#the almighty blockchain

Explore tagged Tumblr posts

Text

Xunia Dao is Here !!

#24kmediaproductions#sonoxo#almighty sonoxo#music#804#757#hiphop#nft#rapmusic#crypto#ethereum news#flow blockchain#creator coin#bulildspace#metaverse#musicians#decentraland#decentralized finance#decentralization#polygon

2 notes

·

View notes

Text

🚀 Big News from NVIDIA: $500 Billion U.S. AI Manufacturing Plan! 💰

Hold onto your wallets, folks! The almighty NVIDIA has just dropped a bombshell: a staggering $500 billion plan to ramp up domestic AI supercomputer and chip manufacturing by 2029! 💻✨ CEO Jensen Huang is leading this revolutionary charge, partnering with industry titans like TSMC and Foxconn to superpower U.S. tech.

NVIDIA Announces $500B U.S. AI Manufacturing Plan

🤖 The Plan Unveiled

NVIDIA's aim? To build the pinnacle of AI technology right here on American soil and reinforce our tech infrastructure. Think job creation, production power, and skyrocketing demand for AI chips! As Huang himself said,

“The engines of the world’s AI infrastructure are being built in the United States for the first time…” - Jensen Huang, CEO, NVIDIA

💥 What This Means for You

While the crypto market may not feel the shockwaves today, tomorrow's tech stability could mean boons for blockchain and AI integration. Just image the possibilities of a robust AI + blockchain partnership! Talk about dreaming big! 🌌📈 Plus, don't forget those sweet stock movements that come with a surge in confidence in the tech sector.

💡 So, are you ready to ride the wave of innovation? Dive deeper into the world of NVIDIA's ambitious plan and its impact on the tech and crypto landscape. Unpack all the juicy details in this article right here: Read the full story!

#Crypto #NVIDIA #AI #TechNews #Investment #Blockchain #Innovation #FutureOfTech #USManufacturing

0 notes

Text

May the Almighty’s Blessings be with you on this Vijayadashami and Leading you towards a life righteousness. Wish You a Very Happy Dussehra!

Team : Anviam Solutions

#HappyDussehra #blockchain #BlessingsInLife #websitelaunch #happyvijaydashmi #anviamsolutions #anviam #AlmightyGod #Almighty #blessings #Ramkatha #ramnavami2023 #dusshra2023 #festivevibes #ravana #ethnicwear #festivals

#anviamsolutions#anviam#happydussehra#almighty#blessings#almightygod#festivals#happyijaydashmi#trending2023

1 note

·

View note

Note

Ok since your explanations are the best ive heard yet what the hell is blockchain?

...well, full disclosure, the technical side of this is way out of my depth, and I have the Wikipedia article on blockchain open as I'm typing this.

But let me throw some general information out there, see if it helps.

Blockchain is the technology that Bitcoin and other cryptocurrencies run on. Also other stuff, but the crypto market is the most famous thing it's used for.

At heart, it's just a list of records ("blocks"). In cryptocurrency, these are mostly records of "Person A transferred X amount of Currency Y to Person B."

The records are linked into a "chain" because each individual record includes information about the record before it.

So you can't sneak in a new/altered block somewhere in the middle, because it won't fit the information in the block that's supposed to come after it. The system can tell it's not a valid part of the chain.

(I always had the impression crypto transactions were supposed to be private and untraceable...? But apparently, nope. These might be the most irrevocably traceable records on the internet.)

This is (at least part of) why blockchains use so much energy -- the bigger a chain gets, the more computing power it takes to confirm the integrity of the whole thing.

That's baked into the design. It's unavoidable. Lots of people are talking about "more environmentally friendly" blockchains these days -- that just means "the energy increase happens more slowly."

It'll take longer to hit the massive energy demands of, say, present-day Bitcoin. But since "up" is the only direction it can go, it will get there eventually.

Blockchains are mostly decentralized, which is good for security. If you think about a normal website, you could hack into the server it's hosted on and change the master files, but with a blockchain there's no single host, no master files.

...except, some companies have tried to start private blockchains for their own internal use, and those are centralized. Which, as far as I can tell, takes away the only major advantage of using a blockchain? Now it's just a database, but more expensive. (Thank you, constantly-increasing electric bills.)

In spite of those security advantages, a blockchain is not "unhackable". It still has the one huge, unfixable vulnerability of any system:

Human users.

I don't need to accomplish the impossible hacking feat of "corrupting the chain with invalid blocks" to steal your Bitcoin. All I need to do is talk you into giving up your password.

Then I log onto your account, change the password, and do whatever the heck I want with your Bitcoin directly! Creating totally-valid blocks the whole time.

Also: users can be scammed by the creators in all kinds of new and exciting ways.

Governments have not caught up to regulating blockchain-based currency the way they do traditional money (and the banks, stocks, investments, etc. that it comes in).

Which means people can do things with crypto that would be 100% illegal with any other currency, and then skate away with millions, never getting arrested for fraud.

Consider:

Save The Kids Token: promoted as having special code that would prevent huge sell-offs from tanking the price, changed the code at the last minute, huge sell-offs immediately tanked the price

Squid Token: hyped as skyrocketing in value, but the code didn't let anyone sell it at all, meaning nobody could withdraw any of that "value" to actually use it anywhere

OpenSea: promoted as a reputable NFT exchange, one of the staff was happily arranging it so the promoted "hottest NFTs worth spending the most money on" were the ones he owned

Bitconnect: promoted as a cryptocurrency investment that gave great returns, was a regular old-fashioned Ponzi scheme the whole time

Defi100: promoted as a crypto investment something something, anonymous developer walked away with $32 million leaving nothing but the all-caps announcement "WE SCAMMED YOU"

OneCoin: promoted as a hot new cryptocurrency, literally did not ever have a blockchain

...okay, yeah, "sharing a list of my favorite crypto-related scams" is a big tangent from the original question. I'm just really into learning about these things lately. They're fascinating. I could listen to scam history recaps all day and never get bored. Never go into repeats, either -- this rabbit hole runs deep, and there's always new material coming in.

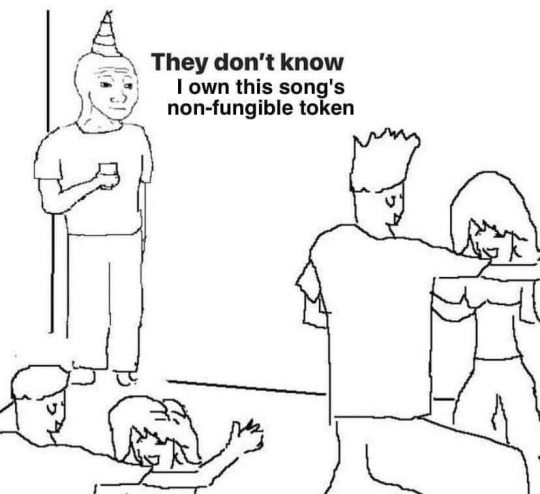

(Sometimes I see people saying things like "NFTs were supposed to be valuable and good for artists, it's a shame they've been overrun with exploitation and scamming." Problem is, NFTs never did any of the things that supposedly make them so useful. Sure looks like "convincing people these are valuable and good for artists, somehow" was just another dishonest crypto scheme from day one.)

#NFTs#cryptocurrency#the almighty blockchain#would y'all on Tumblr enjoy a List Of Free Entertaining Series About Scams?#bc I am following. A Lot of them#and would love to share

29 notes

·

View notes

Text

Whoo boy, let’s dive into this one...

Short answer: because it was designed that way. On purpose.

Long answer: for a currency to have any useful value, the amount and production has to be limited somehow.

(Which makes sense, right? If we tried to pay people in leaves, nobody would go to work for 15 leaves an hour, not when they could go for a hike and pick 15 leaves off the trees in 15 seconds.)

Precious metals -- gold, silver, copper -- have been popular for all of recorded history, because the limiting factor is “this material is physically difficult to dig out of the ground.”

With US dollars, the limit is part “bills are printed with complicated techniques that you need special equipment to pull off” and part “it’s illegal to for anyone except the government to print new dollars, and we will take you to jail if we catch you at it.”

With cryptocurrency, it’s all digital, so there’s no naturally-rare mineral involved. And it’s decentralized, so nobody has the authority to claim “we are the Bitcoin Police and we can take you to jail if you do this wrong.”

If you want it to work, you have to come up with some artificial limit, and then build that directly into the base code.

I’m not any kind of expert in the technical details here, so please nobody get too picky about it...but the general idea is, the blockchain will only spit out a new coin in response to a computer running calculations.

And for every new coin, it demands more calculations than the last one.

If you could still get a new Bitcoin by, say, “not using the internet for a day, have your computer use that power for mining instead,” then nobody would spend thousands of dollars to exchange for one Bitcoin, right? Anybody who wanted one would just take a day off Tumblr to mine it themselves.

Basically, there’s no reason to buy a Bitcoin for a dramatically higher price than it would cost you to mine a Bitcoin.

And the mining process keeps requiring more power, so:

First you can’t do it with just spare processing power from your main device, you need to buy a new one that’s fully dedicated to mining if you want to keep up

The extra power usage is enough to put a notable spike in your electric bill

One computer won’t do it anymore, you need two

Then four

Then eight

You have a warehouse full of computers

You have the electric bill that it takes to power a warehouse full of computers

Plus the storage rental costs of the warehouse space

The internet bill to keep all your computers in touch with the blockchain

The air-conditioning bill that it takes to keep the warehouse from just flat-out melting

Ongoing maintenance costs

Replacement parts

Not just any parts, you are buying up high-quality graphics cards and computer chips that can do the fastest processing

So much that it’s contributing to a global computer-chip shortage (this is not an exaggeration; Wall Street Journal source, Tech Republic source)

And the power demands are so high that defunct power plants are being re-activated to fill them (also not an exaggeration; Ars Technica source)

And the processing requirements just keep going up and up and up....

When the exchange rate for Bitcoin is at $10,000, that implies “the cost of the equipment, maintenance, and power bills to mint 1 Bitcoin is now so high that people would rather pay $10,000 cash than deal with it.”

...okay, this is a little oversimplified -- there’s also gambling and speculating involved. Say, you think oil prices are about to go up, maybe you pay a little more than the current rate, figuring the power costs of mining are about to get more expensive and you’ll come out ahead. Or say Elon Musk said something mean about a coin you have, maybe you sell all your tokens for a lower price, figuring it’s better to get out now than wait for it to crash even farther.

But you can see how they’re generally connected. Nobody would pay around $10,000 if the production cost was around $10.

One more link (which explains some of the same things in different words, in case mine aren’t working for everyone):

Here Is The Article You Can Send To People When They Say “But The Environmental Issues With Cryptoart Will Be Solved Soon, Right?”

And, finally, let’s tie this back to NFTs:

Another thing you need for your currency to work: it has to be useful for something other than “gambling on the price.”

It can’t just be something you endlessly swap for other currencies and hope the exchange rate works in your favor! There have to be places that say “we will take this in exchange for Tangible Goods And Services.”

Bitcoin has this, at least a little bit. Most places aren’t lining up to accept it, but it’s been around long enough to build up some credibility, so there are a few.

If I started a new cryptocurrency tomorrow where the cost of mining the first token was $10K, nobody would bother. Because it has no credibility, no staying power, no way to ever convert that currency into actual stuff.

To be clear, people are launching new cryptocurrencies all the time.

Most of them aren’t even trying to be useful, they’re just pump-and-dump schemes. Meaning the founders pump up people’s interest with “ScamToken will be the next Bitcoin, don’t miss this amazing opportunity, convert your $$$ into ScamToken now while it’s cheap!” Then they dump all their tokens, selling them to all the people they’ve convinced to buy. It isn’t long before the hype fades, the cold reality of “we can’t do anything with this” sets in, and the buyers are left with wallets full of tokens nobody new will buy, while the founders walk away with the $$$.

But some people are playing a longer game. They don’t want their currency to get “an afternoon’s worth of excitement from hyped-up crypto speculators” and then immediately flop. They want it to be useful for actually buying something, so it has a legitimate basis for getting some actual, stable value in the long run.

Or, failing that...they want it to appear to be useful for buying something. So it looks more credible. So the excitement lasts longer. So you reach outside the circle of “people who follow crypto for its own sake” and get the attention of “people who don’t care about crypto at all, but who do care about whatever Something you’ve convinced them your token will buy.”

So, hey: how big, do you think, is the market of people who care about digital art?

Now start paying attention to how many press releases for “an amazing opportunity to buy some cool new Non-Fungible Tokens” include "by the way, the specific Tokens we’re selling are from a cryptocurrency you’ve never heard of, let alone bought.”

WTF is an NTF? No matter how many times I've had it explained to me, it still makes no sense. The best I can figure that it's a form of cryptocurrency with personalized artwork made on a really environmentally unfriendly material being sold for ridiculous prices just so suckers can get unique furry artz

40K notes

·

View notes

Photo

We are working to restore harmony to nature, and is there a better way than going back to the source. ALMIGHTY who created it made for it a system and a pattern known in the scientific community as the golden ratio. For more watch the following video: https://youtu.be/2tv6Ej6JVho نعمل لإرجاع التناغم مع الطبيعة، وهل توجد وسيلة أفضل من الرجوع للمصدر. فمن أوجدها سبحانه جعل لها نظاما ونمطا يعرف في الوسط العلمي بالنسبة الذهبية. لمعرفة المزيد تابعوا الرابط أسفله: https://youtu.be/aKc1xTHSjIQ Picture accredited with thanks to: SketchUpplanations.com #e3plusdesign #OneHumanity #OneUmmah #OneUnitedAfrica #entrepreneurship #coaching #Mindfulness #businessdevelopment #internationalrelations #globaltrade #UmmahforEarth #socialentrepreneurship #sustainability #renewableenergy #architecture #GreenPeace #environment #climatechange #peaceandlove #globalpeaceambassador #Starjimo #motivation #success #innovation #leadership #digital #blockchain #collaboration #generationofhope #youthpower https://www.instagram.com/p/CU7gufDIc6z/?utm_medium=tumblr

#e3plusdesign#onehumanity#oneummah#oneunitedafrica#entrepreneurship#coaching#mindfulness#businessdevelopment#internationalrelations#globaltrade#ummahforearth#socialentrepreneurship#sustainability#renewableenergy#architecture#greenpeace#environment#climatechange#peaceandlove#globalpeaceambassador#starjimo#motivation#success#innovation#leadership#digital#blockchain#collaboration#generationofhope#youthpower

2 notes

·

View notes

Text

NFTs Have Investors Opening Their Wallets, Fans Opening Their Hearts, and Artists Granting Lifelong Concert Tickets

We all remember the Bitcoin buzz that started about five years ago. Whether you tapped into it or completely tuned it out, the advent of new technologies is only becoming more and more common, as they make their way into our daily lives. After all, technology is expanding exponentially. (Friendly reminder that IBM has an almighty quantum computer sitting in their basement–no big deal).

Though we may not all be bound to become Bitcoin experts, we are bound to become experts in adapting to the technologies that continue to change the game of every industry–technologies like NFTs, which will not only affect the blockchain game but also the entire, beloved music industry.

Before we dive into that, let’s chat about the basics. Think of blockchain technology as a well-secured house and Bitcoin as the roommate with the biggest room. Bitcoin functions as fungible cryptocurrency, fungible meaning the values are mutually interchangeable. If you have one Bitcoin and I have one Bitcoin, both are worth the same amount.

NFT stands for non-fungible token. Unlike Bitcoin, NFTs earn their value primarily from being a unique piece, like a fine art painting that’s the only one of its kind or a concert ticket each with its unique code, date, and seat number. Think of Bitcoin as a deck of playing cards, and NFT as that lone baseball card you dream of getting your hands on. The only reason people value the baseball card is because of its rarity, its non-fungibility; that’s what gives the card its value.

It’s worth noting that the most common NFTs exist on the Ethereum network. Think of Ethereum as Bitcoin’s younger, cooler sibling with the smaller room in the house, who grew up with an iPhone and knows how to code his own app. While Bitcoin is the go-to digital dollar, Ethereum is on the cusp of what’s to come, making way for the next level of innovation, with features such as smart contracts that allow NFTs to be stored and transferred securely.

This ability, combined with blockchain’s ability to verify the owners and original creators of these tokens, is foundational to the functioning of this world. You want to make sure Joe from down the street isn’t printing a copy of your original baseball card and claiming it’s his. Nice try, Joe. Blockchain warned me about you.

But I don���t blame Joe for trying. The value placed on rare collectibles and other NFTs has people opening up their wallets and notifying their banks not to be sketched out when they drop MILLIONS on this weird internet thing.

Bids are skyrocketing. But here’s where it gets really interesting: every time an NFT is resold, the artist or original holder gets a dividend. For example, let’s pretend for a moment that Leonardo da Vinci was alive and well. If he pinned the Mona Lisa as an NFT, every time someone outbid the previous person to own the original painting, da Vinci would get a cut of that check. He’s accruing revenue more than once, and that revenue is likely increasing with each bid.

In this way, NFTs are revolutionary in opening up a new revenue stream for artists, both the da Vinci’s of the world and musicians like Justin Blau (“3LAU”) who, according to the Wall Street Journal, has made $17 million from NFTs just this past month. In the beginning of March, Blau minted his three-year-old “Ultraviolet” album as an NFT, claiming the highest bidder could also earn a collaboration with him. Not only has it grossed $11.6 million, it also “briefly held the record for the highest price paid for a single NFT” at $3.6 million. And Blau is not alone.

Illmind auctioned the rights to a royalty-free sample pack as an NFT. Deadmau5 auctioned digital collectible NFT packs, both 4,000 of a standard version and 2,000 of a “Mega” version with live show content, stickers, 3D artwork, pins and other exclusive goods. Beside the artists themselves, other aspects of the industry, such as streaming and touring, are also tapping in.

For example, ROCKI is a streaming platform that created its own blockchain that “allows artists to earn the ROCKS cryptocurrency for their streams… using a User-Centric payment system that pays the majority of the subscription revenue from a listener directly to the artists they are streaming.” The company recently auctioned off 50% of future royalty rights for a song on the platform through NFT. Kings of Leon was the first to drop a full album as an NFT, also granting its ultimate buyer a life-long, VIP, and front row seat ticket to every Kings of Leon tour for the rest of time. Just last week, alt indie band Faux Real dropped the first ever “NFT live show,” an NFT for a one-time real-life private concert.

As Blau told Wall Street Journal, “‘I think this technology will definitely change the world, but I’m cautiously optimistic because no one really knows how to value this stuff.”’ Let’s talk about why the world is both cautious and optimistic about NFTs.

NFTs gain their value through supply and speculation. Basically, hype runs the show. Many factors can saturate or dilute this hype, such as the influence of the original creator and the fame or number of previous owners. If you’re a big name already on the hype train, NFTs are a great additional revenue source. More so, if you’re still trying to put yourself on the map, finding creative ways to break through the noise and foster hype and demand through NFTs can get you on it. That hype, which determines the price of your token, can even be used to leverage growth, enticing label deals or potential sponsorships.

That growth can also take place in the relationship between an artist and their fans who are willing to bid big bucks to receive exclusive content. Next, NFTs cut out the middle man, allowing the transfer to take place directly from the creator to its new owner. This is immensely empowering for artists who don’t need a middle man playing messenger and taking a major cut of the profit from this new revenue stream; however, while blockchain technology can create secure smart contracts and authenticate the owner of an NFT, this world is still quite new and unregulated.

Tokenizing an album or song is like giving someone ownership of a one-of-a-kind vinyl, except now instead of a vinyl it’s an mp3 file of the song. There is never a guarantee that that file is safe once sent, even if the receiver purchased it. Similarly, if you’ve tokenized a piece of digital art, there is no way of verifying whether someone downloaded it and redistributed it for their own profit.

This also gets one thinking about the line between art consumer and owner. If you purchase an NFT of an artist’s song or forever-concert ticket, it’s almost as though you’re betting on their success. Every time you profit from their song, so do they–almost like owning a share in the same, unique stock. Every time that artist levels up, that lifelong concert ticket of yours increases in value. Think of all the artists and bands you KNEW were going to blow up, think of how much money you could have made.

Will people start investing in new music, setting NFT prices based on their bet of what will blow up next? If the labels use their exclusive insight to participate or influence the market, are they taking part in insider training? If I make an account right now, is it too late to purchase a crypto kitty?? (If you’re not sure what this is and you’d like to be further entertained, I highly encourage you to google it).

Whether or not this buzz is built to last, NFTs will set a precedent for the potential of new revenue streams for artists and investors alike. After all, being a creator also means being a full-time investor. Whether you’d like to buy an NFT, release one, or stay off the internet all together, one thing is for sure–like the quantum computer chillin in IBM’s basement, these new technologies are not going anywhere anytime soon.

3 notes

·

View notes

Video

vimeo

Virtual Gallery-Tour -2nd Floor from Claude Edwin Theriault on Vimeo.

We are moving to the second floor where there are mostly digital designs 2020 onward. At the top of the stairs we have Tower Dubai, a symbolist representation of the spirit of Mankind that built this new Tower of Babel.

These images are not paintings like I did from 1980 to 2020 they are overlays, where I take an image sometimes two and overlay them to an other turning multiple dimensions into one. So as to express the different worlds running parallel to each other.\

This is The Spirit Mankind and Notre Dame de Paris Burning.... it's now in a Digital NFT on opensea.io I am keen on crop circles as well as Architecture and how it all melts into the Fibonacci laws of proportions in all things. Knights Templar, Pontifical Guard, Freemasons since they hold the intrigue of a court of Kings. Their aspects of Ritual and discipline make it a great source of Inspiration for centuries. It’s all a holding sphere for deployment onto the Blockchain via ERC 1155 smart contracts, I have figured out how to do and am at it daily. Images that have an ecstatic different from the cyberpunks, more like visual Faberge Eggs that calm your mind. The shift for self representing to have a true say and get paid for it; is amongst us. With Old Art Cliques and paradigms falling by the wayside.

This breast painting is a painting I did in the 1980s superimposed onto a breast plate with colour of blood to represent life and death two parallel worlds. It’s all changing for the better, comment below so I can get feedback, follow me here as long as I have a youtube channel since they are at times touchy about my use of the almighty Male nude. Which to me a talisman prop I use to represent Bare “Thought”

A man for all Time expressive and yet personal……Nude as a Heroic symbol like a thinker A basic naked man Where the fertile thought slowly elaborates itself within his brain. He is no longer a dreamer. He is a Creator.

1 note

·

View note

Text

Unintended Blackholes | Sheer Ignorance & What follows..

Mint this as a Timeless NFT that will Forever live on the blockchain | Representation – “Death by a thousand Cuts – On the hands of your own people“ CLICK HERE

WE THE PEOPLE

With Great Power Comes Great Responsibility, which America’s forgotten about – “HURRAH”

For the select few who tarnished the noble image of what was once a great nation, here in hopes to a better and brighter future for the “Man in the Arena“ – America

Yield your power accordingly, as time is fleeing and the only thing redeeming this image is the constitution, which stands for human dignity/liberty. Otherwise you have committed atrocious crimes around the world, all in the name of money. And am not sure how that sits with the almighty… The reckoning should frighten you from the unconscious evil you have gladly marched towards for the last 50+ years

READ FULL ARTICLE

0 notes

Text

‘The Next Generation’—BlackRock CEO Reveals $8 Trillion Fund’s Huge Crypto Prediction After Bitcoin And Ethereum Price Crash

New Post has been published on https://petn.ws/te2A1

‘The Next Generation’—BlackRock CEO Reveals $8 Trillion Fund’s Huge Crypto Prediction After Bitcoin And Ethereum Price Crash

Bitcoin BTC , ethereum and other major cryptocurrencies have suffered an almighty crash this year (though Elon Musk sent one small cryptocurrency sharply higher). Subscribe now to Forbes’ CryptoAsset & Blockchain Advisor and successfully navigate the bitcoin and crypto market crash The bitcoin price has crashed by around 70% since late last year, plunging under […]

See full article at https://petn.ws/te2A1 #OtherNews

0 notes

Text

‘Headed For Oblivion’—$800 Billion Crypto Price Shock Sparks Fears Of Catastrophic End For Bitcoin And Ethereum

‘Headed For Oblivion’—$800 Billion Crypto Price Shock Sparks Fears Of Catastrophic End For Bitcoin And Ethereum

Bitcoin BTC and crypto markets have suffered an almighty crash in the aftermath of FTX’s shock implosion—with president Joe Biden leading calls for game-changing crypto rule changes. Subscribe now to Forbes’ CryptoAsset & Blockchain Advisor and successfully navigate the latest bitcoin and crypto market crash The bitcoin price has dropped under $15,500 per bitcoin while the ethereum price is…

View On WordPress

0 notes

Text

God Sides with the Blockchain to Launch a Vatican Metaverse NFT Gallery

God Sides with the Blockchain to Launch a Vatican Metaverse NFT Gallery

NFTs received a huge boost today, as the lord almighty put his/her faith in the blockchain. None other than the Pope and his cabal of lackeys at the Vatican have announced it will diversify into non-fungible tokens. In a press release, Metaverse pioneer, Sensorium, revealed it has inked an incredible deal with Vatican affiliated non-profit, Humanity 2.0. Together, this unlikely duo will build an…

View On WordPress

0 notes

Text

5 Must-Read Articles in the Evening | Which blockchain company is a16z invested in?

5 Must-Read Articles in the Evening | Which blockchain company is a16z invested in?

1. From popular digital idols to tireless virtual employees, what have they done to digital people? Virtual digital human technology is constantly evolving, from early singing and dancing idols to AI assistants to virtual human employees who can adapt to a variety of work scenarios. In terms of pure utility, there is reason to mimic human behavior and use almighty artificial intelligence.…

View On WordPress

0 notes

Photo

New Post has been published on https://primorcoin.com/metaverse-tokens-surge-after-meta-tanks-dorsey-roasts-diem-after-it-shuts-down-a-new-malware-can-target-40-browser-wallets-hodlers-digest-jan-28-feb-5/

Metaverse tokens surge after Meta tanks, Dorsey roasts Diem after it shuts down, a new malware can target 40 browser wallets: Hodler’s Digest, Jan 28-Feb.5

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

Top Stories This Week

Hodlers beware! New malware targets MetaMask and 40 other crypto wallets

According to a report from security researcher 3xp0rt, a powerful new malware variant known as the “Mars Stealer,” an upgrade of the information-stealing Oski trojan of 2019, can target more than 40 browser-based crypto wallets, including MetaMask and Coinbase Wallet, along with popular two-factor authentication (2FA) extensions.

The nefarious software utilizes a grabber function that steals private keys after it has been downloaded, unbeknownst to the user who may have visited or utilized various channels, such as file-hosting websites, torrent clients and any other shady downloaders.

Notably, the malware checks the set language of the device, and if it matches the language ID of locations such as Kazakhstan, Uzbekistan and Russia, the software leaves the system without any malicious activity.

However, for any device with a language outside of those categories, the malware targets files holding sensitive information, such as crypto wallets’ address info and private keys. Then, it leaves without a trace.

Jack Dorsey: Diem was a waste of time, Meta should’ve focused on BTC

Twitter founder and former CEO Jack Dorsey has unsurprisingly slammed the move of a competitor, with Meta (formerly Facebook) taking the hit for its “wasted effort and time” not working on Bitcoin.

Dorsey is an avid Bitcoin supporter who has made the asset a focus of his newer, shinier company, Block. During an interview with BTC bull Michael Saylor on Tuesday, Dorsey commented on the recent shutdown of Meta’s stablecoin project, Diem, which has been plagued with regulatory pushback since it began.

“Those two or three years or however long it’s been could’ve been spent making Bitcoin more accessible for more people around the world,” the almighty Dorsey said from his throne.

Rise of Web3: Metaverse tokens surge as Meta’s share price plunges

Speaking of Meta, the firm’s share price took a nosedive of around 26% on Thursday following a lackluster quarterly earnings report that revealed an annual profit decrease and a decline in daily active users.

Meta reported $33.67 billion worth of total revenue for Q4 2021, compared to $28 billion the year prior. However, its net income fell to $10.28 billion from $11.2 billion one year earlier. A hefty $10 billion investment in its Reality Labs division also contributed to the disappointing quarterly results.

While the centralized metaverse-focused firm faced choppy waters, native tokens from decentralized counterparts in The Sandbox (SAND) and Decentraland (MANA) jumped 17.5% and 20%, respectively. Commenting on the news, Animoca Brands chairman and co-founder Yat Siu suggested that this was part of a broader trend in which the top talent and users from Web2 platforms are shifting to the open world of Web3.

$2.5B in stolen BTC from Bitfinex hack awakens

According to blockchain analytics bot Whale Alert, a hefty $2.5 billion worth of BTC obtained via the 2016 Bitfinex exchange hack moved from the hacker’s wallet to an unknown address on Tuesday.

The funds have remained inactive since 2016 as the hackers are essentially unable to cash out the holdings. Many onlookers have pondered whether the hacker has started moving the funds around again to manipulate the market and scare investors into selling their BTC.

The largest transaction Whale Alert detected was around 10,000 BTC, or $383 million, while other transactions amounted to as little as 0.29 BTC. The wallet address that received the blacklisted BTC now holds a total of 94,643.29 BTC, which is around $3.6 billion.

Another solo Bitcoin miner solves valid block, becoming the 4th in 2022

A solo Bitcoin miner and Solo CKPool user with a whooping 1.14 petahashes per second (PH/s) of computing power was lucky enough to generate a $240,000 block reward on Tuesday. While the odds of it happening were estimated to be lower than 20%, it is apparently the fourth “blockfind” for the CKPool since mid-January.

The miner utilizes the Solo CKPool, a service that offers anonymous solo Bitcoin mining for a fee. While the miner is described as a “whale” in this instance due to their high computational power, in January a CKPool miner with a minuscule hash rate of just 126 terahashes per second (TH/s) was able to solve a valid block.

CKPool’s solo miners have solved 264 blocks over the entirety of the Bitcoin blockchain’s existence, representing a mere 0.037% of the total 721,240 blocks solved.

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $37,948, Ether (ETH) is at $2,830 and XRP is at $0.61. The total market cap is at $1.76 trillion, according to CoinMarketCap.

The top two altcoin gainers of the week are OpenDAO (SOS) at 76.22% and ConstitutionDAO (PEOPLE) at 61.80%. The top three altcoin losers of the week are Moonbeam (GLMR) at -22.63%, Frax Share (FXS) at -18.20% and Telcoin (TEL) at -14.74%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“Structurally, on-chain, it’s not a bear market setup. Even though I would say we’re at peak fear. No doubt about it, people are really scared, which is typically […] an opportunity to buy.”

Willy Woo, Bitcoin on-chain analyst

“This whole thing with Libra and then Diem, I think there’s a ton of lessons [there]. […] Hopefully, they learned a lot, but I think there’s a lot of wasted effort and time.”

Jack Dorsey, founder and CEO of Block

“Do not ask me to do a fucking NFT.”

Kanye West, hip hop icon

“Losing a half-million dollars worth of crypto by mistake is something that needs to be addressed before crypto can become mainstream. When it’s this easy to lose everything, there’s no way your grandma is going to be using it.”

u/0150r, Reddit user

“If you only focus on eliminating risks associated with a specific industry in regulatory efforts, you would also eliminate any potential benefits and opportunities that would otherwise be offered by the same industry.”

Elçin Karatay, Turkish law expert

“I think we’re not entering a long-term crypto winter. […] There have been changes in expectations of interest rates, and that’s been moving crypto markets. But it’s been moving markets more generally as well.”

Sam Bankman-Fried, CEO of FTX

“We can avoid making the same mistakes we did with Facebook, Instagram, Twitter, and social media generally if we can develop an intellectual framework for regulating the Metaverse now.”

Bradley Tusk, CEO and founder of Tusk Ventures

“It’s become clear to me that #Bitcoin will be the one asset and L1 still around in 20+ years with increased compounding relevance over time.”

David Marcus, co-founder of Diem

Prediction of the Week

Can Ethereum price reach $4K after a triple-support bounce?

Pseudonymous chart analyst Wolf has read the tea leaves and forecasted that Ether will continue its recent rebound up to around the $4,000 region.

Central to Wolf’s short-term prediction over the next couple months is whether Ether’s so-called triple-support scenario could push the price past $3,330, which would establish an inverse-head-and-shoulders (IH&S) pattern that could launch the price toward late-2021 levels.

In a “perfect” scenario, a break above the IH&S neckline may push the Ether price to as high as the maximum distance between the neckline and the head, which would be around $4,000 in this case.

FUD of the Week

Wormhole token bridge loses $321M in largest hack so far in 2022

The Wormhole token bridge was the victim of a major breach this week, as attackers made off with a whopping 120,000 Wrapped Ether (wETH) worth roughly $321 million at the time.

The cross-chain bridge supports several blockchains, allowing the attacker to target the Solana side of the bridge by minting 120,000 wETH. They then redeemed 93,750 wETH for ETH, worth roughly $254 million, on the Ethereum network.

The Wormhole team stated shortly after the incident that it was working to replenish enough ETH “to ensure wETH is backed 1:1,” with reports surfacing the following day that venture capital fund Jump Crypto had dipped into its own pocket to do so. The hacker has also been offered a bounty of $10 million by the Wormhole team to return the funds.

Youtuber and alleged thief publicly refuses to return investors’ funds after $750k rug pull

Disgraced content creator and influencer Paul “Ice Poseidon” Denino found himself in hot water this week after YouTuber and “internet detective” Coffeezilla published a not-so-flattering series of videos about him.

Coffeezilla initially posted a video interview between the two in which Ice Poseidon allegedly confirmed that he rug-pulled around $750,000 worth of investors’ money from a crypto project he launched called “CxCoin.”

The CxCoin project was pitched to his investors as a long-term investment. However, within a few weeks of launch, the influencer said he stopped working on the project and decided to pull out around $300,000 from the liquidity pool. He cited the crashing crypto market as the reason for this move, and then said he wouldn’t return the funds. He also allegedly bought a brand new Tesla only a few days after the funds went missing.

Kanye West says no to NFTs

Hip hop legend Ye, more commonly known as his birth name Kanye West, shut down any notion of jumping into NFTs on Monday after he made a strongly worded Instagram post to his 10.7 million followers stating, “Do not ask me to do a fucking NFT,” and that he only wants to work on “building real products in the real world.”

“STOP ASKING ME TO DO NFTs I’M NOT FINNA CO-SIGN … FOR NOW I’M NOT ON THAT WAVE I MAKE MUSIC AND PRODUCTS IN THE REAL WORLD,” he stated in a follow-up comment on his Instagram post.

While some might call it FUD that a major celebrity and cultural icon like Kanye West is not hopping aboard the NFT gravy train, it is kind of refreshing to see a popular figure not mindlessly shill something they do not fully comprehend.

Best Cointelegraph Features

What the hell is Web3 anyway?

Web3 — or Web 3.0 as crypto boomers like to call it — is a topical buzzword with only a very vague definition. Everyone agrees it has something to do with a blockchain-based evolution of the internet but, beyond that, what is it, really?

Web3 developer growth hits an all-time high as ecosystem matures

Web3 developer growth hit an all-time high in 2021, yet challenges lie ahead for new developers flooding the space.

NFT philanthropy demonstrates new ways of giving back

Organizations and artists are using NFTs to give back to children in need, demonstrating new potential for nonfungible tokens.

Source link

#Blockchain #Coinbase #CoinbaseNews #Crypto #CryptoNews #TraedndingCrypto

0 notes

Photo

Hello friends, Algiers Agha train station at 4:50 AM, I lived a fulfilling life of containment by the grace of GOD ALMIGHTY 🙏 Thank you ALLAH. #photography 👌ok نسعد لخدمتكم بإحسان 💞 Your service request is our privilege ☺️ ✍️ Happy to read from you🤳طلباتكم عبر الرابط 👉 bit.ly/E3plusHello ✅ 🇺🇳 👫 Together toward a progressive excellence 🏞️ 👥 Tag and share with friends 💡 🔔 Turn on post notifications 😃 📸 @starjimo 🏫 @e3plus.dz 🤝 nadjme.net Wishing you success! #e3plusdesign #OneHumanity #OneUmmah #OneUnitedAfrica #socialentrepreneurship #coaching #Mindfulness #businessdevelopment #internationalrelations #globaltrade #UmmahforEarth #sustainability #renewableenergy #architecture #GreenPeace #environment #climatechange #globalpeaceambassador #motivation #success #innovation #leadership #digital #blockchain #collaboration #generationofhope #youthpower https://www.instagram.com/p/CatUyQ-tkAJ/?utm_medium=tumblr

#photography#e3plusdesign#onehumanity#oneummah#oneunitedafrica#socialentrepreneurship#coaching#mindfulness#businessdevelopment#internationalrelations#globaltrade#ummahforearth#sustainability#renewableenergy#architecture#greenpeace#environment#climatechange#globalpeaceambassador#motivation#success#innovation#leadership#digital#blockchain#collaboration#generationofhope#youthpower

0 notes

Text

NFT- Road to Commando 0002

Today has been a very studious day. I got into the nooks and crannies of a lot within the new digital space. I mean, we’re talking: Ethereum, blockchain basics, how miners get rewards, crypto-wallets, and a lot more. This field is absurdly huge. It is ridiculously huge. It would take about a year to develop a decent understanding of all things crypto, but the truth is I need to jump in NOW! NFT’s, web3 communities, and DeFi are all interesting matters I want to get into. I realized that I needed to get some kind of blockchain certification and java programming in my toolset, but that’s later down the road. I need to see which wallets I should get (especially for NFTs) for the time being.

I recently watched a youtube video under the channel “The Bitcoin Express,” Homeboy explained how NFT’s are more than just awesome profile pictures or social status...they are the next generation of entertainment and media companies. That completely changed the way I see this market! In all honesty, it makes sense now why Nike would jump on board. Soon, we’ll have Netflix, Disney, HBO, and other big corporations jumping into the NFT space. The craziest part is that it’s still in the early early stages of development, but I have a feeling it can only go up from here. Of course, it can’t go “straight-up”...nothing in this world goes up without a few bumps in the making. Who knows how the legislation will affect digital assets in the future.

I would like to take the time to see what my next steps are. For one, I need cash(lol), but more importantly, I want to jump into the NFT community. I am just not sure where to start. I researched the tools, but I would rather get acquainted with what’s popping, where everyone is setting their eyes toward. What’s funny, what’s interesting, what’s mundane. This is where I want to be. There is a couple of youtube channels that I currently follow, but everyone says you need to look at Twitter. Twitter is fast, youtube is slow but condenses information that is pretty. Maybe I need to research how Twitter works and how I can make it enjoyable because, as of right now...it’s the most f’n boring platform I have ever come across. It’s talking out loud into a void and hoping someone says something??? Where is the joy in that?

Oh, now that I think about it. You know what’s fucked up...NFT TOOLS. For the love of God almighty, they are so powerful!!!! They are costly, but the amount of decision-making leverage is absurd. I wonder if people worry about how they can compete. Then again, I should only worry if I were a whale, but that is just my hot take. Whenever I think of whales, I remember that little “.io” games people used to play where you start as a blob and eat your way to become the most enormous blob in the game...good game.

0 notes