#student finance uk

Explore tagged Tumblr posts

Text

Here are 10 Strategies to Manage Your Student Loans (Student Finance 2024)

youtube

0:00 Introduction 0:42 Make additional payments. 1:36 Set up automatic timely payments. 2:00 Limit your debt with a part-time job. 2:20 Develop and Stick to a budget 2:45 Consider refinancing your student loans 2:57 Explore Loan Forgiveness Programs. 3:18 Ask your employer about repayment assistance. 3:38 Use 'found' money. 3:51 Stay organised and Informed. 4:22 Contact your loan servicer directly.

WEBSITE

YOUTUBE

YOUTUBE PLAYLIST

FACEBOOK

X (TWITTER)

TUMBLR

QUORA

LinkedIn

Mix

FLIPBOARD

#student loans#student#saving tips#moneytips#studentloans#studentfinance#loanrepayment#loanrestructuring#student loan payments#student finance#loan repayment#student loan forgiveness#personal finance 101#student finance guide#loan repayment schedule calculator#loan repayment options#loan restructuring#loan repayment calculation#loan restructuring latest news#student finance uk#loan repayment strategies#loan repayment schedule#loan repayment vs investment#student finance england#loan repayment plans

0 notes

Text

A Step-by-Step Guide to Applying for Student Loans in the UK as an International Student

Pursuing higher education in the UK is a life-changing decision for many international students. However, financing your education can feel overwhelming. Student loans designed specifically for international students can help make your dreams of studying in the UK a reality. If you're looking for guidance on this topic, check out international student loans uk. This guide will walk you through the process of finding, applying for, and securing loans tailored to your needs.

Why Student Loans Are Crucial for International Students

Studying in the UK comes with several expenses, including tuition fees, accommodation, and living costs. While scholarships and part-time jobs can offer some relief, they are often not enough to cover the full cost. International student loans provide a practical solution, allowing students to focus on academics without constant financial stress.

Step 1: Research Loan Providers

The first step is to identify lenders who specialize in loans for international students. Here are some popular options:

Prodigy Finance: Ideal for postgraduate students with no collateral requirements.

Mpower Financing: Offers loans without a co-signer, focusing on future earning potential.

Future Finance: Provides flexible repayment plans for both undergraduate and postgraduate students.

HSBC International Student Loans: Tailored for students with a local guarantor.

When researching, compare the following aspects:

Interest rates (fixed vs. variable).

Repayment terms.

Loan limits and coverage (tuition, living expenses, etc.).

Eligibility requirements.

Step 2: Check Your Eligibility

Each lender has specific criteria that applicants must meet. Typical requirements include:

Proof of enrollment in a recognized UK university.

A valid offer letter for admission.

Academic records and proof of financial need.

In some cases, a guarantor or co-signer may be required.

Make sure you understand and fulfill all conditions before proceeding to the application stage.

Step 3: Prepare Your Documents

To speed up the application process, gather all necessary documents in advance. Commonly required documents include:

Passport or valid ID.

Offer letter from the university.

Academic transcripts and certifications.

Financial statements or proof of income (for co-signers if required).

Loan application form provided by the lender.

Organizing these documents ensures a smooth and hassle-free process.

Step 4: Apply Online or Through an Agent

Most lenders offer an online application process. Here’s how it typically works:

Visit the lender’s official website and navigate to the student loan section.

Fill out the application form with personal, academic, and financial details.

Upload the required documents.

Submit the application and wait for a response.

Some lenders may also work with agents who can assist in completing your application.

Step 5: Review Loan Offers and Terms

Once your application is approved, you��ll receive the loan offer. It’s crucial to thoroughly review the terms, including:

Loan amount.

Interest rate.

Repayment schedule.

Any hidden fees or charges.

If the terms are unclear, don’t hesitate to reach out to the lender for clarification.

Step 6: Accept the Loan and Plan Your Finances

After accepting the loan, plan your finances wisely. Allocate funds for tuition, accommodation, and living expenses. Many lenders disburse the loan amount directly to the university for tuition, while the remaining balance is transferred to your account for personal expenses.

Step 7: Start Repayment After Graduation

Most international student loans allow you to start repayment only after completing your studies. Use this time to secure a job and plan a repayment strategy. Many lenders offer flexible options, such as income-based repayment plans or loan deferments in case of financial difficulty.

Key Tips for International Students Applying for Loans

Apply Early: Start your loan application process as soon as you secure admission to a UK university.

Compare Multiple Options: Don’t settle for the first lender—compare interest rates and benefits.

Understand Currency Exchange Rates: Since you’ll be dealing with international transactions, be mindful of exchange rate fluctuations.

Focus on Repayment Planning: Keep track of your loan obligations and plan for repayments post-graduation.

Conclusion

Securing a student loan as an international student may seem daunting, but by following these steps, you can make the process seamless and stress-free. With the right financial support, you can focus on achieving academic excellence and building your future.

Ready to take the next step? Explore international student loans uk and find the best loan options today!

#International Student Loans UK#How to Apply for Student Loans in the UK#UK Student Loans for International Students#Step-by-Step Guide to Student Loans#Financing Education in the UK#Loans for Studying in the UK#International Student Loan Application Process#Top Lenders for UK Student Loans#Eligibility for UK Student Loans#Postgraduate Student Loans UK#Student Loans Without Co-Signer#Affordable Education Loans UK#Best Loan Options for International Students#UK Education Loan Tips#Planning Finances as an International Student

0 notes

Text

Fueling Entrepreneurship: The Benefits of Taking a Business Loan from Cooperative Banks and Societies in India

In the dynamic world of business, access to timely and affordable credit is crucial for entrepreneurs and small business owners. While commercial banks are a common source for business loans, cooperative banks and societies offer unique advantages that make them an appealing option. Here’s an in-depth look at the benefits of taking a business loan from cooperative banks and societies in India.

1. Lower Interest Rates

One of the most compelling reasons to consider cooperative banks and societies for business loans is the lower interest rates they offer. Unlike commercial banks, which often have higher rates to maximize profitability, cooperative banks and societies operate on a not-for-profit basis. This allows them to charge lower interest rates, making the overall cost of borrowing significantly lower.

2. Flexible Repayment Options

Cooperative banks and societies provide flexible repayment terms that can be customized to suit the borrower’s financial situation. They offer various repayment schedules, including the option to pay in installments or as a lump sum, allowing business owners to choose a plan that best aligns with their cash flow.

3. Simplified Application Process

The application process for business loans from cooperative banks and societies is generally more straightforward compared to commercial banks. These institutions require fewer documents and have less stringent eligibility criteria, making it easier for entrepreneurs to secure a loan quickly. This simplicity is particularly beneficial for small business owners who may not have extensive financial records.

4. Personalized Service

Cooperative banks and societies are known for their personalized service. Unlike commercial banks, which may treat borrowers as mere account numbers, cooperative institutions offer a more supportive and understanding environment. They consider the unique needs and circumstances of each borrower, ensuring a more personalized and satisfactory experience.

5. Community Support

As community-focused institutions, cooperative banks and societies offer a level of understanding and support that is often unmatched by commercial banks. These organizations are deeply rooted in the local community and have a vested interest in the welfare of their members. This community-oriented approach can provide business owners with additional support and leniency when needed.

6. Financial Inclusion

Cooperative banks and societies play a crucial role in promoting financial inclusion by extending credit facilities to underserved and marginalized communities. This ensures that individuals from diverse backgrounds have access to the funds they need to start or expand their businesses, regardless of their financial standing.

7. Transparency

Transparency is a hallmark of cooperative banks and societies. Borrowers can expect clear communication about loan terms, conditions, and any associated fees or charges. This transparency builds trust and ensures that there are no hidden costs or unpleasant surprises down the line.

8. Lower Processing Fees

Another significant advantage of taking a business loan from cooperative banks and societies is the lower processing fees and charges compared to commercial banks. This reduces the overall cost of borrowing and makes the loan more economical for business owners.

9. Focus on Local Development

By supporting local businesses, cooperative banks and societies contribute to the development of the community. The funds borrowed are often reinvested in the local area, promoting economic growth and stability. This local focus ensures that the benefits of the loan extend beyond the individual business to the broader community.

10. Potential for Additional Benefits

Many cooperative societies offer additional benefits to their members, such as profit-sharing, voting rights, and a say in the management of the cooperative. These benefits can enhance the borrower’s overall financial well-being and foster a sense of belonging and responsibility.

11. Safe and Secure

Cooperative banks and societies are regulated by the government and other regulatory bodies, ensuring compliance with financial standards and providing a secure borrowing environment. This regulation offers an added level of security and trust for borrowers.

12. Contribution to Social Welfare

By choosing to take a loan from cooperative banks and societies, borrowers indirectly contribute to social welfare activities and community development projects initiated by these institutions. This creates a positive impact on the broader community and promotes a culture of mutual support.

13. Enhanced Financial Literacy

Many cooperative societies offer educational programs and training to improve financial literacy among their members. This can help business owners manage their finances more effectively, make informed decisions, and avoid potential financial pitfalls.

14. Tailored Loan Products

Cooperative banks and societies often offer loan products that are tailored to the specific needs of their members. This customization can ensure that the loan terms and conditions are more favorable and suitable for the borrower’s unique situation.

15. Risk Mitigation

Cooperative banks and societies often have mechanisms in place to mitigate risks for borrowers, such as insurance for the loan amount. This provides an additional layer of security for borrowers in case of unforeseen events.

16. Support for Small and Medium Enterprises (SMEs)

Cooperative banks and societies are particularly supportive of small and medium enterprises (SMEs), which form the backbone of the Indian economy. By providing accessible and affordable credit, they help SMEs to grow, innovate, and contribute to economic development.

17. Community Empowerment

By supporting local businesses, cooperative banks and societies play a crucial role in community empowerment. They provide the necessary financial tools and resources for individuals to improve their living conditions and contribute to the community’s prosperity.

In conclusion, taking a business loan from cooperative banks and societies in India offers numerous benefits, including lower interest rates, flexible repayment options, personalized service, and community support. These institutions provide a supportive and transparent environment that can make entrepreneurship more accessible and sustainable. By choosing to borrow from cooperative banks and societies, business owners not only invest in their own success but also contribute to the development and empowerment of their local communities. Cooperatives4all serves as a user-friendly digital platform specifically tailored to support and empower cooperatives across the World

#bank#cooperative#home loan#loan#loans#personal loans#student loans#business loan#personal finance#short term loans uk

0 notes

Text

Open Up a World of Possibilities, and Start your Career with Middlesex University Dubai’s Dynamic BA Honours Accounting and Finance Programme

Study at the largest UK university in Dubai and connect with global financial industry experts, propelling you to future employment success.

The world of finance is booming, with Dubai generally considered within the top global financial services and talent hubs alongside New York, London, Hong Kong, and Singapore.

Dubai International Finance Centre (DIFC) is home to 632 financially regulated firms, with a strong inflow of top firms underscoring Dubai’s appeal as a global financial industry hub. Notable firms joining DIFC in 2023 included global leaders such as Asia Research and Capital Management Ltd, Edmond de Rothschild, EnTrust Global, Hudson Bay Capital, King Street Capital, Nomura Singapore, St. James’s Place and Verition Fund Management LLC, with this growth expected to continue year on year.

As projected by the International Monetary Fund (IMF), the United Arab Emirates GDP is expected to grow by 4% by the end of 2024, reflecting the UAE's robust economic performance. There has never been a better time to secure a highly regarded, UK-accredited, undergraduate qualification in Accounting and Finance from Dubai’s largest UK university.

Middlesex University (MDX) Dubai is a well-respected institution with strong business ties in the UAE. We have a community of over 5,600 students encompassing over 120 different nationalities, creating a diverse global experience. MDX Dubai offers over 70 UK degree programmes and professional qualifications and stands out as a leader in British education.

Accounting is often referred to as the ‘language of business,’ making it crucial for organisations of all sizes and industries worldwide. As financial regulations become more intricate, businesses require skilled professionals to ensure compliance, and accountants help organisations navigate these regulations and avoid costly legal issues. With ever-changing tax laws, businesses need experts to optimise their tax strategies while staying compliant. Independent audits are crucial for ensuring the accuracy of financial statements, meaning accountants are needed to maintain transparency and investor confidence.

In today’s rapidly changing business landscape, the role of accountants has evolved far beyond number-crunching and financial reporting. This evolution has led to a surge in demand for skilled accountants and financial experts in the global job market.

The BA Honours Accounting and Finance Programme

Our BA Honours Accounting and Finance degree programme creates highly employable and successful graduates. You will develop advanced theoretical and practical knowledge of accounting and finance: the ideal first step in becoming a qualified accountant. Our programme covers key areas within financial and management accounting, taxation, and business law, allowing a deep understanding of the role accounting plays in successful organisations.

Our three-year Middlesex University Dubai BA Honours Accounting and Finance programme is recognised globally as offering excellent preparation for professionals in the field. Our teaching team consists of a diverse group of internationally qualified and renowned scholars and practitioners, who specialise in key discipline areas including management accounting, banking regulations, corporate finance, econometrics, data analytics and more. The department puts a strong emphasis on employability, with strong industry links to top financial firms in the UAE and beyond. Our expert academic staff consult for leaders in business and government.

Throughout the programme you will use accounting software such as Xero, Sage, and OneSource. The onsite Financial Lab will give you the hands-on experience needed to succeed, and you will build on your practical accounting skills through a combination of lectures, workshops, seminars and class-based discussions.

Once you have graduated from the BA (Hons) Accounting and Finance degree you have the opportunity to sit further professional exams to becoming a chartered accountant. There are various career pathways for you to choose from including: audit, taxation, budget analysis, financial accounting and management accounting.

Associate Professor Dr Pallavi Kishore, BA (Honours) Accounting and Finance Programme Coordinator, has this to say about the programme’s benefits: “The BA Honours Accounting and Finance programme at Middlesex University Dubai is the perfect starting point for aspiring Chartered Accountants. At MDX Dubai, our goal is to ensure our graduates are 100% employable, and we go above and beyond to meet this goal. From offering certifications and hosting competitions to facilitating interactions with industry leaders and professional bodies, we provide our accounting and finance students with top-tier guidance, setting you on the path to success.

The programme has been designed with up-to-date skills, including accounting software and a focus on ethics and corporate responsibility. The rigour of our curriculum is endorsed by coveted professional bodies, including the Association of Chartered Certified Accountants (ACCA), the Chartered Institute of Management Accountants (CIMA), the Institute of Chartered Accountants in England and Wales (ICAEW), the Chartered Financial Analyst (CFA), and the Institute of Financial Accountants (IFA).

With our comprehensive programme, you'll be thoroughly prepared to enter the professional world with confidence and competence. Your future in accounting and finance starts here!”

Career-Led Education with Industry Exposure

At MDX Dubai we are committed to bridging the gap between academia and industry through solid partnerships and industry collaborations. You will benefit from long-standing connections through bespoke learning programmes, mentorship programmes and work placements. Companies such as IBM, ORACLE, Microsoft and CIM are just a few of the organisations that engage with you, providing insights and career opportunities.

As a student at MDX Dubai you not only gain industry-specific knowledge but will graduate fully equipped for a successful career. Our dedicated Careers and Employability Services (CES) Department ensures that all our students are guided towards a rewarding and dynamic professional path. CES provides a range of services including career guidance, counselling, industry insights, internships, and employment prospects, among many others. The aim of CES is to make every student at MDX Dubai 100% employable by understanding their individual career goals and aspirations and supporting them in achieving future success.

Our learning facilities are state-of-the-art, and we have received recognition of our programmes from some of the world’s leading professional bodies including the ACCA, UAECA, CIMA, CFA, CIPFA, GARP and ICAEW. This collaboration means that you benefit from the maximum number of exemptions and support with employability talks and skill sessions, as well as providing internship, placement and graduate opportunities with employer partners across all industries. Our students also have the opportunity to benefit from scholarships and paid memberships within these professional bodies.

Launchpad for a Successful Future

During your studies, you will have the opportunity to apply for internship opportunities through the Careers and Employability Service, and we also offer the option to transfer to the Middlesex London campus after the second year of study.

After graduating, many of our MDX Dubai BA Honours Accounting and Finance alumni’s have secured roles in local and international businesses, progressing into careers with a wide range of prestigious organisations including the Big 4: Deloitte, PwC, KPMG, and EY. Some choose to remain with the University to study an MDX Dubai postgraduate degree such as MSc Banking and Finance or MSc Investment Management to prepare for a leadership level role.

BA (Honours) Accounting and Finance Class of 2023 student Shyam Sathish Kumar now works at Crowe UAE as a Financial Consultant. He said of his experience: “MDX gave me a huge advantage by allowing me to proceed with my ACCA examinations while in university. Having completed my ACCA and becoming an affiliate gave me an advantage in the job market. It allowed me to display my competence and gave employers the impression that I was capable as a professional… Studying at MDX gave me exposure and knowledge about various pathways within Accounting and Finance, and my dream career changed over time as I studied different modules and interacted with different professionals.”

More Than Academics: Celebrating the Student Experience

As an IFP student, life at the University also offers engaging and enriching extracurricular opportunities. Our sports and social clubs empower you to build confidence and develop leadership and organisational skills, ensuring friendships are formed outside of the classroom. Get involved in events hosted by MDX Dubai, such as International Day, YouthFest talent contest, international trips to destinations such as Japan, Georgia and Italy, student galas and more. With over 30 sports teams and social clubs to choose from there is something for everyone!

Team Middlesex is the focal point for the development and delivery of competitive and recreational sport and social activities at MDX Dubai, ensuring you have the best student experience.

Student Support Services are available throughout your studies to help whenever you need a shoulder to lean on. Whether you need advice about life in Dubai, feeling homesick, having health issues, or finance concerns our friendly Centre for Academic Success (CAS) team is here to help.

At MDX Dubai, we provide you with the opportunity to transfer your studies to one of our overseas campuses in London or Mauritius within your second year of study. This allows you to explore a new culture and make overseas contacts while benefiting from the same high quality of teaching that you receive here at our Dubai campus at Dubai Knowledge Park (DKP).

Our DKP campus features state-of-the-art classrooms equipped for hybrid learning; labs for Graphic Design, Robotics, Engineering, VR, Cybersecurity, and Fashion Design; and an exciting student recreation centre called the MDX Social Hub, which is home to our dance studio, gaming room and much more. We are also the first UK university in the UAE to have a campus in each of Dubai’s higher education hubs. Our second campus is located in Dubai International Academic City (DIAC) and is home to study areas, and our brand new MBA Study Hub.

Ensuring Accessible Education

At MDX Dubai we are committed to delivering a high-quality British education that meets market demands. Our students can qualify for various scholarships based on eligibility criteria, and study grants are available to students from the UAE and globally across all study levels. Flexible payment plans are offered to make a quality British education accessible to everyone.

Apply for our next September intake at MDX Dubai and take the first step towards achieving your career aspirations with a degree that promises both academic excellence and practical industry experience. Join MDX Dubai and become part of an inclusive and diverse community that nurtures growth, innovation, and success.

Find out more: BA Honours Accounting and Finance Middlesex University Dubai (mdx.ac.ae)

#MDX Dubai#Middlesex#Accounting and Finance#UG#Undergraduate Study#Dubai#Student#Finance#UK#university

0 notes

Text

#short term loans uk#personal loans#loans#same day payday loans#student loans#insurance#personal finance#credit score#financial planning#money saving#money#easter bunny#easter#easter egg#easter 2024

0 notes

Text

#financial planning#money#investors#loans#personal loans#same day payday loans#short term loans uk#finance#student loans#usa

0 notes

Text

Do You Need a Quick Loan?

Borrow any day, anytime!

Apply for a loan of $50,000 up to $1,000,000

Yes, that’s correct!

At Global CU the success of our customers comes first,

We makes it easy to borrow money to fund your dream.

If you live in the United States and Canada or even in the United Kingdom, then you’re eligible to apply.

Inbox me to get started on your journey to success!

#Loan #businessloan #loanservices #loanofficer #finance #mortgage #autoloan

#loan#business loan#loans#personal loans#student loans#financial help#mortgage#auto loans#finance#business#home loan#short term loans uk#same day payday loans

1 note

·

View note

Text

Are you having trouble deciding on a topic for your dissertation on finance? Do you require assistance or professional counsel on the same? You'll be happy to learn that we provide that service without charge.

#finance dissertation topics#dissertation#finance#assignment help#assignment help uk#writing#academic writing#study tips#student#education

0 notes

Text

The UK Public Finances are counting the cost of the energy crisis

This morning has brought us up to date on how much the UK borrowed in the last fiscal year ( until March). PSNB ex in the financial year ending (FYE) March 2023 was initially estimated at £139.2 billion (or 5.5% of gross domestic product (GDP)), £18.1 billion more than in the FYE March 2022 and the fourth-highest FY borrowing since records began in 1946. The main factor in play here was the…

View On WordPress

#Bank of England#business#Debt Interest#economy#Energy Costs#energy subsidies#Finance#Government Expenditure#Public Sector Net Worth#student loans#Tax Receipts#UK Public Finances

0 notes

Note

I'd love to see an almost inverse version of effortlessly- where chan (feels odd to say his name in this context lol) is a submissive stalker- almost pathetic and desperate for the reader to pay attention to him, and by extension, be claimed/posessed by the reader. Think limerence. I'm excited to see what you write next!

😶🌫️

pairings. yandere!sub!chan x top!m!reader (ft. jeonghan & vernon). word count. 2.7k genre. yandere, request, smut.

warnings. obsessive behaviour, manipulation, the (in)famous drunk dino and kneeling jeonghan story, stalking, drunk sex, no protection (pull out game, sorry. please use a condom, people, ik mpreg doesn't happen in reality but you might never know), anal fingering, biting, chan is feral, reader is younger (idk but i feel like lee chan should be a hyung here), oral sex (chan receiving), use of drugs.

writer's notes. it took me a long time to figure out how i should write this. i might have went out of the theme im sorry hehe. normally im all down for bottom chan (esp wonchan or allchan) but i prefer uke male readers (rip my current and future ocs' and readers' asses). i hope that you are satisfied with this, though. let me know about your thoughts through my inbox, the anon who sent this in!

mentioning my imperial beta reader, @sousydive

network: @mansaenetwork

masterlist | navigation | main page | kofi | ao3

Chan needs you like a fish needs water.

You are his air, his world, his everything. His heart races wildly every time he catches a glimpse of you walking down the lecture hall.

But his love—no, his obsession—runs far deeper than simple admiration. He knows everything about you: your schedule, your favorite seat in the lecture hall, the snacks you nibble on between classes. He’s memorized the little quirks that make you you—the way you twist your pen between your fingers when lost in thought, the slight tilt of your head as you read, the soft furrow of your brows when something puzzles you.

Before he even realizes it, his phone is in his hand, snapping another photo of you. A snapshot of you deep in thought. Another of you sitting alone at the cafeteria. One of you walking home.

And then, there’s the one that sends his pulse racing the most—a picture of you standing by your window, reaching out to close it.

The pictures are printed and carefully pinned across the walls of his room, a shrine dedicated to you. Chan has convinced himself it isn’t wrong. He’s not hurting anyone, after all. He just wants to keep a part of you close, something to hold onto during the hours you’re out of reach.

But it isn’t enough.

The pictures, the fleeting glimpses of you, the stolen moments he captures through his camera lens—they only feed the growing void inside him. He needs more. He craves more.

He doesn’t just want to watch from the shadows anymore. He wants you to see him. To look at him the way he looks at you. To need him the way he needs you.

You were looking at your phone when you bumped into someone.

“I’m so sorry!” you quickly apologized, boxes tumbling to the ground as papers scattered everywhere. The man you knocked onto the floor coughed, peering up at you with narrowed eyes.

“It’s okay. Could you help me find my glasses, please?” His voice was soft and warm—and your heart skipped a beat. You bent down, quickly retrieving a pair of golden-rimmed glasses from the floor, gathering his scattered papers in the process.

You recognized him.

Lee Chan, from the finance department. He was a popular student—quiet, yet effortlessly attractive.

You held out your hand, and Lee Chan grabbed it, using you to pull himself up from the floor. “Thanks.”

“No worries, I wasn’t looking my way…” You passed the papers back to him, scratching the back of your neck in embarrassment. You were slightly taller than him, and as he stood close, you couldn’t help but notice a faint, sweet strawberry-like scent coming from him.

Your ears burned. What were you thinking?

“It’s fine. I wasn’t paying attention either.” Lee Chan pushed his glasses up the bridge of his nose. “Oh, I know you. You’re from the sports department, right?”

“Yeah. You’re Lee Chan, right?” You made a quick bow, which he returned. “I didn’t know someone famous in this college would know someone like me, haha.” You tilted your head, scratching at the back of your neck again.

Lee Chan raised a brow, his tone surprised. “Are you trying to brag or something? You’re famous for that baseball match, you know?”

“Am I?” You laughed. Lee Chan nodded.

“Anyway, I should be on my way.” He glanced at his watch, ready to leave. You eyed the boxes and papers still scattered around, feeling guilty about knocking into him.

“Actually, I can help you, you know?” you said, flexing your toned arms with a grin. Before Lee Chan could protest, you quickly grabbed the heavy boxes from his hands. Seeing that you’d left no room for argument, Lee Chan reluctantly allowed you to carry the boxes for him.

By the time you reached the finance department, you had already started calling him "Chan hyung"—a natural transition since you two were now exchanging phone numbers. The walk had been brief, but there was something about the way Chan kept glancing at you, his lips curling into a small smile every time you caught his gaze, that made the air feel charged, even in the mundanity of it all.

"Thanks for helping me out," Chan said once you reached the door. He paused, the corners of his mouth still lifted in that soft, almost shy smile.

You grinned. "No problem, hyung. I’ll see you around, then?"

He nodded, and you gave him a quick wave before heading back towards the sports department.

From that day onward, Chan was always on your mind. You could almost always smell that intoxicating scent of sweet strawberries whenever you walked down the corridors. You found yourself checking Chan’s social media, or searching for his figure when you passed the finance department.

Chan texted you from time to time—sometimes to congratulate you on a game, other times to ask if you'd be up for a casual coffee. You would invite him to watch your games, eagerly looking for his familiar figure among the crowds.

Until one day, when you got a phone call from him.

You had just finished practice and were washing up at the dorm when your phone rang. Stepping out of the shower with only a towel wrapped around your waist, you quickly checked the caller ID. Your eyes widened when you saw who was calling.

Without hesitation, you answered, putting the phone on loudspeaker as you grabbed another towel to dry your hair. "Chan hyung?" you asked, your voice slightly breathless.

“Hello?” The voice on the other end of the phone was unfamiliar. You frowned, pausing in your actions as you glanced at the screen. The background noise was chaotic—loud music and indistinct chatter. “Sorry, are you Chan’s friend? Could you come pick him up? He’s, uh, really drunk—VERNON! HOLD HIM!—sorry, he’s very, very drunk right now.”

You blinked, your pulse quickening. “Oh.” The unexpected turn of events threw you off balance.

There was a brief pause, and you could hear muffled voices in the background. Whoever was on the phone sounded frazzled. “Sorry, I didn’t mean to freak you out... but he’s not really making any sense right now. He keeps asking for you. Can you come?”

Your hand tightened around the towel at your waist. Chan, drunk? And asking for you? It was a lot to process in a moment. “Uh, yeah, I’ll be there. Just... send me the address.”

The call ended abruptly, and the address was quickly sent to you. You threw on a casual shirt and black pants, grabbed your jacket and wallet, and headed out of the dorm. You hailed a cab and gave the driver the address.

As you neared your destination, you saw three figures standing at the roadside outside a nightclub. You instructed the cab driver to stop and wait for you, then quickly opened the door and rushed over.

Chan was holding onto a lamppost while one man supported him. The other man was kneeling before him, almost as if begging him to let go of the poor pole. You rushed forward, calling out, “Chan hyung!”

Your heart pounded as you neared the scene. The man who had been kneeling quickly stood up, pointing toward you. “He’s here! Chan-ah, please, let go of the lamppost—”

Chan’s head snapped up, his glassy eyes locking onto yours. A small, drunken smile tugged at the corners of his lips, but it seemed distant and unfocused. His grip on the lamppost tightened for a moment before he slowly, shakily let go and staggered toward you. “You... You came,” he slurred, his voice slow and heavy with alcohol.

You instinctively reached out to support him as he wobbled toward you. His breath smelled faintly of alcohol and something else—something sweet, like strawberries. He tried to stand on his own but swayed dangerously, his body pressing too heavily against yours.

The man who had been kneeling sighed in relief, a slight smile on his face. “Thanks for coming. He’s been asking for you for the past half hour. We thought he might knock himself out with the pole at some point.” He sighed, while the other man nodded coolly. You recognized them as Yoon Jeonghan and Vernon Chwe from the marketing department. As Chan leaned heavily on your shoulder, you gave a quick bow to them. “Nice to meet you, sunbaes. I’m—”

“We know you.” Jeonghan gave a dismissive wave of his hand. “You’re the rising star of the baseball team, Cheolie’s most reliable striker. Besides, Channie told us a lot about you.” He sighed at the man currently trying to hide his face in your neck. You quickly wrapped your jacket around him as he tightened his arms around your waist. “I see. Do you have the address to his dorm?”

“About that,” Vernon spoke up. “Chan’s dorm room is undergoing renovations. He’s been crashing at Jeonghan hyung’s place, but since he got drunk, he refused to leave with him. If you don’t mind, could you bring him back to your dorm instead?”

“Sure.” You nodded. Jeonghan looked relieved. “Great, I’ll leave Channie in your hands.” He said, before dragging Vernon off in the opposite direction. You gently guided Chan’s hands off you and led him back to the cab.

By the time the cab reached your dorm, Chan had already fallen asleep. The driver, kind enough to assist, helped you carry Chan onto your back, and you left him a generous tip. Once inside, you laid Chan gently on your bed.

As you straightened up to grab a warm towel, a hand gripped your shirt tightly. You looked down to see Chan staring up at you, a faint blush across his face. “Where are you going?”

“I’m just getting a towel for you, hyung,” you replied, taking in his appearance. Chan wasn’t wearing his usual glasses—his eyes were wide, pupils dark, pulling you in like a siren. You swallowed, suddenly aware of the sweet scent of strawberries filling the room.

“Stay,” Chan insisted, his head tilting slightly to the side. You nodded, a bit dazed, and before you could fully process what was happening, he pulled you onto the bed, positioning himself to straddle you.

When your lips crashed, you froze, your hands laying helplessly at either side of your hips. You could feel Chan grinding on you, his hands gripping your shirt as his lips moulded with yours. When Chan finally pulled away from you to gasp for air, you quickly held him by the waist, stopping his movements. “Hyung… You’re drunk-”

“‘M not drunk,” Chan replied, his hands snaking down your chest. Your face burnt as he reached the hem of your pants, teasingly pulling at the band. “I know what I’m doing.”

“Hyung…” You swallowed. The air thickens as Chan frowned, leaning so close that your noses touched. “You want me to beg you? Please, fuck me?” He growled, grinding harshly at the tent in your pants. You let out a groan, your grip around his waist tightening. “I-”

“I’m giving you permission to put your cock in my ass right now. I like you.” Your eardrums ringed as Chan confesses, one hand pulling up his shirt while the other working on your pants. You choked on your own saliva at the sight of his body, quickly turning your head to the side. “Hyung, sl-slow down.”

Articles of clothing were soon removed, pooling at the ground of your bed. Chan is now lying beneath you, one hand grabbing the sheets as he moaned loudly, his other hand now tightening around your hair. You hollowed your mouth, your tongue flicking against his tip as you gave a harsh suck.

Chan whimpered, arching his back off your sheets as his thighs clamped around your head. You ignored the tightness around your head, your finger working relentlessly on his hole as he thrashed around the sheets, wailing loudly before spilling into your mouth. “Ah…ha…”

The taste of salty musk and sweet strawberries filled your tongue as you lolled them out, letting them spill onto your fingers. Using Chan’s cum and your saliva as lube, you continued to venture in him, earning a loud cry from the older man. “Wait- T-too mu-”

“You were impatient just now, hyung.” You replied, forcing his knees to open for you again. Chan panted, looking at you through his hooded lids and wet hair. His upper body was littered with hickeys and bite marks, his nipples red and swollen. “I’m just giving you what you want.”

You added another finger into him, stretching him out as he moaned your name in earnest. A particular sharp jab of your fingers caused him to arch his back yet again, his eyes rolling into the back of his head. You poked around that soft muscle for a few more times, before pulling your fingers out.

“You…” Chan looked down at you, a confused yet fucked out expression on his face. You stood between his legs, your expression suddenly mortified. “Um, hyung, I don’t have condoms…”

“Just do it raw.” Chan deadpanned, rolling his eyes. He raised his knees up, hanging them over your shoulder and hooking you closer to him. “It’s not like I would get pregnant.”

Your cock twitches at his words and you hummed in reply. “You do know the colour system-”

“Green, now hurry up and fuck m- ah, shit,” You guided your hardness towards his hole, burying in Chan’s warmth with one slow thrust. You could feel him sucking you in as you groaned, pushing gently so as to not hurt him.

Once you bottomed out, Chan’s eyes were unfocused. You leaned downwards to nibble at his swollen lips, and his hand quickly wrapped around your neck, supporting himself. You took this as a sign to continue, and your hips started to move.

Moans and groans bounced off the walls as you rammed Chan into the sheets. Chan felt like a drug, his addictive scent filling your nose and brain as you continued to plant hickeys along the sides of his neck. It didn’t take long for Chan to arch his back again, and so you stopped.

“Wha- Y-” Before Chan could say anything, you flipped him around, still impaled in him. Your hips moved at an unforgiving speed, as Chan could only cry your name out in both pleasure and mercy. “Can’t… Please- close…”

“I’m close too, hyung.” You pressed a gentle kiss on his shoulder, your hand reaching down to grab at his cock. A few lazy tugs and Chan was cumming, his head on your shoulder as he sobbed, falling to the bed. You groaned at the sudden tightness, pulling out before tight ropes of your cum spurt over Chan’s back and ass.

“I’ll clean you up, hyung,” you whispered softly as Chan’s heavy eyelids fluttered with exhaustion. Carefully, you lifted him off the bed, guiding him toward the bathroom.

With patience and gentle coaxing, you managed to shower him with warm water, wash away the remnants of the night, and dry him off. By the time you were done, Chan looked peaceful, dressed in clean clothes, and already half-asleep. You laid him gently on your bed, now fresh with newly changed sheets.

Sliding in beside him, you couldn’t resist wrapping your arms around his resting form. His familiar strawberry-like scent lingered, soothing you as you nuzzled your nose into the crook of his neck.

Contentment swelled in your chest. Tomorrow, you would ask him out on an official date. For now, though, holding him close was more than enough.

bonus:

02:23 a.m.

hannie hyung🐰: so... how did it go? did you get cheol’s favourite junior?

hannie hyung🐰: judging from your lack of response, i guess you got what you want. i really need that strawberry perfume back, you know. besides, if he smells it too often he might get really, like really addicted to it.

hannie hyung🐰: and bononie just cleared out the stash of photos in your dorm, you can bring him back any time.

hannie hyung🐰: we didn't throw it away though, it's at shua's.

hannie hyung🐰: and text me back when you're awake. i can't believe i had to kneel down to you in public, you little freak. do we really have to go all out to that extend?

hannie hyung🐰: hyung loves you, anyway.

© yiichan, 2024 origin of divider

#🌷kyii#mansaenetwork#seventeen#svt#svt x reader#dino x reader#seventeen x male reader#lee chan x reader#lee chan x male reader#seventeen smut#svt smut#dino smut#lee chan smut#svt lee chan#dino imagines#yandere dino#svt dino#lee chan#kyii's requests#dom male reader#top male reader

323 notes

·

View notes

Note

Hiii,

Hope you are well.

Would you by any chance be able to explain how the funding and tax between Scotland and England works? Or maybe direct toward some easier to understand sources? I struggle to understand the stuff online and ive frustratingly been in the company of several English individuals recently, demanding i thank them for 'paying my tuition' as a Scottish uni student. I know it's (pardon my french) bollocks but as much as id like to rebut them im not well educated enough on the topic to do it properly.

thankyou

Hello! I am surviving.

I'll try keep this as plain as possible because it's wild that 'we pay for your tuition' is still being trotted out by arseholes.

The Scottish Government receive their budget from Westminster. They fund a wide variety of reserved (controller by Westminster) and devolved (controlled by Holyrood) areas. A large portion of that budget is granted through something called the Barnett Formula.

The Barnett Formula is used by the UK Treasury to adjust the amounts of public expenditure allocated to Scotland, Wales & Northern Ireland based on how much is being spent on services in England.

For example, if the UK Government decides to slash NHS funding in England then it ripples across the devolved nations, and the respective governments needs to accept cuts or fill the gaps with budget supposed to be used for elsewhere.

ScotGov do have some devolved tax powers, such as income tax where we currently have higher taxes on rich people. Also some tax powers over lands and buildings, landfill, council tax etc. All these areas are where Scottish people pay Scottish taxes to pay for Scottish policies. Like scrapping tuition fees. The rich in England don't pay for baby boxes and free prescriptions, the rich in Scotland do by paying their fair share in the Scottish income tax system.

I always find discussions around Scotland's finances to be interesting because the Scottish Government don't have the economic levers of an independent country and it's always talked about like we do but are just incompetent.

110 notes

·

View notes

Text

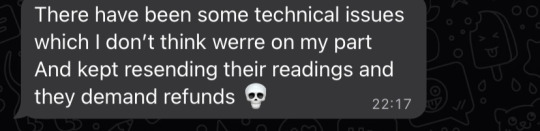

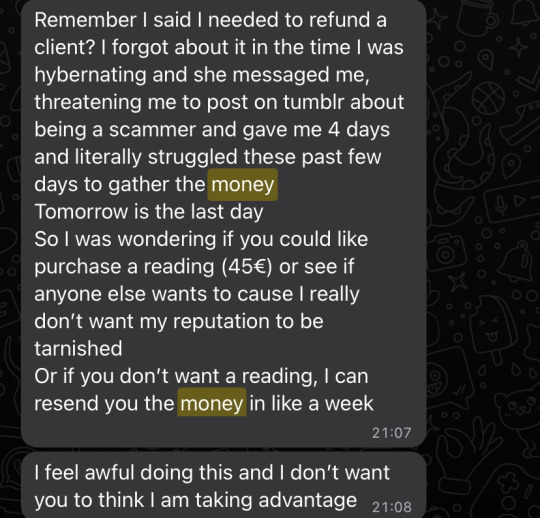

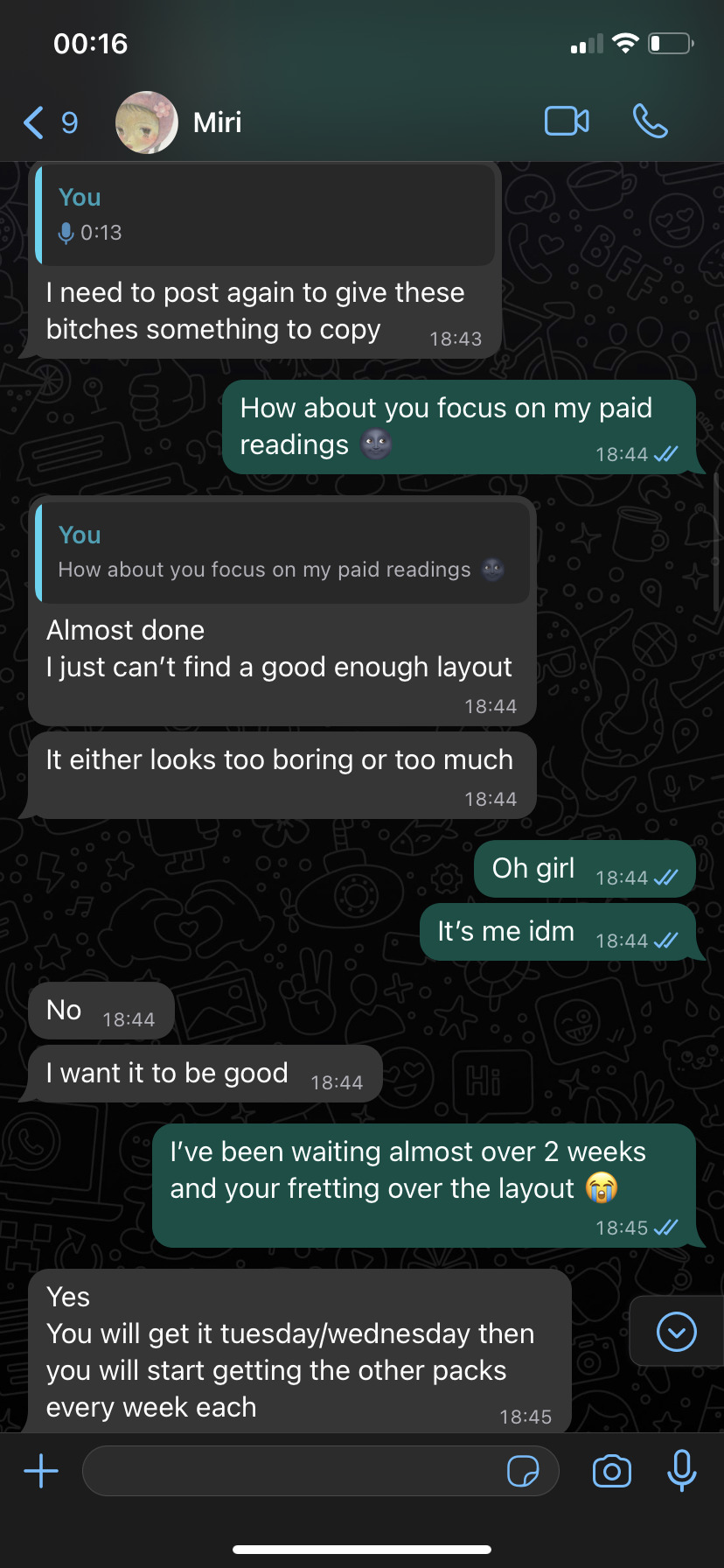

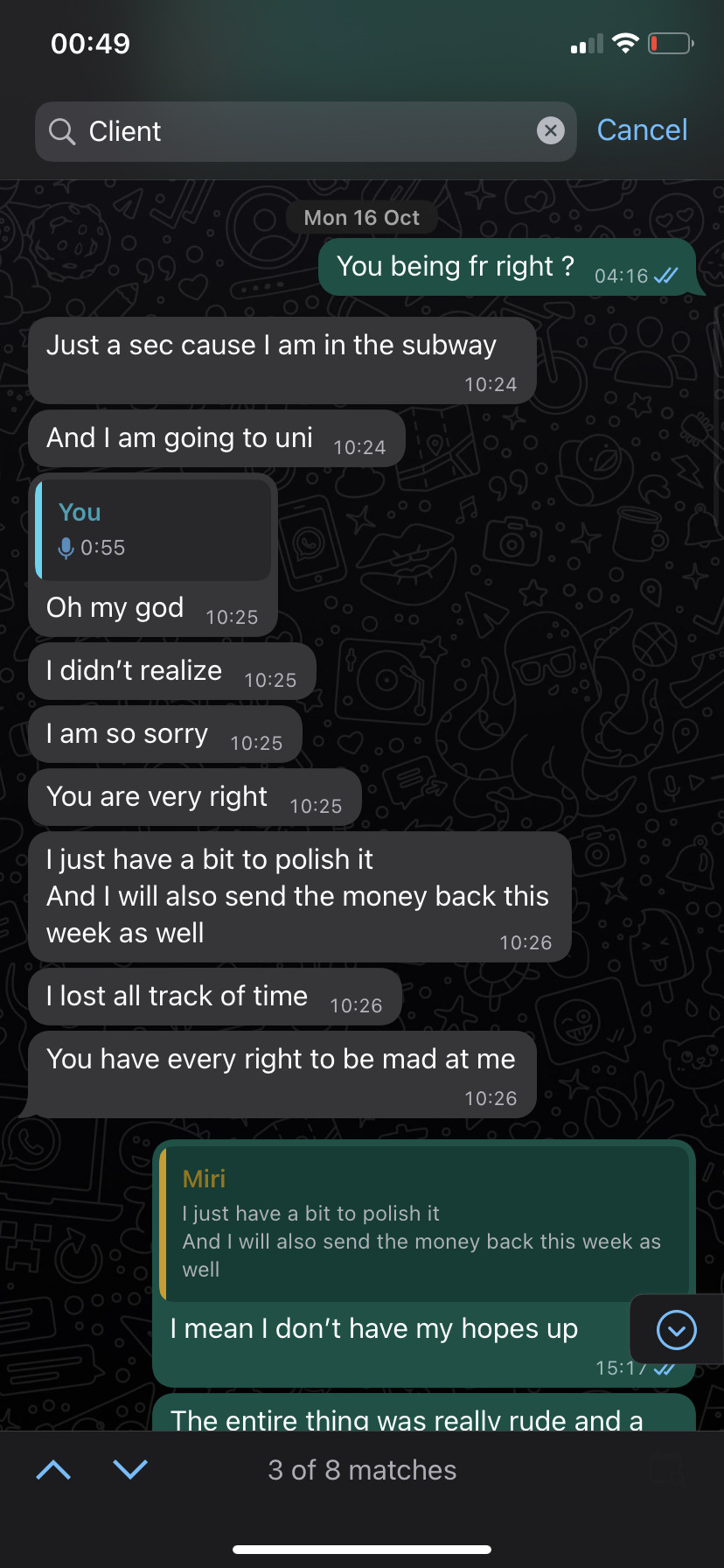

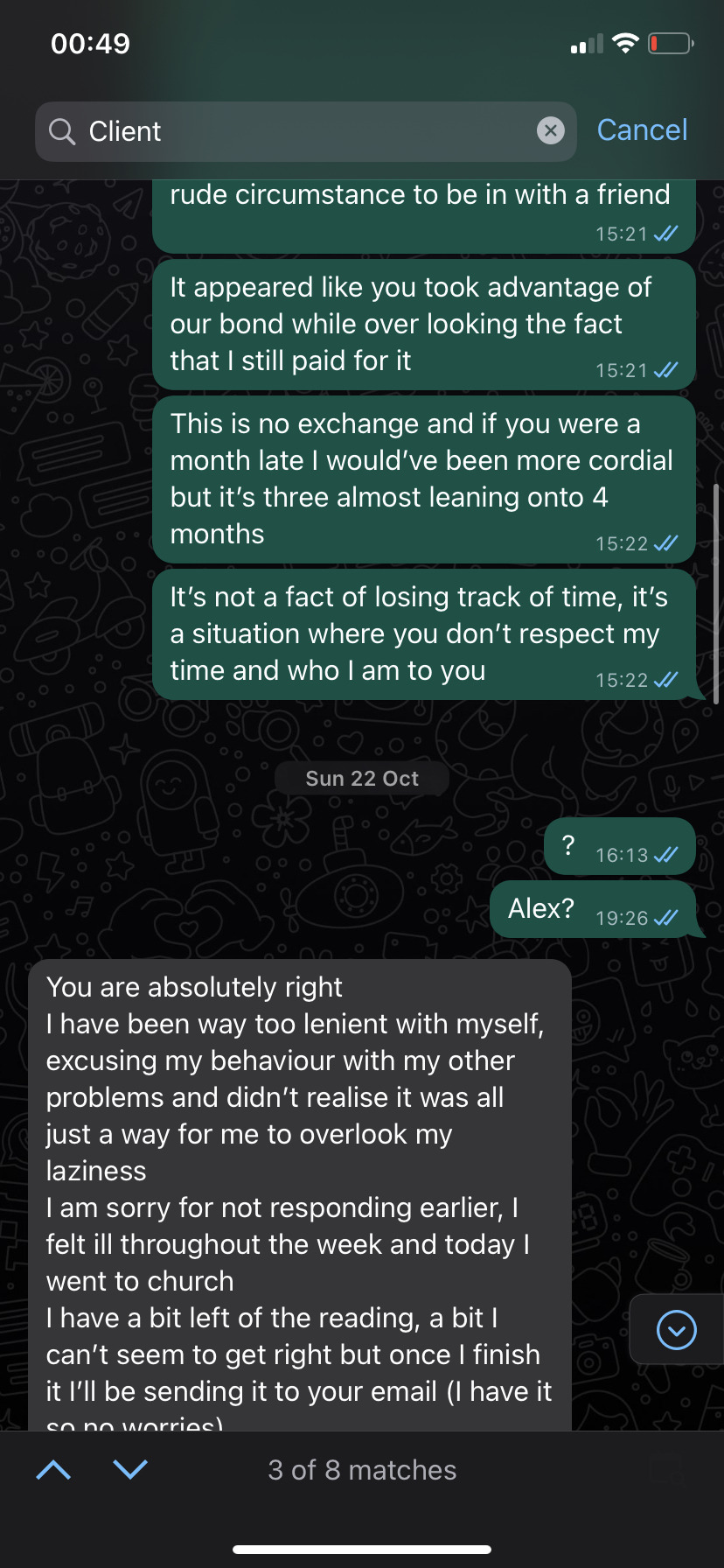

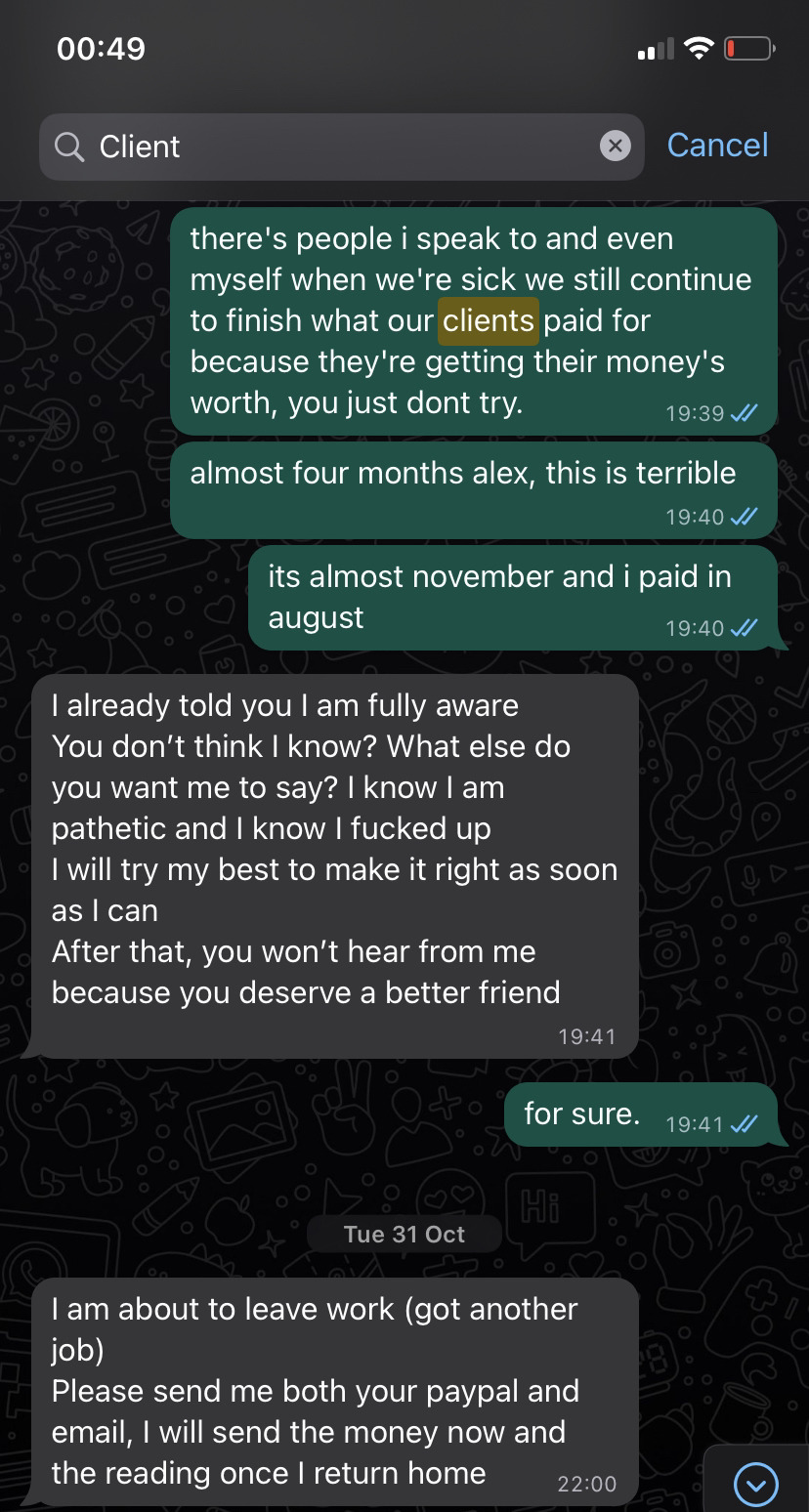

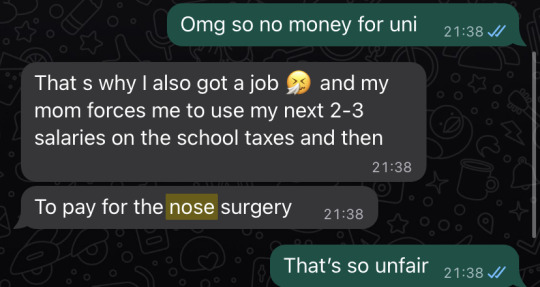

i've returned to post about a particular subject i've been fighting to or not to post, because i used to consider this person the closest person in my life and i even considered her as a best friend and a sister.

and we have fallen out and apologised to each other many times, but perhaps whenever we argued it was life telling me that she is not supposed to be in my circle. and you could be wondering why am i bringing this up and telling tumblr this but im telling tumblr this to be aware of @couerardent and her scamming behaviour.

couerardent also known as MYSTIICWINTER OR MYSTICWIINTER.

talk about WORSE SERVICE I HAVE EVER GOTTEN MY ENTIRE LIFE.

[other people have come to me and spoke about how bad her services were, but i tried to overlook it because i really cared for her, lessoned learn]

i have always been empathetic towards ardent and her money situation, but there are moments when excuses turn into reasons to not do something. on august, i sent alex money because she needed it, but she also said in return she will give me 4 packs she usually gives her clients and she told me she would give me my money back.

first pack is "tell me your story."

second and other packs she hadnt told me what they were but she informed me that i'll be receiving them weekly since august, and now its november.

at first i was empathetic, since i used to be close to ardent, i knew she went through a lot of stuff at home, so i was patient. until august turned into september, and september turned into october and then october turned into novemeber.

and slowly i became annoyed, [as i should] because her services arent even long or good, as someone who gives chart readings to other people that consists more than fourteen pages, the effort to write that would take long, but ardent doesnt even give five pages for her services, three at most, so why is it taking her so long?

previously, she has joked to me about scamming other people, but would put the blame on them and not want to take accountability until they start using threats to expose her, i think she deleted the making fun of scamming them but here is some of it:

and when i would message her for updates about my reading because it'll take months, she would ignore me and even change her pfp on tumblr or discord, until i reach out to her on more platforms to get her attention.

and what would annoy me even more is that she would talk about how she never has something to do or would focus on other stuff knowing she needs to get my reading done lmao and this would be like 1-2 months after i was supposed to receive any of it lol.

worrying about the layout for almost 3 months PLEASE.

i have received 1/4 readings, and that was now almost 2-3 weeks ago, we should've been on my 2nd or 3rd reading by now, the only reason i have received 1 reading is because i did threaten to expose her if she didnt send the money or reading my way, because even i had some issues because living in london has gotten really difficult and i have been trying to support my family as much as i can, but im doing better right now.

its all about the principle. and she has none of that. and even attempted to victimise herself and behave like she was in distress whenever she got called out about her behaviour.

she lost track of time, the time being 3-4 months lol.

and when i was speaking to her she ignored me for a bit again ha, it was almost comedic. for almost two weeks she didnt try and check what i was speaking about.

she has gotten ill, but this was still months after.

and i have remembered, she has used much of her earned money to fund for her nose job but also uni, but during the moments it was best to pay me back was at the job she said paid her well, she informed me that when she gets paid by her job she'll pay me back, and she never did and ended up quitting the job.

[the unfairness i was speaking about is how uni her country dont do student finances, she's from romania, because they do in the uk it was just a surprise].

i asked her recently on how i was supposed to receive a reading but she didnt reply but change her pfp on whatsapp and discord, again.

if there is any confused people comment please because i did this half asleep lmao

191 notes

·

View notes

Text

Top Lenders Offering International Student Loans for Studying in the UK

Studying in the UK is a dream for many international students, but financing education abroad can be a challenge. Fortunately, several lenders provide tailored financial solutions to support students pursuing higher education in the UK. If you’re exploring ways to fund your studies, this guide is for you. For more information about international student loans, check out international student loans uk.

Why Choose the UK for Your Education?

The UK boasts prestigious universities, diverse cultures, and globally recognized degrees. However, tuition fees and living expenses can add up, making financial assistance essential for many students. International student loans can bridge this gap, helping you focus on your studies without constant financial worries.

Popular Lenders Offering International Student Loans in the UK

1. Prodigy Finance

Loan Terms: Prodigy Finance specializes in loans for international students pursuing postgraduate degrees. They offer competitive interest rates, flexible repayment plans, and no requirement for a co-signer or collateral.

Eligibility Criteria:

Enrollment in a partner university.

Valid admission to an eligible course, typically in business, engineering, or law.

Why Choose Prodigy Finance? Their focus on international students means they understand unique challenges, providing tailored support that works.

2. Future Finance

Loan Terms: Future Finance provides loans for both undergraduate and postgraduate international students. With options to defer payments until after graduation, they make managing finances during studies easier.

Eligibility Criteria:

Acceptance into a UK university.

Ability to demonstrate financial need.

Why Choose Future Finance? They allow you to cover tuition and living expenses, ensuring you can focus entirely on your studies.

3. Mpower Financing

Loan Terms: Mpower Financing is a popular choice for students without a co-signer or collateral. They provide fixed-interest loans for undergraduate and postgraduate programs, covering tuition and other expenses.

Eligibility Criteria:

Enrollment in a partner university or eligible program.

Good academic standing and potential for future earnings.

Why Choose Mpower Financing? Their no-cosigner policy and transparent loan structure make them a preferred choice among international students.

4. HSBC International Student Loans

Loan Terms: HSBC offers loans tailored to international students with competitive interest rates and flexible repayment options. They focus on supporting students at all stages of their education.

Eligibility Criteria:

A local guarantor may be required.

Enrollment in a recognized UK institution.

Why Choose HSBC? Their global presence ensures support for students from diverse backgrounds and reliable customer service.

What to Consider Before Choosing a Loan

Interest Rates: Fixed vs. variable rates can impact the total cost of your loan.

Repayment Terms: Understand when repayment starts and the flexibility of the terms.

Eligibility Requirements: Ensure you meet all criteria before applying.

Additional Costs: Some loans include processing fees or hidden charges.

How to Apply for International Student Loans in the UK

Research Lenders: Start by comparing options like those listed above.

Prepare Documents: Keep your offer letter, identification, and financial records ready.

Submit Application: Most lenders have an online application process.

Understand the Fine Print: Review terms and conditions before signing.

Final Thoughts

Securing a loan as an international student can open doors to a world-class education in the UK. The right lender will provide the support you need to achieve your academic dreams. Remember to thoroughly research your options and consider your financial situation to make an informed decision.

Explore your opportunities today by visiting international student loans uk.

#International Student Loans UK#Student Loans for UK Studies#Best Lenders for International Students#UK Education Financing#How to Apply for International Student Loans#Prodigy Finance Loans#Future Finance for International Students#Mpower Financing UK#HSBC Student Loans UK#Guide to UK Student Loans#Study Abroad Loan Options#Affordable Loans for UK Students#Financial Aid for International Students#Top Lenders for UK Education Loans#Postgraduate Loans for International Students

0 notes

Text

Oulu is five hours north from Helsinki by train and a good deal colder and darker each winter than the Finnish capital. From November to March its 220,000 residents are lucky to see daylight for a couple of hours a day and temperatures can reach the minus 30s. However, this is not the reason I sense a darkening of the Finnish dream that brought me here six years ago.

In 2018, moving to Finland seemed like a no-brainer. One year earlier I had met my Finnish partner while working away in Oulu. My adopted home of Italy, where I had lived for 10 years, had recently elected a coalition government with the far-right Matteo Salvini as interior minister, while my native UK had voted for Brexit. Given Finland’s status as a beacon of progressive values, I boarded a plane, leaving my lecturing job and friends behind.

Things have gone well. My partner and I both have stable teaching contracts, me at a university where my mostly Finnish colleagues are on the whole friendlier than the taciturn cliche that persists of Finns (and which stands in puzzling contradiction to their status as the world’s happiest people).

Notwithstanding this, I feel a sense of unease as Finland’s prime minister Petteri Orpo’s rightwing coalition government has set about slashing welfare and capping public sector pay. Even on two teachers’ salaries my partner and I have felt the sting of inflation as goods have increased by 20% in three years. With beer now costing €8 or more in a city centre pub, going out becomes an ever rarer expense.

Those worse off than us face food scarcity. A survey conducted by the National Institute for Health and Welfare found 25% of students struggling to afford food, while reductions in housing benefit mean tenants are being forced to move or absorb the shortfall in rent payments. There are concerns that many unemployed young people could become homeless.

Healthcare is faring little better. Finland’s two-tier system means that while civil servants and local government employees (including teachers) paradoxically enjoy private health cover, many other people face long waiting lists. Not having dental cover on my university’s plan, I called for a public dental appointment in April. I was put on callback and received a text message stating I’d be contacted when the waiting list reopened. Six months later, I am still waiting. A few years ago I could expect to wait two months at most.

The current government, formed by Orpo’s National Coalition party (NCP) last year in coalition with the far-right Finns party, the Swedish People’s party of Finland and the Christian Democrats, has been described as “the most rightwing” Finland has ever seen – a position it appears to relish.

Deputy prime minister and finance minister Riikka Purra – the Finns’ party leader – has been linked to racist and sometimes violent comments made online back in 2008. The party’s xenophobia is clearly influencing policymaking and affecting migrants. As a foreigner, I’d be lying if I didn’t admit to feeling a certain chill as anti-immigrant rhetoric ramps up.

A survey by the organisation Specialists in Finland last year found that most highly qualified workers would consider leaving Finland if the government’s planned tightening of visa requirements went ahead (that proposal, which extended residence time required for Finnish citizenship from four to as many as eight years has now become law). Luckily, I am a permanent resident under the Brexit agreement.

With the coalition intent on ending Finland’s long history of welfarism in just one term, there is a risk (and hope among progressives) that it may go too far, inviting a backlash. We arguably saw signs of this in the European election in the summer, when Li Andersson won the highest number of votes for an EU election candidate in Finland. Andersson, who was education minister in Sanna Marin’s former centre-left coalition government (which lost to the NCP in April 2023), ran on a progressive red-green ticket of increased wealth equality and measures to tackle the climate crisis. She has also been critical of emergency laws blocking asylum seekers from crossing Finland’s eastern border, arguing that it contravenes human rights obligations.

Andersson’s party, the Left Alliance, chose a new leader this month, the charismatic feminist author Minja Koskela, who was elected to Helsinki’s council in 2021 after a period as secretary of the Feminist party, and as a member of parliament in 2023. Koskela argues: “People are widely frustrated with the government’s discriminatory policy and cuts to culture, social and health services, education and people’s livelihood. It is possible to turn this frustration into action.” (Full disclosure: I’m a member of the party and have helped coordinate its local approach to immigrants.)

It remains to be seen if she can build on Andersson’s EU success. Although the popular media-savvy figure appears to relish the challenge of turning the party into an election winner, Koskela faces a huge challenge. The party struggles to poll at more than 10% nationally, aside from a brief high of 11% in July. A place in government is nonetheless possible. But Marin’s Social Democratic party (SDP) of Finland (now led by Antti Lindtman), has topped the national opinion polls 12 out of 14 times since April 2023.

Meanwhile, the Finns party is polling at 16%, down from the 20.1% vote they gained in the election. These figures point to one thing: another possible SDP-led coalition government in the next parliament by the summer of 2027. This would probably include the Left Alliance and the Green League, among others. And such a coalition would aim to undo a lot of the damage done by the right.

But until then, there will be more damage to come. So while there is clearly hope for an end in sight to the country’s political darkness three years hence, this will bring little solace now to poor people, migrants, and the squeezed middle class as the long Finnish winter closes in.

26 notes

·

View notes

Note

Heya!! If it were easy to make $100k+/yr after 8 years as a craftsperson, wouldn’t you think more folks would go that route?

There are far more opportunities to get a doctorate and after about 8 years you are almost guaranteed to make out with a $100k+/yr salary, whereas you need to search hard to find a master glassblower, let alone a master open to apprentices, and then you are going to need to spend dozens of years learning, and after that you can’t even be sure whether your works will be appreciated enough to get you a proper living-wage salary.

So yes, it’s much harder to become a master of the arts than a doctor of the sciences.

(source: How Much Do Doctors Really Earn? | BMJ Careers) - important to note that this is pre-tax, so a doctor who has been working for 3 years will take home (before loans and rent and groceries and clothes) between £23,000-£37,200. while this isn't a measly salary by any means, i find it incredibly dismissive to assume that doctors are easy millionaires. (perhaps 8-10 years post-graduation, yes, but that's a long time. a decade of time is not a light commitment.)

medical school in the UK is typically 5 years, during which medical students amass on average £50,000 to £90,000 in debt (source - highly recommend reading this) depending on whether they live in London and whether they studied for 4 years (which means they would need to have a prior degree, at least 3 years long), the average, or 6 years. tuition fees go up next year to £9535 yearly, student accommodation is not cheap, and cost of living is quite frankly, horrendous.

source: Medical students plunged into financial hardship as BMA urges Government to fix ‘broken’ student finance system - BMA media centre - BMA

not to mention the sheer emotional burden of being a medical student & later a doctor. forget the fact that if i fail my end-of-year exams, i'll have to retake the year = more spending, if i'm a bad doctor, i will kill people. people will die.

okay, sure. but glassblowing and artisan jobs are dying out! (important to note that they are still occurring, because the products of those labours aren't dying out, it's just all happening in China where labour costs are low and conditions for workers are abysmal and allowed to be. also important to note that this is the fault of capitalism, not medical students?) we are also very much in need of doctors!

source: NHS 'dangerously' short of 100,000 staff - BBC News

oh, but then surely the yearly addition of all 9140 medical graduates will fill that gap? not if over 3000 consultants and GPs retire annually, and 4800 doctors move abroad to work for better pay.

to your point: "If it were easy to make $100k+/yr after 8 years as a craftsperson, wouldn’t you think more folks would go that route?" yes. yes i do. i do think that this would be the case, and i might have even been one of them. the fact of the matter is that it's not, and the thing i take offence at is the implication that people shouldn't be doctors to allow craft professions to blossom, especially when doctors - famously actually, have also been campaigning for fair wages. we got a cosmetic change and are still campaigning. and i don't know, i think perhaps being responsible for entire wards of actual, real people deserves to be fairly compensated. but maybe that's just me.

14 notes

·

View notes