#Fintech Cryp Stock Market Financial Technology Budgeting

Explore tagged Tumblr posts

Text

What Is Financial Technology — Fintech and how is it useful in 2020? (with examples)

If you see the pattern then in the 21st-century financial technology which is popularly referred to as fintech has risen dramatically since the last 5 years and is projected to rise more in upcoming days. The sole purpose of Fintech is to modernize traditional financial trading that includes anything from mobile payments applications to cryptocurrency.

‘At the end of the day, customer-centric fintech solutions are going to win.’ — Giles Sutherland, Carta Worldwide

Mobile applications play a major role in fintech with mobile app users can do a variety of financial activities like money transfer, avail mobile banking, invest directly from mobile, get advice on the phone, etc.

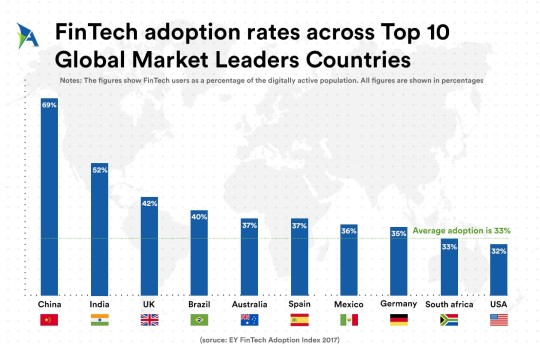

According to EY’s 2017 Fintech Adoption Index, one-third of users utilize at least three to four or more fintech services and those users are also increasingly aware of fintech as a part of their daily lives.

Fintech is also subtly helping cryptocurrency and as the current market tells that cryptocurrency is booming and a lot of development is happening in cryptocurrencies such as bitcoin, Ethereum, Litecoin, Tether (USDT), Libra and many more.

In simple language, if we have to describe what fintech is then any individual or company that uses the internet, mobile phones, cloud services and software technology to connect financial service at one place at any time it resulted in innovation; innovation in financial technology which says FINTECH.

Some of the Factsheet about Fintech

PayPal is one of the most well-known fintech companies, with a transaction volume of US$333.8 billion in 2019 as per Statista

Venmo is another, which reached its first US$1 billion transaction volume in January 2016 as per Venmo

Stripe is the biggest fintech company in the United States and one of PayPal’s biggest competitors, worth US$22.5 billion by Forbes

China’s online payment market is dominated by three services that make up 66% of all digital transactions made in China (Alipay, China pay, and Tenpay), which make up 29%, 19.5%, and 17.6% of the market, respectively according to Bloomberg

Ant Financial is the biggest fintech company globally, with an estimated worth of US$75 billion by Investopedia

Types of Fintech services trends in 2020

At first, fintech was dedicatedly made to function as back-end systems for banks and other financial entities. But as time passed, more and more innovation happened, range of applications increased and Fintech has now taken the front seat of the mainstream business where today, millions of consumers and businesses are using various forms of fintech in their daily financial transactions, usually via a smartphone. So here the gist of how fintech is being used in 2020, along with some of its traditional uses.

Mobile Payments

21st Century is leading by mobile and globally the number of mobile users is increasing. If you look at the facts then With 5.11 billion unique mobile users worldwide, it’s not surprising that global mobile payment transactions will be worth over $1 trillion in 2019. By 2023, that figure is expected to exceed US$4.3 trillion.

If you try to observe the current payment pattern, then at least 64% of smartphone users have used their mobile phone to transfer payment or any kind of financial transaction that includes apple pay, Google Wallet, Paypal, UPI services, etc. These Fintech service providers constantly improve their products and services to serve better to customers.

In fact, you can say that Fintech is helping us all to move towards a cashless society. Check out some of the Top-notch mobile payment offerings

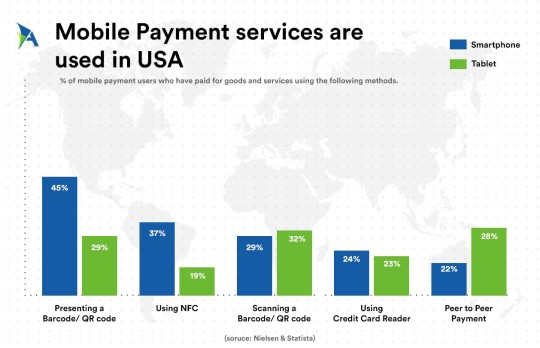

Here are quick stats by Statista about How the mobile payment services are used in U.S

Stock-Trading Apps

In the 1940s no one would have imagined that money can be associated with so many forms like Stock trading to Cryptocurrency and what not. This is the time where stock trading platforms are using digital robotics-based financial advisors to answer the customer about their investment even if they can predict the future by every microsecond as per the market’s situation.

If you look into the past or ask any of the investors then they will tell you that they need to physically go to the stock exchange establishments in order to buy/sell stocks or scripts. Today, the stock trading solutions allow anyone to easily trade stocks at the flick of a finger on their smartphones from anywhere around the corner.

Robotics advising made it like that that it works on specific smart algorithms and other smart calculations that Financial advisers can analyze numerous portfolio options more efficiently, 24/7, simultaneously. No wonder, an increasing number of Robo-advising services continue to emerge.

Another popular and highly innovative fintech contribution is the invention of stock-trading apps.

With cheaper and low-minimum stock-trading apps in the market, investing had never been easier. Thanks to these fintech innovations, making those stock-trading apps can now be done anywhere, without any budgetary constraints.

Budgeting Assitance Applications

Remember there’s one time when our parents were used to sitting once in a month with stacks of bills, future plans, grocery, health policy etc. and trying to figure out how they’ll be allocated funds to react to things. Nowadays all this is just history.

Thanks to budgeting applications that monitor our daily, weekly, monthly expense and plan our budget accordingly to the needs more efficiently. Budgeting apps and fintech apps working like a tag team when it comes to serving the best to consumers.

One of the most common uses of fintech in 2019 is budgeting apps for consumers, which have grown exponentially in popularity over the last few years.

Blockchain and Cryptocurrency

61% of high-profile digital companies worldwide are investing in blockchain, according to a report by identity management firm Okta shared with Cointelegraph on April 2. San Francisco-based enterprise identity provider Okta has released a survey on new trends in technological developments and business opportunities of the world’s largest companies.

In its first “Digital Enterprise Report,” Okta surveyed 1,050 IT, security and engineering decision-makers from global companies with at least $1 billion in revenue. Okta explained that decision-makers were defined as someone at the company who is “responsible for making technology purchasing decisions.”

cryptocurrency and the very famous Blockchain technology helped financial transactions faster and very much secure by days in going. Some cryptocurrency trading platforms include Coinbase, Robinhood, Cash App, Gemini, and Binance.

AI Virtual Assistants

Rise of Artificial Intelligence (AI) has opened new opportunities for every industry and it can be especially helpful for Fintech. AI and digital banking have led to the banks improving their services and offerings in the field of mobile banking. With AI users mobile experience and access to financial services from any financial institution is rapidly increasing and has become so easy as well.

Crowdfunding Platforms

Crowdfunding platforms have the ability to send or receive money from any users around the globe. It allows businesses or any individuals to pool funding from a variety of sources all in the same place. Now it’s possible to go straight to the investors to support a startup or Idea. And while their applications range from family and friends funding to fan and patron funding, the number of crowdfunding platforms have multiplied over the years.

There are many more included in the list whether its Insurance or Payment Gateways, Digital Lending, and Credit card, etc. The matter of fact is that there’s one simple question bugging around anyone’s mind.

But a million-dollar question, who uses fintech?

Who are the other users of fintech? And how is fintech being used in different ways?

Check your smartphone and honestly tell me how many fintech apps are installed in that genius piece of machinery you own? Is it a Banking app, Budgeting App, Stock trading app, Currency Monitoring app or a digital payment application? There are many players in the league who use fintech in their business.

Consumers

B2C for small businesses

B2B for banks

Bank’s business clients

Enough of sci-fi names. Let’s dig in a little deeper to understand the crux of it.

1. B2C (Business to Client)

The range of clients for fintech is rising very vast. Applications like PayPal, Venmo and Apple Pay, Google Pay allow clients or consumers to transfer money via the internet or mobile technology, and budgeting apps like Mint allow customers to manage their finances and expenses.

The Banking industry is paying its focus on B2C B2C applications like transferring payment to pay bills.

2. B2B (Business to Business)

Before the existence of fintech, traditional businesses went to the banks and asked for loans and financial services. But thanks to the revolutionary innovation in the field of fintech, businesses can easily avail loans, financing, and other financial services through mobile & web technology. On top of that, cloud-based platforms and even customer-relationship management services like Salesforce (CRM) — Get Report provides B2B services that allow companies to interact with financial data to help improve their services.

What’s the Catch? Why do you require a Stock Trading App?

More and more people have started trading and investing online nowadays due to easy accessibility. It is more feasible to not rent/buy an office for modern-day brokers since their clients have started opting for a portable solution.

What are the Options? Why hire us?

Our team’s mentors have been in the Stock and Currency Trading market for the past 15 years and so they know the ins and outs of this industry. Discuss with the best and get to know the infinite possibilities that technology can offer you and your clients.

Archisys has developed some Fintech apps and part of their development from scratch to deployment.

Stock Book: Share Market Companion

Stock Book is a smart companion for every investor and stock market trader. Track & analyze favorite company’s financial strength by star rating reviews and technical tools.

It also has an educational section about the stock market (Share Bazar) basic by Mandira Bedi. Stock Book is a smart companion for every investor and stock market trader. Track & analyze favorite company’s financial strength by star rating reviews and technical tools.

visit case study

Find My Trade

A startup company came up with an idea of bringing in all the Trade Advisors together within a common platform for them in order to share their knowledge as well as guide traders (old and new). They named the platform ‘FindMYTrade’

But one of the major challenges was to make the platform engaging for its users. Unlike other social sharing platforms, this wasn’t a content sharing or video sharing platform for entertainment purposes but an entirely information-centric platform. So, making it addictive enough for users to stay hooked onto the app was already challenging.

visit case study

The entire financial world has already entered into an era of evolution. Banks and other financial institutions are also making massive changes to keep up with this transformation towards technology and innovation.

Behind all of these are the collective, powerful disruptions that fintech brings. Fintech companies are trying to push their boundaries in payment, auditing, insurance, blockchain, and other influential financial services. As such, more financial, as well as non-financial institutions, will be forced to invest more and more funds into fintech startups to keep up with the ever-changing digital trends.

Archisys bring their best men on the ground to help startups or any individuals or companies who want to disrupt the financial business whether it’s an idea or a game-changing financial service. Archisys aims to deliver the best this industry has ever seen and we constantly educate everyone to make a difference in their respective domain.

1 note

·

View note