#stockmarketquotes

Explore tagged Tumblr posts

Text

The Secret to Becoming a Profitable Trader: Essential Strategies and Tips for Beginner Traders

The Secret to Becoming a Profitable Trader: Essential Strategies and Tips for Beginner Traders

Becoming a profitable trader in the stock market is an enticing goal, but it requires more than just luck. It demands a solid understanding of trading concepts, strategies, risk management, and continuous learning. In this comprehensive guide, we will unlock the secret to becoming a profitable trader, focusing on essential strategies and tips for beginner traders. Whether you're interested in options trading, swing trading, or gaining a comprehensive understanding of the stock market, this article will provide valuable insights to help you embark on your trading journey.

1. Education: The Foundation of Successful Trading

To begin your trading journey, it is crucial to educate yourself about the fundamentals of trading. For beginners in options trading, it is essential to grasp the basics of options, including terminology, strategies, and risk management. Numerous online courses, books, and reputable trading platforms offer educational resources to help you gain a solid foundation in options trading.

If swing trading piques your interest, focus on learning technical analysis, chart patterns, and market indicators. Developing a trading plan that aligns with your risk tolerance and time commitment is essential for success in swing trading.

Furthermore, gaining knowledge about various stock market strategies, such as day trading, long-term investing, and value investing, will provide you with a diverse set of tools to approach the market. Understanding the principles behind each strategy and how they align with your trading goals is crucial.

2. Develop a Trading Plan for Success

A well-defined trading plan is a secret weapon for profitable traders. Your trading plan should encompass the following elements:

- Goal Setting: Clearly define your financial goals, risk tolerance, and time commitment. Determine whether you seek short-term gains or long-term investments and how much capital you are willing to risk.

- Risk Management: Establish effective risk management strategies, such as setting stop-loss orders and determining appropriate position sizes. This ensures that potential losses are limited, and your capital is protected.

- Trading Style: Identify your preferred trading style, whether it's day trading, swing trading, or long-term investing. Each style requires different strategies and time commitments, so choose one that aligns with your personality, lifestyle, and goals.

3. Practice with Paper Trading

Before risking real money, it is advisable to practice your trading strategies using a paper trading account. Many brokerage platforms offer paper trading features that allow you to simulate trades without actual capital. This invaluable practice helps you test your strategies, refine your skills, and gain confidence in your decision-making abilities.

4. Stay Informed and Analyze the Market

To stay ahead in the market, it is essential to stay informed about market trends, news, and economic indicators. Regularly follow reliable sources such as financial news websites, industry publications, and market analysis reports to stay updated.

Additionally, I learned to analyze charts, identify patterns, and utilize technical indicators to make informed trading decisions. Technical analysis can provide valuable insights into market movements and help you identify potential entry and exit points.

5. Seek Guidance and Mentorship:

Consider seeking guidance from experienced traders or enrolling in reputable trading classes or coaching programs. Receiving guidance from professionals who have achieved success in trading can significantly accelerate your learning curve. Look for educational resources provided by established trading institutions or platforms that offer comprehensive training and mentorship.

TraderPearl, for instance, offers step-by-step knowledge in trading and provides coaching services specifically tailored for beginners. The guidance and insights from experienced traders can help you avoid common pitfalls and develop effective strategies.

Becoming a profitable trader is a journey that requires dedication, continuous learning, and disciplined execution of strategies. By investing time in education, developing a trading plan, practicing paper trading, staying informed, and seeking guidance, you can unlock the secret to becoming a profitable trader. Remember to approach trading with patience, discipline, and risk management to increase your chances of success in the dynamic world of the stock market.

#stockmarket#stockmarkets#stockmarketnews#stockmarketinvesting#indianstockmarket#stockmarketindia#stockmarketeducation#stockmarketcrash#stockmarkettips#stockmarketquotes#stockmarkettrader#pakistanstockmarket#stockmarketanalysis#stockmarketlab#stockmarketinvestor#stockmarketmemes#stockmarketca#stockmarketmindgames#woodstockmarket#stockmarketing#stockmarketmonitor#stockmarkettrading#stockmarketcourse#stockmarketupdate#usstockmarket#stockmarket101#philippinestockmarket#stockmarketopportunities#instastockmarket#stockmarketprice

0 notes

Text

10 Most Asked Questions in the Stock Market

The individuals who are starting their journey into investing through the stock market may have many questions. They might be confused about how to invest in the stock market? Or what homework is to be done before investing in the share market? that will help to select the right stocks for investment which will reap huge benefits in the long-run.

Here, we have tried to cover some of the questions that individuals would have who are planning to invest in the stock market or are already market players (investors) in the share market.

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari sir.

1. How to find good companies as there are many publicly listed companies in the Indian stock market? An easier way is to use a stock screener. A stock screener is a tool to choose a few companies from a pool of all the listed companies on a stock exchange using filters. The individuals can apply some filters like valuations, the market cap of the company etc. The filters should be specific to the industry that the individual is analysing and get a list of stocks based on the criteria applied.

2. How much time should I spend while researching stocks? It depends on whether the individual is selecting the stock for trading or for long-term investment. If the individual is trading in stocks, then there is no need to spend a lot of time on fundamentals. Rather, here the person should read charts, trends, patterns etc and get more involved in the day-to-day market activity.

On the contrary, if the person is investing for the long-term then more time should be invested while studying the stocks. It is essential to check the fundamentals of the company, its management, financial, competitors etc if the investment horizon is of more than 1 year.

3. Where can I get the company’s financial report and other information? The company information is easily available on stocks exchanges (NSE, BSE), company website under investor relations or about us section of the website. The information is also available on other financial websites like money control, screener.com etc.

We also recommend reading annual reports of the company to have a deep understanding of the company’s business and its future prospects.

4. Should I invest in the upcoming IPOs? IPOs are the products of the bull market. The companies generally get public when everything is good in the market like people are optimistic, the economy is doing well to earn listing profits. The real test of a company is during the bear market i.e how they survive in the falling market.

If the individual can find such IPOs that are very promising (good business model, strong financials, efficient management, decent valuation etc), then feel free to invest in them.

5. Is investing in small-caps more profitable than bluechip companies? Small-cap companies have the potential to grow faster compared to bluechip companies. There can be a number of hidden gems in the small-cap industry that are yet not discovered by the market. On the other hand, large-cap companies have already proved their potential to the market.

Besides, the quality of stock is more important than the size of the company. There are a number of large-cap companies which has consistently given good returns to their shareholders. Overall, investing in small caps can be more profitable than large caps only if the fundamentals and future prospects of the business look promising.

6. Should I invest in stocks when the market is at high? If the market is high, then start making the watchlist of stocks. Keep an eye on the stocks with good fundamentals. If the investor finds some good stocks and is ready to invest, then avoid lump sum investment. Average out the stocks, this will reduce the chances of buying stocks at a high price.

7. What kind of stocks should be avoided for investment? The individual should avoid investing in stocks having low liquidity. The low liquidity makes it hard to trade in these stocks. Additionally, finding the data for analysing these companies might be hard as information on public platforms is generally not easily available. Thus, lack of research may result in loss-making investments. Additionally, one should also avoid investing in penny stocks.

8. How many stocks should I buy in my portfolio? The portfolio should not be over diversified as over-diversification does not yield good results and it becomes difficult to keep an eye on all the stocks. Similarly, the portfolio should not also be concentrated in one or two stocks/ industries as a tremendous fall in the price of one stock will adversely affect the overall portfolio performance.

Usually, investors can have 8-10 stocks in the portfolio depending on the amount of investment.

9. How much returns can I expect from the market? A stock portfolio will include multiple stocks. Sometimes, some stocks will perform exceedingly well, while some will not. The portfolio return will be the result of performing and non-performing stocks.

In the bull market, the portfolio will give attractive returns (the benchmark index Nifty gave a return of ~67% from April 01,2020 till December 18,2020. However, during a bad market- the returns can be as low as 1-2% or market returns can also be negative.

If you want to learn more about trading then join Investingdaddy.com

10. How can I track my stock portfolio? To be a successful investor it is important to do portfolio analysis at regular intervals. But how exactly to track your stock portfolio? Is it only checking the stock price movement? Or is there much more to check?

#stockmarket#stockmarkets#stockmarketnews#stockmarketinvesting#indianstockmarket#stockmarketindia#stockmarketeducation#stockmarketcrash#stockmarkettips#stockmarketquotes#stockmarkettrader#pakistanstockmarket#stockmarketanalysis#stockmarketlab#stockmarketinvestor#stockmarketmemes#stockmarketca#stockmarketmindgames#woodstockmarket#stockmarketing#stockmarketmonitor#stockmarkettrading#stockmarketcourse#stockmarketupdate#usstockmarket#stockmarket101#philippinestockmarket#stockmarketopportunities#instastockmarket#stockmarketprice

1 note

·

View note

Text

Share With "TRADERS" 🤣

👉Losses Are The Small Fees For "Stock Market"…📚💯

👉Follow Us @money143mafia . . . .

#stockmindset_hindi #stockmarketeducation #startupnews #businessindia #sharemarket #sharemarketnews #stocks #niftyfifty #investingeducation #stockmarketmemes #businessnews #investing #nse #stockmarketindia #banknifty #stockmarketquotes #thetrendingindia #trading

0 notes

Link

Top 85 Valuable Quotes About Stock Market And Investing

See some amazing stock market quotes about investing from famous investors, businessmen, financial advisers and professors.

1 note

·

View note

Video

youtube

One good strategy and planning is to re-invest the profits netted from preceding investments. This impression is called ‘Compounding’

#stockmarketquotes#stockmarketnews#stockmarketind#YogeshwarVashishtha Stockmarket Trademarket Training learn Mumbai

1 note

·

View note

Link

best share market institute in Indore

1 note

·

View note

Photo

Consistency and trade management make you profitable not your expensive indicator. #india #intradaytrader #profit #indianstockexchange #business #investor #indianstockadvisor #stockmarketquotes #mcx #stockmarkets #zerodha #instagram #stockmarketinvesting #bsesensex #market #rakeshjhunjhunwala #nsemumbai #indianstock #stockmarketmemes #daytrading #optionstrading #nyse #share #futuresandoptions #nationalstockexchange #marketnews #economy #stockmarketeducation https://www.instagram.com/p/CCx-37MlPKm/?igshid=1a11jx6uxp2xs

#india#intradaytrader#profit#indianstockexchange#business#investor#indianstockadvisor#stockmarketquotes#mcx#stockmarkets#zerodha#instagram#stockmarketinvesting#bsesensex#market#rakeshjhunjhunwala#nsemumbai#indianstock#stockmarketmemes#daytrading#optionstrading#nyse#share#futuresandoptions#nationalstockexchange#marketnews#economy#stockmarketeducation

1 note

·

View note

Photo

No lockdown blues for Mr. Ambani! 🤑 . . . . . @sheldonsgomes #mutualfundssahihai #finance101 #businessmotivational #sharebazar #sharebazaar #learnfromhome #indianstocks #sheldonsgomes #sensextoday #moneycontrol #sharemarketnews #stockmarketquotes #personalfinance101 #indiansharemarket #dalalstreet #businessindia #valueinvestor #indianeconomy #financetips #indianstockmarket #marketnews #stocks101 #nifty50 #indianmarket #investingtips #gst #zerodha#investing101 #valuation #sharemarket (at Mumbai, Maharashtra) https://www.instagram.com/p/CBFctV7ns6w/?igshid=1melx1c3urm7y

#mutualfundssahihai#finance101#businessmotivational#sharebazar#sharebazaar#learnfromhome#indianstocks#sheldonsgomes#sensextoday#moneycontrol#sharemarketnews#stockmarketquotes#personalfinance101#indiansharemarket#dalalstreet#businessindia#valueinvestor#indianeconomy#financetips#indianstockmarket#marketnews#stocks101#nifty50#indianmarket#investingtips#gst#zerodha#investing101#valuation#sharemarket

1 note

·

View note

Text

youtube

Market Analysis NIFTY and BANK-NIFTY | Tomorrow with logic 06-Mar

#stockmarket#stockmarkets#stockmarketnews#stockmarketinvesting#indianstockmarket#stockmarketindia#stockmarketeducation#stockmarketcrash#stockmarkettips#stockmarketquotes#stockmarkettrader#pakistanstockmarket#stockmarketanalysis#stockmarketlab#stockmarketinvestor#stockmarketmemes#stockmarketca#stockmarketmindgames#woodstockmarket#stockmarketing#stockmarketmonitor#stockmarkettrading#stockmarketcourse#stockmarketupdate#usstockmarket#stockmarket101#philippinestockmarket#stockmarketopportunities#instastockmarket#stockmarketprice

1 note

·

View note

Text

To receive timely, comprehensive, and diverse market information, StockPro is an excellent starting point; however, don't limit yourself to just that as there is no shortage of valuable sources available. You won't want to miss out on the latest news, analysis and advice - follow StockPro now!

#stockmarket#stockmarkets#stockmarketnews#stockmarketinvesting#indianstockmarket#stockmarketindia#stockmarketeducation#stockmarketcrash#stockmarkettips#stockmarketquotes#stockmarkettrader#stockmarketcourse#stockmarketupdate#usstockmarket#stockmarket101#philippinestockmarket#stockmarketopportunities#instastockmarket#stockmarketprice#stockmarketph#thestockmarket#stockmarketgame#stockmarketcrash2020#stockmarketadvisory#stockmarkettraining#learnstockmarket#stockmarketgains#stockmarketleader#livestockmarketing#education

0 notes

Link

In the stock market field, people measure themselves on the success of their investments. But, success is a lonely road. It lies in the fact that it’s an insurance plan, not an investment plan or a welfare plan. The markets can be seen as brutal to your dreams when you look at the people at the top of their game. You wonder how it’s possible that they achieved such greatness and I still cannot. It seems practically impossible as you gaze at those icons to understand how someone could ever reach such dizzying heights.

0 notes

Photo

Agree 💯? . . . Follow @theprolifictrader . . . . #investingtips #wareenbuffet #stockmarket #stockmarketquotes (at USA) https://www.instagram.com/p/CkYsX-dtEu8/?igshid=NGJjMDIxMWI=

0 notes

Text

#stockmarket#stockmarkets#stockmarketnews#stockmarketinvesting#stockmarketindia#stockmarketeducation#stockmarketcrash#stockmarkettips#stockmarkettrading#stockmarketcourse#stockmarketquotes#stockmarkettrader#stockmarketmemes#stockmarketanalysis#stockmarketopportunities#stockmarketlab#stockmarketinvestor#stockmarketupdate#stockmarketing#stockmarketmindgames#stockmarketca

1 note

·

View note

Text

AngelOne में फ्री डीमैट Account खोले

AngelOne में फ्री डीमैट Account खोले और 500रू तक का Cashback पाए लिंक नीचे दी गई हैं !

#OptionTradingWizard#powerofStock#OptionTrading#VivekBajaj#nktalks#stockmarketupdate#sharemarkethindi#stockmarketcrash#BigBull#stockmarket#nifty50#stockmarketeducation#intags#stockmarketmemes#stockmarketquotes#harshadmehta#stockmarkettrader#stockmarketindia#stockmarkets#stockmarketinvesting#stockmarketnews#stockmarkettips#scam1992#success

0 notes

Photo

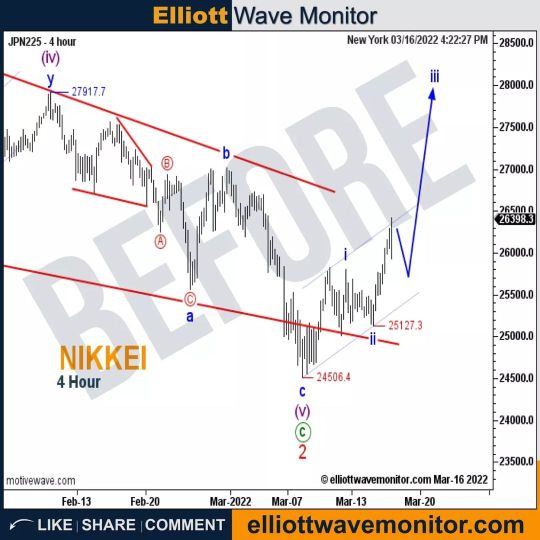

That's Why You Should Visit elliottwavemonitor.com Daily . . . #stockmarket #stocks #stockmarketindia #stockmarketnews #stockmarketinvesting #stockmarkets #stockmarketeducation #stockmarkettips #stockmarketmemes #stockmarketquotes #stockmarketanalysis #stockmarkettrader #stockmarketcrash #stockmarketupdate #stockmarketbasics #stockmarketlab #stockmarketsimplified #stockmarketinvestor #stockmarketforbeginners #stockmarkettrading #stockmarketcourse #stockmarketing #stockmarketmindgames #stockmarket101 #stockmarkettraining #stockmarketindiatips #stockmarketlearning #stockmarketfacts #stockmarketadvisory #stockmarketgame (at USA) https://www.instagram.com/p/Cbim3Hpg4NR/?utm_medium=tumblr

#stockmarket#stocks#stockmarketindia#stockmarketnews#stockmarketinvesting#stockmarkets#stockmarketeducation#stockmarkettips#stockmarketmemes#stockmarketquotes#stockmarketanalysis#stockmarkettrader#stockmarketcrash#stockmarketupdate#stockmarketbasics#stockmarketlab#stockmarketsimplified#stockmarketinvestor#stockmarketforbeginners#stockmarkettrading#stockmarketcourse#stockmarketing#stockmarketmindgames#stockmarket101#stockmarkettraining#stockmarketindiatips#stockmarketlearning#stockmarketfacts#stockmarketadvisory#stockmarketgame

1 note

·

View note

Photo

Daily Quote Enjoy!!!😇😇 Want to earn money visit Key Points And discover techniques of earning money online. Like in Bio🔗 #stockmarketquotes #stockmarketqoutes #stockmarketquote #quote #stockmarketadvantage https://www.instagram.com/p/CaM62BxJlU8/?utm_medium=tumblr

0 notes