#Medicare Insurance

Explore tagged Tumblr posts

Text

🚨 - This Weeks Healthcare Cabinet Elections: The Real Impact on Medicare Beneficiaries and Unpacking the Inflation Reduction Act

#healthcare#medicare#cincinnati ohio#akron ohio#columbus ohio#cleveland ohio#ohio news#ohio#trump administration#trump#president trump#politics#robert f kennedy#cabinet#medicare insurance#medicare supplement plans#medicare plans#somewhere in ohio#medicare advantage#medicare advantage plans#prescription drugs#2024 elections#donald trump#trump vance#trump 2024#healthcare reform#health information#inflation reduction act#medicine#medicaid

7 notes

·

View notes

Text

Affordable Health Insurance

Health insurance is a type of insurance that helps cover the cost of medical expenses. It can be provided by an employer or purchased individually from an insurance company. Health insurance plans typically have different levels of coverage, ranging from basic to comprehensive, and they often come with different costs, such as premiums, deductibles, and co-pays.

Before signing up for a health insurance plan, it's important to understand your specific healthcare needs and budget. You should consider factors such as your age, health status, and any pre-existing conditions you may have. You should also research the various affordable health insurance plans available to you and compare their costs and benefits.

Some common types of health insurance plans include HMOs, PPOs, and EPOs. HMOs typically have lower out-of-pocket costs but limit you to a specific network of healthcare providers. PPOs offer more flexibility in choosing healthcare providers but may have higher out-of-pocket costs. EPOs are a hybrid of HMOs and PPOs, offering some of the benefits of both.

Ultimately, choosing the right health insurance plan for you and your family requires careful consideration and research. By understanding your healthcare needs and the different options available to you, you can make an informed decision that best meets your needs and budget.

#affordable health insurance#affordable health insurance in texas#affordable health insurance in California#affordable health insurance in Florida#insurance policy#insurance types#cover insurance#health care insurance#medicare insurance#medicare health insurance#health plan#insurance coverage#medicare dental#dental vision#dental health insurance#dental vision insurance

2 notes

·

View notes

Text

Health insurance is not a provider. It is a denier.

28K notes

·

View notes

Text

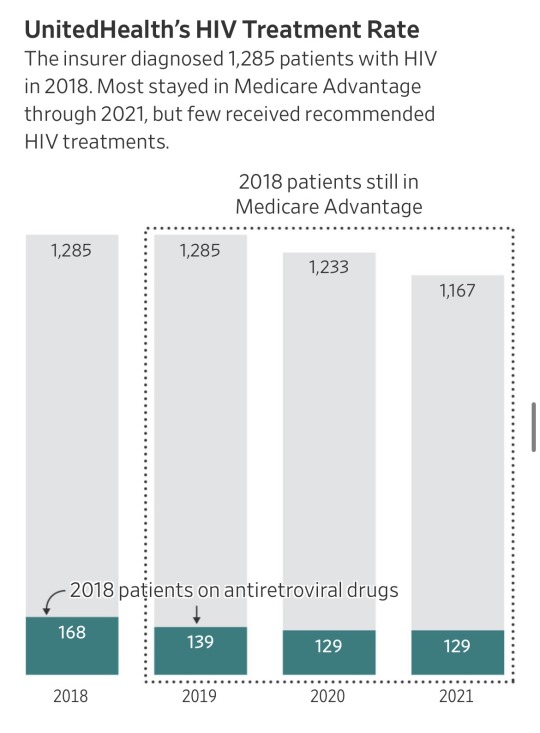

“It seems like almost all of those people don’t have HIV,” said Jennifer Kates, HIV policy director at KFF, a health-research nonprofit. “If they did, that would be substandard care at a pretty severe level,” she said.

Ya’ll. United Health just got accused of $17 billion in medicare fraud.

Basically they made up diagnosis which are improbable or impossible, “forgot” to remove ones which had been cured, and overall allegedly stole billions from taxpayers.

The government pays insurers a base rate for each Medicare Advantage member. The insurers are entitled to extra money when their patients are diagnosed with certain conditions that are costly to treat.

… About 18,000 Medicare Advantage recipients had insurer-driven diagnoses of HIV, the virus that causes AIDS, but weren’t receiving treatment for the virus from doctors, between 2018 and 2021, the data showed. Each HIV diagnosis generates about $3,000 a year in added payments to insurers.

… He said internal company data for 2022 showed a treatment rate for patients UnitedHealth diagnosed with HIV of more than triple what the Journal found. He said the pandemic disrupted care, lowering treatment rates during the period analyzed by the Journal, and that the analysis failed to account for patients who started treatments in future years.

The Medicare data, however, show UnitedHealth’s patients with insurer-driven HIV diagnoses were on the antiretrovirals at low rates even before the pandemic, and hardly any started the drugs in the years after UnitedHealth diagnosed them.

Source: https://www.wsj.com/health/healthcare/medicare-health-insurance-diagnosis-payments-b4d99a5d

I bet United Health really wishes it was a different week right now.

UPDATE/EDIT: Article is from July. I didn’t notice myself since it came up in my news feed. Don’t always trust the internet to be time accurate. 😎My guess is it is getting promoted due to current events. However, there are some updates concerning actions taken based on the report which you can look into by checking the authors’ other articles.

18K notes

·

View notes

Text

Martin Agency Inc

Established in 1908, Martin Agency Inc. is a full-service independent insurance agency dedicated to providing exceptional coverage solutions to Arkansas, Missouri, Tennessee, and Mississippi. Offering a wide range of insurance policies, including auto insurance, home insurance, poultry farm insurance, medicare insurance, and many more. Martin Agency prides itself on representing top-rated insurance companies. With a team of experienced and knowledgeable insurance agents, Martin Agency is committed to going above and beyond to help clients find customized insurance plans that align with their unique needs and budgets.

Address: 210 W Broadway St, Pocahontas, AR 72455, USA Phone: 870-892-5222 Website: https://www.martinagencyinc.com/

#Insurance Agency#Auto Insurance Agency#Home Insurance Agency#Poultry Farm Insurance#Medicare Insurance

0 notes

Text

इन्शुरन्स (बीमा) का महत्त्व: जयपुर टैंकर ब्लास्ट से सीखे गए सबक

हाल ही में जयपुर-अजमेर हाईवे पर हुए टैंकर ब्लास्ट ने हमें ज़िंदगी की अनिश्चितता का कड़वा सच दिखाया। ऐसे हादसे न सिर्फ भावनात्मक रूप से चोट पहुँचाते हैं, बल्कि भारी आर्थिक नुकसान भी करते हैं। हालाँकि हम ऐसे हादसों को पूरी तरह रोक नहीं सकते, लेकिन सही बीमा होना ऐसी परिस्थितियों में आर्थिक सुरक्षा और मानसिक शांति ज़रूर देता है। बीमा क्यों ज़रूरी है? बीमा आपकी खुशियाँ नहीं खरीद सकता, लेकिन इसकी…

#All About Automobiles#Automobiles#मेडिकल इंश्��ोरेंस#Insurance - All About#Insurance Learning#Insurance Underwriting#Medicare Insurance#My Infographic Post#Vehicle Insurance

0 notes

Text

UnitedHealth executive killed in Manhattan in targeted attack

UnitedHealth executive killed in Manhattan in targeted attack - https://www.reuters.com/world/us/unitedhealthcare-ceo-fatally-shot-ny-post-reports-2024-12-04/

https://www.reuters.com/world/us/unitedhealthcare-ceo-fatally-shot-ny-post-reports-2024-12-04/

Includes video with images of shooter.

#reuters#united healthcare#medical insurance#health insurance#american health system#american healthcare#medicare insurance

0 notes

Text

Why Add Medicare Insurance to Your Future Plans?

Being financially covered in critical times provides a sense of tranquility. Everyone needs a financial backup as the future is unpredictable. However, medicare insurance helps many people to cover medical bills when they face any health issue. Receiving medical security keeps a person stress-free from any concern related to health. Read more...

0 notes

Text

Life Insurance Services in Allentown PA

LP Insurance Group PA - Macungie provides expert life insurance services in Allentown PA, ensuring personalized coverage to meet your needs. We also specialize in Medicare Insurance Services, offering tailored solutions for comprehensive healthcare coverage. Trust us for reliable Life Insurance and Medicare Insurance plans in Allentown, PA.

1 note

·

View note

Text

Maximizing Medicare Insurance Leads: Strategies and Insights for The Live Lead

In the competitive landscape of Medicare insurance, acquiring high-quality leads is paramount for growth and success. At The Live Lead, we specialize in providing top-tier Medicare insurance leads to help your business thrive. In this blog, we'll delve into effective strategies to maximize your Medicare insurance leads and explore how partnering with The Live Lead can elevate your lead generation efforts.

Understanding the Importance of Medicare Insurance Leads

Medicare insurance is a vital service for millions of seniors across the United States. As the demand for Medicare plans increases, insurance providers face the challenge of connecting with potential clients. This is where high-quality Medicare insurance leads become crucial. These leads not only increase your client base but also enhance your business's credibility and revenue.

Key Strategies to Generate Medicare Insurance Leads

1. Targeted Marketing Campaigns

Effective lead generation begins with targeted marketing campaigns. Identifying and understanding your target audience is essential. Utilize demographic data to create campaigns that resonate with seniors eligible for Medicare. Tailoring your message to address their specific needs and concerns will increase engagement and lead conversion rates.

2. Content Marketing

Content marketing is a powerful tool for attracting and engaging potential leads. Create informative and valuable content that addresses common questions and concerns about Medicare. Blog posts, articles, and videos that explain the benefits, coverage options, and enrollment processes can establish your expertise and build trust with your audience.

3. Social Media Engagement

Social media platforms provide a direct line of communication with your target audience. Use platforms like Facebook, Twitter, and LinkedIn to share relevant content, engage with followers, and run targeted ad campaigns. Social media engagement helps you reach a broader audience and encourages potential leads to interact with your brand.

4. Email Marketing

Email marketing remains one of the most effective ways to nurture leads. Develop a comprehensive email marketing strategy that includes informative newsletters, personalized offers, and follow-up emails. Segment your email list based on factors like age, location, and preferences to deliver tailored content that resonates with each recipient.

5. Partnerships and Referrals

Building partnerships with healthcare providers, senior centers, and community organizations can expand your reach and credibility. Encourage satisfied clients to refer their friends and family to your services. Referral programs can incentivize clients to spread the word about your Medicare plans, generating high-quality leads through word-of-mouth.

6. Search Engine Optimization (SEO)

Optimizing your website for search engines is crucial for attracting organic traffic. Conduct keyword research to identify relevant terms potential clients are searching for, such as "Medicare plans," "Medicare enrollment," and "Medicare coverage options." Incorporate these keywords into your website content, blog posts, and meta descriptions to improve your search engine rankings and attract more leads.

7. Paid Advertising

Investing in paid advertising can yield significant returns by placing your brand in front of a targeted audience. Pay-per-click (PPC) advertising on platforms like Google Ads and social media can drive traffic to your website and generate leads. Create compelling ad copy and landing pages that encourage visitors to take action, such as filling out a contact form or requesting a consultation.

Why Choose The Live Lead for Medicare Insurance Leads?

At The Live Lead, we understand the nuances of the Medicare insurance market and the challenges providers face in lead generation. Here's why partnering with us can give your business a competitive edge:

1. High-Quality Leads

We pride ourselves on delivering high-quality Medicare insurance leads that are pre-qualified and ready to convert. Our rigorous lead verification process ensures that you receive leads genuinely interested in Medicare plans, increasing your chances of successful conversions.

2. Customized Lead Generation Solutions

Every business is unique, and so are its lead generation needs. We offer customized lead generation solutions tailored to your specific requirements. Whether you're looking for exclusive leads, shared leads, or real-time leads, we have the expertise to provide the best-fit solution for your business.

3. Advanced Technology and Data Analytics

Our advanced technology and data analytics capabilities allow us to identify and target the most promising leads. By leveraging data-driven insights, we optimize our lead generation strategies to deliver the best results for your business.

4. Dedicated Support

At The Live Lead, we are committed to your success. Our dedicated support team works closely with you to understand your goals, address any challenges, and ensure a seamless lead generation process. We are here to help you every step of the way.

5. Proven Track Record

With years of experience in the lead generation industry, we have a proven track record of helping Medicare insurance providers grow their client base. Our satisfied clients testify to the effectiveness of our lead generation services and the positive impact on their business.

0 notes

Text

🚨 - Understanding the “Biden Pill Policy”: An Informational Guide for Ohio Medicare Beneficiaries (Article Below) 👇

#Medicare #InflationReductionAct #Medicaid #Ohio #MedicarePartD #MedicareAdvantage #MedicareSupplement #Educational

#healthcare#akron ohio#medicare#cleveland ohio#cincinnati ohio#ohio#columbus ohio#ohio news#somewhere in ohio#medicare insurance#medicare supplement plans#medicare plans#medicare advantage#medicare advantage plans#medication#medicine#medicare part d#prescription drugs#health information#inflation reduction act#prescription medication#politics#education#health insurance#insurance#insurance broker#open enrollment#insurance agent#healthcare reform#healthcareseniors

1 note

·

View note

Text

turning 65 medicare leads

What is Medicare Medicare is a federal health insurance program primarily for people aged 65 and older, "turning 65 medicare leads" though it also covers certain younger individuals with disabilities. It consists of several parts, each covering different aspects of healthcare:

Medicare Part A: Covers hospital stays, skilled nursing facility care, hospice care, and some home health care.

Medicare Part B: Covers outpatient services, doctor visits, preventive care, and medical supplies.

Medicare Part C (Medicare Advantage): Plans offered by private insurance companies that combine Part A and Part B coverage, often with additional benefits like vision and dental.

Medicare Part D: Prescription drug coverage, offered through private insurance companies.

When and How to Enroll Initial Enrollment Period (IEP): This is the seven-month period that begins three months before the month you turn 65, includes the month you turn 65, and ends three months after that month. It’s crucial to enroll during this period to avoid potential penalties.

Special Enrollment Periods (SEP): If you have qualifying circumstances, such as continuing to work past 65 and having employer coverage, you may qualify for a Special Enrollment Period.

General Enrollment Period (GEP): If you miss your Initial Enrollment Period and do not qualify for a Special Enrollment Period, you can enroll during the General Enrollment Period, which runs from January 1 to March 31 each year, with coverage starting July 1.

Considerations for Choosing Coverage Medicare Advantage vs. Original Medicare: Medicare Advantage plans (Part C) offer an alternative to Original Medicare (Parts A and B). They often include prescription drug coverage and additional benefits, but restrict you to a network of providers. Original Medicare allows more flexibility in choosing healthcare providers but requires separate enrollment in Part D for prescription drug coverage.

Medigap Policies: Also known as Medicare Supplement Insurance, these policies help cover costs that Original Medicare doesn’t, such as copayments, coinsurance, and deductibles. They can provide financial security by limiting out-of-pocket expenses.

Understanding Costs Premiums: Most people do not pay a premium for Medicare Part A (if they or their spouse paid Medicare taxes while working). Part B and Part D premiums are based on income and can change annually.

Deductibles and Copayments: Both Original Medicare and Medicare Advantage have cost-sharing requirements, including deductibles, copayments, and coinsurance. Medigap policies can help cover these expenses.

Planning for the Future Reviewing Coverage Annually: Medicare plans can change annually, so it’s important to review your coverage options during the Annual Enrollment Period (October 15 to December 7) to ensure your plan still meets your needs.

Considering Long-Term Care: Medicare does not cover long-term care (custodial care), so you may want to consider long-term care insurance or Medicaid planning for potential future needs.

Conclusion Turning 65 and becoming eligible for Medicare is a significant milestone. Understanding the different parts of Medicare, " when and how to enroll, and the various coverage options available can help you make informed decisions about your healthcare. Whether you choose Original Medicare with or without a Medigap policy, or opt for a Medicare Advantage plan, careful planning and consideration of your healthcare needs and budget are key to ensuring you have the coverage you need as you enter this new phase of life."turning 65 medicare leads"

#best medi#medicare insurance leads#best medicare#medicare insurance#top medical tourism company in india#medical insurance in usa#medicare advantage plans

0 notes

Text

Health insurance inflicts more terror, pain, trauma, and suffering than we know.

If you had a seven year old who died because billionaires needed to be persuaded to give him life-saving care and they took too long, you would walk this Earth forever thinking of how your child suffered. For what? Shareholder profit?

Health insurance has to be phased out immediately and replaced with Medicare For All.

Health care good enough for Congress is good enough for all of The People.

6K notes

·

View notes

Text

Claeys Group Insurance Services Explains the Benefits of Using an Independent Agency when exploring Medicare Insurance

Consult with an Independent Agency for Help Navigating Medicare Coverage Options, like Claeys Group Insurance Services in Tyler, TX. Claeys Group Insurance recommends that new Medicare Beneficiaries researching coverage options reach out to an Independent Insurance Agency for best results. Working with an independent agency gives Medicare beneficiaries the peace of mind that they are receiving…

View On WordPress

1 note

·

View note

Text

Martin Agency Inc

Established in 1908, Martin Agency Inc. is a full-service independent insurance agency dedicated to providing exceptional coverage solutions to Arkansas, Missouri, Tennessee, and Mississippi. Offering a wide range of insurance policies, including auto insurance, home insurance, poultry farm insurance, medicare insurance, and many more. Martin Agency prides itself on representing top-rated insurance companies. With a team of experienced and knowledgeable insurance agents, Martin Agency is committed to going above and beyond to help clients find customized insurance plans that align with their unique needs and budgets.

Address: 210 W Broadway St, Pocahontas, AR 72455, USA Phone: 870-892-5222 Website: https://www.martinagencyinc.com/

#Insurance Agency#Auto Insurance Agency#Home Insurance Agency#Poultry Farm Insurance#Medicare Insurance

0 notes

Text

Welcome to Senior Healthcare Team Insurance Agency – your trusted family-owned national independent insurance agency. We specialise in helping seniors and their loved ones navigate Medicare Supplement insurance choices with unbiased assistance. Our goal is to provide peace of mind by simplifying the process and ensuring you secure quality, low-cost healthcare tailored to your needs and budget. Explore more at Senior Healthcare Team. Your retirement deserves the best care!

1 note

·

View note