#throwback to those eos days

Explore tagged Tumblr posts

Text

the batbrothers as different flavors of EOS lip balm

dick: vanilla bean- it’s a classic, and therefor practically everyone loves it. it’s sweet and not too overbearing- a well rounded flavor.

jason: sweet mint- some people swear by it, others despise it. it leaves your lips tingling- but in the best way possible. and it’ll always be my personal favorite

tim: summer fruit- super vague about the actual flavor- what fruit does “summer fruit” entail? regardless, it’s a crowd favorite- even if we don’t fully know what it tastes like

damian: lemon drop (with spf 15!)- another controversial one. it’s sour, but so many people love it. unhinged for a lip balm flavor, and yet- it works.

#i’m so sorry#i don’t even know what this is#but i think it makes sense#throwback to those eos days#batfamily#batfam#batbros#incorrect batkids#incorrect batbros#bat brothers#dc headcanon#dc robin#tim drake#dick grayson#jason todd#damian wayne#funny#funny bats#batfamily headcanons#batman#batkids#eos lip balm

117 notes

·

View notes

Text

Collection of asks 2 - BTSandVMIN

I had to make a second one because the length of the first one was getting way too long. If you are curious about some of my older asks here is the link to my first collection post - Collection of asks - BTSandVMIN

I have this post because I feel some of the asks I answer are worth saving, for me personally, and perhaps for you as well. But I don’t want to put them all in my Masterpost where I want to keep it a bit more structured for my longer posts and analysis. So for asks that are more about answering specific questions or about general things or my feelings I will put them here.

Asks are written more in the moment than my usual posts, so they might be less accurate as it’s all mostly from the top of my head. The newest ones will actually be on top, and then they will get older going down the list. I’ll update it regularly as I answer more asks. :)

Look at jhope's interaction with maknae line

Sorry for spamming with asks

You're so right about how any ship can be possible if you focus on it

I reject any idea of a couple being pushed to protect another

What do you think of vmin’s busan forehead kiss?

About tae changing the choreo of fake love

What do you think of that famous ji/kook trip together ?

"Friends" doesn't speak about a friendship to me and the title seems like a way to "hide" the true meaning. Thoughts?

I honestly do feel his "best" friend is only ever needed when it's convenient to him

When j/k wore matching shirts asked them something like are u guys dating Its so differnt from his rn to vmin

Looking at th and jm for what they are or represented to be their bond shouldn't be taken at face value. Just reminding that jealousy amongst bandmates do exist

Jimin kissed tae on the pretext of kissing tanny. tae blanked out for a few secs after that

Jin in Jimins Festa profile this yr called Tae his "Bf" and then the next word is "best friend"

I dont think vmin or any other ship in bts for that matter are in any form of relationship right now.

Kind of agree with vmin not spending much time together outside of work & things they do/say barely even give off that "possibly a couple" vibe in general

IF feelings are involved, who do you think fell first and why?

You already said that you ship them, but do you think that they're real?

I found it kinda weird how jimin apparently "didn't know" 4 o'clock was inspired by him

Have u seen that one radio interview in the past Th openly called out jm for liking men?

We never see them hangout tgt I mean we have seen ji/kook tgt more often and tae with his wooga squad

What did you think about jimin playing the video game using tae's acc while the latter looked from behind?

When tae posted 'lets keep going for a long time i only have u' they probably only knew e/o for about 2 yrs and now we also know that at that time they still argued and fought with e/o alot. Yet they felt so strongly for their frienship.

What are your thoughts about tae choosing " my time " to recommend it to a non army.

If we look at their personalities tae is more of introverted and shy these days while jimin is more outgoing and loud. But when it comes the them jimin is always the one who seems cautious

Is it my imagination or is Jimin VERY loud lately? I feel like the roles have somehow been reversed.

The timeline of the dumpling incident really confuses me.

Why do i feel like vmin dont hangout outside of work anymore

Just read your ji/kook vs vmin post regarding festa and I agree. you can tell that jm gets very serious when it comes to tae

A possible sexual relationship between Jimin and Tae. I've seen subtle hints where this might be happening behind the scenes like the recent bang bang con

Whenever joon says stuff like 'what a nice friendship/bcoz he is your friend' vmin have a very neutral or blank face

When do you think their friendship turned into something more?

Did u see how tae coloured jimin's name on the soft board with purple.

Jimin recently in this festa says jk is his soul brother

Nj nearly always tries to underplay vmin's bond.

Sweet Night: “Sharing my fragile truth That I still hope the door is open Door'

I feel like jimin was reluctant to talk about the dumpling incident probably bcoz it involves him getting drunk?

Your opinion on the whole "that's smth a couple would do" "you two look like a couple" for ji/kook vs "it's cause he's your friend "

What ur opinion is on the new kdrama that is based on homosexuality.

Tae has many a times mentioned wanting to have kids or wanting to be father.

Taehyung has always talked about having a family, children and wife etc.

I personally feel the maknae line in general have been advised not to do lives alone tgt bcoz of the intense shipping

I spend hours reading your posts and I could never get tired of it

I have a doubt about vmin recently V is so close to JK it seems like V avoiding jimin

Taehyung talked about the movie Call Me by Your Name and its soundtrack

I honestly like how unpopular vmin are.

Let's say JM and TH have other partners - do you think said partners would be okay with a whole song of vmin declaring each other as soulmates?

In the end there is no moment that is unique to a ship. do you agree?

Some vlives are arranged by the company and sometimes members themselves when the find free time they go live.

What was the point of making a decision tght to come on vlive tgh infront of the fan to then not do it?

It cant be the company stopping v and jm from doing a live can it?

Do you the think the reason vmin dont do vlive is because taehyung's feelings are one sided?

Theory on a possible reason on why vmin has not gone to do a vlive on their own for so long?

On bon voyage 3 j hope mentions how v and jk were hugging each other in their sleep.

Ji/kook is obvious (ear nibble) and Tae reacting blank to Vmin moments

But why they dont have funny bro handshake like v/kook?

You are so delusional like seriously how do you function in real life

You know how vmin called eo soulmates. The term can also be taken in a platonic way too right

If there’s a real ship in bts, can you give me your opinion on who?

Tae kissing jimin's cheek after they won an award in some music show (About ship edits)

I think vmin is real. Can you do a Sweet night analysis because in my opion the song dosen't match with the drama

Why are you a Vmin shipper if you don't think Jimin is gay or at least bisexual?

I don't blame V and Jimin for not doing Vlive together

You know that blurry picture of vmin in 2014?

Tae and jk seem like the members who are most non straight to u and also that jimin might be straight so then isnt it more possible for t**k***k to be the couple?

Do you think that vmin are straight?

Can you tell me what makes you think jk is not straight

Ppl connect sweet night and 4 o' clock with vmin After tae's live yesterday n i m also seeing some ppl being offended by it.

Why do I sense that Tae has more of crush on Jimin (and realized it) but Jimi is oblivious?

Will you still publish that long vmin and lgbt in korea analysis.

Even namjoon said they should go live to discuss about their song.

I dont really consider minjoon vlive as one they did themselves. it was mostly organised by the company

Maknae line avoid vlives and its really weird that jimi would do it with rm but not tae

Shouldnt it be easy for them to go live tght than anyone else?

Tae is very reluctant or scared to do a vlive with jimin

In the past month when vmin did mention about the song they just made superficial comments

Hi 💙 do you write vmin fics?

I also feel that jm is nervous to talk about the song even though he said he will in the comeback show

If jimin doesn't go live today as well maybe we can get a vmin live?

Vmin antis say vmin are not friends irl and use the fact that they are never spotted hanging out offscreen as "proof"

Will you do a Vmin throwback - 2019?

Can we even be considered delulu anymore for thinking not all of this is a coincidence?

Sweet night doesn't really fit the couple relationship in the drama

What do you mean when you say 'not being delulu'?

I dont know why after listening to sweet night i feel very nervous?

Maybe the lyrics to SN are very well just about the drama/webtoon.

Do you think the songs lie and stigma are related ?

Namjoon talking about Friends 2 - Making excuses

Namjoon talking about Friends 1 - Can’t write about them

About the “Hello my alien” line in Friends

Do you think they gone do fansing this period of promoting?

Jm said when he wants to make and gift a song if he finds someone he loves and he actually helped write n produce the melody of chingu

Omg Ive been crying over the vmin song lyrics ever since they came out.

Thoughts about the song and what you took out of it

Its not a light hearted thing to call each other soulmate

This kind of debunks the christmas song theory… i feel sad like they are commercialising their friendship

Jimin is partly involved in the making and it will be about Jimin and Tae’s bond

I fear that vmin will become the next larry

Chrismats song, smile awards. Arent those awards previously decided and even the words written for them by the company?

I was wondering if you're going to write something about bv4 and all the vmin we got there

Do you think that vmin say they love each other truly or for fan service?

Recently i watched a vkook video to compare

Do you know how exactly vmin met?

Whenever I do get the chance to focus on Vmin it’s usully one of three things

At the airport Tae had his arm around Jimin's shoulder but removed it quickly when they arrived in front of the cameras.

I don’t care if people don’t ship Vmin romantically. But with Vmin doing things like this you can’t really blame us if we do.

I got a looooot of asks on the Christmas song and I will adress the ones I have left all in one go

The reaction in bv was probably cause he wants to visits there and jm got there first

Vmin talked about tannie and how they went to visit tannie at tae's parents house

Just do it how you feel comfortable, we are waiting for your analysis

What video is the gif you post with this : Jimin and V talking about going to the Sapporo snow festival and playing in the snow together

This break was an opportunity for them to be around other friends and family so maybe they just wanted to spend this time apart

Do you really think vm are soulmates? Sometimes i feel like we might be over using this word for them

Once again thank you for all the asks you send! And also sorry for not being able to keep up and answer them all. I’ll try to answer some old ones as well whenever I can, and I will keep adding some of them to this list. I hope you found something interesting. Thanks for reading!

#vmin#vmin analysis#btsandvmin#Btsandvmin ask#btsandvmin masterpost#vmin masterpost#Btsandvmin answer#95z is love#my post#keep loving vmin

43 notes

·

View notes

Text

Up from the Depths P.1 - Re-Review #32

Now, just to stick my personal opinion in here... we’re about to get to two of my all time favourite episodes. The amount of references to Jeff, and the purpose for IR - there’s just golden moments everywhere you look. So let’s have a look at some of them.

“What is it, John?”

“You’re gonna’ want to see this.”

“The TV-21! No, it can’t be...”

Well, it is (or we wouldn’t have an episode)!

“Is that what I think it is?”

“It’s the TV-21!”

“Is anyone gonna’ clue me in here?”

“It’s the TV-21!”

“That is not helping!”

Don’t worry, Alan, I’ll try and catch you up. But that just serves as another well-placed reminder of all the things Alan (and Kayo) is too young to remember about IR.

The fact Jeff etched his name onto the ship does not surprise me. It goes towards showing how proud he was of it, and completely fits in with everything we are told about him by Grandma (once again, wonderfully well placed comments).

Now, the TV-21, is given to us as “the first Thunderbird”, the fastest ship (at the moment), and Jeff’s pride and joy. There’s a nice little reference to Jeff’s previous careers as well, with the fact they’ve added the ‘Colonel’. Nice touch.

But of course, of all the places to crash land, it had to be in the Mariana’s Trench. I mean, there is a reason why it’s “the world’s last unmapped ocean”, according to the crew. It’s a pretty dangerous place. If you want to read about it, feel free, National Geographic have some incredibly interesting articles on what they theorise could be down there based on their limited exploration. But what we do know, is that it’s actually a very hostile seascape, and that the marine life which inhabits it seems to have evolved drastically to cope. I think that if we are ever able to understand it, we will know a lot more towards global warming and the mutations of animals. But I hate swimming. Water’s not my area. I prefer to research land mammals and leave my colleagues with the wet-weather adventures.

Anyhow, I think it’s totally awesome that Virgil was playing the piano and that Scott was sat at Jeff’s desk in the opening for this episode too. It’s always nice to see little throwbacks to this very human family.

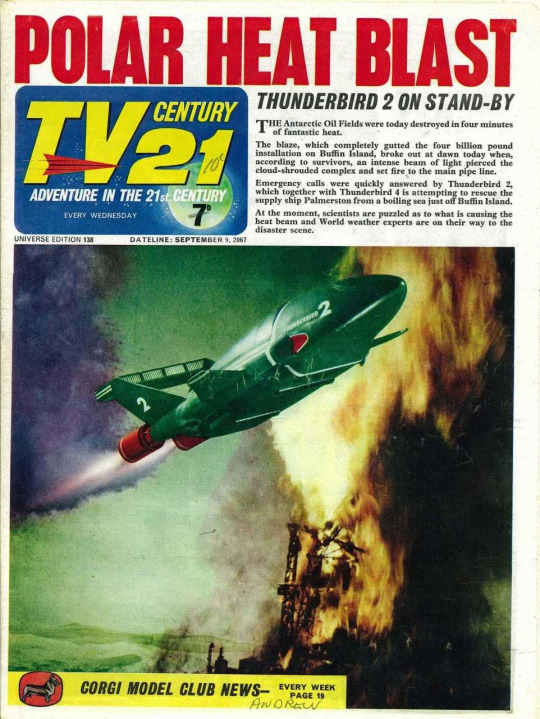

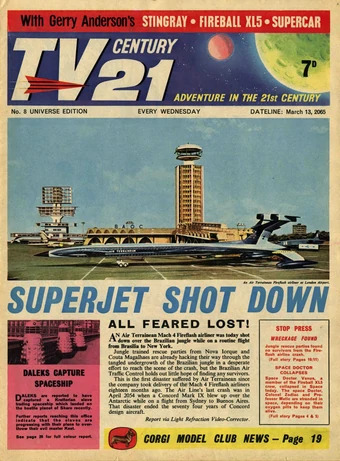

So let’s discuss the origins of TV-21 for a moment. Before it was a Thunderbird, it was a comic series! And it’s original name was ‘TV Century 21′ which was eventually shortened to TV21. It had various mergers, which featured additions to the name, but TV21 stuck for the majority of issues. It was a weekly comic published by City Magazines, beginning around 1965. It’s content was... drum roll... the sci-fi TV series created by Gerry and Sylvia Anderson’s company: Century 21 Productions - thus where the comics name originated from, the TV being added to clarify where the material was coming from and hopefully encourage people to watch and read both in tandem.

The comic often had newspaper front pages, dedicated to the fictional news stories of the multiple Anderson worlds, e.g. Thunderbirds, Captain Scarlet, Stingray.

Some really well known artists of the time worked on the comics, which only serves to increase their value. In our current day, the original ‘TV Century 21′ editions (Issues 1 - 154) are really hard to find, and so they sell/auction for incredibly high prices when one can be found - like much of the Anderson’s work which made it’s way into print. It does also mean that the first half of this great comic series is practically lost to the world.

Which is a big shame, because it was in many of these first issues (with their print time colliding with the original air slot of ‘Thunderbirds’) featured many episode-story related additions. For instance;

The supposed capture of ‘The Hood’ - which might have gone someway to explaining his disappearance during Series 2 of the show.

An addition to the US Army’s story line from ‘Pit of Peril’.

An addition to the events of ‘Sun Probe’, as well as an in-depth story on Thunderbird Three investigating the connection between the sun and natural disasters (better known now as global warming). My dad still has his copy of this edition, and I have no plans on selling it. It’s ironic that it features the only story line relevant to my current career. Hey, maybe there is such a thing as fate over coincidence (as ‘Doctor Who’ does suggest).

A special story for Thunderbirds Two and Four, upon which it is rumoured that the opening rescue of the ‘Thunderbirds’ (2004 film) was based upon. I personally think this was one of the best stories for the pair, and I’m disappointed it never appeared in an episode (as such). There were also rumours that this story was an expansion of the TOS episode ‘Atlantic Inferno’, but those were never confirmed and all suggestions ever made pointed towards it being a completely separate idea. There are interesting similarities in places though, so it’s worth consideration.

An expansion to Thunderbird Two’s ‘disappearance’, after the events of ‘Terror in New York City’, which covered the rumours spiraling during the time Thunderbird Two was out of operation, and some of the missions which were undertaken during said time.

And one of the few Fireflash related stories to feature outside of the TOS TV episodes. It was also one of the comic editions which fans come to know as ‘Thunderbirds meets Doctor Who’. At the time, both shows were scoring some of the highest viewings, and so I suppose these crossover editions only made sense. Many of the early editions featured such crossovers, including 2 other issues which I’ve posted above.

When we actually get to 2065, there’s going to be a bit of confusion over dates - the comics (set still in the futurist time - ever encroaching for us) were released on the corresponding dates, but with the year still set a hundred forward, e.g. 1965 was 2065, but the 13th March was the 13th March.

Right, enough of my geek-worthy knowledge on comics, and back to the episode. I mean, look at Scott’s face. He’s definitely had enough of my comic-based ramblings.

“Begging your forgiveness, Your Mongrel-ship.”

I think the fact that Parker serves Sherbet tea (with one sugar) it’s just classic.

“I believe ‘wild goose chase’ were the words they used.”

“Well, as it happens, Parker loves a good chase. Parker, bring the car around would you? That’s right Sherbet. ‘On the double’.”

“hOn the double, hit his. Taking horders from ha mut, never though hI’d see the day.”

He does it anyway though - dedication right there,

Well now, time to visit the ocean. Did anyone else think the Deep Ocean Surveyor looked a bit... wrong? I had bad feelings about that thing from the start.

“This ship sure is a weird looking thing.”

Yeah, thanks for the back up there Gordon. Should have kept a closer eye on that one, although I do completely understand why they got so distracted and don’t blame them for it.

I love how Scott - Mr in command and always right - turns straight towards the TV-21 as soon as he knows they’re no injuries to worry about and that the DOS is all okay. Wasn’t he the one saying there was a rescue to prioritise only minutes ago?

“Gordon, what about the TV-21? Have they found part of the wreck?”

“Stand by, Scott, I’ll take a closer look. Just gotta’ clear some debris. It’s not just part of the wreck, it’s the whole thing!”

That is actually quite surprising! You know, something surviving like that. Good craftsmanship is all I can say.

https://www.youtube.com/watch?v=UvltZMDOK5g

I can’t describe this scene any better than the scene itself, so I’m just gonna’ leave it there for you to re-watch at your own leisure. The faces are pictures!

“Why’s everyone making such a big deal about a wrecked plane? I don’t even remember it!”

“The TV-21 was Dad’s baby. The first ever super Mach-20 ship. It was the prototype to Thunderbird One. Dad invested everything into, but The Hood sabotaged it in flight. Dad had to abandon the plane somewhere over the Maraina Trench rather than let The Hood get his hands on it. I remember it broke Dad’s heart. I always thought it was smashed and lost in the deep.”

And there we have a link to that Hood-Jeff backstory (which the writer’s then conveniently shoved into a like ten-fifteen second explanation of ‘I am a bad guy because’, but hey, we’re not quite there yet!) that kinda gets forgotten.

“Cor!”

“I believe the word you’re looking for is Bingo. Well done Bertie.”

“Very smart of you to track that signal John.”

“We got lucky.”

You don’t have to be so modest you know John.

“It seems The Hood may be up to his old tricks.”

“I’ve seen engineering like this before. It’s the work of The Mechanic.”

“Oh no! That’s The Mechanic’s ship! Thunderbird Four, get out of there!”

“Too late.”

Yeah... it might have been good to notice that a little bit sooner.

Now, someone has some serious anger issues! I mean, I now he wants them out of the way (and later on that’s he’s being controlled), but that was seriously uncalled for!

“You better come up with something fast. Thunderbird Four’s hull integrity is failing. You’re getting crushed!”

Thanks Virgil, we can see that, unfortunately. This is another of those moments where - even though I know how it ends - I have a little panic.

“Hull integrity at 28%. Gordon what are you doing?”

“The airlock’s jammed. I can’t get the door open.”

“Then make a new door! But do it fast, you don’t have long. Hull at 7%. Gordon, get out now! Thunderbird Four is offline.”

“What happened?”

“Thunderbird Four's been rendered in operative.”

“Gordon!”

“I’m here. I’m okay. But Thunderbird Four’s a little... ur... beat up.”

This is a little like that moment in ‘EOS’, where I think our collective hearts stopped.

I know Gordon left the sub to try and free it, but it was actually a good thing that he did, else he probably would have been crushed, which wouldn't have been good. He was caught a little in the blast anyway, so I’m surprised he was a well-able to continue as he was.

But back to those serious anger issues - The Mechanic, you need to learn that once you have damaged someone’s ship past the piloting level, you don’t need to then snap it in two - that is just downright mean, not to mention unnecessary!

Poor Thunderbird Four. I seriously thought at the time that it wasn’t going to be recoverable. Look at Gordon’s poor little face.

The determination to get the TV-21 back as well was just wonderful.

“Not possible, only Thunderbird Four can survive the pressure. We need to come up with something extraordinary and fast.”

“We can use the TV-21!”

“It’s been sitting on the bottom of the ocean for years. Do you think it will still work?”

“Absolutely. I build things to last.”

“Gordon, we need you to get on board the TV-21.”

“I always wanted to fly Dad’s plane.”

Of course he did.

Now this was a sight to behold. Look at him!

“I can’t believe we used to wear these things.”

This was such a lovely little throw back moment.

“You could try the Jeff Tracy fix. After all, it is Dad’s plane.”

“FAB. This is TV-21. We have lift off.”

And hell did that work!

Rescue count: 35

I mean, let’s just momentarily forget that this part ends with The Mechanic making a grand come back and stealing it.

“To The Mechanic, let me tell you who you’re dealing with. We’re International Rescue; you can’t push us around, you cant tell us what to do, and you absolutely, positively can’t take our stuff!”

“No, let me tell you who you’re dealing with. I’m The Mechanic. I take what I want, from who I want, whenever I want it.”

Yeah... shivers.

Let’s just remember Gordon’s great moment getting to pilot it.

“So tell me, what is it like flying Dad’s plane?”

“It was awesome.”

See, that’s a nicer ending.

#Thunderbirds are go#TAG#Up from the Depths#Part 1#Darkestwolfx#Re-Review Series#Gordon Tracy#John Tracy#Scott Tracy#Virgil Tracy#jeff tracy#alan tracy#tv-21#Grandma Tracy#The Mechanic#deep Ocean Surveyor#IR#International Rescue#Gerry Anderson#Slyvia Anderson#Thunderbird Four

26 notes

·

View notes

Photo

There are drugstore beauty products you use even though they're not as good as your luxury favorite simply because you're trying to stick to a budget… and then there are the ones you use because they're legitimately just as good. Sometimes $15-and-under beauty products beat the odds and just nail the formulations, colors, and packaging as well (if not better) than their pricier counterparts. Over the years, I've come across a handful of these serums, mascaras, and shampoos—drugstore beauty products I continue to use even though I have access to the most luxurious brands in the world. This list is dedicated to those makeup, skincare, and haircare products (some new, some classic) I recommend giving a try. Below, find 15 high-end products I absolutely love, as well as 15 cheaper alternatives I stan just as much. Every time I wash my blonde hair with this (delightfully non-stinky, non-drying) purple shampoo, people ask if I got my hair re-highlighted. As long as this beautifully packaged bottle is on the market, I'll never spend more than $12 on toning shampoo again. I swear by glycolic acid treatments to keep dull skin and breakouts at bay, and this $15 toner proves you don't need to blow your budget to reap the ingredient's benefits. The product smells like subtly like flowers, looks beautiful on my countertop, and leaves my skin consistently radiant (I use it about four times a week after cleansing and before moisturizing). Sold. My nontoxic skincare guru Racheli (also a Who What Wear beauty writer) introduced me to this almost alarmingly affordable all-natural skincare trio, which is basically the perfect serum starter pack: a moisturizing hyaluronic acid serum, a retinol to fight wrinkles and breakouts, and a brightening vitamin C serum. These formulas are fast-absorbing and always leave my skin more radiant. I discovered this blush-highlighter hybrid from '90s throwback brand Hard Candy a few years ago and keep coming back to it. The product is as pigmented as blushes four times the price, and the color gradient of bright coral to glowy pinkish-white leaves a luminous finish on the cheeks that I just can't quit. I've been dealing with the worst dry patches lately, and this new exfoliator from Bliss works shockingly well to clear dead skin and flakiness, leaving only plump, hydrated skin. The product, which has a jelly-like texture, is really gentle, though—no harsh, irritating ingredients. Just skin-loving goodies like fruit enzymes, cellulose, vitamin B5, niacinamide, and sodium hyaluronate (aka hyaluronic acid). This sleeper hit dry shampoo has a super-fine mist that soaks up grease without leaving a thick white residue. I also love that it smells fresh but not too overpowering, so you don't smell super strong all day like other pricier dry shampoos. I exclusively use cream highlighters, and I'm super impressed by these sticks by Burt's Bees (which come in both highlighter and blush form). They have a clear hydrating core in the middle, so they blend beautifully and allow for a natural, lit-from-within glow. Makeup artists and beauty editors were all instantly obsessed when L'Oréal came out with this pretty pink tube of mascara last year. It leaves lashes fluffy and feathery thanks to its fiber wand, which delivers a ton of product to each lash without them looking clumpy. More proof that nontoxic skincare doesn't have to be expensive. I keep this vegan and 99% natural rosewater spray in my travel bag because it's super versatile. I use it to dampen my Beautyblender for makeup, as a micellar water to take off my makeup, and as a refreshing mist throughout the day. I basically only ever want to use liquid eye shadows that don't require brushes to apply, and this unique pick is a favorite, drugstore or not. It's essentially a lipgloss for your eye—apply it alone for a subtle wash of shimmer or on top of another eye shadow to make it glow. It goes on like a liquid but dries down for crease-free long wear. I'm obsessed with the shades, too, especially the luminescent yellow and pink. This is a little pricier for a drugstore buy, but what can I say? It's French. This gentle cleansing lotion is one of my all-time favorite face washes—it leaves my skin clean but also unbelievably soft. Say hello to my holy-grail sunscreen (which, if you've read any of my SPF stories on Who What Wear before, you already know). This Japanese-made product is so thin, sheer, and fast-absorbing it's hard to believe there's any sunscreen in it at all (but trust me, there is!). Every time someone I know goes to Japan, I beg them to stock up. There's simply no sunscreen in the U.S., not even the priciest ones, that I prefer over this. It's simply silly to spend more than $8 on falsies when so many makeup artists and beauty editors agree these are the best. I love the flexible strip and natural fluttery look of these lashes, which are easy to apply, comfortable to wear, and just plain pretty. Expensive eye glosses, face glosses, and lipglosses are super trendy right now, but a $4 tube of Aquaphor will give you the same results. Not only does this stuff work wonders to heal dry lips, but you can also tap it on top of your cheekbones and over your eye shadow for that au courant dewy skin look everybody's loving right now. You'll be hard-pressed to find a more sustainably made, nontoxic body lotion than EO's. It's made with 100% natural plant ingredients and fragrances (and smells incredible, like fresh lavender). It absorbs quicker than most natural lotions and leaves the skin impossibly smooth. Not to mention $15 for 32 ounces? Incredible. Next: I Never Used Eye Cream Until I Discovered This $7 One. Opening Image: Burt's Bees

0 notes

Text

MASS EFFECT ANDROMEDAAAAAAAA

This is gonna be a rambly mess of feelings because I played end game last night and have a lot of thoughts. I’m using a cut but if you’re reading on mobile just scroll really fast past this post.

Okay first of all, I played Sara Shepard, kept the default name (you get to hear it in dialogue!!!!) and default appearance (during the preview I was hesitant to waste even a second of play time on altering my appearance). I romanced Jaal because I really loved his emotional dialogue. I saved the salarian pathfinder instead of the krogan (I thought Drack was gonna kill me). I put colonies on every world, got everything up to 100% viability, and had a planet named after me. I saved Sloane but I couldn’t shoot Reyes in the back.

I got everyone but Peebee loyal because no where on the description box does it tell you how important getting remtech out of the vaults is. By the time I realized I needed it to trigger her mission, I had already cleared the vault and couldn’t go back in. So if you’re reading this and you haven’t cleared all the vaults yet, GET THE REMTECH.

This is going to be so rambly and out of order but I just found the Jaal sex scene on youtube so let’s start with that. I try really hard not to judge other people’s player creations but this one is . . . not great. Please pay no attention to that.

youtube

It’s like they tried to recreate Amy Schumer and could only work with what Bioware gave them. It’s uncanny valley for sure.

I actually really like that the romances are so different??? That it’s not “and here you’ll get a romance scene and of course before endgame you’ll have the sex” and the formula from the first three games. I like that this was just a random date on Aya that ended up being, like, the ultimate romance moment of the game. It’s frickin great.

I’ve since watched the Suvi romance just for some contrast and because she’s the one I’m least likely to want to romance on my own playthrough. Though Ryder has some HILARIOUSLY awkward dialogue (“I like you you’re pretty I like seeing you on the bridge.” Kallo: “kill. me. now.”) that romance doesn’t do nearly as much for me and lacks any semblance of the scorching alien sex scene you get with Jaal. No one takes their clothes off, for starters, and you definitely don’t get boobs and alien oral sex.

So anyway: romance in this game is great. I’m pretty sure I could have romanced Vetra as a lady, because she was responsive and didn’t shut me down, and I really want to try that. Obviously Liam. Cora shot me down, and so did Lexi. Kallo and Drack weren’t even options, though I’d only romance Drack for the novelty of it. Gil’s only an option for dudes.

Okay let’s talk about ENDGAME because I just played it and it’s still fresh in my mind. The endgame of Andromeda is what Mass Effect 3 should have been. YOUR WHOLE SQUAD SHOWS UP. ALL OF THEM ARE THERE IN THE FINAL BATTLE and since you can’t direct anyone it doesn’t matter that you can’t direct them either. As you’re charging through the forest in the Nomad all of the various fleets show up. I literally cried when Sloane showed up to make sure that everyone knew that Kadara had helped.

SPEAKING OF KADARA let’s talk about open world. I’m really grateful that I spent the week before this playing Dragon Age because the maps in Andromeda are basically identical, only space age. It also employed the same method of highlighting loot (only they call it crates). So it’s nice that in the vaults where you need a path, you get the path of previous Mass Effect missions, but you still get open world exploring.

THE VAULT PUZZLES lol so many videos on youtube of people bitterly complaining about the vault puzzles, I thought they were going to be murderously hard. One guy spent literally two hours trying to figure out a puzzle that you couldn’t use the vault key on. I finished it in under two minutes. It’s basically sudoku with shapes instead of numbers and oddly shaped boxes but it’s still sudoku. I got that. I did not have nearly as much luck with knowing which console to interact with at which time, but you know whaaaatever.

BACK TO FEELINGS also I had a lot of siblings feelings about Scott, and a ton of feelings about the fact that I, the sister, saved him, the brother. It was like Jill of the Jungle all over again. I want to play as male Ryder but I also don’t want to lose that feeling ever.

I was playing on easy and the endgame was actually super easy. I mean yeah and architect showed up AND nullifiers AND observers AND whatever the ones that make other ones are called, but honestly with your whole squad there it barely mattered? By the time I figured out what Scott was doing and actually paid attention to the architect they’d already mostly taken it down themselves.

It was just nice to feel like all of the work I’d put into the galaxy paid off. That all the other pathfinders showed up and had all their moments. That you fought beside salarians and turians and also the angara.

WHICH ALSO OKAY so when you get to choose a representative to the Nexus you can choose the Moshae??? Love that that’s an option.

AND back to combat I really miss the power wheel, even though this made combat go a lot faster. I didn’t like that I couldn’t direct my squad powers, so combos largely happened by accident, or I made my own with my powers. I never could figure out the mechanics of the favorite profiles, let alone how to switch on the fly like they showed in the combat video. Nor could I find any guide online. 60 hours of game play and I couldn’t figure it out. So much for that being intuitive, Bioware. BUT, I like that there’s finally a reason that Shepard I mean Ryder has so many extra powers and abilities, and Sara teaching Sam how to be a real boy was really cute. ALSO CUTE: THE SPACE HAMSTER.

And idk I just started thinking about the throwbacks to ME3, the fact that you meet ex-Cerberus scientists in the wilds of Kadara and Conrad Verner’s sister in the port. That Zaeed Massani’s son is in the desert of Eos. That fallout from the Overlord Project follows you to Andromeda. There are so many interesting easter eggs for those who played the original trilogy but this also was really accessible for anyone who’s never played the originals.

Not related: I had some HILARIOUS bugs in later stages. My ship wouldn’t load sometimes and I found this out because I went up the stairs to the conference center and literally fell out of the spaceship into space because the floor hadn’t loaded. Related: I like that falling off shit doesn’t get you the dreaded death music, that you just pop back up right next to whatever you fell off.

I like some of the social issues it touched on. The trans woman you meet in the colony on Eos who came to Andromeda to start her new life as a woman. Gil deciding to have a baby with his friend Jill.

COLONIZATION BABIES. Y’all I want to read (or write) the fic where plural marriages are a thing, and Sara proposes to everyone (including Drack) on the Tempest to make sure they always get to stay together and also because they’re all pretty conveniently in love with each other in various ways because what they really love and want to keep doing is exploring and pathfinding. I want one of them thinking maybe I want to colonize and farming for a bit and being okay at it but ultimately finding it boring as shit so they come back and they’re given a bit of shit for it but it’s okay. I want Sara having Liam’s baby but sleeping in Jaal’s bed most nights while Liam hangs out in Peebee’s escape pod. I want Cora having Gil’s second baby and letting him name it whatever he wants, which is how she ends up with a child named after a drive coil. I want them having petty fights about who left crumbs on the counter in the galley that Lexi tries to mediate. I want them to go to port thinking they want nothing more than to not see each other for a few days and then to end up back in each others presence in an hour because they had a thought they couldn’t wait to share. This may or may not have been influenced by the latest book in the Expansion series, but that’s a different post.

Because, finally, I LOVE THIS CREW. I started this game off just so unsure of Cora and her talking about what a poooowerful biotic she is and how she scared everyone in the Milky Way and blah blah blah but by the time I finished her loyalty mission I was literally crying about how much I loved her. Last night after endgame I finally finished all of the piddly requests and requirements to make movie night happen and it honestly was the best fucking thing to end a game on. Next play through I’m waiting to do that the very last thing, because it felt like the end of the party at the Citadel DLC, everyone sitting around on a couch and laughing and just being their perfect selves.

In conclusion:

Detractors: no power wheel, no squad powers, actually wonky facial animation, some game glitches (I could never complete a mission on the Nexus because I’d already scanned a thing and it kept telling me I hadn’t.) (previously mentioned falling through the floor of my ship)

Positive: heavy on feelings, so many feelings, all of the feelings, my crew, INTERESTING AS FUCK stories, choices that matter, endgame appearances by everyone, twin feelings, open world exploring

EDITED TO ADD: OMFG THE QUARIANS. WE GONNA GET QUARIANS IN ANDROMEDA 2.

4 notes

·

View notes

Text

Bitcoin, Ripple, Ethereum, EOS, Bitcoin Cash, Litecoin, Tron, Stellar, Bitcoin SV, Cardano: Price Analysis, Jan. 30

Bitcoin, Ripple, Ethereum, EOS, Bitcoin Cash, Litecoin, Tron, Stellar, Bitcoin SV, Cardano: Price Analysis, Jan. 30

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The market data is provided by the HitBTC exchange.

Crypto investors lost about $1.7 billion worth of cryptocurrencies to hackers in 2018. Though prices are down, it has not deterred the criminals. The volume of stolen coins in 2018 was 3.6 times larger than in 2017, according to the report from research company CipherTrace.

Hacks are a major problem in crypto that needs to be solved before the asset class can be seen positively by the regulators and adopted by the mainstream economy.

However, the entry of investment firm Fidelity into the cryptocurrency custody space instills confidence. According to sources cited by Bloomberg, its custody services are likely to be offered starting in March. Initially, the services will be open only to select institutional clients, but the firm plans to expand operations to a larger audience in the future.

The Middle East seems to be warming up to cryptocurrencies. Saudi Arabia and the United Arab Emirates have officially announced the joint development of an interbank digital currency called “Aber.” At first, it will be used only by a limited number of banks.

While the fundamental factors continue to improve, the crypto prices are not showing any signs of a recovery. Let’s look at the critical levels to watch out for.

BTC/USD

Bitcoin (BTC) is trying to turn around from $3,355. The bulls are attempting to defend the support at $3,236.09. They will encounter resistance at the 20-day EMA and above that at the 50-day SMA. Upon crossing the moving averages, the next resistance will be at the downtrend line, and above it at $4,255.

Conversely, if the price turns down from either one of the overhead resistances, the BTC/USD pair will again drop to the support at $3,236.09. A break of this level will resume the downtrend and trigger a number of stop losses on the long positions that can result in a quick drop to $3,000, and below that to $2,600.

At present, both moving averages are sloping down, and the RSI is in the negative zone. This suggests that the bears have the upper hand. Therefore, we shall wait for the price to sustain above the downtrend line before turning positive.

XRP/USD

Ripple (XRP) has bounced sharply from the critical support of $0.27795, which shows buying at lower levels. It has broken out of the downtrend line and is currently at the 20-day EMA.

If the bulls push the price above the 20-day EMA, the XRP/USD pair can rally to the 50-day SMA. The zone between the 20-day EMA and the 50-day SMA might act as a stiff resistance. A breakout above this resistance zone will be a positive sign.

Therefore, we suggest long positions on a close (UTC time frame) above the 50-day SMA with the stop below $0.275. The first target objective is $0.38239, above which the upward move can stretch to $0.4.

Our bullish view will be negated if the price turns down from the 20-day EMA and plunges below $0.27795.

ETH/USD

Ethereum (ETH) bounced back from $103, close to its first support at $100. It will now pull back to $116.3, where it might face resistance.

If the ETH/USD pair turns down from $116.3, it can again fall to $100, and below that to $83. The 20-day EMA is trending down and the RSI in the negative territory which suggests that supply exceeds demand.

If the bulls scale above $116.3, the digital currency will again face selling close to the moving averages. It will turn positive if the price rises above $134.5. We might suggest long positions if the price sustains above the moving averages.

EOS/USD

EOS has held the support at $2.1733 for the past two days. The bulls are currently attempting to push the price back into the overhead range.

If they succeed, the EOS/USD pair will move up to $2.5, where it might face resistance from the moving averages. A break out of $2.6 will increase the chances of a rally to $3.05 and above that to $3.2081.

Conversely, if the price reverses direction from the current level and plummets below $2.1733, it can correct to $1.7746, and below that to $1.55. We shall wait for the digital currency to scale above the moving averages before suggesting a trade.

BCH/USD

Bitcoin Cash (BCH) is finding some buying close to $105. It can now move up to $121.3, which will act as a roadblock.

The downsloping 20-day EMA will also attract sellers. If the bulls scale above this resistance, the BCH/USD pair can move up to $141.

But if the price turns down from $121, a drop to $100, and below that to $73.5 will be possible. We shall turn positive if we see evidence of strong buying.

LTC/USD

Litecoin (LTC) continues to trade in the tight range of $29.349–$33. The bulls have defended the support of the range for the past two days.

We now expect the bulls to push the price to the top of the range at $33. A break out of this resistance will be a positive move that can carry the LTC/USD pair to $36.428, and above it to $40.784.

On the other hand, if the bulls fail to break out of the overhead resistance at $33, the virtual currency will extend its stay in the range. The trend will turn negative on a breakdown of the support zone at $29.349 and $27.701. Therefore, we suggest the traders hold their long positions with the stop loss at $27.5.

TRX/USD

While other major cryptocurrencies are struggling to hold up, Tron (TRX) is showing strength. It held the support at the 20-day EMA for the past two days and is now attempting to break out of the overhead resistance at $0.02815521 once again.

If the bulls sustain above $0.02815521, the TRX/USD pair will move up to $0.03128011, and above that to $0.03575668. Above this level, the cryptocurrency will attempt to hit its pattern target of $0.038.

Our bullish view will be invalidated if the price fails to sustain above $0.02815521. A break below the 20-day EMA can plunge the digital currency to $0.02306493, below which a slide to $0.02113440 will be probable. We suggest traders continue to hold their long positions with the stops at $0.023.

XLM/USD

Stellar (XLM) has continued to make new yearly lows. Usually, after a breakdown from a critical level, a throwback rally to retest the level is likely to follow. Hence, a move to $0.09285498 cannot be ruled out.

If the XLM/USD pair breaks out and sustains above $0.09285498, the bulls will attempt to scale above the downtrend line, which can result in a trend change.

However, if the price turns down from the breakdown level of $0.09285498, the cryptocurrency can slump to $0.07864971, and further to $0.05795397. We shall watch for a trend reversal before turning positive on the pair.

BSV/USD

The bulls have been trying to hold the support at $65.031 for the past two days. If successful, Bitcoin SV (BSV) will attempt to rally to $80.352.

However, with both moving averages sloping down and the RSI in the negative territory, the path of least resistance is to the downside.

The BSV/USD pair can sink to $57, and below that to $38.528 if the price closes (UTC time frame) below $62. We shall wait for the trend to change from down to up before proposing any trades.

ADA/USD

Although Cardano (ADA) broke below the support line of the ascending channel on Jan. 29, the bulls are trying to defend the next support at $0.036815.

If the price bounces from the current level, it can move up to the 20-day EMA, which will act as a resistance. The ADA/USD pair will show strength if it sustains above the uptrend line, which will now act as a hurdle.

However, if the price drops below $0.036815, a fall to the yearly low of $0.027237 is probable. The bearish crossover of the moving averages and the RSI in the negative zone indicate that the sellers have the upper hand. We couldn’t find any buy setups at the current levels, so we are not suggesting any long positions yet.

The market data is provided by the HitBTC exchange. The charts for the analysis are provided by TradingView.

Original Source http://bit.ly/2WwSW08

0 notes

Text

Bitcoin, Ripple, Ethereum, EOS, Bitcoin Cash, Litecoin, Tron, Stellar, Bitcoin SV, Cardano: Price Analysis, Jan. 30

Bitcoin, Ripple, Ethereum, EOS, Bitcoin Cash, Litecoin, Tron, Stellar, Bitcoin SV, Cardano: Price Analysis, Jan. 30

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The market data is provided by the HitBTC exchange.

Crypto investors lost about $1.7 billion worth of cryptocurrencies to hackers in 2018. Though prices are down, it has not deterred the criminals. The volume of stolen coins in 2018 was 3.6 times larger than in 2017, according to the report from research company CipherTrace.

Hacks are a major problem in crypto that needs to be solved before the asset class can be seen positively by the regulators and adopted by the mainstream economy.

However, the entry of investment firm Fidelity into the cryptocurrency custody space instills confidence. According to sources cited by Bloomberg, its custody services are likely to be offered starting in March. Initially, the services will be open only to select institutional clients, but the firm plans to expand operations to a larger audience in the future.

The Middle East seems to be warming up to cryptocurrencies. Saudi Arabia and the United Arab Emirates have officially announced the joint development of an interbank digital currency called “Aber.” At first, it will be used only by a limited number of banks.

While the fundamental factors continue to improve, the crypto prices are not showing any signs of a recovery. Let’s look at the critical levels to watch out for.

BTC/USD

Bitcoin (BTC) is trying to turn around from $3,355. The bulls are attempting to defend the support at $3,236.09. They will encounter resistance at the 20-day EMA and above that at the 50-day SMA. Upon crossing the moving averages, the next resistance will be at the downtrend line, and above it at $4,255.

Conversely, if the price turns down from either one of the overhead resistances, the BTC/USD pair will again drop to the support at $3,236.09. A break of this level will resume the downtrend and trigger a number of stop losses on the long positions that can result in a quick drop to $3,000, and below that to $2,600.

At present, both moving averages are sloping down, and the RSI is in the negative zone. This suggests that the bears have the upper hand. Therefore, we shall wait for the price to sustain above the downtrend line before turning positive.

XRP/USD

Ripple (XRP) has bounced sharply from the critical support of $0.27795, which shows buying at lower levels. It has broken out of the downtrend line and is currently at the 20-day EMA.

If the bulls push the price above the 20-day EMA, the XRP/USD pair can rally to the 50-day SMA. The zone between the 20-day EMA and the 50-day SMA might act as a stiff resistance. A breakout above this resistance zone will be a positive sign.

Therefore, we suggest long positions on a close (UTC time frame) above the 50-day SMA with the stop below $0.275. The first target objective is $0.38239, above which the upward move can stretch to $0.4.

Our bullish view will be negated if the price turns down from the 20-day EMA and plunges below $0.27795.

ETH/USD

Ethereum (ETH) bounced back from $103, close to its first support at $100. It will now pull back to $116.3, where it might face resistance.

If the ETH/USD pair turns down from $116.3, it can again fall to $100, and below that to $83. The 20-day EMA is trending down and the RSI in the negative territory which suggests that supply exceeds demand.

If the bulls scale above $116.3, the digital currency will again face selling close to the moving averages. It will turn positive if the price rises above $134.5. We might suggest long positions if the price sustains above the moving averages.

EOS/USD

EOS has held the support at $2.1733 for the past two days. The bulls are currently attempting to push the price back into the overhead range.

If they succeed, the EOS/USD pair will move up to $2.5, where it might face resistance from the moving averages. A break out of $2.6 will increase the chances of a rally to $3.05 and above that to $3.2081.

Conversely, if the price reverses direction from the current level and plummets below $2.1733, it can correct to $1.7746, and below that to $1.55. We shall wait for the digital currency to scale above the moving averages before suggesting a trade.

BCH/USD

Bitcoin Cash (BCH) is finding some buying close to $105. It can now move up to $121.3, which will act as a roadblock.

The downsloping 20-day EMA will also attract sellers. If the bulls scale above this resistance, the BCH/USD pair can move up to $141.

But if the price turns down from $121, a drop to $100, and below that to $73.5 will be possible. We shall turn positive if we see evidence of strong buying.

LTC/USD

Litecoin (LTC) continues to trade in the tight range of $29.349–$33. The bulls have defended the support of the range for the past two days.

We now expect the bulls to push the price to the top of the range at $33. A break out of this resistance will be a positive move that can carry the LTC/USD pair to $36.428, and above it to $40.784.

On the other hand, if the bulls fail to break out of the overhead resistance at $33, the virtual currency will extend its stay in the range. The trend will turn negative on a breakdown of the support zone at $29.349 and $27.701. Therefore, we suggest the traders hold their long positions with the stop loss at $27.5.

TRX/USD

While other major cryptocurrencies are struggling to hold up, Tron (TRX) is showing strength. It held the support at the 20-day EMA for the past two days and is now attempting to break out of the overhead resistance at $0.02815521 once again.

If the bulls sustain above $0.02815521, the TRX/USD pair will move up to $0.03128011, and above that to $0.03575668. Above this level, the cryptocurrency will attempt to hit its pattern target of $0.038.

Our bullish view will be invalidated if the price fails to sustain above $0.02815521. A break below the 20-day EMA can plunge the digital currency to $0.02306493, below which a slide to $0.02113440 will be probable. We suggest traders continue to hold their long positions with the stops at $0.023.

XLM/USD

Stellar (XLM) has continued to make new yearly lows. Usually, after a breakdown from a critical level, a throwback rally to retest the level is likely to follow. Hence, a move to $0.09285498 cannot be ruled out.

If the XLM/USD pair breaks out and sustains above $0.09285498, the bulls will attempt to scale above the downtrend line, which can result in a trend change.

However, if the price turns down from the breakdown level of $0.09285498, the cryptocurrency can slump to $0.07864971, and further to $0.05795397. We shall watch for a trend reversal before turning positive on the pair.

BSV/USD

The bulls have been trying to hold the support at $65.031 for the past two days. If successful, Bitcoin SV (BSV) will attempt to rally to $80.352.

However, with both moving averages sloping down and the RSI in the negative territory, the path of least resistance is to the downside.

The BSV/USD pair can sink to $57, and below that to $38.528 if the price closes (UTC time frame) below $62. We shall wait for the trend to change from down to up before proposing any trades.

ADA/USD

Although Cardano (ADA) broke below the support line of the ascending channel on Jan. 29, the bulls are trying to defend the next support at $0.036815.

If the price bounces from the current level, it can move up to the 20-day EMA, which will act as a resistance. The ADA/USD pair will show strength if it sustains above the uptrend line, which will now act as a hurdle.

However, if the price drops below $0.036815, a fall to the yearly low of $0.027237 is probable. The bearish crossover of the moving averages and the RSI in the negative zone indicate that the sellers have the upper hand. We couldn’t find any buy setups at the current levels, so we are not suggesting any long positions yet.

The market data is provided by the HitBTC exchange. The charts for the analysis are provided by TradingView.

Original Source http://bit.ly/2WwSW08

0 notes

Text

Bitcoin, Ripple, Ethereum, EOS, Bitcoin Cash, Litecoin, Tron, Stellar, Bitcoin SV, Cardano: Price Analysis, Jan. 30

Bitcoin, Ripple, Ethereum, EOS, Bitcoin Cash, Litecoin, Tron, Stellar, Bitcoin SV, Cardano: Price Analysis, Jan. 30

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The market data is provided by the HitBTC exchange.

Crypto investors lost about $1.7 billion worth of cryptocurrencies to hackers in 2018. Though prices are down, it has not deterred the criminals. The volume of stolen coins in 2018 was 3.6 times larger than in 2017, according to the report from research company CipherTrace.

Hacks are a major problem in crypto that needs to be solved before the asset class can be seen positively by the regulators and adopted by the mainstream economy.

However, the entry of investment firm Fidelity into the cryptocurrency custody space instills confidence. According to sources cited by Bloomberg, its custody services are likely to be offered starting in March. Initially, the services will be open only to select institutional clients, but the firm plans to expand operations to a larger audience in the future.

The Middle East seems to be warming up to cryptocurrencies. Saudi Arabia and the United Arab Emirates have officially announced the joint development of an interbank digital currency called “Aber.” At first, it will be used only by a limited number of banks.

While the fundamental factors continue to improve, the crypto prices are not showing any signs of a recovery. Let’s look at the critical levels to watch out for.

BTC/USD

Bitcoin (BTC) is trying to turn around from $3,355. The bulls are attempting to defend the support at $3,236.09. They will encounter resistance at the 20-day EMA and above that at the 50-day SMA. Upon crossing the moving averages, the next resistance will be at the downtrend line, and above it at $4,255.

Conversely, if the price turns down from either one of the overhead resistances, the BTC/USD pair will again drop to the support at $3,236.09. A break of this level will resume the downtrend and trigger a number of stop losses on the long positions that can result in a quick drop to $3,000, and below that to $2,600.

At present, both moving averages are sloping down, and the RSI is in the negative zone. This suggests that the bears have the upper hand. Therefore, we shall wait for the price to sustain above the downtrend line before turning positive.

XRP/USD

Ripple (XRP) has bounced sharply from the critical support of $0.27795, which shows buying at lower levels. It has broken out of the downtrend line and is currently at the 20-day EMA.

If the bulls push the price above the 20-day EMA, the XRP/USD pair can rally to the 50-day SMA. The zone between the 20-day EMA and the 50-day SMA might act as a stiff resistance. A breakout above this resistance zone will be a positive sign.

Therefore, we suggest long positions on a close (UTC time frame) above the 50-day SMA with the stop below $0.275. The first target objective is $0.38239, above which the upward move can stretch to $0.4.

Our bullish view will be negated if the price turns down from the 20-day EMA and plunges below $0.27795.

ETH/USD

Ethereum (ETH) bounced back from $103, close to its first support at $100. It will now pull back to $116.3, where it might face resistance.

If the ETH/USD pair turns down from $116.3, it can again fall to $100, and below that to $83. The 20-day EMA is trending down and the RSI in the negative territory which suggests that supply exceeds demand.

If the bulls scale above $116.3, the digital currency will again face selling close to the moving averages. It will turn positive if the price rises above $134.5. We might suggest long positions if the price sustains above the moving averages.

EOS/USD

EOS has held the support at $2.1733 for the past two days. The bulls are currently attempting to push the price back into the overhead range.

If they succeed, the EOS/USD pair will move up to $2.5, where it might face resistance from the moving averages. A break out of $2.6 will increase the chances of a rally to $3.05 and above that to $3.2081.

Conversely, if the price reverses direction from the current level and plummets below $2.1733, it can correct to $1.7746, and below that to $1.55. We shall wait for the digital currency to scale above the moving averages before suggesting a trade.

BCH/USD

Bitcoin Cash (BCH) is finding some buying close to $105. It can now move up to $121.3, which will act as a roadblock.

The downsloping 20-day EMA will also attract sellers. If the bulls scale above this resistance, the BCH/USD pair can move up to $141.

But if the price turns down from $121, a drop to $100, and below that to $73.5 will be possible. We shall turn positive if we see evidence of strong buying.

LTC/USD

Litecoin (LTC) continues to trade in the tight range of $29.349–$33. The bulls have defended the support of the range for the past two days.

We now expect the bulls to push the price to the top of the range at $33. A break out of this resistance will be a positive move that can carry the LTC/USD pair to $36.428, and above it to $40.784.

On the other hand, if the bulls fail to break out of the overhead resistance at $33, the virtual currency will extend its stay in the range. The trend will turn negative on a breakdown of the support zone at $29.349 and $27.701. Therefore, we suggest the traders hold their long positions with the stop loss at $27.5.

TRX/USD

While other major cryptocurrencies are struggling to hold up, Tron (TRX) is showing strength. It held the support at the 20-day EMA for the past two days and is now attempting to break out of the overhead resistance at $0.02815521 once again.

If the bulls sustain above $0.02815521, the TRX/USD pair will move up to $0.03128011, and above that to $0.03575668. Above this level, the cryptocurrency will attempt to hit its pattern target of $0.038.

Our bullish view will be invalidated if the price fails to sustain above $0.02815521. A break below the 20-day EMA can plunge the digital currency to $0.02306493, below which a slide to $0.02113440 will be probable. We suggest traders continue to hold their long positions with the stops at $0.023.

XLM/USD

Stellar (XLM) has continued to make new yearly lows. Usually, after a breakdown from a critical level, a throwback rally to retest the level is likely to follow. Hence, a move to $0.09285498 cannot be ruled out.

If the XLM/USD pair breaks out and sustains above $0.09285498, the bulls will attempt to scale above the downtrend line, which can result in a trend change.

However, if the price turns down from the breakdown level of $0.09285498, the cryptocurrency can slump to $0.07864971, and further to $0.05795397. We shall watch for a trend reversal before turning positive on the pair.

BSV/USD

The bulls have been trying to hold the support at $65.031 for the past two days. If successful, Bitcoin SV (BSV) will attempt to rally to $80.352.

However, with both moving averages sloping down and the RSI in the negative territory, the path of least resistance is to the downside.

The BSV/USD pair can sink to $57, and below that to $38.528 if the price closes (UTC time frame) below $62. We shall wait for the trend to change from down to up before proposing any trades.

ADA/USD

Although Cardano (ADA) broke below the support line of the ascending channel on Jan. 29, the bulls are trying to defend the next support at $0.036815.

If the price bounces from the current level, it can move up to the 20-day EMA, which will act as a resistance. The ADA/USD pair will show strength if it sustains above the uptrend line, which will now act as a hurdle.

However, if the price drops below $0.036815, a fall to the yearly low of $0.027237 is probable. The bearish crossover of the moving averages and the RSI in the negative zone indicate that the sellers have the upper hand. We couldn’t find any buy setups at the current levels, so we are not suggesting any long positions yet.

The market data is provided by the HitBTC exchange. The charts for the analysis are provided by TradingView.

Original Source http://bit.ly/2WwSW08

0 notes

Text

Bitcoin, Ripple, Ethereum, EOS, Bitcoin Cash, Litecoin, Tron, Stellar, Bitcoin SV, Cardano: Price Analysis, Jan. 30

Bitcoin, Ripple, Ethereum, EOS, Bitcoin Cash, Litecoin, Tron, Stellar, Bitcoin SV, Cardano: Price Analysis, Jan. 30

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The market data is provided by the HitBTC exchange.

Crypto investors lost about $1.7 billion worth of cryptocurrencies to hackers in 2018. Though prices are down, it has not deterred the criminals. The volume of stolen coins in 2018 was 3.6 times larger than in 2017, according to the report from research company CipherTrace.

Hacks are a major problem in crypto that needs to be solved before the asset class can be seen positively by the regulators and adopted by the mainstream economy.

However, the entry of investment firm Fidelity into the cryptocurrency custody space instills confidence. According to sources cited by Bloomberg, its custody services are likely to be offered starting in March. Initially, the services will be open only to select institutional clients, but the firm plans to expand operations to a larger audience in the future.

The Middle East seems to be warming up to cryptocurrencies. Saudi Arabia and the United Arab Emirates have officially announced the joint development of an interbank digital currency called “Aber.” At first, it will be used only by a limited number of banks.

While the fundamental factors continue to improve, the crypto prices are not showing any signs of a recovery. Let’s look at the critical levels to watch out for.

BTC/USD

Bitcoin (BTC) is trying to turn around from $3,355. The bulls are attempting to defend the support at $3,236.09. They will encounter resistance at the 20-day EMA and above that at the 50-day SMA. Upon crossing the moving averages, the next resistance will be at the downtrend line, and above it at $4,255.

Conversely, if the price turns down from either one of the overhead resistances, the BTC/USD pair will again drop to the support at $3,236.09. A break of this level will resume the downtrend and trigger a number of stop losses on the long positions that can result in a quick drop to $3,000, and below that to $2,600.

At present, both moving averages are sloping down, and the RSI is in the negative zone. This suggests that the bears have the upper hand. Therefore, we shall wait for the price to sustain above the downtrend line before turning positive.

XRP/USD

Ripple (XRP) has bounced sharply from the critical support of $0.27795, which shows buying at lower levels. It has broken out of the downtrend line and is currently at the 20-day EMA.

If the bulls push the price above the 20-day EMA, the XRP/USD pair can rally to the 50-day SMA. The zone between the 20-day EMA and the 50-day SMA might act as a stiff resistance. A breakout above this resistance zone will be a positive sign.

Therefore, we suggest long positions on a close (UTC time frame) above the 50-day SMA with the stop below $0.275. The first target objective is $0.38239, above which the upward move can stretch to $0.4.

Our bullish view will be negated if the price turns down from the 20-day EMA and plunges below $0.27795.

ETH/USD

Ethereum (ETH) bounced back from $103, close to its first support at $100. It will now pull back to $116.3, where it might face resistance.

If the ETH/USD pair turns down from $116.3, it can again fall to $100, and below that to $83. The 20-day EMA is trending down and the RSI in the negative territory which suggests that supply exceeds demand.

If the bulls scale above $116.3, the digital currency will again face selling close to the moving averages. It will turn positive if the price rises above $134.5. We might suggest long positions if the price sustains above the moving averages.

EOS/USD

EOS has held the support at $2.1733 for the past two days. The bulls are currently attempting to push the price back into the overhead range.

If they succeed, the EOS/USD pair will move up to $2.5, where it might face resistance from the moving averages. A break out of $2.6 will increase the chances of a rally to $3.05 and above that to $3.2081.

Conversely, if the price reverses direction from the current level and plummets below $2.1733, it can correct to $1.7746, and below that to $1.55. We shall wait for the digital currency to scale above the moving averages before suggesting a trade.

BCH/USD

Bitcoin Cash (BCH) is finding some buying close to $105. It can now move up to $121.3, which will act as a roadblock.

The downsloping 20-day EMA will also attract sellers. If the bulls scale above this resistance, the BCH/USD pair can move up to $141.

But if the price turns down from $121, a drop to $100, and below that to $73.5 will be possible. We shall turn positive if we see evidence of strong buying.

LTC/USD

Litecoin (LTC) continues to trade in the tight range of $29.349–$33. The bulls have defended the support of the range for the past two days.

We now expect the bulls to push the price to the top of the range at $33. A break out of this resistance will be a positive move that can carry the LTC/USD pair to $36.428, and above it to $40.784.

On the other hand, if the bulls fail to break out of the overhead resistance at $33, the virtual currency will extend its stay in the range. The trend will turn negative on a breakdown of the support zone at $29.349 and $27.701. Therefore, we suggest the traders hold their long positions with the stop loss at $27.5.

TRX/USD

While other major cryptocurrencies are struggling to hold up, Tron (TRX) is showing strength. It held the support at the 20-day EMA for the past two days and is now attempting to break out of the overhead resistance at $0.02815521 once again.

If the bulls sustain above $0.02815521, the TRX/USD pair will move up to $0.03128011, and above that to $0.03575668. Above this level, the cryptocurrency will attempt to hit its pattern target of $0.038.

Our bullish view will be invalidated if the price fails to sustain above $0.02815521. A break below the 20-day EMA can plunge the digital currency to $0.02306493, below which a slide to $0.02113440 will be probable. We suggest traders continue to hold their long positions with the stops at $0.023.

XLM/USD

Stellar (XLM) has continued to make new yearly lows. Usually, after a breakdown from a critical level, a throwback rally to retest the level is likely to follow. Hence, a move to $0.09285498 cannot be ruled out.

If the XLM/USD pair breaks out and sustains above $0.09285498, the bulls will attempt to scale above the downtrend line, which can result in a trend change.

However, if the price turns down from the breakdown level of $0.09285498, the cryptocurrency can slump to $0.07864971, and further to $0.05795397. We shall watch for a trend reversal before turning positive on the pair.

BSV/USD

The bulls have been trying to hold the support at $65.031 for the past two days. If successful, Bitcoin SV (BSV) will attempt to rally to $80.352.

However, with both moving averages sloping down and the RSI in the negative territory, the path of least resistance is to the downside.

The BSV/USD pair can sink to $57, and below that to $38.528 if the price closes (UTC time frame) below $62. We shall wait for the trend to change from down to up before proposing any trades.

ADA/USD

Although Cardano (ADA) broke below the support line of the ascending channel on Jan. 29, the bulls are trying to defend the next support at $0.036815.

If the price bounces from the current level, it can move up to the 20-day EMA, which will act as a resistance. The ADA/USD pair will show strength if it sustains above the uptrend line, which will now act as a hurdle.

However, if the price drops below $0.036815, a fall to the yearly low of $0.027237 is probable. The bearish crossover of the moving averages and the RSI in the negative zone indicate that the sellers have the upper hand. We couldn’t find any buy setups at the current levels, so we are not suggesting any long positions yet.

The market data is provided by the HitBTC exchange. The charts for the analysis are provided by TradingView.

Original Source http://bit.ly/2WwSW08

0 notes

Text

Bitcoin, Ripple, Ethereum, EOS, Bitcoin Cash, Litecoin, Tron, Stellar, Bitcoin SV, Cardano: Price Analysis, Jan. 30

Bitcoin, Ripple, Ethereum, EOS, Bitcoin Cash, Litecoin, Tron, Stellar, Bitcoin SV, Cardano: Price Analysis, Jan. 30

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The market data is provided by the HitBTC exchange.

Crypto investors lost about $1.7 billion worth of cryptocurrencies to hackers in 2018. Though prices are down, it has not deterred the criminals. The volume of stolen coins in 2018 was 3.6 times larger than in 2017, according to the report from research company CipherTrace.

Hacks are a major problem in crypto that needs to be solved before the asset class can be seen positively by the regulators and adopted by the mainstream economy.

However, the entry of investment firm Fidelity into the cryptocurrency custody space instills confidence. According to sources cited by Bloomberg, its custody services are likely to be offered starting in March. Initially, the services will be open only to select institutional clients, but the firm plans to expand operations to a larger audience in the future.

The Middle East seems to be warming up to cryptocurrencies. Saudi Arabia and the United Arab Emirates have officially announced the joint development of an interbank digital currency called “Aber.” At first, it will be used only by a limited number of banks.

While the fundamental factors continue to improve, the crypto prices are not showing any signs of a recovery. Let’s look at the critical levels to watch out for.

BTC/USD

Bitcoin (BTC) is trying to turn around from $3,355. The bulls are attempting to defend the support at $3,236.09. They will encounter resistance at the 20-day EMA and above that at the 50-day SMA. Upon crossing the moving averages, the next resistance will be at the downtrend line, and above it at $4,255.

Conversely, if the price turns down from either one of the overhead resistances, the BTC/USD pair will again drop to the support at $3,236.09. A break of this level will resume the downtrend and trigger a number of stop losses on the long positions that can result in a quick drop to $3,000, and below that to $2,600.

At present, both moving averages are sloping down, and the RSI is in the negative zone. This suggests that the bears have the upper hand. Therefore, we shall wait for the price to sustain above the downtrend line before turning positive.

XRP/USD

Ripple (XRP) has bounced sharply from the critical support of $0.27795, which shows buying at lower levels. It has broken out of the downtrend line and is currently at the 20-day EMA.

If the bulls push the price above the 20-day EMA, the XRP/USD pair can rally to the 50-day SMA. The zone between the 20-day EMA and the 50-day SMA might act as a stiff resistance. A breakout above this resistance zone will be a positive sign.

Therefore, we suggest long positions on a close (UTC time frame) above the 50-day SMA with the stop below $0.275. The first target objective is $0.38239, above which the upward move can stretch to $0.4.

Our bullish view will be negated if the price turns down from the 20-day EMA and plunges below $0.27795.

ETH/USD

Ethereum (ETH) bounced back from $103, close to its first support at $100. It will now pull back to $116.3, where it might face resistance.

If the ETH/USD pair turns down from $116.3, it can again fall to $100, and below that to $83. The 20-day EMA is trending down and the RSI in the negative territory which suggests that supply exceeds demand.

If the bulls scale above $116.3, the digital currency will again face selling close to the moving averages. It will turn positive if the price rises above $134.5. We might suggest long positions if the price sustains above the moving averages.

EOS/USD

EOS has held the support at $2.1733 for the past two days. The bulls are currently attempting to push the price back into the overhead range.

If they succeed, the EOS/USD pair will move up to $2.5, where it might face resistance from the moving averages. A break out of $2.6 will increase the chances of a rally to $3.05 and above that to $3.2081.

Conversely, if the price reverses direction from the current level and plummets below $2.1733, it can correct to $1.7746, and below that to $1.55. We shall wait for the digital currency to scale above the moving averages before suggesting a trade.

BCH/USD