Don't wanna be here? Send us removal request.

Text

Review: Is the When token from Whenhub a scam or not?

Some tokens promoted by public figures have been revealed to be scams in the past. For instance, the 2 founders of Centra faced criminal charges, and the boxer Floyd Mayweather and the music producer DJ Khaled had to settle with the SEC after getting paid to promote Centra.

Scott Adams, the famous cartoonist creator of Dilbert, has developed in recent years an audience on social media by sharing his thoughtful views on US politics and world affairs in general. When he started to forcibly promote the When token, we decided to have a deeper look at the product.

Please find below the result of our research:

1/ It seems that the When ICO was not successful, but it’s hard to tell because there is limited information online

After a private sale, the WhenHub token public scale was supposed to take place from November 10 to December 31, 2017 but it was apparently postponed to a later date.

We could not find any information on whenhub.com regarding the success or failure of the ICO, such as the completion rate of the public subscription.

The ICO price was $0.1 and the token is now trading at $0.04 as of June 12th at a -60% decrease.

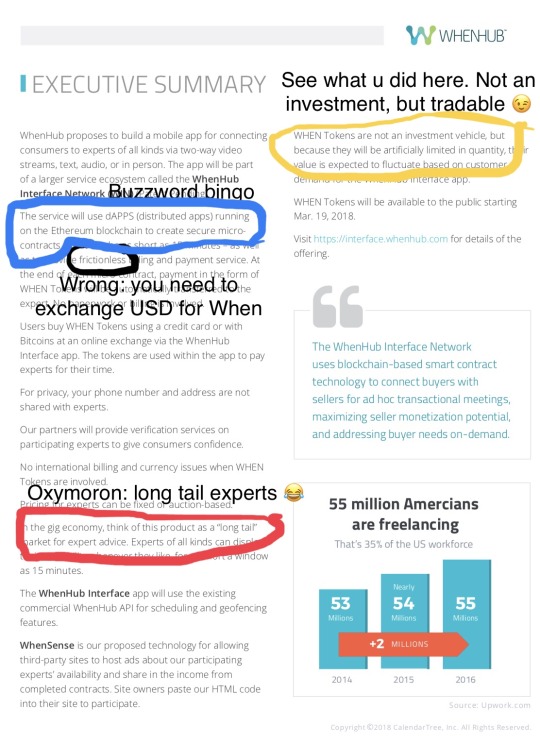

2/ The white-paper is a good marketing material, very short on technical details

We know nothing about the Whenhub architecture. The executive summary is a collection of buzzwords and empty concepts:

3/ The flows of When tokens look weird, they are hard to explain

* A focus on the “millionaire” addresses *

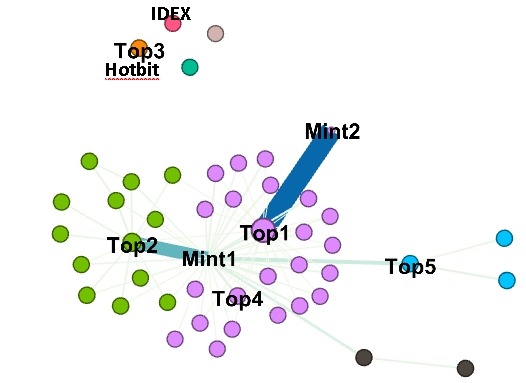

There are 2 mints that have created ~316.1 millions of tokens so far.

Mint2 transfers tokens to the top1 address (balance of ~101.6M of tokens) exclusively

Mint1 transfers tokens to the top2 address (balance of ~27.4M of tokens) as well as many other millionaire addresses (incl. top1).

It is not clear to us how, when and for the profit of whom the future ~565M tokens will be minted (to make up for the 875M total supply)

Top1 and Top2 addresses re-transfer tokens to many other millionaire addresses, probably to give the impression that wealth is not concentrated into the hands of a few but distributed among many users. In reality, we can guess that only a few people control those millionaire addresses. We don’t know for sure but it’s possible.

4 millionaire addresses have no link with any other millionaire address. At least 2 of them belong to exchanges (Top3 is a Hotbit address).

* Stats on addresses *

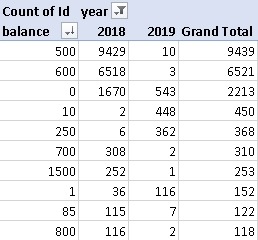

Half of the ~22,000 addresses were created in May 2018. Only ~10% of the addresses were created in 2019 meaning that the application is barely used:

Around 18,000 addresses have a balance of 500 and 600 and were created in 2018. It’s weird:

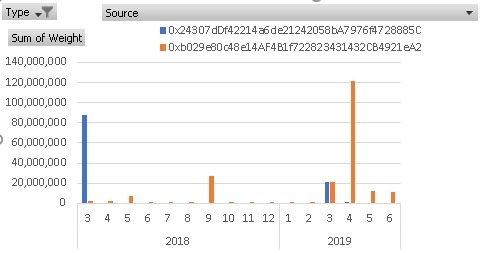

Out of the 47 “millionaire” addresses, 12 were created in April 2019. Indeed, ~121.7M tokens were minted in April 2019 which indicates that beyond the Hotbit & IDEX addresses, some wealthy investors (EF?) bought at that time or that the core team is making some big moves to sell some of their tokens to the public (?). This is the timeline of emission of the 2 mints:

That address created in June 2019 seems particularly interesting. We will follow it very closely: https://etherscan.io/address/0x66Fd9341e4Ac713d72a1cF0aFF76760Ae403B337#tokentxns

4/ The token is only available on third-rate exchanges (far from being in the top 10 exchanges)

We had never heard of those exchanges before doing this research: Hotbit, Idex, Latoken, Finexbox

5/ The token is unnecessary to the core business of the Whenhub application

Paying freelancers for services or experts to answer questions online is nothing new. There are dozens of applications available, some launched decades ago. None of the big ones use a token, which proves that a token is not necessary. Indeed, Whenhub users could pay experts directly in USD, EUR or their local fiat currency. Whenhub could even have offered the option to pay with bitcoin. It does not require a private token. If the purpose is to pre-buy services (same as when you buy tokens at the fair, to use with several attractions), then you don’t need a market tradable token. It could be implemented as “points” within the application, using regular technology.

In general, utility tokens don’t need to be traded, unless price discovery is needed. To hire experts, no price discovery is necessary because the price is known upfront! Why people would need to trade the When token? It can only be used within the Whenhub application anyway. If you buy some, it’s to use it within the application or to speculate. We can’t think of a third option.

Having exhausted all the options, we are left with the final question: is the only purpose of the When token to make their creators rich through speculation? The probability is very high, but we don’t know for sure.

6/ As a co-founder of Whenhub, Scott is biased and has a direct interest in pushing the price of the token up

It’s possible that Scott remains driven by rational motives. We can’t read his mind. He may be deeply convinced about the advantages of the When token. It’s unlikely, but it’s possible.

If Scott’s motivation for shilling the When token was solely to make money, it would show a lack of character (greed) but that wouldn’t necessarily be a problem from a legal perspective. We are not lawyers and we are not accredited investors, so we don’t know the exact limit between “promoting a token forcibly” and “giving financial advice”.

Conclusion

To summarize the findings, it looks like the sole purpose of the When token is to enrich its creators through speculation. But that may be due to a lack of communication from the Whenhub team. Also, we can’t read Scott’s mind. It’s possible that Scott is sincere, that he is promoting his startup in good faith, and not trying to dump its token to get rich at the expense of his social media audience. If that’s the case, we can assume that he will be sincerely sorry if the startup ends up failing and the individual buyers of the When token lose their money.

2 notes

·

View notes