#stockmarketing

Explore tagged Tumblr posts

Text

youtube

#footballedit#hockeyedit#trendingreels#stockmarketing#howtostartstockmarketing#howtoearnmony#howtolearnstockmarketing\#Youtube

0 notes

Text

Multibagger Stock: Gokaldas Exports advances 1260% in 4 years, 2358% in 11 years. Can it rally more?

Readmore- https://researchintensify.blogspot.com/2024/11/best-sebi-registered-ra-firm.html

Take advantage of our 2-day free trial and flat 10% discount on all services. Our expert research and market analysis will guide investors in making informed and worthwhile decisions. Trust the best SEBI-registered research advisory firm. Visit- https://intensifyresearch.com/

#share this post#stocks#stock market#sharemarket#stockinvestment#sharethecare#stocksinvestment#investingtheshare#stockmarketing#st

0 notes

Text

Unpacking Qualys Stock: A Cloud Security Investment Option

Just as navigating the vast sea requires a steady hand, so does the world of investment. Join us as we chart a course through the ever-evolving landscape of cloud-based information stock investments with our latest blog spotlighting Qualys Stock (NASDAQ: QLYS). Discover why Qualys emerges as a beacon of opportunity in the realm of cybersecurity solutions, offering a blend of innovation and reliability.

0 notes

Text

Unleashing the beauty of craftsmanship: Behold this stunning Handicraft Bull Statue, where artistry meets tradition. 🎨✨ Order now at www.bookbargainbuy.in or call 088008 74369 🛒

#Unleashing the beauty of craftsmanship: Behold this stunning Handicraft Bull Statue#where artistry meets tradition. 🎨✨#Order now at www.bookbargainbuy.in or call 088008 74369 🛒#Stockmarketing#Stocklovers#HandmadeArt#Craftsmanship#ArtistryInTheDetails

0 notes

Text

The Secret to Becoming a Profitable Trader: Essential Strategies and Tips for Beginner Traders

The Secret to Becoming a Profitable Trader: Essential Strategies and Tips for Beginner Traders

Becoming a profitable trader in the stock market is an enticing goal, but it requires more than just luck. It demands a solid understanding of trading concepts, strategies, risk management, and continuous learning. In this comprehensive guide, we will unlock the secret to becoming a profitable trader, focusing on essential strategies and tips for beginner traders. Whether you're interested in options trading, swing trading, or gaining a comprehensive understanding of the stock market, this article will provide valuable insights to help you embark on your trading journey.

1. Education: The Foundation of Successful Trading

To begin your trading journey, it is crucial to educate yourself about the fundamentals of trading. For beginners in options trading, it is essential to grasp the basics of options, including terminology, strategies, and risk management. Numerous online courses, books, and reputable trading platforms offer educational resources to help you gain a solid foundation in options trading.

If swing trading piques your interest, focus on learning technical analysis, chart patterns, and market indicators. Developing a trading plan that aligns with your risk tolerance and time commitment is essential for success in swing trading.

Furthermore, gaining knowledge about various stock market strategies, such as day trading, long-term investing, and value investing, will provide you with a diverse set of tools to approach the market. Understanding the principles behind each strategy and how they align with your trading goals is crucial.

2. Develop a Trading Plan for Success

A well-defined trading plan is a secret weapon for profitable traders. Your trading plan should encompass the following elements:

- Goal Setting: Clearly define your financial goals, risk tolerance, and time commitment. Determine whether you seek short-term gains or long-term investments and how much capital you are willing to risk.

- Risk Management: Establish effective risk management strategies, such as setting stop-loss orders and determining appropriate position sizes. This ensures that potential losses are limited, and your capital is protected.

- Trading Style: Identify your preferred trading style, whether it's day trading, swing trading, or long-term investing. Each style requires different strategies and time commitments, so choose one that aligns with your personality, lifestyle, and goals.

3. Practice with Paper Trading

Before risking real money, it is advisable to practice your trading strategies using a paper trading account. Many brokerage platforms offer paper trading features that allow you to simulate trades without actual capital. This invaluable practice helps you test your strategies, refine your skills, and gain confidence in your decision-making abilities.

4. Stay Informed and Analyze the Market

To stay ahead in the market, it is essential to stay informed about market trends, news, and economic indicators. Regularly follow reliable sources such as financial news websites, industry publications, and market analysis reports to stay updated.

Additionally, I learned to analyze charts, identify patterns, and utilize technical indicators to make informed trading decisions. Technical analysis can provide valuable insights into market movements and help you identify potential entry and exit points.

5. Seek Guidance and Mentorship:

Consider seeking guidance from experienced traders or enrolling in reputable trading classes or coaching programs. Receiving guidance from professionals who have achieved success in trading can significantly accelerate your learning curve. Look for educational resources provided by established trading institutions or platforms that offer comprehensive training and mentorship.

TraderPearl, for instance, offers step-by-step knowledge in trading and provides coaching services specifically tailored for beginners. The guidance and insights from experienced traders can help you avoid common pitfalls and develop effective strategies.

Becoming a profitable trader is a journey that requires dedication, continuous learning, and disciplined execution of strategies. By investing time in education, developing a trading plan, practicing paper trading, staying informed, and seeking guidance, you can unlock the secret to becoming a profitable trader. Remember to approach trading with patience, discipline, and risk management to increase your chances of success in the dynamic world of the stock market.

#stockmarket#stockmarkets#stockmarketnews#stockmarketinvesting#indianstockmarket#stockmarketindia#stockmarketeducation#stockmarketcrash#stockmarkettips#stockmarketquotes#stockmarkettrader#pakistanstockmarket#stockmarketanalysis#stockmarketlab#stockmarketinvestor#stockmarketmemes#stockmarketca#stockmarketmindgames#woodstockmarket#stockmarketing#stockmarketmonitor#stockmarkettrading#stockmarketcourse#stockmarketupdate#usstockmarket#stockmarket101#philippinestockmarket#stockmarketopportunities#instastockmarket#stockmarketprice

0 notes

Text

10 Most Asked Questions in the Stock Market

The individuals who are starting their journey into investing through the stock market may have many questions. They might be confused about how to invest in the stock market? Or what homework is to be done before investing in the share market? that will help to select the right stocks for investment which will reap huge benefits in the long-run.

Here, we have tried to cover some of the questions that individuals would have who are planning to invest in the stock market or are already market players (investors) in the share market.

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari sir.

1. How to find good companies as there are many publicly listed companies in the Indian stock market? An easier way is to use a stock screener. A stock screener is a tool to choose a few companies from a pool of all the listed companies on a stock exchange using filters. The individuals can apply some filters like valuations, the market cap of the company etc. The filters should be specific to the industry that the individual is analysing and get a list of stocks based on the criteria applied.

2. How much time should I spend while researching stocks? It depends on whether the individual is selecting the stock for trading or for long-term investment. If the individual is trading in stocks, then there is no need to spend a lot of time on fundamentals. Rather, here the person should read charts, trends, patterns etc and get more involved in the day-to-day market activity.

On the contrary, if the person is investing for the long-term then more time should be invested while studying the stocks. It is essential to check the fundamentals of the company, its management, financial, competitors etc if the investment horizon is of more than 1 year.

3. Where can I get the company’s financial report and other information? The company information is easily available on stocks exchanges (NSE, BSE), company website under investor relations or about us section of the website. The information is also available on other financial websites like money control, screener.com etc.

We also recommend reading annual reports of the company to have a deep understanding of the company’s business and its future prospects.

4. Should I invest in the upcoming IPOs? IPOs are the products of the bull market. The companies generally get public when everything is good in the market like people are optimistic, the economy is doing well to earn listing profits. The real test of a company is during the bear market i.e how they survive in the falling market.

If the individual can find such IPOs that are very promising (good business model, strong financials, efficient management, decent valuation etc), then feel free to invest in them.

5. Is investing in small-caps more profitable than bluechip companies? Small-cap companies have the potential to grow faster compared to bluechip companies. There can be a number of hidden gems in the small-cap industry that are yet not discovered by the market. On the other hand, large-cap companies have already proved their potential to the market.

Besides, the quality of stock is more important than the size of the company. There are a number of large-cap companies which has consistently given good returns to their shareholders. Overall, investing in small caps can be more profitable than large caps only if the fundamentals and future prospects of the business look promising.

6. Should I invest in stocks when the market is at high? If the market is high, then start making the watchlist of stocks. Keep an eye on the stocks with good fundamentals. If the investor finds some good stocks and is ready to invest, then avoid lump sum investment. Average out the stocks, this will reduce the chances of buying stocks at a high price.

7. What kind of stocks should be avoided for investment? The individual should avoid investing in stocks having low liquidity. The low liquidity makes it hard to trade in these stocks. Additionally, finding the data for analysing these companies might be hard as information on public platforms is generally not easily available. Thus, lack of research may result in loss-making investments. Additionally, one should also avoid investing in penny stocks.

8. How many stocks should I buy in my portfolio? The portfolio should not be over diversified as over-diversification does not yield good results and it becomes difficult to keep an eye on all the stocks. Similarly, the portfolio should not also be concentrated in one or two stocks/ industries as a tremendous fall in the price of one stock will adversely affect the overall portfolio performance.

Usually, investors can have 8-10 stocks in the portfolio depending on the amount of investment.

9. How much returns can I expect from the market? A stock portfolio will include multiple stocks. Sometimes, some stocks will perform exceedingly well, while some will not. The portfolio return will be the result of performing and non-performing stocks.

In the bull market, the portfolio will give attractive returns (the benchmark index Nifty gave a return of ~67% from April 01,2020 till December 18,2020. However, during a bad market- the returns can be as low as 1-2% or market returns can also be negative.

If you want to learn more about trading then join Investingdaddy.com

10. How can I track my stock portfolio? To be a successful investor it is important to do portfolio analysis at regular intervals. But how exactly to track your stock portfolio? Is it only checking the stock price movement? Or is there much more to check?

#stockmarket#stockmarkets#stockmarketnews#stockmarketinvesting#indianstockmarket#stockmarketindia#stockmarketeducation#stockmarketcrash#stockmarkettips#stockmarketquotes#stockmarkettrader#pakistanstockmarket#stockmarketanalysis#stockmarketlab#stockmarketinvestor#stockmarketmemes#stockmarketca#stockmarketmindgames#woodstockmarket#stockmarketing#stockmarketmonitor#stockmarkettrading#stockmarketcourse#stockmarketupdate#usstockmarket#stockmarket101#philippinestockmarket#stockmarketopportunities#instastockmarket#stockmarketprice

1 note

·

View note

Text

Best coaching institutes for stock market in Hyderabad

NCFM Academy provides comprehensive Best coaching institutes for stock market in Hyderabad. Students can learn the basics of trading and understand the intricacies of the stock market. Experienced instructors guide students to gain knowledge and develop the skills required to succeed in the stock market.

1 note

·

View note

Text

The 2020s news cycle is just a really long version of We didn’t start the fire

10K notes

·

View notes

Text

The Best Mutual Fund App in India for Seamless Investing

Introduction: With the increasing popularity of mutual funds as an investment option in India, having a reliable and user-friendly mutual fund app is essential. In this article, we will explore the best mutual fund app in India that provides a seamless investing experience for users.

Groww: Groww has emerged as one of the most preferred mutual fund apps in India. Its user-friendly interface and intuitive design make it easy for both beginners and experienced investors to navigate through various investment options. The app offers a wide range of mutual funds across different categories, including equity, debt, and hybrid funds. Groww provides detailed information about each fund, including historical performance, risk analysis, and expense ratio. It also offers features like goal-based investing, tax-saving funds, and the ability to track and manage multiple investments in one place.

ETMONEY: ETMONEY is another popular mutual fund app in India known for its simplicity and convenience. The app provides a seamless investment experience by offering a wide selection of mutual funds from top asset management companies.

Paytm Money: Paytm Money, backed by the trusted brand of Paytm, has gained significant traction in the mutual fund market. The app offers a user-friendly interface with a simple and straightforward investment process. Paytm Money provides a vast range of mutual funds from different asset management companies, along with detailed information on each fund's performance, risk analysis, and historical data.

0 notes

Text

Gold Rate Forecast 2023

Gold is considered one of the most precious assets that will never lose its authenticity in the market for long. The article solely deals with the Gold Rate Forecast or the prediction for the Gold Rate for tomorrow. Also, there is an overview of the prediction of this entire month, next month, and the whole financial year 2020-21. If you want to have an overview of the prediction for the next financial years 2021-22 & 2022-23 is also given.

Read more

0 notes

Text

Online Technical Analysis Course : Take online technical analysis courses. Learn technical analysis online to gain new skills and advance your career with Aryaa Money!

0 notes

Text

Me going through my dashboard and seeing Castiel: Ooh, the paper's in today! Me seeing it many times in the trending tags: Oh, it's really full today...

6K notes

·

View notes

Text

Gaslight, Gatekeep, Girl found dead in a hidden room.

[First] Prev <–-> Next

#poorly drawn mdzs#mdzs#lan xichen#jin guangyao#jiang cheng#wei wuxian#qin su#EDIT: Tumblr published an earlier draft with only half the notes I wrote so: late entry on my JGY thoughts.#Unlike the mystic powers of the stockmarket (what the OG meme is referring to) I think this situation calls for more active investigation.#qin su is such a deeply tragic character to me and I really wish we got a bit more from her.#Love everyone who sent me messages about her after the last time she appeared.#I think she needs a spin off of her being a transmigrator SO badly.#MDZS has so many interesting characters - but it sometimes fails to give them the proper room to really develop past a role in the plot.#That's just the consequence of writing a story like MDZS. Not every character in a book *needs* to have a rich inner life and backstory!#To do so would bog down the story and obliterate any notion of pacing. It's just not possible.#Jin Guangyao (nee Meng Yao) is unfortunately not free from this leeway rule. He is the culprit of this murder mystery plot#and thus NEEDS to encapsulate the themes of the book. And personally he's a 7 out of 10 at best on this front (in the AD).#MDZS is about rumours twisting reality and working towards truth. And about how people & situations are rarely ever black & white#JGY has his motivations. He's well written in regards to his actions making sense for his character.#What started as good traits (drive to succeed & improve his image) became twisted over time (do anything to maintain his image)#and it's a good parallel to WWX! He has the same arc (with different traits)! Bonus points for IGY in that regard.#but man....by the time we confront this guy for murder there's not a lot of grey morality. He's just...deep in the hole *he* dug.#There's a beautiful tragedy to it! More on JGY in later comics - this is getting pretty long already!

2K notes

·

View notes

Text

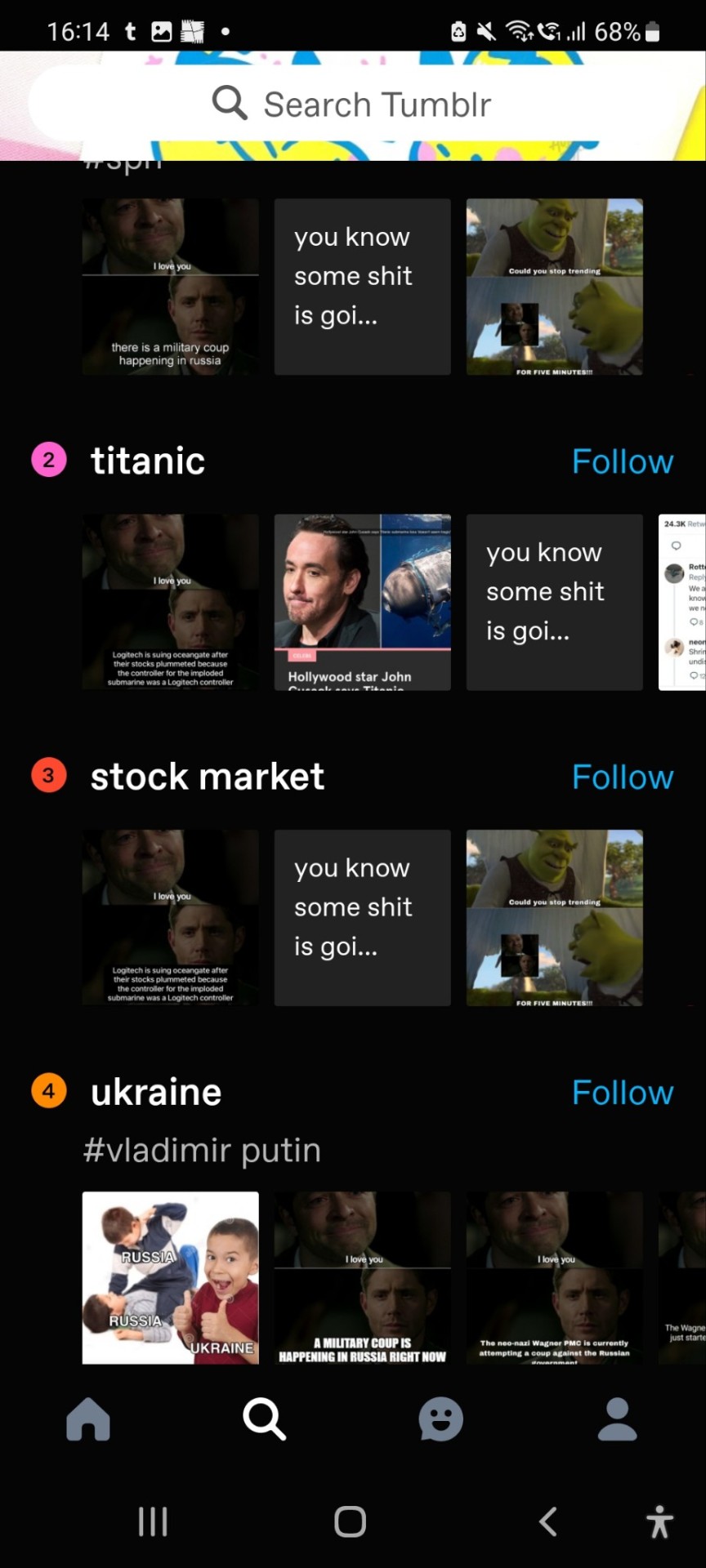

Nothing will ever match up to November 5th 2020 but June 24th 2023 came pretty damn close

#destiel#supernatural#spn#russia#ukraine#titanic#titan#news#someone please help i am so confused and only getting news updates through the destiel meme#november 5 2020#apparently something is going on with the stock market now too ??#stockmarket

2K notes

·

View notes

Text

i just opened the app

716 notes

·

View notes

Text

At The Firm (Tradcath)

Heretics instructing me to monitor spending, but I have a responsibility as a christian man, and that is to become the first daytrading billionaire.

As I was crushing up my piracetam tablets to put in my kratom potion this morning, I remembered just how warm and beautiful god's love truly is. My employer has no idea I'm daytrading right now, and I thank our father so much for protection from my boss.

All I want to say folks is, fuck 'em. Daytrade and sip on that disgusting green drank.

#gnosis#trad catholic#catholicism#nootropic#kratom#motivation#mindset#accounting#day trading#financial freedom#stockmarket

25 notes

·

View notes