#payment gateway services in India

Explore tagged Tumblr posts

Text

With Haoda pay, access efficient payout solutions in India. Streamline transactions, guarantee timely payments, and elevate financial management on our trusted platform.

0 notes

Text

Payout service provider for India - India Payouts

India Payouts is a payment solution provider based in India that offers secure and reliable payout options for businesses. They specialize in payouts for online industries such as gaming and forex trading, but their services can be used for a wide range of businesses.

Here are some of the key services that India Payouts offers:

Multiple Payout Methods: They provide various payout options to suit your needs, including account transfers, debit/credit card transfers, UPI transfers, and payouts to popular wallets like Paytm and Amazon Pay.

Bulk Payouts: India Payouts can handle large volume payouts efficiently, making them a good option for businesses that need to make a lot of payments quickly and easily.

Security: India Payouts uses secure protocols to ensure the safety of your financial data.

In addition to these core services, India Payouts may offer other features such as real-time tracking and automated payouts. Be sure to check their website for the latest info

Contact us or Visit to our website: https://www.indiapayouts.com/

#payment gateway for gambling in india#gaming payout api#payment gateway for gaming in india#payment gateway for games india#payout api provider in india#payment gateway for games in india#gambling payment gateway#gaming payouts api#gaming payouts api provider in india#payout service provider in india#payout api india#payout api provider india

0 notes

Text

Payment gateway provider in india | Zyro

Discover Zyro, the leading Payment Gateway Provider in India, offering secure, fast, and user-friendly payment solutions tailored for businesses of all sizes.

For more information visit our website: www.zyro.in/blog

#best payment service provider in india#best payment gateway provider in india#best financial services provider

0 notes

Text

Get the best payment gateway development services and ensure secure translation, and 100% protection against frauds and data breaches.

#leading Payment Gateway Development Services in india#best payment gateway solution provider in india#best payment gateway software development for online business

0 notes

Text

Stripe Payout API vs. PayerVault Payout API: Revolutionizing Payment Gateways

The world of payment gateways is evolving at a breakneck pace. If you're a business owner looking to optimize your financial operations, you've likely come across the buzzwords "PayerVault" and "Stripe Payout API." But what sets these two apart, and which one should you choose? Let's embark on a journey of exploration.

Overview: Payment gateways are the unsung heroes of modern commerce. They facilitate the seamless transfer of funds, making online transactions smoother than ever. In this digital age, choosing the right payment gateway can make or break your business's financial success.

The Tale of Two Titans: PayerVault vs. Stripe Payout API:

Imagine a world where you can set up your payment gateway in just two hours, compared to the industry norm of days or even weeks. Enter PayerVault, a game-changer that offers lightning-fast registration and integration. On the flip side, Stripe Payout API, a well-established player, might leave you waiting.

The Need for Speed: Time is money, as the saying goes. PayerVault takes this seriously by providing near-instant transaction settlements, often within minutes. Stripe, while reliable, operates on a different timeline, usually requiring one business day for transfers to land in your account.

Counting the Costs: Every penny saved matters. PayerVault offers an attractive pricing structure, with fees as low as 1% per transaction. In contrast, Stripe's fees can range from 1.9% to 3%. The choice becomes clear when cost-effectiveness is a priority.

User-Friendly Experience: Complexity should never be an obstacle. PayerVault prides itself on offering an intuitive platform suitable for beginners and experts alike. With Stripe, customization is possible, but it may involve a steeper learning curve.

Real-Life Triumphs: If you're seeking proof of these platforms' prowess, look no further than real-world success stories. Businesses of all sizes have witnessed remarkable revenue boosts after switching to PayerVault.

Summary: The battle of payment gateways continues to unfold, with PayerVault emerging as a formidable contender. However, the right choice depends on your unique business needs and priorities. Dive into our comprehensive blog comparing PayerVault and Stripe Payout API to make an informed decision that could reshape your financial future.

In the ever-evolving landscape of payment gateways, it's crucial to stay informed and adaptable. Explore the possibilities, seize opportunities, and choose the gateway that aligns with your vision.

[Click here to read the article]

Join the discourse on Tumblr and share your insights in the comments below. Your perspective might just be the catalyst for someone else's financial breakthrough. 💼🌟

#ecommerce#online#online store#paying#payment gateway#payment processing#payment systems#payments#payouts#small business#businesses#business#high risk merchant account#high risk payment gateway#payment services#payervault#payervault payment gateway#payment gateway with lowest charges in India#payment gateway with fastest setup in India#payout api#paypal#best payout gateway in India#payout#lowest transaction payment gateway in India

0 notes

Text

Full Video Link - https://youtube.com/shorts/WLPH99R9qfE Hi, a new #video on #shopify #paymentprovider #paymentmethod #paymentgateway #ecommerce #store #pos for #merchandiser is published on #codeonedigest #youtube channel. @java #java #awscloud @

Shopify Payment Provider | Payment Gateway | Payment Methods for Merchandiser

View On WordPress

#best payment provider for shopify#payment gateway#payment gateway shopify#payment gateway shopify india#payment gateway tutorial#payment providers shopify#payment service provider#shopify best payment provider#shopify payment gateway#shopify payment gateway india#shopify payment gateway integration#shopify payment gateway setup india#shopify payment methods#shopify payment providers#shopify payment setup#shopify payment tutorial#shopify payments setup

0 notes

Text

Business Setup in India by MAS LLP: Your Partner for Growth

Setting up a business in India is a lucrative opportunity due to its growing economy, diverse market, and skilled workforce. However, navigating the legal and regulatory framework can be challenging. That’s where MAS LLP steps in, offering expert assistance to help you establish your business smoothly and efficiently.

Why Choose MAS LLP for Business Setup in India? MAS LLP is a leading consultancy that specializes in business formation and compliance services. With years of experience, MAS LLP has assisted numerous entrepreneurs and companies in setting up their businesses across India. Here’s why partnering with MAS LLP is a smart choice:

Comprehensive Services MAS LLP provides a full suite of services, from company registration and legal compliance to tax advisory and financial consulting. Their team of experts ensures that every step of the business setup process is handled professionally.

Expert Knowledge of Indian Regulations India's business environment is governed by complex laws and regulations, including the Companies Act, FDI norms, and various tax laws. MAS LLP has in-depth knowledge of these regulations, ensuring that your business complies with all legal requirements from the start.

Tailored Solutions for Different Business Structures Whether you are looking to establish a private limited company, a partnership, an LLP, or a sole proprietorship, MAS LLP can help you choose the right structure based on your business goals and operational needs.

Steps to Setting Up a Business in India with MAS LLP

Business Structure Selection Choosing the right business structure is crucial for long-term success. MAS LLP provides guidance on selecting the best structure, whether it's an LLP, private limited company, or branch office.

Company Registration MAS LLP will help you with the process of registering your business with the Ministry of Corporate Affairs (MCA). This includes obtaining a Director Identification Number (DIN), Digital Signature Certificate (DSC), and filing the required documents for incorporation.

Tax Registration Once your business is registered, MAS LLP assists in obtaining necessary tax registrations such as GST, PAN, and TAN, ensuring your company is compliant with India’s tax laws.

Legal Compliance Keeping up with regulatory requirements is essential for any business. MAS LLP provides ongoing legal compliance support, including annual filings, audit reports, and statutory compliance.

Banking and Financial Setup MAS LLP also assists with setting up business bank accounts, payment gateways, and financial structuring, helping you manage your financial operations efficiently.

Why Set Up a Business in India? India is a growing economy with a young, dynamic workforce and a vibrant consumer market. By setting up your business here, you tap into a diverse and large customer base, benefit from government incentives for startups, and gain access to various sectors like IT, manufacturing, and retail.

Additionally, India offers excellent opportunities for foreign investors with simplified FDI policies. With MAS LLP by your side, you can navigate the challenges of setting up a business in India with ease and focus on what really matters—growing your business.

Conclusion MAS LLP is your go-to partner for setting up a business in India. Their expertise in regulatory compliance, business formation, and financial consulting ensures that you can establish your business smoothly and start operating without any legal or financial hurdles.

Whether you are a local entrepreneur or a foreign investor, MAS LLP offers tailored solutions to meet your unique business needs. Get in touch with MAS LLP today and take the first step towards establishing a successful business in India!

6 notes

·

View notes

Text

Understanding the Importance of Credit Ratings for SMEs, MSMEs, and Startups in India

In the ever-evolving landscape of the Indian economy, Small and Medium Enterprises (SMEs), Micro, Small and Medium Enterprises (MSMEs), and startups play a pivotal role. These entities not only drive innovation but also create significant employment opportunities and contribute extensively to the GDP. However, one of the fundamental challenges they face is access to capital. This is where the importance of a robust credit rating comes into play.

Why is Credit Rating Crucial?

1. Access to Finance: Credit ratings determine the creditworthiness of a business. A high credit rating reassures lenders of the lower risk involved in extending credit to the business. This can lead to easier access to loans, lower interest rates, and more favorable repayment terms. For SMEs, MSMEs, and startups, which typically face higher scrutiny from financial institutions, a good credit rating can open doors to essential funding.

2. Credibility with Suppliers: A strong credit rating not only helps in securing finance but also enhances the business's credibility in the eyes of suppliers. Companies with better credit ratings can negotiate better credit terms such as longer payment durations and bulk order discounts, which can significantly improve cash flow management.

3. Competitive Advantage: In a market teeming with competition, a good credit rating can serve as a badge of reliability and sound financial health. This can be particularly beneficial in tendering processes where the financial stability of a business is a key consideration.

4. Lower Borrowing Costs: Businesses with higher credit ratings can secure loans at lower interest rates. Lower borrowing costs mean that the business can invest more in its growth and development, improving profitability and sustainability over time. This is especially critical for SMEs, MSMEs, and startups, where financial leverage can determine market positioning and long-term success.

How to Improve Your Credit Rating?

Improving and maintaining a good credit rating requires a strategic approach, including timely repayment of loans, prudent financial management, maintaining a balanced debt-to-income ratio, and regular monitoring of credit reports for any discrepancies.

Need Expert Guidance?

Understanding the nuances of credit ratings and effectively managing them can be complex. This is where expert financial advisory services, such as those offered by Finnova Advisory, come into play. Finnova Advisory specializes in providing tailored financial solutions that cater specifically to the unique needs of SMEs, MSMEs, and startups in India.

Whether you are looking to improve your credit score, secure funding, or streamline your financial strategies, connecting with the experts at Finnova Advisory can provide you with the insights and support you need to thrive in a competitive marketplace.

To learn more about how Finnova Advisory can assist your business in achieving financial excellence, visit their website or reach out directly for a personalized consultation. Remember, a robust credit rating is your gateway to not only securing finance but also establishing a strong foundation for your business's future growth and success.

5 notes

·

View notes

Text

Making Financial Transactions Effortless and Smart

From seeking quick loans to making international money transfers or even paying utility bills, these transactions have become an integral part of our routine. But what if there was a way to simplify these processes, making them not just effortless but also smart? Enter Muthoot FinCorp ONE, an all-in-one digital financial platform designed to revolutionize the way you handle your finances.

The Convenience You Deserve

At Muthoot FinCorp ONE, convenience isn’t just a promise; it's a commitment we live by. Muthoot FinCorp ONE gives you the ability to secure a Gold Loan swiftly, without any hassle, and from anywhere you prefer, be it the comfort of your home or at any of our 3600+ branches across India. With our quick doorstep service, you can have your Gold Loan sanctioned in as little as 30 minutes*. Plus, we offer competitive interest rates as low as 0.83%* per month and, as a cherry on top, a zero* processing fee. You can avail the Gold Loan at offered gold rates up to ���4200/gm, making it a lucrative and hassle-free option for your financial needs.

Digital Gold and Beyond

We understand the importance of diversifying your portfolio, which is why we offer the opportunity to invest in Digital Gold. With an entry point as low as Re. 1, you can start your journey into gold investment, secured at 99.99% purity, and trade it at market prices, all stored safely and securely.

NCDs for a Secure Investment Future

For those seeking stability and high returns, our Non-Convertible Debentures (NCDs) present an excellent opportunity to build a robust investment portfolio. Starting with just Rs. 10,000, enjoy returns of up to 9.43%* with fast-tracked investments, high-yield, low-risk opportunities, and flexible tenure durations to suit your needs.

Simplified Forex Transactions

Navigating the complexities of foreign exchange transactions can be daunting, but not with Muthoot FinCorp ONE. Enjoy secure and reliable forex services with competitive exchange rates and guaranteed 24-hour* transfers. We also provide a buy-back guarantee, ensuring your peace of mind throughout the process.

Seamlessly Handle Payments and Recharges

From bill payments to recharges, Muthoot FinCorp ONE simplifies it all. Recharge your DTH or prepaid mobile, pay electricity, internet, or LPG gas cylinder bills instantly, or manage your financial services and taxes hassle-free—all with a few taps on our app. Moreover, pay your rent or vendors effortlessly, making the entire process quick, secure, and available 24x7.

Our commitment to making your financial life easier continues with the Muthoot FinCorp ONE app. It’s your gateway to effortless Gold Loans, Digital Gold investments, Forex transactions, and more, available whenever and wherever you need it. Expect regular updates, enhanced services, and an unwavering dedication to simplifying your financial journey.

Muthoot FinCorp ONE is not just about transactions; it's about transforming the way you interact with your finances. Experience ease, convenience, and reliability—all in one place.

At Muthoot FinCorp ONE, we're not just simplifying financial transactions; we are empowering you to make smarter choices, effortlessly. Join us and witness a new era of financial convenience and intelligence.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

2 notes

·

View notes

Text

How Much Does It Cost to Develop an eCommerce Mobile App

By 2027, the total annual revenue of the eCommerce industry will reach a staggering USD 5.56 trillion. To put that into perspective, it is more than the GDP of the UK. And that will grow as more people prefer to buy products and services online.

This has encouraged small and large businesses to actively participate in doing more commerce business. We know this because we have worked on many eCommerce app development projects. One of the most common questions is about the eCommerce mobile app development cost.

‘How much is it to develop an eCommerce mobile app?’

We will answer it in this post and a few essential factors you need to know about before hiring eCommerce app developers.

Factors That Influence eCommerce App Costs

Let’s look at the factors that decide the cost of eCommerce app development in 2023.

How complex the app is

Developing an eCommerce app like Amazon or Flipkart is a massive task as it involves extensive work and development. And the app is highly complex due to a variety of features.

A few of the elements that make the app complex are:

User account creation.

Payment gateways.

Product catalogues.

The check-out process.

Rewards systems.

EMI payment options.

The more complex the app is, the more expensive the development process is. If you are a small business looking to sell your products, that will cost you less.

Platforms the app is being developed for

If you want to develop the app natively for iOS and Android, that will cost you a lot. It will take a lot of time, and you also need to hire different production teams to work on different app iterations.

This is also going to cost you more money.

The best way to avoid such issues is to do the required market research and create an app that caters to your target audience.

Using a cross-platform app development approach is also highly recommended.

Integration and use of third-party APIs

Creating features natively for your app can increase the overall cost of development, as a developer needs to spend time on it. And that will take more time and money out of your pocket.

Instead, you can integrate third-party APIs to bring all the capabilities and functionalities to your site.

Since they already have working features, you don’t need to worry about their performance.

Whether you want maintenance

Other factors to consider when building an eCommerce app are regular updates and maintenance. You can enter an AMC contract with the eCommerce development company you are working with if needed.

That’s going to cost you extra. However, you can also do that if you want to have an AMC outside of the existing contract.

Either way, maintenance is a crucial element of any app. And the more complex the app is, the more it will cost you.

Customization and design requirements

Suppose you want a highly customized eCommerce mobile app with an impeccably unique design that will take time and cost you more. Developing customized apps right from the ground up is a time-intensive process.

Opting for that will save the time needed to complete the project, which naturally makes the app cost more.

The same thing happens with the design, too. You may use templates or themes available with a few edits. And that brings the cost down.

Where your development partner is located

If you hire eCommerce app developers in the US or the UK, that’s going to cost a lot of money because they charge higher. On the other hand, choosing a partner from India or the Philippines can cost you a lot less money.

There are several reasons for this, and the biggest reason is that labour in India and the Philippines is more affordable.

Hence, you get impressive value for every dollar you invest in the project. And you can get all these without compromising on the quality.

The app development process

Yes, that’s right. Depending on the development process, the cost can vary.

Let’s say you are developing a new eCommerce app right from scratch. It takes time to be ideated, planned, and executed meticulously.

This takes a lot of time.

Instead of that, you can build a clone of an existing app.

And that will cost a lot less as the idea is already there. You must clone the app to fit your products and brand preferences.

Payment gateways

Payment gateways are essential for accepting online payments. But they will cost a lot as integrating them takes time and effort.

Depending on your business, these options change, such as:

Hosting payment gateway as needed into the app.

Integrating the API.

Setting up alternative payments.

Effectively embed the payment gateways into the app.

Integrating mobile wallets as per your needs.

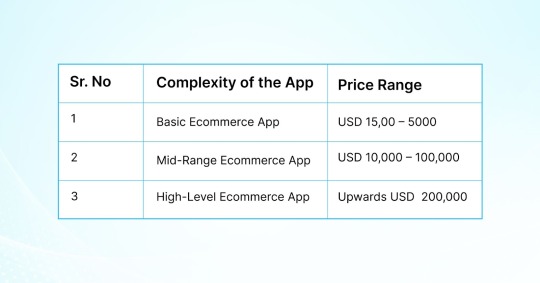

The Cost of Developing eCommerce Apps

We hope you understand the factors affecting the cost of developing an eCommerce app. This is how we explain the cost to our clients. We educate our clients when they want to know about the project's cost.

Here is a table with the approximate amount for developing an eCommerce app.

Benefits of Having an eCommerce App for Your Business

While developing an eCommerce app is a considerable investment, it has the potential to take your business to the next level.

Here are a few advantages of using ecommerce apps.

Ease of use

It enables your users to buy products and services more conveniently. They can buy your products anywhere—while travelling, from their office, or at home.

And that can make your business more user-friendly, improving your sales.

Customer experience

Having an ecommerce app improves the overall customer experience. The convenience they can enjoy is unparalleled. And this will positively influence your business.

Brand awareness

People will use it more when your business has an excellent eCommerce app. And they will talk about it in their community, friend circles, etc. This is great for your business as it can expand your brand awareness.

A competitive edge

You can trump your competition with a high-performing and intuitive mobile app to sell your products. As you offer a more convenient way, you can also attract users from your competition

Improved sales

Selling products and services at the store and from your eCommerce app leads to more sales. And you can also reach more people than you could not previously.

How to Develop an eCommerce App on a Budget?

An intelligent approach and expert eCommerce app development company like AddWeb Solution can help you build an eCommerce app on a budget.

Here is what you can do.

Step 1

Don’t release the app with all the features at first. Develop only the most important factors first and add more features later if your users need them.

Step 2

Shopify, WooCommerce, etc., offer many pre-built eCommerce platforms. Use this to save time and money.

Step 3

You must work with an agency that can offer you affordable services. AddWeb Solution in India is an excellent option to do that.

Step 4

Instead of using proprietary software programs, develop the app using open-source platforms and technologies. Some of the open-source technologies are even better than their paid counterparts.

Step 5

You can also reuse the code from your previous app. If you can use some parts of the code, it would reduce the overall development cost for sure.

Step 6

Many eCommerce app development companies offer multiple engagement options. Opt for a fixed-price agreement option, which ensures more value for your project and reduces costs.

Related Article: VueStorefront Headless Commerce A Modern Solution for eCommerce Challenges

Why Choose Us for eCommerce App Development?

When hiring eCommerce app developers, you must hire a reliable eCommerce mobile app design and development company like us.

And if you are wondering why AddWeb Solution is unique, here are a few reasons.

Our expertise in the industry

AddWeb Solution is among the most respected agencies offering eCommerce app development services. We have earned that image by working on diverse projects from large and small businesses during the last decade.

This expertise enables us to work on diverse eCommerce app projects innovatively and deliver the best service at all times.

Trained and skilled developers

You can hire eCommerce app developers confidently from AddWeb Solution. They have the experience and qualifications to do what they are doing. Our practice is to train each of our developers in the latest technologies and frameworks as they are released.

So, you never have to worry about the talent working on your project when you choose AddWeb Solution's eCommerce app development services.

Streamlined development process

Imagine if you have not planned your app development. The result is a waste of resources in terms of money, time, talent, etc. But that does not happen at AddWeb Solution.

We plan every single project we undertake, eCommerce app development or not.

This helps us deliver the project on time, ensure value to the client's investment, and make it easier for them to quickly take their product to the market.

Advanced eCommerce apps

We believe in creating apps that help your business grow. And technology plays a massive role in that. Having realized this, our team of expert eCommerce app developers always leverage the latest technologies to make your app.

This empowers your app with all the features and advanced functionalities you need to impress your existing and prospective customers.

Multiple QA processes

Quality means the world to us as an eCommerce development company in India. We have multiple quality assessment processes and tests to keep the apps we develop at the highest echelon of quality.

Regardless of your industry, your app will always comply with industry standards and often exceed the benchmarks of global quality expectations. Son, you don't need to worry about the quality of our apps.

Conclusion

eCommerce apps help sell your products and services and reach more users easily. Most people worldwide use a smartphone, so you can make your app available to them to encourage them to buy from you. This is a marketing strategy that many businesses have used and has proven highly effective. However, when developing an eCommerce mobile app for your business, you must hire eCommerce app developers who can deliver value and quality. And that’s something we can offer you aplenty.

We have served numerous businesses looking to expand their reach and sales through dedicated eCommerce mobile apps. We have always served tailored eCommerce development services that exceeded their expectations.

Source: How Much Does It Cost to Develop an eCommerce Mobile App

2 notes

·

View notes

Text

Experience seamless transactions with Haoda Pay's reliable payment gateway services in India. Secure, efficient, and designed for your business success.

0 notes

Text

PAYOUTS SERVICES IN INDIA FOR YOUR BUSINESS NEEDS - INDIA PAYOUTS

India Payouts is a payment API provider company in India that offers secure and reliable payout solutions for businesses. Their services are designed to streamline the payout process for businesses in various industries, including online gaming, forex trading, and others. They offer features like instant money transfer, real-time tracking, and robust security.

Here are some additional details you can include in your description, depending on what information is most relevant to your target audience:

Supported industries: India Payouts caters to a wide range of industries, but you can mention some of the specific industries they highlight on their website, such as online gaming, forex trading, etc.

Benefits for businesses: Focus on the benefits that India Payouts offers to businesses, such as streamlining payout processes, reducing costs, and improving efficiency.

Security features: Since security is a major concern for businesses that handle financial transactions, you can mention the specific security measures that India Payouts has in place to protect client information.

Ease of integration: If India Payouts offers an easy-to-integrate API, you can mention this as a benefit for businesses looking to quickly implement their payout solution.

Contact us or Visit to our website: https://www.indiapayouts.com/

#payment gateway for gambling in india#gaming payout api#payment gateway for gaming in india#payment gateway for games india#payout api provider in india#payment gateway for games in india#gambling payment gateway#gaming payouts api#gaming payouts api provider in india#payout service provider in india#payout api india#payout api provider india

1 note

·

View note

Text

Payment gateway provider in india | Zyro

In the digital era, the importance of a seamless and secure online payment experience cannot be overstressed for businesses aiming to succeed in the competitive landscape. With the rise of eCommerce and online services, choosing the right payment gateway provider is a critical decision for entrepreneurs and businesses across India. Zyro emerges as a leading contender in this domain, offering a robust, reliable, and efficient payment solution tailored to the unique needs of Indian businesses. Here's why Zyro stands out as the preferred payment gateway provider in India.

Unmatched Security Measures

At the core of Zyro's payment gateway services is an uncompromising commitment to security. Recognizing the critical nature of transaction security, Zyro implements advanced encryption technologies and complies with global security standards, including PCI DSS, to ensure that every transaction processed is secure from end to end. This level of security not only protects businesses from potential fraud but also builds trust with customers, encouraging repeat transactions.

Diverse Payment Options for Enhanced Customer Satisfaction

India's payment ecosystem is characterized by its diversity, with customers having varied preferences ranging from credit and debit cards to UPI and mobile wallets. Zyro's payment gateway accommodates this diversity by supporting a wide array of payment methods. By integrating Zyro, businesses can offer their customers the convenience of choosing their preferred payment mode, thereby enhancing user experience and potentially increasing conversion rates.

Seamless Integration and User-Friendly Interface

One of the standout features of Zyro's payment gateway is its seamless integration capabilities. Businesses can easily integrate Zyro with their websites or mobile applications, thanks to its user-friendly interface and straightforward integration process. This ease of integration ensures that businesses, regardless of their size or technical expertise, can leverage Zyro's payment solutions without any hassle.

Competitive Pricing Without Hidden Fees

Understanding the budget constraints that many businesses face, especially startups and SMEs, Zyro offers its premium payment gateway services at competitive rates. This transparent pricing model ensures that businesses can access top-notch payment solutions without worrying about overstepping their budgetary limitations. Moreover, Zyro's pricing structure is straightforward, with no hidden fees, providing businesses with clear visibility into their payment processing costs.

Round-the-Clock Customer Support

Zyro distinguishes itself by offering exceptional customer support. Recognizing the importance of uninterrupted business operations, Zyro provides 24/7 customer service to address any issues or queries that businesses may encounter. This relentless support ensures that businesses can count on Zyro to resolve any potential transactional challenges swiftly, keeping their operations smooth and efficient.

Comprehensive Analytics for Informed Decision-Making

In addition to its core payment gateway services, Zyro offers businesses valuable insights through comprehensive analytics and reporting tools. These tools allow businesses to track transaction patterns, understand customer behavior, and gain a deeper understanding of their financial operations. Armed with this information, businesses can make data-driven decisions to optimize their services and offerings.

Conclusion

As the digital economy in India continues to flourish, having a reliable, secure, and efficient payment gateway provider like Zyro becomes indispensable for businesses looking to thrive. With its state-of-the-art security measures, diverse payment options, seamless integration, competitive pricing, dedicated customer support, and insightful analytics, Zyro is positioned as the leading payment gateway provider in India. By choosing Zyro, businesses not only elevate their transaction processes but also enhance their overall customer experience, setting the stage for greater success in the digital marketplace.

For more information visit our website: www.zyro.in/blog

#best payment service provider in india#best payment gateway provider in india#best financial sevice provider

0 notes

Text

#payment gateway development#payment gateway software development in india#payment gateway development services

0 notes

Text

How to Pay your SMFG India Credit EMI Online?

To understand the steps involved in making your SMFG India Credit EMI payment online, it is particularly important to understand the concept of Loan Account Number:

What is a Loan Account Number?

The Loan Account Number is a unique 14 digit code that acts as a reference to your loan account with Fullerton India. It differentiates your loan account from other loan accounts with SMFG India Credit. This specific number is displayed at the top of your monthly statement and can also be viewed on your dashboard whenever you log in to our customer service portal. It will help our customer service representative to pull out and extract your details from our records easily in case you raise any queries online,through our customer care centre, or at our branches spread far and wide across India.

Steps to Make your EMI Payment Online

Here are the steps involved in making your SMFG India Credit EMI payment online

To opt for SMFG India Credit pay online feature, please visit the site. Click on the “Quick Links” menu on the top right and select “Pay EMI”.

You will be redirected to the payment page.

Here, you will be asked to type in your Loan Account Number in ohttps://www.smfgindiacredit.com/.rder to fetch the Payable amount or the outstanding loan amount.

You can then either choose to pay the entire payable amount, the monthly EMI obligation, or any custom amount. You must bear in mind if you are opting to pay an amount greater than your monthly EMI obligation, prepayment charges will be applicable. If you opt to pay an amount less than your monthly obligation, interest charges will be applied to the outstanding loan amount.

You are then required to enter your phone number and email ID registered with SMFG India Credit.

You will be presented with two payment modes i.e PayTM and Bill desk

If you select PayTM as your payment mode, you will be provided with further options such as BHIM UPI, debit card, and net banking. You can also login to your PayTM account and use your saved options for payment including your Pay-TM wallet. However, please bear in mind you cannot use this option for payment of all SMFG India Credit loans.

If you opt for Bill Desk as the payment option, you will be taken to the payment gateway page. Here, you would be provided with further options of Netbanking, Debit Card, Google Pay or UPI/wallets as per your liking.

To make things simpler, you can also select the ECS facility to auto-debit your monthly EMI payment obligation on a particular day of the month. To do this, you can raise a request through the Service Connect portal or via the Contact Us section.

Source: https://www.smfgindiacredit.com/knowledge-center/how-to-pay-emi-online.aspx

2 notes

·

View notes

Text

woocommerce development company in india

When it comes to ecommerce, WooCommerce is one of the most popular platforms available. According to Builtwith, over 40% of all online stores use WooCommerce. It’s a great choice for both small businesses and larger companies alike. But in order to get the most out of WooCommerce, businesses need to choose the right development company.

It’s important to partner with a development company that has experience in the ecommerce space. Specifically, the company should understand the needs and requirements of running an effective WooCommerce store. This can include understanding how to set up the platform properly, providing maintenance services, and providing support and customization.

Businesses should also look for a company that has experience in the latest technologies. As technology advances in this space, businesses need to stay ahead of the curve in order to remain competitive. This includes understanding and leveraging the latest payment gateways, checkout flows, and marketing strategies.

It’s also important to find a development company that is responsive and can meet timelines. In the ecommerce sphere, time is money, and businesses need to find a development partner that can keep up with the deadlines. This includes designing a website quickly and having the necessary skills and personnel to implement the changes.

Overall, when choosing a WooCommerce development company for businesses, it’s important to do research and look for a company that has experience in the ecommerce space, as well as expertise in the latest technologies and responsive timelines.

Woocommerce Consulting Services

In addition to choosing the right WooCommerce development company, businesses should also consider investing in consulting services. This can be especially helpful for businesses that are new to the platform, as they can get guidance and advice on best practices.

Consulting services from a WooCommerce development company can help businesses implement the platform, set up their store, and optimize the customer experience. This can include advice on product pages, checkout flow, and shipping fulfilment. It can also be helpful for developing strategies for website promotion, increasing the visibility of the store, and boosting sales.

Consulting services can also help businesses optimize their stores for search engine visibility and conversations. WooCommerce and SEO are closely intertwined, and a good consulting service can help businesses capitalize on SEO techniques to increase traffic to their store.

Finally, consultants can provide advice and feedback on security, payments, and other related aspects of the store in an effort to reduce fraud and optimize checkout functions. This is critical in order to ensure that customers feel safe shopping on the store and are confident that their data is secure.

Overall, consulting services can be a great way for businesses to ensure that they are set up for success with WooCommerce. These services can help businesses get the most out of the platform and maximize their returns.

Woocommerce ServicesWoocommerce Consulting Serviceswoocommerce development company in indiamagento developers middletownmagento development company usa

2 notes

·

View notes