#xrp/usd

Explore tagged Tumblr posts

Text

XRP at a Crucial Juncture: Will Liquidity Absorption Alter the Game?

The XRP market finds itself at a critical juncture, with the emergence of potential signs of liquidity absorption sparking questions about the cryptocurrency's future trajectory. A sudden dip in XRP/USDT has raised concerns among traders and investors, prompting a closer examination of key indicators that could influence its price movements.

As of the latest update, XRP is trading at $0.509052, accompanied by a 24-hour trading volume of $1.7 billion. The past 24 hours have seen a 5.18% decline in XRP, heightening the apprehension within the market. A detailed analysis of the 4-hour Relative Strength Index (RSI) reveals a value of 31.63, indicating that XRP has entered oversold territory. This signals the potential for a price correction or a rebound in the near future.

A deeper dive into the 4-hour chart showcases the 50 EMA, 100 EMA, and 200 EMA, all pointing towards a short-term downward trend for XRP. The 4-hour Moving Average Convergence Divergence (MACD) aligns with this, reflecting negative momentum in XRP's price.

While these indicators collectively present a complex picture, the oversold RSI, combined with the downward momentum signaled by the MACD, suggests that XRP could be poised for a price correction. However, it is crucial to acknowledge the inherent unpredictability of cryptocurrency markets, where various factors can influence the direction of prices.

An essential factor to consider is the overall sentiment in the cryptocurrency space, as news, regulatory changes, and market sentiment can significantly impact XRP's price movements. Staying informed and prepared for potential market shifts becomes imperative for traders and investors in this context.

Moreover, the concept of liquidity absorption and approaching the order block introduces the potential for alterations in market structure. Traders are advised to closely monitor XRP's price action in the coming days, as it could offer valuable insights into the cryptocurrency's future direction.

In conclusion, XRP stands at a crossroads, with keen attention on signs of liquidity absorption and potential shifts in market structure. The combination of an oversold RSI and downward momentum in the MACD hints at the possibility of a price correction or rebound. However, the inherent volatility of the cryptocurrency market emphasizes the need for caution and constant awareness of external factors influencing XRP's price movements

0 notes

Text

Crypto Price Today: Bitcoin Opens 2025 Above $95,000, Majority of Altcoins See Gains

The majority of cryptocurrencies began 2025 with notable gains, as reflected on both national and international price charts. Bitcoin, on Thursday, January 2, saw a 1.72 percent increase on global exchanges, bringing its value to $95,130 (roughly Rs. 81.5 lakh), according to CoinMarketCap. On Indian exchanges such as CoinDCX and CoinSwitch, Bitcoin’s price rose by 1.28 percent in the past 24…

View On WordPress

#binance coin#binance usd#bitcoin#bitcoin cash#bitcoin price today usd 95000 market profits ether cardano dogecoin solana xrp ripple cryptocurrency#braintrust#cardano#cartesi#circuits of value#dash#dogecoin#ether#flex#kishu inu#litecoin#monero#polkadot#polygon#qutm#ripple#shiba inu#solana#tether#tron#uniswap#usd coin#wrapped bitcoin#zcash

1 note

·

View note

Text

Ripple Announces Ripple USD Exchange Partners for Global Distribution

Former FDIC Chair Sheila Bair, Vice Chairman of Partners Capital and former CENTRE Consortium CEO David Puth, and Ripple Executive Chairman Chris Larsen Join the RLUSD Advisory Board Ripple, the leading provider of digital asset infrastructure for financial institutions, announced its exchange partners and customers for Ripple USD (RLUSD), an enterprise-grade, USD-denominated stablecoin created…

1 note

·

View note

Text

Widespread Worries Emerge as $100M Selloff Hits the Global Crypto Market

In a significant turn of events, the global cryptocurrency market underwent a massive liquidation exceeding $100 million within the last 24 hours, driven by a notable reduction in investor risk appetite. This downturn has triggered concerns and discussions within the crypto community, marking a period of heightened volatility and uncertainty.

CoinGlass data unveils a staggering $107.25 million in liquidation impacting approximately 55,000 traders. Among the major cryptocurrencies, Ethereum led the individual liquidations with $22.94 million, closely followed by Bitcoin at $20.75 million and Solana at $6.53 million. Notably, the largest single liquidation of $3.20 million occurred on OKX – ETH-USD-SWAP.

When examining crypto exchanges, Binance emerged as the frontrunner with $52.62 million in liquidation, trailed by OKX at $34.19 million and Bybit with $12.06 million. Despite the overall market turmoil, there was a 1.81% surge in total BTC Futures open interest over the last 24 hours.

However, Bitcoin open interest on the CME exchange experienced a 1.66% decline to $4.69 billion or $114.49K BTC. Simultaneously, Bybit observed a 1.05% dip in Bitcoin open interest to 76.49K BTC or $3.14 billion.

Analysts attribute this market downturn to profit-booking maneuvers, advising traders to carefully evaluate market conditions. The impending release of Q4 preliminary U.S. GDP data and PCE inflation data this week adds an extra layer of uncertainty, potentially influencing the Federal Reserve's economic stance.

Ongoing legal challenges within the crypto space, notably the SEC's actions against major exchanges like Binance and Coinbase, contribute to investor concerns. The outcomes of these legal battles, combined with macroeconomic factors such as the upcoming Federal Reserve meeting, are keenly anticipated for potential insights into future regulatory developments.

Against this backdrop, the global crypto market experienced a 3.16% decline to $1.59 trillion, accompanied by a 34.50% rise in overall trading volume to $42.49 billion. Leading cryptocurrencies, including Bitcoin, Ethereum, Solana, BNB, and XRP, witnessed substantial declines over the past 24 hours.

0 notes

Text

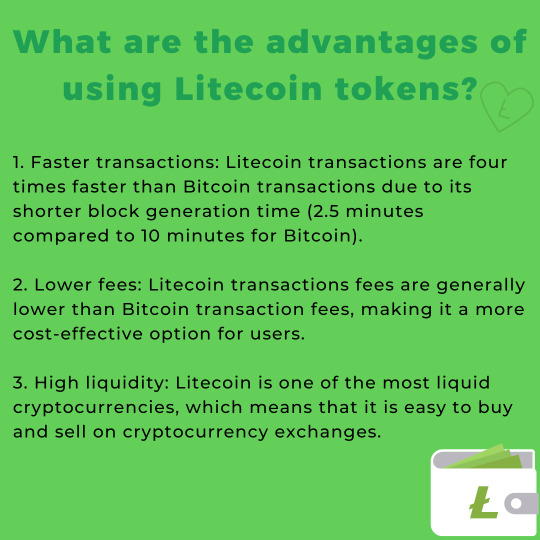

La crypto-monnaie votée cette semaine est le LITECOIN (LITE).

Le Litecoin est une crypto-monnaie facile à acheter et à vendre sur les échanges de crypto-monnaies.

www.flashlly.com/fr

#Flashlly #plateforme #cryptomonnaie #crypto #blockchain #technologie #quotidiencrypto #investir #investisseur #bitcoin #apprendrelescryptos #echange #flashllyers

#crypto#cryptocurrency#flashlly#plateforme#échange#monnaie#hausse#finance#investissement#wallet#btc#bitcoinnews#bitcoin#dollar#usd#dogecoin#litecoin#ltc#ripple#xrp#bourse#commencement#maintenant#website#épargne

0 notes

Text

The Expansive World of Altcoins: Exploring the Diversity Beyond Bitcoin

Bitcoin, the original cryptocurrency, has long dominated headlines and market discussions. However, the world of digital currencies is vast and diverse, with thousands of alternative coins, or altcoins, each offering unique features and value propositions. Altcoins encompass a broad range of projects, from utility tokens and stablecoins to meme coins and more. This article delves into the rich ecosystem of altcoins, highlighting their significance, various types, and the innovative projects that make up this vibrant space, including a mention of Sexy Meme Coin.

Understanding Altcoins

The term "altcoin" refers to any cryptocurrency that is not Bitcoin. These coins were developed to address various limitations of Bitcoin or to introduce new features and use cases. Altcoins have proliferated since the creation of Bitcoin in 2009, each aiming to offer something different, whether it be improved transaction speeds, enhanced privacy features, or specific utility within certain ecosystems.

Categories of Altcoins

Utility Tokens: Utility tokens provide users with access to a specific product or service within a blockchain ecosystem. Examples include Ethereum's Ether (ETH), which is used to power applications on the Ethereum network, and Chainlink's LINK, which is used to pay for services on the Chainlink decentralized oracle network.

Stablecoins: Stablecoins are designed to maintain a stable value by being pegged to a reserve of assets, such as fiat currency or commodities. Tether (USDT) and USD Coin (USDC) are popular stablecoins pegged to the US dollar, offering the benefits of cryptocurrency without the volatility.

Security Tokens: Security tokens represent ownership in a real-world asset, such as shares in a company or real estate. They are subject to regulatory oversight and are often seen as a bridge between traditional finance and the blockchain world.

Meme Coins: Meme coins are a playful and often humorous take on cryptocurrency, inspired by internet memes and cultural trends. While they may start as jokes, some have gained significant value and community support. Dogecoin is the most famous example, but many others, like Shiba Inu and Sexy Meme Coin, have also captured the public's imagination.

Privacy Coins: Privacy coins focus on providing enhanced privacy features for transactions. Monero (XMR) and Zcash (ZEC) are notable examples, offering users the ability to transact anonymously and protect their financial privacy.

The Appeal of Altcoins

Altcoins offer several advantages over Bitcoin, including:

Innovation: Many altcoins introduce new technologies and features, driving innovation within the cryptocurrency space. For example, Ethereum introduced smart contracts, enabling decentralized applications (DApps) and decentralized finance (DeFi) platforms.

Specialization: Altcoins often serve specific niches or industries, providing targeted solutions that Bitcoin cannot. For instance, Ripple (XRP) focuses on facilitating cross-border payments, while Filecoin (FIL) aims to create a decentralized storage network.

Investment Opportunities: The diverse range of altcoins presents numerous investment opportunities. Investors can diversify their portfolios by investing in projects with different use cases and growth potentials.

Notable Altcoins in the Market

Ethereum (ETH): Ethereum is the second-largest cryptocurrency by market capitalization and has become the backbone of the DeFi and NFT (Non-Fungible Token) ecosystems. Its smart contract functionality allows developers to create decentralized applications, leading to a thriving ecosystem of financial services, games, and more.

Cardano (ADA): Cardano is a blockchain platform focused on sustainability, scalability, and transparency. It uses a proof-of-stake consensus mechanism, which is more energy-efficient than Bitcoin's proof-of-work. Cardano aims to provide a more secure and scalable infrastructure for the development of decentralized applications.

Polkadot (DOT): Polkadot is designed to enable different blockchains to interoperate and share information. Its unique architecture allows for the creation of "parachains," which can operate independently while still benefiting from the security and connectivity of the Polkadot network.

Chainlink (LINK): Chainlink is a decentralized oracle network that provides real-world data to smart contracts on the blockchain. This functionality is crucial for the operation of many DeFi applications, making Chainlink a vital component of the blockchain ecosystem.

Sexy Meme Coin: Among the meme coins, Sexy Meme Coin stands out for its combination of humor and innovative tokenomics. It offers a decentralized marketplace where users can buy, sell, and trade memes as NFTs (Non-Fungible Tokens), rewarding creators for their originality. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of Altcoins

The future of altcoins looks promising, with continuous innovation and increasing adoption across various industries. As blockchain technology evolves, we can expect altcoins to introduce new solutions and disrupt traditional systems. However, the market is also highly competitive, and not all projects will succeed. Investors should conduct thorough research and due diligence before investing in any altcoin.

Conclusion

Altcoins represent a dynamic and diverse segment of the cryptocurrency market. From utility tokens and stablecoins to meme coins and privacy coins, each category offers unique features and potential benefits. Projects like Ethereum, Cardano, Polkadot, and Chainlink are leading the way in innovation, while niche coins like Sexy Meme Coin add a layer of cultural relevance and community engagement. As the cryptocurrency ecosystem continues to grow, altcoins will play a crucial role in shaping the future of digital finance and blockchain technology.

For those interested in the playful and innovative side of the altcoin market, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to explore this exciting project and join the community.

107 notes

·

View notes

Note

would you be interested in doing a post on crypto? Such as your experience with it and how it works. And why it is important ? it still confusing for me to fully grasp. Thank you :)

Crypto is digital money that exists only electronically. It’s not controlled by central banks or governments. It uses blockchain technology—a ledger enforced by a network of computers.

You store your crypto in digital wallets and can use it for purchases and investments. Just like stock market you can convert to real dollars and withdrawal.

For the last couple of years, large financial companies have been testing a quantum financial system (ISO 20022) which would be an international standard for exchanging electronic messages in the financial industry. This is estimated to be rolled out on a large scale in about a decade.

XRP for example is a digital currency created by Ripple to enable quick money transfers. Some believe it could play a key role in a future global financial system, often referred to as the Quantum Financial System (QFS), by acting as a bridge currency that facilitates value exchange between different currencies and networks.

In plain words, cryptocurrency is a new form of currency and we are still in the beginning stages of it all. Which means the ability to make a ton of money easier than ever before :) Bitcoin is a perfect example, was at 40k I believe beginning of the year and now 100k, this means that if you invested $5,000 USD in January, you would now have made 13,000 USD letting it just sit there. If you are actively trading in crypto and meme coins you have the ability to 100x your returns. For example when people buy in to a coin that’s trending/ new/ getting hype, like XRP recently, there is a significant surge.

To trade crypto you can use centralized exchanges like Binance, Fidelity Investments, Robinhood Crypto, OANDA etc. These platforms allow you to buy, sell and trade various cryptos. This is basically what the general population does. There are other ways like using bots, staking, futures and options, margins and leverage etc.

With meme coins, as they trend you have the ability to make a lot of money overnight. This ofcourse depends on your ability to study the trends and the communities built around those coins. It is always a risk!!!!

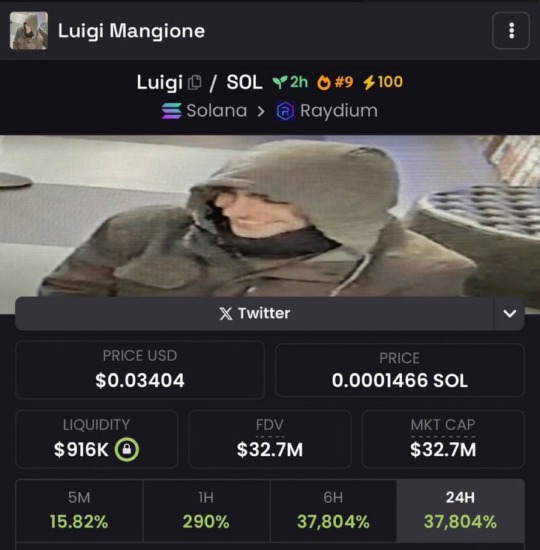

Here’s an example for meme coins:

$330k to $34M (100x) in less than 2h for a meme coin created for Luigi Mangione last week. So if you had put in $3,000 in the coin when it was at 330k, in 2 hours you would have made $300,000.

I can’t say enough that this involves you being on top of trends and markets.

THIS IS NOT FINANCIAL ADVICE!!! The market is very volatile and you are basically gambling your money! Staying informed is crucial!!!! :)

26 notes

·

View notes

Text

Let me educate you more about xlm and xrp

Xlm and xrp is a digital asset backed up by silver and gold, it will be used as the new currency when nesara and qfs system kicks in .

And the usd will collapse .

Banks will bankrupt.

You see why it needs to be done soon.

So everything can be switched to xlm and xrp to avoid losing all your funds in the banking system.

Dm for more information…

#maga 2024#donald trump#america#bank of america#bad government#fypシ#xlm#xrp news#qfs#bitcoin#breaking news#highlights#cnn news

8 notes

·

View notes

Text

BTC/USD: Bitcoin Surges 5% as Christmas Eve Ignites Crypto Market Momentum

Bitcoin (BTC/USD) experienced a notable rebound on Christmas Eve, reversing a three-day downward trend. The digital asset surged by over 5%, climbing from an intraday low of $93,000 to $99,000. This sharp price appreciation has sparked discussions about a potential Santa rally as the year draws to a close. With just a few trading days remaining, Bitcoin has solidified its position as one of the top-performing assets of the year, boasting an impressive annual gain of 123%.

The Broader Market Sentiment

The surge in Bitcoin prices reflects renewed optimism among investors, particularly as global economic uncertainties continue to push interest toward decentralized finance. Positive sentiment is further fueled by expectations surrounding the crypto industry’s growth under the administration of former President Donald Trump. With a focus on economic innovation, Trump has appointed a team comprising billionaires and tech entrepreneurs tasked with fostering crypto adoption and expanding institutional involvement.

Institutional Adoption and the Rise of Crypto ETFs

Bitcoin and Ethereum Exchange-Traded Funds (ETFs)

Currently, Bitcoin and Ethereum dominate institutional investment avenues, as evidenced by the approval of 11 Bitcoin ETFs and 9 Ethereum ETFs. These developments have positioned the two largest cryptocurrencies as primary gateways for mainstream and institutional investors looking to gain exposure to digital assets without directly holding them.

Prospective ETF Approvals for Emerging Tokens

Speculation is mounting about the potential approval of ETFs for other prominent tokens. Solana (SOL/USD), XRP (XRP/USD), and Reserve Rights (RSR/USD) are among the contenders for ETF listings in the coming year. Such listings could further legitimize these assets and drive significant inflows, enhancing their market value and liquidity.

Regulatory Outlook and Leadership Changes

The crypto industry is poised for potential regulatory reforms under a new Securities and Exchange Commission (SEC) leadership. Paul Atkins, rumored to succeed current SEC Chair Gary Gensler, is widely regarded as a pro-crypto advocate. If appointed, Atkins may introduce deregulation policies that promote innovation while addressing compliance concerns, setting the stage for broader crypto adoption.

Bitcoin’s Performance in 2023: A Year in Review

Key Milestones and Price Trends

Bitcoin’s 123% surge in 2023 underscores its resilience amid volatile market conditions. The cryptocurrency began the year with cautious optimism, trading around $44,000, before climbing to new heights fueled by institutional interest and technological advancements.

Catalysts for Growth

Several factors contributed to Bitcoin’s remarkable performance:

Institutional Interest: The introduction of Bitcoin ETFs increased accessibility for traditional investors.

Macro-Economic Factors: Persistent inflation and concerns over fiat currency depreciation drove investors toward digital assets as a hedge.

Technological Developments: Advances in Bitcoin’s Layer 2 scaling solutions, such as the Lightning Network, improved transaction efficiency.

Regulatory Clarity: Positive regulatory developments provided confidence to market participants.

Short-Term Outlook for Bitcoin

As the year concludes, analysts predict further volatility with a bias toward upward momentum. Traders are monitoring technical resistance levels near $100,000, a psychological barrier that could attract increased buying pressure if breached.

Broader Implications for the Crypto Market

The Role of Altcoins in the Current Rally

While Bitcoin continues to dominate, altcoins are also gaining traction. Solana, XRP, and RSR have displayed robust performance, spurred by rumors of upcoming ETFs and improved network functionalities. Investors are diversifying portfolios to capitalize on the growth potential of these emerging projects.

Institutional Adoption Trends

The influx of institutional capital into crypto assets is set to accelerate, driven by regulatory advancements and the proliferation of ETFs. Financial institutions are exploring blockchain-based solutions, further embedding cryptocurrencies into mainstream financial systems.

Regulatory Framework: A Turning Point

The anticipated appointment of a more crypto-friendly SEC Chair could pave the way for streamlined regulations, enhancing transparency and investor protection without stifling innovation. A favorable regulatory environment could unlock new opportunities for growth and development across the crypto ecosystem.

Predictions for 2024: What Lies Ahead?

Bitcoin’s Price Trajectory

Analysts project that Bitcoin may test higher resistance levels, potentially breaching the $100,000 mark. Factors such as increased institutional adoption, regulatory reforms, and macroeconomic trends will likely influence its price dynamics.

Altcoins on the Rise

Altcoins like Solana and XRP are positioned for substantial gains, driven by technological upgrades and anticipated ETF approvals. Investors should monitor developments in network scalability and interoperability, which could drive demand for these assets.

Evolving Market Infrastructure

The crypto landscape is expected to witness advancements in infrastructure, including decentralized finance (DeFi) protocols, non-fungible tokens (NFTs), and cross-chain interoperability. These innovations could attract new participants and boost overall market capitalization.

Regulatory Clarity and Adoption

With regulatory reforms on the horizon, 2024 could mark a turning point for mass adoption. Clearer guidelines may encourage institutional investors to allocate larger portions of their portfolios to cryptocurrencies, enhancing market stability and credibility.

Investment Strategies for Crypto Traders

Risk Management in Volatile Markets

Given the inherent volatility of cryptocurrencies, traders should employ risk management strategies such as stop-loss orders and position sizing to safeguard capital. Diversification across multiple assets can also mitigate risks.

Long-Term Holding vs. Active Trading

Investors should assess their risk tolerance and investment horizon before selecting a strategy. Long-term holders benefit from compounding gains, while active traders capitalize on short-term price fluctuations.

Leveraging Fundamental and Technical Analysis

Combining fundamental analysis, which evaluates project viability, with technical analysis, focusing on price patterns and trends, can provide a comprehensive approach to decision-making.

Conclusion: Capitalizing on Crypto Opportunities

Bitcoin’s 5% Christmas Eve rally highlights the resilience and growth potential of the cryptocurrency market. With institutional adoption on the rise, regulatory reforms in progress, and technological advancements unfolding, 2024 presents significant opportunities for investors.

As market dynamics continue to evolve, staying informed and adaptable will be key to navigating the complexities of the crypto space. Whether focusing on Bitcoin, altcoins, or emerging technologies, prudent strategies can help traders capitalize on this rapidly expanding market.

3 notes

·

View notes

Text

Crypto Predictions: Seven Top Coins Post Bitcoin ETFs Correction

The recent cryptocurrency market upheaval, seemingly influenced by the "buy the rumor, sell the news" trend, highlights the impact of heightened expectations surrounding the approval of exchange-traded funds (ETFs) for the primary cryptocurrency. This phenomenon draws parallels with the legal cannabis market, where anticipatory hype led to market losses post-legalization. However, the groundbreaking nature of cryptocurrencies, unlike cannabis, suggests a potential for more substantial shifts in the financial landscape.

The recent crypto selloff, attributed in part to FTX's bankruptcy and subsequent liquidation sale, has prompted market scrutiny. CoinDesk suggests a potential optimistic trajectory now that this event is behind us, signaling the possibility of brighter days ahead. Here are insights into seven key cryptocurrencies amidst these developments:

Bitcoin (BTC-USD): Bitcoin has dipped below the significant $40,000 mark, marking a seven-week low, attributed to FTX's liquidation sale. CoinDesk suggests a potential easing of bearish pressure, opening avenues for bullish sentiments, especially among contrarians. However, caution is advised as BTC currently trades below the 50-day moving average, emphasizing the importance of monitoring the market dynamics.

Ethereum (ETH-USD): Ethereum, closely following Bitcoin's market movements, has faced a 7.5% dip in the past seven days. While trading near its 50-day moving average, investors should be cautious in interpreting this as corrections occurred pre-Bitcoin's ETF approvals. Monitoring major fund outflows will be crucial for predicting potential recovery and identifying discount opportunities.

Tether (USDT-USD): Tether, functioning as a stablecoin, plays a vital role in the crypto ecosystem as a pegged liquidation mechanism. The deviation from its one-to-one peg, currently at 0.999 to the dollar, underscores a shift in the value dynamics between fiat and crypto dollars. Observing this trend reversal is crucial for strategic re-entry into the virtual currency space.

Solana (SOL-USD): As an alternative cryptocurrency, Solana has faced a substantial downturn, slipping over 7% in the past 24 hours and nearly 16% in the trailing seven days. Its challenge to maintain the 50-day moving average raises questions about a potential long-term discount. Patience is advised, considering historical rebounds after similar downturns.

XRP (XRP-USD): XRP's legal battles with the SEC have led to uncertainties, reflected in its recent market struggles. A deviation below the 200-day moving average and a 9% loss in the past seven days pose challenges. Patience is key, given previous recovery trends, but careful monitoring is essential to gauge a genuine bottoming level.

Dogecoin (DOGE-USD): Despite its origins as a joke, Dogecoin has evolved into a top-performing cryptocurrency, resilient to market fluctuations. With a modest 3% loss in the past 24 hours, it stands out for its community-driven support. While caution is advised, overlooking Dogecoin's unique position in the crypto landscape might disregard its significance as a decentralized investment class.

In navigating the post-Bitcoin ETFs correction landscape, investors are urged to exercise patience, monitor key indicators, and carefully assess the distinct dynamics of each cryptocurrency for informed decision-making.

4 notes

·

View notes

Text

افضل العملات للتداول؛ في عالم يتسم بالتطور التكنولوجي السريع والابتكارات المستمرة، برزت العملات الرقمية كأحد أبرز الظوا��ر في مجال الاقتصاد العالمي. لقد غيّرت هذه العملات، بقيادة البيتكوين ومتبوعة بعملات مثل إيثيريوم وريبل، الطريقة التي ننظر بها إلى المعاملات المالية والاستثمارات. مع تنامي شعبيتها، أصبح التداول اليومي باستخدام العملات الرقمية نشاطًا محوريًا لكثير من المستثمرين حول العالم، حيث يجذبهم إمكانية تحقيق أرباح سريعة نتيجة للتقلبات العالية في أسعار هذه العملات. ومع ذلك، يحتاج المتداولون إلى فهم عميق للسوق وتوخي الحذر الشديد نظرًا للمخاطر المرتبطة بهذا النوع من التداول. فإن اختيار افضل العملات للتداول يعتمد على عدة عوامل مثل الاستقرار الاقتصادي، السيولة، والتقلبات في أسواق الصرف الأجنبي.تعرف في التالي على أهم 7 عملات في العالم مع أهم المعلومات المتوافرة عنها. افضل العملات للتداول: العملات الأكثر شيوعًا للتداول بشكل عام، العملات الأكثر شيوعًا للتداول تشمل: الدولار الأمريكي (USD): يعتبر الدولار الأمريكي أحد أكثر العملات تداولاً في العالم بسبب قوة الاقتصاد الأمريكي ودوره كعملة احتياطية عالمية. اليورو (EUR): اليورو هو العملة الرئيسية لمنطقة اليورو ويعتبر ثاني أكثر العملات تداولاً بعد الدولار الأمريكي. الين الياباني (JPY): الين معروف بكونه عملة "ملاذ آمن"، حيث يميل المستثمرون إلى اللجوء إليه في أوقات عدم اليقين الاقتصادي. الجنيه الاسترليني (GBP): على الرغم من التقلبات التي قد تنتج عن الأحداث السياسية مثل البريكست، يظل الجنيه الاسترليني عملة مهمة في سوق الفوركس. الفرنك السويسري (CHF): يعتبر الفرنك السويسري أيضًا عملة ملاذ آمن ويتميز بالاستقرار. الدولار الكندي (CAD): يتأثر الدولار الكندي بشكل كبير بأسعار السلع، خاصة النفط، نظرًا لأهمية صادرات النفط في الاقتصاد الكندي. الدولار الأسترالي (AUD): يعتبر الدولار الأسترالي عملة شعبية للتجار الذين يركزون على السلع، خاصة المعادن. من المهم الانتباه إلى أن تداول العملات ينطوي على مخاطر، ويجب القيام به بعد إجراء بحث دقيق وربما استشارة مستشار مالي. كما أن الوضع الاقتصادي العالمي والأحداث الجيوسياسية يمكن أن تؤثر بشكل كبير على أسواق الفوركس. "قد يهمك: أفضل مول في نخلة جميرا" "اطلع على: عملية تجميل الأنف" أفضل العملات الرقمية للتداول اليومي اختيار أفضل العملات الرقمية للتداول اليومي يعتمد على عدة عوامل مثل السيولة، التقلب، والوصول إلى معلومات السوق. إليك بعض العملات الرقمية التي يفضلها المتداولون اليوميون عادة: بيتكوين (Bitcoin, BTC): تعتبر البيتكوين أكثر العملات الرقمية شهرة ولها أعلى سيولة في السوق. هذا يجعلها خيارًا جيدًا للتداول اليومي. إيثيريوم (Ethereum, ETH): تعتبر الإيثيريوم ثاني أكبر عملة رقمية من حيث القيمة السوقية، وتتميز بتقلبات سعرية يمكن أن توفر فرصًا للمتداولين. ريبل (Ripple, XRP): تعتبر XRP واحدة من العملات الرقمية التي تشهد تقلبات كبيرة، مما يمكن أن يوفر فرصًا للمكاسب (أو الخسائر) خلال يوم التداول. لايتكوين (Litecoin, LTC): تشبه لايتكوين البيتكوين لكنها تقدم سرعات معاملات أسرع ورسومًا أقل، مما يجعلها خيارًا جذابًا للتداول اليومي. كاردانو (Cardano, ADA): تعتبر كاردانو واحدة من العملات الرقمية التي تحظى بشعبية كبيرة بين المتداولين اليوميين بسبب قدرتها على توفير تقلبات سعرية مربحة. بينانس كوين (Binance Coin, BNB): صممت لاستخدامها ضمن منصة بينانس، وتعتبر BNB خيارًا جيدًا للتداول اليومي بفضل سيولتها العالية واستخدامها المتزايد. بولكادوت (Polkadot, DOT): تعتبر Polkadot واحدة من العملات الرقمية الحديثة التي توفر فرصًا للتداول بسبب تقلباتها السعرية. "تعرف على: استكشاف ملاذ البيع بالتجزئة في جميرا: سيركل مول" من المهم الإشارة إلى أن التداول اليومي في سوق العملات الرقمية يحمل مخاطر كبيرة ويتطلب معرفة جيدة بالسوق واستراتيجيات التداول. تقلبات الأسعار يمكن أن تكون حادة وغير متوقعة، لذا يُنصح بإجراء بحث شامل والتفكير في الحصول على نصائح من مستشارين ماليين متخصصين في هذا المجال قبل البدء بالتداول.

3 notes

·

View notes

Text

Best Top 10 Cryptocurrency to Invest 2023

March 1, 2023 by Adil Ali

Ethereum is a revolutionary cryptocurrency that’s snappily gaining traction in the global request. Its smart contracts, dApps, interoperability, and brisk sale pets make it a seductive option for businesses and inventors likewise. As further people borrow Ethereum and its DeFi capabilities, the eventuality for the platform to transfigure the way we do deals and contracts continues to grow. also, updates similar to EIP- 1559 on the horizon pledge to make Ethereum indeed more important. With such a promising future, Ethereum looks to be a decreasingly feasible platform for digital deals.

1. Bitcoin (BTC)

Market Cap: $458 billion

Bitcoin is the first and most popular cryptocurrency, created in 2009 by an unknown person or group using the alias Satoshi Nakamoto. It operates on a decentralized tally called blockchain, which allows for secure, transparent, and tamper-resistant deals. Bitcoin is known for its high volatility and is frequently considered a store of value or digital gold.

2. Ethereum (ETH)

Market Cap: $216 billion

Ethereum is the alternate-largest cryptocurrency by request capitalization and was created in 2015 by Vitalik Buterin. Unlike Bitcoin, Ethereum is further than just a digital currency; it’s a decentralized platform that enables inventors to make and emplace decentralized operations( dApps) on its blockchain. The platform’s native currency is Ether( ETH), which is used to pay-for-sale freights and computational services on the Ethereum network.

3. Tether (USDT)

Market Cap: $66 billion

Tether is a stablecoin that was created to be pegged to the US bone at an 11 rate. It was launched in 2014 by Tether Limited and is used as a means of transferring finances between exchanges and trading cryptocurrency without having to convert back to edict currency. Tether is controversial, with some critics claiming that it isn’t completely backed by US bones

4. USD Coin (USDC)

Market Cap: $54 billion

USD Coin, established by the financial technology corporation Circle and the cryptocurrency exchange Coinbase, is a stable coin tied to the American dollar. It’s backing of USD and routine audit protocols guarantee the stability and clarity of its operation.

5. Binance Coin (BNB)

Market Cap: $52 billion

Established in 2017, Binance Coin is the crypto asset associated with the renowned Binance Exchange, one of the largest crypto trading platforms globally. This digital asset is utilized to pay for trade fees on the Binance Exchange, as well as to access reduced commission fees on the same exchange.

6. Ripple (XRP)

Market Cap: $18 billion

In 2012, Ripple Labs initiated the cryptocurrency known as Ripple. This global payment system enables instantaneous and dependable cross-border payments with the utilization of its blockchain technology. Financial institutions and payment providers can benefit from Ripple’s services.

7. Cardano (ADA)

Market Cap: $18 billion

Input Output Hong Kong (IOHK), a blockchain research and development company, created Cardano, a decentralized platform, in 2017. With a vision of tackling the scalability and security issues that have affected preceding blockchain networks, Cardano is a third-generation blockchain. The native currency of the platform, ADA, is employed to pay transaction fees and to involve oneself in the governance of the Cardano network. Save to documented

8. Binance USD (BUSD)

Market Cap: $18 billion

Binance USD, a fiat-pegged stablecoin developed by the renowned crypto exchange Binance, is constantly monitored to guarantee transparency and maintain full US dollar support. Its main purpose is to allow seamless transfers and trading of digital assets without the need for reverting to conventional money.

9. Solana (SOL)

Market Cap: $15 billion

Solana was founded in 2017 by Solana Labs, to create a blockchain platform with speedy transactions and minimal costs for decentralized applications. As a result, SOL is the cryptocurrency native to this platform, utilized for transaction fees and to join in the administration of the Solana network.

10. Polkadot (DOT)

Market Cap: $10 billion

The Web3 Foundation designed the Polkadot platform in 2016 to bring together different blockchains and allow for seamless interconnectivity. To guarantee high performance and scalability, Polkadot uses a specialized technique called sharding. The native currency of the network is DOT, which is utilized to pay for transaction costs and grant holders a say in Polkadot’s governance.

Conclusion:

Ultimately, while these crypto assets vary in attributes and functions, they all share the objective of furnishing a distributed and safe system of exchanging value. As the industry of cryptocurrency persists to advance, we can assume to witness more breakthroughs and novel applications emerge, generating a thrilling period for both financiers and consumers. It is crucial to complete comprehensive research and recognize the risks linked with investing in any cryptocurrency.

8 notes

·

View notes

Text

From Bitcoin to Beyond: Exploring the Evolving Landscape of Cryptocurrencies

Over the past decade, cryptocurrencies have emerged as a disruptive force in the world of finance and technology, with Bitcoin leading the way as the pioneering digital currency. The concept of a decentralized, borderless, and secure form of money challenged the traditional financial system, opening the door to a myriad of new possibilities. As the blockchain technology behind cryptocurrencies continues to evolve, the landscape of digital finance is undergoing a transformation that reaches far beyond the realms of Bitcoin.

The Genesis: Bitcoin's Impact and Legacy

Bitcoin, created by the pseudonymous Satoshi Nakamoto in 2009, was the first successful implementation of a peer-to-peer electronic cash system that operates without the need for intermediaries like banks. Its underlying technology, blockchain, introduced a distributed and immutable ledger, ensuring transparency and security in financial transactions.

Bitcoin's rise in popularity sparked interest among tech enthusiasts, libertarians, and investors seeking an alternative to the traditional financial system. Its decentralized nature and limited supply, capped at 21 million coins, instilled confidence in its ability to act as a store of value akin to digital gold.

The Altcoin Era: Diverse Cryptocurrencies Emerge

Following the success of Bitcoin, a wave of new cryptocurrencies, often referred to as "altcoins," flooded the market. These altcoins sought to address perceived limitations in Bitcoin's design or aimed to serve specific use cases.

Ethereum, launched in 2015 by Vitalik Buterin, revolutionized the crypto landscape by introducing smart contracts. These self-executing contracts enabled developers to create decentralized applications (dApps) on top of the Ethereum blockchain. This innovation laid the foundation for the explosive growth of the decentralized finance (DeFi) ecosystem, enabling peer-to-peer lending, decentralized exchanges, and other financial services without intermediaries.

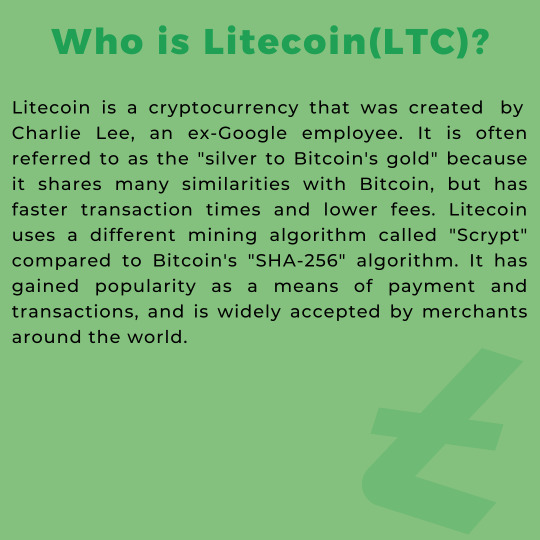

Other notable cryptocurrencies, such as Ripple (XRP), Litecoin (LTC), and Cardano (ADA), each brought their unique features and use cases to the table. Ripple, for instance, targeted faster and cheaper cross-border payments, while Litecoin aimed to be a more efficient and lighter version of Bitcoin for everyday transactions.

The Rise of Stablecoins: Stability in a Volatile Market

Cryptocurrencies have a reputation for extreme price volatility, which has limited their adoption for everyday transactions. To address this issue, stablecoins were introduced. These digital assets are pegged to stable assets like fiat currencies (USD, EUR, etc.) or commodities, reducing price fluctuations and making them more suitable for day-to-day use.

Tether (USDT), the first stablecoin, was launched in 2014, and it quickly became the most widely used stablecoin in the market. As regulatory scrutiny increased, more transparent and regulated stablecoins like USD Coin (USDC) and DAI emerged, further solidifying the role of stablecoins in the cryptocurrency ecosystem.

Institutional Adoption: A Paradigm Shift

In the early days, cryptocurrencies were primarily embraced by individual investors and tech enthusiasts. However, as the market matured and regulatory frameworks became clearer, institutional players started to take notice.

Major financial institutions, asset management firms, and even governments began to explore cryptocurrencies as potential investment vehicles and digital store of value. The entry of institutional investors, like Tesla and MicroStrategy, into the market signaled a shift towards wider acceptance and recognition of cryptocurrencies as legitimate assets.

Beyond Currency: NFTs and the Metaverse

Cryptocurrencies are not limited to being just a form of money. Non-Fungible Tokens (NFTs) have emerged as a revolutionary use case within the crypto space. NFTs represent unique digital assets and have found applications in art, collectibles, virtual real estate, and more.

The concept of the metaverse, a virtual world where users can interact, socialize, and conduct business, has gained traction with the help of blockchain technology. Virtual real estate within these metaverses is being bought and sold using cryptocurrencies and NFTs, opening up entirely new economic opportunities in the digital realm.

To know more click here -

Despite the progress and success of cryptocurrencies, several challenges remain. Regulatory uncertainty, scalability issues, energy consumption concerns (particularly for proof-of-work blockchains like Bitcoin), and security vulnerabilities need to be addressed to ensure the long-term sustainability and widespread adoption of cryptocurrencies.

2 notes

·

View notes

Video

youtube

everything from everywhere,xrp news today,xrp news,xrp ripple,ripple price,bitcoin,buy ripple,ripple bitcoin,ripple news,ripple coin,ripple xrp,ripple xrp price,xrp coin,xrp usd,xrp coinmarketcap,xrp price,ripple daily news,bitcoin news,bitcoin price,ripple xrp news,crypto,btc,xrp price prediction,ripple xrp news today,brad garlinghouse,crypto news,crypto daily,digital asset investor,bearablebull,xrp moon,cardano,ada,vechain,vet,chainlink,link

3 notes

·

View notes

Text

What is crypto currency ? a digital currency in which transactions are verified and records maintained by a decentralized system using cryptography, rather than by a centralized authority.

What is lunoaward? It is an organisation that have came to help people explore and achieve there dream by giving rewards to people that are interested in investing on it every day

Type of crypto currency and there price in the market sells

Bitcoin (BTC) Price: $23,765. Market cap: $459 billion. ...

Ethereum (ETH) Price: $1,612.30. Market cap: $197 billion. ...

Tether (USDT) Price: $1.00. ...

BNB (BNB) Price: $306.24. ...

USD Coin (USDC) Price: $1.00. ...

XRP (XRP) Price: $0.3884. ...

Cardano (ADA) Price: $0.3796. ...

Binance USD (BUSD) Price: $1.00.

Let invest and make Big money crypto

2 notes

·

View notes

Text

#USD #Coin #Dogecoin #Litecoin #XRP #TRON #Bitcoin #cash What can you do to retrieve USDT if it was mistakenly sent to the wrong wallet address? #CryptoRecovery #MightyHackerRecovery #Binance #Coinbase #Blockchain #USDT #LostCrypto #CryptoScams #HackerHelp Mighty Hacker Recovery did an amazing job helping me recover my lost Bitcoin wallet. Their expertise was impressive, and they made the process smooth and secure. If you're in a similar situation, I highly recommend reaching out to them on WhatsApp at +1 (845) 699-5044. #USD #Coin #Dogecoin #Litecoin #XRP #TRON #Bitcoin #cashapp ASMR: BTS: Pewdiepie: A leading YouTube personality Billie Eilish: A popular artist MrBeast: A popular topic Sidemen: A popular topic A popular topic Ishowspeed: Linkin Maizen: Gametoons: ASMR Shorts: Song: Movie: DJs:

1 note

·

View note