#stocks to buy for big growth

Explore tagged Tumblr posts

Text

youtube

The World of Growth Stocks: 3 Top-Ranked Stocks to Buy for Big Growth

Are you ready to supercharge your investment portfolio with high-growth stocks? In this video, we delve into the world of growth investing to uncover 3 top-ranked stocks to buy for big growth. Uber Technologies, Meta Platforms (formerly Facebook), and Salesforce.

👉 Subscribe to my channel to stay tuned: https://bit.ly/4aXYMxD

Welcome to Financial Life, your go-to destination for all things finance, investing, and wealth-building strategies. In today's video, titled "3 Top-Ranked Stocks," we delve into the dynamic world of investments to bring insights into three stellar companies poised for success.

Join us as we analyze their recent performances, explore their growth prospects, and discuss why they could be the next big winners in your investment journey.

Discover why these companies represent more than just investments—they embody visions of a future ripe with potential. Embrace growth and watch as your portfolio ascends to new heights!

If you found this video helpful, don't forget to like, share, and subscribe to our channel for more content on investment strategies and market trends. Happy investing, and may your portfolio flourish with abundance!

#the world of growth stocks#top stocks to buy now#stocks#3 best stocks to buy#3 top-ranked stocks to buy for big growth#best stocks to buy#high growth stocks 2024#stocks to buy for big growth#top growth stocks to buy now#world of growth stocks#stock market#financial education#Youtube

0 notes

Text

Amazon annihilates Alexa privacy settings, turns on continuous, nonconsensual audio uploading

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me in SAN DIEGO at MYSTERIOUS GALAXY on Mar 24, and in CHICAGO with PETER SAGAL on Apr 2. More tour dates here.

Even by Amazon standards, this is extraordinarily sleazy: starting March 28, each Amazon Echo device will cease processing audio on-device and instead upload all the audio it captures to Amazon's cloud for processing, even if you have previously opted out of cloud-based processing:

https://arstechnica.com/gadgets/2025/03/everything-you-say-to-your-echo-will-be-sent-to-amazon-starting-on-march-28/

It's easy to flap your hands at this bit of thievery and say, "surveillance capitalists gonna surveillance capitalism," which would confine this fuckery to the realm of ideology (that is, "Amazon is ripping you off because they have bad ideas"). But that would be wrong. What's going on here is a material phenomenon, grounded in specific policy choices and by unpacking the material basis for this absolutely unforgivable move, we can understand how we got here – and where we should go next.

Start with Amazon's excuse for destroying your privacy: they want to do AI processing on the audio Alexa captures, and that is too computationally intensive for on-device processing. But that only raises another question: why does Amazon want to do this AI processing, even for customers who are happy with their Echo as-is, at the risk of infuriating and alienating millions of customers?

For Big Tech companies, AI is part of a "growth story" – a narrative about how these companies that have already saturated their markets will still continue to grow. It's hard to overstate how dominant Amazon is: they are the leading cloud provider, the most important retailer, and the majority of US households already subscribe to Prime. This may sound like a good place to be, but for Amazon, it's actually very dangerous.

Amazon has a sky-high price/earnings ratio – about triple the ratio of other retailers, like Target. That scorching P/E ratio reflects a belief by investors that Amazon will continue growing. Companies with very high p/e ratios have an unbeatable advantage relative to mature competitors – they can buy things with their stock, rather than paying cash for them. If Amazon wants to hire a key person, or acquire a key company, it can pad its offer with its extremely high-value, growing stock. Being able to buy things with stock instead of money is a powerful advantage, because money is scarce and exogenous (Amazon must acquire money from someone else, like a customer), while new Amazon stock can be conjured into existence by typing zeroes into a spreadsheet:

https://pluralistic.net/2025/03/06/privacy-last/#exceptionally-american

But the downside here is that every growth stock eventually stops growing. For Amazon to double its US Prime subscriber base, it will have to establish a breeding program to produce tens of millions of new Americans, raising them to maturity, getting them gainful employment, and then getting them to sign up for Prime. Almost by definition, a dominant firm ceases to be a growing firm, and lives with the constant threat of a stock revaluation as investors belief in future growth crumbles and they punch the "sell" button, hoping to liquidate their now-overvalued stock ahead of everyone else.

For Big Tech companies, a growth story isn't an ideological commitment to cancer-like continuous expansion. It's a practical, material phenomenon, driven by the need to maintain investor confidence that there are still worlds for the company to conquer.

That's where "AI" comes in. The hype around AI serves an important material need for tech companies. By lumping an incoherent set of poorly understood technologies together into a hot buzzword, tech companies can bamboozle investors into thinking that there's plenty of growth in their future.

OK, so that's the material need that this asshole tactic satisfies. Next, let's look at the technical dimension of this rug-pull.

How is it possible for Amazon to modify your Echo after you bought it? After all, you own your Echo. It is your property. Every first year law student learns this 18th century definition of property, from Sir William Blackstone:

That sole and despotic dominion which one man claims and exercises over the external things of the world, in total exclusion of the right of any other individual in the universe.

If the Echo is your property, how come Amazon gets to break it? Because we passed a law that lets them. Section 1201 of 1998's Digital Millennium Copyright Act makes it a felony to "bypass an access control" for a copyrighted work:

https://pluralistic.net/2024/05/24/record-scratch/#autoenshittification

That means that once Amazon reaches over the air to stir up the guts of your Echo, no one is allowed to give you a tool that will let you get inside your Echo and change the software back. Sure, it's your property, but exercising sole and despotic dominion over it requires breaking the digital lock that controls access to the firmware, and that's a felony punishable by a five-year prison sentence and a $500,000 fine for a first offense.

The Echo is an internet-connected device that treats its owner as an adversary and is designed to facilitate over-the-air updates by the manufacturer that are adverse to the interests of the owner. Giving a manufacturer the power to downgrade a device after you've bought it, in a way you can't roll back or defend against is an invitation to run the playbook of the Darth Vader MBA, in which the manufacturer replies to your outraged squawks with "I am altering the deal. Pray I don't alter it any further":

https://pluralistic.net/2023/10/26/hit-with-a-brick/#graceful-failure

The ability to remotely, unilaterally alter how a device or service works is called "twiddling" and it is a key factor in enshittification. By "twiddling" the knobs and dials that control the prices, costs, search rankings, recommendations, and core features of products and services, tech firms can play a high-speed shell-game that shifts value away from customers and suppliers and toward the firm and its executives:

https://pluralistic.net/2023/02/19/twiddler/

But how can this be legal? You bought an Echo and explicitly went into its settings to disable remote monitoring of the sounds in your home, and now Amazon – without your permission, against your express wishes – is going to start sending recordings from inside your house to its offices. Isn't that against the law?

Well, you'd think so, but US consumer privacy law is unbelievably backwards. Congress hasn't passed a consumer privacy law since 1988, when the Video Privacy Protection Act banned video store clerks from disclosing which VHS cassettes you brought home. That is the last technological privacy threat that Congress has given any consideration to:

https://pluralistic.net/2023/12/06/privacy-first/#but-not-just-privacy

This privacy vacuum has been filled up with surveillance on an unimaginable scale. Scumbag data-brokers you've never heard of openly boast about having dossiers on 91% of adult internet users, detailing who we are, what we watch, what we read, who we live with, who we follow on social media, what we buy online and offline, where we buy, when we buy, and why we buy:

https://gizmodo.com/data-broker-brags-about-having-highly-detailed-personal-information-on-nearly-all-internet-users-2000575762

To a first approximation, every kind of privacy violation is legal, because the concentrated commercial surveillance industry spends millions lobbying against privacy laws, and those millions are a bargain, because they make billions off the data they harvest with impunity.

Regulatory capture is a function of monopoly. Highly concentrated sectors don't need to engage in "wasteful competition," which leaves them with gigantic profits to spend on lobbying, which is extraordinarily effective, because a sector that is dominated by a handful of firms can easily arrive at a common negotiating position and speak with one voice to the government:

https://pluralistic.net/2022/06/05/regulatory-capture/

Starting with the Carter administration, and accelerating through every subsequent administration except Biden's, America has adopted an explicitly pro-monopoly policy, called the "consumer welfare" antitrust theory. 40 years later, our economy is riddled with monopolies:

https://pluralistic.net/2024/01/17/monopolies-produce-billionaires/#inequality-corruption-climate-poverty-sweatshops

Every part of this Echo privacy massacre is downstream of that policy choice: "growth stock" narratives about AI, twiddling, DMCA 1201, the Darth Vader MBA, the end of legal privacy protections. These are material things, not ideological ones. They exist to make a very, very small number of people very, very rich.

Your Echo is your property, you paid for it. You paid for the product and you are still the product:

https://pluralistic.net/2022/11/14/luxury-surveillance/#liar-liar

Now, Amazon says that the recordings your Echo will send to its data-centers will be deleted as soon as it's been processed by the AI servers. Amazon's made these claims before, and they were lies. Amazon eventually had to admit that its employees and a menagerie of overseas contractors were secretly given millions of recordings to listen to and make notes on:

https://archive.is/TD90k

And sometimes, Amazon just sent these recordings to random people on the internet:

https://www.washingtonpost.com/technology/2018/12/20/amazon-alexa-user-receives-audio-recordings-stranger-through-human-error/

Fool me once, etc. I will bet you a testicle* that Amazon will eventually have to admit that the recordings it harvests to feed its AI are also being retained and listened to by employees, contractors, and, possibly, randos on the internet.

*Not one of mine

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/03/15/altering-the-deal/#telescreen

Image: Stock Catalog/https://www.quotecatalog.com (modified) https://commons.wikimedia.org/wiki/File:Alexa_%2840770465691%29.jpg

Sam Howzit (modified) https://commons.wikimedia.org/wiki/File:SWC_6_-_Darth_Vader_Costume_(7865106344).jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/deed.en

#pluralistic#alexa#ai#voice assistants#darth vader mba#amazon#growth stocks#twiddling#privacy#privacy first#enshittification

4K notes

·

View notes

Text

#bohostyle#marketing#branding#handmade#quilting#sales#home decor#business#business growth#accounting#best handmade items#biggest discount sale#biggest sale#big savings#shopping weekends#weekend exclusive discount sale#limited offer#limited stock#maha sale#65% discount sale#limited time offer#buy it now

1 note

·

View note

Text

Once again trapped in trying to figure out what Wayne Industries actually Does. "Everything!" yeah sure but they had to get there somehow. Amazon was an online bookstore at first there was a lot of very rapid growth between then and now.

Usually I hear that they started as a shipping business which makes sense when Gotham is 90% waterfront, but at some point they had to transition from just shipping other people's things to shipping things they made as well. I suppose if they started making their own transports for shipping (starting with their own steamboats and later trains and cars) that would make sense. Maybe in the industrial revolution they even bought their own steel mill upon getting tired of having fluctuating prices or a steel shortage and just deciding they were going to get their own damn steel and sell the extra instead. If they chose to manufacture higher quality steel instead of cheapest possible steel that's also laying the groundwork for them to be well liked by their customers. Not railroad barons but making the steel to lay the railroad and build the trains. It's the 1800s so they have a couple patented medicines by then as well that are.... not really medicine but no one has officially noticed yet. They ship their own chemicals out west for a good time.

In 1880s Alan Wayne makes the building that becomes Wayne Tower?? Which I think is much too early, but apparently we were building sky scrapers in 1888 so business must have been booming I fucking guess. This is also the man that has them go corporate.

Of course the railroads start to fall out with the growth of cars and car lobbying. They are still used along with boats for transport but with railroads not being built as much and not being maintained and the union wars, Wayne Industries has to make a pivot somewhere to stay in the race. The family can have a lot of personal money but the business itself is still going strong in Gotham even before Bruce takes over.

I guess if they're already in shipping, they're probably importing as well by then. They may have started with steamboats but then in WWI and WWII all steel factories started producing things for the war efforts, surely they made a couple big ships by then capable of crossing the Atlantic, if they weren't already in oceanic shipping by then. It lets them ride out the great depression because of government maritime subsidies that were a little out of control until the new deal kicked in. That would've also presumably kept WI employees working in the depression and cemented them harder in the city as smaller businesses closed around them.

The patented medicine starts shifting to actual generics that are a little less Heroic post 1918.

Maybe at around that point was when WI started manufacturing... sort of everything. You get your ships, and all the things on board that you need to run a ship. You get your ovens and stoves and big pots and your radar and hell your sailors can even buy their boots and uniforms from us.

When WWII ends they shift back to transporting other people's goods but also maybe more luxury vehicles as well. Cruise services. Some nicer kitchen installations. Kitchens on land even. Get a nice WI electric mixer. Get your waterfront boots. Get your generic ibuprofen.

At that point we're closer to Martha and Thomas' era and they're just... Along for the ride I guess. Thomas is a figurehead CEO. He's off doing medical school and mostly just shows up for formalities, while Martha works in the Wayne Foundation (either the only thing Thomas really made or opened in the 60s to try and get Gotham really booming) as a charity liason. They're still not really celebrities as much as a charismatic couple in high circles. WI doesn't need them to function. It's basically just funding them as they do their own things.

And then the murders happen

And then Bruce, over eighteen, shows up having inherited the figurehead CEO title and his entire family's controlling stock in WI, and announces they're going to be doing things his way now.

The CEO/Board of directors is supposed to do things in the best interest of their stock holders.

If Bruce is the controlling stock holder, they do what he says his best interest is.

93 notes

·

View notes

Text

I've been thinking about how it might be useful, if not necessarily entirely fulfilling for whatever it is that I need out of them, to ask politicians how they would define a healthy economy, as opposed to just asking them how they would try to ensure a healthy economy.

President Joe Biden took to the White House lectern Friday to tout the healthy economy – strong job creation, lowering inflation and increased workforce participation and job satisfaction. - US News, Sep. 1, 2023

And

"I think we will see a big pickup in growth. We may not see it in the winter quarter...but I’m hopeful that we’ll see it in the spring,” Larry Kudlow, head of the National Economic Council, said on Fox Business. “It’s a fundamentally healthy economy,” he said, touting the 3.5 percent unemployment rate and “tremendous wage gains.” - The Washington Post, Jan. 30, 2020

In both cases they are offering a few signs of a healthy economy, the things that are quantified and measured as indicators, like unemployment, inflation, and wages.

But... wouldn't 'the ability to buy or rent a living space, and food security, for as many people as possible' make more sense?

Yeah, low inflation is the sign of a good economy, but what is the healthy economy actually doing? The jobs being created, are they actually full time and paying a living wage?

Fuck knows how many times a person at the podium has referenced the stock market as a signifier of the economy's health, and we all know that's barely relevant to the lives of us normal people.

I guess the question I'd want to ask politicians is "if the economy's health were measured in percentage of people who are able to afford housing, food, and other essentials on a full-time job with no government assistance, is the economy actually healthy?"

Low inflation means jackshit if the minimum wage is still no inflation. Job creation means something, but not if it's so far from your home that you spend most of your paycheck commuting. 'Tremendous wage gains' don't mean much if you're looking at an average that includes the CEOs and allows their paychecks to skew the data upwards.

How many of your citizens can afford housing, groceries, and medical care on a full-time wage, without government assistance?

#phoenix talks#economics#phoenix politics#healthy economy#terminology#this is more of a#vent post#than anything else honestly

119 notes

·

View notes

Text

Melissa Ryan at Ctrl Alt Right Delete:

On Saturday, February 15, I was standing outside a Tesla dealership in the heart of Seattle with a sign that said “BigBalls can lick Deez Nuts” and a photo of DOGE dipshit Edward “BigBalls” Coristine. As about 80 of us stood on the street chanting and yelling, an older couple stopped to compliment my sign. They were out for a walk after their breakfast and wondered what the fuss was about. I told them if they wanted to join us, they could hold my sign. To my surprise, they grabbed the sign and spent the next hour happily waving it at passing cars. The key to effective resistance is to make your opponent pay a price for their overreach—or at least instill fear that there might be a price to pay. Clearly, everyone involved in Trump 2.0 believes they can fuck around and will never have to find out. It’s up to us to change that. But how do regular people with limited resources extract a price from a rising fascist movement? The first answer is everything we can think of. No one who’s lived their whole life in the United States has ever faced something like this, and none of us knows for sure what’s going to derail the march toward fascism. In times like these, we should foster creative actions, not wag our fingers or tut-tut ideas.

But there is a very specific target that deserves special focus—Tesla Motors. Tesla is the basis of Elon Musk’s mystique and his wealth. His stake in the company is worth around $145 billion at today’s valuation—more than a third of his total net worth. Elon clearly isn’t scared about the legal consequences of his actions. Why should he be? The courts have never held him accountable in any meaningful way before, and now he’s protected by an increasingly authoritarian regime. But legal consequences aren’t the only cost an effective resistance can make opponents pay. The first thing you need to know is that Tesla Motors is a house of cards. As I write this, Tesla’s market cap stands at $1.12 trillion—about $400 billion more than Toyota, Honda, Ferrari, BMW, Mercedes-Benz, Porsche, Volkswagen, Ford, GM, Stellantis and Hyundai COMBINED. Tesla’s stock has been on a hype-fueled rocket ride since the start of the pandemic. But Wall Street investors hate uncertainty, and in the end, hype is no match for quarterly profits. Most of Tesla’s extreme valuation is based on the cockamamie idea that the company can continue growing at the rate it achieved early in the pandemic—and the mistaken belief that Tesla is a tech company, rather than a car company. But Tesla’s market dominance and opportunities for growth weren’t built to last. Only one in three Americans are open to buying EVs today, and there’s much more competition in the market than there was even 5 years ago. Chinese EV companies are eating Elon’s lunch. And far from the game changer Elon promised, the Cybertruck is looking more like an anchor around Tesla’s neck. Tesla sales are already tanking in Europe because of Musk’s tumbling reputation.

For the first time in a decade, Tesla reported fewer sales in 2024 than in 2023. Now, buyers in the U.S. are starting to price-in Elon’s ties to Trump and far-right movements around the world—and the potential social consequences of driving a car so closely associated with Musk’s personal brand. If that spreads, it could pop the hype bubble. Tesla insiders know it, and so do big Wall Street research firms.

Tesla, the crown jewel of Elon Musk’s empire, has become increasingly persona non grata among the left in the USA, and that is due to Musk’s turn to the far-right that began as early as the COVID pandemic and accelerating further in recent years.

22 notes

·

View notes

Text

"Just moved back home with my mom four months ago and look at how fat I am already! Of course, ahead of me returning mom packed the house with fattening food..... she always told me about how if I transition I'll become a fat girl. I said I'll try really hard to stay in shape and that she was exaggerating! But she said all that estrogen and progestrone they pump trans girls full of will make sure I get big and fat eventually, no matter how much I take care of myself. And sure, I've seen plenty of TikToks and vids of trans girls getting fat, who hasn't? But there were still plenty of sexy, slim trans girls! I was so addicted to watching their transformations.... getting big boobs, curvy hips, and if you didn't transition super young they were even giving trans girls hrt mixtures these days that enhanced the growth of male genitals instead of shrinking them....

I started transitioning late in high school, but I was already something of a femboy so it was a natural progression for me.... I admired other girls so much, I just wanted to be one of them! But as soon as I came out, showing my mom all these TikTok and Instagram transformations with trans girls embracing getting a big cock and staying nice and fit, she laughed. She insisted I'd become fat if I transitioned, mocking how big and saggy my boobs would get, all the cellulite I'd have, a big fat flabby ass. I'd be a walking tub of lard.... with a big cock, she admitted, so at least I'd have that to occupy my time with, jerking off as I descend into morbid obesity.

Well, I never said I was bright..... I spent two years at college as the perfect sorority girl! I told my college insurance I transitioned in high school and didn't need to worry about male puberty like other trans girls. They seemed very happy about this.... I was put on hormones that jumped me from a B-Cup to a DD, and a six-inch cock to a foot long..... the other sorority girls loved playing with my cock, sucking it, riding it, titty fucking it.... I was such a queen! They worshipped my cock, not tiny and pathetic like the other trans girls.... and my orgasms were so strong! I blew more than a dozen heavy loads at a time, nice and thick, white and creamy. The other trans girls were so jealous a few went through male puberty just to take my hormone mixture! Poor things.... I'd been preparing my voice and stuff forever, not so much those little spoiled princesses who were so shocked when they let themselves go on testosterone. But any good trans girl should crave the stuff and embrace having a nice big cock like me!

I was so proud after two years I signed that I'd be dropping from the sorority, almost to gloat to my mom. As if to say: look at me! I'm fit, sexy, with big boobs and a huge cock. One of the first things I did was strip and show her my beautiful, ideal trans girl body.... so smug in my confidence that I proved her wrong I forgot one tiny thing.... I was back home with her. She smiled at my naked body, grabbing and checking my breasts, spinning me around, she examined my big, swollen balls, and my fat cock. She kissed it, up its length, then sucked it. She smiled ear to ear, I was so confused.... she acted like 'she won' or something..... Mom gave me an incredible blow job..... she told me I was right, that she was just a dumb, naïve woman from an older generation who didn't know better.... and now that I'm home, with such an impressive cock, I might as well keep her satisfied.

Soooo.... here I am! Mom is unsurprisingly pregnant and I'm... looking like quite the fool! Not only is my cock now basically mom's property, she doesn't even let me please myself, or I get punished badly.... she stocks the house with fattening food and buys me all kinds of take out all day. I only get to cum when I'm fucking her or eating. She loves to suck me off as I eat a fattening meal, or jerk my cock.... my orgasms are soooo strong..... I cum fifteen times in a row sometimes, drooling like an idiot, stuffing my face with greasy food like the spoiled trans girl she'd always assume I'd become! Not that I mind.... I guess. I'm looking so sexy, don't you think? Being so big and fat suits me very well, mom was right! Although I know soon my girly physique and frame will give out and I'll get a huge apron of a gut, my perfect DDs are already up to FFs, and before long they'll be saggy and oversized LLs or bigger flowing down my huge, round gut..... my ass will only get bigger, my poor beautiful thighs, arms, and this delightfully pretty face I'm blessed with..... buried in fat as mom uses my cock all day. And for some reason I'm looking forward to doubling and tripling my weight..... I mean, if I put on 100lbs in four months, I can only imagine how big I'll be in four years.... my poor, beautiful body, the envy of any trans girl.... all gone. Oh well. ❤️"

7 notes

·

View notes

Text

“Environmental restoration may be the art form of the twenty-first century” — from Helping Nature Heal (Ten Speed Press, 1991)

Environmental restoration is the other side of the coin to much of the activity that Earth First! has so far been engaged in — that is, grappling with the toxic forces of ‘law’ and ‘order’ in a very overt way. Such activity is the defensive work, a holding operation, crucial in many ways and important for bringing people together as a group, cementing the bonds between them in shared, often harrowing experience. However it is important not to get hung up on the adrenaline and peculiar glamour of such frontline situations.

Environmental restoration is proactive — whereby we set our own agenda — as opposed to campaigns, which usually involve little more than reacting to the latest state or business atrocity. Restoration therefore helps to signal our ultimate indifference to politicians and the fleeting games that they play. Restoration is less dramatic and more humble than the preservation battles, but it does establish a vital new paradigm: humanity as creator and healer — one who adds value or — makes reparations to nature — rather than one who is unable to do anything but destroy and despoil.

There is no immediate gratification, no overnight old growth forest or pristine wilderness — rather a slow, cumulative process of getting to grips with what surrounds you, and establishing an intimacy and a rapport with a given area of land. There are strong personal and spiritual repercussions: the realisation that you have set in motion a process that will extend far beyond your lifetime leads you into a deeper comprehension of nature, and the scale on which she works. Some of you goes with the tree branches as they steadily rear up towards the sky.

Earth repair work is becoming increasingly widespread in the US, India and elsewhere, but is still relatively uncommon in Britain. We featured Alan Watson’s visionary Trees for Life project in Do or Die #2 (Write to the editorial address for a copy of that article), and a similar project, albeit on a much more modest scale, is that run by the group Tree Spirit on their newly acquired 24 acre plot at Maes y Mynach, near Shrewsbury.

Tree Spirit exist to promote an appreciation of trees and the spiritual, social and ecological roles that they fulfil. To this end, they publish a newsletter, hold regular ‘tree moot’ gatherings, and campaign for the preservation of woodland areas. On a more practical level they also operate their own tree nursery, with stock largely drawn from commercial nursery surplus. (A word of advice to EF!ers interested in tree rearing with a view to clandestine or authorised planting: due to the exigencies of the deranged market system that we live under, many nurseries are forced to destroy thousands of perfectly good trees every year — generally from March through to June. This is for no other reason than to make way for the new stock (and to protect prices, of course). It is therefore worth approaching your local nursery at this time of year — you can take the trees off their hands, leave them with a clear conscience, and acquire the raw materials for reforestation at little or no cost.)

Another lesson to be learnt from Tree Spirit’s purchase of Maes y Mynach concerns funding. The purchase was partly financed by the Forestry Commission’s Woodland Grant Scheme, which is well worth looking into for anyone contemplating such a project. Although the buying and selling of land is obviously a complete absurdity, it is true to say that if you buy land where it is cheapest — i.e. Wales or Scotland (Particularly Scotland where there is currently a glut on the market as the big estates are further dismembered) — and then reforest it under the Woodland Grant Scheme, you actually stand to make a profit (Over, say, about 10 years), which can then be reinvested in additional acquisitions — this is Tree Spirit’s intention. And before you know it, your mighty empire of reforestation has expanded, and the wildwood has returned... NOT! (Ecological capitalism, any one?) Copies of the Woodland Grant Scheme are available from ‘The Wilderness’, South Downs EF!, or you local Forestry Commission office. Bear in mind the fact that, as the WGS is an attempt by the Forestry Commission to restore an image tarnished by decades of desecrating the landscape with conifers, the grants for broadleaved tree planting are very generous. Even more incredibly the grants for ‘natural regeneration’ are the most generous of all. For non-interventionist EF! types, this has to be worthy of serious attention. (A word of warning however. The Forestry Commission has reportedly begun to revert back to type — plans are afoot to increase funding for large scale conifer plantations, and to reduce it for broadleaved planting, particularly if it is small scale. If true, I guess it just goes to show that you can’t keep a bad institution down.)

Maes y Mynach is itself a former Forestry Commission plantation, and part of Tree Spirit’s vision for the land involves rectifying the environmental damage that such a plantation entails. Their aim is twofold: firstly, to create a mixed woodland for ecological reasons — to which end, a very wide range of trees are being planted: oak, ash, birch, rowan, willow, lime, chestnut, hazel, hawthorn, wild cherry, bird cherry, aspen, field maple, sycamore, yew and larch. Ultimately they intend to encircle the entire plot with a good mixed hedge, which will in itself be extremely valuable to wildlife.

Secondly there is the human element — acknowledging that we do have a place in nature, and that we are not intrinsically hostile to the natural world, as some strands in deep ecology seem to suggest. Tree Spirit hope that Maes y Mynach will be “a place where people can come to do practical conservation work, enjoy nature, relax and generally find a little bit of peace and quiet... it will be a place where people can stay for a few days without being told to move on or “get orf my land”. However they emphasize that “it will not become a permanent encampment for all and sundry. For those who have something constructive to offer or who need a little time away from the madness of modern society, Maes y Mynach will be accessible.”

To achieve these aims a tremendous amount of work is in order. Most of the tree planting has been done, but some still remains — particularly the hedgerows. Planting season is October through to April. Many paths need clearing as there is still a great deal of felled wood strewn about from the forestry operations. Tree Spirit want to create a pond, which will serve as both a wildlife feature and as drainage for the main track. Maes y Mynach also has a spring, which is currently being made into a source of clean water. The most ambitious plan is to construct a roundhouse, for which planning permission has already been obtained. It will be 32 feet in diameter, 13 feet high at the central point and crowned with a turf roof. It is envisaged that the roundhouse will act as a workshop, storage space, communal gathering/celebratory venue, and as a sleeping area. (Perhaps a future EF! gathering could be held there.)

Anyone who is interested in helping out with this inspiring project should contact Tree Spirit at:

Hawkbatch Farm, Arley, Nr. Bewdley, Worcs. DY12 3AH (Phone: 0299 400586) OR: Shelley and Jeff Griffiths, 95 Anstey Rd., Perry Barr, Birmingham B44 8AN (Phone: 021 356 2206)

As Tree Spirit say, in a phrase that could serve as a motto for all our efforts: “Cooperation for mutual benefit and input of constructive energies will go a long way.”

#Earth First! UK#eco action#ecology#environmental restoration#Green Anarchism#anarchism#revolution#climate crisis#climate change#resistance#community building#practical anarchy#practical anarchism#anarchist society#practical#daily posts#communism#anti capitalist#anti capitalism#late stage capitalism#organization#grassroots#grass roots#anarchists#libraries#leftism#social issues#economy#economics#anarchy works

5 notes

·

View notes

Text

September 19, 2024

HEATHER COX RICHARDSON

SEP 20

Yesterday morning, NPR reported that U.S. public health data are showing a dramatic drop in deaths from drug overdoses for the first time in decades. Between April 2023 and April 2024, deaths from street drugs are down 10.6%, with some researchers saying that when federal surveys are updated, the decline will be even more pronounced. Such a decline would translate to 20,000 deaths averted.

With more than 70,000 Americans dying of opioid overdoses in 2020 and numbers rising, the Biden-Harris administration prioritized disrupting the supply of illicit fentanyl and other synthetic drugs. They worked to seize the drugs at ports of entry, sanctioned more than 300 foreign people and agencies engaged in the global trade in illicit drugs, and arrested and prosecuted dozens of high-level Mexican drug traffickers and money launderers.

In March 2023 the Biden-Harris administration made naloxone, a medicine that can prevent fatal opioid overdoses, available over the counter. The administration invested more than $82 billion in treatment, and the Department of Health and Human Services worked to get the treatment into the hands of first responders and family members.

Addressing the crisis of opioid deaths meant careful, coordinated policies.

Also today, markets all over the world climbed after the Fed yesterday cut interest rates for the first time in four years. In the U.S., the S&P 500, which tracks the stock performance of 500 of the biggest companies on U.S. stock exchanges, the Nasdaq Composite, which is weighted toward the information technology sector, and the Dow Jones Industrial Average, an older index that tracks 30 prominent companies listed on U.S. stock exchanges, all hit new records. The rate cut indicated to traders that the U.S. has, in fact, managed to pull off the soft landing President Joe Biden and Treasury Secretary Janet Yellen worked to achieve. They have kept job growth steady, normalized economic growth and inflation, and avoided a recession.

As they have done so, the major U.S. stock indices have had what The Guardian's Callum Jones calls “an extraordinary year.” Jones notes that the S&P 500 is up more than 20% since the beginning of 2024, the Nasdaq Composite has risen 22%, and the Dow Jones Industrial Average has gone up 11%.

Bringing the U.S. economy out of the pandemic more successfully than any other major economically developed country meant clear goals and principles, and careful, informed adjustments.

And yet the big story today is that Republican North Carolina lieutenant governor Mark Robinson frequented porn sites, where between 2008 and 2012 he wrote that he enjoyed watching transgender pornography; referred to himself as a “black NAZI!”; called for reinstating human enslavement and wrote, “I would certainly buy a few”; called the Reverend Dr. Martin Luther King Jr. a “f*cking commie bastard”; wrote that he preferred Adolf Hitler to former president Barack Obama; referred to Black, Jewish, Muslim, and gay people with slurs; said he doesn’t care about abortions (“I don’t care. I just wanna see the sex tape!” he wrote); and recounted that he had secretly watched women in the showers in a public gym as a 14-year-old. Andrew Kaczynski and Em Steck of CNN, who broke the story, noted that “CNN is reporting only a small portion of Robinson’s comments on the website given their graphic nature.”

After the first story broke, Natalie Allison of Politico broke another: that Robinson was registered on the Ashley Madison website, which caters to married people seeking affairs.

Robinson is running for governor of North Carolina. He has attacked transgender rights, called for a six-week abortion ban without exceptions for rape or incest, mocked survivors of school shootings, and—after identifying a wide range of those he saw as enemies to America and to “conservatives”—told a church audience that “some folks need killing.”

That this scandal dropped on the last possible day Robinson could drop out of the race suggests it was pushed by Republicans themselves because they recognize that Robinson is dragging Trump and other Republican candidates down in North Carolina. But here’s the thing: Republican voters knew who Robinson was, and they chose him anyway.

Indeed, his behavior is not all that different from that of a number of the Republican candidates in this cycle, including former president Trump, the Republican nominee for president. Representative Virginia Foxx (R-NC) embraced Robinson’s candidacy, and House speaker Mike Johnson (R-LA) welcomed “NC’s outstanding Lt. Governor” to a Republican-led House Judiciary Committee meeting “on the importance of election integrity.” “He brought the truth with clarity and conviction—and everyone should hear what he had to say!” Johnson posted to social media. Robinson spoke at the Republican National Convention.

The difference between the Democrats and the Republicans in this election is stark, and it reflects a systemic problem that has been growing in the U.S. since the 1980s.

Democracy depends on at least two healthy political parties that can compete for voters on a level playing field. Although the men who wrote the Constitution hated the idea of political parties, they quickly figured out that parties tie voters to the mechanics of Congress and the presidency.

And they do far more than that. Before political thinkers legitimized the idea of political opposition to the king, disagreeing with the person in charge usually led to execution or banishment for treason. Parties allowed for the idea of loyal and legitimate opposition, which in turn allowed for the peaceful transition of power. That peaceful exchange enabled the people to choose their leaders and leaders to relinquish power safely. Parties also create a system for criticizing people in power, which helps to weed out corrupt or unfit leaders.

But those benefits of a party system depend on a level political playing field for everyone, so that a party must constantly compete for voters by testing which policies are most popular and getting rid of the corrupt or unstable leaders voters would reject.

In the 1980s, radical Republican leaders set out to dismantle the government that regulated business, provided a basic social safety net, promoted infrastructure, and protected civil rights. But that system was popular, and to overcome the majority who favored it, they began to tip the political playing field in their direction. They began to suppress voting by Democrats by insisting that Democrats were engaging in “voter fraud.” At the same time, they worked to delegitimize their opponents by calling them “socialists” or “communists” and claiming that they were trying to destroy the United States. By the 1990s, extremists in the party were taking power by purging traditional Republicans from it.

And yet, voters still elected Democrats, and after they put President Barack Obama into the White House in 2008, the Republican State Leadership Committee in 2010 launched Operation REDMAP, or Redistricting Majority Project. The plan was to take over state legislatures so Republicans would control the new district maps drawn after the 2010 census, especially in swing states like Florida, Michigan, Ohio, Pennsylvania, and Wisconsin. It worked, and Republican legislatures in those states and elsewhere carved up state maps into dramatically gerrymandered districts.

In those districts, the Republican candidates were virtually guaranteed election, so they focused not on attracting voters with popular policies but on amplifying increasingly extreme talking points to excite the party’s base. That drove the party farther and farther to the right. By 2012, political scientists Thomas Mann and Norm Ornstein warned that the Republican Party had “become an insurgent outlier in American politics. It is ideologically extreme; scornful of compromise; unmoved by conventional understanding of facts, evidence and science; and dismissive of the legitimacy of its political opposition.”

At the same time, the skewed playing field meant that candidates who were corrupt or bonkers did not get removed from the political mix after opponents pounced on their misdeeds and misstatements, as they would have been in a healthy system. Social media poster scary lawyerguy noted that the story about Robinson will divert attention from the lies about Haitian immigrants eating pets, which diverted attention from Trump’s abysmal debate performance, which diverted attention from Trump’s filming a campaign ad at Arlington National Cemetery.

When a political party has so thoroughly walled itself off from the majority, there are two options. One is to become full-on authoritarian and suppress the majority, often with violence. Such a plan is in Project 2025, which calls for a strong executive to take control of the military and the judicial system and to use that power to impose his will.

The other option is that enough people in the majority reject the extremists to create a backlash that not only replaces them, but also establishes a level playing field.

The Republican Party is facing the reality that it has become so extreme it is hemorrhaging former supporters and mobilizing a range of critics. Today the Catholic Conference of Ohio rebuked those who spread lies about Haitian immigrants—Republican presidential candidate Trump and vice presidential candidate J.D. Vance were the leading culprits—and Teamsters councils have rejected the decision of the union’s board not to make an endorsement this year and have endorsed Democratic presidential candidate Vice President Kamala Harris. Some white evangelicals are also distancing themselves from Trump.

And then, tonight, Trump told a Jewish group that if he loses, it will be the fault of Jewish Americans. "I will put it to you very simply and gently: I really haven't been treated right, but you haven't been treated right because you're putting yourself in great danger."

Mark Robinson has said he will not step aside.

—

4 notes

·

View notes

Text

No. 7.5 - 1978 Reflections, and the Halls of Mystery

Welcome back to the end-of-the-year recaps! This is technically the first TSR iteration of it!

1. Coolest ideas

It's a lot of stuff from D2. The big ticket item is "neutral-ground hostile shrine" -- any time you can muck about with otherwise hostile people without drawing swords immediately is a big win. I know that the reaction table is supposed to mitigate that some but, cmon. Sometimes you just can't think of a good reason that the 9th goblin pack tonight is not immediately hostile. This is a way more natural way to handle it. And it lets you talk and such and experience their culture from their perspective!

2. Coolest Module You Haven't Heard Of

This is honestly a hard one because all of these modules are intensely well known. Gun to my head, I would probably vote for G1. The D-series is cool but frankly there have been more better and more interesting iterations of subterranean hexcrawls -- Veins of the Earth being the currently famous one. But the thing about G1 is, G1 is a surprisingly natural and fun location. Unlike the others in the GDQ series, G1 is genuinely an adventure you could slot anywhere with no context. It is simply a fun raid on a fortress, which I never get tired of. The twists of "they're piss drunk" and "there's a slave revolt in the basement" are really good (albeit in 2024 a little stale) twists on the classic raid-on-fortress formula.

3. The Growth of Module Design

Honestly 1978 represents a rather stagnant year for module design. The most innovative design feature I see is how D1-D3 feeds into one another in a much more naturalistic way than its predecessors, and all through that deeply useful combination of hexmap and random tables with a handful of pre-programmed setpieces. I am eager to see hexmap technology get much better going forward.

…

Surprisingly, 1978 wasn't too much to talk about? I don't generally think of Gary as an "innovator" in module design space. His main contribution is taking things that already exist and making them feel more natural. Which is not to say that I now buy into Gygaxian Naturalism as this great feat, more than a lot of his competition at the time was seemingly intentionally anti-Naturalism. Their work feels like the reaction to me, Gary is just staying the course of "this should make an amount of sense". Although, his random dungeon monsters mishmash still feels as nonsensical as all hell.

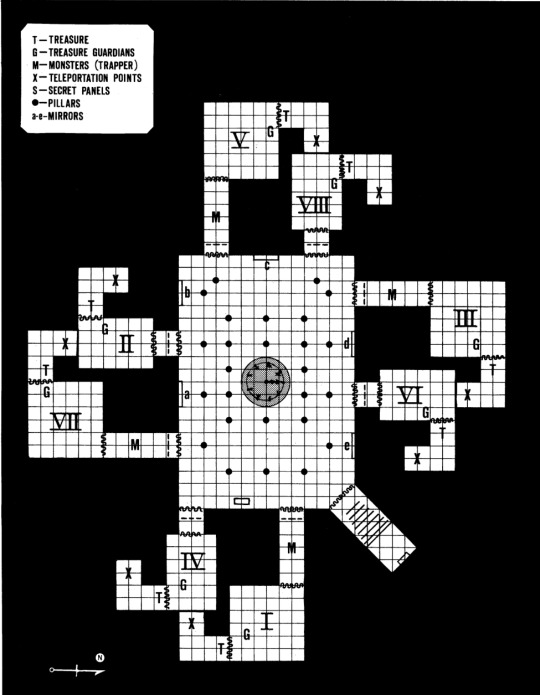

The Halls of Mystery (From Dragon 21, December 1978)

And as threatened, we're going to have a very brief section on The Halls of Mystery, which holds the dubious honor of 1st Dragon Magazine dungeon. I would throw the full header at you, but everything is by Don Turnbull. You may recognize his name, at publication time he works for Games Workshop and he will be heading up TSR, Inc.'s UK branch starting in 1980, leading to the much-beloved Fiend Folio.

So. Not much to say about this, actually, It's a very large room with some branches. The main schtick of the Halls is that the main chamber contains several mirrors, some of which are magical. There's a big riddle on the desk on the south side, the riddle solution is actually quite obvious (say Excalibur three times -- and hey, Don told us the answer and rationale of the puzzle! Thanks Don!). When you move the central cylinder, it teleports you to the corresponding position in the dungeon. The rest is a lightweight stocking of the dungeon with monsters, treasure, et c. If you're keeping score, this is a Zelda puzzle. It's very cute and lightweight and honestly it's so neutrally written (no statistics are given and it would be trivially easy to restock it at any level) that you could genuinely use it in 2024 with very little effort. It's adorable! It is also wonderfully lean, clocking in at two total pages and frankly it's super refreshing to have such a light read of a module here.

Happily, next time we will be covering B1 - In Search of the Unknown, which is the second Basic D&D adventure we will be reviewing in this series (The adventure printed in the Basic rulebook, Tower of Zenopus, was first. This is our first lettered Basic adventure.) And, funnily, the first TSR module in this lineup I've never read before. See you then!

8 notes

·

View notes

Text

In the stock market, a short squeeze is a rapid increase in the price of a stock owing primarily to an excess of short selling of a stock rather than underlying fundamentals. A short squeeze occurs when demand has increased relative to supply because short sellers have to buy stock to cover their short positions.

What's a Short Squeeze and Why Does It Happen?

Key Points

A stock that rallies hyperbolically when there are no obvious current events driving the response, could be experiencing a short squeeze.

A short squeeze can potentially be worth trading, but only if you exercise great care.

The aim of short selling is to generate profit from a stock that declines in value. (Short selling involves borrowing a security whose price you think is going to fall from your brokerage and selling it on the open market. Your plan is to then buy the same stock back later—hopefully for a lower price than you initially sold it for—and pocket the difference after repaying the initial loan.) While there are potential benefits to going short, there are also plenty of risks. One big risk is when a bullish catalyst (earnings, news, technical event, etc.) pushes the stock price higher, prompting short sellers to "head for the exits" all at once. As the shorts scramble to buy back and cover their losses, upward momentum can build on itself, causing the stock to move sharply higher. This is known as a short squeeze.

Understanding the short squeeze

What makes a short squeeze so dangerous? Think of it this way: When you buy a stock, the worst thing it can do is drop to zero. But the upside is unlimited. If a stock has a growth narrative and there are enough believers, the share price can go well beyond what looks reasonable by traditional fundamental metrics.

Classic signs of a short squeeze can include:

A security has a significant amount of short sellers (short interest) who believe the stock price is going to fall, and then instead the stock price sharply rises, forcing many of these leveraged short sellers to quickly exit their positions, buying back the stock in the face of potentially increasing losses.

A dynamic narrative that tries to justify the detachment of share prices from a company's intrinsic value

A case for massive growth as well as for financial stress

Traders with deep pockets aligned on both sides of the trade, often using options and other leveraged instruments

With GameStop (GME) in 2021 and Tesla (TSLA) in 2020, there were many classic signs of a short squeeze. Traders with short positions were covering because they had to, either because they had sustained large losses or shares were no longer available to be borrowed. In 2022, short sellers targeted troubled companies such as Bed, Bath & Beyond (BBBY) and Carvana (CVNA). In early 2023, the most heavily shorted companies included Coinbase Global (COIN), a cryptocurrency firm, and Occidental Petroleum (OXY).

When a stock suddenly experiences a dramatic climb, with or without good news, it's important to ask yourself, "Who would buy shares up here?" The answer? Someone who doesn't have enough money to hold on any longer, or someone whose pain threshold has finally been crossed.

Proceed with caution

If you're a long-term investor who happens to own a stock that's getting squeezed, it's probably not a good time to trade. Instead of acting on emotions, remember what got you to where you are in your investing journey—and where you'd like to be. If buying a stock that's in squeeze territory doesn't fall within your long-term objectives, you might want to step aside and not trade. If you do decide to venture in, make sure you have no illusions and no misconceptions of the dangers. Understand that when you’re dealing with a stock that’s being squeezed, you're taking a big risk.

Identifying a short squeeze can be relatively simple—after the fact. The trick is to identify the conditions that could lead to a squeeze ahead of time, and then determine how you might want to play it (or not).

Shorting a stock is a complicated business. Because you can't sell something you don't own, shorting requires the seller to "borrow" the stock (and pay interest to the stock lender), then sell it. Locating the shares can sometimes be difficult for your clearing firm because of high demand or a small number of outstanding shares.

Measuring a short squeeze can involve a metric called the short interest ratio, a.k.a. "days to cover." It indicates, in days, how long it would take to cover or buy back all the shorted shares. Basically, you divide the number of shares sold short by the average daily trading volume. The more days to cover, the more pronounced the effect can be.

Another measure is "short interest as a percentage of float," which reflects the number of short-sold shares in proportion to the total number of shares available for trading in the public markets. Most stocks have a small amount of short interest, usually in the single digits. The higher that percentage, the greater the bearish sentiment may be around that stock. If the short % of the float reaches 10% or higher, that could be a warning sign.

Consider the fundamentals

If you're buying a stock that seems to be in the throes of a short squeeze, especially at high levels, it helps to understand other potential reasons why the stock might be moving.

Consider checking the fundamentals. Is there anything that would make you want to own the stock? Are you tempted to buy it because everyone else is? It's important to always do your homework, and remember it's never wise to go all in. A stock that's in a short squeeze may still have a long way to climb, and if you don't think the fundamentals support higher prices, then perhaps you should look elsewhere.

In the case of TSLA in 2020, there were some positive fundamentals underlying the short squeeze, including the company's more consistent profitability and hopes of it being included in the S&P 500 Index (SPX). The stock saw its share price run up to new highs, then decline nearly 60%.

But then TSLA rallied again and split its shares, and its addition to the SPX became a reality, illustrating that a short squeeze doesn't always have to end badly. Other stocks that were caught up in short squeezes haven't always fared so well, in part because they didn't have the fundamental support.

Playing the squeeze on the long side?

If you want to trade a stock during what might be a short squeeze—that is, buying a stock with a higher short interest in order to potentially play the upside of a squeeze—here are some things to consider:

Trading such a stock may be okay as long as you understand the risk and how to control it. Whether you make small or large trades, you have to control and limit the risk. Decide how much money you would be comfortable losing in any trade ahead of time.

Don't underestimate how high the stock can go and how long it can take. When a stock gets caught up in a short squeeze, analysts generally expect it to correct eventually, but no one knows to what price and when; if it happens at all.

If the stock still has very weak fundamentals, yet is moving significantly higher without any real, structural changes in the corporation, then be extremely careful buying on this type of upward momentum. The markets may run out of new buyers willing to pay higher and higher prices and the stock may in the end fall quickly.

The bottom line

A short squeeze is a high-risk situation and it may cause havoc in the market, but most don't last forever. Most eventually subside.

#kemetic dreams#the big short#finance#financial#short squeeze#stocks#financialnews#investing#earningsreport#stockmarket#market#money#make money online#earn money online#make money from home#old money#millionaire#profit#finances#income

11 notes

·

View notes

Text

Two weak spots in Big Tech economics

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me in AUSTIN on Mar 10. I'm also appearing at SXSW and at many events around town, for Creative Commons, Fediverse House, and EFF-Austin. More tour dates here.

Big Tech's astonishing scale is matched only by its farcical valuations – price-to-earnings ratios that consistently dwarf the capitalization of traditional hard-goods businesses. For example, Amazon's profit-to-earnings ratio is 37.65; Target's is only 13.34. That means that investors value every dollar Amazon brings in at three times the value they place on a dollar spent at Target.

The fact that Big Tech stocks trade at such a premium isn't merely of interest to tech investors, or even to the personal wealth managers who handle the assets of tech executives whose personal portfolios are full of their employers' stock options.

The high valuations of tech stocks don't just reflect an advantage over bricks and mortar firms – they are the advantage. If you're Target and you're hoping to hire someone who's just interviewed at Amazon, you have to beat Amazon's total compensation offer. But when Amazon makes that offer, they can pay some – maybe even most – of the offer in stock, rather than in cash.

This is a huge advantage! After all, to get dollars, both Amazon and Target have to convince you to spend money in their stores (or, in Amazon's case, with its cloud, or as a Prime sub, etc etc). Both Amazon and Target get their dollars from entities outside of the firm's four walls, and the dollars only come in when they convince someone else to do business with them.

But stock comes from inside the firm. Amazon makes new Amazon shares by typing zeroes into a spreadsheet. They don't have to convince you to buy anything in order to issue that new stock. That is their call, and their call alone.

Amazon can buy lots of things with stock – not just the labor of in-demand technical workers who command six-figure salaries. They can even buy whole companies using stock. So if Amazon and Target are bidding against one another for an anticompetitive acquisition of a key supplier or competitor, Amazon can beat Target's bid without having to spend the dollars its shareholders would like them to divert to dividends, stock buybacks, etc.

In other words, a company with a fantastic profit/earning ratio has its own money-printer that produces currency that can be used to buy labor and even acquire companies.

But why do investors value tech stocks so highly? In part, it's just circular reasoning: a company with a high stock price can beat its competitors because it has a high stock price, so I should buy its stock, which will drive up its stock price even further.

But there's more to this than self-fulfilling prophecy. The high price of tech stocks reflects the market's belief that these companies will continue to grow. If you think a company will be ten times bigger in two years, and it's only priced at three times as much as mature rivals that have stopped growing altogether, then that 300% stock premium is a bargain, because the company will have 1,000% growth in just a couple years. Tech companies have proven themselves, time and again, to be capable of posting incredible growth – think of how quickly Google went from a niche competitor to established search engines to the dominant player, with a 90% market share.

That kind of growth is enough to make anyone giddy, but it eventually runs up against the law of large numbers: doubling a small number is easy, doubling a large number is much, much harder. A search engine that's used by 90% of the world can't double its users – there just aren't enough people to sign up. They'd need to breed several billion new humans, raise them to maturity, and then convince them to be Google users.

And here's the thing: the flipside of the huge profits that can be reaped by investors who buy stocks at a premium in anticipation of growth is the certainty that you will be wiped out if you're still holding the stock when the growth halts. When Amazon stops growing, its PE ratio should fall to something like Target's, which means that its stock should decline by two thirds on that day.

Which is why Big Tech investors tend to be twitchy, hair-trigger types, easily stampeded into mass selloffs. That's what happened in 2022, when Facebook admitted to investors that it had grown more slowly than it had projected, and investors staged the largest stock selloff in history (to that point – hi, Nvidia!), wiping a quarter-trillion dollars off Meta's valuation in a day:

https://www.forbes.com/sites/sergeiklebnikov/2022/02/03/stocks-plunge-after-facebooks-massive-sell-off-nasdaq-falls-37/

As Stein's Law has it: "anything that can't go on forever eventually stops." Growth stocks have to stop growing, eventually, and when they do, you'd better beat everyone else to the fire exit, or you're going to get crushed in the stampede.

Which is why tech companies are so obsessed with both actual growth, and stories about growth. Facebook spent tens of billions on bribes to telcos around the world, demanding that they charge extra to access non-Facebook websites and apps, in a bid to sign up "the next billion users":

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

That wasn't just about some ideological commitment to growth – it was about the real, material advantages that a growing company has, namely, that it can substitute the stock it creates for free by typing zeroes into a spreadsheet for money that it can only get by convincing you to give your money to it.

"Facebook Zero" (as this bribery program was called) was about actual growth: finding people who weren't Facebook users and turning them into Facebook users, preferably forever (thanks to Facebook's suite of lock-in tactics that make it a digital roach motel that users check into but don't check out of):

https://www.eff.org/deeplinks/2021/08/facebooks-secret-war-switching-costs

But plenty of the things that Big Tech gets up to are about the narrative of growth. That's why Big Tech has pumped every tech bubble of this stupid decade: metaverse, cryptocurrency, AI. These technologies have each been at the forefront of Big Tech marketing and investor communications, but not solely because they represented a market opportunity. Rather, they represented a more-or-less plausible explanation for how these companies that were on the wrong side of the law of large numbers could continue to double in size, without breeding billions of new customers to sign up for their services.

The tell – as always – comes in the way that these companies refute their critics. When critics point out that Facebook spent $1.2 billion on a metaverse product that only has 32 users:

https://futurism.com/the-byte/metaverse-decentraland-report-active-users

Or that practically no one buys anything with cryptocurrency:

https://www.mollywhite.net/annotations/latecomers-guide-to-crypto/

Not even when the government gives them free crypto and passes a law forcing merchants to accept crypto:

https://bitcoinblog.de/2024/09/02/weak-bitcoin-adoption-in-el-salvador-disappoints-the-president/

Or that hardly anyone uses AI, and what uses it does have are often low-value:

https://www.wheresyoured.at/oai-business/

The "narrative entrepreneurs" behind the claims of infinite growth from these technologies all have the same response: "That's what they said about the web, and yet it grew really fast! People who lacked the vision to understand the web's potential missed out. Buy [crypto|metaverse|AI] or have fun being poor!"

It's true – there were a lot of people who were blithely dismissive of the web, and they were wrong. But the fact that the web's skeptics were wrong doesn't mean that skepticism itself is foolish. People were also skeptical of Qibi, Beanie Babies, and the Segway – all of which were predicted to continue to increase in value forever and become permanently installed as significant facts in the economy. The fact that lots of people think something is stupid is not a reliable indicator that it is actually great.

So it's not just that capitalism adopts "the ideology of a tumor" in insisting that infinite growth is possible. The value in corporate claims to eternal growth is not aesthetic, it is material. If the market believes a company will grow, then that company gets to print its own money, which lets it outcompete mature rivals, which lets it grow some more.

But! When the company runs out of growth potential, the process runs in reverse. Not only do executives – whose portfolios are stuffed full of their own company's shares – stand to lose most of their net worth overnight, but once a company's stock starts to decline, it can expect to see an exodus of the key personnel who are compensated in now-worthless stock. That means that once a company hits a bad bump in the road that sets it off course, it needs to worry about losing all the skilled employees who can get it back on the road.

So growth is important, not for its own sake, but for how it affects the cost basis of companies, and thus determines their competitive outlook. But not all growth is created equal.

Remember when Facebook pissed away billions in a bid to capture "the next billion users"? Those users – people from poor countries in the global south – were not as valuable to Facebook as its US customers. The news that sparked a $250 billion, one-day selloff of Facebook shares wasn't merely about anemic growth – it was specifically about anemic growth in the USA.

American customers are worth more than other users to Big Tech – that's true even of users from other populous countries, and of users from other wealthy countries. Norway is rich as hell, but each Norwegian Facebook user is worth pennies on the kroner compared to American users. And there are brazilians of people in South America, but they're worth even less per capita than Norwegians are. Even the whole EU, with its 500m+ relatively wealthy consumers, is only worth a fraction of the US market.

Why is the American market so prized by Big Tech? Because it the only country in the world at the center of a Venn diagram with three overlapping circles. America is the only country in the world that is:

a) populous;

b) wealthy; and

c) totally lacking in legal privacy protections.

The US Congress last updated American consumer privacy law in 1988, when the Video Privacy Protection Act was passed to protect Americans from the high-tech threat of…video store clerks leaking your rental history to the newspapers. Despite the bewildering, obvious, serious privacy risks that have emerged since Die Hard was in theaters, Congress has done nothing to extend Americans' consumer privacy rights.

There are other rich countries where privacy law sucks, but they are small countries with few people. There are extremely populous poor countries with shitty privacy laws, but they're poor. Tech has to steal the private data of dozens of those people to make as much money as they can get from selling the data of just one American. And there are other rich, populous countries – like Germany, say – but those countries actually defend the privacy of the people who live there, and so the revenue tech gets from each of those users is even lower than the RPU for the undefended poor people of the global south.

America is exceptional in that it represents the one place where there are lots of wealthy people who are totally defenseless. We're an all-you-can-eat buffet for the privacy-annihilating voyeurs of Silicon Valley.

These are the two dirty secrets of Big Tech's economics. These companies are reliant on the fragile narrative of infinite growth, and that narrative isn't merely about global growth, but it is particularly and especially about growth in the USA.

Tech's power comes from an implausible story of discovering an endless stream of Americans to sign up and screw over. That story is extremely load-bearing – so much so that by the instant at which the first crack appears, collapse is only moments away. And boy, are there cracks:

https://www.wheresyoured.at/power-cut/

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/03/06/privacy-last/#exceptionally-american

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#privacy first#usa usa usa#bubblenomics#economics#business#big tech#monopolies#financialization#privacy#surveillance advertising#commercial surveillance#ai#metaverse#stock swindles#cryptocurrency

241 notes

·

View notes

Text

SEBI's Investigation into Quant Mutual Fund: Should Investors Worry?

Quant Mutual Fund has expanded rapidly over the last five years, going from Rs 100 Crore to Rs 90,000 Crore. Regretfully, SEBI searches on their operations in Hyderabad and Mumbai have uncovered possible front-running, leading them to open a probe into this growth.

Recognizing Front Running

Brief explanation: It's against the law to front run. Insider trading happens when someone make money off of proprietary knowledge before big trades affect stock values.

For example, let's say a fund decides to put Rs 500 crore into a lesser-known company's stock, which could raise the stock price. When the price rises after the fund invests, the person who is aware of this scheme and buys shares early will profit.

Results of the SEBI Study

What Could Take Place: Investors may become uneasy due to the probe and withdraw their capital. This would make it tough for Quant Mutual Fund to keep operating smoothly and growing.

Impact on Small-cap Stocks: Quant has a large part of its money, over 20%, in smaller companies. These stocks might now see more price ups and downs, which could worry investors.

Recent Investments by Quant Mutual Fund

Commodities Sector: They’ve invested in big names like Shree Cement, Gujarat Mineral Development Corporation, and Tata Steel.

Consumer Sector: They’ve bought shares in Aditya Birla Fashion & Retail, Asian Paints, and Indiabulls Real Estate.

FMCG Sector: The fund has shares in Marico and Hindustan Unilever.

Financial Sector: Quant has significant investments in HDFC Bank and HDFC Life Insurance.

Healthcare and IT: Shares in Dr Reddy’s Laboratories and Zydus Lifesciences, along with HCL Technologies and Infosys, are part of their portfolio.

click here to read more

2 notes

·

View notes

Text

As a stab at an explanation for why this site’s management (and others) is acting like this - none of these big websites have ever made any money. I don’t think it’s possible for them ever to make money. Instead, these sites have always survived off their ability to potentially make money, with investors subsidising these platforms via betting on them on the stock exchange. Investors had both infinite money for the last decade due to quantitative easing and low interest rates, and social media platforms easily showed their potentiality for making money via their rapid growth.

Now, that’s no longer an option - investors have less cash to throw at structurally unprofitable properties now interest rates are being raised, so social media companies are now trying to demonstrate their potential profitability by rack renting their userbases. This is destroying their sites. Tumblr emulating twitter, introducing features that users do not use but sound like they could be the next Twitch like Tumblr live, is designed to encourage investors to speculate on tumblr’s stock - given twitter’s collapse, tumblr could be the new twitter, so investors should buy its stock in order to help it bridge a $30m deficit grow into that. It won’t work however. It’ll just ruin the whole thing.

34 notes

·

View notes

Text

Understanding Impermanent Loss: A Simple Guide to Navigating DeFi Risks

DeFi (Decentralized Finance) offers a world of exciting opportunities to grow your wealth through liquidity pools, staking, and yield farming. But just like any investment, it comes with its risks—one of the most talked-about risks being impermanent loss.

I know, the term sounds a bit daunting, but don’t worry. By the end of this article, you’ll not only understand what impermanent loss is but also how you can manage it like a pro. Let’s break it down in the simplest terms so you can confidently step into the world of DeFi.

What Exactly Is Impermanent Loss

Think of impermanent loss as a missed opportunity—one that happens when you provide liquidity to a decentralized exchange (DEX), and the value of your assets changes. Imagine you have two types of assets in equal amounts—let’s say $100 worth of Ether (ETH) and $100 worth of stablecoins. You put them together into a liquidity pool.

Now, the price of ETH rises significantly. Since liquidity pools need to maintain an equal value of both assets, some of your ETH will be sold to maintain the balance. When you withdraw your funds later, you may find you have more stablecoins but fewer ETH than when you first deposited them.

In simple terms, the loss is "impermanent" because it only happens when you withdraw your funds while the price of the assets in your pool has changed. If the prices of the tokens you provided liquidity for return to their original levels, the loss disappears. But, if the prices don't return, the loss can become permanent.

Why Is It Called “Impermanent”

You might be wondering, “If the loss is impermanent, why is it such a big deal?” The key here is timing. If the price of the assets in the pool returns to its original value, then the loss goes away, and you’re in the clear.

However, if the market keeps moving in the wrong direction, and you decide to withdraw your funds, the loss becomes "permanent." So, just like watching the stock market or any investment, the key is timing and understanding when to hold on and when to pull out.

The Role of Liquidity Pools in DeFi

To understand impermanent loss better, it helps to know how liquidity pools work. Platforms like STON.fi DEX rely on liquidity pools to allow users to trade tokens without a central authority. When you deposit two different tokens (like ETH and USDT) into a pool, you’re providing liquidity that allows others to trade those tokens. In return, you earn a portion of the trading fees.

But here’s the catch: the platform automatically adjusts the ratio of tokens in the pool whenever the prices change. So if one token (like ETH) rises in value, the system will sell some of that ETH and buy more of the other token (like USDT) to keep the balance.

This is where the risk comes in. When you withdraw your liquidity, you may find that you have more of the less valuable token and less of the more valuable one. That’s impermanent loss in action.

How To Manage Impermanent Loss Effectively

While it sounds complicated, there are strategies to minimize impermanent loss and make the most out of your DeFi experience. Here are some tips:

1. Stablecoin Pools Are Your Friend

Stablecoins, like USDT, DAI, or USDC, are pegged to the value of fiat currencies (like the US dollar), which means they don’t experience the same kind of price volatility as other tokens like ETH or BTC. Providing liquidity to stablecoin pools can drastically reduce your risk of impermanent loss because the value stays relatively constant.

2. Choose Tokens with Low Volatility

If you’re looking to add tokens to your liquidity pool, consider choosing assets with a history of stable prices. Volatile assets are more likely to cause impermanent loss, so keeping an eye on the market trends is key. It’s like investing in bonds instead of stocks—you’ll earn more stability in your returns, even if the growth potential is lower.

3. Diversify Your Investments