, Asterix has some great literal depth going on - puns and word play, the English translation names are all extremely clever, there are many hidden details in the superb art to explore that you will quite often miss when you initially read it and in a lot of the truly classic albums they are satirising a real life country/group/person/political system, usually in an incredibly clever and humorous way.

What I found especially appealing was that it was also a brilliant microcosm of many classical studies subjects - ancient Egypt, the Romans and Greek art - and is a good first step for young children wanting to explore that stuff before studying it at school.

What I discovered recently was that Uderzo was colour blind which explains why he much preferred the clear line to any hint of shade, and it was that that enabled his drawings to redefine antiquity so distinctively in his own terms. For decades after the death of René Goscinny in 1977, Uderzo provided a living link to the golden age of the greatest series of comic books ever written: Paul McCartney to Goscinny’s John Lennon. Uderzo, as the Asterix illustrator, was better able to continue the series after Goscinny’s death than Goscinny would have been had Uderzo had died first, and yet the later books were, so almost every fan agrees, not a patch on the originals: very much Wings to the Beatles. What elevated the cartoons, brilliant though they were, to the level of genius was the quality of the scripts that inspired them. Again and again, in illustration after illustration, the visual humour depends for its full force on the accompaniment provided by Goscinny’s jokes.

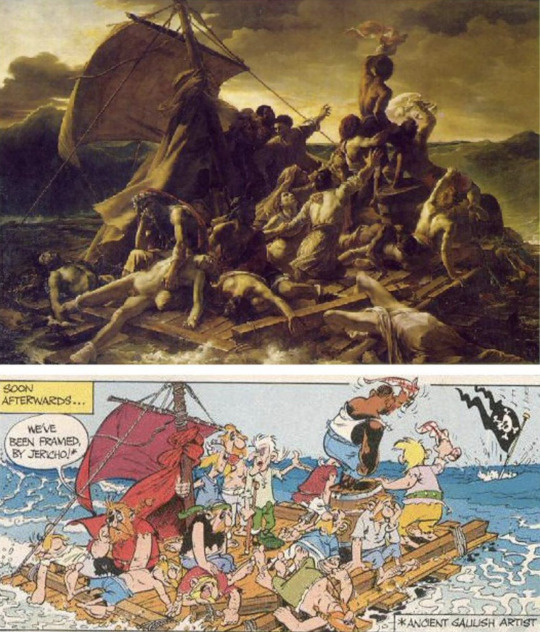

Here below is a great example:

There’s a lot of genius in this. Uderzo copied Theodore Géricault’s iconic ‘Raft of the Medusa’ 1818 painting in ‘Asterix The Legionary’. The painting is generally regarded as an icon of Romanticism. It depicts an event whose human and political aspects greatly interested Géricault: the wreck of a French frigate, Medusa, off the coast of Senegal in 1816, with over 150 soldiers on board. But Anthea Bell’s translation of Goscinny’s text (including the pictorial and verbal pun ‘we’ve been framed, by Jericho’) is really extraordinary and captures the spirit of the Asterix cartoons perfectly.

This captures perfectly my sense of humour as it acknowledges the seriousness of life but finds humour in them through a sly cleverness and always with a open hearted joy. There is no question that if humour was the measuring yard stick then Asterix and not Tintin would win hands down.

It’s also a mistake to think that the world of Asterix was insular in comparison to the amazing countries Tintin had adventures. Asterix’s world is very much Europe.

Every nationality that Asterix encounters is gently satirised. No other post-war artistic duo offered Europeans a more universally popular portrait of themselves, perhaps, than did Goscinny and Uderzo. The stereotypes with which he made such affectionate play in his cartoons – the haughty Spaniard, the chocolate-loving Belgian, the stiff-upper-lipped Briton – seemed to be just what a continent left prostrate by war and nationalism were secretly craving. Many shrewd commentators believe that during the golden age when Goscinny was still alive to pen the scripts, that it was a fantasy on French resistance during occupation by Nazi Germany. Uderzo lived through the occupation and so there is truth in that. Perhaps this is why the Germans are the exceptions as they are treated unsympathetically in Asterix and the Goths, and why quite a few of the books turn on questions of loyalty and treachery.

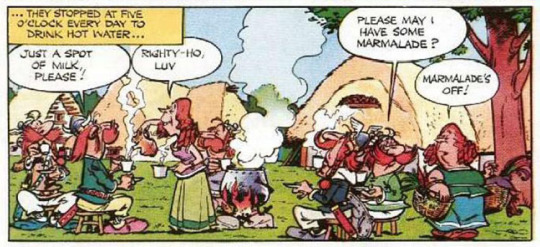

Even the British are satirised with an affection that borders on love: the worst of the digs are about our appalling cuisine (everything is boiled, and served with mint sauce, and the beer is warm), but everything points to the Gauls’ and the Britons’ closeness. They have the same social structure, even down to having one village still holding out against the Romans; the crucial and extremely generous difference being that the Britons do not have a magic potion to help them fight. Instead they have tea, introduced to them by Getafix, via Asterix, which gives them so much of a psychological boost that it may as well have been the magic potion.

I re-read ‘Asterix in Britain’ (Astérix chez les Bretons) in the light of the 2016 Brexit referendum result and felt despaired that such a playful and respectful portrayal of this country was not reciprocated. Don’t get me wrong I voted for Brexit but I remain a staunch Europhile. It made me violently irritated to see many historically illiterate pro-Brexit oiks who mistakenly believed the EU and Europe were the same thing. They are not. One was originally a sincere band aid to heal and bring together two of the greatest warring powers in continental Europe that grotesquely grew into an unaccountable bureaucratic manager’s utopian wet dream, and the other is a cradle of Western achievement in culture, sciences and the arts that we are all heirs to.

What I loved about Asterix was that it cut across generations. As a young girl I often retreated into my imaginary world of Asterix where our family home had an imaginary timber fence and a dry moat to keep the world (or the Romans) out. I think this was partly because my parents were so busy as many friends and outsiders made demands on their time and they couldn’t say no or they were throwing lavish parties for their guests. Family time was sacred to us all but I felt especially miffed if our time got eaten away. Then, as I grew up, different levels of reading opened up to me apart from the humour in the names, the plays on words, and the illustrations. There is something about the notion of one tiny little village, where everybody knows each other, trying to hold off the dark forces of the rest of the world. Being the underdog, up against everyone, but with a sense of humour and having fun, really resonated with my child's eye view of the world.

The thing about both Asterix and Tintin books is that they are at heart adventure comics with many layers of detail and themes built into them. For children, Asterix books are the clear winner, as they have much better art and are more fantastical. Most of the bad characters in the books are not truly evil either and no-one ever dies, which appeals hugely to children. For older readers, Tintin has danger, deeper characters with deep political themes, bad guys with truly evil motives, and even deaths. It’s more rooted in the real world, so a young reader can visualise themselves as Tintin, travelling to these real life places and being a hero.

As I get older and re-read Asterix and Tintin from time to time I discover new things.

From Asterix, there is something about the notion of one tiny little village, where everybody knows each other, trying to hold off the dark forces of the rest of the world. Being the underdog, up against everyone, but with a sense of humour and having fun, really resonated with my child's eye view of the world. In my adult world it now makes me appreciate the value of family, friends, and community and even national identity. Even as globalisation and the rise of homogenous consumerism threatens to envelope the unique diversity of our cultures, like Asterix, we can defend to the death the cultural values that define us but not through isolation or by diminishing the respect due to other cultures and their cultural achievements.

From Tintin I got wanderlust. This fierce even urgent need to travel and explore the world was in part due to reading the adventures of Tintin. It was by living in such diverse cultures overseas and trying to get under the skin of those cultures by learning their languages and respecting their customs that I realised how much I valued my own heritage and traditions without diminishing anyone else.

So I’m sorry but I can’t choose one over the other, I need both Asterix and Tintin as a dyad to remind me that the importance of home and heritage is best done through travel and adventure elsewhere.

Thanks for your question.

297 notes

·

View notes

Note

world building question that is always fun. Currency's, what are they called in each city state?

First of all, we know the canon global currency had been ‘valors’, a gold coin which were minted at the Institute of War. Since the collapse of the Institution, and the subsequent Summit at the Bastion, there is little sense of a united world currency, with valors often collected and melted down into a nation-state’s own coins instead. The Institute of War is an offensive memory best left forgotten. Still, for the most part, gold is gold, no matter where in the world it is spent or what imagery is inscribed into it.

Piltover’s gold standard is known as the ‘dogma’. The root of its naming comes from - as much with Piltovian naming convention - a turn of phrase that is equal parts a serious philosophical point... and a joke. The idea that ‘money makes the world go around’ is not a new one, and Piltover’s naming of their gold standard after the unquestioned belief of the power of money is, in the modern day and age, a stark commentary on the rising force of economics within politics as well as a pun on that same topic. It’s also given rise to plenty of puns and twists on common aphorisms. ‘Every dogma has its day’, for one.

Since the finding of the dragon in the Ironspikes, Piltover has had a massive influx of silver. At the time, everyone in Piltover above the age of seven was granted a commemorative silver coin, known colloquially now as a ‘drake’. In short order, much of the rest of the silver was mixed with tin and iron to enter into circulation as the ‘half-drake’, a coin the same size but with different decorations. Anyone with a fire cantrip or access to an open flame can easily assess whether a drake or a half-drake is counterfeit: the core of the coin will heat to the point of glowing after only a few moments of contact with fire, while a falsified coin would either not glow at all or be glowing all the way through. While most people treat their commemorative drake as an art piece or a collectible, there have been some who have traded it away, and they have been noted in other city states due to the trade routes that Piltover has mastery over. In addition to the drake and half-drake, Piltover also has a more standardised silver coin, known as the ‘arian’, which has been made and minted with normal silver.

The dogma, the arian, the drakes and half-drakes are not used in daily life or in everyday purchases. They are the high-end of the spectrum of wealth, and to throw them around is somewhere between gauche, foolish, and show-offish. The half-drakes are not uncommon in certain places, but the coins most used in daily transactions are the tin and brass coins, the ‘quid’ and the ‘penny’.

Piltover has started taking influence from Ionian tradition of scrip, expanding on this and combining it with their concept of promissory notes to make a certain level of paper-based currency acceptable within certain levels of society. The quid, particularly, is more popular in its paper form, and Piltover has by this point mostly phased out the tin coin entirely in favour of a paper version. However, most individuals prefer cold hard cash, so coins will - in one form or another - remain entirely necessary for the functioning of their flourishing economy.

As far as other nations go, most have their own version of the gold standard. Demacia has Crowns, Noxus has Marks, Zaun has Aurums, Ionia has the Ryō (in different shapes - square, hexagon, circular, triangular - depending on the area), Bilgewater has Doubloons and Galleons, the Freljord (or at least the part of the Freljord that relies on currency) uses the Vechus, and Bandle City uses the charmingly-named Roubees (though this name refers to all of their currency, regardless of what metal the coins are made from). Shuriman gold has, for a long time, just been referred to as ‘gold’ in whatever dialect is necessary, without a particular name given to the coins themselves. With the re-emergence and attempted unification of the Shuriman nation, perhaps the Nfr-nb (’nefer-nub’) will regain some prominence in the world economy.

Most nations will also have their own silver, too, though terms are often more fluid: pallas, pluribus, victoriatus, tenner. Likewise, most nations have a copper or bronze coin for the lowest denomination possible, and the names are often a variation of a term for smallness - such as bit, semi, or flick - though most just call them coppers. Given how Piltover is seen as the centre of all trade in Runeterra, the terms ‘arian’ and ‘penny’ are coming into popular usage throughout the world.

Iron coins are also used by certain nations who have access to large iron deposits - such as Noxus, Demacia and Ionia - though such coins are not used in Piltover (and are even confiscated at the borders, and often returned on an individual’s departure). The rule against iron coins is one of Piltover’s more baffling economic laws, but the government provides equivalent scrip or silver (at a fairer rate at the compulsory border seizure than in the city banks or coin exchanges) in exchange so such a law is not often challenged.

(I must admit, much of my personal headcanons comes from Maelstrom, (my good friend and writing buddy Stormarrow was a huge motivator and motivation for me), but I thought I’d expand on these ideas here, and consolidate my version of currency, which had taken some serious deviation from the original intent.)

(Also, whoops, here’s my 2014 version on this same topic, man I write a lot).

8 notes

·

View notes

Text

The Authority of Money

During my recent trip to the U.S., I decided to play tourist and visit a few places that I had never been. One of the more interesting destinations was the Money Museum at the Federal Reserve Bank in Chicago, Illinois.

youtube

No matter how much it’s talked about in the news and politics, I really had no idea exactly what the Federal Reserve Bank does. I know its name is printed at the top of all of my Benjamin, but that was about the extent of my knowledge. With the help of a friend I’ve had for 40 years, I signed up to take the tour and get a glimpse behind the scenes of the place that money calls home. Knowing the amount of money that passes through the place and seeing the turn of the century style conjured up images of caper stories the whole time I was there. I couldn’t help but think

“okay, if I was going to rob this place, how would I do it?”

The Guided Tour

While it was interesting to learn what the Federal Reserve Bank does, the real beauty of the visit was a special tour through some of the innards with a guide who knows trivia that spans centuries and literally trillions of dollars. Jerry, our tour guide, was a fascinating man who returned from the boredom of retirement to be a tour guide, talking guests through the museum.

He wore a light green and white suit, looking like he too had been minted by the U.S. government decades ago. Over the course of the next hour or so, he shared background on the Fed, stories and more numbers than anyone should be able to recall.

In the main museum, we got to see a number of displays about the history of currency in the United States, including a couple of displays of One Million Dollars:

We also got to learn a bit about what the Federal Reserve Bank does in a video that was put together in-house – nice, but a bit dry. I’m sharing what I took away from it, which may be entirely inaccurate, due to my failing memory.

The Fed’s charter is to “oversee how monetary policy is implemented.” It comes down to three primary functions:

they oversee how payment systems work, so the way checks are cashed, the way credit card and online transactions take place;

they are the regulators of banks in the U.S., so they’re the ones who go in and audit banks to make sure they’re not breaking any laws and

The most visible function is that they’re responsible for moving cash around.

youtube

For most of us, that’s the fascinating part of what they do. Every day of the week, shipments of currency come from the United States mints to the Federal Reserve Bank. The Fed then ships that currency out to the banks that need it. While the larger bills are transported by armored car every day, the $1 bills are packed into unmarked semi-trailers and driven to the building to prepare them for distribution.

I guess it’s not much different from shipping a truckload of iPhones to a warehouse, but somehow it SEEMS riskier that they do that.

On the flip side of things, the Fed gets deliveries of cash from the banks, which is counted and bundled for re-distribution. This is also the step that includes pulling old and worn bills out of circulation. One of the most surprising things I saw was how little wear a bill needs for it to be taken out of circulation. Most of the bills in your wallet are probably not going to pass.

About $17 Million in currency is destroyed every day at the Chicago Fed, which is one of 12 Federal Reserve Banks. The Money Museum even gives you a small bag of shredded money as a souvenir, which contains the remnants of currency equal to about $370. One of the more interesting facts about this shredded currency is that until the mid 20th century, the shredded bills were burned, but because of the toxic chemicals used in the ink, they had to stop doing that.

It’s now shipped off to special landfills for toxic materials. Kind of makes you worry about handling it every day, doesn’t it?

A Personal Tour

I had the pleasure of getting a more personal tour, including a trip to see the money sorting and counting machines (through a thick glass window, of course), but sadly the machines weren’t operating that day.

Those functions are visible from an additional section of the Museum that was closed off in 2001, so not many people get to visit it.

youtube

My other favorite part was looking at the high denomination currency that’s no longer in circulation. One display has a $10,000 bill in it, along with several other bills from the 200-ish years of American money printing. The 10k bills were printed until the 1940s and discontinued when it became apparent that virtually all bills above $1000 in denomination were being used for criminal purposes.

Just over 300 of the bills survive, most of which are in the hands of collectors. About 9 years ago, one of them actually arrived at the Fed through normal banking channels! Someone had gotten hold of it (perhaps stored in a box in an attic somewhere), taken it to their local bank and deposited it. With a quick bit of research, they’d have discovered it was worth close to 10 times that to a collector.

youtube

I’d love to make a few suggestions to the guys at the Money Museum as improvements, but since this is solely for PR (admission is free), I’m sure they are limited in how much they invest in the tour. Although considering the constant saber-rattling in Congress about the Fed, maybe they could use a bit stronger PR push.

One of my biggest pet peeves with 90% of museums is that no one really thinks about photos. Placement of light fixtures to minimize glare, setting up obstruction free angles and allowing guests the chance to pose without impeding traffic are critical factors for any museum and most of them don’t think that through.

Re-open the closed section of the tour. Money counting and shredding is one of the more fascinating things that happens at the Fed and no one gets to see it. I get it. 9/11 happened. But the security checks and procedures keep out bank robbers, so I’m sure they can be effective for other people, too.

Tell some stories. Interactive displays are all well and good, but you’ve got an asset like Jerry who has hundreds of stories in his arsenal. I’m the only one who heard any of them. Everyone else just heard him introduce the video and rattle off a lot of facts and figures.

Stories = excitement. Spend a little money and create a new video to share some of these stories in the context of explaining what the Fed does.

All unsolicited advice, of course, but I found the place fascinating and woefully under-utilized. As an average tourist, there just wouldn’t be a lot to hold my interest without some upgrades.

A blog post by Mike Fraser, We are the outside-the-Box, professionals here to give you the best change, solutions and strategies to develop your business idea. I can take your dream and help you make it an attainable goal. Our life experience and formal education has led us to the following conclusions:

Everyone has an amazing idea. It’s the execution that gets the job done. We are your executioner.

Brussels sprouts do not taste that great, no matter what my mom says.

Our team is made of all A personalities. We don’t care who gets the credit – We just want to win.

You will not regret giving us the opportunity to facilitate, compose and engineer the growth of your business. A professional prepared business plan can not only help your start-up company to obtain venture capital, traditional loans but can also help to maximize the efficiency and profitability of your business.

An optimal business plan can be your road map to a successful business. We thrive on building relationships and take great pride in the company we keep.

The post The Authority of Money appeared first on Business Plan Ideas | Business Plan Steps.

via Business Plan Ideas | Business Plan Steps https://businessplanpro.pennistonemedia.com/2020/07/22/the-authority-of-money/

96 notes

·

View notes

Text

Rufus Shinra Analysis in FFVII Remake (2020) vs FFVII (1997)

taken from my original thread on twitter here.

[MASSIVE REMAKE AND OG GAME SPOILERS, you have been warned]

From what we’ve seen in Final Fantasy VII Remake so far, Rufus (in my opinion) is 100% more interesting than he was in the original Final Fantasy VII. In the original game, Sephiroth/JENOVA infiltrates the Shinra building and murders everyone inside. Then, Sephiroth/JENOVA stabs President Shinra and leaves his body at his desk with Masamune sticking out of his back. Palmer, who had witnessed the entire thing, calls Rufus (who is in Junon) for backup. Rufus responds by boarding a helicopter to come assume command of the company in the wake of his father’s death.

Rufus arrives just as the protagonists discover President Shinra’s body, and they rush out to confront him. Rufus doesn’t know who they are, so he asks. Each of the gang gives a brief one-liner of their “occupations”, and Rufus responds with “what a crew” which is A REALLY GOOD SNARKY LINE I’M SAD ISN’T IN THE REMAKE. In Final Fantasy VII Remake, the part where the party reveals their ‘occupations’ is instead given to Heidegger, and only Aerith, Barret and Red XIII are present.

An interesting major divergence from the original game then happens in Remake. In the original, Rufus begins his inauguration speech:

That’s right. I’ll let you hear my new appointment speech. ...My old man tried to control the world with money. It seems to have been working. The population thought that Shinra would protect them. Work at Shinra, get your pay. If a terrorist attacks, the Shinra army will help you. It looks perfect on the outside. But, I do things differently. I’ll control the world with fear. It takes too much to do it like my old man. A little fear will control the minds of the common people. There’s no reason to waste money on them.

As Rufus begins by talking about how Shinra used to work, the player starts to think “Oh good, maybe things are about to change for the better. Maybe he’s a good guy!” WRONG.

Rufus then drops the bombshell that he has no intention of being ‘better’ than his father—in fact, he’s worse. While his father used money to rule, Rufus will instead rule with fear. I’m not sure why this speech was cut from the Remake, but my guess is that they’re going to keep it for a later instalment because it’s just a+ in terms of setting up just how cruel Rufus actually is.

In the original, Cloud then asks Barret to take Aerith and escape the building (present in Remake) because the revelation that Sephiroth is alive “is the true threat to the planet” (not present in Remake). when Rufus and Cloud are alone, Rufus asks, “why do you want to fight me?”

Cloud responds, “you seek the promised land and Sephiroth.” Rufus’ last line before the boss battle is “I see. I guess this means we won’t become friends.” THIS IS A REALLY INTERESTING LINE which is not in the Remake because OG!Rufus and Remake!Rufus are quite different.

In the original it is implied that Rufus was planning to team up with Cloud, or at least gain their support since they’re both going after Sephiroth. It’s only after Cloud refuses his offer that they fight, and the fight was more of a story fight than a true challenge.

HERE IS WHERE THE FINAL FANTASY VII REMAKE REALLY DIFFERS RE: RUFUS. Remake gives us a short scene with the Turks thinking back on their actions regarding the Sector 7 pillar, before Tseng gets a phone call from Rufus and says, “the VP needs us.” The Turks then leave.

The first time Rufus is seen is when the AVALANCHE helicopter is shot down, and Reno asks, “you sure you want to do this personally, boss?” to which Rufus smirks. In the original, Rufus arrives at the Shinra HQ because he heard that his father had died. In the Remake, Rufus was already on his way to Midgar when his father dies. Why is this? An important clue comes from the Turk-centric game Before Crisis, as well as the actual boss battle vs Rufus himself.

Before Crisis reveals that Rufus had previously planned to assassinate his father with the help of AVALANCHE but was found out. This assassination attempt is confirmed to be canon within the Remake from one of Heidegger’s lines early in the Remake. President Shinra placed Rufus under house arrest, but still retained him as VP (even if in name only). While fighting Rufus in the Remake, he tosses two coins in the air and the camera gives us a closeup of them. The coins read “Shinra Inc.” and “A New Era”, among other things.

Players of the original will know that “A New Age” is how Rufus brands his version of Shinra, particularly seen on his banners during his parade in Junon. Remake!Rufus has already managed to have his new currency minted BEFORE HIS FATHER EVEN DIES. So, what does this mean?

It means that what’s likely to be the case in Remake is that Rufus called Tseng to come pick him up because he’s either staging another coup/planning to take control right there and then. He just happened to have weird timing and arrived at the same time as Sephiroth/JENOVA and the protagonists, and his father had just died (at the hands of Sephiroth/JENOVA).

Rufus in the original didn’t show any sadness about his father dying, but Remake!Rufus appears to have taken that one step further in that he was preparing for another attempt, and had already had his new currency minted in preparation for his success and ascension.

It’s interesting also to compare President Shinra and Rufus. President Shinra is very much tied into the corporate structure—he rules using his wealth, he’s very business minded, and his closest allies are his execs. Rufus on the other hand prefers to use fear and black ops to get his way, which is shown by how he has a much stronger relationship with the Turks. The Remake showcases this internal conflict nicely with a brief scene near the end.

In this scene, Heidegger slips up and calls him “Mister Vice President”, which Rufus ignores. Tseng then walks in and says, “Mister President”, and Rufus replies, “that’s right.” Tseng smirks at Heidegger as they leave. This shows how Heidegger (and the other exec’s) control is being usurped by the Turks. I’m interested to see how the Shinra power struggles are going to be further explored in the Remake, because it’s one of my favourite parts of the whole game.

With regards to the actual boss battle itself, it’s very interesting how much stronger they’ve made Rufus in Remake. the original boss battle was very easy and was more of a story fight than a true fight. Rufus in the Remake is one of the hardest bosses because he just fucking counters EVERYTHING you do. he’s DESIGNED to be irritating as shit to the player, because he has a single attack that staggers him instantly, but the game doesn’t tell you what it is. Furthermore, the way Rufus fights is incredibly flashy—spins and twirls, shooting coins, etc. it’s all a dance to him. It’s very strongly implied that he must have been trained by the Turks, because he’s still a regular human, but he’s on a comparable level to Reno and Rude, if not even stronger.

In the original, Rufus fights Cloud because Cloud refuses to let him leave, Cloud having recognized him as a threat. In the Remake, Rufus HIMSELF chooses to fight Cloud. He willingly gets out of his helicopter to confront cloud BECAUSE HE WANTS TO. Reno even points out that Rufus doesn’t have to do it personally, but Rufus craves a fight with cloud. Rufus in the Remake fights cloud for sport and takes great pleasure in doing it as well.

In the Remake he comes off as a highly dangerous opponent who is both smart AND a capable fighter, giving Cloud a run for his money, while in the original he was pretty much just trust fund kid with shotgun and dog.

Remake!Rufus and Dark Nation/Darkstar combo off each other incessantly, implying that they’ve been fighting together for a very long time. Rufus also CONSISTENTLY taunts you throughout the entire fight, while Cloud (and the player) are getting really annoyed at him.

All of these elements set Rufus (and by extension, New Age!Shinra) up to be way stronger and more dangerous opponents than they were in the original game, where after the beginning Midgar portion they were pretty much just joke opponents vs the real threat, Sephiroth.

Another extra thought: Why can Rufus seemingly see the whispers?

The whispers are said in the Remake to be drawn to people who attempt to alter destiny’s course and ensure that they do not. Rufus seems to be able to see them, but Tseng cannot, and is confused by it. I’m assuming what this means is that Rufus’ actions have already defied fate in some way. Nothing of what he did on-screen really changed the original game’s timeline, so I think this means that he has done something off-screen that we the player hasn’t seen yet, but had timeline changing effects. Another idea is that in the original game Rufus and Shinra just “follow” sephiroth in the same way cloud and co. do. If the Remake is giving Rufus/Shinra more agency, as well as Cloud and co. themselves, it’s not hard to imagine that now Rufus himself can possibly pursue new timelines/events, rather than just following after Sephiroth. In the original, you have parties of people just following “Sephiroth” to the northern crater for the Reunion, but now all bets are off. Rufus also “dies” in the original and Advent Children retconned it, and I’m wondering if this means Rufus is also defying his fate to “die” on top of Shinra HQ near the endgame.

I'm REALLY interested in this re-imagining of Rufus and Shinra, and i can't wait to see more of them in remake. THANK YOU FOR READING ALL THESE MUSINGS ON MY FAVOURITE CHARACTER IN FFVII.

11 notes

·

View notes

Text

IOSG: Get a summary of the Ethereum DeFi ecosystem and understand the smart contract audit process

Decentralized exchanges and oracles are basic application modules that explain to you just about all DeFi projects. Decentralized exchanges provide token exchanges, and oracles provide price-feeding mechanisms for various DeFi protocols. Compiled by: IOSG Ventures Token value flow of DeFi ecology @IOSG VC: From the vertical standpoint, users' rights and interests are tokenized layer by layer from the proper execution of the underlying assets, and the rights and interests are displayed by means of different tokens, and finally flow into the top-user aggregation layer to meet up various economic activities and requirements of users. For example , Ether can be mortgaged in the Maker Vault mortgage pool to lend out the stable currency Dai, and Dai can enter the Compound or Aave protocol for re-mortgage, expressing equity in cDai or aDai, and the top-level get back maximization tool such as RAY can automatically Allocate user rights and interests to different lending agreements to have maximum benefits. This shows a complete vertical flow case. From the horizontal perspective, decentralized exchanges and oracles are basic application modules that explain to you all projects. Decentralized exchanges provide token exchange, and oracles provide price-feeding mechanisms for various DeFi protocols. They serve as DeFi infrastructure Through the entire flow of DeFi value. Security Audit Technology of Smart Contract @IOSG VC: Security audits in a wide sense frequently utilize the combination of technologies shown above to find known or suspicious vulnerabilities in smart contracts that could allow attackers to steal funds. Security audits have greatly increased the threshold for attacking smart contracts, so every public project must be audited. It's like every door lock can be opened by the proper person with the proper skills, but we must still put in a lock to your door. Nevertheless , most security audit techniques are inefficient in detecting unsuspected issues, and they are definately not claiming that any audited smart contract is 100% "secure" or won't be attacked as time goes on. In addition , due to budget constraints, you can find sometimes trade-offs in exactly how many security audits to conduct. The aforementioned might sound a bit sad, but this is the reality we have to face. As a user of smart contracts, what does this mean to us? Listed here are the points you want to make:

* As always, only put the funds that you could afford in the worst case into the smart contract; * Only deposit funds for safety audited projects; * The potential rewards or advantages of DeFi applications should compensate for the extra security risks. The pulse of a Algorand Foundation and Circle have reached a cooperation to issue USDC on the Algorand chain The Algorand Foundation announced that it has already reached a cooperation with Circle to issue USDC on the Algorand chain. USDC is founded on an open standard and governance framework manufactured by the Centre Consortium (a joint investment and operation company of Coinbase and Circle) to understand a completely mortgaged stable currency for USD. FIT, Binance, Coinbase officially launched COMP, and Coinbase Earn added support for COMP FTX recently launched the COMP contract and DeFi index contract, and Binance in addition has launched the Compound governance token COMP, and opened the COMP/BTC, COMP/BNB, COMP/BUSD, COMP/USDT trading markets, and the COMP deposit channel has become open. And the cryptocurrency exchange Coinbase in addition has officially launched the Compound governance token COMP, and users can trade, send, receive or store COMP. ConsenSys Diligence launches blockchain project security audit database ConsenSys Diligence launched a blockchain project security audit database, which can be open source and displays relevant security audit information on the basis of the project, including audits, bounty, and contract warehouse lists. All project data is stored in JSON files. The goal of this database would be to aggregate blockchain security data for users, to not guarantee the security of any particular project. @IOSG VC: OpenZeppelin performed the Timelock Audit, Governance System Audit, Tether Integration Audit, MCD & DSR Integration Audit & COMP Distribution System Audit. However, Trail of Bits has been around charge of Compound Protocol Security Assessment, Compound V2 Security Assessment & Compound Governance Security Assessment. Certora and Gauntlet also participated in the security analysis, performing Formal Verification of Compound Protocol and Market Risk Assessment, respectively. In terms of the amount of projects covered Trail of Bits, OpenZeppelin and Consensys Diligence seem to be the absolute most reliable auditors. They've been followed by Chain Security (now element of PwC), SmartDec and QuantStamp. The DeFi Money Market Agreement DMM Telegram Group was attacked through the public offering, and users have already been compensated with USD 40, 000 DeFi Money Market Protocol DMM's official Twitter stated that its telegram group was maliciously hijacked through the public offering, and the attacker imposted the DMM Foundation in order to steal funds. The corresponding DMG amount was compensated for people who were deceived in the token sale. Startup Notabene is launching a compliance platform for crypto exchanges Start-up Notabene wrote a write-up about Notabene, its compliance platform for cryptocurrency exchanges. The platform is made to help worldwide virtual asset service providers (VASP) comply with the travel rules proposed by the Financial Action Task Force (FATF), allowing exchanges to begin integrating travel rules within their compliance workflows. @IOSG VC:

Notabene is the first professional KYC platform set up for compliance transactions. Its team began operations in February 2020 and won its first customer Concordium, which can be the very first public chain infrastructure established for compliance. Notabene focuses on the overall process of users' digital asset transactions as opposed to just identity verification. Including connecting the customer's identity with the digital encrypted currency account, real-time monitoring and evaluation, and providing continuous SAAS services. Cryptocurrency trading KYC is dramatically distinctive from KYC in conventional finance. The KYC business process of cryptocurrency transactions requires the following aspects. StarkWare launches STARK-based verifiable delay function service "VeeDo" StarkWare, a zero-knowledge proof research and development organization, launched a STARK-based Verifiable Delay Function (VDF) service "VeeDo" on the Ethereum mainnet. VDF is just a function that delivers delay and time lag through calculations. The first application that StarkWare intends to resolve with VeeDo is the trustless and uncontrollable random proof concept (PoC) on Ethereum. @IOSG VC: At the conclusion of May possibly this season, StarkWare also announced on twitter that it might soon complete the development of the ethSTARK code and open source it. ethSTARK is founded on the Ethereum Foundation funding StarkWare in July 2018 to develop a STARK-friendly hash function and offer open source ZKP code because of its ecology. Once ethSTARK is completed, the code will run 20 times faster than any existing ZKP code.. StarkWare raised $30 million in October 2018. Investors include Consensys, Coinbase Ventures, Intel Capital, Pantera and Sequoia.

Incognito releases Incognito Portal that supports BNB and BTC anonymous transactions Incognito, a provider of cryptocurrency privacy solutions, has released the Incognito Portal. The aim is to open a trustless bridge to Binance and allow BNB to conduct completely confidential transactions. Portal can connect the blockchain to the anonymous privacy layer without advanced level smart contracts. Loopring protocol Loopring supports RenBridge in an individual interface, and renBTC can be minted with BTC Loopring Protocol Loopring adds RenBridge that supports the Ren protocol in an individual interface, allowing users to mint renBTC with Bitcoin and use it in zkRollup mode. Currently renBTC has supported deposits in Loopring Exchange and Loopring Pay, and the renBTC/USDT trading pair will be launched in about a week. @IOSG VC: Unlike decentralized projects such as tBTC and sBTC that require users to mint coins on the project's internet site, renBTC is more like a DeFi LEGO block. This project allows renVM to be directly built-into DeFi applications. Cooperation with projects including the Loopring Agreement has exposed the flow of traffic for renBTC. Source: etherscan We see that the transaction volume of renBTC increased by 364% in the 2 days from 18th to 19th. At the time of June 29, 2020, the supply chain reached 1000+renBTC. Currently, renBTC is just a decentralized Bitcoin-anchored currency project. The largest project. Investment and financing events AVA Labs completed 12 million USD in token private placement financing, led by Galaxy Digital, NGC, and Bitmain AVA Labs, a decentralized service platform, completed a $12 million AVAX token private placement financing. Now, five institutions led by Galaxy Digital, Bitmain, Initialized Capital, NGC Ventures, and Dragonfly Capital. After the fundraising, Avalanche's Denali testnet was successfully closed, and much more than 1, 000 full nodes participated in staking and participated in the consensus agreement. Kevin Sekniqi, co-founder and chief operating officer of AVA Labs, said that the newest funds will be useful for the further development of the AVA blockchain network, and its particular mainnet will be launched in July. The AVA blockchain platform is driven by the Avalanche consensus protocol, which aims to permit one to create a public or private blockchain that can run smart contracts and cross-chain. Japanese financial giant SBI Holdings will launch its first crypto fund in Japan Japan financial giant SBI Holdings stated at its business report meeting on the 26th that it will launch Japan's first encrypted asset fund. It's expected to start recruiting individual investors from the summertime of 2020. The fund contains three investment targets: BTC, ETH, and XRP. After the introduction of the aforementioned three tokens, the foundation is certainly a financial product for institutional investors. Yibang International was officially listed on Nasdaq, with the last issue price of US$5. 23 per share, and the sum total issuance size of approximately US$107. 5 million Bitcoin mining machine producer Ebang International announced the details of its IPO, the following: 1 . It plans to market 19, 264, 337 common shares at a high price of 5. 23 US dollars per share, and the sum total issuance scale is approximately 100. 75 million US dollars. 2. The precise launch time is June 26, the stock code is EBON, and the issuance is expected to end on June 30; 3. The company has granted the underwriters to buy 2, 889, 650 shares at the original public offering price within 30 days from the date of the release of the last prospectus Rights to additional Class A common shares. Celsius received a $10 million investment from Tether, with a post-investment valuation of $150 million Crypto lending platform Celsius Network announced that it has received a US$10 million investment from stablecoin issuer Tether, meaning the post-investment valuation is near US$150 million. Opyn completes $2. 16 million in financing, led by Dragonfly Capital On-chain options platform Opyn announced the completion of a US$2. 16 million financing led by Dragonfly Capital. Other investors include Version One Ventures, Uncorrelated Ventures, 1kx, aCapital, DTC Capital, CoinFund, and individual investors Balaji Srinivasan, Robert Leshner ( Compound CEO), Dylan Field, Linda Xie and others. Opyn said it will utilize the funds to expand the team, recruit core staff, and additional develop the protocol and improve security. Freelance market Braintrust completes $6 million seed round financing to construct labor solutions through blockchain Braintrust, the freelance market, announced a $6 million seed round of funding. Investors include True Ventures, Homebrew Ventures, Uprising Ventures, Galaxy Digital, IDEO CoLab, Kindred Ventures, and Vy Capital. Some angel investors also participated in the financing. Braintrust is capable of 100% remote operation and operation, the reason would be to help employers find very skilled technical talents which can be difficult to employ and retain in the traditional market. W3BCloud, a joint venture between chip giant AMD and ConsenSys, completes US$20. 5 million in initial financing W3BCloud, a joint venture between chip giant AMD and Ethereum developer ConsenSys, has completed US$20. 5 million in financing, that will be used to launch decentralized data center networks global. The company plans to put into operation 40 data centers within four years. W3BCLOUD uses ConsenSys' computer software development experience in the blockchain field to develop blockchain data center solutions based on AMD hardware. The partners stated that the blockchain data center solution manufactured by W3BCLOUD will mainly address the needs of enterprises and governments for cloud computing blockchain infrastructure. IOSG post-investment project progress Filecoin's preparation for the testnet reward plan is expected to be completed on July 6 Filecoin stated that the preparations because of its testnet reward plan are expected to be completed on July 6. The preparations for the test are mainly from the promised capacity upgrade to real data, packaging multiple transactions, and fast retrieval (news may be added later). The time scale ends two weeks before the test plan goes live. Celer Network updates the roadmap and will update the token economic model in the third quarter Celer Network (CELR) updated the project roadmap. Celer Network will update the Celer Network token economic model (cEconomy) in the third quarter of the year, add layer-2 expansion support to more main chains (layer-1 blockchains), release Celer Network PoS Optimistic Rollup side chain mainnet 1 . 0, Build easy-to-use SDK etc . In the fourth quarter, Celer Network will perform Celer Network state channel network mainnet upgrades with multi-client state synchronization and receiver delegation functions, release Celer Network PoS Optimistic Rollup side chain mainnet 2. 0, and transfer non-encrypted users through the CelerX mobile app Bring into the blockchain field. Maker approves the proposal to incorporate KNC and ZRX as mortgage assets MakerDAO has completed and approved KNC and ZRX because the governance vote for the Maker agreement mortgage asset proposal. A week ago, Maker begins a two-week voting on ENJ, LEND, LINK, MATIC, PAXG and WKT as collateral asset proposals. Kyber Network becomes the startup pool of Bancor V2, and Bancor V2 code is expected to be deployed to the key network in July Bancor announced that Kyber Network (KNC) is just about the startup pool for Bancor V2. Bancor V2's new KNC reserve pool enables KNC holders to offer liquidity and receive a percentage of the KNC reserve pool transaction fee while maintaining their long positions in KNC.

1 note

·

View note

Text

The Authority of Money

During my recent trip to the U.S., I decided to play tourist and visit a few places that I had never been. One of the more interesting destinations was the Money Museum at the Federal Reserve Bank in Chicago, Illinois.

youtube

No matter how much it’s talked about in the news and politics, I really had no idea exactly what the Federal Reserve Bank does. I know its name is printed at the top of all of my Benjamin, but that was about the extent of my knowledge. With the help of a friend I’ve had for 40 years, I signed up to take the tour and get a glimpse behind the scenes of the place that money calls home. Knowing the amount of money that passes through the place and seeing the turn of the century style conjured up images of caper stories the whole time I was there. I couldn’t help but think

“okay, if I was going to rob this place, how would I do it?”

The Guided Tour

While it was interesting to learn what the Federal Reserve Bank does, the real beauty of the visit was a special tour through some of the innards with a guide who knows trivia that spans centuries and literally trillions of dollars. Jerry, our tour guide, was a fascinating man who returned from the boredom of retirement to be a tour guide, talking guests through the museum.

He wore a light green and white suit, looking like he too had been minted by the U.S. government decades ago. Over the course of the next hour or so, he shared background on the Fed, stories and more numbers than anyone should be able to recall.

In the main museum, we got to see a number of displays about the history of currency in the United States, including a couple of displays of One Million Dollars:

We also got to learn a bit about what the Federal Reserve Bank does in a video that was put together in-house – nice, but a bit dry. I’m sharing what I took away from it, which may be entirely inaccurate, due to my failing memory.

The Fed’s charter is to “oversee how monetary policy is implemented.” It comes down to three primary functions:

they oversee how payment systems work, so the way checks are cashed, the way credit card and online transactions take place;

they are the regulators of banks in the U.S., so they’re the ones who go in and audit banks to make sure they’re not breaking any laws and

The most visible function is that they’re responsible for moving cash around.

youtube

For most of us, that’s the fascinating part of what they do. Every day of the week, shipments of currency come from the United States mints to the Federal Reserve Bank. The Fed then ships that currency out to the banks that need it. While the larger bills are transported by armored car every day, the $1 bills are packed into unmarked semi-trailers and driven to the building to prepare them for distribution.

I guess it’s not much different from shipping a truckload of iPhones to a warehouse, but somehow it SEEMS riskier that they do that.

On the flip side of things, the Fed gets deliveries of cash from the banks, which is counted and bundled for re-distribution. This is also the step that includes pulling old and worn bills out of circulation. One of the most surprising things I saw was how little wear a bill needs for it to be taken out of circulation. Most of the bills in your wallet are probably not going to pass.

About $17 Million in currency is destroyed every day at the Chicago Fed, which is one of 12 Federal Reserve Banks. The Money Museum even gives you a small bag of shredded money as a souvenir, which contains the remnants of currency equal to about $370. One of the more interesting facts about this shredded currency is that until the mid 20th century, the shredded bills were burned, but because of the toxic chemicals used in the ink, they had to stop doing that.

It’s now shipped off to special landfills for toxic materials. Kind of makes you worry about handling it every day, doesn’t it?

A Personal Tour

I had the pleasure of getting a more personal tour, including a trip to see the money sorting and counting machines (through a thick glass window, of course), but sadly the machines weren’t operating that day.

Those functions are visible from an additional section of the Museum that was closed off in 2001, so not many people get to visit it.

youtube

My other favorite part was looking at the high denomination currency that’s no longer in circulation. One display has a $10,000 bill in it, along with several other bills from the 200-ish years of American money printing. The 10k bills were printed until the 1940s and discontinued when it became apparent that virtually all bills above $1000 in denomination were being used for criminal purposes.

Just over 300 of the bills survive, most of which are in the hands of collectors. About 9 years ago, one of them actually arrived at the Fed through normal banking channels! Someone had gotten hold of it (perhaps stored in a box in an attic somewhere), taken it to their local bank and deposited it. With a quick bit of research, they’d have discovered it was worth close to 10 times that to a collector.

youtube

I’d love to make a few suggestions to the guys at the Money Museum as improvements, but since this is solely for PR (admission is free), I’m sure they are limited in how much they invest in the tour. Although considering the constant saber-rattling in Congress about the Fed, maybe they could use a bit stronger PR push.

One of my biggest pet peeves with 90% of museums is that no one really thinks about photos. Placement of light fixtures to minimize glare, setting up obstruction free angles and allowing guests the chance to pose without impeding traffic are critical factors for any museum and most of them don’t think that through.

Re-open the closed section of the tour. Money counting and shredding is one of the more fascinating things that happens at the Fed and no one gets to see it. I get it. 9/11 happened. But the security checks and procedures keep out bank robbers, so I’m sure they can be effective for other people, too.

Tell some stories. Interactive displays are all well and good, but you’ve got an asset like Jerry who has hundreds of stories in his arsenal. I’m the only one who heard any of them. Everyone else just heard him introduce the video and rattle off a lot of facts and figures.

Stories = excitement. Spend a little money and create a new video to share some of these stories in the context of explaining what the Fed does.

All unsolicited advice, of course, but I found the place fascinating and woefully under-utilized. As an average tourist, there just wouldn’t be a lot to hold my interest without some upgrades.

A blog post by Mike Fraser, We are the outside-the-Box, professionals here to give you the best change, solutions and strategies to develop your business idea. I can take your dream and help you make it an attainable goal. Our life experience and formal education has led us to the following conclusions:

Everyone has an amazing idea. It’s the execution that gets the job done. We are your executioner.

Brussels sprouts do not taste that great, no matter what my mom says.

Our team is made of all A personalities. We don’t care who gets the credit – We just want to win.

You will not regret giving us the opportunity to facilitate, compose and engineer the growth of your business. A professional prepared business plan can not only help your start-up company to obtain venture capital, traditional loans but can also help to maximize the efficiency and profitability of your business.

An optimal business plan can be your road map to a successful business. We thrive on building relationships and take great pride in the company we keep.

The post The Authority of Money appeared first on Business Plan Ideas | Business Plan Steps.