#retirement income

Explore tagged Tumblr posts

Text

What You Must NOT Do When Investing: Key Mistakes Conservative to Balanced Investors Should Avoid By Costas Souris of Quality Group

Investing wisely is essential, whether you are managing a lump sum or making regular contributions to your portfolio. For conservative to balanced investors aiming for financial stability and growth, avoiding common missteps is critical. Here are the top pitfalls you should steer clear of to maintain a balanced to your investment.

1. Ignoring Asset Allocation

One of the most critical strategies in investment is proper asset allocation. Diversifying your investments across various asset classes such as stocks, bonds, real estate, and fixed income can mitigate risks and maximize returns under different market conditions. Conservative investors should avoid high-risk assets, while balanced investors need a well-rounded portfolio that aligns with their risk tolerance and financial goals.

2. Chasing High Returns Without Assessing Risks

High returns are often accompanied by high risks. It’s vital for investors to thoroughly assess the potential risks associated with any lucrative investment opportunity. Understanding the investment's volatility and market conditions is crucial to avoid unexpected losses. Seek solutions with capital protection and minimal risk and volatility, yet deliver handsome returns.

3. Overlooking Investment Fees and Costs

Investments come with various fees—fund management fees, transaction fees, or penalties for early withdrawal—that can significantly reduce your returns over time. Choose investments with low or no fees to enhance your earnings, especially when investing a significant lump sum. New generation investments come with 100% allocation, no fees!

4. Neglecting Regular Investment Reviews

The financial market constantly changes, and so should your investment strategy. Regularly review your investments—at least annually or after major life changes—to ensure they remain aligned with current market conditions and your financial objectives. This practice is crucial for responding effectively to market downturns or economic shifts.

5. Making Emotional Investment Decisions

Investing can be an emotional journey. However, successful investing requires keeping emotions like fear and greed at bay. Make decisions based on long-term objectives rather than short-term market fluctuations to avoid detrimental impacts on your investment's performance.

6. Disregarding Liquidity Needs

Before committing to long-term investments, consider your short-term liquidity needs. Conservative investors should have readily accessible funds to cover emergencies without the need to withdraw investments prematurely, potentially incurring losses.

7. Underestimating Tax Implications

Investments may have tax implications that can affect your net returns. Understanding how your returns are taxed—whether through dividends, interest, or capital gains—and utilizing tax-advantaged accounts can significantly enhance your overall returns.

8. Investing Without Adequate Research

Diving into investments without proper research is a common error. Leverage the vast resources available online to thoroughly understand the nature and risks of your investments. Do not rely on well-intended opinions from friends and family. Make your own decisions, keep asking questions until you are satisfied.

9. Overlooking Passive Income Opportunities

Growing wealth is about earning passive income. Investments that offer steady, predictable income can provide "money at work" benefits. Ensure these investments keep pace with inflation and offer the flexibility needed to adjust as your financial needs evolve. A passive income strategy enables financial independence!

Conclusion

A disciplined approach is crucial for conservative to balanced investors looking to grow their wealth while minimising risks. By avoiding these common pitfalls, you can ensure a robust investment strategy that remains responsive to both market conditions and your financial goals.

Quality Group SA specialises in fixed-term, fixed-return investments that are ideal for conservative investors. Our products provide capital protection by insurance with reliable, predictable income, ensuring your investment is secure. Moreover, our solutions beat inflation and bank deposit rates providing double digit returns without the volatility of markets and in hard currency.

Connect with us at https://qualitygroupsa.com/connect/ to explore investment opportunities tailored for your financial security.

Authored by Costas Souris, January 2025

------------------------------------------------------------------------------

#costas souris#qualitygroupsa#fixedincome#buildingwealth#privatelending#litigationfunding#investmentopportunity#justicefunding#retirement income

0 notes

Text

10 Proven Ways to Generate Retirement Income and Maintain Lifelong Happiness

Discover practical strategies to secure retirement income while enjoying a fulfilling and stress-free life Retirement marks a new chapter filled with opportunities to enjoy the fruits of your labor. However, achieving financial security and emotional satisfaction during this period requires thoughtful planning. Learning how to generate retirement income effectively can help you maintain…

View On WordPress

#financial freedom strategies#passive income ideas#Personal development#Personal finance#Retirement income#Retirement Planning Advice

0 notes

Text

Dementia in Retirement: How to Prevent Brain Decline

Summary

1. Social Connections: Nurture Positive Relationships

2. Be a Lifelong Learner: Use It or Lose It

3. Hyper-Oxygenation: Exercise for Your Brain

4. Nutrition: Feed Your Brain

5. Sleep: Recharge Your Brain

6. Stress Management: Protect Your Brain from Harm

7. Mental Stimulation: Stay Engaged with Puzzles and Games

Connect with Bibi Apampa The Retirement Queen for more infirmation at https://RetirementQueen.net

Dementia in Retirement: How to Prevent Brain Decline

Article

Retirement is often seen as a time to relax and enjoy the fruits of years of hard work. However, one of the challenges many retirees face is the increased risk of cognitive decline, including dementia. Thankfully, there are several proactive measures that can be taken to maintain brain health and stave off dementia. Below are key strategies for keeping your brain sharp and healthy during retirement:

1. Social Connections: Nurture Positive Relationships

Human beings are social creatures, and maintaining vibrant, positive relationships can significantly impact your brain health. Engaging in meaningful conversations, dialogues, and collaborations stimulates the brain by challenging it to think critically, listen actively, and process emotions. Surrounding yourself with people who uplift and energize you can reduce the risk of isolation, which is linked to cognitive decline. Make an effort to stay socially active through hobbies, clubs, volunteering, or simply spending quality time with loved ones.

2. Be a Lifelong Learner: Use It or Lose It

The brain thrives on challenges. Adopting a mindset of continuous learning is essential for keeping your cognitive functions sharp. Whether it's learning a new language, picking up a musical instrument, or diving into a new hobby, these activities activate different parts of the brain, enhancing neural connections. Without mental stimulation, the brain begins to divert its resources elsewhere, leading to a decline in cognitive function. So, stay curious and embrace opportunities to challenge your mind.

3. Hyper-Oxygenation: Exercise for Your Brain

Physical exercise isn’t just good for the body—it’s essential for the brain. Regular aerobic activity, such as brisk walking, jogging, or swimming, increases blood flow and oxygenation to the brain, promoting neurogenesis (the creation of new brain cells). Studies have shown that exercise can significantly reduce the risk of dementia and improve overall brain function. Aim for at least 30 minutes of moderate exercise most days of the week to keep your brain in top shape.

4. Nutrition: Feed Your Brain

Your diet plays a critical role in brain health. Foods rich in antioxidants, omega-3 fatty acids, and vitamins help protect the brain from oxidative stress and inflammation, both of which are linked to cognitive decline. The Mediterranean diet, which emphasizes fruits, vegetables, whole grains, fish, and healthy fats, is widely recognized for its brain-boosting benefits. Include foods like leafy greens, berries, nuts, and fatty fish in your meals to support brain health and longevity.

5. Sleep: Recharge Your Brain

Quality sleep is essential for brain function and memory consolidation. During sleep, the brain clears out toxins that can lead to cognitive decline and dementia. Lack of sleep, on the other hand, has been associated with increased risks of Alzheimer’s disease. Aim for 7-9 hours of restful sleep per night to give your brain the time it needs to repair and rejuvenate.

6. Stress Management: Protect Your Brain from Harm

Chronic stress can have a devastating effect on the brain, accelerating aging and increasing the risk of dementia. Practices like mindfulness, meditation, and yoga have been shown to reduce stress and improve cognitive function. Taking time to relax and engage in activities that bring joy can protect your brain from the harmful effects of prolonged stress.

7. Mental Stimulation: Stay Engaged with Puzzles and Games

In addition to learning new skills, engaging in mentally stimulating activities like puzzles, chess, or Sudoku can enhance cognitive reserve and delay the onset of dementia. These activities challenge your brain to think strategically, solve problems, and retain information—key functions that protect against cognitive decline.

Conclusion

Dementia is a growing concern as we age, but it’s not inevitable. By staying socially connected, committing to lifelong learning, exercising regularly, eating a brain-healthy diet, managing stress, and getting enough sleep, retirees can significantly reduce the risk of dementia and enjoy a fulfilling, mentally active retirement. Protect your brain, and your golden years can truly shine.

Connect with Bibi Apampa The Retirement Queen at https://RetirementQueen.net

#retirementplanning#retirementplan#retireearly#retirementqueen#financialeducation#financialadvisor#financialindependence#retireyoungretirerich#retirementbusiness#retirerich#dimentia#retirement business#retirement income#retirement planning#retirementqueentips

1 note

·

View note

Text

Worried About Retirement Finances? You Might Be Better Off Than You Think!

Retirement is a major life transition, and it’s natural to feel a bit anxious about finances. Even if you’ve been diligently saving, it’s easy to wonder if you’ll have enough to support your desired lifestyle. However, the good news is, many people approaching retirement are in a better financial position than they realize. Let’s delve deeper into how you can turn those retirement dreams into a…

#budget travel#compound interest#financial security#investments#pension#retirement income#retirement planning#slow travel#travel tips

0 notes

Text

Maximizing Retirement Income: Comparing Fixed, Variable, and Indexed Annuities

View On WordPress

#annuities#annuity investments#annuity types#deferred annuity#financial planning#fixed annuity#immediate annuity#indexed annuity#retirement income#variable annuity

0 notes

Text

4 Investment Options To Help Generate Retirement Income

Planning for retirement requires careful consideration of investment options that can help generate income to support your lifestyle after you stop working. Here are four investment options to consider:

Dividend-Paying Stocks: Dividend-paying stocks are shares of companies that distribute a portion of their profits to shareholders regularly, typically every quarter. These dividends can provide a steady stream of income during retirement.

Look for companies with a history of consistent dividend payments and sustainable business models. While dividend payments are not guaranteed and can fluctuate, investing in a diversified portfolio of dividend-paying stocks can help mitigate risk. Additionally, reinvesting dividends can compound returns over time, enhancing the growth of your investment.

Bonds: Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When you invest in bonds, you’re essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Bonds are generally considered less risky than stocks, making them a popular choice for retirees seeking stable income.

Government bonds, such as U.S. Treasury bonds, are often considered the safest option, while corporate bonds offer higher yields but come with greater credit risk. To manage risk, diversify your bond portfolio across different issuers, maturities, and credit qualities.

Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-generating real estate across various sectors, including residential, commercial, and industrial properties. By investing in REITs, you can gain exposure to real estate without the hassle of directly owning and managing properties.

REITs typically distribute a significant portion of their taxable income to shareholders in the form of dividends, making them attractive for income-oriented investors. Moreover, REITs may provide diversification benefits as their returns may not be highly correlated with those of traditional stocks and bonds. However, investors should carefully evaluate the quality of the underlying real estate assets, as well as the REIT’s management and financial health.

Annuities: Annuities are financial products offered by insurance companies that provide a guaranteed stream of income for a specified period or the rest of your life. There are various types of annuities, including immediate annuities, deferred annuities, fixed annuities, and variable annuities, each with its features and benefits. Immediate annuities start paying out income immediately after you make a lump-sum payment, while deferred annuities allow you to accumulate funds over time before converting them into income.

Fixed annuities offer a predetermined interest rate for a set period, whereas variable annuities allow you to invest in underlying sub accounts that may fluctuate based on market performance. Annuities can provide retirees with a reliable source of income, but they often come with fees, surrender charges, and complex terms, so it’s essential to thoroughly understand the terms and conditions before investing.

In conclusion, building a diversified portfolio of investment options tailored to your retirement income needs and risk tolerance is crucial. Consult with a financial advisor offering retirement planning services in Fort Worth TX to develop a personalized retirement plan that aligns with your goals and circumstances. By combining various income-generating investments, you can create a robust financial strategy to support your retirement lifestyle.

0 notes

Text

Are you tired of worrying about money in retirement?

Are you afraid of living a lesser life than you had hoped for?

Imagine a future where you can enjoy your golden years without constantly fretting about finances.

It's a dream many share but few achieve.

However, what if I told you that this dream could become your reality? at https://retirementincomehelp.org

0 notes

Text

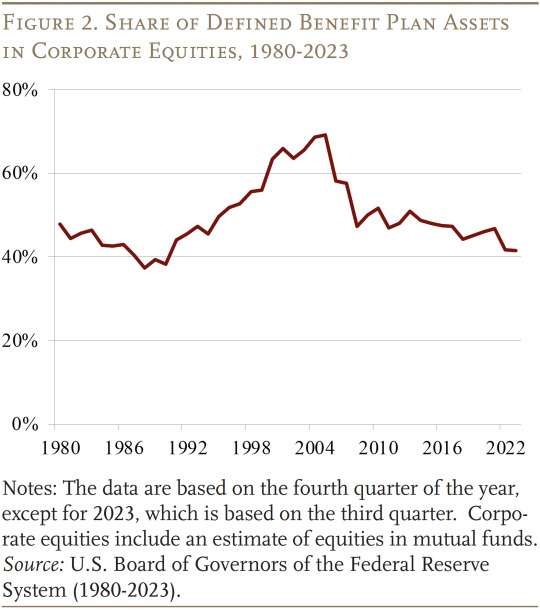

IBM has reopened its defined benefit plan to use the plan’s surplus – rather than corporate cash – to fund retirement contributions.

This shift has been fueled by a more favorable regulatory environment and the improved funded status of defined benefit plans.

While using “trapped surpluses” helps the firm, workers may well come out behind unless the gains are shared.

Interestingly, the analysis finds that only a handful of other large companies are likely candidates to follow IBM’s lead.

Thus, the move should be viewed as a financial maneuver, not a meaningful change in the provision of retirement income.

0 notes

Text

Glad Fyodor's finally dead, everyone's alive and we can go back to solving cases and flirting fighting with the PM :D

#bungou stray dogs#bsd#armed detective agency#I mean I had this piece started since the Kunikida... incident#so might as well finish it and hope for the best#fanart#digital art#all character tags incoming!!#mushitaro oguri#edgar allan poe#aya koda#bsd sigma#sigma#dazai osamu#ranpo edogawa#yosano akiko#kunikida doppo#atsushi nakajima#lucy maud montgomery#izumi kyouka#kenji miyazawa#tanizaki junichirou#naomi tanizaki#kirako haruno#fukuzawa is okay. he's just retired with his cats

5K notes

·

View notes

Text

Retirement planning is an essential aspect of financial management that allows individuals to enjoy a comfortable and secure future. In the UK, with a rapidly ageing population and evolving economic landscape, the importance of effective retirement planning cannot be overstated. This article aims to provide valuable insights and strategies to help you navigate the complexities of retirement planning.

#Retirement Planning#Financial Security#Investment Strategies#Savings Plans#Pension Funds#Long-term Financial Goals#Retirement Income#Financial Advisors#Wealth Management#Estate Planning#Tax Efficiency#Wills & Trusts

0 notes

Text

How we invest today... is how we live tomorrow By Costas Souris Quality Group

Litigation funding is an exciting alternative asset class gaining mainstream traction among both individual and institutional investors. Simply put, investors fund legal cases managed by law firms and, in return, earn a fixed return with a fixed term. This innovative investment option is focused on UK personal injury and civil cases. Investors are attracted for four principal reasons: Passive income in hard currency Insulated from market volatility Superior double digit returns Capital is insured Explore this rewarding investment avenue with specialists Quality Group! Connect with us Quality Group SA Costas Souris

#costas souris#qualitygroupsa#fixedincome#privatelending#buildingwealth#litigationfunding#investmentopportunity#justicefunding#retirement income

0 notes

Text

Yann Faho's 4 Creative Financial Ideas for Early Retirement

Quick retirement is a want that many people want. The idea of breaking free from the grind each day and having more time to pursue one's passions is fairly attractive. However, attaining early retirement requires cautious making plans and innovative monetary strategies. Yann Faho, an economic professional acknowledged for his revolutionary strategies, has come up with 4 innovative financial ideas that can help you in your direction to early retirement.

1. The Art of Geoarbitrage

One of Yann Faho's most imaginative standards is the artwork of geo arbitrage. This time period refers to the practice of strategically dwelling in a vicinity with a lower fee of living whilst earning better earnings from an area-impartial process or investments. By doing this, you may stretch your dollars further and keep more money for retirement.

2. Side Hustles and Passive Income Streams

Yann Faho believes that a diverse income portfolio is fundamental to attaining early retirement. In addition to your number one process, remember beginning a side hustle or investing in passive profit streams. Side hustles can be something from freelance work, consulting, selling handmade crafts, or maybe developing a web course. The earnings from these sports can complement your savings and bring you closer to your retirement goals.

3. Radical Frugality

One of the most honest but impactful ideas proposed by way of Yann Faho is the concept of radical frugality. This method makes substantial modifications to your spending habits and finds ways to cut pointless expenses. It's about distinguishing between what you need and what you want. By adopting a minimalist technique in your lifestyle, you could shop more and redirect the ones budget closer to your retirement savings.

4. Tax Optimization

Yann Faho emphasizes the significance of knowledge of the tax laws to your country And optimizing your economic selections to reduce your tax legal responsibility. A tax-optimized funding method can substantially grow your retirement financial savings over the years. It may also contain the usage of tax-advantaged retirement debts, taking gain of tax deductions, or exploring tax-efficient funding options.

Conclusion

Yann Faho's four creative economic ideas for early retirement aren't handiest innovative but additionally sensible. By learning the art of geo arbitrage, diversifying your profit sources, working towards radical frugality, and optimizing your taxes, you could extensively boost your chances of retiring early and taking part in the lifestyles you have usually dreamed of. Keep in mind that early retirement is manageable with the proper monetary strategy and disciplined execution, and Yann Faho's ideas provide an extremely good roadmap to get you there. Start implementing these strategies these days, and your early retirement dream may be nearer than you observed.

0 notes

Text

Learn how to build multiple income streams for a Rich and Peaceful Retirement

Go To

https://bibiapampa.info/sustainable-retirement-wealth/

#retirement#passiveincomeonline#retire early#retirement income#retirement planning#retire#retirementplannigeria retirementqueen#retireearly#retirementqueennigeria#retirementqueen#bibiapampa

0 notes

Text

Planning Your Personal Finances (Part 1)

The act of financial planning consists of both the short and long-term planning of your finances, which includes all the money you receive (whether you earn it, inherit it, win it, or otherwise), and how you fund your life goals from now until your death and even after your death – including planning for your family members’ future by planning how your estate will be handled. Financial planning…

View On WordPress

0 notes

Text

Exploring Roth IRA Accounts: Tax-Advantaged Investing for Retirement

Written by Delvin As you plan for your retirement, it’s crucial to consider different investment options that can help you grow your savings while enjoying tax advantages. One such option is the Roth Individual Retirement Account (IRA). In this blog post, we’ll explore the features, benefits, and considerations of Roth IRA accounts, empowering you to make informed decisions about your retirement…

View On WordPress

#After-tax contributions#Backdoor Roth IRA#dailyprompt#Estate planning with Roth IRA#Financial#Financial Literacy#Investment options#Retirement accounts#Retirement income#Retirement investment options#Retirement planning#Retirement savings#Retirement savings strategies#Retirement tax planning#Roth IRA#Roth IRA benefits#Roth IRA conversion#Roth IRA eligibility#Roth IRA vs. traditional IRA#Tax-advantaged investing#Tax-efficient savings#Tax-free growth#Tax-free withdrawals

1 note

·

View note

Text

Retirement planning in the Philippines: your guide to secure your financial future

Retirement is an important phase of life that requires careful financial planning to ensure a comfortable and stress-free future. As retirement approaches, it’s essential to have a solid plan in place to secure your financial stability. In this guide, we will explore the key steps to planning for retirement in the Philippines, including how to start a retirement plan and determine the amount of…

View On WordPress

#financial planning#future planning#retirement accounts#retirement advice#retirement expenses#retirement goals#retirement guidance#retirement in the Philippines#retirement income#retirement investments#retirement lifestyle#retirement options#retirement planning#retirement planning tips#retirement savings#retirement security#retirement strategies#retirement vehicles#Sun FlexiLink#Sun Life retirement plans#Sun MaxiLink One#Sun MaxiLink Prime

0 notes