#Bank CSP

Explore tagged Tumblr posts

Text

How does the PNB CSP registration help applicants?

PNB CSP registration can help applicants submit their CSP applications to work as a Bank Mitra of the Punjab National Bank. Additionally, submitting genuine and detailed information about them as well as their retail outlets can help banks process their applications not only quickly but also favorable to the applicants. All nationalized banks in India request applicants to register themselves with them before sending their CSP applications, so the Punjab National Bank also follows the same procedure while considering CSP applications for approval.

The PNB CSP registration typically involves the process of registering as a Customer Service Point for the Punjab National Bank. Although the bank has many branches in urban areas, it aims to extend its banking services to all corners of the country. This is the main reason behind the opening of customer service points by the bank in the country’s rural and remote areas. It also helps them considerably in minimizing its overall expenses that involve opening its branch offices in those areas. PNB is dedicated to providing its customer service points with all the required technical as well as financial support to facilitate its CSPs to provide efficient banking services to the public. It offers them not only an attractive monthly basic pay but also handsome commissions for their services rendered to the people in rural areas.

Above all, the CSP registration process helps the Punjab National Bank get precise information about its applicants as well as the infrastructure available in their proposed CSP outlets. It helps the bank make knowledgeable decisions on appointing its bank CSP provider. Although the CSP registration process varies between banks, the Punjab National Bank follows the common guidelines as laid down by the banking industry. The bank also has its own selection processes when choosing its service providers.

Any loyal and sincere Bank CSP provider of the Punjab National Bank will be capable of earning a substantial amount of money as monthly income. The bank also permits its customer service points to provide their customers with other essential services in addition to its basic banking services. They may include accepting the payment for utility bills, DTH recharges, mobile recharges, as well as other services required to be performed by the public. With the dedicated and prompt services, these CSP providers of PNB will also get a lot of incentives as well as financial support not only from the bank but also from the government.

All nationalized banks in India identify and select CSP providers based on certain norms, such as their place, infrastructure, and inclination to partake in the program. They also go through an onboarding process, which may consist oftraining on banking processes, and regulations, as well as the exploitation of relevant technology.

They will also set up the necessary infrastructure, which may comprise computers, biometric devices, internet connectivity, and secure banking software. These CSP providers thus act as an energetic bridge between old-style banking services and remote or unbanked communities, nurturing financial inclusion as well as promoting the economic growth of banks as well as the country.

Source Link - https://cspbankmitrabc.blogspot.com/2024/05/how-does-the-pnb-csp-registration-help-applicants.html

0 notes

Text

Empowering Rural India through Kiosk Banking

State Bank of India (SBI) has revolutionized the banking landscape in India by introducing Kiosk Banking, bringing services to rural and remote regions. It's a network of kiosks offering basic banking to those without traditional options. To benefit from this initiative, individuals can Apply For CSP Registration and enjoy the convenience and empowerment that SBI Kiosk Banking brings to their lives. Applying for CSP Registration The SBI CSP Apply process is straightforward and hassle-free. Here's how you can start with SBI Kiosk Banking • Find the closest SBI Kiosk Bank branch: Go to the SBI website and use the "Kiosk Locator" to locate the nearest branch. • Open a bank account: If you don't have an account with SBI, you can open a savings account at the kiosk. Fill out the account opening form and bring a valid ID and address proof. • Use banking services: After opening an account, you can access basic services like deposits, withdrawals, and transfers. Provide your account details and Aadhaar number to use these services. Benefits of SBI Kiosk Banking Choosing to Apply For CSP Registration offers several advantages that cater to the needs of rural and remote communities. Let's explore the benefits it brings: • Ease of Access: SBI makes banking reachable to people in far-off regions through kiosk banking, ensuring everyone can access banking services. • Convenient Banking: The kiosk offers convenient banking services like depositing, withdrawing, and transferring money, saving people the trouble of travelling to a distant bank. • Financial Inclusion: SBI Kiosk Banking aims to include financially marginalized individuals by offering them banking services and empowering their involvement in the official economy. • Improving Lives: This initiative enhances the lives of rural communities by allowing them to safeguard their savings, investments, and finances through access to banking services. • Safety and Security: SBI Kiosk Bank branches prioritize the safety and security of customers' money and personal information by implementing stringent security measures. Overall, SBI Kiosk Banking stands as a pioneering initiative by the State Bank of India to extend basic banking services to rural and remote areas, fueling financial inclusion and economic empowerment. Through SBI CSP Apply, individuals residing in these regions can take advantage of the services offered by SBI Kiosk Bank, securing and managing their money for a better future. By embracing technology and innovative solutions, SBI continues to bridge the gap and uplift the lives of millions in India's rural landscape. Blog Source: https://bankmitraregistration.wordpress.com/2023/07/11/empowering-rural-india-through-kiosk-banking

0 notes

Text

amen

#mello#death note#i bought csp ex 2.0 my bank account hates me#i got new brushes tho so#worth it totally#mihael keehl#death note fanart#mello death note#v’s gallery

961 notes

·

View notes

Note

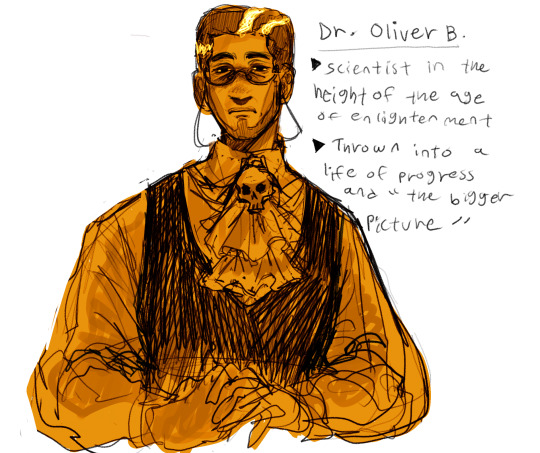

Could we possibly get more information about this Frankenstein AU? 👉👈 You have me intrigued

YESS Tldr under cut

Oliver is a scientist who works on a project that he discovers will not finish until much after his death. He has a mental breakdown but is so swept up in progress and the push for the bigger picture that Oliver decides fuck it i will science so good and well that i never have to do anything else again to be a respected scientist. Mike was recently murdered and now that he's over his initial reaction where he blackmails Oliver's reputation for freedoms but after oliver is like sounds good ^^ to everything they become buddies. Oliver figures out the bigger picture is to be happy and decides to change his perspective. Mike seeks out his murderer with barely a shred of evidence

#TY FOR THIS ASK#sorry ab it being slow i wanted to doole for it u understand#doodle#dude i just typed out all the image ids and then. accidentally deleted it all i think#also all the text#AAAAAAAAAAAAA#ill add it later sobs#tma au#tma#tma art#tma fanart#the magnus archive fanart#the magnus archives#oliver banks#mike crew#terminal velocity#frankenstein tv au#NOOOO ONE OF RHEM WAS A DOODLE I SCREENS HOT FROM CSP AND DLETED#my hubris.#huh. my entire post cleared twice now#did i mess it up twice bbbbbb#im sorry i wrote out so much but i am not doing that again#later timmeee :')#my friends r right i should stop insta deleting things#i keep hitting undo for typing#then.#anyways three times total deleted during the making of this post jesus christ

183 notes

·

View notes

Text

#guilty gear#guilty gear strive#ggxx#ggx2#ggst#happy chaos#i no#bridget#csp#clip studio#clip studio paint#my art#shitpost art#bank#bank robbery

120 notes

·

View notes

Text

happy birthday mr. banks

#paul banks#interpol nyc#interpol band#FINALLY.FOR ONCE IN MY LIFE I FINISHED A DRAWING OF A GUY I LIKE BEFORE THE END OF HIS BIRTHDAY#this was done entirely (with exception of the graphical elements) with the polyline tool in CSP !#i love the angles it gives lineless art. very appealing to me

13 notes

·

View notes

Text

Valentine ft: my fursona

I only do classy valentines.

2 notes

·

View notes

Text

Apply for an Instant PAN Card and get your Physical PAN Card delivered at your doorstep. Fast, secure, and hassle-free process at JustForPay. Start your application today!

For more info visit at: https://www.justforpay.co.in/pancard

#Pan Card Status Check by Mobile Number#Instant Pan Card to Physical Pan Card Apply#Nsdl Payment Bank Csp Registration Online#Digital Pan Card Apply Online#Nsdl Payment Bank Csp Registration

0 notes

Text

Simplify your NSDL Payment Bank CSP Registration with JustForPay's secure and easy-to-use API. Register online and start offering payment services today. Fast, reliable, and efficient.

For more info visit at: https://justforpay.in/service

#Nsdl Payment Bank Distributor Api#Nsdl Payment Bank Csp Provider Api#Nsdl Payment Bank Csp Login Api#Nsdl Payment Bank Csp Registration Api#Nsdl Payment Bank Csp Registration Online Api#Digital Pan Card Apply Online Api

0 notes

Text

Become a Digital Banking Agent with PayPoint India | CSP Registration

PayPoint India offers seamless CSP registration for individuals looking to become a digital bank center agent. With PayPoint, you can easily get a PayPoint franchisee and set up your own digital bank shop to provide essential banking services to your community. As the top banking CSP provider in India, we offer comprehensive support to help you create a successful business. Whether you’re aiming to offer financial services or expand your business, PayPoint India provides everything you need to become a trusted digital bank center agent. Join today!

0 notes

Text

How to Get Started as a Bank CSP Provider

Becoming a Bank CSP Provider or Bank Mitra is a lucrative business opportunity that can help you earn a steady income while serving your community. A Bank Mitra is a banking agent who provides basic financial services to people who do not have access to traditional banking facilities. Bank Mitras helps bridge the gap between banks and their customers in remote and rural areas. In this article, we will discuss the steps involved in becoming a Bank CSP Provider and how to register for the same. Step 1: Understand the Requirements The first step towards becoming a Bank CSP Provider is to understand the requirements set by the banks. Each bank has its own set of guidelines and criteria for selecting Bank Mitras. It is essential to research and gather information about the banks and their requirements before proceeding with the registration process. Some of the common requirements for Bank Mitra Registration include the following: • Minimum age limit of 21 years • Educational qualifications (minimum 10th standard) • Good communication skills • No criminal record Step 2: Identify the Bank Once you have understood the prerequisites, the subsequent step is to recognize the bank with which you intend to collaborate. It is crucial to select a bank that is firmly established and has a credible standing in the market. You can visit the websites of various banks and check their requirements and guidelines for Bank Mitra Registration. Step 3: Gather the Required Documents Once you have identified the bank, the next step is to gather the necessary documents required for registration. The documents required may vary from bank to bank, but some of the common documents include: • Proof of identity, which may include an Aadhaar card, PAN card, driving license, or any other valid identity card. • Address proof (electricity bill, passport, etc.) • Educational certificates • Bank account details • Passport size photographs Step 4: Submit the Application After gathering all the required documents, the next step is to submit the application for Bank Mitra Registration. The application form can be downloaded from the bank's website or obtained from their nearest branch. The application form must be filled out carefully, and all the details must be provided accurately. Step 5: Training and Certification Once your application is accepted, the bank will provide you with training and certification. The training will equip you with the necessary skills and knowledge to perform your Bank Mitra duties. The certification process may vary from bank to bank, but it generally involves assessing your skills and knowledge. Winding it up Becoming a Bank Mitra or Bank CSP Provider is an excellent opportunity to serve your community while earning a steady income. Remember to maintain a positive attitude, be persistent in your efforts, and provide excellent customer service to ensure your success as a Bank Mitra. Blog Source: https://applyforcspbank.finance.blog/2023/05/16/how-to-get-started-as-a-bank-csp-provider

0 notes

Text

Why Trust Online CSP Provider for SBI Kiosk Banking

In today's digital age, the world has become a global village where everything is just a click away. Banking has also evolved over time, making accessing financial transactions easier and more convenient than ever. One such innovation in banking is SBI Kiosk Banking, which allows you to take advantage of various banking features such as cash deposits, withdrawals, and money transfers at your nearest CSP. However, many are reluctant to trust online CSP providers for this service. This blog post explains why you should trust an Online CSP Provider to start SBI Kiosk Banking and how it can help you in the long run.

Why join SBI kiosk Banking

You should trust this online CSP provider to start SBI Kiosk Banking for many reasons. First, they have the expertise and experience to do the job quickly and easily. We can also provide all the resources and support you need to succeed. In addition, they can offer competitive prices and terms that can save you money.

Working with an online CSP provider ensures that your financial information is secure. We use the latest security measures to protect your data and keep your account safe. You can also be sure that your transactions will be processed quickly and efficiently. With an Online CSP Provider, you can focus on running your business without worrying about financial security.

Why trust your online CSP provider for sbi kiosk bank CSP

This online CSP provider is authorized and regulated by the Reserve Bank of India (RBI). They are authorized to provide banking services on behalf of SBI. CSPs must comply with regulatory requirements and security standards set by the RBI. This allows CSPs to maintain high security and provide reliable services to their customers. Additionally, these online CSP providers use advanced security technologies to protect customer data and transactions. We use encryption, firewalls, and other security measures to ensure the security of our customer's data. Additionally, we provide customer support services to address any concerns or issues our customers may have.

You should trust this online CSP provider for SBI Kiosk Banking for many reasons.

• First, the provider has extensive experience in creating and managing such processes. • Second, the provider can offer a comprehensive service package that meets all your needs. • Third, service providers can offer competitive rates that will help save costs. • Finally, service providers are willing to provide support and assistance when needed.

In conclusion, partnering with an online CSP provider is a safe and reliable option to start SBI kiosk banking. The provider is authorized and regulated by the RBI and uses advanced security technology to protect customer data and transactions. Online CSP service providers who provide reliable service and customer support are trusted partners of SBI Kiosk Banking.

Blog Source: https://bankmitraregistration.wordpress.com/2023/05/08/why-trust-online-csp-provider-for-sbi-kiosk-banking

#csp provider#all bank csp#online csp provider#csp registration#bank mitra registration#kiosk csp registration#bank csp

0 notes

Text

goodmorning. back to another 5 hours of being my own it guy

#I HATE CSP WHY CANT IT HUST WORK#i dont wanna call tech support but my subscription vanished and its saying my bank account is fake😁

1 note

·

View note

Text

Benefits of Services Offered by a CSP Bank

The major benefit of services offered by a CSP Bank of a nationalized bank is scalability. The services of these banks will be capable of scaling up or down based on demand. It, in turn, allows banks to efficiently manage their resources and handle variations in workload without substantial infrastructure investment. Another notable benefit of the services of these banks is cost savings.

For more information kindly read this - https://bankmitrabc.blogspot.com/2024/02/benefits-of-services-offered-by-a-csp-bank.html

0 notes

Text

👉 अब बनाये अपने रिटेल आउटलेट को बैंकिंग सेवा केंद्र (Bank CSP) बैंक की Distributor CSP/BC बने और अपने Area मे CSP/ BC बनाये और कमाये 50000- 100000/- P/M Hurry Up ! Apply Now !

एक पहल आत्मनिभारता की ओर - क्रेडिट मनी !!

Credit Money is Nationalize Channel Partner of Nationalized Banks and NBFCs. We provide our services in Pan India. Credit Money invites you for as a Corporate BC partner or BC Partner in your Area.

Features & Supports: •India's leading & Award-winning Brand. •Low Setup cost. •Highest Payout structure in the market. •One stops Banking, Financial & Corporate Advising Services. •End to end business setup support by Sales Team Back office & Training Team. •Dedicated growth/ sales manager to grow business. •Online marketing support. •Digital collateral for marketing. •Manpower training programs. & More..

Know More Contact us-

Visit-https://creditmoney.co.in/ Mail- [email protected] Call or WhatsApp - 9643051489

#loan#suvidha#applynow#finance#personalloan#homeloan#creditmoney#creditmoney11#digital#marketing#credit#online#shop#hurryup#business#offer#instantloan#franchise#Bank#CSP#bc#NSDL#CSC#BankBC#suryodaybank#bestbankcsp#axisbankcsp#BankingServices#cspbank#BankofBarodacsp

#creditmoney#creditmoney11#finance#loans#money#personalloan#insurance#loan#credit#india#bankingandfinance#bank#banking#investments#funding#profit#csp

0 notes

Text

In a world where banking is becoming increasingly digital, having a online Bank Customer Service Point (CSP) can be a game-changer to your usual Business taking it from good to great by enhancing customer experiences, increasing loyalty, and attracting new clients. In this article, bank csp provider egovernancecsp.in will present the key benefits to transform your business to great with a CSP.

0 notes