#payroll solutions for small business

Explore tagged Tumblr posts

Text

Do you feel hardship while managing the salaries of employees?

Connect with Business Financial Group! Our professionals provide the best payroll services for small business, peachtree corners. For more details, visit us!

0 notes

Text

Top Outsourcing Companies in Dubai: HR, Payroll & Software Solutions

In the fast-paced business world of today businesses are constantly searching for ways of streamlining their processes in order to cut costs, improve efficiency, and increase efficiency. The most efficient method to accomplish these objectives is outsourcing. For companies in Dubai outsourcing HR, payroll and software solutions is a popular option. This allows businesses to concentrate on their core skills while delegating the more complicated and time-consuming jobs to reputable outsourcing firms. In this article we'll review the best outsourcing firms in Dubai that are experts in payroll, HR software and what they can do to benefit your company.

Top Outsourcing Companies in Dubai

Dubai is a major business hub, has an array of outsourcing companies that offer complete HR software, payroll, and HR solutions. Here are a few of the most reputable companies located in the region:

1. OPS (Outsourcing Payroll Solutions)

OPS is among the top outsourcing firms in Dubai that specializes in HR payroll, payroll, and software solutions. OPS offers businesses effective and efficient HR outsourcing solutions that assist simplify the HR processes, payroll procedures and also ensure compliance. With a thorough knowledge of UAE labor laws and regulations, OPS offers tailored services for companies of all sizes. The services offered by the company include:

Payroll outsourcing: OPS handles everything from payroll processing through tax calculation, making sure that timely and accurate payments are made to employees.

HR outsourcing: OPS offers comprehensive HR-related solutions, which include employee benefits, recruitment, and management of performance.

software for HRMS: OPS provides businesses with sophisticated payroll and HR software that makes HR work easier like the tracking of attendance as well as payroll management and even reporting.

Through a partnership with OPS Businesses in Dubai can improve their payroll and HR functions and reduce administrative costs, and make sure that they are in compliance with local laws.

2. Gulfhr

Gulfhr is an eminent outsourcing firm located in Dubai which offers a wide selection of payroll and HR solutions for companies across the UAE. It is a leader in offering specific services, such as processing payroll and recruitment, HR management as well as employee benefit. Gulfhr is renowned for its dependable and affordable outsourcing solutions, which aid companies manage complex HR tasks effectively. Their extensive HRMS application makes it simpler for companies to manage employee information, keep track of attendance and be in compliance with UAE labor laws.

Gulfhr's extensive knowledge of local laws and regulations as well as their commitment to providing high-quality services is a reliable business partner in Dubai who want to streamline payroll and HR processes.

3. Al Masar HR & Payroll Services

Al Masar is a prominent outsourcing firm located in Dubai which focuses on providing payroll and HR services to companies across a variety of sectors. Their offerings include HR processing, payroll processing, control, management of recruitment as well as benefits for employees. Al Masar offers customized HRMS software that helps businesses control their workforce effectively. The company is committed to offering cost-effective and reliable outsourcing solutions for businesses of any size.

4. Paywell Payroll Solutions

Paywell is a reputable payroll outsourcing firm based in Dubai that provides complete payroll services to companies throughout the UAE. Paywell is a specialist in providing accurate and prompt pay processing and tax calculation, and conformity to UAE laws regarding labor. Paywell's payroll software was designed to make payroll simpler and help ensure that companies are fully compliant with the current laws. Paywell also offers the HR outsourcing service, which makes it a single-source solution for companies looking to improve their payroll and HR functions.

5. FMS Tech

FMS Tech is a Dubai-based firm that offers Payroll and HR outsourcing services, along with custom software for payroll and HRMS. FMS Tech is known for its unique approach to managing HR and processing payroll. Its solutions can help companies reduce the manual burden and automate payroll processes and increase HR efficiency. FMS Tech also offers end-to-end HR solutions, such as hiring, management of employees and performance monitoring.

Why Outsource HR, Payroll, and Software Solutions?

Outsourcing is a smart move that a lot of businesses in the UAE are taking to reduce operating costs and improve efficiency. By outsourcing crucial functions like payroll processing, HR management and software companies can save time, money and also resources. Here are some major advantages outsourcing payroll, HR, and software:

Cost efficiency Outsourcing can help businesses save money on hiring internal teams for HR and payroll management. This includes training, salaries as well as benefits. Third-party companies typically provide affordable services that can be scaled to suit your needs at a lower cost which help businesses to manage their budgets efficiently.

Expertise and specialization HR outsourcing companies are experts in HR procedures including labor laws, as well as rules and regulations within the UAE as well as Dubai. When they partner with experts from these companies, businesses have access to the most effective industry practices and can ensure compliance with local laws.

time savings HR payroll, HR, and software management consume a lot of work and energy. The outsourcing of these tasks allows businesses to concentrate on their main business and strategic objectives while entrusting administration tasks to experts.

access to Advanced Technology The majority of outsourcing companies provide state-of-the-art software for HR Management Systems (HRMS) along with payroll applications. The technology is able to automate and simplify tasks like paying for payroll, tracking attendance and employee benefits administration.

Protection from Risk Outsourcing companies keep current with the most recent legislation and regulations that pertain to payroll and HR. This allows businesses to reduce the threat of non-compliance which could result in financial or legal penalties.

HR & Payroll Software Solutions

The HR and payroll software plays an essential role in the efficient functioning department of Human Resources. With the appropriate software, businesses can automate the calculation of payroll as well as monitor employee benefits, keep track of attendance and create reports. The most important advantages of HR and payroll software are:

Payroll Automation Automating payroll can reduce errors and make timely and exact payment to employees. The program calculates salary as well as bonuses as well as tax deductions and creates payslips in just two clicks.

Compliance Management Payroll and HR software helps businesses comply with local labor laws and tax regulations by automatic updating to reflect any modifications that are made to law.

employee Data Management: The software organizes and stores information about employees, including personal details, attendance records and performance evaluations.

reporting and analytics The HR and payroll software gives businesses detailed reports and analysis on the cost of payroll, attendance of employees and other HR-related metrics.

Self-Service Portals Many HRMS platforms provide self-service portals that allow employees to look up their payslips, apply for leave and also update their personal details.

Why Choose HR & Payroll Outsourcing Companies in Dubai?

Dubai is a center for business from across the globe outsourcing payroll and HR functions to specialist companies can give businesses an edge. With outsourcing, companies can be sure that they're in compliance with local regulations, stay ahead of the pack and take advantage of the most recent HR technology. Here are a few good reasons why outsourcing services for payroll and HR in Dubai are a great option:

Experience in Local Regulations: Outsourcing firms located in Dubai are knowledgeable about the laws governing labor in the UAE and regulations, making sure that companies remain in compliance with all legal requirements.

Cost-effective solutions Outsourcing enables businesses to cut costs that are associated with running an in-house HR department and payroll.

Scalability as businesses expand outsourcing firms can expand their offerings to meet the ever-changing needs of their clients.

The focus is on core business functions By outsourcing payroll and HR functions, companies can concentrate on what they excel at, whether they're expanding their product range or establishing different markets or increasing the customer experience.

Conclusion

As the businesses operating in Dubai continue to expand and develop outsourcing HR payroll, software and solutions are essential to keeping the efficiency of operations and to ensure compliance. Organizations like OPS offer cost-effective and reliable outsourcing services that assist businesses to streamline their payroll and HR processes. With the help of advanced HRMS programs and automation of payroll processes, companies can reduce time, lower risks and focus on their primary tasks.

If you're seeking to streamline your payroll and HR functions, OPS offers comprehensive outsourcing solutions that are tailored to the specific requirements of businesses in Dubai and throughout the UAE. Don't hesitate to partner in OPS today to streamline your payroll and HR processes and keep ahead of your competitors.

#best payroll company for small business#payroll companies for small business#payroll services for midsize business#payroll management software#payroll training#dubai labor law#payroll outsourcing for small business#payroll outsourcing for midsize business#payroll management system software#dubai minimum wage#outsourcing company in dubai#outsource company in uae#outsourcing companies in dubai#hr outsourcing services#hr management solutions#hr & payroll software#payroll hrms software

0 notes

Text

G&S Accountancy offers a range of professional services designed to support businesses, including accounting, tax planning, audits, payroll, and advisory services. Their expertise helps businesses maintain financial health, improve operational efficiency, and navigate complex regulations. With a focus on personalized solutions, they cater to both small and large organizations, ensuring compliance and financial growth.

#Accounting Services#Tax Planning#Business Consulting#Payroll Services#Financial Audits#Tax Advisory#Small Business Solutions#Financial Reporting#Compliance Services

0 notes

Text

Biz Control: Empowering Businesses with Smarter, Streamlined Solutions

Visit our website: Biz Control Official Website

In today’s competitive landscape, businesses are under constant pressure to enhance efficiency, cut costs, and deliver superior services. The solution? Smarter management tools that simplify operations and empower teams. Biz Control, a revolutionary business management platform, is designed to do just that.

With a focus on innovation and adaptability, Biz Control delivers tailored solutions for businesses across various industries, helping them stay ahead of the curve.

Learn more: Biz Control Homepage

What Makes Biz Control a Game-Changer?

Biz Control combines the power of technology with user-friendly design to create an all-in-one business management solution. Whether you’re managing real estate transactions, tracking employee attendance, or nurturing customer relationships, Biz Control offers the tools you need to operate smarter and grow faster.

Key Features of Biz Control

1. Real Estate Management

Biz Control is redefining real estate management. Its unique features allow:

Direct Unit Bookings: Make bookings anytime, from any location.

Property Dealer Facilitation: Property dealers can buy or sell units for clients directly through the platform, eliminating the need for on-site visits.

2. HR & Salary/Attendance System

Efficiently manage your workforce with tools that:

Automate Attendance Tracking: Capture employee attendance with just one click.

Generate Salaries Seamlessly: Simplify payroll processing while reducing errors.

Optimize HR Workflows: Save time and focus on strategic HR initiatives.

3. Customer Relationship Management (CRM)

Strengthen customer connections with tools to:

Track Leads and Opportunities: Never miss a potential deal.

Enhance Communication: Stay connected with customers through centralized data.

Leverage Analytics: Use insights to make informed decisions.

Why Businesses Love Biz Control

Customizable for Every Industry: Tailored solutions for unique business challenges.

Cloud-Based Accessibility: Work from anywhere, anytime.

User-Friendly Interface: Easy to adopt and navigate, even for non-tech-savvy users.

Scalable for Growth: Designed to grow alongside your business.

How Biz Control Transforms Your Business

With Biz Control, you can:

Simplify day-to-day operations.

Minimize manual errors and reduce costs.

Gain real-time insights into business performance.

Free up time for strategic decision-making.

Join the Biz Control Revolution

It’s time to say goodbye to outdated systems and embrace smarter, streamlined solutions. With Biz Control, your business can achieve unmatched efficiency, productivity, and growth.

Ready to transform your operations?

Visit us today: www.bizcontrol.in

#**Tags for Biz Control:**#- Business Management Software#- All-in-One Business Solution#- Real Estate Management#- HR and Payroll Automation#- Attendance Management System#- CRM Software#- Smart Business Solutions#- Cloud-Based Business Tools#- Employee Management System#- Customer Relationship Management#- Property Dealer Software#- Streamlined Business Operations#- Business Productivity Tools#- Workforce Management#- Digital Business Solutions#- Innovative Business Tools#- Enterprise Management Software#- Small Business Management App#- Automated Business Processes#- Smarter Business Operations

0 notes

Text

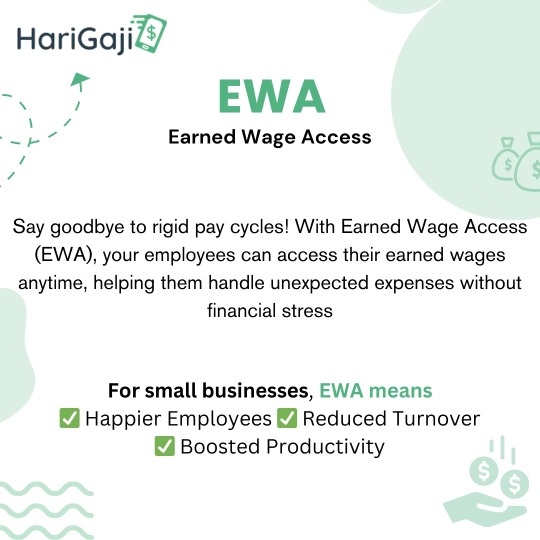

EWA (Earned Wage Access) is a flexible payroll solution designed to support small businesses by giving employees access to their earned wages before the scheduled payday. This innovative service allows workers to withdraw a portion of their wages whenever they need it, reducing financial stress and improving job satisfaction. For small businesses, EWA offers a low-cost, easy-to-integrate solution that can help attract and retain top talent without the complexities of traditional payroll systems.

By providing employees with greater financial flexibility, EWA can boost productivity, reduce absenteeism, and promote a positive workplace culture. Unlike payday loans or credit options, EWA does not come with high-interest rates or debt cycles. This solution benefits both employees and employers, creating a more satisfied and engaged workforce. For small businesses looking to improve employee retention and streamline operations, EWA presents a modern and cost-effective alternative to conventional payroll systems.

1 note

·

View note

Text

How to Choose the Best Payroll Software for Your Business

Managing payroll effectively is critical for any business. It ensures employees are paid on time, complies with legal requirements, and builds trust within the organization. With numerous payroll software options available, choosing the right one can seem overwhelming. Here's a guide to help you select the best payroll software for your business needs.

1. Understand Your Business Needs

Start by identifying the specific payroll challenges your business faces. Consider factors like:

The size of your workforce.

Frequency of payroll processing (weekly, bi-weekly, monthly).

Employee types (full-time, part-time, contractors).

Need for tax filing and compliance support.

2. Key Features to Look For

A good payroll software solution should have essential features to streamline your payroll process. Look for:

Automation: Automatic salary calculations, tax deductions, and compliance updates.

Direct Deposit: Ability to pay employees directly to their bank accounts.

Tax Management: Automatic generation and filing of tax forms like W-2s and 1099s.

Employee Self-Service: Portals for employees to view payslips, update personal details, and manage tax information.

Scalability: Software that grows with your business as you add employees.

Integration: Compatibility with your existing HR, accounting, and time-tracking tools.

3. Consider Ease of Use

Payroll software should simplify your tasks, not complicate them. Opt for a solution with an intuitive interface, clear navigation, and user-friendly dashboards. Many providers offer free trials—take advantage of these to assess usability.

4. Prioritize Security

Payroll data contains sensitive employee information. Choose software with robust security features, such as:

Data encryption.

Multi-factor authentication.

Regular updates to protect against cyber threats.

5. Evaluate Support and Customer Service

When issues arise, having reliable customer support is invaluable. Look for software providers that offer:

24/7 support.

Multiple channels for help (chat, phone, email).

Comprehensive documentation or training resources.

6. Compare Pricing Options

Payroll software pricing varies widely based on features and scale. Understand the cost structure:

Subscription fees (monthly or annual).

Per-employee charges.

Additional costs for features like tax filing or advanced analytics. Choose software that fits your budget without compromising on essential features.

7. Read Reviews and Seek Recommendations

Explore reviews on trusted platforms like G2, Capterra, or Trustpilot. Ask for recommendations from peers or industry networks to gain insights into the software’s performance and reliability.

8. Opt for Cloud-Based Solutions

Cloud-based payroll software offers flexibility and convenience. It allows you to access payroll data anytime, anywhere, and often includes automatic updates for compliance and feature improvements.

9. Assess Scalability and Future-Proofing

If your business is growing, ensure the payroll software can handle increased demands. Look for solutions that allow you to add new employees or expand to global payroll systems seamlessly.

10. Test Before You Buy

Most payroll software providers offer free trials or demos. Use these to evaluate the software’s functionality, ease of use, and how well it integrates into your existing processes.

Conclusion

Choosing the best payroll software for your business involves understanding your specific needs, prioritizing essential features, and evaluating options carefully. By investing in the right solution, you can streamline payroll processes, ensure compliance, and focus more on growing your business.

More info: https://ahalts.com/solutions/hr-services/complete-payroll

#Payroll software#Business payroll solutions#Payroll management#Payroll tools#Employee salary processing#Payroll automation#Small business software#Payroll software features#Payroll compliance#Tax management software

0 notes

Text

Professional Payroll Outsourcing in India

Expert Payroll Solutions for Growing Businesses! Choose Professional Payroll Outsourcing in India to handle complex payroll tasks with precision, compliance, and expertise.

Trust Hire in Any Domain for professional payroll outsourcing.

Visit us: https://hireinanydomain.com/hire-payroll-experts/

#Payroll Processing Companies in India#Payroll Processing Outsourcing Firm in India#Payroll Processing Services in India#Payroll Service Companies in India#Payroll Service Providers in India#Payroll Services in India#Payroll Services for Small Business in India#Payroll Services Pricing in India#Professional Payroll Outsourcing in India#Payroll Management India#Outsource Payroll India#Payroll Solutions India#HR and Payroll India#Affordable Payroll India#Business Payroll Services India

0 notes

Text

Construction Onboarding Services - Hybrid Payroll

What is the 4 step onboarding process?

Construction onboarding is the process of integrating new employees, contractors, or subcontractors into a construction project or company. Due to the unique and often hazardous nature of construction work, onboarding in this industry focuses heavily on safety protocols, site-specific procedures, and regulatory compliance. Here's what construction onboarding typically includes:

The 4-step onboarding process generally follows this structure:

Pre-boarding: This step occurs before the new hire’s first day. It includes sending necessary paperwork, setting up workspaces, and providing information about what to expect on day one. It helps ease anxiety and create excitement for the role.

Orientation: The formal introduction to the company, covering company policies, benefits, systems, and a general overview of the organization. This is where new hires meet key people, learn about the company's mission, and get acquainted with the tools they'll be using.

Training: This step focuses on teaching the new hire the specific skills, tools, and processes they need to perform their role. Depending on the complexity of the job, this could range from a few days to several months.

Integration: The final step is ongoing support to ensure the new hire feels fully integrated into the company culture and their team. This could involve mentorship, regular check-ins, and continued learning opportunities to solidify their role within the organization.

Following this process helps ensure a smooth transition and sets the employee up for long-term success.

#retail industry hr services#workforce ancillary management#small business payroll outsource#peo management software#finance industry payroll solutions#enpense management services#hospitality workforce scheduling#real time payroll processing

0 notes

Text

youtube

The Indian Accountant. is an accounting company headquartered in Kolkata, India, with operations globally. Our experienced staff of professionals includes Certified Public Accountants (CPAs), Enrolled Agents (EAs), Chartered Accountants (CA-India), and other professional staff in various stages of certification

#Accounting Services in USA#Bookkeeping Services in USA#importance of financial report#importance of financial reporting#Book Keeping Solutions#Financial Advisory Services#Small Business Accounting#Tax Compliance Services#Cash Flow Management#Company Formation and Registration#Self Assessment Tax Returns#Strategic Financial Planning#Auditing and Assurance#Budgeting and Forecasting#VAT Registration and Filing#Payroll management Services in USA#Tax Planning and Optimization in USA#Accountant Services in USA#Corporate Accounting in USA#Accounting Services for USA Businesses#Bookkeeping Services for USA Businesses#Youtube

0 notes

Text

Blockchain and Payroll: Is It the Future?

Payroll is just one of the areas in which blockchain technology has been marked as a revolutionary breakthrough capable of transforming. Blockchain might simplify payroll procedures and be more efficient due to its decentralized, transparent, and secure nature. This is especially true in areas where traditional banking systems are ineffective. Blockchain technology has the potential to revolutionize payroll processing in Lagos by providing several benefits that conventional methods cannot offer. Let us read this blog further and learn more in detail…Continue Reading

#elevate accounting#accountant in lagos#accounting services in lagos#best accountant in lagos#best accountant for small business#payroll processing in lagos#blockchain technology#blockchain solutions#payroll and hr

0 notes

Text

#Small business HR#HR for small businesses#HR management#HR compliance#Employee relations#Payroll management#Benefits management#HR outsourcing solutions#HR challenges for small businesses#HR legal compliance#HR services for small business#Outsourcing HR tasks#Bambee HR review#Affordable HR services#HR risk mitigation#Hiring and recruitment#Employee performance management#Small business legal issues#HR support for startups#Hybrid HR solutions

0 notes

Text

How to Manage Your Business Finances Accounting Basics

#rp account#accounting#erp#erp software#erp solution#finance#hr payroll software#application tracking system#recruiting software for small business

0 notes

Text

Small businesses measure the ROI (Return on Investment) of their HR initiatives

Measuring the ROI of HR initiatives is essential for small businesses in India to assess the effectiveness of their investments in human capital and strategic HR initiatives. Despite resource constraints, small businesses can adopt practical approaches to evaluate ROI and demonstrate the impact of HR initiatives on organizational performance. One approach is to define clear objectives and key performance indicators (KPIs) aligned with HR goals, such as employee retention rates, productivity levels, training effectiveness, or cost savings related to HR processes. Utilizing HR analytics tools or performance management software can facilitate data collection, analysis, and reporting, providing insights into the outcomes and ROI of HR initiatives over time. Additionally, conducting employee surveys, feedback sessions, or focus groups can gather qualitative insights into employee perceptions and satisfaction regarding HR programs and initiatives. By integrating quantitative and qualitative data, small businesses can make informed decisions, prioritize investments, and continuously improve HR strategies to maximize ROI and drive sustainable business growth.

#hrms payroll software#hrms systems#hrms#hrms software#hrms solutions#small business#employeeengagement

0 notes

Text

Navigating the intricate landscape of financial management in the UAE presents

Navigating the intricate landscape of financial management in the UAE presents a unique set of challenges and opportunities for businesses of all sizes. From startups finding their footing to established multinational enterprises, grasping the significance of robust accounting practices, tax obligations, and VAT regulations is paramount.

Corporate Tax and VAT Dynamics in the UAE

Renowned for its tax-friendly environment, the UAE stands out for its absence of corporate and personal income taxes for most entities and individuals. However, nuanced tax regulations apply to specific industries and activities. Typically, businesses face a 20% corporate tax rate on taxable profits, while a 5% VAT is standard for most goods and services unless exemptions or zero-rated categories apply.

Exemplary VAT Consulting Support in the UAE

Navigating the intricacies of VAT compliance and optimization demands specialized expertise. FST Accounting emerges as a beacon of proficiency in Financial Consulting in the UAE. Leveraging a profound understanding of UAE tax frameworks and extensive hands-on experience, FST Accounting delivers tailor-made VAT consulting solutions, ensuring compliance and strategic tax maneuvering.

VAT Accounting Precision in the UAE

Accurate VAT accounting stands as a cornerstone for businesses operating in the UAE. VAT-registered entities must meticulously record transactions, apply the appropriate VAT rates, and diligently submit VAT returns to the Federal Tax Authority (FTA). FST Accounting steps in with comprehensive VAT accounting services, safeguarding compliance and fortifying tax positions.

UAE Corporate Tax Landscape Unveiled

While the UAE predominantly refrains from corporate income tax imposition, specific sectors like oil and gas entities and branches of foreign banks face corporate tax obligations. It's imperative for businesses within these realms to grasp their tax responsibilities and engage professional counsel for seamless implementation.

Diving into VAT Varieties

Within the UAE, VAT treatments primarily fall into two categories: standard-rated and zero-rated supplies. Standard-rated supplies incur a 5% VAT, while zero-rated supplies enjoy a 0% VAT rate. Examples of zero-rated supplies encompass select exports, international transportation, and healthcare services.

Embracing Excellence in Financial Management

For dependable accounting services, adept financial consulting, and meticulous tax preparation in the UAE, enterprises entrust FST Accounting. Serving as a conduit for success and compliance, FST Accounting emerges as the partner of choice in navigating the intricate realm of UAE financial regulations.

Tagged: Accounting services in UAE, Financial consulting in UAE, Tax preparation in UAE

#Accounting services Uae#Financial consulting Uae#Tax preparation uae#Bookkeeping solutions Uae#Small business accounting Uae#Payroll management Uae#Auditing services Uae#Tax planning Uae#Financial reporting Uae#CPA services Uae#Budgeting and forecasting Uae#Business advisory Uae#Financial analysis Uae#QuickBooks consulting Uae#Tax compliance Uae#certified accountant near me#cpa accountant near me#accountants near me#tax accountant near me#accounting services

0 notes

Text

Payroll Services Pricing in India

Competitive Payroll Pricing for Every Budget! Explore Payroll Services Pricing in India that’s affordable and customizable to fit your business’s unique payroll requirements.

Hire in Any Domain offers flexible payroll plans to suit your needs.

Visit us: https://hireinanydomain.com/hire-payroll-experts/

#Payroll Processing Companies in India#Payroll Processing Outsourcing Firm in India#Payroll Processing Services in India#Payroll Service Companies in India#Payroll Service Providers in India#Payroll Services in India#Payroll Services for Small Business in India#Payroll Services Pricing in India#Professional Payroll Outsourcing in India#Payroll Management India#Outsource Payroll India#Payroll Solutions India#HR and Payroll India#Affordable Payroll India#Business Payroll Services India

0 notes

Text

Introducing the greytHR-Tally JV Integration: One-Click Payroll JV Posting to Tally

greytHR-Tally JV Integration

Tally is India’s most popular accounting and ERP software and powers most businesses. And greytHR is India’s most popular HRMS, payroll and workforce management software on the cloud.

You already knew this, but here’s the good news. We are delighted to announce a seamless integration between greytHR and Tally for automatically posting various payroll journal vouchers (JV) every month!

The greytHR-Tally JV Integration brings you a bunch of benefits:

Enjoy one-click payroll JV entry after an easy, one-time setup

Save several hours on payroll JV entry each month

Minimize manual errors by eliminating spreadsheets and ad-hoc communication

Enjoy 100% security against data leaks with direct posting from greytHR to Tally

How Does It Work?

Without this integration, the payroll team needs to generate the payroll JV report from greytHR, then pass it on to the accounts team. The latter, in turn, manually enters this data into Tally. This process quickly gets complex and manual entry increases multi-fold, especially in larger organizations with a number of payroll components/cost centers.

Now, the greytHR-Tally JV Integration automates this process. Using the greytHR add-on for Tally, with a single click, you fetch the payroll JV from greytHR and post it to Tally, as shown above. It’s as simple as that.

Let’s Get Started!

If you’re a greytHR customer, simply raise a support ticket to enable this feature for your organization.

Check out our How-To Video and FAQ Section to explore this integration further.

Not a greytHR user? Discover how 20,000+ businesses are elevating their HR game with greytHR — book a free demo now.

Source Link

#hr software india#best hr software in india#free hrms software#hr payroll software#hrms software solution#hr management software#top hr software#payroll management#payroll software#payroll management system#payroll services#payroll in india#payroll management software#payroll software in india#payroll software for small business#best payroll software in india#greytHR

0 notes