#va home loan

Explore tagged Tumblr posts

Text

VA Loans can help make homeownership possible for those who have served our country. These loans offer great benefits for eligible individuals and can help them buy a VA-approved house or condo, build a new home, or make improvements to their house.

ChangeMyRate.com compares multiple lenders and loan options for VA Loans — all in one place. Do you know how much home you can afford? Take the first step by getting pre-approved here for FREE! No SSN Required https://bit.ly/3pvLVQS

#mortgage#realestate#housing#buyahouse#homeowner#homebuyer#homeownership#applynow#real estate#buyahome#valoan#va#vahomeloan#va home loan

2 notes

·

View notes

Text

National Association of Realtors (NAR) agreed to pay $418 million in damages to settle some of their real estate commission lawsuits.

National Association of Realtors (NAR) recently reached a settlement that impacted real estate commissions for different mortgage loan types in Kentucky On March 15th, 2024, the National Association of Realtors (NAR) agreed to pay $418 million in damages to settle some of their real estate commission lawsuits. The settlement prohibits NAR from requiring a seller’s agent to engage in cooperative…

#Active duty#Fort Knox#Kentucky#Mortgage loan#nar settlement#Refinancing#va home loan#VA loan#VA Mortgage#Veteran

0 notes

Text

For veterans and active-duty service members, the VA home loan program offers a range of benefits, including the opportunity to tap into their home equity through a cash-out refinance. Whether you're looking to fund home improvements, consolidate debt, or cover unexpected expenses, a VA home loan cash-out refinance can be a powerful financial tool. Let's explore how this option works and how it can help you achieve your financial goals.

0 notes

Text

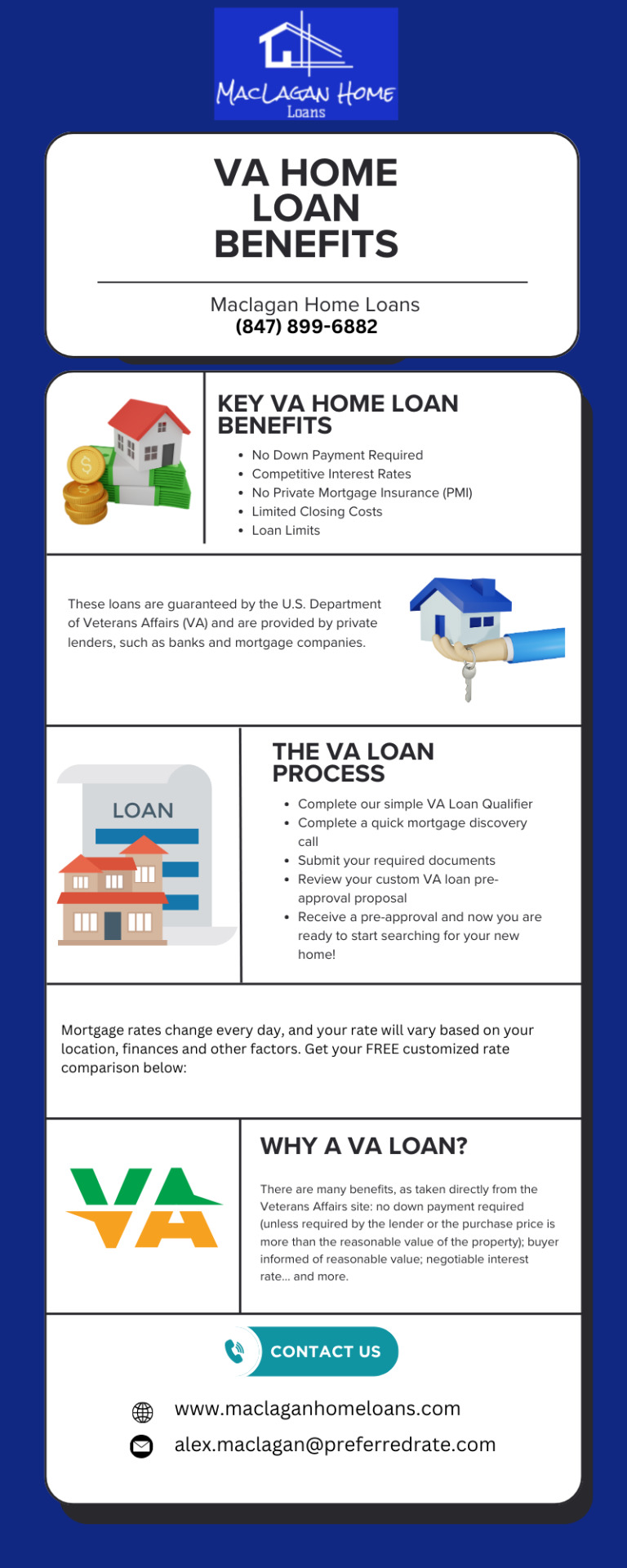

Va Home Loan Rate - Maclagan Home Loans

Discover competitive VA home loan rates with Maclagan Home Loans. If you are a first-time home buyer or an experienced investor, we will help you know the differences between loan programs to enable you to make the best choice. Get started today!

0 notes

Text

When I’m writing my Modern AU but then try to figure out and calculate how the life I gave the Batch is financially possible:

#I’ll be writing#and then I’ll be like wait how do they own a house in the suburbs in this economy?#so then I’ll be like ok 99 was the homeowner so maybe he already paid it off and now they only worry about property tax and bills#but it doesn’t stop there#now I’m looking up the prices of homes in the 80s#then I start looking up details on VA loans#then I’m calculating ok this sibling has this job so this would be what they make in a year after taxes#then I add them up#but wait#Crosshair and tech are in college how are they affording that?#then I remember the GI bill#but then I’m like ok but what if they go on vacation?#so then I’m like ok they give off the vibes that they would choose to drive everywhere they could within reason#BUT THEN I’m like hold up what if they brought Omega to Disney World#so now I’m looking at ticket hotel and airfare costs#and seeing what military and veterans discounts are#meanwhile this fic hasn’t even been fully written I’m just brainstorming and writing all these details in a brainstorming document#I’ll apply suspension of disbelief and ‘don’t worry about it’ to other things like face tattoos in the suburbs and timeline and ages#but for the financial aspect I’m like ‘how can I make this as true to reality as possible’?#star wars tbb#star wars the bad batch#the bad batch#bad batch modern au#sw bad batch

81 notes

·

View notes

Text

When looking at where the Black sides are, we could start by considering where they are not.

FHA and VA loans are credited with helping form the middle class of America by making homeownership available to a large portion of the population. Large housing complexes were developed, beginning with Levittown in Long Island, NY. Similar complexes sprung up in many major cities with one thing in common. No homes could be sold to Black people, with the federal government fully backing redlining, which made segregated housing the rule and not the exception. Black sides of town evolved where the whites elected not to go. There were housing complexes created for Black and Jewish people as well; these “projects” were definitely not intended for the middle class.

(continue reading)

#politics#redlining#housing#housing discrimination#racism#structural racism#anti blackness#fha loans#va loans#home loans#levitt town#generational wealth#segregation#housing projects

65 notes

·

View notes

Text

For people wanting to own a house in country places, the USDA Home Loan program is like an awesome chance that only opens for them. It helps such folks reach their dream of becoming homeowners. This blog focuses on key aspects, benefits, and requirements for securing a USDA home loan, aiding home buyers in rural or small areas.

#property#real estate#united states#gustancho associates#gca mortgage#usa#va loans#fha loan#first time home buyer#bad credit score#usda loans#fha loans

2 notes

·

View notes

Text

VA Announces Changes Meant To Stop Foreclosures On Veterans Using VA-Backed Loans

The Department of Veterans Affairs is extending a pandemic-era program that helped financially strapped veterans keep their homes after criticism that it wasn’t doing enough to prevent those with VA-backed loans from foreclosure.

View On WordPress

2 notes

·

View notes

Link

Smart Home.IQ Touch Panel.Sky Bell

#gulf coast#smart home#country living#country life#city country#fence#school district#biloxi#with acreage#land#new build#new constr#new construction#vinyl flooring#property#first time home buyer#va loans#fha#usda

2 notes

·

View notes

Text

I got caught in the crazy housing market with high interest rates on overpriced homes. My mortgage is $1,100 which is well below rent in my neighborhood between $1,500-$2,200 requiring 3x's in income 👀

#Thankfully I used the VA home loan which got me a 4% interest rate instead of the 6-7% with others.#Honestly tho rent prices are OUT OF CONTROL so I probably would've still bought my house even with a higher mortgage.

6K notes

·

View notes

Text

Why Mortgage Interest Rates May Not Fall in 2025

As 2025 approaches, many homeowners and prospective buyers are hoping for a decrease in mortgage interest rates, which have been at elevated levels in recent years. However, despite these hopes, several key factors suggest that mortgage interest rates may not significantly fall in 2025.

1. Ongoing Inflation Concerns

The Federal Reserve has been focused on tackling inflation, which has remained persistently above its 2% target in recent years. While inflation has moderated in some areas, the overall economic landscape still shows signs of price pressures in certain sectors. If inflation remains stubbornly high, the Federal Reserve may maintain its restrictive stance on interest rates to curb inflationary pressures. Mortgage rates are closely tied to the Fed's benchmark rates, and until inflation is firmly under control, the central bank may resist lowering rates, which could prevent a significant drop in mortgage rates.

2. Strong Economic Growth and Labor Market

The U.S. economy has shown resilience in the face of challenges such as the pandemic and global economic uncertainty. The labor market, in particular, has remained robust, with low unemployment rates and steady wage growth. While this is positive for consumers and the overall economy, strong economic performance can also push inflationary pressures higher, prompting the Federal Reserve to keep interest rates elevated. With a strong economy, there may be less urgency for the Fed to reduce rates in the near future, which would likely keep mortgage rates from falling dramatically.

3. Global Economic Factors

Mortgage rates in the U.S. are influenced not only by domestic conditions but also by global economic trends. Events such as geopolitical tensions, trade disruptions, and fluctuations in global energy prices can influence inflation and economic growth. For example, if global supply chain issues persist or if oil prices surge, these factors could contribute to rising inflation, limiting the Fed’s ability to reduce interest rates. Additionally, many central banks around the world, including the European Central Bank and Bank of Japan, have also maintained higher interest rates in response to global inflationary pressures.

4. Structural Changes in the Housing Market

The housing market itself is undergoing significant changes, with a shortage of housing inventory in many areas. This imbalance between supply and demand has kept home prices relatively high. Even if mortgage rates were to fall slightly, high home prices and limited inventory may prevent many buyers from entering the market, limiting the potential impact of lower rates.

In conclusion, while many hope for a decrease in mortgage rates in 2025, the combination of inflationary concerns, strong economic performance, global factors, and housing market dynamics may mean that rates will remain elevated or only modestly decrease. Buyers and homeowners should prepare for a potential environment of higher rates, at least in the near term.

Lanny Mixon, NMLS# 2450250

Private Mortgage Advisors, LLC

312 Hemphill St.

Hattiesburg, MS 39425

601-480-9659

Click Here to Apply Online!

#home mortgage#home loans#mortgage#first time home buyer#mortgage lending#fha loans#usda loans#va loans#home buyers guide#conventional mortgage#mortgage interest rates#interest rates

0 notes

Text

Kentucky VA Lender Mortgage Information The Department of Veterans Affairs (VA) offers financing for Veterans. The VA determines eligibility and will issue a certificate of eligibility to qualifying applicants. Must be a Veteran, Active Duty Military, or member of the Reserves. 100% Financing No Monthly Mortgage Insurance Closing costs can be gifted by immediate family or by seller contributions…

View On WordPress

#Active duty#fha-loans#Fort Knox#home-buying#Kentucky#Mortgage loan#real estate#Refinancing#va home loan#VA loan#VA Mortgage#Veteran

0 notes

Text

Website: https://duanebuziakmortgagemaestro.com/

Address: 4860 Cox Rd, Glen Allen, VA 23060

Phone: +1 804-212-8663

Trust the Mortgage Maestro to Make Your Dream Home a Reality.

Welcome to Coast2Coast Mortgage! I m Duane Buziak Mortgage Maestro, a state licensed home loan expert dedicated to making sure your home financing experience is top-notch.

Switched to brokering some years ago as I have long believed the best advice comes from someone independent, not tied, captive, or bound. I have a multitude of loan options, some might even say the most in the state. In addition, as I always start all loan applications with a soft touch, this will NOT affect your credit!

Business Email: [email protected]

Tiktok: https://www.tiktok.com/@duanebuziak1

Twitter: https://twitter.com/duanebuziak

Youtube: https://www.youtube.com/user/duanebuziak

Facebook: https://www.facebook.com/duanebuziaktheoneandonly

Instagram: https://www.instagram.com/duanebuziakmortgagemaestro/

Linkedin: https://linkedin.com/in/duanebuziak

Pinterest: https://pinterest.com/duanebuziak/

Zillow: https://www.zillow.com/lender-profile/duanembuziak/

Lendingtree: https://reviews.lendingtree.com/duane-buziak/1110647

#mortgage rates#home loan#cash-out refinance#mortgage calculator#pre-approval#mortgage interest rates#best mortgage rates#FHA loan#VA loan#Veteran loan#first-time home buyer#refinancing#mortgage loan officer in Richmond#VA#mortgage loan officer in Virginia#mortgage broker#mortgage lender#apply for a mortgage#loan officer near me

1 note

·

View note

Text

Discover the Exceptional VA Home Loan Benefits with Maclagan Home Loans - Unlock exclusive advantages for veterans and active-duty service members. Explore low-interest rates, zero down payment options, and more!

0 notes

Text

Tailored Mortgage Solutions from Herring Bank in Amarillo, TX

Here's another blog post with engaging mortgage-related content for Herring Bank, designed to enhance SEO:

Tailored Mortgage Solutions from Herring Bank in Amarillo, TX

Explore the best mortgage options designed to fit your life goals with Herring Bank.

Achieve Your Homeownership Dreams with Herring Bank

For decades, Herring Bank has provided Amarillo and surrounding communities with reliable mortgage solutions tailored to each borrower’s unique needs. Whether you're looking to buy your first home, refinance an existing mortgage, or tap into your home’s equity, Herring Bank is here to help you unlock the doors to your dream home.

Why Herring Bank Stands Out in Mortgage Lending

Expertise You Can Trust Herring Bank’s team brings years of industry expertise, guiding you through the mortgage process step-by-step. With our dedication to customer service and financial guidance, we ensure that your home financing experience is seamless and stress-free.

Competitive Rates and Flexible Terms At Herring Bank, we understand that affordability is key. We offer competitive interest rates and flexible loan terms to suit your financial needs, ensuring that your mortgage aligns with your budget and long-term plans.

Customizable Mortgage Options From conventional loans to FHA, VA, and jumbo loans, we provide a variety of mortgage products. Our goal is to make homeownership accessible, whether you’re buying a first home, an investment property, or refinancing to save on monthly payments.

The Herring Bank Mortgage Process – Simplified for You

Consultation Speak with our mortgage advisors to discuss your goals and options. We’ll help determine the best loan type for you.

Application Complete a secure, user-friendly online application in minutes, or visit us at our Amarillo location for personalized service.

Approval Our team reviews and underwrites your application quickly to provide prompt approval, allowing you to move forward with confidence.

Closing Once approved, we’ll finalize your mortgage, guiding you through the closing process with clarity and ease.

Explore Herring Bank’s Full Range of Services

Beyond mortgages, Herring Bank offers banking services designed to support your entire financial journey, from checking and savings accounts to investment and personal loans. We’re committed to being a reliable partner, no matter where you are in life.

Ready to take the next step in homeownership? Visit Herring Bank today to learn more about our mortgage services in Amarillo, TX, and start building a future in the home you deserve.

0 notes