#s&w 4506

Explore tagged Tumblr posts

Text

91 notes

·

View notes

Text

George W. Maher, architect - part 2

My previous post focused on Maher-designed houses on Hutchinson St., now a Chicago historic district. For this post, I spent part of a day photographing some of Maher's other residential work in Chicago.

Stevenson-Colvin House

Address: 5940 N. Sheridan Rd.

Year Built: 1909

Architect: George W. Maher

The Stevenson-Colvin House

The Harry M. Stevenson house at 4950 N. Sheridan Road dates to 1909 and is a rare survivor of the large homes that lined the street in the first decades of the 20th century. The house, referred to today as the Colvin house for its second owner, features a distinctive Maher dormer, second floor windows recessed behind columns, and a motif of tulips and triangles. It has been restored in recent years and now functions as an events venue.

Classic Chicago Magazine

I took the following photos of the Colvin House during a past Open House Chicago weekend, sponsored by the Chicago Architecture Center:

Unfortunately, the interior has been remodeled, removing virtually all of Maher's original design. The chandelier, however, and the stair rail, are original. The house is now an events venue.

Residence of Edwin M. Colvin, Esq., Chicago. The Architectural Record, 1916 Feb., v. 39, p. 175. ill, plans.

J.H. Hoekscher House

4506 N. Sheridan Rd., 1902

4506 N. Sheridan shortly after completion in 1902 (Inland Architect)

Interior photos available here

King / Nash House, 1901-1902

3234 W Washington Blvd., Chicago

This house is an amalgamation of the Sullivanesque, Colonial Revival, and Prairie styles. It was originally commissioned by wealthy businessman Patrick J. King, but its most well-known occupant was the influential Irish-Catholic politician Patrick A. Nash, who lived here from 1925 to 1943, when Washington Boulevard was one of the city's most-fashionable addresses.

Chicago Landmarks

Davey Pate / Charles Comiskey House, 1901

5131 S. Michigan Ave., Chicago

Maher designed this house for Chicago lumberman Davey Pate. The house was later owned by Charles Comiskey, long-time owner of the Chicago White Sox baseball team.

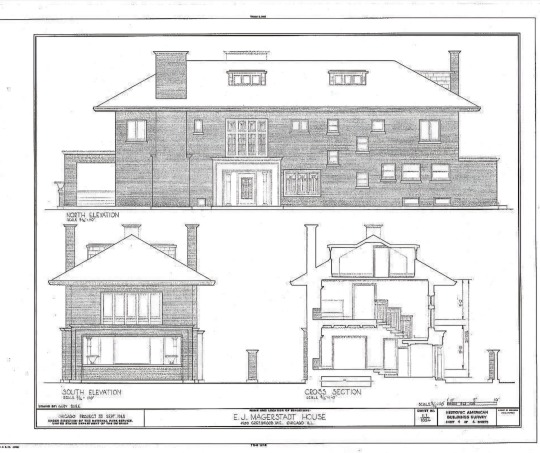

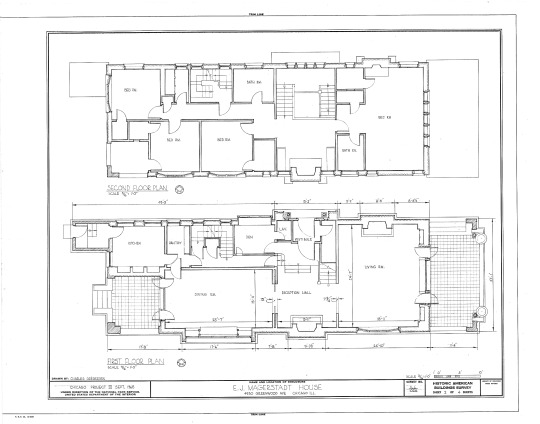

Magerstadt House, 1906-1908

4930 South Greenwood Avenue, Chicago

Completed the same year that Maher was devising a master plan for the Northwestern University campus, the Magerstadt House sits sideways on its deep, narrow lot, with the front door facing what is now the driveway. Visible from the street is a rectangular side porch whose pillars sport carved poppies.

Chicago Magazine

Elevation and plans above and photos below, HABS survey documents

This house is probably one of the finest works of George W. Maher, a contemporary of Frank Lloyd Wright, and one of the Prairie School. It shows a relationship to Wright's work of the time in its cubist massing, ribbons of windows, simple, low-pitched roof, and deep, unbroken eaves. The influence of Art Nouveau is also evident, as is seen in the extensive use of the poppy motif in the ornament and interior finish.

Library of Congress

This photo and other interior views on Redfin

Link: Magerstadt House HABS Report

5 notes

·

View notes

Text

IMI Defense Paddle Double Magazine Pouch

fits 1911 single stack variants, Sig Sauer P220,S&W 4506 4516

1 note

·

View note

Text

Kristanna Loken as Terminatrix T-X Terminator 3: Rise of the Machines

#terminator 3#Kristanna Loken#rise of the machines#the terminator#gif#terminatrix#t-x#2003#movie#smith & wesson#S&W 4506#gun#shooting#Terminator 3: Rise of the Machines

34 notes

·

View notes

Photo

Watched Predator 2 the other day and man it has been too long! What gets me is that each of the investigators/ detectives/ officers have some odd and funky attachment on their firearm. Like, I get the movie was made in the 90′s and everything was ‘futuristic’ but my dudes... my dudes... what is even half of the attachments on these pistols? We have a MK VII Desert Eagle with a random laser sight on it. A Sig P226 with what is apparently a LASERAIM sight. Then a S&W 4506 with the old, clunky, but practical (at that time) pistol light.

Now, I know this is a ridiculous post and I’m going to say something really ludicrous, but I think that there should be a contest of having the most obscure and unnecessary firearm to have; all the while it still functions extremely well. What I’m really trying to say is being back the big, clunky, old, timey-wimey pistols just for kicks. Hopefully no one actually uses it in real life. If you do please refrain from using it for actual self-defense. I strongly advise against using such a thing for self-defense due to it being non-practical. Again, simply for fun and jolly laughter of such nonsense.

( source )

#firearm#firearms#pistol#handgun#Predator 2#Desert eagle#Deagle#Sig#Sig Sauer#Sig P226#S&W 4506#Smith & wesson#Smith and wesson#Magnum research#gunblr#4506#P226

1 note

·

View note

Photo

HOW DO I FILE BACK TAX RETURNS?

Tax Consultation, Tax Negotiation and Settlement

You forgot to file your tax return last year or the year before.

Perhaps it’s even been longer than that since the last time you filed a tax return: five years, ten years, or even more. You’d like to get your taxes caught up and everything straightened back out, but you’re not really sure how. How should you handle filing back tax returns?

Step One: Get Past the Block

There are any number of reasons why you might have stopped filing your taxes. Perhaps you knew you owed money, and you didn’t have the funds to pay. Maybe a former spouse was responsible for filing your taxes, and after your divorce or their death, you had no idea how to file the taxes yourself. Maybe you just lost track of your tax documents, had no idea how to file your taxes, and chose not to file–and over time, that negligence compounded. Whatever led to your failure to file your taxes, however, it’s time to get past the block!

You need to file your taxes for a number of reasons. Not filing your taxes can be a felony. Not only that, it may be necessary to buy a home or take out a significant loan. Unfiled taxes could even prevent you from getting health insurance or filling out federal aid forms for your child to attend college. Delinquent taxpayers may even be added to the no-fly list, have their wages garnished, and face other serious problems that limit their lives. Whatever has stopped you from filing your taxes in the past, it’s time to get past it. If you don’t file your return within three years of the return’s due date, you will miss out on any refund you might receive from the IRS.

Step Two: Gather Your Records

Before you can file past tax returns, you’ll need to gather your records for those years. You can fill out Form 4506-T, Request for Transcript of Tax Return, to get your past tax records: W-2s and 1099s that indicate your income during those missing years. Find any information you can about your deductions for those years, as well. The more detailed your records from those years, the better the job you can do of itemizing your deductions. Make sure to consider:

Penalty relief waivers. Did the IRS make an error? Do you have a reasonable reason for why you were unable to file? If so, you may be able to fill out a penalty relief waiver, which could prevent penalties.

Proof of health insurance. You may need to provide proof of health insurance for recent years in order to prevent tax penalties. Contact your insurance company if needed.

Retirement savings and education expenses. Take a look at these statements to see what deductions you could qualify for on those missing years. In some cases, those deductions can significantly reduce your tax burden.

Information about your dependents during those years. What dependents were you responsible for each tax year? Pay particular attention to kids’ ages during the years your taxes went unpaid.

Any self-employment income. Did you have additional income for the years you failed to file? If you had self-employment income over $600, you will need to include the income from those areas as well as information for your W-2’s. Make sure you have gathered all of your 1099 forms as well as your W-2 forms.

Investments and other income. If you had investments that provided income or savings accounts with substantial income, you may need proof of the income from those investments.

Step Three: Look for Qualified Tax Experts

If you’re struggling with unpaid taxes and back tax returns, you may need help from a professional. Tax experts can help guide you through the process and ensure that you receive the support you need through the process–and keep you on the sunny side of the law. If you need a tax expert, whether due to unpaid past taxes or other serious tax concerns, contact Advance Tax Relief today to learn more about the options available to you and how we can help. While you can file your past tax returns through online programs, you may miss out on key deductions and other elements that can help you better understand exactly how much you owe.

Tax experts can also ensure that you have access to key information, including the appropriate tax laws for each year you failed to file. Tax laws change every year, and filing with the wrong laws in place could mean that you just have to turn around and file all over again. Working with the right tax expert, on the other hand, can ensure that you get it right the first time, which means less of a headache for you in the long run. Go in prepared with the right questions, including:

Are you eligible for the IRS Fresh Start Program? The IRS Fresh Start program helps provide relief for individuals with past due tax debt. Under the terms of this program, the IRS will not file a Notice of Federal Tax Lien until a taxpayer has more than $10,000 in tax debt. The program also allows taxpayers who have higher debts, including up to $50,000 of debt, to make monthly payments for up to 6 years. You may also remove the lien if your debt is under $25,000 and you have set up direct debits from your account.

What experience does your accountant have with past due taxes? When you look for an accountant or tax expert, make sure you know you know what experience they have with past due taxes. You want an accountant who can help you avoid any unnecessary fines, penalties, or fees associated with the process.

Are you looking for a qualified tax expert to help handle your unpaid taxes? Contact Advance Tax Relief today to learn more about how we can help you get those unpaid taxes filed and your taxes on track to being paid.

GET TAX RELIEF HELP TODAY

If you think that you may need help filing your 2018/2019 tax return and past due tax returns, you may want to partner with a reputable tax relief company who can help you get the max refund and reduce your chances for an IRS AUDIT.

Advance Tax Relief is headquartered in Houston, TX with a branch office in Los Angeles, CA. We help many individuals just like you solve a wide variety of IRS and State tax issues, including penalty waivers, wage garnishments, bank levy, tax audit representation, back tax return preparation, small business form 941 tax issues, the IRS Fresh Start Initiative, Offer In Compromise and much more. Our Top Tax Attorneys, Accountants and Tax Experts are standing by ready to help you resolve or settle your IRS back tax problems.

Advance Tax Relief is rated one of the best tax relief companies nationwide.

#TaxDebtHelp #FilingBackTaxesHelp #TaxReliefHouston #BackTaxRelief #TaxAttorneysNearMe #IRSLawyer #TaxReliefFirms #OfferInCompromise #TaxResolution #LocalTaxAttorney #HelpFilingBackTaxes #TaxDebtSettlement #TaxReliefAttorneys #IRSHelp #TaxRELIEF #TaxAttorneys #AuditHelp #BackTaxes #OfferInCompromise #WageGarnishmentHelp #AuditReliefHelp #SmallBusinessTAXES

0 notes

Text

Character Interview

Repost. Don’t reblog.

NAME: James Crockett NICKNAME: Sonny AGE: 37 (mid-series) SPECIES: Human

personal.

MORALITY: lawful / neutral / chaotic / good / neutral / evil / true RELIGIOUS BELIEF: (Nondenominational) Christan... but he has his doubts. SINS: greed / gluttony / sloth / lust / pride / envy / wrath VIRTUES: chastity / charity / diligence / humility / kindness / patience / justice PRIMARY GOALS IN LIFE: Make the world a safer place for kids; protect his family & friends

LANGUAGES KNOWN: English; Spanish; (not fluent in) Vietnamese SECRETS: As an undercover det. and survivor of a severe identity crisis, he’s known his share of lies and deceit. When it comes to internal feelings, Sonny’s easier to read than an open book! SAVVIES: Knowledge of various combat techniques (hand-to-hand as well as weaponry). Skilled with handguns; uses: SIG Sauer P220, Detonics Pocket 9, Bren Ten, S&W Model 645, S&W Model 4506, Detonics Combat-Master, and S&W CS45.

physical.

BUILD: scrawny / bony / slender / fit / athletic / curvy / herculean / pudgy / average HEIGHT: 5′11″ ( 1.75 m ) WEIGHT: 165 lbs. ( 74.84 kg) SCARS/BIRTHMARKS: Shoulder wound ABILITIES/POWERS: 6th sense RESTRICTIONS: Trick knee

favourites.

FOOD: Shellfish, Hot dog DRINK: Black Jack, beer PIZZA TOPPING: EVERYTHING COLOUR: White, Blue MUSIC GENRE: Blues Rock, Classic Rock, Soft Rock BOOK GENRE: Crime/Mystery Fiction MOVIE GENRE: Drama SEASON: Winter (especially January - when Miami nights are at the coolest of the year) CURSE WORD: Hell, Damn SCENT(S): Sea spray, cigarette smoke, cheap cologne

fun stuff.

BOTTOM OR TOP: Depends on how tired he is from working. Switch. SINGS IN THE SHOWER: No. LIKES BAD PUNS: Yes -- Unless they’re Stan’s bad puns.

Tagged by: @goldenedtriangle Tagging: @annastrxng

3 notes

·

View notes

Text

Strongly correlated electrons and hybrid excitons in a moiré heterostructure

1.

Cao, Y. et al. Unconventional superconductivity in magic-angle graphene superlattices. Nature 556, 43–50 (2018).

2.

Yankowitz, M. et al. Tuning superconductivity in twisted bilayer graphene. Science 363, 1059–1064 (2019).

3.

Liu, X. et al. Spin-polarized correlated insulator and superconductor in twisted double bilayer graphene. Preprint at http://arxiv.org/abs/1903.08130 (2019).

4.

Sharpe, A. L. et al. Emergent ferromagnetism near three-quarters filling in twisted bilayer graphene. Science 365, 605–608 (2019).

5.

Lu, X. et al. Superconductors, orbital magnets and correlated states in magic-angle bilayer graphene. Nature 574, 653–657 (2019).

6.

Sidler, M. et al. Fermi polaron-polaritons in charge-tunable atomically thin semiconductors. Nat. Phys. 13, 255–261 (2017).

7.

Efimkin, D. K. & MacDonald, A. H. Many-body theory of trion absorption features in two-dimensional semiconductors. Phys. Rev. B 95, 035417 (2017).

8.

Yu, H., Liu, G.-B., Tang, J., Xu, X. & Yao, W. Moiré excitons: from programmable quantum emitter arrays to spin-orbit–coupled artificial lattices. Sci. Adv. 3, e1701696 (2017).

9.

Wu, F., Lovorn, T. & MacDonald, A. Topological exciton bands in moiré heterojunctions. Phys. Rev. Lett. 118, 147401 (2017).

10.

Wu, F., Lovorn, T., Tutuc, E. & MacDonald, A. H. Hubbard model physics in transition metal dichalcogenide moiré bands. Phys. Rev. Lett. 121, 026402 (2018).

11.

Ruiz-Tijerina, D. A. & Fal’ko, V. I. Interlayer hybridization and moiré superlattice minibands for electrons and excitons in heterobilayers of transition-metal dichalcogenides. Phys. Rev. B 99, 125424 (2019).

12.

Rivera, P. et al. Interlayer valley excitons in heterobilayers of transition metal dichalcogenides. Nat. Nanotechnol. 13, 1004–1015 (2018).

13.

Seyler, K. L. et al. Signatures of moiré-trapped valley excitons in MoSe2/WSe2 heterobilayers. Nature 567, 66–70 (2019).

14.

Tran, K. et al. Evidence for moiré excitons in van der Waals heterostructures. Nature 567, 71–75 (2019).

15.

Alexeev, E. M. et al. Resonantly hybridized excitons in moiré superlattices in van der Waals heterostructures. Nature 567, 81–86 (2019); correction 572, E8 (2019).

16.

Jin, C. et al. Observation of moiré excitons in WSe2/WS2 heterostructure superlattices. Nature 567, 76–80 (2019); correction 569, E7 (2019).

17.

Wang, Z. et al. Evidence of high-temperature exciton condensation in two-dimensional atomic double layers. Nature 574, 76–80 (2019).

18.

Gerber, I. C. et al. Interlayer excitons in bilayer MoS2 with strong oscillator strength up to room temperature. Phys. Rev. B 99, 035443 (2019).

19.

Zheng, L., Ortalano, M. W. & Das Sarma, S. Exchange instabilities in semiconductor double-quantum-well systems. Phys. Rev. B 55, 4506–4515 (1997).

20.

Ezawa, Z. F. Quantum Hall Effects: Field Theoretical Approach and Related Topics (World Scientific, 2000).

21.

Zhang, Y. et al. Direct observation of the transition from indirect to direct bandgap in atomically thin epitaxial MoSe2. Nat. Nanotechnol. 9, 111–115 (2014).

22.

Özçelik, V. O., Azadani, J. G., Yang, C., Koester, S. J. & Low, T. Band alignment of two-dimensional semiconductors for designing heterostructures with momentum space matching. Phys. Rev. B 94, 035125 (2016).

23.

Xu, X., Yao, W., Xiao, D. & Heinz, T. F. Spin and pseudospins in layered transition metal dichalcogenides. Nat. Phys. 10, 343–350 (2014).

24.

Back, P. et al. Giant paramagnetism-induced valley polarization of electrons in charge-tunable monolayer MoSe2. Phys. Rev. Lett. 118, 237404 (2017).

25.

Smoleński, T. et al. Interaction-induced Shubnikov–de Haas oscillations in optical conductivity of monolayer MoSe2. Phys. Rev. Lett. 123, 097403 (2019).

26.

Hanson, R., Kouwenhoven, L. P., Petta, J. R., Tarucha, S. & Vandersypen, L. M. K. Spins in few-electron quantum dots. Rev. Mod. Phys. 79, 1217–1265 (2007).

27.

Eisenstein, J. P., Pfeiffer, L. N. & West, K. W. Compressibility of the two-dimensional electron gas: measurements of the zero-field exchange energy and fractional quantum Hall gap. Phys. Rev. B 50, 1760–1778 (1994).

28.

Hunt, B. M. et al. Direct measurement of discrete valley and orbital quantum numbers in bilayer graphene. Nat. Commun. 8, 948 (2017).

29.

Imada, M., Fujimori, A. & Tokura, Y. Metal-insulator transitions. Rev. Mod. Phys. 70, 1039–1263 (1998).

30.

Camjayi, A., Haule, K., Dobrosavljević, V. & Kotliar, G. Coulomb correlations and the Wigner–Mott transition. Nat. Phys. 4, 932–935 (2008).

31.

Zarenia, M., Neilson, D. & Peeters, F. M. Inhomogeneous phases in coupled electron-hole bilayer graphene sheets: charge density waves and coupled Wigner crystals. Sci. Rep. 7, 11510 (2017).

32.

Ludwig, D., Floerchinger, S., Moroz, S. & Wetterich, C. Quantum phase transition in Bose–Fermi mixtures. Phys. Rev. A 84, 033629 (2011).

33.

Laussy, F. P., Kavokin, A. V. & Shelykh, I. A. Exciton-polariton mediated superconductivity. Phys. Rev. Lett. 104, 106402 (2010).

34.

Wang, L. et al. One-dimensional electrical contact to a two-dimensional material. Science 342, 614–617 (2013).

35.

Kim, K. et al. van der Waals heterostructures with high accuracy rotational alignment. Nano Lett. 16, 1989–1995 (2016).

36.

Catellani, A., Posternak, M., Baldereschi, A. & Freeman, A. J. Bulk and surface electronic structure of hexagonal boron nitride. Phys. Rev. B 36, 6105–6111 (1987).

37.

Laturia, A., Van de Put, M. L. & Vandenberghe, W. G. Dielectric properties of hexagonal boron nitride and transition metal dichalcogenides: from monolayer to bulk. npj 2D Mater. Appl. 2, 6 (2018).

38.

Larentis, S. et al. Large effective mass and interaction-enhanced Zeeman splitting of K-valley electrons in MoSe2. Phys. Rev. B 97, 201407 (2018).

39.

Rytova, N. S. The screened potential of a point charge in a thin film. Moscow Univ. Phys. Bull. 22, 18–21 (1967).

Google Scholar

40.

Lu, C.-P., Li, G., Watanabe, K., Taniguchi, T. & Andrei, E. Y. MoS2: choice substrate for accessing and tuning the electronic properties of graphene. Phys. Rev. Lett. 113, 156804 (2014).

41.

He, K., Poole, C., Mak, K. F. & Shan, J. Experimental demonstration of continuous electronic structure tuning via strain in atomically thin MoS2. Nano Lett. 13, 2931–2936 (2013).

42.

Conley, H. J. et al. Bandgap engineering of strained monolayer and bilayer MoS2. Nano Lett. 13, 3626–3630 (2013).

43.

Zhu, C. R. et al. Strain tuning of optical emission energy and polarization in monolayer and bilayer MoS2. Phys. Rev. B 88, 121301 (2013).

44.

Frisenda, R. et al. Biaxial strain tuning of the optical properties of single-layer transition metal dichalcogenides. npj 2D Mater. Appl. 1, 10 (2017).

Article

Google Scholar

45.

Giannozzi, P. et al. QUANTUM ESPRESSO: a modular and open-source software project for quantum simulations of materials. J. Phys. Condens. Matter 21, 395502 (2009).

46.

Dal Corso, A. Pseudopotentials periodic table: from H to Pu. Comput. Mater. Sci. 95, 337–350 (2014).

47.

Rasmussen, F. A. & Thygesen, K. S. Computational 2D materials database: electronic structure of transition-metal dichalcogenides and oxides. J. Phys. Chem. C 119, 13169–13183 (2015).

48.

Zollner, K., Faria, P. E. Jr & Fabian, J. Proximity exchange effects in MoSe2 and WSe2 heterostructures with CrI3: twist angle, layer, and gate dependence. Phys. Rev. B 100, 085128 (2019).

Let's block ads! (Why?)

https://ift.tt/2V5X60y from https://ift.tt/34CzyDB

0 notes

Text

Training Day has had quite the influence on me.

59 notes

·

View notes

Photo

restroom @restroom

hat auf deine Bilderserie geantwortet “restroom @restroom hat auf deine Bilderserie geantwortet “restroom...”

Well, at some point I'm going to have to go in for something in the *sigh* loathsome .45ACP calibre, likely a P220 dressup as/or BDA (but only blued slide/stainless-frame ); the odious S&W 4506 no-dash; and, to add insult to insult, the frankly disgusting Detonics Combat Master. All the aforementioned pieces arrive _per_ the _Miami Vice_ franchise (the pilot-gap and Burnett arc in particular); which means at some ludicrous point in my life I'll not only …

… be carrying again, but attempting to manage it with a lumbering Bren Ten in a pre-Jackass Jackass Rig as well as the Detonics in whatever elastic ankle-bracelet allows for that hunk of worthless iron's attachment to my (woefully-underdeveloped) right calf. Good news, pinned to th'arse of all these miseries, is that, glimpsing either of these, one can safely assume that my existential pin's been pulled, and within a month I'll be in sandwich-friendly Spreadable Mode®.

I’ve got you. Let’s launch that revival.

Steal his look :

Sig Sauer P226 two-tone 9x19 $820

LAR Grizzly Mk I two-tone .45 Winchester Magnum $1350

AMT Harballer 7″ slide .45 ACP $599.95

IAI Automag IV .45 Winchester Magnum $467.46

Browning Hi Power Renaissance with mother-of-pearl grips 9x19 $3750

Linda Farrow Luxe 249 Tortoiseshell neutral glasses €363.90

Jack Russel The Ultimate Leather Shoulder Holster $119

Circola Moda suit with grey, blue and green pol. blend w/ pinstripe print $68

FIAT 124 Spider Lusso manual 6-speed $28490

AIWA personal cassette player HS-F07 $289

6 notes

·

View notes

Text

A Demon's Angel

read it on the AO3 at http://ift.tt/2gts4dd

by TheWickedMadame (SilverAngel621), Word_Smith_94

When Seraphim Commander Castiel raided an underworld demon slave trade ring, he didn't expect to find a small six-year-old demon child with his wings clipped. The abused child clung to the Angel, smelling of cherry pie and the stink of sulfur. Castiel was a warrior, hardened by battle and wholly dedicated to his mission. He didn't have a child sized place in his life.

The moment Dean saw the white avenging angel cutting through the mean demons, he knew he wanted to be close to him forever. He’ll find a way to live with the angel, even if he has to wait a while, and then he can get what he wants from the angel. After all, he didn’t learn all those tricks for nothing. Of course, there’s something he needs from the angel first...

Castiel wants but won’t let himself act. Dean wants but fears rejection. Who’ll make the first move?

Words: 4506, Chapters: 2/?, Language: English

Fandoms: Supernatural

Rating: Explicit

Warnings: Underage

Categories: M/M

Characters: Castiel (Supernatural), Dean Winchester, Sam Winchester, Michael (Supernatural), Lucifer (Supernatural), Anna Milton, Bartholomew (Supernatural), Gabriel (Supernatural), Naomi (Supernatural)

Relationships: Castiel/Dean Winchester, Lucifer/Michael (Supernatural)

Additional Tags: Extremely Underage, Daddy Kink, Praise Kink, Tail Kink, Tail Sex, Double Penetration, w/tail and dick, D/s undertones, Dom/sub, Sub!Dean, Bottom Dean, Dom!Castiel, Top Castiel, Top Castiel/Bottom Dean Winchester, Dean in Panties, Crossdressing, Panties, Angel/Demon Relationship, Anal Sex, Rimming, Anal Fingering, Masturbation, Come Marking, Size Kink, Underage - Freeform, Shota, Wing Kink

read it on the AO3 at http://ift.tt/2gts4dd

13 notes

·

View notes

Text

From the Guns.com Vault: Deals on the Sig Sauer P220 (PHOTOS)

First introduced in 1975, the P220 design is still going strong nearly 45 years later. (Photo: Richard Taylor/Guns.com)

As the prime example of the late 20th Century European-designed large frame single stack pistol, the Sig Sauer P220 takes the cake — and we have several in stock in the Guns.com Vault.

A modernized answer to Sig’s 1940s-era P210 to replace the latter in the service of the Swiss Army, the P220 was introduced in 1975 and was immediately met with open arms by military users around the world. Switzerland adopted the new 9mm handgun as their Pistole 75 — where it continues to serve today both in the Alps and with the Swiss Guard of the Vatican. In addition, overseas military customers included the Japanese Army, which produced them under license by MinebeaMitsumi, as well as a host of smaller countries.

Originally designed to use a heel-mounted magazine release, a change to a frame-mounted push-button release and chamberings in .45ACP led to adoption by numerous police organizations in the U.S. in the 1980s. With their DA/SA trigger and slightly shorter profile than the 1911, the guns competed with contemporary domestic offerings like the S&W 4506.

Available in several options when it came to caliber, barrel length, frame height, and magazine capacity, your typical P220 floating around in the U.S. will be in either .45ACP or 10mm with a 4.4-inch barrel. While the more vintage, typically West Germany-marked examples, will have a smooth dustcover on the frame and a more streamlined look, modern examples of the handgun will sport an accessory rail.

The first of what Sig Sauer later took to labeling as their “Classic Line” of pistols, the same basic design of the P220 was modified and evolved into the more compact P225 and P245, the double-stacked P226, P227, P228, and P229; as well as the sub-compact P239 series handguns. In fact, Sig’s Armorer’s Course on the Classic Line covered all the above in one session as the concept of their construction was so similar.

The P220 Legion series in an enhanced version of the gun that started it all for the Classic Line. Finished in a what Sig calls a Legion gray coating and featuring custom G-10 grips with a Legion medallion, these P220s are improved with updated X-Ray high visibility day/night sights as well as front cocking serrations. When it comes to ergos, these guns have a reduced and contoured elite beavertail, aggressive front strap checkering and an X-Five undercut on the trigger guard as well as other tweaks.

Our Vault currently has three different certified pre-owned P220 Legions including those chambered in .45ACP and 10mm Auto starting at $1,099– which is a bargain when you consider new models have an MSRP of almost $2K.

The Legion series of P220s are immediately identifiable and we have certified pre-owned models priced right.

The P245, which was essentially a .45ACP P220 that sported a 3.9-inch barrel and shorter grip, was introduced in 1999 but later evolved into the P220 Carry which is a standard model today and we have a couple of those in stock as well at attractive prices. Like $899 attractive.

The P220 Carry, with its 3.9-inch barrel, is an example of the series meant for more everyday use.

Updated for today’s more tactical market is the Sig P220 Scorpion Elite which includes Hogue G-10 Piranha grips and a factory FDE finish.

No longer offered in Sig’s catalog, this sweet desert themed .45ACP runs $900.

For those looking for some more flash, there is always this factory two-tone stainless over black Nitron model with the classic pebble Sig grips and night sights.

Price? $799Of course, should you want a new P220, we have that covered as well in Standard, Combat, Equinox, and Hunter models with prices starting at $929.

The post From the Guns.com Vault: Deals on the Sig Sauer P220 (PHOTOS) appeared first on Guns.com.

from Guns.com http://bit.ly/2WHMjeE from Blogger http://bit.ly/2IlXU9Z

0 notes

Text

Tax transcript types and why you might need one to file your tax return

Prior year tax returns serve many purposes.

This filing season, a check of last year's return will show you what your tax liability for 2017 was. You can compare that to your final 2018 tax bill to see if the Tax Cuts and Jobs Act (TCJA) did indeed lower your taxes even though your refund this year was smaller.

You'll also need past year tax data if you're applying for a major loan, such as a mortgage.

And if you're electronically filing your tax return this year, you'll need data from your previous year's taxes to complete that task.

Record keeping, however, has never been your strong suit. So what do you do?

The Internal Revenue Service's Get Transcript services can help.

Types of transcripts: A tax transcript isn't a copy of your prior filings. Rather, it generally summarizes your tax return or other tax-related information.

The IRS actually offers taxpayers five types of transcripts:

Tax Return Transcript — This shows most line items from your return, including your adjusted gross income (AGI) from the original tax return (Form 1040, 1040A or 1040EZ for tax years prior to 2018) you filed. Information also is provided from any forms and schedules you filed along with your 1040. A tax return transcript, however, doesn't show changes made after you filed your original return. This transcript is only available for the current tax year and returns processed during the prior three years. It usually meets the needs of lending institutions offering mortgages and student loans.

Tax Account Transcript — This transcript shows basic data such as return type, marital status, adjusted gross income, taxable income and all payment types. It also shows changes made after you filed your original return. You can download a tax account transcript for the current tax year and up to 10 prior years. If, however, you want a copy of this type of transcript mailed to you, you're limited to the current tax year and returns processed during the prior three years.

Record of Account Transcript — This version combines the tax return and tax account transcripts into one complete transcript. This transcript is available for the current tax year and returns processed during the prior three years using Get Transcript Online or by submitting Form 4506-T.

Wage and Income Transcript — This shows data from information returns sent to the IRS, such as Forms W-2, 1099, 1098 and Form 5498, IRA Contribution Information. Current tax year information may not be complete until July. This transcript is available for up to 10 prior years using Get Transcript Online or Form 4506-T.

Verification of Non-filing Letter — This document provides proof that the IRS has no record of a filed Form 1040, 1040A or 1040EZ for the year you requested. It doesn't indicate whether you were required to file a return for that year. This letter is available after June 15 for the current tax year or anytime for the prior three tax years using Get Transcript Online or Form 4506-T. You must use Form 4506-T if you need a letter for tax years older than the prior three years.

There is no charge for whatever type of transcript you request and are available for the most current tax year after the IRS has processed the return.

Getting your transcripts online: All transcript types are available online, but the tax return transcript is sufficient for most taxpayer needs.

As noted in the synopses of the various tax transcript types, you can get these filing summaries by downloading the data through a special site at IRS.gov or by requesting your transcripts be sent to you by U.S. Postal Service mail.

To use the online option, go to Get Transcript Online. There you can view, print or download a copy of the transcript you need. You will, however, need some information to complete your online transcript request, which requires you to authenticate your identity and create an account using the Secure Access process.

Before you start, have handy:

Your Social Security number, date of birth, filing status and mailing address from latest tax return,

An accessible email account,

Your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or car loan to validate your identity and

A mobile phone with your name on the account so that a verification code can be sent to you to set up your account.

The verification code step is part of the two-step authentication process is now part of the IRS' effort to make its online services more secure from hackers looking to steal taxpayer identities.

If the mobile phone number is not in your name, for example, your line is part of a family plan account that's under your spouse's name, you may opt during the registration process to have an activation code snail mailed to you.

Getting your transcript through the mail: Obtaining your transcript via snail mail also could be an option if you're not in a big hurry to get the document(s).

But to request delivery this way, you still need to use your computer to access Get Transcript by Mail at IRS.gov.

And again, you'll need some identifying information to request the mailed paper copy, including your:

Social Security number or Individual Tax Identification Number (ITIN),

Date of birth and

Mailing address from your latest tax return.

This request will get your tax return or tax account transcript delivered by your postal carrier in five to 10 calendar days at the address the IRS has on file for you.

If you don't have access to a computer to ask for a mailed copy of your transcript, you can call toll-free (800) 908-9946 to request one.

Prior filing data required to e-file: Knowing what was on your last tax return is more important for some taxpayers this filing season. They will be asked for the AGI from their 2017 tax returns in order to validate their electronic signature when they file their 2018 taxes.

If you use the same tax software this year as you did to file last year — or go to the same tax preparer to have your taxes done — the commercial tax software product (or your tax pro) will carry over your prior-year information.

That usually makes for an easy, seamless e-signature validation process.

However, if you switched tax software (or preparers), you may be required to enter the AGI information manually.

E-signature validation: Every taxpayer (and spouse if filing a joint return) must sign his or her tax return. Without that John Hancock, the IRS won't process your filing.

When you file electronically, you still must sign your return. In e-filing cases, that's done by using a four-digit Personal Identification Number (PIN), also known as a Self-Select PIN, that you, the taxpayers, create.

Just like with a pen-and-paper signature, your PIN e-signature is how you acknowledge that information on your return is true and accurate. And so that the IRS knows the return is truly and accurately from you and not an identity thief, the e-signature must be validated.

To validate your PIN, you must enter your birth date and either your prior year AGI as shown on that return or Self-Select PIN you used the year before.

If you kept a copy of your prior-year tax return, completing this validation task is easy. You'll find your 2017 tax year AGI on line 37 of Form 1040, line 21 on Form 1040-A or line 4 on Form 1040-EZ. (Note that for the 2018 tax year filing, there's just one Form 1040, with six schedules used depending on your filing situation.)

However, if you don't have a copy of your 2017 tax return, see if you can get a copy from the tax preparation software or the tax preparer you used last year.

If not, then it's time to Get Transcript.

You also might find these items of interest:

'Trusted' taxpayers to get more ID theft protection

Free File 2019 is open with taxpayer protection upgrades

IRS expands info available via Taxpayer Online Account tool

Advertisements // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ // <![CDATA[ (adsbygoogle = window.adsbygoogle || []).push({}); // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]> // ]]>

from Tax News By Christopher https://www.dontmesswithtaxes.com/2019/02/tax-transcripts-and-why-you-might-need-one-to-e-file-your-tax-return.html

0 notes

Photo

(via South Grand Lake Home w/Magnificent View of Duck Creek - 33796 S. 4506 Rd., Afton OK) Reduced $64K!

0 notes

Photo

He really has two cause carrying only one S&W 4506 in a shoulder holster would pull your arm out of the socket.

In Training Day, Denzel Washington’s character has two sidearms because he’s a crooked cop. One pistol is sideways (Crooked) and the other is upright (Cop).

398 notes

·

View notes

Text

TEKTRONIX TDS3012B Oscilloscope 100MHz 4-ch 1.25GS/s w/FFT & TDS3TRG

$1,730.00

End Date: Jan-20 09:51

Buy It Now for only: US $1,730.00

Buy it now |

from bettyboopbii09 https://bayfeeds.com/ebayitem?site=0&i=263399092400&u=4506&f=4281

0 notes