#precious metals outlook

Explore tagged Tumblr posts

Text

Silver Price Forecast Update – 22-11-2024

As silver continues to play a vital role in both industrial applications and investment portfolios, the price forecast for November 22, 2024, shows a dynamic outlook. This article delves into the key factors driving silver prices, technical analysis for traders, and market trends to watch as the silver market navigates the evolving financial landscape. Market Trends to Watch for Silver on…

#market update on silver#precious metals outlook#silver market trends#silver price fluctuations#silver price forecast#silver price movement#silver price support and resistance#silver technical analysis#silver trading opportunities#silver trading strategies

0 notes

Text

Let’s do some more Free Cities hairstyles and headwear! Here’s the main post

Y’all already know the Myrish love some lace. Wealthy women wear it all the time, but the style depends on the situation. Usually they wear very detailed pieces, and have a head piece to drape over bc of length, but in mourning they wear thick lace flat over their heads to cover their faces

Norvoshi women shave their heads, but wealthy ones wear wigs. Since the upper city is said to be grim, they definitely wear simple styles, very sleek and severely combed. They’re a sober, religious people and have a pretty serious outlook on life, but I think they still like to prove their affluence

Lorath is cold and bleak, so hair coverings are definitely common there. Both for weather and for common sense, as women are working and need to keep it out of their face and clean. Lots of neutral and natural colors, as I don’t think Lorath is getting all the bright dyes from Yi Ti and Pentos

Volantis is said to be super hot, wet, and just hella humid so I think the women slick back their hair so that it won’t frizz up from the weather. Because of this, keeping it neat is a sign of wealth. Hairpieces are light and beautiful, but not too big or heavy bc Volantis is just too crowded and busy for all that

Qohor is said to be the most “exotic” of the free cities, which I take to mean they probably have more influences from farther East. Their artisans are famed, so I definitely think there’s intricately crafted face chains and headwear made of precious metals. Probably lots of small figures and charms with religious influence, for the Black Goat

#asoiaf#ASOIAF hair and clothing#this one was actually kinda hard#the wiki of ice and fire doesn’t have super detailed descriptions on some of the ppl of the free cities#so I had to use my imagination I hope it’s up to par

793 notes

·

View notes

Text

Anubis

Offerings

Water, wine, whiskey, rum, scotch, beer, black coffee, milk, juice, teas, energy drinks.

Meat, fish, fruits and vegetables, bread, grains, nuts, honey, cakes and other sweets, too (like dark chocolate or cinnamon flavored candies). Spices (like turmeric, cinnamon, pepper, paprika, saffron, etc.) and spicy food.

Plants or scents (perfumes, incense, candles, essential oils) like like lavender, frankincense, myrrh, cedar wood, sandalwood, cassia, eucalyptus, camphor oil, cedar oil, peppermint, rose, thyme, and almond oil. (Please make sure these are okay to burn before doing so).

Knives, bow and arrows, or other weapons can be dedicated to Inpw.

Precious metals and stones like gold, silver, lapis lazuli, obsidian, onyx, black tourmaline, smokey quartz.

Funerary objects and materials like natron, linen bandages, imagery/figurines of the canopic jars, heart scarabs, coffin imagery/figurines, acacia gum or gum arabic.

Items like the feather of maat, scales of justice, the ankh, the sekhem scepter, the was scepter, the double crown, the crook and flail, You may also offer him imagery of him, a seated/laying down dog, or any of the previous objects listed (drawings, printed pictures, figurines).

Devotional Acts

Visit a cemetery and help clean up graves. Pay respects to the dead and help make their graves look nice, decorate it with flowers, or ask to pour out a libation to the deceased when you go and visit. Clean up any debris or trash you found around the site. Along these lines, getting in the habit of saying a prayer for the deceased to have an easy transition is also a great devotional act. You don’t have to address anybody in particular, just the act is enough.

If you have any desire to go into death work that can be a great devotional act- this can be done by being a death doula, mortuary science, death investigation, autopsy technician, forensic science technician, funeral assistant, etc. Helping the dead and treating them with respect is always appreciated.

Fostering dogs or helping out at dog shelters is a great devotional act for Anpu!

Volunteer at an orphanage. Anubis is associated with orphans, so helping those who have lost their parents can be incredibly beneficial to the child and something you can do in honor of him.

Doing things that will help make your heart lighter at the end of your life. This is going to look different person to person but it can include coming out if you’re closeted, being true to yourself, setting boundaries, dealing with your trauma and going to therapy to unpack whatever it is that you’ve been through, getting on medication for any mental illness you have, going down a career path you’re passionate about, picking up new hobbies, making new friends that will help you, finding a community that will accept you, etc. Again, this will look different for everybody. Ask yourself what will make your heart feel lighter at the end of your life?

Signs

Anubis is well known for sending dogs along people’s paths. I’ve seen that he’s most likely to send black dogs to a person- they may appear randomly along your path or they could appear as a stray dog looking for a home. He may also send you jackals, wolves, coyotes, foxes, or leopards- depending on what’s native to your area but they may also appear randomly through images. Along these lines, you could also come across scared signs and symbols of him, or you may see him.

You may get feelings of easiness, calmness, as well.

Signs from him could be your own life transforming around you. You could see yourself transforming much faster, where you’re learning lessons that you need to or you’re getting on a career path that will help you. Transformation can also take the form of being better at setting boundaries or becoming a better communicator.

As the god who renews the life of the dead, you could find yourself with renewed hope, feeling refreshed, or just an overall better outlook of life.

#anubis#inpw#offerings; devotional acts; signs#offerings#devotional acts#signs#offerings to anubis#devotional acts for anubis#signs from anubis#anpu#kemetic#kemetic paganism#kemetism#ancient kemet#pagan#paganism#ancient egypt#deity worship#deity work

24 notes

·

View notes

Note

hey, love the longlegs content you've been doing lately! <3 how do you think he would react to his s/o introducing him to newer rock/metal bands like My Chemical Romance or Ghost? would he be a grumpy oldies enjoyer who rejects anything not from the 70s, or would he find it romantic to share his s/o's tastes in music? i can't help but imagine him dancing with his lover to I'm not okay by My Chemical Romance, if he does end up liking it........

Totally an grumpy oldies enjoyer. I dont think he would want to expand his horizons any further than the 70s. His reasoning is, "If he knows what he likes, why change?"Not the best outlook on life, but i digress. He does seem like the type to belive that his genre of music is superior to all others (what a fucking snob), stuck on an era that does not exist anymore. I think the music would play more into his past regrets more than anything else, it's probably why he's so stuck up on it.

There would be some deal of resistance when you first start showing him newer music, but will eventually cave, if only to bond with you. He sees how much you really get into it. Singing in the car, or dancing around the kitchen while preparing a meal, head bopping to the beat. He can't help but fall in love with the music after associating it with these precious moments.

After the eureka moment where he associates the band with you, Kobble would go back and devour every single one of their albums. I do think he would find it romantic to share music with you since it's so personal to him. I think after he finds a song he really digs, he would play it and sing it for you (to the best of his ability). Think of it as a sort of mating ritual for him. He'll expect you to do the same for him, even if you insist on the inability to sing.

#I personally think he would EAT up Korn or MCR or Alice Cooper (not ooc at all of me to think that)#him dancing to “Im Not Okay” would be peak. cause he is not okay#i think he would cook if he sung Freak On A Leash#especially with those weird ass noises in the middle of the song. i love Korn#longlegs#longlegs x reader#dale kobble x reader#dale kobble#ask

28 notes

·

View notes

Text

Art Advice: Advancing in Art: The 3 Ps

For people who are new to art, new to a different medium, or just need some motivation.

Keeping what I call "The Three Ps" in mind will help you power through and not quit before you've reached your goal.

I - PRACTICE

It sounds cliché, but practicing is necessary; not just for art, but for everything. Much like athletes spend years in the youth levels, learning the skills, before they can become professionals... and then even when they're pros, they go to training every day, to hone their skills. Just like they do, so, too, must an artist practice.

Practice can be anything. It doesn't mean you must shade so many spheres before you can-- no! You can shake it up! You practice and hone your skills with every drawing you make. You can practice drawing your OCs, your pet, your favorite piece of decoration in your house. Practice with something that makes you excited to draw!

Train yourself to draw different things. When you do a new drawing, try different head angles, lighting, perspective. Try landscapes, still lives, different types of animals. It won't come out perfect the first few times, but keep trying. Each different thing you learn will add new skills to your set, and the more of these you collect, the easier it will become to make that drawing just as it is in your head!

Every artist screws up sometimes; even professionals! Do not be discouraged; every mistake takes you one step closer to where you want to be.

Don't worry about making everything perfect. Just draw! Then look at the imperfections and address them, but don't let them hold you back! Here's an article that will help you keep a positive outlook when things don't come out the way you want: [Art Advice: How to Have a Positive Outlook] It also explains a method that you can use to analyze your not-perfect drawings to identify what you need to fix and how (See #2 in that article).

II - PATIENCE

I often see beginner artists feeling upset because they're not getting "good" at art quickly. Art learning is a long-term process; it takes several years for people to get "good" at art. In fact, you never stop learning and changing and improving. The trick is to stick with it and not give up!

"Rome was not built in a day." - proverb; unknown source

Be patient with yourself. Give yourself time. In the meantime, enjoy the ride!

III - PERSEVERANCE

Imagine a miner who's digging for a precious metal, has been digging for years, becomes disappointed, and gives up and closes the mine. But they were two days away from hitting the vein! They just didn't know it and quit before they could reap the results! Don't be the miner who gives up before hitting the vein!

Keep on arting! Keep on practicing! Keep on challenging yourself and keep it fun! You WILL get to where you want to be!

Keep your goal in mind and don't give up before you reach it!

All the best wishes, ~B~

MORE ART ADVICE ARTICLES

You can find the index to all Art Advice Articles [here] including:

How to Deal with Art Block

How to Have a Positive Outlook

How to Develop Your Own Style

etc.

#art advice#art tips#art help#art resources#positivity#artists on tumblr#art tutorial#motivation#how to#art#barananduen

61 notes

·

View notes

Text

Santa Claus Fails To Call , January Trifecta Update & 2025 Outlook

I’m delighted to share that I’ll be presenting at MoneyShow’s 2025 Portfolio Playbook Virtual Expo. It’s scheduled to run Jan. 28-29, 2025 on the firm’s online platform. Hope you can join me live!

Get my full 2025 forecast, plus hot stock and ETF picks for the AI Tech Super Boom! 2024 was a huge year, and the market has come a long way over the past two years so some profit taking is not unusual. My bullish 2024 Annual Forecast was on target with my best-case scenario of 15-25%. Election cycle pattern since 1949 paints a rather bullish picture for 2025. I expect the market to be up 8-12%. My January Barometer Holds the Key.

Dozens of speakers will be joining me for this extraordinary event, the FIRST virtual Expo MoneyShow is hosting in the new year. It’s designed to give you a “playbook” for the year ahead – one that includes guidance and recommendations for your stocks, bonds, precious metals, real estate, cryptocurrencies, and more.

Not only will you enjoy more than 20 live webinar presentations with top money experts, but you’ll also get to ask them questions and receive answers tailored to YOU. Plus, you’ll be able to explore our virtual exhibit hall. There, you’ll discover resources from some of the country’s top financial product and services providers.

All of this content is available to you for FREE when you participate. MoneyShow simply asks that you REGISTER in advance by clicking here:

REGISTER FOR THE FREE VIRTUAL EXPO HERE

After you’re registered, MoneyShow will send you a reminder email about the event the day before and each day the Expo is running on their platform. That will ensure you don’t miss out on guidance for 2025 from me and 20+ financial experts!

Jeffrey Hirsch Editor-in-Chief The Stock Trader's Almanac & Almanac Investor

6 notes

·

View notes

Text

Silvercorp Metals: A Standout in Silver Mining Amid Rising Demand

Source: mining.com

Category: News

A Silver Surge Driven by Renewables and Geopolitics

Silvercorp Metals has capitalized on the remarkable growth in silver prices in 2024, with its price surging over 25% year-to-date (YTD). Industry analysts attribute this rise to a combination of factors, including increasing industrial demand, especially from electric vehicle (EV) manufacturers, and geopolitical uncertainties. The dollar index’s volatility and conflicts in regions like Ukraine and the Middle East further heightened the appeal of precious metals as a stable investment.

Beyond its traditional investment value, silver’s applications in emerging technologies have expanded. Its use in solar panels, electronics, and advanced healthcare technologies has supported demand growth. According to the Silver Institute, silver consumption for solar energy has more than tripled in five years, rising from 74.9 million ounces in 2019 to a projected 232 million ounces by the end of 2024. This aligns with the broader push for renewable energy and sustainability, positioning silver as a critical resource in the global transition to green energy.

Silvercorp Metals: Poised for Growth

Among leading silver mining stocks, Silvercorp Metals Inc. (NYSE:SVM) stands out for its potential in this thriving market. Industry experts foresee sustained demand for silver in renewable energy and electronics, offsetting uncertainties tied to global economic and monetary policies. Unlike gold, which sees only 10% of its output used industrially, over half of all silver production serves industrial applications. This diverse demand profile enhances silver’s long-term investment appeal.

In 2024, industrial demand for silver is projected to reach a record 700 million ounces, marking a 7% year-over-year increase. This milestone reflects strong growth in industrial applications, jewelry, and silverware. Meanwhile, mine production is expected to rise marginally by 1%, creating a favorable supply-demand dynamic for silver prices. Exchange-traded products (ETPs) tied to silver are also set for their first annual inflows in three years, fueled by anticipated interest rate cuts, periods of dollar weakness, and declining bond yields.

Production Outlook: A Global Perspective

Global silver production is expected to grow modestly by 1% in 2024, reaching 837 million ounces. Key contributors to this growth include Mexico, Chile, and the United States, offsetting reduced outputs from countries like Peru, Argentina, and China. Mexico, in particular, is projected to increase its production by 10 million ounces (a 5% year-over-year rise) to reach 209 million ounces. This uptick is driven by improved mill throughput and upgraded ventilation systems at Pan American Silver’s La Colorada mine, alongside a recovery at Newmont’s Peñasquito mine.

As silver continues to gain traction in industrial and renewable sectors, companies like Silvercorp Metals are well-positioned to capitalize on these trends. With industrial applications and investment demand soaring, the outlook for silver and leading miners in the industry appears promising, making stocks like Silvercorp an attractive consideration for investors.

#silver#gold#jewelry#jewellery#handmade#earrings#silverjewelry#ring#handmadejewelry#rings#style#bracelet#sterlingsilver#coins#jewels#silverjewellery#art#jewelrydesigner#diamond#bullion#design#k#bracelets#m#diamonds#silvercoins

3 notes

·

View notes

Text

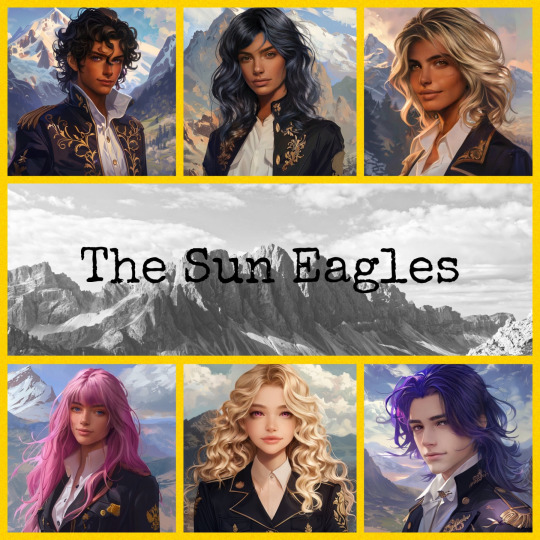

Introducing: The Sun Eagles House

Hailing from the mountainous range of the Quailax Kingdom, the Sun Eagles House is neither too big nor too small. Middle ground seems to be the name of the Sun Eagles' game, never coming in first nor last during events and never drawing unnecessary attention to themselves. This house flies under the radar, easily overlooked but given more freedom because of it. This is mostly in part attributed to House Leader Zanis Ironforce, who's cunning and sharp mind provides a unique outlook, and Vice-Leader Cyian Stonepelt, who very much would like to not be here right now.

The students of the Sun Eagles House have proficiencies in Dark Magic Studies and Arithmancy Studies. With the Quailax Kingdom's natural landscape being a mountain range full of precious gems and ores and with metal working being one of the main exports, it is rather clear to see why these students are also the ones proficient not only with heavy weaponry, but able to move efficiently in armor as well.

The Sun Eagles House is funded poorly by the Quailax Kingdom. They receive low-quality accommodations and supplies at The Magus Sanctorium. While the Kingdom has funds to spare, the need for workers in the mines and forges and artisans to craft metalwork outweigh the desire to send Magii to the school. As such, they only partially fund it due to it's relative insignificance. Because of the labor demand of the Kingdom, most of the students part of the Sun Eagles House are that of nobility, rather than commoners. Notable Students Include: Cyian Stonepelt, Zanis Ironforce, and Renath Quartzlight.

House Roster:

House Leader: Zanis Ironforce (he/him)

Status: Nobility. Son of the Kingdom's Main Advisor to the King.

Strengths: Enchantment, Axes, Strategy || Weaknesses: Divination, Calvary, Swords

Weighted Grade Point Average: 3.65 || Letter Grade: B

Vice-Leader: Cyian Stonepelt (they/them)

Status: Nobility. Child of the Cousin of the King.

Strengths: Transmutation, Bows, Armor || Weaknesses: Enchantment, Runes, Leadership

Weighted Grade Point Average: 2.40 || Letter Grade: C-

First House Officer: Traki Goldreaver (they/them)

Status: Commoner. Part of the scholarship program.

Strengths: Heavy Weapons, Armor, Evocation || Weaknesses: Illusion, Aerial Combat, Diplomacy

Weighted Grade Point Average: 3.39 || Letter Grade: B-

Second House Officer: Renath Quartzlight (they/them)

Status: Nobility. Child of a noble family.

Strengths: Arithmancy, Divination, Polearms || Weaknesses: Evocation, Armor, Bows

Weighted Grade Point Average: 4.01 || Letter Grade: B+

First House Prefect: Taisar Steelchaser (she/her)

Status: Commoner. Daughter of weapon forgers.

Strengths: Abjuration, Aerial Combat, Heavy Weapons || Weaknesses: Transmutation, Swords, Alchemy

Weighted Grade Point Average: 4.30 || Letter Grade: A-

Second House Prefect: Uthan Silvergloom (he/him)

Status: Nobility. Son of a noble family.

Strengths: Illusion, Swords, Calvary || Weaknesses: Abjuration, Heavy Weapons, History

Weighted Grade Point Average: 3.58 || Letter Grade: B

~

Faculty Advisor: Professor Tahlvin Marbleglade, Head of the Illusion Department

House Student Body Size: Average

#the magus sanctorium#sun eagles#ro: zanis ironforce#ro: traki goldreaver#ro: cyian stonepelt#side characters#quailax kingdom

13 notes

·

View notes

Text

“What are the major blood vessels that run through the neck called?” Slade asks, his back to Rose, his hands busy with operating the makeshift laboratory’s equipment. He did this sometimes, quizzed her on things she had already learnt, on the rare occasion that he runs out of super-soldier serum and doesn’t have the next batch ready yet. He says it’s to make sure her memories while on the serum and her memories while not on it don’t get jumbled; Rose suspects he just likes to make her obey him even when she isn’t chemically forced to.

Rose lifts her head, curtains of white hair falling over her face as she does so, and says nothing.

(A man had stood over her like this, once, and had screamed at her to cry. She hadn’t obeyed then. She’s not going to obey now).

Slade doesn’t quite turn around, but he does turn his head to the side so that he can look at her over his shoulder. “Don’t make me ask again.”

Her lips betray her before her conscious mind can stop them. “Carotids.”

Slade lets out a pleased hum. Rose tries not to retch and mostly fails, a flood of bile overflowing through the gap between her lips and running down the sides of her face to stain her bodysuit.

She can’t even wipe it away.

“How many are there?”

Not for the first time, Rose wishes that her hands were free so that she could rip out her own vocal chords before they betrayed her again. As it is, she closes her eyes—or rather, eye, singular, now—and slumps back against the radiator she is chained to, taking comfort in the way the sharp metal edges of the device dig into her back in a way that is uniquely real, and prepares for her body to betray her once again. “Two.”

“Where?”

“On either side.”

“Either side of what?”

“The neck.”

“Good girl.”

~~~

Unlike most people, Rose Wilson disliked late mornings.

It wasn’t that she thought there was anything wrong with waking up late—she wasn’t her father, she didn’t share the same gung ho military outlook on life that led him to live his life like a wannabe Spartan—it’s just that she liked the solitude early morning would bring. Those precious few hours in which everyone was asleep and she was unaccounted for were more precious to her than any of her meager belongings. Usually, she’d spend those precious hours on the roof, either going for an early morning swim in the rooftop pool or taking the opportunity to lounge about in the early morning California sunlight, but today she’d slept in a little longer than usual and didn’t have enough time to do either of those things before her teammates wake up, so she decides to just get herself a coffee and spend the time she does have scrolling mindlessly on her phone.

She would have done just that if she hadn’t walked into the kitchen to find her teammates sitting around the table, clear-eyed and awake and evidently waiting for her. The back of Rose’s palms starts itching, but she pushes her instinctual paranoia aside and leans against the doorframe, letting her one-eyed gaze sweep over the assembled heroes questioningly. None of them meet her gaze. Some rub their arms or scratch the back of their necks, but not one of them looks at Rose.

Ah, she thinks, feeling bitterness roil up from her stomach. This is it, then. The moment they finally kick her off the team for good. She’d been wondering when they would finally muster up the courage to just get it over with.

In any case, Rose isn’t about to make it easy for them by taking the hint and packing up her stuff like a good little bunny. If they want her off the team, they’re gonna have to look her in the eye and say that, she decides, doing her best to pretend her mouth doesn’t suddenly taste of bile.

With that in mind, she pushes away from the doorframe and walks up to the table, putting her hands on her hips and looking down at her teammates with narrowed eyes. “There a team meeting no one bothered to tell me about or something?”

Her teammates shy away from her gaze, all save for Tim, who is the only one with the courage to at least turn his head and look her in the eye. She thinks she could respect him for that, if he was anyone else, if this situation was anything but what it was.

Rose’s lip curls. “Well?”

Tim’s eyes slide to the empty chair to his left. “Sit down, Rose.”

She doesn’t move. “I’ll pass.”

Tim sighs, long and weary, like a suffering parent talking to a particularly obstinate teenager, and Rose think she’s never wanted to punch someone in the face as much as wants to punch him now.

Perhaps sensing her rising hostility, Conner stands up and places a hand on her shoulder in a way that doesn’t feel placating at all.

“No one wants to make this any harder than it needs to be, Rose,” he says, his voice hard, and Rose wonders when he began to use his super-strength as an implicit threat. She shrugs her shoulder, trying to shake off his hand, but his grip simply tightens, his invulnerable fingers denting the scales of her armor under them. Rose exhales in pain and surprise and tries to shove him away, but he simply catches her hand and twists it behind her back painfully, forcing a pained grunt past her lips. Her free hand drops down to reach for a weapon, a flashbang, anything, but Conner grabs that arm as well and twists it behind her back next to its neighbor.

“What the—ow, fuck, let go of me!” Rose snarls, straining against his hold. “What the hell is the matter with you?!”

“I’m sorry, Rose,” Tim says, his face like stone. “But you forced us into this.”

Rose doesn’t understands until he reaches into his utility belt and pulls out a syringe dripping with a very familiar yellow liquid. Her eye widens in horror.

“You wouldn’t,” she says, her voice half gasp, half whisper.

“We invited you back because we needed your skillset, Rose.” Tim takes a step forward, and Rose almost dislocates her own shoulder trying to pull herself away. “But we don’t need you.”

Rose’s one eye sweeps desperately over the room, looking first at Eddie, who disappears in a puff of smoke without even looking at her once, and afterwards at Cassie. To her shock, the demigoddess keeps her gaze on the wooden wall of the cabin, shame coloring her face. She nods, even though Tim isn’t even looking in her direction. “Do it.”

Rose doesn’t even have time to feel the cold sting of betrayal before the syringe plunges down towards her neck. The last thing she sees before everything goes dark are the blurry faces of her teammates flitting around the edges of her vision, faces and mouths stretched into unnatural grins, her father’s laughter ringing in her ears as the cabin burns.

“Good girl,” he says, again and again, in between bouts of cackling. “Good girl. Good girl. Good girl. Good girl…”

Rose doesn’t exactly wake up screaming, but she does find herself sitting up in bed, breathing heavily, once her enhanced mind chases away the petrifying fog of terror that’s enveloped her senses. Pushing down the panic worming its way into her heart, she reaches for her phone and swipes a thumb across its surface to unlock it, quickly selecting the camera app and taking a picture of her own neck. She holds it up in the darkness of the room and tries to focus on her breathing. No marks. No bulging yellow veins, no round patch of dead skin, no pulsing muscles. Nothing.

Not that that means anything, Rose reminds herself sharply. After all, the first time her father drugged her the effects lasted for well over a week, more than enough time for the marks to disappear. She needs to go through her checks, needs to reestablish what reality is and isn’t, needs to-

“Rose?” She feels a hand settle on her shoulder, invisible thanks to her blind spot. “What’s wrong?”

Rose’s breath hitches and she blindly shoves away the person the hand belongs to, registering the shocked yelp she makes as she falls out of bed. Rose scoots backwards and turns her head so she can look at Cassie—Cassie who turned away, Cassie who let it happen—as looks up at her from where she’s fallen, tangled in a nest of sheets. “Hey, what the hell!?”

“Don’t touch me,” Rose snarls, kicking the covers away and scrambling to her feet, breathing hard, her mind whirling as it tries to separate nightmare from reality. Was she dosed with the serum and is only now snapping out of it? Was it all a horrible nightmare? Do they want her to think it was all just a horrible nightmare because they did drug her but ran out of serum halfway?

She’s being stupid (is she?).

Tim would never have done that (wouldn’t he?).

The team would never have let him (does she know that for sure?).

Cassie would stop it (what if she didn’t?).

Or… could this be the dream?

Maybe she’s back with her father. Maybe she never escaped. Maybe all of this is just an induced hallucination, created to ensure her mind remains dormant while her father uses her—uses her body— as he sees fit. He knows people who could do it. Telepaths, supervillains who specialize in mind control, scientists, hypnotists…

Maybe she imagined Dick. Maybe there were never any Titans. Maybe the real Cassie has never even met her. Maybe the past years have all been a figment of her imagination. Maybe she’s alone in that stupid cabin in the middle of fucking nowhere with only him for company and she doesn’t even know it.

“… Babe, what’s wrong?”

Rose blinks. Cassie is standing in front of her now, her gaze having softened, her hand hanging in the air as if she’d reached for Rose again but thought better of it. And Rose…

She wants this to be real. She wants it to be over.

“Babe?” Cassie asks again, moving her hand forward but stopping just before palming her cheek. Asking for permission.

Rose turns her head and takes a shaky breath, trying not to think about the fact that her father never asked for permission for anything. No, she says without saying anything, and half expects the world to collapse then and there.

It doesn’t.

“Okay.” Cassie lowers her hand and takes a step back. “Sure. Whatever you want.”

Rose takes another heavy breath and moves to sit down on the edge of the bed, pushing her hair back with one hand and sighing. Cassie sits down as well, and Rose finds herself leaning into her without really meaning to. Cassie, taking that as assent, begins rubbing calming circles into the small of her back.

“I get it,” Cassie says after some time.

“No, you don’t,” Rose says, but doesn’t move away. “None of you ever did.”

They stay like that for some time, neither saying a word. The only sound Rose hears by the time they both go back to sleep is the sound of her father’s laughter still ringing in her ears.

#rose wilson#ravager#rosecassie#cassierose#rose x cassie#cassie x rose#wonder girl#teen titans#teen titans vol 3#teen titans vol3#teen titans volume 3#teen titans 2003#cassie sandsmark#cassandra sandsmark#young justice#had a long bus ride today and thought I’d post the results here#I’ve been writing too much angst lately tbh#think I might go with something a little more cheery next time#inspired by what PTSD dreams actually look like#according to testimony from people who have them at least#there’s a fascinating article on it somewhere but I can’t remember where

53 notes

·

View notes

Text

Are We At The “Sweet Spot” to Buy Gold, Silver, and Bitcoin?

Charlotte of Investing News and Chris discussed how the stock market and precious metals will behave going into the end of the year. “I can have a bearish outlook on the markets yet still be in positions. I follow the trends, not opinions, news, projections, etc. No one knows what will happen. I let the charts paint the picture, analyze the information, invest accordingly, and manage the risk.”

Watch Today’s Free Video Here

2 notes

·

View notes

Text

Gold Prices Hold Near One-Month Highs Amid Fed Rate Cut Speculation: Market Insights and Analysis

In the dynamic world of commodities trading, gold prices have recently been a focal point, with bullion prices hovering close to one-month highs and nearing the pivotal $2,400 per ounce mark. This surge comes amidst mounting speculation that the Federal Reserve will embark on interest rate cuts as early as September, a move aimed at bolstering economic recovery amidst persistent global uncertainties.

Gold's Resilience in Current Market Dynamics

Spot gold, a reliable indicator of market sentiment, experienced a slight dip of 0.3% in Asian trading, settling at $2,384.47 per ounce. Similarly, August gold futures saw a marginal decrease of 0.2%, trading at $2,392.55 per ounce. Despite these minor corrections, the overall sentiment remains bullish, underpinned by investor optimism fueled by expectations of monetary easing by the Fed.

Broader Metals Market Movements

Alongside gold, other precious metals also displayed mixed movements. Platinum futures declined by 0.6% to $1,039.25 per ounce, reflecting varied investor sentiment within the sector. Silver futures followed suit with a 1% drop to $31.370 per ounce, illustrating divergent market dynamics in the precious metals arena.

Impact of Dollar Weakness on Metal Prices

A significant factor influencing these movements was the weakening of the US dollar, which hit a near one-month low. The inverse relationship between the dollar and commodity prices was evident as the dollar's depreciation bolstered demand for commodities priced in USD, including gold and silver.

Copper's Surprising Rally

Contrary to the downward trend in precious metals, copper futures on the London Metal Exchange surged by 1% to $9,983.0 per ton. This unexpected rally underscores copper's critical role as an industrial metal, influenced by global economic indicators and infrastructure developments.

Market Outlook and Strategic Considerations

Looking ahead, market participants are closely monitoring upcoming economic data releases and Federal Reserve announcements for further clues on interest rate adjustments. The prospect of lower interest rates typically supports non-interest-bearing assets like gold, enhancing its appeal as a safe-haven investment during uncertain economic times.

Stay Informed with Spectra Global Ltd

For comprehensive insights into market trends, strategic trading opportunities, and expert analysis on commodities and forex trading, visit Spectra Global Ltd. Our platform equips traders with the tools and information needed to navigate volatile markets effectively.

#GoldPrices#FederalReserve#InterestRateCuts#Commodities#MarketAnalysis#PreciousMetals#Copper#Silver#Platinum#TradingInsights#MarketOutlook

2 notes

·

View notes

Text

Discover the Timeless Charm of Medieval Clothing

In medieval times, clothing was an vital outlook of daily life and social prominence. The type of clothing people chosen to wore varied extensively based on factors such as social class, profession, and climate. Here is an synopsis of medieval clothing:

Fabrics:

Linen: Very often used for undergarments and lightweight outer clothing.

Wool: A extensively used fabric for outer garments, specifically in colder climates. It could be rugged or fine based on the quality.

Silk: Specially meant for the wealthier classes people due to its expensiveness and elegance. It was often used for premium garments.

Social Class Distinctions:

Nobility/Royalty: The wealthy classes wore detailed and splendidly colored clothing decorated with jewels, gold, and customized embroidery. Velvet and silk were common for royal people.

Commoners/Peasants: Their clothing was modest and made from low cost fabrics like plain wool or linen. Colors were more normal, and garments were practical for daily work.

Styles:

Tunics and Surcoats: These were common for both men and women. The length and style may vary to their preference, and medieval tabard and surcote were often belted at the waist.

Houppelande: Medieval Houppelande gown a baggy outer garment with a fitted bodice and wide, flowing sleeves, popular in the later medieval period.

Hoods and Headgear: Medieval hoods and chaperons were common, and hoods with tippets or liripipes were fashionable.

4.Footwear:

Pointed Shoes: Extremely popular in the late medieval period. The length of the points could vary dramatically.

Boots: Most common for outdoor activities and leather shoes were worn by both men and women.

5.Accessories:

Belts: Often adorned with viking leather belt with solid brass buckles and could be highly decorative.

Jewelry: Rings, brooches, and necklaces were worn, with precious metals and gemstones for the wealthy.

6.Layering:

Clothing was multilayered, especially in colder climates. This could include a combination of undertunics, overtunics, and cloaks.

7.Sumptuary Laws:

In some societies, sumptuary laws regulated the types of medieval clothing that individuals could wear based on their social class. These laws were intended to maintain social hierarchy and prevent lower classes from imitating the styles of the wealthy.

It's important to note that the specifics of medieval clothing varied greatly across regions and time periods, spanning from the 5th to the 15th century. Additionally, the availability of certain fabrics and styles was influenced by trade routes and technological advancements.

3 notes

·

View notes

Video

youtube

Building Wealth With Gold IRA Investments

Retirement and how it is spent is a worry that consumes numerous Americans. Setting up your IRA account during your working a very long time to secure a retirement of bounty ought to be principal to you. Taking into account the current situation visit site here with the economy, you would be justified in having a restless outlook on when you finally quit working professionally.

Gold IRA investments give an ideal approach to increasing the worth of your retirement account. The strength that is given by gold investing in IRAs guarantees the increase in worth of your account over the long run. Gold is a product whose price isn't impacted by market influences. Its worth is directed upon by the law of market interest. With the interest for gold barely met by the stockpile, the normal outcome is at gold costs to rise.

To make gold IRS investments you should initially set up an independently managed IRA account. This is achieved either by doing a rollover of funds from a current retirement account or you can put aside a direct installment to open one. Actual treatment of actual resources of a gold IRA by the account owner as well as its director is completely disallowed by the IRS. As per IRS rules, actual gold should be saved directly into an IRS-authorize vault so as not to run into fines and punishments forced by the public authority.

When you have successfully set up your gold IRA you can start your quest for reasonable gold IRA investments. Remembering that the IRS has set norms for actual gold resources that you can keep in your account would keep you from purchasing unacceptable things, accordingly squandering your assets. Gold bullion coins or bars must be at least.999 fine to qualify for your account. A legitimate gold vendor can be your partner in choosing the right gold things for your IRA.

You shouldn't oblige yourself to actual resources when you think about gold IRA investments. Investment opportunities in mining organizations could in like manner be thought about. Actual gold can give you a dependable increase in esteem in time for your retirement however at that point stocks actually finishes the work of increasing its worth at a lot quicker rate. In any case, similar to all stocks, its worth is can be impacted by market influences and consequently implies more gamble. However, stocks can in any case give a method for diversifying your investment portfolio.

Gold IRA investments can likewise be as other precious metals like silver, platinum and palladium. These were augmentations to the standard prior forced by the IRS on precious metals in IRA. The consideration of other precious metals in IRA has opened the ways to contemporary investments for account owners since gold is considerably more expensive.

9 notes

·

View notes

Text

Gold Prices Surge to ₹89,350 per 10 Grams Amid Rupee Depreciation

Introduction

The Indian gold market has witnessed a significant uptick, with prices reaching ₹89,350 per 10 grams. This surge is primarily attributed to the depreciation of the Indian rupee against the US dollar, influencing the cost dynamics of imported commodities like gold.

Current Gold Price Trends

As of February 25, 2025, standard gold (99.5% purity) escalated by ₹250, settling at ₹88,950 per 10 grams, up from the previous ₹88,700. This marks a continuation of the upward trend observed earlier in the month, with prices nearing the all-time high of ₹89,450 recorded on February 20, 2025.

Impact of Rupee Depreciation

The depreciation of the rupee plays a pivotal role in the rising gold prices. On February 25, the rupee weakened by 51 paise, closing at 87.23 against the US dollar. A weaker rupee makes imports more expensive, directly affecting commodities like gold, which rely heavily on imports to meet domestic demand.

Silver Market Dynamics

Contrary to gold's upward trajectory, silver experienced a decline. Prices fell by ₹500, bringing the rate below the ₹1 lakh threshold to ₹99,500 per kilogram. This downturn is attributed to weaknesses in industrial metals and a rebound in the dollar index, factors that collectively influence silver's market performance.

Global Influences on Precious Metals

International factors, notably trade policies, have a profound impact on precious metal markets. Recent announcements of new tariffs by the US have introduced uncertainties, prompting investors to gravitate towards safe-haven assets like gold. This shift in investment strategies has contributed to the escalation of gold prices on a global scale.

Future Outlook

Analysts anticipate that if the rupee continues to depreciate and global uncertainties persist, gold prices may maintain their upward momentum. Conversely, silver's performance will likely depend on industrial demand and broader economic indicators. Investors are advised to monitor currency fluctuations and international trade developments closely, as these factors will significantly influence the precious metals market in the coming months.

Conclusion

The recent surge in gold prices to ₹89,350 per 10 grams underscores the intricate relationship between currency valuation and commodity pricing. As the rupee faces depreciation pressures, imported commodities like gold become more expensive, leading to price hikes in the domestic market. For those tracking the 10 gm gold coin rate today, staying informed about currency trends and global economic policies is crucial. Stakeholders, including investors and consumers, should monitor these factors to navigate the evolving landscape of the precious metals market effectively.

0 notes

Text

Invest in Silver 2025: Take Advantage of Our Free 6-Month Layaway Plan

As we approach 2025, many investors are seeking ways to diversify their portfolios and protect their wealth against economic uncertainties. One of the most reliable and historically proven assets for wealth preservation is silver. If you’re considering adding precious metals to your investment strategy, now is the time to think about investing in silver 2025.

One of the most attractive ways to invest in silver is through our Free 6-month Silver Layaway Plan (up to 1,000 oz). This flexible and cost-effective option allows you to secure silver now, while paying over six months without interest, giving you the advantage of price appreciation over time. In this article, we’ll explore the benefits of silver investment in 2025, how the silver market is expected to perform, and why our Free 6-month Silver Layaway Plan is a fantastic opportunity for both seasoned investors and those new to precious metals.

The Benefits of Investing in Silver

Silver has long been regarded as a store of value. From ancient times to the present, it has held its place as one of the most trusted forms of money and a hedge against inflation and economic uncertainty. As we look toward silver 2025, there are several reasons why silver remains an attractive investment:

Hedge Against Inflation Silver, like gold, acts as a hedge against inflation. When the value of the dollar declines due to inflationary pressures, the value of silver tends to increase. This makes silver a great tool to preserve purchasing power over time, especially in an era of rising global inflation rates.

Industrial Demand Unlike gold, silver has a significant industrial use. It’s a crucial component in electronics, solar panels, medical devices, and even electric vehicles. As industries continue to grow and innovate, the demand for silver is expected to rise. This increased demand is anticipated to put upward pressure on silver prices, making it an even more valuable asset in the years ahead.

Global Economic Uncertainty With political tensions, trade wars, and the global economic outlook constantly shifting, silver offers a safe-haven investment. During times of financial crisis, silver is often sought after for its tangible value, providing a sense of security to investors.

Affordable Compared to Gold Silver is a more affordable alternative to gold, making it accessible for investors at all levels. This makes it a great entry point for those looking to diversify their portfolios but without the high entry costs associated with gold.

Silver 2025: What’s in Store for the Market?

Looking ahead to silver 2025, the outlook for silver is incredibly promising. Analysts predict that silver prices will continue to rise due to various factors, such as:

Increased Demand from Green Technologies The push for renewable energy and green technologies has been a key driver in silver’s market growth. Silver is used extensively in solar panels, and as the world moves toward cleaner energy, silver demand is expected to surge. According to industry reports, global silver demand from the solar industry alone is anticipated to double in the next decade.

Economic Recovery and Inflationary Pressures As the global economy recovers from the pandemic, many countries are facing inflationary pressures due to expansive fiscal and monetary policies. Silver is often seen as a safe haven in times of economic uncertainty, which could drive more investors toward the precious metal.

Investment Demand With interest rates expected to remain relatively low in the coming years, investors are likely to continue looking for alternative investments like silver to offer both growth potential and protection against market volatility. As silver becomes more attractive, it will likely see increased demand from both retail and institutional investors.

Why Use Our Free 6-Month Silver Layaway Plan?

For those looking to invest in silver without the immediate upfront costs, our Free 6-month Silver Layaway Plan offers a great opportunity. This plan allows you to lock in today’s price for silver while spreading your payments over six months, interest-free. Here’s why this plan is perfect for silver investors in 2025:

Affordability and Flexibility One of the biggest advantages of the Free 6-month Silver Layaway Plan is affordability. Instead of having to pay for all your silver at once, you can break up the payments over six months, making it easier to manage your finances. This is especially helpful for investors who want to purchase larger quantities, up to 1,000 ounces, without the pressure of immediate full payment.

Protection Against Price Increases With silver prices expected to rise in the coming years, locking in your purchase price today ensures that you won’t have to pay higher prices if the market heats up. By securing your silver now, you can benefit from price appreciation while enjoying the flexibility of the layaway plan.

No Interest Charges The Free 6-month Silver Layaway Plan comes with the added benefit of no interest charges. This means that you can enjoy the advantage of spreading your payments over time without worrying about the extra cost of interest or hidden fees. It’s a simple, straightforward way to invest in silver with no surprises.

Large Purchase Capacity Whether you’re looking to purchase a small amount or a larger bulk quantity, our 6-month Silver Layaway Plan allows you to secure up to 1,000 ounces of silver. This is ideal for investors who wish to make larger purchases, ensuring they get the best possible price for their silver without needing to make a massive upfront payment.

Security and Peace of Mind Silver is a tangible asset that you can physically hold, unlike stocks or bonds. Our layaway plan ensures that you’re locking in the physical silver you want while securing the price, giving you peace of mind that you’re making a sound investment in a time of economic uncertainty.

How to Get Started with Our Free 6-Month Silver Layaway Plan

Getting started with our Free 6-month Silver Layaway Plan is easy. Here’s a simple step-by-step guide to help you begin:

Select Your Silver Browse our selection of silver products, from bars to coins, and choose the quantity and type of silver you want to purchase. Whether you’re looking for 1 oz silver coins or larger 100 oz bars, we offer a range of options to suit your needs.

Secure Your Silver Once you’ve selected the silver you wish to purchase, you can lock in the price by placing a deposit. This secures your silver and ensures that you’ll receive it at the current market price.

Set Up Your Payment Plan Choose your payment plan, which allows you to pay over six months with no interest. You can make monthly payments according to your budget and easily track your progress through our online portal.

Receive Your Silver Once you’ve completed your payments, we’ll ship your silver directly to you. It’s that simple!

Conclusion

As we look ahead to silver 2025, the outlook for silver remains incredibly positive, with rising industrial demand, economic uncertainty, and inflationary pressures driving the price of silver upward. If you’re considering adding silver to your investment portfolio, there’s no better time than now to take advantage of our Free 6-month Silver Layaway Plan. With up to 1,000 ounces available and no interest charges, this flexible and affordable plan allows you to secure silver at today’s prices while paying over time. Don’t miss out on this opportunity to invest in silver and take advantage of the potential growth of this precious metal in the years to come. Start your investment journey today and take control of your financial future with silver!

0 notes

Text

Platinum Market: Key Trends and Innovations Driving Industry Growth

The global platinum market size is estimated to reach USD 9.6 billion by 2027 registering a CAGR of 5.0%, according to a new report by Grand View Research, Inc. Rising product demand for investment related prospect is expected to fuel the market growth over the forecast period. The key reason behind this paradigm is the falling prices of the commodity amid the COVID-19 pandemic. The low prices of the product are likely to offer numerous opportunities for the consumers to buy the platinum related stocks and once the global pandemic situation normalizes, the prices are likely to increase due to the steady demand from industrial sector.

Thereby, providing huge margins for the investors in the industry. Another key prospect for the market growth is the global automotive industry. Automotive manufacturers use platinum as a critical raw material for catalytic conversion. Although, the automotive industry is likely to observe slow growth, in terms of production, due to the global pandemic situation it is likely to rebound with consumption of commodity in the manufacturing of heavy duty vehicles.

In 2018, the product demand in heavy duty vehicles manufacturing increased by nearly 4% owing to the higher production rate of trucks, particularly in North America region. In addition, implementation of strict regulatory norms in India and China are likely to enhance the rates of catalytic fitments in 2020 to 2021. The industry comprises of multinational vendors as well as few regional vendors. Industry participants are forming joint ventures to enhance their regional presence and cater to rising demand from the industrial sector.

Gather more insights about the market drivers, restrains and growth of the Platinum Market

Platinum Market Report Highlights

• Primary source, that is the mined platinum, is likely to remain the dominant segment over the forecast period. The new mines discovered across the Indian subcontinent are likely to have a positive impact on the segment growth

• However, secondary or recycled source segment is expected to record the fastest CAGR over the forecast period due to strict regulations to enhance the recycling efforts of precious metals, such as platinum

• Automotive is projected to remain the dominant application segment over the forecast period owing to the replacement of palladium from platinum in autocatalysts

• The jewelry application segment is likely to have sluggish growth due to limited product demand as a result of its high costs as compared to other precious metals

• Asia Pacific is projected to be the largest regional market over the forecast period. China and Japan are the major consumers in the region owing to the strong manufacturing base coupled with steady investment prospects

Platinum Market Segmentation

Grand View Research has segmented the global platinum market on the basis of source, application, and region:

Platinum Source Outlook (Volume, Kilograms; Revenue, USD Million, 2016 - 2027)

• Primary

• Secondary

Platinum Application Outlook (Volume, Kilograms; Revenue, USD Million, 2016 - 2027)

• Automotive

• Jewelry

• Industrial

• Investment

Platinum Regional Outlook (Volume, Kilograms; Revenue, USD Million, 2016 - 2027)

• North America

o U.S.

• Europe

o Germany

o U.K.

• Asia Pacific

o China

o Japan

• Central & South America

o Brazil

• Middle East & Africa

List of Key Players of Platinum Market

• Vale SA

• Asahi Holdings, Inc.

• African Rainbow Minerals

• Eastern Platinum

• Eurasia Mining PLC

• Anglo American Platinum Ltd.

• Implats Platinum Ltd.

• Sibanye-Stillwater

• Norilsk Nickel

• Northam Platinum Ltd.

Order a free sample PDF of the Platinum Market Intelligence Study, published by Grand View Research.

#Platinum Market#Platinum Market Size#Platinum Market Share#Platinum Market Analysis#Platinum Market Growth

0 notes