#there are some options of private health insurance but you pay for the national healthcare fund from your paycheck anyway

Explore tagged Tumblr posts

Text

Some people: Oooh, you have public healthcare! It's great!

The national healthcare fund in Poland (NFZ): *cuts the already very low budget for dentistry, and makes it so dental surgeries and clinics will be paid mostly for check-ups and teeth extractions, actual restorative treatment - dangerously underfunded - be damned*

#public healthcare in Poland#I wonder when my boss will say 'fuck it we're going full private'#he had to a few years back and it wasn't great - or so I've heard#NFZ is trying very hard to force him to do it#along with the rest of dentistry that still works with NFZ for some reason#public healthcare funding in Poland absolutely sucks#I pay 9% tax for healthcare and I'm just waiting for it all to crash and burn#public healthcare in this country is good if you have an accident or sth - and are insured!#you don't have to worry about the hospital bill#and maybe if you have cancer but it's not that great either#surgery and chemo will be paid for#but you pay for most tests and specialist visits out of your pocket#because the queue for tests and specialist appointments is often months if not years long#if you can wait - then sure#if it's urgent - you pay on your own#there are some options of private health insurance but you pay for the national healthcare fund from your paycheck anyway#and can't opt out of it#sorry for the tag rant

1 note

·

View note

Photo

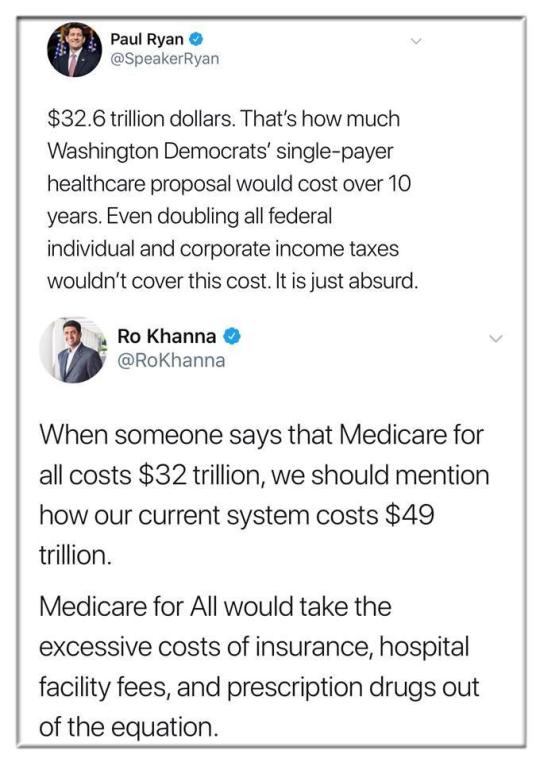

Every problem they promised nationalized health would cause is now happening under for-profit plans. I wait forever for appointments. "Death panels"decide which care is "too expensive" (unprofitable). I can't choose ANY doctor, only those in my HMO or PPO.

But I can lose my house, even if I HAVE insurance because I got cancer and drug companies know you'll pay ANYTHING to stay alive...20% of $30,000-a-month medicine adds up fast. It's literally a robbery where you exchange your money for your life. All so some fat cat investor who provides NOTHING helpful to anyone can make even more bucks just sitting around owning healthcare stock.

If universal health was really SO bad.... don't you think EVERY other country would have switched back to private insurance by now???

Finally, the quality of care in the US is abysmal because this "gotta get obscenely rich off each patient" ethos is so pervasive and there are only a few minutes to TREAT but no time to actually provide CARE.

In Chile, my GFs ob/gyn will sit down and talk to her in his office for 20 minutes. That is UNHEARD of in the US. It's all rush rush. Volume = $$$

Private insurance forces us into this paradigm. Many doctors now get into healthcare.. not primarily to help people but primarily to get rich, especially surgeons. Many surgeons will avoid suggesting conservative options first because surgery is reimbursed so well. (Truly unfair to GPs who deal with more subtle hard-to-diagnose illnesses.) Docs HAVE to see 40 patients a day because insurance companies pay them as little as possible per patient, which is why doctors are always overbooked.

The entire American private HC system is twisted by the inescapable greed of American culture. (I think doctors should be very well paid. I'm not blaming them. I'm blaming a system built on greed that has been perverting medicine since Nixon changed a law making it legal to profit (shareholders & stocks) off medicine. It's just unethical to get rich (as a passive shareholder or CEO) off the inevitably of illness! Rich shareholders just skim money off sick helpless people. It's obscene!

I was in medicine in the 1990s and we called health a crisis THEN! It's 33 years later and the power of greed has kept the status quo... we pay more than any other country with worse healthcare outcomes than most single payer program countries because doctors can focus on CARE and drug companies, medical products companies, ambulance services etc. in single payer countries. Medical companies aren't all out to earn far FAR more than their products and services actually cost because costs are REGULATED.

In the US care prices are simply whatever the market can possibly bear and costs go up every single year by far more than inflation.

Wait until you get cancer before you argue how great the US system is. Go ask someone who lost their life savings even WITH insurance before you defend this unethical level of greed. (You're either a fool or someone putting those obscene profits in your own pocket at everyone else's expense.)

End of rant. Thanks for listening!

15K notes

·

View notes

Text

How Much Do Phlebotomists Earn Per Hour? A Comprehensive Salary Guide for 2024

# How Much Do Phlebotomists Earn Per Hour? A Comprehensive Salary Guide for 2024

**Meta Title:** Phlebotomist Hourly Earnings in 2024: Your Ultimate Salary Guide **Meta Description:** Discover how much phlebotomists earn per hour in 2024. Explore salary averages, factors influencing pay, benefits, and expert insights.

—

## Introduction

If you’re considering a career in phlebotomy or are simply curious about the financial landscape of this vital healthcare role, you’re in the right place. Phlebotomists are trained professionals who specialize in drawing blood for tests, transfusions, research, or donation. Their work is crucial in diagnosing and treating various medical conditions. This article will delve into how much phlebotomists earn per hour in 2024 and what factors can affect these salaries.

Let’s dive into this comprehensive salary guide and equip you with the knowledge needed to navigate your career in phlebotomy.

## Phlebotomist Hourly Salary Overview

According to the Bureau of Labor Statistics (BLS), the median hourly wage for phlebotomists in the United States in 2023 was approximately $19.27. As we move into 2024, you can expect this figure to adjust slightly based on inflation rates and job market demands.

### Phlebotomist Average Hourly Wage

| **Location** | **Average Hourly Wage** | |————————–|————————–| | National Average | $19.27 | | New York | $24.05 | | California | $23.12 | | Texas | $18.55 | | Florida | $17.99 |

### Factors Affecting Phlebotomist Salaries

Phlebotomist salaries can vary significantly based on several factors:

1. **Location**: Urban areas and states with higher costs of living typically offer better salaries. For example, phlebotomists in New York City earn significantly more than those in rural areas.

2. **Experience Level**: Entry-level phlebotomists can expect to start at a lower wage. However, with additional certifications and years of experience, salaries can increase notably.

3. **Employer Type**: Phlebotomists employed in hospitals often earn more than those working in outpatient labs or private practices.

4. **Certification and Education**: Accredited certifications such as the National Certified Phlebotomy Technician (NCPT) can bolster your earning potential. Generally, the more qualifications you have, the higher your hourly rate can be.

5. **Work Schedule**: Phlebotomists may earn more when working evening, weekend, or holiday shifts due to shift differentials.

## Salary By Experience Level

Understanding how experience influences salary can help you set realistic financial goals for your career in phlebotomy. Here’s an overview of salary ranges based on experience:

| **Experience Level** | **Average Hourly Wage** | |————————–|————————–| | Entry-Level (0-1 year) | $15.00 – $18.00 | | Mid-Level (2-5 years) | $18.00 – $22.00 | | Experienced (5+ years) | $22.00 – $28.00 |

## Benefits Beyond Salary

In addition to hourly wages, phlebotomists often enjoy a range of benefits that can enhance their overall compensation package:

– **Health Insurance**: Many employers offer comprehensive health coverage options. – **Retirement Plans**: 401(k) matching and retirement savings plans can significantly boost long-term financial security. - **Paid Time Off (PTO)**: Many phlebotomy roles provide vacation and sick leave, which can be a valuable benefit. – **Educational Assistance**: Some employers offer financial support for continued education and certification.

## Practical Tips for Boosting Your Salary as a Phlebotomist

If you’re aiming to increase your hourly wage as a phlebotomist, consider the following practical tips:

– **Obtain Additional Certifications**: Specialized certifications such as those in advanced phlebotomy techniques or lab management can make you a more desirable candidate.

– **Continue Education**: Pursuing further education in nursing, lab technology, or related fields can open doors to higher paying positions.

– **Network Professionally**: Connecting with other professionals in the field can lead to job opportunities and mentorship that can enhance your career trajectory.

– **Seek Higher Responsibility Roles**: Positions that require supervisory or managerial skills can lead to promotions and pay raises.

## First-Hand Experience: Phlebotomists Share Their Stories

To provide deeper insights, we spoke to several phlebotomists about their experiences in the field, salary expectations, and advice for newcomers.

### Case Study 1: Anna, 3 Years Experience

*Location*: Chicago, IL *Current Salary*: $20.00/hour

Anna started her journey in a small clinic. She noted, “At first, I was on the lower end, earning around $17.00 an hour. But after completing my certification, I was able to negotiate a higher salary and now work for a hospital where I earn more.”

### Case Study 2: Mark, 1 Year Experience

*Location*: Dallas, TX *Current Salary*: $16.50/hour

Mark emphasizes the importance of networking: “I found my current job through a connection I made at a local training seminar. It’s crucial to meet people in the industry.”

### Case Study 3: Lisa, 10 Years Experience

*Location*: Los Angeles, CA *Current Salary*: $28.50/hour

Lisa moved up the ranks by taking on supervisory roles, stating, ”Leadership opportunities have really paid off. My salary reflects my experience and commitment to the field.”

## Conclusion

As we look ahead to 2024, becoming a phlebotomist can offer not just job satisfaction but also competitive wages and benefits. Understanding the factors that affect your earnings, along with the opportunities for advancement and additional certifications, can help you make informed career decisions.

Whether you’re just starting your journey or considering a pivot within the healthcare field, phlebotomy presents a promising and rewarding career path. With the right strategies and insights, you can maximize your earning potential and enjoy a fulfilling professional life.

—

By providing a detailed and thorough exploration of phlebotomist salaries, we hope this guide equips you with the knowledge you need to succeed in this essential profession. If you’re considering this field, prepare to make an impact—one blood draw at a time!

youtube

https://phlebotomytechnicianprogram.org/how-much-do-phlebotomists-earn-per-hour-a-comprehensive-salary-guide-for-2024/

0 notes

Text

Is Rehabilitation Free? A Comprehensive Guide

Rehabilitation plays a crucial role in helping individuals recover from injuries, illnesses, or addiction. However, a common question arises: Is rehabilitation free? The answer depends on several factors, including the type of rehabilitation, your location, insurance coverage, and the availability of public health services. This article explores when rehabilitation may be free and the associated costs across various settings.

Understanding Rehabilitation: What Does It Involve?

Rehabilitation encompasses services aimed at restoring function and quality of life after injury, surgery, or illness. It can involve physical rehabilitation, addiction recovery, or psychological therapy, and the costs for these services vary depending on the care needed and where it is provided.

Public Health Systems: When Is Rehabilitation Free?

In countries with universal healthcare, such as the UK and Canada, rehabilitation services are often free or heavily subsidized through government funding. In these systems, basic rehabilitation — such as physical therapy after surgery or stroke recovery — may be covered, although there might be limits on the duration or intensity of care provided.

Private Rehabilitation: What Are the Costs?

Private rehabilitation services are typically not free unless covered by insurance. Costs can vary widely based on the level of care and type of facility. Private centers often provide personalized and quicker services, but patients should expect significant out-of-pocket expenses if they don’t have insurance coverage.

Free Rehabilitation for Specific Conditions

In some cases, rehabilitation may be free or subsidized for specific groups, such as veterans, individuals with disabilities, or those recovering from workplace injuries. Government programs or insurance policies like workers’ compensation often cover these rehabilitation costs, either fully or partially.

Government Programs: Free or Subsidized Rehabilitation

Many governments offer programs that provide free or reduced-cost rehabilitation services for eligible individuals. Programs like Medicare and Medicaid in the U.S. or similar initiatives in other countries often cover rehabilitation for elderly or low-income individuals. If you qualify, rehabilitation may be available at little to no cost.

Insurance Coverage: Is Rehabilitation Free?

If you have health insurance, your rehabilitation services may be fully or partially covered. This often includes physical therapy, addiction recovery, or occupational therapy. However, co-pays and deductibles might still apply, depending on your policy.

Rehabilitation Costs Around the World

The availability of free rehabilitation varies by country. In nations with universal healthcare, rehabilitation is often provided at no cost to citizens. In countries with privatized healthcare systems, such as the United States, free rehabilitation is less common, although some public programs or insurance may cover it.

Charitable Organizations: Free Rehabilitation Options

Certain non-governmental organizations (NGOs) and charities provide free rehabilitation services, particularly for low-income individuals or specific groups, such as those recovering from addiction. These services may be offered directly or through financial assistance for private care.

Out-of-Pocket Costs

For individuals without insurance or access to government programs, rehabilitation can be expensive. Extended treatments or specialized therapies, such as those required for long-term recovery, may incur significant out-of-pocket expenses.

How to Access Free or Low-Cost Rehabilitation

To find free or affordable rehabilitation, start by exploring public health services, government programs, and charitable organizations. Sliding scale fees based on income may also be available, making rehabilitation more accessible for those with limited financial resources.

Common Myths About Free Rehabilitation

A common misconception is that rehabilitation is always costly. While some treatments can be expensive, many programs and services are designed to make rehabilitation affordable or even free, particularly in countries with robust public healthcare systems or for those eligible for specific government programs.

The Future of Free Rehabilitation Services

As healthcare systems evolve, more countries may prioritize making rehabilitation services accessible to all. Advancements in technology, such as telehealth, could also reduce costs, making rehabilitation more widely available.

Conclusion

So, is rehabilitation free? It can be, depending on your location, insurance coverage, and eligibility for public programs. While rehabilitation isn’t universally free, there are many resources available to reduce costs or provide services at no charge. It’s essential to explore all options, including public health services, insurance, and charitable organizations, to access the care you need.

🔗Read More: https://ramadiphysio.com/is-rehabilitation-free/

0 notes

Text

5 Essential Tips for Navigating Health Coverage as a Student in Switzerland

Switzerland is renowned for its exceptional healthcare system, which is often regarded as one of the best in the world. As a student studying in this picturesque country, it is crucial to familiarize yourself with the intricacies of health coverage to ensure your well-being throughout your academic journey.

In Switzerland, every resident, including international students, must have mandatory health insurance coverage. The Swiss healthcare system operates on the principle of compulsory health insurance.

This means that all residents are required by law to have basic health insurance coverage called LaMaladie (LAMal). This insurance provides access to a wide range of medical services and treatments while ensuring financial protection against hefty medical bills.

It is important to note that LAMal covers both illness and accidents, including emergency hospital stays and general practitioners' visits. When it comes to selecting a health insurance provider, students have the freedom to choose from a variety of approved insurers operating in Switzerland.

These providers offer different policies with varying premium rates and service levels. It is advisable to conduct thorough research and compare various options before making a decision.

Additionally, universities often provide guidance on choosing suitable insurance providers that cater specifically to students' needs. The cost of health coverage in Switzerland can be intimidating for some students due to high premiums associated with mandatory health insurance.

However, it's essential not only to focus on premiums but also consider deductibles and co-pays when evaluating potential policies. Deductibles are the annual amount individuals must pay out-of-pocket before their insurance coverage kicks in fully.

Co-pays refer to the portion of medical expenses that individuals must cover themselves at each doctor's visit or hospital stay. By understanding these financial aspects upfront, you can make informed decisions about the level of coverage you require based on your anticipated healthcare needs.

Navigating through the intricacies of health coverage as a student in Switzerland might seem overwhelming initially; however, armed with knowledge about mandatory insurance, choosing the right provider, and understanding financial aspects such as deductibles and co-pays, you can ensure that your healthcare needs are met efficiently. In the subsequent sections, we will explore additional tips that will further enhance your experience in navigating health coverage as a student in Switzerland.

Tip 1: Mandatory Health Insurance Requirement

Tip 1: Mandatory Health Insurance Requirement In Switzerland, having health insurance is not a choice but a legal obligation. As a student studying in this picturesque country, it is essential to understand the mandatory health insurance requirement and ensure compliance with the law.

The Swiss healthcare system operates on the principle of universal coverage, making it one of the best in the world. To begin with, every resident in Switzerland, including international students, must have basic health insurance known as LaMaladie or Krankenversicherung.

This coverage ensures that everyone has access to necessary medical care without any financial barriers. It is important to note that this requirement applies irrespective of the duration of your stay or your nationality.

The responsibility of obtaining health insurance lies with each individual. As a student, you have various options when it comes to selecting an insurance provider.

You can either choose one from the numerous private insurers available or opt for one of the approved public insurers. While both types offer similar coverage at comparable costs, public insurers are often preferred due to their non-profit nature and comprehensive benefits.

When selecting a health insurance provider, consider factors such as premiums, coverage limits, customer service, and additional services offered. It is advisable to do thorough research and compare different providers before making a decision.

The Federal Office of Public Health (FOPH) provides detailed information about approved insurers on their website. Once you have chosen an insurer and obtained your mandatory health insurance policy, you will need to provide proof of coverage to your educational institution or authorities responsible for registration purposes.

Failure to comply with this requirement can result in penalties and may even jeopardize your student status in Switzerland. Remember that having mandatory health insurance is not only legally required but also crucial for your own well-being while studying abroad.

It ensures access to quality healthcare services when needed and protects you from potential financial burdens associated with medical emergencies or routine treatments. Understanding the mandatory health insurance requirement in Switzerland is of utmost importance for international students.

By adhering to this legal obligation and carefully selecting the right insurer, you can ensure peace of mind regarding your healthcare needs. So, be proactive, research diligently, and make an informed decision when obtaining health coverage as a student in Switzerland.

Tip 2: Choosing the Right Health Insurance Provider

Choosing the right health insurance provider is a crucial step for students in Switzerland to ensure comprehensive coverage and access to necessary medical services. With numerous options available, it can be overwhelming to make an informed decision.

However, by considering a few key factors, students can navigate this process more effectively. First and foremost, it is imperative to evaluate the reputation and reliability of potential health insurance providers.

Look for companies that have been operating in Switzerland for an extended period and have established a positive track record of delivering quality services. Conduct research by reading customer reviews, testimonials, and checking ratings from independent agencies.

One essential aspect to consider is the breadth of the provider's network of healthcare professionals and facilities. Ensure that your chosen insurer has contracts with a wide range of doctors, specialists, clinics, hospitals, and pharmacies within your area or near your educational institution.

This will enable you to conveniently access healthcare services without facing excessive out-of-pocket expenses or restrictions on provider choices. Another significant factor when choosing an insurance provider is their customer service quality.

Opt for companies that prioritize customer satisfaction by providing responsive and efficient support through multiple channels such as phone helplines or online chat platforms. It is important to feel confident that reliable assistance will be readily available when dealing with any potential issues or concerns related to claims processing or policy inquiries.

Additionally, when assessing different health insurance providers in Switzerland as a student, it is essential to carefully review their coverage options and benefit packages. Compare different plans based on their premiums, deductibles, co-payment requirements (if any), coverage limits for specific treatments or medications relevant to your needs as a student studying abroad.

Furthermore, consider whether the insurer offers additional benefits such as coverage for preventive care services like vaccinations or routine check-ups that are particularly important during your time as a student in Switzerland. By taking these factors into consideration while selecting a health insurance provider in Switzerland as a student, you can make an informed choice that aligns with your needs and ensures access to comprehensive healthcare services throughout your academic journey.

Tip 3: Navigating Co-Pays and Deductibles

Navigating Co-Pays and Deductibles: One crucial aspect of understanding health coverage as a student in Switzerland is familiarizing yourself with co-pays and deductibles. Co-pays refer to the fixed amount you are required to pay for a covered service, while deductibles are the amount you must pay out-of-pocket before your insurance kicks in.

Knowing how these factors affect your expenses and benefits can help you make informed decisions regarding your healthcare. When it comes to co-pays, it's important to understand that different services may have varying amounts set by your insurance provider.

For instance, a routine doctor's visit might require a lower co-pay than specialist consultations or hospital stays. Researching and comparing co-pays between various insurance plans can assist you in finding the most cost-effective option for your specific needs.

Additionally, be sure to inquire about any potential discounts or reduced rates available for students when discussing co-pays with different insurers. Deductibles play a significant role in managing healthcare expenses as well.

It is vital to comprehend the deductible amount specified by your chosen health insurance provider because this will determine how much you need to pay out-of-pocket before receiving coverage. Lower deductible plans typically have higher premiums, meaning that you will contribute more each month but face lower initial costs when seeking treatment.

Conversely, higher deductible plans often involve lower monthly premiums but require larger out-of-pocket payments before reaching the deductible threshold. Consider your overall health condition and medical history when deciding on an appropriate deductible level that strikes a balance between affordable monthly payments and potential future expenses.

Furthermore, keep in mind that some services may not require meeting the deductible at all. Preventive care measures like vaccinations or regular check-ups might be fully covered without any initial costs on your part.

Understanding these exceptions will help you prioritize preventive care while planning for potential expenses related to other types of treatments or procedures. Navigating through co-pays and deductibles in Swiss health coverage can be daunting at first, but with careful consideration and research, you can find an insurance plan that meets your individual requirements and budget.

Tip 4: Making Use of Supplementary Insurance

Making Use of Supplementary Insurance: Supplementary insurance is an additional coverage option that can provide you with added benefits and services beyond what is covered by mandatory health insurance in Switzerland.

As a student, it is crucial to explore and consider the various supplementary insurance options available to ensure comprehensive coverage for your specific needs. Here are some key factors to keep in mind when making use of supplementary insurance.

First and foremost, it is essential to understand the different types of supplementary insurance plans available. These plans can cover a wide range of services, such as dental care, alternative medicine treatments, vision care, and even worldwide emergency medical assistance.

Carefully evaluate your own health needs and preferences to determine which areas could benefit from additional coverage. For instance, if you wear glasses or contact lenses or require frequent dental check-ups or treatments, opting for a supplementary plan that covers these expenses can greatly ease the financial burden.

Next, thoroughly research different insurance providers offering supplementary plans and compare their offerings in terms of coverage limits, premiums, waiting periods (if any), reimbursement policies, and customer reviews. Consider seeking advice from fellow students or consulting with a knowledgeable insurance broker who can guide you through the process of selecting the most suitable plan based on your individual circumstances.

Furthermore, remember that while supplementary insurance can enhance your healthcare experience as a student in Switzerland, it comes at an additional cost. Evaluate your budget carefully before committing to any plan.

Take note of any exclusions or limitations within the policy terms and conditions; some may have specific criteria for reimbursements or treatment eligibility that need to be thoroughly understood before making a decision. By making informed choices regarding supplementary insurance options in Switzerland as a student, you can ensure comprehensive coverage tailored to your specific healthcare requirements.

It provides peace of mind knowing that certain areas not covered by mandatory health insurance are also taken care of under this additional policy layer. Keep in mind that reviewing your coverage regularly and adapting it as necessary will allow you to maximize the benefits available to you throughout your academic journey in Switzerland.

Tip 5: Getting Familiar with Emergency Services

In the unfortunate event of a medical emergency, it is crucial for students in Switzerland to have a clear understanding of the emergency services available to them. Tip 5 focuses on getting familiar with emergency services and ensuring that students know how to seek immediate assistance when needed.

Switzerland boasts an efficient and well-structured healthcare system, providing comprehensive emergency care facilities across the country. In Switzerland, emergency services can be accessed by dialing the universal emergency number, 112.

This number connects you to a central dispatch center where trained professionals assess your situation and dispatch appropriate assistance. It is important to remain calm and provide all necessary information such as your location, description of the incident or illness, and any other relevant details that could aid responders in providing prompt and accurate assistance.

Once an ambulance is dispatched, it typically arrives within minutes to provide on-site medical treatment or transfer you to the nearest hospital for further care. Switzerland's emergency medical services are known for their advanced equipment and highly skilled personnel who prioritize patient safety while delivering timely intervention.

It is worth mentioning that in critical situations, helicopters may be utilized for swift transportation when necessary. Moreover, it is essential for students to keep their health insurance card handy at all times as it contains important information required during emergencies.

This card ensures that your medical treatment is covered by your insurance provider without any delays or complications. Familiarizing yourself with the specific coverage provided by your insurer in case of emergencies will help you navigate the process more smoothly and avoid unexpected financial burdens during already stressful situations.

Conclusion: Ensuring Your Health While Studying

Ensuring your health while studying in Switzerland is of utmost importance. By understanding the mandatory health insurance requirement, you can ensure that you are compliant with the Swiss healthcare system and have access to essential medical services. Choosing the right health insurance provider is crucial because it will determine the quality of coverage and services you receive.

Take your time to research different providers, compare their policies, and consider factors such as reputation, customer service, and affordability. Additionally, navigating co-pays and deductibles requires careful consideration to manage any out-of-pocket expenses effectively.

By understanding how these costs work and budgeting accordingly, you can avoid any financial surprises when seeking medical care. Supplementary insurance can provide additional coverage beyond what is offered by basic health insurance plans.

It is advisable to assess your specific needs and explore options that cater to them. This way, you can enhance your coverage based on individual circumstances such as pre-existing conditions or specific medical requirements.

Familiarizing yourself with emergency services is vital in maintaining your well-being while studying in Switzerland. Being aware of emergency numbers and knowing where nearby hospitals or clinics are located can save valuable time in critical situations.

Moreover, make sure to keep all relevant documents handy in case of emergencies or unexpected hospital visits. In essence, by following these five essential tips for navigating health coverage as a student in Switzerland, you can ensure that your physical well-being remains a priority throughout your academic journey.

By being proactive in securing appropriate health insurance coverage from a reputable provider, managing co-pays and deductibles wisely while considering supplementary options when needed, and staying informed about emergency services available to you, you will be well-prepared for any healthcare eventualities that may arise during your studies abroad. Remember that taking care of your health not only contributes to academic success but also allows for an enriching experience overall as you explore a new country with peace of mind regarding your well-being.

0 notes

Text

What Is Health Insurance and How It Works

What Is Health Insurance? Health insurance in simple terms is an agreement between You (a consumer) and a corporation. In this arrangement, the corporation commits to covering either a portion or the entirety of the insured individual's medical expenses. This coverage is provided in exchange for the payment of a monthly premium by the consumer. Typically, this agreement spans a one-year period, throughout which the insurance company takes on the responsibility of covering particular costs associated with sickness, injury, maternity care, or preventive healthcare. In the U.S., health insurance contracts typically include certain exclusions to the coverage, such as: - A deductible, which necessitates the insured individual to bear some healthcare expenses "out-of-pocket" until a specified limit is reached, after which the company's coverage kicks in. - One or multiple co-payments, which mandate the insured individual to pay a predetermined portion of the expense for certain services or procedures. ELITEHINT'S KEY TAKEAWAYS 😃 - In exchange for a monthly premium payment, health insurance covers the majority of the medical and surgical costs as well as preventive care expenses that the insured individual incurs. - Typically, as the monthly premium increases, the out-of-pocket expenses for the insured decrease. - Almost all insurance policies include deductibles and co-pays, but these out-of-pocket costs are now limited by federal legislation. - Medicare, Medicaid, and the Children's Health Insurance Program (CHIP) are federal health insurance schemes that provide coverage to the elderly, disabled, and those with low income. How Health Insurance Works Accessing health insurance in the United States can be complex. It's an industry filled with numerous regional and national players, and their coverage, pricing, and accessibility can differ greatly from one state to another, and even within different counties. Approximately half of the population receives health insurance as a perk of their employment, with a portion of the premiums being covered by the employer. The cost to the employer is tax-deductible, and the benefits received by the employee are generally tax-free, though there are some exceptions for employees of S corporations. Individuals who are self-employed, freelancers, and gig workers have the option to purchase insurance independently. The Affordable Care Act of 2010, often referred to as Obamacare, required the establishment of a nationwide database, known as HealthCare.gov. This platform enables people to find standard plans from private insurers in their areas. For taxpayers earning between 100% and 400% of the federal poverty level, the costs of these insurance plans are subsidized. Certain states, but not all, have developed their own versions of HealthCare.gov, customized to meet the needs of their residents. Individuals who are over 65 years old, those with disabilities, End-Stage Renal Disease, or ALS are eligible for federally-subsidized care via Medicare. Meanwhile, families with incomes close to the poverty line can qualify for subsidized coverage through Medicaid. Types of Health Insurance Managed care insurance plans, as they are known, necessitate that policyholders receive their care from a specified network of healthcare providers. If patients opt for care outside of this network, they are typically required to bear a larger portion of the cost. In some cases, the insurance company may outright deny payment for services sought outside of the network. Numerous managed care plans, such as health maintenance organizations (HMOs) and point-of-service plans (POS), necessitate that patients select a primary care physician. This physician is responsible for managing the patient's overall care, making treatment suggestions, and providing referrals to medical specialists. In contrast, preferred-provider organizations (PPOs) do not necessitate referrals but do offer lower rates for using practitioners and services within their network. Insurance providers may decline coverage for specific services that were sought without prior approval. They may also refuse to cover the cost of brand-name drugs if a generic or similar medication is available at a reduced price. All these regulations should be clearly outlined in the documentation provided by the insurance company. It is advisable to confirm directly with the company before undertaking a significant expense. Some Health Insurance Terms Copays, Deductibles, and Coinsurance - The deductible refers to the annual amount that the policyholder is required to pay out of pocket before the insurance company starts covering the costs. This amount is now limited by federal legislation. - Copays refer to fixed charges that policyholders are obligated to pay for certain services like doctor consultations and prescription medications, even after reaching their deductible. - Coinsurance represents the proportion of healthcare expenses that the policyholder is responsible for, even after fulfilling their deductible. However, this continues only until they hit their annual out-of-pocket maximum. ALSO READ: Life Insurance: What It Is and How It Works High-Deductible Health Plans (HDHP) High-deductible health plans (HDHPs) are becoming increasingly favored types of health insurance. These plans feature higher deductibles and lower monthly premiums. Only individuals using these plans are eligible to establish a Health Savings Account (HSA), which provides significant federal tax advantages. As defined by the IRS for 2023, a high-deductible health plan is one that comes with a minimum deductible of $1,500 for an individual or $3,000 for a family. The maximum total out-of-pocket expenses are capped at $7,500 for an individual and $15,000 for a family. High-deductible health plans provide a distinctive benefit: if you're enrolled in one, you're allowed to establish and deposit pretax earnings into a health savings account, which can be utilized for eligible medical costs. These plans offer a threefold tax advantage in that: - Deposits are subject to tax deductions - Deposits increase on a tax-deferred basis - Authorized withdrawals for medical costs are exempt from taxes Federal Health Insurance Plans In the US, not all health insurance is supplied by private firms. Federal health insurance plans like Medicare, Medicaid, and the Children's Health Insurance Program (CHIP) offer coverage to the elderly, disabled, and individuals with low income. The Affordable Care Act (ACA) In 2010, President Barack Obama enacted the Affordable Care Act (ACA). In states that participated, this act broadened Medicaid, a government initiative that offers healthcare to low-income individuals. The ACA has forbidden insurance firms from refusing coverage to individuals with pre-existing conditions and permitted children to stay on their parents' insurance plan until they turn 26. Alongside these modifications, the ACA initiated the federal Health Insurance Marketplace. This platform assists individuals and businesses in finding high-quality insurance plans at reasonable prices. All insurance plans available through the ACA Marketplace are mandated to cover 10 essential health benefits. Individuals can locate the Marketplace for their state on the HealthCare.gov website, if one is available. Under the ACA, taxpayers were obligated to have medical insurance meeting federally specified minimum standards or face a tax penalty. However, this penalty was abolished after December 31, 2018, by the Tax Cuts and Jobs Act. A 2012 Supreme Court decision invalidated an ACA stipulation that mandated states to broaden Medicaid eligibility to receive federal Medicaid funds, leading several states to opt against expanding their Medicaid programs. As of 2023, it's estimated that around 40 million individuals are covered by health insurance through the Affordable Care Act. Medicare and CHIP Medicare and the Children's Health Insurance Program (CHIP), two public health insurance plans, offer subsidized coverage for individuals with disabilities and children. Medicare is accessible to individuals aged 65 or older, and also caters to those with specific disabilities, End-Stage Renal Disease, and ALS. CHIP provides health coverage for children under 19 who come from low-income families. Why Do I Need Health Insurance? If you are young, in good health, and fortunate, the monthly premium might surpass your insurance costs. However, if you, or a family member, have a chronic condition requiring treatment, get injured in an accident, or contract a disease, you could be faced with medical bills that are beyond your financial capacity to pay. Who Needs Health Insurance? The straightforward response is everyone. Health insurance helps to mitigate the financial burden of both minor and major medical problems, encompassing surgeries and treatments for life-threatening diseases and debilitating conditions. How Do You Get Health Insurance? If your employer provides health insurance as part of their employee benefits package, you will have coverage, though you'll likely need to contribute towards the expenses. If you're self-employed, you have the option to buy health insurance through a federal or state Health Insurance Marketplace. Individuals who are 65 or older are eligible for federal Medicare insurance, though many choose to supplement its coverage. Low-income individuals and families are eligible for subsidized coverage through federal programs such as Medicaid or Medicare. How Much Does Health Insurance Cost? The price of health insurance can greatly differ depending on factors such as the extent of coverage, the type of plan you choose, the deductible, and your age at the time of enrollment. Additional costs can also arise from copays and coinsurance. A reasonable estimation of the costs of various plans can be obtained by examining the four tiers of coverage offered by the federal Health Insurance Marketplace. These tiers are categorized as bronze, silver, gold, or platinum, with each tier's pricing reflecting the level of coverage it offers and the associated costs to the policyholder. Conclusion Unlike numerous countries, the U.S. doesn't operate a universal government healthcare system. Instead, it utilizes a complex arrangement of subsidies and tax incentives, making healthcare affordable for most individuals most of the time. If you're employed, you likely have health insurance that your employer subsidizes. If you're self-employed, you have the option to obtain insurance directly from a private insurer. If your income is low, you may be eligible for financial assistance to offset the costs. If you're elderly or disabled, you can access coverage through federal programs like Medicare or Medicaid. Disclaimer: Elitehint is an independent publisher and comparison service, not an insurance agent or advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific insurance decisions. keep in mind that Past performance is not indicative of future results Read the full article

0 notes

Text

Navigating the Cost of Living in Delaware in 2023

The cost of living is a fundamental aspect of our daily lives. It influences where we choose to reside, work, and plan for the future. In 2023, understanding the cost of living in Delaware is essential for residents and those considering relocating to the First State. Delaware has a rich history, beautiful beaches, and vibrant communities. Let's look into the current cost of living in Delaware and explore the key factors shaping its residents' financial landscape.

Projected Living Costs in Delaware

Housing Costs

Housing costs are a significant component of living in any state. Delaware offers diverse housing options, from cozy apartments to spacious family homes. In 2023, the average monthly house rent for a one-bedroom apartment in Delaware can range from $1,000 to $1,400, depending on the location. Homebuyers should anticipate varying costs across the state, with median home prices hovering around $250,000 to $350,000.

Utility Bills

Utilities, including electricity, water, heating, and internet, are essential expenses for every household. Delaware residents can expect to spend approximately $150 to $200 per month on utilities. Remember that costs may fluctuate based on usage and weather conditions, particularly in the winter when heating bills tend to rise.

Transportation

The cost of transportation in Delaware largely depends on whether you own a car. Delaware's gasoline prices are slightly above the national average, so that a full tank can cost anywhere from $45 to $60, depending on your vehicle's fuel efficiency. If you rely on public transportation, Delaware offers various options, such as buses and commuter trains, with monthly passes ranging from $60 to $120.

Healthcare

Factors like insurance coverage and specific medical needs can influence healthcare costs in Delaware. On average, residents can expect to pay approximately $300 to $600 monthly for health insurance premiums. It's important to note that these costs can vary significantly based on the coverage level and provider.

Taxes

Delaware is known for its tax-friendly environment. The state doesn't impose a sales tax, which is a considerable consumer advantage. However, residents pay state income tax, varying rates depending on income. Property taxes can also differ by county. Generally, Delaware's property taxes are reasonable compared to some neighboring states.

Childcare and Education

If you have children, childcare and education costs are significant. The price of childcare can range from $1,000 to $1,500 per month per child. Delaware is home to a mix of public and private schools, with education expenses varying depending on the institution. Public education is funded through property taxes, so that the cost can vary based on location.

Entertainment and Lifestyle

The cost of entertainment and lifestyle choices depends on personal preferences. Delaware offers various activities and cultural experiences, from dining out to enjoying the beautiful beaches. On average, residents allocate around $200 to $400 monthly for entertainment, dining, and leisure activities.

In 2023, Delaware maintained its reputation as an attractive state with a manageable cost of living. The state's affordability and quality of life make it an appealing destination for both residents and newcomers. Understanding the current Delaware cost of living is important for making informed decisions and ensuring a comfortable and satisfying lifestyle in The First State.

0 notes

Text

What You Should Know About a Homecare Provider

Home care providers provide services to people living at home. They can help patients manage their chronic illnesses or assist with daily activities. They can also run errands and perform household chores. They can even take the patient to medical appointments.

Discharge planning includes the provision of a written statement that informs the client or legal representative about their rights. It also describes any changes to the client’s plan of care.

Cost

While many people consider homecare provider to be an expensive option, it is actually quite affordable. Many home care services cost less per hour than traditional nursing homes, and a healthy senior can get all of the assistance they need from several short visits a week.

The cost of home care is based on a number of factors, including the amount of time spent by the caregiver in your home and the supplies necessary to provide the service. The national average is $27 an hour, but this varies by state and region. Many families explore financial assistance options such as Medicare, veterans affairs, reverse mortgage loans, and private insurance.

When searching for a home care provider, consider using a registry platform that provides detailed information about the caregiver’s qualifications, area of expertise, and past experience. This will ensure that you find a qualified caregiver who meets your needs and fits well with your family. You can also ask friends and family for recommendations.

Qualifications

Home health care providers provide a variety of services to help seniors and the disabled remain in their homes. These services include helping with activities of daily living, medication reminders, and meal preparation. They may also assist with transportation and run errands. They can even help with bathing and dressing.

A person can qualify for home health care if they meet certain requirements. For example, they must have a physician-prescribed plan of treatment. This will often involve a nurse practitioner. In some cases, a physical or occupational therapist will be involved.

In addition, a person must be certified as homebound. This means they cannot leave the home without assistance, such as a cane, wheelchair, or walker. They must also have a doctor who can document that they cannot safely leave the house on their own. Additionally, a home health agency must be licensed. This includes a private home health agency and Medicare-certified agencies. Those that are not licensed must be registered with the department of health.

Licensing

Homecare services providers must comply with state regulations. These rules usually govern the training and licensing of employees, use of care plans, and periodic inspections by state health departments. Most states also require businesses to carry liability insurance. This type of insurance protects customers against theft or abuse by their caregivers.

There are two main types of home care providers: private companies and licensed home healthcare agencies (LHCSAs). LHCSAs are Medicare "providers" and may receive payments from clients who pay privately or under private insurance coverage, and they can also contract to provide services to Medicaid beneficiaries who have been enrolled in a managed care plan.

Non-medical home care companies don't have the same strict licensing requirements as medical home healthcare agencies, but they do need to follow a well-organized business plan and meet local and federal registration requirements. Additionally, they should establish strong partnerships and referral networks with hospitals, clinics, and senior centers to expand their client base and build credibility in the industry.

Insurance

Licensed home healthcare agencies and medical professions working in a patient’s home require professional and general liability insurance. This insurance protects against claims stemming from slip-and-fall injuries, wrongful death, and other damages caused by a care worker. It also covers costs of defending against false or baseless lawsuits.

Many private health insurance plans offer some form of home health care coverage, although Medicare does not cover this service. Some Medicare beneficiaries purchase private Medigap policies that minimize their out-of-pocket costs for nonmedical home care services, but these are not designed to cover all of the cost of in-home health care services.

Home care providers should develop relationships with community partners and senior referral sources to build a strong client base. This will help them establish credibility in the industry, and increase their business opportunities. In addition, home health aides should invest in networking to develop business connections with potential clients and employers. Moreover, they should seek out professional associations and industry leaders to stay informed about the latest trends in their field.

0 notes

Text

Canada PR: What You Need to Know

As an accomplished professional, you have likely considered relocating abroad at some point to advance your career or experience life in another country. Canada, with its natural beauty, high quality of life, and stable economy, is an appealing option for many. However, moving to Canada is not straightforward. There are specific requirements to obtain permanent residency (PR) status.

Before packing your bags, you must determine if you are eligible for one of the immigration programs and understand the obligations involved. The process requires patience, as it can take between 15 to 24 months or longer in some cases to obtain Canada PR. You will need to meet language, education, work experience, and medical requirements. There are also application fees and paperwork to prepare. While the road to becoming a permanent resident of Canada is not always easy, with the right preparation and persistence, you can make Canada your new home.

Canada PR Requirements: Eligibility and Process

Canada PR Requirements: Eligibility and Process

To be eligible for permanent residency (PR) in Canada, you must meet the following basic requirements:

Have at least one year of full-time (or equivalent part-time) skilled work experience in the last 10 years. The work experience must be in a high-demand occupation that is classified as Skill Type 0, A, or B in the National Occupational Classification system.

Meet minimum language requirements in English or French, demonstrated by language test results. For most economic immigration programs, the minimum is Canadian Language Benchmark (CLB) 7.

Have a post-secondary degree, diploma or training, or occupational certification for your skilled work experience.

Have enough funds to settle in Canada. The settlement funds requirement is to ensure you can financially establish yourself in Canada.

Clear a medical exam and security checks. A panel physician approved by Immigration, Refugees and Citizenship Canada (IRCC) will assess if you have any health conditions that could pose excessive demand for health or social services.

Pay the application processing fees. The fees include application fees for you and any dependents.

If you meet the eligibility criteria, you can apply for PR through various economic immigration programs like Express Entry, Provincial Nominee Program, Atlantic Immigration Program, or Rural and Northern Immigration Program. The process typically includes submitting an online application, language tests, education assessments, medical exams, and verifying work experience and settlement funds.

Make sure to check: TRV Full Form

Benefits of Canada PR: Advantages for You and Your Family

As a permanent resident of Canada, you and your family members can enjoy several benefits.

Healthcare Coverage

As a PR, you and your dependents are entitled to public healthcare insurance under the Canada Health Act. This provides universal coverage for medically necessary hospital and physician services. Prescription drugs, dental care and vision care may require additional private insurance.

Education

Your children have access to free primary and secondary school education in the public school system, including the opportunity to learn both English and French. As a PR, you may also be eligible for domestic tuition fees at colleges and universities.

Employment Opportunities

Gaining PR status opens up more job prospects as you have full access to the Canadian labor market. You can work for any employer in Canada without the need for a work permit. Your spouse or common-law partner may also work in Canada without a work permit.

Protection under Canadian Law

As a PR, you have the right to live, work or study anywhere in Canada, and you are entitled to the full protection of Canadian laws and the Canadian Charter of Rights and Freedoms. You can also apply for Canadian citizenship after 3 years of residing in Canada with PR status.

In summary, permanent residence in Canada provides you and your loved ones with healthcare, education, employment and legal benefits as well as a pathway to citizenship. With the privileges of being a Canada PR, you can truly call this welcoming nation your new home.

How to Maximize Your Chances of Getting Canada PR

To maximize your chances of getting permanent residency in Canada, there are several key steps you can take:

Do Your Research

Learn about the various programs and pathways available to become a permanent resident, such as Express Entry, Provincial Nominee Programs, Family Sponsorship, etc. Determine which program you may be eligible for based on your skills, experience, and personal situation.

Focus on Your Language Skills

Strong English or French language skills are required for most permanent residency programs. If needed, take a language test like the IELTS or CELPIP to prove your proficiency. High scores on these tests can help boost your eligibility and competitiveness.

Build Your Credentials

Work on obtaining the necessary credentials, work experience, job offers, etc. required for your target program. This could include things like educational degrees or diplomas, skilled work experience, job offers from Canadian employers, etc. The stronger your credentials, the better your chances.

Gather Your Documents

Compile all the necessary paperwork to support your application like language test scores, educational credentials, proof of funds, medical exams, police clearances, resumes, job offers, etc. Make sure all your documents are official and up-to-date before applying.

Consider Hiring an Immigration Representative

An authorized immigration representative such as a lawyer or consultant can help ensure you submit a strong, error-free application. They are up-to-date with the latest program rules and can guide you through the complex application process.

Following these key steps will help strengthen your Canada PR application and maximize your chances of success. With time, patience, and perseverance, you can achieve your goal of becoming a permanent resident of Canada.

Conclusion

As you've learned, applying for permanent residency in Canada requires careful preparation and patience. While the process can seem complicated, if you ensure you meet the eligibility criteria, submit a complete application, and provide accurate supporting documentation, you have a strong chance of success. With scenic natural beauty, a stable economy, and an overall high quality of life, Canada is an attractive place to call home. By following the necessary steps and maintaining an optimistic outlook, you'll be well on your way to gaining permanent residency status in this welcoming nation. The rewards of navigating the process are well worth the effort. With hard work and perseverance, you can make Canada your permanent home.

0 notes

Text

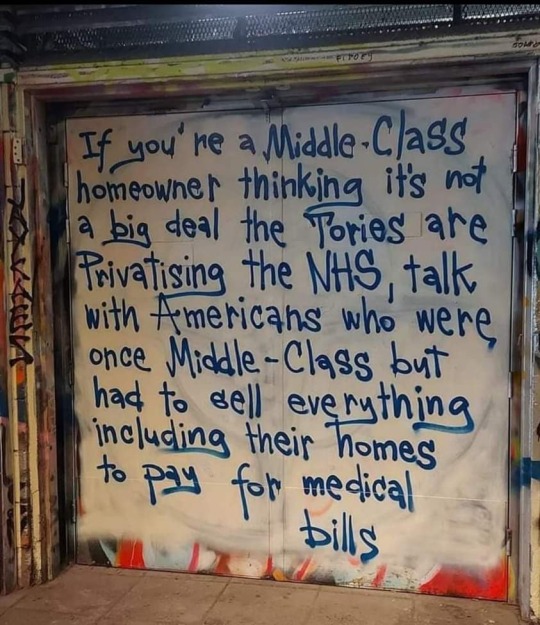

The privatized health care system also has a massive time/system navigation cost that is passed onto the individual. People who don’t want nationalized healthcare will try to tell you that this is actually a benefit of our system, and we are lucky because we have have choices. This is an illusion, in reality it creates a burden of research for the average person and also is used to deflect from the fact that the system leaves a vast number of workers uninsured.

Most US healthcare companies have confusing in-network/out-of-network policies. not all doctors/hospitals accept all insurance plans, which means people often have to do pretty extensive research to find a provider that accepts their plan. It can be confusing to find a doctor who is in-network, and even then you’re still left with a flat fee co-pay at the beginning of most visits.

The end result is that poor people get worse care. It takes time and effort to find a provider who even accepts your insurance, and an honest mistake can end up costing you thousands of dollars. A plan that costs less monthly will often come with higher up front costs and/or less coverage on anything outside of a yearly check up.

you also really don’t get to pick your healthcare plan. Some people looooove to talk about the free market and individual freedom blah blah. Most people get insurance through their employer, who might offer a few plan options from one contracted insurance company. The employer pays a large portion of the cost for a health insurance plan, and then the remaining cost comes our of your pre-tax income. There might be a high cost and a low cost plan that each employee is allowed to choose between. in theory you can choose your job based on the insurance benefits. the reality is that after the age of 26 in the states, just having a job that provides insurance feels like a huge relief.

I imagine that the conservative viewpoint is this: businesses can exercise choice, and they can negotiate collectively, which will push insurers to keep prices down. I mean- what company wouldn’t prioritize the health of their employees?? Free market keeps the costs low and the people happy.

Problem is that most companies don’t care about their employees health, and many industries have found ways to simply avoid paying for their coverage at all. Admittedly, there are some fields with traditionally a competitive hiring market. In this context, some employers are incentivized to provide attractive options as part of a benefits package. For example, some corporate office jobs, like tech or legal, might see value in offering a relatively high quality plan which can give some element of genuine stability.

Beyond that, you’re probably kinda fucked. A small company might not have the margins to subsidize an expensive plan for its employees. So you could be employed and insured, but stuck with an expensive plan that covers very little. Many service industry jobs have moved to part-time labor because you’re only required to insure full-time employees. Many industries have moved towards working with contracted labor so they don’t have to bring in a full-time worker and their pesky health needs. There are some regulations which are meant to stop companies from using the contractor designation inappropriately, but these laws are pretty regularly abused.

What we’re left with is a system which provides no meaningful “competition” or “choice” for the average person. You are beholden to the whims of your employer, and you should feel lucky to have health insurance at all. Maybe some middle/upper middle class worker groups are insulated from this problem, but everyone loses in a system where a false “choice” justifies leaving many many people uninsured or underinsured.

Employers will always find to cut costs, and humanity is expensive.

#i accidentally wrote something way too long#sorry guys#US healthcare is just a mess and it makes me feel insane#there is this absurd capitalist drive to erase human empathy and care out of our society lol#like fr people are writing algorithms to maximize profit#because when real people decide how to do things#they’re stupid consciences get in the way#maybe valuing money and ‘realism’ over emotion is a net bad#did anyone stop and think

37K notes

·

View notes

Text

Understanding Commercial Prescription Drug Insurance | Insurance Professionals of Arizona

One area of healthcare that can be the most expensive for consumers, but which we don’t really think about, is the price of prescription drugs.

Last year when my father-in-law was diagnosed with a form of leukemia. The type of leukemia that he had is very treatable with daily medication, which was great news.

Then he found out that his prescription for his illness would cost $5000 per month. No matter how bad you need medicine, few of us can afford a $60,000 yearly price tag for our prescriptions.

In fact, according to a 2018 Consumer Reports survey of 1,200 adults taking prescription drugs, many Americans report that in order to afford their prescriptions, they have to cut back in other areas of the budget, like groceries.

Some people even decide to delay their retirement plans because of the cost of the prescriptions.

The Consumer Report survey found that many others change the use and amounts of their prescriptions to save money. The report found that:

30% did not fill a prescription

20% switched to a supplement, over-the-counter medication, or an alternative treatment

18% took expired medication

16% did not take the drug as scheduled

15% cut pills in half without a doctor’s approval

You never want to be in a position where you have to compromise your health because of your budget concerns. The best way to prepare for these kinds of unexpected bills related to prescription drug costs is to have a commercial prescription drug insurance policy.

Because commercial prescription drug insurance is often combined within your health insurance policy we will address everything you need to know about health insurance in general before talking specially about prescription drug coverage.

In this article, we will talk help you understand the components of commercial health insurance and the options that are available to you, as well as discuss the role of the prescription drug insurance portion of that policy and how to protect yourself and your family from large healthcare costs and prescription drug bills.

WHAT IS COMMERCIAL HEALTH INSURANCE?

Private insurance companies offer commercial health insurance policies that offset the out-of-pocket costs that consumers have to pay for healthcare services, which include hospital costs and doctor visits, treatment, tests and labs, and in many cases, prescription drugs as well.

Policyholders pay a monthly premium that funds these policies.

After a consumer pays a premium they will pay an agreed portion of their healthcare costs and the insurance company will provide coverage for the rest.

Often employers will offer group health insurance policies as a benefit to their employees. Employers often cover part of the premium’s cost for their employees. Nearly 50% of Americans get their health insurance through an employer.

However, you can also purchase health insurance as an individual if you do not receive a health insurance benefit through your employer or you do not qualify for government insurance benefits.

Insurance carriers are regulated by federal and state laws and requirements. This means that commercial health insurance providers and policies will vary by state.

Some providers will only work in certain states, and keep in mind that the policies offered by national companies tend to vary by state to meet to each state’s particular requirements.

HOW DOES COMMERCIAL HEALTH INSURANCE WORK?

When you buy a commercial health insurance policy, the idea is to protect yourself from exorbitant or catastrophic health costs. You want to choose a plan which covers the services you need and has a monthly premium you can afford.

Keep in mind that in addition to your monthly premium, many plans also have a deductible.

This is the amount of money your have to pay first towards you healthcare costs in that calendar year before the insurance will pay its share.

When choosing a plan, consider both the premium and the deductible amounts.

A lower premium is typically offset by a higher yearly deductible, and vice versa. The amount of your annual deductible will usually be listed on your insurance card.

The exact healthcare services and costs covered by your commercial health insurance will vary depending on the policy you choose, but in general, commercial health insurance pays for a significant portion of the covered person’s medical expenses.

Most qualifying expenses include routine doctor visits and medical care, inpatient hospital stays, emergency services, mental and behavioral health, substance abuse treatment, and preventive care.

Preventive care is performed regularly to detect or prevent health issues early, so they can be avoided or treated before they become more serious. Most commercial health insurance policies cover these preventive services at no cost to the patient.

Preventive care is performed regularly to detect or prevent health issues early, so they can be avoided or treated before they become more serious. Most commercial health insurance policies cover these preventive services at no cost to the patient.

Elective procedures that are not deemed “medically necessary” by the carrier or a physician, generally are not covered.

When you have a commercial healthcare insurance policy and you see a doctor, the office will submit a claim for the care provided to the insurance company.

The insurance company will directly reimburse the doctor for their work and pay the covered amount of the bill. If a balance remains after the insurance company has paid its portion, you will be billed for it.

Most insurance carriers have contracts with specific providers, so the insurance policy will generally cover a larger portion of the overall cost if you visit a doctor who is within your insurance provider’s network.

WHAT IS COMMERCIAL PRESCRIPTION DRUG INSURANCE?

Commercial prescription drug insurance is a policy that is designed to cover part of the cost of medications prescribed by a doctor, and which are filled by a pharmacy.

Most commercial health insurance plans already include commercial prescription drug insurance as part of the policy.

However, there are plans which just cover prescriptions that can be purchased separately if your policy does not provide prescription coverage. These stand-alone prescription drug policies are offered by large commercial health insurance providers.

Just as with health insurance plans, the policyholder will pay a monthly premium for their commercial prescription drug insurance. Additionally, most plans also have an annual deductible, and a co-pay is charged based on the type of drug prescribed.

Insurance providers prefer to have prescriptions filled with generic drugs, which cost the least if they are available. When you opt for a prescription at a lower tier, your co-pay will be smaller. Name-brand drugs typically cost more, especially if a generic version is available.

HOW CAN I MAKE SURE I HAVE THE RIGHT COMMERCIAL PRESCRIPTION DRUG COVERAGE?

As you can see, there are lots of ways to meet your personal healthcare insurance needs. Not every policy will work for every consumer or every family. Your personal healthcare needs and conditions will play a factor in your decisions about your coverage.

Buying policies vary greatly in terms of premium price, deductible, and co-payments. A careful evaluation of all your options in terms of your personal situation is the best way to make sure you have the right commercial healthcare and prescription drug coverage.

At Insurance Professionals of Arizona, we have decades of experience in health insurance and we can assess your personal needs to get you the best policy at the best price. This is our specialty.

There is an old saying that you don’t need insurance until you need it. Don’t wait to get the healthcare insurance and prescription drug insurance you need until after you receive a challenging diagnosis.

At IPA, we want you to be prepared for anything so that you can have the peace of mind and financial security you need to fully enjoy your life.

We’re here to help. Contact us today or fill out an interest form here on the website and we will get in touch with you. Let our expert brokers help you get properly protected today. Call us Today (480-981-6338)

#insurance professionals of arizona#insurance#Insurance Professionals of Arizona#Drug Insurance#Commercial Prescription Drug Insurance

0 notes

Text

Is Physiotherapy Covered by Medicare?

Whether or not a physical therapy practice is Medicare-covered depends on the plan. Medicare Advantage plans can offer a lower cost alternative for PT sessions, but deductibles and coinsurance still apply.

Physiotherapy falls under the Chronic Disease Management (CDM) scheme for Medicare. This covers a variety of conditions that can be treated by multiple healthcare practitioners. To know more about whether is physiotherapy covered by Medicare, visit the MVP Rehab Physiotherapy website or call 0450603234.

Medicare is a national health insurance program funded through premiums you pay, general revenue from the federal government and state payments. It offers a variety of coverage options such as Medicare Part A and Medicare Part B. Part B covers up to 80% of the cost of medically necessary outpatient physical therapy, as long as you’ve met the deductible and coinsurance.

A physical therapist, or physiotherapist, uses massage, heat treatments and exercise to reduce pain, improve range of motion and help patients regain their previous mobility. They evaluate a patient’s medical condition and then create a physical therapy plan, which is approved by a physician.

The plan of care is then implemented by a physical therapist, which involves regular evaluations and documentation. This documentation must be legible and relevant to defend the services you bill, and comply with Medicare regulations such as MPPR. WebPT’s Plan of Care Report simplifies the process by automatically identifying pending certifications and recertifications.

Physiotherapy is a health care profession focused on promoting movement and maximising human potential. It encompasses a broad range of techniques that can include manual therapy, heat or cold therapy, exercise, electrotherapy, patient education and advice about how to manage pain and injuries.

Typically, a physiotherapist will assess the patient at the first appointment and take a detailed medical history. They will also carry out a thorough physical examination and look at any X-rays that may have been taken.

Medicare Part B covers physiotherapy sessions, but you are responsible for the Medicare Part B deductible and 20% coinsurance. Some private physiotherapy providers offer flexible payment plans and accept credit cards. However, it’s important to remember that Medicare considers it illegal for any provider to waive copayment fees. For this reason, it is vital that you check with your insurance company before receiving treatment to ensure you are aware of the cost of your care. This way you can avoid any surprises later on.

Geriatric physiotherapy helps older adults overcome common conditions like reduced muscle strength, balance, and coordination. It also addresses problems like pain, stiffness, and weakened bones.

Physiotherapy treatment modalities can include massage, heat or cold therapy, electrical currents (like TENS), and exercises to relieve pain, strengthen muscles, and improve mobility. Some physiotherapists use pools to help patients move more easily in warm water and exercise in a safe environment.

Medicare Supplement insurance, or Medigap, can cover a portion of your out-of-pocket costs for physiotherapy. Depending on your situation and how you became eligible for Medicare, there are up to 10 different Medigap plans: A, B, C, D, F, G, K, L, M, and N (plans in Massachusetts, Minnesota, and Wisconsin have different plan names). Each plan offers standardized benefits, but the cost—or premium—varies by company.

Most Medicare Supplement insurance plans are attained age-rated, which means the premium increases as you get older. It’s best to contact a licensed insurance agent for pricing and availability.

Medicare Advantage plans must offer the same benefits as Original Medicare, but some may vary in how they cover physiotherapy and other services. Check with your plan to see if physiotherapy is covered, and if so, how much you might be required to pay out of pocket per visit. Many people who need physiotherapy also enroll in Medicare Supplement insurance (Medigap) to help cover any out-of-pocket expenses.

Medicare Part B covers 80% of medically necessary outpatient physiotherapy costs after you meet the Part B deductible and pay 20% coinsurance. Previously, Medicare had a maximum limit on how much it would pay for outpatient physical therapy each year, but this cap was removed in 2018.

Physiotherapy can include certain exercises, massages and treatments based on physical stimuli like heat, cold, electrical currents or ultrasound. It can help relieve pain, strengthen weak muscles and teach you to manage your symptoms at home. It’s often used after surgery, or in cases of injury or chronic health conditions that impact mobility and balance. To know more about whether is physiotherapy covered by Medicare, visit the MVP Rehab Physiotherapy website or call 0450603234.

#physio bonnyrigg#doctor of physiotherapy#ndis physiotherapy providers#is physiotherapy covered by medicare#physiotherapy bonnyrigg#dr physio#ndis physiotherapy fees#medicare physiotherapy rebate

0 notes

Text

Your Guide for Moving to the UK from Australia — My Blog

Moving from Australia to the UK can be a big transition, but with proper preparation and planning, the process can be less stressful.