#pnb internet banking

Explore tagged Tumblr posts

Text

[ad_1] In adherence to the Reserve Bank of India (RBI) guidelines, Punjab National Bank (PNB), nation’s leading public sector bank, urges its customers to update their “Know Your Customer” (KYC) information by 23.01.2025 to ensure smooth functioning of their accounts. This is applicable only for those customers whose accounts were due for KYC updation as of 30.09.2024. As part of the KYC compliance exercise, PNB customers are requested to provide their updated information like identity proof, address proof, recent photo, PAN/Form 60, income proof, mobile number (if not available) or any other KYC information at any branch. It can also be done through PNB ONE/Internet Banking Services (IBS) or registered e-mail/post to their base branch by 23.01.2025. Failure to update KYC details within the stipulated time may result in restrictions on account operations. For any assistance, customer can visit their nearest PNB branch or check the official website https://www.pnbindia.in/ CAUTION FOR CUSTOMERS OF PNB: Please don’t click/download any link/file received from any unverified sources to update your KYC. [ad_2] Source link

0 notes

Text

[ad_1] In adherence to the Reserve Bank of India (RBI) guidelines, Punjab National Bank (PNB), nation’s leading public sector bank, urges its customers to update their “Know Your Customer” (KYC) information by 23.01.2025 to ensure smooth functioning of their accounts. This is applicable only for those customers whose accounts were due for KYC updation as of 30.09.2024. As part of the KYC compliance exercise, PNB customers are requested to provide their updated information like identity proof, address proof, recent photo, PAN/Form 60, income proof, mobile number (if not available) or any other KYC information at any branch. It can also be done through PNB ONE/Internet Banking Services (IBS) or registered e-mail/post to their base branch by 23.01.2025. Failure to update KYC details within the stipulated time may result in restrictions on account operations. For any assistance, customer can visit their nearest PNB branch or check the official website https://www.pnbindia.in/ CAUTION FOR CUSTOMERS OF PNB: Please don’t click/download any link/file received from any unverified sources to update your KYC. [ad_2] Source link

0 notes

Text

2BHK & 3BHK Flat for Sale at Newtown action area 1 | Flat in Complex | starting price ₹-41 Lakh

✅ LOCATION - Newtown Action Area 1, Just Nearest DLF 1 & Coal Bhawan & Newtown Bus St

✅ PROJECT DETAILS :-

BLOCK - 3

G+4 Storied Building.

Ground Floor Car Parking & Commercial Space.

2BHK - 797, 896, 944, 993 Sqft.

3BHK - 1113, 1173, 1197, 1203, 1256, 1344 Sqft.

Approx 50 Flats.

All Leading Bank Loan Available Like SBI, BOB, LIC HFL, PNB, UCO, IDBI ETC.

Possession 🤝 - December, 2025.

✅ AMENITIES :-

Mandir.

AC Community Hall (Rooftop)

AC Yoga Room (Rooftop)

AC Gymnasium.

Rooftop Sitting Zone With Relaxing Area.

Indoor Gaming Room.

Automatic Lift Facility.

High Speed Internet in Common Area.

24*7 Gated Security.

CCTV Camera Surveillance.

24*7 Power Backup Facility.

Water Treatment Plant.

Waste Disposal.

Fire Extinguisher.

Children's Park/ Garden.

✅ PRICING FEATURES :-

👉 PRICE - 5,200/- Per Sq. Ft. Rate.

👉 Car Parking at Extra Cost.

👉 GST Applicable As Per Govt Norms.

We are happy to help you find your DREAM HOME 🏡

CALL for more info 📞 9875369644 (Call Or WhatsApp)"

Thank you,

One Acre

0 notes

Text

How does the PNB CSP registration help applicants?

PNB CSP registration can help applicants submit their CSP applications to work as a Bank Mitra of the Punjab National Bank. Additionally, submitting genuine and detailed information about them as well as their retail outlets can help banks process their applications not only quickly but also favorable to the applicants. All nationalized banks in India request applicants to register themselves with them before sending their CSP applications, so the Punjab National Bank also follows the same procedure while considering CSP applications for approval.

The PNB CSP registration typically involves the process of registering as a Customer Service Point for the Punjab National Bank. Although the bank has many branches in urban areas, it aims to extend its banking services to all corners of the country. This is the main reason behind the opening of customer service points by the bank in the country’s rural and remote areas. It also helps them considerably in minimizing its overall expenses that involve opening its branch offices in those areas. PNB is dedicated to providing its customer service points with all the required technical as well as financial support to facilitate its CSPs to provide efficient banking services to the public. It offers them not only an attractive monthly basic pay but also handsome commissions for their services rendered to the people in rural areas.

Above all, the CSP registration process helps the Punjab National Bank get precise information about its applicants as well as the infrastructure available in their proposed CSP outlets. It helps the bank make knowledgeable decisions on appointing its bank CSP provider. Although the CSP registration process varies between banks, the Punjab National Bank follows the common guidelines as laid down by the banking industry. The bank also has its own selection processes when choosing its service providers.

Any loyal and sincere Bank CSP provider of the Punjab National Bank will be capable of earning a substantial amount of money as monthly income. The bank also permits its customer service points to provide their customers with other essential services in addition to its basic banking services. They may include accepting the payment for utility bills, DTH recharges, mobile recharges, as well as other services required to be performed by the public. With the dedicated and prompt services, these CSP providers of PNB will also get a lot of incentives as well as financial support not only from the bank but also from the government.

All nationalized banks in India identify and select CSP providers based on certain norms, such as their place, infrastructure, and inclination to partake in the program. They also go through an onboarding process, which may consist oftraining on banking processes, and regulations, as well as the exploitation of relevant technology.

They will also set up the necessary infrastructure, which may comprise computers, biometric devices, internet connectivity, and secure banking software. These CSP providers thus act as an energetic bridge between old-style banking services and remote or unbanked communities, nurturing financial inclusion as well as promoting the economic growth of banks as well as the country.

Source Link - https://cspbankmitrabc.blogspot.com/2024/05/how-does-the-pnb-csp-registration-help-applicants.html

0 notes

Text

Cost of Living in Spain: Budgeting Tips and Financial Support Options for Indian Students

You've finally made the exciting decision to study in Spain! While visions of tapas, siestas, and sangria may be dancing in your head, your practical side is wondering just how you'll manage your money. Studying abroad is an investment, and you want to make the most of this experience without breaking the bank. Although the cost of living in Spain is lower than in many other European countries, you'll still need to budget wisely. But don't stress! With some strategic planning and resourcefulness, studying in Spain can be affordable. Expert tips from overseas education consultants can be of great help here!

This guide will break down the average costs, scholarship options, and money-saving tips to help you create a realistic budget. Follow this advice, and you can fully immerse yourself in Spanish culture without going into debt. ¡Vamanos!

Study in Spain: Average tuition and living costs

Let's talk about expenses while studying in Spain according to overseas education consultants:

Tuition fees

For Indian students, tuition fees in Spain are quite affordable compared to other European countries. Undergraduate programs cost between 6,000 to 18,000 euros per year. Private universities charge higher fees of 10,000 to 18,000 euros. Medicine, business, and engineering degrees have higher fees.

Living expenses

As per overseas education consultants, studying in Spain is generally cheaper than in other Western European countries. You'll need around 800 to 1,100 euros per month to cover basic living expenses like accommodation, food, and transport. Rent costs between 350 to 750 euros per month for a one-bedroom apartment. Groceries cost around 300 euros per month. Local transport is around 50 euros per month.

Additional costs

Don't forget additional costs like health insurance (around 50-100 euros per month), phone/internet (30-50 euros per month), entertainment (around 100-200 euros per month) and any extra tuition fees for courses.

Financial assistance

There are scholarships and loans available for Indian students in Spain. The ICCR and the Spanish government offer scholarships covering tuition and living costs. Student loans from Indian banks like SBI, BOB, and PNB offer loans up to 20 lakhs for studying in Spain. Some private education loan companies also lend to students going to Spain.

Budgeting tips to save money as an international student

As an international student studying in Spain, keeping expenses in check is key. Here are some tips to help you budget wisely:

Find affordable housing

Housing will likely be your biggest expense. Look for shared student housing or host families to cut costs. If renting an apartment, choose a place close to campus or public transit to avoid transportation fees. Negotiate the best deal you can- you never know what discounts may be available!

Buy a student travel pass

Public transit in Spain is very affordable, especially if you buy a discounted student travel pass. These passes often allow unlimited travel within a city, so you can easily get around without a car. Some even provide access to bike-sharing or reduced-fare taxis.

Take advantage of student discounts

Show your student ID whenever making a purchase. Many businesses like museums, gyms, and retailers offer student discounts of 10-50% off. Download student discount apps like UniDays, Student Beans, or Youth Discount to find deals.

Cook meals at home

Eating out frequently can drain your budget fast. Buy groceries and cook meals at home instead. Shop at budget supermarkets and meal prep on weekends to have leftovers during the week.

So there you have it, my friend. Studying abroad in Spain can be an amazing adventure, but you'll need to be smart with your money. Make a detailed budget, look for discounts and scholarships, consider working part-time if your visa allows, and don't be afraid to ask for help from your university or fellow students. The financial aspect may seem daunting at first, but with some planning and resourcefulness, you can make your Spanish dreams a reality without breaking the bank. The experiences you gain will be well worth the effort. Best of luck with your studies abroad!

0 notes

Text

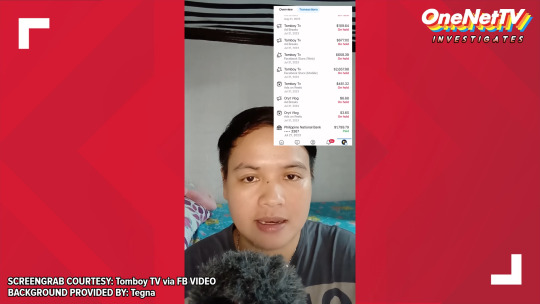

BALITANG NEGOSYO: Dabaweña Vlogger 'Tomboy TV' highlights Payment Delays and On Hold statuses to be critically concerned for Social Media Monetization [#OneNETnewsInvestigates]

DAVAO CITY, DAVAO DEL SUR -- In the ever-changing landscape of social media monetization… Meta Platforms Inc. (MPi), a company that owns American-based social media Facebook, provides different ways to enable content creators make money from their videos. These tools include Stars, Fan Subscriptions, Brand Collaborations (formerly known as Branded Content), Ads on Reels, In-Stream Ads and Performance Bonuses. Each of these features gives creators an opportunity to earn money from their creations while interacting with online netizens at a more personal level.

A financial social media analyst, who is a local Dabaweña content vlogger in Davao City, Davao del Sur named Ms. Benje Llanos alias 'Tomboy TV' has been very vocal about her experience with Facebook's latest monetization payouts.

For instance, her video personally uploaded Monday night (April 15th, 2024 -- Davao local time) highlights how Ms. Llanos brazenly and desperately frustrated with the payment system by Facebook, now replaced into global Artifical Intelligence (AI), instead of real social media employees at Facebook and MPi. Since late-July 2023 to date, there have been no payments made with constant "On Hold" status appearing everywhere on her recorded payment transaction records, except for successful transactions via local banking institution of Philippine National Bank (PNB).

If you don't know the ins and outs of Facebook monetization, one possible reason for indefinite payment delays or 'On Hold' status is that Facebook has a very strict verification process. Whether your first time on this social media platform or someone who knows nothing about it, ensure that all relevant digital documentations are purely submitted and verified correctly to avoid unnecessary setbacks.

Some creators like Ms. Llanos have been able to go around these obstacles thanks to the support of local banks like PNB that release their rightful earnings in American U.S. dollars. However, overall user experience can differ particularly when it comes to individuals who rely heavily on continuous proceeds from their internet contents.

Our financial investigative team of OneNETnews made us understand what social media monetization problems mean in reality for people like Ms. Llanos. This ongoing investigation details her circumstances and its wider implications for localized content producers thus revealing how complicated the digital economy is.

We contacted regional spokespersons for Facebook Philippines and the company's home country in Menlo Park, California, United States of America (U.S.A.) via Creator Business Support and by e-mail correspondent; but no comment was given for an infinite period as of this press time.

Much unfortunate for Ms. Llanos and others alike, it is rarely obvious that there exists a difficulty in sailing through the dynamic aspects of monetizing social media, since monetization was added in the late mid-2010s. For example, Facebook has various offerings for creators looking to earn money but payment delays and 'On Hold' statuses can obstruct this process.

A sustainable digital ecosystem that is fairer and more transparent can be achieved when content creators identify these issues' origins like dubsmashing, memes that don't own, or even worse by illegally posting audiovisual copyrighted content (which all of them are unlicensed with FILSCAP or Filipino Society of Composers, Authors and Publishers), in exception for royalty-free licensed music, so as to improve the current situation through advocating for more open and efficient means of paid content creators.

SCREENGRAB COURTESY: Tomboy TV via FB VIDEO BACKGROUND PROVIDED BY: Tegna

SOURCE: *https://www.facebook.com/100057082885553/videos/422666903741452/ [Referenced FB VIDEO via Tomboy TV Oryt] *https://www.facebook.com/100022782392152 [Referenced FB Profile via Benje Llanos] *https://www.youtube.com/watch?v=WCmlPg3cR2k [Referenced YT VIDEO via The Homebase Edit] *https://clearvoice.com/resources/facebook-content-monetization/ [Referenced Editorial Article via Clearvoice - Altimese Nichole] *https://blog.hubspot.com/marketing/history-facebook-adtips-slideshare [Referenced Editorial Article via Hubspot - Jay Fuchs] *https://www.facebook.com/business/goals/monetize-content/ *https://www.facebook.com/business/help/321041698514182/ *https://creators.facebook.com/monetize-with-fan-subscriptions/ *https://creators.facebook.com/tools/earn-money/ *https://creators.facebook.com/tools/in-stream-ads and *https://creators.facebook.com/tools/ads-on-facebook-reels

-- OneNETnews Team

#OneNETnewsInvestigates#davao city#davao del sur#Tomboy TV#monetization#payout issues#facebook#content creator#business news#fyp#awareness#exclusive#first and exclusive#OneNETnews

0 notes

Text

MARKET GROWTH PROSPECTS OF BANKING SECTOR IN INDIA, 2023- 24 – DART CONSULTING FORECASTS HIGHER GROWTH IN THE NEXT FIVE YEARS

India’s banking sector is sufficiently capitalized and well-regulated. The financial and economic conditions are comparatively better even by comparing with well developed economies. Indian banks are generally resilient and have withstood the global downturn well as can be noted by reviewing previous years records.

The Indian banking industry has recently witnessed the rollout of innovative banking models like payments and small finance banks. In recent years, the Banks are increasingly focusing widening banking reach, through various schemes like the Pradhan Mantri Jan Dhan Yojana and Post payment banks. The rise of Indian NBFCs and fintech have significantly enhanced India’s financial inclusion and helped fuel the credit cycle in the country.

Here is a quick overview of key players in the industry.

HDFC Bank Ltd

HDFC Bank Ltd (HDFC) offers personal and corporate banking, private and investment banking, and other related financial solutions to individuals, MSMEs, government, and agriculture sectors, financial institutions and trusts, and non-resident Indians. It provides a range of deposit services and card products; loans for homes, cars, commercial vehicles, and other personal and business needs; insurance for life, health, and non-life risks; and investment solutions such as mutual funds, bonds, equities, and derivatives. HDFC also provides services such as cash management, corporate finance advisory, customized banking solutions, project and structured finance, trade financing, foreign exchange, internet banking, and payment and settlement services, among others. The bank operates in India through a network of branches, ATMs, phone banking, net banking, and mobile banking. It has overseas branches in Bahrain, Hong Kong, and the UAE, and representative offices in the UAE and Kenya. HDFC is headquartered in Mumbai, Maharashtra, India.

ICICI Bank Ltd

ICICI Bank Ltd (ICICI Bank) provides personal and corporate banking, investment banking, private banking, venture capital, life and non-life insurance solutions, securities broking, and asset management services to corporate and retail clients, high-net-worth individuals, and SMEs. It offers a wide range of products such as deposits accounts including savings and current accounts, and resident foreign currency accounts; investment products; and consumer and commercial cards. ICICI Bank offers to lend for home purchase, commercial business requirements, automobiles, personal needs, and agricultural needs. The bank offers services such as foreign exchange, remittance, import and export financing, advisory, trade services, personal finance management, cash management, and wealth management. It has an operational presence in Europe, Middle East, and Africa (EMEA), the Americas, and Asia. ICICI Bank is headquartered in Mumbai, Maharashtra, India.

State Bank of India

State Bank of India (SBI) is a universal bank. It provides a range of retail banking, corporate banking, and treasury services. The bank serves individuals, corporates, and institutional clients. Its major offerings include deposits services, personal and business banking cards, and loans and financing. The bank provides services such as mobile banking, internet banking, ATM services, foreign inward remittance, safe deposit locker, money transfer, mobile wallet, trade finance, merchant banking, project export finance, treasury, offshore banking, and cash management services. It operates in Asia, the Middle East, Europe, Africa, and North and South America. SBI is headquartered in Mumbai, Maharashtra, India.

Punjab National Bank

Punjab National Bank (PNB) offers retail and commercial banking, agricultural and international banking, and other financial services. Its retail and commercial banking portfolio offers credit and debit cards, corporate and retail loans, deposit services, cash management, and trade finance. Its international banking portfolio includes foreign currency accounts, money transfers, letters of guarantee, and world travel cards, and solutions to non-resident Indians. PNB also offers merchant banking, mutual funds, depository services, insurance, and e-services. The bank operates in India and has overseas operations in the UK, Bhutan, Myanmar, Bangladesh, Nepal, and the UAE. PNB is headquartered in New Delhi, India.

Bank of Baroda

Bank of Baroda (BOB) offers retail, agriculture, private and commercial banking, and other related financial solutions. It includes loans, deposit services, and payment cards. The bank offers loans for homes, vehicles, education, agriculture, personal and corporate requirements, mortgage, securities, and rent receivables, among others. It provides current and savings accounts; fixed and recurring deposits; debit, credit, and prepaid cards. The bank also provides insurance coverage for life, health, and general purposes. It offers services such as treasury, financing, mutual funds, cash management, international banking, digital banking, internet banking, start-Up banking, and wealth management. The bank has operations in Asia-Pacific, Europe, North America, and the Middle East and Africa. BOB is headquartered in Baroda, Gujarat, India.

Industry Performance

The health of the banking system in India has shown steady improvement, according to the Reserve Bank of India’s latest report on trends in the sector. From capital adequacy ratio to profitability metrics to bad loans, both public and private sector banks have shown visible improvement. And as credit growth has also witnessed an acceleration in 2021-22, banks have seen an expansion in their balance sheet at a pace that is a multi-year high. As of November 4, 2022, bank credit stood at Rs. 129.26 lakh crore (US$ 1,585.09 billion). As of November 4, 2022, credit to non-food industries stood at Rs. 128.87 lakh crore (US$ 1.58 trillion).

Given the increasing intensity, spread, and duration of the pandemic, economic recovery the performances of key companies in the industry was positive. The reported margin of the industry by analyzing the key players was around 13.7% by taking into consideration the last 3 years’ data. Details are as follows.

Companies Net Margin EBITDA/Sales

HDFC Bank Ltd. 23.5% 31.2%

ICICI Bank Ltd. 22.3% 30.4%

State Bank of India 10.0% 25.7%

Punjab National Bank 4.0% 10.0%

Bank of Baroda 8.9% 13.9%

Industry Margins 13.7% 22.2%

Industry Trends

The macroeconomic picture for 2023 portends mixed fortunes for consumer payment players. Higher rates should boost banks’ net interest margins for card portfolios, but persistent inflation, depletion of savings, and a potential economic slowdown could weigh on consumers’ appetite for spending. Digital identity is expected to evolve as a counterbalancing force to mitigate fraud risks in the long run. Transaction banking businesses are standing firm despite recent market uncertainties. For many banks, these divisions have been a steady source of revenues and profits.

Over the long term, banks will need to pursue new sources of value beyond product, industry, or business model boundaries. The new economic order that will likely emerge over the next few years will require bank leaders to forge ahead with conviction and remain true to their purpose as guardians and facilitators of capital flows. With these factors in mind, the industry is still showing huge growth potential, some of the growth divers that is propelling the industry are:

Rising rural income pushing up demand for banking

Rapid urbanisation, decreasing household size & easier availability of home loans has been driving demand for housing.

Growth in disposable income has been encouraging households to raise their standard of living and boost demand for personal credit.

The industry is attracting major investments as follows.

On June 2022, the number of bank accounts—opened under the government’s flagship financial inclusion drive ‘Pradhan Mantri Jan Dhan Yojana (PMJDY)’—reached 45.60 crore and deposits in the Jan Dhan bank accounts totaled Rs. 1.68 trillion (US$ 21.56 billion).

Some of the major initiatives taken by the government to promote the industry in India are as follows:

As per the Union Budget 2022-23:

National Asset reconstruction company (NARCL) will take over, 15 non-performing loans (NPLs) worth Rs. 50,000 crores (US$ 6.70 billion) from the banks.

National payments corporation India (NPCI) has plans to launch UPI lite this will provide offline UPI services for digital payments. Payments of up to Rs. 200 (US$ 2.67) can be made using this.

In the Union budget of 2022-23 India has announced plans for a central bank digital currency (CBDC) which will be possibly know as Digital Rupee.

Through analyzing the performance of the contributing companies for the last three years, we can ascertain that the sector witnessed compounded annual growth rate (CAGR) of 9.9% at the end of 2022. Details are as below.

Companies CAGR

HDFC Bank Ltd. 14.02%

ICICI Bank Ltd. 7.3%

State Bank of India 8.4%

Punjab National Bank 9.2%

Bank of Baroda 10.7%

Industry CAGR 9.9%

Working through partnerships both with NBFCs and FinTech is high on the agenda of the Indian banking sector, and this is an area of focus of the FICCI National Committee on Banking. Banks will have to play a very constructive role as India aspires to be the leading economy in future. The strengthened banking sector has the potential to contribute directly and indirectly to GDP, increase job creation and enhance median income. Technology interventions to strengthen the quality and quantity of credit flow to the priority sector will be an important aspect. The need for sustainable finance / green financing is also gaining importance.

With these attributes boosting the sector, the Indian banking industry is likely to grow 5% more than the reported growth rate and is expected to exhibit CAGR of 10.4% in the next five years from 2023 to 2027.

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services. More details at https://www.dartconsulting.co.in/dart-consultants.html

0 notes

Text

Do you collect data because you can protect it? Or are you capable of protecting data so you collect it?

The module 3 of our Data Privacy course focused on the pillars of compliance and the manual of now to make a data privacy manual according to the standards made by the National Privacy Commission. I remember two key things about the lesson. First is do not collect what you can protect. Second is Sir explaining that the university recently got an award or seal.

See you in jail, are the last words said in the discussion as Sir explained because if the organization that created the data privacy manual is lacking or has a problem, it is punishable by law. Which is why the five pillars of compliance aim to guide an organization on what they need to comply fully to ensure data privacy.

The university has posted in the internet that it now has a seal that shows that they follow the standards of data privacy. I remember this seal that relates to data privacy can also be seen on the doors of 7Eleven and Philippine National Bank (PNB). I forgot the name and so I checked the university website now and I see it along with the other badges that the school acquired that ensures students and visitors about their security and privacy. The seal is called the DPO/DPS badge and the website also includes a transparency badge. As the first journal entry explained, transparency is about providing the public info of the different documents or forms that the school use and how it uses the information users provide. This also includes how they store, destroy, and process such information.

Lastly, as I am about to leave the website, I noticed about the Data privacy statement of the university website that pops up when you enter it and redirect you to the data privacy statement. Moreover, the data privacy manual of the school is also given alongside Non-Disclosure Agreement forms for researchers and encoders.

0 notes

Text

PNB customer big update, bank launches IVR based UPI 123pay, now make UPI payment without internet, know how

PNB UPI 123pay: Punjab National Bank (PNB) becomes the first public sector bank to introduce an IVR-based UPI solution – UPI 123PAY, aligning with the Digital Payment Vision 2025 towards a cashless and cardless society. What is UPI 123PAY Unified Payments Interface (UPI) is a 24-hour payment channel enabling customers to perform fast, encrypted and real-time payments. Till now, the solution was…

View On WordPress

0 notes

Text

Promotive: Leading Website Designing and Social Media Marketing Agency in Greater Noida

In today’s virtual-first global, having an impactful on-line presence is vital for any enterprise. From a well-designed website to a strong social media strategy, those factors power achievement by means of attracting and engaging clients. For companies in Greater Noida and Noida, Promotive offers a one-prevent answer as a pinnacle website designing company in Greater Noida and a most useful social media marketing company in Noida.

Located at Office 311, 03rd Floor, Above PNB Bank, Sector 51, Noida, U.P., 201301, Promotive makes a speciality of presenting groups with virtual solutions that raise their logo. With a group of talented designers and social media specialists, Promotive creates websites that aren’t just visually attractive however also consumer-pleasant, responsive, and optimized for engines like google. Whether you’re seeking to redecorate your present internet site or develop a brand new one, their custom web site design services ensure that your website online reflects your brand identification and meets your unique business goals.

In addition to web site design, Promotive also excels as a social media advertising and marketing company in Noida. Recognizing the energy of social media in today’s marketplace, they provide complete SMM (Social Media Marketing) offerings that help brands connect with their target market and drive significant engagement. Their social media team crafts techniques that are tailor-made to your commercial enterprise, concentrated on the platforms wherein your target audience is maximum active, along with Instagram, Facebook, Twitter, and LinkedIn. From content advent to paid marketing, Promotive’s SMM offerings aim to reinforce your brand’s visibility and foster a faithful customer base.

As a reputable SMM advertising and marketing business enterprise in Noida, Promotive employs statistics-pushed insights and marketplace tendencies to create campaigns that convert. The team video display units and analyzes engagement, adjusting techniques to maximize effects. By partnering with Promotive, agencies advantage gets right of entry to to professional steerage and impactful strategies that make sure their brand stands proud inside the competitive digital landscape.

Promotive’s commitment to excellence and patron delight has earned it a sturdy popularity inside the Noida and Greater Noida region. Their information spans internet site development, search engine marketing, social media advertising and marketing, and greater, making them a super companion for organizations seeking a complete digital advertising and marketing approach.

For greater records, visit their website at https://promotive.Co.In/ , or contact them without delay at [email protected] or (+91) 70490-63460. Whether you're looking to create an effective website or build a strong social media presence, Promotive is right here to help take your emblem to the following stage.

#smo marketing company in noida#best digital marketing agency in gurgaon#website designing company in greater noida#bulk whatsapp marketing in noida#top seo company in noida#best companies in noida for digital marketing#digital marketing company in greater noida#video marketing company in gurgaon#best digital marketing company in gurgaon#best whatsapp marketing company in noida

0 notes

Text

Zero Balance Account: Punjab National Bank का Zero Account खुलवाने से पहले ये जरूर देखे

Zero Balance Account: Punjab National Bank का Zero Account खुलवाने से पहले ये जरूर देखे, Punjab National Bank का Zero Balance Account इन दिनों बहुत चर्चा मे है, तो अगर ये ख़ाता खुलवाने का सोच रहे हैं तो ये इम्पोर्टेन्ट जानकरी जरूर पड़े, कोई भी खाता खुलवाने से पहले उसकी पूरी detail जरूर निकाला करें, आइये देखते हैं क्या ये account आपके लिए अच्छा हैं या नहीं, लोग खाता खुलवाने के बाद कई बार फस जाते क्योंकि उन्हें पूरी जानकारी पता नहीं होती हैं.

Zero Balance Account: Punjab National Bank का Zero Account खुलवाने से पहले ये जरूर देखे

Punjab National Bank मे 6 तरिके के savings account खुलते हैं, जिनमे से एक zero account है, हालांकि बिलकुल zero account ना खुलवाये क्योंकि उसमे फीचर भी ना के बराबर मिलते हैं, Punjab national bank का उन्नति (Unnati) Savings account खुलवाये,

features

Pnb उन्नति zero savings account के features Mab Maintaln balance Rural Area500 RsSemi Urban1,000 RsUrban2,000 RsMetro City2,000 RsZero Balance Account मेन्टेन करने पडेगे जोकि बहुत कम है और अगर आप Rural (गाँव) Area से हैं तो, तो आपको 500Rs ही मेन्टेन करने हैं, Debit Card इसमें आपको Rupay Classic Debit card जोकि wifi debit card है, इसमें आप एक बार 5000 ही Debit Card TypeRupay Debit CardWifi Yes Tap & PayWifi limit 5000 ₹ SingleIssuances Fees0Annual Charge150+GstCard LimitAny bank ATM withdraw- 25000 dailyswipe - 60,000Zero Balance Account Transaction Limit इसमें आपको 6 महीने मे 40 ट्रांसक्शन कि limit मिलती है, आप 6 महीने मे 40 ट्रांसक्शन ही कर सकते हैं, उसके बाद पैसे देने पडेगे, लेकिन ये 40 ट्रांसक्शन limit - IBS,ATM, Si इन पर कोई Limit नहीं, ये 40 कि limit Cash Withdraw जो bank मे जाकर करते हैं पर्ची भरके करते हैं, इन पर लगेगी, Internet बैंकिंग, Upi, atm पर कोई Limit नहीं हैं, इन पर 40 कि कोई limit नहीं हैं.

Zero Balance Account Cheque Book आपको एक 25 Pages कि cheque book मिलेगी, passbook भी फ्री मिलेगी, interest Rate and FD आपको इस account मे 2.70% ब्याज मिलेगा, वहीँ Fd 1 साल के लिए करवाते हो तो 6.80% ब्याज मिलेगा, लेकिन 444 दिनों कि FD करवाने पर आपको 7.25% ब्याज मिलेगा, 1 साल से सिर्फ 2 महीने 20 दिन अधिक कि FD करवाते हैं तो आपको 7.80% का ब्याज मिलेगा.

घर बैठे खाता खोले PNB उन्नति Savings Account

आपको कुछ ज्यादा करने कि जरूरत नहीं हैं, सिर्फ PNB One App को Install करने कि जरूरत हैं, और आपको Aadhar Kyc और Video kyc से अपना ये Pnb उन्नति account खोल सकते हैं,

निष्कर्ष और सलाह

हम आशा करते हैं इस Pnb Unnati Savings Zero balance account के बारे मे पूरी जानकारी दे चुके हैं, अगर कोई जानकारी छूट गई हैं तो कृपया हमें कमेंट मे जरूर बताये, हम आपको unnati Savings account खोलने कि सलाह देते हैं हालांकि 5 और Zero balance account है, लेकिन ये उन्नति zero balance account सबसे अच्छा हैं कई सारे features के साथ आता हैं. Punjab National Bank account online कैसे खोले 10 मिनट मे PNB Aadhar Link Online: PNB Account में कैसे होगा Aadhar Card Link Online Pnb bank का ATM पिन कैसे बनाएं Punjaab National Bank Debit card पर इंटरनेशनल ट्रांजैक्शन चालू कैसे करें Read the full article

0 notes

Text

Vietnam

Economy

Tasa de crecimiento del PIB: 2.6% cambio anual (2021) Banco Mundial

Producto bruto interno: 366.1 miles de millones USD (2021) Banco Mundial

PIB per cápita: 3,756.49 USD (2021) Banco Mundial

Producto nacional bruto: 1.08 billones Dólares PPA (2021) Banco Mundial

PNB per cápita: 11,080 Dólares PPA (2021) Banco Mundial

Usuarios de Internet: 74.2% de la población (2021)Banco Mundial

Moneda: Đồng vietnamita

GDP growth rate: 2.6% annual change (2021) World Bank Gross Domestic Product: 366.1 billion USD (2021) World Bank GDP per capita: USD 3,756.49 (2021) World Bank Gross National Product: $1.08 trillion PPP (2021) World Bank GNP per capita: 11,080 PPP Dollars (2021) World Bank Internet users: 74.2% of the population (2021) World Bank Currency: Vietnamese Đồng

0 notes

Link

PNB Net Banking is one of the best and most anticipated services to transfer funds online. Punjab National Bank (PNB) offers a huge range of services related to personal banking. To know how you can use PNB net banking services read the blog.

0 notes

Photo

Customers may use Punjab National Bank's net banking services to perform a variety of tasks online. Customers can access their account information, make online purchases, and more from the comfort of their own homes. There are numerous other advantages of using this service. PNB Bank Internet Banking facility is easy, quick, and secure. Customers can access their account information, make online purchases, and more from the comfort of their own homes.

#PNB online net banking#internet banking services#pnb internet banking service#net banking service#pnb personal loan#pay credit card bills#ppf account

0 notes

Link

#tech#technology#tech news#technology news#techblog#techblogger#hindi tech news#digital banking#digitalindia#makeinindia#internet banking#mobile banking app#pnb latest news#pnb#pnboneapp#mobile app#google play store#banking#punjab national bank#banking services#banking sector#bankingfacilities#bankingsecurity#financesector#reporter17#trendzplay

0 notes