#sell foreclosure house for cash

Explore tagged Tumblr posts

Text

Selling your house for cash during foreclosure offers several key advantages: it provides a quick escape from mounting debt, helps preserve your credit score by avoiding a completed foreclosure, and puts immediate cash in your pocket to restart financially. The streamlined process eliminates common hurdles like buyer financing falling through or lengthy closing periods, allowing you to move forward with dignity and potentially keep some of your home equity rather than losing everything to the bank.

While you might receive less than market value, the speed and certainty of a cash sale can outweigh this drawback when facing the time pressures and severe financial consequences of foreclosure. If you want to hire a professional cash home buyers to sell home fast for cash in Charlotte NC during foreclosure, then Chris Angel Home Buyers can be your reliable option. For more details call us at 704-989-5804 or visit our site now.

#cash home buyers#sell my house for cash#we buy houses for cash#cash home sales#sell foreclosure house for cash

1 note

·

View note

Text

Sell Underwater House Seattle: Marmot Buys Homes Helps You Avoid Major Losses

youtube

Selling your underwater house in Seattle doesn't have to lead to major losses. By partnering with Marmot Buys Homes, you'll navigate the complexities with ease. They offer a streamlined process, maximizing financial stability and minimizing stress. Their expert team guides you, avoiding common selling pitfalls and ensuring a swift, hassle-free transaction. With Marmot's support, you'll make informed decisions, ensuring your future opportunities are secure. Discover more about how Marmot can assist you.

Understanding Underwater Mortgages in Seattle

Maneuvering the concept of underwater mortgages in Seattle can be challenging, but it is crucial to grasp the basics for informed decision-making. An underwater mortgage occurs when your home's market value falls below the remaining loan balance. In Seattle's dynamic housing market, this situation can arise unexpectedly, affecting your financial flexibility. To comprehend the mortgage definition fully, recognize it as a legal agreement where you borrow money to purchase property, agreeing to repay over time. Staying informed about fluctuations in Seattle's housing market helps you anticipate potential risks. Understanding these fundamentals empowers you to navigate complex scenarios with confidence and strategy.

The Risks of Selling an Underwater Home

Selling an underwater home in Seattle presents significant risks that you need to carefully consider. You face intimidating financial implications, as the sale might not cover your outstanding mortgage. This shortfall could lead to debt accumulation or damaging credit scores. Market trends add complexity; Seattle's fluctuating real estate landscape means timing your sale is vital. If property values drop further, losses can escalate. You'll need to evaluate whether holding the property until the market improves is viable. Ignoring these risks might lead to compounded financial strain. A strategic approach is essential to mitigate potential setbacks and protect your financial future.

How Marmot Buys Homes Can Assist You

If you're contemplating selling your underwater home in Seattle, Marmot Buys Homes can provide valuable assistance. Marmot's Process is streamlined to offer clarity and efficiency, ensuring you fully understand each step. You won't feel lost or overwhelmed, as their team provides unparalleled Homeowner Support, guiding you through the intricacies of selling a property that's underwater. They assess your home's value without the typical pitfalls of traditional selling methods, allowing you to make informed decisions. With Marmot, you're not just a client; you're a partner in a process designed to minimize financial loss and maximize your peace of mind.

The Advantages of Quick, Hassle-Free Transactions

When time is of the essence, opting for a quick, hassle-free transaction can be a game-changer in selling your underwater home. Quick sales not only save you time but also minimize stress, allowing you to focus on future opportunities. By choosing this approach, you avoid the lengthy processes of traditional sales, reducing emotional and financial burdens. The benefits are clear:

- **Fast resolution**: Move forward without delays.

- **Stress reduction**: Eliminate the anxiety of prolonged uncertainty.

- **Financial stability**: Secure your finances swiftly.

- **Streamlined process**: Simplify complex procedures.

Embrace the advantages of quick, hassle-free transactions to regain control and peace of mind.

Steps to Sell Your Underwater House Successfully

Successfully selling your underwater house requires a clear strategy and a proactive approach. First, study current market trends to understand your home's position. Knowledge is power; it helps you set a realistic price that aligns with market expectations. Next, develop strong negotiation strategies. Anticipate potential buyer objections and prepare effective responses. Highlight your home's unique features to attract interest and justification for your pricing. Also, consider hiring a real estate expert who excels in underwater properties; they can guide you through complexities. Finally, remain flexible and open to creative solutions, ensuring a smooth sale even in challenging circumstances.

#foreclosure help Seattle#mortgage assistance Seattle#best mortgage assistance Seattle#sell underwater house Seattle#sell house fast Seattle#sell house fast Seattle WA#cash home buyers Seattle#property liquidation Seattle#selling house no equity Seattle#mortgage help Seattle#quick home sale Seattle#sell house for cash Seattle#Youtube

0 notes

Text

🏠 Transforming Lives, One House at a Time 🏠

At City Lights Home Buyers, we take pride in bringing new life to homes across Michigan! From probate properties to those in need of a little TLC, we’re here to offer a fair cash offer and a hassle-free process to help you move forward.

✨ Want to know how we can help you, too? Learn more about our process on our homepage or get to know us and see how we’ve made a difference for Michigan homeowners facing probate and other challenges. Check out our latest probateinsights here.✨

#CityLightsHomeBuyers #MichiganHomes #SellYourHouseFast #ProbateSolutions #BeforeAndAfter

#Probatesolutions#CityLightsRentals#CityLightsHomeBuyers#sell your house for cash#sell my house for cash#sell your house fast#we buy houses#we buy mobile homes#cheap old houses#foreclosures#probateprocess#we buy houses for cash

0 notes

Text

The Role of Local Schools in Selling Your Grand Junction Property

When it comes to selling a home, several factors can significantly influence buyer interest and perceived value. One of the most crucial aspects is the quality of local schools. For many families, the school district can be a deciding factor when purchasing a property. In Grand Junction, Colorado, where community and education are highly valued, understanding the role of local schools in the home-selling process is essential. This article will explore how schools affect property sales, what buyers are looking for, and how you can leverage this information when selling your home.

The Impact of Schools on Home Values

1. Market Demand and Pricing

Properties located in districts with highly-rated schools often see higher demand and, consequently, higher Selling Home in Grand Junction Colorado prices. Families are generally willing to pay a premium to live near quality educational institutions. According to various studies, homes in desirable school districts can command prices that are 10% to 20% higher than comparable homes in areas with less favorable school options.

2. Long-Term Investment

Many buyers view a home as a long-term investment. Good schools contribute to stable property values over time, making neighborhoods with strong educational institutions appealing for buyers looking for a solid investment. When buyers feel confident that their property will appreciate, they are more likely to make a purchase.

3. Increased Buyer Interest

Properties near reputable schools tend to attract a larger pool of potential buyers. Families with children or those planning to start families often prioritize school quality, leading to quicker sales and less time on the market. Homes in strong school districts typically receive multiple offers, further driving up the selling price.

What Buyers Look for in Local Schools

1. School Ratings and Reputation

Buyers frequently research school ratings and reviews before making a purchase. Websites like Great Schools and Niche provide detailed information on school performance, test scores, and parent reviews. As a seller, it’s beneficial to highlight nearby schools with strong ratings in your listing.

2. Proximity to Schools

Many families prefer homes that are within walking distance or a short drive from schools when considering Selling Home in Grand Junction Colorado. Convenient access allows parents to drop off and pick up their children easily. Including information about the proximity of schools in your marketing materials can make your property more attractive.

3. Diversity of Educational Options

Parents often look for various educational options, including public, private, and charter schools. Highlighting the diversity of educational opportunities in your area can make your home more appealing. Grand Junction has several highly regarded schools, and showcasing this variety can help attract buyers with specific educational preferences.

4. Extracurricular Activities and Programs

Buyers are also interested in the extracurricular offerings of local schools. Sports teams, music programs, and clubs can enhance a child’s educational experience. If nearby schools offer a rich array of activities, make sure to mention these in your property listing or during showings.

How to Leverage School Information When Selling

1. Create Informative Marketing Materials

When listing your home, include detailed information about nearby schools in your marketing materials. Create a one-page flyer highlighting school ratings, achievements, and extracurricular offerings. This will help potential buyers see the value of living in your neighborhood.

2. Host Open Houses and Highlight Schools

During open houses, consider inviting local school representatives or providing brochures from nearby schools. You can also share your personal experiences with the schools, such as involvement in events or programs. This personal touch can resonate with potential buyers.

3. Use Online Platforms to Promote School Quality

Leverage online platforms and social media to promote the strengths of local schools. Share articles, testimonials, and success stories related to the schools in your area. Engaging with the community online can increase interest in your property and highlight the advantages of living in your neighborhood.

4. Collaborate with Local Realtors

Work with local real estate agents who have a deep understanding of the Grand Junction market and the value of schools in property sales. They can help you craft compelling marketing strategies that emphasize the benefits of nearby educational institutions, making your home more appealing to potential buyers.

5. Connect with Families Moving to the Area

If you know families relocating to Grand Junction, reach out and provide them with information about local schools. Personal connections can go a long way in generating interest in your property, especially if families perceive the home as a perfect fit for their children’s education.

Conclusion

The quality and reputation of local schools play a significant role in the home-selling process in Grand Junction. Understanding how schools impact property values, market demand, and buyer preferences can give you a competitive edge when selling your home.

By highlighting the strengths of nearby educational institutions, creating informative marketing materials, and collaborating with local real estate professionals, you can effectively leverage the appeal of local schools to attract potential buyers and sell your home quickly. At Convergence Properties Inc., we are dedicated to helping you navigate the selling process, ensuring you make the most of your home’s unique selling points, including the valuable asset that is education. If you’re ready to sell your Grand Junction home or have questions about the market, contact us today for expert guidance and support.

#sell house Mesa county#cash home buyers in Mesa county#top real estate agents in Mesa county co#foreclosures in colorado

0 notes

Text

Good News Home Buyer

Real Estate service in Lafayette, IN

We are a no-nonsense house buying company that buys houses in cash. We don’t waste our time with lowball offers that won’t get accepted. Schedule a call with us and receive your all cash offer within 30 minutes of the walkthrough, or virtual tour.

Business Hours: Mon-Sat: 9am-5 pm Payment Methods: cash Contact Name: Daniel Deines

Contact Us:

Good News Home Buyer Address: Lafayette, IN, USA 47905 Phone: +1 765–328–4440 Business Email: [email protected] Website: https://goodnewshomebuyer.com/

Service Area:

Flora, Kokomo, Shadeland, Peru, Attica, Delphi, Fowler, Wabash, Winamac, Remington, Logansport, Veedersburg, Crawfordsville

Follow On:

Facebook: https://www.facebook.com/profile.php?id=61557971547539 X (Twitter): https://x.com/GoodNewshomebuy Instagram: https://www.instagram.com/goodnewshomebuyer/ Pinterest: https://www.pinterest.com/goodnewshomebuyer/ YouTube: https://www.youtube.com/@GoodNewsHomeBuyer LinkedIn: https://www.linkedin.com/company/good-news-home-buyer/about/?viewAsMember=true

#Cash House Buyer#Cash Land Buyer#Relocated/Relocation#Inherited Property#Probate#Foreclosure#Delinquent Taxes#Need to Sell#Bad Tenants#Vacant

1 note

·

View note

Text

#Pre-Foreclosure in Galveston County#we buy houses galveston#sell my house galveston#cash home buyers in galveston#sell my house fast galveston tx

0 notes

Text

If you're thinking of selling your house in San Antonio TX, now might be a good time. But before you put your home up for sale, it's essential to know what to expect in the current market. Every season has its advantages and disadvantages. So which is the best or worst time of year to sell your house? Here’s what you need to know.

#sell your house in san antonio#sell my home fast for cash#sell my home fast#sell your home before foreclosure#sell your Texas home#selling your home in San Antonio TX

0 notes

Text

7.Understanding the benefits of We Buy Homes For Cash

Many people are realizing the benefits of selling their home quickly for cash. People who have been thinking about selling their house fast have been in a difficult situation and have been worrying about the time, energy and money needed to sell their home. With the help of "We Buy House For Cash" services they can quickly get rid of their property with minimal effort and expense.

In today's competitive market, homeowners are encouraged to find the best ways to sell their property to get top dollar. For homeowners who want to quickly and safely move on with their lives, We Buy Houses For Cash can offer a quick and profitable solution. This method eliminates the need to go through lengthy listing processes, wait times, and other details that can complicate the traditional selling process.

We Buy Houses for Cash has many benefits. It is extremely convenient for sellers as the transaction usually takes less than one to two months. In addition, the homeowner doesn't need to make any repairs or renovations to the property in order to make it more attractive to potential buyers. Furthermore, no legal fees or commissions need to be paid.

Buyers can also choose the best house for http://edition.cnn.com/search/?text=mortgage their needs with the "We Buy Houses For Cash” approach. Furthermore, they can also avoid the problem of buyers no-showing during an inspection, as the entire transaction is handled over the phone or via mail.

This type of sale has one of the greatest advantages: buyers get cash upon closing the deal. Sellers don't have the luxury of waiting for months for the money to be paid. Additionally, if the homeowner is facing foreclosure, then the We Buy Houses For Cash approach can provide a reprieve from this situation.

We buy houses for cash, making the whole process much easier for sellers. They don't have to spend time dealing with realtors or worry about all the paperwork involved in the sale. They need to give the company some basic information about their property and they will get a guarantee offer in a matter of days.

Speed & Convenience

The fact that we buy houses for cash services offer a fast and convenient way of selling a home is a great benefit to homeowners. They don't have to worry about lengthy negotiations or financial institutions' paperwork. In addition, they no longer need to wait months until they finally receive the proceeds from the sale.

We Buy Houses For Cash is a convenient service that allows homeowners to move quickly without having to deal with the hassles of traditional home selling. The company also arranges for closings to be held at their offices, which can help homeowners avoid having to travel far to attend.

Lastly, with We Buy Houses For Cash services, homeowners don't have to worry about making costly repairs or renovations needed to make their home attractive to potential buyers. All they have to sell my house fast virginia do is provide basic information to receive a guaranteed offer within days.

Peace of mind

One of the greatest benefits of We Buy Houses for Cash is the peace-of-mind they offer sellers. They will take away the stress of listing a home, as well as all the uncertainty that comes with traditional methods of selling.

We Buy Houses For Cash services guarantee that the seller will receive a certain amount of cash, unlike traditional home sales. This means there won't be any surprises at the closing. The transaction is also protected by a secure system that keeps all public records safe.

Buyers can receive a guaranteed offer within 24hrs. Once the deal is closed, they no longer have to worry about any future problems. This way, everyone involved will be sure that everything goes as planned.

Selling a home can be a daunting task, and We Buy Houses For Cash services provide a fast and easy way for homeowners to get rid of their property quickly. They can help you sell your home quickly and efficiently, while also being reliable, reliable, and dependable.

The Advantages

Our We Buy Houses For Money services offer many advantages over traditional methods for selling a house. One of the most important ones is the speed in which the entire transaction can be completed. This type of sale also eliminates the need for extensive listing and waiting times, as well as the burden of paying for legal costs and commissions.

This approach is attractive to homeowners because it doesn't require costly repairs or renovations. Buyers get their money on the same day and don't have to wait for months to receive the funds. This allows them to move quickly.

Sellers can feel confident knowing that the "We Buy Houses For Cash” approach will ensure that they receive the agreed-upon amount. Furthermore, all public records related to the sale will be kept secure, completely avoiding the need to worry about future problems or complications.

Overall, We Buy Houses For Cash services are a great option for homeowners who need to sell their house quickly and securely. They are faster and more reliable than traditional methods, and they can eliminate the need for costly repairs or renovations.

Contacting We Buy Houses For Cash is the first step in selling your home. Homeowners will provide some basic information about their property, and the company will arrange for an inspection. Once all this information is received, the buyer will make a proposal and, if accepted, the closing date will be set.

Both buyers and sellers find the "We Buy Houses For Cash” process extremely efficient and convenient. Buyers get their money from the deal on the same day, and sellers don't need to worry about extensive listing and waiting times, as well as legal fees and commissions. This makes this approach attractive for those who want to move quickly and safely.

We Buy Houses For Cash companies will also ensure that all public records related to the sale are kept secure, so that both buyers and sellers don't have to worry about any kind of complications or future problems. This type of sale is also safer because all transactions are done over a secure network.

Finally, homeowners don't need to worry about making repairs or renovations to the property in order to make it attractive to potential buyers. This makes it much easier and more convenient for all parties.

1 note

·

View note

Note

Hello Nicholas!

I hope this isn't a weird question, but I saw in one of your posts that you used to be in a huge amount of debt and now you're living more comfortably- how did you manage to get out of debt? I feel like every time I start even trying to figure out where to start, it's just all too big to ever get out from under. Do you have any advice for me?

Hope you have a great day!

Hey there! Yes, from about 2007-2010 (before I transitioned), I was making less than $10k/year. I defaulted on all my credit cards, exhausted my retirement, and nearly lost my house. It sucked, and in 2024, I'm finally start to feel somewhat secure. What I learned (assuming living in the US, I also did not have student loan debt):

I had to first figure out the sources of my debt. A big chunk of it was because of bad spending habits due to mental illness (hoarding + retail therapy when I was dysphoric/depressed). Another chunk was from being in an abusive friendship. Another, from being unemployed. And the last, was general capitalism (this was during the housing crisis.)

I started working on improving myself to curb behaviors that led to debt. I started working on my hoarding. I started transition to improve my mental health (had to sell some stuff to afford HRT). It took until 2015 to ditch my abuser, alas.

I started working on new job skills. I swallowed my pride and got an office job after a failed 3-year stint at freelancing. It was shitty, but enough to take care of my income emergencies -- keeping my house out of foreclosure. I got a better job 8 months later. It also sucked and I was in it for 7 years, but eventually changed industries and that's when my career took off. Because with each new job, I've gotten better and better pay.

I started using budgeting software. YNAB is my favorite. I try to account for every single dollar I have.

I started spending smarter. Food was the expense I had the most control over. I went to the salvage grocery store (you can find non-expired stuff if you hunt) and bought the "ugly" produce 1 day away from rotting from the local markets. I actually managed to eat well once I found these grocery stores, and my food bill became a fraction of what it'd been at typical grocery stores. I do wish that I had given food pantries a shot, but I was in denial about my poverty at the time.

I sold a ton of useless crap. I got rid of a good chunk of my nerd "collectibles". I only miss a few things over a decade later.

I negotiated with my debt collectors. I managed to set up payment plans with my credit card companies, condo association, and the IRS. I also did a debt consolidation loan once I qualified and was sure I could commit to the monthly payments. It forced me to be super strict about my budget and for about 5 years I didn't buy much for myself. It sucked, but I cleared a bunch of debt that way.

I got help from my family. I was embarrassed to tell my family about my predicament, but it became impossible to hide. I got help cleaning out my hoard and my mother has gracefully given me generous cash gifts every now and then. Never enough to be life-changing, but enough to give me a mental breather.

I played the credit score game. This one seems counter-intuitive, and requires some self-control about not abusing credit cards. Many people recommend the "snowball" method for paying off cards (pay off your lowest debt asap, then go to the next one), but I went with a "credit utilization" method (bring my highest used cards down to the next utilization level, then move to other cards) so I would see immediate changes in my credit score. What is credit card utilization? It's the percentage of how much of your credit card you're using. A card with a $1,000 limit and $100 on it = 10% utilization. Your credit score changes when you cross the following thresholds: 90%, 70%, 50%, 30%, 10%. Once my credit score started going up past 400 (especially as defaults started falling away), I applied for a secured card. As I started using that better, I applied for a few more cards, then for credit line increases every 6 months. My car insurance rates were tied to my credit score, so as soon as that improved, I switched companies and saved money there.

Mistakes I made:

Being in denial that I was poor. I didn't really look for resources on how to live while in poverty. This hurt me a lot because I ended up neglecting myself out of pride, which made my situation even worse.

Payday loans. I got stuck in the payday cycle for about 8 years. I wish I had sold more stuff or asked family for money to have never needed that initial loan. Once you are in the cycle, it becomes very difficult to get out.

Not going to a food bank.

Not asking for help sooner. And not just financial help.

Not getting out of abusive situations sooner. This is hard, and I sympathize with anyone in a similar position. But if you think it's time to move on, trust your gut - don't sacrifice yourself for people who don't care about you.

Ignoring debt collectors, because I was too afraid to negotiate for a plan. The IRS was so patient with me in the end, even after defaulting twice on plans.

Not considering getting a roommate to reduce costs, or not thinking of doing more things like shared meals with my fellow poor friends. Again, denial and pride. Humility is not a bad word and I wished I had learned it sooner.

Not changing jobs sooner. Curbing my hoarding and getting a better job are responsible for about 90% of me being where I am financially today.

Getting out of debt is a marathon. It took over a decade for me, and I am *still* feeling the sting of poverty. I wish you the best of luck. Folks are welcome to tack on specific tricks and strategies -- this is just a general outline of my particular journey.

#chit chat#my most toxic traits at the time were individualism and stoicism and by god they nearly killed me

133 notes

·

View notes

Text

Wall Street Journal goes to bat for the vultures who want to steal your house

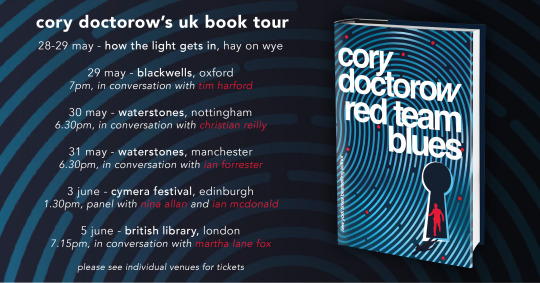

Tonight (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Tomorrow (June 6), I’m on a Rightscon panel about interoperability.

The tacit social contract between the Wall Street Journal and its readers is this: the editorial page is for ideology, and the news section is for reality. Money talks and bullshit walks — and reality’s well-known anticapitalist bias means that hewing too closely to ideology will make you broke, and thus unable to push your ideology.

That’s why the editorial page will rail against “printing money” while the news section will confine itself to asking which kinds of federal spending competes with the private sector (creating a bidding war that drives up prices) and which kinds are not. If you want frothing takes about how covid relief checks will create “debt for our grandchildren,” seek it on the editorial page. For sober recognition that giving small amounts of money to working people will simply go to reducing consumer and student debt, look to the news.

But WSJ reporters haven’t had their corpus colossi severed: the brain-lobe that understands economic reality crosstalks with the lobe that worship the idea of a class hierarchy with capital on top and workers tugging their forelacks. When that happens, the coverage gets weird.

Take this weekend’s massive feature on “zombie mortgages,” long-written-off second mortgages that have been bought by pennies for vultures who are now trying to call them in:

https://www.wsj.com/articles/zombie-mortgages-could-force-some-homeowners-into-foreclosure-e615ab2a

These second mortgages — often in the form of home equity lines of credit (HELOCs) — date back to the subprime bubble of the early 2000s. As housing prices spiked to obscene levels and banks figured out how to issue risky mortgages and sell them off to suckers, everyday people were encouraged — and often tricked — into borrowing heavily against their houses, on complicated terms that could see their payments skyrocket down the road.

Once the bubble popped in 2008, the value of these houses crashed, and the mortgages fell “underwater” — meaning that market value of the homes was less than the amount outstanding on the mortgage. This triggered the foreclosure crisis, where banks that had received billions in public money forced their borrowers out of their homes. This was official policy: Obama’s Treasury Secretary Timothy Geithner boasted that forcing Americans out of their homes would “foam the runways” for the banks and give them a soft landing;

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

With so many homes underwater on their first mortgages, the holders of those second mortgages wrote them off. They had bought high-risk, high reward debt, the kind whose claims come after the other creditors have been paid off. As prices collapsed, it became clear that there wouldn’t be anything left over after those higher-priority loans were paid off.

The lenders (or the bag-holders the lenders sold the loans to) gave up. They stopped sending borrowers notices, stopped trying to collect. That’s the way markets work, after all — win some, lose some.

But then something funny happened: private equity firms, flush with cash from an increasingly wealthy caste of one percenters, went on a buying spree, snapping up every home they could lay hands on, becoming America’s foremost slumlords, presiding over an inventory of badly maintained homes whose tenants are drowned in junk fees before being evicted:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

This drove a new real estate bubble, as PE companies engaged in bidding wars, confident that they could recoup high one-time payments by charging working people half their incomes in rent on homes they rented by the room. The “recovery” of real estate property brought those second mortgages back from the dead, creating the “zombie mortgages” the WSJ writes about.

These zombie mortgages were then sold at pennies on the dollar to vulture capitalists — finance firms who make a bet that they can convince the debtors to cough up on these old debts. This “distressed debt investing” is a scam that will be familiar to anyone who spends any time watching “finance influencers” — like forex trading and real estate flipping, it’s a favorite get-rich-quick scheme peddled to desperate people seeking “passive income.”

Like all get-rich-quick schemes, distressed debt investing is too good to be true. These ancient debts are generally past the statute of limitations and have been zeroed out by law. Even “good” debts generally lack any kind of paper-trail, having been traded from one aspiring arm-breaker to another so many times that the receipts are long gone.

Ultimately, distressed debt “investing” is a form of fraud, in which the “investor” has to master a social engineering patter in which they convince the putative debtor to pay debts they don’t actually owe, either by shading the truth or lying outright, generally salted with threats of civil and criminal penalties for a failure to pay.

That certainly goes for zombie mortgages. Writing about the WSJ’s coverage on Naked Capitalism, Yves Smith reminds readers not to “pay these extortionists a dime” without consulting a lawyer or a nonprofit debt counsellor, because any payment “vitiates” (revives) an otherwise dead loan:

https://www.nakedcapitalism.com/2023/06/wall-street-journal-aids-vulture-investors-threatening-second-mortgage-borrowers-with-foreclosure-on-nearly-always-legally-unenforceable-debt.html

But the WSJ’s 35-paragraph story somehow finds little room to advise readers on how to handle these shakedowns. Instead, it lionizes the arm-breakers who are chasing these debts as “investors…[who] make mortgage lending work.” The Journal even repeats — without commentary — the that these so-called investors’ “goal is to positively impact homeowners’ lives by helping them resolve past debt.”

This is where the Journal’s ideology bleeds off the editorial page into the news section. There is no credible theory that says that mortgage markets are improved by safeguarding the rights of vulture capitalists who buy old, forgotten second mortgages off reckless lenders who wrote them off a decade ago.

Doubtless there’s some version of the Hayek Mind-Virus that says that upholding the claims of lenders — even after those claims have been forgotten, revived and sold off — will give “capital allocators” the “confidence” they need to make loans in the future, which will improve the ability of everyday people to afford to buy houses, incentivizing developers to build houses, etc, etc.

But this is an ideological fairy-tale. As Michael Hudson describes in his brilliant histories of jubilee — debt cancellation — through history, societies that unfailingly prioritize the claims of lenders over borrowers eventually collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Foundationally, debts are amassed by producers who need to borrow capital to make the things that we all need. A farmer needs to borrow for seed and equipment and labor in order to sow and reap the harvest. If the harvest comes in, the farmer pays their debts. But not every harvest comes in — blight, storms, war or sickness — will eventually cause a failure and a default.

In those bad years, farmers don’t pay their debts, and then they add to them, borrowing for the next year. Even if that year’s harvest is good, some debt remains. Gradually, over time, farmers catch enough bad beats that they end up hopelessly mired in debt — debt that is passed on to their kids, just as the right to collect the debts are passed on to the lenders’ kids.

Left on its own, this splits society into hereditary creditors who get to dictate the conduct of hereditary debtors. Run things this way long enough and every farmer finds themselves obliged to grow ornamental flowers and dainties for their creditors’ dinner tables, while everyone else goes hungry — and society collapses.

The answer is jubilee: periodically zeroing out creditors’ claims by wiping all debts away. Jubilees were declared when a new king took the throne, or at set intervals, or whenever things got too lopsided. The point of capital allocation is efficiency and thus shared prosperity, not enriching capital allocators. That enrichment is merely an incentive, not the goal.

For generations, American policy has been to make housing asset appreciation the primary means by which families amass and pass on wealth; this is in contrast to, say, labor rights, which produce wealth by rewarding work with more pay and benefits. The American vision is that workers don’t need rights as workers, they need rights as owners — of homes, which will always increase in value.

There’s an obvious flaw in this logic: houses are necessities, as well as assets. You need a place to live in order to raise a family, do a job, found a business, get an education, recover from sickness or live out your retirement. Making houses monotonically more expensive benefits the people who get in early, but everyone else ends up crushed when their human necessity is treated as an asset:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Worse: without a strong labor sector to provide countervailing force for capital, US politics has become increasingly friendly to rent-seekers of all kinds, who have increased the cost of health-care, education, and long-term care to eye-watering heights, forcing workers to remortgage, or sell off, the homes that were meant to be the source of their family’s long-term prosperity:

https://doctorow.medium.com/the-end-of-the-road-to-serfdom-bfad6f3b35a9

Today, reality’s leftist bias is getting harder and harder to ignore. The idea that people who buy debt at pennies on the dollar should be cheered on as they drain the bank-accounts — or seize the homes — of people who do productive work is pure ideology, the kind of thing you’d expect to see on the WSJ’s editorial page, but which sticks out like a sore thumb in the news pages.

Thankfully, the Consumer Finance Protection Bureau is on the case. Director Rohit Chopra has warned the arm-breakers chasing payments on zombie mortgages that it’s illegal for them to “threaten judicial actions, such as foreclosures, for debts that are past a state’s statute of limitations.”

But there’s still plenty of room for more action. As Smith notes, the 2012 National Mortgage Settlement — a “get out of jail for almost free” card for the big banks — enticed lots of banks to discharge those second mortgages. Per Smith: “if any servicer sold a second mortgage to a vulture lender that it had charged off and used for credit in the National Mortgage Settlement, it defrauded the Feds and applicable state.”

Maybe some hungry state attorney general could go after the banks pulling these fast ones and hit them for millions in fines — and then use the money to build public housing.

Catch me on tour with Red Team Blues in London and Berlin!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/04/vulture-capitalism/#distressed-assets

[Image ID: A Georgian eviction scene in which a bobby oversees three thugs who are using a battering ram to knock down a rural cottage wall. The image has been crudely colorized. A vulture looks on from the right, wearing a top-hat. The battering ram bears the WSJ logo.]

#pluralistic#great financial crisis#vulture capitalism#debts that can’t be paid won’t be paid#zombie debts#jubilee#michael hudson#wall street journal#business press#house thieves#debt#statute of limitations

129 notes

·

View notes

Text

We Buy Houses for Cash Hemet – Your Quick and Reliable Selling Solution

If you're looking for a fast, stress-free way to sell your home, Joe Homebuyer SoCal Metro is here to help. We buy houses for cash Hemet, offering a quick and reliable solution for homeowners who need to sell without the hassle. Whether you’re dealing with foreclosure, an inherited property, or simply want to move on quickly, our cash offers make the process simple and efficient. No repairs, no lengthy waiting periods—just a straightforward cash offer. Let us help you sell your house on your terms.

#sell my house fast Hemet#CA#we buy houses for cash Hemet#how to sell my house fast Hemet#Sell my house fast in Hemet with cash buyers

2 notes

·

View notes

Text

Sell Underwater House Seattle: Unlock Your Home's Value With Marmot Buys Homes

youtube

Release your underwater home's value in Seattle with Marmot Buys Homes. If you're struggling with a mortgage that exceeds your home's worth, Marmot offers a straightforward solution without the hassle of repairs or agents. You'll receive a competitive, no-obligation offer based on real market conditions, enabling a swift and stress-free exchange. Seattle's dynamic real estate market can be challenging, but Marmot simplifies the process with quick evaluations and closures. Their process brings financial relief and peace of mind, allowing you to shift smoothly. Discover how to leverage their expertise for an efficient and beneficial home sale solution.

Understanding Underwater Mortgages

When you hear someone mention an "underwater mortgage," they're talking about a situation where the remaining balance on a home loan exceeds the property's current market value. This predicament can be intimidating, yet understanding it is vital for maneuvering potential solutions. An underwater mortgage often results from market fluctuations, where property values drop after you've purchased your home. This can be challenging, especially if you need to sell the house or refinance the mortgage.

You can take proactive steps to address this situation. First, it's important to assess your financial options. Mortgage relief programs might be available, offering a lifeline to those struggling with underwater mortgages. These programs can sometimes facilitate loan modifications, making your payments more manageable and aligning them with your home's current value.

Additionally, stay informed about market trends and consider consulting with a real estate expert to explore all possible avenues. Understanding your mortgage structure and your financial standing will empower you to make informed decisions. Remember, an underwater mortgage isn't an insurmountable obstacle. With the right strategies and knowledge, you can tackle this challenge effectively and work towards financial stability.

Benefits of Selling to Marmot

Choosing to sell your underwater house to Marmot can offer several advantages, especially if you're seeking a quick and hassle-free transaction. Marmot specializes in purchasing homes like yours where traditional sales might falter, guaranteeing you avoid lengthy processes and uncertainty. By choosing Marmot, you're opting for efficiency, with a focus on providing quick cash for your property without the typical roadblocks.

You'll appreciate the streamlined approach Marmot takes. Forget about staging, repairs, or dealing with real estate agents. Marmot buys homes as-is, which means you don't have to invest additional time or money into a property that's already costing you. This hassle-free method allows you to focus on your next steps without the stress of a drawn-out sale.

Moreover, Marmot's experience in the Seattle housing market guarantees you're getting a fair offer, reflecting current market conditions. You'll receive an offer quickly, allowing you to make informed decisions with speed and confidence. This approach not only saves time but also reduces the emotional toll that comes with being underwater on your mortgage. With Marmot, you're not just selling a house; you're gaining peace of mind and financial relief.

The Selling Process Explained

With the benefits of selling to Marmot in mind, let's explore how the selling process unfolds. First, you'll contact Marmot to discuss your property. They'll assess the unique aspects of your home and consider current market timing and effective selling strategies. This initial step is essential as it sets the stage for a seamless transaction.

Once the assessment is complete, Marmot will present you with a fair, no-obligation offer. Unlike traditional selling methods, there's no need to worry about repairs or staging. Marmot understands the challenges of selling an underwater house and focuses on providing you with a hassle-free experience. Their offer reflects current market conditions and strategic insight, ensuring you reveal your home's true value.

Upon accepting the offer, Marmot streamlines the closing process, often completing it within days. This approach allows you to move forward without delay, freeing you from the burdens of an underwater mortgage. Here's what you can expect in the process:

- **Quick Evaluation:** Fast assessment of your property's potential.

- **Fair Offers:** A competitive offer based on strategic market timing.

- **Swift Closure:** Rapid closing process tailored to your schedule.

Embrace this efficient method and achieve mastery over your real estate journey.

Seattle Real Estate Market Insights

Although the Seattle real estate market has experienced its share of fluctuations, it remains one of the most dynamic and sought-after in the United States. You're likely aware that Seattle trends reveal a city constantly evolving with its booming tech industry and thriving cultural scene. These factors make Seattle's housing market a prime target for investors and homeowners looking to maximize their property's value.

However, with such enticing opportunities come inevitable market fluctuations. Shifts in demand, economic conditions, and interest rates can all impact your home's value. Staying informed about Seattle trends is essential for making sound decisions, especially if you're considering selling an underwater house. Understanding how these fluctuations affect property values in different neighborhoods can give you an edge.

Seattle's diverse neighborhoods offer a range of real estate options, each responding differently to market changes. Some areas may see rapid appreciation, while others might experience slower growth. By keeping a finger on the pulse of Seattle trends, you can anticipate shifts and act strategically. This awareness not only helps you navigate the complexities of selling an underwater house but also guarantees you reveal the full potential of your home in this ever-changing market.

Steps to Get Started

Selling an underwater house in Seattle might seem challenging, but taking the right steps can simplify the process and help you make informed decisions. Start by understanding your home's current value through a professional home valuation. This step helps you gauge how much you owe compared to what your home is worth. Having a precise valuation sets the foundation for your next moves.

Next, explore your mortgage options. Contact your lender to discuss possibilities like a short sale or loan modification. These alternatives can alleviate financial burdens while allowing you to shift smoothly. Knowing your options empowers you to make strategic choices tailored to your situation.

Finally, connect with a reputable home-buying company like Marmot Buys Homes, which specializes in assisting homeowners in similar predicaments. Their expertise can guide you through the selling process, guaranteeing you access your home's potential value.

- **Determine Your Home's Value**: Obtain a professional home valuation to understand your financial position.

- **Explore Mortgage Solutions**: Consult your lender about options such as short sales or modifications.

- **Partner with Experts**: Reach out to Marmot Buys Homes for specialized assistance in selling your underwater property.

Taking these steps guarantees a smoother path to resolving your underwater mortgage situation.

#foreclosure help Seattle#mortgage assistance Seattle#best mortgage assistance Seattle#sell underwater house Seattle#sell house fast Seattle#sell house fast Seattle WA#cash home buyers Seattle#property liquidation Seattle#selling house no equity Seattle#mortgage help Seattle#quick home sale Seattle#sell house for cash Seattle#Youtube

0 notes

Text

Facing foreclosure in Michigan?

You’re not alone.

At City Lights Rentals, we help homeowners navigate challenging situations with a fair cash offer and a quick sale. Skip the stress—no repairs, no hidden fees. Learn more about how we can help you avoid foreclosure and find peace of mind by visiting our foreclosure guide. Get to know our team on the About Us page and see why we’re trusted by homeowners across the state. Take control and make your move today! #CityLightsRentals #ForeclosureHelp #MichiganHomes

#Michiganhomes#real estate#we buy houses#foreclosurehelp#webuyhomesinmichigan#foreclosures#sell your house fast#sell your house for cash

0 notes

Note

Don’t you think the maturity difference between Rafe and Barry is a little weird? I mean Barry lives alone and sells drugs while Rafe is so dependent on his dad. And isn’t the age difference also a little strange?

I don’t mean this as hate just genuinely asking.

Canonically? Not even a little bit. Almost everything about Barry is speculation. How old is he? We don't actually know because the show never confirms it, if he celebrates his 24th birthday in season 4 we can't argue he's actually 27 just because fandom says he is. He refers to the trailer(s) as his, but does he own them? Were they passed down when his parents died or were they foreclosures or is he renting or did he scrounge up enough cash to buy the property? Again, we don't know. In the first episode, Rafe and Barry clearly know each other but they aren't chummy. When Rafe gets himself into trouble he runs to Barry both to get high and to get help from someone who's just as loose with their morals as he is, and in turn Barry gets money. I won't say what formed between them is platonic because that would be a lie but I also don't think it was intentional, especially on Barry's part.

Is there a power imbalance? I don't really think so. Does Barry appear to have way more life experience? Yeah!

I think that's something Rafe would be attracted to (no matter how he views Barry; as a partner or a friend or a brother, etc.) because he thrives on guidance. And yes, Rafe is mentally ill and struggling with addiction while his father neglects and physically abuses him. He wants affection and reassurance and help which he has outright asked for only to be told very coldly to "man up." (and I want to take a second to point out so it's not glossed over that RAFE IS AN ADDICT. Rafe needs to get high often, drugs require money, Ward gives it to him. In what world would Rafe have the capacity to turn away offerings that carry little to no expectations from him? Houses, cars, money, etc., it's provided for him so what's the point of going to school or working hard like Barry has to?) At such an uncertain time in his young life it makes sense, at least to me, Rafe would be trying his hardest for approval. Especially with Sarah pulling away from the family and potentially making room for him to weasel his way into Ward's unfeeling heart. So I don't think Rafe's relationship with his father should be used as an example of why he's unfit for a relationship with someone more stable. If anything, I feel Barry and Rafe's lives would be better together, mainly because I feel Rafe would be pushed to get help and have the support to do it.

okay, but In fanfiction? Where they're dating or fucking? Sure, the age difference is a little off. As someone in their mid-twenties I sure as shit wouldn't date someone with 'teen' in their age. BUT I think it's fair to assume Barry The Drug Dealer didn't have the greatest moral compass to begin with, worsening after time with Rafe. Would he take advantage of Rafe's vulnerability? depends on what I'm writing, but probably, yeah, at least in the beginning. Would he use Rafe for status or money? same thing, probably in the right circumstances. There's probably more I could say but I feel like I'm rambling and I'm not sure I'm doing a good job at answering this anyway. But thank you for asking (:

#was this the answer you wanted?#lmk#cause i feel like way better people could've gotten this ask and given you a satisfying answer#i originally just answered with “rafe and barry are evil so it doesn't matter!! <3” but that felt dismissive#tbh if y'all don't agree with something#tell me because i barely remember whats canon and what i just made up in my noggin#rafebarry

17 notes

·

View notes

Text

The Benefits Of Selling Your Home For Cash: A Financial Guide To A Better Future

Selling your house as-is can be a strategic decision that offers surprising benefits for homeowners looking to streamline the selling process and maximize their returns. In this comprehensive guide, we'll explore the advantages of selling your house in its current condition and how it can lead to a successful and stress-free transaction.

Simplified Process: One of the most significant benefits of selling your house as-is is the simplified process it offers. Rather than investing time and money into costly repairs and renovations, you can sell the property in its current condition, saving yourself the hassle of managing construction projects or dealing with contractors. This streamlined approach allows you to focus on other priorities and move forward with the sale more quickly.

Time Savings: Undertaking major renovations or repairs before selling your house can be time-consuming, with projects often taking weeks or even months to complete. By selling your house as-is, you can bypass this lengthy process and expedite the sale timeline. This is particularly advantageous if you're in a hurry to sell due to reasons like job relocation, financial distress, or an impending foreclosure. With an as-is sale, you can typically list your property and find a buyer much faster, saving you valuable time and effort.

Cost-Effective: Selling as is house can be a cost-effective option, especially if you're facing budget constraints or looking to maximize your net proceeds from the sale. Rather than spending money on repairs and upgrades, you can sell the property in its current condition and avoid the financial outlay associated with home improvement projects. This can result in a higher profit margin from the sale, as you won't be subtracting renovation costs from your proceeds.

Transparent Transaction: Selling your house as-is allows for a more transparent transaction between you and the buyer. Since you're not making any promises or representations about the condition of the property, there's less risk of disputes or legal issues arising after the sale. Buyers who purchase a house as-is are typically aware that they're taking on the responsibility for any necessary repairs or upgrades, reducing the likelihood of post-sale conflicts.

Attracting Investors and Cash Buyers: Houses sold as-is often attract investors and cash buyers who are looking for opportunities to acquire properties at a discount and add value through renovations or resale. These buyers are typically more experienced in real estate transactions and are willing to overlook cosmetic issues or minor repairs in exchange for a favorable purchase price. By marketing your house as-is, you can tap into this pool of motivated buyers and increase your chances of finding a qualified purchaser quickly.

Flexible Terms: Selling your house as-is provides greater flexibility in terms of negotiation and contractual arrangements. Since you're not investing in costly renovations or upgrades, you can afford to be more accommodating to buyers' preferences regarding the sale price, closing date, and other terms. This can help expedite the sales process and ensure a smoother transaction for both parties involved.

Avoiding Emotional Attachment: For homeowners who have lived in their house for many years, there can be a strong emotional attachment to the property. Selling the house as-is allows you to detach emotionally and focus on the practical aspects of the transaction. Rather than getting caught up in sentimental considerations or trying to achieve a certain aesthetic appeal, you can approach the sale with a clear and objective mindset, leading to better decision-making and a more successful outcome.

In conclusion, selling your house as-is offers a range of surprising benefits that can make the selling process easier, faster, and more cost-effective. From simplified transactions and time savings to attracting motivated buyers and avoiding emotional attachment, there are numerous advantages to selling your house in its current condition. By considering the benefits outlined in this guide, you can make an informed decision about whether selling your house as-is is the right choice for you.

2 notes

·

View notes

Text

Quick Cash assistance from Direct Lenders for Short Term Loans

Today, obtaining quick financial help without a debit card is not a difficult chore. Consumers in need have the option of applying for short term loans direct lenders and receiving sums of money ranging from £100 to £1000 without providing any kind of security as collateral. Furthermore, you have 2-4 weeks starting from the original clearance date to return this sum. Remember that compared to other loans, the interest rates are a little excessive.

To be eligible for a short term loans direct lenders, you must first complete the following requirements: You have worked for a reputable company for at least six months, your regular bank account is at least 90 days old, you are at least 18 years old, a citizen of the United Kingdom, and you make at least £500 a month in income.

For those who are coping with circumstances that affect credit negatively, such as defaults, arrears, foreclosure, missed payments, judgements from national courts, voluntarily entered into individual agreements, or insolvency. Now people may easily apply for same day loans UK and obtain the necessary funds without worrying about a credit check. The purpose of lenders is to give money to salaried people in the UK.

Applying for short term loans UK online is completely free. You must go to the lender's website and begin filling out a straightforward application form with all necessary information. Following approval of your request, the lender will deposit the money safely immediately into your bank account. With the help of same day loans UK, you can pay off a variety of obligations, including credit card debt, unpaid bank overdrafts, unpaid grocery bills, vacation expenses, and so on.

Do Same Day Loans UK represent my only choice?

No, and before taking on one of them, we advise you to take into account all other possible borrowing choices. You can cover an unexpected bill by using savings, borrowing from friends and family, or selling a high-value item you no longer need. If you've tried everything else, an installment loan, like the same day loans UK offered by Payday Quid, is also an alternative.

What could I do with a £2,000 Same Day Loans UK?

This kind of loan can be used for a variety of things, like replacing your automobile if it is no longer safe to drive it or paying for urgent house repairs like a new boiler. It's up to you how you utilize your payday loan, but you should only apply for one if it is absolutely required.

Depending on the lender, you may have up to 35 days to repay the money you borrowed through a short term loans UK direct lender. A loan of this size, however, might strain many people's finances because it must be repaid in one month plus interest. Instead, we advise taking into account an installment loan. If you choose Payday Quid, the lenders through our broker partner provide repayment terms between 3 and 36 months, allowing you to spread the cost of your borrowing over a longer period of time.

#same day loans uk#same day payday loans#short term loans uk#payday loans online#short term cash loans#short term loans#same day loans online

4 notes

·

View notes