#taxknowledge

Explore tagged Tumblr posts

Text

Huge Announcement! Our Firm Express Tax Financial Group is now helping taxpayers get IRS tax relief! IRS problems are a very personal type of problem and people often do not know where to turn for help, especially during times like these.

Many people just live with their back tax problem for months and sometimes years, assuming that nothing can be done about it. It’s easy for good, hard-working Americans to fall behind. Providing IRS Tax help to South Atlanta & surrounding areas was a natural evolution for us at Express Tax Financial Group.

I have come across many people who have tried to handle their IRS situation themselves (or with their current CPA or person who prepared their taxes) but didn’t receive the relief they were seeking.

The professionals on our staff know the “ins and outs” of the tax system and can negotiate a personalized solution for you.

My firm now handles IRS representation services which include: Preparation of Unfiled Income Tax Returns, Penalty Reduction, Offers in Compromise, Payment Plans, Financial Hardship Plans, Wage Garnishment/Bank Levy Releases, Audits and IRS Appeals.

We’ll listen to your IRS difficulties in our office, or via zoom, in complete confidence at NO CHARGE. We’ll answer your questions, explain your options, and suggest solutions and provide you with a written estimate of our fees to permanently resolve your IRS difficulties. Send us a private message or check out our website at www.expresstaxrescue.com

2 notes

·

View notes

Text

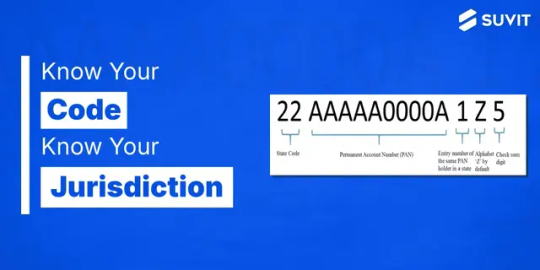

Your Essential 2025 Guide to GST State Codes and Jurisdiction

Understanding GST State Codes is crucial for seamless tax compliance in India.

What Are GST State Codes?

These are two-digit numerical identifiers assigned to each Indian state and union territory under the Goods and Services Tax system.

They form the first two digits of your 15-digit GSTIN, indicating the registration state. For example, Gujarat's code is 24, while Maharashtra's is 27.

Why Are They Important?

Accurate use of GST State Codes ensures:

Correct Tax Allocation: Taxes are directed to the appropriate state.

Smooth Compliance: Reduces errors in GST returns.

Efficient Inter-State Transactions: Mandatory for inter-state supplies.

How Are They Used?

GST State Codes are essential for:

GST Registration: Ensuring your business is registered in the correct state.

Invoice Generation: Calculating applicable tax liabilities.

Filing GST Returns: Determining where your business needs to file returns.

For a comprehensive list of GST State Codes and more detailed information, check out our full guide.

Stay compliant and ensure your business runs smoothly by mastering GST State Codes! 📊✅

0 notes

Text

Affordable Online Income Tax Courses for Professionals

Discover affordable online income tax courses designed for professionals looking to enhance their skills and stay updated on the latest tax regulations. These expert-led courses cover everything from tax preparation to compliance, offering flexibility and value. Perfect for accountants, financial advisors, or business owners aiming to manage taxes efficiently and boost their career prospects. Start learning today!

#IncomeTaxCourses#OnlineTaxTraining#AffordableLearning#TaxPreparation#ProfessionalDevelopment#TaxCompliance#FinancialEducation#CareerGrowth#TaxSkills#LearnTaxOnline#TaxProfessionals#FlexibleLearning#BoostYourCareer#OnlineEducation#TaxKnowledge

0 notes

Text

Quiz: What was the tax rate on the 1913 tax return?

#GuessTheAnswer#DidYouKnow#TriviaChallenge#HistoryOfTaxes#TaxKnowledge#TaxTalk#FinanceTrivia#MoneyMatters#SmartFinance#UnderstandTaxes#1913TaxRate#TaxHistory#HistoricalTaxes#IncomeTaxHistory#FirstIncomeTax#TaxTrivia#TaxQuiz#QuizTime#TestYourKnowledge#FunTaxFacts

0 notes

Text

Quiz: What administration imposed the highest tax rate?

#TaxTalk#MoneyMatters#FinanceTrivia#SmartFinance#UnderstandTaxes#GuessTheAnswer#DidYouKnow#TriviaTime#FunTaxFacts#TaxKnowledge#LearnAboutTaxes#TaxEducation#KnowYourTaxes#TaxSmart#FinancialLiteracy#TaxHistory#IncomeTaxRate#HistoricalTaxes#TaxMilestones#TaxPolicies#TaxTrivia#QuizTime#TriviaChallenge#TestYourKnowledge#TaxFacts

0 notes

Text

Want to avoid the IRS debt trap? Knowledge is power! My latest article breaks down the common causes of tax debt, so you can steer clear. Get smarter about your taxes ➡️

0 notes

Text

Understanding Property Taxes Before Buying: What You Should Know

Are you in the market for a new home? Congratulations! Buying a property is an exciting milestone in anyone's life. However, amidst all the excitement, it's crucial to be well-informed about the financial aspects, particularly property taxes. Understanding property taxes before making a purchase is essential for a smooth homeownership journey. In this comprehensive guide, we'll walk you through everything you need to know about property taxes and how they can impact your decision to buy.

What Are Property Taxes?

Property taxes are levied by local governments on real estate properties. These taxes are a significant source of revenue for municipalities and are used to fund essential services such as schools, roads, and public safety. The amount of property tax you owe is typically based on the assessed value of your property and the tax rate set by your local government.

Factors Influencing Property Taxes

Several factors can influence the amount of property taxes you'll pay:

Property Value: The assessed value of your property plays a crucial role in determining your property tax bill. Assessors determine this value based on various factors, including the size, location, and condition of the property.

Location: Property tax rates can vary significantly from one location to another. Different municipalities have different tax rates, and even within the same city or county, tax rates can vary based on the neighborhood or school district.

Tax Exemptions and Deductions: Some homeowners may qualify for tax exemptions or deductions that can lower their property tax bill. These exemptions may be available for seniors, veterans, individuals with disabilities, or properties used for certain purposes, such as agriculture or conservation.

Assessment Methods: The method used to assess property value can also impact property taxes. Some jurisdictions use market value assessment, while others may use a cost approach or income approach.

Importance of Researching Property Taxes

Before buying a property, it's essential to research the property taxes in the area thoroughly. Here's why:

Budgeting: Property taxes can significantly impact your monthly housing expenses. By understanding the property tax rates in different areas, you can budget accordingly and avoid any financial surprises after purchasing a home.

Affordability: High property taxes can make homeownership less affordable, especially for first-time buyers or those on a tight budget. By researching property taxes beforehand, you can make informed decisions about the affordability of a particular property.

Resale Value: Property taxes can affect the resale value of a home. Potential buyers may be deterred by high property taxes, so it's essential to consider this factor when evaluating the investment potential of a property.

How to Research Property Taxes

Researching property taxes is relatively straightforward and can be done using various online resources:

Local Government Websites: Many local government websites provide information on property tax rates, assessment methods, and exemptions. You can often find property tax calculators or lookup tools to estimate your potential tax bill.

Real Estate Websites: Some real estate websites also provide property tax information for listings. You can use these platforms to compare property tax rates in different neighborhoods or cities.

Tax Assessors' Offices: The tax assessor's office in your area can provide detailed information about how property taxes are calculated and assessed. You can contact them directly or visit their office for assistance.

Conclusion

In conclusion, understanding property taxes before buying a home is essential for any prospective homeowner. By researching property taxes in advance, you can budget effectively, assess the affordability of a property, and make informed decisions about your investment. Remember to consider factors such as property value, location, and tax exemptions when evaluating property taxes. If you have any questions or need assistance with understanding property taxes, don't hesitate to reach out to mysmartcousin for expert guidance. Happy house hunting!

0 notes

Text

Filing Your Income Tax Return Made Easy...

#Legalcy#Legalcyy#LegalcyPvtLtd#LegalcyPrivateLimited#incometax#taxreturn#taxseason#taxes#taxpreparation#taxhelp#taxtips#taxdeadline#taxrefund#taxfiling#taxprofessional#taxlaw#taxdeductions#taxplanning#taxservices#taxadvice#taxlawyer#taxaccountant#taxsavings#taxknowledge#incometaxreturn#incometaxupdates#tax#taxtime#facelessincometax#income

0 notes

Video

youtube

TDS ki कक्षा|Part 3|Interest, Fees, Penalty, Prosecution, Expense Disallowance under TDS|Income Tax

TDS ki कक्षा TDS Knowledge series Part 3 @cadeveshthakur #tds #incometax #cadeveshthakur #trending #viral TDS compliance and the consequences associated with it. In this video, we’ll explore various sections of the Income Tax Act related to TDS (Tax Deducted at Source) and discuss the implications for defaulting taxpayers. Here’s the content breakdown: 📌 Timestamps 📌 00:00 to 00:56 Introduction 00:57 to 02:46 Content Part3 02:47 to 03:54 Example 03:55 to 08:48 Assessee in default 08:49 to 11:00 example 11:01 to 17:07 late fees 17:08 to 23:40 interest 23:41 to 31:51 how to calculate interest & fees 31:52 to 37:00 penalties 37:01 to 38:30 prosecution 38:31 to 39:43 disallowance 1. Section 201: Assessee in Default o Explanation of what constitutes an “assessee in default.” o Consequences for failure to deduct or pay TDS. o Key points: Interest (Section 201(1A)): When a deductor fails to deduct tax at source or doesn’t deposit it to the Government’s account, they are deemed an assessee in default. They become liable to pay simple interest: 1% per month (or part of a month) on the amount of tax from the date it was deductible to the date of deduction. 5% per month (or part of a month) on the amount of tax from the date of deduction to the date of actual payment. Interest as Business Expenditure: Clarification that interest paid under Section 201(1A) cannot be claimed as a deductible business expenditure. Penalty (Section 221): If a person is deemed an assessee in default under Section 201(1), they are liable to pay penalty under Section 221 in addition to tax and interest under Section 201(1A). The penalty amount cannot exceed the tax in arrears. Reasonable Opportunity: The assessee has the right to be heard and prove that the default was for good and sufficient reason. 2. Section 234E: Late Fee for TDS/TCS Returns o Explanation of late fees for non-filing or late filing of TDS/TCS returns. o Due dates for filing TDS/TCS returns. o Late fee calculation: INR 200 per day until the default continues (not exceeding the TDS/TCS amount). o FAQs on Section 234E. 3. Section 276B: Prosecution for Failure to Deduct TDS o Overview of prosecution provisions for non-compliance with TDS obligations. 4. Disallowance of Expenses (Section 40(a)(i)/(ii)) o Explanation of disallowance of expenses if TDS is not deducted or paid. #youtubevideos #youtube #youtubeviralvideos #tdsfreecourse #freecourse #taxdeductedatsource #TDSCompliance #IncomeTax #TaxDeduction #TCSReturns #LateFiling #Penalty #BusinessExpenditure #TaxLiabilities #FinancialCompliance #TaxPenalties #TaxationLaws #AssesseeInDefault #InterestPayment #TaxProcedures #LegalObligations #TaxAwareness #TaxEducation #FinancialLiteracy #TaxPlanning #TaxConsultancy #TaxAdvisory #TaxProfessionals #TaxUpdates #TaxGuidance #TaxTips #TaxAccounting #TaxFiling #TaxReturns #TaxPolicies #TaxChallenges #TaxSolutions #TaxExperts #TaxCompliance #TaxAware #TaxMistakes #TaxConsequences #TaxPenalties #TaxKnowledge #TaxRules #TaxRegulations #TaxBestPractices #TaxManagement #TaxUpdates #TaxNews #TaxInsights #TaxGuidelines #TaxCode #TaxEnforcement #TaxEnforcementActions #TaxPenaltyProvisions #TaxPenaltyLaws #TaxPenaltyGuidance #TaxPenaltyExplained #TaxPenaltyFAQs #TaxPenaltyCompliance #TaxPenaltyAvoidance #TaxPenaltyMitigation #TaxPenaltyResolution #TaxPenaltyAdvice #TaxPenaltyConsulting #TaxPenaltyExperts #TaxPenaltyHelp #TaxPenaltyTips #TaxPenaltyEducation #TaxPenaltyAwareness #TaxPenaltyPrevention #TaxPenaltyManagement #TaxPenaltyStrategies #TaxPenaltyUpdates #TaxPenaltyNews For more detailed videos, below is the link for TDS ki कक्षा TDS Knowledge series https://www.youtube.com/playlist?list=PL1o9nc8dxF1RqxMactdpX3oUU2bSw8-_R

#youtube#what is tds#tax deducted at source#how to file tds return#how to issue tds certificate#tds due dates fy 2024-25#tds due dates fy 2023-24#tds free course#cadeveshthakur

0 notes

Text

Income Tax Deduction & Exemptions Explained

Understand income tax deductions and exemptions with Setupfilings. Our comprehensive guide provides clarity and helps you optimize your tax savings.

Read the article for complete information: https://setupfilings.com/learn/income-tax-deduction-exemption/

#IncomeTaxDeductions #TaxExemptions #TaxSavings #SetupFilings #TaxGuide #OptimizeTax #TaxPlanning #FinancialSavings #IncomeTaxTips #TaxKnowledge #FinancialClarity

0 notes

Text

Worried About Tax Complexities ?

Don't worry we got you covered...

we are always here to help into that.

for more details and consultation:

visit : www.taxwarrior.in

For Free Tax consultation contact - +91 7505864052

.

.

#finance #company #tax #myth #financeiro #financegoals #taxreturn #loanapproval #taxprofessional #taxreturns #companyregistration #startup #workplace #taxwarrior #taxsaving #family #taxknowledge #gstreturn #Incometaxnotice #reasonsofnotice #taxlaws #taxpayers #taxreturn #taxinformation #ITR #itrfiling

0 notes

Photo

In order to minimize the potential income tax burden of operating in numerous states, the federal government passed Public Law 86-272. This law can prevent a state from taxing businesses that operate within the state so long as the business satisfies certain strict requirements. Public Law 86-272 prevents states from imposing income taxes on businesses whose only activities in the state are restricted to the “mere solicitation” of sales of tangible personal property. So the law only applies to: 1. Net income taxes • It does not apply to gross receipts taxes (e.g. Ohio commercial activity tax, Texas margin tax, Washington B&O tax). • No application to withholding or other taxes • Does not affect an employer’s responsibility to withhold income tax, pay unemployment tax and disability insurance, and cover workers’ compensation. See e.g. VA Public Document 94-192. 2. Sales of tangible personal property • Sales of services and digital products are typically not covered 3. Limited to “mere solicitation” Wisconsin Dept. of Revenue v. William Wrigley, Jr. Co., 505 U.S. 214 (1992) #StephensBrosTaxService #SaveonTaxes #SmallBusiness #SelfEmployed #BusinessOwner #Taxpayer #TaxAdvice #TaxKnowledge #PublicLaw #Tangible #PersonalProperty #Unemployed #Employer #Sales #NetIncomeTax #Receipts #TaxBurden https://www.instagram.com/p/BvRvi_unTiF/?utm_source=ig_tumblr_share&igshid=1sbx76j4deevu

#stephensbrostaxservice#saveontaxes#smallbusiness#selfemployed#businessowner#taxpayer#taxadvice#taxknowledge#publiclaw#tangible#personalproperty#unemployed#employer#sales#netincometax#receipts#taxburden

0 notes

Text

Quiz: What was the first income tax rate?

#TaxTalk#MoneyMatters#FinanceTrivia#TaxTime#FinancialLiteracy#GuessTheAnswer#DidYouKnow#LearnAndEarn#SurprisingTaxFacts#TaxKnowledge#LearnAboutTaxes#TaxEducation#KnowYourHistory#TaxSmart#HistoryQuiz#TaxHistory#HistoricalTaxes#GovernmentPolicies#TaxFacts#PoliticalTrivia#TaxTrivia#FunTaxFacts#QuizTime#TestYourKnowledge#TriviaChallenge

0 notes

Text

Quiz: What was the first income tax rate?

#TaxTrivia#QuizTime#HistoryQuiz#TriviaChallenge#TestYourKnowledge#IncomeTaxFacts#TaxHistory#HistoricalTaxes#FirstTaxRate#TaxMilestones#GuessTheAnswer#DidYouKnow#TriviaTime#FunTaxFacts#TaxKnowledge

0 notes

Text

Want to Get Easy Bank Loan Approval ?

File Income Tax Return On Time. we are always here to help into that. for more details and consultation: visit : www.taxwarrior.in For Free Tax consultation contact - +91 7505864052 . . #finance#company#tax#myth#financeiro#financegoals#taxreturn#loanapproval#taxprofessional#taxreturns#companyregistration#startup#workplace#taxwarrior#taxsaving#family#taxknowledge#gstreturn#Incometaxnotice#reasonsofnotice#taxlaws#taxpayers#taxreturn#taxinformation#ITR#itrfiling

0 notes

Video

The Great Press Release Flip-Flop. . • Do persons who do not meet the filing threshold but have Social Security (or RRB) Income have to file in order to get the stimulus money? . • The IRS released a press release (IR 2020-61) on March 31st that said they would have to file: . • I am not typically required to file a tax return. Can I still receive my payment? . • Yes. People who typically do not file a tax return will need to file a simple tax return to receive an economic impact payment. . Low-income taxpayers, senior citizens, Social Security recipients, some veterans and individuals with disabilities who are otherwise not required to file a tax return will not owe tax. . #eachoneteachone #stephensbrostaxservice #knowyourworth #knowledgeispower #taxlaw #taxknowledge #entrepreneur #homeowner #pressrelease #taxstrategist #yosephstephens #socialsecurity #socialsecuritydisability #seniorcitizen #taxreturn #covid #newyork #newjersey #florida #pennsylvania https://www.instagram.com/p/B-oVcOEjxXB/?igshid=q2j9zbzh09uy

#eachoneteachone#stephensbrostaxservice#knowyourworth#knowledgeispower#taxlaw#taxknowledge#entrepreneur#homeowner#pressrelease#taxstrategist#yosephstephens#socialsecurity#socialsecuritydisability#seniorcitizen#taxreturn#covid#newyork#newjersey#florida#pennsylvania

0 notes