#taxdeadline

Explore tagged Tumblr posts

Photo

Here’s what you might be up against (depending on your circumstances) if you missed the tax extension deadline this year: 1️⃣ Failure-to-File Penalty. The penalty rate is 5 percent of the unpaid tax per month, up to 25 percent (max). 2️⃣ Failure-to-Pay Penalty. This is charged at 0.5 percent of the unpaid tax per month, up to a maximum of 25 percent. 3️⃣ Interest on Penalties. This starts accumulating the day after your taxes become due, at 3 percent on top of the short-term rate. In extreme cases, the IRS may also impose additional penalties for egregious violations related to late tax filing, such as fraud or willful neglect. If that’s what you’re up against, we should absolutely have a conversation so you can prepare for the IRS’s response to that.

#TaxDeadline#TaxTips#IRS#Finance#TaxPlanning#TaxPenalties#FailureToFile#FailureToPay#AvoidTaxProblems#FinancialLiteracy#TaxSeason#MoneyManagement#TaxHelp#LateFiling#TaxAdvice#IRSResponse#UnderstandYourTaxes#TaxDeductions#TaxStrategy#InterestRates#TaxConsequences#KnowYourRights#FinancialEducation#PenaltyAwareness#FilingTaxes#TaxCompliance#FinancialWellness#WealthManagement#IRSConsequences#ConsultATaxPro

1 note

·

View note

Text

ITR Filing Last date Extended 15 November 2024

Important Tax Update! The CBDT has officially extended the deadline for filing income tax returns for the Assessment Year 2024-25 to November 15, 2024! This gives you additional time to submit your returns, so don’t miss out!

To ensure your tax filings are accurate and timely, it’s essential to consult a tax professional. Get expert guidance to navigate the tax filing process smoothly. If you have questions or need assistance, feel free to DM us—we’re here to help!

Visit our website for more information: taxring.com

#ITR#TaxUpdate#IncomeTax#TaxFiling#CBDT#TaxDeadline#FinanceTips#TaxConsultant#TaxAdvice#TaxSeason#FinancialPlanning#TaxReturn#TaxHelp#IncomeTaxReturn#TaxProfessional#2024TaxSeason#ExtendedITRDeadlineFor2024#IncomeTaxFilingDeadlineExtendedToNovember2024#LastDateForIncomeTaxReturnFiling#CBDTAnnouncementOnTaxFiling#ImportantTaxUpdateForAssessmentYear202425#HowToFileITRBeforeNovember15#TaxFilingHelpForIndividualsAndBusinesses#MaximizeYourTaxReturnsBeforeTheDeadline#ConsultTaxProfessionalsForFilingITR#UnderstandingTheNewTaxFilingDeadline#ITRSubmissionDeadlineNovember2024#EssentialTaxTipsForFilingReturns#WhatYouNeedToKnowAboutITR2024#AvoidPenaltiesWithTimelyTaxFiling

0 notes

Text

ITR Filing: All You Need to Know to Avoid Late Fees

The last date for filing your ITR is near, and waiting until the last minute can lead to errors, penalties, and missed deductions. Filing your ITR on time ensures compliance, helps secure refunds, and provides an accurate financial record. To meet the deadline stress-free, organize your income, investment, and deduction records today. Early preparation will help you avoid common mistakes and guarantee you get the most out of eligible deductions and credit

0 notes

Text

#truck2290#taxfiling#trucktax#taxseason#heavyvehicletax#2290online#Truck2290#Form2290#IRSDeadline#TaxDeadline#Truckers

0 notes

Text

Penalties for Missing the Form 2290 Deadline

Failing to file Form 2290 on time incurs a 4.5% monthly penalty on the unpaid HVUT, accumulating for up to five months. Additionally, if taxes aren’t paid when filing, there’s a 0.5% monthly penalty, plus 0.54% interest on the outstanding amount until fully paid. Timely filing and payment can help avoid these escalating charges.

#Form2290#TruckTax#IRSDeadline#Truckers#HeavyVehicleUseTax#HVUT#FileNow#TaxDeadline#Truck2290#2290Online

0 notes

Text

🚨 Reminder: The tax deadline is approaching!

📅 October 15th is the final date for Personal Tax Filers and C-Corporations to file their returns. ⏰ Don’t wait until the last minute— reach out now for assistance! 💼📊

0 notes

Text

🚨Reminder: The tax deadline is approaching!

📅 October 15th is the final date for Personal Tax Filers and C-Corporations to file their returns. ⏰ Don’t wait until the last minute—reach out now for assistance! 💼📊

#TaxDeadline#TaxFiling#TaxConsulting#TaxSeason#Accounting#TaxHelp#BusinessTax#PersonalTax#TaxAdvisor

0 notes

Text

Avoid AED 10,000 penalty! Register your business for corporate Tax now

Contact Us Today!

Visit us: https://lvsdxb.com/

Call us: Call us: (+971) 58 556 7272 | (+971) +971501427727

Mail us: [email protected]

#CorporateTax#TaxRegistration#AvoidPenalties#BusinessTax#UAECorporateTax#BusinessSetupUAE#TaxConsultancy#BusinessAdvice#CorporateCompliance#BusinessTaxUAE#UAEBusiness#TaxPlanning#TaxDeadline#TaxSavings#LeVamos#UAEEntrepreneurs#BusinessConsultants#SmallBusinessUAE#TaxServices#TaxFiling

0 notes

Text

Truckers face looming tax deadline

Operators of large trucks and buses must file their Form 2290 by Sept. 3.

0 notes

Text

What are some easy ways to save on income taxes this year?

#incometax#taxseason#taxrefund#taxtips#taxes#taxprep#financialplanning#charteredaccountant#taxhelp#personalfinance#accounting#taxdeadline#taxprofessional#entrepreneurtaxes#smallbusinesstaxes#investing#taxfiling#moneymanagement#financialliteracy#taxcalculator#taxdeductions#taxcredits#taxfree#taxplanning#wealthmanagement#financialfreedom#adulting#savemoneyontaxes#taxmythbuster#fica

0 notes

Text

Income Tax Return Filing for AY 2024-25

File Your ITR within due date in order to avoid penalty and to avail tax saving investment benefits under old tax regime. Order Now

#IncomeTax#TaxFiling#TaxSeason#ITR#ITRfiling#TaxReturn#TaxPayer#TaxCompliance#FinancialYear#TaxDeductions#TaxRefund#TaxPlanning#TaxBenefits#TaxSavings#Taxation#TaxDeadline

0 notes

Text

It's #TaxDay and the offical tax deadline! A reminder you have until end of the today to complete and submit your 2023 federal tax return or file for an extension.

Our Managing Partner, Paul Miller, CPA NYC is featured in U.S. News and World Report to share which states can file directly with the #IRS. Learn more: https://money.usnews.com/.../these-12-states-can-now-file...

#taxdeadline#taxseason#accountingservices#cpafirm#taxadvice#taxes#tax#cpa#accountant#cpa nyc#accountant nyc#best cpa firm#cpa firm nyc#accountant NYC#accountant Long Island

1 note

·

View note

Text

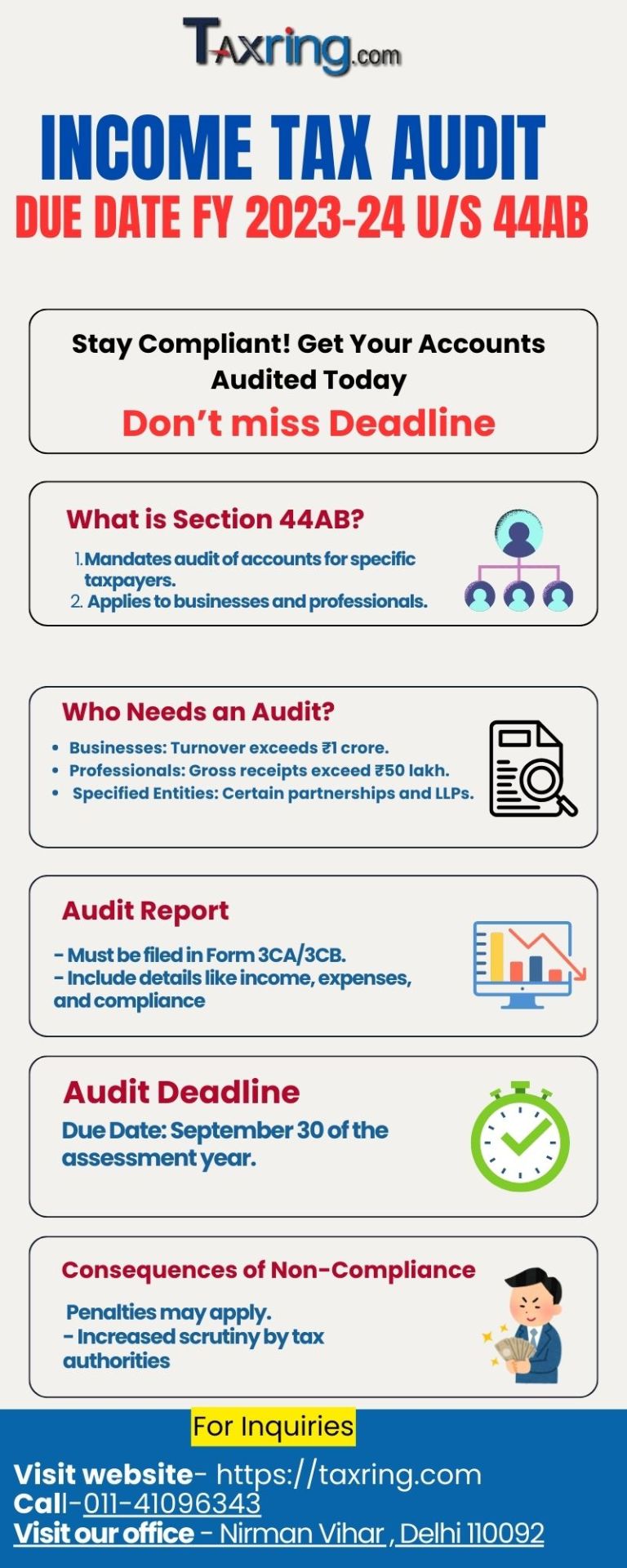

As the September 30 deadline approaches, it’s essential for taxpayers to understand the implications of late filing of tax audit reports. The penalties can be significant, and potential glitches on the ITR e-filing portal could further complicate matters. By taking proactive measures, staying informed, and ensuring timely submission, taxpayers can avoid unnecessary stress and penalties. For those needing assistance, consulting with tax professionals can be invaluable in navigating this complex process. why you need tax consultant

#income tax#tax audit#income tax audit#tax audit due date extension#tax audit due date#income tax audit fy 2024 25#tax audit last date for fy 2024 2025#income tax login#income tax return#tax refund#itr#TaxDeadline#FY2023-24#TaxFiling#AvoidPenalties#TaxProfessionals#TaxCompliance#BusinessTaxes#IndividualTaxes#TaxRegulations#FinancialPlanning#TaxTips#TaxHelp#AuditRequirements#IncomeTaxAudit#SeptemberDeadline#TaxAdvice#TaxSeason

0 notes

Text

Filing Your Income Tax Return Made Easy...

#Legalcy#Legalcyy#LegalcyPvtLtd#LegalcyPrivateLimited#incometax#taxreturn#taxseason#taxes#taxpreparation#taxhelp#taxtips#taxdeadline#taxrefund#taxfiling#taxprofessional#taxlaw#taxdeductions#taxplanning#taxservices#taxadvice#taxlawyer#taxaccountant#taxsavings#taxknowledge#incometaxreturn#incometaxupdates#tax#taxtime#facelessincometax#income

0 notes

Text

#Form2290#HeavyVehicleTax#TruckTax#TaxDeadline#Truckers#IRSForm2290#TruckDrivers#TaxCompliance#TruckFleet#TaxFiling

0 notes

Text

What to Do If You’ve Filed Late

If you’ve missed the Form 2290 deadline, file as soon as possible to minimize penalties and interest. Pay what you can to reduce late payment fees, and consider requesting penalty relief by providing a valid reason, such as illness or unexpected events, to the IRS. Taking these steps promptly can help lower the financial impact.

#Form2290#TruckTax#IRSDeadline#Truckers#HeavyVehicleUseTax#HVUT#FileNow#TaxDeadline#Truck2290#2290Online

0 notes