#prepaidcard

Explore tagged Tumblr posts

Photo

Prepaid Card Management System Solution Proposal Template https://fintechrfps.com/product/prepaid-card-management-system-solution-proposal-template/?utm_source=tumblr&utm_medium=social&utm_campaign=fintechrfps

0 notes

Text

Top Off, Tap, and Dine: Mastering Food Court Efficiency with Prepaid Cards and Smart Software

Food courts struggle with inefficiency caused by:

Outdated methods:** Paper coupons are slow, wasteful, and error-prone. Customers fumble with them, cashiers spend time sorting and validating them, and they're susceptible to loss or theft. This disrupts the flow of service and creates unnecessary friction for both customers and staff.

Limited POS systems:** Traditional POS systems often fall short when it comes to managing prepaid accounts effectively. They may lack features for:

Prepaid account creation and loading:** Cashiers might need to manually enter top-up amounts, slowing down the transaction process.

Transaction tracking:** Limited visibility into prepaid card usage makes it difficult to track spending patterns and identify trends.

Reporting and analytics:** Without robust reporting capabilities, it's challenging to gain insights into customer behavior and optimize food court operations.

Solution: Introduce "Top Off, Tap, and Dine," a revolutionary software suite featuring:

Prepaid Cards:** Eliminate cash handling, expedite transactions, and offer customers a convenient payment option.

Smart Software: Manage prepaid accounts, track spending, and generate insightful reports for informed decision-making.

Benefits:

Increased Efficiency:** Faster transactions, reduced wait times, and improved staff productivity.

Enhanced Customer Experience:** Convenient payment option, reduced queuing, and potential for loyalty programs.

Data-Driven Insights:** Track sales trends, optimize menu offerings, and make data-backed decisions for improved profitability.

Let's ditch the paper and outdated systems. Schedule a demo today and see how "Top Off, Tap, and Dine" can transform your food court into a model of efficiency!

We hope you enjoyed reading our blog posts about food court billing solutions. If you want to learn more about how we can help you manage your food court business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91–9810078010 or by email at [email protected]. Thank you for your interest in our services.

#foodcourt#cashless#technology#restaurants#software#efficiency#business#prepaidcard#foodservice#restauranttech#customer experience#data#analytics#nextgen#foodcourtowners)#restaurantmanagement#foodtech

1 note

·

View note

Text

Orbex, a leading online forex trading platform, has recently launched a new prepaid card and Orbex Card App. The prepaid card can be used for online purchases and ATM withdrawals, while the app provides users with real-time access to their card balances and transaction history.

0 notes

Text

Mergers and Acquisitions: The route to enter the multi-billion-dollar prepaid card industry in 2023

Looking at the potential growth opportunity in the prepaid card, global firms are adopting the mergers and acquisition strategy to mark their foray into the multi-billion-dollar market. According to PayNXT360 estimates, the global market is expected to grow at a CAGR of 10.3% between 2023 to 2027, increasing from US$1533.37 billion in 2022 to reach US$2540.68 billion by 2027. Read more

#prepaidcardmarketresearch#marketresearch#business#prepaidcard#fintechmarketresearch#paymentmethod#consulting#digitalbusiness

0 notes

Link

#howtoactivatenetspendprepaidcard#howtoactivatenetspendprepaidvisadebitcard#netspend#netspendcard#netspenddebitcard#netspendprepaid#netspendprepaidcard#netspendprepaidcardactivation#netspendprepaidcardreview#netspendprepaiddebit#netspendprepaiddebitcard#netspendprepaidmastercard#netspendprepaidvisa#netspendprepaidvisacard#netspendreview#NetSpendVisaPrepaidCard#prepaidcards#prepaiddebitcard

0 notes

Text

The New Normal: Why Food Courts are Embracing Prepaid Card Cashless Transactions

In recent years, there's been a noticeable shift towards cashless transactions, particularly in food courts. As society becomes increasingly digital, the convenience and efficiency of prepaid card cashless transactions are reshaping the way we dine and pay. Understanding this trend is crucial, as it highlights significant changes in consumer behavior and business operations.

The Evolution of Payment Methods in Food Courts

Food courts have come a long way from the days of strictly cash payments. Initially, coins and paper bills were the only methods of transaction, with cash registers handling all the money. Over time, the introduction of credit and debit cards revolutionized payment methods, making transactions quicker and more secure. Today, the latest evolution is prepaid card cashless transactions, which are rapidly gaining popularity.

Understanding Prepaid Card Cashless Transactions

Prepaid card transactions involve using a card that has been preloaded with a specific amount of money. These cards can be used much like a debit or credit card, but they draw from the preloaded balance rather than a bank account or credit line. In food courts, these prepaid cards are often linked to specific vendors or can be used across multiple outlets within a food court.

Benefits of Prepaid Card Cashless Transactions for Consumers

Convenience and Speed

One of the primary benefits of prepaid card transactions is the sheer convenience they offer. There's no need to fumble for change or worry about carrying enough cash. With a prepaid card, transactions are swift and seamless, making the dining experience more enjoyable.

Enhanced Security

Prepaid cards also provide enhanced security. Unlike cash, if a prepaid card is lost or stolen, it can be deactivated and replaced, minimizing the risk of financial loss. Additionally, these cards often come with security features such as PINs or biometric verification.

Budget Management

For consumers, prepaid cards offer a great way to manage budgets. Since the cards are preloaded with a fixed amount, it's easier to keep track of spending. This feature is particularly useful for students or those trying to stick to a specific budget.

Benefits for Food Court Operators

Streamlined Operations

For food court operators, prepaid cards streamline operations significantly. They reduce the need for cash handling, which can be time-consuming and prone to errors. This efficiency allows staff to focus more on service quality.

Reduced Cash Handling

Handling cash involves several steps: counting, storing, and transporting money to the bank. By adopting prepaid card transactions, food courts can minimize these tasks, reducing the risk of theft and human error.

Improved Sales Tracking and Analytics

Prepaid card systems often come with robust tracking and analytical tools. Operators can gain insights into sales patterns, peak times, and popular items. This data is invaluable for making informed business decisions and improving overall operations.

Impact on Customer Experience

Faster Service

With prepaid card transactions, service speeds up. Customers no longer have to wait for cash transactions to be processed. This efficiency leads to shorter queues and a more pleasant dining experience.

Reduced Wait Times

Less time spent handling cash means faster service for everyone. Customers can get their food quicker, and staff can serve more customers in the same amount of time, enhancing the overall experience for everyone.

Loyalty Programs and Rewards

Prepaid cards can be integrated with loyalty programs, offering rewards for frequent use. This integration encourages repeat business and enhances customer satisfaction by providing incentives for continued patronage.

Technological Advancements Enabling Cashless Transactions

Contactless Payment Technology

The advent of contactless payment technology has been a game-changer. Customers can simply tap their prepaid cards on a reader, and the transaction is completed in seconds. This technology is not only faster but also more hygienic, reducing physical contact.

Mobile Payment Integration

Many prepaid card systems are now integrated with mobile payment platforms like Apple Pay and Google Wallet. This integration allows customers to use their smartphones for transactions, adding another layer of convenience.

Point-of-Sale (POS) Systems

Modern POS systems are equipped to handle prepaid card transactions effortlessly. They are designed to process payments quickly and securely, ensuring a smooth experience for both customers and staff.

Case Studies of Successful Implementations

A Major Mall Food Court

In a bustling mall, the implementation of prepaid card transactions transformed the food court experience. By reducing cash handling, operators noticed a significant decrease in wait times and an increase in customer satisfaction.

University Campus Food Court

On a university campus, a food court adopted prepaid card transactions to cater to the tech-savvy student population. The move was met with enthusiasm, as students appreciated the convenience and security of cashless payments.

Challenges and Concerns

Potential Technological Barriers

While the benefits are clear, there are challenges to consider. Some customers may face technological barriers, such as not owning a smartphone or being unfamiliar with prepaid cards.

Issues of Inclusivity for Non-Digital Users

Inclusivity is a major concern. It's important to ensure that all customers, including those who are not tech-savvy, can still access food court services without feeling excluded or inconvenienced.

Addressing Security Concerns

Measures to Prevent Fraud

To address security concerns, food courts can implement measures such as encryption and tokenization. These technologies help protect sensitive information and prevent fraud.

Ensuring Data Privacy

Ensuring data privacy is crucial. Food courts must comply with data protection regulations and use secure systems to handle customer information, maintaining trust and confidence.

Consumer Education and Adaptation

Importance of Educating Consumers

Educating consumers about the benefits and usage of prepaid cards is essential. Clear communication can help alleviate any apprehensions and encourage adoption.

Strategies to Encourage Adoption

Strategies to encourage adoption include offering incentives, providing easy-to-understand instructions, and ensuring staff are trained to assist customers with any questions or issues.

Environmental Impact

Reduction in Paper and Plastic Waste

Moving to prepaid card transactions can reduce the need for paper receipts and plastic cash wrappers. This shift contributes to a decrease in waste and supports environmental sustainability.

Sustainable Practices in Food Courts

Food courts can adopt sustainable practices by using digital receipts and eco-friendly card materials, further enhancing their environmental impact.

Global Perspectives

Adoption in Different Regions

The adoption of prepaid card transactions varies globally. In some regions, cashless payments are already the norm, while others are still transitioning. Understanding these differences is key to successful implementation.

Cultural Factors Influencing Adoption

Cultural factors play a significant role in how quickly new payment methods are adopted. Societies with a strong preference for cash may require more time and effort to shift towards cashless options.

Conclusion

The shift towards prepaid card cashless transactions in food courts is part of a broader trend towards digital and efficient payment methods. This transition brings numerous benefits for both consumers and operators, from convenience and security to streamlined operations and enhanced customer experiences. As technology continues to advance, we can expect even more innovative payment solutions that will further transform the dining experience.

We hope you enjoyed reading our blog posts about food court billing solutions. If you want to learn more about how we can help you manage your food court business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91–9810078010 or by email at [email protected]. Thank you for your interest in our services.

FAQs

How do prepaid cards work in food courts? Prepaid cards are preloaded with a specific amount of money and can be used like debit or credit cards at participating food court vendors. The transaction amount is deducted from the card balance.

Are prepaid card transactions secure? Yes, prepaid card transactions are secure. They often include security features such as PINs or biometric verification and can be deactivated if lost or stolen.

Can I still use cash in food courts? While many food courts are moving towards cashless transactions, some may still accept cash. It's best to check with the specific food court for their payment policies.

What happens if I lose my prepaid card? If you lose your prepaid card, you can usually report it to the issuing authority to deactivate it and get a replacement. This process helps protect your remaining balance.

How can food courts encourage the use of prepaid cards? Food courts can encourage the use of prepaid cards by offering incentives such as discounts, loyalty points, or rewards for using the card. Educating customers on the benefits and providing support for first-time users can also help.

#CashlessTransactions#PrepaidCards#FoodCourts#DigitalPayments#CashlessDining#PrepaidCardBenefits#ModernPaymentMethods#FoodCourtTrends#CustomerExperience#ConvenientPayments#SecureTransactions#TechInFoodService#DigitalTransformation#ContactlessPayments#SustainableDining#FutureOfPayments#FoodServiceInnovation#CashlessFuture#FoodCourtTech#PaymentSolutions

0 notes

Text

From Cash to Cards: The Evolution of Food Court Payments and the Rise of Prepaid

Food courts have always been bustling hubs of activity, where people gather to enjoy a variety of cuisines in a communal setting. Over the years, the way we pay for our food has dramatically changed. From the clinking of coins to the swiping of cards, and now the tapping of prepaid cards, the evolution of food court payments reflects broader trends in technology and consumer behavior. Let's take a journey through this fascinating transition.

The Early Days: Cash is King

Back in the day, cash was the undisputed ruler of food court transactions. The sound of cash registers and the sight of bills and coins changing hands were omnipresent. Cash was simple and universally accepted, but it came with its own set of challenges. Handling large volumes of cash could be cumbersome and posed security risks for both customers and vendors. Making change was a hassle, and cash management required rigorous processes to avoid discrepancies and theft.

The Advent of Credit and Debit Cards

Enter the age of plastic. Credit and debit cards began to revolutionize the way we paid for everything, including our meals at food courts. These cards offered a convenient alternative to cash, eliminating the need to carry large amounts of money. They provided an additional layer of security and simplified record-keeping for businesses. With cards, transactions became faster, and the problem of making exact change became a thing of the past.

Transition Period: Cash to Cards

The transition from cash to cards wasn't instantaneous. Consumers and businesses alike had to adapt to this new mode of payment. Initially, there was some resistance, especially from those who were comfortable with cash. However, as card payment systems became more reliable and ubiquitous, the convenience they offered led to widespread acceptance. Businesses invested in card terminals, and consumers grew accustomed to the ease of swiping their cards.

The Role of Technology in Payment Evolution

Technology has played a pivotal role in the evolution of payment systems. The development of secure payment gateways and encryption technologies enhanced the safety of card transactions. Innovations like contactless payments further sped up the transaction process, making it even more convenient for customers in a hurry. The advent of mobile payment solutions and digital wallets also contributed to the decline of cash usage in food courts.

Emergence of Prepaid Cards

Prepaid cards entered the scene as a novel payment method designed to offer the benefits of cards without some of their drawbacks. Unlike credit and debit cards, prepaid cards are not linked to a bank account or credit line. Instead, they are pre-loaded with a specific amount of money. This innovation appealed to those who wanted to manage their spending more effectively and avoid the risks associated with carrying cash or using credit.

Benefits of Prepaid Cards

Prepaid cards offer several advantages:

Budget Management: Users can load a specific amount onto the card, making it easier to stick to a budget.

Security and Fraud Prevention: Since prepaid cards are not linked to personal bank accounts, the risk of fraud is minimized.

Convenience and Accessibility: These cards are easy to obtain and use, even for those without access to traditional banking services.

How Prepaid Cards Work in Food Courts

Using prepaid cards in food courts is straightforward. Customers can purchase or reload their cards at designated kiosks or online. Once loaded, the cards can be used at any participating vendor within the food court. The transaction process is quick and seamless, often involving a simple tap or swipe. The integration of prepaid card systems with food court POS (point of sale) systems ensures smooth and efficient transactions.

Case Studies: Successful Implementation

Example 1: A Major Food Court Chain

A large, well-known food court chain implemented a prepaid card system to streamline operations and enhance customer experience. The chain reported increased transaction speeds, reduced cash handling issues, and improved customer satisfaction. The data collected from prepaid card usage also provided valuable insights into consumer preferences and spending patterns.

Example 2: Small Independent Food Courts

Even smaller, independent food courts have successfully adopted prepaid cards. For instance, a local food market in a busy metropolitan area introduced prepaid cards to cater to the tech-savvy younger crowd. The initiative was well-received, leading to higher sales and a more efficient checkout process.

Consumer Perspectives on Prepaid Cards

Feedback from consumers about prepaid cards has generally been positive. Many appreciate the control over spending and the reduced risk of overspending. Surveys indicate that users find prepaid cards to be convenient, especially for regular visits to food courts. Personal stories highlight how these cards have made quick meals more efficient and less stressful.

Business Perspectives on Prepaid Cards

From a business standpoint, prepaid cards offer several advantages. They help reduce the costs associated with cash handling and processing fees. The prepaid model also ensures that businesses receive payment upfront, improving cash flow. Moreover, the data collected from prepaid card transactions can be used to tailor offerings and promotions to meet customer demands more effectively.

Challenges and Criticisms

Despite their benefits, prepaid cards are not without criticism. Some consumers feel that the need to preload funds can be inconvenient. There are also concerns about the fees associated with certain prepaid cards, which can add up over time. However, many of these issues are being addressed as the market for prepaid cards evolves, with more consumer-friendly options becoming available.

Future Trends in Food Court Payments

Looking ahead, the future of food court payments is poised to be even more dynamic. Emerging technologies such as biometric payments, blockchain, and AI-driven payment systems are likely to further transform the landscape. These advancements promise to make transactions even faster, more secure, and more personalized. The continued rise of mobile payments and digital wallets also suggests a future where physical cards might become obsolete.

Comparing Payment Methods: Cash, Cards, and Prepaid

Each payment method has its pros and cons:

Cash: Universally accepted but cumbersome and less secure.

Credit/Debit Cards: Convenient and secure but require bank accounts and can incur fees.

Prepaid Cards: Great for budgeting and security but may have preloading inconvenience and associated fees.

The best payment method depends on individual preferences and specific scenarios.

Conclusion

The evolution of food court payments from cash to cards and the rise of prepaid cards reflects broader technological advancements and changing consumer behaviors. Prepaid cards, in particular, have carved out a significant niche by offering a blend of convenience, security, and budget control. As we look to the future, the continuous innovation in payment technologies promises to make our dining experiences even more seamless and enjoyable.

FAQs

What are prepaid cards? Prepaid cards are payment cards loaded with a specific amount of money in advance, used for transactions until the balance is depleted.

How do prepaid cards differ from credit/debit cards? Unlike credit or debit cards, prepaid cards are not linked to a bank account or credit line. They are pre-funded and can be used until the pre-loaded amount is spent.

Are prepaid cards secure? Yes, prepaid cards are generally secure as they are not connected to personal bank accounts, reducing the risk of fraud.

Can prepaid cards be used everywhere? Prepaid cards can be used at any vendor that accepts them, which typically includes a wide range of retailers and food courts.

What happens if a prepaid card is lost? If a prepaid card is lost, the user should report it immediately to the issuer. Most issuers

We hope you enjoyed reading our blog posts about food court billing solutions. If you want to learn more about how we can help you manage your food court business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91–9810078010 or by email at [email protected]. Thank you for your interest in our services.

#FoodCourtPayments#PaymentEvolution#FromCashToCards#PrepaidCards#FoodCourtTechnology#CashlessPayments#DigitalPayments#PrepaidBenefits#ConvenientPayments#SecureTransactions#BudgetFriendly#PaymentInnovation#CustomerExperience#BusinessEfficiency#FutureOfPayments#TechInFoodCourts#DiningExperience#TransactionSecurity#ConsumerTrends#FoodCourtEvolution

0 notes

Text

The Smart Way to Handle School Meals: Prepaid Card Solutions

In today's fast-paced world, managing school meals efficiently is crucial for both parents and schools. Gone are the days of sending cash or checks in envelopes with students, as the digital age has ushered in a smarter solution: prepaid card solutions for school meals.

Traditional Payment Methods

Traditional methods of paying for school meals, such as cash or checks, pose numerous challenges for both parents and schools. Cash can easily be lost or stolen, while checks require manual processing and can lead to errors.

Introduction of Prepaid Card Solutions

Prepaid card solutions offer a modern alternative to traditional payment methods. These cards are loaded with funds by parents or guardians and can be used specifically for school meal purchases.

Benefits of Prepaid Card Solutions

The benefits of using prepaid card solutions for school meals are manifold. Firstly, they provide unparalleled convenience for parents, eliminating the need for sending cash or writing checks each day. Additionally, prepaid cards offer enhanced security and safety, as there is no risk of cash being lost or stolen.

Convenience for Parents

With prepaid card solutions, parents can easily manage and track their child's meal payments online. They can reload funds as needed, set spending limits, and receive notifications for each transaction, ensuring complete control over their child's meal account.

Security and Safety

Prepaid cards come with built-in security features such as PIN protection and fraud monitoring, offering parents peace of mind knowing that their child's meal funds are safe and secure.

Budget Management for Parents

Prepaid card solutions also aid in budget management for parents, allowing them to allocate specific amounts for school meals each week or month. This helps in controlling spending and ensures that funds are available when needed.

Customization and Control

Unlike cash or checks, prepaid card solutions offer customization options such as setting dietary restrictions or specifying which items can be purchased with the card. This level of control ensures that students are only consuming meals that meet their nutritional needs.

Streamlined Processes for Schools

From the school's perspective, prepaid card solutions streamline administrative tasks associated with managing meal payments. They reduce the need for manual cash handling, minimize errors, and simplify reconciliation processes.

Reduced Stigma for Students

Prepaid card solutions also help in eliminating the stigma often associated with free or reduced-price meal programs. Since all students use the same payment method, there is no differentiation based on financial status.

Integration with School Systems

Prepaid card solutions can seamlessly integrate with existing school systems, including point-of-sale systems and student information databases. This ensures smooth implementation and minimal disruption to school operations.

Accessibility for All

One of the most significant advantages of prepaid card solutions is that they ensure equal access to nutritious meals for all students, regardless of their socioeconomic background. By removing barriers to payment, schools can better serve their entire student population.

Case Studies

Numerous schools and districts across the country have successfully implemented prepaid card solutions for handling school meals. From urban districts to rural communities, these solutions have proven to be effective in improving efficiency, security, and equity in school meal management.

Conclusion

In conclusion, prepaid card solutions offer a smart and efficient way to handle school meals for both parents and schools. With benefits such as convenience, security, and customization, these solutions are revolutionizing the way meal payments are managed in educational institutions.

FAQs

Are prepaid card solutions compatible with all schools?

Yes, prepaid card solutions can be customized to meet the specific needs of any school or district.

How do parents reload funds onto prepaid cards?

Parents can reload funds online using a debit or credit card, or through various payment methods offered by the card provider.

What happens if a prepaid card is lost or stolen?

Parents can immediately report the card as lost or stolen, and the card provider will deactivate the card and issue a replacement.

Can prepaid cards be used for purchases other than school meals?

No, prepaid cards are typically restricted to use for school meal purchases only, ensuring that funds are allocated for their intended purpose.

Are there any fees associated with using prepaid card solutions?

Some card providers may charge nominal fees for certain services, such as card replacement or online account management. However, these fees are often minimal and transparent.

We hope you enjoyed reading our blog posts about prepaid card school billing solutions. If you want to learn more about how we can help you manage your business, please visit our website here.

We are always happy to hear from you and answer any questions you may have. You can reach us by phone at +91 9810078010 or by email at [email protected]. Thank you for your interest in our services.

#SchoolMeals#PrepaidCards#SchoolPayments#EducationTech#MealManagement#Parenting#SchoolNutrition#FinancialLiteracy#StudentSecurity#Budgeting#DigitalPayments#ChildNutrition#MealPlanning#SchoolLunch#CashlessSchools#SmartPayments#SchoolResources#FamilyBudget#StudentHealth#MealPrep

0 notes

Text

How Prepaid Cards Are Transforming the Nightclub Scene

Nightlife has always been an integral part of socializing and entertainment, with nightclubs being popular destinations for people looking to unwind and have a good time. However, the traditional methods of payment, such as cash or credit cards, are gradually being replaced by a more convenient and secure alternative – prepaid cards. In this article, we'll delve into the significant changes prepaid cards are bringing to the nightclub scene, revolutionizing the way people experience nightlife.

Understanding Prepaid Cards

Prepaid cards, also known as stored-value cards, are payment cards that are loaded with a specific amount of funds in advance. These cards function similarly to debit or credit cards but are not linked to a bank account. Users can reload funds onto the card as needed, making them a convenient and flexible payment option.

Challenges in the Nightclub Scene

Nightclub-goers often face challenges when it comes to making payments. Long lines at the bar, the risk of losing cash, and concerns about credit card security are some of the common issues encountered. Additionally, managing expenses in a dynamic and fast-paced environment can be daunting.

Benefits of Prepaid Cards

Prepaid cards offer several benefits that address the challenges faced by nightclub patrons. One of the most significant advantages is the convenience and security they provide. With a prepaid card, users can make quick and secure transactions without the need to carry cash or worry about the safety of their credit card information.

Convenience and Security

Prepaid cards offer a level of convenience and security that traditional payment methods cannot match. Users can simply load funds onto their card before heading to the nightclub, eliminating the need to carry large amounts of cash. Additionally, prepaid cards are not linked to personal bank accounts, reducing the risk of identity theft or fraud.

Budget Management

Another key benefit of prepaid cards in the nightclub scene is their role in budget management. By loading a specific amount of funds onto the card, users can set a budget for their night out and avoid overspending. This feature is especially useful in environments where impulse spending is common.

Exclusive Offers and Rewards

Prepaid card providers often partner with nightclubs to offer exclusive deals and rewards to cardholders. These incentives may include discounts on drinks or VIP access to events. By using a prepaid card, nightclub-goers can take advantage of these perks and enhance their overall experience.

Adoption by Nightclub Businesses

Recognizing the benefits of prepaid cards, many nightclub businesses are now implementing prepaid card systems. These systems streamline the payment process, reduce transaction times, and improve overall customer satisfaction. By embracing prepaid cards, nightclubs can stay ahead of the curve and attract more patrons.

Case Studies

Several nightclubs have already experienced success with prepaid card systems. For example, One Club saw a significant increase in customer spending after introducing prepaid cards, thanks to the convenience and rewards offered. Similarly, another Club reported a decrease in transaction times and an uptick in customer loyalty.

Future Trends

The future of prepaid cards in the nightclub scene looks promising. As technology continues to advance, we can expect to see more innovative features and functionalities added to prepaid card systems. Additionally, increased consumer awareness and acceptance will drive further adoption.

Challenges and Solutions

Despite their many benefits, prepaid cards still face challenges in widespread adoption. Concerns about fees, privacy, and regulatory compliance remain top priorities for both consumers and businesses. However, industry stakeholders are actively working to address these issues and ensure a seamless experience for all parties involved.

Regulatory Considerations

Regulatory oversight is another factor influencing the use of prepaid cards in the nightclub industry. Governments around the world are implementing measures to protect consumers and prevent financial crimes. By adhering to these regulations, nightclub businesses can build trust with their customers and avoid potential legal pitfalls.

Consumer Education

Lastly, consumer education plays a crucial role in the success of prepaid cards. Many people are still unfamiliar with how prepaid cards work and the benefits they offer. By providing clear and accessible information, businesses can empower consumers to make informed decisions about their payment options.

Conclusion

In conclusion, prepaid cards are transforming the nightclub scene by offering a convenient, secure, and efficient payment solution. From streamlining transactions to providing exclusive rewards, prepaid cards are revolutionizing the way people experience nightlife. As technology advances and consumer awareness grows, we can expect prepaid cards to become even more prevalent in the future, further enhancing the nightclub experience for all.

FAQs

Are prepaid cards safer than carrying cash in a nightclub?

Yes, prepaid cards offer enhanced security features such as fraud protection and the ability to block transactions if the card is lost or stolen.

Can I reload funds onto my prepaid card while at the nightclub?

Some prepaid card providers offer mobile apps or online platforms where users can reload funds instantly, providing added convenience.

Do prepaid cards have any hidden fees?

It depends on the provider. It's essential to read the terms and conditions carefully to understand any associated fees before using a prepaid card.

Can I use a prepaid card for online purchases after leaving the nightclub?

Yes, most prepaid cards can be used for online transactions, making them versatile payment options beyond the nightclub scene.

Are prepaid cards accepted at all nightclubs?

While the acceptance of prepaid cards may vary from one nightclub to another, an increasing number of establishments are embracing this payment method due to its popularity among patrons.

We hope you enjoyed reading our blog posts about night club billing solutions. If you want to learn more about how we can help you manage your night club business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91 9810078010 or by email at [email protected]. Thank you for your interest in our services.

www.atsonline.in/Night-Club-POS.html

#Nightclub#Nightlife#PrepaidCards#PaymentSolutions#Convenience#Security#BudgetManagement#ExclusiveOffers#Rewards#CustomerExperience#Technology#Innovation#ConsumerEducation#Regulations#DigitalPayments#CashlessTransactions#Clubbing#Entertainment#FutureTrends#FinancialSecurity#FAQs

0 notes

Photo

Prepaid Card Management System Solution Proposal Template https://fintechrfps.com/product/prepaid-card-management-system-solution-proposal-template/?utm_source=tumblr&utm_medium=social&utm_campaign=fintechrfps

0 notes

Text

Boost Efficiency in Cafeterias with Prepaid Cards: A Comprehensive Guide

Introduction

In today's fast-paced world, efficiency is key, especially in high-traffic places like cafeterias. One innovative solution that has gained significant traction is the use of prepaid cards. These cards streamline transactions, reduce wait times, and enhance overall customer experience. In this article, we'll delve into the various ways prepaid cards can boost efficiency in cafeterias, making operations smoother and more customer-friendly.

The Benefits of Prepaid Cards

Enhancing Transaction Speed

Prepaid cards significantly speed up the transaction process. With a simple swipe or tap, customers can pay for their meals swiftly, reducing long queues and wait times at the cashier.

Streamlining Operations

From the cafeteria's perspective, prepaid cards streamline operations by minimizing the need for handling cash. This not only reduces the risk of errors but also frees up staff to focus on providing excellent service.

Encouraging Repeat Business

Prepaid cards can be integrated with loyalty programs, offering incentives for repeat customers. This encourages loyalty and increases the likelihood of customers returning to the cafeteria.

Implementing Prepaid Card Systems

Choosing the Right Provider

When implementing a prepaid card system, it's crucial to choose the right provider. Look for a provider that offers robust security features, seamless integration with existing systems, and excellent customer support.

Customizing Card Options

Offering a variety of prepaid card options allows customers to choose what works best for them. Whether it's a reloadable card or a one-time use card, providing flexibility enhances customer satisfaction.

Overcoming Challenges

Educating Customers

One challenge in implementing prepaid card systems is educating customers about their benefits and usage. Clear signage, informational materials, and friendly staff can help overcome this hurdle.

Handling Technical Issues

Like any technology, prepaid card systems may encounter technical glitches from time to time. It's essential to have a contingency plan in place and a responsive support team to address issues promptly.

Boost Efficiency in Cafeterias with Prepaid Cards: FAQs

How do prepaid cards benefit cafeteria operations? Prepaid cards enhance efficiency by speeding up transactions, streamlining operations, and encouraging repeat business.

Can prepaid cards be customized for different needs? Yes, prepaid cards can be customized to offer various features such as re-loadable options, loyalty programs, and special promotions.

Are prepaid card transactions secure? Most prepaid card systems come with robust security features to protect both customers and cafeteria operators from fraud and data breaches.

What happens if a prepaid card is lost or stolen? Many prepaid card providers offer options to freeze or deactivate lost or stolen cards to prevent unauthorized use. Customers can typically request a replacement card with the remaining balance transferred.

Can prepaid cards be integrated with existing cafeteria systems? Yes, many prepaid card systems are designed to integrate seamlessly with existing point-of-sale (POS) systems, making implementation smooth and hassle-free.

Are there any fees associated with prepaid cards? Some prepaid card programs may have fees associated with initial purchase, reloads, or account maintenance. However, these fees are often outweighed by the benefits of using prepaid cards.

Conclusion

In conclusion, prepaid cards offer a myriad of benefits for boosting efficiency in cafeterias. From speeding up transactions to streamlining operations and fostering customer loyalty, prepaid cards are a valuable tool for modernizing cafeteria management. By overcoming challenges and implementing best practices, cafeterias can harness the power of prepaid cards to enhance the overall dining experience for both customers and staff.

We hope you enjoyed reading our blog posts about canteen and cafeterias billing solutions. If you want to learn more about how we can help you manage your food court business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91–9810078010 or by email at [email protected]. Thank you for your interest in our services.

#Efficiency#Cafeteria#PrepaidCards#CustomerExperience#LoyaltyPrograms#StreamliningOperations#TransactionSpeed#CashlessPayment#Technology#DiningExperience#Convenience#CustomerService#DigitalPayments#Innovation#FoodService#Modernization#Sustainability#DigitalTransformation#PointOfSale#CashlessSociety

0 notes

Text

Hong Kong bets on consumption voucher schemes to revive pandemic-hit economic growth

In response to the economic crisis, the Hong Kong government has been running a consumption voucher for the last three years, including 2023. Designed to stimulate consumer spending, this scheme is aimed at uplifting the economy by providing direct financial support to residents. As part of the 2023 consumption voucher scheme, authorities in Hong Kong distributed the second installment of e-vouchers to eligible citizens in July 2023. The second installment of the scheme is expected to inject HK$13 billion into the local market, thus supporting the recovery of the domestic economy.

Click here to read more - https://www.paynxt360.com/view-point/hong-kong-bets-on-consumption-vouc/712

0 notes

Text

"Unlocking Financial Independence with Prepaid Cards"

Prepaid cards offer a versatile and secure financial solution, providing users with the convenience of a debit card without the need for a traditional bank account. These cards are preloaded with a specific amount of money, making them ideal for budgeting, travel, and gifting. They also serve as an excellent tool for managing expenses, as they help users avoid overspending and incur no debt. Additionally, prepaid cards are widely accepted at numerous merchants and online platforms, offering both flexibility and control over personal finances.

https://www.globalinsightservices.com/request-sample/GIS25099@/?utm_source=SnehaPatil-Article

Their accessibility and ease of use make them a popular choice for individuals seeking financial independence and security.#PrepaidCards #FinancialIndependence #BudgetingTools #SecureSpending #TravelFinance #GiftCards #MoneyManagement #DebitAlternatives #SpendingControl #NoDebt #FinancialSecurity #CashlessPayments #EasyBudgeting #FlexibleSpending #CardBenefits

0 notes

Text

PhonePe pulls the plug on acquisition deal with ZestMoney in India

PhonePe, one of the leading mobile wallet and prepaid payment instrument providers in India has raised multi-million-dollar deals in H1 2023. These funding rounds are part of the firm’s strategy to expand into new business verticals such as consumer lending and insurance, among others. Read more

#prepaidpayment#prepaidcard#bnplmarketresearch#bnplindustryinindia#buynowpaylater#zestmoneyinindia#phonepe#mobilewallet

0 notes

Text

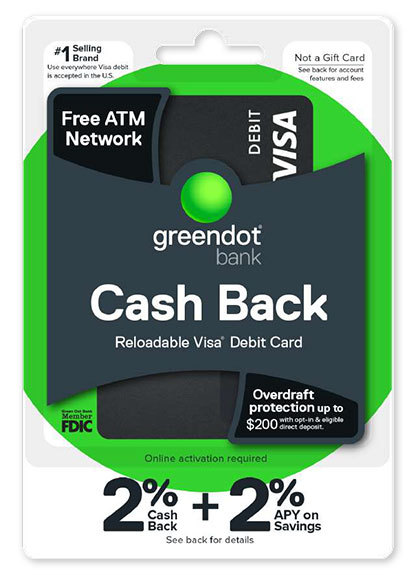

#GreenDotReloadablePrepaidCard #PrepaidCard #CardQuestions

Thinking about this Green Dot Reloadable Prepaid Card With Cash Back and I was wondering if this will work on Etsy.

I don't want a credit card but I just want a reloadable gift card to use on Etsy since most sellers don't do Ebay.

I was wondering if there are any Etsy sellers that follow me would the site accept this card?

Image not mine but link is there.

Green Dot Reloadable Prepaid Cards | DollarTree.com

0 notes