#top 10 discord bots 2020

Text

13 Discord Bots for Your Web3 Server by Category

#Discordbots are a great way to make your #web3server more engaging and fun. They can do things like generate random chat messages, run polls, and more. Here are a few

Discord bots are a great way to make your server more engaging and fun. They can do things like generate random chat messages, run polls, and more. Here are a few discord bots that we think are worth checking out:

Best Bots for Discord Moderation

Discord moderation bots are a great way to keep your Discord server clean and organized. By using a moderation bot, you can automatically remove…

View On WordPress

#best discord bots 2019#best discord bots for your server#best discord bots to grow your server#best discord bots to have#best discord music bots#best discord music bots 2021#discord bot for your discord server#discord bot for your discord server 2022#discord bots for your discord server#discord bots for your discord server 2022#discord for beginners#discord music bot tutorial#discord setup guide with bots#how to get bots for your discord server#how to make a discord bot#how to setup a discord server#the best discord bots 2020#top 10 discord bots 2020#top 10 discord bots you can use on your server#top 10 discord game bots 2020#top 5 discord bot 2022#top 5 discord bots 2022#top 5 discord bots for your discord server#top 5 discord bots for your discord server 2022

0 notes

Text

challenge: 30 questions tag

apparently someone is on a tag game roll so here i am also rolling

(it’s @gimbapchefs)

+ the lovely @jiminslight @jkjms

.

1. name/nickname: kristine/kris

2. star sign: leo

3. height: 5'3/160cm because we use metric here ok

4. birthday: aug 12, 1996

5. favorite band: I WONDER WHO THAT COULD BE

6. time: 6.18a.m. and I’M STILL AWAKE DAMN IT

7. favorite solo artist: chungha

8. song stuck in your head: highlight - not the end

9. last movie you watched: the croods 2 lmaooo

10. free space! memories 2020 when

11. last show: trying and failing to finish ep 1 of 千秋 (thousand autumns)

12. when i created this blog: 2021!!

13. what i post: bts, reblogs other stuff very rarely

14. last thing i googled: DISCORD BDAY BOT DOWN??

15. other blogs: i mean @rawrkats is still there but i don’t use it anymore

16. do i get asks? NOT ENOUGH

17. why i chose my url? JIKOOK (calico + cooky)

18. following: 119

19. followers: im gonna reach a milestone give or take 50 followers yeah

20. average hours of sleep: weekdays, 4-6hrs. weekends, YOLO.

21. lucky number: 7!

22. instruments: tried and failed to learn the guitar because i cannot commit. and it hurts my fingers??

23. what am i wearing? black shirt, shorts. im bout to sleep yo

24. dream job: anything that’s more time flexible

25. favorite food: i eat everything

26. tea or coffee: coffee (iced)

27. nationality: malaysian

28. favorite song: of all time?! i don’t have one D: instead let me tell you ONE of my fav bts songs: pied piper

29. last book i read: what’s a book?

30. top three fictional universes i would like to live in: ✨ BTS UNIVERSE ✨, 2. whatever universe that bt21 is in, 3. ....hogwarts? idk

.

I DID IT. now to let other people suffer (jk i love you all): @loversmore @rosebowl @userjiminie @kerasines @jungkooksglasses @pjmsdior @parkandblues @taehkims @euphhorias + others who want to overshare

16 notes

·

View notes

Text

Stratus’s Comprehensive Shiny Den Exploit Guide

Have you heard about the shiny den exploit in Sword and Shield? If you haven’t, it is basically a method that can be used to obtain a limitless amount of shiny pokemon from dens in the wild area and (to a certain degree) being able to choose which specific pokemon you would like limitless shinies of. Neat, huh?

Maybe you have heard of this method before. Maybe you’ve attempted it yourself using youtube videos as guide. Maybe, like me, you became extremely frustrated at your percieved inability to get it right. If that is you, know that I feel your pain, having spent countless hours trying to obtain a shiny pokemon from a den only for it not to be shiny at the end because of one small step that I missed or mistake I made. In fact, that is exactly what inspired me to create this guide.

Below the cut, I will explain, in as much detail as humanly possible, how to take advantage of the shiny den exploit. Follow each step exactly, and you will be rewarded with a shiny for your efforts. Are you ready, dear reader? Well, here we go.

1. This method, to me, is one of those things that is all about the set-up. If you don’t set up everything exactly right, something might be off at the end and prevent you from your ultimate goal. So, this is how you should prepare yourself to begin:

1a. Before you get started, go to settings in your game and make sure that auto-save feature is switched OFF.

1b. Now, press the home button to get out of your game, go to your Switch’s system settings, scroll down to “system”, and then to “date and time”, and make “synchronize clock via internet” is set to OFF.

2. Buy a wishing piece, if you don’t have one already. Please note that this method ONLY works if you use a wishing piece. If you just use a den you got naturally in the wild area, none of the following will work.

3. Now, throw the wishing piece into an empty den. (If you are searching for an event Pokémon, make sure that the Pokémon in the den is one of the event Pokémon. It doesn’t have to be the exact Pokémon you want, so long as it’s part of the same event, because you will be able to reset your shiny pokemon, as I will explain later.) If you are looking for a specific shiny Pokémon, be sure to check Serebii’s dem listing to ensure that the Pokémon will spawn in the den. (Serebii’s den listing: https://www.serebii.net/swordshield/maxraidbattles/den106.shtml )The game should save while you are tossing the wishing piece in the den. After this point, DO NOT SAVE.

3. Go into the raid and catch the Pokémon. You MUST catch the Pokémon to proceed to the next step. To make this easier, you may turn on the internet and invite others to help you take down the Pokémon in the den. The Pokémon that you catch in this den is known as the seed Pokémon.

4. Next, we will check the seed Pokemon. To do this, you will need to connect to a seed-checking bot in a trade and offer up your seed Pokemon. I know of two free options: Dudu Bot (http://116.202.105.91/) and Dizzy’s Pokémon server ( https://discord.gg/WDUYBA ).I will describe how to use the seed checking bot on Dizzy’s server because that is the one that I prefer to use.

4a. In your game, connect to the internet.

4b. Go to the discord server (on your phone, computer, whatever). In the server, go down to one of the “seed checking” channels.

4c. In the channel, type $CheckMySeed or !CheckMySeed depending on which channel you are using, 1 or 2. This will put you in Jiggly or Wiggly bot’s line.

4d. Once it is your turn in line, Jiggly or Wiggly bot will send you a discrete link trade code. In your game, click link trade, enter the given code, and start searching. You should connect with the Jiggly bot shortly.

4e. After you connect with the bot, offer your “seed” Pokémon—that is, the one you caught in the den—for trade. You should get a communication error, and the trade will be ended.

4f. Go back to the seed checking channel to see the results of your seed checking. It should look something like this:

The important thing for us to note here is the number listed after Star Shiny at Frame: This number represents the amount of frames you will have to skip to get to your shiny den. In this example, I would have to skip 558 frames to get to my shiny den, where one frame = one day.

5. Now that you have these results, use a date calculator to find your “target date.” Here is a link to the calculator I use: (https://www.timeanddate.com/date/dateadd.html). I will describe how to use it in detail below:

5a. Put in today’s date as your start date.

5b. Put in the number of frames to your shiny den in the “add” section

5c. Calculate new date.

5d. Now, SUBTRACT 4 from the date you calculated. This will be your target date, and places you 3 skips before your shiny den date. The target date is not the date that the shiny pokemon will appear at, but rather will serve as a save point for you, just prior to the date that the shiny pokemon will appear.

6. Now that you have your target date figured out, WITHOUT SAVING, close your game. By this, I mean, press the home button, press X on the game, and close out the software.

7. This brings us to our first important checkpoint. Open your game again, and check that your game meets the following conditions:

7a. You are standing in front of the den that you dropped the wishing piece into, and a beam of light should be coming out of it. DO NOT TOUCH THE DEN AGAIN.

7b. You do NOT still have the Pokémon you traded to the bot (that is, the seed pokemon is gone).

If you don’t meet 7a, this likely means that you used a naturally occuring den rather than one triggered by a wishing piece. If you don’t meet 7b (that is to say, you still have the seed pokemon) this likely means that you saved somewhere after catching the pokemon in the den. If either of these are the case, you will have to start this process over from the beginning with another wishing piece.

If you meet conditions 7a and 7b, you can continue with the next phase of the process.

8. WITHOUT SAVING, fly to a Pokémon center. This is where you will begin the process of date skipping. (The reason why you want to be in a Pokémon center instead of the wild area is that if you skip so many days in the wild area, where the weather changes, your game is likely to crash.)

9. Now it’s time to preform the date skipping glitch. Below is the method I use.

9a. In your game, click the Y button, and then click + to turn on internet communication

9b. Go to link battle.

9c. Select single battle and start looking for an opponent.

9d. Press home button for several seconds to bring up a mini menu that pulls up on the side of your game. It should look like this:

9e. As soon as you see the black box at the bottom that says that an opponent has been found, switch airplane mode ON.

9f. You should get a communication error, see the blue battle screen appear, then disappear, leaving you standing in the Pokémon center. Now that this is done, we can begin to date-skip.

!!!MAKE SURE THAT NO MENUS ARE OPEN BEFORE PROCEEDING ANY FURTHER. If a menu is open, the date-skipping will not work!!!

10. To skip dates, do the following:

10a. Click the home button. Go to system settings, and go down to date and time. DOUBLE CHECK THAT INTERNET SYNCHONIZATION IS OFF.

10b. Select date and time. Move one day forward. Click OK. (For example, if your date is 1/1/2020, change it to 1/2/2020.)This counts as skipping one frame.

10b. You will have to skip forward ONE DAY AT A TIME. BE EXTRA CAREFUL AROUND THE ENDS OF MONTHS/THE END OF YEARS. Repeat step 10a until you reach your target date.

If you would like an indication that you are doing the date skipping correctly, you can go into your game and check for a very brief black flash. This tells you that you have successfully skipped frames.

11. This brings us to our second important checkpoint. Open your game, and make sure that your game meets the following conditions:

11a. The screen flashes black for a split second.

11b. Your character is standing in the pokemon center.

11c. Leave the Pokémon center and find your den again. The beam should still be in it and the bottom should be glowing.

If you meet 11a, b, and c, you may continue to the next step.

12. In front of your den, WITHOUT COLLECTING THE WATTS FROM IT, save the game. You have now established your save point.

Optionally, you can check to verify that you have completed your date skipping successfully by completing step 4 a second time. To do this, simply go into your den, catch the pokemon in it, and use Dudu or Jiggly/Wiggly bot to check it again. If you have successfully completed your date skipping, it should tell you that you are 4 frames away from your Star Shiny Frame. After you have completed this, close the software of your game and reload it. You should be standing in front of your den with the beam still in it.

13. This is where things start to get kind of tricky. The method we use to date-skip the final 3 days will be different than the method we previously used. I will describe it step by step:

13a. Turn airplane mode OFF.

13b. Make sure your game is on LOCAL COMMUNICATION (not connected to the internet).

13c. Click on your den.

13d. Click “invite others”.

13e. Wait until your game starts looking for participants. The timer at the top of the screen should be counting down, and the pokeballs should be spinning underneath your name. The screen should look like this:

13f. Click the home button.

13g. Go to your Switch’s system settings.

13h. Go down to date and time.

13i. Skip one day forward. Click ok.

13j. Go back into your game.

13k. Stop looking for participants (select quit), and go back to where you can see your character standing in front of the den. The weather should change, and the bottom of the den should begin glowing again, as to where you can collect watts from it again. If this isn’t the case, click the home button, close your game, reopen it, and complete step 13 again from the beginning.

13l. Complete steps 13c-k TWO MORE TIMES. If you are using Jigglybot, you should notice that the date that you are currently on is 1 day prior to your originally calculated shiny date. That’s fine.

14. This is it. The moment of truth. The pokemon that is in your den now should be your long-awaited shiny. However, we are going to check to make sure that it is. There are two methods you can use to check your den:

Option A: If you like the pokemon in your den, and would like to keep this pokemon in the den, you may check it by doing the following:

-connect to the internet

-invite others to join your raid. Note: you must have an actual person join the raid for this to work. This will not work with NPCs.

-once you click “start battle”, bring up the side menu that allows you to turn on airplane mode.

-as soon as you see your characters feet, turn on airplane mode. You will get kicked out of the den, and will end up standing in front of the den again with the beam still in it. First, though, you will be able to see the pokemon, and note whether it is a shiny or not.

-From here you can go back in and “host” the den over and over again, turning on airplane mode as soon as you see your character’s feet. You can round up some friends to catch the pokemon and trade it to you later.

Option B: if you don’t want to keep the pokemon in the den, you can simply check it yourself by going into the den without inviting others. Once you determine whether it is shiny or not, without finishing the raid, close your game. You will be back to 3 frames before your shiny den. To get it back, simply repeat step 13 again. Note: when you repeat step 13, DO NOT reset your date three days backward. Simply start from the date that you are currently on. For example, if your original shiny date was March 5th, you will skip three days forward to March 8th.

Of course, you also have the option of simply going into the den and catching the shiny. However, if you catch the pokemon in the den and complete the raid, the beam of light in the den will disappear and you will no longer have a shiny den.

FAQ:

What if my pokemon is not shiny?

If your pokemon is not shiny the first time you check your den, don’t fret! You probably are off just a tiny bit on your date skipping. Here is how to troubleshoot:

1. Once you determine that your pokemon is not shiny, close out of the game without finishing the raid. When you reopen it, you will be back at your save point.

2. At your save point, go into the den and catch the pokemon again. Follow step 4 to check your seed again. This should tell you exactly how many frames you are away from your shiny.

Alternatively, you could try doing step 13 again, but skipping 4 times instead of 3, or 2 times instead of 3. This will likely yield you your shiny pokemon. Note: when resetting, do not reset your date 3 days backward. Simply skip forward from the date you are currently. NEVER reset your date backward.

How do I change the shiny pokemon in the den?

It’s easy! Simply close out of your game and return to the save point. From here, repeat step 13. You will notice that the first 3 pokemon you encounter are the same, but the 4th (your shiny) is different. You can repeat this process over and over until you find the shiny you want!

This concludes my shiny den exploit guide! I hope to anyone that used it that it worked for you, and that you found the shiny pokemon you sought! If it didn’t work, or you still find yourself hopelessly confused, feel free to DM me or send me an ask. I would be glad to walk you through this process step-by-step and answer any questions you might have!

46 notes

·

View notes

Text

My 2020 reviews

All the cool kids were doing these so now I finally dragged my ass into doing them too lmao.

Albania- Fall from the Sky

A song I swear cursed this whole contest from the moment it won Festivali i Këngës. Like with the shitshow this song caused I just knew the whole year was fucked. With half the fandom whining they didn’t get their first club song of the year to the other half smugly shoving it as their winner despite no other songs being around to compare it to, the whole fiasco just left me knowing that 2020 would end in tears, just hopefully not my own.

As for the song, it’s lame. It’s a standard ballad with OBSCENE amounts of autotune, which is weird because the girl can actually sing pretty decently without it, so why they decided to make her sound like a damn computer is beyond me. And WHY did they translate it, haven't the past few years proven that Albania's better off leaving their songs in Albanian?

Armenia- Chains on You

A bootleg Ariana Grande song, and a really shit one at that. The kind of song only people who think being young, gay and mean counts as having a personality would say is good.

Australia- Don’t Break Me

One of the few decent Australian entries (but that REALLY isn’t saying much coming from me, I barely care they’re in the contest by this point) but marred by a horribly untidy performance and lacklustre lyrics. At least it’s not fucking pop-opera, that’s all I can say. I’d rather listen to the sound of my face being dragged down the runway at Heathrow airport than be subjected to another Zero Gravity.

Austria- Alive

One of those pseudo-jazz dance songs, á la Olly Murs or Bruno Mars (I swear there’s a song like this in every recent contest). I mean, it’s good, but it’s just kinda meh since I’m kinda getting tired of this genre rearing its fedora-wearing head every time a new lineup rolls in.

Azerbaijan- Cleopatra

One of the “better” trashy entries this year, comprised of about five different musical genres, six ancient cultures being appropriated and absolutely zero class. Probably sounds at least 50% better when you’re absolutely steaming drunk and face down on the floor in the middle of a gay bar.

Belarus- Da Vidna

Somehow, this song sounds both very unique and original yet trite and average at the same time. I couldn’t decide whether listening to it was a new experience or if I’d heard it a million times before.

Belgium- Release Me

A song which just drones on till it ends. I would say it’s ripping off the song that won last year, but it forgot that having a chorus stops your song from being three minutes of snooze.

Bulgaria- Tears Getting Sober

A typical breathy mumble-girl song, AKA a genre I can’t fucking stand. Really don’t see the hype with this one, the melody is pretty but the vocals are out for lunch and it’s otherwise completely and utterly boring.

Croatia- Divlji Vjetre

One of the token big dramatic ballads you listen to once, enjoy, then forget about until Darius in the Discord server plays it one night whilst you’re hitting up the radio bot with requests. You’ll find that “nice, but forgettable” is a common theme for this year.

Cyprus- Running

Ironically Cyprus didn’t send a crappy Fuego knockoff for 2020, and I say ironically because a crappy Fuego knockoff would’ve actually stood out this year, and I say crappy because honestly Fuego wasn’t even all that great to begin with.

"Running” itself is just one of those edgy tortured soul pop songs which, let’s be honest, would have been paired with an impressive performance which would’ve overshadowed how bland it is. Kind of like “You’re the Only One”. Or even Fuego for that matter.

Czech Republic- Kemama

Standard Afro-pop, a genre we don't often see at the contest so I'll let it pass. I feel like this is the kind of song that’s infinitely better live, and that it would’ve been one of those songs that suddenly became a frontrunner after the semi finals, but I guess we’ll never know eh?

Denmark- Yes

The quintessential mid-10s Eurovision song. It's got guitars, happy people, Scandinavian origins… it’s just a typical radio guitar song, nothing special.

Estonia- What Love Is

I mean it's better than La Forza. Granted, the sound of someone pissing directly onto a microphone installed in the bowl of a toilet would sound better than La Forza but still.

Going back to this song, it’s just... a standard Eastern-ballad with some very desperate lyrics. It feels kind of outdated, if I’m honest. Like something about this just reeks of 2011.

Finland- Looking Back

Yet another dreary, forgettable ballad. It comes to something when the best song they COULD have sent was a party song which sounded like it was from the mid 90s. At least that song was memorable.

That said, this one at least has some decent lyrics. Bravo for that I guess.

France- Mon Alliée

France decides to say “fuck it” to being an underground fan-favourite and takes a leaf out of the UKs book by sending the same rent-a-Swede schlock they’ve been sending since 2015. I’m just confused as to why anyone in their right mind would choose to follow the UKs example but you do you France.

Germany- Violent Thing

A rehash of Sweden's entry from two years ago, but this time sung by Justin Bieber circa 2008. Kind of alright if you can stomach the singer's whiny voice, but otherwise pretty dull and kinda forgettable.

Greece- Superg!rl

Hello fellow kidz, we are hearing you like the girl power? The super heroes? The t3xt $p3ech? We made you song, please give us the votes *dabs*

Georgia- Take me as I Am

I mean… this sure is a choice. This feels like one of those songs that everyone memes on because the lyrics are kinda janky and the singer’s voice (and accent) take a bit of getting used to, but other than that it’s just one of those NQ songs for hipster fans to declare as their unironic winner at a later date.

All in all this just feels like the male equivalent of one of those mid-10s fat acceptance women’s songs, only a lot shoutier and this time he has more flaws than not being skinny.

Iceland- Think About Things

A bootleg George Ezra song, performed by a load of disinterested tumblr users in their pyjamas. Because if there’s one thing that sells me on a song, it’s being given the evils by a bunch of nerds who look like they’ll send me death threats for not agreeing with their Pokémon headcanons.

To be fair, the song is kind of groovy since it sounds so 70s, but the performance is very off-putting to people who aren’t in the Eurovision loop. And also people who are, because I sure as Hell don’t see the appeal in this myself and this whole performance just feels like Save Your Kisses for Me without the charm. I feel like this would’ve come second or third, definitely with a lot of televotes but either the jury would’ve dragged it down or it wouldn’t have scored enough televotes to win.

Ireland- Story of my Life

A song that’s at LEAST ten years out of date by this point, think like an early Katy Perry, Jessie J or Avril Lavigne song. I’ll forgive it because even though it sounds like it should’ve been entered in 2013 (at the latest), it at least evokes some nostalgic memories of shitty school discos and holiday parks.

Israel- Feker Libi

The female equivalent of the Czech song. Unsurprisingly, people went wild for it when it was released. I guess only women are allowed to sing Afro-pop at this contest.

Like with the Czech song, I’ll forgive it since Afro-pop is a cool genre anyway, and even though this is just another club song I can at least see myself dancing to it.

Italy- Fai Rumore

Well, at least my wish of “Italy sends a typical power ballad devoid of anything the mainstream fandom likes” finally came true. It was pretty refreshing to have a year where people weren’t shoving Italy’s entry up my nose left right and centre.

In terms of my actual thoughts I can’t deny that the guy has a tremendous voice, but for some reason the song just doesn’t… click with me. I guess I like my male Italian singers a little more gruff and raspy, if you know what I mean. They gotta sound like they smoke at LEAST five packets of cigarettes a day for me to take notice.

Malta- All of my Love

Listen I am 100% rooting for Destiny Chukunyere to win this contest some day but man was this song a disappointment. It feels so… un-special and generic, like it gets the job done and that’s it. It’s not the stand-up-and-belt-it-out soul anthem I’d hoped for, it’s just… there.

Moldova- Prison

All I remember about this song is that it vaguely reminds me of that one Meccano song about the gypsy who makes a deal with the moon or something. And I’ve TRIED to remember more about what it sounds like, trust me.

Latvia- Still Breathing

The one horrible weird song you get every year which overuses strobe effects to the point it comes with an epilepsy warning. Would be bearable if it wasn't for the singer’s insistence that this is actually some feminist masterpiece when it's really just a self-empowerment club song about the singer fingerbanging herself over the fact she writes music.

Lithuania- On Fire

One of the songs everyone thought was going to win at one point, even though it seems like a surefire non-qualifier to me. It’s one of those weird entries, but not the kind of over the top, batshit insane, you’d-have-to-be-drunk-to-enjoy-it weird, the kind of subdued surreal weird. Like this is weed instead of LSD or cocaine weird.

Granted my mom, who I consider to be a "typical" Eurofan, actually really liked this song when she saw it in the recaps, so who knows maybe this would have done well with televoters after all.

Netherlands- Grow

I appreciate this song for how artsy and clever it is with its structure, since it starts off acapella and the instrumental builds up with the song until it stops suddenly, symbolising a person’s growth from a child into an adult, and ending suddenly with their death (Geddit? The song’s called “Grow”). But it feels like the kind of song that would be lost on a Eurovision audience. The juries would have taken note, for sure, but the televote… let’s be honest, they’d have been too busy drunk voting for Russia to care about anything else.

North Macedonia- You

Well, it's better than the miserable dirge they sent last year, but given how I'd rather pleasure myself with a steak knife than listen to that song, that really isn't saying much.

Going back to “You”, it really just feels like a diet version of Switzerland’s entry from last year, combined with Sweden’s song from 2018. What I’m saying is it’s your average “I’m a man in a club and I want to dance with and probably fuck this hot girl I just met” song, which I a new genre I just made up. You’re welcome.

Norway- Attention

One of those songs you appreciate because it sounds nice and the singer has a good voice, but instantly forget because it’s really not all that interesting. If I sound like I'm repeating myself, welcome to Eurovision 2020.

Poland- Empires

“Rise Like a Phoenix” but sung by a wannabe Adele and not a mascara-wearing Jesus in a dress. Like a lot of other songs on this list, it’s just average across the board, likeable when it’s on, but instantly forgettable as soon as the next song comes on.

Portugal: Medo de Sentir

Pretty, but also similar to their ill-fated 2018 entry, only with a bit more energy and less pink hair. What I’m saying is this would have been another NQ unless the crowd who enjoy subtle ambience music come in to save it like they did with Slovenia's entry last year.

Romania- Alcohol You

See Bulgaria, because this is practically the same song. It’s just as dreary, just as badly sung (if not worse because holy shit this girl sounds like she’s being suffocated), and I suppose you COULD excuse that by saying she’s drunk or hungover… but I don’t want to listen to someone ungracefully mumble into a microphone for three minutes.

Russia- Uno

A classic big camp party song, the kind of song people who haven’t watched Eurovision since 2003 think wins on the regular. I can see why people would like it (especially in this boring year lmao, I applaud Russia for taking the opportunity to loosen their corset and just send a complete mess instead of their usual clinical vote grabs), but it’s just not something I enjoy. It's the song that plays into the misconception that Eurovision is just a clown show for drunk people, like this is just here to be that one flash-in-the-pan meme song that only entertains people who don’t really care about Eurovision until the day before it airs. Kind of like the old ladies they sent in 2012 (remember them?).

San Marino- Freaky!

San Marino, in true Sammarinese fashion, have yet again sent a decade-ambiguous song which sounds like it was either released in 1978 or 2003. I feel like this would have been one of those songs which could have surprised us if it had a really wacky, creative performance (think like Moldova in 2018), but this is San Marino so you know that would never happen.

Serbia- Hasta la Vista

Insert unoriginal joke about a decade wanting their shitty trend back right here.

Okay maybe that’s a bit harsh, especially considering how this song is actually, yanno, unique in comparison to the rest of this year. But it still feels weirdly dated, in a way where I can’t decide whether it sounds like it belongs in 1998 or 2018. I suppose girl power ages a song regardless of when it was released.

Slovenia- Voda

Yet another standard Balkan-European power ballad which you appreciate because it’s well sung, but forget the moment it ends because it’s kinda boring.

… Does anyone else have a bit of deja vu?

Spain- Universo

For some reason I feel like this song is shilling itself out to someone but I have no idea who. Aside from the horny people voting solely because the singer is moderately attractive even with that wretched Jedward haircut.

Sweden- Move

Imagine soul but… boring.

Switzerland- Répondez Moi

Imagine Arcade but… in French.

United Kingdom- My last Breath

Not the best the UK could have done, but it’s at least a modern offering unlike the residual dregs of the mid-90s that we sent throughout the 2010s. It’s definitely a bit too generic to have done any better than maybe 15th, but hey at least the cancellation means we won’t have to see it not do as well as the BBC thinks it’s entitled to do, prompting a billion clickbait articles about how Brexit somehow affected our performance.

Ukraine- Solovey

At long last we come to something you probably weren't expecting: a song I actually really like. Which is weird because I usually don't care for or don't like whatever Ukraine vomits into the contest, so I was pleasantly surprised to find a song I liked from them in such a weak year.

This song isn’t for everyone, it’s white noise singing which is a very acquired taste, but this is honestly the only 2020 song I find myself coming back to over and over. And it’s in Ukrainian too, so you don’t have to put up with their usual mangled English offerings.

#and that conclude's the mods thoughts lmao#eurovision#if this is good i might do this with other years let me know what you think#mod speaks#mod reviews

9 notes

·

View notes

Link

fortnite montage gameplay italia live stream di RAVEN 2.0 #fortnite2020 giochi e divertenti video sul canale grazie a tutti ci vediamo nella battaglia reale dove sono raverzx ciao @RAVEN2.0 @raverzx #italia #fortnite #kill #king #games GAME GIOCO 2020 cartoons WOOLY MAMMOTH SKIN #UseCodeFusion #EpicPartner #ItsRedFusion tik tok fortnite,two,tormentone,فورتنيت,raverzx,games,ragazza,California,VITTORIA REALE,far ridere,players,Girls,discord,discord bot,fortnite,ragazze,cool,alexa,fortnite challenge,cartoons,come vincere a fortnite,Fortnite,tik tok,challenge,RAVEN 2.0,scorregge,funny,one,fortnite item shop,fortnite montage,fortnite live,a fortnite fashion show,a fortnite montage,rich b fortnite montage,top,10,kills,fortnite sex,fortnite sex montage

1 note

·

View note

Photo

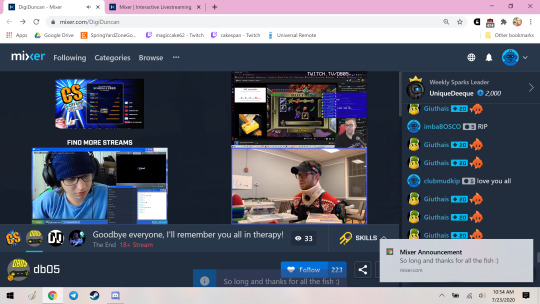

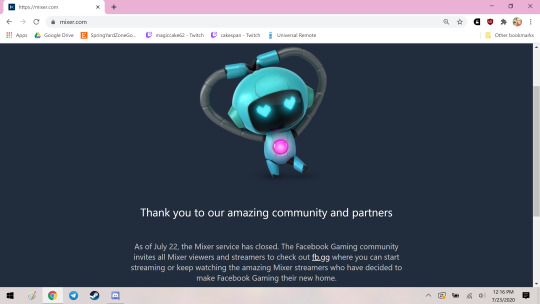

The final moments of Mixer - What happens at the end of all things?

There weren’t a lot of people online for Mixer’s final moments, and I feel like this should be documented somewhere. So here it is: what it was like to watch interactive livestreaming platform Mixer exhale its very last breath.

It was announced that Mixer would be shut down on July 22nd, 2020. So hundreds of users gathered to watch the few final streams. In the minutes leading up to 12:00 midnight PST, users watched a purple and orange confetti graphic fall from the banner at the top of the site, covering streams and chats in small circles. A celebration of the end, we waited for the clock to roll over. What does the End look like? What happens when a website ceases to exist? We all wanted to find out.

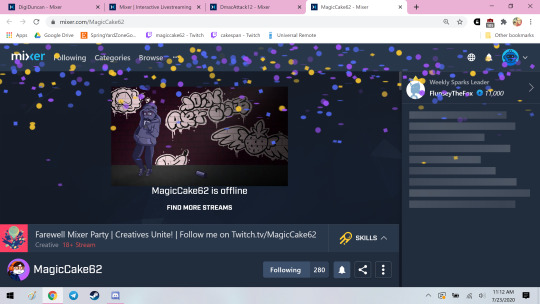

For the final hours I watched Mixer user Magiccake62 (now on Twitch under the same name!) stream her usual creative art stream; on this night she chose to make clay figures to celebrate the release of indie game Ooblets. From her hands sprang small birds, mushrooms, and frogs; all collectible creatures from the game. Finally she said, “What are they gonna do, BAN me?” and streamed a movie from her childhood. Fortunately for Maggiccake62, no copyright strikes were received, and she was able to continue until the movie’s end.

Midnight came, and then went. And it was uneventful. We were all still here. Streams were still running. I was confused, so I did what every person born into the Age of the Internet would do. I googled it. I found one single source. (https://dotesports.com/streaming/news/mixer-shutdown-reportedly-set-for-july-23-after-marketing-error) Gaming news website DotEsports was the only reporter of... a marketing error? Despite all official sources listing the 22nd as the true shutdown time, DotEsports insists the true shutdown to be 11am PST on the 23rd. Honestly, this is so on brand for Mixer, you wonderful garbage website.

So we laughed and shrugged, some of us kept streaming, but most of us went to bed.

I needed to see the End. What does it feel like when our provider provides no more? Where do you go when you are kicked out of your home? How often does a community simply cease to exist?

I set my alarm early. I woke up at 8:45 PST. Only a few streamers were active. Most were bots running pre-recorded content; facecams saying “Thank you and remember to follow me on Twitch.tv!”. Of the few active users, I saw gamers playing Miinecraft, Fortnite, and various first person shooters that I’m not familiar with. I saw one dude streaming porn (because what are they gonna do, BAN him?). Someone was doing a radio show entitled “Mixer’s Funeral” which featured a looping gif of Gibby from iCarly playing a trumpet in front of a coffin, accompanied by various ‘80’s popular music titles. At 9:00am PST Halo Infinite was announced; many users livestreamed their reaction to the title.

Around 10:00am PST I stumbled upon a co-stream hosted by users DigiDuncan, Gambiy23, and DB05 (all can be found on Twitch under those same names). Each streamer did their own thing; Gambiy23 streamed sitcom King of Queens right from Netflix (because what are they gonna... you know the rest), DigiDuncan scrolled through Mixer watching bits and pieces of others’ final streams, and DB05 watched Youtube poops. On a Discord call together, they wanted to stream until the very end. So this is where I stayed, tuning in and out of chat, laughing along at the long-forgotten sitcom. I got cozy, and waited.

At around 10:40am PST, Gambiy23 received a copyright strike from Mixer and was banned, ceasing the King of Queens stream. I guess even at the End of all things, there are still rules.

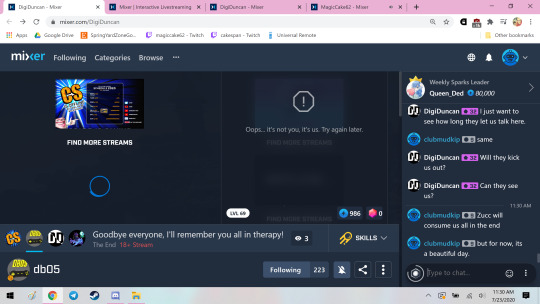

[First Screenshot] Knowing that the end was near, DB05 began playing a cutscene of the moon falling to the earth from Legend of Zelda: Majora’s Mask. The building music made my heart pound. At 10:54am PST, Mixer pushed notifications reading “So long, and thanks for all the fish :)”, a quote mentioned before the planet Earth is demolished in order to make way for the hyperspace bypass, featured in the book series Hitchhiker's Guide to the Galaxy written by Douglas Adams. When I hear this quote, I think of it as a goodbye to the universe itself; an acknowledgement of the many wonders one has experienced in their life; one last expression of gratuity for the world they inhabited and the gifts they received from it. It was fitting. Mixer, unafraid, gazed into the void and shouted a final “thank you”. At the same time as the push notifications, MixerBots spammed chats with emojis of goldfish, prompting users to do the same. We sent to chats our final “i love you’s”, “thank you’s”, sent emojis and encouragements, “goodbye’s” and “goodnight’s”. DigiDuncan scrolled through the front page of Mixer, and we watched the streams start to blink out, leaving a blue Mixer “X” logo in their place. The confetti showers returned. The site began to lag. Finally, the clock struck 11:00am PST.

And the moon fell.

For a few seconds, the streamers laughed. “Is that it?”, “Is it over?” DB05’s moon had fallen, and the cutscene continued to play. A brilliant flash of white, and Link awakens in the past. The streamers look on, “We’re still he-” Silence cut them off.

The voices of 10 million users, silenced in an instant.

I think we expect the End to be deafening, chaotic, and frightening. Like an Action/disaster movie, filled with explosions and screams and panic. But instead the End was peaceful. Quiet. Almost comforting. It was like sitting atop a hill in the morning before the birds start to sing, watching the sun rise over the horizon. Alone, yet serene.

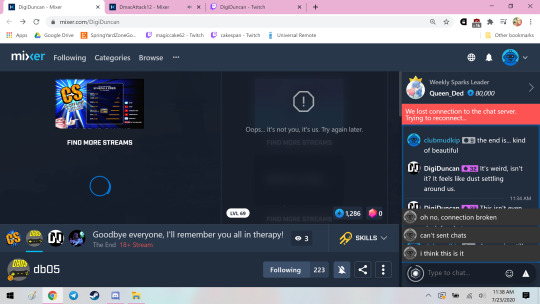

[Second Screenshot/Third Screenshot] Almost immediately, I realized I could still click around the site. The confetti continued to fall. At 11:12am PST, I returned to the userpage of my friend. All the streams had ended, but the content was still there. User’s “About Me” pages were still active, along with all of their clips, previously recorded streams, and other things like “Stream rules”. I was able to watch the tail end of Magiccake62’s stream from the previous night. I scrolled through Mixer’s homepage, clicking on names to read their bios and watch the stored video clips. It felt like wandering through a neighborhood evacuated before a storm; no time to bring your possessions with you. Houses left unlocked, devoid of life and frozen in time.

[Fourth Screenshot] by 11:13am PST Chats still remained active as long as you did not navigate away from the page. I continued to talk with some of the users that had been watching the stream. Just a few remaining voices, alone in this huge, empty city.

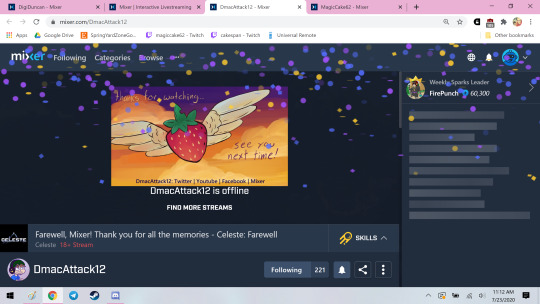

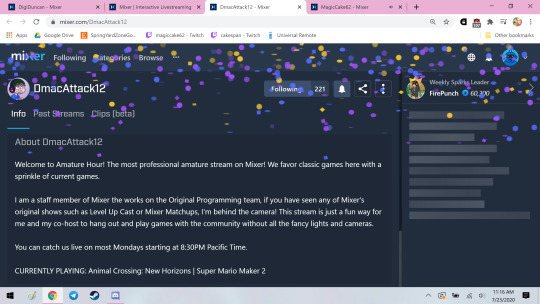

[Fifth screenshot/Sixth Screenshot] As I continued to look through the abandoned homes, I caught the tail end of DMacAttack12’s pre-recorded finale stream from the previous night. He was playing indie game Celeste: Farewell. The main character, upon reaching the top of the mountain, experiences a dream where she sees a long dead friend. She apologizes to the friend for not attending the funeral, and the friend laughs. “The Funeral wasn’t for me. It was for all of you, stuck living on without me,” she chortled. The main character awakens from her dream, and takes the time to reconnect with her friends in the present. Perhaps Mixer’s last day was always meant to be that; not a goodbye, but a way to reconnect with each other.

[Seventh Screenshot] At 11:30am PST, the majority of the streams’ “offline” screencaps had vanished. Chats continued to function, but you could not join new ones. Trying to visit a new stream would result in the chat section loading forever. The voices were dwindling. As far as I could tell, it was just myself and DigiDuncan. We talked about the future and exchanged Twitch handles, and thanked each other for being here - at least we could watch this noiseless sunrise together. We wondered if we were truly alone, if anyone could hear us. We wondered how long this would last. How long did the two of us have, in the End?

[Eighth Screenshot] At 11:38am PST, chat function disconnected. I could no longer send messages to my new friend. Error messages began popping up in place of streams. DigiDuncan told me they were using chat via OBS, a client that helps you set up and organize your stream (I was just using in browser), so their world was completely different from the one that I was experiencing. I worried about DigiDuncan. I was forced out, and I don’t know if they were left to experience the End alone.

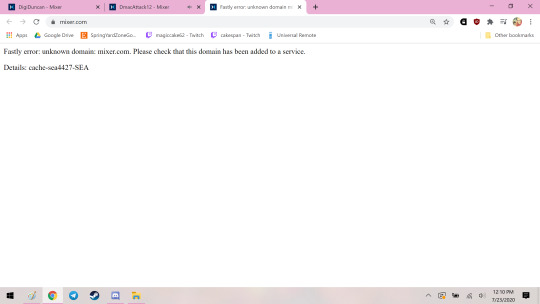

[Ninth Screenshot] At 12:10pm PST, All mixer URLs began returning this error message. The End was no longer a void, but a brilliant blinding white light. But as quickly as it came, it vanished.

[Tenth Screenshot] I returned to the Mixer homepage at 12:11pm PST to find it completely empty, but still stylized with the Mixer logo and signature blue backgrounds. The booming voice of the error message notifies me that something has gone wrong as the homes filled with memories I had been visiting vanish around me, leaving endless winding pavement streets and empty grass lots in their wake. What was once a bustling community was now nothing at all. Any presence of the people who once lived here, their culture, their love and their stories, had simply evaporated into the sunrise. With no other words or pictures to advertise streams, everything is quiet. It is peaceful.

It is the End.

[Eleventh Screenshot] By 12:16pm PST, all Mixer URLs displayed a graphic of a blue robot with hearts for eyes. This continues to be the case at the time of posting. With no users and no staff, Mixer itself is Alone, yet serene. In this graphic, at the End of all things, Mixer sighs a final “thank you” to the diaspora.

Goodnight Mixer. So long and thanks for all the fun :)

1 note

·

View note

Link

Still Looking for a New Gaming Console? Here’s Why One Saturday in mid-December, Chris Vernon was driving as fast as he could to a GameStop in Memphis. He had spent weeks combing the internet for new PlayStation 5 consoles, and had just heard about a new shipment’s arrival at a store nearby. It was the only present his 10-year-old son, William, wanted for Christmas. The problem was, lots of other children around the country were asking for new video game consoles, too. Mr. Vernon, a local sports radio host and podcaster for “The Ringer,” arrived too late. He waited in line for four hours before being told that the store had run out. He returned home, “crestfallen,” to tell William the bad news. Since their highly anticipated release in November, the new generations of consoles — Microsoft’s Xbox Series X and Sony’s PS5 — have been in short supply. Gamers have flooded online stores in the hundreds of thousands, crashed websites, lined up outside stores and shaken their fists in frustration when scalpers snagged devices, then resold them for double the price. “It’s completely chaotic,” said Rupantar Guha, an analyst at GlobalData, an analytics company in Britain. Microsoft and Sony would not give sales totals for the devices, which arrived on the market during a pandemic-fueled surge in gaming. But David Gibson, the chief investment officer at Astris Advisory, a financial advisory firm in Tokyo, estimated that Sony had sold at least six million PS5s through the end of 2020 and that Microsoft had sold three million of the Xbox Series X and the smaller Series S. “In a lot of ways, they don’t want to satisfy demand initially. They want to have an ongoing gap between supply and demand,” Mr. Gibson said. “They want to have buzz and excitement around it for a longer period of time.” Scarcity is typical for new consoles, but the coronavirus pandemic exacerbated it by closing factories in China early last year. Then the demand for laptops and other electronics for remote work led to a shortage of chips and other computer parts. Malfunctioning chips played a role in the supply problems as well. Sony declined to comment, instead referring to a November post on Twitter in which the company mentioned the high demand. Microsoft said in a statement that it saw huge demand, too, and was “working tirelessly with our manufacturing and retail partners to replenish Xbox hardware as quickly as possible.” Mike Spencer, Microsoft’s head of investor relations, said in an interview this week that the company had topped $5 billion in gaming revenue in a quarter for the first time. Microsoft sold every Xbox unit it had last quarter, he said, adding that supply is likely to be constrained at least through June. U.S. consumers spent $7.7 billion on video games in December, according to the NPD Group, up 25 percent from a year earlier. Hardware sales accounted for $1.35 billion, the most for a December since 2013, the last time new-generation consoles were released. (Nintendo’s Switch, which first went on sale in 2017, outsold both the PlayStation and Xbox last month.) When Mr. Vernon, 42, recounted his console-hunting tale on his radio show, a listener with an extra PlayStation reached out to him. Mr. Vernon drove to the man’s house, bought the console and surprised William with it days later. “It was the hardest gift for anyone that I’ve ever tried to buy,” Mr. Vernon told The New York Times. “It ended up all being worth it for that moment.” One of the most vexing issues are the scalpers. Some are using so-called purchase bots — also known as “Grinch bots” — to snap up online offers faster than humans can. “None of these devices are reaching their customers,” Mr. Guha said. “They are just going missing somewhere in between.” Online scalper groups are claiming credit for buying thousands of consoles, though their numbers may be exaggerated. Walmart said in a blog post in December that it had blocked more than 20 million bot attempts to buy PS5s in one 30-minute stretch in November. Resellers list consoles on places like eBay and Facebook Marketplace for up to $1,000, double the retail price. Mr. Guha said he had seen a PS5 advertised for $5,000. Crep Chief Notify, a British reseller company that scalpers use, said it had more than 5,000 customers. The group charges $40 a month for a suite of tools, advice on how to resell items and access to a server on Discord, a messaging app. Max Heywood, a 19-year-old British student who is one of the company directors, said Crep Chief Notify did not use purchase bots but supplied software that monitors online stores and notifies users when new items are in stock. Bradley Gee, another Crep Chief director, pushed back against criticism that the company helps people resell the consoles at higher prices. “To be totally honest, it’s basic supply and demand,” Mr. Gee, 21, said. “There’s millions of consoles available. If you didn’t get one, it is unfortunate.” He added: “We just help members secure them. They can then do what they wish with the console.” To beat out scalpers, buyers are following Twitter accounts that announce when stores like Target, Walmart and Best Buy get new shipments. And a group of college students has seen huge interest in a free browser extension they created to notify people when digital stores restock. More than 100,000 people have installed OctoShop, a Google Chrome extension made by five students from schools in Texas and Pennsylvania. Rithwik Pattikonda, a computer science major at the University of Texas, said the idea for a shopping aide had come about during the toilet paper shortage at the beginning of the pandemic. It morphed into a tool for outsmarting scalpers chasing consoles. “The goal is to give the power to regular people,” Mr. Pattikonda, 20, said. He added that several thousand people have said OctoShop has helped them obtain a console. For many, though, the search has remained fruitless. Shannon-Leigh Bull of Warwickshire, England, has been trying to surprise her boyfriend with a new PlayStation since November. “Sometimes, you’re waiting more than an hour and you finally get through and it’s out of stock,” Ms. Bull, 22, said. “It’s like having your dreams crushed, because you thought and hoped you’d actually get one.” “I feel like giving up, and that I’m never going to get it.” Karen Weise contributed reporting. Source link Orbem News #Console #Gaming #Heres

0 notes

Text

Russian Internet Efforts Go Further Than Just Helping President Trump Being Elected

This post originally appeared on RUSI.org on 10 May 2019

The findings of Robert Mueller’s report demonstrate the sophistication of Russia’s information operations. Yet the 2016 US election may have been a proof of concept for future efforts.

Most of the investigations into Russian interference in the US electoral campaign and the alleged collusion between Donald Trump’s presidential electoral campaign and Russian elements are now over; the debate will continue to rage in the US media, and questions will endure about how Special Counsel Robert Mueller discharged his duties. Still, the report is out, and most of the opinions now expressed are largely along well-established partisan lines. Yet a less-discussed but nevertheless critical aspect of this episode is what it reveals about the broader details of Russia’s disinformation campaigns on social media. The Russian Internet Research Agency (IRA), which is accused of running a ‘Troll Farm’, generated most of the hostile activity related to the US elections. It had two goals in the run up to the 2016 American ballots: a broader goal of ‘sowing discord in the in the U.S. politicalsystem’, and more narrowly to successfully elect Donald Trump as president, through a wider series of operations known as ‘Project Lakhta’.

Russia has long felt the West has been using the internet to influence Russia’s youth and, in Moscow’s view, the West simply got a taste of its own medicine. This operation was almost certainly seen in Moscow as defensive, notwithstanding its offensive character, being implemented to expose the hypocrisy Russia saw in Western societies and their discourse about democracy.

And the operation was long in the planning. In 2014 the Russian IRA consolidated its US ‘specialists’ into its ‘Translator’ department and started creating fictious personas on social media networks; these would be imaginary individuals sharing profile images created in-house at the Russian IRA.

The fictious individuals, in turn, produced written posts about political topics, and images designed to go viral within their political demographic target area; Russians had used a similar strategy that same year during their war which led to the seizure of Crimea from Ukraine.

Though total numbers of such imaginary actors are hard to gauge, a 2018 US Senate reportindicates that the Russian IRA had managed to reach extensive audiences, as ‘posts on Instagram received 187 million engagements and that Russian IRA posts on Facebook received almost 77 million engagements’.

Mueller’s report pushes these estimates higher; up to 126 million users on Facebook engaged with or actively helped spread Russian propaganda, including Donald Trump, who on 19 September 2017 tweeted from his personal account to a Russian propaganda account, @10_gop. The Russians had tweeted him ‘We love you, Mr. President!’ He replied: ‘I love you- and there is no question - TOGETHER , WE WILL MAKE AMERICA GREAT AGAIN!’.

Of course, Mueller does not suggest that President Trump knew this was a Russian propaganda account when he replied to it.

Either way, these fictitious personas would start a pattern of interactions with American citizens, reaching out to and contacting them personally. Once they started to build a relationship they would inform US citizens of rallies they were planning to hold. These were deliberate ruses, similar to ‘spearfishing’ attacks, which are more typically reserved for hacking. They required specialist researching and tracking of individuals before making contact. The purpose was to mobilise people for various rallies and other activities, and the ruses often succeeded in attracting hundreds of participants.

In the past the Russian IRA has set up ‘help hotlines’ for people ‘struggling with sexual behavior’ in order to use the information provided to them as blackmail. They have had some success with such traps.

In 2015, Moscow’s scope widened; apart from creating fake accounts for individuals, Russia started creating ‘grassroots’ organisations. Their goal, broadly, was to sow discord. This applied to both the far left and far right of the US political spectrum. A series of ‘hard left’ groups, mostly centered on race relations in the US with various names such as ‘Blacktivist’, ‘Black Matters’ and ‘Don’t Shoot Us’ were promoted; so were pro-Muslim groups, such as ‘United Muslims of America’.

New Knowledge, a think tank, noted in its 2018 report that ‘some of the most sophisticated IRA efforts on Facebook and Instagram specifically targeted Black American communities’ and that the Russian IRA was able to create a sprawling mass that mixed fake and real news, to create a believable but false news system designed to exploit organic protest movements.

These groups could draw from one another; if a Russian propaganda promoting left-wing issues posted something controversial, it could be reposted to a far-right group as evidence of Black or Muslim radicalisation.

The process could be infinitely repeated, with both political sides feeding off of one another. As well as simply posting reactionary content, the Russians also generated ‘counter protests’ to protests they had set up, another example of their infinite flexibility and flair to read local situations.

It is likely that many of these activities were designed to show ‘proof of concept’, to justify to the political leadership of the Russian IRA that the entire effort was worthwhile, and that it was producing the expected results.

And the costs, for the advertising at least, were very low. The various Russian-sponsored groups took out approximately 3,500 adverts on Facebook and spent just over $100,000doing so, a small amount compared to the large media ‘footprint’.

The high rate of content production obscures the fact that much of it appears to be low quality; many of the images were hastily put together and the copy is sometimes sloppy. But to a large extent this did not matter as the content was amplified by a Russian-created ‘bot network’.

Unlike the specialists, which are real agents of the Russian IRA, the purpose of a bot network is not to create new content or contact American citizens. Rather, it is designed to ‘repost’ or share content with a wider audience. Such networks are often easier to detect and can be removed by social media companies, but they are cheaper to maintain.

Overall, the total cost of the operation would have been relatively high and must have enjoyed support from the top of the political leadership in Moscow. For, while the advertising spend of $100,000 may seem low (for context Marvel spent £153.5 million on adverts recently to promote its latest film), the overall cost of the Russian operation is likely to have been much higher, although still trifling if compared with the outcome.

And there is no question that this was an operation to which Moscow devoted a great deal of attention. Russian agents, engaging in online accounts, coming into the office every day, creating fictitious personas, going online to engage in local issues in US politics, over years, to create an entirely plausible narrative. It requires an ability to be both responsive to local American politics and creative in how it is spun to fit a narrative.

No space online is immune from such operations. Even ‘architecture Twitter’, where architects on Twitter discuss buildings they enjoy has become a meta political discussion on both sides; classical buildings, it seems, are linked with ideas of white cultural hegemony, and brutalist architecture with, allegedly, the failings of immigration. Alt-right commentators, such as Lauren Southern, make links between cultural and architectural traditions and anti-immigration, which they see as disrupting cultural hegemony. The Russian IRA can use any online space, in any discussion, and slowly pivot towards political ideas and make links to ‘far right identity politics’.

To a large extent, therefore, a Russia-led operation to disrupt the US elections would have happened, even if Trump had not won the Republican nomination. The US would have likely seen a different, but equal in size and scope, disinformation campaign. There was extensive Russian interest in information warfare since before Trump, and there will only be more of an appetite for it in 2020.

0 notes

Link

LCS 2020 SUMMER

Official page | Leaguepedia | Liquipedia | Live Discussion | Eventvods.com | New to LoL

FlyQuest 2-3 Team SoloMid

Congratulations to TSM! They have secured themselves NA's first seed at the 2020 World Championships! FlyQuest is locked as NA's second seed.

Player of the Series: Bjergsen

FLY | Leaguepedia | Liquipedia | Discord | Website | Twitter | Facebook | YouTube | Subreddit

TSM | Leaguepedia | Liquipedia | Discord | Website | Twitter | Facebook | YouTube | Subreddit

MATCH 1: FLY vs. TSM

Winner: Team SoloMid in 34m

Runes | Match History | Game Breakdown

Bans 1 Bans 2 G K T D/B FLY lucian nidalee twisted fate hecarim leona 52.7k 4 1 H4 TSM thresh Lillia shen leblanc syndra 68.7k 20 11 C1 H2 M3 I5 I6 B7 E8 B9

FLY 4-20-9 vs 20-5-50 TSM Solo ornn 2 0-5-2 TOP 6-3-12 3 camille Broken Blade Santorin graves 2 2-4-2 JNG 2-0-11 1 sett Spica PowerOfEvil viktor 3 1-4-2 MID 8-0-10 2 zilean Bjergsen WildTurtle caitlyn 1 1-4-2 BOT 4-1-9 1 ashe Doublelift IgNar lux 3 0-3-1 SUP 0-01-8 4 karma Biofrost

MATCH 2: FLY vs. TSM

Winner: Team SoloMid in 41m

Runes | Match History | Game Breakdown

Bans 1 Bans 2 G K T D/B FLY lucian nidalee zilean camille volibear 67.3k 7 1 M1 H2 H4 I5 I6 I10 TSM thresh Lillia shen orianna syndra 85.9k 20 10 O3 B7 I8 B9 E11

FLY 7-20-19 vs 20-7-48 TSM Solo ornn 2 1-7-5 TOP 6-1-5 3 jax Broken Blade Santorin graves 2 1-4-4 JNG 3-3-12 1 sett Spica PowerOfEvil azir 3 2-2-2 MID 2-1-10 2 twisted fate Bjergsen WildTurtle caitlyn 1 3-4-3 BOT 8-1-5 1 ashe Doublelift IgNar pantheon 3 0-3-5 SUP 1-1-16 4 bard Biofrost

MATCH 3: TSM vs. FLY

Winner: FlyQuest in 42m

Runes | Match History

Bans 1 Bans 2 G K T D/B TSM thresh shen Lillia rakan mordekaiser 73.1k 12 6 H2 I3 C6 FLY nidalee caitlyn zilean jax lucian 74.8k 14 7 M1 H4 C5 C7 B8 C9

TSM 12-14-31 vs 14-12-33 FLY Broken Blade jayce 3 3-3-5 TOP 1-4-4 3 gangplank Solo Spica sett 1 3-3-7 JNG 3-3-8 1 hecarim Santorin Bjergsen twisted fate 2 2-1-8 MID 2-2-9 2 orianna PowerOfEvil Doublelift ashe 2 1-6-4 BOT 6-1-6 1 senna WildTurtle Biofrost bard 3 3-1-7 SUP 2-2-6 4 nautilus IgNar

MATCH 4: FLY vs. TSM

Winner: FlyQuest in 35m

Runes | Match History | Game Breakdown

Bans 1 Bans 2 G K T D/B FLY lucian nidalee zilean evelynn bard 69.0k 19 10 M1 O3 I4 I6 B8 I10 B11 TSM thresh Lillia shen gangplank mordekaiser 60.1k 8 2 H2 H5 I7 I9

FLY 19-8-40 vs 8-19-20 TSM Solo ornn 3 6-1-7 TOP 1-2-6 3 jayce Broken Blade Santorin volibear 2 3-2-10 JNG 2-5-4 1 sett Spica PowerOfEvil azir 2 1-3-11 MID 4-1-0 2 syndra Bjergsen WildTurtle caitlyn 1 6-1-7 BOT 1-5-5 1 ashe Doublelift IgNar pantheon 3 3-1-5 SUP 0-6-5 4 morgana Biofrost

MATCH 5: TSM vs. FLY

Winner: Team SoloMid in 33m

Runes | Match History

Bans 1 Bans 2 G K T D/B TSM thresh lillia shen pantheon mordekaiser 66.5k 18 11 H2 C4 H5 C6 B8 FLY nidalee caitlyn zilean bard tahmkench 56.2k 11 1 O1 I3 C7

TSM 18-11-42 vs 11-18-25 FLY Broken Blade camille 3 4-2-5 TOP 6-6-0 4 gangplank Solo Spica graves 2 3-1-6 JNG 2-2-5 1 sett Santorin Bjergsen twisted fate 2 5-0-11 MID 2-3-4 2 orianna PowerOfEvil Doublelift senna 1 6-5-8 BOT 1-3-8 1 ashe WildTurtle Biofrost rakan 3 0-3-12 SUP 0-4-4 3 leona IgNar

*Spoiler-Free Schedule;

**Patch 10.16 Notes: Yone Disabled — LCS Summer Playoffs.

This thread was created by the Post-Match Team.

submitted by /u/TheRogueCookie to r/leagueoflegends

[link] [comments] https://ift.tt/eA8V8J

from reddit: the front page of the internet https://www.reddit.com/

0 notes

Text

WARNING TO ALL BITCOIN BEARS!!!! ANTHER BREAKOUT IS COMING!! ETHEREUM PUMPING LIKE CRAZY TO $500!!??

With #bitcoin recovering slightly from the recent dump, could another pump be on the cards taking it above that $12,000 level we faced resistance at previously! Let’s take a look at some #btc analysis.

🔰Join Today:

🔰Discord:

🚨 MEGA BITCOIN BLUEPRINT SALE 🚨

➖

🔥 Up To $600 Discount – Limited Time 🔥

🔲 My Top 3 Recommended Exchanges

🔵 Phemex – $120 FREE Bonus

🟠 Bybit – $90 FREE Bonus

🟣 DueDex – $200 FREE Bonus

🔥TRADE CALLS 🔥

Copy My Trades – 21 DAY FREE TRIAL:

▪️

💰 Learn How I Made $8,000 Profit In 1 Trade (Free Training) 💰

🔰Smart Trading & Bots with 3Commas

✳️30% OFF 3Commas:

❎Tutorial:

📚TUTORIALS

🔵Phemex Tutorial –

🟠Bybit Tutorial –

💬 Free Crytojack Chat Telegram Group

▪️

🌍Follow Me Behind The Scenes 🌍

⭕️Instagram:

⭕️Twitter:

⭕️Facebook:

◾️Join Trading View Pro:

➖

🔶EXCHANGES 🔶

➖Coinbase

➖Buy/Sell $100 Get $10 FREE

➖Join Today:

➖Binance (BTC-ALTCOINS)

➖ Get 10% OFF

➖

◽️HARDWARE WALLET◽️

🔒 Ledger (Nano X Is Best)

➖Purchase:

🔒Trezor (Safe Place To Store Bitcoin)

➖

✉️ CONTACT ME ✉️

[email protected]

Time Stamps:

0:00 – Intro

1:28 – BTC Analysis

3:57 – ETH Analysis

5:07 – DEFI

5:27 – Sponsorship Multiplier

8:12 – BTC S2F Model

10:10 – BTC 200W Moving Average

12:40 – Giveaway Winner

Take everything I say as pure entertainment value only. Do not take any financial advice from me at all. I am not a financial advisor, I am only documenting my crypto journey for others to watch. With every investment platform, altcoin or program there are a lot of risks. Know what you’re getting into and do your own research first!

Please understand that leverage trading is very risky and around 70% of people who leverage trade over a period of time may lose money. Keep this in mind and aim to learn the right techniques and trading style before jumping in blind.

#bitcoin #cryptocurrency #bitcoinnews

VIDEO TRANSCRIPT

COMING SOON!

source https://www.cryptosharks.net/warning-to-all-bitcoin-bears-anther-breakout-is-coming-ethereum-pumping-like-crazy-to-500/

source https://cryptosharks1.blogspot.com/2020/08/warning-to-all-bitcoin-bears-anther.html

0 notes

Text

May 11, 2020 at 06:25PM - Geneshift: Battle Royale Turbo (100% discount) Ashraf

Geneshift: Battle Royale Turbo (100% discount) Hurry Offer Only Last For HoursSometime. Don't ever forget to share this post on Your Social media to be the first to tell your firends. This is not a fake stuff its real.

KEY FEATURES IN GENESHIFT (AND THE INCLUDED DLC)

Battle Royale Turbo

Loot, survive, and be the last man standing. Play in a series of turbo-fast, back to back rounds where each battle royale lasts only 3 minutes. Get bonus points for winning each round as you level up for the final showdown.

Zombie Comebacks

If you die you can keep playing as a zombie and prepare for the next round. Even better, if you kill a living player you can come back to life and get a second chance.

Singleplayer Bot Matches

Play against intelligent, life-like bots on various difficulty levels. While playing offline you can still complete challenges, level up, unlock new items, and compete on leaderboards.

Full Singleplayer Campaign (Included DLC Bonus)

Save the world in the singleplayer campaign. You can play solo or co-op with up to 4 friends online. Progress in the campaign is shared with progress in multiplayer modes.

Join Multiplayer Instantly

Start playing within seconds of game launch. No need to queue before joining a game.

5 Classic Game Modes

Play Battle Royale, Capture the Flag, Team Deathmatch, Conquest, and Checkpoint Racing.

Strategic Progression System

Level up and unlock new items as you progress to the top tier weapons, cars, and abilities.

Daily Leaderboards

Compete on daily leaderboards, and receive bonus rewards for finishing near the top.

Over 100 Challenges

Earn bonus XP by completing challenges, like mid-air knife attacks and vehicle jumps.

Insane Vehicle Action

Ride with allies to do drive-by shootings, detonate car bombs, and fire homing missiles.

Over 30 Tactical Skills

Unlock special abilities like Invisibility, Bouncing Bullets, Fire Balls, and Teleportation.

Secret Base Building

Place hidden chemicals to gain secret benefits, like selling weapons and spying on enemies.

Constant Development

I’ve been working on Geneshift for 10 years now, listen to feedback in Discord every day, and regularly update based on community suggestions!

from Active Sales – SharewareOnSale https://ift.tt/2Lna30h

https://ift.tt/2xYLcwM

via Blogger https://ift.tt/35ONDyo

#blogger #bloggingtips #bloggerlife #bloggersgetsocial #ontheblog #writersofinstagram #writingprompt #instapoetry #writerscommunity #writersofig #writersblock #writerlife #writtenword #instawriters #spilledink #wordgasm #creativewriting #poetsofinstagram #blackoutpoetry #poetsofig

0 notes

Text

Bitcoin DOUBLE Trap Analysis?! April 2020 Price Prediction & News Analysis

VIDEO TRANSCRIPT