#salesforce lending management

Explore tagged Tumblr posts

Text

Increase Process Efficiency With Salesforce Loan Software

Overcome loan lifecycle inefficiencies and streamline workflows with the latest Salesforce Loan Software called Loans Neo. Salesforce Loan origination software lets businesses automate processes like amortization, loan application and approval, EMI scheduling, tracking of payments, penalties, or charges for delayed payments.

#salesforce loan software#salesforce loan platform#salesforce loan automation#salesforce loan underwriting#salesforce loan origination#salesforce loan origination system#salesforce loan management#salesforce loan management software#salesforce loan management system#salesforce loan management solution#salesforce loan management app#salesforce loan processing#salesforce loan processing software#salesforce loan servicing#salesforce loan servicing software#salesforce lending platform#salesforce lending software#salesforce lending management#nbfc loan management software#loan management software for nbfc#loan origination software for banks#software for loan management#loan software for lenders#loan servicing software for private lenders#mortgage loan servicing software for small lenders#loan management software for small business#loan software for small business#small business lending software#small business loan origination software

0 notes

Text

The Role of AI and Automation in Loan and Mortgage Management with Salesforce FSC

AI and automation are revolutionizing loan and mortgage management with Salesforce Financial Services Cloud (FSC). From streamlining loan processing to improving risk assessment and customer experience, intelligent automation enhances efficiency and accuracy. Discover how financial institutions can leverage AI-driven insights to optimize lending operations and boost customer satisfaction.

0 notes

Text

Optimizing Loan Origination and Management: Enhance Your Lending Process 🚀

What is Loan Management Software? 💡

Loan management software is a powerful tool for lenders to streamline the entire loan lifecycle, from origination to servicing. With a loan origination system (LOS), lenders can efficiently process applications, approve loans, and manage repayment schedules. These solutions offer automation, scalability, and customizable workflows to simplify complex tasks in lending processes.

Key Features of Loan Management Software 🛠️

Loan Origination: Automates application intake, credit checks, and loan approval, reducing manual work and increasing speed.

Loan Processing: Handles data entry, document verification, and underwriting, ensuring a smooth loan approval process.

Credit Origination: Integrates credit checks and evaluations directly into the loan process, improving accuracy and efficiency.

Loan Servicing: Automates payment processing, monitoring, and renewal reminders to ensure seamless servicing throughout the loan's life cycle.

Scalable & Customizable: Designed to grow with your business, ensuring flexibility and adaptability to meet your unique needs.

Benefits of Using Loan Origination Software 📈

Efficiency: Automates critical processes, reducing manual tasks and increasing operational efficiency.

Accuracy: Reduces errors in data processing and ensures accurate loan decisions.

Compliance: Helps ensure that all loans are processed in line with regulatory standards.

Customer Satisfaction: Speeds up loan approval times, improving borrower experience and satisfaction.

Scalable Solutions: Adapts to your business needs, whether you handle a few loans or thousands.

Conclusion 🌟

Adopting a loan origination platform can dramatically enhance your lending operations. With the right loan management solutions, lenders can automate critical tasks, improve decision-making, and increase efficiency across all stages of the loan lifecycle.

Looking to optimize your loan origination processes? Visit Cloudsquare to explore advanced Salesforce loan origination systems that can streamline your lending operations and improve your business's productivity! 🌐

1 note

·

View note

Text

Dialer Solutions for Money Lending & ACD Services in Manila

The financial industry, particularly money lending, requires efficient communication tools to manage customer interactions, loan approvals, and collections effectively. A Dialer for Money Lending streamlines these operations, ensuring better customer engagement and optimized workflow. In Manila, businesses are leveraging ACD (Automatic Call Distribution) Solutions to enhance their call center efficiency and customer service experience.

What is a Dialer for Money Lending?

A Dialer for Money Lending is an automated system designed to handle loan-related calls efficiently. It helps financial institutions and lending companies automate customer outreach, payment reminders, and collections while maintaining compliance with regulations.

Benefits of a Dialer for Money Lending

Automated Call Management:

Reduces the need for manual dialing, improving efficiency.

Increased Collections Efficiency:

Automated reminders and follow-ups help reduce overdue payments.

Enhanced Customer Experience:

Ensures timely communication with borrowers, improving trust and satisfaction.

Integration with Loan Management Systems:

Syncs with CRM and loan processing software for seamless operations.

Cost Savings:

Reduces operational costs by automating repetitive tasks.

ACD Solutions Services in Manila

ACD (Automatic Call Distribution) Solutions play a vital role in managing high call volumes and directing inquiries to the appropriate agents. These systems enhance customer service efficiency by ensuring that calls are routed to the most qualified representative.

Key Features of ACD Solutions:

Intelligent Call Routing: Ensures customers are directed to the right department.

Skill-Based Distribution: Assigns calls to agents based on expertise.

Real-Time Call Monitoring: Helps supervisors track and improve performance.

IVR (Interactive Voice Response) Integration: Enhances customer self-service options.

Top Dialer & ACD Solution Providers in Manila, Philippines

1. Lgorithm Solutions

Visit: https://lgorithmsolutions.com/ Lgorithm Solutions is a top provider of dialer and ACD solutions for money lending businesses. Their system integrates seamlessly with CRM platforms, automates call handling, and provides real-time analytics to enhance business operations.

2. CallHippo

CallHippo offers an advanced cloud-based dialer with ACD functionality. With features such as predictive dialing, call tracking, and CRM integration, it supports money lending businesses in managing high call volumes efficiently.

3. Five9

Five9 provides cloud-based ACD and dialer solutions, helping financial institutions automate their loan processing calls and improve customer engagement. It integrates with major CRM platforms like Salesforce and Zendesk.

4. RingCentral

RingCentral’s VoIP solutions include ACD and dialer capabilities, ensuring that loan inquiries and payment follow-ups are handled efficiently through automated workflows and intelligent call routing.

5. Aircall

Aircall offers an easy-to-use dialer with built-in ACD services, perfect for money lending firms looking to optimize customer communication and enhance collection efforts.

Choosing the Right Dialer & ACD Solution for Your Business

When selecting a Dialer for Money Lending or ACD Solution in Manila, consider the following:

Scalability: Can the solution grow with your business?

Compliance Features: Does it meet local financial regulations?

CRM Integration: Does it sync with your existing loan management system?

Automation Capabilities: Can it handle automated reminders and payment collections?

Cost-Effectiveness: Does it offer value for money?

Conclusion

For money lending businesses and call centers in Manila, a Dialer for Money Lending and ACD Solutions are essential for optimizing operations, enhancing customer service, and improving loan collections. Investing in a robust system can make a significant difference in efficiency and customer satisfaction.

If you are looking for a reliable solution, Lgorithm Solutions is a leading provider. Visit https://lgorithmsolutions.com/ to explore their innovative dialer and ACD services tailored to the finance industry.

0 notes

Text

Leveraging Technology in Commercial Loan Brokering: Tools and Software!

Introduction: In the digital age, technology has become an indispensable tool for commercial loan brokers looking to streamline processes, enhance efficiency, and deliver superior service to clients. From customer relationship management (CRM) systems to loan origination platforms, there is a wide array of technology and software tools available to empower brokers in their day-to-day operations. By leveraging these tools effectively, brokers can gain a competitive edge, increase productivity, and unlock new opportunities for growth. Here's an exploration of the best technology and software tools available for commercial loan brokers.

Customer Relationship Management (CRM) Systems: CRM systems are essential for managing client relationships, tracking leads, and organizing communication. These platforms enable brokers to centralize client data, streamline workflows, and automate routine tasks such as email marketing and appointment scheduling. Popular CRM systems for commercial loan brokers include Salesforce, HubSpot, and Zoho CRM.

Loan Origination Platforms: Loan origination platforms streamline the loan application and approval process, from initial client intake to final funding. These platforms typically offer features such as online application forms, document management, credit scoring, and compliance tracking. By automating manual processes and reducing paperwork, loan origination platforms help brokers save time and improve efficiency. Examples of loan origination platforms include Blend, Lendio, and Encompass.

Financial Analysis Software: Financial analysis software enables brokers to perform in-depth analysis of clients' financial statements, cash flow projections, and creditworthiness. These tools offer features such as ratio analysis, trend analysis, and scenario modeling to help brokers assess risk and make informed lending decisions. Popular financial analysis software for commercial loan brokers includes RiskCalc, Sageworks, and Moody's Analytics.

Document Management Systems: Document management systems simplify the storage, organization, and retrieval of important documents and files related to loan transactions. These systems offer features such as cloud storage, version control, and document sharing to ensure that all parties involved in the transaction have access to the necessary information in a secure and efficient manner. Examples of document management systems include DocuWare, M-Files, and Laserfiche.

Communication and Collaboration Tools: Effective communication and collaboration are essential for successful brokerage. Communication and collaboration tools such as video conferencing, instant messaging, and project management platforms facilitate seamless communication and collaboration among brokers, clients, lenders, and other stakeholders. Examples of communication and collaboration tools include Zoom, Slack, Microsoft Teams, and Asana.

Conclusion: Technology has revolutionized the way commercial loan brokers operate, enabling them to streamline processes, enhance efficiency, and deliver superior service to clients. By leveraging CRM systems, loan origination platforms, financial analysis software, document management systems, and communication and collaboration tools, brokers can gain a competitive edge, increase productivity, and unlock new opportunities for growth. As technology continues to evolve, brokers must stay informed about the latest trends and innovations to remain competitive in the dynamic landscape of commercial loan brokering.

#CommercialLoans#LoanBrokering#FinTech#CRMTools#LoanOrigination#FinancialSoftware#DocumentManagement#BusinessEfficiency#TechForFinance#CollaborationTools#LoanBrokerTips#CommercialFinance#DigitalTransformation

1 note

·

View note

Text

Customer Relationship Management (CRM) solutions are revolutionizing the financial industry by streamlining lending processes, enhancing customer experiences, and driving data-driven decision-making. Companies like TechMatrix Consulting, a trusted Salesforce Partner with a global presence, empower lenders with personalized CRM for lending implementations to meet evolving business needs. CRMs help automate workflows, improve communication, ensure compliance, and deliver actionable insights. With over a decade of expertise and a team of 250+ certified professionals, TechMatrix ensures long-term benefits by building trust, enabling scalability, and fostering collaboration. You can just transform your lending operations with CRM solutions tailored to your goals.

#CRM for lending#Financial industry transformation#Salesforce CRM solutions#TechMatrix Consulting#Customer-centric CRM for banks#CRM benefits in lending#Streamlining loan processes#Lending automation with CRM#Data-driven decisions in lending

0 notes

Text

Agentic AI Solutions, What is it and what examples are there?

Agentic AI solutions encompass a range of applications designed to act autonomously and make decisions based on data. Here are some notable examples available today:

Customer Service Bots: Tools like Zendesk and Intercom utilize AI to handle customer inquiries, provide support, and even escalate issues when necessary.

Personal Assistants: Virtual assistants like Siri, Google Assistant, and Alexa can perform tasks, manage schedules, and provide information based on user commands.

Robotic Process Automation (RPA): Platforms like UiPath and Automation Anywhere automate repetitive tasks across various business processes, allowing for more efficient workflows.

AI in Finance: Solutions like Kabbage and ZestFinance use AI to evaluate loan applications and creditworthiness, streamlining the lending process.

Healthcare AI: Tools like IBM Watson Health assist in diagnosis and treatment planning by analyzing medical data and research.

Predictive Analytics: Platforms such as Salesforce Einstein and Microsoft Azure AI analyze trends to forecast outcomes, helping businesses make informed decisions.

Autonomous Vehicles: Companies like Waymo and Tesla are developing self-driving technology that relies on advanced AI for navigation and safety.

Content Generation: Tools like Jasper and Copy.ai leverage AI to create marketing copy, blog posts, and other written content.

Supply Chain Optimization: Solutions like Llamasoft use AI to enhance logistics, inventory management, and demand forecasting.

These applications demonstrate the versatility and growing capability of agentic AI solutions across various industries, enabling more efficient operations and improved decision-making.

Contact Us

0 notes

Text

Enhance your lending operations with our loan management software. Our loan processing software offers comprehensive features to automate workflows, ensure compliance, and improve efficiency. Tailored for financial institutions of all sizes, our solutions support seamless loan processing and management. Discover the benefits today and optimize your lending process.

0 notes

Text

Data Modelling in Salesforce Marketing Cloud

Data modelling is perhaps one of the most crucial factors contributing to a robust digital marketing strategy, with Salesforce Marketing Cloud (SFMC) offering itself as an enterprise-grade platform allowing businesses to fully leverage their data. Good data modelling in SFMC can dramatically optimize your marketing operations and improve customer interaction like no other email software. In this article, I will discuss the importance of data modelling in Salesforce Marketing Cloud, how to do data modelling, and best practices.

What Is Salesforce Marketing Cloud?

Salesforce Marketing Cloud is an all-in-one cloud marketing platform that empowers customers to run B2B or B2C-oriented promotions through various channels such as email, mobile, and social networks. It allows marketers to run tailored, data-backed campaigns that speak directly to customers and deliver outstanding conversion rates. One of the key aspects of it is to be able to manage and model data.

Salesforce Marketing Cloud Data Modelling Explained

A data model is a framework that defines how information and business rules are stored, organized, and accessed within a system.

Why is Data Modelling Important in Salesforce Marketing Cloud?

Structured Data: It ensures that data is organized so that it becomes easy to fetch and use.

More Individualized Campaigns: A well-organized data model enables marketers to create more detailed customer profiles, which can be used in highly individualized campaigns.

Efficiency: Data modelling eliminates redundancy and makes data processing & analysis more efficient.

Scalable: A strong data model lends itself to scalability, meaning your marketing operations can grow with the business without having to start over.

Key Components of Salesforce Marketing Cloud Data Modelling

Data Extensions: A data extension is a primary building block for storing and managing data in the Marketing Cloud. In this way, they resemble database tables given each extension can contain different types of data (e.g., customer details, purchase history, and engagement stats).

Attribute Groups and Data Designer: Marketing Cloud includes an interface called Data Designer, which organizes your data extensions into attribute groups. This is a visual editing tool that allows you to define relationships between fields and create the data model in an easy-to-understand manner.

Contact Builder: Contact Builder is another important tool responsible for building a centralized view of each customer by integrating segmentation data from various sources. Marketers can use it to define and manage relationships between various data entities, so the underlying model also shows in detail for a typical customer journey.

Journey Builder: Journey Builder hooks into the data model to deliver personalized customer journeys for a best-in-class marketing automation service offering. Journey Builder uses this structured data to make triggers to fire off actions and communications based on customer behaviour and preferences, thereby improving campaign effectiveness.

Salesforce Marketing Cloud Data Modelling Best Practices

Define Clear Objectives: You must have your objectives set up before you go and model the data as part of the Salesforce Marketing Cloud Implementation. Having a clear expectation of what you want your data to do will be the cornerstone on which your model structure and organization is built.

KISS (Keep It Simple, Stupid): Complex data models can be hard to deal with and maintain. Aim for simplicity by identifying key data points and relationships that directly impact your marketing objectives. Complexity in a ternary expression will cause confusion, and bugs too.

Consistent Data Definitions: Use the same columns in all three tables. Standardize data definitions throughout the enterprise. Along those lines are naming conventions, types of data formats to be used, and the different ways in which you measure an effect. Standardization ensures uniformity, minimizes discrepancies, and allows for easier data integration and analysis.

High-Quality Data: High-quality data is the cornerstone of effective modelling, so deliver that high-quality data. Set up data validation so the data which enters your system is accurate, complete, and up-to-date. And you can avoid data quality issues over time through established data cleansing routines.

Utilize Automation: Automation tools in Salesforce Marketing Cloud to automate data management processes. Solve routine operational tasks like data imports, updates, and syncing automatically, so there is time for your strategic activities.

Partner with Salesforce Implementation Partners: Partnering with Salesforce Implementation partners is a great way to gain access to industry-specific expertise and knowledge. These partners have deep experience in configuring and tuning Salesforce Marketing Cloud from your data model to be robust and scalable. They serve on your committee and it speeds yours up as well as helps you avoid the pitfalls of the less principled approaches.

Advanced Data Modelling Techniques

Segmentation and Targeting: Advanced data models enable complex segmentation and targeting strategies. Marketers can craft relevant campaigns that speak to very specific segments of the audience by filtering out (segmenting) customers into groups based on a variety of criteria ranging from demographics, behaviour, or preferences — generally placing users in several different buckets.

Predictive Analytics: By using predictive analytics in your data model, you can predict how customers are going to act and understand trends. Predictive models use historical data analysis to predict future actions in order so businesses can act proactively implement marketing strategies and resource allocation.

Powering Your Data Model with External Data Sources: Enhancing your data model with external data sources can provide a more comprehensive view of your customers. Integrate data from social media, third-party analytics providers, and what not to enrich customer profiles, and also to enhance the effectiveness of your marketing campaigns.

Real-Time Data Processing: The ability to process large volumes of real-time data is necessary in today's digital era where everything happens at breakneck speed. Incorporating real-time data feeds into your model enables you to react instantly to customer behaviours, making your marketing messages more timely and relevant!

Conclusion

Data modelling is one of the core parts of Salesforce Marketing Cloud that helps you with your successful digital marketing strategy. Structured and organized data can boost personalization, optimize efficiency, and drive scalable growth for businesses. Application of tools such as Data Extensions, Attribute Groups, and Contact Builder within Journey Builder as well as deployment of best practices in addition to advanced techniques can be leveraged to construct a rich data model for greater marketing benefits. And working with Salesforce Implementation partners can even enhance your strategy and obtain the support necessary to gain the most out of Salesforce Marketing Cloud. Even in an era where digital marketing is constantly changing, a well-designed data model has remained central to the success of any data-driven MarTech stack.

#salesforce#technology#crm#business#salesforce implementation services#salesforce implementation partners#salesforce marketing cloud

0 notes

Text

Everything You Need to Know About Einstein Copilot

Salesforce is revolutionizing the way sales, marketing, and customer service professionals work with its latest offering, Einstein 1. This upgraded version of the Salesforce platform introduces a comprehensive suite of tools designed to seamlessly integrate AI into everyday workflows. At the core of this groundbreaking innovation is the Einstein Copilot solution, which serves as a virtual AI assistant within the Salesforce ecosystem.

In this article, we’ll explore the Einstein Copilot overview and dive into its features, including Copilot for sales teams, Copilot for customer service, and Copilot for business insights. We’ll also examine how Salesforce AI integration enhances these fields.

What is Salesforce Einstein Copilot?

Think of Salesforce Einstein Copilot as your personal assistant within the Salesforce ecosystem. It’s like having a helpful AI chatbot by your side, specifically designed to assist CX (Customer Experience) staff in getting things done efficiently.

Similar to other AI tools you may have encountered, this Salesforce AI assistant can tackle various tasks for you. From coding assistance to creating visualizations and setting up online stores, Salesforce Copilot capabilities are there to lend a hand. For sales teams, it provides valuable guidance, making the process of closing deals smoother and faster.

What’s impressive is that Einstein Copilot taps into a wealth of customer data from the Salesforce Data Cloud. This includes information like customer interactions, insights, and even conversations from platforms like Slack. With its easy-to-use interface, it can help automate responses to customers, craft sales emails, and create personalized experiences effortlessly.

What are the Salesforce Copilot Features?

Let’s dive into the Copilot features provided by Salesforce and see how streamlining workflows with Copilot functions:

Copilot for Sales Teams

Sales teams rely heavily on Salesforce to manage customer interactions and drive revenue. With Copilot, sales professionals gain a powerful ally in their daily routines. Copilot assists in meeting preparation by researching accounts and automatically updating Salesforce with pertinent information. During meetings, it surfaces customer sentiment insights and summarizes key discussions, making it easier for sales reps to stay informed and engaged.

Moreover, Copilot extracts actionable next steps from video calls, ensuring that no opportunities are overlooked. Additionally, the tool allows users to search for specific details within customer conversations and generate sales emails tailored to their brand’s tone and style, saving valuable time and effort.

Copilot for Customer Service

Exceptional customer service is essential for building long-term relationships with clients. Salesforce Copilot enhances the customer service experience by providing personalized and efficient assistance. Customer service representatives can rely on Copilot to respond to queries with relevant answers grounded in company data. Whether through email, live chat, or social media, Copilot ensures consistent and timely responses, improving customer satisfaction.

Furthermore, the virtual Salesforce AI assistant offers step-by-step guidance, empowering service teams to resolve issues quickly without disrupting their workflow.

Copilot for Marketing

Marketing professionals face the challenge of capturing and retaining customer attention in a crowded digital landscape. Salesforce Copilot offers valuable support in crafting compelling marketing campaigns. It generates email copy, blog posts, and other content to engage audiences effectively. By leveraging Einstein and the Data Cloud, Copilot optimizes campaign segmentation, ensuring that messages reach the right audience segments.

Additionally, marketers can create personalized landing pages and contact forms based on consumer behavior, further enhancing the customer experience. Surveys generated by Copilot provide valuable insights into customer preferences, enabling marketers to refine their strategies for better results.

Copilot for Business Insights

In addition to supporting sales, marketing, and customer service functions, Copilot offers valuable insights and assistance to other departments within an organization. Developers can benefit from Copilot’s ability to translate natural language prompts into actionable code and identify vulnerabilities.

Moreover, Copilot integrates seamlessly with Tableau, enabling businesses to transform raw data into actionable insights. This improves data analysis efficiency and empowers decision-makers with valuable insights to drive business growth.

Conclusion

In conclusion, Salesforce Copilot marks a significant advancement in AI-powered support, reshaping how sales, marketing, and customer service tasks are managed. By harnessing Copilot’s capabilities, organizations can streamline their workflows, boost productivity, and enhance customer satisfaction, ultimately driving success in today’s competitive market.

For expert guidance and seamless CRM implementation, consider partnering with Manras. As a certified Salesforce consultant specializing in CRM implementation, Manras is recognized as a top-tier Salesforce Summit (Platinum) partner. Manras’s tailored CRM consultation services can help businesses navigate the complexities of Salesforce Copilot, unlocking its full potential and paving the way for improved efficiency and growth.

Read More: https://www.manras.com/unlocking-einstein-copilot-your-ultimate-guide/

0 notes

Text

Business Development Representative - Remote

Company: Array Array is a financial innovation platform that helps digital brands, financial institutions, and fintechs get compelling consumer products to market faster. We deliver a suite of credit and identity monitoring tools, privacy protection, and a financial ads marketplace via embeddable widgets or a clean, modern API. Our private label offerings help drive revenue and increase engagement for our customers while empowering millions of consumers to achieve their financial goals. As a remote-first company, we’re focused on providing opportunities for high performing individuals to have deep impact in the fast growing fintech space. A clear mission, a commitment to continuous improvement and a willingness to experiment empower us individually and together deliver the best products for our clients and users. We are looking for a Business Development Representative experienced in top-of-funnel sales in B2B SaaS products. Within this role, you would be the face of the company, creating relationships with clients and applying sales strategies while promoting our growth. We see this BDR as a step towards a career in sales for individuals who succeed. Array expects exponential growth in the near term. Come grow with us. You Will: - Develop top-of-funnel sales opportunities with target prospects in main market segments, direct-to-consumer industries such as lending, lead generation providers, DTC marketers, mortgage companies, etc. - Qualify prospects and present Array's value proposition. - Conduct research to identify new markets and customer needs. - Prepare sales materials and communications for client meetings and prospect outreach. - Develop mastery of sales enablement tools. - Manage, document and plan all activity with proficiency in Salesforce. - Collaborate with sales leadership to share market feedback, set strategy, prioritize industry segmentation. - Assist with meeting scheduling at conferences and trade shows. You Have: - Excellent sales and negotiation skills. - Outstanding ability to explain technical products to a non-technical audience. - Bachelor's degree or equivalent experience in Business, Business Administration, Sales, or related field. - 1 or more years of sales experience. - Proven working experience as a business development representative or other relevant role. - Proficiency in customer relationship management (CRM) software, such as Salesforce. Personal Qualities: - Integrity – we are building a culture that defines our company. That happens with the people we hire. - Candor – we are a small team in a 100% virtual company that works hard, so our relationships need to be built on a foundation of trust. We do what's right for our customers, and for each other. - Energy - Array is on the move. In less than 2 years, we now have over 100 deployments, and we are growing every week. We want to hire team members with a passion to grow with us. We see this BDR position as a step towards an Account Executive position for individuals who succeed. Array expects exponential growth in the near term. Come grow with us. Pay Transparency: Salary Range: $60,000 (base); $90,000 OTE The pay range above represents the current low and high end of the compensation band for this position and may change in the future. Actual compensation may vary depending on factors such as candidate skills, qualifications and experience. Other compensation may include equity options and incentives. Array Offers All Full Time Employees the following Benefits and Perks: - Full medical, dental, and vision, premiums covered at 100% for full-time employees and 70% for dependents - Unlimited PTO and sick leave + 14 company holidays to encourage a healthy work-life blend - Partnership with Spring Health to support mental health - 100% 401k match up to 4% with immediate vesting - Generous and competitive parental leave for all parents - $2,000 medical travel coverage - $1,000 desk setup subsidy to set-up your unique remote office - $100/month to subsidize wifi/cell phone expenses - Summer Fridays (half-day Fridays) from May to September - Arrayaversary Kits for work anniversaries - Mentorship Circle Programs for career growth and development Not sure if you meet the Qualifications? We know that folks tend to only apply if they check every box. If you think you have the appropriate qualifications, but don’t meet every single one, we encourage you to still apply. We’d love to hear from you. One of our core values at Array is to care and support one another, and that’s why we strive to create an environment where everyone feels empowered to bring their best selves to work. Diversity, equity, and inclusion foster collaboration, comfort, and confidence. We’re at our collective best when we each feel our best. We are proud to be an equal opportunity workplace; we are committed to equal employment opportunity regardless of race, color, ancestry, religion, sex, national origin, sexual orientation, age, citizenship, marital status, disability, gender identity or Veteran status. APPLY ON THE COMPANY WEBSITE To get free remote job alerts, please join our telegram channel “Global Job Alerts” or follow us on Twitter for latest job updates. Disclaimer: - This job opening is available on the respective company website as of 8thJuly 2023. The job openings may get expired by the time you check the post. - Candidates are requested to study and verify all the job details before applying and contact the respective company representative in case they have any queries. - The owner of this site has provided all the available information regarding the location of the job i.e. work from anywhere, work from home, fully remote, remote, etc. However, if you would like to have any clarification regarding the location of the job or have any further queries or doubts; please contact the respective company representative. Viewers are advised to do full requisite enquiries regarding job location before applying for each job. - Authentic companies never ask for payments for any job-related processes. Please carry out financial transactions (if any) at your own risk. - All the information and logos are taken from the respective company website. Read the full article

0 notes

Text

7 Compelling Reasons to Leverage Salesforce for Loan Origination and Decisioning

Discover the power of leveraging Salesforce for streamlined loan origination and decisioning. This comprehensive guide outlines 7 compelling reasons why Salesforce is a game-changer in the financial landscape. From enhanced customer interactions to robust analytics, Salesforce transforms the lending process. Explore how this versatile platform can elevate your business, ensuring efficiency and precision in every step of loan management. Stay ahead in the competitive financial industry by harnessing the capabilities of Salesforce for unparalleled success.

0 notes

Text

5 AppExchange Apps That Will Transform Financial Services

Dreamforce, Salesforce's biggest annual event, frequently sheds light on important trends, disseminates breaking news, and prognosticates changes for the following year. This year, much attention was paid to the requirement of financial services implementing digital transformation, especially about engaging consumers and creating lifelong relationships. We've heard a lot about this idea and how digital transformation can help to future-proof your organization during the past year. The good news is that you can start increasing your productivity and streamlining procedures right away. However, this can be very overwhelming. How? Find out by reading on!

The Salesforce AppExchange

The most reliable enterprise cloud marketplace, Salesforce's AppExchange offers more than 7,000 apps and accredited consulting firms to help Salesforce's capabilities grow. It offers applications for all divisions, markets, and corporate use cases. Make your financial institution more powerful by using apps from AppExchange. To get you started on your path to streamlining processes and optimizing productivity, we've chosen five programs that address specific pain issues within the financial services sector.

1. Give your group more precise data

Consider your data's existing state. What is the largest problem you are now facing? It's redundant for a lot of Salesforce users. It is well known that Cloudingo has a greater ability to search through data and identify duplicate records. In addition to mass merging duplicate entries, this application verifies mailing addresses, cleans lists before records are sent to SFDC, matches import records with pre-existing Salesforce information, and does a lot more to help clear out data cobwebs.

2. Cut down on time spent navigating between email and Salesforce

Spend more time interacting with customers and less time switching platforms. Users of Cirrus Insight can manage sales without ever leaving their email inboxes. You can build and update Salesforce data (leads, contacts, and opportunities), track email openings, make follow-up reminders, schedule sales calls, and more, regardless of the email program you use.

3. Produce reports and proposals more quickly

Nintex Drawloop DocGen's ability to be used by anyone in any industry, regardless of IT literacy, is one of its biggest features. Using pre-defined templates, users can manage access to documents based on stage or user rights, preventing human mistakes and assuring legal and policy compliance. Automate the assignment of tasks, alarms, and follow-ups to ensure that nothing is overlooked. Nintex provides click-not-code solutions for anything from quotations to proposals, NDAs, order forms, and more.

4. Increase the output of sellers

What are some of the toughest problems you encounter if you operate in the wealth management sector? For many people, it's the loan origination procedure, which may quickly become tedious and difficult. The Encompass Connector streamlines the loan origination process, removes complications, and lowers the cost of lending and investing at scale to serve as an all-in-one mortgage management solution. To reduce friction and enable lenders to synchronize data effortlessly between the Encompass and Salesforce platforms in real-time, Encompass creates a secure bidirectional link. This connection will ultimately save your lenders time and money.

5. Boost post-purchase management

Once a deal is tagged as "Closed Won," TaskRay Post-Sale, which is entirely native to Salesforce, organizes and manages your work, teams, and procedures. After a client signs the dotted line, visibility is improved, cross-team cooperation is effortless, and manual work is decreased, all of which contribute to a better client experience. Consistency across your business is ensured with pre-built templates, out-of-the-box functionality, and unified data. TaskRay allocates the appropriate individuals to the appropriate tasks at the appropriate times without ever requiring data to be moved from Salesforce, allowing you to concentrate more on developing client relationships.

0 notes

Text

Hiring a Salesforce Developer – How Does it Help Your Business?

About 150,000 companies, both large and small, use Salesforce. It’s used for customer relationship management and to handle businesses by creating unique solutions.

When you hire a Salesforce developer, it can be a very beneficial investment. Salesforce developers are qualified to build unique solutions on the Salesforce platform that help you enhance productivity and efficiency and gain profitable insights into your business.

Salesforce developers assist you in integrating with other systems, automating processes and tasks, and building unique features and applications on the platform.

Integrate With Other Systems:

Salesforce developers provide assistance when you wish to merge Salesforce with other systems, like your accounting software. They help provide a streamlined experience for your users while making it effortless for you to maintain and analyze data on various systems, i.e., Xero, Netsuite, WordPress, or Outlook.

Migrate Data to Salesforce:

A Salesforce developer makes it easier when the time comes for you to transfer all your data to Salesforce from another system or CRM. This includes data extraction, cleaning it up, formatting it, and bringing it into Salesforce so that it is appropriately arranged and accessible.

Within Salesforce, You Can Design Forms:

With the help of Salesforce developers, you can design custom forms that can be used within Salesforce and by the public on other platforms or your website. You can use these forms for various purposes, like gathering feedback, registering for different events, or gathering customer information.

Track and Manage Employees:

Salesforce developers furnish you with unique solutions on your platform that help you track and manage employees, like attendance, tracking their performance, and leave management.

Automate Processes and Tasks:

Salesforce developers help you automate repetitive tasks and processes, like creating events and tasks, updating records, and sending emails. This saves your team time and effort while ensuring that all important tasks are taken care of regularly.

Build Personalized Features and Applications:

Salesforce developers can lend a hand in constructing features and applications on the platform that fit your business like a glove. These include custom reports and dashboards, which can help provide insights into the business and help make data-driven decisions. For instance, a personalized dashboard helps you keep track of key metrics, like customer satisfaction, in real time.

Push Queries To Salesforce:

Salesforce developers help you merge Salesforce with your website. This means that all the queries and other such data are automatically pushed to Salesforce. This is a tremendous help when you wish to manage and track your website inquiries, making it easier for you to respond to them in a timely manner.

Event Management System:

Salesforce developers help build personalized solutions on the platform that help you manage and keep track of events, like workshops, conferences, and trade shows. This would include certain features like ticketing, registration, attendee tracking, and scheduling.

Why You Should Hire Salesforce Develop Based On Skill Set

When you want to hire Salesforce developer, make sure you give importance to the skill set and experience of the candidates. You will find that different developers have different areas of specialization, making it important to figure out what specific skills you are looking for.

One area you should consider is the various types of frameworks and tools available in Salesforce. If you are looking for a true asset to the business, you should hire someone who is an expert in these.

Given below are the various types of Salesforce developers based on their skill sets:

1. Visualforce developer

If you need to create and build custom user interfaces on the Salesforce platform, you should consider hiring a Visualforce developer. Visualforce developers are adept at the Visualforce framework, which they use to build personalized user interfaces on the platform.

2. Integration developer

Should you need to connect Salesforce to other systems or/and platforms, then an integration developer is your best bet. Integration developers have experience merging Salesforce with other systems, which helps create a seamless user experience.

3. Lightning developer

If you must build a modern, responsive user interface on the Salesforce platform, you need to hire a Lightning developer. Lightning developers are skilled at working with the Lightning framework, which they use to build user interfaces optimized for different devices and screen sizes.

4. Apex developer

If you need to build unique integrations or applications on the Salesforce platform that are complicated or which require advanced programming skills, you should hire an Apex developer. Apex developers are well-versed in the Apex programming language, which they use to create solutions on the Salesforce platform.

Basically, you should hire a Salesforce developer based on their skill set so that you can create custom solutions on the Salesforce platform that are custom-made for your business needs. Whether you need to hire an Integration developer, Apex developer, Lightning developer, or Visualforce developer will depend on your needs.

Additionally, it is important that you look for other qualities in a possible candidate, which can include:

Good ability to work with a team, in addition to good communication skills.

A track record boasting deliveries of high-quality software within budget and on time.

Excellent problem-solving skills.

Adaptability and willingness to learn new technologies.

When appraising a candidate, you can go over several steps to assess their experience and skill, including:

You can ask them to provide examples of past projects that they have worked on, along with the challenges they faced.

You can ask for references from past employers to verify their experience.

Give them a technical assessment challenge to test out their knowledge and skills.

You should check their Salesforce certification status to check if they possess the necessary expertise and credentials.

Salesforce Development: In-House vs. Outsource

When you think of who to hire for Salesforce development, you are faced with a couple of options: outsource or do it in-house. If you wish to build a team of your own, you will be responsible for hiring employees with the required experience and skill sets. On the other hand, if you want to outsource this development, you don’t have to think about hiring and managing anyone.

When to Hire In-House

Seeking instant support

Budget is not an issue

You need full control

You already have proper experience with managing

When to Outsource

Budget is a constraint.

The project is not big

Unfamiliarity with the Salesforce development process

You are good with communicating in a different time zone

When Do You Not Hire A Salesforce Developer?

There may be certain projects and situations where you do not need to hire a Salesforce developer. For instance, if your only use of Salesforce is for basic contact management, and you don’t have any complicated customization requirements, then you do not require a dedicated Salesforce developer. Here, it would be considered cost-effective to train existing employees on the basics of the platform or to use resources already provided.

Another situation where you might not need a Salesforce developer is if you already work with a trusted consulting partner who handles all your Salesforce needs. Here, it is more profitable to keep working with the existing partner and use their experience rather than bringing someone new on board.

Overall, the decision to hire should be based on specific business goals and needs. It’s important for you to consider the current and upcoming Salesforce requirements and the cost and advantages of hiring a full-fledged, dedicated developer before you decide.

Our Salesforce developers have between 2 to 5+ years of experience and our 16+ years of industry experience. CRMJetty can be your Salesforce development partner.

Original Blog: https://www.crmjetty.com/blog/hiring-salesforce-developer-how-does-it-help-your-business/

0 notes

Text

Salesforce Finance Cloud for Banking is a CRM solution designed for financial institutions. It helps manage customer interactions, streamline processes, and includes financial planning tools. This document It is discusses How Salesforce solutions can benefit wealth and asset management, insurance companies, capital markets, banking, and lending for customers. For more information, contact our specialists.

1 note

·

View note

Text

What Is Financial Technology — Fintech and how is it useful in 2020? (with examples)

If you see the pattern then in the 21st-century financial technology which is popularly referred to as fintech has risen dramatically since the last 5 years and is projected to rise more in upcoming days. The sole purpose of Fintech is to modernize traditional financial trading that includes anything from mobile payments applications to cryptocurrency.

‘At the end of the day, customer-centric fintech solutions are going to win.’ — Giles Sutherland, Carta Worldwide

Mobile applications play a major role in fintech with mobile app users can do a variety of financial activities like money transfer, avail mobile banking, invest directly from mobile, get advice on the phone, etc.

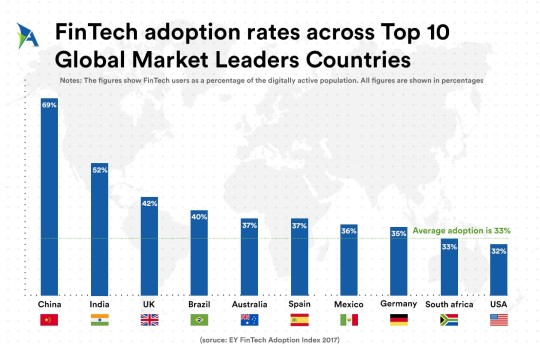

According to EY’s 2017 Fintech Adoption Index, one-third of users utilize at least three to four or more fintech services and those users are also increasingly aware of fintech as a part of their daily lives.

Fintech is also subtly helping cryptocurrency and as the current market tells that cryptocurrency is booming and a lot of development is happening in cryptocurrencies such as bitcoin, Ethereum, Litecoin, Tether (USDT), Libra and many more.

In simple language, if we have to describe what fintech is then any individual or company that uses the internet, mobile phones, cloud services and software technology to connect financial service at one place at any time it resulted in innovation; innovation in financial technology which says FINTECH.

Some of the Factsheet about Fintech

PayPal is one of the most well-known fintech companies, with a transaction volume of US$333.8 billion in 2019 as per Statista

Venmo is another, which reached its first US$1 billion transaction volume in January 2016 as per Venmo

Stripe is the biggest fintech company in the United States and one of PayPal’s biggest competitors, worth US$22.5 billion by Forbes

China’s online payment market is dominated by three services that make up 66% of all digital transactions made in China (Alipay, China pay, and Tenpay), which make up 29%, 19.5%, and 17.6% of the market, respectively according to Bloomberg

Ant Financial is the biggest fintech company globally, with an estimated worth of US$75 billion by Investopedia

Types of Fintech services trends in 2020

At first, fintech was dedicatedly made to function as back-end systems for banks and other financial entities. But as time passed, more and more innovation happened, range of applications increased and Fintech has now taken the front seat of the mainstream business where today, millions of consumers and businesses are using various forms of fintech in their daily financial transactions, usually via a smartphone. So here the gist of how fintech is being used in 2020, along with some of its traditional uses.

Mobile Payments

21st Century is leading by mobile and globally the number of mobile users is increasing. If you look at the facts then With 5.11 billion unique mobile users worldwide, it’s not surprising that global mobile payment transactions will be worth over $1 trillion in 2019. By 2023, that figure is expected to exceed US$4.3 trillion.

If you try to observe the current payment pattern, then at least 64% of smartphone users have used their mobile phone to transfer payment or any kind of financial transaction that includes apple pay, Google Wallet, Paypal, UPI services, etc. These Fintech service providers constantly improve their products and services to serve better to customers.

In fact, you can say that Fintech is helping us all to move towards a cashless society. Check out some of the Top-notch mobile payment offerings

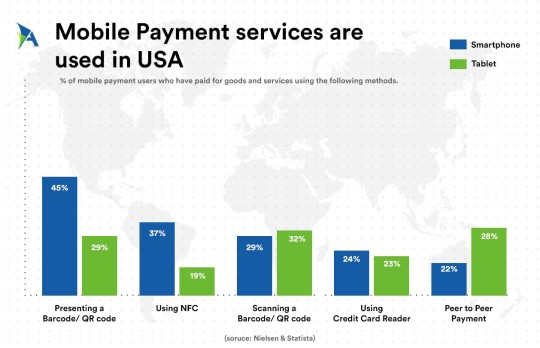

Here are quick stats by Statista about How the mobile payment services are used in U.S

Stock-Trading Apps

In the 1940s no one would have imagined that money can be associated with so many forms like Stock trading to Cryptocurrency and what not. This is the time where stock trading platforms are using digital robotics-based financial advisors to answer the customer about their investment even if they can predict the future by every microsecond as per the market’s situation.

If you look into the past or ask any of the investors then they will tell you that they need to physically go to the stock exchange establishments in order to buy/sell stocks or scripts. Today, the stock trading solutions allow anyone to easily trade stocks at the flick of a finger on their smartphones from anywhere around the corner.

Robotics advising made it like that that it works on specific smart algorithms and other smart calculations that Financial advisers can analyze numerous portfolio options more efficiently, 24/7, simultaneously. No wonder, an increasing number of Robo-advising services continue to emerge.

Another popular and highly innovative fintech contribution is the invention of stock-trading apps.

With cheaper and low-minimum stock-trading apps in the market, investing had never been easier. Thanks to these fintech innovations, making those stock-trading apps can now be done anywhere, without any budgetary constraints.

Budgeting Assitance Applications

Remember there’s one time when our parents were used to sitting once in a month with stacks of bills, future plans, grocery, health policy etc. and trying to figure out how they’ll be allocated funds to react to things. Nowadays all this is just history.

Thanks to budgeting applications that monitor our daily, weekly, monthly expense and plan our budget accordingly to the needs more efficiently. Budgeting apps and fintech apps working like a tag team when it comes to serving the best to consumers.

One of the most common uses of fintech in 2019 is budgeting apps for consumers, which have grown exponentially in popularity over the last few years.

Blockchain and Cryptocurrency

61% of high-profile digital companies worldwide are investing in blockchain, according to a report by identity management firm Okta shared with Cointelegraph on April 2. San Francisco-based enterprise identity provider Okta has released a survey on new trends in technological developments and business opportunities of the world’s largest companies.

In its first “Digital Enterprise Report,” Okta surveyed 1,050 IT, security and engineering decision-makers from global companies with at least $1 billion in revenue. Okta explained that decision-makers were defined as someone at the company who is “responsible for making technology purchasing decisions.”

cryptocurrency and the very famous Blockchain technology helped financial transactions faster and very much secure by days in going. Some cryptocurrency trading platforms include Coinbase, Robinhood, Cash App, Gemini, and Binance.

AI Virtual Assistants

Rise of Artificial Intelligence (AI) has opened new opportunities for every industry and it can be especially helpful for Fintech. AI and digital banking have led to the banks improving their services and offerings in the field of mobile banking. With AI users mobile experience and access to financial services from any financial institution is rapidly increasing and has become so easy as well.

Crowdfunding Platforms

Crowdfunding platforms have the ability to send or receive money from any users around the globe. It allows businesses or any individuals to pool funding from a variety of sources all in the same place. Now it’s possible to go straight to the investors to support a startup or Idea. And while their applications range from family and friends funding to fan and patron funding, the number of crowdfunding platforms have multiplied over the years.

There are many more included in the list whether its Insurance or Payment Gateways, Digital Lending, and Credit card, etc. The matter of fact is that there’s one simple question bugging around anyone’s mind.

But a million-dollar question, who uses fintech?

Who are the other users of fintech? And how is fintech being used in different ways?

Check your smartphone and honestly tell me how many fintech apps are installed in that genius piece of machinery you own? Is it a Banking app, Budgeting App, Stock trading app, Currency Monitoring app or a digital payment application? There are many players in the league who use fintech in their business.

Consumers

B2C for small businesses

B2B for banks

Bank’s business clients

Enough of sci-fi names. Let’s dig in a little deeper to understand the crux of it.

1. B2C (Business to Client)

The range of clients for fintech is rising very vast. Applications like PayPal, Venmo and Apple Pay, Google Pay allow clients or consumers to transfer money via the internet or mobile technology, and budgeting apps like Mint allow customers to manage their finances and expenses.

The Banking industry is paying its focus on B2C B2C applications like transferring payment to pay bills.

2. B2B (Business to Business)

Before the existence of fintech, traditional businesses went to the banks and asked for loans and financial services. But thanks to the revolutionary innovation in the field of fintech, businesses can easily avail loans, financing, and other financial services through mobile & web technology. On top of that, cloud-based platforms and even customer-relationship management services like Salesforce (CRM) — Get Report provides B2B services that allow companies to interact with financial data to help improve their services.

What’s the Catch? Why do you require a Stock Trading App?

More and more people have started trading and investing online nowadays due to easy accessibility. It is more feasible to not rent/buy an office for modern-day brokers since their clients have started opting for a portable solution.

What are the Options? Why hire us?

Our team’s mentors have been in the Stock and Currency Trading market for the past 15 years and so they know the ins and outs of this industry. Discuss with the best and get to know the infinite possibilities that technology can offer you and your clients.

Archisys has developed some Fintech apps and part of their development from scratch to deployment.

Stock Book: Share Market Companion

Stock Book is a smart companion for every investor and stock market trader. Track & analyze favorite company’s financial strength by star rating reviews and technical tools.

It also has an educational section about the stock market (Share Bazar) basic by Mandira Bedi. Stock Book is a smart companion for every investor and stock market trader. Track & analyze favorite company’s financial strength by star rating reviews and technical tools.

visit case study

Find My Trade

A startup company came up with an idea of bringing in all the Trade Advisors together within a common platform for them in order to share their knowledge as well as guide traders (old and new). They named the platform ‘FindMYTrade’

But one of the major challenges was to make the platform engaging for its users. Unlike other social sharing platforms, this wasn’t a content sharing or video sharing platform for entertainment purposes but an entirely information-centric platform. So, making it addictive enough for users to stay hooked onto the app was already challenging.

visit case study

The entire financial world has already entered into an era of evolution. Banks and other financial institutions are also making massive changes to keep up with this transformation towards technology and innovation.

Behind all of these are the collective, powerful disruptions that fintech brings. Fintech companies are trying to push their boundaries in payment, auditing, insurance, blockchain, and other influential financial services. As such, more financial, as well as non-financial institutions, will be forced to invest more and more funds into fintech startups to keep up with the ever-changing digital trends.

Archisys bring their best men on the ground to help startups or any individuals or companies who want to disrupt the financial business whether it’s an idea or a game-changing financial service. Archisys aims to deliver the best this industry has ever seen and we constantly educate everyone to make a difference in their respective domain.

1 note

·

View note