#us credit rating

Explore tagged Tumblr posts

Text

youtube

📉 Is the United States' Credit Rating in Jeopardy? 📈

In our latest video, we dive deep into the potential consequences of an impending government shutdown on the US credit rating. Moody's Investors Service has issued a warning, and it's a wake-up call for all of us.

Join us as we unravel the intricacies of this critical issue, shedding light on how political polarization and fiscal challenges are impacting the nation's financial stability.

Discover the ripple effect of a credit rating downgrade - from Treasury bonds to your mortgage rates. We've got all the insights you need to make informed financial decisions.

Stay in the loop with the latest in finance and economics. Watch our video, like, subscribe, and hit that notification bell to stay ahead of the game!

#america#credit rating#shutdown#us credit rating#government shutdown#finance news#economic impact#economic implications#financial markets#fiscal policy#credit downgrade#smart finance#economic analysis#us politics#Youtube

0 notes

Text

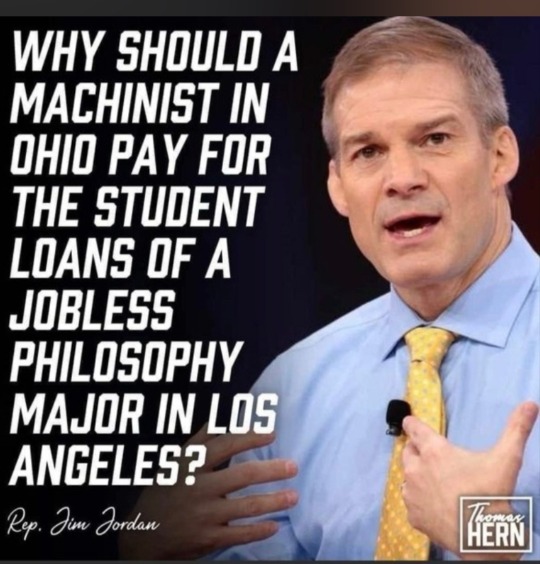

#trump#donald trump#trump 2024#president trump#donald j. trump#ohio#us taxes#death and taxes#bailout#student loans#loans#debt#debt consolidation#gop#college#university#ownership#money management#money making#money#banks#interest rates#nyse#world economic forum#economy#anti capitalism#freedom#shopping#credit cards#saving 6

39 notes

·

View notes

Text

now that i can give a more coherent update, the prognosis is basically that she will be in indefinite hospice treatment with symptomatic treatment where possible. the main concern is her platelet count, because her blood is unable to clot and so even a little bump could cause big problems for her. and then her appetite to ensure she keeps her weight on and strength up

we ended up at the kindest emergency vet we've ever been to and god i cannot even begin to get into how many traumatic experiences we've had with horrible emergency vets... but they were all amazing there and the main vet took so much time to break down what was going on and keep us informed on every single test they did and then afterward wrote up a super detailed report so we could go to a non-emergency vet to continue her meds if they improve her qol

and already a day and a half later she is seeing a huge improvement in her energy and comfort, like she's doing things i haven't seen since before the lethargy first set in which i am so beyond grateful i get to see again even if i know she isn't 'getting better'

#i don't know what they did to the bill but i will say they charged us about half of what i was bracing for#like i was fully prepared to be taking out an independent credit line for this#considering how extensive the testing was/past experience/etc#and i didn't have to do that#and i know this is something they went in and manually adjusted for us after finding out it was cancer/not treatable#because we were already very close to the final charge halfway through the tests#before meds/her chest xrays/more rounds of blood testing which were ofc all on emergency rates too

14 notes

·

View notes

Text

Writing this cover letter and I can't help but feel excited about the possibility of maybe getting a job at Nintendo if this application is well received but the simultaneous reality of probably needing to move to Germany for it is something I do not want to grapple with

#ironically i would have to go home to the netherlands for my videogames because german cases are ugly as fuck#with their big ass age logo#and you know#german text#like no offense to the german language it is a lot nicer than most people give it credit for#strongly prefer it over french#but being dutch it just feels wrong to have games with text on them that isnt dutch or english#and also once more why is that age rating so big and ugly#there is this perfectly fine small pegi logo everyone else here uses why not germany

2 notes

·

View notes

Text

doing boring adult things kinda makes me horny. got approved for a credit card with unreal benefits that'll help us afford groceries. got a crock pot recipe pulled up in a tab to make today. kinda gets me going

#the credit card has an UNREAL interest rate (derogatory) but im just gonna pay it off when we use it#like...5% cashback on groceries????#in this economy??#sign me up.

8 notes

·

View notes

Text

😐

#yall pls donate for me this month i used a tenth of my take home pay on gfms this july#it's not a lot considering conversion rates but i got surprised by my credit card bill

1 note

·

View note

Text

i've come to accept that my mom is never going to respect my personal boundaries but I need her to respect my financial ones

#when I wanted a $200 bicycle from Walmart and she took my debit card and bought a $400 sports bike while I was at school#i got a bunch of messages from creditkarma and a bank the other day and thought someone stole my SSN#NOPE she decided to sign me up for a credit card without my consent :)#it's got an insane APR and I'm between jobs so I can't even use it#and if she taking the time to talk to me she would know I've seen cards like that and I ignore them because the interest rate is too high#anyways 🚬#dzifa speaks

2 notes

·

View notes

Text

.

#wh. um. fuck.#dad's told me about my nan's will#and uh.#the money goes first to my grandad's looking after obviously#but um once he's not around (in a year or two dad says‚ with his alzheimers)#then it's split between the family in percentages ive forgotten - including my mum‚ which is lovely#but basically in two/three years. i could have enough money to buy my own place.#ive no idea what my credit rating looks like in the least but i guess i have that amount of time to find out and sort it out#i imagine it's not very good - i don't have a credit card or anything like that but i haven't used my overdraft since i was at uni#but dad says i could get 60 grand! so if i buy somewhere with 60k up front and the rest as mortgage? right?#i have no clue whatsoever how to do all that stuff or even like how much furniture costs or how to choose a mattress or anything#ive never had anything like that new#so um. yeah. that's. something#i don't know what to do with it or anything. but it's a thing.#for now i need to go back and find a flat my own cs ive got like 6 weeks now to move from this place#and i have to ring the estate agent landlord people to find out if i can just move upstairs or what. cs that'd be my first choice honestly#but um. my brains gone to mush#i knew my grandparents were well-off but i didn't know it was by that much#or that id get such a high percentage - tho that's half what my dad's getting so i guess that makes sense#he says he's gonna buy a boat and go to south america#which sounds bonkers honestly like he's not a sailor whatsoever#but i guess he's a lot more sensible now he's been sober a year than he ever was when i was a kid

4 notes

·

View notes

Text

Writers/Actors on strike on top of video game workers and SFX workers starting to unionise, UAW imminent strike, looming federal shutdown; man it sucks to be a money guy right now tbh. UPS was smart to make an honest deal, but imagine if Teamsters were all on strike right now too.

#I want to see the upper middle and moneyed classes all squirm under the weight of labor#with the feds too busy to strong arm autoworkers or really any union atm it'd be funny if more unions geared up for solidarity strikes#apparently the US already got downgraded to AA+ credit rating lmao due to the current issues

4 notes

·

View notes

Text

rent is 38% of my monthly income :(

#78% of this current check :((#im so tired of being broke and still working almost full-time and being a student#i'm anticipating a pretty big refund from the school from tuition assistance#it's not free money like half of it is gov loans i'll eventually have to pay back#but i'm going to use this money to pay off my credit card which is a higher interest rate. so essentially just refinancing my debt#maybe a miracle will happen and loan forgiveness will happen at some point#i think i'm at about 20k in debt right now

2 notes

·

View notes

Text

i am feeling ✨ Uneasy!

#personal#the engineering chronicles#fuck my professors actually for the amount of hw they assigned us over break and for mis communicating the deadline of one assignment and#also there is sm due in the next two weeks like next week we have four (4) major things due none of which we’ve gone over/been able to#start… this is a 2 credit class btw <3#also there’s smth funky going on w my code for one of the things due this week the serial monitor is like attacking me w backward question#marks and i don’t know why 😭😭 everything online is just saying it’s probably bc the baud rate of the monitor and the Serial.begin() command#are different but they’re Not and i emailed my prof and she said exactly the same thing even though i specifically mentioned in my email#that i know abt the baud rate thing and that that’s Not the issue like. AAAAAA

3 notes

·

View notes

Text

Personal Loan vs. Credit Card: Which is Better?

When faced with a financial need, many people turn to either personal loans or credit cards as solutions to manage expenses. Both options offer flexibility and quick access to funds, but choosing the right one for your situation can be a challenge. Should you opt for a personal loan, which is typically a fixed sum with predictable payments, or a credit card, which allows you to borrow as you go? In this article, we’ll compare the two options to help you make an informed decision about which might be the better choice for your financial needs.

What is a Personal Loan?

A personal loan is a type of unsecured loan that you can use for a variety of purposes, such as consolidating debt, funding a large purchase, or paying for an unexpected expense like a medical emergency. Typically, personal loans come with a fixed interest rate and repayment term, meaning that you’ll pay back the loan in equal installments over a set period, which can range from a few months to several years.

Because personal loans are often unsecured (meaning they don’t require collateral), they usually come with higher interest rates than secured loans like mortgages or auto loans. However, they tend to offer lower rates compared to credit cards, especially if you have good credit.

What is a Credit Card?

A credit card is a revolving line of credit, which means you can borrow money up to a certain limit, pay it back, and borrow again. Credit cards offer flexibility in terms of repayment, as you can choose to pay off the balance in full each month or make minimum payments. However, if you don’t pay off the balance in full, interest is charged on the remaining balance, often at a high rate.

Credit cards often come with benefits such as rewards points, cash back, and perks like travel insurance or purchase protection. However, the interest rates on credit cards can be much higher than those on personal loans, especially if you carry a balance month to month.

Key Differences Between Personal Loans and Credit Cards

1. Interest Rates

One of the biggest differences between personal loans and credit cards is the interest rate. Personal loans generally come with lower interest rates compared to credit cards. The average interest rate for a personal loan is usually lower than that of most credit cards, particularly for borrowers with good or excellent credit.

Credit cards, on the other hand, have high-interest rates, especially if you don’t pay off your balance in full each month. If you carry a balance, credit card interest can quickly accumulate, making it an expensive option for borrowing money.

2. Repayment Terms

Personal loans come with fixed repayment terms, which means you know exactly how much you’ll pay each month for the duration of the loan. This can make budgeting easier and help you stay on track with your repayment plan. If you borrow a personal loan for a large purchase or to consolidate debt, you’ll likely know exactly when you’ll be debt-free, which can provide peace of mind.

Credit cards, in contrast, offer more flexible repayment terms. You can carry a balance from month to month and make minimum payments, but the interest charges can add up over time, and you may find yourself in debt for longer than you intended. If you choose to only make minimum payments, it can take years to pay off the balance, depending on how much you owe.

3. Credit Limits

Credit cards offer a revolving line of credit, which means you can borrow money up to a certain credit limit. Your credit limit depends on your creditworthiness, and if you reach your limit, you won’t be able to borrow more until you pay down the balance. However, credit card limits tend to be lower compared to the amount you could borrow with a personal loan.

With a personal loan, you typically borrow a set amount of money upfront. Once you receive the loan, you can’t borrow more without applying for a new loan. The amount you can borrow depends on factors like your credit score, income, and the lender’s requirements.

4. Uses of the Funds

While both personal loans and credit cards offer flexibility, they’re often used for different purposes. Personal loans are often used for large, one-time expenses like home renovations, debt consolidation, or covering emergency medical bills. Since personal loans offer a lump sum of money, they’re ideal for situations where you need a specific amount of money upfront.

Credit cards, on the other hand, are best for ongoing expenses, smaller purchases, or everyday spending. They offer the flexibility to borrow as needed, which is helpful for those who don’t know exactly how much they will need. Credit cards can also be useful for building or maintaining credit, as long as you manage them responsibly.

Advantages of Personal Loans

Predictable Payments: Personal loans offer fixed monthly payments, which can make budgeting easier. You’ll know exactly when your loan will be paid off, and the fixed payment amount means you don’t have to worry about fluctuating balances.

Lower Interest Rates: For those with good credit, personal loans typically offer lower interest rates than credit cards. This can save you money in interest, particularly if you need to borrow a large sum of money.

Debt Consolidation: Personal loans can be an effective tool for consolidating multiple high-interest debts into one monthly payment, potentially lowering your overall interest costs.

Fixed Loan Amount: When you take out a personal loan, you know exactly how much money you will receive, which is helpful when you have a specific need in mind.

Advantages of Credit Cards

Flexibility: Credit cards offer flexibility, allowing you to borrow as much or as little as you need up to your credit limit. This can be helpful if you don’t know exactly how much money you’ll need for a given expense.

Rewards and Perks: Many credit cards offer rewards points, cash back, or other perks for every dollar spent. If you use your credit card responsibly, you can earn rewards that can offset some of the costs of borrowing.

No Need for Collateral: Like personal loans, credit cards don’t require collateral, which means you don’t have to risk assets like your home or car in order to borrow money.

Building Credit: Using a credit card responsibly can help improve your credit score. If you make timely payments and keep your balance low relative to your credit limit, you can boost your credit score over time.

Which Is Better for You?

The decision between a personal loan and a credit card ultimately depends on your financial situation, needs, and goals. If you need to borrow a specific amount of money for a large, one-time expense and prefer predictable monthly payments, a personal loan may be the better option. Personal loans also tend to offer lower interest rates, which can save you money if you plan on borrowing a significant sum.

On the other hand, if you need ongoing access to credit for smaller purchases or flexibility in borrowing, a credit card might be the right choice. Credit cards can also be beneficial for building or maintaining credit, as long as you’re able to manage the balance responsibly.

If you’re carrying high-interest debt, you may also want to consider using a personal loan to consolidate your credit card debt. This can lower your interest rate and simplify your payments, giving you a clearer path to becoming debt-free.

Conclusion

Both personal loans and credit cards have their pros and cons, and choosing the right option depends on your specific financial needs. Personal loans tend to offer lower interest rates and fixed repayment terms, making them ideal for large expenses or debt consolidation. Credit cards, however, provide flexibility and rewards, making them better for ongoing or smaller purchases.

Before making a decision, take the time to evaluate your financial situation, determine how much you need to borrow, and consider how you want to repay the debt. Whether you choose a personal loan or a credit card, make sure to borrow responsibly and prioritize making timely payments to protect your financial health.

#Personal loan#Credit card#Personal loan vs credit card#Best personal loan options#Credit card debt#Interest rates on personal loans#Benefits of personal loans#Advantages of credit cards#Debt consolidation with personal loans#Personal loan for large expenses#Credit card for small purchases#Repayment terms for personal loans#Fixed-rate personal loan#Revolving credit card#Borrowing money with a credit card#Credit card vs personal loan interest rates#Flexibility of credit cards#Using personal loans for debt consolidation#How to manage personal loans#Credit card rewards and benefits#Credit card vs personal loan for emergencies#Personal loan for home improvements#Is a personal loan better than a credit card?#How credit cards impact credit score#Managing credit card balances#Personal loan for medical expenses#Personal loan repayment plans#Building credit with credit cards#Credit card limits#Unsecured personal loan

0 notes

Text

Let's talk about former Treasury Secs warning the country....

youtube

View On WordPress

0 notes

Text

Discover the Best Credit Card for Reward Points and Daily Use from the Top Rated Credit Card Company

When it comes to managing finances and getting the most out of your everyday spending, choosing the right credit card can make a significant difference. The market today is flooded with options, but finding the best credit card for reward points, the best credit card for daily use, and identifying the top-rated credit card company can feel overwhelming. Thankfully, Novio stands out as a trusted name, offering credit cards tailored to fit various lifestyles, preferences, and financial goals.

Why Reward Points Matter Credit cards that offer reward points are not just a payment tool—they’re an opportunity to earn while you spend. Whether you’re shopping for groceries, dining out, booking travel, or making large purchases, the best credit card for reward points allows you to collect valuable points that can be redeemed for cashback, discounts, gift cards, or other perks.

Benefits of Reward Points Credit Cards: Savings on Spending: Accumulated points can be redeemed to offset future expenses, offering direct savings. Travel Perks: Many reward points can be used for flights, hotels, or travel experiences. Customizable Rewards: Choose what benefits you based on your preferences—cashback, dining discounts, or travel upgrades. Exclusive Offers: Access special deals and discounts on lifestyle and luxury products. Novio’s credit cards excel in this area, ensuring cardholders get the best credit card for reward points, tailored to their spending habits.

The Importance of a Credit Card for Daily Use A credit card isn’t just for large or sporadic purchases—it’s a financial tool that can streamline everyday transactions. The best credit card for daily use is one that offers convenience, rewards, and cost-effectiveness, all while fitting seamlessly into your lifestyle.

Key Features to Look for in a Daily Use Credit Card: Low Fees: Look for minimal or no annual fees and affordable interest rates. Universal Acceptance: Ensure the card is widely accepted at retail stores, online platforms, and service providers. Cashback Rewards: Many daily use credit cards offer cashback on essentials like groceries, fuel, and utility payments. Contactless Payments: Simplify transactions with quick and secure tap-and-go features. Bill Payment Features: Automate recurring expenses like phone bills or subscriptions for added convenience. Novio’s offering in the category of best credit card for daily use ensures that you have a reliable partner for everyday transactions, all while earning valuable rewards.

What Makes Novio a Top Rated Credit Card Company When selecting a credit card, the reputation and reliability of the provider are just as crucial as the card’s features. Novio has positioned itself as a top-rated credit card company, thanks to its commitment to customer satisfaction, transparency, and innovation.

Why Novio is Trusted by Millions: Customer-Centric Approach: Novio prioritizes user-friendly services, ensuring hassle-free applications, transparent billing, and prompt customer support. Innovative Features: From cutting-edge security to AI-driven spending insights, Novio stays ahead of trends to offer the best user experience. Diverse Card Options: Whether you’re a frequent traveler, a shopaholic, or a daily spender, Novio has a card tailored to your needs. Rewards That Matter: With Novio, you get access to some of the most lucrative reward programs, proving its commitment to being a top-rated credit card company. Features of Novio’s Best Credit Cards The Best Credit Card for Reward Points: Novio’s reward-based credit card offers:

High Earning Rate: Earn points on every purchase, with bonus points for specific categories like travel, dining, or entertainment. Exclusive Partnerships: Gain additional points when shopping with Novio’s partner brands. Flexible Redemption: Redeem points for travel, cashback, gift cards, or premium memberships. Welcome Bonuses: Enjoy a significant boost in points as a welcome gift when you sign up. The Best Credit Card for Daily Use: For everyday transactions, Novio’s daily-use card ensures:

Cashback on Essentials: Earn cashback on groceries, fuel, and utility bills. Zero Interest Periods: Take advantage of interest-free days on purchases. Budget-Friendly Fees: A low or zero annual fee ensures long-term affordability. Easy Payments: Integrated contactless technology and seamless online payments. Security Features Across All Novio Cards: Fraud Protection: Advanced fraud detection technology safeguards your transactions. Instant Alerts: Get real-time updates for every transaction to stay informed. Card Locking: Lock and unlock your card instantly via the app in case of theft or loss. Choosing the Right Card for Your Lifestyle Everyone’s financial needs are different, so the best credit card for one person might not be the ideal choice for another. However, with Novio, there’s a card for every lifestyle.

For Shoppers: The best credit card for reward points is perfect for shopaholics who want to earn big on retail purchases. From clothing and gadgets to home goods, every transaction can bring you closer to your next reward.

For Families: The best credit card for daily use ensures that families can handle day-to-day expenses like groceries, utilities, and dining while earning cashback and enjoying zero interest periods.

For Travelers: Frequent flyers can maximize rewards with travel-centric features, including free lounge access, bonus points on flight bookings, and more.

Novio’s Commitment to Customer Satisfaction Novio isn’t just a top-rated credit card company because of its products—it’s their approach to customer service that sets them apart. From instant card issuance to 24/7 customer support and a user-friendly app, Novio ensures that your experience is smooth from start to finish.

Personalized Recommendations: Based on your spending patterns, Novio offers tailored suggestions to help you make the most of your credit card benefits.

Financial Education: Novio provides resources and tips to help you manage your credit wisely and avoid unnecessary debt.

Transparent Policies: No hidden fees, no surprises—Novio believes in clear, upfront communication.

Why Novio Stands Out in the Market With so many credit card companies to choose from, Novio’s dedication to innovation, customer satisfaction, and value creation puts it at the forefront of the industry. Their diverse range of credit cards means there’s something for everyone, whether you’re looking for the best credit card for reward points, the best credit card for daily use, or simply a reliable card from a top-rated credit card company.

Conclusion Choosing the right credit card can transform the way you manage your finances and enjoy everyday perks. Novio’s lineup of credit cards offers unmatched benefits, whether you’re looking to maximize reward points, streamline daily expenses, or align with a trusted provider. As a top-rated credit card company, Novio combines innovation, transparency, and customer satisfaction to deliver products that truly enhance your financial lifestyle.

Explore Novio’s credit card options today and discover the perfect fit for your needs—because when it comes to your finances, settling for anything less than the best isn’t an option. With Novio, every transaction is an opportunity to earn, save, and enjoy.

0 notes

Text

Ready to own your dream home? Work with a best-rated Mortgage Broker in Malabar, Pagewood, Bronte, Waverley, Edge Cliff and around. See what our clients have to say.

Visit Our Website: www.auspakhomeloans.com.au

#affordable vehicle financing#best car loan rates in sydney#financing for new and used cars in nsw#local brokers for car loans in waverley#new vehicle loan requirements#secured vehicle loans#vehicle loan eligibility criteria#vehicle loan for electric cars#vehicle loan with bad credit#finance

0 notes