#va loans explained

Explore tagged Tumblr posts

Text

How to Apply for a VA Home Loan

The VA domestic mortgage application is one of the most recommended perks reachable to cutting-edge and former participants of the U.S. military. This initiative, managed via the Department of Veterans Affairs (VA), objectives to assist provider members, veterans, and eligible surviving spouses reap the dream of homeownership with favorable phrases and conditions. If you are thinking about making…

View On WordPress

#apply for va benefits#apply for va home#guide to va home loans#help buying a home#home loans#home loans for veterans#how to buy a house#how to get an va loan#how to reduce your closing costs for a va home loan#how to use va loans#how va loans work#va home loans#va home loans for veterans#va loan for investment property#va loans#va loans explained#va loans what you need to know#va mortgage loans#veterans home loans#what is a va home loan

0 notes

Text

Cater's Name

If you have ever wondered why Cater’s name is being pronounced “Keito” in the game, while Ace’s seiyuu Yamashita pronounced it as “Kate” when speaking in English at Anime Expo 2023, it is because Cater, Keito and Kate are all ケイト in Japanese.

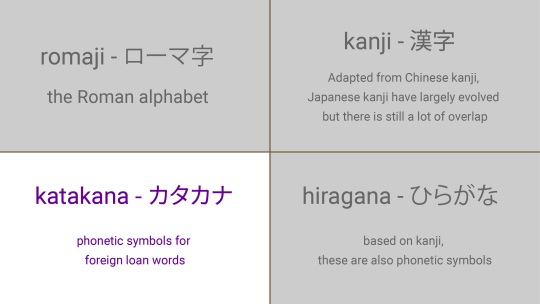

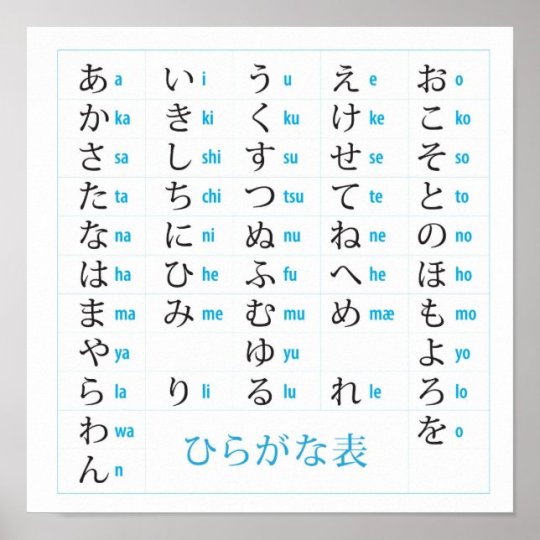

Unlike the English language, which can create any of a number of different sounds with the same letters, Japanese is a phonetic language: what you see is what you get.

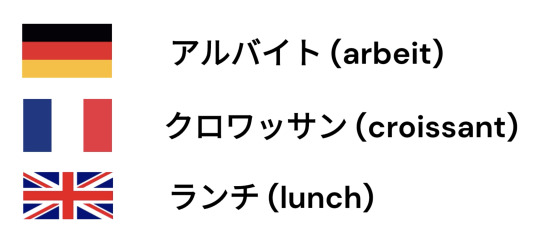

Much like how English has foreign loan words like “rendezvous” and “tsunami,” Japanese also has foreign loan words from languages like German, French, English, and more.

When these words are adopted into Japanese they must adapt to the katakana alphabet which is a specific writing system for foreign loan words.

This tends to impact the way that the words are pronounced, which is common in any language that adopts loan words, like how the Japanese word “karate” can be pronounced “kur-ah-tee” in the US.

Some sounds don’t exist in Japanese, like “R” and “L.” As a result, certain compromises must be made to pronunciation with the adoption of new words.

Words that end in “R” are often changed to end in an “ah” sound, such as “Silver” becoming “Sil-bah.” (The “sih” sound in “Silver” also does not really exist, which is why it is being pronounced like, “she.”)

This means that “Cater” would technically be pronounced “Keita,” but (like all languages), there are no hard rules to katakana (ex: encore, another r-ending word like Silver, is pronounced “ahn-coh-ru” rather than “en-coh-rah”).

This is because “keito” is specifically the pronunciation of the gambling term, “cater.”

While outdated, “Ace,” “Deuce,” “Trey,” “Cater,” “Cinq” and “Sice” are all actual gambling terms, used for both cards and dice.

When these terms were imported to Japan, “cater” was assigned the pronunciation keito instead of keita, possibly because it was based on the pronunciation by English speakers rather than its spelling.

Hence the Japanese-language pronunciation of Cater’s name.

But that’s not all!

Another quirk of adopting words into Japanese is that all words must end with “a,” “i,” “u,” “e,” “o” or “n.”

This is why Riddle’s and Deuce’s names sound like they end in “u,” while Jade’s and Floyd’s names sound like they end in “o."

Thanks to various celebrities, the average Japanese-language speaker is more familiar with the first name “Kate” than we are with the outdated gambling term “cater,” and “Kate” is also pronounced ケイト (Keito) in Japan.

This is all explained explicitly in official Twisted Wonderland fan book, which says, “In English, this name is usually spelled as ‘Cate’ or ‘Kate,’ but Cater’s name is different, as it is referring to the number ‘4’ in card game terminology.”

From a Japanese-speaker’s perspective Cater’s name may look like a misspelling of the name “Kate,” which is a misunderstanding that this explanation in the fan book is possibly trying to clear up.

If you were wondering why Ace’s voice actor said “Kate” during the Anime Expo 2023 panel, that is why! He pronounces Cater as “Keito” in Japanese, but he was speaking in English, and he knows that “Keito” is Japanese for the English name “Kate,” so he adapted accordingly.

(The archived livestream of the Twisted Wonderland panel at Anime Expo 2023 is on Aniplex USA's YouTube channel, and this moment can be seen here!)

youtube

So what should you use when talking about Cater?

Language is all about communication, so if the person you’re talking to speaks English, “Cater” is the way to go.

But if you ever find yourself talking to Ace's VA Yamashita Seiichiro and say “Cater,” he might not understand who you mean, and you might want to go with “Keito” or “Kate” instead.

211 notes

·

View notes

Text

Bad Credit Mortgages Explained: How Mortgage Brokers Can Assist You in Finding the Right Loan

Having bad credit can make securing a mortgage seem daunting, but it doesn’t mean homeownership is out of reach. While traditional lenders may be hesitant to approve a loan for someone with poor credit, there are still options available. A mortgage broker can be your best ally in navigating the world of bad credit mortgages, helping you find the right loan that aligns with your financial situation. In this article, we’ll explain what bad credit mortgages are and how mortgage brokers can assist you in securing one.

What Is a Bad Credit Mortgage?

A bad credit mortgage, often referred to as a subprime mortgage, is a home loan specifically designed for individuals with a low credit score or poor credit history. Lenders view applicants with low credit scores as higher-risk borrowers, which can make it harder to qualify for a standard loan. Bad credit mortgages typically come with higher interest rates and stricter terms compared to conventional mortgages, reflecting the added risk to the lender.

Factors That Affect Your Credit Score

Before diving into bad credit mortgages, it’s important to understand what affects your credit score:

- Payment History: Missed or late payments can significantly lower your score.

- Credit Utilization: How much of your available credit you’re using can impact your score.

- Length of Credit History: The longer you’ve responsibly managed credit, the better.

- Types of Credit: A mix of different types of credit (e.g., credit cards, loans) can boost your score.

- Recent Inquiries: Applying for too much credit in a short time can lower your score.

For those with a score below 620, finding a conventional mortgage may be difficult, but this is where a bad credit mortgage becomes an option.

How Mortgage Brokers Can Help with Bad Credit Mortgages

1. Access to Specialized Lenders

Mortgage brokers have access to a wide network of lenders, including those that specialize in bad credit mortgages. Unlike going directly to a single bank, which may reject your application based on credit alone, brokers can connect you with lenders who are more flexible and willing to work with low credit scores. This increases your chances of finding a suitable loan.

2. Expert Guidance and Tailored Solutions

A mortgage broker can assess your overall financial situation, not just your credit score. They’ll take into account factors like your income, employment history, and any assets you might have. From there, they can recommend loan options that fit your circumstances, whether it's an FHA loan, a VA loan (if applicable), or another type of loan designed for borrowers with lower credit.

For example, FHA loans are government-backed mortgages that are more forgiving of credit issues, allowing scores as low as 500 (with a higher down payment). A broker familiar with these options can guide you through the application process.

3. Negotiating Terms

Brokers often have relationships with lenders, which can help in negotiating better terms, even with bad credit. While your interest rate may still be higher than that of a borrower with excellent credit, a broker can work to find you a competitive rate and favorable loan conditions.

4. Saving Time and Stress

Applying for a mortgage when you have bad credit can be overwhelming. You might feel unsure about which lenders will approve you or what documentation is needed. A mortgage broker can streamline this process by handling the research, paperwork, and communication with lenders on your behalf. This saves you time and reduces stress by letting the broker do the legwork.

5. Improving Your Credit Profile

Mortgage brokers don’t just help you secure a loan—they can also provide valuable advice on improving your credit. If you’re not in a rush to buy, they may suggest actions to boost your credit score, such as paying off specific debts or correcting errors on your credit report. Improving your credit score, even slightly, can help you secure better mortgage terms in the future.

6. Guidance Through the Approval Process

Getting approved for a bad credit mortgage often requires more documentation and proof of financial stability. Mortgage brokers can help you gather and organize these documents, making sure your application is as strong as possible. They’ll ensure you meet the lender’s requirements, increasing your chances of approval.

What to Expect with a Bad Credit Mortgage

While a bad credit mortgage can help you achieve homeownership, it’s important to understand the trade-offs involved:

- Higher Interest Rates: Expect to pay more in interest over the life of the loan compared to borrowers with good credit. A mortgage broker can help minimize this by finding the best available rate for your situation.

- Larger Down Payments: Some lenders may require a larger down payment to offset the risk. A mortgage broker can explain the minimum down payment requirements for different types of loans, like FHA or subprime mortgages.

- More Fees: Bad credit mortgages may come with higher fees, including mortgage insurance premiums or origination fees. A broker can help you understand these costs upfront and compare them across different lenders.

Can You Refinance a Bad Credit Mortgage?

One of the advantages of working with a mortgage broker is that they can help you develop a long-term strategy. If you secure a bad credit mortgage now but improve your credit score later, refinancing into a better mortgage with a lower interest rate may become an option. Mortgage brokers can monitor your situation and guide you through the refinancing process when the time is right.

Conclusion

Having bad credit doesn’t mean you have to give up on your dream of homeownership. With the help of a mortgage broker, you can find a loan that suits your financial situation, even with a lower credit score. Brokers have the expertise and connections to find lenders who are more flexible and willing to work with you. They can simplify the process, negotiate better terms, and provide guidance to improve your financial future. If you’re concerned about bad credit, reaching out to a mortgage broker can be the first step toward owning your home.

3 notes

·

View notes

Text

Here's something that I doubt everyone knows about the disability crisis in the United States. For a civilian to get disability payments, they have to be "totally" disabled; in other words, you have to prove you cannot get any job in any industry based on Department of Labor statistics in your state, not *just* that you have a debilitating condition. For a veteran to get disability payments, they have to prove a percentage of how disabled they are, and getting 100% disability as a veteran is no easy task wording is critical in the documentation if anyone at any point in your medical history intentionally or not downplays your disability you will get percentage points taken off how much pay you get as a disabled veteran. This is particularly difficult for people with any pride or dignity left because, in both civilian and veteran cases, you must explain just how awful it is in explicit terms and quantifiable, dehumanized ways to sate the court's interest, or you will not get "total" disability. Furthermore, until you are considered "permanently" disabled, you must repeat this process every 3-5 years. Yet, again no one anywhere can talk about you improving or you're out (for civilians), or your disability percentage amount is reduced (for veterans.) Also, if you manage to prove a "permanent" disability, you still get checked every seven years to make sure it's still "permanent." Finally, to get your student loans discharged as a civilian, you must prove your disabled status is both "total and permanent," guess what if one of those changes? Those loans come right back. Also, your loans go into forbearance if you're" totally disabled" and not considered "permanent" or "short-term" (more than 2 weeks, up to a year). Yes, that is the one that accrues interest. Not deferment. For short-term disability, you can defer, but if you're long-term, non-permanent, you forbear. Most people on long-term disability are medically permanently disabled but not in the eyes of the law because of their age, even if it is a chronic or progressive disease. This is why people die waiting for total disability, let alone permanent. My disability attorney said straight to my face 10 years ago, "You should get disability because you have a chronic disabling condition in two systems, but it's going to be a fight because you are so young." I was 28, by the way. She said if I had "just Lupus" or "just medication-resistant dysthymia and generalized anxiety," I wouldn't have stood a chance. My cousin "just" had Lupus and was in end-stage renal failure, it took her 3 years to get disability, and by then, she had a kidney transplant. She was in her 20s and on her parents' insurance. I have a friend whose veteran husband couldn't get 100% VA disability because some doctor at some VA clinic years ago had written down "mild back pain" when describing the pain he felt from degenerative disc disease and 2 herniated discs. It took years to get that one note out of his file. No matter what any other doctor said. So when I say you can't comprehend the disability crisis in the United States, I'm talking about this. Thanks for coming to my TED Talk.

18 notes

·

View notes

Note

okay yes i am the strauss person from earlier. i swear its like people think you end up liking everything the character stands for or something. its all about what they mean to you i think, but people still find a way to hate it. i think this fandom is pretty odd when it comes to being tolerant about that cause if you have an answer/opinion they dont like its like its all out war. also yeah i totally agree with the micah thing too he's a super good character hes just easily dislikable. doesn't mean his va or actual writing is bad, the fact that hes so irrevocably evil (sorta, i don't mean actually evil but you know) makes him a very good villain.

also like i almost wanna explain, idk, you seem safe. when i first started playing the game i was afraid of conflict. super afraid of gunfights and whatever. and strauss was a way to earn money, which i was super down for doing because the whole gang had my heart already, but a way to do it without making a lot of noise. sure the lending is kinda terrible but to me it wasn't any worse, and was perhaps better, than gunning down lawmen and robbing from the banks, because the bank holds the people's money. he was just a non-directly-violent, sly way to do it. and it ended up with me liking him a lot. so when i took those missions in ch6 and had to go through the aftermath of it i was so angry with myself i didn't touch the game for a week cause i was convinced i was the reason he was kicked. and then the news charles gives you didn't help either. honestly im Just broken

I've only watched Markiplier's playthough to the end and I'm currently playing in chapter 4, so I have no idea what happens with Strauss there. But I also plan on avoiding most, if not all, of his side missions. But it is all just personal stuff. I personally just really hate the loan sharks missions. Plus my understanding of the bank robberies are that you wait until some big company needs to move money and that's when you rob the bank. The people's money wouldn't be enough to risk a bank job, if I've understood it correctly. But Dutch was meant to be someone who stole from the rich and gave to the poor, there's a few bits of dialogue where the gang say stuff like "remember when we used to help people". But we don't know when this changed though. Strauss and Micah are just meant to show that Dutch doesn't really make sense. And I'm not saying robbing a bank isn't bad, at the end of the day it's all bad, but I don't like seeing the poor person's live I'm destroying when I could just go do something else. Not to mention the whole "beat them/kill them if they don't give you their last bit of cash". I think Strauss' missions just feel a bit more real, the rest of the game is like cartoon violence in a way. But again, nothing wrong with liking the character. He's not real and liking bad characters does not reflect on real life morals. Not going to sit here pretending like I didn't go murder/steal from a bunch of stage coaches because my sweetheart Alden gave me those missions

10 notes

·

View notes

Text

VA Loan With Recent Late Payments

For many veterans and active-duty service members, getting a VA loan is often the realization of a dream. Veterans who have served their nation will find it easier to become homeowners thanks to the loans, which are backed by the U.S. Department of Veterans Affairs. What transpires, though, if an applicant's credit report shows recent late payments? They may still be eligible for a VA loan. Understanding manual underwriting guidelines will help you find the solution.

The Importance of Manual Underwriting Guidelines

Automated systems typically evaluate an applicant's eligibility for mortgage lending based on predetermined criteria. These requirements frequently include income, debt-to-income ratios, and credit scores. Life's difficulties can occasionally result in late payments, which might not be properly represented in an automated system's evaluation. Manual underwriting guidelines are used in this situation.

A human underwriter reviews each application and piece of supporting documents individually in manual underwriting. This enables a more comprehensive assessment of the applicant's financial status, accounting for variables outside the scope of automated criteria. There are features in VA loans that permit manual underwriting, giving applicants who have recently made late payments the chance to explain their situation and establish their trustworthiness.

Guidelines for VA Loans with Recent Late Payments

Explanation of Late Payments

Providing a concise and convincing justification is one of the most important components of manual underwriting guidelines for VA loans with recent late payments. Explaining the facts behind the late payments, whether they were brought on by unforeseen events like medical emergencies or brief financial troubles, can have a big impact on the underwriter's choice.

Evidence of Reestablished Credit

Demonstrating that you have taken action to improve your credit position is essential in manual underwriting. If you have made consistent on-time payments after having made late payments in the past, it demonstrates a promising trend and a dedication to sound financial management.

Stable Income and Employment

The underwriters will also take your present employment situation and steady income into account. Concerns regarding your ability to make mortgage payments in the future can be reduced by a steady employment history and income.

Compensating Factors

Manual underwriters frequently search for mitigating elements that can balance off the detrimental effects of previous late payments. These can include a sizable cash reserve, a sizable down payment, or a low debt-to-income ratio. These elements reflect your capacity to manage a mortgage despite previous credit difficulties and financial stability.

Meeting VA's Residual Income Requirement

To guarantee that borrowers can comfortably make their mortgage payments after taking into account other monthly responsibilities, the VA has a residual income requirement. Your case may be stronger if you meet or surpass this requirement during manual underwriting.

Lender Discretion

It's significant to note that lenders may differ in their manual underwriting judgments. While some might be more forgiving when taking recent late payments into account, others might have tougher requirements. You can locate the ideal fit for your case by looking around for a lender with manual underwriting and experience with VA loans.

Conclusion

Even though previous late payments might at first seem to be a barrier to getting a VA loan, manual underwriting guidelines offer a method for eligible applicants to realize their ambition of becoming a homeowner. These rules give applicants the option to present a more thorough picture of their financial status while also acknowledging the influence that life's struggles can have on credit records. Veterans and active-duty service members can improve their chances of navigating the manual underwriting process for VA loans by giving detailed explanations, proof of credit improvement, and other supporting elements. As you start down the path to homeownership, keep in mind that manual underwriting is a chance for you to share your background and demonstrate your dedication to sound money management.

#property#gustancho associates#real estate#united states#first time home buyer#gca mortgage#va loans#fha loan#usa#loan officer#bad credit score

2 notes

·

View notes

Text

Control the Controllables If You’re Worried About Mortgage Rates

Control the Controllables If You’re Worried About Mortgage Rates

Control the Controllable If You’re Worried About Mortgage Rates

Chances are you’re hearing a lot about mortgage rates right now, and all you really want to hear is that they’re coming back down. And if you’ve seen headlines about the early November Federal Funds Rate cut by the Federal Reserve (The Fed), maybe you got hopeful mortgage rates would start to decline right away. Although some media sources may lead you to believe that the Fed’s actions determine mortgage rates, in reality, they don’t.

The truth is, the Fed, the job market, inflation, geopolitical changes, and a whole list of other economic factors influence mortgage rates, too. So, while recent actions from the Fed set the stage for mortgage rates to come down over time — it's going to be a gradual and, likely bumpy, process.

Here’s the best advice anyone can give you right now. While you may be tempted to wait for rates to fall, it’s really hard to try and time the market — there’s just too much that can have an impact. Instead, set yourself up for homebuying success by focusing on the factors you can control. Here’s what to prioritize if you’re looking to put your best foot forward.

Your Credit Score

Credit scores can play a big role in your mortgage rate. And the difference of just a few points can make a significant impact on your monthly payment. As an article from Bankrate explains:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

With rates where they are today, maintaining a good credit score is one of the keys to getting the best rate possible. To find out where your credit score stands and what you can do to give it a boost, reach out to a trusted loan officer.

Your Loan Type

There are many types of loans, and each one offers different terms for qualified buyers. The Consumer Financial Protection Bureau (CFPB) says:

“There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose. Talking to multiple lenders can help you better understand all of the options available to you.”

Work with your team of real estate professionals to see which loan types you may qualify for and figure out what will work best for you financially.

Your Loan Term

Just like with loan types, you have options when it comes to terms, or the length of your loan. As Freddie Mac says:

“When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Lenders typically offer mortgages in 15, 20, and 30-year terms. And which term you go with has a direct impact on your rate. Talk to your lender about which one is right for your situation.

Bottom Line

Remember, you can’t control what happens in the broader economy or when mortgage rates will come down. But there are actions you can take that could help you set yourself up for success.

Let’s connect to go over what you can now do that’ll make a difference when you’re ready to make your move.

0 notes

Text

The Majority of Veterans Are Unaware of a Key VA Loan Benefit

For over 79 years, Veterans Affairs (VA) home loans have helped countless Veterans achieve the dream of homeownership. But according to Veterans United, only 3 in 10 Veterans realize they may be able to buy a home without needing a down payment (see visual below):

That’s why it’s so important for Veterans – and anyone who cares about a Veteran – to be aware of this valuable program. Knowing about the resources available can make the path to homeownership easier and keep life-changing plans from being put on hold. As Veterans United explains:

“The ability to buy with 0% down is the signature advantage of this nearly 80-year-old benefit program. Eligible Veterans can buy as much house as they can afford, all without the need to spend years saving for a down payment.”

The Advantages of VA Home Loans

VA home loans are designed to make homeownership a reality for those who have served our country. These loans come with the following benefits according to the Department of Veterans Affairs:

Options for No Down Payment: One of the biggest perks is that many Veterans can buy a home with no down payment at all, making it simpler to get started on your homebuying journey.

Limited Closing Costs: With VA loans, there are limits on the types of closing costs Veterans have to pay. This helps keep more money in your pocket when you’re ready to finalize the sale.

No Private Mortgage Insurance (PMI): Unlike many other loan types, VA loans don’t require PMI, even with lower down payments. This means lower monthly payments, which adds up to big savings over time.

Your team of expert real estate professionals, including a local agent and a trusted lender, are the best resource to understand all the options and advantages available to help you achieve your homebuying goals.

Bottom Line

Owning a home is a key part of the American Dream, and VA home loans are a powerful benefit for those who’ve served our country. Let’s connect to make sure you have everything you need to make confident decisions in the housing market.

0 notes

Text

Mortgage Lenders Edmonton – Providing Home Loans To Buyers

Applying for a mortgage is one of the biggest financial steps you'll ever take. Whether you are applying for the first time, or refinancing, selecting the appropriate lender and broker can be the biggest difference between ease, experience, and terms of the loan. How Mortgage Lenders Work

The mortgage lenders edmonton are a type of financial institution that provides loans to home buyers and refinancers. These comprise banks, credit unions, or mortgage companies with specialty expertise. They offer fixed-rate, adjustable-rate, FHA, VA, and jumbo loan products among others.

The selection of lender should be a decision heavily influenced by lender's reputation, interest rates, fees, and the range of options available. A good mortgage lender will explain the process; therefore, being candid about the terms and conditions of the whole process.

Mortgage Lenders Edmonton The Role of Mortgage Brokers

This will help you in determining the most suitable loan according to your financial condition. The best mortgage broker edmonton are middlemen between you and potential lenders. They have their networking of lenders whom they can tap, thereby saving for you all the legwork like comparing rates, negotiating terms, and managing paperwork. They are very helpful in cases where your financial situation is a bit complicated or when you don't have great credit. Finding the Best Mortgage Broker

Aspects to Consider When it comes to choosing the best mortgage broker, the following aspects are unavoidable. First, check the credentials and licensing in your state, ensuring that you are dealing with authorized dealers.

A good record and positive customer reviews define a good broker, who should also be well connected within the industry. The best mortgage broker edmonton needs to be clear on their charges and compensation because this affects the overall cost of your loan. Another good factor is to choose one who communicates well, gives responses promptly, and answers any questions you may have. Choosing the Right Person The best mortgage lenders edmonton or broker for you will depend on your specific needs, financial status, and property type. You should take time to research so you can compare options with top professionals before making that final decision, the right lender or broker may just help navigate the mortgage process into something smooth, cost-effective, and you will get your dream home.

0 notes

Text

Choosing the Right Boise Mortgage Lender for Your Home Financing Needs

Buying a home is one of the most significant financial decisions most people will make in their lifetime. Whether you are a first-time homebuyer or looking to refinance your existing property, finding the right Boise mortgage lender is crucial to ensuring a smooth and successful home buying experience. With the right lender, you can secure favorable terms, competitive rates, and a mortgage that aligns with your financial goals.

In this article, we'll explore the essential aspects of choosing a mortgage lender and the benefits of working with a Boise mortgage company that understands the local market. We'll also guide you through the mortgage process and what to look for when selecting the right lender.

Understanding the Role of a Boise Mortgage Lender

A mortgage lender plays a pivotal role in helping you secure financing for your home. They provide the funds you need to purchase or refinance a property, and they set the terms of your loan, including the interest rate, repayment schedule, and closing costs. In Boise, mortgage lenders can be banks, credit unions, or independent mortgage companies. Each lender offers different loan programs and financial products, so it's essential to compare options before making a decision.

When selecting a Boise mortgage lender, one of the primary factors to consider is the lender's reputation. Look for reviews from other homebuyers in the area and assess whether the lender is known for providing excellent customer service, competitive rates, and transparent loan terms. A reliable mortgage lender can help make the home buying process less stressful and more rewarding.

Why Work with a Local Boise Mortgage Company?

Choosing a local Boise mortgage company can offer several advantages, especially if you are purchasing property in the area. Local lenders have a deeper understanding of the Boise real estate market and are more familiar with the trends, property values, and the unique needs of buyers in the region. This local expertise allows them to provide personalized recommendations and loan options that are tailored to your specific situation.

Furthermore, a Boise mortgage company may have established relationships with local real estate agents, appraisers, and title companies, which can streamline the loan process and help you close on your home more efficiently. Local lenders may also have more flexible loan options that are suited to Boise's housing market.

Key Factors to Consider When Choosing a Mortgage Lender

Choosing the right mortgage lender is a critical step in the home buying journey. Here are some key factors to consider:

Loan Products Offered

Not all lenders offer the same loan products. Some may specialize in conventional loans, while others may focus on government-backed loans such as FHA, VA, or USDA loans. Before selecting a Boise mortgage lender, ensure that they offer the type of loan that fits your needs. A local Boise mortgage company might also provide special loan programs for first-time buyers or those with unique financial circumstances.

Interest Rates and Fees

Interest rates can significantly impact the overall cost of your mortgage. Even a small difference in rates can save or cost you thousands of dollars over the life of the loan. When comparing Boise mortgage lender it's essential to obtain quotes from multiple sources to ensure you're getting a competitive rate. Additionally, ask about closing costs and other fees associated with the loan to avoid any surprises at closing.

Customer Service and Communication

The home buying process can be complex, and you want a lender who will be responsive and communicate clearly throughout the process. A mortgage lender with a strong reputation for excellent customer service can make a significant difference in your experience. A Boise mortgage company that offers personalized support will be able to answer your questions, explain the loan terms, and help you feel confident about your decision.

Pre-Approval Process

Getting pre-approved for a mortgage is an essential first step in the home buying process. A pre-approval gives you an idea of how much you can borrow, which helps you set a realistic budget for your home search. The pre-approval process also shows sellers that you are a serious buyer with financing already in place. Many Boise mortgage lenders offer quick and easy pre-approval processes that allow you to get started on your home search right away.

Flexibility and Loan Terms

Some lenders offer more flexible loan terms than others. For example, if you're self-employed, you may need a lender who is willing to consider alternative documentation for your income. Similarly, if you have a lower credit score, some Boise mortgage lenders may have programs designed for borrowers with less-than-perfect credit.

Steps in the Mortgage Process

The mortgage process involves several steps, and understanding each one can help you navigate the journey more effectively:

Pre-Approval

As mentioned earlier, the pre-approval process involves providing your financial information to a Boise mortgage company so they can determine how much you are qualified to borrow. This step is crucial because it helps you narrow down your home search to properties within your budget.

Loan Application

Once you've found a home, the next step is to submit a formal loan application. You'll provide detailed financial information, including your income, assets, and debts. The lender will also run a credit check to assess your creditworthiness.

Loan Processing and Underwriting

During this phase, the lender will review your application, verify your financial information, and order an appraisal of the property. The underwriter will evaluate your application to ensure that it meets the lender's guidelines and determine whether to approve or deny the loan.

Closing

If your loan is approved, the final step is closing. This is when you sign the necessary documents, pay closing costs, and receive the keys to your new home. Your Boise mortgage lender will coordinate with the title company and other parties to ensure that the process goes smoothly.

Conclusion

Selecting the right Boise mortgage lender can make all the difference in your home buying journey. By choosing a lender with a strong reputation, competitive rates, and excellent customer service, you can ensure a smoother process from start to finish. Additionally, working with a local Boise mortgage company can provide you with tailored loan options and personalized support throughout the home buying process. Take the time to compare lenders and explore your options to find the one that best meets your needs.

0 notes

Text

How a Mortgage Broker Can Simplify Your Home Buying Experience

Buying a home is one of the most significant financial decisions many people will make in their lifetime. With numerous mortgage options, complex paperwork, and ever-changing interest rates, navigating the home buying process can feel overwhelming. This is where a mortgage broker comes in—a professional who can simplify the entire experience, saving you time, stress, and potentially a lot of money.

What Is a Mortgage Broker?

A mortgage broker acts as a middleman between you, the homebuyer, and potential lenders. Unlike a loan officer who works for a specific bank, a broker works with multiple financial institutions to find a mortgage that best fits your financial situation. Their role is to assess your financial status, shop around for loan options, and guide you through the application process.

How Does a Mortgage Broker Help?

Here are several ways a mortgage broker can streamline the home buying process:

1. Access to Multiple Lenders

Mortgage brokers have access to a wide range of lenders, including banks, credit unions, and private lenders. This extensive network allows them to compare multiple loan products and find one that aligns with your needs and budget. Instead of applying for loans individually, your broker can handle everything at once, presenting you with the best offers.

2. Expert Guidance and Advice

One of the most challenging parts of buying a home is understanding all the terminology and requirements surrounding mortgages. Mortgage brokers are experts in this area, and they can explain complex terms and conditions in a way that makes sense to you. They assess your financial situation, help you understand your options, and recommend the most suitable mortgage product.

3. Negotiating Better Rates

Because brokers work with numerous lenders and bring in multiple clients, they often have leverage to negotiate better interest rates and terms than a borrower could secure independently. This can lead to significant long-term savings.

4. Streamlined Paperwork and Documentation

Mortgage applications require detailed documentation, including income verification, credit history, employment status, and more. A mortgage broker will help you gather and organize all necessary paperwork, ensuring that everything is submitted correctly. This reduces the chances of delays or mistakes, keeping the process on track.

5. Time and Stress Savings

Instead of spending hours researching loans, comparing rates, and filling out multiple applications, a mortgage broker handles these tasks for you. They simplify the process by acting as a single point of contact for all your mortgage-related needs, making the entire experience less stressful and time-consuming.

6. Tailored Loan Solutions

Every buyer’s financial situation is unique. Whether you’re a first-time homebuyer, self-employed, or have less-than-perfect credit, a mortgage broker can help you find loan options tailored to your circumstances. They have experience with various loan types, including conventional, FHA, VA, and jumbo loans, ensuring you receive a solution that fits your specific needs.

7. Guidance Through Closing

The closing process is where many buyers feel the most overwhelmed. A mortgage broker assists with the final stages, ensuring that everything runs smoothly—from securing final loan approval to signing the necessary documents at closing. Their guidance reduces the chances of last-minute surprises, making the final steps of home buying seamless.

Is Using a Mortgage Broker Worth It?

For many homebuyers, especially those unfamiliar with the mortgage process, using a mortgage broker can be a smart move. The broker's expertise, access to multiple lenders, and ability to save you time and money make them a valuable asset. Some brokers charge a fee for their services, while others are paid by the lenders—so it’s important to discuss costs upfront. However, the potential savings from securing a better mortgage rate or avoiding costly mistakes usually outweigh these fees.

Conclusion

Purchasing a home doesn’t have to be a stressful or complicated experience. By working with an expert, independent mortgage broker, you can simplify the process, receive expert guidance, and find the best loan for your situation—all while saving time and money. Whether you're a first-time buyer or a seasoned homeowner, a mortgage broker can be the key to a smoother, more efficient home buying experience.

2 notes

·

View notes

Text

Unlock Your Financial Potential with Original Wealth

At Original Wealth, we are dedicated to helping you achieve your financial goals through expert advice and comprehensive financial solutions. Our firm specializes in providing tailored services to meet your unique needs, whether you’re looking for a mortgage broker, need assistance with a home loan, or are seeking a commercial loan. With our extensive experience and commitment to excellence, we are here to guide you through every step of the financial process.

Expert Mortgage Broker Services

Navigating the world of mortgages can be complex and overwhelming, especially if you’re not familiar with the intricacies of the process. At Original Wealth, our role as a trusted mortgage broker is to simplify this journey for you. We have established relationships with a wide network of lenders, which allows us to offer you a diverse range of mortgage options tailored to your financial situation and goals.

Our team of experienced mortgage brokers will work closely with you to understand your specific needs, whether you’re buying your first home, refinancing an existing mortgage, or investing in property. We take the time to explain the various mortgage products available, including fixed-rate and adjustable-rate mortgages, to ensure you make an informed decision. By leveraging our industry knowledge and connections, we can help you secure the best mortgage rates and terms that align with your financial objectives.

Tailored Home Loan Solutions

Purchasing a home is one of the most significant financial decisions you will ever make. At Original Wealth, we understand the importance of finding the right home loan that fits your budget and long-term plans. Our team is dedicated to providing personalized home loan solutions designed to make your home buying experience as smooth and stress-free as possible.

Whether you’re a first-time homebuyer or looking to upgrade to a new property, we offer a range of home loan options to suit various needs. Our experts will guide you through the entire loan application process, from pre-approval to closing, ensuring that you understand every step along the way. We’ll help you evaluate different loan products, including conventional loans, FHA loans, and VA loans, to find the one that best meets your needs. Our goal is to secure a home loan with favorable terms and competitive interest rates that support your financial well-being.

Comprehensive Commercial Loan Services

For businesses seeking financing solutions, Original Wealth offers a variety of commercial loan options to support your growth and operational needs. Securing a commercial loan can be a crucial step in expanding your business, purchasing new equipment, or funding a new project. Our team is well-versed in the nuances of commercial lending and is equipped to provide you with expert guidance throughout the loan process.

We work with a diverse range of lenders to offer commercial loan products that cater to different types of businesses and industries. Whether you need a term loan, a line of credit, or equipment financing, we will help you explore the best options available. Our comprehensive approach includes assessing your business’s financial health, understanding your funding requirements, and finding a loan solution that aligns with your business goals. By partnering with us, you gain access to competitive rates and favorable terms that can help propel your business forward

Our Service Areas

Original Wealth proudly serves a broad range of locations, bringing our financial expertise to communities in need. We are dedicated to offering outstanding services across our service areas, ensuring that individuals and businesses have access to reliable financial solutions whenever they need them.

Contact Original Wealth Today

If you are seeking professional financial guidance, look no further than Original Wealth. Whether you need a knowledgeable mortgage broker, are interested in finding the right home loan, or require a tailored commercial loan solution, our team is here to assist you. Contact us today to schedule a consultation or learn more about how we can help you achieve your financial goals. Our friendly and skilled staff are ready to provide the support and solutions you need to succeed.

In Summary

At Original Wealth, we are committed to providing exceptional financial solutions to meet your needs. From expert mortgage broker services and personalized home loan solutions to comprehensive commercial loan services, we are here to guide you through every step of your financial journey. With a focus on quality service and client satisfaction, we are your trusted partner for all your financial needs. Reach out to us today and discover how we can help you unlock your financial potential.

0 notes

Text

Residential Mortgage Refinancing and Home Financing Companies

Introduction to Mortgage Refinancing

Refinancing your mortgage can be a strategic move to improve your financial situation. When you refinance, you essentially replace your current mortgage with a new one, often with different terms. The main goal of residential mortgage refinancing is to secure better interest rates, reduce monthly payments, or switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage.

Benefits of Residential Mortgage Refinancing

One of the primary benefits of refinancing is the potential to save money on interest. If market rates have dropped since you first took out your mortgage, refinancing can lower your interest rate, reducing your overall cost. Additionally, refinancing can help homeowners access equity built up in their homes. This can be particularly useful for funding home improvements, consolidating debt, or managing large expenses.

Another advantage of refinancing is the ability to change the loan term. Homeowners might choose to refinance from a 30-year mortgage to a year mortgage to pay off their loan faster and save on interest payments over the life of the loan. Conversely, switching to a longer-term loan can lower monthly payments, providing immediate financial relief.

Considerations Before Refinancing

Before deciding to refinance, homeowners should consider several factors. First, it’s important to evaluate the current mortgage interest rates compared to your existing rate. Even a small decrease in the rate can lead to significant savings over time. Additionally, consider the costs associated with refinancing, such as closing costs, which can range from of the loan amount. These costs should be weighed against the potential savings.

Credit scores also play a crucial role in refinancing. Lenders typically offer better rates to borrowers with higher credit scores. Therefore, it’s advisable to check your credit report and, if necessary, take steps to improve your credit before applying for a refinance.

Home Financing Companies and Their Role

Home financing companies are essential players in the mortgage market. They offer a variety of loan products to meet the diverse needs of homebuyers and homeowners. These companies can provide both traditional mortgages and specialized loans, such as VA loans for veterans or FHA loans for first-time homebuyers.

When considering residential mortgage refinancing, partnering with a reputable Home Financing Companies can make the process smoother and more efficient. These companies have the expertise to guide you through the refinancing process, ensuring you understand your options and helping you choose the best loan product for your situation. They can also help you navigate the necessary paperwork and legal requirements, making the experience less daunting.

Choosing the Right Home Financing Company

Selecting the right home financing company is crucial for a successful refinancing experience. Start by researching potential companies online and reading reviews from other homeowners. Look for companies with a strong reputation for customer service and transparent business practices. It's also beneficial to get recommendations from friends, family, or financial advisors who have had positive experiences with refinancing.

When you have a list of potential companies, compare their offerings. Pay attention to the interest rates, fees, and loan terms they provide. It's also important to consider the level of support and guidance they offer throughout the refinancing process. A good home financing company will take the time to explain your options and answer any questions you may have, ensuring you feel confident in your decision.

The Refinancing Process

The refinancing process typically begins with an application. You'll need to provide information about your current mortgage, income, assets, and debts. The home financing company will use this information to determine your eligibility and offer loan options.

Next, the company will perform a credit check and may require an appraisal of your home. This helps them assess the value of your property and the amount of equity you have. Once these steps are complete, the company will present you with a loan estimate, outlining the terms and costs of the new mortgage.

If you decide to proceed, you'll need to provide additional documentation, such as tax returns and bank statements. The home financing company will then underwrite the loan, ensuring all information is accurate and meets their criteria. Finally, you'll close on the new loan, paying any necessary fees and signing the required paperwork.

Conclusion

Residential mortgage refinancing can be a powerful tool for homeowners looking to improve their financial situation. By securing better interest rates, reducing monthly payments, or accessing home equity, refinancing can provide significant benefits. Partnering with a reputable home financing company is essential to navigating the refinancing process successfully. By researching and choosing the right company, you can ensure a smooth and beneficial refinancing experience.

0 notes

Text

Understanding the Role of a Mortgage Advisor in Atherstone

In the intricate world of real estate financing, mortgage advisors play a crucial role in guiding individuals and families through the complexities of securing a home loan. Atherstone, known for its quaint charm and growing residential areas, sees a rising demand for expert financial advice in navigating the mortgage landscape.

What Does a Mortgage Advisor Do? Mortgage advisor atherstone act as intermediaries between lenders and borrowers, offering personalized guidance tailored to each client’s financial situation and homeownership goals. They help potential homebuyers understand the various mortgage products available, such as fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans like FHA and VA loans.

Why Consult a Mortgage Advisor in Atherstone? For residents of Atherstone looking to buy their dream home or refinance an existing property, consulting a mortgage advisor can provide significant advantages. Advisors have access to a wide range of lenders and mortgage products, allowing them to find competitive interest rates and terms that suit their clients’ needs.

The Process Explained

Initial Consultation: Advisors begin by assessing the client’s financial situation, including income, credit history, and existing debts.

Mortgage Product Selection: Based on the client’s profile, the advisor recommends suitable mortgage options and explains the pros and cons of each.

Application and Approval: Once a mortgage product is chosen, the advisor assists in completing the application and ensures all necessary documents are submitted to the lender.

Benefits of Using a Mortgage Advisor

Expertise and Market Knowledge: Advisors stay updated on market trends and lender policies, providing clients with informed decisions.

Personalized Service: Each client receives tailored advice that considers their unique financial circumstances and long-term goals.

Finding the Right Mortgage Advisor in Atherstone When selecting a mortgage advisor, residents should look for professionals with a proven track record of success and a commitment to client satisfaction. Reading client testimonials and checking credentials can help in making an informed choice.

Click here for more information:-

hinckley mortgage advice

Mortgage broker Hinckley

0 notes

Text

Critical Strategies for Successful Mortgage Origination in Today's Market

Navigating the mortgage origination process in today's dynamic market requires a strategic approach that balances industry knowledge, client needs, and regulatory compliance. This article explores essential strategies for mortgage professionals to thrive in the current market environment, from understanding market trends to fostering client relationships and effectively leveraging technology.

Understanding Current Market Trends

To succeed in mortgage origination, professionals must stay informed about current market trends. Factors such as interest rates, housing inventory levels, and economic conditions significantly impact borrower demand and lending practices. Monitoring these trends allows mortgage professionals to anticipate market shifts and tailor their strategies accordingly.

In today's market, low interest rates have spurred refinancing activity, while competitive housing markets have increased demand for purchase loans. Adapting to these trends involves:

Offering competitive loan products.

Staying flexible with underwriting guidelines.

Providing personalized financial solutions that meet diverse borrowers' needs.

Leveraging Technology for Efficiency

Technology plays a pivotal role in modern mortgage origination. From digital loan applications to automated underwriting systems, technology streamlines processes, reduces paperwork, and enhances the overall borrower experience. Mortgage professionals can leverage technology to expedite loan approvals, improve communication with clients, and ensure compliance with regulatory requirements.

Integration of customer relationship management (CRM) tools and mortgage-specific software enables efficient lead management, pipeline tracking, and task automation. Embracing digital platforms also facilitates remote work capabilities, allowing mortgage teams to collaborate effectively and serve clients regardless of geographical constraints.

Building Strong Client Relationships

Successful mortgage origination hinges on building strong client relationships based on trust, transparency, and excellent service. Establishing rapport with borrowers involves active listening, understanding their financial goals, and providing clear, timely communication throughout the loan process.

Effective communication includes educating clients about loan options, explaining mortgage terms and conditions, and addressing any concerns or questions promptly. Mortgage professionals who prioritize client satisfaction often earn referrals and repeat business, contributing to long-term success in a competitive market.

Navigating Regulatory Landscape

Compliance with regulatory guidelines is non-negotiable in mortgage origination. Mortgage professionals must stay updated on federal and state regulations, licensing requirements, and industry standards to mitigate risks and ensure ethical practices.

Adhering to regulations such as the Truth in Lending Act (TILA), Real Estate Settlement Procedures Act (RESPA), and Fair Housing Act (FHA) promotes consumer protection and enhances credibility within the industry. Implementing robust compliance procedures, conducting regular training sessions, and maintaining accurate documentation are essential for minimizing legal exposure and fostering a culture of compliance.

Diversifying Product Offerings

Offering a diverse range of mortgage products enhances market competitiveness and meets varying borrower needs. Mortgage professionals should familiarize themselves with conventional loans, government-backed programs (such as FHA, VA, and USDA loans), jumbo mortgages, and specialty products tailored to specific demographics or financial situations.

Tailoring product offerings to local market conditions and borrower demographics can lead to increased loan volume and customer satisfaction. Partnering with reputable lenders and wholesale channels expands product availability and strengthens relationships within the lending community.

Emphasizing Professional Development

Continuous learning and professional development are integral to thriving in the mortgage origination industry. Mortgage professionals should pursue industry certifications, attend seminars and conferences, and stay abreast of emerging trends and best practices.

Networking with peers, industry experts, and professional associations fosters knowledge sharing and career growth opportunities. Engaging in mentorship programs and seeking guidance from seasoned professionals can provide invaluable insights and support career advancement goals.

Successful mortgage origination in today's market requires a strategic blend of industry expertise, technological proficiency, client-focused service, regulatory adherence, product diversification, and ongoing professional development. By understanding market trends, leveraging technology for efficiency, building strong client relationships, navigating regulatory requirements, diversifying product offerings, and emphasizing continuous learning, mortgage professionals can position themselves for success amidst evolving market dynamics.

As the mortgage landscape continues to evolve, adapting to change and embracing innovation will be crucial for maintaining competitiveness and delivering exceptional value to borrowers seeking financing solutions. By implementing these key strategies, mortgage professionals can navigate challenges, capitalize on opportunities, and achieve sustainable growth in their origination practices.

0 notes

Text

Worried About Mortgage Rates? Control the Controllables

Chances are you’re hearing a lot about mortgage rates right now. You may even see some headlines talking about last week’s Federal Reserve (the Fed) meeting and what it means for rates. But the Fed doesn’t determine mortgage rates, even if the headlines make it sound like they do.

The truth is, mortgage rates are impacted by a lot of factors: geo-political uncertainty, inflation and the economy, and more. And trying to pin down when all those factors will line up enough for rates to come down is tricky.

That’s why it’s generally not worth it to try to time the market. There’s too much at play that you can’t control. The best thing you can do is control the controllables.

And when it comes to rates, here’s what you can influence to make your moving plans a reality.

Your Credit Score

Credit scores can play a big role in your mortgage rate. As an article from CNET explains:

“you can’t control the economic factors influencing interest rates. but you can get the best rate for your situation, and improving your credit score is the right place to start. lenders look at your credit score to decide whether to approve you for a loan and at what interest rate. a higher credit score can help you secure a lower interest rate, maybe even better than the average.”

That’s why it’s even more important to maintain a good credit score right now. With rates where they are, you want to do what you can to get the best rate possible. If you want to focus on improving your score, your trusted loan officer can give you expert advice to help.

Your Loan Type

There are many types of loans, each offering different terms for qualified buyers. The Consumer Financial Protection Bureau (CFPB) says:

“there are several broad categories of mortgage loans, such as conventional, fha, usda, and va loans. lenders decide which products to offer, and loan types have different eligibility requirements. rates can be significantly different depending on what loan type you choose.”

When working with your team of real estate professionals, make sure you find out what’s available for your situation and which types of loans you may qualify for.

Your Loan Term

Another factor to consider is the term of your loan. Just like with loan types, you have options. Freddie Mac says:

“when choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Depending on your situation, the length of your loan can also change your mortgage rate.

Bottom Line

Remember, you can’t control what happens in the broader economy. But you can control the controllables.

Work with a trusted lender to review what you can do to make a difference. By being strategic with these factors, you may be able to combat today’s higher rates and lock in the lowest one you can.

Need a hand to discuss mortgage rates and home prices? Chat with top-rated real estate agents in Chicago, Illinois.

0 notes