#tax help

Explore tagged Tumblr posts

Text

2 notes

·

View notes

Text

Taxes 2024: glass's quick and gritty guide to free filing those bitches

By god I hate doing my taxes but what I hate more is paying money for someone to do them for me.

Here's the thing. If taking your W2s and property taxes to someone with the training and paying them $70 makes you feel better. Do it. BUT if you're stubborn and bitchy, you CAN do it yourself and if you're reading this post I'm going to make the assumption that your AGI is less than $79000 and therefore you qualify for free file. (and if you don't know what an AGI is then yes, you qualify).

It's honestly going to be okay. We will get through it together.

This guide is not going to be thorough, and while I will try to answer questions if you ask them, I'm not an expert: my knowledge comes from filing my own taxes for the fourth (fifth?) year in a row using the free file program and going through a number of life changes that I have to reflect on my taxes.

The post includes a link and screenshots. I will describe the bare minimum information of the images in Alt Text, but will not fully transcribe the full text as all the images will be from the IRS website which has accessibility options.

Here we go:

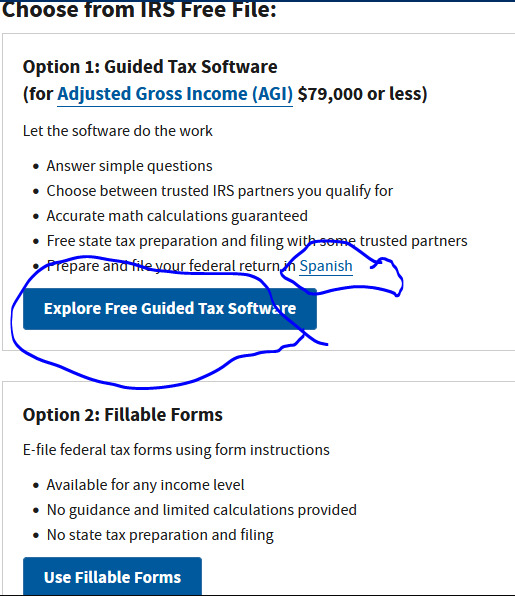

I want you to go to this page and then chose the first big blue button (unless you want it all in Spanish, then click on Spanish and I'll pray for you that it's all the same process)

If you are a brave, brave soul then take the fillable forms and be free, my children. I cannot help you there.

BUT if you chose the guided software options it's going to take you to these options

You may chose to browse options on your own. This does feel somewhat choose-your-own-adventure and I'm not your mother or your boss. HOWEVER. I implore you to take the guidance as far as you can. Chose the big blue button that says "Find Your Trusted Partner(s)" (very polycurious, if I may say).

This survey is meant to be straightforward. There is a little blue questionmark that opens to explain the filing statuses very clearly and in detail. Chose the right status for you, then some other questions will show up. Answer the questions that come up (again, this general page should be info that is straightforward. most of us should be able to answer the general questions with just what's in our heads), then click next when the questions are done.

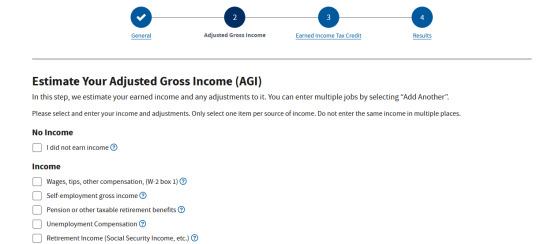

Now, you will need to know your income for this page, which probably mean you need your W2s or whatever other forms you might have that reflect/summarize your 2023 income. You don't need to get into extreme detail, you just need totals. Worked a couple of jobs and have W2s for all of them? Add "box 1" from each W2 together, select the first box under "Income" and type in your total in the fillable box that opens.

Further down this page is space for adjustments to your income, so stuff about student loans and health savings would be helpful, but again this survey isn't about the nitty gritty. Round numbers are fine.

Once you're done here, you'll click next and then it'll ask you about the Earned Income Tax Credit which is really just about if you have kids or not. Answer that question, click next and BOOM

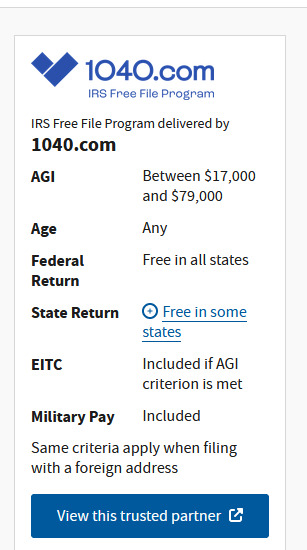

This is the only free file partner that I qualify for this year (again, life changes), but in previous years I have used HRBlock and Tax Slayer. All three sites have been guided similarly to this survey and as easy to use as can be possible given the US tax system.

Thus ends my guided portion, as going to 1040(.)com will show you a great deal of my personal info, but I will give you a few more notes:

Throughout the year, collect your tax forms/important papers in a safe, secure place that YOU WILL NOT FORGET. (preferably a safe or at least a heavy fireproof security box).

Once you get to the tax website you're going to use, you will need all those papers.

Start your filing early. I like to start when I get my W2s.

For one, you'll get everything done and then in April when someone, stressed and anxious, asks if you remember that taxes are due, you can smugly say you filed ages ago. For another, if you do run into significant issues, you have lots of time to resolve them.

Don't necessarily file super early. Sometimes congress does stuff that affects taxes as late as March. It's easier and less stressful to edit your pending forms than it is to file a correction.

When you have all the information in, look up the local and national news and see if there's anything going on regarding taxes. This year there's talk about extending the child tax credit. I haven't kept up with that because it doesn't apply to me, but it might be important to you. If there's nothing happening that might affect you, go ahead and file.

If you have a question, ask! Even the free file services have a help section

I lied, one last snip. This is from 1040. They have an FAQ section, and it's not just about the site itself. I have submitted questions to all three services I've used and all of them have answered me.

They won't hold your hand through every step, but if you have a specific question, they'll do their best to answer it.

You can also do a general internet search! "what this form?" and "do i need to include XYZ on my taxes" are all things i've found the answers for by searching them on duckduckgo

HRBlock has a huge amount of accessible information that I've used often.

I'll wrap here by just saying - if you get frustrated, save your work and walk away.

I called my employer's HR to ask something, waited a couple days then started an email to them, and realized the answer as I was writing the email.

The earlier you start, the more time you have to figure things out. You can do it. Good luck.

#US taxes#taxes#tax help#sorry it's all one block of text. I don't have the energy to make it less Like This

7 notes

·

View notes

Text

I can't tell which states are which (both colors look almost exactly alike to me) but reblogging for anyone who can tel.

psa for usamericans

if you live in any of the states below: the tax filing resource you should be looking for is IRS Direct File; you can file federal taxes directly on the IRS' website, they have a free support helpline if you're stuck, they'll also redirect you to a free preparer for state taxes, and it should work with most tax situations

if you live in any other state (or aren't eligible for Direct File) and your total income for the year was $84,000 or less, you're eligible for IRS Free File; this only covers federal taxes, and works through external providers, but will guarantee that you can use their tax preparation services for free

if you are eligible for Direct File, though, you should use it! obviously very few things about the current political situation are certain right now, but it is a genuinely good and revolutionary way to handle tax paperwork and it's a lot more likely to stick around and expand into more states if more people actually know how to access it and end up using it

14K notes

·

View notes

Text

QUESTION PLEASE HELP

So I made $187usd off of commissions in 2024. Do I need to file this in my taxes?

1 note

·

View note

Text

🐉💎 BookWyrm Taxes: Tax Help with a Legendary Twist!

Dragons know the value of a good treasure hoard, and so do we! Whether you're an individual filer or a small business owner, BookWyrm Taxes is here to help you:

✨ Maximize your refund

✨ Protect your wealth

✨ Make tax season stress-free and successful

📖 "Let’s grow your treasure hoard together!"

Reach out today to schedule your consultation. Let’s make your finances legendary!

0 notes

Text

SV Tax Services: Professional Tax Help You Can Trust

0 notes

Text

flickr

Influencers, YouTubers, Twitch streamers, and content creators in general are under increasing scrutiny from tax authorities like the Canada Revenue Agency (CRA) and the Internal Revenue Service (IRS). We provide confidential, specialized tax help for content creators. Take advantage of all credits and benefits available to you and enjoy stress-free tax filing and audit help. Secure your financial future with Faris CPA today!

0 notes

Text

Maximize your tax savings and minimize stress with Syriac CPA, Certified Public Accountant. Our expert tax prep services ensure accurate, efficient, and personalized support tailored to your unique financial situation. Contact us today to get started!

#tax savings#certified public accountant#cpa service#financial advice#stress free taxes#tax season#syriac cpa#tax expert#financial planning#tax help

0 notes

Text

Don’t guess your tax liabilities—analyze them! Get expert analysis now! For more info visit www.syriaccpa.com #taxliability #taxservices #taxhelp #TaxPreparation #SyriacCPA

0 notes

Text

1 note

·

View note

Text

Why Consult with a Certified Financial Planner for Your Investment Goals?

Navigating the complex landscape of investment planning can be challenging, and seeking guidance from a Certified Financial Planner (CFP) can significantly enhance your financial journey.

CFPs are trained and certified professionals with expertise in various financial aspects, including investment strategies, retirement planning, and wealth management. Their comprehensive knowledge ensures that your investment goals align with your broader financial objectives.

One of the key benefits of consulting a CFP for your investment goals is the personalized approach. CFPs take the time to understand your unique financial situation, risk tolerance, and long-term objectives. This enables them to tailor investment strategies that suit your specific needs, promoting a more effective and customized financial plan.

Additionally, CFPs adhere to a strict code of ethics and a fiduciary duty to act in their clients' best interests. This commitment ensures that their recommendations prioritize your financial well-being, providing you with a level of trust and confidence in your investment decisions.

In the dynamic world of finance, staying informed about market trends, tax implications, and regulatory changes is crucial. Certified Financial Planners possess the expertise to navigate these complexities, offering you informed insights and strategies to optimize your investments.

By consulting with a Certified Financial Planner, you gain a valuable ally in your financial journey, ensuring that your investment goals are not only met but strategically aligned with your overarching financial plan.

The Lighthouse Companies | https://mylighthouseco.com/

#The Lighthouse Companies#Financial Planning#Investments#Financial Advisor#Financial Planner#Insurance#Insurance Company#Investment Services#Real Estate Listings#Investment Management#Financial Planners#Tax Strategies#Tax Help#Tax Assistance#Insurance Agency#Real Estate Agent#Rental Properties#Arkansas Best Neighborhoods

0 notes

Text

Navigating Colorado Payroll and Taxation: A Comprehensive Guide.

Subheadings:

Understanding Colorado Payroll Taxes

Navigating Colorado State Tax Filing

Internal Revenue Service in Colorado: What You Need to Know

Payroll Management in Colorado: Best Practices

Tax Dispute Resolution in Colorado: Your Options

Seeking Tax Help in Colorado: Resources and Assistance

Tax Resolution Services in Colorado: How They Can Help

Summary:

Navigating payroll and taxation in Colorado requires a comprehensive understanding of state-specific regulations and federal mandates. From managing payroll taxes to filing state taxes and resolving disputes, individuals and businesses must stay informed and compliant. This blog explores key aspects of Colorado payroll and taxation, providing insights into state tax filing, IRS operations, payroll management best practices, tax dispute resolution options, and available assistance services. Whether you're a taxpayer or a business owner, this guide aims to equip you with the knowledge needed to navigate Colorado's complex tax landscape effectively.

For personalized assistance with Colorado payroll and taxation matters, call [Pro Automations] now!

Understanding Colorado Payroll Taxes: Colorado imposes various payroll taxes, including state income tax, federal income tax, Social Security tax, and Medicare tax. Employers are responsible for withholding these taxes from employees' paychecks and remitting them to the appropriate tax authorities. Understanding the rates, thresholds, and filing requirements is essential for accurate payroll management.

Navigating Colorado State Tax Filing: Colorado residents must file state income tax returns annually, typically by April 15th. The Colorado Department of Revenue oversees state tax administration, and taxpayers can file online or by mail. Deductions, credits, and exemptions may impact the amount owed or refunded, making it crucial to understand applicable tax laws and regulations.

Internal Revenue Service in Colorado: What You Need to Know: The Internal Revenue Service (IRS) operates in Colorado, enforcing federal tax laws and providing taxpayer assistance. Taxpayers can access IRS services online, by phone, or in person at local IRS offices. Understanding IRS procedures, deadlines, and available resources can streamline federal tax compliance and resolution processes.

Payroll Management in Colorado: Best Practices: Effective payroll management involves accurate record-keeping, timely tax withholding, and compliance with state and federal regulations. Employers must stay updated on changes in tax laws and maintain meticulous payroll records to ensure accuracy and avoid penalties. Leveraging payroll software and consulting with tax professionals can streamline payroll processes and minimize compliance risks.

Tax Dispute Resolution in Colorado: Your Options: Taxpayers facing disputes with the Colorado Department of Revenue, or the IRS have various resolution options, including informal negotiations, appeals, and formal hearings. Understanding the dispute resolution process, gathering supporting documentation, and seeking professional assistance can increase the likelihood of a favorable outcome. Prompt action and compliance with deadlines are crucial when resolving tax disputes.

Seeking Tax Help in Colorado: Resources and Assistance: Colorado offers various resources and assistance programs to help taxpayers navigate complex tax issues. From free tax preparation services for low-income individuals to taxpayer advocacy services, accessing available support can alleviate financial burdens and ensure compliance with tax laws. Additionally, online resources, workshops, and seminars provide valuable information on tax-related topics.

Tax Resolution Services in Colorado: How They Can Help: Tax resolution services specialize in assisting taxpayers with resolving tax debts, audits, and other tax-related challenges. These professionals offer expertise in negotiating with tax authorities, developing repayment plans, and representing clients in disputes. By leveraging their knowledge and experience, taxpayers can effectively address tax issues and achieve favorable outcomes.

Conclusion:

Navigating Colorado's payroll and taxation landscape requires diligence, understanding, and access to relevant resources. Whether you're managing payroll for your business or filing taxes as an individual, staying informed about state and federal regulations is essential. By leveraging available assistance services, seeking professional guidance, and maintaining compliance with tax laws, you can navigate Colorado's tax environment with confidence and peace of mind.

#Colorado payroll#Colorado state tax filing#IRS Colorado#payroll management#tax dispute resolution#tax help#tax resolution services#Colorado tax assistance#tax compliance.

0 notes

Text

Tim’s workaholic tendencies are so funny. Imagine this boy is sooo high on pain meds and trying so desperately to type up a report but it’s just “the susspetttttttttttttttttttttttttttttttttttttttggffggggggggg g gg. g” but bc he’s so out of it he’s like “i am doing so well at report writing” and so he submits it- confidentially might i add. Batman receives it like “this is obviously a coded message, my son needs help.”

#dcu#batman#batfam#batfamily#batkids#tim drake#bruce wayne#bruce like the mother he is: MY BABY BOY NEDDS HELP OH MY GOD and he walks in fully suited and sees Tim passed out on the couch with his#laptop overheating on his chest#taxes talks too much#batfanon#a less dramatized version of this could happen no one forgot abt u timmy d who falls asleep on roller coasters

6K notes

·

View notes

Text

#AI bookkeeping#tax help#bookkeeping and tax help#bookkeeping services for small businesses#Outsourced accounting#accounting outsourcing

0 notes

Text

Are @mcalistersdeli teas tax deductible? Asking for myself

1 note

·

View note

Text

Are you really an Innocent Spouse?

The IRS might think so!

But it won’t be easy !

You May Be Eligible!

You may request innocent spouse relief if:

You filed a joint return with your spouse

Your taxes were understated due to errors on your return

You didn't know about the errors

Errors that cause understated taxes include:

Unreported income

Incorrect deductions or credits

Incorrect values given for assets

When you file a joint tax return with your spouse, regardless of how you file, you are both responsible for the tax and any interest or penalty due.

This is true even if:

You later divorce

A divorce decree states that your spouse is responsible for the taxes

Your spouse earned all of the income

The IRS considers many facts about your situation before a decision is made.

You are not eligible for relief in any year when:

You signed an offer in compromise with the IRS

You signed a closing agreement with the IRS covering the same taxes

A court made a final decision denying you relief

You participated in a related court proceeding and didn't ask for relief

Types of Innocent Spouse Relief

When you apply for innocent spouse relief, review all types of relief if you are eligible. You don't have to request them separately.

Separation of Liability Relief

If your joint tax return understated the amount of taxes due and you are divorced, separated or no longer living with your spouse, you may be able to pay only your share of the understated taxes.

Equitable Relief

If you are not eligible for other forms of relief, you may get relief from paying taxes that your spouse understated or underpaid if it would be unfair to hold you responsible based on all the facts and circumstances.

Just another method to rid yourself of a martial liability if you qualify.

www.taxreliefservices.com

#tax relief#taxreduction#accounting#tax#tax expert#tax help#taxprofessional#tax reprieve#personal debt#taxpayers#innocent spouse

0 notes