#property market in thailand

Explore tagged Tumblr posts

Text

Property Market in Thailand

Thailand's property market is undergoing a cautious revival, driven by a confluence of factors. Domestic demand remains robust, particularly for suburban houses and condominiums offering more living space and amenities that cater to remote work lifestyles. The rise of remote work has not only influenced property preferences but has also opened doors for those who can relocate for work or choose a more flexible work-life balance. This, coupled with Thailand's reputation for a welcoming culture, affordable cost of living, and natural beauty, is reigniting interest among foreign investors seeking a slice of paradise. However, the market remains somewhat segmented, with a dichotomy between tourist hotspots and secondary locations. While luxury properties in established tourist destinations like Phuket and Koh Samui are experiencing a slower recovery due to the ongoing international travel restrictions, areas closer to Bangkok or offering a more relaxed pace of life are witnessing increased interest.

The property market is also undergoing a transformation, with a growing emphasis on sustainable developments that incorporate eco-friendly practices and energy efficiency features. This resonates with a new generation of environmentally conscious buyers and aligns with Thailand's commitment to sustainable tourism. Additionally, the integration of PropTech (property technology) is streamlining processes, enhancing transparency, and creating a more user-friendly experience for buyers and investors. Online platforms are facilitating property searches, virtual tours, and digital transactions, while big data analytics are providing valuable insights into market trends and buyer preferences. Finally, the Thai government's potential introduction of targeted initiatives to stimulate specific segments of the property market, such as tax breaks for first-time homebuyers or investment incentives for specific regions, could further influence market dynamics.

With thorough research, professional guidance from experienced real estate agents and legal advisors, and a clear understanding of the evolving market landscape, Thailand's property market can present a compelling opportunity for both domestic and international buyers seeking a property investment, a permanent residence, or a vacation home in this captivating Southeast Asian nation.

Visit our website for more information: https://www.phuket-solicitor.com/property-market-in-thailand/

#property market in thailand#property law in thailand#property lawyers in thailand#properties in thailand#lawyers in thailand#thailand

0 notes

Text

Here are some brief explanations for some of our prompts for ThaiTheKnot2025! (Our other prompts, such as “ceremonies” and “The Pillow Arrangement,” will have dedicated posts.)

🏳️🌈Garland

Floral garlands, generally known as phuang malai (พวงมาลัย) symbolize respect and luck across Thai culture. Garlands and other forms of floral art were historically used in various royal and religious ceremonies and are traditionally made with fresh flowers. Garlands are handmade, with the garland highly symbolic of the patience and attention needed for the threading process. Today, you can find markets and stalls that sell garlands of all shapes, sizes, and arrangement types across Thailand. Some of the flowers used for phuang malai include jasmine, champaca, orchids, marigolds, and gardenias.

For weddings specifically, malai song chai (มาลัยสองชาย) is usually made with jasmine and crown flowers since they are associated with love and happiness. In the Thai wedding ceremony, both bride and groom often wear malai song chai, and other variations of garlands can be worn by other important family members or guests. (macramebynicha)

This is an example of a Lady Pattern Garland, which is a popular choice for weddings. (PraewWedding)

Some beliefs about weddings says that the bride and groom should use only one Malai throughout the whole day and not change it to a fresh pair halfway or something like that so that their marriage would be smooth and have no reason for a fight to happen between them, so they wouldn't have any reason to break up. (Origin Vertical Blog, translated by @recentadultburnout)

🏳️🌈Newlyweds’ house (เรือนหอ)

“A groom moving into a bride's family's house is a traditional way of Thai marriage. Each couple can do whatever they want, of couse. Buying a new place only for themselves is an appealing choice for many of those who can, but I want to point out that a groom marrying in is historically done and a very normal choice in Thai.” (recentadultburnout) One of the traditional choices is the groom builds a new house on the bride's family's property/near the bride parent's house to use as the couple's home after the wedding. Buying one from the parents (sometimes they happen to have several buildings in the same fence) is also ok. (recentadultburnout)

“Traditionally, after the wedding, the banana tree and sugar cane will get planted at the newlyweds' house as a wish for the couple to have a sweet, flourishing life with many children.” (recentadultburnout)

🏳️🌈Ring & Jewelry

“A wedding ring is a western influence, but a popular one. At this point, it's the norm for a married couple to have one.” (recentadultburnout)

“In the process of giving the engagement ring, the groom first puts the ring on the bride, and then the bride bows down to the groom. Like this Link. After that, it's the bride who will put the ring on the groom, followed by the couple bowing down to pay homage to their parents.” (recentadultburnout) Here is a video that shows what a ceremony could look like.

youtube

Typically, when considering the bride’s dowry, jewelry and gold are offered.

🏳️🌈Sinsod Thongman (Dowry)

Dowry, or sinsod thongman, is the practice of a groom paying the family of the bride to ensure the bride’s good status. Dowry and its definitions differ across Asian cultures, but for Thailand, dowry is a social practice that is still widely done. Traditionally, to offer a very sizable and generous dowry means that the groom is financially stable and can care for the bride. To do so also strengthens the connections between groom and bride and their families (Thai Embassy).

The amount of dowry is dependent on several factors, including social status, level of education, and lifestyle of the bride. “When a man and a woman decide to marry, The men will send his parents or recruit elderly men who have a high position in society or may be their respected elder relatives, known as "tâo gàe", to approach the woman's parents in order to ask the woman to be his bride and be the one who talks about the dowry.” (recentadultburnout)

When the proposals are accepted, there is a dowry counting ceremony, in which the parents of the bride will pretend to count the dowry. Some families keep the dowry themselves, but usually, the dowry is given back to the bride and groom and used to start their marital life. (recentadultburnout)

Dowry is usually given in the form of jewelry, gold, and money, but it can take the form of anything valuable.

In a traditional Thai marriage, dowry is expected. However, some modern marriages forgo dowry altogether. Nonetheless, the decision to not have a dowry should be discussed with both families. (Thai Embassy)

🏳️🌈Surname

“The wife's taking her husband's last name after marriage is the most common, but the opposite, or both of them keeping their own last names or even go creating their own new last name, is also an option. As for using both last names, it's not so popular among Thai couples, but it's what quite a few Thai-foreign couples want. This option can be a bit more difficult compared to the others due to its being out of the norm and the process of obtaining it can be confusing, so many people will choose to make their old last names into middle names as a way to keep them instead of actually trying to use both.” (recentadultburnout)

🏳️🌈 What's ThaiTheKnot2025? 🏳️🌈 Guidelines 🏳️🌈 Prompts 🏳️🌈 Discord & Carrd

57 notes

·

View notes

Note

why do you continue to watch gmmtv shows when you clearly don’t enjoy them?

This is the kind of rude, cowardly anonymous ask that I would typically just delete, but I’m in the mood to be generous so I will respond and use it as an educational moment.

I have to start by rejecting your premise. I enjoy plenty of GMMTV shows. My favorite Thai bl of this year is Cherry Magic Thailand. I wrote quite lovingly about it on this hellsite for 12 weeks. I was also a big fan of Cooking Crush and The Trainee this year, Kidnap is giving me joy weekly, and I’m currently in the midst of a really interesting discussion with people far more mature than you about Peaceful Property. GMMTV is also responsible for some of my all time favorite Thai shows including Bad Buddy, 3 Will Be Free, Midnight Museum, Theory of Love, Moonlight Chicken, and Dark Blue Kiss, and many more besides that I liked a lot. You don't know me. You have made the mistake of assuming that because you’ve seen a small fraction of my posts about specific things, you know what I think about all kinds of things. But as my beloved departed grandfather loved to say, when you assume you make an ass out of u and me.

So with that out of the way, let’s get to the real question underneath your logical fallacy: why don’t I keep my mouth shut instead of posting about the flaws I observe in these shows? There are a number of reasons for that.

First, I am extremely open about the fact that I am interested in the art and science of narrative storytelling, and I often post about it from a critical lens. This is all in the pinned post at the top of my blog, but I doubt someone with your lack of manners bothered to look there before sending me this ask.

Second, I don’t believe in the popular fandom idea that all meta discussion of shows should be positive and centered on stanning for actors or pairs and their shows. That's a fine pursuit for folks who enjoy engaging with media that way, but I personally find that boring and intellectually empty, and have very little interest in it. I like to learn from the things I enjoy, and you can't learn if you're not willing to think critically about why something in a story may or may not be working.

Third, my favorite thing about watching media is discussing it with like-minded people, and the way to find like-minded people is to share your honest feelings about what you're watching. I have made some of the best friends of my life by posting my unfiltered thoughts about whatever I'm watching in various social media spaces, and having people come and say "hey, me too" or "I don't quite agree but what an interesting thought." We connect with others through sharing our thoughts and feelings. If you censor yourself in fandom spaces, you will not find your people.

Fourth, on the specific topic of GMMTV: they are the largest and best resourced ql-producing studio in the biggest ql-producing country, and part of a giant media conglomerate that controls much of the media in Thailand. Their shows matter in terms of the influence they have over the rest of the industry, and so the messages they send with their shows also matter. I will never ignore them completely even when I choose not to watch some of their shows, because where they go, the larger ql industry follows. When I see a trend in their shows that is harmful, like, say, the repeated use of marginalized identities for marketing their shows that they then disrespect in the way the stories are executed, that needs to be pointed out and examined, and I am hardly the only one doing so.

I'll end by asking you a question, anon: what did you hope to accomplish by sending me this ask? Unlike many of the other folks who have been engaging in critical discussion with me over the last couple days, you had nothing constructive to say. You didn't put forward an interpretation or share your own feelings, you didn't contribute to the collective analysis process, and you didn't offer any commiseration or even a clear disagreement with anything I said. From where I'm sitting, your only intent was to attempt to shame me for speaking. You will never be successful at that, and it's a pretty ugly impulse that you should examine in yourself. When you find yourself being awful to real human beings because you can't manage your emotions about fictional media, it's time to think about what you're doing here. I hope you'll reflect on that, and take good care.

78 notes

·

View notes

Note

Hi ABL! Can I be what I'm assuming is the 80th person to ask for your analysis about the move of Prem and Boun to GMMTV? Particularly, any thoughts on:

Why did the move happen and does it mean anything that they moved together?

What might this mean for new series with them as a pair and the potential to break up their pairing?

Are there any GMMTV talents that you'd love to see Boun or Prem paired with?

Thanks in advance for any insights!

BounPrem move to GMMTV

DISCUSS!

AKA Thai BL industry speculation, my favorite game!!

I am actually cautiously optimistic about this.

They're an ideal pair for GMMTV to get. Especially if GMMTV continues optioning Japanese IP. These two are beautifully suited to A LOT of yaoi. Just imagine them in a Thai version of Takumi-kun? !

Rise up Broccoli Nation... let's talk kabedons!

Why did the move happened?

From BounPrem's perspective:

I think they've been pretty underserved by their current home and that home is pushing them towards pulps (I refuse to talk about Even Sun and I found Between Us pretty darn disappointing too.) If they want higher quality narratives and content, GMMTV is a better home for them.

Also it will handle their brand better for sponsorship and longevity. I was shocked not to see them on more stuff in Bangkok. Most sponsor gigs and major promos and billboards and such were GMMTV pairs and... ZeeNunew

Right now there are good indication for pairs who WANT to stick together (even while aging up) that GMMTV can handle it - because of what they've done with OffGun and TayNew recently.

It's clear that GMMTV will throw a good pair at decent content (or at least popular stuff) pretty regularly. With GMMTV, BounPrem stand an even better chance at landing a prestige piece, since they have an established fan base.

From the pair's perspective, this is a good career move.

Now, from GMMTV's perspective, let's talk...

Does it mean anything that they moved together?

Yes, it most likely means GMMTV signed them as a BL pair. Some of GMMTV's other hot properties like EarttMix, OffGun, and TayNew clearly want to do (and have done) more than just BL for GMMTV. Even "second levels" like JimmySea are being split for het dramas. It means they lose their BL talent for a good potion of filming season, while they film some other property.

If GMMTV can sign a high value pair that's happy to stay doing BL regularly, that will work very well for them.

ALSO they've add a hot property pair into their stable that's on the EarthMix (highly commercial) level AND willing to do high heat. I think this is key. GMMTV has shown they want to move into sexier stuff (NC-GMMTV?) with things like Moonlight Chicken and Only Friends. VERY few of their existing pairs are willing to go there, and can do it as well as, BounPrem. These 2 do lust and thirst in a way that most GMMTV pairs can't (they are just too brotherly with each other).

I think this is a sign GMMTV want's to enter the after dark market, and move international markets too. (The higher heat stuff tends to be particularly popular outside of Thailand.)

Also, I think it's pretty clear some of GMMTV's hoped for heavy hitters last year (like PerthChimon) aren't working out for them, so it makes sense to onboard a solid bankable pair whole cloth at this juncture.

I said a while ago I thought GMMTV would make a play for ZeeNunew. I didn't have BounPrem on the list as a backup option, but these pairs are kinda similar, and fill the same niche.

Anyway, smart move all 'round, IMHO.

What might this mean for new series with them as a pair and the potential to break up their pairing?

I think the pairing is now less likely to break up than ever.

I think they've possibly been tempted to sign BY a prestige new series carrot. We could get something historical with them in it. Or, like I said, something Japanese IP. Probably higher heat than GMMTV has given us in a full BL.

Eyes Target the Finder thoughtfully. (It was VERY popular when I was over there.)

Are there any GMMTV talents that you'd love to see Boun or Prem paired with?

Like I said, I think GMMTV's objective in signing them would actually be the opposite - NOT to split the pair.

But if you just want me to speculate for fun (and piss stadn off), I'm always happy to do so.

First is great with anyone, so First with either... or both. First is like the MSG of GMMTV, always improves the taste of any dish.

It might be fun to see Jimmy paired with Prem. But in all honestly I really want a Jimmy + Khaotung thing to happen.

I think Mix has some BDE too, so I think he should play the seme for a change, why not him and Prem?

As for Boun, I think he's a little more dependent on the pairing. It's hard for me to imagine him with someone else. Lemme think. Someone with a very soft screen presence, maybe? How about Gun?

Heh he, now I'm just winding ya'll up.

Let me have my foibles.

#fun fun speculation#thai bl#bl industry chat#BounPrem#gmmtv#thai bl branded pairs#smart move gmmtv very smart

133 notes

·

View notes

Text

Thai Elite Visa

The Thai Elite Visa, managed by the Thailand Privilege Card Company Limited under the Ministry of Tourism and Sports, is a government-endorsed residency program. Offering a mix of long-term stay options and exclusive benefits, the visa caters to affluent individuals, retirees, business professionals, and frequent travelers. It combines convenience with lifestyle perks, making it one of Thailand's most attractive residency solutions.

1. Overview of the Thai Elite Visa

The Thai Elite Visa allows for long-term residency ranging from 5 to 20 years, depending on the selected package. It includes multi-entry privileges, expedited immigration processing, and access to premium services, making it ideal for those seeking stability in Thailand without the complexity of visa renewals.

2. Core Benefits

Residency Convenience:

Validity for up to 20 years without the need for frequent renewals.

Simplified annual reporting instead of the standard 90-day reporting for other visa types.

Airport and Travel Services:

Fast-track immigration services at major Thai airports.

Access to luxury airport lounges and personal assistance upon arrival and departure.

Premium Lifestyle Perks:

Discounts at hotels, golf courses, spas, and medical facilities.

Annual health check-ups at leading hospitals in Thailand.

Family-Friendly Options:

Specific packages allow family members to join with reduced fees.

3. Membership Packages

3.1 Elite Easy Access

Duration: 5 years.

Cost: 600,000 THB.

Ideal For: Frequent visitors or those seeking medium-term stays.

3.2 Elite Privilege Access

Duration: 10 years.

Cost: 1 million THB.

Best For: Long-term residents seeking premium lifestyle benefits.

3.3 Elite Superiority Extension

Duration: 20 years.

Cost: 1 million THB.

Focus: Affordable extended residency for long-term stability.

3.4 Elite Ultimate Privilege

Duration: 20 years.

Cost: 2.14 million THB.

Exclusive Features: Additional concierge services, medical benefits, and bespoke support.

3.5 Family Packages:

Elite Family Excursion (5 years): 800,000 THB for two members.

Elite Family Premium (10 years): 1 million THB for the principal member and 800,000 THB per additional family member.

4. Eligibility and Application Process

Eligibility Requirements:

Open to individuals of all nationalities.

Must be at least 20 years old (for some packages).

Applicants must not have a criminal record.

Application Steps:

Document Submission:

Passport copies, completed application form, and recent photographs.

Fee Payment:

Membership fees must be paid upon application approval.

Visa Collection:

The visa can be collected from a Thai embassy, consulate, or immigration office.

5. Limitations of the Thai Elite Visa

No Path to Citizenship:

The visa does not offer a route to permanent residency or Thai citizenship.

Employment Restrictions:

The visa does not include a work permit. Separate applications are required for those intending to work.

Cost Implications:

The upfront fee may not suit those seeking short-term or low-cost residency options.

6. Tax and Legal Considerations

Tax Residency:

Holding a Thai Elite Visa does not automatically make the holder a tax resident. To qualify, the individual must spend at least 180 days annually in Thailand.

Income Tax:

Income earned in Thailand is subject to Thai tax laws.

Re-Entry Permits:

Multi-entry privileges simplify travel, reducing the need for re-entry permits.

7. Contribution to the Thai Economy

Tourism and Hospitality:

Visa holders contribute significantly to Thailand’s tourism and luxury service sectors.

Real Estate Investment:

Many holders invest in condominiums, supporting the property market.

Economic Stability:

The program attracts high-net-worth individuals, adding foreign revenue and promoting local economic activity.

Conclusion

The Thai Elite Visa offers an unparalleled combination of long-term residency, exclusive services, and premium benefits, making it ideal for those looking to establish a stable presence in Thailand. While it comes with a significant financial commitment, the visa's convenience and lifestyle advantages make it a worthwhile investment for those who meet its criteria. Applicants are encouraged to consult with legal and financial experts to fully understand their options and responsibilities.

#thailand#thai#visa#thaivisa#immigration#immigrationlawyers#immigrationinthailand#immigrationlawyersinthailand#elitevisa#thaielitevisa#visainthailand#visathai

3 notes

·

View notes

Text

Thailand Permanent Residency

Thailand's permanent residency (PR) framework originates from the 1927 Alien Registration Act, with major reforms occurring in:

1950 Immigration Act (established modern categories)

1979 Immigration Act (current statutory basis)

2008 Nationality Act amendments (tightened naturalization pathways)

1.2 Jurisdictional Authorities

Primary Oversight: Ministry of Interior (Section 37 Immigration Act)

Implementation: Immigration Bureau (Division 1, Section 3)

Adjudication: Special Committee chaired by Permanent Secretary for Interior

1.3 Relevant International Obligations

While Thailand maintains strict immigration controls, certain bilateral agreements influence PR considerations:

ASEAN agreements on skilled labor mobility

US-Thai Treaty of Amity (limited PR implications)

Japan-Thai Economic Partnership (special professional categories)

2. Eligibility Matrix

2.2 Qualitative Assessments

Character Evaluation:

Police clearance from all countries of residence

Neighborhood certification (conduct verification)

Employer/associate testimonials

Integration Metrics:

Thai language proficiency (CEFR A1 minimum)

Cultural knowledge exam (80% pass mark)

Community participation evidence

3. Procedural Architecture

3.1 Document Preparation Protocol

Core Documentation:

Visa History: Certified copies of all visas + entry stamps

Financial Evidence:

Bank statements (6 months, certified)

Tax records (RD.90 forms)

Investment certificates (BOI/SEC approved)

Supporting Materials:

Property Documents: Chanote + household registration

Employment Verification:

Work permits (all versions)

Social fund records

Company financials (for business owners)

4. Financial and Tax Considerations

4.1 Cost Structure Analysis

Official Fees:

Application fee: THB 7,600

Approval fee: THB 191,400

Alien book: THB 800 (annual)

Re-entry permit: THB 3,800 (single), THB 9,800 (multiple)

Unofficial Costs:

Document procurement: THB 15,000-50,000

Legal representation: THB 100,000-500,000

Expediting services: Market rate THB 200,000+

4.2 Tax Implications

Pre-PR: Only Thai-sourced income taxable

Post-PR: Worldwide income potentially taxable (if remitted)

Wealth Tax: None currently, but property transfer taxes apply

5. Rights and Privileges

5.2 Occupational Restrictions

Registered Profession Requirement: Must work in field specified at application

Business Ownership: Permitted but requires MOI notification

Government Employment: Prohibited without special approval

6. Judicial and Administrative Review

6.1 Appeal Process

Rejection Appeals: 30 days to file with Immigration Commission

Judicial Review: Available at Administrative Court

Success Rates: <15% for appeals, <5% for judicial review

6.2 PR Revocation

Grounds include:

Criminal conviction (1+ year sentence)

Tax evasion findings

Extended overseas absence (5+ years)

National security concerns

7. Strategic Application Approaches

7.1 Category Optimization

Employment Track: Ideal for corporate executives (minimum THB 150k salary preferred)

Investment Route: Best for property developers (BOI projects favored)

Family Path: Most reliable for long-term married couples (10+ years marriage ideal)

7.2 Document Enhancement Strategies

Tax Augmentation: Voluntary additional tax payments to demonstrate commitment

Community Engagement: Documented volunteer work with registered charities

Language Certification: Official CU-TFL test scores preferred over immigration exam

8. Comparative Regional Analysis

8.2 Global Benchmarks

Processing Time: Thailand (3-5 yrs) vs Canada (1.5 yrs)

Cost: Thailand (~6K)vsUK( 6K)vsUK( 3K)

Success Rate: Thailand (8%) vs Australia (25%)

9. Emerging Trends and Reforms

9.1 Digital Transformation

E-Application Pilot: Limited testing in Bangkok

Blockchain Verification: For document authentication

Automated Background Checks: Integration with INTERPOL databases

9.2 Policy Shifts

Talent-Centric Quotas: Increasing STEM professional allocations

Retirement PR Pathway: Under consideration for high-net-worth retirees

Dual Citizenship Tolerance: Parliamentary study underway

10. Practical Challenges and Solutions

10.1 Common Obstacles

Document Procurement: Especially for older visa records

Bureaucratic Delays: Particularly at verification stage

Exam Preparation: Lack of standardized study materials

10.2 Mitigation Strategies

Early Retention: Engage immigration lawyer at least 2 years pre-application

Parallel Processing: Initiate document requests simultaneously

Mock Examinations: Utilize private language schools for test prep

11. Longitudinal Case Studies

11.1 Successful Applications

Tech Executive: Approved in 3.5 years via employment track

THB 250k monthly salary

Certified Thai language proficiency

BOI-company sponsorship

Investor: Approved in 4 years via property route

THB 25M Bangkok condo portfolio

Additional THB 5M government bonds

Documented charity contributions

11.2 Rejection Analysis

Common Factors:

Inconsistent tax payments (78% of failed cases)

Language test failures (62%)

Suspicious financial patterns (45%)

12. Future Outlook

12.1 Projected Reforms

Points-Based System: Under consideration (2026 target)

Premium Processing: THB 500k+ for expedited review

Regional PR Options: Special economic zone programs

12.2 Demographic Impacts

Current PR holder demographics:

Chinese: 32%

Japanese: 18%

Western: 22%

Other Asian: 28%

13. Conclusion: Strategic Imperatives

Thailand's PR system remains: ✔ Highly exclusive (0.03% approval rate) ✔ Process-intensive (1000+ document pages typical) ✔ Discretionary in nature (despite codified rules)

Critical success factors:

Early preparation (3-5 year horizon)

Comprehensive documentation

Professional guidance

Financial commitment

The program continues evolving toward:

Greater transparency in decision-making

Enhanced digital infrastructure

Strategic alignment with economic development goals

Prospective applicants should monitor:

Annual quota announcements (December)

Ministerial regulation changes

Judicial rulings on PR-related cases

#thailand#visa#immigration#thaivisa#thailandvisa#visainthailand#thaipr#thaipermanentresidency#thailandpermanentresidency#immigrationinthailand#thaiimmigration

2 notes

·

View notes

Text

Good News - March 22-28

(Edit to update support link) Like these weekly compilations? Tip me at $kaybarr1735 or check out my Dandelion Doodles!

1. Scimitar-horned Oryx: A Story of Global Conservation Success

“Eight years following the first reintroductions of the species in a protected range in Chad, the species has been downlisted to ‘Endangered’ [an improvement from “extinct in the wild”] in the most recent IUCN Red List update.”

2. Thailand moves closer to legalising same-sex marriage

“Under the law, it describes a marriage union as one between two individuals, rather than a man and a woman. It will give LGBTQ+ couples the ability to adopt, have equal access to marital tax savings, rights to property and the ability to decide medical treatment when their partner is incapacitated.”

3. Juvenile platypus found in NSW: a sign of breeding success

“A baby platypus was discovered in the Royal National Park less than a year after 10 were reintroduced to the area, marking the end of a half-century local extinction. […] “Finding the juvenile platypus is a clear sign the reintroduced population is not just surviving but thriving, adapting well to their environment, and contributing to the genetic diversity and resilience of this iconic species.””

4. New Laws Protect Bird-Friendly Yards From Neighborhood Rules

“A blossoming legislative trend prevents homeowners associations, which set landscaping rules for a growing number of Americans, from forbidding native plants.”

5. Bookstores Around The World Are Flourishing Again

“[I]t’s not just the major chains like Barnes & Noble that are flourishing, as the US book sales market continues to both grow and diversify, the majority of the retail book market is controlled by small indie stores.”

6. 'Like a luxury condominium': Providence zoo unveils new red panda habitat

“"Kendji and Zan's new home boasts a spacious two-story, climate-controlled indoor space designed to mimic their natural Himalayan habitat," the zoo said in a news release. "This ensures their well-being regardless of fluctuating Rhode Island temperatures and humidity."”

7. The first CULTIVATE Mobile Research Lab on food sharing in Barcelona

“[Volunteers] engaged in growing, cooking and eating food together, and redistributing surplus food, as well as other actors involved in food sharing and sustainable food systems in Barcelona and its surroundings.”

8. New Methane Rule Will Reduce Natural Gas Waste, Generate Money for Taxpayers, Help Address Climate Change

“The Bureau of Land Management’s final rule on reducing methane waste from oil and gas production on public lands will conserve critical energy resources, with the added benefit of decreasing toxic pollution [….] The rule will benefit wildlife, public lands, water resources, and nearby communities. By requiring royalties for wasted methane, the rule will also generate more than $50 million each year for American taxpayers.”

9. 'Exceptional' Two-Headed Snake Undergoes Surgery in Missouri

“Tiger-Lily's [the snake’s] abnormal ovaries were then removed during surgery at the Saint Louis Zoo Endangered Species Research Center and Veterinary Hospital on March 11. The procedure went smoothly, with her ovaries being successfully removed, and the snake is recovering well.”

10. Aruba Embraces the Rights of Nature and a Human Right to a Clean Environment

“A draft constitutional amendment would make the Carribean nation the second country in the world to recognize that nature has the right to exist.”

March 15-21 news here | (all credit for images and written material can be found at the source linked; I don’t claim credit for anything but curating.)

#hopepunk#good news#deer#conservation#endangered#animals#africa#thailand#lgbtq#gay rights#gay marriage#same sex marriage#platypuses#australia#hoa#native plants#wildflowers#bookstore#books#zoo#red panda#barcelona#spain#food#food insecurity#interdependence#natural gas#climate change#snake#palm beach

7 notes

·

View notes

Text

By: Keith Woods

Published: Jul 2, 2023

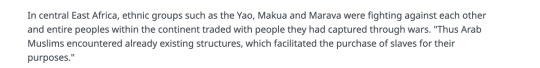

A look at slavery outside of the West

It has become popular to blame White people for slavery, to the point that many actually believe slavery was invented by or exclusively practiced by Europeans.

But the history of slavery outside the West is far more brutal.

The Arab slave trade emerged in the 7th century, 10 centuries before the Atlantic slave trade

Arabs sold Africans to the Middle East for a variety of jobs such as domestic work or harem guards - castrating male slaves was common, causing over half of males to bleed to death

The Arab slave trade was particularly brutal: it's estimated that 3/4 captured slaves died before they reached the market for sale

Historians estimate that between 10 and 18 million people were enslaved by Arab slave traders, including women and children taken as concubines.

Arabs did not create the slave trade out of nothing, in fact, enslaving conquered tribes was already common practice in Central Africa when they arrived.

The West African Songhai Empire relied heavily on captured slaves in all levels of society, even as soldiers.

Africans themselves also played a large role in facilitating the trans-Atlantic slave trade.

African tribes conducted raids on rival groups to provide slaves for sale. African middlemen facilitated trade between European traders and African suppliers.

The Arabs also had a slave trade in Europe. Estimates are that up to 1.25 million Europeans were enslaved by Barbary pirates, who would raid villages in coastal countries like Italy, France, England and Ireland, bringing them to North Africa for sale.

In some cases entire villages would be captured, such as the Irish coastal village of Baltimore, entirely raided in 1631.

These slaves faced a brutal future, engaging in hard labour or sexual servitude, and spending nights hot and overcrowded prisons called bagnios.

Many slaves captured by Barbary pirates were sold eastwards into the Ottoman Empire. Slavery was central to the Ottoman Empire, most towns had dedicated slavery markets called Yesirs.

Slaves came from Africa, the Caucasus, the Balkans and Eastern & Southern Europe.

Sexual slavery was a big part of Ottoman society. Slavic women were popular slaves, and Köçeks became a popular source of entertainment in the 19th century:

These were young boys, usually from European backgrounds, who were circumcised, cross-dressed and trained as dancers.

Hereditrary slavery is recorded in China dating back to the Xia Dynasty in 2100 BC. Africans purchased on the Silk Road were used as a sign of wealth.

After Chinese law began to treat women as property around 1000AD it was common to sell daughters and sisters into slavery.

The Mongols enslaves tens of thousands of Chinese as punishment for resistance.

In the post-Mongol Ming Dynasty, thousands of slaves were employed to do bureaucratic jobs for the government, and rich families also employed thousands of slaves to perform menial labour.

Slavery was common in American civilizations like the Aztec and Maya

Among the Aztecs, slavery was a punishment for a variety of crimes or even failure to pay taxes. Husbands and wives sold each other in times of economic hardship. Slaves were identified by wooden collars.

Slavery was also common practice in the civilizations of South-East Asia.

The Khmer Empire had a massive slave class that did much of the work building monuments like Angkor Wat. Historians estimate 25-35% of the population of Thailand/Burma were slaves in the 17th century.

Slavery also existed among Native American tribes. Slavery was common practice among Northwest tribes like the Tlingit, for whom one third of their population during the mid-1800s were slaves.

Various tribes practiced debt-slavery and enslaved captives of other tribes.

The only difference between these cases of slavery and that practiced by Europeans is that Europeans abolished slavery on humanitarian grounds, and spread this across the globe.

The intense focus on the White role in slavery is a product of widespread Anti-White animus.

==

American exceptionalism comes in two varieties: "we're exceptionally virtuous," and "we're exceptionally evil."

Both rely on lying about or being ignorant of history.

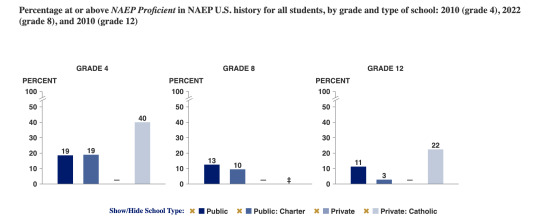

https://www.nationsreportcard.gov/dashboards/schools_dashboard.aspx

And that's just American history. Can you imagine world history?

#Keith Woods#slavery#history#history of slavery#exceptionalism#American exceptionalism#inverted exceptionalism#religion is a mental illness

26 notes

·

View notes

Text

On an island in the Singapore Strait, a thicket of apartment blocks peers mournfully over the sea. A corps of green-shirted gardeners dutifully tends the lawns and herbaceous borders along the roadside. A few cars slip along smooth roads to a commercial center with gleaming marble floors. Amidst the hundreds of closed shopfronts three restaurants are open—a fried chicken chain, a small café, and a gleaming and empty hot pot restaurant. Five duty-free shops are doing better business; some young men are stocking up on beer and Copper Dog whiskey at 11 a.m.

Welcome to Forest City: planned residents, 700,000; current residents, roughly 9,000. Launched in 2014 as part of China’s Belt and Road Initiative, the mega-project is headed by once-real estate giant Country Garden, a behemoth that now sits on the edge of bankruptcy.

At first glance, the project seems yet another tale of a ghost-city built on the back of a Chinese real estate bubble—and then doomed by the COVID-19 pandemic and economic slowdown. Yet Forest City’s story is also a deeply Malaysian tale, involving property-speculating sultans, nationalist politicians, and the country’s complex relationship with Beijing and its own ethnically Chinese minority.

Building a new city to lodge hundreds of thousands of residents on four new artificial islands in the Singapore Strait was always an ambitious venture. But the main market was not locals, but rather speculative buyers from the People’s Republic of China. When sales opened in December 2015, buyers flooded in, many of them buying “pre-sales” of uncompleted apartments. “You’d have buses coming over from Singapore every day filled with people who just landed,” said Tan Wee Tiam, head of research at KGV International Property Consultants. “There were over 1,000 agents in the sales hall, and it still wasn’t enough. … You felt like you were in China.”

Buyers were often looking for not a permanent residence but an investment that could also be a potential holiday home, or accommodation for children who were headed to study in Singapore. Some were reportedly even offered the opportunity to buy a flat in China and get one free in Forest City, said Christine Li, head of research in the Asia-Pacific for Knight Frank.

Yet this reliance on the Chinese buyers also left the project brutally exposed to changes in Chinese policy. The first blow came in 2017, when the Chinese government suddenly imposed capital controls preventing individuals from moving more than $50,000 out of the country annually. The minimum price of a Forest City apartment sits at around $75,000 and can be as much as $3.5 million. Then came the pandemic years which froze international travel—and stamped hard on Chinese real estate and growth.

Yet, Forest City’s staff seem to be holding out hope. Shane Lim, a hire from Singapore, showed me around and assured me that the place is working to attract buyers from across the world, including the Middle East, Indonesia, and Thailand. Still, he estimated that about 70 percent of his colleagues in the sales team are from China.

Halfway through my tour, a Malaysian man calling himself Ozzy introduced himself and his two wives. Now living in the United States, he’s searching for a place to buy in Malaysia that he can use to visit his daughter in Singapore and rent out when he’s away. Looking around, though, he’s unconvinced.

“Look at how empty this place is,” he said. “I’d only be able to rent it out for one or two months a year. … When I visited in 2018 this place was packed. Now there’s no one here. It’s like it’s haunted.” Lim stared at his shoes until Ozzy moved off. He then firmly assured me that the sales hall is busier on weekends.

A wet Wednesday afternoon might not be a peak sales period, but it is hard to escape the reality that the putative new city is barely lived in. Surveying one of the towers I descend from the 34th floor to the first, looking for signs of occupancy—a pair of shoes at the door, furniture seen through the windows that face the corridor, or even just curtains drawn over said windows. The place is eerily well maintained but empty. Just 25 of the 390 flats show any signs of current occupancy.

I met a single resident, a Malaysian Indian woman who said she lived in Forest City with her husband. Declining to give her name, she informed me a neighboring tower is busier. That would not be hard to believe. Some floors in this tower were completely empty with flats whose doors open to the touch, revealing light-filled marble interiors into which dead leaves have blown. Others had notices of a residents’ meeting dated October 2022 still taped to the door.

According to Li, there are signs that buyers may be slowly coming back. But she also suggested that Country Garden might have aimed too high, used to China’s experience of breakneck speed urbanization, supported by strong government support for infrastructure development. That policy created plenty of “ghost cities” in China itself—but until the recent real estate crisis, also huge profits.

Forest City has also suffered from being a political football since its launch, something Country Garden may well not have anticipated. “I did notice Chinese developers tend not to focus on the political climate,” Li said. “They are not used to the idea of general elections, change of government, and change of policies overnight.”

Despite its vast scale, the first time locals heard about Forest City was in 2014, when fisherman woke up one day to find barges dumping sand off the coast. Newspapers dug into the story, revealing that Country Garden’s main partner was none other than the sultan of Johor state, Ibrahim Ismail.

The tie made sense. Many businesses take on Johor royals as partners, benefiting from the influence they wield in the state. The Malaysian government is also bent on transforming southern Johor into a new economic hub, the Shenzhen to Singapore’s Hong Kong. The city was made a duty-free zone. When further investigations also revealed rushed environmental reviews, it took diplomatic protests from Singapore for the central government to intervene and ensure the proper process was followed.

However, things began to shift when the Malaysian government’s grip on power loosened. Rocked by the world’s largest corruption scandal, the China-linked 1Malaysia Development Berhad, voters turned against it. And at 93 years old, former Malaysian Prime Minister Mahathir Mohamad exited retirement to lead an opposition filled with former opponents, previously imprisoned under his watch, against a government coalition he once led for 22 years.

Forest City became one of Mahathir’s favorite targets. Inveighing against government corruption and waste, he accused the government of planning to sell out Malaysia to foreigners. Most provocatively, he claimed that the thousands of mainly Chinese buyers of Forest City apartments would be allowed to settle, become Malaysian citizens, and vote in its elections. In a country where ethnically Chinese make up 23 percent of the citizenry—and are often stereotyped as wielding undue political influence due to their wealth—the claim was explosive.

After his shock triumph in the 2018 elections, then-Prime Minister Mahathir followed through on his threats declaring that foreigners would not be allowed to buy property in Forest City. Despite legal challenges, the announcement apparently hit Forest City sales hard.

Five years and a series of dizzyingly complex political maneuvers later, the current Malaysian government is led by Prime Minister Anwar Ibrahim. His support is mainly built by ethnic minority-backed parties that triumphed in 2018. To secure his grip on power he needs two things. The first is economic growth. The second is increased support from Malay voters, to which end he has courted the sultans who act as power brokers in their states and take turns acting as Malaysia’s head of state. Perhaps none is more influential than the sultan of Johor, who started his five-year tenure in February this year.

In this context, Anwar seems to have rediscovered the charm of Chinese investment, and Forest City. He has repeatedly praised the Belt and Road Initiative, and in August last year he announced Forest City would be designated a special financial zone with residents offered multiple-entry visas, fast-track entry for those working in Singapore, and a flat income tax rate of 15 percent.

The sultan of Johor has also suggested reviving a proposed high-speed rail link between Malaysia’s capital of Kuala Lumpur and Singapore, with an extra stop at Forest City. And who knows what will happen. After, all the $10.5 billion Melaka Gateway project—launched under the Belt and Road Initiative and apparently scrapped in 2020—is also back underway, after finding new support from the state and federal governments. The developer behind the project recently acquired a major new shareholder, the sultan of Johor.

But the heyday of Chinese investment in Malaysia may well not be coming back. Ten years since China launched the Belt and Road Initiative, it has begun to pull back sharply on its overseas investments. China’s own economic slowdown and business wariness about the increasingly capricious regulatory environment is part of the story. But, the large number of projects gone sour also appears to have made Chinese investors more wary.

Meanwhile, Malaysia is struggling not to get left holding the bag. Should Country Garden go bankrupt, it’s uncertain what will happen to Forest City. At that point the Malaysian government could face the unpalatable option of a potential bailout by the Chinese government, leaving a chunk of Malaysian land in Beijing’s hands. Alternatively, it could step in itself—becoming the proud proprietor of what the developers still proclaim to be “A Prime Model for Future Cities.”

6 notes

·

View notes

Text

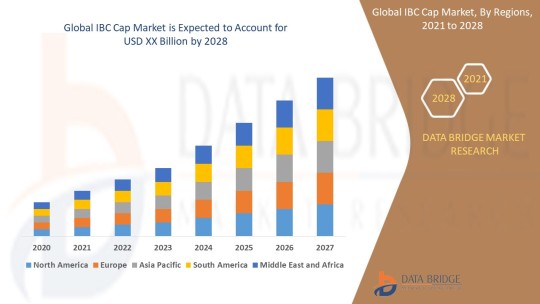

IBC Cap Market Size, Share, Trends, Growth and Competitive Analysis

"IBC Cap Market – Industry Trends and Forecast to 2028

Global IBC Cap Market, By Product Type (Flange, Plugs, Vent-in Plug, Vent-out Plug and Screw closure), Type (Plastic IBC, Metal IBC and Composite IBCs), Material Type (Plastics, Metal, Aluminium and Steel), End Use (Chemicals & Fertilizers, Petroleum & Lubricants, Paints, Inks & Dyes, Food & Beverage, Agriculture, Building & Construction, Healthcare & Pharmaceuticals and Mining), Application (Food And Drinks, Chemical Industry, Oil and Agriculture), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028

Access Full 350 Pages PDF Report @

The global IBC cap market is expected to witness significant growth over the forecast period due to the increasing demand for intermediate bulk containers (IBCs) in various industries such as chemicals, food and beverages, pharmaceuticals, and others. The IBC caps play a crucial role in ensuring the safe storage and transportation of liquid products. The market growth is also being driven by technological advancements in IBC cap designs, such as tamper-evident seals and spouts for easy dispensing. Additionally, the growing focus on sustainability and recyclability of packaging materials is further boosting the adoption of IBC caps made from eco-friendly materials.

**Segments**

- Based on material type, the IBC cap market can be segmented into plastic, metal, and others. Plastic caps are widely used due to their lightweight nature and cost-effectiveness. - By cap type, the market can be categorized into screw caps, snap-on caps, and flip-top caps. Screw caps are preferred for their secure sealing properties. - On the basis of end-user industry, the market can be divided into chemicals, food and beverages, pharmaceuticals, and others. The chemicals segment is anticipated to hold a significant market share due to the widespread use of IBCs for storing chemical products.

**Market Players**

- TPS Industrial Srl - Schuetz GmbH & Co. KGaA - Mauser Packaging Solutions - Time Technoplast Ltd - Berry Global Inc. - THIELMANN UCON AG - Precision IBC, Inc. - Peninsula Packaging LLC

These market players are actively involved in strategic initiatives such as product launches, partnerships, and acquisitions to strengthen their market presence and expand their product offerings. The competitive landscape of the IBC cap market is characterized by intense competition, prompting companies to focus on innovation and quality to gain a competitive edge.

The Asia-Pacific region is expected to witness substantial growth in the IBC cap market, driven by the rapid industrialization and the increasing adoption of IBCsThe Asia-Pacific region represents a significant growth opportunity for the global IBC cap market due to several key factors. With rapid industrialization and the expanding manufacturing sector in countries like China, India, and Southeast Asia, there is a growing demand for efficient storage and transportation solutions, including IBCs and their associated caps. The increased focus on chemical production, food processing, and pharmaceutical manufacturing in the region further fuels the need for reliable packaging solutions like IBC caps. As these industries continue to grow, the adoption of IBC caps is expected to rise, driving market expansion in the Asia-Pacific region.

Moreover, the emphasis on enhancing safety standards and ensuring product integrity is a crucial factor contributing to the growth of the IBC cap market in Asia-Pacific. Regulations regarding the safe handling and transportation of hazardous chemicals and pharmaceuticals necessitate the use of high-quality caps that can effectively seal and protect the contents of IBCs. As companies in the region strive to comply with stringent regulatory requirements, the demand for advanced and secure IBC caps is projected to increase significantly.

Additionally, the shift towards sustainability and eco-friendly practices is another trend shaping the IBC cap market in Asia-Pacific. With growing environmental concerns and increasing awareness about plastic pollution, there is a rising preference for IBC caps made from recyclable and biodegradable materials. Market players in the region are focusing on developing sustainable packaging solutions to meet the evolving consumer demands and align with global sustainability goals. This shift towards eco-friendly IBC caps not only addresses environmental concerns but also presents market players with opportunities to differentiate their offerings and attract environmentally conscious customers.

Furthermore, the competitive landscape of the IBC cap market in Asia-Pacific is characterized by the presence of both local manufacturers and international players. Local companies often have a strong understanding of regional market dynamics and customer preferences, giving them a competitive advantage in catering to specific industry needs. On the other hand, multinational companies bring technological expertise and a wide product portfolio, which can appeal to a broader customer base seeking innovative and**Global IBC Cap Market, By Product Type**

- Flange - Plugs - Vent-in Plug - Vent-out Plug - Screw closure

**Type**

- Plastic IBC - Metal IBC - Composite IBCs

**Material Type**

- Plastics - Metal - Aluminium - Steel

**End Use**

- Chemicals & Fertilizers - Petroleum & Lubricants - Paints, Inks & Dyes - Food & Beverage - Agriculture - Building & Construction - Healthcare & Pharmaceuticals - Mining

**Application**

- Food And Drinks - Chemical Industry - Oil and Agriculture

The Global IBC Cap market is experiencing significant growth due to the rising demand for intermediate bulk containers across various industries. Plastic caps are increasingly preferred for their lightweight and cost-effective nature, driving market growth within the material type segment. Screw caps, known for their secure sealing properties, dominate the cap type category. The chemicals segment is anticipated to hold a substantial market share among end-user industries, attributed to the widespread use of IBCs for chemical storage. The market players in the industry are focusing on strategic initiatives like product launches and partnerships to enhance their market presence and offerings. The competitive landscape is intense, spurring companies to innovate and prioritize quality for a competitive advantage.

In Asia-Pacific, the IBC cap market is poised for robust growth fueled by rapid industrialization and the expanding manufacturing sector, particularly in countries like China,

Countries Studied:

North America (Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru, United States, Rest of Americas)

Europe (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Russia, Spain, Sweden, Switzerland, United Kingdom, Rest of Europe)

Middle-East and Africa (Egypt, Israel, Qatar, Saudi Arabia, South Africa, United Arab Emirates, Rest of MEA)

Asia-Pacific (Australia, Bangladesh, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Sri Lanka, Thailand, Taiwan, Rest of Asia-Pacific)

Key Coverage in the IBC Cap Market Report:

Detailed analysis of IBC Cap Market by a thorough assessment of the technology, product type, application, and other key segments of the report

Qualitative and quantitative analysis of the market along with CAGR calculation for the forecast period

Investigative study of the market dynamics including drivers, opportunities, restraints, and limitations that can influence the market growth

Comprehensive analysis of the regions of the IBC Cap industry and their futuristic growth outlook

Competitive landscape benchmarking with key coverage of company profiles, product portfolio, and business expansion strategies

TABLE OF CONTENTS

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Research Methodology

Part 04: Market Landscape

Part 05: Pipeline Analysis

Part 06: Market Sizing

Part 07: Five Forces Analysis

Part 08: Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers and Challenges

Part 13: Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Browse Trending Reports:

Calcium Glycinate Market Retinal Biologics Market Facial Fat Transfer Market Angio Suites Diagnostic Imaging Market Adoption Of Benelux Power Tools Market De Quervains Tenosynovitis Treatment Market Biodetectors And Accessories Market Colposcope Market Sports Medicine Market Automotive Adhesives Market Infrared Imaging Market Vapour Deposition Market Professional Diagnostics Market Ct Scanner Market Programmable Application Specific Integrated Circuit Asic Market Hospital Operating Room Or Products And Solutions Market Castor Oil Market Zika Virus Infection Drug Market Toluene Diisocynate Market Antibiotic Resistance Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]"

2 notes

·

View notes

Text

Thailand Long-Term Resident Visa

Thailand's Long-Term Resident Visa offers a gateway to a relaxed and fulfilling lifestyle in the Land of Smiles. This visa provides individuals with the opportunity to reside in Thailand for an extended period, enjoying the country's vibrant culture, stunning landscapes, and affordable cost of living.

Eligibility Criteria and Application Process

To qualify for the Long-Term Resident Visa, applicants must meet specific criteria, including:

Age: Be at least 50 years old.

Financial Stability: Demonstrate a monthly income of at least 50,000 Thai Baht or its equivalent.

Health Insurance: Have health insurance coverage that includes hospitalization and outpatient treatment.

No Criminal Record: Have no criminal convictions.

The application process involves submitting various documents, such as:

Passport and visa application forms

Proof of income

Health insurance certificate

Police clearance certificate

Recent passport-sized photographs

Once submitted, the application is reviewed by the Thai immigration authorities. The processing time may vary, but generally, it takes a few weeks to receive a decision.

Benefits of the Long-Term Resident Visa

The Long-Term Resident Visa offers several advantages to its holders, including:

Multiple-Entry: Enables multiple entries into Thailand within a year.

Extended Stay: Allows for a stay of up to one year per visit.

Dependents: Permits the inclusion of dependents, such as spouse and unmarried children under 20 years old.

Work Permit Exemption: Exempts visa holders from the requirement to obtain a work permit for certain activities, such as consulting or freelance work.

Tax Benefits: Offers potential tax advantages for individuals who meet specific criteria and are considered non-resident taxpayers.

High-Quality Healthcare: Provides access to Thailand's world-class healthcare facilities and services.

Vibrant Lifestyle: Offers a unique cultural experience and a high quality of life in a tropical paradise.

Living in Thailand on a Long-Term Resident Visa

Thailand offers a diverse range of living options to suit various preferences and budgets. From bustling cities like Bangkok to serene coastal towns like Phuket, there is something for everyone.

The cost of living in Thailand is generally lower than many Western countries, making it an affordable destination for retirees and digital nomads. Housing options include condominiums, villas, and rental properties.

The Thai culture is known for its warmth, hospitality, and respect for tradition. Expats can immerse themselves in the local way of life by learning the Thai language, exploring traditional markets, and participating in cultural events.

Considerations for Obtaining a Long-Term Resident Visa

While the Long-Term Resident Visa offers many benefits, it is essential to consider the following factors before applying:

Financial Requirements: Ensure that you meet the minimum income requirements and can maintain a comfortable lifestyle in Thailand.

Healthcare Coverage: Verify that your health insurance meets the necessary criteria and provides adequate coverage for your needs.

Tax Implications: Understand the potential tax implications of residing in Thailand as a non-resident taxpayer.

Lifestyle Preferences: Consider whether Thailand's culture and way of life align with your personal preferences and expectations.

The Long-Term Resident Visa presents an excellent opportunity for individuals seeking a fulfilling and enjoyable lifestyle in a tropical paradise. By carefully considering the eligibility criteria, benefits, and potential challenges, you can make an informed decision about whether this visa is the right choice for you.

#thailand#thailand law firm#thailand long-term resident visa#thailand visa#immigration in thailand#immigration lawyers in thailand#lawyers#immigration

2 notes

·

View notes

Text

The building market in Phuket is distinct. There are local area legislations, tax guidelines, and building civil liberties that differ from those in various other component of Thailand or your home nation. If you're new to investing or even possessing home in Phuket, navigating these lawful complexities could be daunting.

Inter Property Phuket

137, 7, Rawai, Mueng, Phuket 83130, Thailand

0959467668

3 notes

·

View notes

Text

Mergers & Acquisitions in Thailand

Thailand has witnessed a surge in mergers and acquisitions (M&As) activity in recent years, driven by various economic factors and strategic considerations. This trend has been fueled by both domestic and international companies seeking to expand their operations, gain market share, and capitalize on the country's economic growth.

Key Drivers of M&A Activity in Thailand

Economic Growth: Thailand's robust economic growth, coupled with its strategic location in Southeast Asia, has made it an attractive destination for foreign investors.

Favorable Government Policies: The Thai government has implemented supportive policies to encourage foreign investment, including tax incentives and streamlined regulatory processes.

Rising Consumer Spending: The growing middle class in Thailand has led to increased consumer spending, creating opportunities for businesses in various sectors.

Strategic Acquisitions: Companies are seeking to acquire businesses with complementary products, services, or distribution networks to enhance their market position.

Synergy Benefits: Mergers and acquisitions can create synergies by combining resources, expertise, and customer bases, leading to cost reductions and revenue growth.

Popular Sectors for M&A Activity

Automotive: The Thai automotive industry has been a major target for M&A activity, with both domestic and international players seeking to expand their manufacturing capabilities and market share.

Real Estate: The booming real estate sector in Thailand has attracted significant investment, with foreign companies acquiring properties and developing projects.

Energy: The energy sector has been another focus of M&A activity, as companies look to secure access to resources and expand their operations in the region.

Technology: The technology sector has seen a rise in M&A deals, driven by the increasing demand for digital solutions and services.

Consumer Goods: The consumer goods sector has been a popular target for M&A activity, with companies seeking to tap into the growing Thai market and expand their product offerings.

Challenges and Considerations

While Thailand offers numerous opportunities for M&A activity, there are also challenges to be considered. These include:

Regulatory Framework: Navigating the regulatory landscape can be complex, requiring careful consideration of legal and compliance issues.

Cultural Differences: Understanding and adapting to cultural differences is essential for successful M&A transactions.

Due Diligence: Conducting thorough due diligence is crucial to identify potential risks and ensure a smooth integration process.

Valuation: Accurately valuing target companies can be challenging, especially in emerging markets.

Despite these challenges, Thailand's M&A market is expected to continue to grow in the coming years, driven by favorable economic conditions and increasing foreign investment. As the country's economy expands and its market becomes more sophisticated, M&A activity will likely play an even more significant role in shaping its business landscape.

#thailand#Mergers & Acquisitions in Thailand#corporate in thailand#corporate lawyers in thailand#lawyers in thailand

2 notes

·

View notes

Text

Property Leasehold in Phuket

Phuket, Thailand, with its pristine beaches, vibrant culture, and thriving tourism industry, has long been a popular destination for foreigners seeking to invest in or rent property. While the process of leasing property in Phuket can be relatively straightforward, it's essential to understand the nuances and legal considerations to ensure a smooth and successful experience.

Understanding the Types of Leases

Short-Term Leases (30 days or less): These are typically used for vacation rentals and are generally managed by property management companies. They offer flexibility but often come with higher rental rates.

Long-Term Leases (1 year or more): These are more common for individuals seeking a permanent or semi-permanent residence in Phuket. They provide stability and can often result in lower rental rates.

Key Considerations for Foreigners

Lease Agreement: A well-crafted lease agreement is crucial to protect your interests. Ensure it clearly outlines the rental amount, duration, maintenance responsibilities, security deposit, and dispute resolution procedures.

Visa Requirements: Your visa status will significantly impact your ability to lease property. While some visas allow for long-term residency, others may have restrictions. Consult with immigration authorities to determine the appropriate visa for your circumstances.

Property Management: Consider hiring a reputable property management company to handle day-to-day tasks like rent collection, maintenance, and tenant disputes. This can save you time and effort, especially if you're not residing in Phuket full-time.

Local Laws and Regulations: Familiarize yourself with Thai property laws and regulations, including tenancy agreements, rent control, and dispute resolution processes. It's advisable to consult with a local lawyer to ensure compliance.

Rental Market Analysis: Research the rental market in your desired area to understand current rental rates, demand, and trends. This information can help you negotiate favorable terms and make informed decisions.

Cultural and Social Norms: Be mindful of Thai cultural and social norms, especially regarding tenant-landlord relationships. Respecting local customs can contribute to a harmonious living environment.

Tips for Successful Property Leasing

Thorough Inspection: Before signing a lease, conduct a thorough inspection of the property to identify any existing issues.

Negotiation: Don't hesitate to negotiate rental rates, terms, and conditions. A well-prepared and informed approach can lead to favorable outcomes.

Emergency Fund: Set aside an emergency fund to cover unexpected expenses, such as repairs or maintenance costs.

Communication: Maintain open and effective communication with your landlord or property manager to address any concerns promptly.

By carefully considering these factors and following the guidelines outlined above, foreigners can successfully navigate the property leasing process in Phuket and enjoy a fulfilling experience in this beautiful tropical paradise.

#lawyers in thailand#thailand#property leasehold in thailand#property lawyers in thailand#property law in thailand#property in thailand

2 notes

·

View notes

Text

Property Services in Thailand

Thailand’s property market is a dynamic and diverse sector, attracting foreign investors, retirees, and expatriates seeking residential, commercial, or rental opportunities. However, navigating the legal, financial, and logistical aspects of property transactions requires a deep understanding of local regulations, market trends, and professional services available.

This article provides an in-depth exploration of property services in Thailand, covering legal frameworks, ownership structures, due diligence, financing, and professional service providers.

1. Overview of Thailand’s Property Market

Thailand’s real estate landscape is segmented into several key markets:

A. Residential Property

Condominiums: The most accessible option for foreigners, who can own up to 49% of a condominium project’s total area freehold.

Houses & Land: Foreigners cannot own land outright but can lease (up to 30 years, renewable) or use structures like Thai companies or usufruct agreements.

Luxury Villas & Gated Communities: Popular among expatriates, often acquired through long-term leases or nominee structures (though legally risky).

B. Commercial Property

Office Spaces: High demand in Bangkok, Phuket, and Chiang Mai.

Retail & Hospitality: Hotels, restaurants, and shops—often purchased by investors under leasehold or Thai corporate ownership.

Industrial & Warehousing: Growing due to Thailand’s manufacturing and logistics sectors.

C. Rental & Investment Properties

Short-term Rentals (Airbnb): Popular in tourist areas but subject to regulations.

Long-term Rentals: Stable income source, especially in expat-heavy cities.

2. Legal Framework for Property Ownership in Thailand

A. Freehold vs. Leasehold Ownership

Freehold (Condos): Foreigners can own condos outright, provided the building’s foreign quota isn’t exceeded.

Leasehold:

Maximum lease term: 30 years (renewable, but not guaranteed).

Common for villas, land, and commercial properties.

Leasehold registrations must be filed at the Land Department.

B. Alternative Ownership Structures

Thai Company Ownership

Foreigners can set up a Thai company to hold land, but the structure must comply with the Foreign Business Act (FBA).

Risks: If deemed a nominee arrangement (illegal), the property can be confiscated.

Usufruct Agreements (Sections 1417-1428, Thai Civil Code)

Grants the right to use and profit from a property for life or a fixed term.

Common among expatriates married to Thai nationals.

Superficies (Right to Build on Land You Don’t Own)

Allows construction on leased land, with ownership of the building.

C. Restrictions on Foreign Ownership

Land Ownership: Prohibited unless through a BOI-promoted investment or treaty (rare).

Condos: Up to 49% foreign ownership per project.

Agricultural Land: Strictly limited to Thai nationals.

3. Key Property Services in Thailand

A. Real Estate Agencies & Brokerage Services

Local Agencies: Specialize in regional markets (e.g., Bangkok, Phuket, Pattaya).

International Firms: CBRE, Knight Frank, and Savills cater to high-net-worth investors.

Due Diligence: Reputable agents verify property titles, zoning laws, and seller legitimacy.

B. Legal & Conveyancing Services

Title Deed Verification: Ensuring the Chanote (Title Deed) is legitimate.

Contract Review: Checking lease agreements, purchase contracts, and mortgage terms.

Dispute Resolution: Handling cases of fraud, encroachment, or breach of contract.

C. Property Management Companies

Rental Management: Handling tenant screening, maintenance, and rent collection.

Maintenance & Security: For condos, villas, and commercial properties.

Short-Term Rental Management: Airbnb compliance, guest management, and cleaning services.

D. Tax & Financial Advisory Services

Transfer Fees: 2% of appraised value (typically split between buyer and seller).

Stamp Duty: 0.5% (if applicable).

Withholding Tax: 1% (for companies) or progressive rate (for individuals).

Capital Gains Tax: Applies if selling within 5 years of purchase.

E. Construction & Renovation Firms

Architects & Engineers: Required for custom builds and major renovations.

Permit Acquisition: Navigating local building codes and zoning laws.

4. Due Diligence: Avoiding Pitfalls in Thai Real Estate

A. Verifying Property Titles

Chanote (Nor Sor 4 Jor): The most secure land title.

Nor Sor 3 Gor: Less secure, requires additional checks.

Red Flags: Missing documents, disputed boundaries, or unclear ownership history.

B. Checking for Encumbrances

Mortgages or Liens: Must be cleared before transfer.

Zoning & Land Use Laws: Ensure the property can be used as intended.

C. Foreign Quota in Condos

Confirm the building hasn’t exceeded the 49% foreign ownership limit.

D. Leasehold Risks

Renewal Clauses: Often unenforceable beyond 30 years.

Subleasing Rights: Must be explicitly stated in the contract.

5. Financing Property in Thailand

A. Thai Bank Mortgages for Foreigners

Eligibility: Typically requires a work permit or long-term visa.

Loan-to-Value (LTV): Usually 50-70% for foreigners.

Interest Rates: 5-7% (higher than in Western markets).

B. International Financing

Some investors secure loans from overseas banks.

Currency Risk: Fluctuations in THB can impact repayments.

C. Cash Purchases

Most common for foreigners due to financing limitations.

6. Emerging Trends & Future Outlook

Digital Transactions: Increasing use of blockchain for property records.

Eco-Friendly Developments: Green buildings and sustainable housing demand.

Rise of Proptech: Online platforms for property searches, virtual tours, and AI-driven valuations.

7. Conclusion

Thailand’s property market offers lucrative opportunities but requires careful navigation of legal, financial, and logistical challenges. Engaging professional services—real estate agents, lawyers, and property managers—is crucial to ensuring secure and profitable investments.

Foreign buyers must prioritize due diligence, understand ownership restrictions, and consider long-term implications of leasehold vs. freehold acquisitions. With the right approach, Thailand remains a compelling destination for real estate investment, whether for personal use, rental income, or capital appreciation.

#thailand#property#propertyservices#propertyinthailand#thaiproperty#propertyservicesinthailand#thaipropertyservices

2 notes

·

View notes

Text

Thailand Regional Office in Thailand

Thailand, a thriving Southeast Asian economy, offers a strategic location, a supportive business environment, and a skilled workforce, making it an attractive destination for companies seeking to expand their operations in the region. Establishing a regional office in Thailand can serve as a gateway to Southeast Asian markets, providing access to a vast consumer base and opportunities for growth.

Key Considerations for Setting Up a Regional Office in Thailand

Type of Entity:

Limited Liability Company (LLC): The most common choice for foreign investors, offering limited liability and flexibility in terms of ownership structure.

Representative Office: A non-profit entity for market research, promotion, and liaison activities but cannot generate revenue locally.

Branch Office: An extension of a foreign parent company, subject to the same regulations as the parent.

Location:

Bangkok: The commercial hub of Thailand, offering excellent infrastructure, a vibrant business community, and a wide range of services.

Other Major Cities: Consider regional centers like Chiang Mai, Pattaya, and Phuket for specific industry needs or to tap into local markets.

Work Permits and Visas:

Work Permits: Obtain work permits for foreign employees working in the regional office.

Visas: Ensure appropriate visas for foreign investors and employees, such as a Business Visa or a Long-Term Stay Visa.

Tax Implications:

Corporate Tax: Understand the corporate tax rates, exemptions, and incentives available in Thailand.

Withholding Tax: Be aware of withholding tax obligations on dividends, interest, and royalties.

Double Taxation Agreements: Explore the benefits of double taxation agreements to avoid paying taxes twice.

Regulatory Compliance:

Labor Laws: Adhere to Thai labor laws regarding minimum wage, working hours, and employee benefits.

Environmental Regulations: Comply with environmental regulations to ensure sustainable operations.

Intellectual Property Protection: Safeguard your intellectual property rights through registration and enforcement.

Business Culture and Etiquette:

Cultural Sensitivity: Respect Thai customs, traditions, and etiquette in business interactions.