#preferred return guaranteed payments

Explore tagged Tumblr posts

Text

#preferred return real estate#preferred return guaranteed payments#Private Real Estate Investing#what is a preferred return#preferred rate of return#preferred return private equity#preferred returns in real estate

1 note

·

View note

Text

Asset Management vs Property Management: Understanding the Key Differences

Asset Management vs Property Management: Understanding the Key Differences

#Asset Management vs Property Management#customizable fund vs individual syndication#Customizable Real Estate Fund#gap funding for real estate investors#preferred return guaranteed payments#preferred return real estate

0 notes

Text

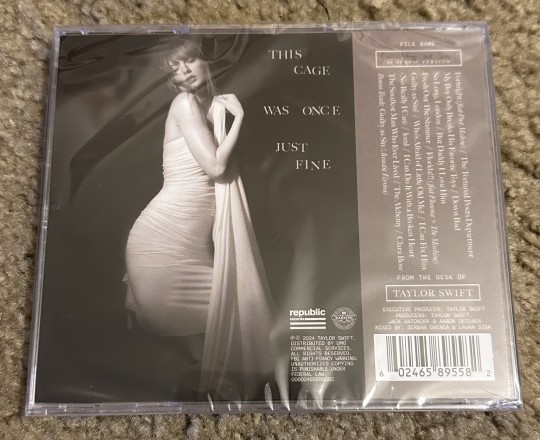

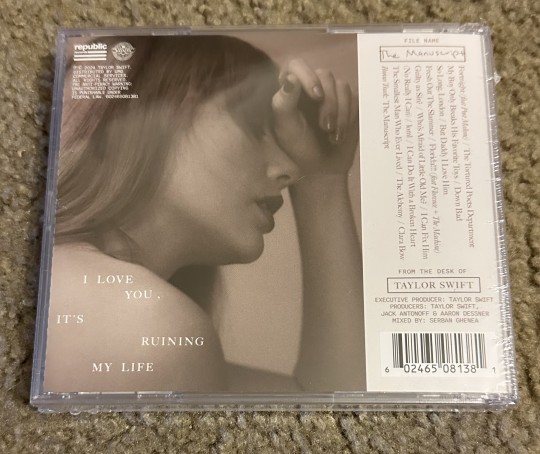

MASSIVE TAYLOR SWIFT CD SALE! INCLUDES NEW ITEMS

Hello, and happy holidays! I'm Chloe, a big Swiftie, and even bigger CD collector. I've been collecting for the better part of thirteen (!!) years now, and in that time, have managed to end up with a... few... duplicates in my hoard. It's time that those repeats go to new Swiftie homes, where they will hopefully bring as much joy to you as they once did to me, and what better time than right before the holidays? So before I post everything (which will be under the cut) I just kind of want to give an overview of how this will work. A sort of FAQ, if you will.

1. To claim an item, you will need to message me. And yes, I do mean mean "message," not "ask." This way ensures not only that Tumblr won't eat your request, as it loves to eat inbox mail, but also so that I can then have a conversation with you about where to send the item(s). 2. I will only accept Venmo/PayPal as forms of payment. Venmo is the preferred method, because they don't charge any sort of fees, but I am aware that Venmo is not available internationally, and PayPal is the safest alternative. Shipping for one single item across the US is about $5, so that's all I'll ask for it. 3. I will ship internationally, but you must prepare for delayed delivery. Since it is the holiday season, I cannot guarantee that anything sent overseas will arrive before Christmas. Please keep this in mind before ordering. Furthermore, in this case, I will ask for the cost of postage in a second payment, and then will provide you with a tracking number in return. 4. If you are buying more than one item, I will combine shipping. Because I cannot possibly guess the cost of shipping for multiple items, I will send a second invoice for the cost of shipping, along with a tracking number for your package. 5. No returns/refunds are allowed. All sales are final, as the whole idea behind this is for me to lighten the load. I have multiple pictures of each item (most of which will not be posted here to avoid making this post even longer), and will send them your way upon request.

Items will be marked as SOLD as they are purchased, so make sure you are checking the post on my blog and not just via reblogs before inquiring! All purchases will be mailed out within three business days of receiving payment. I will also message you to let you know exactly when they go out!

Thank you for taking the time to read this; merry Swiftmas!!

ITEMS FOR SALE

Taylor Swift (Promo Version) SOLD

Beautiful Eyes EP (Walmart Exclusive) SOLD

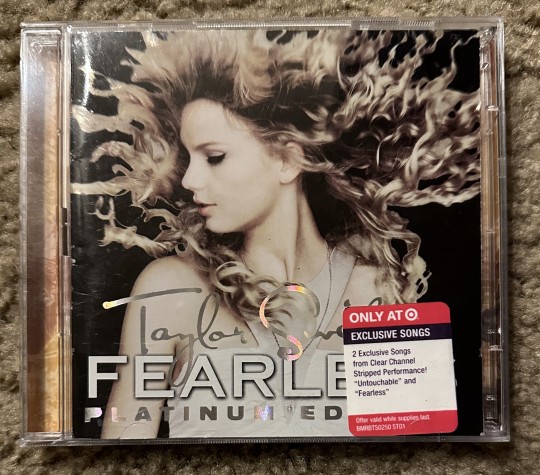

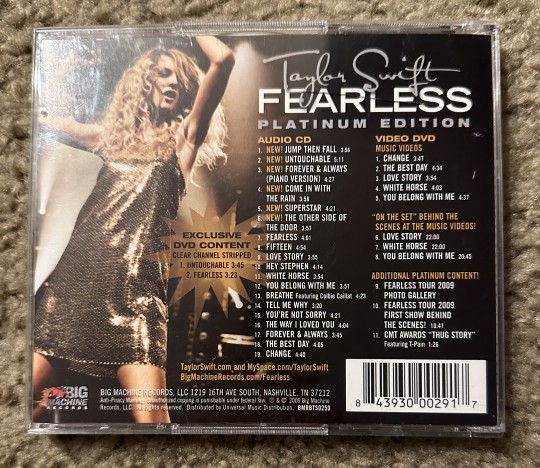

Fearless Platinum Edition (Target Exclusive) - $25 - TWO AVAILABLE This version of the album comes with additional DVD content--specifically, it's two of the songs she performed at Clear Channel Stripped! The case has some minor cracks and the "sticker" is just a reprint for identification purposes, but both discs and all inserts are in really good condition! The second copy is basically identical, but I can send pictures if you're interested in seeing it specifically.

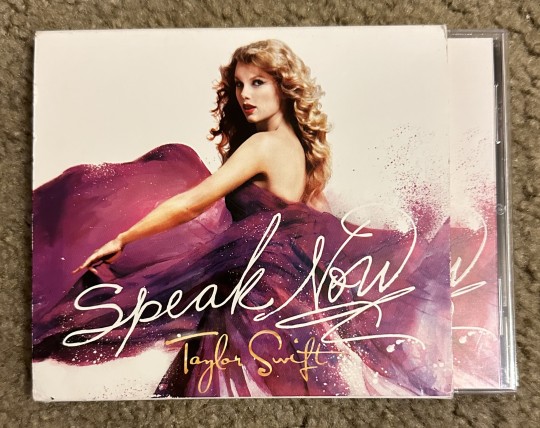

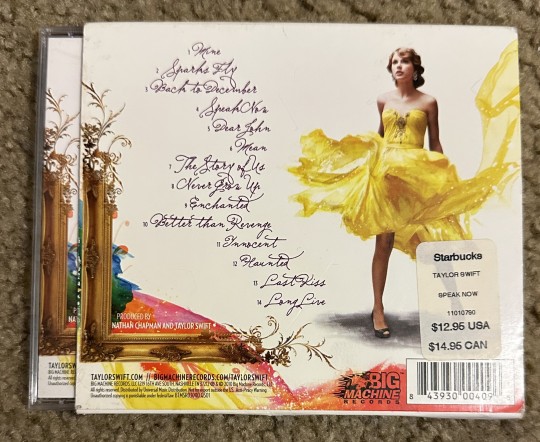

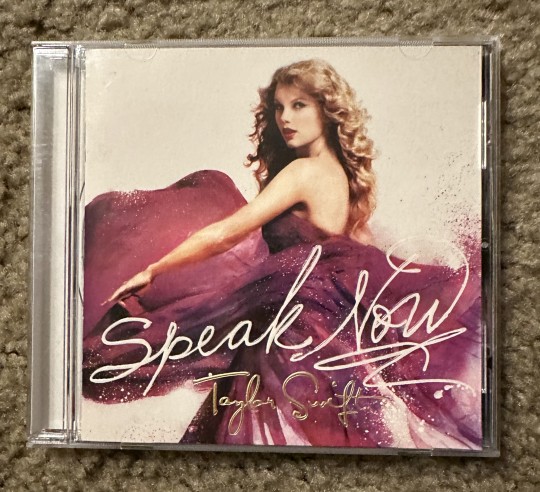

Speak Now (Starbucks Exclusive) - $30 Nothing on the CD is different from other US versions of this album, but this one, sold exclusively at Starbucks back in the day, comes with a fancy "O-ring" slipcover! Not many were made, so it's considered to be on the rarer side.

Speak Now (Walmart Exclusive) - $15 This version was sold exclusively to Walmart and contained a cute little coupon for Covergirl products! Unfortunately, this copy did not come with the insert, which is why I'm selling it off. The only notable differences between it and any other standard copy of Speak Now are the catalogue number and UPC. All the songs are the same.

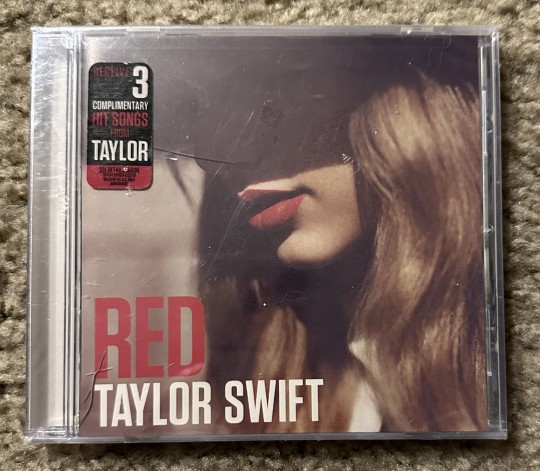

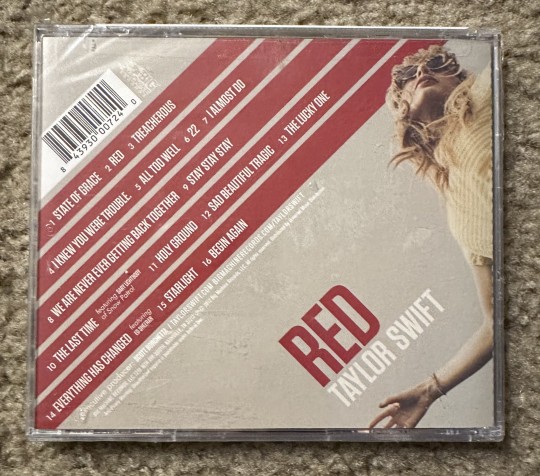

Red SOLD

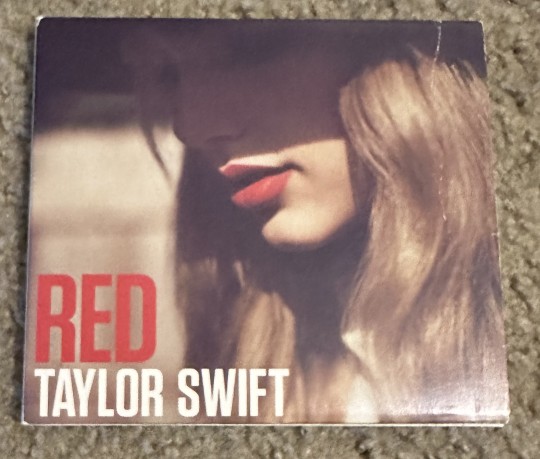

Red (Starbucks Exclusive) - $30 This Starbucks exclusive "digipak" version of Red folds in the middle, much like a vinyl record! It does have a small fold in the cover (see the first photo), but the CD and booklet are in perfect condition. This copy was sent to me with the second disc from the Target version of Red, so it will also be included with this purchase. You're basically getting the deluxe version in a cool, rare case haha. :)

Red (Costco Exclusive) - $30 Yes, there are a few minor case cracks on the front side (thanks, kitties), but the album is still sealed and comes with its insert! What sets this rare version aside from its peers is the hype sticker on the front, and the inclusion of a flyer that, while no longer valid, once allowed you to download 3 additional Taylor Swift songs for free!

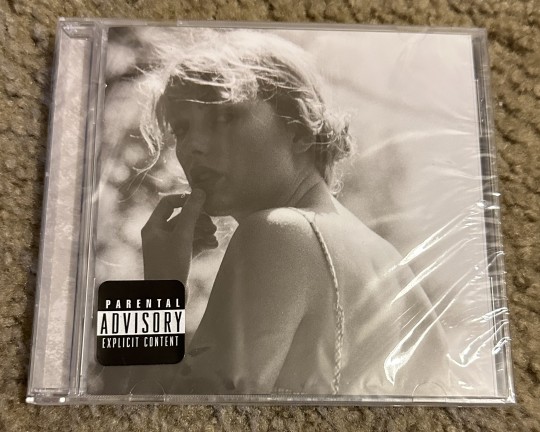

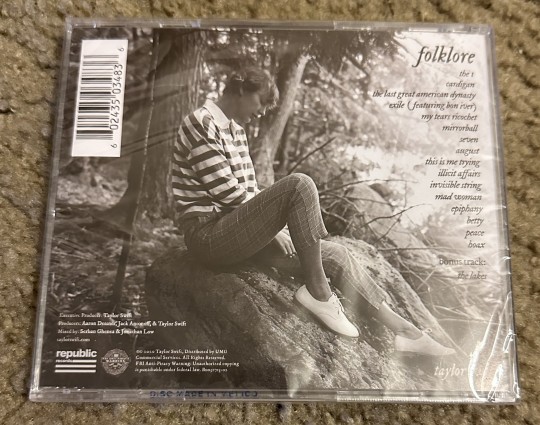

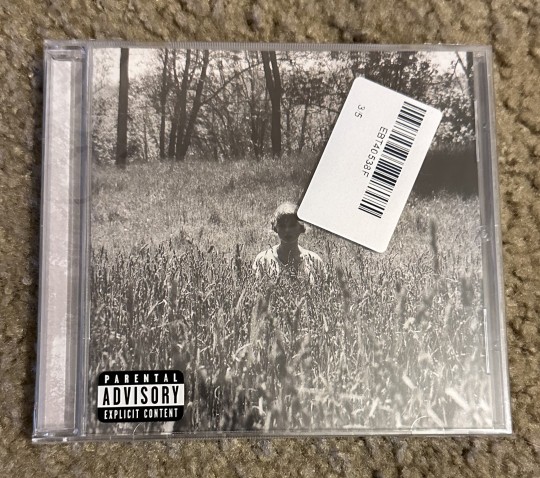

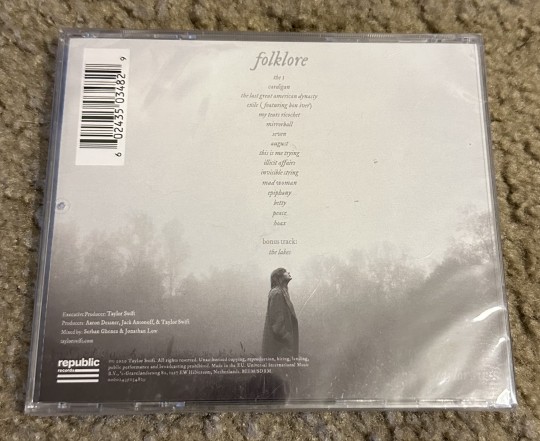

Red (Deluxe Edition) (Target Exclusive) SOLD folklore: "meet me behind the mall" edition - $15 This version was sold exclusively on Taylor's website! Though it's no different than the one you can get at Target content-wise, it does have a different catalogue number and UPC, so if you're into that sort of thing, this is a steal. Plus, it's brand new!

folklore: "in the weeds" edition - $20 I'm only charging a little extra for this one for two reasons. One, it is a little more sought-after, so if it doesn't sell here, it's going to eBay. Two, it's the EU version (which means nothing content-wise, just catalogue number and UPC-wise), so it cost a little more to get it to me. This one also was a website exclusive, and it's sealed!

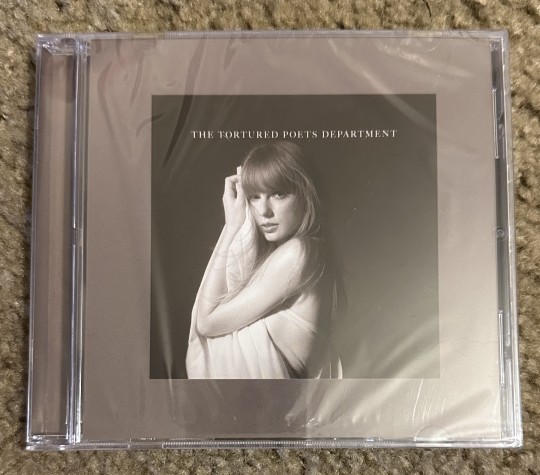

TTPD: Down Bad (Acoustic Version) - $10 Back in June, this was one of two versions of TTPD posted exclusively to Taylor's website. My post office lost my order, so I ended up contacting the store to get a new one sent out. Months later, the package mysteriously arrives! Here's your chance to own that surprise CD!

TTPD: Guilty as Sin? (Acoustic Version) - $10 This CD was also part of the lost package! It too likely has mysterious teleportation powers*, and for the fine price of ten bucks, could also magically show up at your house soon! *This statement has not been proven as fact by the author.

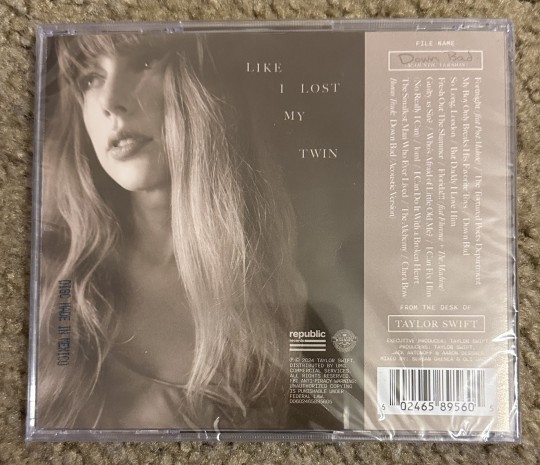

TTPD: The Manuscript (Collector's Edition) - $30 This one was sent to me by mistake when ordering another item from the webstore. They let me keep it, but I don't need it. Again, their loss is your gain! It's also sealed!

More to come in the following days as I downsize, but this is a good place to start, yeah? Please reblog so this reaches as many genuine Swifties as possible! Thank you in advance!!

#taylor swift#ttpd#swiftmas#cd#eras tour#(it's not really eras tour but I know tumblr only uses the first five tags to get the word out and 'eras tour' is a popular tag right now)#personal#text

40 notes

·

View notes

Text

July 1987, Moscow, USSR.

41-year-old Donald Trump arrives in Moscow with his wife, Czech model Ivana Zelnichkova, at the invitation of the Soviet Ambassador to the

United States (!!! ) Yuri Dubinina. The invitation was approved by the politburo of the ck kprs.

Trump, who is in a financial crisis - his assets are plummeting rapidly and the debt is rising - reflects on his condition in a famous joke:

-- "See that beggar in the hat on 5th Avenue?" "- he tells his companion, who just gave a diamond necklace.

"That man is 1.5 billion dollars richer than me! "

"But he's got nothing!" "

"He has nothing, but I have 1.5 billion in debt!" "

Returning from Moscow, bankrupt Trump unexpectedly receives a loan from a consortium of 16 banks and buys a Plaza Hotel in New York. Soon, it will get another loan from a consortium of 22 banks to buy Eastern Air Lines Shuttle (renamed Trump Shuttle).

What happened in Moscow in 1987? Who has been funding Trump?

Financing came from Soviet sources of KGB in the United States - through guarantees of loans, not direct monetary payments. In Moscow-1987, Trump's first political contract took place - he was offered support for a future US presidential campaign, and he agreed.

Volodymyr Kryuchkov, head of the KGB, in a report from the Politburo presented Trump as a suitable American candidate who could become a controlled president of the United States.

Before the trip to Moscow, Trump said he would never run for president, because he prefers the free life of a businessman. But after 1987, he changed his position.

---

1996-1997, Moscow, Russia.

Trump visits Moscow three times, meets with Russian businessmen, trying to build ** Trump Tower Moscow without his own investment, only at the expense of Moscow criminal structures funds.

The agency (FSB) watches over him without putting pressure. It's a relief for Trump, but he also doesn't get money, which leaves him frustrated in Yeltsin's Russia.

---

July 1998, Moscow.

Vladimir Putin becomes the director of the FSB. General Philip Bobkov, a former deputy chairman of the KGB, who oversees foreign intelligence and handled Trump's case, is his adviser.

Bobkov passes Putin a compromise on Trump. Trump gets a "message": the FSB returned control and remembers about it.

---

November 2013, Moscow.

After the 2008 financial crisis, Trump returns to Moscow as a bankruptcy, holding the Miss Universe contest in Crocus City.

Event organizer Araz Agalarov pays Trump $14 million and gives unlimited access to young contestants. The FSB films all the events in high resolution, including moments with underage girls posing as contestants.

Putin's agents remind Trump of his 1987 "obligation" promising funding and intelligence support for his presidential campaign.

---

2016 is trump's victory

Putin's propagandists are celebrating:

“America is ours!” "

---

July 16, 2018, Helsinki, Finland.

Trump's closed-door meeting with Putin. Only their translator is an FSB agent.

Putin shows Trump records of his meetings in Crocus City. Trump comes off as a loser and tells reporters:

"... I don't trust my intelligence agencies... i trust Vladimir Putin... "

---

January 6, 2020, Washington DC.

Trump is losing the election. Putin's agents are sending him a "message" - not to concede defeat, to lift up his supporters and attack the US Congress.

Trump urges supporters to storm Capitol.

---

March 22, 2024 Moscow.

Putin burns Crocus City - a kind of Trump signal.

---

Bottom line:

Trump is all in:

1. Many-year cooperation with Soviet and Russian intelligence services.

2. Funding from an enemy state.

3. Compromise in the form of video recordings.

4. Direct communication with terrorist attacks organized by Putin.

Putin has made Trump his "pocket president".

19 notes

·

View notes

Text

Writing Share Tag

tagged by @noblebs, thank you!

The last thing I wrote before I went on vacation was an outline for one of my anthologies.... so I'll share part of that!

Gargoyle Adoption The carver is a middle-aged dwarf woman, with her beard braided back into her hair so it doesn’t interfere with her work. The adoption center looks like an eclectic curiosity shop or antique store, since all the “animals” are basically just living statues. All the gargoyles are loose around the store, but they don’t move until people get near them. The door is big enough for the biggest creatures with several smaller-sized doors within it. Begins with the dwarf carving a gargoyle that will go up for adoption in the shop; their personal pet gargoyle is bugging them—it’s noticeably decorated with gems and engravings. She waves it away, telling it to go eat its food that she set out for it Is forced to stop carving when a customer/potential adopter comes into the store (rings the bell at the counter?). The customer is a very serious-looking elf in fancy elf clothes. Can’t decide on gender. Dwarf asks what she can do for them. They ask if she’s open for Specially Commissioned Gargoyles. She says she is, but that her work doesn’t come cheap. They say no problem, I’m good for it. Elf produces a lovingly detailed sketch of the commission they want. It’s very complex, they’ve obviously thought a ton about this design. The dwarf looks over it, impressed, but not without misgivings. She compliments the drawing, but reminds the elf that a gargoyle is a living creature, as unpredictable as any animal. It may appear as though she can mold it to act however she wants, but the gargoyle has its own personality and preferences. If the gargoyle she carves doesn’t bond with them, she can’t help. She’ll refund the price of the adoption fee, but the commission money itself won’t be returned. The elf hesitates, but ultimately agrees to those terms. Payment is exchanged, the elf leaves, and the dwarf sets aside her first project to get started on the commission. Her office/workspace is a complete mess except for the spot where she carves the gargoyles. She has a specially organized set of tools, magnifying mirrors, magical and mundane light sources, etc. It’s very professional She starts with a solid block of the magical stone that all gargoyles are made of, chipping away at it once piece at a time. Her pet gargoyle hangs around. The more she carves the elf’s design, the more it seems like a kid’s drawing iterated upon by adult perspective, trying to make realistic something imagined from youth. This gargoyle design must be a childhood dream pet they’ve been aching to make a reality She can’t help but hope it likes them, even though she knows there’s no guarantee. Thinks about some of the gargoyle commissions she’s done where it hasn’t worked out. Starts talking to the in-progress gargoyle as she carves, which is something she normally does, but this time it’s more directly about how great it is to be someone’s companion animal. About all the things she and her gargoyle do. Her gargoyle lands on the desk and agrees (it can't speak but you know. animal sounds) with how great it is. She hopes this is enough to convince the magic in the stone to agree.

What happens next!!! A thrilling cliff hanger only to be answered whenever I write this thing for real!

Tagging: @foxys-fantasy-tales @noblebs @ceph-the-ghost-writer @auntdarth @damageinkorporated @srjacksin @void-botanist @vacantgodling @duelistkingdom and anyone else who wants to share something!

15 notes

·

View notes

Text

Imagine, for a moment, that your most clandestine internet searches—anxiety-riddled deep dives on WebMD, Google queries wondering if your cat is trying to kill you, or why farts smell the way they do—were the key to finding a soulmate. Would you sign up for a dating site that guaranteed connection in return for your browser history?

For more than a decade, developers have tried to perfect the science of compatibility. Tinder promised infinite swipes. Bumble let women make the first move. Feeld championed polyamory. Grindr was a gay utopia (until it became overrun with ads). Lex was entirely text based. And Pure, an anonymous dating app, was all about shameless hookups. Now as AI reimagines the landscape of Big Dating, one platform is offering a solution no one asked for: matching singles based on their browser histories.

While the idea sounds antithetical to an era where dating and social media profiles writ large are perfectly curated, that’s exactly the point, according to Browser Dating artist and developer Dries Depoorter, who is known for creating digital projects with an eye for mischief that blur the line between reality and farce. (He insists the dating site is 100 percent legit.)

“There’s honesty in that,” Depoorter, who is based in Ghent, Belgium, says of the concept.

Despite their flaws, dating sites and apps also remain the best place to meet future partners (if you’re young and horny they are mostly unavoidable). According to Pew Research, 42 percent of US adults say online dating made finding a partner easier.

But online dating today has become more about the illusion of potential rather than the reality of who someone actually is. The attraction of discovery—believing our private curiosities make for a better portrait of who people actually are—appealed to Depoorter. He thinks Browser Dating can be a genuine alternative to finding genuine love.

As opposed to Hinge or Raya, where users craft their profiles with expertly angled-photos and facts cherry-picked to make themselves seem as witty and interesting as possible, on Browser Dating, there is no hiding the real you. “Instead of choosing the best pictures or best things about yourself, this will show a side of you that you’d never pick. You’re not able to choose from your search history—you have to upload all of it.”

Though, for now at least, users of Browser Dating have a small pool to choose from—less than 1,000 users have signed up since its launch last week. Users are first required to download a Chrome or Firefox extension, which they use to export their recent browser history and then upload to the site. Profiles feature the usual bare outline of a person: age, location, gender, and sexual preference. A browsing personality profile is also generated for each user, offering insight into how they navigate the internet. Matches are not limited by location, though Depoorter says there is an option to restrict search by state or country, if they so choose. Once matched, you won’t see the other person’s search history, only a summary of “fun facts” about shared interests—perhaps pointing out your bizarre Wikipedia obsession with the “dancing plague” or the time of day you’re most active online—which is meant to accentuate the harmonies of your online behaviors.

Unlike most dating apps, which charge monthly or annual fees for their paid tiers, there is only a one-time payment of €9 to sign up granting users unlimited matches; a free option limits users to five matches. Depoorter says he doesn’t want to exploit users by having them pay on a recurring basis. When I suggest that that kind of pay model is mostly unheard of today, he pushes back. “I’m an artist, I like to do things differently.”

Early reviews and reactions have been mixed. “Super weird,” one app developer noted on X.

“This is the wildest idea,” said another user on Product Hunt. “I love the audacity.”

“Good to see the privacy focus from the start given how sensitive some of this data might be,” a programmer posted on Bluesky.

The biggest concern for users—justifiably so—is around privacy and user safety, and given the amount of personal data the Depoorter is asking people to fork over, those issues are also on his mind. The site scans up to 5,000 recent browser searches or goes back as far as search history is stored, which could be several years, but never exceeds the maximum number of entries. (Browsing data from Incognito mode sessions cannot be uploaded). Depoorter uses Firebase, Google’s open-source tool for developing AI apps, to store and manage data.

“It’s not exposed to the internet.” Depoorter says of the AI processing, which he says happens locally. “I don’t want to expose any browser history to another company.”

Already there have been complaints of lagging email verification and the site not allowing users to delete their profile; Depoorter says he has since fixed these issues. Browser Dating doesn’t currently allow for the uploading of photos, but he is working to change that, and says he plans to implement more features in the coming months, including an app for easier communication between connections and a recommendation feature that suggest possible first date locations.

The idea originally came to Depoorter in 2016 at V2, an experimental art and tech center in Rotterdam. He was hosting a workshop that explored unique connections between attendees who were familiar with his work and who agreed to share a year’s worth of their search history.

The nature of Depoorter’s art as a digital provocateur has sought to interrogate the subtext of hidden connections, taking a “critical and humorous” approach to some of the most urgent questions of his generation. Surveillance, AI, machine learning, and social media are recurring themes across his explorations. “Difficult subjects,” he says when we speak over Zoom. “But there is no big message. I want to leave that open. If anything, I want to show what is possible with technology in a playful way.”

In 2018, in a series titled “Jaywalking,” he turned live surveillance feeds into video art, forcing viewers to confront the use of public data as a means of privacy invasion. He followed that with Die With Me, a chatroom app that could only be accessed when your phone had less than 5 percent battery life; though Depoorter is quick to reject definitive interpretations of his art, it read as a comment on the value of time and the importance of how to use it when we know it’s running short. For those who can look beyond the shock of Browser Dating’s initial conceit, the question is also an urgent one: What if the curiosities we try so hard to conceal are actually the things that can bring us together?

Depoorter, 34, doesn’t claim to be any kind of dating guru. “I’m not a specialist,” he tells me. He surfed Tinder in the app’s early days but has been with his partner for 10 years. He promises that despite his work as an artist, the site is not a gimmick, and he wants to continue to scale. Already people have suggested that it might work better for matching potential friends rather than romantic partners. Depoorter anticipates there will be hurdles but doesn’t sugarcoat them; he is aware of just how difficult it may be to onboard users hesitant to share their personal anxieties and desires.

“Either people are fans of the idea or they are not,” he says. “There is no convincing them.”

4 notes

·

View notes

Text

What advice do you need to hear right now?

Attention! This reading is for entertainment purposes only. You make your own decisions and are responsible for them yourself, so it's up to you to listen to advice or not.

Choose one or more cards. Trust your intuition.

Card 1: Invention: Burning with passion Although the card said about passion for work or your projects, i added other cards and created next situation: here we are talking about workaholic, who work very hard, they are completely immersed in process, they are giving their forces and energy for complete tasks on the work. And they can neglect their own rest and free time, deny themselves pleasure. If you continue to work hard then everything will end in burnout and lack of strength. The cards advise you to reconsider your work schedule and your strength it is important to relax and spend time for your own pleasure, for example, alone with yourself or with people who charge you with energy. It is important to let yourself relax and not think about projects, work, but devote time to yourself and your rest. It is also very important to be able to delegate your work to others; here I see people who prefer to do everything on their own, but in this case it is very important to be able to share responsibilities, not to be stubborn, but to ask for help from others. As a result, this will save you, if not from all the burdens, then from most of them and you will be able to continue working at your usual pace.

Card 2: Knowledge Here we are talking about people who are in a difficult situation and do not know how to act, how to resolve it because of many thoughts in your head, you get confused and do not know what to do. Maybe you asked for advice another people but it is useless because they see the situation based on their views and their experience, and you have a completely different position and also a different experience. In this situation very important not to rely on the opinion of other people, but it is important to listen to yourself, determine the pros and cons, look at the situation from an objective point of view. Most importantly, in no case should you act to your own detriment, since in the future not very good consequences can be expected. Always choose yourself, put yourself and your interests first and this will save you from problems in the future.

Card 3: Challenge: Standing up for your rights. First of all, I would like to note that you are on the right track and you do not need to doubt it. Maybe you are facing difficulties and think that everything you are doing is a waste of time and effort, but! You should get out the thoughts and continue to move on, defend your position, fight for your goals, dreams, plans and then they will definitely come true and happy moments will appear in your life, you will feel stability, people will reach out to you offer their help or vice versa ask you for help (naturally not for free, in return, you will receive payment, whether it is money, guaranteed help from a person in the future or anything else). So be confident in yourself and in your path.

Thank you for reading! I will be glad of any feedback <3

83 notes

·

View notes

Note

Sorry if this is super obvious, but are you still doing portrait commissions for charity? If so, can you link your PayPal?

Hello! I am currently busy with a bunch of em' actually :)

I am currently working on five, and have gotten more requests in the meantime. I will try to do as much as I can, and am slowly messaging the latest requests to warn them about the potential wait times. If it becomes at some point undoable for me, I will make a post to signal a hiatus or end of the commissions.

I am not comfortable publicly linking my paypal, but will send invoices in private chats with my clients. My usual commission process is as follows:

I chat with the client until they give me enough details I need for the illustration. This is where I give the price gauge for the commission.

I send a first sketch for approval, covering things like composition, pose, sometimes colors depending on the process.

Once approved by the client, I start working. I notify them when I am done and ask for the money. I do not accept money until I am finished with the piece, but I do not show the piece until I have been paid.

Once paid, I show the final piece, tweak things if need be (if the tweaks are significant and require me redoing some parts entirely, I can ask for more upfront) and send the client the full resolution files via their preferred method, usually email.

The charity commissions make this a bit difficult for cases like yours, as I encourage people to directly donate to the campaigns I am helping to avoid losing money to transfer fees. I usually do not accept upfront payment, but in this case I am not sure how to proceed - saying "donate upfront please!" goes against the personal guidelines I use for private commissions, which I set up based on how I work and client/artist trust, but would be much better for the families, as they need the money as fast as possible to survive. I encourage giving them money if you can, regardless. These are innocent people trying to escape a deadly situation.

It's a bit of a tricky situation - I want people to donate immediatly, but currently cannot guarantee being able to draw for you in return due to the amount of work I am already on, especially not as fast as usual.

If you would like a portrait and to pay via paypal, you will have to wait a little for me to complete my current commissions until I can take yours, with a slim chance I will unfortunately not be able to work with you.

I understand if this is a setback, as it boils down to not being able to fullfill the paid service I'm advertising. I will work so I do not leave behind anyone who's commission I have already accepted, and will not take money until I know I can complete the associated commission as to not pay anyone pay for nothing.

#also i just got a minimum wage job so i got way less free time to draw and way more full body exhaustion haha#the tldr is if you want to hire me rn because you want to hire me and not bc you want to donate yea you will have to wait a bit#but i encourage donating just to help#ask

7 notes

·

View notes

Text

How to Plan a Bullet Repayment Strategy for Your Loan?

A personal loan is one of the most convenient financial tools for managing urgent expenses, be it medical emergencies, business needs, or home renovations. While most personal loans follow an Equated Monthly Installment (EMI) structure, some borrowers opt for a bullet repayment strategy—a method where the principal amount is paid in a lump sum at the end of the loan tenure while interest payments are made periodically.

A bullet repayment strategy requires careful financial planning to ensure timely loan closure without financial strain. In this guide, we will explore how to plan a bullet repayment strategy for your loan, its advantages and disadvantages, and tips to manage repayments effectively.

1. What Is Bullet Repayment?

Bullet repayment is a loan repayment structure where the borrower pays only interest during the loan tenure and clears the principal amount in one lump sum at the end.

✅ Example of Bullet Repayment:

Loan Amount: ₹5,00,000

Interest Rate: 10% per annum

Loan Tenure: 5 years

Monthly Payment: Interest-only payments

Final Payment: ₹5,00,000 (Principal) in the last installment

📌 Tip: Bullet repayment is commonly used in business loans, bridge loans, and investment-backed loans but can also be applied to personal loans with specific lender approvals.

2. When Should You Choose Bullet Repayment?

A bullet repayment strategy is suitable in the following situations:

✔️ If You Expect a Large Future Cash Inflow – Ideal for borrowers expecting bonuses, property sales, or business profits at the end of the loan tenure. ✔️ If You Want Lower Monthly Outflows – Since only interest is paid monthly, it reduces immediate financial burden. ✔️ If Your Investment Returns Are Higher Than Loan Interest – Investors who earn higher returns from stocks or real estate may prefer bullet repayment to maximize gains. ✔️ For Short-Term Personal Loans – Best suited for short-term loans where the lump sum repayment is manageable.

📌 Tip: Consider bullet repayment only if you have a clear repayment plan at the end of the loan tenure.

3. How to Plan a Bullet Repayment Strategy?

A bullet repayment strategy requires disciplined financial planning to avoid repayment stress at the end of the loan term. Follow these steps to plan effectively:

A. Assess Your Financial Situation

Before opting for bullet repayment, evaluate your income sources, expenses, and financial stability.

✅ Key Considerations:

Do you have a reliable source of income to fund the final lump sum payment?

Are you expecting a bonus, investment maturity, or business revenue?

Will the bullet repayment affect your cash flow or financial security?

📌 Tip: If your future income is uncertain, reconsider opting for a bullet repayment loan.

B. Open a Dedicated Savings or Investment Fund

Since the entire loan principal is due at the end, create a separate savings account or investment fund for gradual accumulation.

✅ Investment Options:

Recurring Deposits (RDs): Monthly deposits with fixed returns.

Fixed Deposits (FDs): Safe investment with guaranteed interest.

Mutual Funds or SIPs: If you have a longer tenure, consider moderate-risk investments for better returns.

📌 Tip: Automate monthly transfers to this account to avoid missing contributions.

C. Set Up a Monthly Contribution Plan

Instead of relying on a one-time large payment, break it into smaller, manageable contributions over the loan tenure.

✅ Example:

Loan Amount: ₹5,00,000

Tenure: 5 Years

Required Monthly Savings: ₹8,334 (₹5,00,000 ÷ 60 months)

📌 Tip: Use a personal loan bullet repayment calculator to determine how much you need to save monthly.

D. Track Interest Payments Diligently

Even though you are not repaying the principal each month, you still need to pay interest regularly.

✅ Ways to Track Payments:

Set up automatic debit for interest payments.

Keep a buffer fund to avoid missing any payments.

Review loan statements periodically to ensure correct calculations.

📌 Tip: Missing interest payments may lead to penalties and negatively impact your credit score.

E. Consider Partial Prepayments

If you have surplus income, consider making partial prepayments towards the principal amount. This will reduce the burden of the final payment.

✅ Advantages of Partial Prepayments:

Lowers total interest cost.

Reduces the final bullet payment amount.

Helps close the loan faster.

📌 Tip: Check if your lender allows penalty-free prepayments before opting for bullet repayment.

4. Pros and Cons of Bullet Repayment Strategy

Pros:

✅ Lower Monthly Financial Burden – No high EMI payments, making it ideal for those with fluctuating income. ✅ Ideal for Business Owners and Investors – Helps free up funds for investments that yield higher returns. ✅ Flexibility in Repayment – Provides time to arrange for a lump sum payment without immediate pressure.

Cons:

🚫 Higher Interest Outgo – Since principal is unpaid for the entire tenure, total interest paid may be higher. 🚫 Requires Strict Financial Discipline – Failing to plan properly can lead to repayment difficulties. 🚫 Not Suitable for Everyone – Risky for salaried employees without additional income sources.

📌 Tip: Evaluate if the total cost of bullet repayment aligns with your financial goals before choosing this strategy.

5. Alternative Repayment Strategies

If bullet repayment doesn’t suit your financial needs, consider these alternatives:

✅ Step-Up EMI Plan: Start with lower EMIs and gradually increase payments as income grows. ✅ Flexible EMI Plan: Some lenders offer seasonal EMIs, ideal for businesses with fluctuating revenue. ✅ Loan Balance Transfer: If interest rates are high, switch to a lender offering better terms.

📌 Tip: Choose a repayment strategy that balances affordability and long-term financial health.

Final Thoughts

A bullet repayment strategy for a personal loan can be a great financial tool if managed properly. It provides flexibility in monthly payments, but requires strong financial planning to ensure smooth closure of the loan.

Before opting for bullet repayment, evaluate your income stability, savings capacity, and financial discipline. If you have a reliable source of future funds, this method can help manage cash flow efficiently.

For expert guidance on personal loan repayment strategies, visit www.fincrif.com today!

#loan apps#personal loan online#fincrif#bank#personal loans#nbfc personal loan#finance#personal loan#loan services#personal laon#bullet repayment strategy#personal loan repayment#what is bullet repayment in loans#bullet repayment vs EMI#benefits of bullet repayment for personal loans#how to manage personal loan repayment#best strategies for bullet loan repayment#impact of bullet repayment on personal loan interest#loan prepayment vs bullet repayment#personal loan repayment planning#lump sum loan repayment strategy#how to pay off a personal loan faster#personal loan interest calculation for bullet payments#bullet repayment vs step-up EMI#should you choose bullet repayment for a personal loan#how to avoid default in bullet repayment loans#saving for bullet repayment on personal loans#loan tenure impact on bullet repayment#financial planning for bullet repayment loans#how to reduce interest costs with bullet repayment

1 note

·

View note

Text

Artificial Condition, Chapter 1

(Curious what I'm doing here? Read this post! For the link index and a primer on The Murderbot Diaries, read this one! Like what you see? Send me a Ko-Fi.)

In which we catch up with our pal.

SecUnits don't care about the news.

Murderbot never paid much attention to it, even after hacking its governor module. Entertainment is less likely to ping alarms, while news is carried on channels closer to protected data.(1) And, of course, news is boring and it never cared.

Now, as it crosses a station, it skims a newsburst while mostly just trying to get through the crowd without attracting attention. Fortunately, the humans of all sorts are too busy with their own journeys to pay it any mind. It has worried a little about security drones scanning for SecUnit specs, since they're all identical, but they shouldn't unless instructed to do so specifically, and nothing's pinged MB yet.

MB is very pleased with how well it's navigated so far.

Then, in the newsfeed, it sees… itself.

It stops near a food court, so people will think it's deciding where to eat, and pays more attention to the news. The image it saw was from the lobby with Pin-Lee's comment to the reporters, and credits MB simply as "bodyguard". The story mentions Mensah buying the SecUnit who saved her(2), as a human interest note to soften the grisly details of the body count. But, the journalists are only used to seeing SecUnits in their assigned roles, and usually in armour, so they haven't yet connected the new augmented human in the Preservation team. Which is good, because it increases MB's confidence in going undetected as itself.

The rest of the story covers how the company, DeltFall, Preservation, and three other political entities are joining forces against DeltFall, even as they fight each other over bond guarantees and jurisdiction.

Still, the newsburst is days old, and now MB wonders if the official news channels will have anything more recent. But, the higher priority is keeping moving.

On that note, MB keeps moving toward the transit ring. It can't use the typical facilities to purchase passage, as weapons scans will reveal it immediately unless it hacks the scanners, and it has no currency so it would have to hack the payment machines as well, and that's just too much work.(3)

So, MB catches a bot transport to the bot-driven transport section of the ring, and downloads some new media, and thinks about why it left Mensah and what it might want out of its life and freedom. Though, before it can have any of that, it needs to answer one very important question, and to do that, it needs to go to a specific place, with only two bot-driven transports leaving in the next cycle. The one leaving later is the better option, as it gives MB more time to talk the bot around.

I could hack a transport if I tried, but I really preferred not to. Spending that much time with something that didn’t want you there, or that you had hacked to make it think it wanted you there, just seemed creepy.(4)

On the way to the cargo transport, it does have to hack an ID-screener and some weapon-scanning drones, as well as a bot guard, but it just deletes any record of its existence, which is downright easy compared to what it usually has to do to work with company equipment.

The first dock it tries, with the bot transport leaving later, has a bunch of humans there dealing with an accident. Reluctantly, because it shouldn't be here in the first place, it goes to the other bot transport. The newsburst has it rattled, and it wants to escape into its media ASAP.

The other transport is a long-range research vessel, currently assigned to an uncrewed cargo run that will stop at the place MB needs. It's owned by a university in this system, and the cargo runs pay for its upkeep between assignments. MB would really like the twenty-one gloriously isolated cycles between here and its destination.(5)

MB finds the research transport, and pings it, receiving a return ping almost immediately. It gives the same offer it gave the first transport: all its media, serials, books, music, and some new shows it picked up on this station, in trade for a ride where it's going.(6) It offers the same explanation for its presence, as well: a free bot making its way back to its human guardian.

There was a pause, then the research transport sent an acceptance and opened the lock for me.

=====

(1) I find this a little suspect, as far as explanations or worldbuilding choices go. I'm not an expert in any sort of communications methods, but I don't feel like this tracks with what I do know about broadcasts or feeds generally or how they'd logically be laid out if they did work this way. (2) That feels like a romance novel title. Technically, it's almost exactly a romance novella title: The A.I. Who Loved Me, book 1 in Alyssa Cole's The Hive series. (Book 2 has no info yet, but book 1 was really cute, I thought. In case anyone wondered.) (3) MB being relatable again. Why do all that work just to look respectable, when you can sneak around and get your real work done in peace? (4) Gotta agree. Even if they can't retaliate against you, either of those just sounds… awkward, at best. (5) Is it just me, or does that sound like the sort of phrase that would not come true when stated in chapter 1 of a book? (6) I could question why a bot transport couldn't download its own entertainment from the feed, but MB's explanation of the feeds possibly raising alarms about bot access have already more or less answered it. As a part-human construct, it probably has access that can look less suspicious.

11 notes

·

View notes

Text

Making Financial Transactions Effortless and Smart

From seeking quick loans to making international money transfers or even paying utility bills, these transactions have become an integral part of our routine. But what if there was a way to simplify these processes, making them not just effortless but also smart? Enter Muthoot FinCorp ONE, an all-in-one digital financial platform designed to revolutionize the way you handle your finances.

The Convenience You Deserve

At Muthoot FinCorp ONE, convenience isn’t just a promise; it's a commitment we live by. Muthoot FinCorp ONE gives you the ability to secure a Gold Loan swiftly, without any hassle, and from anywhere you prefer, be it the comfort of your home or at any of our 3600+ branches across India. With our quick doorstep service, you can have your Gold Loan sanctioned in as little as 30 minutes*. Plus, we offer competitive interest rates as low as 0.83%* per month and, as a cherry on top, a zero* processing fee. You can avail the Gold Loan at offered gold rates up to ₹4200/gm, making it a lucrative and hassle-free option for your financial needs.

Digital Gold and Beyond

We understand the importance of diversifying your portfolio, which is why we offer the opportunity to invest in Digital Gold. With an entry point as low as Re. 1, you can start your journey into gold investment, secured at 99.99% purity, and trade it at market prices, all stored safely and securely.

NCDs for a Secure Investment Future

For those seeking stability and high returns, our Non-Convertible Debentures (NCDs) present an excellent opportunity to build a robust investment portfolio. Starting with just Rs. 10,000, enjoy returns of up to 9.43%* with fast-tracked investments, high-yield, low-risk opportunities, and flexible tenure durations to suit your needs.

Simplified Forex Transactions

Navigating the complexities of foreign exchange transactions can be daunting, but not with Muthoot FinCorp ONE. Enjoy secure and reliable forex services with competitive exchange rates and guaranteed 24-hour* transfers. We also provide a buy-back guarantee, ensuring your peace of mind throughout the process.

Seamlessly Handle Payments and Recharges

From bill payments to recharges, Muthoot FinCorp ONE simplifies it all. Recharge your DTH or prepaid mobile, pay electricity, internet, or LPG gas cylinder bills instantly, or manage your financial services and taxes hassle-free—all with a few taps on our app. Moreover, pay your rent or vendors effortlessly, making the entire process quick, secure, and available 24x7.

Our commitment to making your financial life easier continues with the Muthoot FinCorp ONE app. It’s your gateway to effortless Gold Loans, Digital Gold investments, Forex transactions, and more, available whenever and wherever you need it. Expect regular updates, enhanced services, and an unwavering dedication to simplifying your financial journey.

Muthoot FinCorp ONE is not just about transactions; it's about transforming the way you interact with your finances. Experience ease, convenience, and reliability—all in one place.

At Muthoot FinCorp ONE, we're not just simplifying financial transactions; we are empowering you to make smarter choices, effortlessly. Join us and witness a new era of financial convenience and intelligence.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

2 notes

·

View notes

Text

Top-rated online retailers in India in 2023

Amazon.com

Amazon is renowned for its exceptional services, providing customers with fast and reliable shipping through Amazon Prime, ensuring quick and convenient deliveries. Their vast selection of products, combined with user-friendly interfaces, offers a seamless shopping experience. Amazon's Kindle e-reader and Fire tablet series have revolutionized digital reading and entertainment. Seeking authenticity in online shopping, do delved into Amazon reviews for unbiased insights. Additionally, Amazon Web Services (AWS) offers robust cloud computing solutions, catering to a wide range of businesses and organizations. Its dedication to customer satisfaction and innovation has solidified Amazon's reputation for delivering outstanding services.

Flipkart.com

Flipkart.com has earned a stellar reputation for its outstanding services, offering a diverse range of products and a user-friendly shopping experience. Their delivery services, including Flipkart Plus, ensure swift and reliable shipments, enhancing customer satisfaction. Flipkart reviews provide a candid glimpse into the user experience, guiding potential buyers. Flipkart's innovative initiatives, such as 'Big Billion Days,' provide customers with access to amazing discounts and deals. Their 'Flipkart Assured' program guarantees quality products with faster delivery. With a commitment to customer convenience, Flipkart continues to be a trusted leader in the Indian eCommerce industry.

Myntra.com

Myntra.com is well-regarded for its exceptional services in the fashion eCommerce sector. It offers a vast and trendy selection of clothing and accessories to cater to diverse preferences. Myntra's user-friendly platform and intuitive app make shopping a breeze for its customers. With swift delivery options and hassle-free returns, Myntra ensures a convenient and satisfying shopping experience. The transparency of Myntra’s customer reviews contributes to a trustworthy online shopping environment.

BigBasket.com

BigBasket.com stands out for its exceptional services in the online grocery sector. It provides a wide array of fresh produce and grocery items, making daily shopping more convenient. The platform's reliable delivery and user-friendly interface streamline the shopping process. Customers review of bigbasket reflect the true essence of the product, helping me make an informed decision. With a commitment to customer satisfaction and timely deliveries, BigBasket offers a convenient and efficient way to meet your grocery needs.

Ajio.com

Ajio.com offers an outstanding online shopping experience, particularly in the fashion and lifestyle sector. It features a diverse range of clothing, accessories, and lifestyle products to cater to various tastes. Ajio's user-friendly website and app make browsing and purchasing a breeze for customers. With quick deliveries and a commitment to quality, Ajio ensures a seamless and satisfying shopping journey. Before making a purchase, analyze reviews of Ajio users to gauge overall satisfaction.

Paytmmall.com

Paytm Mall stands out for its excellent services in the eCommerce realm, offering a wide array of products and services. With an easy-to-navigate platform and a user-friendly app, it provides a seamless shopping experience. Its digital wallet integration simplifies payments, while special offers and cashback deals enhance savings for customers. Paytm mall reviews showcase a diverse range of opinions, enriching the decision-making process. Quick and reliable deliveries, along with a commitment to customer satisfaction, make Paytm Mall a preferred choice for online shoppers.

fliptwirls.com

fliptwirls is a revolutionary eCommerce platform that offers an unparalleled shopping experience. With an extensive product catalog covering a wide range of categories, it caters to all customer needs. The website's intuitive interface and mobile app make shopping effortless and enjoyable. The value of Fliptwirls real reviews lies in their ability to capture the nuances of individual experiences. Fliptwirls’ commitment to exceptional customer service, secure transactions, and lightning-fast deliveries ensures a seamless and satisfying shopping journey for all.

Blinkit.com

Blinkit.com excels in providing exceptional services in the quick delivery and essentials shopping sector. With a wide range of daily necessities available, Blinkit offers convenience and ease for customers. The platform's swift and reliable delivery options ensure that essential items are readily accessible. The detailed narratives within blinkit reviews paint a comprehensive picture of the product's performance. Committed to enhancing customer satisfaction, Blinkit makes shopping for essentials a hassle-free experience.

nykaa.com

Nykaa.com stands out as a premier destination for beauty, wellness, and fashion enthusiasts. With an extensive collection of both domestic and international brands, it offers a diverse range of products to cater to various preferences. Nykaa's user-friendly website and mobile app provide a seamless shopping experience. Nykaa reviews act as a community forum, fostering an exchange of knowledge among consumers. Its swift deliveries, commitment to quality, and access to beauty and skincare advice make Nykaa.com a go-to platform for beauty and fashion needs.

croma.com

Croma.com is a leading online retailer, specializing in electronics and tech gadgets. It offers a vast array of the latest gadgets, appliances, and electronics, ensuring that customers have access to the best in technology. Reading croma reviews is like having a conversation with fellow shoppers, sharing valuable insights. The user-friendly interface and informative product details make shopping for electronics a breeze. With Croma's reliable delivery and after-sales services, customers can trust that they are making a smart choice for their tech needs.

2 notes

·

View notes

Text

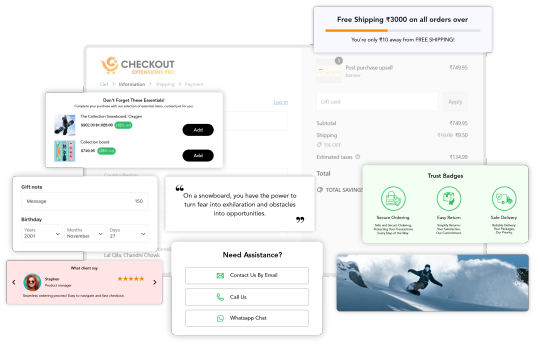

How Checkout Extensions Pro Delivers a Seamless, High-Converting Experience?

Your online store’s success hinges on many factors — quality products, engaging marketing, fast-loading pages — but when it comes down to sealing the deal, nothing matters more than your checkout process. The checkout is where browsing turns into buying. If it’s confusing, lengthy, or uninspiring, your customers may leave before ever clicking “Complete Purchase.”

That’s why Checkout Extensions Pro is rapidly becoming a must-have tool for Shopify merchants who want to take their checkout experience from basic to brilliant. By making your checkout smarter, more engaging, and tailored to your brand, this app can help you recover abandoned carts, boost average order value, and build stronger customer loyalty.

Let’s explore how Checkout Extensions Pro works and why investing in your checkout might be the smartest move you can make for your Shopify store this year.

Why your checkout deserves more attention

The checkout page is arguably the most critical page on your entire website. It’s the final barrier between interest and revenue. Yet surprisingly, many merchants overlook it. They invest heavily in homepage design, product photography, and marketing campaigns but settle for a plain, default checkout experience.

This is risky. A bland or poorly optimized checkout can erode trust, frustrate shoppers, and cause them to bail at the last second. Research suggests that up to 70% of shopping carts are abandoned, with extra costs, complicated processes, and lack of trust all being top reasons.

That’s why focusing on Shopify checkout customization isn’t just a nice-to-have — it’s a competitive necessity. A customized, streamlined checkout reassures shoppers, makes them feel valued, and nudges them toward completing their purchase.

What Checkout Extensions Pro brings to your business

Checkout Extensions Pro was built specifically to give Shopify merchants more control, flexibility, and creativity over their checkout flow. Unlike standard checkout setups, this tool lets you add rich features and branding touches without complex coding or expensive developers.

Here’s what sets it apart:

✅ Smart upsells & cross-sells: Offer relevant products right on the checkout page, increasing your average order value without disrupting the buying flow. Whether it’s a “You might also like” carousel or a small add-on discount, you can drive extra revenue at the moment customers are most ready to spend.

✅ Trust-building elements: Add custom guarantees, secure payment icons, or brief testimonials to reduce anxiety and reinforce buying confidence.

✅ Custom fields & personalization: Want to collect special instructions, gift notes, or delivery preferences? It’s simple to add extra fields so your customers feel heard and your fulfillment team gets all the details right.

✅ Flexible branding: Make sure your checkout truly feels like your brand. With a shopify custom checkout, you can adjust fonts, colors, imagery, and even messaging to ensure it matches your storefront perfectly — building a cohesive, memorable experience from first click to final receipt.

✅ Analytics & A/B testing: See which offers or layouts perform best. The tool provides detailed insights so you can continuously refine your checkout strategy.

The big payoff: more revenue, less friction

Improving your Shopify checkout with Checkout Extensions Pro can deliver immediate, tangible benefits:

🚀 Fewer abandoned carts: By making the checkout shorter, clearer, and more trustworthy, you remove barriers that cause customers to leave.

💰 Higher average order value: Targeted upsells and cross-sells mean more items per order, boosting your revenue without increasing your marketing spend.

🎯 Stronger customer loyalty: A pleasant, reassuring checkout experience makes customers more likely to return — and recommend your store to friends.

In short, instead of being just a transactional page, your checkout becomes a strategic tool for growth.

Easy to set up — powerful to scale

One of the biggest advantages of Checkout Extensions Pro is its user-friendly interface. You don’t need to write a single line of code to start customizing your checkout. Prebuilt templates and drag-and-drop elements let you launch changes in minutes.

For larger brands or those with in-house developers, the platform also offers robust APIs and advanced customization options. This means you can create entirely unique checkout experiences that truly set your store apart — whether that’s for seasonal campaigns, loyalty offers, or VIP customer flows.

Final thoughts: it’s time to rethink checkout

Many store owners think of the checkout simply as the last step of the sales funnel. But with the right approach, it’s actually a critical opportunity to maximize revenue, collect valuable customer data, and reinforce why your brand is the best choice.

Checkout Extensions Pro is the perfect partner for merchants who want to transform this stage from a simple form into a high-converting, brand-building powerhouse.

If you’re serious about reducing cart abandonment and turning more visitors into delighted, repeat customers, it’s time to upgrade your checkout strategy. Explore Checkout Extensions Pro today and see how effortless it can be to build a smarter, more profitable checkout for your Shopify store.

0 notes

Text

Finding the Right Cricket Store: A Complete Guide for Every Player

Whether you're a beginner or a pro, choosing the right cricket store can make a big difference in your game. From premium equipment to personalised service, a good cricket store offers more than just gear it becomes your go-to resource for all things cricket. Here’s what to look for:

1. Wide Range of Quality Equipment

A reliable cricket store should stock everything bats, pads, gloves, helmets, bags, and accessories. Look for options that include English willow bats, lightweight pads, and gloves with superior grip and protection.

2. Genuine and Trusted Brands

The best cricket stores ensure that every product is 100% genuine and sourced from trusted manufacturers. This guarantees both performance and durability.

3. Expert Assistance and Advice

A good cricket store doesn’t just sell gear it offers guidance too. Knowledgeable staff or detailed product descriptions online can help you choose equipment that suits your style and level of play.

4. Easy Online Shopping Experience

Today, many top cricket stores operate online with smooth browsing, secure payments, and fast delivery. Shopping from a reputable cricket store online saves time and gives access to more variety.

5. Customisation and Player Support

Advanced cricket stores now offer customisation like tailored bats or embroidered kit bags to match personal preferences. Plus, they provide after-sales support and return policies for added peace of mind.

Conclusion: Choosing the right cricket store means more than just getting the gear it’s about finding a partner in your cricket journey. Look for stores that combine quality, trust, and service, whether online or offline. The right store ensures you play at your best, every time you step on the field.

1 note

·

View note

Text

A Trusted Destination for Online Gaming Enthusiasts

KingExchange.com has become a prominent platform in the quickly growing world of online gaming and sports betting, providing gamers worldwide with a smooth and exciting experience. KingExchange.com has established itself as a one-stop shop for strategy, entertainment, and online excitement, whether it is live sports betting, casino games, or real-time card game activity. The website redefines the norm for online exchanges in India and abroad with its user-friendly layout and extensive betting possibilities, which appeal to both novice and experienced bettors.

KingExchange.com Overview

KingExchange.com is a complete exchange platform that blends the thrill of live sports with the complexity of contemporary digital gambling, making it more than just another betting website. Users may quickly join, be verified, and start playing a range of games, including live casino tables, football, tennis, kabaddi, and cricket betting. The platform's greatest strength is how adaptable it is, providing something for all kinds of players, regardless of their betting preferences or skill level.

Its user interface is designed to be less complicated, giving consumers a simplified dashboard that makes navigating simple. With only a few clicks, you may play live games like Teen Patti, Andar Bahar, and Baccarat or wager on IPL matches. For individuals who like live-action gambling, KingExchange.com is not only quick but also dependable due to its real-time betting odds and prompt outcomes.

Transactions that are safe and smooth

The safety of their financial information and transactions is a top worry for everyone new to online betting. By using top-notch encryption technology and collaborating with trustworthy payment channels, KingExchange.com allays these concerns. Numerous ways, such as UPI, bank transfers, IMPS, and other wallet services, are available for users to deposit and withdraw money. Additionally, the technology guarantees prompt withdrawal processing, reducing delays and fostering consumer confidence.

Additionally, the site offers round-the-clock customer service for any questions pertaining to transactions. The committed support staff is prompt and helpful in fixing difficulties, whether they be related to wallet balance or payment time. In a sector where consumer distrust is common, this layer of dependability further enhances KingExchange.com's trustworthiness.

The Core of KingExchange.com: Live Betting

The live betting function on KingExchange.com is one of its main draws. Live betting enables users to put bets while the game is in progress, in contrast to conventional betting systems where you place your stake before the action starts. In addition to adding to the excitement, this real-time function enables strategic bettors to make well-informed judgments depending on the match's development.

Because they may wager on every ball, over, or innings, cricket fans especially like this option. KingExchange.com makes sure that the activity never stops, whether it's local T20 leagues, international cricket, or the Indian Premier League. Users have the opportunity to obtain the finest returns on their predictions since the live odds are updated in real-time.

Play Casino Games Online and Have Fun in Real Time

Beyond sports, KingExchange.com has a wide selection of online casino games that put the pleasure of Las Vegas right at your fingertips. Classic games including Baccarat, Blackjack, Roulette, and Poker are available to players; they are all televised in high definition and are hosted by live dealers. For players who like the atmosphere of actual casinos, this enhances the gaming experience by making it more immersive and participatory.

Indian classics like Teen Patti and Andar Bahar are available on the site for fans of card games. These games are ideal for both brief breaks and extended sessions since they are quick-paced, simple to comprehend, and very captivating. KingExchange.com is unique because of the high caliber of its gaming software, which guarantees fluid gameplay even during periods of high traffic.

Bonuses and Promotions That Provide Value

KingExchange.com provides enticing welcome incentives and recurring promotional offers because it recognizes the value of customer pleasure and retention. Sign-up bonuses and deposit match offers are often available to new customers, providing them with more dollars to explore the site. Furthermore, frequent holiday promotions and seasonal campaigns are launched, providing current members with loyalty benefits, cashback, and free bets.

These incentives improve the likelihood of winning without taking on excessive financial risk in addition to making the gaming experience more pleasurable. It's a clever strategy to maintain the thrill while promoting ethical gaming.

A Platform Made for Users on the Go

A mobile-optimized platform is essential in today's fast-paced world, and KingExchange.com delivers. The website works well on tablets and smartphones and is totally responsive. Without a separate app, users can simply play, wager, and manage their accounts using the mobile web.

Every aspect of the desktop interface, including as live betting, casino games, transaction management, and customer service, is still available on the mobile edition. For customers who want to play games on the move or who need to make a fast wager while on the road, this makes it perfect.

Conclusion: The Reasons KingExchange.com Is the Best Option

A reliable, effective, and very exciting platform is provided by KingExchange.com for anybody wishing to get started in the world of online sports betting and digital gaming. It is a leading competitor in the online exchange industry because to its extensive selection of games, real-time betting capabilities, safe transactions, and helpful customer service.

KingExchange.com offers a thrilling and safe atmosphere to test your abilities and luck, regardless of whether you are a devoted cricket fan, a casino fanatic, or simply someone looking for some interactive fun. The platform is expected to establish itself as a major participant in the Indian online gaming market because to its frequent upgrades, user-friendly features, and expanding player base.

0 notes

Text

What to Look for in on the net Slot Internet websites

Online slot gaming has slot online rapidly develop into among the preferred kinds of digital enjoyment, giving players the thrill of spinning reels through the consolation of their own individual houses. These platforms supply quick access to lots of slot game titles, catering to both equally beginners and seasoned players alike. nevertheless, in advance of diving into the planet of online slots, it’s imperative that you look at a couple of essential factors to guarantee a secure, pleasing, and potentially fulfilling experience.

Just about the most critical elements To judge When selecting a web based slot website is protection. Along with the growing range of on the net scams and info breaches, ensuring that your personal and financial facts is safeguarded needs to be a top precedence. A reputable slot web-site will use protected encryption engineering, offer you confirmed payment techniques, and be accredited by a reliable gaming authority. finding the time to research a platform’s safety actions prior to signing up may help you stay away from avoidable threats and give you assurance whilst participating in.

Yet another vital issue to take into account is definitely the fairness on the online games, significantly the return-to-participant (RTP) prices. Players who have interaction in on line slots for actual revenue are By natural means enthusiastic about maximizing their probabilities of winning. reliable slot web-sites generally provide information regarding the RTP percentages in their online games, which reveal simply how much of the wagered money is paid out back again to gamers with time. If a site doesn’t disclose this info or lacks transparency about its game mechanics, it could be a good idea to appear elsewhere. Knowing the chances can help you make knowledgeable conclusions and boosts your overall gaming method.

The variety of slot games readily available on a platform is also value Checking out. Not all internet sites present the exact same selection, and finding one which satisfies your Choices can considerably boost your practical experience. Some platforms give attention to common a few-reel slots, while some attribute modern day video slots with immersive themes, bonus rounds, and progressive jackpots. when you’re new to on line slots, it’s practical to decide on a website that offers demo versions or absolutely free spins so you can find a sense for that gameplay just before wagering serious dollars. A diverse activity library makes certain that you’ll often have a thing new and fascinating to test.

Betting limitations are A further important consideration when deciding on a web based slot website. Anyone has a unique spending budget for enjoyment, and it’s essential to discover a platform that aligns using your economic comfort and ease zone. prior to registering, Check out the least and highest guess quantities for various video games. Some sites cater to relaxed players with very low-stakes possibilities, while some are made for significant rollers. knowing the betting structure in advance helps you manage your bankroll successfully and keep away from overspending.

Ultimately, executing a certain amount of analysis prior to deciding on an internet slot web page could make a major variation with your Total knowledge. From ensuring your data is protected to locating a platform with reasonable RTP premiums, a wide variety of game titles, and appropriate betting limitations, Every single component contributes to a more enjoyable and gratifying gaming session. Slot games are supposed to be enjoyable and thrilling, and when performed on the dependable System, they also can provide the chance to get genuine revenue.

So before you decide to spin the reels, go to the trouble To judge your options and decide on a web-site that meets your needs. a bit planning goes a great distance in assisting you take pleasure in the game safely and responsibly.

0 notes