#usd / jpy

Explore tagged Tumblr posts

Text

Just reminding you all that with some moon time in the Bells Hells future, I do still have this shirt in my shop ^_- (and on other things too)

Get it here!

#critical role#ruidus#sailor moon#moon revenge#funny#boost#I will also point out that the USD to JPY means fewer dollars go a LONG way as yen right now#so every little bit helps more than you think it might ^___^#Even $1 or $2 on patreon/ko-fi per month#or even just a one time donation nearly doubles when it becomes yen now!!

37 notes

·

View notes

Text

#Email#More#In this Article#ASICS#Rank 10#Name: atmos x ASICS GT-2160 “Tapetum”#Colorway: TBC#SKU: 1203A576-001#MSRP: ¥18#700 JPY (Approx. $130 USD)#Release Date: December 18#2024#Where to Buy: atmos tokyo

3 notes

·

View notes

Text

fellas i may be (checks exchange rate) about 16 bucks less ri-

ONLY 16 DOLLARS???????????? FOR 2570 YEN??????????? JAPAN ARE YOU OKAY??????????????????????HELLO??????? i thought the national bank intervened but i guess it didnt help at all.....

#lol you can see the 2 interventions but it jumped right back up#1 usd = 157 jpy...............god........#for those who dont know it used to be about 1USD = 110JPY until 2021#and during last year's trip it was like 1 usd = 140 jpy#- blue

5 notes

·

View notes

Text

My View this week on #USD and #JPY pair,

Before taking any trade there confirmation and other confluence behind, so before taking this trade look for confirmation, if u don’t see anything please don’t trade u gonna lose money

if u wanna now more DM is open,

Forex is all about logic, not always going to work but, we look for higher possibility to work

Let’s win together

#forextips#forexsignals#forexmoney#forex#foryou#forexeducation#forexstrategy#education#usdollar#usd / jpy#gold#xauusd

13 notes

·

View notes

Text

manifesting the skk figures binning as soon as they're released

#want them so bad but like. objectively they're not That great. like. 1. furyu (self explanatory). 2. ugly support poles. 3. awkward poses#based on kinda mid art. 4. kinda awkward face sculpts. and 5. mid paint jobs.#but i love their bases and i want to pretend they're getting married and i want them in my collection#but they're 28000 jpy each And are releasing the same month (which would make them 400 usd + shipping total if exchange rates stay the same#i need them to bin so bad bc i am Not spending over 18000 jpy on either of them individually#romeo.txt

3 notes

·

View notes

Text

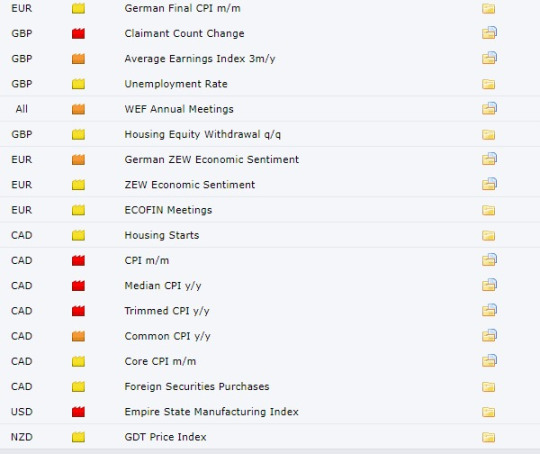

Many Data News Today Data in GBP , USD , CAD (CPI)

Many Data News Today

Data in GBP , USD , CAD (CPI)

All currency pairs (like EURUSD , USDCAD , AUDCAD etc ) will affect

Gold , Oil as well

If you trade any of them and don't want to loss Money join our Services and get Accurate signals Before News

link - https://bit.ly/3D4WrlJ

WHATSAPPGROUP

Facebook Group - https://www.facebook.com/groups/795723915142894

Facebook Page - https://www.facebook.com/ForexGoldRecommendation

Telegram group - https://t.me/klseusmarkettips

3 notes

·

View notes

Text

2024年 11月度ランキング発表!!

赤や黄色に染まる色鮮やかな紅葉の中、EA達が赤く燃えるようにプラス色に染まったか・・・ 独断と偏見で選んだ自動売買EAの2024年 11月度ランキング発表!! ーゴゴジャン人気ランキングー 環境を整える *ゴゴジャン公式フォワードテストでは、FXTFを使用しています。フォワードテストと同じ業者を使用した方が成績の剥離が少なくなるのでお勧めです。 FXTF メタトレーダー4[MT4]で24時間取引可能!口座開設はFXTF ―VPSを利用する― *パソコンを常時稼働よりやっぱりVPSがベストと考えます。 国内口座であれば、お名前.comのFX専用VPSは十分なパフォーマンスです。 第9位 一本勝ち -136.4pips 最近絶好調だったのに・・・でもまだ年間収支はプラスだ!このまま年末に突入(…

#AssyeGBP#FX EA自動売買#FX EA自動売買ランキング#GTX#homelink#Panda-C pro USD JPY M15#Tokyo Fixing USDJPY je#TOKYO PREMIUM#アノマリーマスター#仲値の極み#勝てるEAとは#幸せの1本勝ち#稼げるEAとは

0 notes

Text

U.S. dollar climbs overnight as speculation grows Trump in election lead

Iryna Ustenko | Istock | Getty Images The U.S. dollar strengthened against the Mexican peso and other major global currencies on Tuesday evening as voting began to wind down in the presidential election. The greenback had gained 2.9% against the Mexican peso at around 10:30 p.m. ET, and was also higher against the Swiss franc, Japanese yen and Chinese yuan. The ICE U.S. Dollar Index rose 1.4%,…

#Australian Dollar/US Dollar FX Spot Rate#Breaking News: Markets#business news#DXY US Dollar Currency Index#EUR/USD#GBP/USD#U.S. dollar#US Dollar/Canadian Dollar FX Spot Rate#US Dollar/Mexican Peso FX Spot Rate#US Dollar/Swiss Franc FX Spot Rate#USD/JPY

0 notes

Text

Here’s why Japan’s stocks are plunging after Shigeru Ishiba’s win

Skyline of Tokyo, Japan. Jackyenjoyphotography | Moment | Getty Images Japan’s Nikkei 225 tumbled over 4% on Monday, following a mixed set of economic data out of Japan and as traders reacted to the election of incoming Prime Minister Shigeru Ishiba. Japan’s August retail sales climbed 2.8% year on year, beating Reuters poll estimates of a 2.3% rise, and up from a revised 2.7% rise in…

0 notes

Text

#Reebok Readies the LTD Premier Road Ultra in “Black”#Name: Reebok Ltd Premier Road Ultra#Colorway: “Black”#SKU: R04722BU000089#MSRP: ¥33#000 JPY (approx. $214 USD)#Release Date: Available Now#Where to Buy: Reebok

0 notes

Text

Relative Vigor Index Explained

The Relative Vigor Index (RVI) is a momentum oscillator used in technical analysis to measure the strength of a trend. Developed by John Ehlers, the RVI is based on the concept that prices tend to close higher than they open in an uptrend and lower than they open in a downtrend. This article will delve into the RVI, explaining its calculation, interpretation, and how it can be effectively used in…

#Crossovers#Divergence#Downtrend#Entry and Exit Points#EUR/USD#Forex#Forex Traders#Forex Trading#MACD#Market Trends#Moving Average#Moving Average Convergence Divergence#Price Movements#Relative Strength#Risk Management#RSI#Signal Line#Stop-Loss#Technical Analysis#Trading Signals#Trading Strategies#Trend Direction#Uptrend#USD/JPY#Volatility

0 notes

Text

I want to see the price violates BSL to take buystop within FVG on hourly USD/JPY and how it will react. Will it form the highest probability of the OB that will take SSL?

#the inner circle trader#smart money#FVG#Fair Value Gap#BSL#Buy Side Liquidity#SSL#Sell Side Liquidity#Buy Stop#Sell Stop#USD/JPY

1 note

·

View note

Text

Forex Update: 📊 USD rallies strong! CAD slips on #BoC cut bets, NZD pressured by China's deflation, GBP steady, JPY gains!

0 notes

Text

2024年 10月度ランキング発表!!

やっと暑さも冷めだした・・・果たしてEA達の熱も冷めてしまったのか・・・ 独断と偏見で選んだ自動売買EAの2024年 10月度ランキング発表!! *以下のバーナーやリンクは広告を含みます。 ーゴゴジャン人気ランキングー 環境を整える *ゴゴジャン公式フォワードテストでは、FXTFを使用しています。フォワードテストと同じ業者を使用した方が成績の剥離が少なくなるのでお勧めです。 FXTF 初心者からプロまで納得のFXTF |…

#AssyeGBP#FX EA自動売買#FX EA自動売買ランキング#GTX#homelink#Panda-C pro USD JPY M15#Tokyo Fixing USDJPY je#TOKYO PREMIUM#アノマリーマスター#仲値の極み#勝てるEAとは#幸せの1本勝ち#稼げるEAとは

0 notes

Text

USD/JPY Price Analysis

The USD/JPY pair oscillates in a narrow trading band during the Asian session on Thursday and is currently placed just above the 149.00 mark, well within the striking distance of the weekly high touched the previous day.

A generally positive risk tone, along with the Bank of Japan's (BoJ) persistent ultra-easy monetary policy, is seen undermining the safe-haven Japanese Yen (JPY) and acting as a tailwind for the USD/JPY pair. The upside, however, remains limited in the wake of subdued US Dollar (USD) price action, which continues to be weighed down by diminishing odds for more rate hikes by the Federal Reserve (Fed) and a further decline in the US Treasury bond yields.

Traders also seem reluctant to place aggressive directional bets and prefer to wait on the sidelines ahead of the release of the latest US consumer inflation figures, due later during the early North American session. The crucial US CPI report will play a key role in influencing market expectations about the Fed's future rate hike path. This, in turn, will drive the USD demand in the near term and help determine the next leg of a directional move for the USD/JPY pair.

From a technical perspective, spot prices remain confined in a familiar range held over the past week or so. This constitutes the formation of a rectangle on short-term charts and points to indecision among traders. The range-bound price action, meanwhile, might still be categorized as a bullish consolidation phase, against the backdrop of a rally from the July monthly swing low. Adding to this, oscillators on the daily chart are still holding in the positive territory.

The aforementioned setup suggests that the path of least resistance for the USD/JPY pair is to the upside. That said, it will still be prudent to wait for a sustained breakout through the 149.30-149.35 supply zone, representing the top end of the trading range, before positioning for any further gains. The subsequent move-up has the potential to lift spot prices back towards the 150.00 psychological mark, which has been speculated as the potential intervention level.

A sustained strength beyond, however, will be seen as a fresh trigger for bullish traders and pave the way for a further appreciating move towards the 151.00 round figure. The momentum could get extended and push the USD/JPY pair closer to the 152.00 mark, or a multi-decade high touched in October 2022.

On the flip side, any meaningful corrective decline now seems to find some support near the 148.55-148.50 zone ahead of the weekly low, around the 148.15 area. This is followed by the 200-period Simple Moving Average (SMA) on the 4-hour chart, currently pegged just below the 148.00 round figure. A convincing break below could drag the USD/JPY pair to the 147.30 area, or the lowest level since September 14 touched last Tuesday.

1 note

·

View note

Text

Japan Q2 GDP, China CPI

People look at the city’s skyline from the Bunkyo Civic Center Observation Deck in Tokyo on August 14, 2024. Philip Fong | AFP | Getty Images Asia-Pacific markets fell on Monday, with Hong Kong’s Hang Seng Index leading losses in the region, following the weaker-than-expected U.S. jobs report on Friday. China’s inflation rate grew 0.6% year on year, lower than the 0.7% expected from economists…

#Asia Economy#Breaking News: Markets#business news#Hang Seng Index#KOSPI Index#Markets#Nikkei 225 Index#S&P 500 Index#USD/JPY#World Markets

0 notes