#tax strategies California

Explore tagged Tumblr posts

Text

Tax Planning In California For Individual

Explore essential strategies for individual tax planning in California. Understand how to minimize tax liabilities, utilize state-specific deductions, and take advantage of retirement savings options to maximize your financial benefits. Stay compliant with California's unique tax laws while optimizing your returns.

#California tax planning#tax strategies California#Tax deductions California#Tax savings tips California#Financial planning California#California tax law#Tax compliance California#nri wealth#financial planning#tax planning

0 notes

Text

Can Advanced Tax Planning Strategies California Help Me Save on Taxes?

When it comes to managing finances, taxes often feel like a daunting challenge. However, with advanced tax planning strategies California, you can minimize liabilities and maximize savings. Whether you're a business owner or an individual, these strategies provide tailored solutions to optimize your financial outcomes.

What Are Advanced Tax Planning Strategies?

Advanced tax planning strategies involve proactive and personalized approaches to tax management. Instead of waiting until the tax season to address liabilities, these strategies assess your financial situation year-round to uncover opportunities for deductions, credits, and exemptions.

For instance, a California resident might leverage tax-advantaged accounts, such as IRAs or HSAs, strategically plan charitable contributions, or restructure business operations to align with tax laws. These methods go beyond basic tax filing, ensuring that you pay only what you owe—no more, no less.

How Can Advanced Tax Planning Save You Money?

Tax planning isn’t just about compliance; it’s about strategy. By utilizing advanced tax planning strategies California, you can legally reduce taxable income and avoid penalties. Here's how:

Optimizing Deductions Many taxpayers overlook deductions they qualify for. Strategies like grouping medical expenses or accelerating certain payments can maximize deductible amounts.

Leveraging Tax Credits California offers various tax credits, including those for clean energy investments, education, and research and development. A proper plan ensures you claim every eligible credit.

Smart Income Timing Adjusting the timing of income and expenses can shift tax burdens to years when rates are more favorable.

Estate Planning If you’re managing significant assets, advanced tax planning helps protect wealth through trusts, gifts, and other legal instruments.

Why Work with Professionals?

The U.S. tax code is complex, and California's specific regulations add another layer of intricacy. Professional guidance ensures compliance and uncovers strategies you might miss. At Optimize Accounting Solutions, we specialize in creating customized plans tailored to your unique financial needs.

Our team stays updated with ever-changing tax laws, allowing us to recommend solutions that align with your goals. Whether you're an entrepreneur navigating business taxes or an individual seeking to reduce personal liabilities, our expertise can make a difference.

Conclusion: Save More with the Right Tax Strategy

In a state like California, where taxes are among the highest in the nation, effective planning is crucial. Advanced tax planning strategies aren’t just for the wealthy—they're for anyone looking to reduce their tax burden and retain more of their hard-earned money.

At Optimize Accounting Solutions, we’re committed to empowering you with actionable strategies that bring measurable results. Contact us today to explore how our expertise can help you save and thrive. Together, we’ll build a tax plan that aligns with your goals and keeps your financial future secure.

Optimize Accounting Solutions 39812 Mission Blvd #218, Fremont, CA 94539, United States (510) 574 8849 [email protected] https://maps.app.goo.gl/wNh21TTwJDLTzWjSA

0 notes

Text

Things Biden and the Democrats did, this week #20

May 24-31 2024

The EPA awards $900 million to school districts across the country to replace diesel fueled school buses with cleaner alternatives. The money will go to 530 school districts across nearly every state, DC, tribal community, and US territory. The funds will help replace 3,400 buses with cleaner alternatives, 92% of the new buses will be 100% green electric. This adds to the $3 billion the Biden administration has already spent to replace 8,500 school buses across 1,000 school districts in the last 2 years.

For the first time the federal government released guidelines for Voluntary Carbon Markets. Voluntary Carbon Markets are a system by which companies off set their carbon emissions by funding project to fight climate change like investing in wind or solar power. Critics have changed that companies are using them just for PR and their funding often goes to projects that would happen any ways thus not offsetting emissions. The new guidelines seek to insure integrity in the Carbon Markets and make sure they make a meaningful impact. It also pushes companies to address emissions first and use offsets only as a last resort.

The IRS announced it'll take its direct file program nationwide in 2025. In 2024 140,000 tax payers in 12 states used the direct file pilot program and the IRS now plans to bring it to all Americans next tax season. Right now the program is only for simple W-2 returns with no side income but the IRS has plans to expand it to more complex filings in the future. This is one of the many projects at the IRS being funded through President Biden's Inflation Reduction Act.

The White House announced steps to boost nuclear energy in America. Nuclear power in the single largest green energy source in the country accounting for 19% of America's total energy. Boosting Nuclear energy is a key part of the Biden administration's strategy to reach a carbon free electricity sector by 2035. The administration has invested in bring the Palisades nuclear plant in Michigan back on-line, and extending the life of Diablo Canyon in California. In addition the Military will be deploying new small modular nuclear reactors and microreactors to power its installations. The Administration is setting up a task force to help combat the delays and cost overruns that have often derailed new nuclear projects and the Administration is supporting two Gen III+ SMR demonstration projects to highlight the safety and efficiency of the next generation of nuclear power.

The Department of Agriculture announced $824 million in new funding to protect livestock health and combat H5N1. The funding will go toward early detection, vaccine research, and supporting farmers impacted. The USDA is also launching a nation wide Dairy Herd Status Pilot Program, hopefully this program will give us a live look at the health of America's dairy herd and help with early detection. The Biden Administration has reacted quickly and proactively to the early cases of H5N1 to make sure it doesn't spread to the human population and become another pandemic situation.

The White House announced a partnership with 21 states to help supercharge America's aging energy grid. Years of little to no investment in America's Infrastructure has left our energy grid lagging behind the 21st century tech. This partnership aims to squeeze all the energy we can out of our current system while we rush to update and modernize. Last month the administration announced a plan to lay 100,000 miles of new transmission lines over the next five years. The 21 states all with Democratic governors are Arizona, California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Jersey, New Mexico, New York, North Carolina, Oregon, Pennsylvania, Rhode Island, Washington, and Wisconsin.

The Department of Transportation announced $343 million to update 8 of America's oldest and busiest transportation stations for disability accessibility. These include the MBTA's the Green Line's light-rail B and C branches in Boston, Cleveland's Blue Line, New Orleans' St. Charles Streetcar route, and projects in San Francisco and New York City and other locations

The Department of interior announced two projects for water in Western states. $179 million for drought resilience projects in California and Utah and $242 million for expanding water access in California, Colorado and Washington. The projects should help support drinking water for 6.4 million people every year.

HUD announced $150 million for affordable housing for tribal communities. This adds to the over $1 billion dollars for tribal housing announced earlier in the month. Neil Whitegull of the Ho-Chunk Nation said at the announcement "I know a lot of times as Native Americans we've been here and we've seen people that have said, ‘Oh yeah, we'd like to help Indians.’ And they take a picture and they go away. We never see it, But there's been a commitment here, with the increase in funding, grants, and this administration that is bringing their folks out. And there's a real commitment, I think, to Native American tribes that we've never seen before."

Secretary of State Antony Blinken pledged $135 million to help Moldavia. Since the outbreak of Russia's war against neighboring Ukraine the US has given $774 million in aid to tiny Moldavia. Moldavia has long been dependent on Russian energy but thanks to US investment in the countries energy security Moldavia is breaking away from Russia and moving forward with EU membership.

The US and Guatemala launched the "Youth With Purpose” initiative. The initiative will be run through the Central America Service Corps, launched in 2022 by Vice President Harris the CASC is part of the Biden Administration's efforts to improve life in Central America. The Youth With Purpose program will train 25,000 young Guatemalans and connect with with service projects throughout the country.

Bonus: Today, May 31st 2024, is the last day of the Affordable Connectivity Program. The program helped 23 million Americans connect to the internet while saving them $30 to $75 dollars every month. Despite repeated calls from President Biden Republicans in Congress have refused to act to renew the program. The White House has worked with private companies to get them to agree to extend the savings to the end of 2024. The Biden Administration has invested $90 Billion high-speed internet investments. Such as $42.45 billion for Broadband Equity, Access, and Deployment, $1 billion for the The Middle Mile program laying 12,000 miles of regional fiber networks, and distributed nearly 30,000 connected devices to students and communities, including more than 3,600 through the Tribal Broadband Connectivity Program

#Thanks Biden#joe biden#us politics#politics#American politics#climate change#climate action#nuclear power#h5n1#accessibility#tribal communities#Moldavia#Guatemala#water#internet

1K notes

·

View notes

Text

What the 2024 election results made clear is that the Obama coalition is dead. If Democrats are to have any shot at reclaiming power, so too must be the niceties and mores of the Obama era.

Yes, Democrats must get mean – ruthlessly, bitterly mean. This is not to say, however, that they need merely to cast aside the former first lady’s once-famous, now-infamous messaging mantra. No, what I prescribe is not just a new approach to political discourse but a new theory of opposition party politics.

Trumpsim has corrupted America in many ways, but one of the most obvious is how voters now expect lawmakers and surrogates to be truly vicious cultural warriors for them. One can see manifestations of this in the congresswoman Nancy Mace’s deranged bullying of the congresswoman-elect Sarah McBride, the endless and deliberate mispronunciation of Kamala Harris’s first name, and the fact that Marjorie Taylor Greene is one of the top fundraisers in the House of Representatives.

This phenomenon also exists on the left. The coffers poured open for Jasmine Crockett following a tête-à-tête with the aforementioned Taylor Greene, during which Crockett mocked her colleague’s “bleach-blonde bad-built butch-body”. And one could argue the strongest period of the Harris-Walz campaign – at least in terms of Democratic enthusiasm – was during the “weird” and “couch” sagas of Brat summer.

As the commentator SE Cupp recently observed, “it doesn’t get said enough, but Trump’s enduring legacy will be convincing BOTH parties to lower the bar, and that possessing moral authority on anything is no longer a currency that matters”. Democrats can either bemoan the fact the fundamental rules of politics and discourse have changed or they can adapt to it. In the four years to come, emboldened voices on the right will work to expand the Overton window. Democrats’ reaction to this effort must not materialize as feigned – or earnest – injury and horror. Take the punch and return the favor.

This new, more muscular messaging strategy must be combined with a far more aggressive war footing in the halls of Congress.

The Democrat Adam Gray’s unseating of the Republican congressman John Duarte in California’s 13th congressional district cemented a nigh-historically tenuous situation for the House Republican party. Mike Johnson, the House speaker, will have only a 220-seat majority. However, Republicans are poised to lose three seats (if not more) as members resign to join the Trump administration. That will leave them with a majority of 217-seats, meaning Johnson can only afford to lose one member on major – and minor – votes.

The Republicans’ legislative to-do list is nothing to scoff at. In addition to renewing Trump’s first term tax cuts and possibly imposing hyper-controversial tariffs on various imports, Johnson will need to pass a bill to fund the government. Democrats must not help him.

Time and again congressional Democrats have swept in to save Republican leaders – and Republican voters – from their own lawmakers. This generosity must end. The Dems must bleed the Republican party of its political capital at every opportunity, even if it means the American people experience some pain. On a Bulwark podcast this week, the writer Jonathan V Last channeled Alan Moore’s iconic comic book anti-hero Rorschach to describe the mentality Democrats should adopt: “The politicians will look up and shout ‘save us,’ and I’ll look down, and whisper ‘no.’”

Yes, Democrats should make the next four years of Republican governance as grueling and painful as possible. Do not help them pass a budget (if Johnson, as Last playfully notes, offers up DC statehood as an incentive for cooperation, we can have another conversation). Do not vote for a single cabinet nominee – even those who qualify as “adults in the room” (sorry, Marco Rubio). Relatedly, do not hold back from highlighting all the darkest aspects of said nominees’ backgrounds – from former Fox host Pete Hegseth’s alleged sexual assault to Robert F Kennedy’s purported role in the deaths of dozens during a 2019 measles outbreak in American Samoa.

While on the Hill, casual comity is fine. Lawmakers should continue to break bread and imbibe brandy with one another. That is all to the good. But Democrats’ outdated impulse to prioritize good relationships with their conservative colleagues at all costs must end. Recall, many of these men and women have spent years valorizing a violent mob that sought to kill them. Comity for the sake of comity is, well, utter comedy.

On that note, there is no world in which Joe Biden and Harris attending the inauguration makes basic strategic sense. Such a move would only serve to undermine trust in a Democratic party brand that’s already on life support. Either Donald Trump is a fascist or he isn’t. There is no such thing as Schrödinger’s autocrat.

Liberals made the decision to compare the former and future commander-in-chief to Hitler. Rhetoric like that can’t be memory-holed. Thus, symbolically lauding the man’s re-ascension to power will not preserve the Democrats’ reputation as the “party of norms”. On the contrary, it will cement the growing sense – particularly after the pardon of Hunter Biden – that Dems traffic in lies and deceit with the same shamelessness as Republicans.

These strategic shifts – in messaging, in oppositional governance, and in observation of norms – will be difficult for some to swallow. After all, as Robert Frost often liked to observe, “a liberal is a man too broadminded to take his own side in a quarrel”. Democrats must get over themselves; far too much is at stake.

What gives me hope now

To the limited extent I’m optimistic about the next four years, my resolve is rooted in the fact that Trump’s incoming administration – and his Republican coalition more broadly – will probably prove to be more fractious and wracked with infighting than it was during his first term. As we saw following the “Doge” chief Vivek Ramaswamy’s deranged, 90’s sitcom-addled tirade about H-1B visas and the “mediocrity” of American culture, deep policy disagreements plague the current marriage of OG Maga and the Silicon Valley tech bro billionaire class.

Steve Bannon, even more recently, vowed to “take down” the “truly evil” Elon Musk and excise him like a cancer from Trump’s orbit. Throughout the president-elect’s last stay in the White House, intra-party conflict was largely drawn along old guard versus new guard lines. Trump has since turned the Republican into a cult of personality. As such, slavish loyalty to the king is the only coin of the realm – and there are now major competing policy interests among his yes-men. Couple this with the reality that Trump is a lame duck and party elites will constantly be jockeying to be viewed as the heir apparent, and his den of vipers may just consume itself.

59 notes

·

View notes

Text

Excerpt from this story from the New York Times:

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

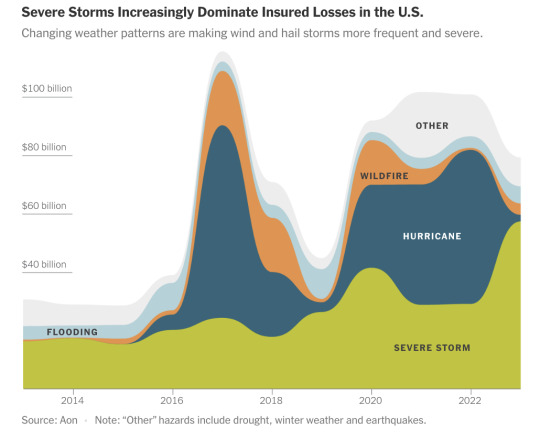

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

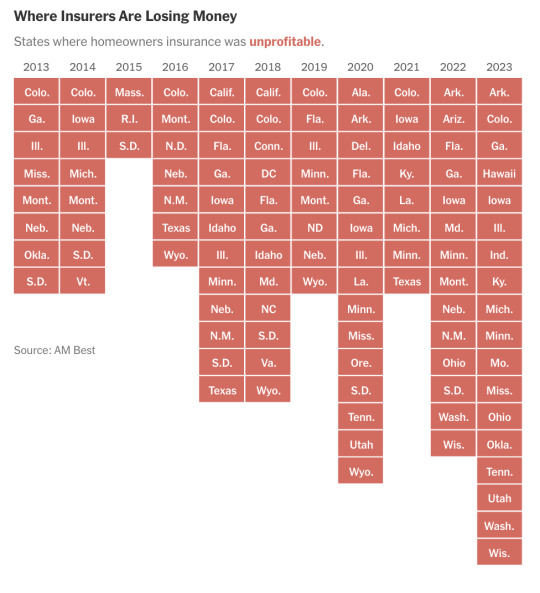

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes, according to census data, including at least 830,000 people who were displaced for six months or longer.

128 notes

·

View notes

Text

This image by Doug Mills NYT of today's new conference is really something.

(Amy Siskind)

* * * *

Special Counsel: "Trump would have been convicted."

January 14, 2025

Robert B. Hubbell

[Note: Due to the late release of the special counsel’s report, this newsletter is a bit disjointed. I wanted to publish on schedule despite the late-breaking news, so I ask your understanding for the seeming lack of organization.]

Last Saturday, I spoke to readers on a Substack livestream. My thesis was that the next week will be among the most challenging we will face as Americans who care about the rule of law.

We will witness a president-elect—who tried to overturn the Constitution in his prior term—swear that he will “preserve, protect and defend the Constitution of the United States”—words that will metastasize into a lie the moment he utters them. He will desecrate the Bible on which he places his hand.

The oath will be administered by a Chief Justice who granted the president-elect immunity from criminal liability, freeing Trump to ignore, attack, and undermine the Constitution.

We will watch confirmation hearings in which woefully unqualified nominees are hypocritically defended by a Republican Party that pays lip service to patriotism, law and order, and morality—except when it comes to GOP nominees credibly accused of rape, sexual assault, addictions, national security concerns, and promises to use the DOJ to exact vengeance on the president’s political opponents.

Those anticipated events are enough to make a rational person take to their bed and pull the covers over their head for the next four years. But it gets worse. Trump and MAGA are threatening to hold the victims of the Los Angeles wildfires as hostages to their efforts to raise the national debt limit (necessary to extend the 2017 tax cuts to billionaires and corporations). See Daily Beast, Republicans Float Holding California Fire Aid Hostage for Key Trump Policy.

It simply doesn’t get any more despicable than that. Every Republican who suggests that aid for victims should be conditioned on tax breaks for billionaires deserves their own circle in Dante’s Inferno.

Today’s newsletter touches on a fair number of stories that can be viewed as “bad news.” Readers sometimes tell me that they stop reading such newsletters. I get it. But I don’t make up the news; I just comment on it.

The advice that I gave to readers on Saturday is that they should adopt two strategies to remain engaged during rough times:

First, don’t collapse the future into the present moment. The future comes at us one day at a time. We will have time to deal with potential crises as they unfold. We don’t have to “fix” everything today. To be sure, we should plan, prepare, and strategize. But not everything we are worried about will materialize. We may successfully stop or delay threats from materializing.

Second, maintain “emotional distance” from bad news. Recognize that you can’t control most of what Trump says or does. Given that fact, recognize that unchanneled anxiety and fear will not change the outcome. Focus on what you can do to change, impede, obstruct, or reverse policies we oppose. I am not saying “Don’t care” or “Hide your feelings.” Feeling anxious or fearful is understandable and natural. But recognize that we have a professional responsibility as citizens to remain informed so we can be effective advocates for the rule of law.

Okay, with that longer-than-usual throat clearing, let’s look at the stories that came at us with high velocity and frequency on Monday.

Judge Cannon continues to act in a lawless manner by obstructing release of portion of Jack Smith reports

Judge Aileen Cannon continues to issue orders regarding the reports of special counsel Jack Smith. As to the portion of the report relating to Trump's unlawful retention of national defense documents, Cannon has slowed the release of that document—including to Congress. Her order permitted the release of the portion of the report relating to Trump's election interference—a case over which she has no jurisdiction.

See MSNBC, Jack Smith's report on Trump election interference set for release after Cannon order

By the time you read this newsletter, it is highly likely that a portion of Jack Smith’s report will have been posted on the DOJ website. If so, I will address that report in Tuesday evening’s newsletter.

Judge Cannon’s unrestrained, lawless assertion of jurisdiction over matters plainly beyond her constitutional authority is a scandal for the federal judiciary. At one point in her order issued on January 13, Cannon says she doesn’t understand why the report regarding the national defense documents needs to be released to Congress. Cannon knows full well that one of Trump's nominees under consideration by the Senate (Kash Patel) is mentioned in the special counsel report.

Her order denying the report to Congress is nothing less than an effort to interfere with the Senate’s constitutional duty of “advice and consent.” See Emptywheel on Substack, Aileen Cannon Interfering with Chuck Grassley and Dick Durbin's Constitutional Duty.

Both the 11th Circuit and the US Supreme Court are to blame for Cannon’s lawless actions—actions that undermine the faith of the American people in the third branch of government. Removal of Cannon from the cases (if not the bench) is long overdue.

UPDATE: Jack Smith’s report is released; says Trump would have been convicted

Per the NYTimes, Jack Smith’s report on Trump's election interference was released on Tuesday morning. See New York Times, Special Counsel Report Says Trump Would Have Been Convicted in Election Case. (Accessible to all.)

Per the Times, the report concluded:

The department’s view that the Constitution prohibits the continued indictment and prosecution of a president is categorical and does not turn on the gravity of the crimes charged, the strength of the government’s proof or the merits of the prosecution, which the office stands fully behind.

Indeed, but for Mr. Trump’s election and imminent return to the presidency, the office assessed that the admissible evidence was sufficient to obtain and sustain a conviction at trial.

Jack Smith’s reached the right conclusion—as is obvious to anyone who watched the January 6 insurrection and related coup unfold on live television.

Hearing on Hegseth nomination set for Tuesday

Despite his manifest unfitness, Pete Hegseth will sit for a confirmation hearing in the Senate on Tuesday. Hegseth lacks the experience and temperament to run a 2 million+ person organization. Hegseth has been accused of rape and sexual harassment. He has been accused of financial mismanagement. His chest is tattooed with symbols associated with Christian nationalists. He opposes women in combat positions in the military. He opposes diversity initiatives in the military.

Trump and his acolytes have turned support for Hegseth into a test of loyalty to Trump. See Intelligencer, Pete Hegseth Is a Test.

The FBI appears to have omitted important witnesses from Hegseth’s background check—including his former wives and the woman who told police in 2017 that Hegseth sexually assaulted her. See NBC News, Pete Hegseth's FBI background check doesn't include interviews with key women from his past.

Hegseth faces a long list of allegations of misconduct. See Mother Jones, A Running List of the Allegations Against Pete Hegseth – Mother Jones. We should expect Republicans to run interference for Hegseth while Democrats try to uncover the truth about Hegseth’s past.

[..]

Concluding Thoughts

January 20, 2025, is Martin Luther King Day. It is also Inauguration Day. I know that many readers will make plans to avoid watching the Inauguration. I know I will—because the Inauguration of Donald Trump will be a moment of national disgrace and desecration rather than an occasion for celebration of the peaceful transfer of power.

If you have other plans, I encourage you to keep them. But if you do not currently have other plans during the Inauguration, join me on a livestream on Substack. While I don’t have the program planned (because of the fires in LA), I intend—among other things—to read portions of Letter From Birmingham Jail and other appropriate documents. I am open to suggestions.

I can’t promise a glossy, high-value production. I can promise we will be together in community on a difficult day for everyone who holds America dear. Details to follow.

Stay strong! Talk to you tomorrow!

[Robert B. Hubbell Newsletter]

#TFG#circus barker#Amy Siskind#press conference#Robert B. Hubbell#Robert B. Hubbell Newsletter#incoming

20 notes

·

View notes

Text

FREE PALESTINE MOVEMENT FAILED

What Hasnt Worked

•Calling Congress members

•Calling Senator

•Signing online petitions

•Attending marches, protests & rallies

•Sharing, resharing, commenting posts online

•None of the above has led to an official arms embargo or permanent ceasefire agreement.

The Ongoing Genocidal Issue

•Per Lancet, 200k Palestinian civilians have been killed by Israel in the genocide since last October including over 40k children.

•Over 20k Palestinian children are missing with many of the missing children being trafficked into sex trafficking rings.

•Tens of thousands of Palestinian civilians remain buried under tons of rubble which will take years to clear.

•Forced starvation & famine perpetrated by Israel continues in Palestine with millions of Palestinians at risk of dying of starvation.

•Winter has arrived in Palestine & Palestinian civilians — including infants — are freezing to death in tents without electricity, heat and some are even without blankets in single digit temperatures.

•Multiple Palestinian infants — some only days old — have died of heart attacks due to the constant, severe, relentless, maniacal bombing by Israel.

•There are images & videos of injured, wounded & dying Palestinian civilians being devoured alive by dogs & cats who are themselves being starved by the genocidal Israeli occupational forces.

•The last functioning hospital in North Gaza — Kamal Adwan Hospital — was besieged by Israel two days ago.

•The doctors & patients at Kamal Adwan Hospital were forcibly evacuated — including critically ill patients on oxygen support & nebulizers.

•The patients at Kamal Adwan Hospital were told they would be evacuated to another hospital via ambulance.

•There have not been reports yet of what happened to the doctors at Kamal Adwan Hospital but the Director of the hospital has been detained.

•Israel did this to another Palestinian hospital only a few months ago — Al-Shifa Hospital.

•It is clear that the IOF will follow the same playbook with Kamal Adwan Hospital — the doctors will be detained, arrested, abused, & tortured — then some of the doctors will be killed & the remaining doctors will be released.

•The infants at Al-Shifa Hospital were left behind by the IOF and there were subsequent videos & images of the deceased infants decomposing corpses.

•It is obvious the same fate awaits the now forcibly evacuated doctors & patients from Kamal Adwan Hospital.

Effective Activism?

•What is effective beyond current BDS (Boycott Divest Sanctions) strategy targeting Chevron, AXA, Siemens, etc. — which has not yet worked?

•As Israels genocide continues unabated, unimpeded & continuously funded by & with weapons provided by the United States.

•Over a year into the onslaught, Israel continues to expand its genocidal aggression to include Occupied Palestinian Territory (OPT) — North Gaza, South Gaza, Rafah, West Bank, East Jerusalem; Lebanon; Syria; Yemen & Iran.

Suggested Actions

Action #1: Mass Strike

•Suggestion: A general strike in the United States where 3.5% of the working population or 11 million Americans strike.

•Action Item: Sign the general strike card:

https://generalstrikeus.com/strikecard?fbclid=PAZXh0bgNhZW0CMTEAAaYrjr4EPUbi7STRSXWejtl9t9axeG70svJcfMCLULy-4OvrHdOWS3EKUBk_aem_0wjAyUoBvXmGBEUR8rVtrA

Action #2: Suing US Government for Genocide

•Suggestion: US citizens in all 50 states follow Californias lead & file lawsuits against their respective state governments for providing “Israeli military aid to support the genocide in Gaza” which violated the constitutional rights of their constituents by using their taxes “for the unlawful purpose of complicity in genocide.”

•Action Item: Read the lawsuit below, track its progress & determine if you can file a similar lawsuit in your home state.

COURT: N.D. Cal.

TRACK DOCKET: No. 3:24-cv-09213 (Bloomberg Law subscription)

Where does pro-Palestine movement go from here?

•We have all been doing the same exact things for over a year with exactly zero results & extremely minimal “wins”(Maersk, cities divesting their bonds, etc.) — but no official arms embargo & no permanent ceasefire agreement.

•Hundreds of thousands of Palestinian civilians have been slaughtered, starved, literally scared to death via heart attack due to relentless bombing, shot at point blank range in the heart, head & stomach including children & infants, burned alive in tents, buried alive in mass graves, tortured in detention centers.

•Children & infants butchered, women murdered, men slaughtered, disabled & elderly civilians ran over by tanks…

•It isnt enough to share & reshare images & videos of the genocide, tweet your support for Palestine, call your Congress members & Senators, sign online petitions, attend rallies marches protests & die-ins — we have all been doing exactly this day in & day out for over a year yet there is STILL no official arms embargo & no permanent ceasefire agreement.

At a Year Plus — Whats Next?

•Along with continuing BDS (boycott divest sanction) efforts as they have been proven to work in the past against the apartheid government in South Africa in the 80s & 90s —

•Along with signing the strike card & striking if you economically & financially can —

•Along with researching the possibility of filing a lawsuit against your elected state officials in your individual state for voting for funding for Israel which violates our constitutional rights as United States constituents as it is using our tax payer dollars “for the unlawful purpose of complicity in genocide” —

Dont Just Reshare Videos — Think

•Lets also ask ourselves what else we can do in this moment beyond just resharing videos on Instagram & Twitter.

•We need to do everything in our power to bring about an official arms embargo & permanent ceasefire agreement.

What Can We Do?

•Share this post. Comment this post with your own ideas. Tag pro-Pali accounts in the comments.

No Complacency During Genocide

•Palestinian civilians continue to be burned alive, buried alive, shot at point blank range in the head heart & stomach, tortured, traumatized, starved to death, repeatedly forcibly evacuated, relentlessly bombed, endlessly humiliated, threatened, intimidated, coerced, gaslit, imprisoned, subjugated, repressed, cut into pieces, dismembered & literally devoured alive by starved dogs & cats.

•We cant allow ourselves to fall into a complacent repetitive lull of “watch reshare retweet wash rinse repeat”.

•What can we do to actually bring about an official arms embargo & permanent ceasefire agreement?

•We have “raised awareness” online, marched, protested, rallied, died in & birddogged — it hasnt worked.

•We need to do more.

•Comment. Share. Think!

•🇵🇸🇵🇸🇵🇸 🍉🍉🍉❤️🔥❤️🔥❤️🔥

#free palestine#palestine genocide#kamal adwan hospital#gaza strip#gaza#gaza genocide#gazaunderattack#north gaza#strike for palestine#general strike#bds movement#boycott israel#boycott divest sanction#keep boycotting#anti zionisim#zionistterror#zionsim is terrorism#genocide#palestinian genocide#israel is committing genocide#usa is funding genocide#anti capitalism#war machine#anti capitalist

26 notes

·

View notes

Text

Trumps territorial Ambition and Economic Strategy: How Greenland, the Panama Canal, Mexico, and Canada Could Reshape U.S. Power;

The United States is often celebrated for its culture of individualism, business innovation, and economic ambition. However, a less glamorous yet equally pivotal aspect of its rise to power has been its use of tariffs and territorial expansion. In the late 18th and 19th centuries, the U.S. was like a tech startup competing against industrial giants such as Britain, relying on tariffs to protect its fledgling industries and grow its economy.

Fast forward to the present, and the discussion about economic expansion has taken on new dimensions, with proposals like acquiring Greenland, controlling the Panama Canal, integrating Mexico and Canada, or using tariffs as a strategic tool. These ideas, while seemingly bold or even outlandish, echo historical strategies that shaped the U.S. into a global superpower. To understand the potential implications, let’s explore the economic and historical context of these proposals and how they might reshape the United States.

Tariffs: The Foundation of Early U.S. Economic Growth

Before the 20th century, tariffs were the backbone of the federal government’s revenue. From the late 18th century to the introduction of income taxes in 1913, tariffs funded as much as 90% of federal expenditures. For example, the Tariff of 1789 provided the young nation with critical revenue while protecting its nascent industries from foreign competition.

Tariffs not only paid for government operations but also supported domestic manufacturing. The Tariff of 1816, the first explicitly protective tariff, helped American industries compete with Britain’s advanced machinery. Similarly, the Morrill Tariff of 1861 raised rates to shield Northern industries during the Civil War. These policies underscored the importance of economic self-sufficiency and industrial development—principles that remain relevant in modern debates about economic strategy.

Greenland: Strategic and Economic Potential

Greenland, governed by Denmark, has long been of interest to the United States. During World War II, the U.S. established military bases there to monitor the Atlantic and protect Allied shipping routes. In 1946, the U.S. offered Denmark $100 million for Greenland, recognizing its strategic importance.

Today, Greenland’s value has only increased. Its vast reserves of rare earth minerals, essential for modern technologies, could reduce U.S. dependence on China for these critical resources. Additionally, as climate change opens new Arctic shipping lanes, Greenland’s location offers unparalleled geopolitical advantages. Acquiring Greenland could bolster U.S. economic and military influence in the Arctic, but such a move would likely face resistance from Denmark and the global community.

The Panama Canal: A Strategic Trade Asset

The Panama Canal, completed in 1914, revolutionized global trade by providing a shortcut between the Atlantic and Pacific Oceans. Originally controlled by the United States, the canal was handed over to Panama in 1999 under the Torrijos-Carter Treaties. During its time under U.S. control, the canal not only facilitated trade but also served as a strategic military asset.

Reclaiming control of the Panama Canal would give the U.S. significant leverage over international shipping. The canal handles approximately 5% of global trade, making it a vital artery of commerce. However, such a move would undoubtedly provoke geopolitical tensions, particularly with Panama and nations dependent on the canal for their trade routes.

Mexico: Economic Integration and Security

Mexico has historically been both a competitor and a partner to the United States. The U.S. annexed much of Mexico’s northern territory following the Mexican-American War in 1848, including present-day Texas, California, and Arizona. Today, Mexico is America’s largest trading partner under the USMCA (United States-Mexico-Canada Agreement).

Integrating Mexico more deeply into the U.S. economy or even considering annexation would have profound implications. Mexico’s manufacturing base, agricultural output, and workforce could provide significant economic benefits. However, it would also require addressing complex issues such as governance, social integration, and disparities in income and development levels. Historically, such large-scale integrations, like the annexation of Texas, have been contentious and politically fraught.

Canada: The 51st State?

Canada, with its vast resources, stable economy, and shared border, has always been a critical ally and trading partner for the U.S. During the War of 1812, American attempts to annex Canada were unsuccessful, and the relationship has since evolved into one of mutual cooperation.

Integrating Canada into the United States would provide unparalleled access to natural resources, including oil, natural gas, and freshwater. Canada’s advanced industries, from technology to healthcare, could strengthen the U.S. economy. However, such a move would face significant cultural and political resistance, as Canadians value their sovereignty and distinct identity. Historically, attempts to merge distinct nations under one government have proven challenging, as seen in the annexation of Hawaii or the Reconstruction-era South.

Historical Lessons and Modern Implications

Throughout U.S. history, territorial acquisitions and economic policies have been driven by the pursuit of growth and security. The Louisiana Purchase, Alaska acquisition, and annexation of Hawaii are examples of successful expansions that enhanced U.S. resources and global influence. However, these moves often came with significant challenges, including resistance from local populations and geopolitical tensions.

Proposals to acquire Greenland, control the Panama Canal, or integrate Mexico and Canada reflect similar ambitions but must be approached with caution. The global political landscape is more interconnected than ever, and such bold moves could provoke backlash from allies and rivals alike.

My concerns

The ideas of acquiring Greenland, controlling the Panama Canal, or integrating Mexico and Canada may seem ambitious, but they are not without precedent, especially with growing concerns of influence of external political players. However, History shows that the United States has consistently pursued strategies to strengthen its economy and global standing, whether through tariffs, territorial expansion, or economic integration. While these proposals carry risks, they also present opportunities to reshape the U.S. economy and its role in the world. The challenge lies in balancing ambition with pragmatism in a complex and interconnected global landscape.

#trump#donald trump#panama canal#canada#gulf of mexico#gulf of america#tariffs#be concerned#body expansion#greenland

6 notes

·

View notes

Text

Go ahead. Play the cat, trapped in a simulacrum, chasing the laser pointer around the house. The biggest story of 2024 will also be the biggest story of 2025: that we are perilously close to full-blown Technocracy. Hemingway famously quipped, “How did you go bankrupt? Two ways. Gradually, then suddenly.” Totalitarianism is like that. ⁃ Patrick Wood, Editor.

As the embers of 2024 spit out their dying sparks and tendrils of smoke corkscrew into 2025, I want to ask: what were the important news stories of this year?

Most people will say something international. The war in Ukraine, the atrocities in Gaza, the fall of Assad.

Maybe some will cite elections, it was a big year for voting after all. A global shift-change in the corridors of power saw a dozen governments swapped out for new faces, with 2 weeks of the year left it’s still possible Trudeau, Macron or Scholz may join the procession.

The tech minded might talk about advancements in Artificial Intelligence.

Those are the big stories of 2024. The banner headlines. Sound and fury and all that signifies. But were they the most important?

No, the important story of 2024 was The Great Reset.

Remember that? It was this pan-global supranational plan to tear down and then rebuild society in a “sustainable”, “inclusive”, “fair” and “secure” way that would – totally accidentally – eradicate civil liberties and individual freedom for every single person on the planet.

It was all the rage a few years ago, you might remember. But when it didn’t go over too well with a lot of people, the powers that be dropped the subject and there’s been very little talk about it since 2022.

Does that mean it’s gone away?

We need to have “object permanence” in politics as in all things. Something doesn’t cease to exist just because you can’t see it anymore. The world doesn’t vanish when you close your eyes.

The Great Reset is still the plan.

It’s still happening. It’s just distributed now. A compartmentalized strategy uploaded to the cloud, everywhere and nowhere. A million nanobots working a million angles to change a million tiny rules and build a million tiny cells.

Like the end of The Usual Suspects, stand the right distance back and you can see the pattern.

Just last week, the UK’s chief medical officer Chris Whitty published his annual health report. What does he recommend? Sin taxes on “unhealthy” foods and 15 minute cities. Labour have already increased “sin taxes” on sugar, salt, alcohol and tobacco. Next comes red meat, dairy and just “carbon” in general.

Earlier this year the UK introduced licensing for keeping chickens. They banned smoking too.

By 2035 it will be impossible to buy a new petrol car in the UK. Or the EU. Or Canada. Or New Zealand. Or Australia. Or Mexico. Or South Africa. Or California, and 11 other US states.

From that point you and your car will be anchored to charging points. Even better your new car will probably have automatic drive features, speed limiters – oh and remote kill switches.

This week, all of sudden, the news tells us that wood burning stoves cause cancer. A ban is already being discussed. Since coal is already a no-no for domestic users (since 2023), there effectively goes your last chance of energy and heat independence. If they ban stoves there will be no heating available to you that can’t be hooked up to a smart meter, surveilled, controlled.

Unless you count burning a candle inside a plant pot. And they’re coming for those too.

The much-publicised murder of Sara Sharif has already been parlayed into a new bill taking away parents “automatic right to homeschool their children” – if the state deems them “vulnerable”.

Digital IDs are coming for everyone from everywhere. Here’s just a selection of reasons –

To secure the border and ensure electoral integrity in the US.

To protect children on social media in Australia.

To promote efficiency in the EU.

To combat illegal immigration in the UK.

To track migrant workers in Russia.

Because they said so in China.

4 notes

·

View notes

Text

Hunter Biden’s Legal Collapse

Wall Street Journal April 5, 2024

By Kimberley A. Strassel

Here are two dates to add to those media timelines of upcoming courtroom drama: June 3 and 20. It won’t be Donald Trump in the dock on those days. It’ll be the other man whose legal woes are destined to feature in this election: Hunter Biden.

Those woes are serious, to read a federal judge’s ruling this week slapping down all eight of Hunter’s motions to dismiss the criminal tax charges against him. The ruling received minimal coverage, even though it began a countdown to two potential Hunter trials (the other for firearm offenses) as his father fights for re-election. Those trials will provide a counterpoint to Mr. Trump’s legal journey.

Joe Biden’s supporters will insist Hunter’s problems aren’t the president’s and are small potatoes next to allegations of conspiracy and obstruction against Mr. Trump. Yet voters like to equal out partisan scenarios, and Republicans have successfully nestled Hunter’s tax misbehavior in an unseemly tale of Joe’s influence peddling. Many Americans will simply view the coming judicial dramas as the Trump Trials on one hand, and the Biden Trials on the other.

If there is a notable difference, it’s that the Hunter cases contain no political upside, as the judge’s ruling clarified this week. Mr. Trump would surely prefer not to be under indictment, but he’s squeezing those lemons for all the lemonade he can make. Every courtroom appearance is a campaign event, every legal opinion a fundraising opportunity; every rally and social-media post contains dire warnings about witch hunts. Polls show a direct correlation between the intensity of the legal campaign against him and the support of his base. The left’s lawfare helped win him the nomination.

Where does Hunter stand, more than a year into his new, no-holds-barred legal approach? Until early 2023, the president’s son was pursuing a sober, below-the-radar legal defense. That changed with the hiring of the high-flying Abbe Lowell, who implemented a hyperpolitical strategy. The team fired off letters to law enforcement demanding investigations into Hunter’s critics, accused special counsel David Weiss of bringing a politically motivated prosecution, and embroiled Hunter in public standoffs with House committees investigating Biden family affairs. The clear goal was to present Hunter as victim of an unfair prosecution that was part of a GOP-inspired plot against the Bidens.

The media lapped it up, but there is no evidence that Hunter’s brassy PR campaign is changing any minds. Polls show little public sympathy for him, no doubt because the felony charges relate a story of a privileged political child who traded off his family name and blew loads of money on sports cars and adult entertainment. The evidence makes it difficult to suggest the prosecution is politically motivated. And a majority of Americans continue to believe Joe Biden was involved in Hunter’s affairs. Unlike Mr. Trump, Team Biden isn’t realizing any political benefit from the drama. If anything, the in-your-face strategy has backfired, serving mainly to elevate the Hunter story in a way that helps Republicans.

All the more so because it’s been a legal disaster. Hunter was on the verge of a wrist slap last summer, until his team questioned immunity provisions in a proposed plea deal and the agreement collapsed. He was subsequently charged with firearm offenses in Delaware and tax offenses in California.

Rather than plead guilty and negotiate, the Lowell legal team carried their flamboyant charges into a California courtroom, filing motions for dismissal on grounds of “selective and vindictive prosecution,” “appropriations clause” violations, “due process” and an argument that Mr. Weiss was unlawfully appointed.

Federal Judge Mark Scarsi this week used an 82-page opinion to remind the Hunter team that sound bites aren’t legal arguments. He efficiently dismantled and dismissed every motion. Yes, Mr. Weiss was duly appointed, and his office is lawfully funded. No, there is no evidence of animus against Hunter; the defense’s “motion is remarkable in that it fails to include a single declaration, exhibit, or request for judicial notice” that demonstrates vindictiveness, beyond media speculation. And there is certainly no reason to throw out the case on grounds that Republicans bragged about provoking the charges, since “politicians take credit for many things over which they have no power and have made no impact.” (Truer words were never written.)

The result: Barring surprises, Hunter begins his California trial on June 20. Judge Scarsi’s ruling could also serve as a template for Judge Maryellen Noreika, who will soon rule on a similar set of dismissal motions in her Delaware courtroom. Assuming she too throws them out, Hunter’s trial there begins June 3.

Mr. Trump’s trials could turn into a liability if he lands a felony conviction, which some of his supporters tell pollsters would be disqualifying. Meantime, Hunter’s indictments are cruising toward potentially messy ends come June—and with them a new GOP cudgel. Just one more reason Joe should have rethought that re-election bid.

9 notes

·

View notes

Text

Song was lead author of a 2023 Jama study examining private equity-owned hospitals. The research studied preventable injuries and illnesses in more than 662,000 hospitalizations at 51 private equity-backed hospitals. Researchers compared those hospital stays with 4.1m hospitalizations at 259 control hospitals. All of the data was derived from Medicare, the federal public health insurance program covering people older than 65 and the disabled. Researchers found a more than 25% increase in incidents such as falls and infections of central lines, tubes inserted near the heart to deliver medicine, fluids and nutrition. That happened even though private equity-backed hospitals tended to admit more socioeconomically advantaged patients. “We should be seeing fewer complications and yet we’re seeing an increase in complications,” said Song. Increased charges and billing, another well-documented strategy firms use to extract profit, are ultimately paid by “society as a whole”, because healthcare is primarily financed through taxes and wages foregone by employees who receive private insurance.

— Private equity’s role in US healthcare remains unchecked after California veto | The Guardian

2 notes

·

View notes

Text

In an Instagram story posted on Sunday, Representative Alexandria Ocasio-Cortez, a New York Democrat, blasted Green Party presidential candidate Jill Stein as "predatory" due to her multiple runs for the White House while struggling to grow the third party at the grassroots level.

In 2016, Stein played kingmaker in several key battleground states. Her vote total was higher than Donald Trump's margin of victory in Wisconsin, Pennsylvania and Michigan—prompting intense backlash from Democrats and political pundits. Not only was Stein widely condemned as a spoiler, but former Secretary of State Hillary Clinton, who was the Democratic nominee during the 2016 election, later accused her of being a "Russian asset."

Ocasio-Cortez accused Stein and the Green Party, which reached its current party status in 2001, for only putting its emphasis on presidential elections. To date, no Green Party candidate has ever held a federal office and only a handful have been elected as state legislators.

Ocasio-Cortez, responding to a question from an Instagram follower about Jill Stein's candidacy, said that "this is a little spicy, but I have thoughts."

"If you run for years in a row, and your party has not grown, has not added city council seats, down ballot seats and state electives, that's bad leadership. And that to me is what's upsetting," the congresswoman said about Stein.

Stein will be on the ballot in Arizona, California, Florida, Louisiana, Michigan, Minnesota, New Jersey, North Carolina, Ohio, Pennsylvania, Texas, Washington and West Virginia, according to Ballotpedia's most-recent update.

She will also be on the ballot in Montana, Utah, Nevada, Alaska, Arkansas, Wisconsin, Tennessee, Maine, Maryland and Missouri, Stein's campaign manager Jason Call previously told Newsweek.

Meanwhile, the Green Party is on the ballot in Mississippi, South Carolina and Hawaii.

The reason for why Stein is on the ballot in some states and the Green Party is on in others is because of ballot access procedures.

On its website, the Green Party states that "at least 144 [party members] hold elected office in 20 states across the United States as of February 15, 2024." The list includes Green Party members of local school, zoning and tax boards, as well as several city council members.

The New York Democrat said that Stein had been the Green Party's candidate for 12 years in a row. However, Howie Hawkins ran as the party's nominee in 2020.

"If you have been your party's nominee for 12 years in a row, and you cannot grow your movement, pretty much at all, and can't peruse any successful strategy...and all you do is show up every four years to speak to people who are justifiably pissed off, you're not serious. To me, it does not read as authentic, it reads as predatory. I'm sorry, I'm just saying it," Ocasio-Cortez said in her Instagram story.

She also asserted that she's not against third parties, overall, and that she has and will continue to endorse some third-party candidates, even against Democrats.

"What I have a problem with is, if you're running for president, you are the DeFacto leader of your party. I've been on record with criticisms of the two-party system. This is not about that," the congresswoman added.

A spokesperson for Stein referred Newsweek to the Green Party candidate's posts on X, formerly Twitter, in response to Ocasio-Cortez.

The Massachusetts native wrote in one post, "What's seriously predatory is pretending your candidate is 'working tirelessly for a ceasefire' [in Gaza] when in reality they're actively arming and funding genocide."

She wrote in a second post, "Democrats sue to kick us off ballots, hire operatives to infiltrate and sabotage us, lock us out of debates, fight ranked-choice voting, then act concerned that Greens have only won 1400 elections. So which party is authentic, and which is predatory?"

Newsweek emailed Ocasio-Cortez's office Sunday afternoon for comment.

The Democratic Party has gone through considerable legal efforts to challenge third parties from appearing on ballots.

Before independent candidate Robert F. Kennedy Jr. suspended his campaign and endorsed Trump, Democratic-funded lawsuits had successfully removed him from the ballot in New York and had tried and failed to remove him in North Carolina and New Jersey.

On Monday, the Wisconsin Supreme Court rejected an attempt by Democratic National Committee (DNC) official David Strange to knock Stein off the state's ballot this year.

Strange said that the Green Party should not be allowed to nominate presidential electors in Wisconsin because it does not have any state officeholders or legislative candidates to nominate these presidential electors. However, the court ruled that "the petitioner is not entitled to the relief he seeks."

Michael White, co-chair of the Wisconsin Green Party, said the complaint was a "mark of fear by the Democratic Party."

In her 2017 book, What Happened, Clinton wrote: "So in each state, there were more than enough Stein voters to swing the result."

Nationally, Stein received 1 percent of the vote in 2016, just under 1.5 million votes. In the 2020 election between Trump and Joe Biden, the Green Party's candidate, Hawkins, only received 0.2 percent of the popular vote.

When asked recently by Newsweek if she feared a similar backlash after Trump's 2016 victory when Clinton and many in the Democratic Party blamed her for taking crucial votes in several battleground states, Stein said those "smear or fear campaigns by the parties of Wall Street have never stopped."

"The exit polls showed the vast majority of our votes in 2016 were non-voters," Stein said, stating it is nonsense to claim her party took votes away from Clinton. "That campaign has never stopped and doesn't influence my thinking. My thinking is on the climate catastrophe, economic hardships and stopping endless wars."

In addition to Stein, Democratic presidential nominee Vice President Kamala Harris could also lose votes in key states to Cornel West, the "Justice for All Party" presidential candidate.

According to the Associated Press, a cohort of Republican strategists, attorneys, and supporters nationwide are striving to influence the upcoming November elections in a manner that potentially benefits Trump. Their objective is to bolster third-party candidates like West who present liberal voters with a different option that might divert support from Harris.

The funding source for this initiative remains ambiguous, but it holds substantial potential to alter outcomes in states that saw extremely narrow margins in the 2020 election won by Biden.

West's campaign has encouraged the effort. Last month, the academic told the AP that "American politics is highly gangster-like activity" and he "just wanted to get on that ballot."

Trump has offered praise for West, calling him "one of my favorite candidates." Of Stein, the former president favors her for the same reason.

"I like her very much. You know why? She takes 100 percent from them. He takes 100 percent," Trump has said.

#nunyas news#having choices is bad for democracy I guess#but only when it might take votes from my side#is that is alex

6 notes

·

View notes

Text

Choose your beer wisely

Even though both Heineken and Corona are foreign beer brands to the US, their expansion strategy and advertising campaign reflect divergent values. Modelo, the parent of Corona, has built its brand around partnership with distributors and consistency in the customer experience. With customers, Modelo chose to absorb additional Federal Excise Tax to maintain price accessibility. It could have followed its competitors to increase prices, since drinkers of imported beer are more affluent. Instead, it considers its position as the preferred imported beer among Hispanics – a group that has lower buying power than others. It also shows willingness to reinforce its identity as a Mexican brand but with US characteristics. It kept its long-neck bottle design and brewing entirely in Mexico yet adopted a non-returnable bottle packaging – a consumption behavior more consistent with US consumers. However, Corona initial advertising tagline on “Fun, Beach, Sun” was insufficient in building a strong brand. The tagline had uneven relatability across US consumers located in beach-deprived locations. Very little in its advertising campaign became a moat when safety and health rumors circulated.

Heineken on the other hand adopted a relatively hostile market penetration strategy. It was less responsive to distributors, less friendly to customers. Instead of playing up its product qualities, Heineken put down its competitors as a “faddish phenomenon”. For example, Heineken described Corona as “a quirky little alternative beer in Texas and California”. Heineken messaging almost came across as “either you are with us or against us” and risks alienating customers of its competitor brands. It also put distributors in a difficult spot, especially if distributers were serving both Heineken and its competitors. With little goodwill built up among stakeholders, Heineken risks brand erosion in the event of a scandal.

#MITSloanBranding2024B #corona #heineken #brand

2 notes

·

View notes

Text

It’s been one of the wettest years in California since records began. From October 2022 to March 2023, the state was blasted by 31 atmospheric rivers—colossal bands of water vapor that form above the Pacific and become firehoses when they reach the West Coast. What surprised climate scientists wasn’t the number of storms, but their strength and rat-a-tat frequency. The downpours shocked a water system that had just experienced the driest three years in recorded state history, causing floods, mass evacuations, and at least 22 deaths.

Swinging between wet and dry extremes is typical for California, but last winter’s rain, potentially intensified by climate change, was almost unmanageable. Add to that the arrival of El Niño, and more extreme weather looks likely for the state. This is going to make life very difficult for the dam operators tasked with capturing and controlling much of the state’s water.

Like most of the world’s 58,700 large dams, those in California were built for yesterday’s more stable climate patterns. But as climate change taxes the world’s water systems—affecting rainfall, snowmelt, and evaporation—it’s getting tough to predict how much water gets to a dam, and when. Dams are increasingly either water-starved, unable to maintain supplies of power and water for their communities, or overwhelmed and forced to release more water than desired—risking flooding downstream.

But at one major dam in Northern California, operators have been demonstrating how to not just weather these erratic and intense storms, but capitalize on them. Management crews at New Bullards Bar, built in 1970, entered last winter armed with new forecasting tools that gave unprecedented insight into the size and strength of the coming storms—allowing them to strategize how to handle the rain.

First, they let the rains refill their reservoir, a typical move after a long drought. Then, as more storms formed at sea, they made the tough choice to release some of this precious hoard through their hydropower turbines, confident that more rain was coming. “I felt a little nervous at first,” says John James, director of resource planning at Yuba Water Agency in northern California. Fresh showers soon validated the move. New Bullards Bar ended winter with plumped water supplies, a 150 percent boost in power generation, and a clean safety record. The strategy offers a glimpse of how better forecasting can allow hydropower to adapt to the climate age.

Modeling studies have long suggested that better weather forecasts would be invaluable for dam managers. Now this is being confirmed in real life. New Bullards Bar is one of a half-dozen pilot sites teaming up with the US Army Corps of Engineers to test how cutting-edge forecasting can be used to optimize operations in the real world. Early tests of the methods, called forecast-informed reservoir operations, have given operators the confidence to hold 5-20 percent reserve margins beyond their reservoirs’ typical capacity, says Cary Talbot, who heads the initiative for the Army Corps.

To Talbot, FIRO could mean a paradigm shift in how the Corps and others run dams. Historically, dam operators under the Army Corps umbrella had to ignore weather forecasts and respond only to rain and snow that was already on the ground. This rule traces back to the notorious capriciousness of traditional forecasts: If an operator takes a bad gamble on a forecasted weather event, the results can be dangerous. But in practice, this forces operators to react later than their gut tells them to, says Riley Post, a University of Iowa researcher who spent over a decade as a hydraulic engineer for the Corps. They might, for example, be expected to hold water in a nearly full reservoir even as heavy rains approach.

Recent developments, however, have sharpened the trustworthiness of forecasts, particularly for atmospheric rivers on the West Coast. Leaps in computing power have enabled ever-more-muscular climate and weather modeling. To pump these models with data, scientists led by the Scripps Institution of Oceanography have since 2016 launched reconnaissance flights over atmospheric rivers of interest, where they release dozens of dropsondes, sensor packs shaped like Pringles cans. The result is a detailed profile of a storm’s strength, size, and intentions, which can then feed into FIRO.

These reports aren’t clairvoyant; all weather forecasts involve a measure of uncertainty. But a dam operator with increased confidence in when, where, and how much water will strike their watershed can take a more “surgical” approach to holding or releasing water, Post says.

And if they know how much time they have, they can also make the most of their existing water. Take Prado Dam, a vintage 1941 facility that was built to shield Orange County from flooding but can also distribute water to 25 groundwater-recharge stations. This past winter, forecasts showed a well-spaced parade of storms tracking its way. So operators pulsed water from the dam into storage at an optimal cadence, giving it time to soak into the landscape. Adam Hutchinson of the Orange County Water District, which manages the groundwater-recharge system, said publicly in July that these actions delivered an “exceptional” boost to water supplies for “those dry years we know are coming.”

Jinsun Lim is an analyst with the International Energy Agency think tank who studies climate resilience in the energy sector. Lim says that this sort of specificity is exactly what hydro officials in many countries wish for: tools that can translate climate impacts at a local level for their unique watersheds and infrastructure. Talbot hasn’t seen anything quite like FIRO deployed abroad, but he says that curious parties from the UK, Chile, Southeast Asia, Australia, and other regions have contacted him. Meanwhile, other corners of the hydro world are applying similar logic to their own climate challenges.

For BC Hydro, which serves 95 percent of British Columbia’s population, heat waves have proven a bigger problem than drought. Rivers and rains remain strong, but the province’s historically mellow springs and summers have warmed up, prompting many people to switch on air conditioners, which jacks up power demand. To keep the ACs humming, BC Hydro keeps a close eye on its fuel supply, that is, its watershed. About 150 monitoring stations, equipped with snow, climate, and surface-water sensors, enable a near-real-time picture of water flows. This helps operators store up water for demand spikes in summer and winter alike.

Tajikistan, which gets fully 98 percent of its power from hydroelectricity, is adapting its fleet with a mix of hard and soft measures. Renovations at the 126-megawatt Quairokkum power plant, built in 1956, were screened against a range of climate scenarios—such as the diminution of its source glaciers. Just replacing its six Soviet-era turbines will hike output to 170 megawatts; the dam will also be reinforced for a 10,000-year flood whose intensity could exceed the previous design standard by anywhere from 15 to 70 percent. Meanwhile, investments by international funders in HydroMet, the country’s long-dysfunctional meteorology service, are paying off: The agency recently gave power generators early notice of a dry year, enabling forward planning.

Recent trends have underlined the need for such changes. Earlier this year, the International Energy Agency said today’s hydropower facilities are on average 2 percent less productive than dams were from 1990 to 2016. Droughts have weakened flows at many plants, the agency said, leaving fossil-based energy to fill a gap the size of Spain’s annual power use. Other dams have been exposed to extreme events for which they weren’t strictly engineered, as in north India in 2021, when a crumbling glacier sent forth a wall of water that wrecked dams and towns downstream. Last month’s disaster in Libya, due to the failure of two flood-control dams hit by a supersized Mediterranean storm, further underlines the risks of maladapted facilities.

Even hydropower’s harshest critics take no issue with nip-and-tuck improvements at today’s dams. But amid a massive expansion planned in the Global South, they warn against overconfidence that hydropower can adapt its way out of climate change. In July, an environmental group in Namibia urged the government to rethink a large dam proposed for the Kunene River, saying it’s prone to the same climate extremes that have sapped the energy of Namibia’s other dams.

As climate disruption sets in, solar and wind can provide equivalent power with less risk, says Josh Klemm, co-executive director of International Rivers, a human rights organization focused on river communities. “We need to really reexamine plans to develop new hydropower,” he says. “We’re only going to deepen our reliance on a climate-vulnerable energy source.”

The Army Corps, meanwhile, is in the early stages of studying whether FIRO can be attempted at 419 other dams under its umbrella. Scaling up FIRO isn’t entirely straightforward; other parts of the US have different kinds of precipitation events than California does, and some of these are currently a lot harder to predict than atmospheric rivers. But Talbot is optimistic that the ever-improving forecast science can find efficiency gains there for the taking. “It’s making your existing infrastructure work harder for you,” he said. “In the face of climate change, this sounds like a great way to position ourselves for buffering that.”

35 notes

·

View notes

Text

From The Nature Conservancy:

Thirteen state and local ballot initiatives related to climate and conservation, totaling more than $18 billion, that The Nature Conservancy engaged in were approved by voters in the United States yesterday. “When the issue of conservation and climate is highlighted and elevated on the ballot, we find time and again that voters overwhelmingly support these initiatives,” said TNC’s Senior Director of Strategy Adam Snyder. “This year is no different, with 66% of voters supporting conservation and climate proposals.”

California: $10 billion climate bond that funds climate resilience, protecting clean drinking water and preventing catastrophic wildfires. Read TNCs statement here.

Washington: An effort to roll back the state's Climate Commitment Act was defeated. The CCA provides millions for conservation, climate and wildfire funding, including funding for Tribal nations and at-risk communities.

Minnesota: Renewal of the Environment and Natural Resources Trust Fund for another 25 years. The fund will provide $2 billion ($80 million per year from state lottery proceeds) to protect water, land and wildlife across the state. Read the statement here.

Suffolk County, N.Y.: Voters approved a ballot measure that will generate $6 billion for clean water and conservation over the next 30 years.

Colorado: Remove the cap for water funding from an existing tax on sports gaming revenue, which will generate an additional $2 to $5 million.

Dupage, Kane, McHenry and Lake counties, Ill.: More than $500 million for conservation and forest preserve districts to buy land, maintain existing public places and improve public recreation opportunities.

Jasper County, S.C.: A sales tax for transportation, which includes a greenbelt component for land conservation that totals $94 million over the life of the program.

Louisiana: Directing federal revenues received by the state from energy production (such as wind, solar, tidal, wave and other alternative or renewable energy sources) to the Coastal Protection and Restoration Fund.

Maine: A $30 million bond that will fund a four-year grant program aimed at enhancing and expanding the state’s trail networks.

Rhode Island: A $53 million environmental bond that will fund a variety of programs, including open space and parks, coastal resilience, forest management and restoration, farmland protection, brownfield reclamation and upgrading a port facility to support offshore wind development.

43 notes

·

View notes

Text

Selling Your Home During a Divorce in Oakland, CA: What You Need to Know

Introduction

Going through a divorce can be one of the most emotionally challenging times in anyone’s life. If you're reading this, you are likely grappling with a decision that many divorcing homeowners face: what to do with the house. The idea of selling your home during such an emotional period might feel overwhelming. You might have concerns about timing, financial implications, and how this decision will impact your future. You’re likely looking for clarity on how the divorce process affects the sale of a home, and what steps you need to take to ensure that selling your home is done smoothly, fairly, and profitably. Most importantly, you're probably wondering how working with an experienced real estate agent can simplify this process and help you avoid costly mistakes. In this post, we’ll guide you through everything you need to know to make an informed decision.

Understanding the Financial Implications of Selling Your Home During Divorce in Oakland, CA

When you sell your home during a divorce in Oakland, CA, understanding the financial implications is crucial. Divorce settlements often require splitting assets, including the proceeds from the sale of your home. This can create tension, particularly if you and your spouse cannot agree on the selling price, how to divide the proceeds, or even whether to sell at all.

In Oakland, where home prices have been on a steady rise, the sale of a home can lead to significant profits. According to recent data, the median home price in Oakland is around $800,000, but this figure can vary depending on location and property condition. The higher the sale price, the more complex the division of proceeds becomes. If the home sells for $800,000, each spouse could be entitled to $400,000 (if divided evenly), but that's before accounting for taxes, outstanding mortgages, repairs, and fees.