#securities transaction tax

Text

It’s typical for taxpayers to employ tax avoidance strategies to reduce their tax payments to the government. Therefore, it’s crucial for the government to monitor and address these strategies by enacting or amending laws to discourage such practices.

#employ tax avoidance strategies#tax payments#Securities Transaction Tax#taxing financial market#mutual funds

0 notes

Text

Stock Investing in India – What is Securities Transaction Tax

Tax evasion is a deep-rooted scourge among many taxpayers. Attempting to avoid paying income tax by not disclosing profits from the sale of securities is an illegal and illegal activity. This not only results in taxpayers shirking their responsibilities as citizens, but also results in a significant reduction in state coffers used for social welfare schemes.

Keeping this in mind, the Indian government has introduced measures to control illegal activities, one of which is the securities trading tax. Since its inception in October 2004, the law requires investors to pay taxes on their capital gains from the stock market.

This is a detailed description of the characteristics, scope and rates of securities trading tax in India.

What is Securities Transaction Tax in India?

Securities Transaction Tax (STT) is a tax on transactions of securities made in the stock exchange of India. Securities refer to negotiable investment instruments such as stocks, checks, bonds, any equity-related funds, etc., issued by a company or government. The main purpose of introducing STT is to curb the tendency of investors to avoid paying the appropriate income tax. Not paying taxes on your capital gains is one of the biggest investing mistakes new investors make. Check out this link for other investing mistakes you want to watch!

Features of Securities Transaction Tax

It is a direct tax that the Central Government levies and collects.

Off-market share transactions do not fall under the ambit of STT.

The rate of STT depends on the type of security being traded and whether the transaction is a sale or purchase.

Sell transactions for both options and futures fall under the scope of the tax regime. Options are valued at a premium and futures are valued at the actual traded price.

Clearing members pay an STT, which is a collective sum of the STTs of trading members under them.

Securities Transaction Tax rates in India

One can trade in securities for investment purposes or for trading purposes. In both cases, the government levies STT. Also, the tax that affects stock market transactions depends on the purpose or nature of the transaction, as explained above. Investment advisors at TejiMandi help you calculate the tax you will pay on capital gains in your investment portfolio, so you don't have to fear the math again!

Income from trading also attracts income tax. It is of two types:

1. Income from professional stock trading

2. Capital gains

The takeaway

Sale Are you looking for a simplified way of investing in stocks? The TejiMandi App is the ultimate destination for all your investment-related needs! Trusted by over 10,000 investors, Teji Mandi makes investing in stocks hassle-free and straightforward. From active portfolio management to practical analysis of stock picks, Teji Mandi ensures that you sail smoothly through your investment journey. Connect with us today to supercharge your investment portfolio!

0 notes

Text

Mastering Accounts Payable: 15 Common Interview Questions and Expert Answers

Preparing for an Accounts Payable (AP) interview is a crucial step in securing a position in this vital finance function. To help you excel in your interview, we’ve compiled a comprehensive guide that covers the 20 most common AP interview questions, each paired with expert answers. In this article, you’ll gain valuable insights into the world of AP and enhance your chances of acing your…

View On WordPress

#Accounting#Accounting Software#Accounting Standards#Accounts Payable#Accuracy in AP#AP Interview#Cost Savings#data security#Disputed Invoices#Financial Regulations#Foreign Currency Transactions#Fraud Prevention#High Invoice Volume#Invoice Processing#Payment Methods#Tax Compliance#Urgent Payments#Vendor Onboarding#Vendor Relationships

0 notes

Note

tell me about your defense contract pleage

Oh boy!

To be fair, it's nothing grandiose, like, it wasn't about "a new missile blueprint" or whatever, but, just thinking about what it could have become? yeesh.

So, let's go.

For context, this is taking place in the early 2010s, where I was working as a dev and manager for a company that mostly did space stuff, but they had some defence and security contracts too.

One day we got a new contract though, which was... a weird one. It was state-auctioned, meaning that this was basically a homeland contract, but the main sponsor was Philip Morris. Yeah. The American cigarette company.

Why? Because the contract was essentially a crackdown on "illegal cigarette sales", but it was sold as a more general "war on drugs" contract.

For those unaware (because chances are, like me, you are a non-smoker), cigarette contraband is very much a thing. At the time, ~15% of cigarettes were sold illegally here (read: they were smuggled in and sold on the street).

And Phillip Morris wanted to stop that. After all, they're only a small company worth uhhh... oh JFC. Just a paltry 150 billion dollars. They need those extra dollars, you understand?

Anyway. So they sponsored a contract to the state, promising that "the technology used for this can be used to stop drug deals too". Also that "the state would benefit from the cigarettes part as well because smaller black market means more official sales means a higher tax revenue" (that has actually been proven true during the 2020 quarantine).

Anyway, here was the plan:

Phase 1 was to train a neural network and plug it in directly to the city's video-surveillance system, in order to detect illegal transactions as soon as they occur. Big brother who?

Phase 2 was to then track the people involved in said transaction throughout the city, based on their appearance and gait. You ever seen the Plainsight sheep counting video? Imagine something like this but with people. That data would then be relayed to police officers in the area.

So yeah, an automated CCTV-based tracking system. Because that's not setting a scary precedent.

So what do you do when you're in that position? Let me tell you. If you're thrust unknowingly, or against your will, into a project like this,

Note. The following is not a legal advice. In fact it's not even good advice. Do not attempt any of this unless you know you can't get caught, or that even if you are caught, the consequences are acceptable. Above all else, always have a backup plan if and when it backfires. Also don't do anything that can get you sued. Be reasonable.

Let me introduce you to the world of Corporate Sabotage! It's a funny form of striking, very effective in office environments.

Here's what I did:

First of all was the training data. We had extensive footage, but it needed to be marked manually for the training. Basically, just cropping the clips around the "transaction" and drawing some boxes on top of the "criminals". I was in charge of several batches of those. It helped that I was fast at it since I had video editing experience already. Well, let's just say that a good deal of those markings were... not very accurate.

Also, did you know that some video encodings are very slow to process by OpenCV, to the point of sometimes crashing? I'm sure the software is better at it nowadays though. So I did that to another portion of the data.

Unfortunately the training model itself was handled by a different company, so I couldn't do more about this.

Or could I?

I was the main person communicating with them, after all.

Enter: Miscommunication Master

In short (because this is already way too long), I became the most rigid person in the project. Like insisting on sharing the training data only on our own secure shared drive, which they didn't have access to yet. Or tracking down every single bug in the program and making weekly reports on those, which bogged down progress. Or asking for things to be done but without pointing at anyone in particular, so that no one actually did the thing. You know, classic manager incompetence. Except I couldn't be faulted, because after all, I was just "really serious about the security aspect of this project. And you don't want the state to learn that we've mishandled the data security of the project, do you, Jeff?"

A thousand little jabs like this, to slow down and delay the project.

At the end of it, after a full year on this project, we had.... a neural network full of false positives and a semi-working visualizer.

They said the project needed to be wrapped up in the next three months.

I said "damn, good luck with that! By the way my contract is up next month and I'm not renewing."

Last I heard, that city still doesn't have anything installed on their CCTV.

tl;dr: I used corporate sabotage to prevent automated surveillance to be implemented in a city--

hey hold on

wait

what

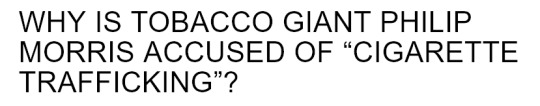

HEY ACTUALLY I DID SOME EXTRA RESEARCH TO SEE IF PHILLIP MORRIS TRIED THIS SHIT WITH ANOTHER COMPANY SINCE THEN AND WHAT THE FUCK

HUH??????

well what the fuck was all that even about then if they already own most of the black market???

#i'm sorry this got sidetracked in the end#i'm speechless#anyway yeah!#sometimes activism is sitting in an office and wasting everyone's time in a very polite manner#i learned that one from the CIA actually

160 notes

·

View notes

Text

india's hindutva middle class is having a meltdown because the new budget upped capital gains taxes and reduced income taxes. tbf they reduced corporate taxes as well so this isn't income redistribution or anything, but this is perceived as an attack by one of modi's strongest voter bases

The budget increased tax on long-term capital gains on all financial and non-financial assets to 12.5% from 10%. Assets held for over a year are considered long term.

Short-term capital gains will now be taxed at 20% instead of 15%.

The budget has also increased the securities transaction tax on derivatives trading.

This was widely expected, with the Economic Survey released a day earlier raising red flags about rising speculation and growing participation of retail investors in Indian equity markets.

62 notes

·

View notes

Text

every once in a while i like to poke my head into "anti [x]" tags just to see what the other side thinks. recently i was looking through "anti ao3" and found a really funny post claiming that ao3 is not anticapitalist, but actually the Definition Of Capitalism, bc it relies on volunteer labor while supposedly having the money to pay a staff.

oh, honey.

but i am not going to make unsubstantiated claims on the internet, no, and this gives me an excuse to look at ao3's whole budget myself, which i've been meaning to do for a while. these numbers are taken from the 2022 budget post and budget spreadsheet.

ao3's total income for 2022, from the two donation drives, regular donations, donation matching programs, interest, and royalties was $1,012,543.42. less than $300 of that was from interest and royalties, so it's almost all donations. and that's a lot, right? surely an organization making a million dollars a year can afford to pay some staff, right?

well, let's look at expenses. first of all, they lose almost $37,000 to transaction fees right away. ao3 and fanlore (~$341k and ~$18k, respectively) take up the biggest chunks of the budget by far. that money pays for, to quote the 2022 budget post, "server expenses—both new purchases and ongoing colocation and maintenance—website performance monitoring tools, and various systems-related licenses."

in some years, otw also pays external contractors to perform audits for security issues, and for more servers to handle the growing userbase. servers are expensive as hell, guys. in 2022, new server costs alone were $203k.

each of their other programs only cost around $3,000 or less, and otw paid around $78k for fundraising and development. wait, how do you lose so much money on your fundraising?? from the 2022 budget post: "Our fundraising and development expenses consist of transaction fees charged by our third-party payment processors for each donation, thank-you gift purchases and shipping, and the tools used to host the OTW’s membership database and track communications with donors and potential donors."

then the otw paid an additional $74k in administration expenses, which covers "hosting for our website, trademarks, domains, insurance, tax filing, and annual financial statement audits, as well as communication, management, and accounting tools."

in case you weren't following all of that math, the total expenses for 2022 come out to $518,978.48. woah! that's a lot! but it's still only a little over half of their net revenue. weird. i wonder what they do with that extra $494k?

well, $400k of it goes to the reserves, which i'll get to in a second. the last $93k, near as i can tell, gets rolled over to the next year. i'll admit this part i'm a little unsure about, as it's not clear on the spreadsheet, but that's the only thing that makes sense.

the reserves, though are clear. the most recent post i could find on the otw site about it were in the board meeting minutes from april 2, 2022: "We’re holding about $1million in operating cash that is about twice the amount of our annual operating costs. There is another $1million in reserves due to highly successful fundraisers in the past. The current plan for the reserves is to hold the money for paid staff in the future. It’s been talked about before in the past and we’re still working out the details, but it’s a rather expensive undertaking that will result in large annual expenses in addition to the initial cost of implementation."

woah....they're PLANNING to have paid staff eventually! wild!

so let's assume, for easy numbers, that the otw currently has $1.5 million in reserves. before we even get to how to use that money, let's look at the issues with implementing paid staff:

deciding which positions are going to be paid, because it can't be all of them

deciding how much to pay them, bc minimum wage sure as hell isn't enough, and cost of living is different everywhere, and volunteers come from all over the world

hiring staff and implementing new systems/tools to handle things like payroll and accounting

making sure you continue to earn enough money both to pay all of the staff and have some in reserves for emergencies or leaner donation drives

probably even more stuff than that! i don't run a nonprofit, that's just what i can think of off the top of my head.

okay, okay, okay. for the sake of argument, let's assume there is a best-case scenario where the otw starts paying some staff tomorrow. how much should they be paid? i'm picking $15 an hour, since that's what we fought for the minimum wage to be. by now, it should be closer to $20 or $25, but i'm trying to give "ao3 is capitalism" the fairest shot it can get here, okay?

ideally, if someone is being paid to help run ao3, they shouldn't need a second job. every job should pay enough to live off of. and running a nonprofit is hard work that leads to a lot of burnout--two board members JUST resigned before their terms were up. what i'm saying is, i'm going to assume a paid otw staff is getting paid for 40 hours of work a week, minimum. that's $31,200.

at $400,000 per year, the otw can afford to pay 12 people. that's WITHOUT taking into account the new systems, tools, software, etc they would have to pay for, any kind of fees, etc, etc.

oh, and btw, if you're an american you're still making barely enough to survive in most places, AND you don't have universal healthcare, vision, or dental. want otw to give people insurance, too? the number of people they can pay goes down.

it's. not. possible.

a million dollars is a lot of money on the face of it, but once you realize how MUCH goes into running something like the otw, it goes away fast.

just for reference, wikipedia also has donation drives every year. wikipedia, as of 2021, has $86.8 million in cash reserves and $137.4 million in investments. sure, wikipedia and ao3 are very different entities, but that disparity is massive. and i should note that if you give $10 to wikipedia they don't give you voting rights, i'm just saying.

by the way, you may have noticed that i didn't mention legal costs at all here. isn't one of otw's big Things about how they do legal advocacy?

yes, it is. they have a whole page about that work. and i can't for the life of me find a source on otw's website (and i'm running out of time to write this post, i'll look harder later), but i am 90% sure i learned before that most, if not all, of otw's legal work/advice/etc is done pro bono. i've also seen an anti-ao3 person claim their legal budget is only $5k or so, but they didn't have a source. but keep in mind that if they don't have a legal budget, all the numbers above stay the same, and if they do, there is even less money available for paid staff.

you can criticize ao3 and the otw all you want! there are many valid reasons to criticize them, and i do not think they're perfect either. but if you're going to do so, you should at least make sure you can back up your claims, bc otherwise you just look silly.

#ao3#otw#anti ao3#bc i want them to see this#otw board#ao3 discourse#ao3 donations#wren wrambles#that post was so unserious i died#if it was more recent (its from mid-july) i wouldve replied directly maybe#but i didnt want to drag the body of a 6-note post into the light OR attack the op directly so#also! if i misunderstood something pls let me know im doing my best

191 notes

·

View notes

Text

UPDATED COMMISSION PRICE SHEET!! YAAAAY YOU WANT TO BUY MY ART SO BAD!!! <3 <3 <3

I take 3 slots at a time w/ availability indicated by the counter in my pinned post, but I am willing to waitlist people!

Please contact me through dms, NOT asks or sumbissions.

If you're unsure about the exact pricing of what you have in mind or have any other questions, my dms are open! please feel free to reach out to me! (note: if you're inquiring about a commission please state this in your FIRST message to me, otherwise i might assume you're a bot and not respond)

*please do NOT send me money through the 'send & recieve' feature on paypal. I use invoices for organization, security, and tax purposes, and I will initiate the transaction once details have been discussed.

#commissions#art#digital art#artists on tumblr#HI!!! SUPPORT YOUR FAVORITE STARVING ARTIST THRU ART SCHOOL!!! I HAVE 2 JOBS AND NEITHER OF THEM PAY ME SHIT <3 <3#will be updating my pinned & carrd links 4 the new price sheet obv but it may take a sec. this is the official price sheet now tho

187 notes

·

View notes

Text

Now all we hear is how banks are suddenly investing in things like BITCOIN. The propaganda is just stunning, for it has once again proven that Julius Caesar was right more than 2000 years ago, and nothing has ever changed.

Things like BITCOIN are a religion, and that is the problem. It would be best never to marry any trade, for you will never look at the world objectively. The code for the BITCOIN programmer was known to have come from the NSA. In 1996, the US government released a white paper entitled, “How to make a mint: the cryptography of anonymous electronic cash.” Released by the National Security Agency Office of Information Security Research and Technology, this document basically explains how a government agency could create something like Bitcoin or another cryptocurrency.

The Federal Reserve is not going to issue a CBDC. All the big banks are creating their own, and then they will be regulated by the Fed. The banks must already report suspicious activity to the Feds. The banks will create the digital currency since they will report “suspicious” activity to the Fed and IRS. If the Fed created a CBDC, they need a search warrant to look into an account where the banks do not.

OPEN YOUR EYES

This is the same scheme they used with covid. Private companies like Facebook and YouTube can regulate free speech that the government cannot. The banks will then report all suspicious activity and your cash flow to the IRS. Wake up! Janet Yellen wanted to audit $600 transaction of Ebay. They are broke and they believe ending cash will result in 35%+ more in tax collections.

This entire digital currency is to provide the government with 100% tracking of every monetary transaction. We will be driven back to barter. Don’t be surprised when they attack gold. All gold refiners already must declare every gram where it came from and where it went.

15 notes

·

View notes

Text

Black Lives Matter is headed for INSOLVENCY after plunging $8.5M into the red - but founder Patrisse Cullors' brother was still paid $1.6M for 'security services' in 2022, while sister of board member earned $1.1M for 'consulting'

By: Harriet Alexander

Published: May 24, 2024

Black Lives Matter Global Network Foundation, a non-profit that grew out of the protest movement, is haemorrhaging cash, financial records show

The group ran an $8.5 million deficit and saw the value of its investment accounts drop by nearly $10 million, with fundraising down 88% year-on-year

Despite the financial woes, the organization still paid relatives of the founder and of a board member hundreds of thousands of dollars for services

Black Lives Matter's national organization is at risk of going bankrupt after its finances plunged $8.5 million into the red last year - while simultaneously handing multiple staff seven-figure salaries.

Financial disclosures obtained by The Washington Free Beacon show the perilous state of BLM's Global Network Foundation, which officially emerged in November 2020, as a more formal way of structuring the civil rights movement.

Yet despite the financial controversy and scrutiny, BLM GNF continued to hire relatives of the founder, Patrisse Cullors, and several board members.

Cullors' brother, Paul Cullors, set up two companies which were paid $1.6 million providing 'professional security services' for Black Lives Matter in 2022.

[ BLM co-founder Patrisse Cullors' (left) employed her brother, Paul Cullors (right) for security at BLM's properties ]

[ Paul Cullors was employed as the head of the security team at the $6 million Los Angeles mansion (pictured) bought with charity donations ]

Paul Cullors was also one of BLM's only two paid employees during the year, collecting a $126,000 salary as 'head of security' on top of his consulting fees. He is best known as a graffiti artist, with no background in security.

Patrisse Cullors defended hiring him, saying registered security firms which hired former police officers could not be trusted, given the movement's opposition to police brutality.

For the previous year, 2021, tax filings revealed that BLM paid a company owned by Damon Turner, the father of Cullors' child, nearly $970,000 to help 'produce live events' and provide other 'creative services.'

Cullors resigned in May 2021.

'While Patrisse Cullors was forced to resign due to charges of using BLM's funds for her personal use, it looks like she's still keeping it all in the family,' said Paul Kamenar, an attorney for the National Legal and Policy Center watchdog group.

Shalomyah Bowers, who took over from Cullors when she resigned, also benefitted handsomely from the group: in 2022, his consultancy firm was paid $1.7 million for management and consulting services, the Free Beacon reported.

And the sister of former Black Lives Matter board member Raymond Howard was also employed in a lucrative role as a consultant.

Danielle Edwards's firm, New Impact Partners, was paid $1.1 million for consulting services in 2022, the Free Beacon said.

BLM GNF also agreed to pay an additional $600,000 to an unidentified former board member's consulting firm 'in connection with a contract dispute'.

The non-profit group ran an $8.5 million deficit, and its investment accounts fell in value by nearly $10 million in the most recent tax year, financial disclosures show.

The group logged a $961,000 loss on a securities sale of $172,000, suggesting the group sustained an 85 percent loss on the transaction. Further details of that security have not been shared.

And the cash flowing into BLM's coffers has dropped dramatically.

Donations plunged by 88 percent between 2021 and 2022, from $77 million to just $9.3 million for the most recent financial year.

Patrisse Cullors, who had been at the helm of the Black Lives Matter Global Network Foundation for nearly six years, stepped down in May 2021, amid anger at the group's financial decisions and perceived lack of transparency.

A year later, in May 2022, it was revealed Black Lives Matter spent more than $12 million on luxury properties in Los Angeles and in Toronto - including a $6.3 million 10,000-square-foot property in Canada that was purchased as part of a $8M 'out of country grant.'

The Toronto property was bought with grant money that was meant for 'activities to educate and support black communities, and to purchase and renovate property for charitable use.'

The group had said it was planning to use the property as main headquarters in Canada, and it has now been named the Wilseed Center for Arts and Activism.

It emerged that Cullors transferred millions from the organization to a charity run by her wife, Janaya Khan, to purchase the property.

Cullors admitted to AP that her group was ill-equipped to handle the finances of a charity which received $90 million the year after George Floyd was killed - but denied any wrongdoing.

Cullors issued a statement denying she used the $6 million LA property for personal purposes, but then had to backtrack and admit she had used the compound for purposes that were not strictly business.

The activist also amassed a $3 million property portfolio of her own, including homes in LA and Georgia, although there is no suggestion of any financial impropriety.

It is not known if the group paid out lucrative contracting fees to Cullors' friends and family past June 2022, when a new board of directors was brought in.

The board is now led by nonprofit adviser Cicley Gay, who has filed for Chapter 7 bankruptcy three times since 2005.

Gay was ordered by a court to attend financial management lessons, and at the time of her appointment in April 2022 had more than $120,000 in unpaid debt.

She was one of three people appointed to the board, the organization said in a tweet. She subsequently was described as being chair of the board.

She told The New York Times she had been appointed to straighten out the organization's finances, after BLMGFN faced intense scrutiny over its spending of donor cash.

'No one expected the foundation to grow at this pace and to this scale,' said Gay.

'Now, we are taking time to build efficient infrastructure to run the largest Black, abolitionist, philanthropic organization to ever exist in the United States.'

It later emerged that Gay has been declared bankrupt three times, according to federal reports obtained by The New York Post.

Gay, a mother of three, filed for bankruptcy in 2005, 2013 and 2016.

BLMGFN has faced intense questions about its handling of donations, which surged in particular during the George Floyd protests in the summer of 2020.

The organization in February 2021 said it had taken in more than $90 million in 2020 and still had $60 million on hand.

Last year, it was down to $42 million, while the Free Beacon reports BLM has now spent two thirds of the $90 million cash it had to hand.

Cullors, the co-founder of the organization, resigned in May 2021 as director of BLMGNF, amid scrutiny of her own property empire. She has written best-selling books, and has a contract with Warner Brothers to produce content.

Then in April 2022 it emerged that BLMGFN had bought a mansion in Los Angeles for $5.8 million, which they said was to be used as a 'safe space' for activists and for events.

The organization responded to the reports in a lengthy Twitter feed, with the group noting that more 'transparency' was required going forward.

[ Black Lives Matter has apologized following an expose that detailed how the organization had used donations to purchase a $6 million home in Los Angeles ]

[ In a lengthy Twitter thread on Monday morning, the group vowed to be more transparent in the future ]

'There have been a lot of questions surrounding recent reports about the purchase of Creator's House in California. Despite past efforts, BLMGNF recognizes that there is more work to do to increase transparency and ensure transitions in leadership are clear,' it stated.

BLM then proceeded to blame the media for the furore and the 'inflammatory and speculative' reports that saw journalists probing the group's financials saying that it 'caused harm'

The reports 'do not reflect the totality of the movement,' the organization claimed.

'We know narratives like this cause harm to organizers doing brilliant work across the country and these reports do not reflect the totality of the movement,' one of the tweets reads. 'We apologize for the distress this has caused to our supporters and those who work in service of Black liberation daily.'

'We are redoubling our efforts to provide clarity about BLMGNF's work,' noting an 'internal audit' was underway together with 'tightening compliance operations and creating a new board to help steer to the organization to its next evolution.'

[ The organization also criticized the original New Yorker article, pictured above, describing it as 'inflammatory and speculative' ]

[ BLM co-founder Patrisse Cullors (above) came under fire last year for a slew of high-profile property purchases. She resigned in May 2021 and has called reports investigation the $6 million mansion 'despicable' and claimed that criticisms against her are 'sexist and racist' ]

[ The home features six bedrooms and a pool in the back. BLM claimed the home was bought to provide a safe house for 'black creativity' but had allegedly tried to hide the home's existence ]

[ The mansion comes complete with a sound stage (pictured) and mini filming studio which the group had used in one of its video campaigns ]

BLM attempted to justify the purchase of the mansion by saying it was made to encourage 'Black creativity' with the property 'a space for Black folks to share their gifts with the world and hone their crafts as we see it.'

The organization also went on to defend how the funds the group raised were spent including the $3 million used for 'COVID relief' and a further $25 million dollars to black-led organizations.

'We are embracing this moment as an opportunity for accountability, healing, truth-telling, and transparency. We understand the necessity of working intentionally to rebuild trust so we can continue forging a new path that sustains Black people for generations,' the group wrote.

The barrage of tweets, which notably had their comments turned off, ended with the group announcing they were 'embracing this moment as an opportunity for accountability, healing, truth-telling, and transparency' and 'working intentionally to rebuild trust.'

[ Internal memos from BLM revealed the group wanted to keep the purchase secret, despite filming a video on the home's patio in May ]

[ The Studio City home - which sits on a three-quarter-acre lot - boasts more than half-dozen bedrooms and bathrooms, a 'butler's pantry' in the kitchen (pictured) ]

Concerns over the groups finances have swirled for years with BLM coming under intense scrutiny in the past.

In February 2022 the group stopped online fundraising following a demand by the California attorney general tho show where millions of dollars in donations received in 2020 went.

The group said the 'shutdown' was simply short term while any 'issues related to state fundraising compliance' were addressed.

--

Everybody figured out that it was a scam and always has been.

criticisms against her are 'sexist and racist'

"How dare you notice the things that I'm doing?" is the manipulative language of an abuser.

to rebuild trust

Grifters gotta grift. Defund BLM.

#Patrisse Cullors#BLM#Black Lives Matter#Buy Large Mansions#con artist#grifters gonna grift#grifters#scam artist#embezzlement#defund BLM#religion is a mental illness

10 notes

·

View notes

Quote

You don’t want to have kids, god bless you. I don’t have kids myself, at least not yet. A lot of people are perfectly fulfilled in that lifestyle. But from a social standpoint, from 10,000 feet, the cavalier dismissal of having kids betrays a failure to understand a key point: you are going to get old, someday, the kind of old where you’ll be physically infirm and need a lot of help just getting around, where you might have Alzheimer’s or dementia, where your social opportunities are much more constrained and you risk being very lonely. You can dismiss this as transactional if you want, but the durable societal script of “you take care of your children when they’re too young to take care of themselves, they’ll take care of you when you’re too old to take care of yourself” has a lot going for it. There’s a retirement crisis facing us; as our population ages, there are more and more people who need to draw on benefit programs like Social Security and Medicare and relative to that number fewer who are paying into those programs. (Taxing the wealthy adequately would go a long way to fixing this.) This isn’t a new problem. The trouble is that as fewer and fewer people have children, the difficulty becomes even more acute, as we have an increasingly-stressed public benefits system and more and more seniors who have no familial support in their golden years. As I said, this is an emotional dynamic as well as a pragmatic one. Old people love their grandkids! Their grandkids bring them joy and give them something in which to invest their hopes for the future. Maybe that means something to you, but it’s fine if it doesn’t. At scale? I think it’s a problem if too few people see things this way. Taking care of our elderly can’t be a task left entirely to the monetary economy.

I Regret to Inform You That We Will All Grow Old, Infirm, and Unattractive

9 notes

·

View notes

Text

Dear humanity

I am Ahmed from Gaza. I am married and have three children: Jumana, 8 years old, Suhad, 6 years old, and Muhammad, 3 years old. Although they are young, they have survived previous wars, but this current war is the most difficult because I am not with them and cannot provide water, food or a safe place.

Our lives changed on October 7, when my children were home with their mother. The sounds of bombing were getting louder everywhere, and with every missile strike, my children’s bodies were shaking. My wife and children left our house in a hurry and moved to another house, then to school. Later, our house was surrounded, burned and completely destroyed. It wasn't just the loss of our home, it was the loss of safety and security and our dreams, including those of our children. They destroyed our home and ruined years of our lives.

I also lost my job. Job opportunities in Gaza are extremely scarce due to the blockade that has been in place for more than 17 years.

Despite my persistent attempts and improving my skills through education and traininig, I was able to open an office for vocational education and training. But I lost my office after its infrastructure was destroyed. I also had a store that sold electronic games, and that was destroyed and burned as well. As a result, my family and I no longer have any way to earn a living. I went to Egypt before the war to take some courses for my business, but I am now stuck in Egypt while my children are with their mother in Gaza due to the closure of the road from Egypt to Gaza due to the war.

I have not seen my children for 8 months due to road closures, and I am desperately searching for a way to save them from the ravages of war. Being away from my children, I feel tremendous pressure and feel extremely responsible for every moment my children and wife spend in fear and devastation. I dream of bringing my children and my wife to Egypt to a safe place where I can build a better future for them, full of safety and hope. They deserve life in all its meanings, including comfort and peace.

I appeal to the whole world to hear my cry, the cry of my wife, and the cry of my children in Gaza. We need a helping hand to wipe away our tears and build a bridge of safety for us.

Perhaps this fundraising campaign represents a beacon of hope amidst the darkness. It is truly the only hope we cling to so strongly.

The aim of the fundraiser is to save my children by traveling to Egypt. Travel costs per person are $5,000, and I also need to cover transportation costs, renting a house in Egypt, and meeting my children's clothing, healthcare, and other humanitarian needs for several months up to a year.

Approximately $1,000 to cover GoFundMe transaction fees (%2.9+$0.30 per transaction)

To learn more about me, please visit my

TikTok account www.tiktok.com/@help.juju

Donations campaign details:

Travel fees for the mother = $5,000

For children: 3*2,500$=7,500$

Total travel fee = $12,500

Passport issuance fees = $1000

Visa fees for Canada and plane tickets for the family are $8,000

Accommodation in Egypt, including renting a house, buying clothes and toys for the children, entertaining them, and conducting a medical examination for the children to check on them. My family of four in Gaza and me alone in Egypt, we are all facing unimaginable challenges. To give us a chance for a better life, we are seeking to raise 58,000 Euros.

There are taxes on money in banks as well as on the crowdfunding fund (GoFundMe) which also has a percentage.

6 notes

·

View notes

Text

When Tax Collector was a profession in Dwarf Fortress

Today, if you dig secure lodgings your dwarves will live in an anarcho-communist society. Sure, you have nominal nobles such as Mayors, Barons and Monarchs, but all the dwarves have access to Fortress resources. However...

Long ago in the yesterday of 2007, nearly a year ago the first Alpha release of Dwarf Fortress has been uploaded to the Bay12 games website. No z-levels, no Artifacts and cats could adopt visitors to your fortress. And when you had appointed a bookkeeper and manager, the dynamic of dwarves would suddenly change...

Your fortress would suddenly go from to anarcho-communist to Capitalist. Dwarves would suddenly gain an account balance on their unit screen and hoard coins in their bedrooms, a new price menu would appear and shop would be available to build. In addition,

Dwarves would be paid salaries for producing goods (receiving a starting sum of ☼200 when the economy was activated.)

Dwarves would pay rent for rooms with higher quality rooms costing more.

The bookkeeper would demand the production of coins.

Nobles would change prices

Legendary noble dwarves didn't need to pay rent

Dwarves would be taxed from their belongings randomly

This neat little arrangement simulated a miniature economy. Dwarves who owned quality goods and better bedrooms would be happier, while dwarves who failed to do so...

she has been evicted lately (mood -10)

Further, developments led to the economy being unlocked on the arrival of a Baron, Count or Duke.

Dwarves paid for rent and food. Dwarves strapped for cash bought poor-quality food and would go into debt to not starve.

Coin moving would take precious work time from dwarves as they carried out transactions and collected their salaries

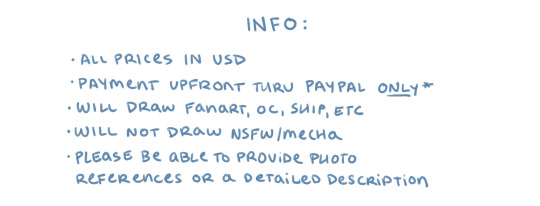

More features only increased the chaos. It was found that producing coins would actually make the citizens finances worse as the time wasted performing transactions, led to increased debt and inevitably mass homelessness. And when I say nobles changed prices, if you thought mandates were annoying then:

Dwarf Fortress's ever-ingenious players thus found themselves devising exploits strategies for preventing a tantrum spiral revolution kicking off whenever the aristocratic parasites barons arrived. These included intensive pumping regimes to quickly boost dwarves' skills to legendary and stockpile hauling cycles to provide easy and consistent employment.

The economy was disabled in 2010, but Toady One (Tarn Adams) has stated that he plans to reintroduce the economy in the future. Due to the unpopularity of its original implementation, it will not be without drastic changes. To this day players discuss possible models. I hope to see the dwarven economy again; imagine a tax collector doing the rounds every week. It would be nice if the value system was ironed out though.

#Dwarf Fortress#Dwarf Fortress Economy#old versions of dwarf fortress#history of dwarf fortress#Tarn Adams#Toady One#lazy nobles#this is why they talk about rent in Boatmurdered#and the rooms are so small

149 notes

·

View notes

Text

Igor Bobic at HuffPost:

Donald Trump is vowing to enact policies if he is elected president in November that would benefit voters’ pocketbooks, while offering few details as to how he plans to pay for them — a series of campaign promises that fly in the face of longstanding Republican Party orthodoxy about fiscal prudence and small government.

Last week, Trump announced that the government would pay for the costs of fertility treatments like in vitro fertilization, which can run to tens of thousands of dollars per cycle, if he becomes president again. He has also proposed eliminating taxes on workers’ tips and on Social Security benefits, which nonpartisan scorekeepers say would add hundreds of billions of dollars to the deficit. His campaign has not said how he intends to pay for these ideas.

Coupled with his plans to extend key parts of his 2017 tax cut bill and cut corporate taxes even more, Trump’s policy blueprint would add nearly $6 trillion to the deficit over 10 years, according to a Penn Wharton Budget Model analysis.

Trump’s plans amount to handing out what now-Utah Sen. Mitt Romney, who lost to former President Barack Obama in the 2012 presidential race, once decried as “gifts.” Trump’s rhetoric shows how he has transformed the party from one which at least touted fiscal responsibility — even if the national debt actually skyrocketed under the last two GOP administrations — to one in which the presidential nominee is free to do whatever it takes to win.

Trump making lofty campaign promises is nothing new. During his 2016 run, he pledged to build hundreds of miles of wall on the southern U.S. border if elected, and to make Mexico pay for it. Mexico did not pay; the U.S. government picked up the tab for the sections of border barrier he was able to build. Trump also promised to repeal and replace the Affordable Care Act with a “much better” health care program. That also never came to pass.

What is noteworthy about Trump’s second run for the White House, however, is his focus on wooing two critical voting blocs for Democrats: women skeptical of his stance on abortion rights and Black and Latino working-class voters. Vice President Kamala Harris, for example, quickly endorsed eliminating taxes on tips last month shortly after Trump did so, an acknowledgement of the idea’s popularity with union workers in Nevada and in other states.

“Trump doesn’t have firmly grounded roots in policy development, developed over many years working with conservative leaders,” GOP strategist Kevin Madden, who served as an adviser to Romney’s 2012 presidential campaign, told HuffPost on Wednesday. “He’s transactional, approaching his audience the same way any real estate professional or salesman would.”

“Both Harris and Trump are under enormous pressure to compete for the remaining sliver of swing voters,” he added. “Their strategies aren’t very different, in that they’re addressing the top issues like inflation, housing and health care by making big promises that poll really well, even though the costs and prospects for turning those promises into actual legislation may be out of reach.”

Harris, meanwhile, has proposed more generous child and earned income tax credits to support families, and payments for Americans to make housing more affordable, insisting that the return on investment these policies would have for the economy would make them functionally pay for themselves. But since she supports rolling back some of Trump’s 2017 tax cuts and raising the corporate tax rate, her agenda is estimated to cost substantially less than that of her GOP rival: about $1.7 trillion over 10 years.

Whoever wins in November will have to deal with making their fuzzy election promises reality by working with Congress to craft legislation. Lawmakers must decide whether and how to extend Trump’s tax cuts, which are set to expire next year for individuals, as well as agree to raise the debt limit — two difficult tasks that will almost certainly require horse-trading on both sides of the aisle.

Donald Trump (and Kamala Harris) are promising to give voters “free stuff” that Mitt Romney criticized in his 2012 run.

#Donald Trump#Mitt Romney#2012 Presidential Election#2024 Elections#2012 Electiomns#2024 Presidential Election#Tips#IVF#Kamala Harris#Earned Income Tax Credit

4 notes

·

View notes

Text

Bookkeeping Services in Delhi by SC Bhagat & Co.

Managing finances efficiently is the backbone of any successful business. Whether you are a startup, a small business, or a large enterprise, having a proper bookkeeping system in place is essential to ensure financial health and compliance with tax regulations. If you are looking for bookkeeping services in Delhi, SC Bhagat & Co. is a trusted partner to help streamline your financial records.

Why Bookkeeping is Essential for Your Business

Bookkeeping involves the systematic recording, organizing, and tracking of all financial transactions made by a business. It provides a clear view of your business's financial status, helping you make informed decisions. Effective bookkeeping helps in:

Financial Analysis: By maintaining up-to-date financial records, businesses can regularly assess their financial health.

Tax Compliance: Proper bookkeeping ensures all financial documents are in order for accurate and timely tax filing.

Cash Flow Management: Tracking cash flow helps in maintaining sufficient funds for daily operations.

Budgeting: It provides accurate data for future budgeting, reducing financial risks.

Benefits of Outsourcing Bookkeeping Services

Outsourcing bookkeeping tasks to professionals like SC Bhagat & Co. brings numerous benefits:

Cost Savings: You eliminate the need for an in-house accounting team, which saves on salaries, office space, and other resources.

Accuracy: Professional bookkeepers have the experience and tools to ensure accuracy in your financial records.

Time Efficiency: Outsourcing allows you to focus on core business activities while the experts handle your books.

Compliance and Expertise: SC Bhagat & Co. ensures that your business complies with all financial and tax regulations, helping you avoid penalties.

SC Bhagat & Co. – Your Reliable Bookkeeping Partner

SC Bhagat & Co. is a renowned firm in Delhi offering comprehensive bookkeeping services. With years of experience, they cater to businesses across various industries. Here’s why SC Bhagat & Co. stands out:

Customized Solutions: They understand that every business has unique needs and provide tailored bookkeeping services.

Expert Team: Their team of certified professionals is well-versed in the latest accounting software and bookkeeping practices.

Accuracy and Timeliness: They ensure that all financial records are accurate and delivered on time, helping you stay ahead in your financial management.

Confidentiality: The firm maintains high levels of data security to ensure your sensitive financial information is protected.

Services Offered by SC Bhagat & Co.

SC Bhagat & Co. offers a wide range of bookkeeping and accounting services, including:

Daily Transaction Recording: Keeping track of daily sales, purchases, payments, and receipts.

Bank Reconciliation: Ensuring that your bank statements match your business's financial records.

Expense Tracking: Managing all expenses to help reduce overheads and increase profits.

Financial Reporting: Providing comprehensive financial reports, including balance sheets, income statements, and cash flow statements.

Tax Preparation: Ensuring all financial records are in order for accurate and timely tax filings.

Why Choose SC Bhagat & Co. for Bookkeeping Services in Delhi?

SC Bhagat & Co. is a reliable name for bookkeeping services in Delhi, offering a combination of expertise, experience, and excellent customer service. By choosing them, you ensure:

Accurate and Timely Reports

Comprehensive Bookkeeping Solutions

Cost-effective Services

Compliance with Latest Financial Regulations

Final Thoughts

Keeping accurate financial records is critical for the success and growth of your business. By outsourcing your bookkeeping services in Delhi to SC Bhagat & Co., you not only ensure compliance and accuracy but also gain access to expert advice, allowing you to focus on growing your business.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

2 notes

·

View notes

Text

Maximizing Your Profit: A Comprehensive Guide to Selling Land for Cash

Selling land for cash is an attractive option for property owners who want to expedite the sale process, avoid lengthy negotiations, and secure a lump sum payment. Unlike traditional real estate transactions involving homes or commercial buildings, selling land comes with unique challenges and opportunities. Whether you own vacant plots, farmland, or recreational property, understanding the intricacies of selling land for cash is crucial to ensure you maximize your profit and minimize risks. This guide will walk you through the essential steps, key considerations, and benefits of, as well as offer insight into market dynamics, finding buyers, and avoiding common pitfalls. From understanding the paperwork involved to knowing how to market your land effectively, being well-prepared can lead to a smooth and profitable transaction.

The Benefits of Selling Land for Cash: Why It’s a Smart Choice?

There are several advantages to selling land for cash that make it a smart choice for many property owners. One of the primary benefits is the speed of the transaction. Cash sales typically proceed much faster than those involving financing, as they eliminate the need for buyer mortgage approvals, appraisals, or loan contingencies. This expedites the closing process, allowing the seller to receive payment quickly. For those looking to liquidate assets for other investments or personal needs, selling land for cash offers immediate liquidity, making it an attractive option for individuals in need of quick financial flexibility. Another significant benefit is the reduced likelihood of the sale falling through. Since cash buyers do not need to secure a loan, there’s less risk of last-minute financing issues that could derail the transaction.

Essential Steps for a Smooth Transaction When Selling Land for Cash

To ensure a smooth and successful transaction when selling land for cash, there are several essential steps that sellers should follow. The first step is conducting a thorough assessment of your land’s value. It’s important to research comparable land sales in the area and possibly seek an appraisal to determine a fair asking price. Overpricing or underpricing your land can deter buyers or result in a loss of potential profit, so getting this right is critical. Once the value is determined, preparing the land for sale is the next step. This includes gathering all necessary documentation, such as the deed, tax information, survey reports, and any relevant zoning or environmental regulations. Having this information readily available not only speeds up the process but also reassures potential buyers of the land’s legitimacy and condition. Marketing the property effectively is another crucial step. Listing the land on popular real estate platforms, engaging with local realtors, and utilizing signage can help attract cash buyers.

Understanding the Market: Key Factors Affecting Selling Land for Cash

The real estate market, particularly for land, can be influenced by several factors that sellers need to be aware of when selling land for cash. Market conditions, including supply and demand, play a significant role in determining how quickly a property will sell and at what price. For instance, if there’s a high demand for land in a particular area due to population growth or economic development, sellers may find that they can command a higher price. Conversely, in a saturated market with more land available than buyers, it may take longer to sell, and sellers may need to adjust their pricing expectations. The location of the land is another critical factor. Proximity to cities, infrastructure, utilities, and amenities can greatly affect the desirability and value of the land. Properties that are easily accessible and near development projects are often more appealing to buyers, while remote or undeveloped land may require more marketing effort.

How to Find Reliable Buyers When Selling Land for Cash?

Finding reliable cash buyers when selling land requires a combination of marketing strategies, networking, and due diligence. One of the most effective ways to attract serious cash buyers is by listing your land on reputable real estate platforms that specialize in land sales. Websites like Zillow, LandWatch, and Realtor.com offer a wide audience and tools to showcase your property effectively. Providing high-quality images, detailed descriptions, and information about the land’s potential uses can significantly increase interest. Another strategy is to network with local real estate agents and land brokers who may have clients looking for land investments.

Common Mistakes to Avoid When Selling Land for Cash

Selling land for cash can be a straightforward process, but several common mistakes can derail the transaction or result in financial loss. One of the most frequent mistakes is overpricing or underpricing the land. While sellers naturally want to maximize their profit, pricing the land too high can deter potential buyers, especially in a competitive market. On the other hand, pricing it too low may lead to missed opportunities for a higher return. Conducting proper market research and seeking professional appraisals can help avoid this pitfall. Another mistake is neglecting to prepare the land for sale. This includes not gathering the necessary documentation or failing to disclose important information about the property.

The Role of Paperwork in Selling Land for Cash: What You Need to Know?

While selling land for cash can simplify the transaction process, proper paperwork is still essential to ensure a legal and secure sale. The most critical document in any land sale is the deed, which proves ownership and must be transferred to the buyer upon completion of the sale. Sellers need to ensure that the deed is clear of any liens or encumbrances that could complicate the transaction. Title searches are often conducted to verify the land’s legal status and ensure there are no claims against it. Another important document is the purchase agreement, which outlines the terms and conditions of the sale, including the sale price, payment schedule, and any contingencies. This contract protects both the buyer and seller by clarifying the responsibilities of each party.

The Pros and Cons of Selling Land for Cash: A Detailed Analysis

Selling land for cash comes with its pros and cons that sellers should carefully consider. One of the biggest advantages is the speed of the transaction. Cash sales tend to close much faster than those involving financing, which can take weeks or even months to complete. For sellers in need of quick liquidity, this is a significant benefit. Cash sales also typically involve fewer contingencies and less paperwork, reducing the complexity of the transaction. Additionally, cash buyers are often more motivated to close the deal quickly, which can provide peace of mind for sellers. However, there are some potential downsides to selling land for cash. For one, cash buyers may expect a discount in exchange for the speed and simplicity of the sale.

Conclusion

Selling land for cash can be a highly profitable and efficient way to liquidate property, provided that the process is managed carefully. Understanding the market, pricing the land correctly, finding reliable buyers, and avoiding common mistakes are all crucial elements to a successful transaction. While cash sales offer the benefit of speed and simplicity, sellers should still be diligent in their paperwork and vetting of potential buyers to ensure a smooth and legally sound sale. By following best practices and being aware of the key factors affecting land sales, property owners can maximize their profits and achieve a successful outcome.

2 notes

·

View notes

Text

How To Identify Motivated Sellers For Cash Deals?

Identifying motivated sellers for cash deals is crucial for securing favorable real estate transactions. Motivated sellers are those who are eager to sell their property quickly, often due to financial difficulties, life changes, or other pressing circumstances. Here’s a comprehensive guide on how to identify these sellers and capitalize on cash deals.

Leverage Public Records

Public records are a valuable resource for identifying motivated sellers. Look for properties with:

Tax Delinquencies: Owners who are behind on property taxes might be more willing to sell quickly to avoid further financial complications. Check local tax assessor websites for lists of delinquent properties.

Foreclosures: Properties in foreclosure are often owned by sellers who need to divest quickly. Foreclosure listings are available through local courthouse records or online databases.

Probate: Estates going through probate may involve motivated sellers, especially if heirs wish to sell inherited properties quickly. Probate records can often be accessed through county court websites or local probate courts.

Monitor Expired Listings

Properties that have been listed for sale but did not sell can indicate motivated sellers. These owners may have been unable to sell their property through traditional channels and might be open to cash offers. Review expired listings on real estate platforms and reach out to these owners to gauge their interest in a cash sale.

Network with Real Estate Professionals

Real estate agents, brokers, and property managers can be excellent sources of information about motivated sellers. Establish relationships with these professionals and let them know you are interested in cash deals. They often come across sellers who need to sell quickly and can provide valuable leads.

Direct Mail Campaigns

Direct mail can be an effective way to identify motivated sellers. Create targeted mailing lists based on criteria such as property tax delinquency, absentee ownership, or property condition. Send personalized letters or postcards offering to purchase their property for cash. Highlight the benefits of a quick and hassle-free transaction to attract sellers who need to sell urgently.

Drive for Dollars

“Driving for dollars” involves driving through neighborhoods and looking for signs of distressed properties, such as:

Overgrown Lawns: Indicates potential absentee owners who might be motivated to sell.

Boarded-Up Windows: Suggests properties that may have been abandoned or neglected.

Maintenance Issues: Properties in disrepair could belong to owners who are eager to sell to avoid further expenses.

Once you identify potential properties, research ownership information and contact the owners to discuss a cash offer.

Utilize Online Resources

Online platforms can provide insights into motivated sellers. Additionally, local real estate investment forums and social media groups can be sources of information about sellers who are eager to close a deal quickly.

Engage with Wholesalers

Real estate wholesalers specialize in finding motivated sellers and can be a valuable resource for cash buyers. Build relationships with local wholesalers who have access to properties from sellers in urgent need of cash transactions. Wholesalers can provide you with leads on potential deals before they become widely known.

Attend Foreclosure Auctions

Foreclosure auctions are a direct way to find motivated sellers. Properties being auctioned are typically owned by individuals facing financial hardship. Attending these auctions can give you access to properties where the sellers are looking for quick sales. Be prepared to act quickly and have your cash offer ready to capitalize on these opportunities.

Look for Divorce and Estate Sales

Divorce or estate sales often involve motivated sellers who need to liquidate assets quickly. Monitor local court records or reach out to attorneys specializing in family law or estate planning to identify potential sellers. These situations can often lead to urgent sales where cash offers are appreciated.

Conclusion

Identifying motivated sellers for cash deals involves leveraging various strategies, from utilizing public records and monitoring expired listings to networking with real estate professionals and employing direct mail campaigns. By staying proactive and using these techniques to sell your home for cash you can uncover opportunities for favorable cash transactions and secure profitable real estate deals.

2 notes

·

View notes