#private pension schemes

Explore tagged Tumblr posts

Text

Pension Concerns in Germany Ahead of Federal Elections

Pension Concerns Rise in Germany Ahead of Federal Elections As political parties, including the Alternative for Germany (AfD) and the Sahra Wagenknecht Alliance (BSW), make bold promises to enhance financial support for pensioners, the topic of pensions has surged to the forefront of public discourse in Germany, especially with the federal elections approaching next year. The coalition…

#aging population#demographic shifts#economic challenges#federal elections#financial support#Germany#pension system#pensions#private pension schemes#retirement

0 notes

Text

Private equity ghouls have a new way to steal from their investors

Private equity is quite a racket. PE managers pile up other peoples’ money — pension funds, plutes, other pools of money — and then “invest” it (buying businesses, loading them with debt, cutting wages, lowering quality and setting traps for customers). For this, they get an annual fee — 2% — of the money they manage, and a bonus for any profits they make.

On top of this, private equity bosses get to use the carried interest tax loophole, a scam that lets them treat this ordinary income as a capital gain, so they can pay half the taxes that a working stiff would pay on a regular salary. If you don’t know much about carried interest, you might think it has to do with “interest” on a loan or a deposit, but it’s way weirder. “Carried interest” is a tax regime designed for 16th century sea captains and their “interest” in the cargo they “carried”:

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity is a cancer. Its profits come from buying productive firms, loading them with debt, abusing their suppliers, workers and customers, and driving them into ground, stiffing all of them — and the company’s creditors. The mafia have a name for this. They call it a “bust out”:

https://pluralistic.net/2023/06/02/plunderers/#farben

Private equity destroyed Toys R Us, Sears, Bed, Bath and Beyond, and many more companies beloved of Main Street, bled dry for Wall Street:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

And they’re coming for more. PE funds are “rolling up” thousands of Boomer-owned business as their owners retire. There’s a good chance that every funeral home, pet groomer and urgent care clinic within an hour’s drive of you is owned by a single PE firm. There’s 2.9m more Boomer-owned businesses going up for sale in the coming years, with 32m employees, and PE is set to buy ’em all:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE funds get their money from “institutional investors.” It shouldn’t surprise you to learn they treat their investors no better than their creditors, nor the customers, employees or suppliers of the businesses they buy.

Pension funds, in particular, are the perennial suckers at the poker table. My parent’s pension fund, the Ontario Teachers’ Fund, are every grifter’s favorite patsy, losing $90m to Sam Bankman-Fried’s cryptocurrency scam:

https://www.otpp.com/en-ca/about-us/news-and-insights/2022/ontario-teachers--statement-on-ftx/

Pension funds are neck-deep in private equity, paying steep fees for shitty returns. Imagine knowing that the reason you can’t afford your apartment anymore is your pension fund gambled with the private equity firm that bought your building and jacked up the rent — and still lost money:

https://pluralistic.net/2020/02/25/pluralistic-your-daily-link-dose-25-feb-2020/

But there’s no depth too low for PE looters to sink to. They’ve found an exciting new way to steal from their investors, a scam called a “continuation fund.” Writing in his latest newsletter, the great Matt Levine breaks it down:

https://news.bloomberglaw.com/mergers-and-acquisitions/matt-levines-money-stuff-buyout-funds-buy-from-themselves

Here’s the deal: say you’re a PE guy who’s raised a $1b fund. That entitles you to a 2% annual “carry” on the fund: $20,000,000/year. But you’ve managed to buy and asset strip so many productive businesses that it’s now worth $5b. Your carry doesn’t go up fivefold. You could sell the company and collect your 20% commission — $800m — but you stop collecting that annual carry.

But what if you do both? Here’s how: you create a “continuation fund” — a fund that buys your old fund’s portfolio. Now you’ve got $5b under management and your carry quintuples, to $100m/year. Levine dryly notes that the FT calls this “a controversial type of transaction”:

https://www.ft.com/content/11549c33-b97d-468b-8990-e6fd64294f85

These deals “look like a pyramid scheme” — one fund flips its assets to another fund, with the same manager running both funds. It’s a way to make the pie bigger, but to decrease the share (in both real and proportional terms) going to the pension funds and other institutional investors who backed the fund.

A PE boss is supposed to be a fiduciary, with a legal requirement to do what’s best for their investors. But when the same PE manager is the buyer and the seller, and when the sale takes place without inviting any outside bidders, how can they possibly resolve their conflict of interest?

They can’t: 42% of continuation fund deals involve a sale at a value lower than the one that the PE fund told their investors the assets were worth. Now, this may sound weird — if a PE boss wants to set a high initial value for their fund in order to maximize their carry, why would they sell its assets to the new fund at a discount?

Here’s Levine’s theory: if you’re a PE guy going back to your investors for money to put in a new fund, you’re more likely to succeed if you can show that their getting a bargain. So you raise $1b, build it up to $5b, and then tell your investors they can buy the new fund for only $3b. Sure, they can get out — and lose big. Or they can take the deal, get the new fund at a 40% discount — and the PE boss gets $60m/year for the next ten years, instead of the $20m they were getting before the continuation fund deal.

PE is devouring the productive economy and making the world’s richest people even richer. The one bright light? The FTC and DoJ Antitrust Division just published new merger guidelines that would make the PE acquire/debt-load/asset-strip model illegal:

https://www.ftc.gov/news-events/news/press-releases/2023/07/ftc-doj-seek-comment-draft-merger-guidelines

The bad news is that some sneaky fuck just slipped a 20% FTC budget cut — $50m/year — into the new appropriations bill:

https://twitter.com/matthewstoller/status/1681830706488438785

They’re scared, and they’re fighting dirty.

I’m at San Diego Comic-Con!

Today (Jul 20) 16h: Signing, Tor Books booth #2802 (free advance copies of The Lost Cause — Nov 2023 — to the first 50 people!)

Tomorrow (Jul 21):

1030h: Wish They All Could be CA MCs, room 24ABC (panel)

12h: Signing, AA09

Sat, Jul 22 15h: The Worlds We Return To, room 23ABC (panel)

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

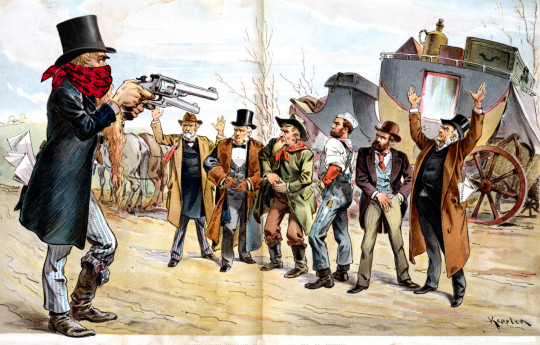

[Image ID: An old Punch editorial cartoon depicting a bank-robber sticking up a group of businesspeople and workers. He wears a bandanna emblazoned with dollar-signs and a top-hat.]

#pluralistic#buyout groups#continuation fraud#pe#pyramid schemes#the sucker at the table#pension plans#continuation funds#matt levine#fiduciaries#finance#private equity#mark to market#ripoffs

309 notes

·

View notes

Text

What is New Unified Pension Scheme 2024: Full Details, Calculator & More

What is the New Unified Pension Scheme (UPS)?

In response to opposition to the National Pension System (NPS) and the increasing demand for the Old Pension Scheme (OPS), the central government has provided a significant benefit to its employees.

Who is Eligible for the New Unified Pension Scheme?

Under this scheme, central government employees who have worked for 25 years will receive a pension equal to 50% of their basic salary from the last 12 months of their job.

States will also have the option to adopt this model. If they do, the total number of central and state employees covered by this scheme could reach 90 lakhs.

Read More>>>

#Unified Pension Scheme#Unified Pension Scheme 2024#new Unified Pension Scheme 2024#new Unified Pension Scheme#What is Unified Pension Scheme#Unified Pension Scheme kya hai#Unified Pension Scheme in hindi#Unified Pension Scheme in english#Unified Pension Scheme pdf#Unified Pension Scheme pdf india#Unified Pension Scheme upsc#Unified Pension Scheme calculator#Unified Pension Scheme details#Unified Pension Scheme calculator india#Unified Pension Scheme kya hai in hindi#Unified Pension Scheme for psu employees#Unified Pension Scheme all informations#Unified Pension Scheme benifites#Unified Pension Scheme for whom#Unified Pension Scheme all details#Unified Pension Scheme review#Unified Pension Scheme eligibility#Unified Pension Scheme amount#What is new Unified Pension Scheme#What is a unified pension scheme?#Which is better#NPS or UPS?#Is UPS scheme for private employees?#एकीकृत पेंशन योजना क्या है?#What is unified scheme?

0 notes

Text

सुक्खू सरकार ने हिम केयर योजना से बाहर किए सरकारी कर्मचारी और पेंशनर, प्राइवेट हॉस्पिटलों में भी नहीं होगा इलाज

Himachal News: हिमाचल प्रदेश की सुक्खू सरकार ने हिमकेयर योजना को संशोधित किया है। सरकार की ओर से जारी अधिसूचना के अनुसार सभी सरकारी सेवारत, सेवानिवृत्त अधिकारियों/कर्मचारियों को मुख्यमंत्री ��िमाचल स्वास्थ्य देखभाल योजना(हिमकेयर) से तत्काल प्रभाव से बाहर कर दिया है। इसके साथ ही निजी अस्पतालों का इंपेनलमेंट 1 सितंबर 2024 से वापस लेने का निर्णय लिया गया है। अब इन अस्पतालों में हिमकेयर योजना के तहत…

0 notes

Text

What Are the Challenges Investors Face When They Plan an Investment in Mutual Funds in Bhavnagar?

Investing can be a journey of both excitement and confusion, especially for newcomers in Bhavnagar. The financial market offers various avenues, and mutual funds stand out as an excellent starting point. However, the road to choosing the right funds is often riddled with challenges. Let's explore the obstacles investors face as they begin their journey of investment in mutual funds in Bhavnagar.

Addressing Investor Challenges

Information Overload: Navigating through countless mutual fund options can overwhelm newcomers, making decision-making daunting.

Defining Investment Objectives: Setting clear financial goals and understanding risk tolerance before diving into investments is crucial.

Assessing Fund Performance: Beyond past returns, evaluating risk-adjusted returns, consistency, and comparisons with peers is essential.

Grasping Fund Fees: Understanding various fees impacting returns, like management fees and sales loads, is key in assessing costs.

Emotional Decision-Making: Emotions often drive impulsive decisions, leading to short-term choices detrimental to long-term goals.

Lack of Expertise: New investors may lack financial knowledge, highlighting the importance of seeking guidance from advisors.

Expert Guidance for Bhavnagar Investors

Shri Money Matters, one of the best mutual fund distributors in Bhavnagar, understands the challenges investors face and offers reliable investments in mutual funds, helping investors gain a basic understanding of key concepts like risk, diversification, asset allocation and streamlining investments for them. Let's explore how investors can benefit from advanced tools and practices offered by them:

Streamlined Selection Process: Distributors utilize advanced tools to simplify fund selection, and investors can easily compare different funds based on crucial criteria.

Thorough Fund Analysis: In-depth research and analysis on mutual funds form the basis of well-informed recommendations, aligning with individual goals.

Tailored Recommendations: Understanding financial profiles and risk tolerance leads to personalized fund recommendations.

Ongoing Support: Ensuring continuous support, addressing concerns, and recommending adjustments as needed.

Fostering Rational Decisions: Guidance in developing a long-term investment mindset focused on rational decision-making.

Mitigating Risk: Encouraging diversification across asset classes to construct well-balanced portfolios.

Portfolio Rebalancing: Regular reassessment for portfolios to stay aligned with objectives.

Personalized Advice: Offering customized advice based on unique circumstances and financial objectives.

Conclusion

Starting your investment journey in mutual funds needs careful planning. While mutual funds are a good start, diversifying your investments is necessary. Shri Money Matters helps investors in Bhavnagar make smart choices, get ongoing help, and stick to a clear investment plan with all the above-listed tools and tactics.

#best mutual fund distributors in Bhavnagar#best insurance company in Bhavnagar#mutual funds investment services in Bhavnagar#life insurance agency in Bhavnagar#health insurance service in Bhavnagar#medical insurance policy in Bhavnagar#general insurance Bhavnagar#corporate bond services in Bhavnagar#loan against mutual funds in Bhavnagar#personal loan in Bhavnagar#national pension system in Bhavnagar#nps in Bhavnagar#private fixed deposit schemes in Bhavnagar

0 notes

Text

I am aware this isn't a Destiel meme but the shitty memes grab enough attention and that's all I need. It's been a long day.

Hi! It's trashbag again. I've got a migraine but I'll power through with a more detailed summary about the Job Quota Protests in Bangladesh.

Currently Bangladesh has 56% quota allocated for govt jobs. 30% of this is for the descendants (children/grandchildren) of freedom fighters. In comparison, ethnic minorities have 5% and the disabled have 1%. It's nearly impossible to get into the govt jobs without inside connections due to rampant corruption and nepotism.

Students have protested for this before, back in 2018. It was bad, university students got tear gassed and shot with rubber bullets.

July 1st the public universities began the protests for the job quota reform again. Coincidentally this also coincided with public university faculty going on strike because of the Prottoy Pension Scheme, which does not provide enough of a financial safety net and also takes a significant chunk out of the faculties' income. So, students did not have any classes to worry about when they went to the streets.

July 14, PM of the country let us just call her Granny because I don't want to raise red flags on my blog. Granny came back from a visit to China, and of all the statements she gave, one said "if there is no quota for the freedom fighters, who will there be quota for? The Rajakars?"

For context, Rajakars were the paramilitary force that were against the independence of Bangladesh. They did their best to thwart liberation. They're national traitors. They've done concentration camps, genocide, murder of intellectuals, rape, torture.

So, the leader of the nation just called us the local equivalent of a Nazi for demanding to lower the freedom fighter quota. She did not want more merit based people working in the government, which as a leader of a nation is absolutely wild to me.

There was a considerable amount of outrage. Students of Dhaka University (DU) who have been protesting since July 1, took the streets at midnight to chant slogans. The chants lose a lot of weight in translation, but they're essentially calling themselves Rajakars (ironically) for wanting equality.

July 15. We've had student protests erupt around the country. The ruling party sent their student wing, BCL, to suppress. Students occupied the dormitory halls and barricaded. People were beaten and attacked in broad daylight. Rajshahi University (RU) had a raid attempt by BCL at 11PM. Jahangirnagar University (JU) had an attack at 3AM.

July 16. Nationwide protests surge. Private Universities - BRAC, NSU, AIUB, IUB, UIU and so on took to the streets and occupied the roads. There's been blockades. The police got involved today, there was an attack on Primeasia University. The first martyr for the movement, Abu Sayed, 25, died by police gunfire. The video of his murder has been all over Facebook. BCL brought in reinforcements. RU had arson. There was open gunfire in DU.

Come evening, there's been a massive misinformation campaign ongoing. There is fear being incited wherever you look. The latest was 27 rapes at Dhaka University, proven false. The main source of communication is Facebook, and they've slowed that right down. There's now confusion on if there will be protests tomorrow. False information that tomorrow's protests were cancelled on the occasion of Ashura spread too far.

Local media isn't reporting shit. Al Jazeera, AP, Reuters, the diplomat have but there needs to be more.

6 officially dead. One is a highschooler.

At least 200 injured. Real numbers are close to 400.

All hope is not lost - 5 DU halls have pledged to ban student politics. But there is a lot left to be done. Please boost this before we spiral into a much worse situation.

#trashbag#destiel news#destiel confession#destiel meme news#bangladesh#quota protests#international news#politics#student protests#us student protests#desi#graphic design is my passion#if the meme made you read#i win#tw rape#breaking news#news#world news

25 notes

·

View notes

Note

I know I’m getting old by the fact that Simon could convince me if he promised to pay for my insurances and my private pension scheme😔

(I just turned 23 last Friday but anyway)

ig if you're old im decomposing.

it's about having your priorities straight, is all.

and very happy belated birthday! 🎉

21 notes

·

View notes

Text

Up to £30bn could be wiped from UK corporate pension scheme liabilities owing to one of the biggest falls in life expectancy in a decade, according to industry experts.

The latest modelling by actuaries saw life expectancy assumptions at retirement age fall 1.9 per cent, or six months, compared with the previous year’s model.

Industry analysts believe the forecasts could slash billions from the total liabilities of private sector defined benefit pension schemes, which stood at £1.28tn at the end of September 2022, according to the Office for National Statistics. …

According to the investigation, the latest drop was owing to high death rates in England and Wales in the second half of 2022. … “The…[actuaries'] view is that these persistently higher than expected deaths may continue, as the underlying drivers appear likely to remain soon.”

Good news! Our mass deaths are turning out to be pretty good for the chequebooks of the capitalists.

20 notes

·

View notes

Text

1

congressional budget office

2

For a capitalist economy to flourish without economic growth, population stabilization is a necessary condition. This condition is, of course, not limited to the capitalist model. It is implausible that any alternative to the capitalist model could deliver zero economic growth with a persistently growing global population. The second critical precondition for a steady state capitalist economy is that everyone must achieve a satisfactory level of consumption. This second precondition, in contrast to the first, is arguably unique to the capitalist model. The fundamental characteristic of capitalist economies, that which sets them apart from centrally managed socialist economies, is that capitalism, formally defined, is the economic system where the means of production resides in the hands of households. By households, of course, I mean private individuals. Some households own more capital than others, but most households in capitalist economies own some capital, whether as shareholders in public corporations, owners or investors in privately held businesses, beneficiaries of pension funds, or holders of corporate bonds. Irrespective of which particular households own it, all capital formation in a capitalist economy originates from households, be it directly or indirectly.

breakthrough institute

3

A pyramid scheme is a business model that recruits members via a promise of payments or services for enrolling others into the scheme, rather than supplying investments or sale of products

wikipedia

12 notes

·

View notes

Text

We have described for you the deplorable criminality which has gained access to our world through the British Government(s) and their collusion with the Holy Roman Empire -- the impersonation of people as different kinds of corporations, the illegal and unlawful direct taxation of civilians by private banks, the use of commercial corporations to usurp national governments, and we have touched upon the corruption of the courts, especially Admiralty Courts and the so-called King's Bench (Maritime Commerce) courts.

We have plainly stated that the courts are bonding court cases and presenting them as investment opportunities. The bond numbers are case numbers, and the odds of conviction and "commission returns" on these bonds run at 96% on average, so the Hired Jurists running these courts are highly motivated to secure convictions by any means possible ---- the courts and the court's officers share in the booty they collect.

Government "Investors" are also highly motivated to keep this gravy train running. Where else can you guarantee yourself a 96% rate of return on a short term bond investment?

When first confronted about this "Court Registry Investment System" court officials stonewalled and denied the existence of any such bond investment (and ultimately, payola) system by which they receive commissions, aka, "pension" payments from all the loot rolling in from the illegal confiscation of privately-held American assets and equally illegal betting on the rigged outcome of court cases controlled by Hired Jurists in the King's Service.

The Guilty Parties observe that there is no law against murdering corporations, stealing from corporations, impounding corporations, etc., but then, in the same token, corporations should have no ability to make unlimited political campaign contributions, should they?

Those responsible for the unconscionable contracts allowing them to create all these Puerto Rican shelf corporations, and the Roman Inferior Cestui Que Vie Trusts that result when the shelf corporations are bankrupted, should be paying all the charges and expenses of maintaining these corporations and should also be paying all taxes owed by these imaginary corporate franchises, too.

The living victims of this personage scheme should be held absolutely harmless from all charges and harm, but as everyone can see and attest, the Parent Corporations and Administrators have been evading their Usufructuary Duty and foisting their responsibility off onto the victims of their inland piracy.

The Admiralty Courts have been busy collecting booty belonging purportedly to "rebels" engaged in illegal commercial mercenary "wars", and salvage fees owed by foreign sovereigns, and managing the Estates of imaginary British Merchant Mariners, who all just happen to be "Taxpayers" --- Warrant Officers who are responsible for collecting tariffs for the King, who are all based out of Puerto Rico and all declared "missing, lost at sea".

The Maritime Commercial Courts operated by the British Crown have been fraudulently confusing themselves -- the so-called United States District Courts -- with district courts of the United States authorized under Article V of the Federal Constitutions. Under this guise of borrowed rectitude, they have been operated as "concessions" to take advantage of the Cestui Que Vie ESTATES purportedly belonging to Municipal "citizens of the United States".

Are we all beginning to get the drift of just how crooked all these operations are and the nature of the "courts" that have been foisted off on the people of this country, who have all suffered crimes of impersonation and identity theft and human trafficking, at the hands of men employed by them to protect their "persons" and who are obligated by contract and treaty to do so?

As mentioned in our International Public Notice: Impersonation, the British Territorial Rump Congress created by Abraham Lincoln changed the meaning of the word "person" to mean "corporation".

See 37th Congress, Second Session, Chapter 49, Section 68.

This was followed up on February 2nd 1871, when the 41st British Territorial U.S. Congress declared itself to be the Successor of all United States Corporations.

The "United States" being referenced is the American Federal Republic and its corporations.

This takeover was done with no Notice to the Public, no listing in the Congressional Record, and, most importantly, no Notice to the Federation of States. It failed all requirements of Due Process.

How is that even possible?

By February 2nd 1871, all the State Governments had been confused with State of State Governments, and the Brits had illegally included State assets as if they were American State of State assets, and rolled everything into "State" Trusts.

They had also demanded that the people of each State write new Constitutions allowing their own British Territorial State-of-State operations to take over.

The American States of States, such as The State of New York, were replaced by British Territorial counterparts calling themselves, for example, "the State of New York". The name change was so slight, a change from "The" to "the", that nobody but British Collaborators knew there had been any change at all.

The new "State" Constitutions enacted between 1863 and 1871 were equally vague and deceitful, appearing very similar to prior service contracts and calculated to hide what was actually going on from the American Public.

By February 2nd 1871, the assets of the actual Autochthonous Nation States had been illegally and illogically misidentified as assets of the Federal Republic and had been cashiered in covert State Trusts, like the Michigan State (Trust).

This is what gives rise to the grammatical nightmare of "the Michigan State Capitol" and "California State University".

As an analogy, if the company hired to mow your lawn went bankrupt, or for any reason failed to perform, would this justify an assumption that your property was part of their bankruptcy or incompetence? Would this scenario justify an assumption that your home was an asset of their bankrupt business? Or an unclaimed chattel of theirs?

Certainly not, yet this is precisely the "reasoning" employed to secretly latch upon the assets of the American States and cashier them in State Trusts controlled by the Perpetrators of this gigantic fraud scheme.

With the State assets illegally cashiered in trusts controlled by the Perpetrators under False Pretenses, the original American State of State organizations inoperable, and British Territorial States of States operating as franchises of the British Territorial corporation calling itself "the United States of America" --- Incorporated, there was nothing to stop the Perpetrators from bypassing Due Process owed to the actual States and People.

According to them and what they told the rest of the world, we had ceased to exist. Our lawful American Government was reportedly "in interregnum" and in the meantime, our British Territorial and Holy Roman Empire Federal Subcontractors were "assuming" a "custodial interest" in our assets.

In this way, the British Territorial Government under contract to our States, contrived to unlawfully convert our State assets into Public Trust assets controlled by their Agents, and to mothball and substitute their own "services" for both our Autochthonous American States-of-State organizations and our lawful State Governments.

This is all premeditated, malicious, self-interested legal chicanery and constructive fraud, by which our foreign employees have attempted to erase our national sovereignty, use our assets as collateral backing their debts, and ultimately, bring False Claims on Abandonment against our assets for their benefit.

We never abandoned anything, just like we never volunteered to act as "Taxpayers" and never knowingly adopted U.S. Citizenship, and were told nothing about the Roman Inferior Trust ESTATES established for us under the resoundingly False Presumption that we were ever "citizens of the United States", either.

These False Friends and False Representatives impersonated the American States and seized upon their assets, and have controlled our State assets by dint of secrecy, False Legal Presumptions, and False Claims dependent on similar names deceits.

Our original state-of-state entities doing business as, for example, The State of New York, were members of the failed Confederation.

Likewise, the stricken State Republics and Republics of State, such as the Texas Republic and Republic of Texas, were members of the failed Federal Republic.

Their assets might, arguably, be salvaged and secured by the British Territorial Federal Subcontractors doing business as the United States of America, Incorporated ---- but not the assets of our Autochthonous Nation-States.

Our Autochthonous unincorporated States of the Union are members of the unincorporated Federation of States.

There are no "United States Corporations" present for British Interests to seize upon or assume any custodial interest in.

In the same way, there is no excuse for them impersonating our States as State Trusts, substituting their state-of-state organizations for ours, nor any of the criminal impersonations and undisclosed registrations of individual Americans that have taken place.

There is no plausible excuse for them bringing their Admiralty and Maritime courts ashore and misaddressing American civilians as corporate franchises and foreign persons in their own country.

All of this is in direct violation of both The Constitution of the United States of America and The Constitution of the United States, Article IV, in its entirety.

These men and women are present in our country to provide us with essential government services in "good faith", not to practice crimes of personage against us and pretend that they are our "representatives", custodians, guardians, and trustees.

For those who cannot believe that the Admiralty and Maritime courts presently operating in this country have been used to promote illegal and immoral confiscation of Autochthonous American assets, to commit personage against average Americans, to create a rigged bond market and to provide commissions masked as "pension payments" to the men and women engaged in this criminal activity, we are attaching a 66 page pdf file that adequately explains the Court Registry Investment System (CRIS) and documents its receipts.

#blacklivesmatter#blackvotersmatters#donald trump#joe biden#naacp#blackmediamatters#blackvotersmatter#news#ados#youtube

2 notes

·

View notes

Text

In 2023, a significant demographic milestone emerged with broad social and economic impacts: the global population of adults aged 50 surpassed the number of children under 15 for the first time. Brunei Darussalam, a small, oil-rich Islamic country on the island of Borneo in Southeast Asia, faces challenges associated with this shift. Ranked as one of the world’s wealthiest nations due to its vast oil and gas reserves, Brunei’s population of 455,858 sees a contrast with a poverty rate of 5%, positioning it 11th out of 78 countries.

Hajah Nor Ashikin binti Haji Johari, Permanent Secretary at the Ministry of Culture, Youth and Sports (MCYS), highlighted the profound economic impact of the aging global population, noting the substantial expenditures on health care, research and support services. Furthermore, Hajah pointed out the rapid growth of the aging population and its broad implications. During Brunei’s chairmanship of the Association of Southeast Asian Nations (ASEAN) in 2021, Johari emphasized Brunei’s leadership in endorsing the ASEAN Comprehensive Framework on Care Economy.

Additionally, in 2017, an action plan spanning five years was adopted to enhance elderly development, welfare and protection, aiming to create a senior-friendly support system and reduce elderly poverty in Brunei. Unfortunately, an aging demographic compounded by an ominous surge in noncommunicable diseases (NCDs) such as heart disease, cancer, chronic respiratory disease and diabetes challenges Brunei’s socio-economic development.

Addressing Poverty and Social Protection in Brunei

Bruneians who live in poverty prefer to use the phrasings “living in need” and “difficult life” over “poverty” and “poor.” This exchange of phrasings intends to protect an individual’s self-confidence and self-esteem. Yet this preference challenges officials’ attempts to accurately assess the severity of poverty and implement targeted interventions.

However, Brunei’s social protection schemes encounter challenges. These challenges include limited coverage, differential treatment between public and private sectors, exclusion of unemployed individuals and inadequate support for vulnerable groups such as divorcees, widows/widowers, single parents, orphans, the abused and disabled people.

The Dual Impact of an Ageing Society

Across developing countries, evidence showcases the productivity, creativity, vitality and participation of older adults in workplaces, communities, households and families. According to ageInternational, some of the pros of an aging society include:

Consumer Market: Older adults can create new opportunities in the consumer market with higher disposable incomes and specific needs that can drive economic growth.

Accumulated Knowledge: An aging population can possess a wealth of knowledge and experience, beneficial for education and mentorship.

Stable Workforce: Older individuals provide greater stability in employment as they switch jobs less frequently.

In addition, the aging population significantly impacts the labor market. The dependency ratio, which compares the number of economically inactive individuals to those who are economically active, is set to increase. According to the International Labour Organization, some of the cons of an aging society include:

Labor Shortages: Addressing the need to create jobs for young individuals and encourage lifelong learning for older individuals to acquire new skills.

Pension and Retirement Challenges: Ensuring adequate pensions and financial support for retirees.

Limited Social Support Systems: Establishing social support systems, including affordable housing and accessible transportation, to enhance the quality of life.

Health care Costs: Investing in health care infrastructure to meet the growing needs of an aging population and prioritizing preventive health care measures.

Brunei at a Demographic Crossroads

As Brunei Darussalam navigates through its complex demographic and health landscape, proactive and holistic measures become imperative for securing the future prosperity of its people. Moreover, by addressing the multifaceted challenges head-on, Brunei is poised to set a precedent for demographic resilience and health sustainability.

Above all, the nation’s commitment to comprehensive solutions promises not only to enhance the well-being of its aging population and reduce elderly poverty in Brunei but also to pave the way for long-term national growth. At this pivotal juncture, Brunei’s journey offers valuable insights into the power of foresight and action in shaping a thriving society.

– Pamela Fenton

4 notes

·

View notes

Text

Union Budget 2024 (India) Summary

The Union Budget 2024 of India focuses on simplifying tax processes, promoting economic growth, and supporting various sectors. Here are the key highlights:

Simplification of Tax Processes

Income Tax Returns (ITR): The process of filing ITR has been simplified.

Revised Tax Deductions and Rates

Standard Deduction: Increased from ₹50,000 to ₹75,000 in the new tax regime.

Family Pension Deduction: Enhanced from ₹15,000 to ₹25,000.

New Tax Structure:

No tax on income up to ₹3 lakhs.

5% tax on income from ₹3 lakhs to ₹7 lakhs.

10% tax on income from ₹7 lakhs to ₹10 lakhs.

15% tax on income from ₹10 lakhs to ₹12 lakhs.

20% tax on income from ₹12 lakhs to ₹15 lakhs.

30% tax on income above ₹15 lakhs.

Changes in Import Taxes

Gold and Silver: Import tax reduced from 6.5% to 6%.

Support for Start-ups and Entrepreneurs

Angel Tax Exemption: Investors in start-ups are exempt from the angel tax.

Late Payment of TDS: No longer considered a crime.

Changes in Capital Gains Tax

Long-Term Capital Gains Tax: Set at 12.5%.

Short-Term Capital Gains Tax: Increased to 20%.

Industrial and Economic Growth Initiatives

Capital Gains: Increase in capital gain limit.

Industrial Parks: Plug and Play Industrial Park Scheme in 100 cities.

Export Concessions: For mineral products.

Support for Women: ₹3 lakh crores provision.

Cheaper Goods: Electric vehicles, gold and silver jewelry, mobile phones, and related parts.

Agriculture: Priority on increasing production.

FDI Simplification: Simplified process for foreign direct investment.

Interest-Free Loans: To states for 15 years.

Rural Development: ₹2.66 lakh crores provision.

Support for Farmers: ₹1.52 lakh crores provision.

Education Loans: Financial support for loans up to ₹10 lakhs for higher education.

Nine Priorities for Upcoming Years

Manufacturing and Services

Urban Development

Energy Security

Infrastructure

Innovation and R&D

Next-Generation Reforms

Productivity and Resilience in Agriculture

Employment and Skilling

Inclusive Human Resource Development and Social Justice

Employment-Linked Incentives

First-Time Employees: One-month wage incentive.

Manufacturing Sector: Incentives for employers and employees for four years.

Youth Employment: Incentives for 30 lakh youths entering the job market.

EPFO Contribution Reimbursement

Government will reimburse ₹3,000 per month towards EPFO contribution for two years for each additional employee.

E-Commerce and Youth Internship Initiatives

E-Commerce Export Hub: To be created in collaboration with the private sector.

Youth Internship Scheme: Internships for 1 crore youth with a one-time assistance of ₹6,000 and a monthly allowance of ₹5,000 during the internship.

The Union Budget 2024 aims to drive economic growth, support various sectors, simplify tax procedures, and provide robust support for employment and youth development. By focusing on these areas, the budget seeks to create a more inclusive and prosperous economy for all citizens. Click here read more

2 notes

·

View notes

Text

Every now and then there's a thread in the german redditsphere asking how people are preparing financially for old age. You'd expect a mix of ETF investment funds, company pension schemes, national old age pension (lol), Riester/Rürup Rente (lol), crypto (lol), mooching off your children (lol) and private savings. But instead the top voted comment is always suicide. And at least half the other comments are some variation of not living to old age. And i don't think any of those are meant ironically. None of the options listed above will be viable when we reach retirement age. This should be alarming.

11 notes

·

View notes

Text

The National Bank of Moldova, BNM, told BIRN on Friday that it is working with the Prevention and Combating Money Laundering Service and other national uthorities to stop illegal financial flows from Russia and the unauthorized use of Russian card payment systems in Moldova.

The BNM added that use of Russian MIR card payment system is illegal in Moldova. It told BIRN that “financial intermediation platforms that are developing extremely quickly at the international level can, however, facilitate cross-border transfers, including some made by certain internationally sanctioned persons or entities from the Russian Federation to… Moldova”.

The bank reacted after the Municipal Council in Orhei, a district in the centre of the country, said it intended to approve several agreements with Promsvyazbank bank, a bank affiliated with the Russian Ministry of Defence and under international sanctions.

A Shor satellite party, the Alternative and Salvation Force of Moldova, FASM, which holds a majority on the council, said it wants to attract funds from Russia to grant “financial aid” to pensioners using MIR cards, which work only in Russia and are not approved by the National Bank of Moldova.

Through these agreements, Shor’s party claims it can give pensioners in the municipality 2,000 lei per month [about 100 euros] for “philanthropic and sponsorship” purposes.

The Eurasia organisation will allocate the money through Promsvyazbank. Eurasia is an organisation created in Russia by Shor’s aides whose purpose, the Moldovan authorities say, is to derail the country’s European course.

The National Bank has warned that such transactions fall under legislation regarding the prevention and combating of money laundering and those regarding the application of international restrictive measures.

“As such, the licensed banks have been warned about the need to maintain a vigilant regime of activity and to apply all due diligence measures to prevent the risks of banks’ involvement in illegal financing schemes, including money laundering and financing schemes of terrorism,” the BNM added.

The BNM’s governor, Anca Dragu, has further specified that citizens who use MIR cards can be held criminally liable.

“Using illegal means of payment, illegal money, has criminal consequences. People should know about this. These facts are being investigated by specialized services for combating money laundering and terrorism,” Dragu said in an interview with Realitatea TV.

Shor used such a scheme of payments to pensioners last year to sway the election of the new governor of the southern pro-Russian region of Gagauzia, and also in the local elections in November 2023.

The authorities have since filed charges of electoral bribery and election fraud by political parties affiliated with Shor. The trial is ongoing.

Shor is currently based in Moscow after receiving a 15-year sentence in April 2023 over the “Grand Theft” of one billion US dollars from three private banks in Moldova between 2012 and 2014. From Moscow, he coordinates several political parties that advocate closer links to Russia, and for Moldova to abandon its European path.

2 notes

·

View notes

Text

Best Investment Advisory Services in Bhavnagar

ShriMoney Matters offers the best investment advisory services in Bhavnagar ranging from investments in mutual funds, life insurance, medical insurance, bonds, general insurance, NPS, etc. to tailor investment strategies to suit your needs, ensuring that you make informed choices for your future. For more details, visit https://www.shrimoneymatters.com/

#best mutual fund distributors in Bhavnagar#best insurance company in Bhavnagar#mutual funds investment services in Bhavnagar#life insurance agency in Bhavnagar#health insurance service in Bhavnagar#medical insurance policy in Bhavnagar#general insurance Bhavnagar#corporate bond services in Bhavnagar#loan against mutual funds in Bhavnagar#personal loan in Bhavnagar#national pension system in Bhavnagar#nps in Bhavnagar#private fixed deposit schemes in Bhavnagar

1 note

·

View note

Text

Unions are important!

When regular people are being treated like workhouse slaves by the mega rich, it is time to remind ourselves why we, the ones who actually outnumber them millions to one, need Unions.

Firstly, especially for those of you in the USA, I will say I am a Union member and have been for many years.

Thanks to unions, I get 25 days of paid holiday per year (increasing with time served), plus an extra 8 days off (paid) in the form of bank holidays. I get up to six months (yes, months) off in paid sick leave per year.

I cannot get fired on the spot for anything less than gross misconduct, and redundancy is a long process with lots of hoops my employer must jump.

I do not get private health care although many companies here offer it (I have the NHS so it's not bad), but I do get free access to an occupational health team - I got paid time off to see the company physiotherapist for months after injuring my achilles tendon.

This is just the everyday benefits, excluding the pay rises the union fights for each year to make sure our wages match inflation and the market rate. I haven't even touched on the maternity/paternity benefits, or the pension scheme.

When I see posts from people in the USA describing their (lack of) working rights, I remind myself how lucky I am to not be American.

Get your shit together and unionise! Or unionize (whichever spelling floats your boatload of tea).

7 notes

·

View notes