#tax free investments

Explore tagged Tumblr posts

Text

Immediate & Guaranteed Tax-Free Fixed Income Plan

Surabhi Financial Services provides a Smart Investment plan giving you an Immediate Tax-Free Guaranteed Regular Income

#tax free#tax free investments#tax benefit#tax free income#financial services tax#invest for tax benefit

0 notes

Text

Throwing up

#yknow that thing where you do crazy amounts of research because you feel like youll miss something important?#like youll miss onething so common everyone else knows about it#in all the GODDAMN research. the books. the online lessons. the videos. THE PERSONAL FINANCE FOR DUMMIES BOOK. FOR DUMMIES.#never in my life did anyone tell me about my tax free savings account SECRET ABILITY#if youre money was in your tfsa. even after you take it out. it stays tax free.#IF YOU USE YOUR TFSA MONEY TO BUY INVESTMENTS. YOU DONT PAY TAX ON THE INCOME YOUD GET FROM THE INVESTMENTS YOU BOUGHT#it keeps its tax free status even when its out of that account???? fucks sake#im still doing research but its looking to be true. or at least a semblance to that.#i fucking hate this. its that whole you missed something so common that everyone knows even though its never come up in your life

2 notes

·

View notes

Text

my dream at this point is to live outside of the U.S, to never use an American dollar again, and to never pay a cent in American taxes again. the U.S treasury exists to subsidize the purchase of U.S weapons. any money spent on education or healthcare is an accident. and I want nothing to do with it.

#Free Palestine#I hope people refuse to pay taxes this year I'm dead serious#I work as a paralegal for an elder law attorney and everyday I see elderly people lose their house and life savings to the healthcare syste#elderly people choosing to just die in order to avoid medical debt (so they can leave an inheritance for their children)#like it's just absolute insanity and makes me terrified of getting sick#meanwhile congress found an extra $14 billion lying around to go kill people who don't have an army#and I want to clarify that the $14 billion is being given to Israel so Israel buys U.S weapons#U.S weapons manufacturers are the biggest donors to all political parties/candidates#both democrats and republicans#genocide joe got millions of dollars in his campaign from these manufacturers#so his role in all this is just to pay his donors (the U.S weapons manufacturers) back for their investment in his campaign#USING OUR MONEY!!!! THE INSANITYYYY#anyway it's crazy to me how frequently people refused to pay taxes in ye olde times as the first and most obvious form of protest....#yet I feel the thought doesn't even cross the minds of organizers today...and why not!#tax fraud > making a silly little poster for a march

5 notes

·

View notes

Note

Why is infrastructure and public transportation so horrible in america compared to the rest of the world?

Capitalism!

#anonymous#ask#politics for ts#i mean of course there's a longer answer#but that's really the main thrust of it#car manufacturers have for example repeatedly killed nationwide high-speed rail#because you guessed it#it would impact their ability to sell cars!#and when everything is privatized and for-profit#that doesn't really incentivize anyone to invest for the public good#especially when Tax Cuts For The Rich strip the public purse of needed funding#so yeah#capitalism#and the libertarian ideology of the American Free Market

20 notes

·

View notes

Text

Tax-Free Bonds vs Equity Investments

Tax-free bonds and equity investments are two different investment options with their own advantages and disadvantages. The choice between the two depends on your individual financial goals, risk appetite, and investment horizon.

Tax-free bonds are issued by government entities and are exempt from income tax. They offer fixed returns for a specified period of time, typically 10, 15, or 20 years. These bonds are considered low-risk investments and are suitable for investors who prioritize safety and stable returns over high-risk, high-reward investments.

On the other hand, equity investments involve buying shares of companies in the stock market. Equity investments are higher-risk investments than tax-free bonds, but they offer the potential for higher returns over the long term. Equity investments require a longer investment horizon and are suitable for investors who can tolerate volatility and are willing to stay invested for an extended period.

When deciding between tax-free bonds and equity investments, you should consider your investment goals, risk tolerance, and time horizon. If you prioritize safety and stable returns, tax-free bonds may be a good option. If you are willing to take on more risk for the potential of higher returns over the long term, equity investments may be a better fit.

It's important to note that diversification is key to a successful investment portfolio. Consider investing in a mix of asset classes, including tax-free bonds and equities, to spread out your risk and increase your chances of achieving your financial goals. It's always a good idea to consult with a financial advisor to determine the best investment strategy for your individual needs.

Visit us for more information:- https://medium.com/@dhherajjhunjhunwala/tax-free-bonds-vs-equity-investments-understanding-the-key-differences-296a526d187b

#equity investments#Tax-free bonds#higher returns#higher-risk#buying shares#diversification#investment strategy

5 notes

·

View notes

Text

"Honestly? Most of the money I make in my criminal enterprises and various schemes is all redirected into my subordinates and investments in the local community. I've even developed several extremely cutting-edge medical technologies that are open for my subordinates and their families to use to take care of cancer and other such nonsense, I swear sometimes I wonder why that hasn't been cured by you heroes yet..."

"Beyond that point, I've even stepped up my investments and schemes, like E.B.I.L... a investment in that craze for Virtual Streamers, a company staffed by those villains who don't want to be involved with combat and such things and my subordinates who act as the management, staff, and other various positions."

You are the supervillain known for having a proper work ethic such as giving incredible health insurance witg dental, days off, vacation, sick time, the whole package because one of your former grunts swapped sides for better pay. Now the good guy is wondering why everyone’s switching sides

#Local Villain pays his taxes and invests in his community#all subordinates get free medical#and everything else they could ask for#then stepped up evil schemes and investments to ensure he could raise their pay

5K notes

·

View notes

Text

A Strategic Approach to College Savings Using Life Insurance for Long-Term Financial Security

Saving for college is a significant financial commitment, and families are constantly seeking strategies to ease this burden. One often overlooked option is saving for college with life insurance. This strategy offers flexibility and financial stability since it not only creates a safety net but also lets cash worth increase with time. Understanding the benefits of a life insurance college fund strategy can help families create a versatile and effective college savings plan.

What is Saving for College with Life Insurance?

Using a permanent life insurance policy—such as whole life or universal life insurance—saving for college with life insurance means building cash worth over time. Permanent life insurance policies generate cash value that is accessible to the policyholder for the duration of their lifetime, whereas term life insurance only offers coverage for a predetermined time. This growing cash value can be borrowed against or withdrawn to help cover the costs of college tuition, books, or other educational expenses.

Why Consider a Life Insurance College Fund Strategy?

A life insurance college fund strategy offers several unique advantages over traditional savings plans. Unlike 529 plans or other college savings accounts, the cash value in a life insurance policy can be used for any purpose, not just education. This flexibility ensures that if your child decides not to attend college, the money can still be utilized for other significant financial goals. Furthermore, the cash value grows tax-deferred, making this strategy a valuable tool for building long-term wealth.

How Does Life Insurance Help with College Savings?

The life insurance college fund strategy is particularly appealing because of the potential for tax-advantaged growth. As premiums are paid into the policy, a portion goes toward building cash value. Over time, this cash value grows, and when it’s time to pay for college, the policyholder can borrow against or withdraw from it. Since loans from life insurance policies are not taxed, it’s a tax-efficient way to access funds for higher education.

Flexibility and Security in College Planning

Unlike traditional college savings vehicles, saving for college with life insurance provides more flexibility. In cases where a child may receive scholarships or choose an alternative career path, the funds in a 529 plan can face tax penalties if used for non-educational purposes. Life insurance, on the other hand, does not have this limitation. The cash value remains available for a wide range of uses, offering financial security beyond education.

Start Early for Maximum Benefits

Starting alife insurance college fund strategy early is crucial for maximizing the benefits. The earlier a policy is purchased, the more time the cash value has to accumulate. By the time college expenses arise, there will be a substantial amount available to cover educational costs. Additionally, starting early ensures lower premiums, making it a more affordable long-term solution for families planning for the future.

Conclusion

Saving for college with life insurance is a flexible and tax-efficient strategy that provides both financial security and peace of mind. With a life insurance college fund strategy, families can build wealth, ensure protection, and fund educational expenses without facing the restrictions of traditional savings plans. Visit retirenowis.com for professional advice to investigate how this strategy might be customized to meet your financial objectives.

Blog Source URL :

#IRA rollover#rollover IRA#401k to IRA rollover#retirement plan rollover#tax-free rollover#rollover retirement funds#retirenow#retire now#Saving for College with Life Insurance#Children’s College Fund Investment#Life Insurance College Fund Strategy#Best Life Insurance for College Savings#College Savings Plans with Life Insurance#Investing in Life Insurance for College#Life Insurance as College Fund#Financial Planning for College with Life Insurance#Tax Benefits of Life Insurance for College Savings#Life Insurance Investment for Education Fund#College Fund Financial Consulting#Life Insurance College Savings Plan#IRA Rollover Guide#Roth IRA Rollover Process#Retirement Account Rollover#How to Rollover 401(k) to IRA#Roth IRA Conversion#IRA Rollover Rules#Rollover IRA vs. Roth IRA#401(k) to Roth IRA Rollover#IRA Rollover Financial Consulting#Best IRA Rollover Options

0 notes

Text

Key Updates and Compliance Strategies for Economic Substance Regulations from the MoF

The economic substance regulations (ESR) were introduced by the UAE’s Ministry of Finance (MoF) to align with global standards on transparency and prevent harmful tax practices. These regulations ensure that UAE-based businesses conducting certain activities have substantial economic presence in the country, rather than simply benefitting from tax advantages. Adhering to these rules is crucial for avoiding penalties and safeguarding the business’s reputation.

In this comprehensive guide, we will walk you through the MoF Economic Substance Regulations ESR, recent updates, compliance strategies, and the penalties that companies face for non-compliance.

Understanding UAE ESR Compliance Requirements

Under the UAE ESR compliance requirements, businesses that engage in “Relevant Activities” such as banking, insurance, shipping, intellectual property, lease finance, holding companies, and distribution and service center must meet certain economic substance criteria. Companies must demonstrate that they are conducting core income-generating activities (CIGAs) in the UAE, which involves having sufficient employees, physical assets, and incurring expenditure in the UAE proportional to the income generated from these activities.

Businesses are required to:

File an ESR notification annually through the Economic Substance Regulations UAE online MOF portal.

Submit an Economic Substance Report outlining their compliance with the regulations.

Pass the Economic Substance Test in UAE, which assesses whether the company has sufficient economic presence in the UAE.

Non-compliance with these requirements can result in ESR penalties and fines UAE, including the exchange of information with foreign tax authorities, damaging a company’s reputation internationally.

ESR Penalties and Consequences for Non-Compliance

The UAE Economic Substance Regulations impose various penalties for non-compliance, ranging from fines to more serious administrative actions. These include:

Failure to Submit ESR Notification:

Penalty: AED 20,000

Consequence: Non-filing will lead to immediate penalties and increased scrutiny for future compliance.

Failure to Submit the Economic Substance Report:

Penalty: AED 50,000

Consequence: Businesses that fail to submit their Economic Substance Report will not only face penalties but could also be reported to international tax authorities.

Failure to Meet the Economic Substance Test:

Penalty (First Year): AED 50,000

Penalty (Subsequent Year): AED 400,000

Consequence: Failing to meet the Economic Substance Test can result in heavy fines and, in severe cases, the suspension or non-renewal of the company’s business license.

Providing Inaccurate Information:

Penalty: AED 50,000

Consequence: Providing false or misleading information in the ESR notification or Economic Substance Report can result in severe financial penalties and reputational damage.

Failure to Maintain Proper Records:

Penalty: AED 50,000

Consequence: Businesses must keep detailed records of their core income-generating activities (CIGAs). Failure to maintain these records can lead to audits and further penalties.

Other Consequences:

Exchange of Information: If a business is found non-compliant, the Ministry of Finance may exchange information about that company with foreign tax authorities. This could affect a company’s international reputation and operations.

License Suspension or Revocation: The Ministry of Finance may take administrative action, including suspending or revoking business licenses, especially for repeat offenders.

Compliance Strategies for UAE Businesses

To avoid penalties, companies should adopt a proactive approach toward compliance. Here are several strategies that will ensure businesses meet all UAE ESR compliance requirements:

Follow a UAE ESR Compliance Checklist: Having a thorough UAE ESR compliance checklist is essential. The checklist should cover all aspects, from ESR notification filing to passing the Economic Substance Test in UAE. Monitoring submission deadlines and ensuring all relevant documents are prepared is vital to avoiding penalties.

Seek Filing Assistance: ESR filing assistance UAE can ensure that your business submits accurate Economic Substance Reports on time. Assistance can also help mitigate the risk of providing incorrect information, which could otherwise lead to penalties.

Regular Audits: Conduct Economic Substance compliance audits UAE to ensure that your business is consistently meeting the economic substance requirements. This is particularly important for businesses in UAE free zones or offshore entities that are subject to increased scrutiny.

How MBG Can Help: ESR Compliance Services UAE

At MBC Legal Consultants, we provide specialized ESR compliance services to help businesses navigate the complex MoF Economic Substance Regulations framework.

Our services include:

ESR advisory services: Tailored guidance to help businesses understand their obligations.

Filing assistance: Helping companies with timely ESR notification filing UAE and Economic Substance Notification and Report submission.

ESR audit services UAE: Conducting thorough audits to assess compliance with the UAE Economic Substance Regulations.

Legal support: Offering legal advisory services on how to meet ESR compliance requirements UAE, ensuring your business is fully compliant with UAE ESR laws for businesses.

As Economic Substance Regulations continue to evolve, businesses need to stay informed and compliant to avoid penalties and reputational damage. The consequences of non-compliance are severe, with significant fines, administrative actions, and possible international repercussions.

By adopting compliance strategies, including seeking UAE ESR advisory services and leveraging professional help for ESR filing assistance, businesses can ensure they meet the MoF Economic Substance Regulations. Contact MBG Legal Consultants for expert assistance in navigating the complex requirements and ensuring that your business stays compliant.

#accounting#business#investing#economic substance regulations#ESR#MOF economic substance regulations#MOF#UAE Compliance#Business Regulations#Economic Presence#Tax Transparency#Compliance Strategies#Relevant Activities#Economic Substance Test#ESR Notification#ESR Report#Penalties#Fines#Non-Compliance Consequences#CIGAs#Filing Assistance#Audits#Legal Support#MBG Legal Consultants#Tax Regulations#Business Reputation#UAE Free Zones#Administrative Actions#International Tax Authorities#Reputational Risk

1 note

·

View note

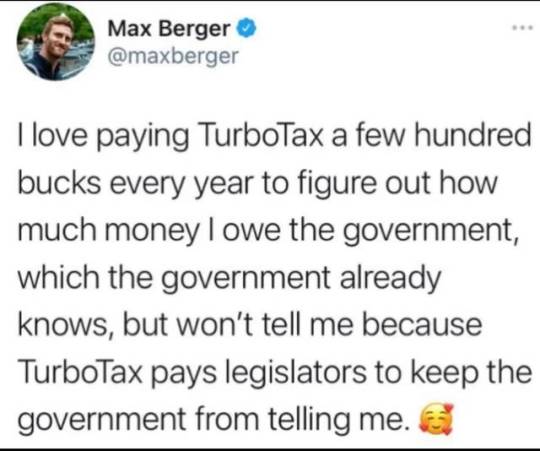

Photo

Look. While i only did tax law for like, 6 months, I can tell you that 95% of the problems I saw were from people using TurboTax. (The other 5% were either an ex-spouse committing fraud or a senile CPA.)

I have just enough complications in my file that I use H&R Block. There’s a free option, a state filing fee, and 2 more advanced options. All in all, not bad.

But do not use TurboTax

#fury’s a lawyer#this is not legal advice#just some life advice#I do not trust TurboTax#but if you don’t have investments and multiple state taxes to untangle#by all means use free filing or the IRS

149K notes

·

View notes

Text

#AIF Category 3#AIF Investments#Commodity Investment India#Fractional Real Estate Investments#Fractional Real Estate tax#Sukanya Samriddhi scheme returns#Investment Options In India#Your Free Finance Newsletter#Retirement planning India#Personal finance learning#Financial education India

0 notes

Text

Dubai's Property Boom: Time to Buy a Villa in Dubai Your Piece of Paradise?

Dubai's property market is booming! Own a luxurious villa with stunning views and a private pool. Enjoy tax-free living and high rental yields. Limited time opportunity - explore your Dubai villa dreams today! Click here to learn more.

View On WordPress

#buy villa Dubai#Dubai Investment Property#Dubai lifestyle#Dubai property boom#Dubai real estate market#Dubai rental income#Dubai villa for sale#Dubai villa investment#invest in Dubai now#tax-free property

1 note

·

View note

Text

Bonds Investment in India: A Top N Overview Discover the key insights into bond investment in India: from government securities to corporate bonds, and explore strategies, risks, and opportunities in this comprehensive guide. Explore lucrative opportunities for high returns with bond investment in India. Bonds typically have a fixed interest rate and maturity date. They are considered relatively safer investments compared to stocks, but the level of risk varies depending on the issuer's credit rating and prevailing economic conditions

#bond investment platform#Bonds Investment#Corporate Bonds#Tax-Free Bonds#online bond platform#Invest in Bonds Online

0 notes

Text

It's the investing that pushes it easily all the way towards the lump sum for me.

$1000/day ISN'T more income from that source than a really safe investment can get right now. 30-year treasury bonds currently pay 4.25% interest a year, every year, for 30 years. That's $425,000 a year for these amounts. Even my bank account's interest would pay more than twice what I currently make.

That COMBINED with being able to pay off huge expenses upfront. You could take one million of that, buy a great house in most parts of the country, buy a good reliable car, pay off your student loans if they're not awful, get the sturdy furniture and appliances, and STILL be making $1050/day in interest on the remaining 9 million.

Explain your reasoning plzzz

#Though it will come out less if the interest from investing the magic tax free gift is taxable. Details#Granted you're totally set either way. Option 1 pays off my entire mortgage in less than a year with more than my current salary left over#Potential for robbery and other f*ckups is a good point though.#Like with the bank account interest you'd need multiple accounts because that's more than is insured at a single bank

28K notes

·

View notes

Text

Indian investors are spoiled these days with a range of choices when it comes to investing.

From investment schemes offering monthly, quarterly, half-yearly, as well as annual returns to schemes offering taxable and non-taxable returns, the list is endless. Choosing the right investment avenue, therefore, may not be as easy as it appears. But a successful investor is not one who invests in the stocks producing maximum returns quickly but one who invests in stocks that are sustainable and that prevent you from paying taxes on your returns. One of the hugely popular investment options, especially among high-net-worth investors, is tax-free bonds.

#right investment avenue#investment options#tax-free bonds#bank Fixed Deposit#high-net-worth individuals

0 notes

Text

things i wish i had known when i escaped my family household and couldn't ask my parents for help

invest in a good mattress early on. there are many other ends you can save on - sleep is not one of them. this is key to how much energy you'll have throughout the day

you don't need a bedframe but you do need a slatted bed base (even if it's just pallets)

opening a bank account is easy

there's youtube tutorials for everything. how to install your washing machine, how to use tools, fixing stuff around the place. channels like dad, how do i? are a godsend

change energy provider as soon as your old deal runs out. you'll get better offers elsewhere and avoid price gouging

assemble a basic first aid kid at home: painkillers, probiotics, alcohol wipes, bandages, tweezers, antihistamine tablets - anything you might need in a pinch

and an emergency toolkit: flashlight, extra batteries, a utility knife, an adjustable wrench, multi-tool, duct tape

set your fridge to the lowest temperature it can go. the energy consumption is minimal in difference and it'll give you +4/7 days on most foods

off-brand products are almost always the same in quality and taste, if not better, for half the price

coupons will save you a lot of money in the long run

there's no reason to be shy around employees at the bank/laundromat/store; most people will be happy to help

vegetarian diets are generally cheap if you make food from scratch

breakfast is as important as they say

keep track of your budget in a notebook or excel file - e.g. rent, phone and internet bills, food, leisure so you'll have an overlook on your spending over the months

don't gamble

piracy is okay

stealing from big stores and chains is also ethically okay

keep medical bills and pharmacy receipts for tax returns

also, file your tax returns early

take up a hobby that isn't in front of a screen. pottery, music, going for a run every now and then, stuff that'll keep you busy and sane

and most importantly... you're allowed to get the stuff you want. treat yourself to the occasional mundane thing. a good scented candle. a bath bomb. that body lotion that makes you feel like royalty. the good coffee beans.

you're free and you deserve to be happy.

#going from being denied basic knowledge to becoming independent over night was wild lmao#but here i am#four years later#doing pretty good#hera screams into the void#moving out#abusive parents

38K notes

·

View notes

Text

Website: https://www.income4myretirement.com

Address: Serving Pennsylvania, New Jersey, and Delaware (USA)

AP&G Financial, LLC is a pioneering firm in retirement income planning, dedicated to maximizing retirement income and minimizing tax liabilities for a secure and comfortable retirement. Founded by Judy Sciaky, a seasoned professional with over 25 years in the advertising business, the firm specializes in creating tax-free income and ensuring a tax-free legacy for heirs. Services include Social Security maximization, protection against financial losses, and strategic retirement planning, catering to clients in Pennsylvania, New Jersey, and Delaware.

Keywords: financial advice near me social security near me retirement financial planning retirement financial advice retirement investment planning legacy planning retirement income planning retirement income strategies social security in new jersey retirement planning services retirement tax planning retirement planning near me tax planning near me retirement income streams asset management near me annuities for retirement income estate planning for retirement tax minimization strategies tax free retirement income retirement savings strategies secure retirement solutions retirement fund management holistic retirement planning social security optimization comprehensive retirement planning pension income planning retirement asset management retirement income analysis retirement readiness assessment retirement income security retirement risk management retirement financial health long term retirement goals secure retirement investments retirement savings growth retirement lifestyle planning financial stability in retirement retirement savings protection financial future security retirement income maximization retirement wealth preservation retirement financial security personalized retirement solutions retirement financial stability retirement tax efficiency retirement wealth transfer retirement income sustainability tax efficient retirement strategies wealth preservation in retirement retirement portfolio optimization retirement income diversification financial independence in retirement planning for a comfortable retirement strategies for retirement success retirement income longevity goal oriented retirement planning retirement planning in pennsylvania tax strategies in new jersey delaware retirement solutions financial stability in pennsylvania retirement savings in new jersey tax free income in delaware legacy planning in pennsylvania retirement risk management in delaware financial security in pennsylvania retirement income maximization in new jersey tax planning in delaware financial advice in pennsylvania asset management in new jersey wealth preservation in delaware income strategies in pennsylvania

#financial security in new jersey#planning services in delaware#investment planning in pennsylvania#financial planning in new jersey#tax strategies near me#retirement solutions near me#financial stability near me#retirement savings near me#tax free income near me#legacy planning near me#retirement risk management near me#financial security near me#retirement income maximization near me#wealth preservation near me

1 note

·

View note